Professional Documents

Culture Documents

PR 2 Ec 70205

PR 2 Ec 70205

Uploaded by

damla87Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PR 2 Ec 70205

PR 2 Ec 70205

Uploaded by

damla87Copyright:

Available Formats

Homework 2 Spring2005, Econ702

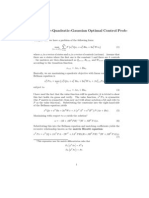

Problem 1 Consider the sequence of markets setting in a stochastic economy that we discused in class. Find an arbitrage condition that links the price of state contigent claims, qt+1 (ht , zt+1 ) and the interest rate Rt+1 (ht+1 ). Problem 2 On Tuesdays lecture we wrote down the problem of the representative agent in the sequence of markets setting, and we obtained a (general) formula for the price of the state n contigent claim, qt+1 (ht , z n ) . Repeat the analysis using particular functional forms for preferences and technology. More precisely, use a constant relative risk aversion (CRRA) utility function and a Cobb-Douglas (CD) production function. Assume full depreciation ( = 1). Also assume that the productivity shock evolves according to a three state Markov Chain, so that for every t, zt {z 1 , z 2 , z3 }. Give formulas for the prices of the state contigent claims. Finally, dene a Suquence of Markets Equilibrium (SME) for this specic example. Problem 3 Consider a stochastic economy in which the production function ft = f (kt , 1) is multiplied by a random shock, zt , zt {z 1 , z 2 , ..., z M } Using the same functional forms as in Problem 2 (but now without full depreciation) i) Write down the Social Planners problem, ii) Find the Euler Equation, and iii) Characterize the steady state solution as much as you can. Problem 4 Consider the following problems: Problem (1)

X

{ct ,kt+1 }0

max

t ln(ct ) , A > 0, a (0, 1)

s.t : ct + kt+1 = Problem (2)

t=0 a Akt

{ct ,At+1 }0

max

s.t : At+1 = R(Atct ), R > 0 1

X t=0

1 1a c 1a t

For both problems nd closed form solutions for the value function and the decision rule (Hint: for the second problem "guess" a value function of the form V (A) = BA1a , where B is a constant to be determined). Problem 5 We have seen in class that the innite horizon household problem can be

formulated in a recursive manner as a functional equation: v (K, a; Ge ) = max u (c) + v (K 0 , a0 ; Ge ) 0

c,a [a,a]

(1)

subject to c + a0 w R K0 = = = = w + aR w (K ) R (K ) Ge (K )

where Ge (.) is the households expectation about aggregate capital next period given current value K. a. Prove that given Ge (.) as a part of the environment and under suitable assumptions on primitives, there exists a unique function V (K, a; G) that solves the Bellman equation above and it is the xed point of the operator T , where T is dened as;

v n+1 = T v n = max {u (c) + vn (K 0 , a0 ; Ge )} 0

c,a [a,a]

(2)

b. Show that under appropriate assumptions on primitives, the resulting value function is strictly increasing, strictly concave, continuous and bounded.

You might also like

- Time Series SolutionDocument5 pagesTime Series Solutionbehrooz100% (1)

- PS5 PDFDocument2 pagesPS5 PDFTaib MuffakNo ratings yet

- Solution Exercises 2011 PartIDocument27 pagesSolution Exercises 2011 PartIcecch001100% (1)

- Ps and Solution CS229Document55 pagesPs and Solution CS229Anonymous COa5DYzJwNo ratings yet

- SX004a-En-EU-Example - Pinned Column Using Non Slender H-Section or RHSDocument5 pagesSX004a-En-EU-Example - Pinned Column Using Non Slender H-Section or RHSKen OkoyeNo ratings yet

- Handout Class 3: 1 The Model EconomyDocument10 pagesHandout Class 3: 1 The Model EconomykeyyongparkNo ratings yet

- Lucas Tree PDFDocument11 pagesLucas Tree PDFJohn Nash100% (1)

- Graduate Introductory Macroeconomics: Mini Quiz 1: Growth Model With TaxesDocument3 pagesGraduate Introductory Macroeconomics: Mini Quiz 1: Growth Model With TaxeskeyyongparkNo ratings yet

- Linear System Ramsey Phase GraphDocument15 pagesLinear System Ramsey Phase Graphmarithzahh9416No ratings yet

