Professional Documents

Culture Documents

(Funds Settlement) : NSE - Valuation Debit, Valuation Price, Bad and Short Delivery, Auction

(Funds Settlement) : NSE - Valuation Debit, Valuation Price, Bad and Short Delivery, Auction

Uploaded by

HRish BhimberCopyright:

Available Formats

You might also like

- Neat System: (National Exchange For Automated Trading)Document7 pagesNeat System: (National Exchange For Automated Trading)neetika0% (1)

- FXKeys Trading Systems & Examples V4.3Document120 pagesFXKeys Trading Systems & Examples V4.3Md Saiful Islam86% (7)

- VipulDocument83 pagesVipulheena572003No ratings yet

- NeatDocument20 pagesNeatAbhi PujaraNo ratings yet

- Presentation On Secondary MarketDocument18 pagesPresentation On Secondary MarketAnonymous fxdQxrNo ratings yet

- Recent Trend in New Issue MarketDocument14 pagesRecent Trend in New Issue MarketAbhi SinhaNo ratings yet

- BSC Online Trading SystemDocument19 pagesBSC Online Trading SystemAaryendr100% (1)

- IC33 Revised Edition EnglishDocument513 pagesIC33 Revised Edition Englishhdsk82No ratings yet

- Stock Market - Barometer of The EconomyDocument12 pagesStock Market - Barometer of The Economysmithusdesai9739No ratings yet

- Project - Future and OptionsDocument24 pagesProject - Future and OptionspankajNo ratings yet

- A Study On OTCEIDocument35 pagesA Study On OTCEIShibinThomas100% (15)

- Benefits of Depository SystemDocument4 pagesBenefits of Depository SystemAnkush VermaNo ratings yet

- Risk Management in Bse and NseDocument52 pagesRisk Management in Bse and NseAvtaar SinghNo ratings yet

- Interconnected Stock Exchange (ISE)Document9 pagesInterconnected Stock Exchange (ISE)Anoop KoshyNo ratings yet

- Secondary Market StructureDocument13 pagesSecondary Market StructureTanvir Hasan SohanNo ratings yet

- Commercial Bill MarketDocument25 pagesCommercial Bill Marketapeksha_606532056No ratings yet

- Over The Counter Exchange of IndiaDocument3 pagesOver The Counter Exchange of IndiaShweta ShrivastavaNo ratings yet

- Online Share Trading SynopsisDocument11 pagesOnline Share Trading Synopsisneeraj_sharma18320100% (1)

- Merchant Banking and Financial Services Question PaperDocument248 pagesMerchant Banking and Financial Services Question Paperexecutivesenthilkumar100% (1)

- UNIT-4 Mergers, Diversification and Performance EvaluationDocument13 pagesUNIT-4 Mergers, Diversification and Performance EvaluationRavalika PathipatiNo ratings yet

- Wholesale Debt Market IndiaDocument9 pagesWholesale Debt Market IndiatawahidNo ratings yet

- HDFC Amc Mock TestDocument19 pagesHDFC Amc Mock Testyogidildar100% (1)

- Marketing Management MeghalDocument30 pagesMarketing Management MeghalDeepak Kumar VermaNo ratings yet

- Case StudyDocument3 pagesCase Studyprabhat mehto100% (2)

- Discount and Finance House of IndiaDocument25 pagesDiscount and Finance House of Indiavikram_bansal_5No ratings yet

- Internship ReportDocument45 pagesInternship ReportShikha YadavNo ratings yet

- Introduction To Indian Financial SystemDocument31 pagesIntroduction To Indian Financial SystemManoher Reddy100% (2)

- MARWADI FINANCE MBA Porject Report Prince DudhatraDocument89 pagesMARWADI FINANCE MBA Porject Report Prince DudhatrapRiNcE DuDhAtRa100% (1)

- Issue ManagementDocument20 pagesIssue ManagementTanmay Sharma100% (2)

- Ch.6-Hire Purchase FinanceDocument45 pagesCh.6-Hire Purchase Financejaludax100% (1)

- NSDL NotesDocument14 pagesNSDL NotesAnmol RahangdaleNo ratings yet

- Form and Contents of A ProspectusDocument3 pagesForm and Contents of A ProspectusSenelwa AnayaNo ratings yet

- Book BuildingDocument10 pagesBook BuildingSaad Mahmood100% (1)

- Fdi in Retail Sector in IndiaDocument12 pagesFdi in Retail Sector in IndiaMi NkNo ratings yet

- Indian Financial System - Win-2009Document1 pageIndian Financial System - Win-2009THE MANAGEMENT CONSORTIUM (TMC) ‘All for knowledge, and knowledge for all’No ratings yet

- Current Trends & Cases in Finance: MicrofinanceDocument101 pagesCurrent Trends & Cases in Finance: MicrofinanceManavAgarwalNo ratings yet

