Professional Documents

Culture Documents

New Form 2550 Q - Quarterly VAT Return P 1-2 (2005 Version)

New Form 2550 Q - Quarterly VAT Return P 1-2 (2005 Version)

Uploaded by

Michelle G. MinorOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

New Form 2550 Q - Quarterly VAT Return P 1-2 (2005 Version)

New Form 2550 Q - Quarterly VAT Return P 1-2 (2005 Version)

Uploaded by

Michelle G. MinorCopyright:

Available Formats

Schedule 1

BIR Form 2550Q - Sept. 2005 (ENCS) Page 2 Schedule of Sales/Receipts and Output Tax (Attach additional sheet, if necessary) Amount of Sales/Receipts Output Tax Industries Covered by VAT ATC For the Quarter For the Quarter

To Item 15A/B Purchases/Importation of Capital Goods (Aggregate Amount Not Exceeding P1 Million) (Attach additional sheet, if necessary) Schedule 2 Date Amount Description Input Tax Purchased (Net of VAT) (A) (B) (C) (D)

Total (To Item 21A/B) Purchases/Importation of Capital Goods (Aggregate Amount Exceeds P1 Million) (Attach additional sheet, if necessary) Schedule 3 A) Purchases/Importations This Quarter Recognized Life Allowable Input Balance of Input Tax Date Amount Input Tax (In Months) to be carried to Est. Life Tax for the Period * Description (Cx10%) (in months) Useful life or 60 mos. (Net of VAT) Next Period Purchased (whichever is shorter) (D) less (G) (A) (B) (C ) (E) (F) (G) (H) (D)

Total (To Item 21C/D) B) Purchases/Importations Previous Quarters Date Purchased (A) Description (B) Amount (Net of VAT) (C ) Balance of Input Recognized Life (In Est. Life Tax from Months) (in months) Previous Period Remaining Life (E) (F) (D)

Allowable Input Tax for the Period * Balance of Input Tax to be carried to Next Period

(G)

(D) less (G) (H)

Total C) Total Input Tax Deferred for future period from current and previous purchases (To Item 23A) * - D divided by F multiplied by Number of months in use during the quarter Input Tax Attributable to Sale to Government Schedule 4 Input Tax directly attributable to sale to government Add: Ratable portion of Input Tax not directly attributable to any activity: Taxable sales to government Amount of Input Tax not x Total Sales directly attributable Total Input Tax attributable to sale to government Less: Standard Input Tax to sale to government Input Tax on Sale to Govt. closed to expense (To Item 23B) Input Tax Attributable to Exempt Sales Schedule 5 Input Tax directly attributable to exempt sale Add: Ratable portion of Input Tax not directly attributable to any activity: Taxable exempt sale Amount of Input Tax not x Total Sales directly attributable Total Input Tax attributable to exempt sale (To Item 23C) Input Tax in Excess of 70% Cap Schedule 6 Total Input Tax Less: 70% of Total Output Tax (70% X P_________________ ) Input Tax in Excess of 70% Cap (To Item 23E) Schedule 7 Period Covered Tax Withheld Claimed as Tax Credit (Attach additional sheets, if necessary) Name of Withholding Agent Income Payment Total Applied Tax Withheld Previous 2 mos. Current mo.

Total (To Item 26B) Schedule 8 Period Name of Miller Covered

Schedule of Advance Payment (Attach additional sheets, if necessary) Name of Taxpayer Official Receipt Amount Applied Number Paid Previous 2 mos. Current mo.

Total (To Item 26C) Schedule 9 Period Covered

VAT Withheld on Sales to Government (Attach additional sheets, if necessary) Name of Withholding Agent Income Payment Total Applied Tax Withheld Previous 2 mos. Current mo.

Total (To Item 26D)

BIR Form 2550Q - Sept. 2005 (ENCS) Output Tax For the Quarter

Page 2

Amount Not Exceeding P1 Million) (Attach additional sheet, if necessary) Input Tax (D)

Balance of Input Tax to be carried to Next Period

(D) less (G) (H)

Balance of Input Tax to be carried to Next Period

(D) less (G) (H)

Tax Credit (Attach additional sheets, if necessary) Applied Current mo.

nce Payment (Attach additional sheets, if necessary) Applied Current mo.

