Professional Documents

Culture Documents

Accountinator Spreadsheet1

Accountinator Spreadsheet1

Uploaded by

GeneVive MendozaCopyright:

Available Formats

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5822)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- 102 Free Master Card For AccountsDocument2 pages102 Free Master Card For AccountsFairdeal Auto40% (5)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- PGL Payor Draft NSJ - 6Document15 pagesPGL Payor Draft NSJ - 6Kicki Andersson100% (1)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Features Common To All ForecastsDocument5 pagesFeatures Common To All ForecastsGeneVive Mendoza40% (5)

- ReactionDocument1 pageReactionGeneVive MendozaNo ratings yet

- G Mango Accounting Pack System v7 2Document13 pagesG Mango Accounting Pack System v7 2GeneVive MendozaNo ratings yet

- Printable MASDocument5 pagesPrintable MASGeneVive MendozaNo ratings yet

- Ethiopia Fiscal Guide 2019Document12 pagesEthiopia Fiscal Guide 2019EmshawNo ratings yet

- Colleges Manila Sy 2024 2025 College of Arts SciencesDocument1 pageColleges Manila Sy 2024 2025 College of Arts SciencesReianne GatmaitanNo ratings yet

- The Negotiable Instruments Act, 1881Document55 pagesThe Negotiable Instruments Act, 1881meghna_mg8780% (5)

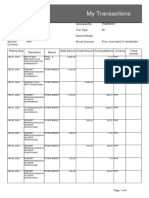

- My Transactions PDFDocument6 pagesMy Transactions PDFgeorgina woelkeNo ratings yet

- 2012 Tea Party Patriots TPP 2012 Form 990 Public InspectionDocument50 pages2012 Tea Party Patriots TPP 2012 Form 990 Public InspectiontexasgaltNo ratings yet

- Contract To SellDocument4 pagesContract To Sellthedoodlbot100% (1)

- This Study Resource Was: Discussion Questions (3 Points Each)Document9 pagesThis Study Resource Was: Discussion Questions (3 Points Each)cykenNo ratings yet

- Tutorial 8Document3 pagesTutorial 8Aaron Tan Wayne JieNo ratings yet

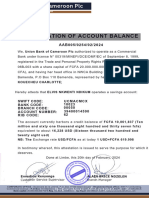

- Attn: The Branch Manager: Plot X, XXXX XXXXX Street, Victoria Island, LagosDocument1 pageAttn: The Branch Manager: Plot X, XXXX XXXXX Street, Victoria Island, LagosTimiNo ratings yet

- Servers As Permanent Establishments - Tax ProjectDocument18 pagesServers As Permanent Establishments - Tax ProjectPranay GovilNo ratings yet

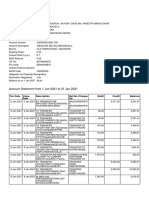

- Sbi Account Jan 2021Document2 pagesSbi Account Jan 2021Manoj GaurNo ratings yet

- Work ExperienceDocument3 pagesWork ExperienceMarinel LadreraNo ratings yet

- Accreditation Fees and Refund PolicyDocument3 pagesAccreditation Fees and Refund PolicyANANTKUMAR GUJARNo ratings yet

- Confirmation For Booking ID # 904851036Document1 pageConfirmation For Booking ID # 904851036rebecca evangelistaNo ratings yet

- UBC Bank StatementDocument2 pagesUBC Bank Statementjeffersonmisnerdnn80No ratings yet

- Learning Resource 11 Jerald Jay CatacutanDocument8 pagesLearning Resource 11 Jerald Jay CatacutanRemedios Capistrano CatacutanNo ratings yet

- 8863 PDFDocument1 page8863 PDFmalar studioNo ratings yet

- Instructions ITR2 AY2021 22Document125 pagesInstructions ITR2 AY2021 22Help Tubestar CrewNo ratings yet

- Can You Deduct Business Loans ExpensesDocument9 pagesCan You Deduct Business Loans ExpensesJulie Ann SisonNo ratings yet

- Internal Revenue Allotment DependencyDocument16 pagesInternal Revenue Allotment DependencyKim SisonNo ratings yet

- National Initiative For Artificial Intelligence & SecurityDocument1 pageNational Initiative For Artificial Intelligence & SecurityHasaan HussainNo ratings yet

