Professional Documents

Culture Documents

Tomahawk 30 Importers Et. Al. v. International Integration

Tomahawk 30 Importers Et. Al. v. International Integration

Uploaded by

PriorSmartCopyright:

Available Formats

You might also like

- Ecocide: Kill the corporation before it kills usFrom EverandEcocide: Kill the corporation before it kills usRating: 4.5 out of 5 stars4.5/5 (4)

- Method of Statement For Installation of Pump (Submersible Pump and Deep Well Pump)Document4 pagesMethod of Statement For Installation of Pump (Submersible Pump and Deep Well Pump)Zin Ko Naing100% (2)

- Petunia Products, Inc. v. RODAN & FIELDS, LLC, MOLLY SIMS, and DOES 1 TO 20Document13 pagesPetunia Products, Inc. v. RODAN & FIELDS, LLC, MOLLY SIMS, and DOES 1 TO 20MaksimNo ratings yet

- RHINO GRASSHOPPER. WWW - Woojsung.com TUTORIAL Woo Jae SungDocument12 pagesRHINO GRASSHOPPER. WWW - Woojsung.com TUTORIAL Woo Jae Sungapi-2601040950% (4)

- One Retail Group v. Ideal Time Consultants - ComplaintDocument83 pagesOne Retail Group v. Ideal Time Consultants - ComplaintSarah BursteinNo ratings yet

- Atari v. NestleDocument39 pagesAtari v. NestleTHROnlineNo ratings yet

- Privacy Pop v. Marketfleet - ComplaintDocument26 pagesPrivacy Pop v. Marketfleet - ComplaintSarah BursteinNo ratings yet

- Final Op Amp Lab ReportDocument7 pagesFinal Op Amp Lab Reportmehrin12367% (3)

- Manual Spare Parts - English 3178049001 PDFDocument799 pagesManual Spare Parts - English 3178049001 PDFYoseth Jose Vasquez Parra100% (2)

- Canada v. HTM Lighting - ComplaintDocument75 pagesCanada v. HTM Lighting - ComplaintSarah BursteinNo ratings yet

- Visual Edge v. Flipside - ComplaintDocument34 pagesVisual Edge v. Flipside - ComplaintSarah BursteinNo ratings yet

- Simplehuman v. Itouchless - First Amended ComplaintDocument50 pagesSimplehuman v. Itouchless - First Amended ComplaintSarah BursteinNo ratings yet

- HIT Promotional Prods. V SolPals - ComplaintDocument97 pagesHIT Promotional Prods. V SolPals - ComplaintSarah BursteinNo ratings yet

- TAC v. PCE - ComplaintDocument41 pagesTAC v. PCE - ComplaintSarah BursteinNo ratings yet

- Lego AS v. ZURU - ComplaintDocument175 pagesLego AS v. ZURU - ComplaintSarah BursteinNo ratings yet

- Kuen Hwa Traffic Industrial V DNA Motor - ComplaintDocument20 pagesKuen Hwa Traffic Industrial V DNA Motor - ComplaintSarah BursteinNo ratings yet

- Sanho Corporation v. Kaijet Tech. - ComplaintDocument27 pagesSanho Corporation v. Kaijet Tech. - ComplaintSarah BursteinNo ratings yet

- Addaday v. Hyper Ice - ComplaintDocument37 pagesAddaday v. Hyper Ice - ComplaintSarah BursteinNo ratings yet

- Laurmark Enterprises v. Kinderhook Industries Et. Al.Document74 pagesLaurmark Enterprises v. Kinderhook Industries Et. Al.PriorSmartNo ratings yet

- Coplus Inc. v. Zhejiang Yuazheng Auto & Motorcycle Accessories - ComplaintDocument94 pagesCoplus Inc. v. Zhejiang Yuazheng Auto & Motorcycle Accessories - ComplaintSarah BursteinNo ratings yet

- Total Import v. Surf City - ComplaintDocument11 pagesTotal Import v. Surf City - ComplaintSarah BursteinNo ratings yet

- Complaint 1-800-Contact v. DittoDocument36 pagesComplaint 1-800-Contact v. DittoTechCrunchNo ratings yet

- Shandong Honghui Food Machine v. Wouldn't It Be Nice LLC - ComplaintDocument17 pagesShandong Honghui Food Machine v. Wouldn't It Be Nice LLC - ComplaintSarah Burstein100% (1)

- Skinify v. Buller - ComplaintDocument31 pagesSkinify v. Buller - ComplaintSarah BursteinNo ratings yet

- Sanho v. Kaijet Tech. - ComplaintDocument27 pagesSanho v. Kaijet Tech. - ComplaintSarah BursteinNo ratings yet

- SMTM Tech Versus AppleDocument30 pagesSMTM Tech Versus AppleMike Wuerthele0% (1)

- Sundesa v. Tejarah Int'l - ComplaintDocument108 pagesSundesa v. Tejarah Int'l - ComplaintSarah BursteinNo ratings yet

- Innovative Imports v. Xtreme - ComplaintDocument40 pagesInnovative Imports v. Xtreme - ComplaintSarah BursteinNo ratings yet

- Kinglite Holdings v. Micro-Star International Et. Al.Document9 pagesKinglite Holdings v. Micro-Star International Et. Al.PriorSmartNo ratings yet

- Myelotec v. Biovision TechnologiesDocument21 pagesMyelotec v. Biovision TechnologiesPriorSmartNo ratings yet

- Jorno v. Hisgadget - ComplaintDocument16 pagesJorno v. Hisgadget - ComplaintSarah BursteinNo ratings yet

- Under The Weather v. Alvantor - ComplaintDocument30 pagesUnder The Weather v. Alvantor - ComplaintSarah BursteinNo ratings yet

- Sundesa v. IMSINC - ComplaintDocument88 pagesSundesa v. IMSINC - ComplaintSarah BursteinNo ratings yet

- Simplehuman v. Shek - ComplaintDocument78 pagesSimplehuman v. Shek - ComplaintSarah BursteinNo ratings yet

- Nordock v. Systems - Nordock MSJ Brief 1Document179 pagesNordock v. Systems - Nordock MSJ Brief 1Sarah BursteinNo ratings yet

- Bao v. Wenzhou Haoke Elec. - ComplaintDocument14 pagesBao v. Wenzhou Haoke Elec. - ComplaintSarah BursteinNo ratings yet

- Alcon V Peugeot MTD OrderDocument8 pagesAlcon V Peugeot MTD OrderTHROnline50% (2)

- Otter Products v. Mean Cat Creations - ComplaintDocument97 pagesOtter Products v. Mean Cat Creations - ComplaintSarah BursteinNo ratings yet

- CLIC Goggles v. Morrison - ComplaintDocument47 pagesCLIC Goggles v. Morrison - ComplaintSarah BursteinNo ratings yet

- Diode V .5DLight - ComplaintDocument23 pagesDiode V .5DLight - ComplaintSarah BursteinNo ratings yet

- Noco Co. v. SBI Smart Brands - ComplaintDocument35 pagesNoco Co. v. SBI Smart Brands - ComplaintSarah BursteinNo ratings yet

- Hangzhou Chic v. Mystery PartiesDocument182 pagesHangzhou Chic v. Mystery PartiesSarah BursteinNo ratings yet

- Tom Tom CounterDocument8 pagesTom Tom CounterTheBusinessInsider100% (2)

- Taiwan Kolin Corp. v. Kolin Electronics, Co.Document18 pagesTaiwan Kolin Corp. v. Kolin Electronics, Co.Jaymie ValisnoNo ratings yet

- CPG Int'l v. Fiber Composites - ComplaintDocument248 pagesCPG Int'l v. Fiber Composites - ComplaintSarah BursteinNo ratings yet

- Theragun v. Massage Guns - ComplaintDocument33 pagesTheragun v. Massage Guns - ComplaintSarah BursteinNo ratings yet

- Kwikspace Guam v. Reaction - ComplaintDocument47 pagesKwikspace Guam v. Reaction - ComplaintSarah BursteinNo ratings yet

- Micrsoft Motorola Patent SuitDocument243 pagesMicrsoft Motorola Patent SuittomkrazitNo ratings yet

- Balanced Body v. Guangzhou Oasis - ComplaintDocument8 pagesBalanced Body v. Guangzhou Oasis - ComplaintSarah Burstein100% (1)

- SpaceCo Business Solutions v. Mass Engineered Design Et. Al.Document9 pagesSpaceCo Business Solutions v. Mass Engineered Design Et. Al.PriorSmartNo ratings yet

- ZURU v. Ontel Prods - ComplaintDocument52 pagesZURU v. Ontel Prods - ComplaintSarah BursteinNo ratings yet

- SolPals v. Handstands Promo - ComplaintDocument48 pagesSolPals v. Handstands Promo - ComplaintSarah BursteinNo ratings yet

- Hyundai Motor Am. v. Depo Auto Parts - ComplaintDocument186 pagesHyundai Motor Am. v. Depo Auto Parts - ComplaintSarah BursteinNo ratings yet

- Panasonic v. Getac Tech. - ComplaintDocument138 pagesPanasonic v. Getac Tech. - ComplaintSarah BursteinNo ratings yet

- Spigen Korea v. Modne - ComplaintDocument105 pagesSpigen Korea v. Modne - ComplaintSarah BursteinNo ratings yet

- Emart Int'l v. Shenzhen Maitewei - ComplaintDocument143 pagesEmart Int'l v. Shenzhen Maitewei - ComplaintSarah BursteinNo ratings yet

- Cargotec Marine Et. Al. v. Quality Pacific ManufacturingDocument11 pagesCargotec Marine Et. Al. v. Quality Pacific ManufacturingPriorSmartNo ratings yet

- Global Protection v. Arthur - ComplaintDocument28 pagesGlobal Protection v. Arthur - ComplaintSarah BursteinNo ratings yet

- Clear Focus Imaging Et. Al. v. Flexcon CompanyDocument44 pagesClear Focus Imaging Et. Al. v. Flexcon CompanyPriorSmartNo ratings yet

