Professional Documents

Culture Documents

100%(2)100% found this document useful (2 votes)

31 viewsThesun 2009-07-16 Page15 1

Thesun 2009-07-16 Page15 1

Uploaded by

Impulsive collectorAmIslamic Bank is launching a new Islamic Structured Deposit product called AmMomentum Select NID-i, targeting a fund size of RM75 million. The 4-year product uses momentum indicators to invest clients' funds across Shariah-compliant equity, energy, agriculture and metal indices. It aims to provide stable returns while avoiding underperforming asset classes. Investors will receive potential payouts of 2% after 1 year and 4% for years 2-3, with a final variable payout. A minimum investment of RM70,000 is required. Separately, Permodalan Nasional Bhd will offer the remaining 1.6 billion units of Amanah Saham Malaysia to all Malaysians

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- One OptionDocument58 pagesOne OptionDelos AlexNo ratings yet

- Hay Group Guide Chart - Profile Method of Job Evaluation - Intro & OverviewDocument4 pagesHay Group Guide Chart - Profile Method of Job Evaluation - Intro & OverviewImpulsive collector100% (1)

- Hay Group Guide Chart - Profile Method of Job EvaluationDocument27 pagesHay Group Guide Chart - Profile Method of Job EvaluationImpulsive collector78% (9)

- Developing An Enterprise Leadership MindsetDocument36 pagesDeveloping An Enterprise Leadership MindsetImpulsive collectorNo ratings yet

- Compensation Fundamentals - Towers WatsonDocument31 pagesCompensation Fundamentals - Towers WatsonImpulsive collector80% (5)

- KL City Plan 2020Document10 pagesKL City Plan 2020Impulsive collector0% (2)

- Thesun 2009-04-21 Page16 PNB Offers 5Document1 pageThesun 2009-04-21 Page16 PNB Offers 5Impulsive collectorNo ratings yet

- Exercise Islamic InvestmentDocument9 pagesExercise Islamic InvestmentWan RuschdeyNo ratings yet

- Nishat Group Final ProjectDocument10 pagesNishat Group Final ProjectMujtaba ChNo ratings yet

- BLP - SME BankDocument15 pagesBLP - SME BankSaadat KhanNo ratings yet

- MDM Chuah Evolution Msian Banking Industry 130411 ABM PDFDocument37 pagesMDM Chuah Evolution Msian Banking Industry 130411 ABM PDFtcngaiNo ratings yet

- Laporan Tahunan 2009Document179 pagesLaporan Tahunan 2009zalifahshafieNo ratings yet

- Finance 745Document16 pagesFinance 745zul hilmiNo ratings yet

- National Unit Trust Berhad (NUTB) Promotional Strategies For Bumiputra in MalaysiaDocument17 pagesNational Unit Trust Berhad (NUTB) Promotional Strategies For Bumiputra in MalaysiaAshish AgarwalNo ratings yet

- Thesun 2009-10-15 Page13 Mier Expects Corporate and Personal Tax CutsDocument1 pageThesun 2009-10-15 Page13 Mier Expects Corporate and Personal Tax CutsImpulsive collectorNo ratings yet

- FM Final DraftDocument20 pagesFM Final DraftMUHAMMAD FAIZUDDIN MUHAMMAD TAUFIQNo ratings yet

- Macroeconomics (ECO 211) Bank Muamalat Malaysia Berhad (BMMB)Document22 pagesMacroeconomics (ECO 211) Bank Muamalat Malaysia Berhad (BMMB)hafyzahNo ratings yet

- Credit Guarantee Fund Scheme For MICRO AND SMALL ENTERPRISESDocument2 pagesCredit Guarantee Fund Scheme For MICRO AND SMALL ENTERPRISESsachinoilNo ratings yet

- Allied Bank PresentationDocument74 pagesAllied Bank Presentationtyrose88100% (3)

- Is Umeme Worth 300 BillionsDocument5 pagesIs Umeme Worth 300 Billionsisaac setabiNo ratings yet

- Thesun 2009-09-09 Page14 Smes Need Attractive Incentives To Venture OffshoreDocument1 pageThesun 2009-09-09 Page14 Smes Need Attractive Incentives To Venture OffshoreImpulsive collectorNo ratings yet

- Case Study Nishat GroupDocument6 pagesCase Study Nishat GroupNoman Sarwar50% (2)

- Wider Credit Yield SpreadDocument3 pagesWider Credit Yield Spreadmeor3705No ratings yet

- Practicum Report - NurDocument117 pagesPracticum Report - NurLuna RoseNo ratings yet

- BBEM1103 Topic 8Document16 pagesBBEM1103 Topic 8NorilahNo ratings yet

- The Beginnings of Capital Markets in MyanmarDocument4 pagesThe Beginnings of Capital Markets in MyanmarTHAN HAN100% (1)

- Thesun 2009-08-19 Page14 Zeti Upbeat On Bond MarketDocument1 pageThesun 2009-08-19 Page14 Zeti Upbeat On Bond MarketImpulsive collectorNo ratings yet

- Sme OmanDocument7 pagesSme OmanakmohideenNo ratings yet

- En Master Prospectus Islamic Funds PDFDocument86 pagesEn Master Prospectus Islamic Funds PDFMAKK Business SolutionsNo ratings yet