- Payroll Accounting 2014 Form1040 Ch4Document4 pagesPayroll Accounting 2014 Form1040 Ch4DanCoppeNo ratings yet

- Export of Service Rules, 2005Document2 pagesExport of Service Rules, 2005mads70No ratings yet

- Tax Invoice: Mudassi R Syed ZaidiDocument2 pagesTax Invoice: Mudassi R Syed ZaidiManoj KumarNo ratings yet

- IT Return IndividualDocument42 pagesIT Return IndividualAllanNo ratings yet

- Tax HeavenDocument8 pagesTax HeavenAlinaNo ratings yet

- Dissertation Report ON " GST and GST Suvidha Kendra " (Research Work)Document57 pagesDissertation Report ON " GST and GST Suvidha Kendra " (Research Work)Pinkey KumariNo ratings yet

- Invoice 110945 SHIVAM JAISWALDocument1 pageInvoice 110945 SHIVAM JAISWALShivam JaiswalNo ratings yet

Accountinator Spreadsheet1

Accountinator Spreadsheet1

Uploaded by

GeneVive MendozaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accountinator Spreadsheet1

Accountinator Spreadsheet1

Uploaded by

GeneVive MendozaCopyright:

Available Formats

In balance?

Date

Explanation

Cash

Sales

OK

OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK

Totals

Opening Balance 9/20/2013 Sales 9/21/2013 Cost of goods sold

35,000.00

10,000.00 15,000.00 10,000.00

19,500.00

10,000.00 9,500.00

OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK

OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK

OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK

OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK

OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK

OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK

Returns and allowances

Cost of goods sold

Other income

Advertising

Car & truck expenses

(5,000.00)

(5,000.00)

0.00

500.00

0.00

0.00

500.00

Commissions & fees

Contract labor

Depletion

Depreciation & Employee benefit section 179 programs expense deduction

0.00

0.00

0.00

0.00

0.00

Insurance (other than health)

Mortgage interest

Other interest

Legal & professional services

Office expense

0.00

0.00

0.00

0.00

0.00

Pension & profitsharing plans

Rent/lease of vehicles, machinery & equipment

Rent/lease of other business property

Repairs & maintenance

Supplies

0.00

0.00

0.00

0.00

0.00

Taxes and Licenses

Travel

Deductible meals and entertainment

Utilities

Wages

0.00

0.00

0.00

0.00

0.00

Other expenses

Specify other expenses

0.00

Accountinator Simple Bookkeeping www.accountinator.com

Cash balance Sales Returns and allowances Cost of goods sold Other income Advertising Car & truck expenses Commissions & fees Contract labor Depletion Depreciation & 179 expense deduction Employee benefit programs Insurance Mortgage interest Other interest Legal & professional services Office expense Pension & profit-sharing plans Rent/lease of vehicles, mach & equip Rent/lease of other business property Repairs & maintenance Supplies Taxes & licenses Travel Deductible meals & entertainment Utilities Wages Other expense Net income

35,000.00 19,500.00 5,000.00 0.00 500.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 25,000.00

Accountinator Simple Bookkeeping Spreadsheet A simple, free and quick way to keep track of your home business's transactions Works for any unincorporated sole proprietor business in the US with less than 355 transactions/year. More information at: www.accountinator.com Simple Instructions 1. In the Accounts page, enter your beginning bank balance in the "Cash" column under "Opening Balance." For each transaction: 2. Enter the date under the "Date" column. 3. Enter a description in the "Description" column. If the transaction is a check written, include the check number. 4. Enter the amount of the transaction under "Cash." Enter receipts as positive and payments as negative. 5. Classify the transaction by entering the amount in the appropriate column ("Sales," "Advertising expense," etc.) Go to the following IRS instruction for more information about classifying expenses. http://www.irs.gov/pub/irs-pdf/i1040sc.pdf 6. If the first column says "OK," then you're in balance. If it says "Oops," then double-check your numbers. Simple Information To check out your cash balance and profitability, click on the "Simple Report" tab below.

Warning! Take proper precautions to keep your account information private.

