Professional Documents

Culture Documents

Indian Confectionery Industry On A Growth Trajectory Driven by Rising Consumerism and Young Consumers

Indian Confectionery Industry On A Growth Trajectory Driven by Rising Consumerism and Young Consumers

Uploaded by

Vaibhav WalkeCopyright:

Available Formats

You might also like

- Full Set of Marketing PlanDocument50 pagesFull Set of Marketing Planren_temanku82% (17)

- Advertisement Project: Submitted By: Nivedita.B Fin 1 Ss 10-12 IIPM BangaloreDocument36 pagesAdvertisement Project: Submitted By: Nivedita.B Fin 1 Ss 10-12 IIPM BangalorenivedhitaaNo ratings yet

- Cadbury Dairy MilkDocument52 pagesCadbury Dairy Milksingh.shekharsuman6788100% (1)

- Group C3Document23 pagesGroup C3Harsh SharmaNo ratings yet

- Chocolate Industry in IndiaDocument9 pagesChocolate Industry in IndiaHormazzNo ratings yet

- Marketing Project C3Document22 pagesMarketing Project C3Harsh SharmaNo ratings yet

- Cake Industry in IndiaDocument15 pagesCake Industry in IndiaGenesian Nikhilesh Pillay50% (2)

- Cadbury Dairy Milk ReportDocument52 pagesCadbury Dairy Milk Reportvebs123100% (1)

- ParleDocument46 pagesParleNikhil Arora100% (1)

- Team Project On Strategic Management by Team 1: Strategic Analysis of Mondelez (Cadbury)Document24 pagesTeam Project On Strategic Management by Team 1: Strategic Analysis of Mondelez (Cadbury)Vinayak SharmaNo ratings yet

- Introduction of IndustryDocument4 pagesIntroduction of IndustryVinayak SharmaNo ratings yet

- Business Strategy Assignment On "Sugar Boiled Confectionery"Document8 pagesBusiness Strategy Assignment On "Sugar Boiled Confectionery"Pawan VintuNo ratings yet

- Marketing ManagementDocument14 pagesMarketing ManagementKartikay Saraf Fic Aryabhatta100% (2)

- Project On ChocoDocument15 pagesProject On ChocoNilay SaxenaNo ratings yet

- A Study On The Chocolate Industry: Lucky Singh 05524001809 Bba (B & I) 3 SemDocument48 pagesA Study On The Chocolate Industry: Lucky Singh 05524001809 Bba (B & I) 3 SemGarima GuptaNo ratings yet

- Economic Importance of BakeryDocument11 pagesEconomic Importance of BakerynitEsh mElodyNo ratings yet

- MKT344.docx Final Project Shad and MahimaDocument4 pagesMKT344.docx Final Project Shad and MahimaKhondoker All Muktaddir Shad 2112328630No ratings yet

- Cadbury Dairy MilkDocument52 pagesCadbury Dairy MilkIONITA GABRIELNo ratings yet

- Chocolate Industry 2013 MRP 3 PDFDocument82 pagesChocolate Industry 2013 MRP 3 PDFShivam PandayNo ratings yet

- Marketing Report On Nestle & Cadbury (Shubhangi Malhotra)Document64 pagesMarketing Report On Nestle & Cadbury (Shubhangi Malhotra)shubhangiNo ratings yet

- Poject On Anmol BiscuitsDocument47 pagesPoject On Anmol Biscuitszishanmallick50% (6)

- Marketing Project - ChaocolatesDocument13 pagesMarketing Project - ChaocolatesVasundhara KaulNo ratings yet

- Research Project On CadburyDocument17 pagesResearch Project On CadburyHamzahKhan75% (4)

- Choclate IndustryDocument28 pagesChoclate IndustryAnkur PandeyNo ratings yet

- Custoomr Setisfection of Parle AgroDocument73 pagesCustoomr Setisfection of Parle AgroPrabhat sharmaNo ratings yet

- Rahul Raj 'Project Report On Amul'Document37 pagesRahul Raj 'Project Report On Amul'rahul khan93% (15)

