Professional Documents

Culture Documents

Thesun 2009-07-17 Page13 Chinas Economy Grows 7

Thesun 2009-07-17 Page13 Chinas Economy Grows 7

Uploaded by

Impulsive collectorCopyright:

Available Formats

You might also like

- Hay Group Guide Chart - Profile Method of Job Evaluation - Intro & OverviewDocument4 pagesHay Group Guide Chart - Profile Method of Job Evaluation - Intro & OverviewImpulsive collector100% (1)

- Binary Options EbookDocument19 pagesBinary Options EbookFlorin ApopeiNo ratings yet

- Hay Group Guide Chart - Profile Method of Job EvaluationDocument27 pagesHay Group Guide Chart - Profile Method of Job EvaluationImpulsive collector78% (9)

- Developing An Enterprise Leadership MindsetDocument36 pagesDeveloping An Enterprise Leadership MindsetImpulsive collectorNo ratings yet

- Compensation Fundamentals - Towers WatsonDocument31 pagesCompensation Fundamentals - Towers WatsonImpulsive collector80% (5)

- KL City Plan 2020Document10 pagesKL City Plan 2020Impulsive collector0% (2)

- Forexia Ecr StrategyDocument29 pagesForexia Ecr StrategyDennis Muzila100% (2)

- Use The Following Information For The Next Three Questions:: Activity 3.2Document11 pagesUse The Following Information For The Next Three Questions:: Activity 3.2Jade jade jadeNo ratings yet

- 6 Simple Strategies For Trading Forex PDFDocument89 pages6 Simple Strategies For Trading Forex PDFAgus Rian75% (4)

- Quiz - Effects of ForexDocument8 pagesQuiz - Effects of ForexVicky CastroNo ratings yet

- Thesun 2009-07-23 Page16 China Says It Has Evidence Rio Staff Stole State SecretsDocument1 pageThesun 2009-07-23 Page16 China Says It Has Evidence Rio Staff Stole State SecretsImpulsive collectorNo ratings yet

- Thesun 2009-10-13 Page17 Singapore q3 Boosts Asian Recovery HopesDocument1 pageThesun 2009-10-13 Page17 Singapore q3 Boosts Asian Recovery HopesImpulsive collectorNo ratings yet

- Thesun 2009-10-20 Page17 Malaysias Interest Rates at Appropriate Level ZetiDocument1 pageThesun 2009-10-20 Page17 Malaysias Interest Rates at Appropriate Level ZetiImpulsive collectorNo ratings yet

- Thesun 2009-10-09 Page16 B Braun Plans rm500m Reinvestment in PenangDocument1 pageThesun 2009-10-09 Page16 B Braun Plans rm500m Reinvestment in PenangImpulsive collectorNo ratings yet

- Thesun 2009-05-26 Page17 Steamlife Expects Better Profit This YearDocument1 pageThesun 2009-05-26 Page17 Steamlife Expects Better Profit This YearImpulsive collectorNo ratings yet

- TheSun 2009-06-26 Page16 Airlines Struggle As Flu Adds To Woes IataDocument1 pageTheSun 2009-06-26 Page16 Airlines Struggle As Flu Adds To Woes IataImpulsive collectorNo ratings yet

- Thesun 2009-10-14 Page15 Merrill Lynch Upbeat On Asia Pacific EconomiesDocument1 pageThesun 2009-10-14 Page15 Merrill Lynch Upbeat On Asia Pacific EconomiesImpulsive collectorNo ratings yet

- Thesun 2009-06-19 Page16 TM Expects 15pct Revenue From Wholesale BusinessDocument1 pageThesun 2009-06-19 Page16 TM Expects 15pct Revenue From Wholesale BusinessImpulsive collectorNo ratings yet

- Thesun 2009-07-15 Page15 China Stonewalling As Spy Probe Widens AustraliaDocument1 pageThesun 2009-07-15 Page15 China Stonewalling As Spy Probe Widens AustraliaImpulsive collectorNo ratings yet

- Thesun 2009-06-18 Page17 Obama To Unveil Financial Supervision ReformsDocument1 pageThesun 2009-06-18 Page17 Obama To Unveil Financial Supervision ReformsImpulsive collector100% (1)

- TheSun 2009-08-28 Page16 Ci Stays in Positive TerritoryDocument1 pageTheSun 2009-08-28 Page16 Ci Stays in Positive TerritoryImpulsive collectorNo ratings yet