- MCB Bank:History: ProfitabilityDocument5 pagesMCB Bank:History: ProfitabilityShaheryar SialNo ratings yet

- Introduction To Unit Trust in MalaysiaDocument12 pagesIntroduction To Unit Trust in MalaysiaEdgy EdgyNo ratings yet

- Welcome To Our PresentationDocument33 pagesWelcome To Our PresentationshafiulNo ratings yet

- About CimbDocument7 pagesAbout CimbShahmin HalimiNo ratings yet

- Thesun 2009-01-13 Page19 Take Micro Financing To Face Slowdown Tee KeatDocument1 pageThesun 2009-01-13 Page19 Take Micro Financing To Face Slowdown Tee KeatImpulsive collectorNo ratings yet

- Change - MGT Case - Study Bank - Islam.bhdDocument24 pagesChange - MGT Case - Study Bank - Islam.bhdashbak2006#zikir#scribd#2009No ratings yet

- FMR - Jun 2010Document9 pagesFMR - Jun 2010Salman ArshadNo ratings yet

- AGROBANKDocument4 pagesAGROBANKYiin YngNo ratings yet

- Thesun 2009-08-13 Page16 Maxis Likely To Relist in Its Entirety Says Ecm LibraDocument1 pageThesun 2009-08-13 Page16 Maxis Likely To Relist in Its Entirety Says Ecm LibraImpulsive collectorNo ratings yet

- Assig Investment Analysis SendingDocument24 pagesAssig Investment Analysis SendingMohamedNo ratings yet

- Small and Medium EnterpriseDocument7 pagesSmall and Medium EnterpriseFarah SyedaNo ratings yet

- Indo 3Document13 pagesIndo 3Novia Eka PermatasariNo ratings yet

- Employment Generation Project (Loan 1290-MON (SF) )Document39 pagesEmployment Generation Project (Loan 1290-MON (SF) )Independent Evaluation at Asian Development BankNo ratings yet

- Islamic Banking: Malaysia'S PerspectiveDocument15 pagesIslamic Banking: Malaysia'S PerspectivejawadNo ratings yet

- Executive Summary 1Document82 pagesExecutive Summary 1madihaijazkhanNo ratings yet

- MCB Bank Limited Formerly Known As Muslim Commercial Bank Limited Was Incorporated by The Adamjee Group On July 9Document6 pagesMCB Bank Limited Formerly Known As Muslim Commercial Bank Limited Was Incorporated by The Adamjee Group On July 9Imdad Ali JokhioNo ratings yet

- AMFI April 24, 2020 Press ReleaseDocument2 pagesAMFI April 24, 2020 Press ReleaseSandip ChandranNo ratings yet

- Co Profile BSNC Leasing LiquidationDocument4 pagesCo Profile BSNC Leasing LiquidationthivvvNo ratings yet

- Thesun 2009-06-23 Page16 Life Insurance Industry Growing Despite SlowdownDocument1 pageThesun 2009-06-23 Page16 Life Insurance Industry Growing Despite SlowdownImpulsive collectorNo ratings yet

- Shaping Macro Dreams Seeding Micro EnterprisesDocument88 pagesShaping Macro Dreams Seeding Micro Enterprisessujay pratapNo ratings yet

- History of RHB Capital BHDDocument7 pagesHistory of RHB Capital BHDMohamad QayyumNo ratings yet

- Study On Mutual Fund - New Fund Offer V/S Equity Initial Public Offer'Document78 pagesStudy On Mutual Fund - New Fund Offer V/S Equity Initial Public Offer'sumesh894No ratings yet

- Ambank DefinitionsintheprospectusDocument4 pagesAmbank DefinitionsintheprospectusImhakim IsmailNo ratings yet

- Bbbm4103 Bank Management - May Semester 2020Document25 pagesBbbm4103 Bank Management - May Semester 2020VithiaNo ratings yet

- IMA Magazine Version 11 No AddsDocument54 pagesIMA Magazine Version 11 No AddsIntekhab Alam AnsariNo ratings yet

- SME Financing: Submitted To Mr. S. Clement September 17,2010Document29 pagesSME Financing: Submitted To Mr. S. Clement September 17,2010scribddddddddddddNo ratings yet

- Firoz ProjectDocument104 pagesFiroz ProjectRishi GoyalNo ratings yet

- Kotak AMCDocument5 pagesKotak AMCBISHWA RATANNo ratings yet

- Thesun 2009-04-02 Page12 WCT Eyes Rm1bil Projects in Msia MideastDocument1 pageThesun 2009-04-02 Page12 WCT Eyes Rm1bil Projects in Msia MideastImpulsive collectorNo ratings yet

- Meezan Bank LimitedDocument13 pagesMeezan Bank LimitedAisha rashidNo ratings yet

- Freedom Unleashed: How to Make Malaysia a Tax Free CountryFrom EverandFreedom Unleashed: How to Make Malaysia a Tax Free CountryRating: 5 out of 5 stars5/5 (1)

- Continuing Reforms to Stimulate Private Sector Investment: A Private Sector Assessment for Solomon IslandsFrom EverandContinuing Reforms to Stimulate Private Sector Investment: A Private Sector Assessment for Solomon IslandsNo ratings yet

- Hay Group Guide Chart & Profile Method of Job Evaluation - An Introduction & OverviewDocument15 pagesHay Group Guide Chart & Profile Method of Job Evaluation - An Introduction & OverviewAyman ShetaNo ratings yet