- Unit 3 Call Money MarketDocument14 pagesUnit 3 Call Money MarketsadathnooriNo ratings yet

- Structure of Indian Financial SystemDocument14 pagesStructure of Indian Financial SystemAnamik vermaNo ratings yet

- Presentation On Government (Gilt Edged) SecuritiesDocument22 pagesPresentation On Government (Gilt Edged) Securitieshiteshnandwana100% (1)

- Code of Conduct For Brokers and Sub-BrokersDocument25 pagesCode of Conduct For Brokers and Sub-BrokersSukirti ShikhaNo ratings yet

- Research Report For Praedico GlobalDocument3 pagesResearch Report For Praedico GlobalAbhishek PatilNo ratings yet

- Nature and Significance of Capital Market ClsDocument20 pagesNature and Significance of Capital Market ClsSneha Bajpai100% (2)

- Call Money MarketDocument24 pagesCall Money MarketiyervsrNo ratings yet

- Insurance IntermediariesDocument9 pagesInsurance IntermediariesarmailgmNo ratings yet

- OTC Exchange of IndiaDocument17 pagesOTC Exchange of IndiaJigar_Dedhia_8946No ratings yet

- Depository System in IndiaDocument4 pagesDepository System in Indiaaruvankadu100% (1)

- 17fb5nCgH5HXWU8WhWO MSXSXV6mwwvQWDocument128 pages17fb5nCgH5HXWU8WhWO MSXSXV6mwwvQWprashant9897271358No ratings yet

- New Issue MarketDocument18 pagesNew Issue MarketKaran JainNo ratings yet

- mBA Project Report Stock ExchangeDocument69 pagesmBA Project Report Stock ExchangeDhruvNo ratings yet

- SebiDocument13 pagesSebiNishat ShaikhNo ratings yet

- On Insider TradingDocument42 pagesOn Insider Tradinggeetanjali100% (1)

- Buy-Back of SharesDocument19 pagesBuy-Back of SharesChirag VashishtaNo ratings yet

- National Stock Exchange: Presented by Benson Berlin Jinshy Pranav PunyaDocument14 pagesNational Stock Exchange: Presented by Benson Berlin Jinshy Pranav Punyapranav sharmaNo ratings yet

- Chapter - 3 Customer Service Element of Logistics 1Document10 pagesChapter - 3 Customer Service Element of Logistics 1Tanaya KambliNo ratings yet

- OTCEI: Concept and Advantages - India - Financial ManagementDocument9 pagesOTCEI: Concept and Advantages - India - Financial Managementjobin josephNo ratings yet

- Mutual Fund Distribution ChannelsDocument15 pagesMutual Fund Distribution Channelsdurgeshnandan600240% (5)

- Understand The Trade Settlements and Over ViewDocument4 pagesUnderstand The Trade Settlements and Over ViewChowdary PurandharNo ratings yet

- Procedure of Buying and SellingDocument5 pagesProcedure of Buying and SellingSaloni Sarvaiya33% (3)

- Secondary MarketDocument20 pagesSecondary Marketoureducation.inNo ratings yet

- 1a Stock ExchangeDocument13 pages1a Stock ExchangeAlok MishraNo ratings yet

- Trading and SettlementDocument12 pagesTrading and SettlementLakhan KodiyatarNo ratings yet

- Regulatory FrameworkDocument15 pagesRegulatory FrameworkDarshit AhirNo ratings yet

- India's Telecommunication Network Is The Second Largest in TheDocument7 pagesIndia's Telecommunication Network Is The Second Largest in TheHRish BhimberNo ratings yet

- Specific OrderDocument12 pagesSpecific OrderHRish BhimberNo ratings yet

- Slides Prepared by John S. Loucks St. Edward's University: 1 Slide © 2003 Thomson/South-WesternDocument44 pagesSlides Prepared by John S. Loucks St. Edward's University: 1 Slide © 2003 Thomson/South-WesternHRish BhimberNo ratings yet

- 13525module 1Document252 pages13525module 1DrVikram NaiduNo ratings yet

- LeasingDocument9 pagesLeasingHRish BhimberNo ratings yet

- Conventional Signs: and Further Information To The Swiss Topographic MapsDocument7 pagesConventional Signs: and Further Information To The Swiss Topographic MapsHRish BhimberNo ratings yet

- Case Study 4 February 2000-Narmada ProjectDocument14 pagesCase Study 4 February 2000-Narmada ProjectHRish BhimberNo ratings yet

- Slides Prepared by John S. Loucks St. Edward's University: 1 Slide © 2003 Thomson/South-WesternDocument36 pagesSlides Prepared by John S. Loucks St. Edward's University: 1 Slide © 2003 Thomson/South-WesternHRish BhimberNo ratings yet