- DBM Group 11Document21 pagesDBM Group 11Rahul RayavarapuNo ratings yet

- Chocolate Market in India: Facts & FiguresDocument4 pagesChocolate Market in India: Facts & FiguresKathir LoveNo ratings yet

- Background of The Study: Influence of Packaging of Cadbury Products On Consumer Purchase DecisionDocument74 pagesBackground of The Study: Influence of Packaging of Cadbury Products On Consumer Purchase DecisionBharath KNNo ratings yet

- (Sec D) Report File On CadburyDocument14 pages(Sec D) Report File On Cadburyavinashchandel2k21No ratings yet

- Cadbury IndiaDocument25 pagesCadbury IndiaRaj MaisheriNo ratings yet

- Rough Draft MobdalexDocument62 pagesRough Draft MobdalexTijo ThomasNo ratings yet

- Marketing Management Project Final VersionDocument34 pagesMarketing Management Project Final VersionSaradha NandhiniNo ratings yet

- Chocolate Industry FinalDocument19 pagesChocolate Industry FinalLakshmi Kapoor100% (1)

- Entreprenial Strategy For A Chocolate CompanyDocument44 pagesEntreprenial Strategy For A Chocolate CompanyPooja MoreNo ratings yet

- Group 2Document23 pagesGroup 2Muhammad FarhanNo ratings yet

- Declaration: MARKETING STRATEGY" Is An Academic Work Done by Gagan Walia SubmittedDocument37 pagesDeclaration: MARKETING STRATEGY" Is An Academic Work Done by Gagan Walia SubmittedDeepanshu SharmaNo ratings yet

- Chocolate Industry 2013 MRP 3Document82 pagesChocolate Industry 2013 MRP 3Hirensinh Gadhavi100% (1)

- 710 1361 1 SMDocument12 pages710 1361 1 SMAngeline TanriNo ratings yet

- Confectionery IndustryDocument9 pagesConfectionery IndustryRashid JamalNo ratings yet

- Nestle ReportDocument61 pagesNestle ReportshipragovilNo ratings yet

- Cadbury Dairy MilkDocument66 pagesCadbury Dairy MilkAniket AgrahariNo ratings yet

- Project On Chocolate IndustryDocument20 pagesProject On Chocolate IndustryCongthu JosephNo ratings yet

- Relaunch Strategy of CadburyDocument22 pagesRelaunch Strategy of CadburyhatkarrohitNo ratings yet

- Synopsis ChocolatesDocument7 pagesSynopsis ChocolatesMohammad BilalNo ratings yet

- Purba 2018 IOP Conf. Ser. Earth Environ. Sci. 209 012011Document12 pagesPurba 2018 IOP Conf. Ser. Earth Environ. Sci. 209 012011donshaNo ratings yet

- UNIBIC Foods India PVT LTDDocument8 pagesUNIBIC Foods India PVT LTDkalimaniNo ratings yet

- Emerging Dairy Processing Technologies: Opportunities for the Dairy IndustryFrom EverandEmerging Dairy Processing Technologies: Opportunities for the Dairy IndustryNo ratings yet

- Food Industry 4.0: Unlocking Advancement Opportunities in the Food Manufacturing SectorFrom EverandFood Industry 4.0: Unlocking Advancement Opportunities in the Food Manufacturing SectorNo ratings yet

- Millets Value Chain for Nutritional Security: A Replicable Success Model from IndiaFrom EverandMillets Value Chain for Nutritional Security: A Replicable Success Model from IndiaNo ratings yet

- Technology of CheesemakingFrom EverandTechnology of CheesemakingBarry A. LawNo ratings yet

- Bioprocessing of Renewable Resources to Commodity BioproductsFrom EverandBioprocessing of Renewable Resources to Commodity BioproductsVirendra S. BisariaNo ratings yet

- Milk and Dairy Products as Functional FoodsFrom EverandMilk and Dairy Products as Functional FoodsAra KanekanianNo ratings yet

