Professional Documents

Culture Documents

Thesun 2009-07-06 Page14 Too Costly For Govt To Take Over Toll Roads Analysts

Thesun 2009-07-06 Page14 Too Costly For Govt To Take Over Toll Roads Analysts

Uploaded by

Impulsive collector0 ratings0% found this document useful (0 votes)

13 views1 pageThe document discusses analysts' views on the likelihood and costs of the Malaysian government nationalizing toll road operators. It provides the following key points:

1) Analysts say it would be too costly for the government to buy out toll operators like PLUS Expressways, which could cost up to RM30 billion, and the funds would be better spent revitalizing the economy.

2) Privately acquiring PLUS Expressways could cost RM15.7 billion, which analysts say the government would also be unlikely to afford given current economic conditions.

3) Nationalizing toll roads would significantly increase the government's budget deficit at a time when funds are already stretched addressing the economic crisis and other priorities.

Original Description:

Original Title

thesun 2009-07-06 page14 too costly for govt to take over toll roads analysts

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses analysts' views on the likelihood and costs of the Malaysian government nationalizing toll road operators. It provides the following key points:

1) Analysts say it would be too costly for the government to buy out toll operators like PLUS Expressways, which could cost up to RM30 billion, and the funds would be better spent revitalizing the economy.

2) Privately acquiring PLUS Expressways could cost RM15.7 billion, which analysts say the government would also be unlikely to afford given current economic conditions.

3) Nationalizing toll roads would significantly increase the government's budget deficit at a time when funds are already stretched addressing the economic crisis and other priorities.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

13 views1 pageThesun 2009-07-06 Page14 Too Costly For Govt To Take Over Toll Roads Analysts

Thesun 2009-07-06 Page14 Too Costly For Govt To Take Over Toll Roads Analysts

Uploaded by

Impulsive collectorThe document discusses analysts' views on the likelihood and costs of the Malaysian government nationalizing toll road operators. It provides the following key points:

1) Analysts say it would be too costly for the government to buy out toll operators like PLUS Expressways, which could cost up to RM30 billion, and the funds would be better spent revitalizing the economy.

2) Privately acquiring PLUS Expressways could cost RM15.7 billion, which analysts say the government would also be unlikely to afford given current economic conditions.

3) Nationalizing toll roads would significantly increase the government's budget deficit at a time when funds are already stretched addressing the economic crisis and other priorities.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

14 theSun | MONDAY JULY 6 2009

business

Too costly for govt to take

over toll roads: Analysts

KUALA LUMPUR: The ernment was most unlikely tionalisation on the corporate

government is unlikely to opt to invoke an expropriation bond market, analysts said

for the nationalisation of the clause in the toll concession that nationalisation would

country’s toll operators as the agreement to nationalise decrease the total outstanding

cost would be too big for the PLUS Expressways as it could amount when toll operators

government to bear amidst involve shelling out a total of retire their bonds.

the current weak economic RM30 billion for the exercise. The opposite would hap-

climate, analysts say. Another option is the pri- pen to Malaysian Government

They say it would not be vatisation route – assuming Securities (MGS) should the

feasible for the government to the target price is RM3.80 government fund its buyout of

buy over toll operators per share and with PLUS toll operators through MGS.

It is very as financial resources Expressways’ debt less cash, An analyst with a local

costly ... and are needed more to-

wards revitalising the

the cost will work out to be

RM15.7 billion.

stockbroking firm who spoke

on condition of anonymity

the move will economy. However, DBS Vickers said if the government decides

“It is very costly... Research said the privatisa- to nationalise toll highways,

put a heavy and the move will tion of PLUS Expressways one big issue would be the

strain on the put a heavy strain was also unlikely as it “will recovery of its investment.

on the government’s likely anger East Malaysian “The government would

government’s budget at a time where citizens who would not not only be saddled with the

budget at a competition for funds

is high due to the

benefit from it, coupled with

the fact that Barisan Nasional

issue of toll rates but also how

it will maintain the highways

time where economic crisis,” said (BN) component parties there apart from recovering its

competition Jupiter Securities head

of research Pong Teng

control 40% of the total BN

coalition.”

investments,” he said.