- Explain The Importance of Purchasing in A Manufacturing OrganizationDocument14 pagesExplain The Importance of Purchasing in A Manufacturing OrganizationHRish BhimberNo ratings yet

- Slides Prepared by John S. Loucks St. Edward's University: 1 Slide © 2003 Thomson/South-WesternDocument54 pagesSlides Prepared by John S. Loucks St. Edward's University: 1 Slide © 2003 Thomson/South-WesternHRish BhimberNo ratings yet

- Slides Prepared by John S. Loucks St. Edward's University: 1 Slide © 2003 Thomson/South-WesternDocument34 pagesSlides Prepared by John S. Loucks St. Edward's University: 1 Slide © 2003 Thomson/South-WesternHRish BhimberNo ratings yet

- Slides Prepared by John S. Loucks St. Edward's University: 1 Slide © 2003 Thomson/South-WesternDocument30 pagesSlides Prepared by John S. Loucks St. Edward's University: 1 Slide © 2003 Thomson/South-WesternHRish BhimberNo ratings yet

- Slides Prepared by John S. Loucks St. Edward's University: 1 Slide © 2003 Thomson/South-WesternDocument34 pagesSlides Prepared by John S. Loucks St. Edward's University: 1 Slide © 2003 Thomson/South-WesternHRish BhimberNo ratings yet

- FlipcartDocument13 pagesFlipcartHRish BhimberNo ratings yet

- Slides Prepared by John S. Loucks St. Edward's University: 1 Slide © 2003 Thomson/South-WesternDocument28 pagesSlides Prepared by John S. Loucks St. Edward's University: 1 Slide © 2003 Thomson/South-WesternHRish BhimberNo ratings yet

- Indian Financial System: FormalDocument4 pagesIndian Financial System: FormalHRish BhimberNo ratings yet

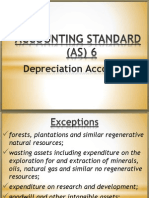

- Depreciation AccountingDocument13 pagesDepreciation AccountingHRish BhimberNo ratings yet

- Slides Prepared by John S. Loucks St. Edward's University: 1 Slide © 2003 Thomson/South-WesternDocument54 pagesSlides Prepared by John S. Loucks St. Edward's University: 1 Slide © 2003 Thomson/South-WesternHRish BhimberNo ratings yet

- Slides Prepared by John S. Loucks St. Edward's University: 1 Slide © 2003 Thomson/South-WesternDocument34 pagesSlides Prepared by John S. Loucks St. Edward's University: 1 Slide © 2003 Thomson/South-WesternHRish BhimberNo ratings yet

- FlipcartDocument13 pagesFlipcartHRish BhimberNo ratings yet

- Meaning and Concept of Capital MarketDocument1 pageMeaning and Concept of Capital MarketHRish BhimberNo ratings yet

- Reliance Industries - Sebi Bans Reliance Industries, 12 Others From Equity Derivative Market For 1 Year - The Economic TimesDocument9 pagesReliance Industries - Sebi Bans Reliance Industries, 12 Others From Equity Derivative Market For 1 Year - The Economic TimesSachinNo ratings yet

- Currency Foreign ExchangeDocument2 pagesCurrency Foreign ExchangeAditya Sudhesh Raghu VamsiNo ratings yet

- Elliott Wave Short Term UpdateDocument12 pagesElliott Wave Short Term UpdateNazerrul Hazwan KamarudinNo ratings yet

- Sudan Divest OilgateDocument41 pagesSudan Divest Oilgatemary engNo ratings yet

- Fixed Income Cheat SheetDocument2 pagesFixed Income Cheat SheetMarco Avello IbarraNo ratings yet

- The Financial System - Assignment 1Document10 pagesThe Financial System - Assignment 1Mohammad ShoaibNo ratings yet

- Rules - EquityDocument7 pagesRules - EquityFabiano JoeyNo ratings yet

- DolphinCapitalInvestors MemorandumDocument39 pagesDolphinCapitalInvestors Memorandumpascal rosasNo ratings yet

- Dvanced Orporate Inance: Derivatives and Hedging RiskDocument29 pagesDvanced Orporate Inance: Derivatives and Hedging RiskMohamed A FarahNo ratings yet

- Internship Report On Janata Bank LimitedDocument38 pagesInternship Report On Janata Bank LimitedFaisal KhanNo ratings yet

- About CAMPDocument7 pagesAbout CAMPeka listyaNo ratings yet

- Set Profit TargetDocument13 pagesSet Profit TargetAnrick AhmedNo ratings yet

- BLWDocument87 pagesBLWFinding Nemo67% (3)

- Tyco Int. ScandalDocument21 pagesTyco Int. ScandalKhaleda Ruma100% (1)

- Security Analysis and Portfolio ManagementDocument71 pagesSecurity Analysis and Portfolio ManagementParitosh KaushikNo ratings yet