- Thesun 2009-10-21 Page15 Msia Lags Rich Nations in Corporate Remuneration DisclosureDocument1 pageThesun 2009-10-21 Page15 Msia Lags Rich Nations in Corporate Remuneration DisclosureImpulsive collectorNo ratings yet

- TheSun 2009-09-10 Page15 Genting Spore Plans Billion-Dollar Rights IssueDocument1 pageTheSun 2009-09-10 Page15 Genting Spore Plans Billion-Dollar Rights IssueImpulsive collectorNo ratings yet

- TheSun 2009-09-15 Page19 Energy Giants To Develop Huge Aussie Gas FieldDocument1 pageTheSun 2009-09-15 Page19 Energy Giants To Develop Huge Aussie Gas FieldImpulsive collectorNo ratings yet

- TheSun 2009-09-04 Page12 Prices Firmer With Interest in HeavyweightsDocument1 pageTheSun 2009-09-04 Page12 Prices Firmer With Interest in HeavyweightsImpulsive collectorNo ratings yet

- Thesun 2009-06-04 Page13 Eas Leaders Firm Against Protectionist MeasuresDocument1 pageThesun 2009-06-04 Page13 Eas Leaders Firm Against Protectionist MeasuresImpulsive collectorNo ratings yet

- Thesun 2009-09-09 Page15 Stiglitz Warns of Economic Double DipDocument1 pageThesun 2009-09-09 Page15 Stiglitz Warns of Economic Double DipImpulsive collectorNo ratings yet

- Thesun 2009-08-27 Page15 Australia Approves Huge Gas Project To Supply China IndiaDocument1 pageThesun 2009-08-27 Page15 Australia Approves Huge Gas Project To Supply China IndiaImpulsive collectorNo ratings yet

- TheSun 2009-06-25 Page17 Obama Takes First Trade Action On ChinaDocument1 pageTheSun 2009-06-25 Page17 Obama Takes First Trade Action On ChinaImpulsive collectorNo ratings yet

- Thesun 2009-06-30 Page17 Wall Street Swindler Madoff Jailed For 150 YearsDocument1 pageThesun 2009-06-30 Page17 Wall Street Swindler Madoff Jailed For 150 YearsImpulsive collectorNo ratings yet

- Thesun 2009-06-09 Page17 Global Airlines To Lose Us$9b This Year Says IataDocument1 pageThesun 2009-06-09 Page17 Global Airlines To Lose Us$9b This Year Says IataImpulsive collectorNo ratings yet

- Thesun 2009-07-28 Page17 World Stocks at 9-Mth PeakDocument1 pageThesun 2009-07-28 Page17 World Stocks at 9-Mth PeakImpulsive collector100% (2)

- TheSun 2009-09-11 Page15 Ipi For July Down 8.4pct Y-O-Y But Up 7.1pct From JuneDocument1 pageTheSun 2009-09-11 Page15 Ipi For July Down 8.4pct Y-O-Y But Up 7.1pct From JuneImpulsive collectorNo ratings yet

- TheSun 2009-07-02 Page16 No Plans For Third Stimulus Package Says NajibDocument1 pageTheSun 2009-07-02 Page16 No Plans For Third Stimulus Package Says NajibImpulsive collectorNo ratings yet

- Thesun 2009-06-02 Page15 GM Files For Bankruptcy Chrysler Sale ClearedDocument1 pageThesun 2009-06-02 Page15 GM Files For Bankruptcy Chrysler Sale ClearedImpulsive collectorNo ratings yet

- TheSun 2009-09-03 Page14 Allow Financial Institutions To Fail Says British EconomistDocument1 pageTheSun 2009-09-03 Page14 Allow Financial Institutions To Fail Says British EconomistImpulsive collectorNo ratings yet

- Thesun 2009-06-16 Page17 Bursa Malaysia Offers Multi-Currency TradingDocument1 pageThesun 2009-06-16 Page17 Bursa Malaysia Offers Multi-Currency TradingImpulsive collectorNo ratings yet

- Thesun 2009-07-01 Page15 Relaxation On Foreign Ownership of Funds Will Not Affect PNBDocument1 pageThesun 2009-07-01 Page15 Relaxation On Foreign Ownership of Funds Will Not Affect PNBImpulsive collectorNo ratings yet

- Thesun 2009-07-22 Page14 The Worst Is Over For Australia Says TreasurerDocument1 pageThesun 2009-07-22 Page14 The Worst Is Over For Australia Says TreasurerImpulsive collector100% (2)