- Applicant DetailsDocument1 pageApplicant DetailsVaibhav WalkeNo ratings yet

- ICICI Prudential Advertisement Review and Song Par Bande Acche HaiDocument3 pagesICICI Prudential Advertisement Review and Song Par Bande Acche HaiVaibhav WalkeNo ratings yet

- Cost Estimation For Everest Cyber CaféDocument1 pageCost Estimation For Everest Cyber CaféVaibhav WalkeNo ratings yet

- Numerical SDocument13 pagesNumerical SVaibhav WalkeNo ratings yet

- Digital ElectronicsDocument9 pagesDigital ElectronicsmanikantamadetiNo ratings yet

- Cooling Tower Failure Report at IndogulfDocument17 pagesCooling Tower Failure Report at IndogulffarooqkhanerNo ratings yet

- FHD 821 E4Document4 pagesFHD 821 E4Mario UrsuNo ratings yet

- Tuguegarao Certificate of Non-Availability of Stocks: Product Code Product Description UOM PriceDocument7 pagesTuguegarao Certificate of Non-Availability of Stocks: Product Code Product Description UOM PriceDivina VidadNo ratings yet

- DLL - Mapeh 6 - Q3 - W9Document6 pagesDLL - Mapeh 6 - Q3 - W9Rodel Poblete100% (1)

- 033 BOD IncubatorDocument4 pages033 BOD Incubatorbhavna sharmaNo ratings yet

- Starz HDTV Schedule - January, 2006Document8 pagesStarz HDTV Schedule - January, 2006Ben YoderNo ratings yet

- Z Section PropertiesDocument6 pagesZ Section PropertiesMaheshNo ratings yet

- AISC Propiedades y Pesos v14 - TOTALDocument77 pagesAISC Propiedades y Pesos v14 - TOTALAlex RiosNo ratings yet

- Elevator PM ChecklistDocument12 pagesElevator PM ChecklistAndrew jacangNo ratings yet

- 3.12 Three Phase AC CircuitsDocument8 pages3.12 Three Phase AC CircuitsnathmanojNo ratings yet

- Driver Training ManualDocument24 pagesDriver Training ManualwingnutimagesNo ratings yet

- Lesson 3 - Advanced WordDocument39 pagesLesson 3 - Advanced WordRosa MasigonNo ratings yet

- Curriculum Vitae PDFDocument1 pageCurriculum Vitae PDFhafid anggitoNo ratings yet

- 31 SDMS 13Document27 pages31 SDMS 13I CNo ratings yet

- Tunnel Diodes Tunnel DiodesDocument15 pagesTunnel Diodes Tunnel DiodesMahy MagdyNo ratings yet

- Data Sheet, Gad, Sizing Calculation, Terminal Arrangement, Support Details of Bus Duct For New IntakeDocument2 pagesData Sheet, Gad, Sizing Calculation, Terminal Arrangement, Support Details of Bus Duct For New IntakeBasabRajNo ratings yet

- LF Pressed Chassis / Ferrite TF1530e: General SpecificationsDocument1 pageLF Pressed Chassis / Ferrite TF1530e: General SpecificationsStefanManoliiNo ratings yet

- Fire Protection SystemsDocument20 pagesFire Protection Systemsmauco lopezNo ratings yet

- Set 1Document8 pagesSet 1T Rakesh Kumar GCETNo ratings yet

- Martin Weatherill CV 4Document3 pagesMartin Weatherill CV 4Michelle MurphyNo ratings yet

- Katalog Plt111 1999 enDocument90 pagesKatalog Plt111 1999 enbajricaNo ratings yet

- Kafka PythonDocument84 pagesKafka PythonFrancisco_smtzNo ratings yet

- Dragon Box v11Document17 pagesDragon Box v11dermordNo ratings yet

- Forging New Generations of EngineersDocument16 pagesForging New Generations of EngineersSnehalPagdhune100% (1)