- Futuretrends in Leadership DevelopmentDocument36 pagesFuturetrends in Leadership DevelopmentImpulsive collector100% (1)

- CLC Building The High Performance Workforce A Quantitative Analysis of The Effectiveness of Performance Management StrategiesDocument117 pagesCLC Building The High Performance Workforce A Quantitative Analysis of The Effectiveness of Performance Management StrategiesImpulsive collector100% (1)

- Coaching in OrganisationsDocument18 pagesCoaching in OrganisationsImpulsive collectorNo ratings yet

- Strategy+Business - Winter 2014Document108 pagesStrategy+Business - Winter 2014GustavoLopezGNo ratings yet

- Strategy+Business Magazine 2016 AutumnDocument132 pagesStrategy+Business Magazine 2016 AutumnImpulsive collector100% (3)

- Megatrends Report 2015Document56 pagesMegatrends Report 2015Cleverson TabajaraNo ratings yet

- Managing Conflict at Work - A Guide For Line ManagersDocument22 pagesManaging Conflict at Work - A Guide For Line ManagersRoxana VornicescuNo ratings yet

- 2015 Summer Strategy+business PDFDocument104 pages2015 Summer Strategy+business PDFImpulsive collectorNo ratings yet

- TheSun 2009-11-04 Page15 Huge Shake-Up For Rbs and LloydsDocument1 pageTheSun 2009-11-04 Page15 Huge Shake-Up For Rbs and LloydsImpulsive collectorNo ratings yet

- Talent Analytics and Big DataDocument28 pagesTalent Analytics and Big DataImpulsive collectorNo ratings yet

- TheSun 2009-11-04 Page14 Significant Success in Islamic Finance Says PMDocument1 pageTheSun 2009-11-04 Page14 Significant Success in Islamic Finance Says PMImpulsive collectorNo ratings yet

- TheSun 2009-11-04 Page11 We Await Answers To Dipang TragedyDocument1 pageTheSun 2009-11-04 Page11 We Await Answers To Dipang TragedyImpulsive collectorNo ratings yet

- Deloitte Analytics Analytics Advantage Report 061913Document21 pagesDeloitte Analytics Analytics Advantage Report 061913Impulsive collectorNo ratings yet

- 2016 Summer Strategy+business PDFDocument116 pages2016 Summer Strategy+business PDFImpulsive collectorNo ratings yet

- Global Talent 2021Document21 pagesGlobal Talent 2021rsrobinsuarezNo ratings yet

- TomatoproductdsDocument8 pagesTomatoproductdsrahuldtcNo ratings yet

- Icici Bank CBRDocument49 pagesIcici Bank CBRHarshad Sutar100% (1)

- Galapagos NV Equity ResearchDocument11 pagesGalapagos NV Equity ResearchBojan NiNo ratings yet

- Cash To Accrual ProblemsDocument10 pagesCash To Accrual ProblemsAmethystNo ratings yet

- Europass CV 120602 QuintanillaClimentDocument3 pagesEuropass CV 120602 QuintanillaCliment1GSITursulaquintanillaNo ratings yet

- Allotment of SharesDocument17 pagesAllotment of SharesRuchi Arora100% (2)

- Industry ProfileDocument26 pagesIndustry ProfileVish SolankiNo ratings yet

- QUIZ Marathon 1:: Master Budget (Set ADocument7 pagesQUIZ Marathon 1:: Master Budget (Set AImelda leeNo ratings yet

- Primary Sources BooksDocument16 pagesPrimary Sources Booksapi-198969071No ratings yet

- Majestic Tamworth InformationDocument29 pagesMajestic Tamworth InformationMetaGaxy DAONo ratings yet

- Coping With Risk in Agriculture2015Document291 pagesCoping With Risk in Agriculture2015marcoNo ratings yet

- Consumer Behaviour On Credit CardsDocument4 pagesConsumer Behaviour On Credit CardsSohil DhruvNo ratings yet

- Activity No. 1 Organizational Set-Up of Immersion EstablishmentDocument6 pagesActivity No. 1 Organizational Set-Up of Immersion EstablishmentJeff RamosNo ratings yet

- Indemnity and GuaranteeDocument15 pagesIndemnity and GuaranteeTariq RahimNo ratings yet

- New Government Accounting System NGASDocument20 pagesNew Government Accounting System NGASIsiah Jarrett Trinidad Abille100% (1)

- 1.0 Executive Summary:: Integrated Marketing CommunicationDocument28 pages1.0 Executive Summary:: Integrated Marketing CommunicationAnubhov Jobair100% (1)

- G.R. No. 140667 August 12, 2004 WOODCHILD HOLDINGS, INC., petitioner, vs. ROXAS ELECTRIC AND CONSTRUCTION COMPANY, INC., respondent G.R. No. 160215 November 10, 2004 HYDRO RESOURCES CONTRACTORS CORPORATION, petitioner, vs. NATIONAL IRRIGATION ADMINISTRATION, respondent.Document29 pagesG.R. No. 140667 August 12, 2004 WOODCHILD HOLDINGS, INC., petitioner, vs. ROXAS ELECTRIC AND CONSTRUCTION COMPANY, INC., respondent G.R. No. 160215 November 10, 2004 HYDRO RESOURCES CONTRACTORS CORPORATION, petitioner, vs. NATIONAL IRRIGATION ADMINISTRATION, respondent.Al AaNo ratings yet

