Professional Documents

Culture Documents

Reliance Industries L TD.: Statement of Profit and Loss For The Year Ended 31 March

Reliance Industries L TD.: Statement of Profit and Loss For The Year Ended 31 March

Uploaded by

Juhi BansalCopyright:

Available Formats

You might also like

- SERIES 65 EXAM STUDY GUIDE 2021 + TEST BANKFrom EverandSERIES 65 EXAM STUDY GUIDE 2021 + TEST BANKNo ratings yet

- How Does Operations Strategies Help A Business Sustain Its Competitive Advantage andDocument5 pagesHow Does Operations Strategies Help A Business Sustain Its Competitive Advantage andKrishna Kannan100% (1)

- Container AccountsDocument9 pagesContainer AccountsNelsonMoseM100% (3)

- Afm PDFDocument5 pagesAfm PDFBhavani Singh RathoreNo ratings yet

- Consolidated Balance Sheet As at 31st March, 2012: Particulars (Rs. in Lakhs)Document25 pagesConsolidated Balance Sheet As at 31st March, 2012: Particulars (Rs. in Lakhs)sudhak111No ratings yet

- Consolidated Balance Sheet: Equity and LiabilitiesDocument49 pagesConsolidated Balance Sheet: Equity and LiabilitiesmsssinghNo ratings yet

- Cash Flow Statements - FinalDocument18 pagesCash Flow Statements - FinalAchal GuptaNo ratings yet

- 8100 (Birla Corporation)Document61 pages8100 (Birla Corporation)Viz PrezNo ratings yet

- Cash Flow Statements - FinalDocument18 pagesCash Flow Statements - FinalAbhishek RawatNo ratings yet

- Cash Flow Statement: For The Year Ended March 31, 2013Document2 pagesCash Flow Statement: For The Year Ended March 31, 2013malynellaNo ratings yet

- ITC Consolidated FinancialsDocument49 pagesITC Consolidated FinancialsVishal JaiswalNo ratings yet

- Tut 4 - Reliance Financial StatementsDocument3 pagesTut 4 - Reliance Financial StatementsJulia DanielNo ratings yet

- Financial Reports of Devi Sea LTD: Profit & Loss Account For The Year Ended 31St March, 2009Document11 pagesFinancial Reports of Devi Sea LTD: Profit & Loss Account For The Year Ended 31St March, 2009Sakhamuri Ram'sNo ratings yet

- Tute3 Reliance Financial StatementsDocument3 pagesTute3 Reliance Financial Statementsvivek patelNo ratings yet

- Rupees 000: Unconsolidated Statement of Financial Position As at December 31, 2011Document17 pagesRupees 000: Unconsolidated Statement of Financial Position As at December 31, 2011Jamal GillNo ratings yet

- Fs Q2fy13crDocument4 pagesFs Q2fy13crAisha HusaainNo ratings yet

- Income: Particulars March, 31 2012 31-Mar-13Document6 pagesIncome: Particulars March, 31 2012 31-Mar-13Tatsat PandeyNo ratings yet

- USD $ in MillionsDocument8 pagesUSD $ in MillionsAnkita ShettyNo ratings yet

- Analysis of Apollo TiresDocument12 pagesAnalysis of Apollo TiresTathagat ChatterjeeNo ratings yet

- Equity Research - Finance Modelling - NIFTY - SENSEX CompaniesDocument46 pagesEquity Research - Finance Modelling - NIFTY - SENSEX Companiesyash bajajNo ratings yet

- Myer AR10 Financial ReportDocument50 pagesMyer AR10 Financial ReportMitchell HughesNo ratings yet

- Wipro Financial StatementsDocument37 pagesWipro Financial StatementssumitpankajNo ratings yet

- Hinopak Motors Limited Balance Sheet As at March 31, 2013Document40 pagesHinopak Motors Limited Balance Sheet As at March 31, 2013nomi_425No ratings yet