- IDX Fact Book 2012 New Hal PDFDocument195 pagesIDX Fact Book 2012 New Hal PDFisabellaNo ratings yet

- Breakfast With Dave 111610Document5 pagesBreakfast With Dave 111610adam2938No ratings yet

- Hull OFOD10e MultipleChoice Questions and Answers Ch05Document6 pagesHull OFOD10e MultipleChoice Questions and Answers Ch05Kevin Molly KamrathNo ratings yet

- Ca English May 2015 1 1Document362 pagesCa English May 2015 1 1Shimpy SinhaNo ratings yet

- Axis Nifty 100 Index Fund - NFODocument12 pagesAxis Nifty 100 Index Fund - NFOhammarworldNo ratings yet

- MBA Finance1YearDocument10 pagesMBA Finance1Yearshahmonali6940% (1)

- Demat Account: Guntur P. Guru Prasad Faculty MemberDocument20 pagesDemat Account: Guntur P. Guru Prasad Faculty MemberPUTTU GURU PRASAD SENGUNTHA MUDALIAR100% (1)

- Gold An Investment RationaleDocument83 pagesGold An Investment Rationaleप्रशांत कौशिक60% (5)

- 20 Forex Trading Strategies - 5 Minute Time Frame PDFDocument52 pages20 Forex Trading Strategies - 5 Minute Time Frame PDFWihartono100% (3)

- Are Mutual Funds Sitting Ducks?: Sophie Shive and Hayong Yun University of Notre DameDocument34 pagesAre Mutual Funds Sitting Ducks?: Sophie Shive and Hayong Yun University of Notre DamebianchaoNo ratings yet

- Indian Banking Industry: Axis Bank LimitedDocument67 pagesIndian Banking Industry: Axis Bank LimitedGAGAN KANSALNo ratings yet

- AAIB Money Market Fund (Juman) : Fact Sheet MayDocument1 pageAAIB Money Market Fund (Juman) : Fact Sheet Mayapi-237717884No ratings yet

- State Bank of HyderabadDocument144 pagesState Bank of HyderabadManu PalegarNo ratings yet

(Funds Settlement) : NSE - Valuation Debit, Valuation Price, Bad and Short Delivery, Auction

(Funds Settlement) : NSE - Valuation Debit, Valuation Price, Bad and Short Delivery, Auction

Uploaded by

HRish BhimberOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

(Funds Settlement) : NSE - Valuation Debit, Valuation Price, Bad and Short Delivery, Auction

(Funds Settlement) : NSE - Valuation Debit, Valuation Price, Bad and Short Delivery, Auction

Uploaded by

HRish BhimberCopyright:

Available Formats

GOPAL BHIMBER

CAPITAL MARKETS

M-I 1002

NSE -Valuation debit, Valuation price, Bad and short delivery, Auction (Funds settlement)

Under rolling settlement, all trades executed on a trading day are settled X days later. This is called T+X rolling settlement, where T is the trade date and X is the number of business days after trade date on which settlement takes place. The rolling settlement prevailing in India is T+2, implying that the outstanding positions at the end of the day T are compulsorily settled 2 days after the trade date. A tabular representation of the settlement cycle for rolling settlement is given below: Activity Day Trading Clearing Rolling Settlement Trading Custodial Confirmation Delivery Generation Settlement Securities and Funds pay in Securities and Funds pay out Valuation Debit Post Settlement Auction Auction settlement Bad Delivery Reporting T T+1 working days T+1 working days T+2 working days T+2 working days T+2 working days T+2 working days T+3 working days T+4 working days

Rectified bad delivery pay-in and payout T+6 working days Re-bad delivery reporting and pickup T+8 working days

Close out of re-bad delivery and funds pay-in & pay-out T+9 working days

Settlement Activities

Pay-in and Pay-out of Funds NSCCL offers Clearing Members the facility of settlement of funds obligations through13 Clearing Banks (as mentioned in the previous chapter). Clearing Members are required to open clearing account with any one bank for the purpose of settlement of their transactions. They are also required to authorize their Clearing Bank to access their clearing account for debiting, crediting, reporting of balances and any other information in accordance with the advice received from NSCCL. Clearing accounts are used exclusively for clearing and settlement of transactions, i.e., for settling funds and other obligations to/from the NSCCL, including payments of margins and penal charges. Clearing Banks debit/credit the clearing account of clearing members as per instructions received from the NSCCL electronically. Pay-in and Pay-out of Securities In order to settle trades in the dematerialized securities, a clearing member needs to open a clearing account with a depository participant (DP). Clearing members are informed of their securities obligation for various settlements through the daily clearing data download. Clearing members are also provided final delivery statement and delivery details statement. Valuation debit. On the second working day after the trading day, settlement of trades is done. This requires all the members to pay-in the required funds and securities by 11:00 am to the NSCCL by giving the required instructions to the respective clearing banks and depositories for the same. By 1:30 pm, on the same