- Data Sheet: Wilo-Star-Z 25/6-3: Pump Curves Single-Phase CurrentDocument3 pagesData Sheet: Wilo-Star-Z 25/6-3: Pump Curves Single-Phase CurrentSenn OdrapmasdNo ratings yet

- CLARK CHALMERS, D. - The Extended MindDocument14 pagesCLARK CHALMERS, D. - The Extended MindVeronica GurgelNo ratings yet

- ACCX-KITCHENHOODS SPMDocument36 pagesACCX-KITCHENHOODS SPMDavina FristantryNo ratings yet

- Chapter 11 Prevention, Mitigation, & Monitoring Measures 4 PipelinesDocument17 pagesChapter 11 Prevention, Mitigation, & Monitoring Measures 4 PipelinesMAT-LIONNo ratings yet

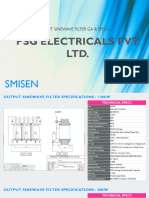

- Smisen Specs SCPL - 23-24 - SPC - PEPL - LCF - 01Document3 pagesSmisen Specs SCPL - 23-24 - SPC - PEPL - LCF - 01Glen CarterNo ratings yet

Indian Confectionery Industry On A Growth Trajectory Driven by Rising Consumerism and Young Consumers

Indian Confectionery Industry On A Growth Trajectory Driven by Rising Consumerism and Young Consumers

Uploaded by

Vaibhav WalkeOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Indian Confectionery Industry On A Growth Trajectory Driven by Rising Consumerism and Young Consumers

Indian Confectionery Industry On A Growth Trajectory Driven by Rising Consumerism and Young Consumers

Uploaded by

Vaibhav WalkeCopyright:

Available Formats

Indian confectionery industry on a growth trajectory driven by rising consumerism and young consumers

Monday, March 07, 2011 08:00 IST

Nandita Vijay, Bangalore

Indias confectionery market is set to witness robust growth in the coming years. The factors contributing to the growth are buoyancy in demand, increasing consumerism, dual family incomes and a rising young population. Confectionery categories are chocolate like eclairs and toffees, sugar confectionery or hard boiled candies lollipops, mints & lozenges, bubble gum and cereal bars. The major confectionery companies in India are Cadbury ( Dairy Milk, Perks, Gems, 5-Star celebrations, Bytes, Dairy Milk Eclairs, Eclairs Crunch, Halls, Bubbaloo Bubblegum), Nestle(Kit Kat, Kit Kat Chunky, Munch, Munch Pop Choc and Milkybar Crispy Wafer), Parle (Simply Imlee), HUL (ChocoMax and Max Magic candy), Perfetti ( Centre Shock, Happydent White, Alpenliebe, Big Babol, Chloromint and Cofitos) and Candico (Mint-O and Loco Poco). It has been reported that the countrys confectionery industry is the largest in the food processing segment. The market is estimated to be about Rs 1,400 crore, registering a growth of 9% per annum. According to Chetan Hanchate, director, Centre for Processed Foods, the Indian market for confectionery has been indicating robust action going by the frequent product launches, and consumer promotions by companies. Confectionery industry overview A major portion of the confectionery industry in India comprise the local subsidiaries of global confectionery majors like Perfetti, Lotte, Wrigley's and Cadbury. Cadbury India, the fully owned subsidiary of Kraft Foods Inc, estimates the total global confectionery market at Rs 41 billion with a volume turnover of about 2,23,500 tonnes per annum. The category is largely consumed in urban areas with a 73% skew to urban markets and a 27% to rural markets. Hard boiled candy accounts for 18%, Eclairs and Toffees account for 18%, Gums and Mints and lozenges are at par and account for 13%. Digestive Candies and Lollipops account for 2.0% share, respectively. The overall industry growth is estimated at 23% in the chocolates segment and sugar confectionery segment has declined by 19%. Giving an overview of the industry in India, a section of management students of the Indian Institute of Management, stated that the confectionery segment is keeping pace with the evolving new Indian consumer, who needs a toffee or a candy or a bubble gum to keep him company. Although the Indian confectionery market has several unorganised players, a lot of consolidation took place post 2005. It all began in June 2004, with the erstwhile Parry`s Confectionery, part of the Chennai-based Murugappa group, was bought over by Koreas Lotte India. This was followed by Godrej Foods & Beverages Limited which acquired Nutrine Confectionery Company Private Limited in June 2006. Close to the heels of this deal was a joint venture effort in April 2007, when the Hershey Company, North America's leading chocolate and confectionery manufacturer, announced the formation of Godrej Hershey Foods & Beverages Ltd., to manufacture and market confectionery across the country. Among the well-known national names are Candico which is engaged in the development of a range of products. Naturo Food & Fruit Products Pvt. Ltd in the outskirts of Bangalore is one of the largest Indian confectionery companies known for its innovative fruit based products. Its Fruit Bars range under the brand n ame Naturo offers a tasty, healthy and appetising fruit snack and is available in Apple, Mango, Strawberry & Orange pure fruit varieties. The fruit bars are manufactured in a captive and HACCP and BRC certified facility is totally natural with no sugar and preservatives added. The fruit bars are manufactured employing a unique retexturised process to retain the vital nutrients of the fruits, stated G Lakshminarayanan, senior vice-president, Naturo Food & Fruit Products Pvt. Ltd Pops Foods Products Private Limited manufactures a range of bubble gums Central Arecanut and Cocoa Marketing and Processing Co- operative Ltd (Campco) based at Mangalore which is producing chocolate for Cadbury-Kraft has now inked a pact with Karnataka Milk Federation to manufacture