- DRB-HICOM Interim Report Mar10Document21 pagesDRB-HICOM Interim Report Mar10Jefrry AbdullahNo ratings yet

- TCS Ifrs Q3 13 Usd PDFDocument23 pagesTCS Ifrs Q3 13 Usd PDFSubhasish GoswamiNo ratings yet

- 1Q2013 AnnouncementDocument17 pages1Q2013 AnnouncementphuawlNo ratings yet

- Tescoar13 GroupincomeDocument1 pageTescoar13 GroupincomeGhada SalahNo ratings yet

- Letter To Shareholders and Financial Results September 2012Document5 pagesLetter To Shareholders and Financial Results September 2012SwamiNo ratings yet

- Financial Statements June 2012 Paper Ad 3rd ProofDocument1 pageFinancial Statements June 2012 Paper Ad 3rd ProofArman Hossain WarsiNo ratings yet

- Ongc Company AnalysisDocument34 pagesOngc Company AnalysisApeksha SaggarNo ratings yet

- Group Case #1Document3 pagesGroup Case #1Brenda Parham50% (2)

- TCS Condensed IndianGAAP Q3 12Document29 pagesTCS Condensed IndianGAAP Q3 12Neha SahaNo ratings yet

- 2014 IFRS Financial Statements Def CarrefourDocument80 pages2014 IFRS Financial Statements Def CarrefourawangNo ratings yet

- BritanniaDocument49 pagesBritanniaParinNo ratings yet

- Asset Management 2011-12Document25 pagesAsset Management 2011-12RabekanadarNo ratings yet

- Ashok LeylandDocument1,832 pagesAshok Leylandjadhavshankar100% (1)

- DLF LTD Ratio Analyses (ALL Figures in Rs Crores) (Realty)Document18 pagesDLF LTD Ratio Analyses (ALL Figures in Rs Crores) (Realty)AkshithKapoorNo ratings yet

- Consolidated Accounts June-2011Document17 pagesConsolidated Accounts June-2011Syed Aoun MuhammadNo ratings yet

- HUL Stand Alone StatementsDocument50 pagesHUL Stand Alone StatementsdilipthosarNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Chinasoft International Limited: Annual Results Announcement For The Year Ended 31 December 2012Document50 pagesChinasoft International Limited: Annual Results Announcement For The Year Ended 31 December 2012alan888No ratings yet

- Consol FY11 Annual Fin StatementDocument13 pagesConsol FY11 Annual Fin StatementLalith RajuNo ratings yet

- Cash FlowDocument14 pagesCash Flowsujitpradhan1989gmaiNo ratings yet

- CHEM Audited Results For FY Ended 31 Oct 13Document5 pagesCHEM Audited Results For FY Ended 31 Oct 13Business Daily ZimbabweNo ratings yet

- LGE 2010 4Q ConsolidationDocument89 pagesLGE 2010 4Q ConsolidationSaba MasoodNo ratings yet

- Patriculars Equity and LiabilitiesDocument12 pagesPatriculars Equity and LiabilitiesSanket PatelNo ratings yet

- 2021 Con Quarter01 AllDocument61 pages2021 Con Quarter01 AllMohammadNo ratings yet

- New Listing For PublicationDocument2 pagesNew Listing For PublicationAathira VenadNo ratings yet

- Pre q12013fsDocument27 pagesPre q12013fsKatie SanchezNo ratings yet

- 9706 s12 QP 43Document8 pages9706 s12 QP 43Adrian JosephianNo ratings yet

- 5ead0financial RatiosDocument3 pages5ead0financial RatiosGourav DuttaNo ratings yet

- CMA Format Munjal ShowaDocument13 pagesCMA Format Munjal ShowaMohit KumarNo ratings yet

- Profit and Loss Account For The Year Ended 31 March, 2012Document6 pagesProfit and Loss Account For The Year Ended 31 March, 2012Sandeep GalipelliNo ratings yet

