Professional Documents

Culture Documents

7 LP Sensitivity Analysis

7 LP Sensitivity Analysis

Uploaded by

zuluagagaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

7 LP Sensitivity Analysis

7 LP Sensitivity Analysis

Uploaded by

zuluagagaCopyright:

Available Formats

ECS716 OPERATIONAL RESEARCH PN PAEZAH HAMZAH

Linear Programming: Sensitivity Analysis

Learning Outcomes Students should be able to: Investigate the effect of changing the objective function coefficient on the optimal solution. Investigate the effect of changing a right-hand-side (RHS) value and determine shadow prices from an optimal tableau.

using both graphical and computer analysis. Sensitivity Analysis In LP, the parameters (input data) of the model can be changed within certain limits without causing the optimum solution to change. Making changes in the parameters to see the effect on optimal solution is known as sensitivity analysis, or postoptimality analysis. The general idea of sensitivity analysis will be performed on 2 cases. I. Sensitivity of the optimum solution to changes in the availability of resources (the right-hand-side of the constraint) II. Sensitivity of the optimum solution to changes in unit profits or unit cost (coefficients of the objective function)

I.

Changes in the Right-Hand-Side Example: Consider the Wyndor Glass problem Maximize subject to: Z = 3X1 + 5X2 4 2X2 12 3X1 + 2X2 18 X1 , X2 0 where ` X1 (Plant 1 hours) (Plant 2 hours) (Plant 3 hours)

X1 = batches of doors to produce per week, X2 = batches of windows to produce per week.

The graphical solution will be used to explain the basis for sensitivity analysis.

The graphical solution is as follows: X2 9 X1 4 3X1 +2X2 18 (2, 6) 6

Corner Point Feasible (CPF) solution CPF solution (0,0) (0,6) (2,6) (4,3) (4,0) Z=3X1+5X2 0 30 36 27 12

Zmax =12

2X212

Feasible region

(4,3)

Optimal solution: X1=2, X2=6 Produce 2 batches of doors and 6 batches of windows per week X1 Maximum Profit =3(2)+5(6)=$36 thousand

If Plant 3 capacity is increased by 1 hour, then the RHS of the third constraint changes from 18 to 19 hours. Accordingly, the feasible region becomes slightly bigger and the optimal solution will change accordingly. Maximize subject to: Z = 3X1 + 5X2 (profit, $000) 4 2X2 12 3X1 + 2X2 19 X1 , X2 0 X1 (Plant 1 hours) (Plant 2 hours) (Plant 3 hours)

Increase the RHS of Plant 3 constraint by 1 hour

. X2 9

Corner Point Feasible (CPF) solution X1 4 3X1 +2X2 18 3X1 +2X2 19 (2.33, 6) CPF solution (0,0) (0,6) (2.33,6) (4,3) (4,0) Z=3X1+5X2 0 30 37 27 12

Zmax =12

2X2 12

Optimal solution: X1=2.33, X2=6 Maximum Profit =3(2.33)+5(6)=$37 thousand

Feasible region

(4,3)

X1

The shadow price is the value of 1 additiona l unit of a scarce resource

Effect of Changing RHS on the Objective Function Value Increasing the RHS value of the second constraint by 1 unit, or equivalently, making 1 additional production hour in Plant 3 available (at no additional cost), causes the total profit to increase by $1,000 from $36,000 to $37,000. The $1,000 increase is also known as the shadow price or the dual price for Plant 3 production capacity. The shadow price can be used as a guideline for Wyndor Glass Inc. in determining the amount of money to spend to increase its capacity. If the production time at Plant 3 were to be increased, the maximum amount of money to spend is $1,000 per hour. In general, a shadow price is the worth of 1 additional unit of a scarce resource. the marginal value of 1 additional unit of a scarce resource. the maximum amount to pay for 1 additional unit of a scarce resource.