- Kenu v. Belkin - ComplaintDocument17 pagesKenu v. Belkin - ComplaintSarah BursteinNo ratings yet

- Port-A-Pour v. Peak Innovations Et. Al.Document15 pagesPort-A-Pour v. Peak Innovations Et. Al.Naim IslamNo ratings yet

- Nokia V Daimler, Regional Court (Landgericht) of Mannheim: 18 August 2020 - Case No. 2 O 34/19Document9 pagesNokia V Daimler, Regional Court (Landgericht) of Mannheim: 18 August 2020 - Case No. 2 O 34/19chen zhangNo ratings yet

- USDISTXND-324cv159d139654076e319-COMPLAINT Against Kubota North America CorporationDocument12 pagesUSDISTXND-324cv159d139654076e319-COMPLAINT Against Kubota North America CorporationSamson AmoreNo ratings yet

- Richmond v. Creative IndustriesDocument17 pagesRichmond v. Creative IndustriesPriorSmartNo ratings yet

- Advance Products & Systems v. CCI Piping SystemsDocument5 pagesAdvance Products & Systems v. CCI Piping SystemsPriorSmartNo ratings yet

- VIA Technologies Et. Al. v. ASUS Computer International Et. Al.Document18 pagesVIA Technologies Et. Al. v. ASUS Computer International Et. Al.PriorSmartNo ratings yet

- Mcs Industries v. Hds TradingDocument5 pagesMcs Industries v. Hds TradingPriorSmartNo ratings yet

- Perrie v. PerrieDocument18 pagesPerrie v. PerriePriorSmartNo ratings yet

- ATEN International v. Uniclass Technology Et. Al.Document14 pagesATEN International v. Uniclass Technology Et. Al.PriorSmartNo ratings yet

- Shenzhen Liown Electronics v. Luminara Worldwide Et. Al.Document10 pagesShenzhen Liown Electronics v. Luminara Worldwide Et. Al.PriorSmartNo ratings yet

- Dok Solution v. FKA Distributung Et. Al.Document99 pagesDok Solution v. FKA Distributung Et. Al.PriorSmartNo ratings yet

- Multiplayer Network Innovations v. IgtDocument8 pagesMultiplayer Network Innovations v. IgtPriorSmartNo ratings yet

- Estimation of The ProjectDocument89 pagesEstimation of The ProjectNaga PrasanthNo ratings yet

- ITK 38 Printer Series: User's ManualDocument79 pagesITK 38 Printer Series: User's Manualparaca500No ratings yet

- Design Project of Four Hundred Seater Twin Engine Passenger AircraftDocument67 pagesDesign Project of Four Hundred Seater Twin Engine Passenger AircraftSugumarNo ratings yet

- PD 142 VM 01 060: OC No. Document No. Total Sheets 3Document4 pagesPD 142 VM 01 060: OC No. Document No. Total Sheets 3GAGANNo ratings yet

- Study 2 POSIX RealTime ExtensionDocument11 pagesStudy 2 POSIX RealTime ExtensionthangmleNo ratings yet

- Chery Maintenance Manual For Oriental SonDocument13 pagesChery Maintenance Manual For Oriental SonAbbode HoraniNo ratings yet

- Examples of Various Formulations of Optimization ProblemsDocument23 pagesExamples of Various Formulations of Optimization ProblemsPanosNo ratings yet

- Max17126 Max17126a PDFDocument34 pagesMax17126 Max17126a PDFVukica IvicNo ratings yet

- Requirements Process: MasteringDocument6 pagesRequirements Process: MasteringmichaelNo ratings yet

- 123Document40 pages123Blue PntNo ratings yet

- MTLx517 PDFDocument1 pageMTLx517 PDFAndy Kong KingNo ratings yet

- Go & NoGo GaugesDocument4 pagesGo & NoGo GaugesAneez ShresthaNo ratings yet

- Online Reservation SystemDocument12 pagesOnline Reservation SystemBaloy N. Da Haus20% (5)

- Coker Ball Valve of Velan PDFDocument8 pagesCoker Ball Valve of Velan PDFmujeebtalibNo ratings yet

- Assignment #1: Solution Due Date: 27 June 2019Document3 pagesAssignment #1: Solution Due Date: 27 June 2019Yadhuvanth kumarNo ratings yet

- 12.5 Oh GR CN ZDL SP Hdil CalDocument22 pages12.5 Oh GR CN ZDL SP Hdil CalStephanyNo ratings yet

- Basic Introduction To FatigueDocument13 pagesBasic Introduction To FatigueMariusz MilewskiNo ratings yet

- Build PropDocument8 pagesBuild PropYour FreedomNo ratings yet

- Safety Contact - Pipeline Bursted During HydrotestDocument1 pageSafety Contact - Pipeline Bursted During HydrotestPinjala AnoopNo ratings yet

- Voltage Amplification, Trail Cable Length & Power ShovelsDocument9 pagesVoltage Amplification, Trail Cable Length & Power ShovelsMaikPortnoyNo ratings yet

- DMWR 55 1520 214Document461 pagesDMWR 55 1520 214mdhelicopters33% (3)

- ElectronicsDocument192 pagesElectronicsMichael100% (2)

- Jupyter TutorialjDocument20 pagesJupyter Tutorialjshani17% (6)

- Quiz - Boilers and Thermic Fluid HeatersDocument3 pagesQuiz - Boilers and Thermic Fluid HeatersMohammad TachtouchNo ratings yet

- P1E ISO CylindersDocument31 pagesP1E ISO CylindersHenrique docinNo ratings yet

- P1125P1/P1250E1: Output RatingsDocument6 pagesP1125P1/P1250E1: Output Ratingsmohsen_cumminsNo ratings yet

Tomahawk 30 Importers Et. Al. v. International Integration

Tomahawk 30 Importers Et. Al. v. International Integration

Uploaded by

PriorSmartOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tomahawk 30 Importers Et. Al. v. International Integration

Tomahawk 30 Importers Et. Al. v. International Integration

Uploaded by

PriorSmartCopyright:

Available Formats

Case 2:13-cv-07158-PA-PJW Document 1 Filed 09/27/13 Page 1 of 53 Page ID #:5

Case 2:13-cv-07158-PA-PJW Document 1 Filed 09/27/13 Page 2 of 53 Page ID #:6

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26

NATURE OF THIS CASE 1. This patent infringement case is brought because Defendant

International Integration, LLC (INTEGRATION) has distributed and sold a roof underlayment product known as Capital 30. This product infringes United States Patent No. 8,105,965 (the 965 Patent). (Ex 1). Plaintiff, Tomahawk 30

Importers, Ltd. (TOMAHAWK) is the exclusive licensee of the 965 Patent. TOMAHAWK is seeking damages and injunctive relief against INTEGRATION for infringement of the 965 Patent. Safeguard 30, LLC (SAFEGUARD) is a direct competitor to INTEGRATION and is seeking damages and injunctive relief for the unfair competitive acts of false marking of their product as Pat ent Pending and falsely stating on their website (www.capital30.com) that they manufacture the only synthetic roofing underlayment.

JURISDICTION 2. This action arises under the United States Patent Act, 35 U.S.C. 1,

et seq. This Court has subject matter jurisdiction of the claims asserted herein under 28 U.S.C. 1331 and 1338(a). The court has pendent jurisdiction over all state law claims for unfair competition.

COMPLAINT - 2

Case 2:13-cv-07158-PA-PJW Document 1 Filed 09/27/13 Page 3 of 53 Page ID #:7

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26

PARTIES 3. Plaintiff, Tomahawk 30 Importers, Ltd., is a Canadian corporation and

the exclusive licensee of the 965 patent. 4. Plaintiff, Safeguard 30, LLC is an Oregon Limited liability company

with a principal place of business in Beaverton, Oregon. 5. Defendant International Integration, LLC is a California limited

liability company with a principal place of business at 1970 W. Holt Ave., Pomona, CA 91768. 6. This Court has personal jurisdiction over Defendants because they are

physically located in this judicial district, conduct business within the State of California, have infringed the 965 Patent in this District, have committed acts of false marking, and have engaged in false advertising. VENUE 7. A substantial part of the acts, events, and omissions giving rise to the

claims asserted in this action occurred within this judicial District, and venue is therefore proper in this court under the provisions of 28 U.S.C. 1391(b) and (c), and 1400(b). Specifically, INTEGRATION has imported and sold products that infringe the 965 Patent from its facilities in Pomona, California.

COMPLAINT - 3

Case 2:13-cv-07158-PA-PJW Document 1 Filed 09/27/13 Page 4 of 53 Page ID #:8

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16

RELEVANT FACTS A Background on Roofing Underlayments 8. Roofing underlayment is used to provide a barrier between the roofing

material (such as tile or shingles) and the supporting roof structure (such as plywood). This underlayment keeps exterior moisture from penetrating into the house. As such, almost every house has a roof with an underlayment. 9. There are two classes of underlayments: organic and synthetic.

Organic generally refers to underlayment products made from felt materials and synthetic generally refers to products made from newer materials, such as polymers. (Ex. 2). 10. The market for roof underlayments is very competitive. There will be

an estimated 1 million new homes built in 2013. (Ex. 3) Each of these homes will

17 18 19 20 21 22 23 24 25 26

typically require an underlayment. Due to the size of this market, there are many competing products sold to large and small manufacturers.

/// /// /// ///

COMPLAINT - 4

Case 2:13-cv-07158-PA-PJW Document 1 Filed 09/27/13 Page 5 of 53 Page ID #:9

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24

The 965 Patent 11. In view of the large demand for synthetic underlayments,

inventor Zhang developed a new and novel underlayment. Mr. Zhang then applied for a United States Patent, using the law firm of Ladas and Parry to prosecute this patent application. Mr. Zhang then satisfied all of the statutory requirements for his patent application which issued into a valid United States patent on January 31, 2012. 12. The 965 patent has four claims and several figures relating to

an improved roofing underlayment. (Ex. 1, Fig. 3).