- Dabur Balance SheetDocument30 pagesDabur Balance SheetKrishan TiwariNo ratings yet

- Banking System of Japan Financial DataDocument44 pagesBanking System of Japan Financial Datapsu0168No ratings yet

- Financial StatementDocument115 pagesFinancial Statementammar123No ratings yet

- Financial Statements: Nine Months Ended 31 March, 2009Document22 pagesFinancial Statements: Nine Months Ended 31 March, 2009Muhammad BakhshNo ratings yet

- Karnataka Bank Results Sep12Document6 pagesKarnataka Bank Results Sep12Naveen SkNo ratings yet

- PhilipsFullAnnualReport2013 EnglishDocument250 pagesPhilipsFullAnnualReport2013 Englishjasper laarmansNo ratings yet

- Sushrut Yadav PGFB2156 IMDocument15 pagesSushrut Yadav PGFB2156 IMAgneesh DuttaNo ratings yet

- MCB Consolidated For Year Ended Dec 2011Document87 pagesMCB Consolidated For Year Ended Dec 2011shoaibjeeNo ratings yet

- Income Tax Law for Start-Up Businesses: An Overview of Business Entities and Income Tax LawFrom EverandIncome Tax Law for Start-Up Businesses: An Overview of Business Entities and Income Tax LawRating: 3.5 out of 5 stars3.5/5 (4)

- Annual Report 2011-12Document152 pagesAnnual Report 2011-12Juhi BansalNo ratings yet

- Assignment - Company AnalysisDocument2 pagesAssignment - Company AnalysisJuhi BansalNo ratings yet

- Number of Hops Between 2 Given End SystemsDocument2 pagesNumber of Hops Between 2 Given End SystemsJuhi Bansal100% (1)

- Cloud ComputingDocument8 pagesCloud ComputingJuhi BansalNo ratings yet

- The Central Processing UnitDocument1 pageThe Central Processing UnitJuhi BansalNo ratings yet

- Intermediate Accounting IFRS Edition: Kieso, Weygandt, WarfieldDocument34 pagesIntermediate Accounting IFRS Edition: Kieso, Weygandt, WarfieldPaulina RegginaNo ratings yet

- MKTG4354 Ch.6Document4 pagesMKTG4354 Ch.6Husam ALswalhaNo ratings yet

- Ceylon Tea With Kepferer Identity PrismDocument2 pagesCeylon Tea With Kepferer Identity PrismThilina100% (1)

- Mini Project HyundaiDocument28 pagesMini Project Hyundaimaraimalai2010No ratings yet

- Capture The Current Business Model: Complex ActivityDocument17 pagesCapture The Current Business Model: Complex ActivitymmuneebsdaNo ratings yet

- Tutorial 2Document7 pagesTutorial 2Shivarni KumarNo ratings yet

- Customer Relationship StrategiesDocument24 pagesCustomer Relationship StrategiesSiddharth Singh TomarNo ratings yet

- Natural Gas Hedging For End UsersDocument5 pagesNatural Gas Hedging For End UsersMercatus Energy AdvisorsNo ratings yet

- Greenlight Capital Open Letter To AppleDocument5 pagesGreenlight Capital Open Letter To AppleZim VicomNo ratings yet

- ADJUSTING ENTRIES PPT TacsanDocument31 pagesADJUSTING ENTRIES PPT TacsanDanicaNo ratings yet

- K03263 - S and OP Article KBDocument4 pagesK03263 - S and OP Article KBProcusto LNo ratings yet

- Topic 2Document3 pagesTopic 2Shao Ning Rachael NeoNo ratings yet

- ABC June 2008Document2 pagesABC June 2008ACCA StudentNo ratings yet

- Rms Policy DocumentDocument6 pagesRms Policy DocumentAshish TripathiNo ratings yet

- Wimba AFBD Form (June 2022)Document4 pagesWimba AFBD Form (June 2022)Darshan PatiraNo ratings yet