Government (Attach additional sheets, if necessary) Applied Current mo.

(To be filled up by the BIR)

DLN:

ANNEX A PSIC:

Republika ng Pilipinas Kagawaran ng Pananalapi

Kawanihan ng Rentas Internas

Quarterly Value-Added Tax Return (Cumulative For 3 Months)

3rd 3 Return From Period 4th (mm/dd/yy) To 8 No. of sheets 9 Line of Business 11 13 If yes, specify No Computation of Tax (Attach additional sheets, if necessary) Sales/Receipts for the Quarter (Exclusive of VAT)

BIR Form No.

2550Q

September 2005 (ENCS)

Ye 5 Short Period No Return? 4 Amended Return? Telephone Number Zip Code

Fill in all applicable spaces. Mark all appropriate boxes with an X. 1st 1 For the Calendar Fiscal 2 Quarter Year Ended ( MM / YYYY ) 2nd 6 TIN 7 RDO

Code attached 10 Taxpayer's Name (For Individual)Last Name, First Name, Middle Name/(For Non-individual) Registered Name 12 Registered Address 14 Are you availing of tax relief under Special Law or International Tax Treaty? Yes Part II

Output Tax Due for the Quarter 15A Vatable Sales/Receipt- Private (Sch.1) 15B 16A Sale to Government 16B 17 Zero Rated Sales/Receipts 18 Exempt Sales/Receipts 19A Total Sales/Receipts and Output Tax Due 19B Less: Allowable Input Tax 20A Input Tax Carried Over from Previous Quarter / Excess over 70% of Output VAT 20A 20B Input Tax Deferred on Capital Goods Exceeding P1Million from Previous Quarter 20B 20C Transitional Input Tax 20C 20D Presumptive Input Tax 20D 20E Others 20E 20F Total (Sum of Item 20A, 20B,20C,20D &20E) 20F Current Transactions Purchases 21 21A/B Purchase of Capital Goods not exceeding P1Million (see sch.2) 21A 21B 21C/D Purchase of Capital Goods exceeding P1Million (see sch.3) 21C 21D 21E/F Domestic Purchases of Goods Other than Capital Goods 21E 21F 21G/H Importation of Goods Other than Capital Goods 21G 21H 21I/J Domestic Purchase of Services 21I 21J 21K/L Services rendered by Non-residents 21K 21L 21M Purchases Not Qualified for Input Tax 21M 21N/O Others 21N 21O 21P Total Current Purchases (Sum of Item 21A,21C,21E,21G,21I,21K,21M&21N) 21P 22 Total Available Input Tax (Sum of Item 20F, 21B,21D,21F,21H,21J,21L&21O) 22 23 Less: Deductions from Input Tax 23A Input Tax on Purchases of Capital Goods exceeding P1Million deferred for the succeeding period (Sch.3) 23A 23B Input Tax on Sale to Govt. closed to expense (Sch.4) 23B 23C Input Tax allocable to Exempt Sales (Sch.5) 23C 23D VAT Refund/TCC claimed 23D 23E Input Tax in excess of 70% cap to be carried to next period (Sch.6) 23E 23F Others 23F 23G Total (Sum of Item 23A, 23B,23C,23D,23E & 23F) 23G 24 Total Allowable Input Tax (Item 22 less Item 23G) 24 25 Net VAT Payable (Item 19B less Item 24) 25 Less: Tax Credits/Payments 26 26A Monthly VAT Payments - previous two months 26A 26B Creditable Value-Added Tax Withheld (Sch. 7) 26B 26C Advance Payments (Sch.8) 26C 26D VATwithheld on Sales to Government (Sch.9) 26D 26E VAT paid in return previously filed, if this is an amended return 26E 26F Others 26F 26G Total Tax Credits/Payments (Sum of Item 26A,26B,26C,26D,26E & 26F) 26G 27 Tax Still Payable/(Overpayment)(Item 25 less Item 26G) 27 Surcharge Interest Compromise 28 Add: Penalties 28A 28B 28C 28D 29 Total Amount Payable/(Overpayment) (Sum of Item 27 & 28D) 29 I declare, under the penalties of perjury, that this return has been made in good faith, verified by me, and to the best of my knowledge, and belief, is true and correct, pursuant to the provisions of the National Internal Revenue Code, as amended, and the regulations issued under authority thereof. 30 31 15 16 17 18 19 20