How to determine the shadow price from a simplex solution? The shadow prices for all the resources can be obtained from the optimal simplex tableau. These are the numbers in the Zj row or the absolute value of the Cj-Zj of the slack variable columns. X1 3 0 0 1 3 0 X2 5 0 1 0 5 0 S1 0 1 0 0 0 0 S2 0 1/3 0.5 -1/3 1.5 -1.5 S3 0 -1/3 0 1/3 1 -1

Cj 0 5 3

Basic S1 X2 X1 Zj Cj-Zj

RHS 2 6 2 36

The shadow price of Plant 1 production time =$0/hr The shadow price of Plant 2 production time =$1,500 /hr The shadow price of Plant 3 production time =$1,000 /hr Question 1: What is meant by $0 shadow price? Why does Plant 1 have $0/hr shadow price? The shadow price of $0 means that it is worth nothing to pay money for additional resource. The shadow price of Plant 1 production is $0/hr because the hours in this plant are still available

Question 2: If Wyndor Glass can increase the capacity of the plants, which plant should receive higher priority? Plant 2, since the dual price is the highest. (Each additional hour of Plant 1 production time will not increase the weekly profit, each additional hour of Plant 2 and Plant 3 production time will increase the weekly profit by $1,500 and $1,000, respectively.)

Question 3: Is it worthwhile to increase the capacities of Plant 2 and 3 at the additional cost of $1,200/hr in each plant? Plant 2: Yes, since the $1,500. shadow price for production time is worth

Plant 3: No, since the shadow price for production time in Plant 3 is worth $1,000. Determination of Range of Feasibility There is a limit on the RHS change in order for the dual values to remain valid. The valid range is termed the range of feasibility.

Example: Consider the optimal simpex tableau for Wyndor Glass Co.

Cj 0 5 3 Basic S1 X2 X1 Zj Cj-Zj X1 3 0 0 1 3 0 X2 5 0 1 0 5 0 S1 0 1 0 0 0 0 S2 0 1/3 0.5 -1/3 1.5 -1.5 S3 0 -1/3 0 1/3 1 -1 RHS 2 6 2 36

Determine the range of feasibility for Plant 2.

II.

Changes in the Objective Function Coefficients Making a change in the coefficient of the objective function (unit profit or unit cost ) will change the slope of Z. Use QM for Windows software to investigate the effect of changing objective coefficients. Example: Change the unit profit of doors to $4,000 per batch. Corner Point Feasible (CPF) solution X1 4 3X1 +2X2 18 (2, 6)

X2 9

X1

0 0 6 6 3 0 0 2 4 4

X2

Z=4X1+5X2 0 30 38 31 16

Zmax =12

2X212

qs

Feasible region

(4,3)

Optimal solution: X1=2, X2=6 Produce 2 batches of doors and 6 batches of windows per week 6 X1 Maximum Profit =4(2)+5(6)=$38 thousand

Change the unit profit of each batch of door to $4,000

Maximize subject to:

Z = 4X1 + 5X2 4 2X2 12 3X1 + 2X2 18 X1 , X 2 0 X1

(profit, $000) (Plant 1 hours) (Plant 2 hours) (Plant 3 hours)

X2 9 X1 4 3X1 +2X2 18 (2, 6) 6

Zmax =12

2X212

Feasible region

(4,3)

X1

Range of Optimality If the change in an objective function coefficient is within a specific range of values, called the range of optimality, the current basic feasible solution will remain optimal. However, current optimal solution will remain optimal for certain changes in the values only. a) The range of optimality for a basic variable: determines the values of objective function coefficient for which the basic variables will remain in the current basic feasible solution. Note: the value of the variables may change. b) The range of optimality for a non-basic variable: determines the objective function coefficient values for which variables will remain non-basic

Example: Consider the optimal simpex tableau for Wyndor Glass Co.