- 010-Reducing Agent SwitchingDocument91 pages010-Reducing Agent Switchingasri nurulNo ratings yet

- Kumar Et Al. (2019)Document17 pagesKumar Et Al. (2019)Lance HuendersNo ratings yet

- ACCA APM M2020 AnswerDocument11 pagesACCA APM M2020 AnswerAilaNo ratings yet

- Financial Management in Current Operations and Expansion of Capital in IndiaDocument40 pagesFinancial Management in Current Operations and Expansion of Capital in IndiaSan Deep SharmaNo ratings yet

- 3.production CostDocument30 pages3.production CostroberaakNo ratings yet

- Cost AccountingDocument5 pagesCost Accountingretchiel love calinogNo ratings yet

- Ppe Depreciation and DepletionDocument21 pagesPpe Depreciation and DepletionEarl Lalaine EscolNo ratings yet

- Abu Dhabi Investor Guide 2021aDocument35 pagesAbu Dhabi Investor Guide 2021aAsma MaatigNo ratings yet

- P2 Workbook Q PDFDocument91 pagesP2 Workbook Q PDFShelley ThompsonNo ratings yet

- Financial Statement Analysis-2Document12 pagesFinancial Statement Analysis-2Glaidel Rodenas PeñaNo ratings yet

- Application of Costing System in The Small and Medium Sized Enterprises (SME) in TurkeyDocument1 pageApplication of Costing System in The Small and Medium Sized Enterprises (SME) in TurkeySantosh DeshpandeNo ratings yet

- Advancedacctg CH08 SolutionsDocument33 pagesAdvancedacctg CH08 SolutionsJaySmith100% (1)

- Lo2 (!)Document2 pagesLo2 (!)a qassasNo ratings yet

Reliance Industries L TD.: Statement of Profit and Loss For The Year Ended 31 March

Reliance Industries L TD.: Statement of Profit and Loss For The Year Ended 31 March

Uploaded by

Juhi BansalOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Reliance Industries L TD.: Statement of Profit and Loss For The Year Ended 31 March

Reliance Industries L TD.: Statement of Profit and Loss For The Year Ended 31 March

Uploaded by

Juhi BansalCopyright:

Available Formats

RELIANCE INDUSTRIES L TD.

STATEMENT OF PROFIT AND LOSS FOR THE YEAR ENDED 31st MARCH 2012

PARTICULARS

INCOME Revenue from operations (gross) Less: Excise Duty Revenue from operations (Net) Other Income Total Revenue EXPENSES Cost of material consumed Add : purchase of stock in trade (Increase)/Decrease in inventories of finished goods and WIP Employee benefit expense Depreciation and Amortisation expenses Finance costs

NOTE 31/03/2012

3,39,792 9,888 329904

6192 336096

274814 1441 (872) 3 4 5 2862 11394 2667 21523 313829

Other Expenses Total Expenses

Profit before tax Current tax

Profit for the year

22267 5150 17117

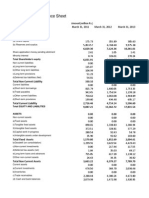

BALANCE SHEET AS AT 31st MARCH 2012

NOTE NO.

31/03/2012

EQUITY AND LIABILITIES

Shareholders funds Share capital Reserves & Surplus Non current liability Long term borrowings Deferred tax liabilities Current liabilities Short term borrowings Trade paybles Other current liabilities Short term provisions 9 10593 40324 13713 4258 8 48034 12122 6 7 3271 166114

TOTAL

295158

ASSETS

Non-current assets Fixed assets Tangible assets Intangible assets Capital WIP Intangible assets under development 88001 25722 3695 4059

NOTES TO PROFIT AND LOSS ACCOUNT

1)INCOME FROM OPERATIONS PARTICULARS Sale of products Income from services Revenue from operations 31/03/2012 339721 71 339792