GOPAL BHIMBER

CAPITAL MARKETS

M-I 1002

day, members get the required funds and securities through the NSCCL. If the seller defaults in paying-in the securities, the NSCCL debits the clearing member with an amount (T+1 closing price of the security). This is known as valuation debit. The respective clearing member is debited by an amount equivalent to the securities not delivered by him and valued at a valuation price. Valuation prices Valuation prices at which valuation debits are conducted are calculated as below: Valuation Price for failure to deliver for Regular Market Deals, Depository Deals: The valuation price for securities which were not delivered on the settlement day for securities, shall be the closing price of such securities, on the immediate trading day preceding the pay-in day for the securities unless prescribed otherwise from time to time by the relevant authority. Valuation Price for Bad Delivery for Regular Market Deals: The valuation price for securities which constitute bad deliveries, shall be the closing price of such securities, on the immediate trading day preceding the bad delivery rectification day for the securities unless prescribed otherwise from time to time by the relevant authority. NSCCL conducts a buying-in auction for security shortages on the day after the pay-out day through the NSE trading system. If the buy-in auction price is more than the valuation price, the member is required to make good the difference. Bad Delivery and short delivery Bad Delivery designation indicating that a security does not meet all of the requirements or have all the necessary endorsements to allow the certificate to be transferred to the buyer on the specified settlement date.it is the opposite of good delivery. On the other hand Short delivery is a market transaction in which an investor sells borrowed securities in anticipation of a price decline and is required to return an equal number of shares at some point in the future.in simple words the delivered stocks worth less than the pay in fund. Auction Auctions are initiated by the Exchange on behalf of trading members for settlement related reasons. The main reasons are Shortages, Bad Deliveries and Objections. There are three types of participants in the auction market. Initiator: The party who initiates the auction process is called an initiator. Competitor: The party who enters on the same side as of the initiator is called a competitor. Solicitor: The party who enters on the opposite side as of the initiator is called a solicitor. The trading members can participate in the Exchange initiated auctions by entering orders as a solicitor. E.g. If the Exchange conducts a Buy-In auction, the trading members entering sell orders are called solicitors. When the auction starts, the competitor period for that auction also starts. Competitor period is the period during which competitor order entries are allowed. Competitor orders are the orders which compete with the initiators order i.e. if the initiators order is a buy order, then all the buy orders for that auction other than the initiators order are competitor orders. And if the initiator order is a sell order then all the sell orders for that auction other than the initiators order are competitor orders. After the competitor period ends, the solicitor period for that auction starts. Solicitor period is the period during which solicitor order entries are allowed. Solicitor orders are the orders which are opposite to the initiator order i.e. if the initiator order is a buy order, then all the sell orders for that auction are solicitor orders and if the initiator order is a sell order, then all the buy orders for that auction are solicitor orders. After the solicitor period, order matching takes place. The system calculates trading price for the auction and all possible trades for the auction are generated at the calculated trading price. After this the auction is said to be complete. Competitor period and solicitor period for any auction are set by the Exchange.

You might also like

- Neat System: (National Exchange For Automated Trading)Document7 pagesNeat System: (National Exchange For Automated Trading)neetika0% (1)

- FXKeys Trading Systems & Examples V4.3Document120 pagesFXKeys Trading Systems & Examples V4.3Md Saiful Islam86% (7)

- VipulDocument83 pagesVipulheena572003No ratings yet

- NeatDocument20 pagesNeatAbhi PujaraNo ratings yet

- Presentation On Secondary MarketDocument18 pagesPresentation On Secondary MarketAnonymous fxdQxrNo ratings yet

- Recent Trend in New Issue MarketDocument14 pagesRecent Trend in New Issue MarketAbhi SinhaNo ratings yet

- BSC Online Trading SystemDocument19 pagesBSC Online Trading SystemAaryendr100% (1)

- IC33 Revised Edition EnglishDocument513 pagesIC33 Revised Edition Englishhdsk82No ratings yet

- Stock Market - Barometer of The EconomyDocument12 pagesStock Market - Barometer of The Economysmithusdesai9739No ratings yet

- Project - Future and OptionsDocument24 pagesProject - Future and OptionspankajNo ratings yet

- A Study On OTCEIDocument35 pagesA Study On OTCEIShibinThomas100% (15)

- Benefits of Depository SystemDocument4 pagesBenefits of Depository SystemAnkush VermaNo ratings yet

- Risk Management in Bse and NseDocument52 pagesRisk Management in Bse and NseAvtaar SinghNo ratings yet

- Interconnected Stock Exchange (ISE)Document9 pagesInterconnected Stock Exchange (ISE)Anoop KoshyNo ratings yet