13.

The owner of the 965 patent is Hangzhou Dinggang Trade Co, Ltd.

Hangzhou Dinggang Trade Co, Ltd. then entered into an exclusive license agreement designating TOMAHAWK as the exclusive licensee of the 965 Patent. (Ex. 4).

25 26

COMPLAINT - 5

Case 2:13-cv-07158-PA-PJW Document 1 Filed 09/27/13 Page 6 of 53 Page ID #:10

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16

INTEGRATIONS INFRINGING PRODUCT 14. INTEGRATION markets and sells construction products, primarily by

importing the products from Chinese manufacturers. INTEGRATION uses a website to advertise a product known as Capital 30. (Ex. 5). 15. On information and belief, the Capital 30 product infringes the 965

Patent and is substantially similar to Safeguard 30s product.

INTEGRATIONS UNFAIR BUSINESS PRACTICES 16. In an effort to unfairly compete and market the Capital 30 product,

INTEGRATION has marked and sold their products with the mark Patent Pending. (Ex. 7). A search of the USPTO database assignor/assignee database does not show any assigned applications to this entity. (Ex. 7).

17 18 19 20

/// ///

21 22 23 24 25 26

/// /// /// ///

COMPLAINT - 6

Case 2:13-cv-07158-PA-PJW Document 1 Filed 09/27/13 Page 7 of 53 Page ID #:11

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21

17.

INTEGRATION also maintains a website at www.capital30.com

where the Capital 30 product is the sole focus of this website. (Ex. 8). The website states: Capital 30 The 1st and only hybrid underlayment Can't decide wether or not to stop using the 30lb for something new in the market? You like the synethics performance, but not the price? Our Hybrid Underlayment is different. Unlike most synethics where you're just working with a sheet of plastic. At the same time traditional 30lb can be hard to work with. We integrated both products into one strong and unique material. The hybrid also feature the characteristics of both products that you will love. Still can't make up your mind, request a free sample to try and see the difference! (emphasis added)

The commercial impression of this advertisement is to convince consumers that only Integration sells a synthetic hybrid underlayment

22 23 24 25 26

/// /// ///

COMPLAINT - 7

Case 2:13-cv-07158-PA-PJW Document 1 Filed 09/27/13 Page 8 of 53 Page ID #:12

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16

COUNT I (Patent Infringement under 35 U.S.C. 271) 18. TOMAHAWK and SAFEGUARD repeat and re-allege the statements

and allegations set forth in paragraphs 1-17 above, and incorporate them herein. 19. 20. TOMAHAWK is the exclusive licensee of the 965 Patent. INTEGRATION has imported, sold, and offered to sell Capital 30, a

roofing underlayment, that infringes one or more claims of the 965 Patent . 21. INTEGRATION has not been granted a license by TOMAHAWK or

the patent owner to sell any product covered by the claims of the 965 Pat ent. 22. INTEGRATION has willfully and intentionally imported, sold, and

offered to sell Capital 30 with full knowledge of the claims of the 965 Patent.

///

17 18 19 20

/// /// ///

21 22 23 24 25 26

/// /// /// ///

COMPLAINT - 8

Case 2:13-cv-07158-PA-PJW Document 1 Filed 09/27/13 Page 9 of 53 Page ID #:13

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16

COUNT II (False Marking 35 USC 292) 23. TOMAHAWK and SAFEGUARD repeat and re-allege the statements

and allegations set forth in paragraphs 1-17 and 19-22 above and incorporate them herein. 24. INTEGRATION has marked the Capital 30 product with the phrase

Patent Pending. INTEGRATION has no such patent pending where the claims of any patent would cover the Capital 30 product. 25. INTEGRATION has falsely marked the Capital 30 product

intentionally, knowing that other patents were either in prosecution or issued that would cover the 965 patent. 26. INTEGRATIONs false marking has caused harm to TOMAHAWK

and SAFEGUARD in that purchasers of roofing underlayment are deceptively

17 18 19 20 21 22 23 24 25 26

induced into buying a product that they believe would be covered by a pending patent.

/// /// /// ///

COMPLAINT - 9

Case 2:13-cv-07158-PA-PJW Document 1 Filed 09/27/13 Page 10 of 53 Page ID #:14

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16

COUNT III (False Advertising Lanham 43(a)) 27. SAFEGUARD repeats and re-alleges the statements and allegations

set forth in paragraphs 1-17, 19-22, and 24-26 above and incorporate them herein. 23. INTEGRATIONs website at www.capital30.com is false and deceptive in

that it advertises that the product, Capital 30, is The 1st and only hybrid underlayment. This advertisement is false in fact there are many competitive hybrid underlayments, including the Safeguard 30 underlayment sold by SAFEGUARD. 24. This advertisement has caused a competitive injury to SAFEGUARD in that

the purchasers have selected Capital 30 underlayment product rather than the Safeguard 30 product but for these false allegations.

17 18 19 20

/// ///

21 22 23 24 25 26

/// /// /// ///

COMPLAINT - 10

Case 2:13-cv-07158-PA-PJW Document 1 Filed 09/27/13 Page 11 of 53 Page ID #:15

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16

PRAYER FOR RELIEF Wherefore, Plaintiff respectfully requests and prays that this Court enter judgment in its favor against defendants, and each of them, and grant the following relief: A. A finding that INTEGRATION has infringed, induced others to

infringe, and/or committed acts of contributory infringement with respect to the 965 patent; B. A finding that INTEGRATIONs infringements of the 965 patent

have been willful; C. A preliminary and final injunction against INTEGRATION, their

officers, directors, and agents against selling products that infringement of the 965 patent during the term of patent enforceability; D. A finding that INTEGRATION falsely marked the Capital 30 product; A preliminary and final injunction against INTEGRATION, their

17 18 19 20 21 22 23 24 25 26

E.

officers, directors, and agents against selling products that are falsely marked with Patent Pending; F. A finding that INTEGRATION falsely advertised the Capital 30

product on their website www.capital 30.com;

COMPLAINT - 11

Case 2:13-cv-07158-PA-PJW Document 1 Filed 09/27/13 Page 12 of 53 Page ID #:16

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16

G.

A preliminary and final injunction against INTEGRATION, their

officers, directors, and agents against the false advertisement of the Capital 30 product on their website; H. Damages for Infringement of the 965 Patent of at least a reasonable

royalty or lost profits; with additional damages for willfulness as provided under the patent statutes; I. J. K. L. M. Damages for the False Marking of the Capital 30 Product; Damages for the False Advertisement of the Capital 30 Product; Attorney fees as provided for under the patent and trademark laws; Interest and costs; and Such other relief as this Court deems just and appropriate.

Respectfully Submitted,

17 18 19 20 21 22 23 24 25 26

/s/ J. Curtis Edmondson J. Curtis Edmondson (CSB #236105) Attorney for Plaintiff Tomahawk 30 Importers, Ltd. and Safeguard 30, LLC

COMPLAINT - 12

Case 2:13-cv-07158-PA-PJW Document 1 Filed 09/27/13 Page 13 of 53 Page ID #:17

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26

DEMAND FOR JURY TRIAL Plaintiff demands a trial by jury of all claims where it is so entitled, pursuant to FRCP 38(b).

Respectfully Requested, /s/ J. Curtis Edmondson J. Curtis Edmondson (CSB #236105) Attorney for Plaintiff Tomahawk 30 Importers, Ltd. and Safeguard 30, LLC

COMPLAINT - 13

Case 2:13-cv-07158-PA-PJW Document 1 Filed 09/27/13 Page 14 of 53 Page ID #:18

EXHIBIT 1

U.S. Pat. No. 8,109,965

Case 2:13-cv-07158-PA-PJW Document 1 Filed 09/27/13 Page 15 of 53 Page ID #:19

Case 2:13-cv-07158-PA-PJW Document 1 Filed 09/27/13 Page 16 of 53 Page ID #:20

Case 2:13-cv-07158-PA-PJW Document 1 Filed 09/27/13 Page 17 of 53 Page ID #:21

Case 2:13-cv-07158-PA-PJW Document 1 Filed 09/27/13 Page 18 of 53 Page ID #:22

Case 2:13-cv-07158-PA-PJW Document 1 Filed 09/27/13 Page 19 of 53 Page ID #:23

Case 2:13-cv-07158-PA-PJW Document 1 Filed 09/27/13 Page 20 of 53 Page ID #:24

Case 2:13-cv-07158-PA-PJW Document 1 Filed 09/27/13 Page 21 of 53 Page ID #:25

EXHIBIT 2

Chotiner, Michael. Do Synthetic Underlayments Make for Better Roofs? JLC 57-62, January, 2013.

Case 2:13-cv-07158-PA-PJW Document 1 Filed 09/27/13 Page 22 of 53 Page ID #:26

Do Synthetic Underlayments Make for Better Roofs?

While some old pros are sticking with organic felts because theyre low-priced and breathable, many are moving to synthetics for greater flexibility

by Michael Chotiner

market and their premium over felt a bit higher, the question is worth revisiting. My own acquaintance with felt underlayment began more than 40 years ago (at the time 15# felt actually weighed 15 pounds per square), when I went up on the roof of my mothers 1952 cape to find and fix the source of a leak in the garage. I stripped away the asphalt shingles and, voil, there was a patch of torn, buckled felt near the valley and some rotted plywood sheathing. I replaced the spongy sheathing, nailed down some new 30# felt, flashed the valley with aluminum coil stock, and the leak was gone. Several years later when the roof was showing its age, I put a new layer of asphalt shingles over the original roof, and the house stayed dry for the 25 remaining years that Mom lived there.

he last time JLC treated the subject of synthetic roofing underlayments in depth (May 2006), author John Nicol acknowledged that synthetics are stronger, lighter, and faster to install than asphalt felts, but asked whether theyre worth the extra cost estimated at about 30 percent at the time. Today, with even more synthetic underlayments on the

Methodology

Synthetic underlayments werent available back then, of course, but would I JANUARY 2013 l JLC l 57

Case 2:13-cv-07158-PA-PJW Document 1 Filed 09/27/13 Page 23 of 53 Page ID #:27 Synthetic Underlayments

We find that synthetics are much easier to use [than felts] and provide much better mid- and long-term protection for the house.