- Thesun 2009-08-25 Page17 Market SummaryDocument1 pageThesun 2009-08-25 Page17 Market SummaryImpulsive collectorNo ratings yet

- TheSun 2009-07-24 Page14 Porsche Boss Resigns VW Tie-Up Gains GroundDocument1 pageTheSun 2009-07-24 Page14 Porsche Boss Resigns VW Tie-Up Gains GroundImpulsive collector100% (2)

- Thesun 2009-05-22 Page15 S and P Cuts Outlook On British Economy To NegativeDocument1 pageThesun 2009-05-22 Page15 S and P Cuts Outlook On British Economy To NegativeImpulsive collectorNo ratings yet

- TheSun 2009-07-27 Page15 Bursa Likely To Break 1165 Resistance LevelDocument1 pageTheSun 2009-07-27 Page15 Bursa Likely To Break 1165 Resistance LevelImpulsive collector100% (2)

- Thesun 2009-07-16 Page16 Rudd Warns China Over Detained Rio SpyDocument1 pageThesun 2009-07-16 Page16 Rudd Warns China Over Detained Rio SpyImpulsive collector100% (2)

- Thesun 2009-08-20 Page17 Australia Inks Massive Engery Deal With ChinaDocument1 pageThesun 2009-08-20 Page17 Australia Inks Massive Engery Deal With ChinaImpulsive collectorNo ratings yet

- Thesun 2009-08-04 Page13 Emerging Markets Power Ahead Japan Gloom DarkensDocument1 pageThesun 2009-08-04 Page13 Emerging Markets Power Ahead Japan Gloom DarkensImpulsive collectorNo ratings yet

- Thesun 2009-08-06 Page13 Lloyds Posts Huge Loss As Bad Debts SurgeDocument1 pageThesun 2009-08-06 Page13 Lloyds Posts Huge Loss As Bad Debts SurgeImpulsive collector100% (2)

- TheSun 2009-08-07 Page15 Mas Posts Record RM876m Net Profit For Q2Document1 pageTheSun 2009-08-07 Page15 Mas Posts Record RM876m Net Profit For Q2Impulsive collector100% (2)

- TheSun 2009-05-20 Page15 China Lets HSB Bea Issue Yuan Bonds in HKDocument1 pageTheSun 2009-05-20 Page15 China Lets HSB Bea Issue Yuan Bonds in HKImpulsive collectorNo ratings yet

- Thesun 2009-05-28 Page17 Chrysler Faces D-Day As GM Nears BankruptcyDocument1 pageThesun 2009-05-28 Page17 Chrysler Faces D-Day As GM Nears BankruptcyImpulsive collectorNo ratings yet

- TheSun 2009-07-30 Page15 Carlsberg Msia To Acquire Spore Ops For Rm370Document1 pageTheSun 2009-07-30 Page15 Carlsberg Msia To Acquire Spore Ops For Rm370Impulsive collector100% (2)

- Thesun 2009-05-08 Page13 TM Mulls Bidding For Digital SpectrumDocument1 pageThesun 2009-05-08 Page13 TM Mulls Bidding For Digital SpectrumImpulsive collectorNo ratings yet

- Thesun 2009-10-12 Page15 High Hurdles For Imf On Road To New World OrderDocument1 pageThesun 2009-10-12 Page15 High Hurdles For Imf On Road To New World OrderImpulsive collectorNo ratings yet

- Thesun 2009-09-02 Page12 Regional Surveys Show Us Economy Picking UpDocument1 pageThesun 2009-09-02 Page12 Regional Surveys Show Us Economy Picking UpImpulsive collectorNo ratings yet

- Thesun 2009-07-09 Page17 China Holds Rio Tinto Exec As Spy Iron Ore Deal Said DoneDocument1 pageThesun 2009-07-09 Page17 China Holds Rio Tinto Exec As Spy Iron Ore Deal Said DoneImpulsive collectorNo ratings yet

- TheSun 2009-11-03 Page15 Us Lender Cit Files For BankruptcyDocument1 pageTheSun 2009-11-03 Page15 Us Lender Cit Files For BankruptcyImpulsive collectorNo ratings yet

- Market Update 3rd November 2017Document1 pageMarket Update 3rd November 2017Anonymous iFZbkNwNo ratings yet