In terms of financing, he

for funds is Siew. It also said that the priva- said, the government was

high due to “Nationalisation of

toll operators would

tisation of Lingkaran Trans

Kota Holdings Bhd (Litrak)

already overstretched in

funding the nationalisation of

the economic not just be costly but – the concession holder of the country’s water assets.

more importantly Damansara-Puchong High- The nationalisation of toll

crisis.” would not have any way (LDP) – by the govern- highways that would require

– Pong Teng Siew significant impact on ment looked stronger as it massive funding would

the economy, the busi- would cost approximately increase the government’s

ness environment as RM1.3 billion to take the budget deficit and contrary

well as the capital markets,” company private compared to to its intention to reduce the

he told Bernama. PLUS Expressways’ RM15.7 deficit.

Calls for the nationalisation billion. The analysts interviewed

of toll highways came about Given that the focus was said the government may look

early this year particularly of on the two stimulus packages, at other options like building

the North South Expressway a bond issuance of RM15.7 new highways or alternative

managed by PLUS Express- billion would not be easily routes as a near to medium

ways Bhd. absorbed, said the Singapore- term solution to the problem

DBS Vickers Research based research house. of road congestion and toll

recently stated that the gov- As for the impact of na- hikes. – Bernama

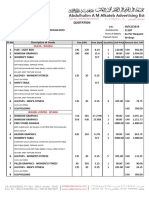

market summary JULY 3, 2009

Share prices expected to trade INDICES

FBMEMAS

CHANGE

7208.01 -13.86

rangebound this week COMPOSITE

INDUSTRIAL

1072.69

2375.51

-6.02

-13.43

SHARE prices on Bursa Malaysia 100,” said the research house. CONSUMER PROD 321.72 -1.86

INDUSTRIAL PROD 82.94 -0.66

are likely to see a rangebound trade Among the biggest beneficiaries will CONSTRUCTION 202.23 -3.71

next week with investors continuing be Genting, YTL Power and Parkson TRADING/SERVICE 143.29 0.16

to be cautious amid bearish market Holdings, which are in both the FBM FINANCE 8542.12 -46.00

sentiments. KLCI and FBM 100. PROPERTIES 697.44 -1.29

The adoption of the FTSE Bursa The top six on the FBM KLCI will be PLANTATION 5375.84 -31.78

Malaysia Kuala Lumpur Composite Index Bumiputra-Commerce, Public Bank, MINING 273.57 0.00

FBMSHA 7429.92 -17.13

(FBM KLCI) effective today from the Kuala Sime Darby, Maybank, Tenaga and IOI FBM2BRD 4725.07 35.32

Lumpur Composite Index (KLCI) is also Corporation, all of which will see their TECHNOLOGY 13.99 -0.17

expected to keep trade rangebound. weightage increase by two percentage

FBM KLCI is made up of the 30 larg- points or more. TURNOVER VALUE

est listed companies by market value, Meanwhile, a dealer said the KLCI 1.097bil RM983mil

with at least a 15% free float. will likely move between 1,040 and

Its constituents are prime market 1,090 this week. billion shares valued at RM5.389

movers and represent about 60-70% He said despite the announcement billion from 6.655 billion shares worth

of the main board’s market capitalisa- of further liberalisation in the capital RM6.932 billion the week before.

tion. market last Tuesday, it will take a while Volume on the Main Board declined

OSK Research Sdn Bhd, in its for the market participants to react to 4.421 billion shares valued at

research note said most fund manag- positively with the transition to the RM5.209 billion versus the previous

ers prefer to benchmark their fund new index. Friday’s close of 5.757 billion shares

against the FBM100 rather than the On Friday-to-Friday basis, the KLCI worth RM6.686 billion.

new FBM KLCI as the former more eased 3.08 points to close at 1,072.69 The Second Board’s volume eased

closely matched the old KLCI in terms compared with last week’s closing of to 304.794 million shares valued at

of diversity. 1,075.77. RM115.711 million from 475.424 million

Sixteen of the current 17 sectors are The Finance Index improved 18.95 shares valued at RM168.85 million the

represented in the FBM100 except for points to 8,542.12, the Plantation Index week before.