- Bbap2103 (Sample 3) PDFDocument10 pagesBbap2103 (Sample 3) PDFFaidz FuadNo ratings yet

- Internship Report of Nepal Bank Limited OveralllDocument7 pagesInternship Report of Nepal Bank Limited OverallldingautamNo ratings yet

- An Empirical Analysis On The Relationship Between Multiple Directorships and Cash Holding: A Study On The Financial Sector 2019-2020 in OmanDocument10 pagesAn Empirical Analysis On The Relationship Between Multiple Directorships and Cash Holding: A Study On The Financial Sector 2019-2020 in OmanBOHR International Journal of Business Ethics and Corporate GovernanceNo ratings yet

- Reserve Bank Pulled Out The Big Guns To Fight Covid-19 Induced Economic Slump - KganyagoDocument9 pagesReserve Bank Pulled Out The Big Guns To Fight Covid-19 Induced Economic Slump - KganyagoCityPressNo ratings yet

- Table of Cases The Indian Contract ActDocument39 pagesTable of Cases The Indian Contract ActpalashnikoseNo ratings yet

- Example Simple Social Security TrustDocument2 pagesExample Simple Social Security TrustFreeman Lawyer86% (7)

- Background Report: Pete SantilliDocument10 pagesBackground Report: Pete Santilliapi-139412189No ratings yet

- Company Analysis - Overview: MMC Norilsk Nickel OJSCDocument8 pagesCompany Analysis - Overview: MMC Norilsk Nickel OJSCQ.M.S Advisors LLCNo ratings yet

- PDF Financial Accounting I 4Th Edition Mohammed Hanif Ebook Full ChapterDocument38 pagesPDF Financial Accounting I 4Th Edition Mohammed Hanif Ebook Full Chapterjessica.kremer824100% (3)

- Fannie Special Exam May 2006Document348 pagesFannie Special Exam May 2006ny1davidNo ratings yet

- SalesA5GST 1Document6 pagesSalesA5GST 1Chintan B BhayaniNo ratings yet

- Internal Control GuideDocument42 pagesInternal Control GuideOrlando Pineda Vallar100% (1)

Thesun 2009-07-16 Page15 1

Thesun 2009-07-16 Page15 1

Uploaded by

Impulsive collector100%(2)100% found this document useful (2 votes)

31 views1 pageAmIslamic Bank is launching a new Islamic Structured Deposit product called AmMomentum Select NID-i, targeting a fund size of RM75 million. The 4-year product uses momentum indicators to invest clients' funds across Shariah-compliant equity, energy, agriculture and metal indices. It aims to provide stable returns while avoiding underperforming asset classes. Investors will receive potential payouts of 2% after 1 year and 4% for years 2-3, with a final variable payout. A minimum investment of RM70,000 is required. Separately, Permodalan Nasional Bhd will offer the remaining 1.6 billion units of Amanah Saham Malaysia to all Malaysians

Original Description:

Original Title

thesun 2009-07-16 page15 1

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentAmIslamic Bank is launching a new Islamic Structured Deposit product called AmMomentum Select NID-i, targeting a fund size of RM75 million. The 4-year product uses momentum indicators to invest clients' funds across Shariah-compliant equity, energy, agriculture and metal indices. It aims to provide stable returns while avoiding underperforming asset classes. Investors will receive potential payouts of 2% after 1 year and 4% for years 2-3, with a final variable payout. A minimum investment of RM70,000 is required. Separately, Permodalan Nasional Bhd will offer the remaining 1.6 billion units of Amanah Saham Malaysia to all Malaysians

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

100%(2)100% found this document useful (2 votes)

31 views1 pageThesun 2009-07-16 Page15 1

Thesun 2009-07-16 Page15 1

Uploaded by

Impulsive collectorAmIslamic Bank is launching a new Islamic Structured Deposit product called AmMomentum Select NID-i, targeting a fund size of RM75 million. The 4-year product uses momentum indicators to invest clients' funds across Shariah-compliant equity, energy, agriculture and metal indices. It aims to provide stable returns while avoiding underperforming asset classes. Investors will receive potential payouts of 2% after 1 year and 4% for years 2-3, with a final variable payout. A minimum investment of RM70,000 is required. Separately, Permodalan Nasional Bhd will offer the remaining 1.6 billion units of Amanah Saham Malaysia to all Malaysians

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

theSun | THURSDAY JULY 16 2009 15

business

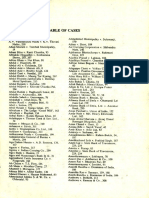

ANWAR FAIZ/THESUN

AmIslamic

Bank

Organisational

AmIslamic targets Services

general

manager

RM75m for new fund Jamaiyah

Mohammed

Nor, Mahdi,

by Eva Yeong advantage of bull markets,” said AmBank (M)

newsdesk@thesundaily.com Mahdi. It also provides diversified Berhad head

exposure to four indices namely eq- of Retail

KUALA LUMPUR: AmBank Group’s uity, energy, agriculture and metal. Distribution

Islamic banking subsidiary AmIs- According to AmBank (M) Bhd Brad Gravell

lamic Bank targets a fund size of structured products, treasury and Hoe at

RM75 million for its second Islamic and markets senior manager Hoe the launch

Structured Deposit product. Cheah Kit, the four-year product of NID-i

Launched yesterday, the new uses a three-month average as its yesterday.

