Professional Documents

Culture Documents

09.a - Tax

09.a - Tax

Uploaded by

mickael28Copyright:

Available Formats

You might also like

- Real Estate Investment Funding Proposal PDF1Document7 pagesReal Estate Investment Funding Proposal PDF1chattelsbrassNo ratings yet

- Corporate Finance NPV and IRR SolutionsDocument3 pagesCorporate Finance NPV and IRR SolutionsMark HarveyNo ratings yet

- CRE GlossaryDocument128 pagesCRE GlossaryWong Shu Yang100% (1)

- Minervini Sepa MethodDocument5 pagesMinervini Sepa Methodmickael2850% (2)

- Liberty Tax Ebook 2011 - DownloadDocument16 pagesLiberty Tax Ebook 2011 - DownloadHabibur RahmanNo ratings yet

- Introduction To Hedge Funds 2018 enDocument20 pagesIntroduction To Hedge Funds 2018 enVeera PandianNo ratings yet

- Investments NotesDocument3 pagesInvestments Notesapi-288392911No ratings yet

- Final Bcom ProjectDocument12 pagesFinal Bcom Projectapi-313898822No ratings yet

- Cost and ManagementDocument310 pagesCost and ManagementWaleed Noman100% (1)

- Top Investment Banking Interview Questions (And Answers)Document31 pagesTop Investment Banking Interview Questions (And Answers)Rohan SaxenaNo ratings yet

- The IRS Position On Cost SegregationDocument8 pagesThe IRS Position On Cost SegregationExpert costsegNo ratings yet

- Investment Alternatives For Tax Savings For Salaried EmployeesDocument10 pagesInvestment Alternatives For Tax Savings For Salaried Employeessanjaymenon94No ratings yet

- Green Investment Bank Model Emerging MarketsDocument47 pagesGreen Investment Bank Model Emerging Marketsjai_tri007No ratings yet

- N1591 2019-20 - Sample Exam QuestionsDocument11 pagesN1591 2019-20 - Sample Exam QuestionsMandeep SNo ratings yet

- Presented To:-: Ms. Khushboo SherwaniDocument19 pagesPresented To:-: Ms. Khushboo SherwaniArchit Goel100% (1)

- Blackstone REIT Fact SheetDocument4 pagesBlackstone REIT Fact SheetchinaaffairsmonitorNo ratings yet

- 2012 PROP 6600 Outline (Draft2)Document7 pages2012 PROP 6600 Outline (Draft2)bert1423No ratings yet

- How To Get Started in Property DevelopmentDocument42 pagesHow To Get Started in Property Developmentjeet1970No ratings yet

- European Crowdfunding Framework Oct 2012Document40 pagesEuropean Crowdfunding Framework Oct 2012Abigail KimNo ratings yet

- Understanding REITDocument13 pagesUnderstanding REITHappyMan100% (1)

- Brian Lord ST Louis Real Estate InvestmentsDocument29 pagesBrian Lord ST Louis Real Estate InvestmentsBrian Lord St. LouisNo ratings yet

- Crowd FundingDocument2 pagesCrowd FundingA171 S. MUJTABANo ratings yet

- Getting in The Financial Planning GameDocument4 pagesGetting in The Financial Planning GameJill Edmonds, Communications DirectorNo ratings yet

- IRS SEE Candidate Information BulletinDocument26 pagesIRS SEE Candidate Information Bulletinva.amazonsellercentralNo ratings yet

- Real Estate ModelsDocument14 pagesReal Estate ModelsderoconNo ratings yet

- Millionacres EbookDocument45 pagesMillionacres EbookAdam Browning0% (1)

- Capital Mind - Creating A Hedge Fund in India - The StructureDocument22 pagesCapital Mind - Creating A Hedge Fund in India - The StructureoceanapolloNo ratings yet

- Private Equity M A and Structured FinanceDocument3 pagesPrivate Equity M A and Structured FinanceKeval2947No ratings yet

- Chapter 18. Lease Analysis (Ch18boc-ModelDocument16 pagesChapter 18. Lease Analysis (Ch18boc-Modelsardar hussainNo ratings yet

- Excel Cre 2014 2Document1 pageExcel Cre 2014 2nono7890No ratings yet

- CrowdfundingDocument23 pagesCrowdfundingSakthiSriNo ratings yet

- Wealth ManagementDocument7 pagesWealth Managementanchit_aswaniNo ratings yet

- DSI's Downtown Developer's GuideDocument64 pagesDSI's Downtown Developer's GuideScott217No ratings yet

- Partnership PresentationDocument128 pagesPartnership Presentationparv dalalNo ratings yet

- Net Lease Tenant ProfilesDocument82 pagesNet Lease Tenant ProfilesnetleaseNo ratings yet

- 01 23 19 Catalina IM Catalina Entitlement Fund PDFDocument52 pages01 23 19 Catalina IM Catalina Entitlement Fund PDFDavid MendezNo ratings yet

- A Guide To Venture CapitalDocument4 pagesA Guide To Venture CapitalgargramNo ratings yet

- Real Estate Cashflow and Financial Modelling PDFDocument6 pagesReal Estate Cashflow and Financial Modelling PDFadonisghlNo ratings yet

- Hours and ProceduresDocument4 pagesHours and ProceduresttawniaNo ratings yet

- Financial Planning Booklet FinalDocument8 pagesFinancial Planning Booklet Finalapi-288542114No ratings yet

- Create Tax Advantaged Retirement Income You Cant OutliveDocument25 pagesCreate Tax Advantaged Retirement Income You Cant OutlivekurtisrroseNo ratings yet

- Intro To Lease OptionsDocument6 pagesIntro To Lease OptionsShaun EveNo ratings yet

- Management Consulting: Executive SummaryDocument10 pagesManagement Consulting: Executive SummarymarioNo ratings yet