Cj 0 5 C1 Basic S1 X2 X1 Zj Cj-Zj X1 C1 0 0 1 X2 5 0 1 0 S1 0 1 0 0 S2 0 1/3 0.5 -1/3 S3 0 -1/3 0 1/3 RHS 2 6 2 36

i) Determine the range of optimality for X1 ii) Determine the range of optimality for S2

QM for Windows Output for Wyndor Glass Co Ranging---------Variable X1 X2 Value 1. 6. Reduced Cost 0 0 Slack/ Surplus 3 0 0 Original Val 3. 5. Original Val 4 12 18 Lower Bound 0. 2. Lower Bound 2. 6. 12. Upper Bound 7.5 Infinity Upper Bound Infinity 18. 24.

Dual Constraint Value Constraint 1 0 Constraint 2 1.5 Constraint 3 1

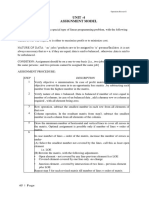

Supplementary Exercises 1. a) Explain the meaning of shadow price. Describe how a firm would use the shadow price associated with a given constraint. b) The operations department of a large company makes three products (A, B, and C). The department is preparing for its final run next week, which is just before the annual two-week vacation during which the entire department shuts down. The manager wants to use up existing stocks of the three raw materials used to fabricate products A, B, and C. She has formulated the linear programming model and obtained an optimal solution given below. A= quantity of product A B= quantity of product B C= quantity of product C Max Z = 12A + 15B + 14C (Profit, RM) subject to Material 1 Material 2 Material 3 3A +5B + 8C 720 kilograms 2A + 3C 600 kilograms 4A +6B + 4C 640 kilograms

A, B, and C 0

The optimal simplex tableau and ranging are as follows:

Basis C S2 A

CB 14 0 12 Zj Cj - Zj

A 12 0 0 1 12 0

B 15 0.1 -3.1 1.4 18.2 -3.2

C 14 1 0 0 14 0

s1 0 0.2 -0.2 -0.2 0.4 -0.4

s2 0 0 1 0 0 0

s3 0 -0.15 -0.35 0.4 2.7 -2.7

RHS 48 232 112 2016

Variable A B C Constraint Constraint 1 Constraint 2 Constraint 3

Value 112 0 48 Dual Value 0.4 1.25 2.7

Reduced Cost 0 3.2 0 Slack/Surplus 0 232 0

Original Value 12 15 14 Original Value 720 600 640

Lower Bound 9.71 -infinity --Lower Bound 480 368 360

Upper Bound 14 18.2 --Upper Bound 1280 Infinity 960

Based on the solution given, answer the following questions: i) If Bs profit per unit could be increased to RM18, how much would B be produced?

ii) What is the range of optimality of C? iii) What is the range of feasibility for Material 3? iv) By how much would profit increase if an additional 100 kilograms of Material 3 could be obtained? v) If the manager can obtain additional 20 kilograms of Material1 and Material3, what would be the effect to the optimal solution and the total profit?

2. Consider the following profit maximization linear programming problem. X 1, X2, and X3 are the units of easy cupcakes, chocolate cupcakes, and vanilla cupcakes to be produced by Diana Bakery. Maximize Z= Subject to Multipurpose flour: Sugar : Milk : 2.25X1 + 2X2 + 2.5X3 1,000 cups 1.5X1 + 2X2 + 2X3 900 cups X1 + 0.75X2 + X3 800 cups X1, X2, X3 0 1.0X1 +1.2X2 + 1.4X3 (Ringgit)

The incomplete final simplex tableau for the above problem is shown below. S 1, S2, and S3 are the slack variables for multipurpose flour, sugar, and milk, respectively. Cj Basis X3 X2 S3 Zj Cj-Zj a) b) c) Complete the above simplex tableau. What are the optimal production quantities? What is the maximum total profit? Which ingredient is not fully utilized? How much is used in the optimal production? If the objective function coefficient for X 2 is changed to 1.5, will the optimal solution change? Justify your answer. State the dual price for the multipurpose flour. price valid? For what values is this dual 1.0 X1 1.5 -0.75 0.0625 1.2 X2 0 1 0 1.4 X3 1 0 0 0 S1 2 -2 -0.5 0 S2 -2 2.5 0.125 0 S3 0 0 1 RHS 200 250 412.5

d) e)

g)

Diana just realized that there were 120 more cups of multipurpose flour available on hand to be used in making the cupcakes. What would be effect on the total profit if these were used in the production?