chocolates at its facility. The company Campco produces all types of moulded chocolates along with semifinished products like cocoa butter and cocoa powder. Food research is open to assess the new product innovations which is a prime factor for the growth of the industry, stated Dr V Prakash, director, Central Food Technological Research Institute, Mysore . We have also developed a tamarind candy and transferred the technology to industry. At Defence Food Research Laboratory at Myore, efforts were on to develop a range of candies and fruit bars for the armed forces stationed in high altitudes, stated Dr AS Bawa. Trends in confectionery: It is observed by a section of food scientists from the University of Agricultural Sciences department of food innovation and research that the confectionery industry has achieved maturity. The growth is attributed through globalised efforts like mergers and acquisitions or joint development efforts. There is also the factor of rising incomes and affordability in many of the developing markets which indicate novel tastes and aspirations for newer confectionery. Another trend is the growing health consciousness which has led to the development of confectionary in low-fat, low-sugar, versions. There is also the inclination to look at products that are free from artificial colours, flavours and additives. This throws open business opportunities for development of ingredients using natural ingredients, stated experts at UAS. The confectionery sector has felt significant changes since a few years. Food consultants are attributing this to changing consumer consumption habits. Confectionery manufacturers are working to influence to healthconscious consumers with functional innovations, ensuring that they still continue to show the streak of active indulgence. Extensive product and market research is on to see that new products come in. Key growth opportunities for the industry are in categories of gum, chocolate and cereal bars, says Dr Prakash. Challenges in the confectionery industry The rising inflation and food prices together with the growing crude prices would impact the confectionery industry in the coming months. While cost of sugar is a concern, there is also the issue of working out costs in packaging driven by petroleum products as confectionery items are packaged in plastic packs. Therefore the industry will now need to work out a pricing due to big jumps in the cost of raw materials such as sugar which cannot be absorbed by the industry, stated observers.

You might also like

- Full Set of Marketing PlanDocument50 pagesFull Set of Marketing Planren_temanku82% (17)

- Advertisement Project: Submitted By: Nivedita.B Fin 1 Ss 10-12 IIPM BangaloreDocument36 pagesAdvertisement Project: Submitted By: Nivedita.B Fin 1 Ss 10-12 IIPM BangalorenivedhitaaNo ratings yet

- Cadbury Dairy MilkDocument52 pagesCadbury Dairy Milksingh.shekharsuman6788100% (1)