- Stock Broking Custodial Services and DepositoriesDocument15 pagesStock Broking Custodial Services and DepositoriesDrRajesh GanatraNo ratings yet

- Standard Chartered Wealth Management PackDocument35 pagesStandard Chartered Wealth Management PackAnura BirdNo ratings yet

- 2023 Commercial Real Estate Magazine Media KitDocument19 pages2023 Commercial Real Estate Magazine Media KitعبدالعزيزNo ratings yet

- Because You Don't Just Build Wealth, You Build Memories.: Wealth Management Solutions From HSBCDocument12 pagesBecause You Don't Just Build Wealth, You Build Memories.: Wealth Management Solutions From HSBCnarayan.mitNo ratings yet

- BitShares White PaperDocument18 pagesBitShares White PaperMichael WebbNo ratings yet

- The Micro Credit Sector in South Africa - An Overview of The History, Financial Access, Challenges and Key PlayersDocument9 pagesThe Micro Credit Sector in South Africa - An Overview of The History, Financial Access, Challenges and Key PlayerstodzaikNo ratings yet

- Hedge Funds - Free Guide #006Document11 pagesHedge Funds - Free Guide #006katrams010No ratings yet

- STARTUPSDocument5 pagesSTARTUPSsreejithNo ratings yet

- I See, There's Some Gap in Your Work History. Why?Document8 pagesI See, There's Some Gap in Your Work History. Why?Minhaj AliNo ratings yet

- SIE Exams - Exam DumpDocument2 pagesSIE Exams - Exam DumpBAnne LabelNo ratings yet

- REPE Case 02 Boston Office Value Added AcquisitionDocument282 pagesREPE Case 02 Boston Office Value Added AcquisitionDavid ChikhladzeNo ratings yet

- Wealth Creation in Real EstateDocument22 pagesWealth Creation in Real EstateAnil BilawalaNo ratings yet

- What You Need To Know About Real Estate InvestingDocument2 pagesWhat You Need To Know About Real Estate InvestingcarloswhitneyNo ratings yet

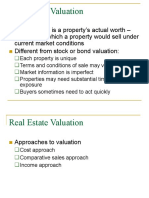

- InVEMA13 - Real Estate ValuationDocument9 pagesInVEMA13 - Real Estate ValuationDaniel ValerianoNo ratings yet

- Capital Raising PresentationDocument24 pagesCapital Raising PresentationMaryJane WermuthNo ratings yet

- Case Study SolutionDocument69 pagesCase Study SolutionPrateek Singhal100% (1)

- Rental Home Financial Projection TemplateDocument61 pagesRental Home Financial Projection TemplateMinh NguyenNo ratings yet

- Blue Chip StocksDocument5 pagesBlue Chip StocksJUNVICENT DELEON100% (1)

- Managing The Narrative: Investor Relations Officers and Corporate DisclosureDocument22 pagesManaging The Narrative: Investor Relations Officers and Corporate DisclosureWihelmina DeaNo ratings yet

- 2016.11.03-Invest in Your Kids FutureDocument44 pages2016.11.03-Invest in Your Kids Futuremickael28No ratings yet

- Saxo Options BrochureDocument35 pagesSaxo Options Brochuremickael28No ratings yet

- 10 - InnovationDocument16 pages10 - Innovationmickael28No ratings yet

- Budget Manual Klein IsdDocument12 pagesBudget Manual Klein Isdapi-237940284No ratings yet

- Annual Budget 2015Document116 pagesAnnual Budget 2015api-301130577No ratings yet

- NDD Town Hall 5.28.13Document1 pageNDD Town Hall 5.28.13Js TechNo ratings yet

- Budget Reform Bill Atty Maria Paula DomingoDocument38 pagesBudget Reform Bill Atty Maria Paula DomingoBernadette LlanetaNo ratings yet

- Ece Laws 6849Document18 pagesEce Laws 6849Eric Chiu AusenteNo ratings yet

- AFM Capital BudgetingDocument16 pagesAFM Capital BudgetingmahendrabpatelNo ratings yet

- CEI Planet Summer 2018Document16 pagesCEI Planet Summer 2018Competitive Enterprise InstituteNo ratings yet

- Fundamental AnalysisDocument22 pagesFundamental Analysissaidutt sharmaNo ratings yet

- Currency Crisis SingaporeDocument43 pagesCurrency Crisis SingaporeGuan YizhengNo ratings yet

- First Half NGBIRR 23-24 Final 16.2.24Document190 pagesFirst Half NGBIRR 23-24 Final 16.2.24Reagan KigumbaNo ratings yet

- Minutes of The Anual General Meeting and of The Extraordinary General MeetingDocument30 pagesMinutes of The Anual General Meeting and of The Extraordinary General MeetingMultiplan RINo ratings yet

- Annual Report Non-Profit Making: OrganizationsDocument15 pagesAnnual Report Non-Profit Making: OrganizationsChandrika DasNo ratings yet

- Premium CH 18 Saving, Investment, and The Financial SystemDocument37 pagesPremium CH 18 Saving, Investment, and The Financial SystemSuraj OVNo ratings yet

- FIN 081 - P2 Quiz2Document55 pagesFIN 081 - P2 Quiz2Grazielle DiazNo ratings yet

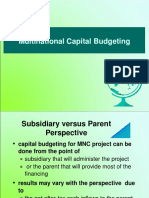

- 14-MNC Capital BudgetingDocument22 pages14-MNC Capital BudgetingRoopa Shree100% (1)

- Department of B.Udget and Management: Republic of The PhilippinesDocument5 pagesDepartment of B.Udget and Management: Republic of The Philippinesruss8dikoNo ratings yet

- July07.2016mandatory Pre-Audit of Government Disbursements and Uses of Funds PushedDocument2 pagesJuly07.2016mandatory Pre-Audit of Government Disbursements and Uses of Funds Pushedpribhor2No ratings yet