Lou Hale, general contractor, Massachusetts

have done anything differently if they had been? Thats what I wanted to work through as I gathered information on more than 20 underlayments both synthetic and organic in preparation for this article. I pored over sell sheets, spec sheets, and installation instructions, and I talked with manufacturers technical reps along with builders and installers who work with both types of underlayment. In addition to matters of cost, ease of installation, and durability, I found we have to wrestle with another fundamental issue: Is it better for a roofing underlayment to be permeable or impermeable?

vapor. The potential result: mold, mildew, and rot in the wooden parts of the roof structure. Most but not all synthetic underlayments are impermeable to both water and vapor. Asphalt felts are semi-permeable theyre pretty good at shedding water, and theyre great at letting vapor pass through, particularly when they get wet.

And after installation, synthetic underlayments promise better performance than felts. Since they provide an impervious secondary layer of moisture protection, a roof protected with synthetic underlayment isnt likely to leak even if a few shingles crack or blow off. Unlike felts, synthetics dont absorb moisture, so they cant rot or dry out, nor do they support mold and mildew growth.

Not All Synthetic Underlayments Are Created Equal

Its important to note that while the manufacturers of synthetics tout their most desirable general properties watershedding ability, strength, light weight, UV resistance, slip-resistance, and such not all synthetic underlayments are the same. Some manufacturers make more than one synthetic underlayment, recommending each for a different application. For example, while some products are recommended for use with all common roofing types asphalt shingles, metals, clay tile, slate, and wood shingles and shakes others are recommended for only one or two applications, say tile and metals. In many cases, the product brand names arent terribly descriptive in suggesting specific applications or indicating a products place in the good-better-best hierarchy. For that reason, Ive tried to sort out key differences among the synthetic underlayments I found in the market, and grouped products with similar properties in each of three tables displayed throughout this article. (A fourth table listing high-temperature synthetic underlayments is available in the online version of this article.) Products Ive listed as GeneralPurpose (facing page) are the lightest, least-expensive materials, and carry the shortest warranties. They are typically recommended for use with one or more of the common roofing materials. Premium products (see table on page 61) are gener-

The Case for Synthetic Underlayments

In addition to being impermeable to water, synthetic underlayments are more tear- and puncture-resistant than asphalt felts. Synthetics also resist expansion and contraction with temperature cycling, so they wrinkle and buckle less severely than felts, with less tearing around fasteners. Virtually all synthetics have a UVresistant coating so they dont degrade with prolonged sunlight exposure. That means that roofs dried-in with synthetic underlayments need not be finished for six to 12 months if theyve been fastened with cap nails or cap staples, which are recommended by most manufacturers. Synthetic underlayments claim significant advantages over felts for installers. Generally, rolls of synthetic material are wider, longer, and lighter than felts. This means easier handling and faster installation. Most claim to have slip-resistant coatings or textures for better traction under wet or dusty conditions. Synthetic materials also remain more flexible in cold weather and roll out without cracking or chatter. This characteristic can lengthen the work season for roofers in colder climates.

The Permeability Debate

One of the most important data points with regard to a roofing underlayment is its permeability rating that is, its resistance to penetration by moisture in both liquid and vapor forms (see Vapor Permeability Classifications, page 62). Everybody agrees that impermeability to liquid water is a good thing in an underlayment; it means the roof deck wont get wet, even if wind-driven rain or ice dams force water under the finish roofing, or the weather turns rainy once the underlayment is down but before the finish roofing has been installed. But impermeability to water vapor might not be such a good thing at least in certain cases (see Whatever Happened to 30# Felt?, page 62). Some pros argue that if a roof deck were to get wet due to a leak at a flashed penetration or a tear in a roofing layer, or because of moisture buildup in an unventilated attic, an impermeable underlayment would trap 58 l JLC l JANUARY 2013

Case 2:13-cv-07158-PA-PJW Document 1 Filed 09/27/13 Page 24 of 53 Page ID #:28

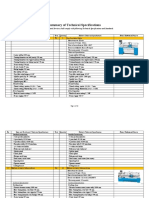

General-Purpose, Low-Permeability Synthetic Roofing Underlayments 1

Product Name Manufacturer NovaSeal 13 Intertape Polymer Corp. intertapepolymer.com Pro-Master Roof Shield UDL Berger Building Products bergerbuildingproducts.com Protex SystemComponents Corp. systemcomponents.net/feltex RhinoRoof Interweave interwrap.com Surround SR Fiberweb surroundtypar.com Titanium UDL 25-plus Interwrap interwrap.com Tri-Flex Xtreme W.R. Grace & Co. graceconstruction.com Typar RoofWrap 30 Fiberweb typar.com Use With 2 a, m, s, t, w Lbs. per Roll 25 Width & Coverage (in./sq.) 48/10 Fasteners Cap nails, cap staples Cap nails Max. UV Exp. (days) 365 Cost Vapor per Permeability (perms) Warranty sq. ft. <0.1 Lifetime $0.14

a, m, s, t, w

28

52/10

365

0.05

25

$0.10

a, m, s, t

26

48/10

Roofing nails, cap nails Roofing nails, cap nails Roofing nails, cap nails Roofing nails Cap nails, cap staples Cap nails

180

<0.1

25

$0.12

a only

25

42/10

30

0.05

10

$0.08

a, t, w

26

45 1/4/10

180

0.4

30

$0.09

m shakes & shingles a, m, s, t, w

31

48/10

180

0.06

25

$0.10

32

40/10

180

0.04

20

$0.16

a, m, s, t

30

41 1/2/10

180

0.54

20

$0.14

(1) This product list is representative of the category, but not comprehensive. (2) a-asphalt shingles; m-metal; s-slate; t-tile; w-wood (3) Also sold under the names BP Deckguard Roof Underlayment, SF Roof Underlayment, and GreenGuard.

ally thicker, heavier, and more expensive, and carry longer warranties. While they may be recommended for use with all common roof finishes, in practice they seem to be used most frequently with metal, tile, slate, and heavyweight asphalt shingles. Vapor-Permeable materials (see table on page 61) are unlike the vast majority of synthetic underlayments, which are impermeable. Doug Snyder, a technical representative for VaproShield, which makes SlopeShield (perm rating: 59) recites the mantra of die-hard fans of asphalt felt: A buildings got to breathe! While the common wisdom holds that impermeable underlayments dont pose a significant risk when placed in a well-ventilated roof design, Snyder asserts that attic ventilation doesnt carry away water vapor. SlopeShield promotes drying by allowing

water vapor to escape, Snyder says, and should be used in any application in which the roofing material is fastened to battens or has an air space underneath, such as tile, wood shakes and shingles, and some metals. Like the impermeable synthetics, SlopeShield will protect sheathing from condensation that typically forms beneath metal and tile roofing.

General-Purpose Underlayments. These materials are typically recommended for use with one or more of the common roofing types. Generally they are the lightest weight, least expensive products, and carry shorter warranties.

Whos Using Synthetic Underlayments and Why?

Paul Ecclestone, product manager for Intertape Polymer Corp., which manufactures Nova Seal underlayments and similar synthetics sold under a variety of brand names, says that sales are on an upswing. We have seen an excellent rebound from the economic downturn and excellent support for our product lines. As con-

tractors become more and more familiar with the benefits of our synthetic roofing underlayment, were seeing higher adoption rates. Ecclestone also attributes at least part of the sales growth to the recent incidence of destructive hurricanes and other storms. On weather-damaged homes, he says, emergency crews can use synthetic underlayments for temporary roofing thatll keep the houses dry until the finish roofing can be put on. Lou Hale, a general contractor from JANUARY 2013 l JLC l 59

Case 2:13-cv-07158-PA-PJW Document 1 Filed 09/27/13 Page 25 of 53 Page ID #:29 Synthetic Underlayments

A majority of my homes are clay tile or slate. We use Grace Ice & Water Shield as the initial underlayment, then apply [a synthetic underlayment] over it. Its bulletproof.

Allan Edwards, custom-home builder, Houston

Premium Underlayments (facing page). These materials are generally thicker, heavier, and tend to carry longer warranties. They are also more expensive: The products listed here are almost 50% more expensive on average than the general-purpose materials. Premium underlayments are used most frequently with metal, tile, slate, and heavyweight asphalt shingles. Vapor-permeable underlayments. These materials are recommended for use on unventilated roofs and with finish roofing materials that are installed with an air space between the roof deck and the underside of the finish roofing, such as wood shingles and shakes, some metals, and tiles.