timber. declined 20.16 points to 5,375.84 while Turnover on the Mesdaq Market

“Given that most institutional the Industrial Index gained 28.94 points dropped to 144.723 million units worth

investors will be benchmarking to 2,375.51. RM24.697 million compared with

against the FBM100, we see the KLCI The FMBEmas slipped 3.45 points 280.855 million shares worth RM49.336

component stocks feeling far less to 7,208.01, the FBM2BRD lost 73.73 million previously.

impact come July 6. points to 4,725.07, the FBM30 gained Call warrants’ volume declined to

“There should be less selling 81.76 points to 6,987.67 and the 69.152 million worth RM12.177 million

pressure on the 70 KLCI stocks that did FBMMDQ dropped 140.66 points to from the previous week’s closing of

not make it to the FBM KLCI as 45 of 3,976.31. 111.811 million valued at RM16.843

these companies will still be in the FBM Weekly turnover dropped to 4.996 million. -- Bernama

You might also like

- Ratio Analysis and Forecasting Quiz - CourseraDocument6 pagesRatio Analysis and Forecasting Quiz - CourseraLuisSalvador19874% (28)

- Suave FinalDocument43 pagesSuave Finalsamir3105100% (6)

- Hay Group Guide Chart - Profile Method of Job Evaluation - Intro & OverviewDocument4 pagesHay Group Guide Chart - Profile Method of Job Evaluation - Intro & OverviewImpulsive collector100% (1)

- Hay Group Guide Chart - Profile Method of Job EvaluationDocument27 pagesHay Group Guide Chart - Profile Method of Job EvaluationImpulsive collector78% (9)

- Developing An Enterprise Leadership MindsetDocument36 pagesDeveloping An Enterprise Leadership MindsetImpulsive collectorNo ratings yet

- Compensation Fundamentals - Towers WatsonDocument31 pagesCompensation Fundamentals - Towers WatsonImpulsive collector80% (5)

- KL City Plan 2020Document10 pagesKL City Plan 2020Impulsive collector0% (2)

- Game TheoryDocument2 pagesGame TheoryTushar BallabhNo ratings yet

- Microeconomic Pindyck CH 16Document37 pagesMicroeconomic Pindyck CH 16JemiNo ratings yet

- TheSun 2008-12-16 Page04 Help Weather Housing Loan Woes GerakanDocument1 pageTheSun 2008-12-16 Page04 Help Weather Housing Loan Woes GerakanImpulsive collectorNo ratings yet

- Thesun 2009-07-09 Page16 B-Land Raises rm190m From Btoto PlacementDocument1 pageThesun 2009-07-09 Page16 B-Land Raises rm190m From Btoto PlacementImpulsive collectorNo ratings yet

- Thesun 2009-01-07 Page15 People Pay For Sweet Toll DealsDocument1 pageThesun 2009-01-07 Page15 People Pay For Sweet Toll DealsImpulsive collectorNo ratings yet

- OutlookDocument4 pagesOutlookgenaNo ratings yet

- Thesun 2009-05-12 Page05 Fire Poser On Bukit GasingDocument1 pageThesun 2009-05-12 Page05 Fire Poser On Bukit GasingImpulsive collectorNo ratings yet

- Thesun 2009-02-20 Page08 Govt Delays Selangor Water Tariff ReviewDocument1 pageThesun 2009-02-20 Page08 Govt Delays Selangor Water Tariff ReviewImpulsive collectorNo ratings yet

- Thesun 2009-03-17 Page09 Decline in Equity Markets Pares Epfs EarningDocument1 pageThesun 2009-03-17 Page09 Decline in Equity Markets Pares Epfs EarningImpulsive collectorNo ratings yet

- Nirmalanomics: Demand Gain Without Fiscal PainDocument23 pagesNirmalanomics: Demand Gain Without Fiscal PainGopalakrishnan SivasamyNo ratings yet

- TheSun 2009-01-23 Page06 Pua Take Back The HighwaysDocument1 pageTheSun 2009-01-23 Page06 Pua Take Back The HighwaysImpulsive collectorNo ratings yet