- 19691ipcc Acc Vol2 Chapter9Document40 pages19691ipcc Acc Vol2 Chapter9m kumarNo ratings yet

- Budget and PlanningDocument9 pagesBudget and Planningyes1nthNo ratings yet

- Arrangement of Funds LPSDocument57 pagesArrangement of Funds LPSRohan SinglaNo ratings yet

- Capitulo 01 Saleh MubarakDocument6 pagesCapitulo 01 Saleh Mubarakpowder0330No ratings yet

- Winter Internship Project ReportDocument26 pagesWinter Internship Project ReportShivin Singh ChauhanNo ratings yet

- Alcantara PetitionDocument137 pagesAlcantara PetitionStaceyNo ratings yet

- Cash Management ReportDocument117 pagesCash Management ReportKinjal UpadhyayNo ratings yet

- USDA Beginning Farmers and Ranchers Programs: Office of Inspector GeneralDocument34 pagesUSDA Beginning Farmers and Ranchers Programs: Office of Inspector GenerallizNo ratings yet

- Mas 02 - Variable Absorption Costing & BudgetingDocument11 pagesMas 02 - Variable Absorption Costing & BudgetingCriane DomineusNo ratings yet

- GST PDFDocument81 pagesGST PDFPankaj JainNo ratings yet

- Business FinanceDocument35 pagesBusiness FinanceJosephat MutamaNo ratings yet

09.a - Tax

09.a - Tax

Uploaded by

mickael28Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

09.a - Tax

09.a - Tax

Uploaded by

mickael28Copyright:

Available Formats

Golden Rules of Investing

Lesson:

Tax:

An investors guide

GOLDEN RULES OF INVESTING

Make more of your money with our FREE guides

22 OcT 2010 10 part series continues 24 SEpT

LESSONS TO cOLLEcT:

n LESSON 6: property

From boom to bust and back again

n LESSON 7: commodities

Maximum returns from oil, gold and more

n LESSON 8: shares

Value vs growth - which Strategy really works best How to protect your wealth from the Government

n LESSON 9: tax

INVESTORSchRONIcLE.cO.Uk

Dont miss out: Profit with investorschronicle.co.uk online trading

n LESSON 10: innovation

GOLDEN RULES OF INVESTING: LESSON 9

Maike Currie

PERSONAL FINANCE Editor investors chronicle

Lesson 9

TAX:

An investors guide

lmost a thousand years ago, according to the Anglo Saxon legend, Lady Godiva rode naked on a horse through the streets following a wager with her husband. Thanks to her efforts the people of Coventry were relieved from an onerous tax burden. Today, the chances that a brave, naked lady on a horse will save investors from the impending tax onslaught are probably as slim as the chances that taxes wont be raised in the near future. In the wake of the credit crunch, and the subsequent spending programs to get the economy back on the move, the UK government is faced with a mountain of debt, and a huge budget deficit. Pushing up taxes to help plug the hole in the countrys finances is a certainty. But even before official announcements that the UKs recovery package will

Maike Currie Maike Currie is part of ICs personal finance team. She started her journalism career in South Africa. On moving to the UK she joined Financial Adviser, a title serving the UKs IFA market, later joining IC.

be funded, in part, from tax increases, investors had to consider how much risk they wanted to take on the tax front. Throughout Investors Chronicles 150-year history, we have advocated the view that tax considerations should never drive your investment decisions, supporting the old investment adage of not allowing the tax tail to wag the investment dog. However, we have maintained that bespoke tax planning driven by the right financial considerations can play an important role in your investment return. It could be the difference between a net return of 72 per cent if capital gains tax is payable, 50 per cent if income tax is due, or 100 per cent if the investment is held in an individual savings account (Isa). This guide brings together the tax planning strategies and vehicles most pertinent to the investor.

GOLDEN RULES OF INVESTING: LESSON 9

Death, taxes AND a gaping hole

We are gripped by a crisis, and its the worst kind its invisible. You cant see the debts mounting up. Walk the high street, go to work, talk to your friends, you wont see the signs of our debts or our deficit.

Nick Clegg t was Benjamin Franklin who famously said: The only things certain in life are death and taxes. Some lesser-known mortal expanded the quote a bit further with the words: Death and taxes may be certain, but we dont have to die every year. As much as it is detested, disliked and shunned, tax is an unavoidable fact of adult life and a major concern to the investor. Making sure you arrange your investments in the most tax-efficient manner is a crucial part of getting the maximum return from your portfolio. Another, more pertinent reason why investors, now more than ever, need to make sure they do not pay more tax than they have to is government debt. The financial crisis of 2007 and 2008 saw governments across the world, and in the UK in particular, launching astronomical spending programmes to get economies back on the move. This has left a gaping hole in the countrys finances in the form of an astronomical budget deficit. According to the National Office of Statistics, in 2009 the UK recorded a general government deficit of 159.2bn, which was equivalent to 11.4 per

hidden liabilities THE public purse COULD face

r t 4 8 . 4

Benjamin Franklin famously said the only things certain in life are death and taxes

This time not even Lady Godiva can save us

cent of gross domestic product (GDP). To get this mountain of debt back to an acceptable level, the government will need to cut spending and increase its revenue. The latter is done by raising taxes. We have already seen dividend tax rates rise to 42.5 per cent and the

GOLDEN RULES OF INVESTING: LESSON 9

current net debt figure

935bn

FINDING THE MONEY

The government intends to tackle the deficit partly through increased taxation and partly through cuts in public expenditure, of which about 20 per cent will come from tax increases. To increase the tax take, the government must ultimately rely on raising more from the three big taxes income tax, national insurance and VAT. A VAT increase to 20 per cent, to take effect from January 2011, will raise about 12bn a year. The coalition government has also stuck in large measure to the tax increases planned by the previous Labour government, in particular, the 50 per cent top rate of income tax, restriction on tax relief on pension contributions and the removal of individual personal allowances above an income of 100,000 per annum. It has also been announced that 900m will be spent on rooting out tax evasion, bad debts and crime with a view to raising a possible 7bn a year by 2014-15. But this is not sufficient to fill the deficit and it seems inevitable that the government will have to raise taxes further. Source: Grant Thornton, Smith & Williamson