You might also like

- MULTIPLE CHOICE. Choose The One Alternative That Best Completes The Statement or Answers The QuestionDocument14 pagesMULTIPLE CHOICE. Choose The One Alternative That Best Completes The Statement or Answers The QuestionTunahan KüçükerNo ratings yet

- Ch13 Exercise+9Document1 pageCh13 Exercise+9Ashley WilkeyNo ratings yet

- CE 366 Exam 3 Review - SDocument7 pagesCE 366 Exam 3 Review - SShaunak TripathiNo ratings yet

- Managerial EconomicsDocument3 pagesManagerial EconomicsWajahat AliNo ratings yet

- This Study Resource Was: Problem 5Document3 pagesThis Study Resource Was: Problem 5Hasan SikderNo ratings yet

- Kentucky Fried Chicken in JapanDocument3 pagesKentucky Fried Chicken in Japanezeasor arinzeNo ratings yet

- Bab Vii BalandcorcardDocument17 pagesBab Vii BalandcorcardCela Lutfiana100% (1)

- IMT 58 Management Accounting M3Document23 pagesIMT 58 Management Accounting M3solvedcareNo ratings yet

- Solution 77Document10 pagesSolution 77karthu48100% (1)

- Midterm Answers 2016Document14 pagesMidterm Answers 2016Manan ShahNo ratings yet

- HW 2. Chapter 4 (3, 4, 8, 9, 10)Document10 pagesHW 2. Chapter 4 (3, 4, 8, 9, 10)VIKRAM KUMAR0% (1)

- The Integration of Process Design and ControlDocument656 pagesThe Integration of Process Design and Controlsheida shNo ratings yet

- Safebuck Design Guideline and DNV RP F110Document8 pagesSafebuck Design Guideline and DNV RP F110Константин ДмитриевNo ratings yet

- API 580 Closed Book QuestionsDocument18 pagesAPI 580 Closed Book QuestionsRavindra S. Jivani86% (7)

- VarianceDocument3 pagesVarianceWan Noor AsmuniNo ratings yet

- Did United Technologies Overpay For Rockwell CollinsDocument2 pagesDid United Technologies Overpay For Rockwell CollinsRadNo ratings yet

- Ilide - Info Review Qs PRDocument93 pagesIlide - Info Review Qs PRMobashir KabirNo ratings yet

- Estimating IRR With Fake Payback Period-L10Document9 pagesEstimating IRR With Fake Payback Period-L10akshit_vij0% (1)

- Practice Qns - Cap StructureDocument8 pagesPractice Qns - Cap StructureSadi0% (1)

- Answers To Practice Questions: Risk and ReturnDocument11 pagesAnswers To Practice Questions: Risk and ReturnmasterchocoNo ratings yet

- CS Executive MCQ and Risk AnalysisDocument17 pagesCS Executive MCQ and Risk Analysis19101977No ratings yet

- Expected Return, Variance & Correlation: SolutionDocument8 pagesExpected Return, Variance & Correlation: SolutionPuneet Meena100% (1)

- Inventory ProblemsDocument4 pagesInventory ProblemsPulkit AggarwalNo ratings yet

- KFC JapanDocument10 pagesKFC JapanAnonymous 5GHZXlNo ratings yet

- A Capacity Planning Assignment 2016 Bassam Senior Modified SolutionDocument10 pagesA Capacity Planning Assignment 2016 Bassam Senior Modified SolutionAhmad Ayman FaroukNo ratings yet