- Secondary Market StructureDocument13 pagesSecondary Market StructureTanvir Hasan SohanNo ratings yet

- Commercial Bill MarketDocument25 pagesCommercial Bill Marketapeksha_606532056No ratings yet

- Over The Counter Exchange of IndiaDocument3 pagesOver The Counter Exchange of IndiaShweta ShrivastavaNo ratings yet

- Online Share Trading SynopsisDocument11 pagesOnline Share Trading Synopsisneeraj_sharma18320100% (1)

- Merchant Banking and Financial Services Question PaperDocument248 pagesMerchant Banking and Financial Services Question Paperexecutivesenthilkumar100% (1)

- UNIT-4 Mergers, Diversification and Performance EvaluationDocument13 pagesUNIT-4 Mergers, Diversification and Performance EvaluationRavalika PathipatiNo ratings yet

- Wholesale Debt Market IndiaDocument9 pagesWholesale Debt Market IndiatawahidNo ratings yet

- HDFC Amc Mock TestDocument19 pagesHDFC Amc Mock Testyogidildar100% (1)

- Marketing Management MeghalDocument30 pagesMarketing Management MeghalDeepak Kumar VermaNo ratings yet

- Case StudyDocument3 pagesCase Studyprabhat mehto100% (2)

- Discount and Finance House of IndiaDocument25 pagesDiscount and Finance House of Indiavikram_bansal_5No ratings yet

- Internship ReportDocument45 pagesInternship ReportShikha YadavNo ratings yet

- Introduction To Indian Financial SystemDocument31 pagesIntroduction To Indian Financial SystemManoher Reddy100% (2)

- MARWADI FINANCE MBA Porject Report Prince DudhatraDocument89 pagesMARWADI FINANCE MBA Porject Report Prince DudhatrapRiNcE DuDhAtRa100% (1)

- Issue ManagementDocument20 pagesIssue ManagementTanmay Sharma100% (2)

- Ch.6-Hire Purchase FinanceDocument45 pagesCh.6-Hire Purchase Financejaludax100% (1)

- NSDL NotesDocument14 pagesNSDL NotesAnmol RahangdaleNo ratings yet

- Form and Contents of A ProspectusDocument3 pagesForm and Contents of A ProspectusSenelwa AnayaNo ratings yet

- Book BuildingDocument10 pagesBook BuildingSaad Mahmood100% (1)

- Fdi in Retail Sector in IndiaDocument12 pagesFdi in Retail Sector in IndiaMi NkNo ratings yet

- Indian Financial System - Win-2009Document1 pageIndian Financial System - Win-2009THE MANAGEMENT CONSORTIUM (TMC) ‘All for knowledge, and knowledge for all’No ratings yet

- Current Trends & Cases in Finance: MicrofinanceDocument101 pagesCurrent Trends & Cases in Finance: MicrofinanceManavAgarwalNo ratings yet

- Unit 3 Call Money MarketDocument14 pagesUnit 3 Call Money MarketsadathnooriNo ratings yet

- Structure of Indian Financial SystemDocument14 pagesStructure of Indian Financial SystemAnamik vermaNo ratings yet

- Presentation On Government (Gilt Edged) SecuritiesDocument22 pagesPresentation On Government (Gilt Edged) Securitieshiteshnandwana100% (1)

- Code of Conduct For Brokers and Sub-BrokersDocument25 pagesCode of Conduct For Brokers and Sub-BrokersSukirti ShikhaNo ratings yet

- Research Report For Praedico GlobalDocument3 pagesResearch Report For Praedico GlobalAbhishek PatilNo ratings yet

- Nature and Significance of Capital Market ClsDocument20 pagesNature and Significance of Capital Market ClsSneha Bajpai100% (2)

- Call Money MarketDocument24 pagesCall Money MarketiyervsrNo ratings yet

- Insurance IntermediariesDocument9 pagesInsurance IntermediariesarmailgmNo ratings yet

- OTC Exchange of IndiaDocument17 pagesOTC Exchange of IndiaJigar_Dedhia_8946No ratings yet

- Depository System in IndiaDocument4 pagesDepository System in Indiaaruvankadu100% (1)

- 17fb5nCgH5HXWU8WhWO MSXSXV6mwwvQWDocument128 pages17fb5nCgH5HXWU8WhWO MSXSXV6mwwvQWprashant9897271358No ratings yet

- New Issue MarketDocument18 pagesNew Issue MarketKaran JainNo ratings yet

- mBA Project Report Stock ExchangeDocument69 pagesmBA Project Report Stock ExchangeDhruvNo ratings yet

- SebiDocument13 pagesSebiNishat ShaikhNo ratings yet

- On Insider TradingDocument42 pagesOn Insider Tradinggeetanjali100% (1)

- Buy-Back of SharesDocument19 pagesBuy-Back of SharesChirag VashishtaNo ratings yet