President/Vice President/Principal Officer/Accredited Tax Agent/ Authorized Representative/Taxpayer (Signature Over Printed Name) Title/Position of Signatory Tax Agent Acc. No./Atty's Roll No.(if applicable) TIN of Signatory Date of Issuance Date of Expiry Treasurer/Assistant Treasurer (Signature Over Printed Name) Title/Position of Signatory TIN of Signatory

Part III Drawee Bank/ Particulars Agency 32 Cash/Bank 32A Debit Memo 33 Check 33A 34 Tax Debit Memo 35 Others 35A Number

32B 33B 34A 35B

Details of Payment Date MM DD YYYY

32C 33C 34B 35C 32D 33D 34C 35D

Amount

Stamp of Receiving Office/AAB and Date of Receipt

(RO's Signature/ Bank Teller's Initial)

Machine Validation (if filed with an accredited agent bank)/Revenue Official Receipt Details (If not filed with an Authorized Agent Bank)

ANNEX A

2550Q

(ENCS)

Yes No

Tax (Attach additional sheets, if necessary)

Output Tax Due for the Quarter

made in good faith, verified by me, and to the best of my knowledge, and belief, l Revenue Code, as amended, and the regulations issued under authority thereof.

Stamp of Receiving Office/AAB and Date of Receipt

(RO's Signature/ Bank Teller's Initial)

You might also like

- MorrisBreann Fall 2020 MGMT 343 Exam #1Document4 pagesMorrisBreann Fall 2020 MGMT 343 Exam #1Breann MorrisNo ratings yet

- New Form 2550 M - Monthly VAT Return P 1-2Document3 pagesNew Form 2550 M - Monthly VAT Return P 1-2Pearl Reyes64% (14)

- Hamid Construction Limited ProfileDocument17 pagesHamid Construction Limited ProfileAqib RafiNo ratings yet

- AGENCYDocument20 pagesAGENCYJoshua CabinasNo ratings yet

- Hampton FreezeDocument19 pagesHampton FreezePurbo KusumoNo ratings yet

- MEMO102018-116 Update On Unilogix Supplied RTE and PastriesDocument4 pagesMEMO102018-116 Update On Unilogix Supplied RTE and PastriesJoseph PaoloNo ratings yet

- Sample SalnDocument3 pagesSample SalnAN NANo ratings yet

- NNNDocument4 pagesNNNJemely BagangNo ratings yet

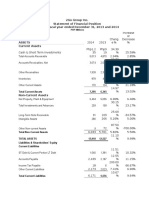

- 2go Group IncDocument7 pages2go Group IncSheenah FerolinoNo ratings yet

- Unit4 ActivityDocument11 pagesUnit4 ActivityJasper John NacuaNo ratings yet

- Sanitary PermitDocument1 pageSanitary PermitCPDOlucena100% (1)

- Drill Contract 1 PDFDocument2 pagesDrill Contract 1 PDFweqweqw0% (1)

- LGU NGAS Chapter 1 and 2Document24 pagesLGU NGAS Chapter 1 and 2Lail PDNo ratings yet

- Sales Part 8: Coverage of Discussion: Obligations of The VendeeDocument7 pagesSales Part 8: Coverage of Discussion: Obligations of The VendeeAmie Jane MirandaNo ratings yet

- CALANTOC - Motion To Dismiss (Improper Venue)Document8 pagesCALANTOC - Motion To Dismiss (Improper Venue)Alfonso DimlaNo ratings yet

- Assessment & AuditDocument17 pagesAssessment & AuditRam SewakNo ratings yet

- Required: 1. Predetermined Overhead Rate For The YearDocument3 pagesRequired: 1. Predetermined Overhead Rate For The YearEevan SalazarNo ratings yet

- Income Taxation IndividualDocument6 pagesIncome Taxation IndividualJessa BeloyNo ratings yet

- Cash FlowDocument12 pagesCash FlowRozaimie Anzuar0% (1)

- 11 Accounting For Merchandising Businesses Part 1Document15 pages11 Accounting For Merchandising Businesses Part 1Aple Balisi100% (1)