western Massachusetts, says his experience supports most manufacturers claims about the benefits of synthetics. When my crew and I are drying-in an addition ourselves, we mostly use synthetics because itll generally be a couple of weeks before our roofer puts the finish on, Hale says. We find that the synthetics are much easier to use [than felts] and provide much better mid- and long-term protection for the house. Convenience also plays a part in Hales decision on which brand to use. My underlayment choice is usually based on my choice of supplier its not worth paying a $20 hot-shot charge to have another supplier bring out a particular brand of underlayment, he says. We use Grace Tri-Flex 30 or RoofTopGuard II, depending on where the material is coming from. My preferred lumberyard keeps Tri-Flex in stock, so if they are making the drop, thats what we use. But I have also used a good bit of the RoofTopGuard II, and its just as good a product. Hale finds that the wider, longer, lighter rolls really do make a difference in the speed of installation. This speed advantage seems to depend, however, on fastening with staples rather than the nails or cap nails most manufacturers recommend. We frequently use staple hammers or plain old roofing guns. While that may not be a manufacturer-approved method, I can tell you it will hold through a New England summer thunderstorm just fine, and its at least twice as fast as using a pneumatic cap stapler. You can literally tack a synthetic roll down on one 60 l JLC l JANUARY 2013

end, have a guy roll out 30 to 40 feet while another guy just walks along the roof and nails it down even on windy days. For Hale, tear resistance is also a big advantage, especially on reroofs, where the surface might not be perfectly flat and smooth. With #30 felt, one missed nail during tear off can lead to a hole and a potential leak. We recently put this to the test on an 1840s cape were remodeling, Hale says. We needed to temporarily dry-in the house over widely spaced sheathing boards that were peppered with jagged nails. We were able to walk up and down that 8-pitch roof without causing a single hole or tear. Thirty-pound felt wouldve fallen apart under our feet. When I ask Hale if the labor savings with a synthetic compensate for the higher cost, he says, The short answer is no, the labor savings are significant but dont equal the increased material cost. However, the peace of mind that comes from all the other benefits, combined with the labor savings, more than justifies the premium for me. Randy Bush of Great Falls, Mont., uses synthetic underlayment because he installs mainly steel roofs. One reason for using synthetic is I dont like the black footprints you get from felt when stepping on it, then onto the metal, he says.Another reason is that an impermeable synthetic more effectively protects the roof deck from dripping condensate that tends to form on the underside of metal roofing. Joe Adams, a Houston builder whose

homes have either copper or comp (premium asphalt shingle) roofs, tells me, My roofer prefers a synthetic underlayment Berger Pro-Master UDL-Plus. He supplements this with Grace Ice & Water Shield [a modified bituminous, self-adhering flashing material] at the valleys and roofwall intersections. Allan Edwards, another Houston builder of high-end custom homes, uses synthetic underlayment in an unexpected way. A majority of my homes are clay tile or slate; a few are metal. We use Grace Ice & Water Shield as the initial underlayment, then apply Titanium UDL-30 Plus over it. Its bulletproof. When I ask if this isnt overkill, Edwards sends me to his roofer, Robert Coreale, owner of Tile Roofs of Texas, for an explanation. Robert says, For most roofers, Ice & Water or Titanium only would be okay, but heres why we go that extra step: Ice & Water should not be exposed to UV for extended periods of time, so you need a layer to protect it. You could use #30 felt or any other type of underlayment for this ply, but we use Titanium because it is very durable and easy to walk on it provides very good traction. The synthetic layer also protects the Ice & Water from

Case 2:13-cv-07158-PA-PJW Document 1 Filed 09/27/13 Page 26 of 53 Page ID #:30

Premium Synthetic Roofing Underlayments 1

Product Name Manufacturer Feltex SystemComponents Corp. systemcomponents.net/feltex NovaSeal Generation II 3 Intertape Polymer Corp. intertapepolymer.com Pro-Master Roof Shield UDL-Plus Berger Building Products bergerbuildingproducts.com RoofTopGuard II Drexel Metals Corp. drexmet.com Sharkskin Comp Kirsch Building Products sharkskin.us Sharkskin Ultra Kirsch Building Products sharkskin.us Titanium UDL 50 Interwrap interwrap.com Titanium UDL 30-plus Interwrap interwrap.com Triflex-30 W.R. Grace & Co. graceconstruction.com Use With 2 a, m, s, t Lbs. per Roll 31 Vapor Max. Width & UV Exp. Permeability Coverage (perms) Warranty (in./sq.) Fasteners (days) 48/10 Roofing nails, cap nails Per local code 180 <1 35 Cost per sq. ft. $0.13

a, m, s, t, w

33

48/10

365

<1

Lifetime

$0.24

a, m, s, t, w

30.3

52/10

365

0.05

25

$0.15

All common 43 roofing materials a, m 38

60/10

180

< 0.1

30

$0.19

48/10

Roofing nails, cap nails Cap nails, cap staples Roofing nails Cap nails, cap staples Cap nails, cap staples

180

<0.1

50

$0.25

a, m, s, t

45

48/10

365

<0.1

50

N/A

a, m, s, t

48

48/10

180

0.05

50

$0.17

All materials on sloped roofs

40

48/10

180

0.06

30

$0.12

All common 28 roofing materials

48/10

180

0.05

25

$0.13

(1) This product list is representative of the category, but not comprehensive. (2) a-asphalt shingles; m-metal; s-slate; t-tile; w-wood (3) Also sold as Xmark, Permafelt, NovaSeal II, WaterBlock RU-200, RoofGuard XB, SF Pro Underlayment.

Vapor-Permeable Synthetic Roofing Underlayments 1

Product Name Manufacturer Deck-Armor GAF gaf.com SlopeShield VaproShield vaproshield.com Use With

2

Lbs. per Roll 37

Width & Coverage (in./sq.) 54/10

Fasteners Cap nails cap staples Screws with plastic caps

Max. UV Exp. (days) 180

Vapor Permeability (perms) 16

Warranty Lifetime

Cost per sq. ft. $0.22

a, m, s, t, w

Any roofing with air space underneath

29

59/8

120

59

20

$0.40

(1) This product list is representative of the category, but not comprehensive. (2) a-asphalt shingles; m-metal; s-slate; t-tile; w-wood

JANUARY 2013 l JLC l 61

Case 2:13-cv-07158-PA-PJW Document 1 Filed 09/27/13 Page 27 of 53 Page ID #:31 Synthetic Underlayments

construction traffic. Stucco and brick layers are not easy on the peel-and-stick.

Whatever Happened to 30# Felt?

Asphalt-impregnated felt aka tar paper enjoyed a 100year run as the preeminent roofing and siding underlayment. First made by soaking rag fibers in tar, the basis later became wood fibers mixed with asbestos and fiberglass for greater strength and economy. In response to oil scarcity in the 1970s, the oil content changed and so did product names. By shifting the pound symbol, 15# felt became #15 felt, which may actually weigh 7.5 to 12.5 pounds per square; #30 felt can weigh between 16 and 27 pounds per square. Today, some smart people still prefer asphalt felts to synthetic alternatives. Chad Fabry, moderator of JLCs Building Science Forum and owner-operator of Rochester, N.Y.based StructureSmart, says, I use #30 felt each time, every time. As far as Im concerned, there isnt yet a purposefully designed product that sports a variable perm rate and water shedding properties that sur-

Better or Just Different?

With all of the underlayment products Ive studied here, and all the testimony Ive reviewed from the pros that use them, Im convinced that there are enough good alternatives to address virtually any roofing job nicely. Im also convinced that youve got to understand the issues and goals of any given job to choose an underlayment wisely. One guy wants to deliver a workmanlike job at the lowest price possible and still make a profit; another wants a bulletproof 100-year roof and has a customer willing to pay for it. Im convinced that synthetic underlayments are more durable and faster to install than felt, but at publication, #15 felt goes for only about 41 2 cents a square foot; #30, about 9 cents. If youre going to cover the felt right away and you can flash vulnerable spots of the roof adequately, why not keep the cost down? On the other hand, even though synthetic materials are more costly, faster installation means lower labor cost, as does the resistance to collateral damage from foot traffic during construction. About the only claim many manufacturers make about synthetic underlayments thats suspect in my mind is that theyre safer underfoot. More than one guy told me a story about expecting to stride up a slope on slip-resistant underlayment only to end up on his butt. The comment in my notes reads, Theyre not less slippery; theyre just different. That comment applies to synthetics in many ways. While I probably wouldnt have done anything different when reroofing my mothers house 40 years ago even if I had known about synthetics, I would do it all differently today. Michael Chotiner is a former contractor who has written extensively on building and home-improvement in print and on the Web. 62 l JLC l JANUARY 2013

Vapor Permeability Classifications

Value Less than 0.1 perm 0.1 to 1.0 perm 1.0 to 10 perms Above 10 perms Classification Impermeable Semi-impermeable Semi-permeable Permeable

Source: Insulations, Sheathings and Vapor Retarders (Research Report 0412), Joseph Lstiburek, Building Science Corporation

Impermeable membranes effectively keep out wind-driven rain and water backed up behind ice dams, but also trap moisture thats trying to escape from unvented attic spaces. Apply semi-permeable underlayments on inadequately vented roofs or provide ventilation before drying-in the roof.

passes the serendipitous invention of felt. Felts perm rating varies. Dry, #15 felt is rated at 6 perms, #30 felt at 5 perms. When wet, however, felts permeability increases to between 20 and 60 perms, according to Martin Holladay of TheEnergyNerd.com. A permeable underlayment may be a good thing, then, for applications such as a roof over an unvented attic or cathedral ceiling, for traditional installations of cedar shake and shingle roofs or for a leaky roof. Whether a permeable underlayment offers a benefit for the most com-

mon home roof assemblies is questionable, however, according to a white paper sponsored by Owens-Corning, coauthored by Joseph Lstiburek of Building Science Corporation. Its title, Vapor Permeability Provides No Performance Benefit for Roofing Underlayments in Ventilated Attics, tells the other side of the story. Test results provided in the paper indicate that layers of asphalt shingles built up in a typical installation form an impermeable barrier that wont allow moisture to escape even if the underlayment can breathe. M.C.

Case 2:13-cv-07158-PA-PJW Document 1 Filed 09/27/13 Page 28 of 53 Page ID #:32

EXHIBIT 3

U.S. Census Bureau News, New Residential Construction in August 2013, September 18, 2013.

Case 2:13-cv-07158-PA-PJW Document 1 Filed 09/27/13 Page 29 of 53 Page ID #:33

U.S. Census Bureau News Joint Release U.S. Department of Housing and Urban Development

U.S. Department of Commerce Washington, D.C. 20233

FOR IMMEDIATE RELEASE WEDNESDAY, SEPTEMBER 18, 2013 AT 8:30 A.M. EDT

CB13-166 Raemeka Mayo or Stephen Cooper Manufacturing and Construction Division (301) 763-5160

NEW RESIDENTIAL CONSTRUCTION IN AUGUST 2013

The U.S. Census Bureau and the Department of Housing and Urban Development jointly announced the following new residential construction statistics for August 2013:

BUILDING PERMITS

Privately-owned housing units authorized by building permits in August were at a seasonally adjusted annual rate of 918,000. This is 3.8 percent (1.3%) below the revised July rate of 954,000, but is 11.0 percent (1.8%) above the August 2012 estimate of 827,000. Single-family authorizations in August were at a rate of 627,000; this is 3.0 percent (0.9%) above the revised July figure of 609,000. Authorizations of units in buildings with five units or more were at a rate of 268,000 in August.