- Group C3Document23 pagesGroup C3Harsh SharmaNo ratings yet

- Chocolate Industry in IndiaDocument9 pagesChocolate Industry in IndiaHormazzNo ratings yet

- Marketing Project C3Document22 pagesMarketing Project C3Harsh SharmaNo ratings yet

- Cake Industry in IndiaDocument15 pagesCake Industry in IndiaGenesian Nikhilesh Pillay50% (2)

- Cadbury Dairy Milk ReportDocument52 pagesCadbury Dairy Milk Reportvebs123100% (1)

- ParleDocument46 pagesParleNikhil Arora100% (1)

- Team Project On Strategic Management by Team 1: Strategic Analysis of Mondelez (Cadbury)Document24 pagesTeam Project On Strategic Management by Team 1: Strategic Analysis of Mondelez (Cadbury)Vinayak SharmaNo ratings yet

- Introduction of IndustryDocument4 pagesIntroduction of IndustryVinayak SharmaNo ratings yet

- Business Strategy Assignment On "Sugar Boiled Confectionery"Document8 pagesBusiness Strategy Assignment On "Sugar Boiled Confectionery"Pawan VintuNo ratings yet

- Marketing ManagementDocument14 pagesMarketing ManagementKartikay Saraf Fic Aryabhatta100% (2)

- Project On ChocoDocument15 pagesProject On ChocoNilay SaxenaNo ratings yet

- A Study On The Chocolate Industry: Lucky Singh 05524001809 Bba (B & I) 3 SemDocument48 pagesA Study On The Chocolate Industry: Lucky Singh 05524001809 Bba (B & I) 3 SemGarima GuptaNo ratings yet

- Economic Importance of BakeryDocument11 pagesEconomic Importance of BakerynitEsh mElodyNo ratings yet

- MKT344.docx Final Project Shad and MahimaDocument4 pagesMKT344.docx Final Project Shad and MahimaKhondoker All Muktaddir Shad 2112328630No ratings yet

- Cadbury Dairy MilkDocument52 pagesCadbury Dairy MilkIONITA GABRIELNo ratings yet

- Chocolate Industry 2013 MRP 3 PDFDocument82 pagesChocolate Industry 2013 MRP 3 PDFShivam PandayNo ratings yet

- Marketing Report On Nestle & Cadbury (Shubhangi Malhotra)Document64 pagesMarketing Report On Nestle & Cadbury (Shubhangi Malhotra)shubhangiNo ratings yet

- Poject On Anmol BiscuitsDocument47 pagesPoject On Anmol Biscuitszishanmallick50% (6)

- Marketing Project - ChaocolatesDocument13 pagesMarketing Project - ChaocolatesVasundhara KaulNo ratings yet

- Research Project On CadburyDocument17 pagesResearch Project On CadburyHamzahKhan75% (4)

- Choclate IndustryDocument28 pagesChoclate IndustryAnkur PandeyNo ratings yet

- Custoomr Setisfection of Parle AgroDocument73 pagesCustoomr Setisfection of Parle AgroPrabhat sharmaNo ratings yet

- Rahul Raj 'Project Report On Amul'Document37 pagesRahul Raj 'Project Report On Amul'rahul khan93% (15)

- DBM Group 11Document21 pagesDBM Group 11Rahul RayavarapuNo ratings yet

- Chocolate Market in India: Facts & FiguresDocument4 pagesChocolate Market in India: Facts & FiguresKathir LoveNo ratings yet

- Background of The Study: Influence of Packaging of Cadbury Products On Consumer Purchase DecisionDocument74 pagesBackground of The Study: Influence of Packaging of Cadbury Products On Consumer Purchase DecisionBharath KNNo ratings yet

- (Sec D) Report File On CadburyDocument14 pages(Sec D) Report File On Cadburyavinashchandel2k21No ratings yet

- Cadbury IndiaDocument25 pagesCadbury IndiaRaj MaisheriNo ratings yet

- Rough Draft MobdalexDocument62 pagesRough Draft MobdalexTijo ThomasNo ratings yet