3 main tax generators*

Income tax

34% 23%

VAT

National Insurance

17%

*As a percentage of the total tax take. All figures are approximate

introduction of a new super income tax band of 50 cent. capital gains tax rates have gone up to 28 per cent for high earners, while national insurance (NI) and value added tax (VAT) are also set to increase next year. A clampdown on tax evaders has further been noted as top priority, and HM Revenue & Customs (HMRC) is increasingly putting the spotlight on the tax matters of the self-employed, entrepreneurs, nondomiciles and high-net-worth individuals. Never has it been more important to get your tax planning right.

GOLDEN RULES OF INVESTING: LESSON 9

CONTRIBUTION OF TOP 2% OF TAXPAYERS TO TOTAL TAX TAKE

The different types of taxes

here are several ways in which the government can raise money from taxes. These include national insurance, council tax, VAT and corporation tax, to name but a few. However, for the purposes of this guide, well focus on the taxes impacting investors and their investments most directly. Income Tax Introduced in 1799, as a means of paying for the war against the French forces under Napoleon, income tax is today levied on your earnings. This will include income from employment, interest earned on your savings, rental income, pension income and dividends (income from shares). Previously the UK had two income tax bands: a basic rate of 20 per cent and a higher rate of 40 per cent, dependent

30%

Income tax was introduced as a means to beat Napoleon

CGT: governments just cant leave it alone

CGT introduced on capital gains accruing after 5 April 1965, fixed at a flat rate of 30 per cent Income tax charge repealed by the incoming Conservative government Criticism of CGT which gave no allowance for inflation when calculating the gain charged to tax leads to Chancellor Sir Geoffrey Howe introducing an indexation allowance

1965

1971

1982

1988

Chancellor of the Exchequer 1971 Anthony Barber

Chancellor Sir Geoffrey Howe

Conservative government introduced a charge to income tax on certain short-term capital gains for chargeable assets acquired or sold after 9 April 1962. This applied to land owned for fewer than three years and other assets owned for less than six months.

GOLDEN RULES OF INVESTING: LESSON 9

TAXPAYERS HAD TO PAY CGT IN 2009

1in131

Heres the truth, the proposed top rate of income tax is not 50 per cent. It is 50 per cent plus 1.5 per cent national insurance paid by employees plus 13.3 per cent paid by employers. Thats not 50%

Andrew Lloyd Webber

on your earnings. However, in April 2009, the then chancellor, Alistair Darling, announced a new super tax band of 50 per cent income tax on anyone earning over 150,000. Capital Gains Tax Capital gains tax (CGT) is the tax charged on investment profits and is typically payable on the sale of an asset such as shares, securities and investment property. It is calculated as the difference between sale proceeds after selling costs and the original cost. CGT is less than 50 years old but since its inception in the 1960s, the regime has been changed a number of times. Its been at the same rate as income tax, lower than income tax, inflation allowances introduced, inflation allowances withdrawn, taper relief given according to the time

an asset is held and different rules applied for different assets. Most recently, Chancellor George Osborne introduced a new CGT rate of 28 per cent for higher earners in his June Emergency Budget speech. For basic-rate payers CGT remained at 18 per cent. The CGT threshold per person (the maximum amount of profit for which you dont have to pay CGT) remained 10,100 for individuals and 5,050 for trusts. Lucy Hardwick, a director in the private clients practice at Deloitte, points out two important points often overlooked when it comes to CGT: First, CGT is always computed in sterling so beware of currency fluctuations which result in gains and losses. Secondly, remember that while sterling cash is an exempt asset, nonsterling deposits are chargeable.

Nigel Lawson abolishes the flat rate, aligning CGT with income tax. Gains were charged at the individuals marginal rate of income tax so the maximum rate was 40 per cent.

Chancellor of the Exchequer Nigel Lawson

Finance Act 1998 introduced significant changes to CGT which included the withdrawal of indexation allowance, phased withdrawal of retirement relief and introduction of taper relief.

Withdrawal of taper relief and introduction of a flat rate of CGT of 18 per cent. Introduction of entrepreneurs relief.

Gordon Brown

George Osborne announces a 28 per cent CGT charge for higher rate taxpayers for post 22 June 2010 capital gains. Entrepreneurs relief is increased

Chancellor of the Exchequer George Osborne

2008

1998

1988

2010

GOLDEN RULES OF INVESTING: LESSON 9

stamp duty contribution to government revenue

2008 2009

3.2bn

of the inheritance you leave for your nearest and dearest but there are a number of IHT-efficient investments such as equities listed on the Alternative Investment Market (Aim), farmland, forestry and business assets. stamp duty Stamp duty applies mainly to purchases of shares in UK companies. The rate of tax is fixed at 0.5 per cent, except for special transactions usually entered into by overseas investors involving intermediaries where the rate is 1.5 per cent. Stamp duty land tax applies to purchase of residential property over 125,000 and to commercial property over 150,000. It accounted for 4.8bn of government revenue in the 2008-09 tax year. The rate of tax varies depending on the amount of the purchase price, from 1 per cent to 4 per cent, explains Sean Randall, a director in Deloittes tax practice. But note that the top rate for residential property will increase from 1 April 2011 to 5 per cent for purchases over 1m. Buyers of 1m-plus homes will pay at least 10,000 more in tax from next year. It is estimated that 10,000 to 15,000 buyers will be affected... resulting in a spike in sales of 1m-plus homes in the run-up to April 2011.