HOUSING STARTS

Privately-owned housing starts in August were at a seasonally adjusted annual rate of 891,000. This is 0.9 percent (13.0%)* above the revised July estimate of 883,000 and is 19.0 percent (11.1%) above the August 2012 rate of 749,000. Single-family housing starts in August were at a rate of 628,000; this is 7.0 percent (13.9%)* above the revised July figure of 587,000. The August rate for units in buildings with five units or more was 252,000.

HOUSING COMPLETIONS

Privately-owned housing completions in August were at a seasonally adjusted annual rate of 769,000. This is 0.3 percent (15.6%)* above the revised July estimate of 767,000 and is 12.1 percent (15.1%)* above the August 2012 rate of 686,000. Single-family housing completions in August were at a rate of 573,000; this is 0.5 percent (12.8%)* above the revised July rate of 570,000. The August rate for units in buildings with five units or more was 191,000. New Residential Construction data for September 2013 will be released on Thursday, October 17, 2013, at 8:30 A.M. EDT. Our Internet site is: http://www.census.gov/starts To learn more about this release and the other indicators the U.S. Census Bureau publishes, join us for the 2013 Economic Indicator Webinar Series. For more information go to www.census.gov/econ/webinar. To receive the latest updates on the Nation's key economic indicators, download the America's Economy app for Apple and Android smartphones and tablets. EXPLANATORY NOTES

In interpreting changes in the statistics in this release, note that month-to-month changes in seasonally adjusted statistics often show movements which may be irregular. It may take 2 months to establish an underlying trend for building permit authorizations, 4 months for total starts, and 6 months for total completions. The statistics in this release are estimated from sample surveys and are subject to sampling variability as well as nonsampling error including bias and variance from response, nonreporting, and undercoverage. Estimated relative standard errors of the most recent data are shown in the tables. Whenever a statement such as 2.5 percent (3.2%) above appears in the text, this indicates the range (-0.7 to +5.7 percent) in which the actual percent change is likely to have occurred. All ranges given for percent changes are 90-percent confidence intervals and account only for sampling variability. If a range does not contain zero, the change is statistically significant. If it does contain zero, the change is not statistically significant; that is, it is uncertain whether there was an increase or decrease. The same policies apply to the confidence intervals for percent changes shown in the tables. On average, the preliminary seasonally adjusted estimates of total building permits, housing starts and housing completions are revised about two percent or less. Explanations of confidence intervals and sampling variability can be found on our web site listed above. * 90% confidence interval includes zero. The Census Bureau does not have sufficient statistical evidence to conclude that the actual change is different from zero.

Case 2:13-cv-07158-PA-PJW Document 1 Filed 09/27/13 Page 30 of 53 Page ID #:34

Table 1. New Privately-Owned Housing Units Authorized in Permit-Issuing Places

[Thousands of units. Detail may not add to total because of rounding]

United States

Period Total In structures with -1 unit 2 to 4 units 5 units or more

Northeast

Midwest

South

West

Total

1 unit

Total

1 unit

Total

1 unit

Total

1 unit

Seasonally adjusted annual rate

2012: August September

827 921

520 559

28 29

279 333

82 88

41 45

128 150

89 94

430 475

275 296

187 208

115 124

October November December

908 933 943

570 574 584

26 29 30

312 330 329

82 78 100

46 44 49

156 164 146

98 94 101

479 488 471

306 309 310

191 203 226

120 127 124

2013: January February March

915 952 890

588 600 599

26 31 25

301 321 266

100 83 100

45 50 49

147 148 139

101 93 93

448 488 450

309 319 322

220 233 201

133 138 135

April May June

1,005 985 918

614 620 625

25 27 26

366 338 267

99 101 105

52 52 52

165 153 145

98 101 102

515 510 458

332 333 331

226 221 210

132 134 140

July (r)

954

609

27

318

113

50

154

104

459

322

228

133

August (p)

Average RSE (%)

1

918

1

627

1

23

4

268

1

125

3

50

3

161

2

107

2

413

1

330

1

219

1

140

1

Percent Change: August 2013 from July 2013 90% Confidence Interval 3 August 2013 from August 2012 90% Confidence Interval

3

-3.8% 1.3 11.0% 1.8

3.0% 0.9 20.6% 0.8

-14.8% 4.9 -17.9% 11.8

-15.7% 3.9 -3.9% 4.8

10.6% 7.0 52.4% 12.7

0.0% 10.9 22.0% 19.8

4.5% 3.5 25.8% 3.3

2.9% 4.3 20.2% 4.0

-10.0% 0.9 -4.0% 1.2

2.5% 1.0 20.0% 1.3

-3.9% 2.5 17.1% 4.0

5.3% 3.2 21.7% 5.1

Not seasonally adjusted

2011: 2012: RSE (%) 624.1 829.7 (X) 418.5 518.7 (X) 21.6 25.9 (X) 184.0 285.1 (X) 68.5 84.7 (X) 39.0 44.2 (X) 102.7 133.0 (X) 70.5 87.3 (X) 320.7 427.8 (X) 227.1 276.0 (X) 132.2 184.2 (X) 81.9 111.2 (X)

2012: Year to Date 2 2013: Year to Date 2 RSE (%)

537.0 650.8 (Z)

345.9 428.8 1

16.1 17.5 3

175.0 204.5 (Z)

55.1 71.9 3

29.0 34.2 2

80.9 101.4 1

57.4 69.8 1

279.1 324.2 (Z)

183.9 229.3 (Z)

121.9 153.3 1

75.6 95.6 1

Year to Date Percent Change 4 90% Confidence Interval

2012: August September

3

21.2% 0.9

80.0 73.7

24.0% 1.0

49.8 43.3

8.7% 5.6

2.7 2.3

16.9% 1.1

27.5 28.1

30.5% 5.2

7.7 7.3

17.8% 7.5

3.9 3.8

25.3% 1.7

12.9 13.4

21.6% 2.0

9.0 8.0

16.2% 0.6

40.8 36.9

24.7% 0.7

26.0 22.0

25.8% 1.9

18.5 16.1

26.4% 2.4

11.0 9.5

October November December

77.5 68.7 67.2

49.6 40.4 36.3

2.4 2.3 2.2

25.5 26.0 28.7

7.6 6.0 7.7

4.3 3.3 3.2

16.2 13.2 9.1

9.9 6.8 5.3

38.0 35.3 34.2

25.2 21.6 20.0

15.7 14.2 16.3

10.2 8.6 7.8

2013: January February March

63.7 66.0 75.8

40.5 42.0 51.4

1.8 2.2 2.0

21.5 21.7 22.4

6.6 4.9 7.2

2.8 2.8 3.8

7.2 7.6 10.9

4.8 5.1 7.6

34.8 37.0 40.4

23.8 24.6 28.4

15.1 16.5 17.4

9.1 9.5 11.6

April May June

90.5 94.9 83.9

59.7 62.4 57.0

2.3 2.4 2.3

28.5 30.1 24.6

8.7 9.7 11.2

5.0 5.4 4.8

16.2 15.4 13.2

10.4 11.0 9.7

45.6 47.4 40.0

31.6 32.3 29.2

20.0 22.3 19.5

12.7 13.7 13.3

July (r)

88.1

58.3

2.6

27.2

10.8

5.0

15.0

10.5

41.2

29.9

21.1

13.0

August (p)

Average RSE (%)

1

84.3

1

57.5

1

2.1

4

24.6

1

11.2

3

4.6

3

15.7

2

10.5

2

36.9

1

29.7

1

20.5

1

12.7

1

(p) Preliminary. (r) Revised. RSE Relative standard error. S Does not meet publication standards because tests for identifiable and stable seasonality do not meet reliability standards. X Not applicable. Z Relative standard error is less than 0.5 percent.

1 3 2 Average RSE for the latest 6-month period. Reflects revisions not distributed to months. See the Explanatory Notes in the accompanying text for an explanation of 90% confidence intervals. 4

Computed using unrounded data.

Case 2:13-cv-07158-PA-PJW Document 1 Filed 09/27/13 Page 31 of 53 Page ID #:35

Table 2. New Privately-Owned Housing Units Authorized, but Not Started, at End of Period

[Thousands of units. Detail may not add to total because of rounding]

United States

Period Total In structures with -1 unit 2 to 4 units 5 units or more

Northeast

Midwest

South

West

Total

1 unit

Total

1 unit

Total

1 unit

Total

1 unit

Not seasonally adjusted

2012: August September

94.5 93.3

46.4 42.4

1.8 2.2

46.4 48.7

9.1 8.4

5.4 4.9

8.7 8.3

5.2 5.3

53.2 53.0

24.8 21.6

23.6 23.5

10.9 10.6

October November December

89.9 90.1 92.5

42.6 43.9 43.0

2.0 2.6 2.8

45.3 43.6 46.7

8.0 8.4 8.2

5.3 5.0 4.6

8.5 8.6 6.5

5.0 4.5 4.6

52.3 51.2 54.3

22.7 24.8 24.7

21.0 21.9 23.5

9.7 9.5 9.1

2013: January February March

92.7 93.4 86.2

43.8 43.9 44.5

2.6 2.4 2.5

46.3 47.1 39.3

7.9 7.2 6.7

4.4 4.5 4.6

8.6 8.8 10.5

5.1 5.5 6.3

54.4 54.7 49.1

25.5 25.0 25.7

21.8 22.6 20.0

8.9 9.0 7.9

April May June (r)

94.6 102.1 102.7

48.6 53.1 51.6

1.9 1.7 2.0

44.2 47.3 49.2

6.5 9.3 9.7

4.2 5.0 4.9

12.6 14.2 14.6

6.7 7.9 7.6

55.3 55.1 54.8

29.1 30.4 29.3

20.2 23.5 23.6

8.5 9.9 9.7

July (r)

101.7

53.3

1.7

46.8

7.9

4.8

14.8

8.3

57.5

29.9

21.6

10.2

August (p)

Average RSE (%)1

101.6

6

53.9

7

2.1

23

45.6

11

9.9

16

4.6

19

15.2

10

8.2

13

55.2

10

31.6

11

21.3

12

9.4

13

Percent Change: 2 August 2013 from July 2013 90% Confidence Interval

3

-0.1% 4.8 7.5% 10.3

1.2% 6.0 16.2% 12.2

27.3% 28.4 18.3% 53.2

-2.5% 7.3 -1.7% 17.0

26.0% 22.9 9.1% 35.4

-4.6% 14.3 -15.6% 17.1

2.8% 13.4 75.3% 34.8

-1.0% 9.3 57.6% 26.6

-4.0% 5.8 3.7% 15.4

5.8% 8.7 27.5% 17.7

-1.2% 12.1 -9.6% 19.3

-7.7% 13.0 -13.4% 43.2

August 2013 from August 2012 90% Confidence Interval 3

(p) Preliminary.