- Capacity Planning, Facility Location & LayoutDocument56 pagesCapacity Planning, Facility Location & LayoutFekadu100% (1)

- Chapter 20Document93 pagesChapter 20Irina AlexandraNo ratings yet

- Bep ProblemsDocument5 pagesBep ProblemsvamsibuNo ratings yet

- Ch08 Linear Programming SolutionsDocument26 pagesCh08 Linear Programming SolutionsVikram SanthanamNo ratings yet

- Chapter 5 Solutions Chap 5 SolutionDocument9 pagesChapter 5 Solutions Chap 5 Solutiontuanminh2048No ratings yet

- Sensitivity Analysis Using The Excel SolverDocument9 pagesSensitivity Analysis Using The Excel SolverReagan SsebbaaleNo ratings yet

- Unit-3 Assignement Model Notes & Practice QuestionsDocument19 pagesUnit-3 Assignement Model Notes & Practice QuestionsIsha NatuNo ratings yet

- Chapter 4 Sensitivity Analysis and The Simplex Method PDFDocument14 pagesChapter 4 Sensitivity Analysis and The Simplex Method PDFUsman GhaniNo ratings yet

- Topic 5: Mathematical ProgrammingDocument28 pagesTopic 5: Mathematical ProgrammingRuthchell CiriacoNo ratings yet

- Formulation of LP Problems-130928022247-Phpapp02Document13 pagesFormulation of LP Problems-130928022247-Phpapp02Anish MonachanNo ratings yet

- Process Selection and Facility LayoutDocument59 pagesProcess Selection and Facility LayoutKhietNo ratings yet

- Practice Question - CompetitionansDocument9 pagesPractice Question - Competitionansanwesh pradhanNo ratings yet

- Applications and Solutions of Linear Programming Session 1Document19 pagesApplications and Solutions of Linear Programming Session 1Simran KaurNo ratings yet

- Assignment 2 PDFDocument10 pagesAssignment 2 PDFvamshiNo ratings yet

- Target CostDocument5 pagesTarget CostWarda RizviNo ratings yet

- Activity Based Costing Test QuestionsDocument5 pagesActivity Based Costing Test QuestionsMehul GuptaNo ratings yet

- Final Doc of Management AssignmentDocument10 pagesFinal Doc of Management AssignmentrasithapradeepNo ratings yet

- Name: Fernandez, Lalaine Michicko L. Section: Date: ScoreDocument3 pagesName: Fernandez, Lalaine Michicko L. Section: Date: ScoreMich FernandezNo ratings yet

- Tme 601Document14 pagesTme 601dearsaswatNo ratings yet

- Target - Costing F5 NotesDocument4 pagesTarget - Costing F5 NotesSiddiqua KashifNo ratings yet

- ZomatoDocument56 pagesZomatopreethishNo ratings yet

- Chap 15Document14 pagesChap 15Syed HamdanNo ratings yet

- Corporate Finance Assignment PDFDocument13 pagesCorporate Finance Assignment PDFسنا عبداللهNo ratings yet

- 01 Time Value of Money PDFDocument31 pages01 Time Value of Money PDFJainn SNo ratings yet

- Online Mid-Term POM May-Aug 2020 G-6Document5 pagesOnline Mid-Term POM May-Aug 2020 G-6Hossain TanjilaNo ratings yet

- Problem SheetDocument15 pagesProblem SheetSunny AvlaniNo ratings yet

- Problem Set 5 (Solution)Document5 pagesProblem Set 5 (Solution)Akshit GaurNo ratings yet

- Marginal Costing - Brief Cases and Solutions PDFDocument7 pagesMarginal Costing - Brief Cases and Solutions PDFKaranSinghNo ratings yet

- Risk Analysis in Capital Investment DecisionsDocument57 pagesRisk Analysis in Capital Investment Decisionsanindya_kundu100% (1)