- Marketing Management Project Final VersionDocument34 pagesMarketing Management Project Final VersionSaradha NandhiniNo ratings yet

- Chocolate Industry FinalDocument19 pagesChocolate Industry FinalLakshmi Kapoor100% (1)

- Entreprenial Strategy For A Chocolate CompanyDocument44 pagesEntreprenial Strategy For A Chocolate CompanyPooja MoreNo ratings yet

- Group 2Document23 pagesGroup 2Muhammad FarhanNo ratings yet

- Declaration: MARKETING STRATEGY" Is An Academic Work Done by Gagan Walia SubmittedDocument37 pagesDeclaration: MARKETING STRATEGY" Is An Academic Work Done by Gagan Walia SubmittedDeepanshu SharmaNo ratings yet

- Chocolate Industry 2013 MRP 3Document82 pagesChocolate Industry 2013 MRP 3Hirensinh Gadhavi100% (1)

- 710 1361 1 SMDocument12 pages710 1361 1 SMAngeline TanriNo ratings yet

- Confectionery IndustryDocument9 pagesConfectionery IndustryRashid JamalNo ratings yet

- Nestle ReportDocument61 pagesNestle ReportshipragovilNo ratings yet

- Cadbury Dairy MilkDocument66 pagesCadbury Dairy MilkAniket AgrahariNo ratings yet

- Project On Chocolate IndustryDocument20 pagesProject On Chocolate IndustryCongthu JosephNo ratings yet

- Relaunch Strategy of CadburyDocument22 pagesRelaunch Strategy of CadburyhatkarrohitNo ratings yet

- Synopsis ChocolatesDocument7 pagesSynopsis ChocolatesMohammad BilalNo ratings yet

- Purba 2018 IOP Conf. Ser. Earth Environ. Sci. 209 012011Document12 pagesPurba 2018 IOP Conf. Ser. Earth Environ. Sci. 209 012011donshaNo ratings yet

- UNIBIC Foods India PVT LTDDocument8 pagesUNIBIC Foods India PVT LTDkalimaniNo ratings yet

- Emerging Dairy Processing Technologies: Opportunities for the Dairy IndustryFrom EverandEmerging Dairy Processing Technologies: Opportunities for the Dairy IndustryNo ratings yet

- Food Industry 4.0: Unlocking Advancement Opportunities in the Food Manufacturing SectorFrom EverandFood Industry 4.0: Unlocking Advancement Opportunities in the Food Manufacturing SectorNo ratings yet

- Millets Value Chain for Nutritional Security: A Replicable Success Model from IndiaFrom EverandMillets Value Chain for Nutritional Security: A Replicable Success Model from IndiaNo ratings yet

- Technology of CheesemakingFrom EverandTechnology of CheesemakingBarry A. LawNo ratings yet

- Bioprocessing of Renewable Resources to Commodity BioproductsFrom EverandBioprocessing of Renewable Resources to Commodity BioproductsVirendra S. BisariaNo ratings yet

- Milk and Dairy Products as Functional FoodsFrom EverandMilk and Dairy Products as Functional FoodsAra KanekanianNo ratings yet

- Applicant DetailsDocument1 pageApplicant DetailsVaibhav WalkeNo ratings yet

- ICICI Prudential Advertisement Review and Song Par Bande Acche HaiDocument3 pagesICICI Prudential Advertisement Review and Song Par Bande Acche HaiVaibhav WalkeNo ratings yet

- Cost Estimation For Everest Cyber CaféDocument1 pageCost Estimation For Everest Cyber CaféVaibhav WalkeNo ratings yet

- Numerical SDocument13 pagesNumerical SVaibhav WalkeNo ratings yet

- Digital ElectronicsDocument9 pagesDigital ElectronicsmanikantamadetiNo ratings yet

- Cooling Tower Failure Report at IndogulfDocument17 pagesCooling Tower Failure Report at IndogulffarooqkhanerNo ratings yet