2) OTHER INCOME PARTICULARS Income from interest Dividend income Sale of inv estments 31/03/2012 4414 143 1635 6192

3) EMPLOYEE BENEFIT EXPENSE PARTICULARS Salaries and wages Contribution to PF and other funds Staff welfare expenses 31/03/2012 2433 215 214 2862

4) FINANCE COSTS PARTICULARS Interest Expenses Other borrowing costs Applicable loss on foreign currency transactions and translation 31/03/2012 1966 18 683 2667

5) OTHER EXPENSES PARTICULARS Manufacturing expenses Selling and distribution expenses Establishment expenses Other expenses 31/03/2012 10307 5393 2344 3479 21523

NOTES TO BALANCE SHEET

6) SHARE HOLDERS FUNDS Authorised share capital : 5000000000 equity shares of Rs. 10 each 1000000000 preference shares of Rs. 10 each 5000 1000 6000 Issued, subscribed and paid up share capital : 327,10,59,340 Equity Shares of ` 10 each fully 3271 3271

7)RESERVES AND SURPLUS Revaluation reserve Capital reserve Securities premium reserve Debentures redemption reserve General reserve Profit & loss account 3127 291 50677 1117 84000 22983

166114

8) LONG TERM BORROWINGS PARTICULARS Secured Non-convertible debentures Long term maturities of finance lease obligations Unsecured Bonds Term loans from banks Deferred payment liabilities 4564 37269 9 48034 SHORT TERM BORROWINGS Secured Working capital loans from banks Unsecured Loans and advances from banks 9836 757 6024 168 31/03/2012

10593

Non current investments Long term loans & advances Current assets Current investments Inventories Trade receivables Cash & bank balances Short term loans & advances Other current assets

26979 14340

27029 35955 18424 39598 11089 249

TOTAL

295140

DISCLOSURES :1). Out of the issued, subscribed and paid up equity share capital, LIC of India holds 23,19,67,257 shares amounting to 7.09% of the share capital. 2)non convertible debentures carry an interest rate of 10.75% and are due for redemption in three annual installment and they are secured by a first charge on various fixed assets and immovable properties of the company. 3) Bonds are unsecured and are due for payment in 2015-16 4) Finance lease obligations are secured against leased assets 5) Out of trade payables sum of Rs 55 crores is due to MSMEs 6) Term loans are unsecured and are due for payment in equal annual installments over next 6 years beginning 2012-13

You might also like

- SERIES 65 EXAM STUDY GUIDE 2021 + TEST BANKFrom EverandSERIES 65 EXAM STUDY GUIDE 2021 + TEST BANKNo ratings yet

- How Does Operations Strategies Help A Business Sustain Its Competitive Advantage andDocument5 pagesHow Does Operations Strategies Help A Business Sustain Its Competitive Advantage andKrishna Kannan100% (1)

- Container AccountsDocument9 pagesContainer AccountsNelsonMoseM100% (3)

- Afm PDFDocument5 pagesAfm PDFBhavani Singh RathoreNo ratings yet

- Consolidated Balance Sheet As at 31st March, 2012: Particulars (Rs. in Lakhs)Document25 pagesConsolidated Balance Sheet As at 31st March, 2012: Particulars (Rs. in Lakhs)sudhak111No ratings yet

- Consolidated Balance Sheet: Equity and LiabilitiesDocument49 pagesConsolidated Balance Sheet: Equity and LiabilitiesmsssinghNo ratings yet

- Cash Flow Statements - FinalDocument18 pagesCash Flow Statements - FinalAchal GuptaNo ratings yet

- 8100 (Birla Corporation)Document61 pages8100 (Birla Corporation)Viz PrezNo ratings yet

- Cash Flow Statements - FinalDocument18 pagesCash Flow Statements - FinalAbhishek RawatNo ratings yet

- Cash Flow Statement: For The Year Ended March 31, 2013Document2 pagesCash Flow Statement: For The Year Ended March 31, 2013malynellaNo ratings yet