1

(r) Revised.

RSE Relative standard error. S Does not meet publication standards because tests for identifiable and stable seasonality do not meet reliability standards.

2 Average RSE for the latest 6-month period. Computed using unrounded data. 3 See the Explanatory Notes in the accompanying text for an explanation of 90% confidence intervals.

Note: These data represent the number of housing units authorized in all months up to and including the last day of the reporting period and not started as of that date without regard to the months of original permit issuance. Cancelled, abandoned, expired, and revoked permits are excluded.

Case 2:13-cv-07158-PA-PJW Document 1 Filed 09/27/13 Page 32 of 53 Page ID #:36

Table 3. New Privately-Owned Housing Units Started

[Thousands of units. Detail may not add to total because of rounding]

United States

Period Total In structures with -1 unit 2 to 4 units 5 units or more

Northeast

Midwest

South

West

Total

1 unit

Total

1 unit

Total

1 unit

Total

1 unit

Seasonally adjusted annual rate

2012: August September

749 854

537 591

(S) (S)

205 254

75 79

48 49

128 147

87 105

376 424

293 308

170 204

109 129

October November December

864 842 983

595 576 620

(S) (S) (S)

252 256 345

75 68 115

42 49 55

151 154 190

109 97 108

425 449 465

291 298 322

213 171 213

153 132 135

2013: January February March

898 969 1,005

614 652 623

(S) (S) (S)

273 307 356

87 106 94

49 67 45

95 135 140

94 94 105

483 505 554

331 350 339

233 223 217

140 141 134

April May June (r)

852 919 835

593 597 605

(S) (S) (S)

244 311 219

79 101 85

60 48 50

154 135 126

108 92 93

412 482 419

291 332 325

207 201 205

134 125 137

July (r)

883

587

(S)

278

110

52

152

99

392

310

229

126

August (p)

Average RSE (%)

1

891

5

628

4

(S)

(X)

252

13

101

16

57

10

147

11

106

9

439

7

317

7

204

9

148

8

Percent Change: August 2013 from July 2013 90% Confidence Interval 2 August 2013 from August 2012 90% Confidence Interval

2

0.9% 13.0 19.0% 11.1

7.0% 13.9 16.9% 10.1

(S) (X) (S) (X)

-9.4% 27.2 22.9% 31.0

-8.2% 38.6 34.7% 31.5

9.6% 18.3 18.8% 23.8

-3.3% 20.9 14.8% 21.3

7.1% 17.1 21.8% 15.8

12.0% 19.7 16.8% 16.1

2.3% 19.2 8.2% 16.8

-10.9% 24.2 20.0% 24.0

17.5% 27.3 35.8% 22.0

Not seasonally adjusted

2011: 2012: RSE (%) 608.8 780.6 1 430.6 535.3 1 10.9 11.4 14 167.3 233.9 3 67.7 79.7 3 41.2 46.5 5 100.9 127.9 2 74.3 92.1 4 307.8 397.8 2 229.3 282.6 2 132.5 175.1 2 85.7 114.1 2

2012: Year to Date 2013: Year to Date RSE (%)

502.3 615.8 2

355.3 423.8 1

7.0 9.2 22

140.1 182.8 5

52.6 63.9 6

31.2 36.2 2

76.2 91.9 3

58.8 67.4 1

259.4 313.2 3

190.6 224.9 2

114.2 146.9 3

74.6 95.4 4

Year to Date Percent Change 3 90% Confidence Interval

2012: August September

2

22.6% 3.8

69.0 75.8

19.3% 3.2

49.3 51.4

32.9% 43.2

0.7 0.8

30.5% 11.6

19.0 23.6

21.4% 10.6

6.9 6.9

15.8% 10.1

4.4 4.1

20.7% 7.3

12.9 13.6

14.6% 6.3

9.1 9.8

20.7% 6.2

33.3 37.5

18.0% 5.2

25.6 26.7

28.7% 10.1

15.8 17.8

27.8% 8.3

10.2 10.8

October November December

77.0 62.2 63.2

50.3 40.1 38.2

1.7 0.8 1.2

25.1 21.3 23.8

7.1 5.1 7.9

3.8 3.5 3.8

15.0 12.1 11.0

10.8 7.4 5.4

37.3 33.0 30.6

24.0 20.5 20.8

17.7 11.9 13.6

11.7 8.7 8.2

2013: January February March

58.7 66.1 83.3

39.4 44.2 52.5

0.7 0.7 2.1

18.6 21.1 28.7

5.4 6.3 7.5

2.8 3.6 3.6

4.2 7.2 10.2

4.1 4.4 7.4

33.8 36.8 47.4

23.4 26.1 30.0

15.4 15.8 18.2

9.0 10.1 11.5

April May June (r)

76.3 87.2 80.7

55.3 57.9 60.9

1.2 1.0 1.0

19.8 28.3 18.8

7.4 9.5 8.1

5.9 4.7 5.1

14.0 14.0 12.7

10.2 10.0 9.9

36.6 44.3 39.8

26.8 30.7 31.7

18.3 19.4 20.2

12.4 12.5 14.3

July (r)

82.4

56.5

1.6

24.3

10.3

5.2

15.0

10.3

36.2

29.0

21.0

12.0

August (p)

Average RSE (%)

1

81.2

5

57.1

4

1.0

38

23.2

13

9.3

16

5.3

10

14.8

11

11.0

9

38.4

7

27.2

7

18.7

9

13.6

8

(p) Preliminary. (r) Revised. X Not applicable.

1 3

RSE Relative standard error. S Does not meet publication standards because tests for identifiable and stable seasonality do not meet reliability standards.

2

Average RSE for the latest 6-month period. Computed using unrounded data.

See the Explanatory Notes in the accompanying text for an explanation of 90% confidence intervals.

Case 2:13-cv-07158-PA-PJW Document 1 Filed 09/27/13 Page 33 of 53 Page ID #:37

Table 4. New Privately-Owned Housing Units Under Construction at End of Period

[Thousands of units. Detail may not add to total because of rounding]

United States

Period Total In structures with -1 unit 2 to 4 units 5 units or more

Northeast

Midwest

South

West

Total

1 unit

Total

1 unit

Total

1 unit

Total

1 unit

Seasonally adjusted

2012: August September

496 511

266 271

(S) (S)

222 232

91 91

36 36

69 72

49 49

215 222

123 126

121 126

58 60

October November December

520 534 551

275 280 284

(S) (S) (S)

236 245 258

90 90 93

34 34 35

76 81 85

51 53 52

225 233 240

128 130 133

129 130 133

62 63 64

2013: January February March

563 581 594

288 292 293

(S) (S) (S)

266 280 290

94 97 98

35 36 35

86 87 89

53 53 54

246 257 268

135 138 141

137 140 139

65 65 63

April May June (r)

607 621 628

302 307 313

(S) (S) (S)

294 303 305

99 101 96

37 37 38

91 93 93

55 56 56

275 281 288

145 148 151

142 146 151

65 66 68

July (r)

640

316

(S)

313

98

38

97

57

293

155

152

66

August (p)

Average RSE (%)1

654

2

321

2

(S)

(X)

322

5

102

6

39

5

99

5

58

7

299

3

156

3

154

4

68

5

Percent Change: August 2013 from July 2013 90% Confidence Interval

2

2.2% 1.4 31.9% 5.2

1.6% 1.4 20.7% 4.8

(S) (X) (S) (X)

2.9% 2.1 45.0% 10.4

4.1% 4.1 12.1% 9.4

2.6% 3.0 8.3% 12.5

2.1% 2.1 43.5% 9.3

1.8% 2.4 18.4% 8.0

2.0% 1.8 39.1% 7.3

0.6% 1.8 26.8% 8.4

1.3% 3.0 27.3% 13.4

3.0% 4.4 17.2% 6.6

August 2013 from August 2012 90% Confidence Interval 2

Not seasonally adjusted

2012: August September 508.6 523.5 279.8 283.8 7.8 8.1 221.0 231.5 92.0 91.6 37.3 36.6 72.1 75.6 51.9 52.7 219.9 227.6 128.7 131.7 124.5 128.8 61.9 62.9

October November December

528.8 535.2 532.5

282.7 278.6 267.7

9.1 9.0 9.2

237.0 247.7 255.7

91.2 90.4 91.3

34.8 34.2 33.6

79.0 82.3 83.4

54.2 54.1 50.6

227.3 232.8 229.3

129.9 128.3 123.4

131.3 129.8 128.6

63.8 62.1 60.0

2013: January February March

543.1 563.6 584.3

271.0 276.3 282.6

9.2 9.2 10.6

262.9 278.0 291.0

92.2 94.7 97.7

33.5 34.5 34.3

82.6 82.7 85.1

49.7 48.5 49.6

236.6 250.3 264.8

127.2 131.6 137.8

131.8 135.9 136.7

60.6 61.8 60.9

April May June (r)

605.3 627.7 640.4

298.6 309.2 323.0

11.1 10.8 10.4

295.6 307.7 307.1

99.3 102.4 96.8

36.9 37.5 38.7

89.0 92.8 95.4

52.4 55.1 57.8

275.5 284.7 294.6

145.2 150.2 156.2

141.5 147.8 153.6

64.2 66.4 70.2

July (r)

655.5

331.5

10.8

313.2

99.0

38.9

99.9

60.4

300.7

162.4

155.9

69.8

August (p)

Average RSE (%)1

665.2

2

336.7

2

11.1

15

317.4

5

101.9

6

39.6

5

102.3

5

61.8

7

303.8

3

162.6

3

157.3

4

72.7

5

(p) Preliminary. (r) Revised. X Not applicable.