inheritance Tax Described by some as the tax everyone aspires to pay, inheritance tax (IHT) is paid on a persons estate at 40 per cent if the total assets on death exceed 325,000 (this is your lifetime tax-free allowance, also called the nilrate band). Married couples and civil partners have a transferable allowance. This means when one partner dies, the other can add to the deceaseds allowance giving couples an effective lifetime allowance of 650,000. The Conservative election manifesto included a pledge to raise the IHT nil-rate band to 1m per person but clearly that wasnt going to be a runner at this stage of an economic crisis... the decision to freeze the nilrate band reinforces the need to make use of the basic planning opportunities for IHT by making full use of exemptions and reliefs, comments Richard Mannion, national tax director at Smith & Williamson. IHT can take a nasty chunk out

The decision to freeze the nil rate band reinforces the basic planning opportunities for IHT by making full use of exemptions and reliefs. Richard Mannion

GOLDEN RULES OF INVESTING: LESSON 9

people sharing INHERITANCE OF average estate

TAX BANDS

Income Tax

Dividends Savings Other

5

0%

Capital Gains TAX (CGT)

Basic rate

10% 20% 20%

Basic rate

1-37,400

Higher rate

Higher rate

32% 40% 40%

18% 28%

37,401-150,000

Top rate

Inheritance tax (IHT)

1-325,000

for individuals

Over 150,000

42% 50% 50%

STAMP DUTY & stamp duty land tax

Over 325,000

40% 0%

for individuals

Up to 125,000

0% 3%

125,000250,000*

1%

1-650,000

*Until 25 March residential properties up to the value of 250,00o are exempt from stamp duty land tax for first-time buyers

married couples/ civil partners

250,000500,000

Over 500,000

Over 650,000

4%

40%

married couples/ civil partners

GOLDEN RULES OF INVESTING: LESSON 9

The year the London Mint first started producing coins

886

Certain collectors items such as classic cars are exempt from tax

Tax-free investments

Assets considered depreciating in value are free from CGT

he number of investments that are completely taxfree are limited to premium bonds, national savings & investment certificates (15,000 per issue, although these are currently suspended from sale) and childrens bonus bonds (3,000 per issue). Certain collectors items such as classic cars, coins and certain personal chattels, depending on their value,

are also exempt. Individual savings accounts (Isas) are sometimes considered to be tax-free investments. However, withholding taxes on dividends cannot be recovered. For income tax purposes it means that they are on equal footing with other equity-based investments in the hands of individuals who pay at the basic rate, says Mike Fosberry, director at Smith & Williamson.

10

GOLDEN RULES OF INVESTING: LESSON 9

Amount EISs cost the Exchequer a year

Tax-EFFICIENT investments

he old adage a tax deferred is a tax saved is as true today as ever. There are a number of tax-efficient investments that can help you save tax, and most tax experts advise that you make use of these while they are still in place. Isas You wont be able to recover withholding taxes on dividends within an Isa, but you will not have to pay CGT. You can save up to 10,200 taxfree, of which 5,100 can be held in cash and the remaining 5,100 can be invested in stocks and shares with either the same or a different provider. Alternatively, you could invest your entire allowance into a stocks-andshares Isa. A couple making regular use of their yearly Isa allowance can accumulate a sizeable pot which could be used to supplement their retirement income later in life. Pensions Pensions attract upfront tax relief. For most people, this tax relief is available at their marginal rate of tax. Taking advantage of this tax subsidy could

190m

It was as true... as taxes is. And nothings truer than them.

Charles Dickens

boost the return on your pension fund by up to 40 per cent (for those with income of less than 150,000). Your pension fund can grow almost entirely free of tax, and 25 per cent can be withdrawn tax-free once you start drawing down your pension. EIS & VCTs Enterprise investment schemes (EIS) and venture capital trusts (VCT) are higher-risk investments with generous tax breaks. You can get 20 per cent income tax relief on a qualifying EIS investment up to 500,000 (which equates to a reduction in your income tax liability of up to 100,000). After three years you can sell the shares completely free of CGT. Tax relief is available at 30 per cent on a VCT investment up to 200,000. VCT dividends are tax-free and the investment can be cashed in tax-free after five years. Angela Beech, partner at accountancy firm Blick Rothenberg, says that VCTs are high-risk investments, but adds that: The fund is quoted on the stock exchange and investors may sell at any time.

Cash Isa

ISA ALLOWANCES

5,100 10,200

Stocks & shares Isa

Overall Isa allowance

10,200

11

GOLDEN RULES OF INVESTING: LESSON 9

Amount of total tax receipts HMRC fails to collect each year

Tax evasion vs Tax avoidance

10%

Since the first tax amnesty in 2007 the Offshore Disclosure Facility taxpayers with undisclosed income and capital gains have been offered a number of opportunities to come clean to HMRC. The purpose of campaigns such as the Liechtenstein Disclosure facility and others was to encourage taxpayers to pay their outstanding tax liabilities along with interest for late payment and a fixed 10 per cent penalty. Recent comments suggest that the government will focus further attention on trying to reduce tax evasion and tax avoidance. It is, however, important to distinguish between the two, as Louise Somerset, tax director at RBC Wealth Management explains: Tax evasion involves breaking the law and clearly should be stamped out. Tax avoidance is simply arranging ones affairs in order to legitimately reduce the tax burden.

Shelter your investments from the impending tax storm

Tax sheltering investments

ax shelter investments allow you to defer your tax liabilities until a later time as well as sometimes giving you a taxfree element, explains Mr Fosberry at Smith & Williamson. Typically such investments roll-up free of all taxes until they are encashed. Offshore insurance bonds If you invest via an offshore investment bond the investment return can grow tax-free until you encash the bond.