- Suncoast Office, A Goal Programming Problem, Solution, Analysis, Sensitivity Analysis, and ReportDocument8 pagesSuncoast Office, A Goal Programming Problem, Solution, Analysis, Sensitivity Analysis, and ReportArka ChakrabortyNo ratings yet

- Mathematical ModelingDocument3 pagesMathematical Modelingcumimayang0% (1)

- LP FormulationDocument21 pagesLP FormulationVarun Pillai100% (1)

- GNB14 e CH 12 ExamDocument6 pagesGNB14 e CH 12 Exama_elsaied0% (1)

- Cross CulturalManagementintheMiddleEastDocument6 pagesCross CulturalManagementintheMiddleEastRaj ManhasNo ratings yet

- Market Research: Summer Internship Project ReportDocument23 pagesMarket Research: Summer Internship Project ReportPOOJA GUPTANo ratings yet

- Af201 Final Exam Revision Package - S2, 2020 Face-to-Face & Blended Modes Suggested Partial SolutionsDocument9 pagesAf201 Final Exam Revision Package - S2, 2020 Face-to-Face & Blended Modes Suggested Partial SolutionsChand DivneshNo ratings yet

- Marketing DossierDocument38 pagesMarketing DossierTigran WadiaNo ratings yet

- Practice Problems in Professional Industrial EngineeringDocument15 pagesPractice Problems in Professional Industrial EngineeringBlair0% (1)

- PolyCom Presentation - MiningDocument15 pagesPolyCom Presentation - MiningzuluagagaNo ratings yet

- GeostatikaDocument20 pagesGeostatikazuluagagaNo ratings yet

- Prefabricated Vertical DrainDocument34 pagesPrefabricated Vertical DrainzuluagagaNo ratings yet

- Finite Element Analysis of Embankments On Soft Ground PDFDocument257 pagesFinite Element Analysis of Embankments On Soft Ground PDFzuluagagaNo ratings yet

- 6 Two Phase+GraphDocument8 pages6 Two Phase+GraphzuluagagaNo ratings yet

- 5-LP Simplex (CJ-ZJ Tableau)Document7 pages5-LP Simplex (CJ-ZJ Tableau)zuluagagaNo ratings yet

- Linear Programming Simplex: Big-M Method: Learning OutcomesDocument4 pagesLinear Programming Simplex: Big-M Method: Learning OutcomeszuluagagaNo ratings yet

- Linear Programming Simplex: Big-M Method: Learning OutcomesDocument4 pagesLinear Programming Simplex: Big-M Method: Learning OutcomeszuluagagaNo ratings yet

- 6-LP Simplex (Two Phase Method)Document6 pages6-LP Simplex (Two Phase Method)zuluagagaNo ratings yet

- 2 Linear Programming Part 1Document21 pages2 Linear Programming Part 1zuluagagaNo ratings yet

- Linear Programming Part II-The Simplex Method (For LP Problems in 2 Variables)Document12 pagesLinear Programming Part II-The Simplex Method (For LP Problems in 2 Variables)zuluagagaNo ratings yet

- Advance Soil Mechanics: Elastic, Plastic and Elasto-Plastic BehaviourDocument52 pagesAdvance Soil Mechanics: Elastic, Plastic and Elasto-Plastic BehaviourzuluagagaNo ratings yet

- BH33A-D1 0.00m-0.50m BH33A-D2 0.50m-1.00m: Civil, Structural & Geotechnical EngineersDocument13 pagesBH33A-D1 0.00m-0.50m BH33A-D2 0.50m-1.00m: Civil, Structural & Geotechnical EngineerszuluagagaNo ratings yet

- Plaxis AsigmentDocument8 pagesPlaxis AsigmentzuluagagaNo ratings yet

- TF21KBS OM511 Chapter9Document49 pagesTF21KBS OM511 Chapter9RashaNo ratings yet