- Ia2 Final Exam A Test Bank - CompressDocument32 pagesIa2 Final Exam A Test Bank - CompressFiona MiralpesNo ratings yet

- TB 16Document70 pagesTB 16Saliha BajwaNo ratings yet

- 03 - HO - Statement of Comprehensive IncomeDocument3 pages03 - HO - Statement of Comprehensive IncomeYoung MetroNo ratings yet

- Tariff and Customs CodeDocument30 pagesTariff and Customs CodeJulius AnthonyNo ratings yet

- PFRS 8 - Operating SegmentsDocument13 pagesPFRS 8 - Operating SegmentsYassi CurtisNo ratings yet

- Gbermic Internal Control CabreraDocument5 pagesGbermic Internal Control CabreraÌÐølJåyskëiUvNo ratings yet

- Tax TablesDocument6 pagesTax TablesChirrelyn Necesario SunioNo ratings yet

- Oblicon (Articles 1305 - 1415)Document9 pagesOblicon (Articles 1305 - 1415)SIMPAO, Ma. Kristine Mae C.No ratings yet

- InventoriesDocument6 pagesInventoriesheythereitsclaireNo ratings yet

- Agro IndustrialDocument14 pagesAgro IndustrialJerome ArtezaNo ratings yet

- Quanti Slide 7 Pert CPMDocument49 pagesQuanti Slide 7 Pert CPMRheanneNo ratings yet

- Diagnostic in Basic AccountingDocument5 pagesDiagnostic in Basic Accountingjapvivi cece100% (2)

- COMPILATION BAR QUESTIONS WEEKS 16, 17, & 18 - EXECUTIVE CLASS FINAL For PrintDocument123 pagesCOMPILATION BAR QUESTIONS WEEKS 16, 17, & 18 - EXECUTIVE CLASS FINAL For PrintEdeline Cosicol0% (1)

- Remedial Law - CRIM PRO (Pros. Centeno)Document61 pagesRemedial Law - CRIM PRO (Pros. Centeno)Eisley Sarzadilla-GarciaNo ratings yet

- Operation Assessment of Almont Inland Resort ButuanDocument54 pagesOperation Assessment of Almont Inland Resort ButuanBeberlie LapingNo ratings yet

- Pas 2Document7 pagesPas 2Justine VeralloNo ratings yet

- Rmo 01-90 - Amended Penalty ProvisionDocument14 pagesRmo 01-90 - Amended Penalty ProvisionRester John Nonato0% (1)

- Auditing Theory SalosagcolDocument4 pagesAuditing Theory SalosagcolRichard DuranNo ratings yet

- Wage Computation TableDocument1 pageWage Computation Tablecmv mendozaNo ratings yet

- Reviewer in LeasesDocument3 pagesReviewer in LeasesNicolaus CopernicusNo ratings yet

- Ground RentDocument13 pagesGround Rentsyed sardar hussain shah100% (1)

- Ais MidtermDocument5 pagesAis MidtermMosabAbuKhaterNo ratings yet

- Jeter Advanced Accounting 4eDocument14 pagesJeter Advanced Accounting 4eMinh NguyễnNo ratings yet

- Estate Tax Amnesty ActDocument10 pagesEstate Tax Amnesty ActJocelyn MendozaNo ratings yet

- Reviewer in Taxation Part III - Business Taxation (USC Fervid)Document11 pagesReviewer in Taxation Part III - Business Taxation (USC Fervid)Kim AranasNo ratings yet

- Deutsche Bank Ag Manila Branch Vs Commissioner of Internal Revenue (CIR) SUMMARYDocument4 pagesDeutsche Bank Ag Manila Branch Vs Commissioner of Internal Revenue (CIR) SUMMARYTinersNo ratings yet

- DILG Legal Opinions 201131 0f79dacaa3Document4 pagesDILG Legal Opinions 201131 0f79dacaa3Al SimbajonNo ratings yet

- Compliance RequirementsDocument27 pagesCompliance Requirementsedz_1pieceNo ratings yet

- FDNACCT - Quiz #1 - Set A - Answer KeyDocument4 pagesFDNACCT - Quiz #1 - Set A - Answer KeyIchi HasukiNo ratings yet