12

GOLDEN RULES OF INVESTING: LESSON 9

Amount govt hopeS to raise from tax crackdown

Tax allowances and reliefs

Tax planning is increasingly about using the statutory reliefs and annual exemptions, comments David Kilshaw of accountancy firm KPMG. There are a number of allowances you can make use of to lighten your tax load some of the most important are listed below: CGT All taxpayers, including children, have an annual CGT exemption of 10,100. Planning point: Transfers of assets between spouses are not subject to CGT, so assets can be transferred between spouses to ensure each spouses CGT allowance is used. Entrepreneurs relief affords a 10 per cent tax rate on the first 5m of capital gains if you satisfy certain criteria. Planning point: Read the small print. You can qualify for entrepreneurs relief if you own 5 per cent of the unquoted trading company you work for but not if you have less. So a 4 per cent shareholder should try to raise his holding to the level of the threshold. Income tax Everyone has a tax-free personal allowance of 6,475. Planning point: If one spouse is not a higher-rate taxpayer, income-producing assets can be transferred to that spouse. He/she can use their personal tax allowance and basic rate band to reduce the joint income tax rate. Inheritance tax Certain gifts out of income can be exempt from IHT. Planning point: Assets gifted more than seven years before death escape IHT, provided the donor does not benefit from the gift, explains Ms Beech of Blick Rothenberg. For example giving shares to a son or daughter who use the annual dividend to pay for repairs to their parents home would be caught, as the parent could be deemed to still own the shares for IHT purposes. Pensions Every person can contribute up to 2,880 per year into a pension, which will be topped up with basic-rate tax relief from the government up to a maximum annual allowance of 3,600. Planning point: Contribute into a self-invested personal pension (Sipp) for your child by putting away 2,880 each year, your child could end up with a pension pot well in excess of 2m when they reach age 65.

7bn

UK-based insurance bonds will have their investment income and growth taxed at a rate of between 15 per cent and 20 per cent a year. You can also withdraw tax-free cash each year up to 5 per cent of your original investment, and if this allowance is not used in any one year, it can be carried forward. Maximum investment plans & endowments Maximum investment plans and endowments are regular premium insurance policies. Provided premiums are paid for at least 75 per cent of a 10-year term and they do not vary within specified limits, tax is limited to insurance company rates of between 15 per cent and 20 per cent. There is no further higher-rate tax to pay on encashment, explains Mr Fosberry.

13

GOLDEN RULES OF INVESTING: LESSON 9

3 Keep your ey

Tax plannin checklist g

e on the ba ll Tax rule chan ges rapidly, and continually. As cl osely as you study the investment m arket, you sh ould study the tax marke t. es work for Investors can you make losses, as well as profits. Maxim ise tax breaks on your losses. Capita l losses, for ex ample, can be offset agai nst your capi tal gains from the same or fu ture tax years. 3Get your timing rig ht Investors thin k a lot about when to sell or buy, bu t as David Ki lshaw of KPMG points out, timing is equally important in tax terms. I f you sell an asset at a pr ofit on 5 April 2011 you have to pay yo ur tax bill on 31 January 2012. Delay your sale by a day to 6 April and you have anothe r 12 months to pay your ta x bill.

3 Make your loss

t Families shou ld make use of personal income tax an d inheritanc e tax allowances and sp read the tax burden. M ak 3 e use of tax-effici ent investments Make use of Isas, pensio ns, EIS, VCTs and offshore bonds, but on ly if these fit in with yo ur investmen t strategy. 3 Invest for ca pital grow th Currently 18 per cent or 28 per cent CGT is better than 20 per cent/40 per cent/50 per 3 Maintain flexibilit cent income tax. Make y use of this w The tax land hile its arou scape could nd. look very di ffe rent when yo 3 Know when to g ur investmen o o to t comes ff fr sh ui tio o re n. Stay flexibl For UK-domic e. iled and resi dent taxpayers, little or no tax can be 3 Get advice saved by having cash offshore. How Speak to the ever, if you are a non-do professional micile and liv s. It might cost you mon e in the UK, you can bene ey up front, fit from the re but it could sa ve yo m u a packet in ittance basis of taxa the long term tion. . 3 know your re ason Never make an investmen t purely for tax purposes dont let th e tax tail wag the inve stment dog!

3 Do simple things firs

14

GOLDEN RULES OF INVESTING: LESSON X

PUT USEFUL INFO UP HERE OR STATS

13.3%

GOLDEN RULES OF INVESTING

Make more of your money with our FREE guides

22 OcT 2010 10 part series continues 24 SEpT

LESSONS TO cOLLEcT:

n LESSON 6: property

From boom to bust and back again

n LESSON 7: commodities

Maximum returns from oil, gold and more

n LESSON 8: shares

Value vs growth - which Strategy really works best How to protect your wealth from the Government Dont miss out: Profit with online trading

n LESSON 9: tax

n LESSON 10: innovation

INVESTORSchRONIcLE.cO.Uk

15

You might also like

- Real Estate Investment Funding Proposal PDF1Document7 pagesReal Estate Investment Funding Proposal PDF1chattelsbrassNo ratings yet

- Corporate Finance NPV and IRR SolutionsDocument3 pagesCorporate Finance NPV and IRR SolutionsMark HarveyNo ratings yet

- CRE GlossaryDocument128 pagesCRE GlossaryWong Shu Yang100% (1)

- Minervini Sepa MethodDocument5 pagesMinervini Sepa Methodmickael2850% (2)

- Liberty Tax Ebook 2011 - DownloadDocument16 pagesLiberty Tax Ebook 2011 - DownloadHabibur RahmanNo ratings yet

- Introduction To Hedge Funds 2018 enDocument20 pagesIntroduction To Hedge Funds 2018 enVeera PandianNo ratings yet

- Investments NotesDocument3 pagesInvestments Notesapi-288392911No ratings yet

- Final Bcom ProjectDocument12 pagesFinal Bcom Projectapi-313898822No ratings yet