product is known as AmMomentum momentum indicator before de-

Select Islamic Negotiable Instrument ploying suitable amounts of clients’

of Deposit (NID-i), a deposit with a investments into indices that are

fixed tenure and returns linked to performing more positively.

the performance of syariah-com- At the end of the first year,

pliant underlying asset which may investors would get a payout of 2%

be equities, bonds, commodities, in the form of Hibah, and 4% payout

foreign exchange, indices or any for second and third years if the

combination of these assets. momentum strategy is more than

“This deposit is close-ended 102.5%. At the end of the fourth

with a targeted size of RM75 mil- year, there will be a final variable

lion during the 30-day offer period,” payout.

said AmBank (M) Bhd retail banking To take up AmMomentum Select

executive director Mahdi Murad. NID-i, a minimum investment of

The 30-day offer period begins RM70,000 is required. The product

July 20. is sold across all AmBank Group

Designed to provide investors distribution channels.

with a “safe and profitable haven” “We are also looking to launch

to place their investments, the one more structured deposit by end

product uses momentum to decide of the year or early next year,” said

how to invest into a portfolio of Hoe.

multiple assets. The upcoming launch would

“It automatically avoids under- most likely be a conventional

performing asset classes and takes product, he said.

1.6bil ASM units

offered to all

M’sians from July 21

KUALA LUMPUR: Permodalan and Indians have been fully

Nasional Bhd (PNB) will be of- subscribed.

fering the remaining 1.6 billion Hamad said the quota on the

Amanah Saham Malaysia (ASM) additional 3.33 billion units was

units, including those initially set imposed for three months from

aside for bumiputras, for sub- April 21 to diversify investor

scription by all Malaysians from profile.

July 21. “The three-month period

PNB president and group was sufficient to give all parties

chief executive Tan Sri Hamad enough time to invest and to

Kama Piah Che Othman said a allow comprehensive participa-

maximum investment limit of tion,” he said.

20,000 units would be imposed Asked whether PNB would

on each account holder for seven lose if the bumiputra quota was

days until July 27. retained, he said: “We can create

“Thereafter, investors can new units when we want to

subscribe for the ASM units with- lauch new products and we can

out any maximum investment add more.

limit depending on the amount of When we have the need

units left. Sales for the additional for anyone to make additional

ASM units are based on a first- investments, we can create new

come, first-served basis,” he told units.”

reporters here yesterday. PNB has various funds for

The 1.6 billion units are part subscription by bumiputra inves-

of the 3.33 billion additional tors. Among them are Amanah

ASM units announced by Prime Saham Wawasan (1.7 billion),

Minister Datuk Seri Najib Abdul Amanah Saham Didik (1.6 bil-

Razak when launching the 2009 lion), Amanah Saham Nasional

Malaysian Unit Trust Week in (921 million) and Amanah Sa-

Johor Baru on April 20. ham Nasional 2 (2.2 billion).

Of the 3.33 billion units, bu- ASM was the second trust

miputra investors were allocated fund launched by PNB for all

50%, Chinese 30%, Indians 15% Malaysians.

and other races 5%. Asked on Amanah Saham

Previously, ASM units were 1Malaysia, Hamad said: “Let

open to Malaysians aged six the prime minister make the an-

months and above irrespective nounce announcement. The date

of race. has been set.”

ASM was launched in 2000 Najib, when speaking at a

with an initial fund size of 2 bil- gathering on the occasion of his

lion units and all had been taken 100th day in office on July 11,

up within 21 days. said the government had agreed

Since then, new additional to PNB establishing a new unit

units have been offered six times trust fund called Amanah Saham

totalling 7.63 billion. The trust 1Malaysia with a size of 10 bil-

units allocated for the Chinese lion units. – Bernama

You might also like

- One OptionDocument58 pagesOne OptionDelos AlexNo ratings yet

- Hay Group Guide Chart - Profile Method of Job Evaluation - Intro & OverviewDocument4 pagesHay Group Guide Chart - Profile Method of Job Evaluation - Intro & OverviewImpulsive collector100% (1)

- Hay Group Guide Chart - Profile Method of Job EvaluationDocument27 pagesHay Group Guide Chart - Profile Method of Job EvaluationImpulsive collector78% (9)

- Developing An Enterprise Leadership MindsetDocument36 pagesDeveloping An Enterprise Leadership MindsetImpulsive collectorNo ratings yet

- Compensation Fundamentals - Towers WatsonDocument31 pagesCompensation Fundamentals - Towers WatsonImpulsive collector80% (5)

- KL City Plan 2020Document10 pagesKL City Plan 2020Impulsive collector0% (2)

- Thesun 2009-04-21 Page16 PNB Offers 5Document1 pageThesun 2009-04-21 Page16 PNB Offers 5Impulsive collectorNo ratings yet

- Exercise Islamic InvestmentDocument9 pagesExercise Islamic InvestmentWan RuschdeyNo ratings yet

- Nishat Group Final ProjectDocument10 pagesNishat Group Final ProjectMujtaba ChNo ratings yet