- Thesun 2009-05-05 Page13 Ci Breaches 1000 Point Psychological BarrierDocument1 pageThesun 2009-05-05 Page13 Ci Breaches 1000 Point Psychological BarrierImpulsive collectorNo ratings yet

- Thesun 2009-07-08 Page15 World Bank Rolls Out Rm32bil in FinancingDocument1 pageThesun 2009-07-08 Page15 World Bank Rolls Out Rm32bil in FinancingImpulsive collectorNo ratings yet

- Market Technical Reading - Selling On The Recent Highflyers May Dampen Sentiment - 22/07/2010Document6 pagesMarket Technical Reading - Selling On The Recent Highflyers May Dampen Sentiment - 22/07/2010Rhb InvestNo ratings yet

- Market Technical Reading - A Penetration of The 10-Day SMA Is Crucial To Trading Sentiment... - 30/09/2010Document6 pagesMarket Technical Reading - A Penetration of The 10-Day SMA Is Crucial To Trading Sentiment... - 30/09/2010Rhb InvestNo ratings yet

- Thesun 2009-10-22 Page17 Brewery Sector To Improve Next Year Says OskDocument1 pageThesun 2009-10-22 Page17 Brewery Sector To Improve Next Year Says OskImpulsive collectorNo ratings yet

- TheSun 2009-10-16 Page15 Ocbc Buys Ings Asian Private BankDocument1 pageTheSun 2009-10-16 Page15 Ocbc Buys Ings Asian Private BankImpulsive collectorNo ratings yet

- Thesun 2009-06-17 Page15 Sports Car Maker To Take Over SaabDocument1 pageThesun 2009-06-17 Page15 Sports Car Maker To Take Over SaabImpulsive collectorNo ratings yet

- Thesun 2009-06-03 Page15 Asean and South Korea Sign Free Trade AgreementDocument1 pageThesun 2009-06-03 Page15 Asean and South Korea Sign Free Trade AgreementImpulsive collectorNo ratings yet

- Thesun 2009-08-11 Page17 Confidence Up But Trading Conditions Still ToughDocument1 pageThesun 2009-08-11 Page17 Confidence Up But Trading Conditions Still ToughImpulsive collectorNo ratings yet

- Market Technical Reading: Uptrend Remains Intact - 03/09/2010Document6 pagesMarket Technical Reading: Uptrend Remains Intact - 03/09/2010Rhb InvestNo ratings yet

- Market Technical Reading: Trading Sentiment To Remain Upbeat... - 30/03/2010Document6 pagesMarket Technical Reading: Trading Sentiment To Remain Upbeat... - 30/03/2010Rhb InvestNo ratings yet

- Thesun 2009-08-03 Page15 China Is Rich Abroad Because of Worker BulgeDocument1 pageThesun 2009-08-03 Page15 China Is Rich Abroad Because of Worker BulgeImpulsive collectorNo ratings yet

- Hay Group Guide Chart & Profile Method of Job Evaluation - An Introduction & OverviewDocument15 pagesHay Group Guide Chart & Profile Method of Job Evaluation - An Introduction & OverviewAyman ShetaNo ratings yet

- Futuretrends in Leadership DevelopmentDocument36 pagesFuturetrends in Leadership DevelopmentImpulsive collector100% (1)

- CLC Building The High Performance Workforce A Quantitative Analysis of The Effectiveness of Performance Management StrategiesDocument117 pagesCLC Building The High Performance Workforce A Quantitative Analysis of The Effectiveness of Performance Management StrategiesImpulsive collector100% (1)

- Coaching in OrganisationsDocument18 pagesCoaching in OrganisationsImpulsive collectorNo ratings yet

- Strategy+Business - Winter 2014Document108 pagesStrategy+Business - Winter 2014GustavoLopezGNo ratings yet

- Strategy+Business Magazine 2016 AutumnDocument132 pagesStrategy+Business Magazine 2016 AutumnImpulsive collector100% (3)

- Megatrends Report 2015Document56 pagesMegatrends Report 2015Cleverson TabajaraNo ratings yet

- Managing Conflict at Work - A Guide For Line ManagersDocument22 pagesManaging Conflict at Work - A Guide For Line ManagersRoxana VornicescuNo ratings yet

- 2015 Summer Strategy+business PDFDocument104 pages2015 Summer Strategy+business PDFImpulsive collectorNo ratings yet

- TheSun 2009-11-04 Page15 Huge Shake-Up For Rbs and LloydsDocument1 pageTheSun 2009-11-04 Page15 Huge Shake-Up For Rbs and LloydsImpulsive collectorNo ratings yet