- Transit Times Volume 3, Number 3Document3 pagesTransit Times Volume 3, Number 3AC Transit HistorianNo ratings yet

- Bullish For A Good Cause, 21 Nov 2009, Straits TimesDocument1 pageBullish For A Good Cause, 21 Nov 2009, Straits TimesdbmcysNo ratings yet

- Thesun 2009-03-05 Page07 Khalid Five Initiatives To Spur State EconomyDocument1 pageThesun 2009-03-05 Page07 Khalid Five Initiatives To Spur State EconomyImpulsive collectorNo ratings yet

- TheSun 2009-02-27 Page12 10pct Less Tariff If Selangor Takes Over WaterDocument1 pageTheSun 2009-02-27 Page12 10pct Less Tariff If Selangor Takes Over WaterImpulsive collector100% (1)

- Current Affairs September 11Document2 pagesCurrent Affairs September 11Michael BenilanNo ratings yet

- Zwe Zim Sitting On Debt Time Bomb BusinesstimesDocument2 pagesZwe Zim Sitting On Debt Time Bomb Businesstimespalae lolNo ratings yet

- RHB Equity - 4 May 2010 (Construction, Semiconductor, Kencana, Daibochi, Hunza Technical: Proton)Document4 pagesRHB Equity - 4 May 2010 (Construction, Semiconductor, Kencana, Daibochi, Hunza Technical: Proton)Rhb InvestNo ratings yet

- Budget 2 2011 3 2 26Document1 pageBudget 2 2011 3 2 26Kumar Makarand BhaskerNo ratings yet

- Thesun 2009-05-07 Page12 Opr Rate Appropriate Says BNM ChiefDocument1 pageThesun 2009-05-07 Page12 Opr Rate Appropriate Says BNM ChiefImpulsive collectorNo ratings yet

- TheSun 2009-02-27 Page02 Reps Will Be Prosecuted For False ReportsDocument1 pageTheSun 2009-02-27 Page02 Reps Will Be Prosecuted For False ReportsImpulsive collectorNo ratings yet

- Index - 2021-01-12T120530.513 PDFDocument1 pageIndex - 2021-01-12T120530.513 PDFAkshay BahetyNo ratings yet

- Thesun 2009-06-05 Page13 PM Wants Broader Trade Base Between Malaysia and ChinaDocument1 pageThesun 2009-06-05 Page13 PM Wants Broader Trade Base Between Malaysia and ChinaImpulsive collectorNo ratings yet

- TheSun 2009-02-04 Page09 No Plan For Spending VouchersDocument1 pageTheSun 2009-02-04 Page09 No Plan For Spending VouchersImpulsive collectorNo ratings yet

- Thesun 2009-06-23 Page05 rm12Document1 pageThesun 2009-06-23 Page05 rm12Impulsive collectorNo ratings yet

- Thesun 2009-03-02 Page07 The Politics of WaterDocument1 pageThesun 2009-03-02 Page07 The Politics of WaterImpulsive collectorNo ratings yet

- Thesun 2009-08-25 Page16 Ijm To Launch Projects Worth Rm1bilDocument1 pageThesun 2009-08-25 Page16 Ijm To Launch Projects Worth Rm1bilImpulsive collectorNo ratings yet

- Morning: BriefDocument25 pagesMorning: BriefLimNo ratings yet

- TheSun 2008-11-20 Page04 Toll Discount Will Benefit Only A FewDocument1 pageTheSun 2008-11-20 Page04 Toll Discount Will Benefit Only A FewImpulsive collectorNo ratings yet

- Thesun 2009-06-16 Page04 Najib Defends Stimulus PackagesDocument1 pageThesun 2009-06-16 Page04 Najib Defends Stimulus PackagesImpulsive collectorNo ratings yet

- Thesun 2009-01-06 Page02 LDP Concessionaire Making Excessive ProfitDocument1 pageThesun 2009-01-06 Page02 LDP Concessionaire Making Excessive ProfitImpulsive collectorNo ratings yet