- Merak Peep Ps PDFDocument2 pagesMerak Peep Ps PDFCHALABI FARESNo ratings yet

- MID TERM MeasurementDocument104 pagesMID TERM MeasurementIA DipsNo ratings yet

- Uncertainties in Fatigue Crack Growth MeasurementsDocument25 pagesUncertainties in Fatigue Crack Growth MeasurementsdilrangiNo ratings yet

- Project Risk Management - ReportDocument50 pagesProject Risk Management - ReportStephen Cole ReyesNo ratings yet

- GAO Cost Estimating Assessment GuideDocument440 pagesGAO Cost Estimating Assessment GuideMarwan Nasution100% (1)

- BSEE Steel Catenary Riser Integrity Management ReportDocument26 pagesBSEE Steel Catenary Riser Integrity Management ReportEyoma EtimNo ratings yet

- Alido, Kevin F - Research WorkDocument4 pagesAlido, Kevin F - Research Workkevin alidoNo ratings yet

- Control of Batch Processes: D. W. T. RippinDocument11 pagesControl of Batch Processes: D. W. T. RippinJonathan Ferney CastroNo ratings yet

- (Tomas Gal, Thomas Gal) Postoptimal Analyses PDFDocument465 pages(Tomas Gal, Thomas Gal) Postoptimal Analyses PDFtiagoalvesaiNo ratings yet

- SFM - Sem 3Document219 pagesSFM - Sem 3Yogesh AnaghanNo ratings yet

- DSS ModelingDocument13 pagesDSS ModelingS.m. ShadabNo ratings yet

- Traceable Loop Antenna Calibration Methods Using A VNADocument25 pagesTraceable Loop Antenna Calibration Methods Using A VNAAton LuanNo ratings yet

- Wasp Best Practices and Checklist: Measurement ProgrammeDocument2 pagesWasp Best Practices and Checklist: Measurement ProgrammeDBachai84No ratings yet

- MSADocument66 pagesMSAGowri Krishna Chikkala100% (3)

- Chapter 3 Linear Programming: Sensitivity Analysis and Interpretation of SolutionDocument6 pagesChapter 3 Linear Programming: Sensitivity Analysis and Interpretation of SolutionHazel PabloNo ratings yet

- Should Cost Modelling Guidance Note May 2021Document24 pagesShould Cost Modelling Guidance Note May 2021Kishora BhatNo ratings yet

- IPA Cost Estimating GuidanceDocument44 pagesIPA Cost Estimating Guidancemmorales7274No ratings yet

- Updated-IEM-IU Thesis GuidelinesDocument30 pagesUpdated-IEM-IU Thesis GuidelinesNK001No ratings yet

- A New Approach To Underground Cable Performance Assessment: M.S. Al-Saud, M.A. El-Kady, R.D. FindlayDocument12 pagesA New Approach To Underground Cable Performance Assessment: M.S. Al-Saud, M.A. El-Kady, R.D. FindlayJovanJoksicNo ratings yet

- MC Kinney SavitskyDocument287 pagesMC Kinney Savitskydilani1234No ratings yet

- POWER and UTILITIES COMPANY A SM FactbookDocument107 pagesPOWER and UTILITIES COMPANY A SM FactbookSantosh Kumar PathakNo ratings yet

- Independence Day Weekend - OTDocument16 pagesIndependence Day Weekend - OTAnupam TripathiNo ratings yet

- DecideIT ManualDocument148 pagesDecideIT Manualanon_819721476No ratings yet

- B14 - Preparation of Cost EstimatesDocument60 pagesB14 - Preparation of Cost Estimatesairillon.phNo ratings yet

- 3 1981 Cornell Compliance and Stress Sensitivity of Spur Gears PDFDocument20 pages3 1981 Cornell Compliance and Stress Sensitivity of Spur Gears PDFSimone PutzuNo ratings yet

- Business Analytics For Decision Making Mid Term Exam DR Mahmoud BeshrDocument7 pagesBusiness Analytics For Decision Making Mid Term Exam DR Mahmoud BeshrMohamed AhmedNo ratings yet