- ITC Consolidated FinancialsDocument49 pagesITC Consolidated FinancialsVishal JaiswalNo ratings yet

- Tut 4 - Reliance Financial StatementsDocument3 pagesTut 4 - Reliance Financial StatementsJulia DanielNo ratings yet

- Financial Reports of Devi Sea LTD: Profit & Loss Account For The Year Ended 31St March, 2009Document11 pagesFinancial Reports of Devi Sea LTD: Profit & Loss Account For The Year Ended 31St March, 2009Sakhamuri Ram'sNo ratings yet

- Tute3 Reliance Financial StatementsDocument3 pagesTute3 Reliance Financial Statementsvivek patelNo ratings yet

- Rupees 000: Unconsolidated Statement of Financial Position As at December 31, 2011Document17 pagesRupees 000: Unconsolidated Statement of Financial Position As at December 31, 2011Jamal GillNo ratings yet

- Fs Q2fy13crDocument4 pagesFs Q2fy13crAisha HusaainNo ratings yet

- Income: Particulars March, 31 2012 31-Mar-13Document6 pagesIncome: Particulars March, 31 2012 31-Mar-13Tatsat PandeyNo ratings yet

- USD $ in MillionsDocument8 pagesUSD $ in MillionsAnkita ShettyNo ratings yet

- Analysis of Apollo TiresDocument12 pagesAnalysis of Apollo TiresTathagat ChatterjeeNo ratings yet

- Equity Research - Finance Modelling - NIFTY - SENSEX CompaniesDocument46 pagesEquity Research - Finance Modelling - NIFTY - SENSEX Companiesyash bajajNo ratings yet

- Myer AR10 Financial ReportDocument50 pagesMyer AR10 Financial ReportMitchell HughesNo ratings yet

- Wipro Financial StatementsDocument37 pagesWipro Financial StatementssumitpankajNo ratings yet

- Hinopak Motors Limited Balance Sheet As at March 31, 2013Document40 pagesHinopak Motors Limited Balance Sheet As at March 31, 2013nomi_425No ratings yet

- DRB-HICOM Interim Report Mar10Document21 pagesDRB-HICOM Interim Report Mar10Jefrry AbdullahNo ratings yet

- TCS Ifrs Q3 13 Usd PDFDocument23 pagesTCS Ifrs Q3 13 Usd PDFSubhasish GoswamiNo ratings yet

- 1Q2013 AnnouncementDocument17 pages1Q2013 AnnouncementphuawlNo ratings yet

- Tescoar13 GroupincomeDocument1 pageTescoar13 GroupincomeGhada SalahNo ratings yet

- Letter To Shareholders and Financial Results September 2012Document5 pagesLetter To Shareholders and Financial Results September 2012SwamiNo ratings yet

- Financial Statements June 2012 Paper Ad 3rd ProofDocument1 pageFinancial Statements June 2012 Paper Ad 3rd ProofArman Hossain WarsiNo ratings yet

- Ongc Company AnalysisDocument34 pagesOngc Company AnalysisApeksha SaggarNo ratings yet

- Group Case #1Document3 pagesGroup Case #1Brenda Parham50% (2)

- TCS Condensed IndianGAAP Q3 12Document29 pagesTCS Condensed IndianGAAP Q3 12Neha SahaNo ratings yet

- 2014 IFRS Financial Statements Def CarrefourDocument80 pages2014 IFRS Financial Statements Def CarrefourawangNo ratings yet

- BritanniaDocument49 pagesBritanniaParinNo ratings yet

- Asset Management 2011-12Document25 pagesAsset Management 2011-12RabekanadarNo ratings yet

- Ashok LeylandDocument1,832 pagesAshok Leylandjadhavshankar100% (1)