- Shiena Talamor - UNIT II Activity Determining Exchange RateDocument7 pagesShiena Talamor - UNIT II Activity Determining Exchange Ratejonalyn sanggutanNo ratings yet

- Pilipinas Shell Petroleum CorporationDocument24 pagesPilipinas Shell Petroleum CorporationGodofredo SabadoNo ratings yet

- RR 14-02Document9 pagesRR 14-02matinikkiNo ratings yet

- Problem Solving No. 123Document5 pagesProblem Solving No. 123Christy Joy BarboNo ratings yet

- PAS 2 Inventories MeasurementDocument6 pagesPAS 2 Inventories Measurementcamille joi florendoNo ratings yet

- Chapter 1 - Fundamental Concepts of Donor's Taxation (Notes)Document3 pagesChapter 1 - Fundamental Concepts of Donor's Taxation (Notes)Angela Denisse FranciscoNo ratings yet

- Questions and CompilationDocument15 pagesQuestions and CompilationJude Thaddeus DamianNo ratings yet

- CHAPTER 12 - BOI and PEZA Registered EntitiesDocument19 pagesCHAPTER 12 - BOI and PEZA Registered EntitiesEmerwin Dela PeňaNo ratings yet

- DO 117 s2017Document24 pagesDO 117 s2017EFLORENDO25No ratings yet

- Quarterly Tax Value-Added Return: Kawanihan NG Rentas InternasDocument5 pagesQuarterly Tax Value-Added Return: Kawanihan NG Rentas InternasStephanie LayloNo ratings yet

- Monthly Value-Added Tax DeclarationDocument17 pagesMonthly Value-Added Tax DeclarationMIRAHNELNo ratings yet

- Monthly Value-Added Tax Declaration: Kawanihan NG Rentas InternasDocument4 pagesMonthly Value-Added Tax Declaration: Kawanihan NG Rentas InternasjamquintanesNo ratings yet

- Case Study On Cinderella Flora Farms PVT LTDDocument1 pageCase Study On Cinderella Flora Farms PVT LTDTosniwal and AssociatesNo ratings yet

- CONSTITUTIONDocument31 pagesCONSTITUTIONpcbranch.copNo ratings yet

- 35 Tayag Vs YusecoDocument2 pages35 Tayag Vs YusecoCollen Anne PagaduanNo ratings yet

- Local Government in The United StatesDocument21 pagesLocal Government in The United StatesAhmed Ali SiddiquiNo ratings yet

- EU Law EssayDocument5 pagesEU Law EssaySNo ratings yet

- Land Acquisition Act: Case StudyDocument8 pagesLand Acquisition Act: Case StudyArshi Khan100% (1)

- Royster Company v. United States, 479 F.2d 387, 4th Cir. (1973)Document7 pagesRoyster Company v. United States, 479 F.2d 387, 4th Cir. (1973)Scribd Government DocsNo ratings yet

- Management Representation LetterDocument2 pagesManagement Representation LetterMahediNo ratings yet

- People vs. GandiaDocument10 pagesPeople vs. GandiaNyanNo ratings yet

- Palweb E-000-000000010756012 17aug2022Document2 pagesPalweb E-000-000000010756012 17aug2022jonas paladioNo ratings yet

- Landbank v. DumlaoDocument13 pagesLandbank v. Dumlaoevelyn b t.No ratings yet

- The Philippine Statute of FraudsDocument3 pagesThe Philippine Statute of FraudsRowena Andaya100% (2)

- Summa Insurance Corporation vs. Court of Appeals and Metro Port Service, IncDocument1 pageSumma Insurance Corporation vs. Court of Appeals and Metro Port Service, IncErvin Franz Mayor CuevillasNo ratings yet

- Waiver and Constitutional RightsDocument6 pagesWaiver and Constitutional Rightspriyanka mohodNo ratings yet

- Spouses Reyes V Lozada 18Document2 pagesSpouses Reyes V Lozada 18Michael MartinNo ratings yet

- 2022 Philippine Government Directory of Agencies and OfficialsDocument293 pages2022 Philippine Government Directory of Agencies and Officialsamazing_pinoyNo ratings yet