- National Stock Exchange: Presented by Benson Berlin Jinshy Pranav PunyaDocument14 pagesNational Stock Exchange: Presented by Benson Berlin Jinshy Pranav Punyapranav sharmaNo ratings yet

- Chapter - 3 Customer Service Element of Logistics 1Document10 pagesChapter - 3 Customer Service Element of Logistics 1Tanaya KambliNo ratings yet

- OTCEI: Concept and Advantages - India - Financial ManagementDocument9 pagesOTCEI: Concept and Advantages - India - Financial Managementjobin josephNo ratings yet

- Mutual Fund Distribution ChannelsDocument15 pagesMutual Fund Distribution Channelsdurgeshnandan600240% (5)

- Understand The Trade Settlements and Over ViewDocument4 pagesUnderstand The Trade Settlements and Over ViewChowdary PurandharNo ratings yet

- Procedure of Buying and SellingDocument5 pagesProcedure of Buying and SellingSaloni Sarvaiya33% (3)

- Secondary MarketDocument20 pagesSecondary Marketoureducation.inNo ratings yet

- 1a Stock ExchangeDocument13 pages1a Stock ExchangeAlok MishraNo ratings yet

- Trading and SettlementDocument12 pagesTrading and SettlementLakhan KodiyatarNo ratings yet

- Regulatory FrameworkDocument15 pagesRegulatory FrameworkDarshit AhirNo ratings yet

- India's Telecommunication Network Is The Second Largest in TheDocument7 pagesIndia's Telecommunication Network Is The Second Largest in TheHRish BhimberNo ratings yet

- Specific OrderDocument12 pagesSpecific OrderHRish BhimberNo ratings yet

- Slides Prepared by John S. Loucks St. Edward's University: 1 Slide © 2003 Thomson/South-WesternDocument44 pagesSlides Prepared by John S. Loucks St. Edward's University: 1 Slide © 2003 Thomson/South-WesternHRish BhimberNo ratings yet

- 13525module 1Document252 pages13525module 1DrVikram NaiduNo ratings yet

- LeasingDocument9 pagesLeasingHRish BhimberNo ratings yet

- Conventional Signs: and Further Information To The Swiss Topographic MapsDocument7 pagesConventional Signs: and Further Information To The Swiss Topographic MapsHRish BhimberNo ratings yet

- Case Study 4 February 2000-Narmada ProjectDocument14 pagesCase Study 4 February 2000-Narmada ProjectHRish BhimberNo ratings yet

- Slides Prepared by John S. Loucks St. Edward's University: 1 Slide © 2003 Thomson/South-WesternDocument36 pagesSlides Prepared by John S. Loucks St. Edward's University: 1 Slide © 2003 Thomson/South-WesternHRish BhimberNo ratings yet

- Explain The Importance of Purchasing in A Manufacturing OrganizationDocument14 pagesExplain The Importance of Purchasing in A Manufacturing OrganizationHRish BhimberNo ratings yet

- Slides Prepared by John S. Loucks St. Edward's University: 1 Slide © 2003 Thomson/South-WesternDocument54 pagesSlides Prepared by John S. Loucks St. Edward's University: 1 Slide © 2003 Thomson/South-WesternHRish BhimberNo ratings yet

- Slides Prepared by John S. Loucks St. Edward's University: 1 Slide © 2003 Thomson/South-WesternDocument34 pagesSlides Prepared by John S. Loucks St. Edward's University: 1 Slide © 2003 Thomson/South-WesternHRish BhimberNo ratings yet

- Slides Prepared by John S. Loucks St. Edward's University: 1 Slide © 2003 Thomson/South-WesternDocument30 pagesSlides Prepared by John S. Loucks St. Edward's University: 1 Slide © 2003 Thomson/South-WesternHRish BhimberNo ratings yet

- Slides Prepared by John S. Loucks St. Edward's University: 1 Slide © 2003 Thomson/South-WesternDocument34 pagesSlides Prepared by John S. Loucks St. Edward's University: 1 Slide © 2003 Thomson/South-WesternHRish BhimberNo ratings yet

- FlipcartDocument13 pagesFlipcartHRish BhimberNo ratings yet

- Slides Prepared by John S. Loucks St. Edward's University: 1 Slide © 2003 Thomson/South-WesternDocument28 pagesSlides Prepared by John S. Loucks St. Edward's University: 1 Slide © 2003 Thomson/South-WesternHRish BhimberNo ratings yet

- Indian Financial System: FormalDocument4 pagesIndian Financial System: FormalHRish BhimberNo ratings yet

- Depreciation AccountingDocument13 pagesDepreciation AccountingHRish BhimberNo ratings yet