- Cost and ManagementDocument310 pagesCost and ManagementWaleed Noman100% (1)

- Top Investment Banking Interview Questions (And Answers)Document31 pagesTop Investment Banking Interview Questions (And Answers)Rohan SaxenaNo ratings yet

- The IRS Position On Cost SegregationDocument8 pagesThe IRS Position On Cost SegregationExpert costsegNo ratings yet

- Investment Alternatives For Tax Savings For Salaried EmployeesDocument10 pagesInvestment Alternatives For Tax Savings For Salaried Employeessanjaymenon94No ratings yet

- Green Investment Bank Model Emerging MarketsDocument47 pagesGreen Investment Bank Model Emerging Marketsjai_tri007No ratings yet

- N1591 2019-20 - Sample Exam QuestionsDocument11 pagesN1591 2019-20 - Sample Exam QuestionsMandeep SNo ratings yet

- Presented To:-: Ms. Khushboo SherwaniDocument19 pagesPresented To:-: Ms. Khushboo SherwaniArchit Goel100% (1)

- Blackstone REIT Fact SheetDocument4 pagesBlackstone REIT Fact SheetchinaaffairsmonitorNo ratings yet

- 2012 PROP 6600 Outline (Draft2)Document7 pages2012 PROP 6600 Outline (Draft2)bert1423No ratings yet

- How To Get Started in Property DevelopmentDocument42 pagesHow To Get Started in Property Developmentjeet1970No ratings yet

- European Crowdfunding Framework Oct 2012Document40 pagesEuropean Crowdfunding Framework Oct 2012Abigail KimNo ratings yet

- Understanding REITDocument13 pagesUnderstanding REITHappyMan100% (1)

- Brian Lord ST Louis Real Estate InvestmentsDocument29 pagesBrian Lord ST Louis Real Estate InvestmentsBrian Lord St. LouisNo ratings yet

- Crowd FundingDocument2 pagesCrowd FundingA171 S. MUJTABANo ratings yet

- Getting in The Financial Planning GameDocument4 pagesGetting in The Financial Planning GameJill Edmonds, Communications DirectorNo ratings yet

- IRS SEE Candidate Information BulletinDocument26 pagesIRS SEE Candidate Information Bulletinva.amazonsellercentralNo ratings yet

- Real Estate ModelsDocument14 pagesReal Estate ModelsderoconNo ratings yet

- Millionacres EbookDocument45 pagesMillionacres EbookAdam Browning0% (1)

- Capital Mind - Creating A Hedge Fund in India - The StructureDocument22 pagesCapital Mind - Creating A Hedge Fund in India - The StructureoceanapolloNo ratings yet

- Private Equity M A and Structured FinanceDocument3 pagesPrivate Equity M A and Structured FinanceKeval2947No ratings yet

- Chapter 18. Lease Analysis (Ch18boc-ModelDocument16 pagesChapter 18. Lease Analysis (Ch18boc-Modelsardar hussainNo ratings yet

- Excel Cre 2014 2Document1 pageExcel Cre 2014 2nono7890No ratings yet

- CrowdfundingDocument23 pagesCrowdfundingSakthiSriNo ratings yet

- Wealth ManagementDocument7 pagesWealth Managementanchit_aswaniNo ratings yet

- DSI's Downtown Developer's GuideDocument64 pagesDSI's Downtown Developer's GuideScott217No ratings yet

- Partnership PresentationDocument128 pagesPartnership Presentationparv dalalNo ratings yet

- Net Lease Tenant ProfilesDocument82 pagesNet Lease Tenant ProfilesnetleaseNo ratings yet

- 01 23 19 Catalina IM Catalina Entitlement Fund PDFDocument52 pages01 23 19 Catalina IM Catalina Entitlement Fund PDFDavid MendezNo ratings yet

- A Guide To Venture CapitalDocument4 pagesA Guide To Venture CapitalgargramNo ratings yet

- Real Estate Cashflow and Financial Modelling PDFDocument6 pagesReal Estate Cashflow and Financial Modelling PDFadonisghlNo ratings yet

- Hours and ProceduresDocument4 pagesHours and ProceduresttawniaNo ratings yet

- Financial Planning Booklet FinalDocument8 pagesFinancial Planning Booklet Finalapi-288542114No ratings yet

- Create Tax Advantaged Retirement Income You Cant OutliveDocument25 pagesCreate Tax Advantaged Retirement Income You Cant OutlivekurtisrroseNo ratings yet

- Intro To Lease OptionsDocument6 pagesIntro To Lease OptionsShaun EveNo ratings yet

- Management Consulting: Executive SummaryDocument10 pagesManagement Consulting: Executive SummarymarioNo ratings yet

- Stock Broking Custodial Services and DepositoriesDocument15 pagesStock Broking Custodial Services and DepositoriesDrRajesh GanatraNo ratings yet

- Standard Chartered Wealth Management PackDocument35 pagesStandard Chartered Wealth Management PackAnura BirdNo ratings yet

- 2023 Commercial Real Estate Magazine Media KitDocument19 pages2023 Commercial Real Estate Magazine Media KitعبدالعزيزNo ratings yet

- Because You Don't Just Build Wealth, You Build Memories.: Wealth Management Solutions From HSBCDocument12 pagesBecause You Don't Just Build Wealth, You Build Memories.: Wealth Management Solutions From HSBCnarayan.mitNo ratings yet

- BitShares White PaperDocument18 pagesBitShares White PaperMichael WebbNo ratings yet

- The Micro Credit Sector in South Africa - An Overview of The History, Financial Access, Challenges and Key PlayersDocument9 pagesThe Micro Credit Sector in South Africa - An Overview of The History, Financial Access, Challenges and Key PlayerstodzaikNo ratings yet

- Hedge Funds - Free Guide #006Document11 pagesHedge Funds - Free Guide #006katrams010No ratings yet