- TheSun 2009-09-10 Page14 Btotos q1 Pre-Tax Profit Up 8.8pctDocument1 pageTheSun 2009-09-10 Page14 Btotos q1 Pre-Tax Profit Up 8.8pctImpulsive collectorNo ratings yet

- Thesun 2009-07-23 Page15 Petronas Gas To Spend Rm1bil To Revamp Ageing PlantsDocument1 pageThesun 2009-07-23 Page15 Petronas Gas To Spend Rm1bil To Revamp Ageing PlantsImpulsive collectorNo ratings yet

- Thesun 2009-06-17 Page14 Malaysia Set To Register Positive Growth in q4Document1 pageThesun 2009-06-17 Page14 Malaysia Set To Register Positive Growth in q4Impulsive collectorNo ratings yet

- Morning: BriefDocument30 pagesMorning: BriefLimNo ratings yet

- Pressure Rising On East Timor To Make A Deal: Vol. 6 / No. 225 / 21 November 2016Document9 pagesPressure Rising On East Timor To Make A Deal: Vol. 6 / No. 225 / 21 November 2016hortalemosNo ratings yet

- Bank Privatisation - Ram Mohan 2020Document3 pagesBank Privatisation - Ram Mohan 2020Aditya GuptaNo ratings yet

- 17 Golam Final (173-183)Document11 pages17 Golam Final (173-183)Shahid Ahmed KhanNo ratings yet

- TPJVol XVIEditionNo01 - 1704390222Document17 pagesTPJVol XVIEditionNo01 - 1704390222Walt ErNo ratings yet

- BKash Performance Analysis & ValuationDocument12 pagesBKash Performance Analysis & ValuationZeehenul IshfaqNo ratings yet

- Thesun 2009-10-20 Page16 RHB Capital To Acquire Bank Mestika For rm1Document1 pageThesun 2009-10-20 Page16 RHB Capital To Acquire Bank Mestika For rm1Impulsive collectorNo ratings yet

- PKFZ: Foolhardy To Ignore New 'Missing Links' and People's InterestsDocument8 pagesPKFZ: Foolhardy To Ignore New 'Missing Links' and People's InterestsMohamad Hafizuddin Bin MajekNo ratings yet

- Pow-Wow On Child Education, 22 May 2009, Straits TimesDocument1 pagePow-Wow On Child Education, 22 May 2009, Straits TimesdbmcysNo ratings yet

- Investing in Toll Highway Private or Public Financing With Scenario-Based SolutionDocument16 pagesInvesting in Toll Highway Private or Public Financing With Scenario-Based Solutionfightingfist02No ratings yet

- Review of Budget 2020 Proposals On The Malaysian Real Estate SectorDocument16 pagesReview of Budget 2020 Proposals On The Malaysian Real Estate Sectorzulkis73No ratings yet

- Women DevelopmentDocument15 pagesWomen DevelopmentSukanya RayNo ratings yet

- IAIAWP24-Broking Telematics-V1Document4 pagesIAIAWP24-Broking Telematics-V1metineeklaNo ratings yet

- Debt Policy of State-Owned Mining Enterprises in Mongolia enDocument27 pagesDebt Policy of State-Owned Mining Enterprises in Mongolia enUsukhbayar GombosurenNo ratings yet

- Leading The Future in The Gulf - Grant ThortonsDocument10 pagesLeading The Future in The Gulf - Grant ThortonsrobynxjNo ratings yet

- Morning: TNB To Invest RM90 Bil For Grid in Next Six Years, Says CEODocument24 pagesMorning: TNB To Invest RM90 Bil For Grid in Next Six Years, Says CEOQuint WongNo ratings yet

- Thesun 2009-06-23 Page16 Life Insurance Industry Growing Despite SlowdownDocument1 pageThesun 2009-06-23 Page16 Life Insurance Industry Growing Despite SlowdownImpulsive collectorNo ratings yet

- TheSun 2009-09-04 Page11 Epf q2 Investment Income Is Rm4.8bDocument1 pageTheSun 2009-09-04 Page11 Epf q2 Investment Income Is Rm4.8bImpulsive collectorNo ratings yet