- FHD 821 E4Document4 pagesFHD 821 E4Mario UrsuNo ratings yet

- Tuguegarao Certificate of Non-Availability of Stocks: Product Code Product Description UOM PriceDocument7 pagesTuguegarao Certificate of Non-Availability of Stocks: Product Code Product Description UOM PriceDivina VidadNo ratings yet

- DLL - Mapeh 6 - Q3 - W9Document6 pagesDLL - Mapeh 6 - Q3 - W9Rodel Poblete100% (1)

- 033 BOD IncubatorDocument4 pages033 BOD Incubatorbhavna sharmaNo ratings yet

- Starz HDTV Schedule - January, 2006Document8 pagesStarz HDTV Schedule - January, 2006Ben YoderNo ratings yet

- Z Section PropertiesDocument6 pagesZ Section PropertiesMaheshNo ratings yet

- AISC Propiedades y Pesos v14 - TOTALDocument77 pagesAISC Propiedades y Pesos v14 - TOTALAlex RiosNo ratings yet

- Elevator PM ChecklistDocument12 pagesElevator PM ChecklistAndrew jacangNo ratings yet

- 3.12 Three Phase AC CircuitsDocument8 pages3.12 Three Phase AC CircuitsnathmanojNo ratings yet

- Driver Training ManualDocument24 pagesDriver Training ManualwingnutimagesNo ratings yet

- Lesson 3 - Advanced WordDocument39 pagesLesson 3 - Advanced WordRosa MasigonNo ratings yet

- Curriculum Vitae PDFDocument1 pageCurriculum Vitae PDFhafid anggitoNo ratings yet

- 31 SDMS 13Document27 pages31 SDMS 13I CNo ratings yet

- Tunnel Diodes Tunnel DiodesDocument15 pagesTunnel Diodes Tunnel DiodesMahy MagdyNo ratings yet

- Data Sheet, Gad, Sizing Calculation, Terminal Arrangement, Support Details of Bus Duct For New IntakeDocument2 pagesData Sheet, Gad, Sizing Calculation, Terminal Arrangement, Support Details of Bus Duct For New IntakeBasabRajNo ratings yet

- LF Pressed Chassis / Ferrite TF1530e: General SpecificationsDocument1 pageLF Pressed Chassis / Ferrite TF1530e: General SpecificationsStefanManoliiNo ratings yet

- Fire Protection SystemsDocument20 pagesFire Protection Systemsmauco lopezNo ratings yet

- Set 1Document8 pagesSet 1T Rakesh Kumar GCETNo ratings yet

- Martin Weatherill CV 4Document3 pagesMartin Weatherill CV 4Michelle MurphyNo ratings yet

- Katalog Plt111 1999 enDocument90 pagesKatalog Plt111 1999 enbajricaNo ratings yet

- Kafka PythonDocument84 pagesKafka PythonFrancisco_smtzNo ratings yet

- Dragon Box v11Document17 pagesDragon Box v11dermordNo ratings yet

- Forging New Generations of EngineersDocument16 pagesForging New Generations of EngineersSnehalPagdhune100% (1)

- Data Sheet: Wilo-Star-Z 25/6-3: Pump Curves Single-Phase CurrentDocument3 pagesData Sheet: Wilo-Star-Z 25/6-3: Pump Curves Single-Phase CurrentSenn OdrapmasdNo ratings yet

- CLARK CHALMERS, D. - The Extended MindDocument14 pagesCLARK CHALMERS, D. - The Extended MindVeronica GurgelNo ratings yet

- ACCX-KITCHENHOODS SPMDocument36 pagesACCX-KITCHENHOODS SPMDavina FristantryNo ratings yet

- Chapter 11 Prevention, Mitigation, & Monitoring Measures 4 PipelinesDocument17 pagesChapter 11 Prevention, Mitigation, & Monitoring Measures 4 PipelinesMAT-LIONNo ratings yet

- Smisen Specs SCPL - 23-24 - SPC - PEPL - LCF - 01Document3 pagesSmisen Specs SCPL - 23-24 - SPC - PEPL - LCF - 01Glen CarterNo ratings yet