- BLP - SME BankDocument15 pagesBLP - SME BankSaadat KhanNo ratings yet

- MDM Chuah Evolution Msian Banking Industry 130411 ABM PDFDocument37 pagesMDM Chuah Evolution Msian Banking Industry 130411 ABM PDFtcngaiNo ratings yet

- Laporan Tahunan 2009Document179 pagesLaporan Tahunan 2009zalifahshafieNo ratings yet

- Finance 745Document16 pagesFinance 745zul hilmiNo ratings yet

- National Unit Trust Berhad (NUTB) Promotional Strategies For Bumiputra in MalaysiaDocument17 pagesNational Unit Trust Berhad (NUTB) Promotional Strategies For Bumiputra in MalaysiaAshish AgarwalNo ratings yet

- Thesun 2009-10-15 Page13 Mier Expects Corporate and Personal Tax CutsDocument1 pageThesun 2009-10-15 Page13 Mier Expects Corporate and Personal Tax CutsImpulsive collectorNo ratings yet

- FM Final DraftDocument20 pagesFM Final DraftMUHAMMAD FAIZUDDIN MUHAMMAD TAUFIQNo ratings yet

- Macroeconomics (ECO 211) Bank Muamalat Malaysia Berhad (BMMB)Document22 pagesMacroeconomics (ECO 211) Bank Muamalat Malaysia Berhad (BMMB)hafyzahNo ratings yet

- Credit Guarantee Fund Scheme For MICRO AND SMALL ENTERPRISESDocument2 pagesCredit Guarantee Fund Scheme For MICRO AND SMALL ENTERPRISESsachinoilNo ratings yet

- Allied Bank PresentationDocument74 pagesAllied Bank Presentationtyrose88100% (3)

- Is Umeme Worth 300 BillionsDocument5 pagesIs Umeme Worth 300 Billionsisaac setabiNo ratings yet

- Thesun 2009-09-09 Page14 Smes Need Attractive Incentives To Venture OffshoreDocument1 pageThesun 2009-09-09 Page14 Smes Need Attractive Incentives To Venture OffshoreImpulsive collectorNo ratings yet

- Case Study Nishat GroupDocument6 pagesCase Study Nishat GroupNoman Sarwar50% (2)

- Wider Credit Yield SpreadDocument3 pagesWider Credit Yield Spreadmeor3705No ratings yet

- Practicum Report - NurDocument117 pagesPracticum Report - NurLuna RoseNo ratings yet

- BBEM1103 Topic 8Document16 pagesBBEM1103 Topic 8NorilahNo ratings yet

- The Beginnings of Capital Markets in MyanmarDocument4 pagesThe Beginnings of Capital Markets in MyanmarTHAN HAN100% (1)

- Thesun 2009-08-19 Page14 Zeti Upbeat On Bond MarketDocument1 pageThesun 2009-08-19 Page14 Zeti Upbeat On Bond MarketImpulsive collectorNo ratings yet

- Sme OmanDocument7 pagesSme OmanakmohideenNo ratings yet

- En Master Prospectus Islamic Funds PDFDocument86 pagesEn Master Prospectus Islamic Funds PDFMAKK Business SolutionsNo ratings yet

- MCB Bank:History: ProfitabilityDocument5 pagesMCB Bank:History: ProfitabilityShaheryar SialNo ratings yet

- Introduction To Unit Trust in MalaysiaDocument12 pagesIntroduction To Unit Trust in MalaysiaEdgy EdgyNo ratings yet

- Welcome To Our PresentationDocument33 pagesWelcome To Our PresentationshafiulNo ratings yet

- About CimbDocument7 pagesAbout CimbShahmin HalimiNo ratings yet

- Thesun 2009-01-13 Page19 Take Micro Financing To Face Slowdown Tee KeatDocument1 pageThesun 2009-01-13 Page19 Take Micro Financing To Face Slowdown Tee KeatImpulsive collectorNo ratings yet

- Change - MGT Case - Study Bank - Islam.bhdDocument24 pagesChange - MGT Case - Study Bank - Islam.bhdashbak2006#zikir#scribd#2009No ratings yet

- FMR - Jun 2010Document9 pagesFMR - Jun 2010Salman ArshadNo ratings yet

- AGROBANKDocument4 pagesAGROBANKYiin YngNo ratings yet

- Thesun 2009-08-13 Page16 Maxis Likely To Relist in Its Entirety Says Ecm LibraDocument1 pageThesun 2009-08-13 Page16 Maxis Likely To Relist in Its Entirety Says Ecm LibraImpulsive collectorNo ratings yet

- Assig Investment Analysis SendingDocument24 pagesAssig Investment Analysis SendingMohamedNo ratings yet

- Small and Medium EnterpriseDocument7 pagesSmall and Medium EnterpriseFarah SyedaNo ratings yet

- Indo 3Document13 pagesIndo 3Novia Eka PermatasariNo ratings yet

- Employment Generation Project (Loan 1290-MON (SF) )Document39 pagesEmployment Generation Project (Loan 1290-MON (SF) )Independent Evaluation at Asian Development BankNo ratings yet

- Islamic Banking: Malaysia'S PerspectiveDocument15 pagesIslamic Banking: Malaysia'S PerspectivejawadNo ratings yet

- Executive Summary 1Document82 pagesExecutive Summary 1madihaijazkhanNo ratings yet