1

RSE Relative standard error. S Does not meet publication standards because tests for identifiable and stable seasonality do not meet reliability standards.

2

Average RSE for the latest 6-month period.

See the Explanatory Notes in the accompanying text for an explanation of 90% confidence intervals.

Case 2:13-cv-07158-PA-PJW Document 1 Filed 09/27/13 Page 34 of 53 Page ID #:38

Table 5. New Privately-Owned Housing Units Completed

[Thousands of units. Detail may not add to total because of rounding]

United States

Period Total In structures with -1 unit 2 to 4 units 5 units or more

Northeast

Midwest

South

West

Total

1 unit

Total

1 unit

Total

1 unit

Total

1 unit

Seasonally adjusted annual rate

2012: August September

686 651

495 512

(S) (S)

182 134

63 72

41 47

120 108

81 93

331 328

262 264

172 143

111 108

October November December

741 677 672

535 520 520

(S) (S) (S)

201 148 144

63 72 57

54 47 47

119 97 100

94 83 93

407 346 352

268 265 269

152 162 163

119 125 111

2013: January February March

720 727 810

554 573 591

(S) (S) (S)

156 147 214

73 65 97

54 45 61

89 108 116

83 94 98

370 373 371

288 305 293

188 181 226

129 129 139

April May June (r)

698 711 759

526 559 540

(S) (S) (S)

166 142 205

62 58 70

46 47 42

127 116 113

92 89 84

353 382 388

267 297 295

156 155 188

121 126 119

July (r)

767

570

(S)

189

79

52

119

91

374

274

195

153

August (p)

Average RSE (%)

1

769

6

573

5

(S)

(X)

191

18

70

17

47

13

120

13

105

13

408

8

301

8

171

14

120

11

Percent Change: August 2013 from July 2013 90% Confidence Interval 2 August 2013 from August 2012 90% Confidence Interval

2

0.3% 15.6 12.1% 15.1

0.5% 12.8 15.8% 12.6

(S) (X) (S) (X)

1.1% 40.3 4.9% 31.7

-11.4% 45.7 11.1% 37.5

-9.6% 22.1 14.6% 39.6

0.8% 24.1 0.0% 23.8

15.4% 30.2 29.6% 34.4

9.1% 23.7 23.3% 23.2

9.9% 22.3 14.9% 17.9

-12.3% 26.5 -0.6% 27.3

-21.6% 20.6 8.1% 29.9

Not seasonally adjusted

2011: 2012: RSE (%) 584.9 649.2 2 446.6 483.0 2 8.4 8.7 18 129.9 157.6 4 72.5 74.7 6 44.0 46.8 6 103.0 110.5 3 75.9 85.2 5 295.5 324.6 2 235.6 250.4 2 113.9 139.4 4 91.2 100.6 4

2012: Year to Date 2013: Year to Date RSE (%)

400.2 475.3 2

290.0 353.5 2

6.4 5.2 19

103.8 116.6 7

50.1 44.9 7

28.0 30.1 6

69.6 70.3 5

49.4 56.0 5

196.8 244.0 3

154.2 185.6 3

83.6 116.1 5

58.4 81.9 4

Year to Date Percent Change 3 90% Confidence Interval

2012: August September

2

18.8% 5.2

64.8 58.7

21.9% 3.8

43.3 46.6

-19.2% 30.1

1.0 0.4

12.4% 15.9

20.5 11.7

-10.3% 11.3

6.1 6.6

7.5% 13.5

3.6 4.5

0.9% 10.3

11.3 10.3

13.2% 9.2

7.0 9.0

24.0% 8.3

30.9 28.7

20.3% 6.4

23.1 23.1

38.9% 12.5

16.5 13.0

40.3% 7.0

9.7 10.0

October November December

67.7 57.8 64.8

50.1 45.6 50.7

0.4 0.7 0.7

17.2 11.5 13.4

6.3 6.2 5.4

5.5 4.3 4.5

11.3 8.9 10.4

9.2 7.8 9.8

36.6 28.7 33.7

24.7 22.4 26.0

13.5 14.0 15.3

10.7 11.1 10.4

2013: January February March

47.5 49.7 61.7

36.9 39.6 45.8

0.6 0.5 0.4

9.9 9.7 15.5

4.6 4.1 6.5

3.4 2.8 3.8

5.5 7.1 7.9

5.1 6.2 6.6

24.8 26.4 29.2

19.6 21.9 23.5

12.5 12.2 18.2

8.8 8.7 11.9

April May June (r)

54.6 58.3 66.0

40.5 46.3 47.0

0.5 0.8 1.2

13.6 11.2 17.8

4.7 4.8 6.4

3.4 4.0 4.0

10.0 9.3 9.4

7.2 7.1 6.9

27.9 31.3 34.1

20.9 24.6 26.0

12.0 12.9 16.1

9.1 10.6 10.2

July (r)

65.6

46.6

0.8

18.2

7.0

4.4

10.1

7.5

32.1

22.4

16.3

12.3

August (p)

Average RSE (%)

1

72.0

6

50.9

5

0.5

38

20.6

18

6.8

17

4.3

13

11.0

13

9.4

13

38.3

8

26.7

8

15.9

14

10.4

11

(p) Prelminary. (r) Revised. X Not applicable.

1 3

RSE Relative standard error. S Does not meet publication standards because tests for identifiable and stable seasonality do not meet reliability standards.

2

Average RSE for the latest 6-month period. Computed using unrounded data.

See the Explanatory Notes in the accompanying text for an explanation of 90% confidence intervals.

Case 2:13-cv-07158-PA-PJW Document 1 Filed 09/27/13 Page 35 of 53 Page ID #:39

EXHIBIT 4

Exclusive License Agreement

Case 2:13-cv-07158-PA-PJW Document 1 Filed 09/27/13 Page 36 of 53 Page ID #:40

Case 2:13-cv-07158-PA-PJW Document 1 Filed 09/27/13 Page 37 of 53 Page ID #:41

Case 2:13-cv-07158-PA-PJW Document 1 Filed 09/27/13 Page 38 of 53 Page ID #:42

EXHIBIT 5

Screenprint of www.capital30.com/products

International Integration LLC Page 1 of 3 Case 2:13-cv-07158-PA-PJW Document 1 Filed 09/27/13 Page 39 of 53 Page ID #:43

International INTEGRATION

Integrating Building Materials questions@internationalintegrationllc.com

z z z z z z z

Home Products Installation MSDS Warranty Gallery Contact Us

Introducing the new generation of hybrid underlayment. Stronger, Lighter, and more Durable alternative to 30lb organic felt.

Capital 30 Hybrid Underlayment

A superior hybrid underlayment for almost half the cost of other synthetic underlayments, with all of the quality and protection of leading underlayments plus ease of installation.

-Hybrid technology combines asphaltic polymer & synthetic fabrics for superior performance -Consistently outperforming conventional 30lb organic felt roof underlayments -Passes 110mph wind test and 4hour water shower test with both cap and roofing nails -Superior adhesion - will not wrinkle or blow in the wind during installation -Easier & Faster to install - lightweight and flexible material -Safer to install - resistance to slipping -Resists leaking and tearing -Left exposed, may protect a house for up to 4 months

http://www.capital30.com/products

9/25/2013

International Integration LLC Page 2 of 3 Case 2:13-cv-07158-PA-PJW Document 1 Filed 09/27/13 Page 40 of 53 Page ID #:44 -Won't stick to metal roofing - thermal stability in excess of 260 F -Meets or Exceeds ASTM D226 Requirements -30 Year limited warranty

Weight per square Squares per roll Roll Length Roll Width Weight/Roll Flexibility Tear Strength -- MD Tear Strength -- CD Tensile Strength -- MD Tensile Strength -- CD Water Shower Test

Hybrid Underlayment (ASTM 30lb specs) 11lbs per square (27 lbs per square) 4.5 squares (2 squares) 145 Feet (66 Feet) 3.1 Feet (3 Feet) 50lbs (54 lbs) Excellent (Stiff and Boardy) >1362 grams (>500 grams) >2400 grams (>500grams)

http://www.capital30.com/products

9/25/2013

International Integration LLC Page 3 of 3 Case 2:13-cv-07158-PA-PJW Document 1 Filed 09/27/13 Page 41 of 53 Page ID #:45 350 lbs (95 lbs) 260 lbs (33 lbs) Passed (Passed) Copyright 2006 International Integration LLC. All rights reserved.

questions@internationalintegrationllc.com close

z z z

http://www.capital30.com/products

9/25/2013

Case 2:13-cv-07158-PA-PJW Document 1 Filed 09/27/13 Page 42 of 53 Page ID #:46

EXHIBIT 6

Photograph of International Integrations Patent Pending Capital 30 Product

Case 2:13-cv-07158-PA-PJW Document 1 Filed 09/27/13 Page 43 of 53 Page ID #:47