- Kernel-Based Portfolio Management ModelDocument8 pagesKernel-Based Portfolio Management ModelvidmantoNo ratings yet

- Dynamic Equilibrium Models III: Infinite PeriodsDocument15 pagesDynamic Equilibrium Models III: Infinite PeriodsDavidNo ratings yet

- Linear Quadratic ControlDocument7 pagesLinear Quadratic ControlnaumzNo ratings yet

- Exam February 2015Document4 pagesExam February 2015zaurNo ratings yet

- Solving Dynare Eui2014 PDFDocument84 pagesSolving Dynare Eui2014 PDFduc anhNo ratings yet

- A User's Guide To Solving Real Business Cycle ModelsDocument18 pagesA User's Guide To Solving Real Business Cycle Modelssamir880No ratings yet

- Global Uniqueness of The Compact Support Source Identification ProblemDocument4 pagesGlobal Uniqueness of The Compact Support Source Identification ProblemPrabha AdhikariNo ratings yet

- The Brock-Mirman Stochastic Growth ModelDocument5 pagesThe Brock-Mirman Stochastic Growth ModelJhon Ortega GarciaNo ratings yet

- EC744 Lecture Note 1: Prof. Jianjun MiaoDocument18 pagesEC744 Lecture Note 1: Prof. Jianjun MiaobinicleNo ratings yet

- Dynamic Programming MethodDocument3 pagesDynamic Programming Methodbobo411No ratings yet

- HW 4Document6 pagesHW 4Alexander MackeyNo ratings yet

- Analysis of Algorithms II: The Recursive CaseDocument28 pagesAnalysis of Algorithms II: The Recursive CaseKamakhya GuptaNo ratings yet

- T6: Introduction To Optimal Control: Gabriel Oliver CodinaDocument3 pagesT6: Introduction To Optimal Control: Gabriel Oliver CodinaMona AliNo ratings yet

- Exsheet 1Document4 pagesExsheet 1pobisas812No ratings yet

- ExercisesDocument15 pagesExercisesDrRooba HasanNo ratings yet

- Chapter 20Document12 pagesChapter 20Ariana Ribeiro LameirinhasNo ratings yet

- Volker Hahn, Fuzhen Wang University of KonstanzDocument3 pagesVolker Hahn, Fuzhen Wang University of KonstanzzaurNo ratings yet

- Exam April 2014Document4 pagesExam April 2014zaurNo ratings yet

- 6 Hansen ModelDocument26 pages6 Hansen ModelSemíramis LimaNo ratings yet

- DP NoasDocument10 pagesDP Noasapurva.tudekarNo ratings yet

- Ee263 Ps1 SolDocument11 pagesEe263 Ps1 SolMorokot AngelaNo ratings yet

- D Alembert SolutionDocument22 pagesD Alembert SolutionDharmendra Kumar0% (1)

- Ece 3084 SP15 HW 01Document3 pagesEce 3084 SP15 HW 01RafaPMNo ratings yet

- Heer and Maussner PP 28-41Document14 pagesHeer and Maussner PP 28-411111111111111-859751No ratings yet

- Lagrange PDFDocument22 pagesLagrange PDFTrần Mạnh HùngNo ratings yet

- Optimal Control ExercisesDocument79 pagesOptimal Control ExercisesAlejandroHerreraGurideChile100% (2)

- Small Gain Theorem and Integral Quadratic Constraints - (Matlab Code) PDFDocument10 pagesSmall Gain Theorem and Integral Quadratic Constraints - (Matlab Code) PDFbehdad1985No ratings yet

- 6 DiscreteDynamicOptimization PSDocument4 pages6 DiscreteDynamicOptimization PSAjay JayakumarNo ratings yet

- Kybernetika 39-2003-4 6Document11 pagesKybernetika 39-2003-4 6elgualo1234No ratings yet

- Exam April 2015Document4 pagesExam April 2015zaurNo ratings yet

- Lec4 PDFDocument7 pagesLec4 PDFjuanagallardo01No ratings yet

- FALLSEM2013-14 CP1806 30-Oct-2013 RM01 II OptimalControl UploadedDocument10 pagesFALLSEM2013-14 CP1806 30-Oct-2013 RM01 II OptimalControl UploadedRajat Kumar SinghNo ratings yet