- MCB Bank Limited Formerly Known As Muslim Commercial Bank Limited Was Incorporated by The Adamjee Group On July 9Document6 pagesMCB Bank Limited Formerly Known As Muslim Commercial Bank Limited Was Incorporated by The Adamjee Group On July 9Imdad Ali JokhioNo ratings yet

- AMFI April 24, 2020 Press ReleaseDocument2 pagesAMFI April 24, 2020 Press ReleaseSandip ChandranNo ratings yet

- Co Profile BSNC Leasing LiquidationDocument4 pagesCo Profile BSNC Leasing LiquidationthivvvNo ratings yet

- Thesun 2009-06-23 Page16 Life Insurance Industry Growing Despite SlowdownDocument1 pageThesun 2009-06-23 Page16 Life Insurance Industry Growing Despite SlowdownImpulsive collectorNo ratings yet

- Shaping Macro Dreams Seeding Micro EnterprisesDocument88 pagesShaping Macro Dreams Seeding Micro Enterprisessujay pratapNo ratings yet

- History of RHB Capital BHDDocument7 pagesHistory of RHB Capital BHDMohamad QayyumNo ratings yet

- Study On Mutual Fund - New Fund Offer V/S Equity Initial Public Offer'Document78 pagesStudy On Mutual Fund - New Fund Offer V/S Equity Initial Public Offer'sumesh894No ratings yet

- Ambank DefinitionsintheprospectusDocument4 pagesAmbank DefinitionsintheprospectusImhakim IsmailNo ratings yet

- Bbbm4103 Bank Management - May Semester 2020Document25 pagesBbbm4103 Bank Management - May Semester 2020VithiaNo ratings yet

- IMA Magazine Version 11 No AddsDocument54 pagesIMA Magazine Version 11 No AddsIntekhab Alam AnsariNo ratings yet

- SME Financing: Submitted To Mr. S. Clement September 17,2010Document29 pagesSME Financing: Submitted To Mr. S. Clement September 17,2010scribddddddddddddNo ratings yet

- Firoz ProjectDocument104 pagesFiroz ProjectRishi GoyalNo ratings yet

- Kotak AMCDocument5 pagesKotak AMCBISHWA RATANNo ratings yet

- Thesun 2009-04-02 Page12 WCT Eyes Rm1bil Projects in Msia MideastDocument1 pageThesun 2009-04-02 Page12 WCT Eyes Rm1bil Projects in Msia MideastImpulsive collectorNo ratings yet

- Meezan Bank LimitedDocument13 pagesMeezan Bank LimitedAisha rashidNo ratings yet

- Freedom Unleashed: How to Make Malaysia a Tax Free CountryFrom EverandFreedom Unleashed: How to Make Malaysia a Tax Free CountryRating: 5 out of 5 stars5/5 (1)

- Continuing Reforms to Stimulate Private Sector Investment: A Private Sector Assessment for Solomon IslandsFrom EverandContinuing Reforms to Stimulate Private Sector Investment: A Private Sector Assessment for Solomon IslandsNo ratings yet

- Hay Group Guide Chart & Profile Method of Job Evaluation - An Introduction & OverviewDocument15 pagesHay Group Guide Chart & Profile Method of Job Evaluation - An Introduction & OverviewAyman ShetaNo ratings yet

- Futuretrends in Leadership DevelopmentDocument36 pagesFuturetrends in Leadership DevelopmentImpulsive collector100% (1)

- CLC Building The High Performance Workforce A Quantitative Analysis of The Effectiveness of Performance Management StrategiesDocument117 pagesCLC Building The High Performance Workforce A Quantitative Analysis of The Effectiveness of Performance Management StrategiesImpulsive collector100% (1)

- Coaching in OrganisationsDocument18 pagesCoaching in OrganisationsImpulsive collectorNo ratings yet

- Strategy+Business - Winter 2014Document108 pagesStrategy+Business - Winter 2014GustavoLopezGNo ratings yet

- Strategy+Business Magazine 2016 AutumnDocument132 pagesStrategy+Business Magazine 2016 AutumnImpulsive collector100% (3)

- Megatrends Report 2015Document56 pagesMegatrends Report 2015Cleverson TabajaraNo ratings yet

- Managing Conflict at Work - A Guide For Line ManagersDocument22 pagesManaging Conflict at Work - A Guide For Line ManagersRoxana VornicescuNo ratings yet

- 2015 Summer Strategy+business PDFDocument104 pages2015 Summer Strategy+business PDFImpulsive collectorNo ratings yet

- TheSun 2009-11-04 Page15 Huge Shake-Up For Rbs and LloydsDocument1 pageTheSun 2009-11-04 Page15 Huge Shake-Up For Rbs and LloydsImpulsive collectorNo ratings yet

- Talent Analytics and Big DataDocument28 pagesTalent Analytics and Big DataImpulsive collectorNo ratings yet

- TheSun 2009-11-04 Page14 Significant Success in Islamic Finance Says PMDocument1 pageTheSun 2009-11-04 Page14 Significant Success in Islamic Finance Says PMImpulsive collectorNo ratings yet

- TheSun 2009-11-04 Page11 We Await Answers To Dipang TragedyDocument1 pageTheSun 2009-11-04 Page11 We Await Answers To Dipang TragedyImpulsive collectorNo ratings yet

- Deloitte Analytics Analytics Advantage Report 061913Document21 pagesDeloitte Analytics Analytics Advantage Report 061913Impulsive collectorNo ratings yet