- Thesun 2009-08-21 Page14 Cut in Operating Expenditure Will Not Reduce Deficit MierDocument1 pageThesun 2009-08-21 Page14 Cut in Operating Expenditure Will Not Reduce Deficit MierImpulsive collectorNo ratings yet

- Business Line - 13 MarchDocument12 pagesBusiness Line - 13 MarchKirti SainiNo ratings yet

- TheSun 2009-01-23 Page18 Spore Taps Reserves For Budget Stimulus Cuts TaxDocument1 pageTheSun 2009-01-23 Page18 Spore Taps Reserves For Budget Stimulus Cuts TaxImpulsive collectorNo ratings yet

- National Monetisation Pipeline: Why in NewsDocument3 pagesNational Monetisation Pipeline: Why in Newssushmita singhNo ratings yet

- Post Budget Impact Analysis 2016-17: Retail ResearchDocument9 pagesPost Budget Impact Analysis 2016-17: Retail ResearchGarry GargNo ratings yet

- Exposes Depth of Corruption, Capitalism and Its Governance Have Sunk in IndiaDocument8 pagesExposes Depth of Corruption, Capitalism and Its Governance Have Sunk in Indiadebdeep sinhaNo ratings yet

- Thesun 2009-06-22 Page14 Measat Targetsrm355m Revenue Next Four YearsDocument1 pageThesun 2009-06-22 Page14 Measat Targetsrm355m Revenue Next Four YearsImpulsive collector100% (1)

- RHB Equity 360° - 19 October 2010 (ILB, Public Bank Technical: Ann Joo)Document3 pagesRHB Equity 360° - 19 October 2010 (ILB, Public Bank Technical: Ann Joo)Rhb InvestNo ratings yet

- Government Support To Private Infrastructure: M ArketsDocument35 pagesGovernment Support To Private Infrastructure: M ArketsspratiwiaNo ratings yet

- GMS Transport Sector Strategy 2030: Toward a Seamless, Efficient, Reliable, and Sustainable GMS Transport SystemFrom EverandGMS Transport Sector Strategy 2030: Toward a Seamless, Efficient, Reliable, and Sustainable GMS Transport SystemNo ratings yet

- Hay Group Guide Chart & Profile Method of Job Evaluation - An Introduction & OverviewDocument15 pagesHay Group Guide Chart & Profile Method of Job Evaluation - An Introduction & OverviewAyman ShetaNo ratings yet

- Futuretrends in Leadership DevelopmentDocument36 pagesFuturetrends in Leadership DevelopmentImpulsive collector100% (1)

- CLC Building The High Performance Workforce A Quantitative Analysis of The Effectiveness of Performance Management StrategiesDocument117 pagesCLC Building The High Performance Workforce A Quantitative Analysis of The Effectiveness of Performance Management StrategiesImpulsive collector100% (1)

- Coaching in OrganisationsDocument18 pagesCoaching in OrganisationsImpulsive collectorNo ratings yet

- Strategy+Business - Winter 2014Document108 pagesStrategy+Business - Winter 2014GustavoLopezGNo ratings yet

- Strategy+Business Magazine 2016 AutumnDocument132 pagesStrategy+Business Magazine 2016 AutumnImpulsive collector100% (3)

- Megatrends Report 2015Document56 pagesMegatrends Report 2015Cleverson TabajaraNo ratings yet

- Managing Conflict at Work - A Guide For Line ManagersDocument22 pagesManaging Conflict at Work - A Guide For Line ManagersRoxana VornicescuNo ratings yet

- 2015 Summer Strategy+business PDFDocument104 pages2015 Summer Strategy+business PDFImpulsive collectorNo ratings yet

- TheSun 2009-11-04 Page15 Huge Shake-Up For Rbs and LloydsDocument1 pageTheSun 2009-11-04 Page15 Huge Shake-Up For Rbs and LloydsImpulsive collectorNo ratings yet

- Talent Analytics and Big DataDocument28 pagesTalent Analytics and Big DataImpulsive collectorNo ratings yet

- TheSun 2009-11-04 Page14 Significant Success in Islamic Finance Says PMDocument1 pageTheSun 2009-11-04 Page14 Significant Success in Islamic Finance Says PMImpulsive collectorNo ratings yet