File updated April 21, 2013

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5822)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- 102 Free Master Card For AccountsDocument2 pages102 Free Master Card For AccountsFairdeal Auto40% (5)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- PGL Payor Draft NSJ - 6Document15 pagesPGL Payor Draft NSJ - 6Kicki Andersson100% (1)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Features Common To All ForecastsDocument5 pagesFeatures Common To All ForecastsGeneVive Mendoza40% (5)

- ReactionDocument1 pageReactionGeneVive MendozaNo ratings yet

- G Mango Accounting Pack System v7 2Document13 pagesG Mango Accounting Pack System v7 2GeneVive MendozaNo ratings yet

- Printable MASDocument5 pagesPrintable MASGeneVive MendozaNo ratings yet

- Ethiopia Fiscal Guide 2019Document12 pagesEthiopia Fiscal Guide 2019EmshawNo ratings yet

- Colleges Manila Sy 2024 2025 College of Arts SciencesDocument1 pageColleges Manila Sy 2024 2025 College of Arts SciencesReianne GatmaitanNo ratings yet

- The Negotiable Instruments Act, 1881Document55 pagesThe Negotiable Instruments Act, 1881meghna_mg8780% (5)

- My Transactions PDFDocument6 pagesMy Transactions PDFgeorgina woelkeNo ratings yet

- 2012 Tea Party Patriots TPP 2012 Form 990 Public InspectionDocument50 pages2012 Tea Party Patriots TPP 2012 Form 990 Public InspectiontexasgaltNo ratings yet

- Contract To SellDocument4 pagesContract To Sellthedoodlbot100% (1)

- This Study Resource Was: Discussion Questions (3 Points Each)Document9 pagesThis Study Resource Was: Discussion Questions (3 Points Each)cykenNo ratings yet

- Tutorial 8Document3 pagesTutorial 8Aaron Tan Wayne JieNo ratings yet

- Attn: The Branch Manager: Plot X, XXXX XXXXX Street, Victoria Island, LagosDocument1 pageAttn: The Branch Manager: Plot X, XXXX XXXXX Street, Victoria Island, LagosTimiNo ratings yet

- Servers As Permanent Establishments - Tax ProjectDocument18 pagesServers As Permanent Establishments - Tax ProjectPranay GovilNo ratings yet

- Sbi Account Jan 2021Document2 pagesSbi Account Jan 2021Manoj GaurNo ratings yet

- Work ExperienceDocument3 pagesWork ExperienceMarinel LadreraNo ratings yet

- Accreditation Fees and Refund PolicyDocument3 pagesAccreditation Fees and Refund PolicyANANTKUMAR GUJARNo ratings yet

- Confirmation For Booking ID # 904851036Document1 pageConfirmation For Booking ID # 904851036rebecca evangelistaNo ratings yet

- UBC Bank StatementDocument2 pagesUBC Bank Statementjeffersonmisnerdnn80No ratings yet

- Learning Resource 11 Jerald Jay CatacutanDocument8 pagesLearning Resource 11 Jerald Jay CatacutanRemedios Capistrano CatacutanNo ratings yet

- 8863 PDFDocument1 page8863 PDFmalar studioNo ratings yet

- Instructions ITR2 AY2021 22Document125 pagesInstructions ITR2 AY2021 22Help Tubestar CrewNo ratings yet

- Can You Deduct Business Loans ExpensesDocument9 pagesCan You Deduct Business Loans ExpensesJulie Ann SisonNo ratings yet

- Internal Revenue Allotment DependencyDocument16 pagesInternal Revenue Allotment DependencyKim SisonNo ratings yet

- National Initiative For Artificial Intelligence & SecurityDocument1 pageNational Initiative For Artificial Intelligence & SecurityHasaan HussainNo ratings yet

- Payroll Accounting 2014 Form1040 Ch4Document4 pagesPayroll Accounting 2014 Form1040 Ch4DanCoppeNo ratings yet

- Export of Service Rules, 2005Document2 pagesExport of Service Rules, 2005mads70No ratings yet

- Tax Invoice: Mudassi R Syed ZaidiDocument2 pagesTax Invoice: Mudassi R Syed ZaidiManoj KumarNo ratings yet

- IT Return IndividualDocument42 pagesIT Return IndividualAllanNo ratings yet

- Tax HeavenDocument8 pagesTax HeavenAlinaNo ratings yet

- Dissertation Report ON " GST and GST Suvidha Kendra " (Research Work)Document57 pagesDissertation Report ON " GST and GST Suvidha Kendra " (Research Work)Pinkey KumariNo ratings yet

- Invoice 110945 SHIVAM JAISWALDocument1 pageInvoice 110945 SHIVAM JAISWALShivam JaiswalNo ratings yet