- The American Occupation in The Philippines: Presented by LIKHADocument35 pagesThe American Occupation in The Philippines: Presented by LIKHAMarc Jiro Dalluay100% (2)

- Why Do We Need Political Parties?Document3 pagesWhy Do We Need Political Parties?AdyaNo ratings yet

- Estrella Vs ComElecDocument8 pagesEstrella Vs ComElecJohnday MartirezNo ratings yet

- Donoghue VDocument1 pageDonoghue VsaurabhNo ratings yet

- Minutes of The 21st UPCSC MeetingDocument6 pagesMinutes of The 21st UPCSC MeetingUPCebuStudentCouncilNo ratings yet

- Done Case DigestDocument7 pagesDone Case DigestKaye Villasana RiosNo ratings yet

- Gelito v. Heirs of Tirol, G.R. No. 196367, February 5, 2020Document3 pagesGelito v. Heirs of Tirol, G.R. No. 196367, February 5, 2020Robert EspinaNo ratings yet

- Yulito L. Gonzaga Adultery Aracelie TaleonDocument3 pagesYulito L. Gonzaga Adultery Aracelie TaleonWendell Maunahan100% (1)

- Final Memorial PetitionerDocument34 pagesFinal Memorial PetitionerasjaNo ratings yet

- United States v. Angel Padilla, AKA "Cuson" James Albizu, AKA "Pito" Roberto Colon, AKA "Papo" Darrell Campbell, AKA "D" Anthony Morales, AKA "Cuba", AKA "Tony Cuba" James Boggio, AKA "Jay" Dionisio Mojica, AKA "Little Johnny" Edwin Gonzalez, AKA "Peachy" Martin Kortright, AKA "Supreme" James Rodriguez, AKA "Spanky" Wilson Rodriguez, AKA "Opie" Rafael Torres, AKA "Ski" Steven Camacho, AKA "Spanky", AKA "Spank" Jaime Rodriguez, AKA "Jay" Anna Rodriguez, AKA "Momma Calderon" Ricardo Fontan Rafael Cruz Marvin Jenkins Joseph Pillot, AKA "Joey" Antonio Feliciano, AKA "Jamaican Tony", AKA "Pat A. Guess", AKA "Christopher Guest" and Trumont Williams, Angel Padilla, AKA "Cuson" Ivan Rodriguez, and Gregory Cherry, AKA "G",aka "Ninja", 203 F.3d 156, 2d Cir. (2000)Document9 pagesUnited States v. Angel Padilla, AKA "Cuson" James Albizu, AKA "Pito" Roberto Colon, AKA "Papo" Darrell Campbell, AKA "D" Anthony Morales, AKA "Cuba", AKA "Tony Cuba" James Boggio, AKA "Jay" Dionisio Mojica, AKA "Little Johnny" Edwin Gonzalez, AKA "Peachy" Martin Kortright, AKA "Supreme" James Rodriguez, AKA "Spanky" Wilson Rodriguez, AKA "Opie" Rafael Torres, AKA "Ski" Steven Camacho, AKA "Spanky", AKA "Spank" Jaime Rodriguez, AKA "Jay" Anna Rodriguez, AKA "Momma Calderon" Ricardo Fontan Rafael Cruz Marvin Jenkins Joseph Pillot, AKA "Joey" Antonio Feliciano, AKA "Jamaican Tony", AKA "Pat A. Guess", AKA "Christopher Guest" and Trumont Williams, Angel Padilla, AKA "Cuson" Ivan Rodriguez, and Gregory Cherry, AKA "G",aka "Ninja", 203 F.3d 156, 2d Cir. (2000)Scribd Government DocsNo ratings yet

- CIR v. Algue DigestsDocument1 pageCIR v. Algue Digestspinkblush717No ratings yet

- Manila: The President of The PhilippinesDocument3 pagesManila: The President of The PhilippinesKd DahilanNo ratings yet

- CREW: U.S. Department of Homeland Security: U.S. Customs and Border Protection: Regarding Border Fence: RE - 16 S1 Hearing (Redacted) 6Document6 pagesCREW: U.S. Department of Homeland Security: U.S. Customs and Border Protection: Regarding Border Fence: RE - 16 S1 Hearing (Redacted) 6CREWNo ratings yet