- RMS 4005 Tutorial 10Document4 pagesRMS 4005 Tutorial 10BrayanO10No ratings yet

- EE364a Homework 6 Solutions: I 1,..., K I I IDocument20 pagesEE364a Homework 6 Solutions: I 1,..., K I I IJessica Fernandes LopesNo ratings yet

- Difference EquationsDocument9 pagesDifference EquationsAndersonNo ratings yet

- DAADocument62 pagesDAAanon_385854451No ratings yet

- Assignment 5 VFI PDFDocument2 pagesAssignment 5 VFI PDFGreco S50No ratings yet

- Sample Research PaperDocument26 pagesSample Research Paperfb8ndyffmcNo ratings yet

- Methods For Applied Macroeconomic Research - ch2Document38 pagesMethods For Applied Macroeconomic Research - ch2endi75No ratings yet

- Mathii at Su and Sse: John Hassler Iies, Stockholm University February 25, 2005Document87 pagesMathii at Su and Sse: John Hassler Iies, Stockholm University February 25, 2005kolman2No ratings yet

- HW01Document3 pagesHW011992714521No ratings yet

- Lect Notes 2Document25 pagesLect Notes 2Safis HajjouzNo ratings yet

- CS 229, Autumn 2012 Problem Set #1 Solutions: Supervised LearningDocument16 pagesCS 229, Autumn 2012 Problem Set #1 Solutions: Supervised LearningAvinash JaiswalNo ratings yet

- Final 2019 SolutionDocument14 pagesFinal 2019 SolutionShokhrud SafarovNo ratings yet

- KKT PDFDocument5 pagesKKT PDFTrần Mạnh HùngNo ratings yet

- Successive Quadratic ProgrammingDocument33 pagesSuccessive Quadratic Programmingsathish22No ratings yet

- EC400 Exam Solution 2012 MicroDocument6 pagesEC400 Exam Solution 2012 MicroAvijit PuriNo ratings yet

- Green's Function Estimates for Lattice Schrödinger Operators and Applications. (AM-158)From EverandGreen's Function Estimates for Lattice Schrödinger Operators and Applications. (AM-158)No ratings yet

- Mathematical Formulas for Economics and Business: A Simple IntroductionFrom EverandMathematical Formulas for Economics and Business: A Simple IntroductionRating: 4 out of 5 stars4/5 (4)

- 1 What Is Dynare?: Introduction To Dynare HandoutDocument7 pages1 What Is Dynare?: Introduction To Dynare Handoutdamla87No ratings yet

- 1.1 Road Map: (K, C) T T TDocument16 pages1.1 Road Map: (K, C) T T Tdamla87No ratings yet

- Education and Labor Market Discrimination: ECON 665 Damla Hacıibrahimoglu Assignment 2 1572791Document1 pageEducation and Labor Market Discrimination: ECON 665 Damla Hacıibrahimoglu Assignment 2 1572791damla87No ratings yet

- Problem Set I: Preferences, W.A.R.P., Consumer Choice: Paolo Crosetto Paolo - Crosetto@unimi - ItDocument26 pagesProblem Set I: Preferences, W.A.R.P., Consumer Choice: Paolo Crosetto Paolo - Crosetto@unimi - Itdamla87No ratings yet

- Lecture Notes On Game Theory: Brian WeathersonDocument142 pagesLecture Notes On Game Theory: Brian Weathersondamla87No ratings yet

- α 1−α α α−1 1/ (1−α) ∗ α 1−α α/ (1−α) α α/ (1−α) GR GR 1/ (1−α)Document2 pagesα 1−α α α−1 1/ (1−α) ∗ α 1−α α/ (1−α) α α/ (1−α) GR GR 1/ (1−α)damla87No ratings yet

- Concavity 1Document10 pagesConcavity 1damla87No ratings yet

- Cross Section AnswersDocument22 pagesCross Section Answersdamla87No ratings yet

- Unit - 1.2-15.07.2020-EC8533 - DTSP-Basics of DFTDocument13 pagesUnit - 1.2-15.07.2020-EC8533 - DTSP-Basics of DFTmakNo ratings yet

- CountersDocument23 pagesCountersMuktinath rajbanshiNo ratings yet

- Programmable Logic ControllersDocument31 pagesProgrammable Logic Controllersgpz10100% (15)