- Talent Analytics and Big DataDocument28 pagesTalent Analytics and Big DataImpulsive collectorNo ratings yet

- TheSun 2009-11-04 Page14 Significant Success in Islamic Finance Says PMDocument1 pageTheSun 2009-11-04 Page14 Significant Success in Islamic Finance Says PMImpulsive collectorNo ratings yet

- TheSun 2009-11-04 Page11 We Await Answers To Dipang TragedyDocument1 pageTheSun 2009-11-04 Page11 We Await Answers To Dipang TragedyImpulsive collectorNo ratings yet

- Deloitte Analytics Analytics Advantage Report 061913Document21 pagesDeloitte Analytics Analytics Advantage Report 061913Impulsive collectorNo ratings yet

- 2016 Summer Strategy+business PDFDocument116 pages2016 Summer Strategy+business PDFImpulsive collectorNo ratings yet

- Global Talent 2021Document21 pagesGlobal Talent 2021rsrobinsuarezNo ratings yet

- Bucking The Buck Us Financial Sanctions and The International Backlash Against The Dollar Daniel Mcdowell Full ChapterDocument68 pagesBucking The Buck Us Financial Sanctions and The International Backlash Against The Dollar Daniel Mcdowell Full Chapterrobert.hanson139100% (8)

- IBM AssignmentDocument9 pagesIBM AssignmentkheramitNo ratings yet

- The Seleucid Mint of Antioch / by Edward T. NewellDocument179 pagesThe Seleucid Mint of Antioch / by Edward T. NewellDigital Library Numis (DLN)0% (1)

- The Ethiopian Financial Institutions and Capital MarketDocument41 pagesThe Ethiopian Financial Institutions and Capital Markethabtamu100% (5)

- Kathleen Brooks On ForexDocument36 pagesKathleen Brooks On ForexLawalNo ratings yet

- Treasury Management AssignmentDocument11 pagesTreasury Management AssignmentBulshaale Binu Bulshaale100% (1)

- Foreign Exchange Operations of Jamuna BankDocument43 pagesForeign Exchange Operations of Jamuna BankHole StudioNo ratings yet

- Vocabulary in Context. MoneyDocument12 pagesVocabulary in Context. MoneyShaxnoza JienbaevaNo ratings yet

- BUS 430 Syllabus Fall 2018Document7 pagesBUS 430 Syllabus Fall 2018rickNo ratings yet

- Section 1 - Reading Comprehension Read The Text Carefully and Answer The Questions That Follow. Choose The Most Appropriate AnswerDocument3 pagesSection 1 - Reading Comprehension Read The Text Carefully and Answer The Questions That Follow. Choose The Most Appropriate AnswerlenakaNo ratings yet

- Trade BackTestDocument8 pagesTrade BackTestDriez 1No ratings yet

- Chapter - 6: International Monetary SystemDocument24 pagesChapter - 6: International Monetary Systemtemesgen yohannesNo ratings yet

- Calculation Variables - Historical - Actuals: Geography Category Title 2014 2015 2016 2017 2018 2019Document1 pageCalculation Variables - Historical - Actuals: Geography Category Title 2014 2015 2016 2017 2018 2019KaranveerGrewalNo ratings yet

- Responsive Document - CREW: Federal Reserve Board of Governors: Regarding Efforts To Influence Financial Regulatory Reform: 6/13/2012 - PDF 5Document188 pagesResponsive Document - CREW: Federal Reserve Board of Governors: Regarding Efforts To Influence Financial Regulatory Reform: 6/13/2012 - PDF 5CREWNo ratings yet

- FRM Learning Objectives 2023Document58 pagesFRM Learning Objectives 2023Tejas JoshiNo ratings yet

- Classification of Money2Document2 pagesClassification of Money2Tilahun TolesaNo ratings yet

- International FinanceDocument44 pagesInternational FinanceSAMSONI lucasNo ratings yet

- Illyria Cow Calves Meta RBN 2012Document20 pagesIllyria Cow Calves Meta RBN 2012helvetica1No ratings yet

- 2011 Traders ManualDocument107 pages2011 Traders ManualPtg Futures100% (3)

- Treasury FunctionsDocument2 pagesTreasury Functionssunshine9016No ratings yet

- Press Release BARX Launch 10092015Document2 pagesPress Release BARX Launch 10092015Anonymous FnM14a0No ratings yet