- 2016 Summer Strategy+business PDFDocument116 pages2016 Summer Strategy+business PDFImpulsive collectorNo ratings yet

- Global Talent 2021Document21 pagesGlobal Talent 2021rsrobinsuarezNo ratings yet

- TomatoproductdsDocument8 pagesTomatoproductdsrahuldtcNo ratings yet

- Icici Bank CBRDocument49 pagesIcici Bank CBRHarshad Sutar100% (1)

- Galapagos NV Equity ResearchDocument11 pagesGalapagos NV Equity ResearchBojan NiNo ratings yet

- Cash To Accrual ProblemsDocument10 pagesCash To Accrual ProblemsAmethystNo ratings yet

- Europass CV 120602 QuintanillaClimentDocument3 pagesEuropass CV 120602 QuintanillaCliment1GSITursulaquintanillaNo ratings yet

- Allotment of SharesDocument17 pagesAllotment of SharesRuchi Arora100% (2)

- Industry ProfileDocument26 pagesIndustry ProfileVish SolankiNo ratings yet

- QUIZ Marathon 1:: Master Budget (Set ADocument7 pagesQUIZ Marathon 1:: Master Budget (Set AImelda leeNo ratings yet

- Primary Sources BooksDocument16 pagesPrimary Sources Booksapi-198969071No ratings yet

- Majestic Tamworth InformationDocument29 pagesMajestic Tamworth InformationMetaGaxy DAONo ratings yet

- Coping With Risk in Agriculture2015Document291 pagesCoping With Risk in Agriculture2015marcoNo ratings yet

- Consumer Behaviour On Credit CardsDocument4 pagesConsumer Behaviour On Credit CardsSohil DhruvNo ratings yet

- Activity No. 1 Organizational Set-Up of Immersion EstablishmentDocument6 pagesActivity No. 1 Organizational Set-Up of Immersion EstablishmentJeff RamosNo ratings yet

- Indemnity and GuaranteeDocument15 pagesIndemnity and GuaranteeTariq RahimNo ratings yet

- New Government Accounting System NGASDocument20 pagesNew Government Accounting System NGASIsiah Jarrett Trinidad Abille100% (1)

- 1.0 Executive Summary:: Integrated Marketing CommunicationDocument28 pages1.0 Executive Summary:: Integrated Marketing CommunicationAnubhov Jobair100% (1)

- G.R. No. 140667 August 12, 2004 WOODCHILD HOLDINGS, INC., petitioner, vs. ROXAS ELECTRIC AND CONSTRUCTION COMPANY, INC., respondent G.R. No. 160215 November 10, 2004 HYDRO RESOURCES CONTRACTORS CORPORATION, petitioner, vs. NATIONAL IRRIGATION ADMINISTRATION, respondent.Document29 pagesG.R. No. 140667 August 12, 2004 WOODCHILD HOLDINGS, INC., petitioner, vs. ROXAS ELECTRIC AND CONSTRUCTION COMPANY, INC., respondent G.R. No. 160215 November 10, 2004 HYDRO RESOURCES CONTRACTORS CORPORATION, petitioner, vs. NATIONAL IRRIGATION ADMINISTRATION, respondent.Al AaNo ratings yet

- Bbap2103 (Sample 3) PDFDocument10 pagesBbap2103 (Sample 3) PDFFaidz FuadNo ratings yet

- Internship Report of Nepal Bank Limited OveralllDocument7 pagesInternship Report of Nepal Bank Limited OverallldingautamNo ratings yet

- An Empirical Analysis On The Relationship Between Multiple Directorships and Cash Holding: A Study On The Financial Sector 2019-2020 in OmanDocument10 pagesAn Empirical Analysis On The Relationship Between Multiple Directorships and Cash Holding: A Study On The Financial Sector 2019-2020 in OmanBOHR International Journal of Business Ethics and Corporate GovernanceNo ratings yet

- Reserve Bank Pulled Out The Big Guns To Fight Covid-19 Induced Economic Slump - KganyagoDocument9 pagesReserve Bank Pulled Out The Big Guns To Fight Covid-19 Induced Economic Slump - KganyagoCityPressNo ratings yet

- Table of Cases The Indian Contract ActDocument39 pagesTable of Cases The Indian Contract ActpalashnikoseNo ratings yet

- Example Simple Social Security TrustDocument2 pagesExample Simple Social Security TrustFreeman Lawyer86% (7)

- Background Report: Pete SantilliDocument10 pagesBackground Report: Pete Santilliapi-139412189No ratings yet

- Company Analysis - Overview: MMC Norilsk Nickel OJSCDocument8 pagesCompany Analysis - Overview: MMC Norilsk Nickel OJSCQ.M.S Advisors LLCNo ratings yet

- PDF Financial Accounting I 4Th Edition Mohammed Hanif Ebook Full ChapterDocument38 pagesPDF Financial Accounting I 4Th Edition Mohammed Hanif Ebook Full Chapterjessica.kremer824100% (3)

- Fannie Special Exam May 2006Document348 pagesFannie Special Exam May 2006ny1davidNo ratings yet

- SalesA5GST 1Document6 pagesSalesA5GST 1Chintan B BhayaniNo ratings yet

- Internal Control GuideDocument42 pagesInternal Control GuideOrlando Pineda Vallar100% (1)