- Question of Chapter 8 StaticsDocument7 pagesQuestion of Chapter 8 Staticsحمزہ قاسم کاھلوں جٹNo ratings yet

- Count Trailing Zeroes in Factorial of A Number - GeeksforGeeksDocument13 pagesCount Trailing Zeroes in Factorial of A Number - GeeksforGeeksWatan SahuNo ratings yet

- Greenwald Explains Value Investing PrinciplesDocument2 pagesGreenwald Explains Value Investing PrinciplesMeester KewpieNo ratings yet

- Aarohi Maths TestDocument4 pagesAarohi Maths TestKratgya GuptaNo ratings yet

- Faculty of Engineering & Technology Mechanical Engineering DepartmentDocument3 pagesFaculty of Engineering & Technology Mechanical Engineering DepartmentVikrant SharmaNo ratings yet

- Mental Math Y5 SPRINGDocument13 pagesMental Math Y5 SPRINGLe NaNo ratings yet

- 2nd Grade Art Lesson OrgDocument6 pages2nd Grade Art Lesson Orgapi-288691585No ratings yet

- Artificial Intelligence in FinanceDocument8 pagesArtificial Intelligence in FinancealainvaloisNo ratings yet

- Problem Set On DICE and RICE ModelsDocument3 pagesProblem Set On DICE and RICE ModelsH MNo ratings yet

- Lecture Note 2019 PDFDocument235 pagesLecture Note 2019 PDFRadhika Goyal100% (1)

- EC6405-Control Systems EngineeringDocument12 pagesEC6405-Control Systems EngineeringAnonymous XhmybK0% (1)

- CBSE Class 12 Physics Worksheet - Electric Charges and Field - 1Document1 pageCBSE Class 12 Physics Worksheet - Electric Charges and Field - 1SiddarthNairNo ratings yet

- Grading Zhusuan Abacus (10,9,8,7,6,5,4,3,2,1)Document19 pagesGrading Zhusuan Abacus (10,9,8,7,6,5,4,3,2,1)preethi29440100% (3)

- Systematially Designed Book For Differential Calculus UPSC CSE IFoS Mathematics Optional Mindset Makers Upendra Singh SirDocument275 pagesSystematially Designed Book For Differential Calculus UPSC CSE IFoS Mathematics Optional Mindset Makers Upendra Singh SirRATNADEEP DASNo ratings yet

- Neural Networks For Modeling and Identification of The Dough Rising Process Inside An Industrial Proofiing ChamberDocument6 pagesNeural Networks For Modeling and Identification of The Dough Rising Process Inside An Industrial Proofiing ChamberSyaiful MansyurNo ratings yet

- Pure MTC Seminar Questions 2022Document6 pagesPure MTC Seminar Questions 2022Majanga JohnnyNo ratings yet

- Secant Method: Civil Engineering Majors Authors: Autar Kaw, Jai PaulDocument24 pagesSecant Method: Civil Engineering Majors Authors: Autar Kaw, Jai PaulJoven MadeloNo ratings yet

- August 19-23 Lesson PlanDocument1 pageAugust 19-23 Lesson Planapi-282162606No ratings yet

- Rational Zero Theorem, Factoring Polynomials, and Polynomial EquationsDocument25 pagesRational Zero Theorem, Factoring Polynomials, and Polynomial Equationsjohn kennethNo ratings yet

- IB Math: Algebra NotesDocument86 pagesIB Math: Algebra NotesAYushi SarafNo ratings yet

- Reflection Notes Grade 10Document9 pagesReflection Notes Grade 10Parv GuptaNo ratings yet

- Bondgraph To Transfer FunctionsDocument19 pagesBondgraph To Transfer FunctionskkkprotNo ratings yet

- Math 104 Berkeley Homework 1Document2 pagesMath 104 Berkeley Homework 1Taylor TamNo ratings yet

- Android - Programatically Setting Up Password Dots in EditText - Stack OverflowDocument3 pagesAndroid - Programatically Setting Up Password Dots in EditText - Stack OverflowVikeshNo ratings yet

- Teaching Note 96-02: Risk Neutral Pricing in Discrete TimeDocument4 pagesTeaching Note 96-02: Risk Neutral Pricing in Discrete TimeVeeken ChaglassianNo ratings yet

- Today Maths Worksheets and AnswersDocument42 pagesToday Maths Worksheets and AnswerspeterNo ratings yet