- Slides Prepared by John S. Loucks St. Edward's University: 1 Slide © 2003 Thomson/South-WesternDocument54 pagesSlides Prepared by John S. Loucks St. Edward's University: 1 Slide © 2003 Thomson/South-WesternHRish BhimberNo ratings yet

- Slides Prepared by John S. Loucks St. Edward's University: 1 Slide © 2003 Thomson/South-WesternDocument34 pagesSlides Prepared by John S. Loucks St. Edward's University: 1 Slide © 2003 Thomson/South-WesternHRish BhimberNo ratings yet

- FlipcartDocument13 pagesFlipcartHRish BhimberNo ratings yet

- Meaning and Concept of Capital MarketDocument1 pageMeaning and Concept of Capital MarketHRish BhimberNo ratings yet

- Reliance Industries - Sebi Bans Reliance Industries, 12 Others From Equity Derivative Market For 1 Year - The Economic TimesDocument9 pagesReliance Industries - Sebi Bans Reliance Industries, 12 Others From Equity Derivative Market For 1 Year - The Economic TimesSachinNo ratings yet

- Currency Foreign ExchangeDocument2 pagesCurrency Foreign ExchangeAditya Sudhesh Raghu VamsiNo ratings yet

- Elliott Wave Short Term UpdateDocument12 pagesElliott Wave Short Term UpdateNazerrul Hazwan KamarudinNo ratings yet

- Sudan Divest OilgateDocument41 pagesSudan Divest Oilgatemary engNo ratings yet

- Fixed Income Cheat SheetDocument2 pagesFixed Income Cheat SheetMarco Avello IbarraNo ratings yet

- The Financial System - Assignment 1Document10 pagesThe Financial System - Assignment 1Mohammad ShoaibNo ratings yet

- Rules - EquityDocument7 pagesRules - EquityFabiano JoeyNo ratings yet

- DolphinCapitalInvestors MemorandumDocument39 pagesDolphinCapitalInvestors Memorandumpascal rosasNo ratings yet

- Dvanced Orporate Inance: Derivatives and Hedging RiskDocument29 pagesDvanced Orporate Inance: Derivatives and Hedging RiskMohamed A FarahNo ratings yet

- Internship Report On Janata Bank LimitedDocument38 pagesInternship Report On Janata Bank LimitedFaisal KhanNo ratings yet

- About CAMPDocument7 pagesAbout CAMPeka listyaNo ratings yet

- Set Profit TargetDocument13 pagesSet Profit TargetAnrick AhmedNo ratings yet

- BLWDocument87 pagesBLWFinding Nemo67% (3)

- Tyco Int. ScandalDocument21 pagesTyco Int. ScandalKhaleda Ruma100% (1)

- Security Analysis and Portfolio ManagementDocument71 pagesSecurity Analysis and Portfolio ManagementParitosh KaushikNo ratings yet

- IDX Fact Book 2012 New Hal PDFDocument195 pagesIDX Fact Book 2012 New Hal PDFisabellaNo ratings yet

- Breakfast With Dave 111610Document5 pagesBreakfast With Dave 111610adam2938No ratings yet

- Hull OFOD10e MultipleChoice Questions and Answers Ch05Document6 pagesHull OFOD10e MultipleChoice Questions and Answers Ch05Kevin Molly KamrathNo ratings yet

- Ca English May 2015 1 1Document362 pagesCa English May 2015 1 1Shimpy SinhaNo ratings yet

- Axis Nifty 100 Index Fund - NFODocument12 pagesAxis Nifty 100 Index Fund - NFOhammarworldNo ratings yet

- MBA Finance1YearDocument10 pagesMBA Finance1Yearshahmonali6940% (1)

- Demat Account: Guntur P. Guru Prasad Faculty MemberDocument20 pagesDemat Account: Guntur P. Guru Prasad Faculty MemberPUTTU GURU PRASAD SENGUNTHA MUDALIAR100% (1)

- Gold An Investment RationaleDocument83 pagesGold An Investment Rationaleप्रशांत कौशिक60% (5)

- 20 Forex Trading Strategies - 5 Minute Time Frame PDFDocument52 pages20 Forex Trading Strategies - 5 Minute Time Frame PDFWihartono100% (3)

- Are Mutual Funds Sitting Ducks?: Sophie Shive and Hayong Yun University of Notre DameDocument34 pagesAre Mutual Funds Sitting Ducks?: Sophie Shive and Hayong Yun University of Notre DamebianchaoNo ratings yet

- Indian Banking Industry: Axis Bank LimitedDocument67 pagesIndian Banking Industry: Axis Bank LimitedGAGAN KANSALNo ratings yet

- AAIB Money Market Fund (Juman) : Fact Sheet MayDocument1 pageAAIB Money Market Fund (Juman) : Fact Sheet Mayapi-237717884No ratings yet

- State Bank of HyderabadDocument144 pagesState Bank of HyderabadManu PalegarNo ratings yet