- STARTUPSDocument5 pagesSTARTUPSsreejithNo ratings yet

- I See, There's Some Gap in Your Work History. Why?Document8 pagesI See, There's Some Gap in Your Work History. Why?Minhaj AliNo ratings yet

- SIE Exams - Exam DumpDocument2 pagesSIE Exams - Exam DumpBAnne LabelNo ratings yet

- REPE Case 02 Boston Office Value Added AcquisitionDocument282 pagesREPE Case 02 Boston Office Value Added AcquisitionDavid ChikhladzeNo ratings yet

- Wealth Creation in Real EstateDocument22 pagesWealth Creation in Real EstateAnil BilawalaNo ratings yet

- What You Need To Know About Real Estate InvestingDocument2 pagesWhat You Need To Know About Real Estate InvestingcarloswhitneyNo ratings yet

- InVEMA13 - Real Estate ValuationDocument9 pagesInVEMA13 - Real Estate ValuationDaniel ValerianoNo ratings yet

- Capital Raising PresentationDocument24 pagesCapital Raising PresentationMaryJane WermuthNo ratings yet

- Case Study SolutionDocument69 pagesCase Study SolutionPrateek Singhal100% (1)

- Rental Home Financial Projection TemplateDocument61 pagesRental Home Financial Projection TemplateMinh NguyenNo ratings yet

- Blue Chip StocksDocument5 pagesBlue Chip StocksJUNVICENT DELEON100% (1)

- Managing The Narrative: Investor Relations Officers and Corporate DisclosureDocument22 pagesManaging The Narrative: Investor Relations Officers and Corporate DisclosureWihelmina DeaNo ratings yet

- 2016.11.03-Invest in Your Kids FutureDocument44 pages2016.11.03-Invest in Your Kids Futuremickael28No ratings yet

- Saxo Options BrochureDocument35 pagesSaxo Options Brochuremickael28No ratings yet

- 10 - InnovationDocument16 pages10 - Innovationmickael28No ratings yet

- Budget Manual Klein IsdDocument12 pagesBudget Manual Klein Isdapi-237940284No ratings yet

- Annual Budget 2015Document116 pagesAnnual Budget 2015api-301130577No ratings yet

- NDD Town Hall 5.28.13Document1 pageNDD Town Hall 5.28.13Js TechNo ratings yet

- Budget Reform Bill Atty Maria Paula DomingoDocument38 pagesBudget Reform Bill Atty Maria Paula DomingoBernadette LlanetaNo ratings yet

- Ece Laws 6849Document18 pagesEce Laws 6849Eric Chiu AusenteNo ratings yet

- AFM Capital BudgetingDocument16 pagesAFM Capital BudgetingmahendrabpatelNo ratings yet

- CEI Planet Summer 2018Document16 pagesCEI Planet Summer 2018Competitive Enterprise InstituteNo ratings yet

- Fundamental AnalysisDocument22 pagesFundamental Analysissaidutt sharmaNo ratings yet

- Currency Crisis SingaporeDocument43 pagesCurrency Crisis SingaporeGuan YizhengNo ratings yet

- First Half NGBIRR 23-24 Final 16.2.24Document190 pagesFirst Half NGBIRR 23-24 Final 16.2.24Reagan KigumbaNo ratings yet

- Minutes of The Anual General Meeting and of The Extraordinary General MeetingDocument30 pagesMinutes of The Anual General Meeting and of The Extraordinary General MeetingMultiplan RINo ratings yet

- Annual Report Non-Profit Making: OrganizationsDocument15 pagesAnnual Report Non-Profit Making: OrganizationsChandrika DasNo ratings yet

- Premium CH 18 Saving, Investment, and The Financial SystemDocument37 pagesPremium CH 18 Saving, Investment, and The Financial SystemSuraj OVNo ratings yet

- FIN 081 - P2 Quiz2Document55 pagesFIN 081 - P2 Quiz2Grazielle DiazNo ratings yet

- 14-MNC Capital BudgetingDocument22 pages14-MNC Capital BudgetingRoopa Shree100% (1)

- Department of B.Udget and Management: Republic of The PhilippinesDocument5 pagesDepartment of B.Udget and Management: Republic of The Philippinesruss8dikoNo ratings yet

- July07.2016mandatory Pre-Audit of Government Disbursements and Uses of Funds PushedDocument2 pagesJuly07.2016mandatory Pre-Audit of Government Disbursements and Uses of Funds Pushedpribhor2No ratings yet

- 19691ipcc Acc Vol2 Chapter9Document40 pages19691ipcc Acc Vol2 Chapter9m kumarNo ratings yet

- Budget and PlanningDocument9 pagesBudget and Planningyes1nthNo ratings yet

- Arrangement of Funds LPSDocument57 pagesArrangement of Funds LPSRohan SinglaNo ratings yet

- Capitulo 01 Saleh MubarakDocument6 pagesCapitulo 01 Saleh Mubarakpowder0330No ratings yet

- Winter Internship Project ReportDocument26 pagesWinter Internship Project ReportShivin Singh ChauhanNo ratings yet

- Alcantara PetitionDocument137 pagesAlcantara PetitionStaceyNo ratings yet

- Cash Management ReportDocument117 pagesCash Management ReportKinjal UpadhyayNo ratings yet

- USDA Beginning Farmers and Ranchers Programs: Office of Inspector GeneralDocument34 pagesUSDA Beginning Farmers and Ranchers Programs: Office of Inspector GenerallizNo ratings yet

- Mas 02 - Variable Absorption Costing & BudgetingDocument11 pagesMas 02 - Variable Absorption Costing & BudgetingCriane DomineusNo ratings yet

- GST PDFDocument81 pagesGST PDFPankaj JainNo ratings yet

- Business FinanceDocument35 pagesBusiness FinanceJosephat MutamaNo ratings yet