- TheSun 2009-11-04 Page11 We Await Answers To Dipang TragedyDocument1 pageTheSun 2009-11-04 Page11 We Await Answers To Dipang TragedyImpulsive collectorNo ratings yet

- Deloitte Analytics Analytics Advantage Report 061913Document21 pagesDeloitte Analytics Analytics Advantage Report 061913Impulsive collectorNo ratings yet

- 2016 Summer Strategy+business PDFDocument116 pages2016 Summer Strategy+business PDFImpulsive collectorNo ratings yet

- Global Talent 2021Document21 pagesGlobal Talent 2021rsrobinsuarezNo ratings yet

- Subjectct12005 2009Document176 pagesSubjectct12005 2009paul.tsho7504No ratings yet

- HUL Case StudyDocument40 pagesHUL Case StudyAditya JhaNo ratings yet

- Chapter 6-Supp, Demand, Govt PolicyDocument46 pagesChapter 6-Supp, Demand, Govt PolicyBrandon BarkerNo ratings yet

- Derivatives OptionsDocument2 pagesDerivatives Optionssaidutt sharmaNo ratings yet

- Ch8 LongDocument14 pagesCh8 LongratikdayalNo ratings yet

- Problems With Solutions (BF)Document6 pagesProblems With Solutions (BF)Saadat KhokharNo ratings yet

- Ho and Branch and Agency AcctgDocument38 pagesHo and Branch and Agency AcctgNiño Dwayne TuboNo ratings yet

- Sample Client: Portfolio ReviewDocument50 pagesSample Client: Portfolio Reviewtimothy sinamoNo ratings yet

- Sample Food Business PlanDocument17 pagesSample Food Business Planhana_kimi_91No ratings yet

- 18/12/2019 11187 As Per Request 30 Days: QuotationDocument3 pages18/12/2019 11187 As Per Request 30 Days: QuotationAdmin SAF PrintersNo ratings yet

- Modeling Attitude Toward RiskDocument11 pagesModeling Attitude Toward RiskFaizan Ul HaqNo ratings yet

- KOZMODocument2 pagesKOZMOSHEELAAANo ratings yet

- Security Analysis and Portfolio Management Project by TanveerDocument77 pagesSecurity Analysis and Portfolio Management Project by TanveeradeenNo ratings yet

- Harish S N - Impact of FIIs On Indian Stock MarketDocument22 pagesHarish S N - Impact of FIIs On Indian Stock MarketHarish SNNo ratings yet

- Chapter 3 ExercisesDocument2 pagesChapter 3 ExercisesHình VậnNo ratings yet

- Case: Blue Ocean Strategy: Theory To PracticeDocument6 pagesCase: Blue Ocean Strategy: Theory To PracticeKushal Kislay100% (1)

- Question: Wembley Travel Agency Specializes in Ights Between Los AnDocument2 pagesQuestion: Wembley Travel Agency Specializes in Ights Between Los AnShweta RayNo ratings yet

- National Income AccountingDocument21 pagesNational Income AccountingJohn Richard RiveraNo ratings yet

- ABC CompanyDocument7 pagesABC CompanyluvckNo ratings yet

- Chapter 2 Project Procurrement Planning and AnalysisDocument31 pagesChapter 2 Project Procurrement Planning and AnalysisMitku AssefaNo ratings yet

- 2 D 604 DD 9 EfDocument28 pages2 D 604 DD 9 EfjaeszNo ratings yet

- Countertops: United StatesDocument4 pagesCountertops: United StatesMichael WarnerNo ratings yet

- A Presentation On NPODocument14 pagesA Presentation On NPOanishNo ratings yet

- TransLink Efficiency ReviewDocument118 pagesTransLink Efficiency ReviewThe Vancouver SunNo ratings yet

- CHAPTER 12 Consumer Protection Short NotesDocument3 pagesCHAPTER 12 Consumer Protection Short NotesnaveenaNo ratings yet

- Cashflow Questionaire OdusamiDocument5 pagesCashflow Questionaire OdusamiSamuel OkorieNo ratings yet