- DLF LTD Ratio Analyses (ALL Figures in Rs Crores) (Realty)Document18 pagesDLF LTD Ratio Analyses (ALL Figures in Rs Crores) (Realty)AkshithKapoorNo ratings yet

- Consolidated Accounts June-2011Document17 pagesConsolidated Accounts June-2011Syed Aoun MuhammadNo ratings yet

- HUL Stand Alone StatementsDocument50 pagesHUL Stand Alone StatementsdilipthosarNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Chinasoft International Limited: Annual Results Announcement For The Year Ended 31 December 2012Document50 pagesChinasoft International Limited: Annual Results Announcement For The Year Ended 31 December 2012alan888No ratings yet

- Consol FY11 Annual Fin StatementDocument13 pagesConsol FY11 Annual Fin StatementLalith RajuNo ratings yet

- Cash FlowDocument14 pagesCash Flowsujitpradhan1989gmaiNo ratings yet

- CHEM Audited Results For FY Ended 31 Oct 13Document5 pagesCHEM Audited Results For FY Ended 31 Oct 13Business Daily ZimbabweNo ratings yet

- LGE 2010 4Q ConsolidationDocument89 pagesLGE 2010 4Q ConsolidationSaba MasoodNo ratings yet

- Patriculars Equity and LiabilitiesDocument12 pagesPatriculars Equity and LiabilitiesSanket PatelNo ratings yet

- 2021 Con Quarter01 AllDocument61 pages2021 Con Quarter01 AllMohammadNo ratings yet

- New Listing For PublicationDocument2 pagesNew Listing For PublicationAathira VenadNo ratings yet

- Pre q12013fsDocument27 pagesPre q12013fsKatie SanchezNo ratings yet

- 9706 s12 QP 43Document8 pages9706 s12 QP 43Adrian JosephianNo ratings yet

- 5ead0financial RatiosDocument3 pages5ead0financial RatiosGourav DuttaNo ratings yet

- CMA Format Munjal ShowaDocument13 pagesCMA Format Munjal ShowaMohit KumarNo ratings yet

- Profit and Loss Account For The Year Ended 31 March, 2012Document6 pagesProfit and Loss Account For The Year Ended 31 March, 2012Sandeep GalipelliNo ratings yet

- Dabur Balance SheetDocument30 pagesDabur Balance SheetKrishan TiwariNo ratings yet

- Banking System of Japan Financial DataDocument44 pagesBanking System of Japan Financial Datapsu0168No ratings yet

- Financial StatementDocument115 pagesFinancial Statementammar123No ratings yet

- Financial Statements: Nine Months Ended 31 March, 2009Document22 pagesFinancial Statements: Nine Months Ended 31 March, 2009Muhammad BakhshNo ratings yet

- Karnataka Bank Results Sep12Document6 pagesKarnataka Bank Results Sep12Naveen SkNo ratings yet

- PhilipsFullAnnualReport2013 EnglishDocument250 pagesPhilipsFullAnnualReport2013 Englishjasper laarmansNo ratings yet

- Sushrut Yadav PGFB2156 IMDocument15 pagesSushrut Yadav PGFB2156 IMAgneesh DuttaNo ratings yet

- MCB Consolidated For Year Ended Dec 2011Document87 pagesMCB Consolidated For Year Ended Dec 2011shoaibjeeNo ratings yet

- Income Tax Law for Start-Up Businesses: An Overview of Business Entities and Income Tax LawFrom EverandIncome Tax Law for Start-Up Businesses: An Overview of Business Entities and Income Tax LawRating: 3.5 out of 5 stars3.5/5 (4)

- Annual Report 2011-12Document152 pagesAnnual Report 2011-12Juhi BansalNo ratings yet

- Assignment - Company AnalysisDocument2 pagesAssignment - Company AnalysisJuhi BansalNo ratings yet

- Number of Hops Between 2 Given End SystemsDocument2 pagesNumber of Hops Between 2 Given End SystemsJuhi Bansal100% (1)

- Cloud ComputingDocument8 pagesCloud ComputingJuhi BansalNo ratings yet

- The Central Processing UnitDocument1 pageThe Central Processing UnitJuhi BansalNo ratings yet

- Intermediate Accounting IFRS Edition: Kieso, Weygandt, WarfieldDocument34 pagesIntermediate Accounting IFRS Edition: Kieso, Weygandt, WarfieldPaulina RegginaNo ratings yet

- MKTG4354 Ch.6Document4 pagesMKTG4354 Ch.6Husam ALswalhaNo ratings yet

- Ceylon Tea With Kepferer Identity PrismDocument2 pagesCeylon Tea With Kepferer Identity PrismThilina100% (1)

- Mini Project HyundaiDocument28 pagesMini Project Hyundaimaraimalai2010No ratings yet

- Capture The Current Business Model: Complex ActivityDocument17 pagesCapture The Current Business Model: Complex ActivitymmuneebsdaNo ratings yet

- Tutorial 2Document7 pagesTutorial 2Shivarni KumarNo ratings yet

- Customer Relationship StrategiesDocument24 pagesCustomer Relationship StrategiesSiddharth Singh TomarNo ratings yet

- Natural Gas Hedging For End UsersDocument5 pagesNatural Gas Hedging For End UsersMercatus Energy AdvisorsNo ratings yet

- Greenlight Capital Open Letter To AppleDocument5 pagesGreenlight Capital Open Letter To AppleZim VicomNo ratings yet

- ADJUSTING ENTRIES PPT TacsanDocument31 pagesADJUSTING ENTRIES PPT TacsanDanicaNo ratings yet

- K03263 - S and OP Article KBDocument4 pagesK03263 - S and OP Article KBProcusto LNo ratings yet

- Topic 2Document3 pagesTopic 2Shao Ning Rachael NeoNo ratings yet

- ABC June 2008Document2 pagesABC June 2008ACCA StudentNo ratings yet

- Rms Policy DocumentDocument6 pagesRms Policy DocumentAshish TripathiNo ratings yet

- Wimba AFBD Form (June 2022)Document4 pagesWimba AFBD Form (June 2022)Darshan PatiraNo ratings yet

- 010-Reducing Agent SwitchingDocument91 pages010-Reducing Agent Switchingasri nurulNo ratings yet

- Kumar Et Al. (2019)Document17 pagesKumar Et Al. (2019)Lance HuendersNo ratings yet

- ACCA APM M2020 AnswerDocument11 pagesACCA APM M2020 AnswerAilaNo ratings yet

- Financial Management in Current Operations and Expansion of Capital in IndiaDocument40 pagesFinancial Management in Current Operations and Expansion of Capital in IndiaSan Deep SharmaNo ratings yet

- 3.production CostDocument30 pages3.production CostroberaakNo ratings yet

- Cost AccountingDocument5 pagesCost Accountingretchiel love calinogNo ratings yet

- Ppe Depreciation and DepletionDocument21 pagesPpe Depreciation and DepletionEarl Lalaine EscolNo ratings yet

- Abu Dhabi Investor Guide 2021aDocument35 pagesAbu Dhabi Investor Guide 2021aAsma MaatigNo ratings yet

- P2 Workbook Q PDFDocument91 pagesP2 Workbook Q PDFShelley ThompsonNo ratings yet

- Financial Statement Analysis-2Document12 pagesFinancial Statement Analysis-2Glaidel Rodenas PeñaNo ratings yet

- Application of Costing System in The Small and Medium Sized Enterprises (SME) in TurkeyDocument1 pageApplication of Costing System in The Small and Medium Sized Enterprises (SME) in TurkeySantosh DeshpandeNo ratings yet

- Advancedacctg CH08 SolutionsDocument33 pagesAdvancedacctg CH08 SolutionsJaySmith100% (1)

- Lo2 (!)Document2 pagesLo2 (!)a qassasNo ratings yet