- Remittances Covering Intermediary Trade) : TO, Lulu Forex PVT LTD Application For Remittance AbroadDocument2 pagesRemittances Covering Intermediary Trade) : TO, Lulu Forex PVT LTD Application For Remittance AbroadRiya sahaNo ratings yet

- A.R.T.S - Acepack Venture SDN BHD Jimmy111Document36 pagesA.R.T.S - Acepack Venture SDN BHD Jimmy111uzaimyNo ratings yet

- Ch02 Foreign Exchange MarketsDocument8 pagesCh02 Foreign Exchange MarketsPaw VerdilloNo ratings yet

- Ghana's Legislative System Provides A Framework For Investment - Ghana 2018 - Oxford Business GroupDocument13 pagesGhana's Legislative System Provides A Framework For Investment - Ghana 2018 - Oxford Business GroupEsinam AdukpoNo ratings yet

Thesun 2009-07-17 Page13 Chinas Economy Grows 7

Thesun 2009-07-17 Page13 Chinas Economy Grows 7

Uploaded by

Impulsive collectorOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Thesun 2009-07-17 Page13 Chinas Economy Grows 7

Thesun 2009-07-17 Page13 Chinas Economy Grows 7

Uploaded by

Impulsive collectorCopyright:

Available Formats

theSun | FRIDAY JULY 17 2009 13

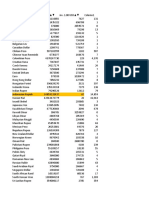

business KLCI

STI

1,108.88

2,401.02

11.64

11.60

Nikkei

TSEC

9,344.16

6,780.30

74.91

41.70

Hang Seng 18,361.87 103.21 KOSPI 1,432.22 11.36

SCI 3,183.74 4.81 S&P/ASX200 3,995.60 71.10

KL market summary

JULY 16, 2009

INDICES CHANGE Shares end firmer on positive sentiment

FBMEMAS 7,483.69 + 75.58

SHARE prices on Bursa Malaysia ended Industrial Index went up 26.29 points to

FBM-KLCI 1,108.88 + 11.64

INDUSTRIAL: 2,423.31 + 26.29 firmer yesterday with the key index up 1.06%, 2,423.31 and the Plantation Index advanced

CONSUMER PRODUCT 328.10 + 3.83 spurred on by the strong performance of 23.14 points to 5,379.88.

INDUSTRIAL PRODUCT 86.04 + 0.26 major regional bourses and a better-than- The FBMEmas Index gained 75.58 points

CONSTRUCTION 212.80 + 3.49 expected Chinese economy. to 7,483.69, the FBM Top 100 firmed up

TRADING SERVICES 147.91 + 1.84 The benchmark FTSE Bursa Malaysia KLCI 80.98 points to 7,280.29 and the FBM2BRD

FINANCE 9,012.62 + 69.87 went up 11.64 points to close at 1,108.88 Index increased 40.72 points to 4,855.14.

PROPERTIES 719.44 + 6.37

PLANTATIONS 5,379.88 + 23.14

after trading at an intra-day high of 1,120.41. The FBMMesdaq Index, was however, down

MINING 295.86 + 20.26 It had opened unchanged at 1,097.24. The 46.25 points at 4,030.12. Advancers led

FBMSHA 7,706.66 + 96.94 market saw heavy trading interest in lower decliners by 398 to 304 while 229 counters EXCHANGE RATES July 16, 2009

FBM2BRD 4,855.14 + 40.72 liners and penny stocks which pushed the were unchanged, 326 untraded and 57 others

TECHNOLOGY 15.49 + 0.12 day’s volume above 1.0 billion units. However, suspended. Overall trading volume stood at Foreign currency Bank sell Bank buy Bank buy

overall gains were limited as investors were 1.666 billion shares worth RM2.139 billion, up TT/OD TT OD

TURNOVER VALUE

seen locking in some profits. The Finance from the 1.365 billion shares worth RM2.139

1.666bil RM2.138bil Index climbed 69.87 points to 9,012.62, the billion on Wednesday. – Bernama 1 US DOLLAR 3.5930 3.5280 3.5180

1 AUSTRALIAN DOLLAR 2.9180 2.7900 2.7740

1 BRUNEI DOLLAR 2.4830 2.4220 2.4140

1 CANADIAN DOLLAR 3.2240 3.1450 3.1330

China’s economy grows

1 EURO 5.0740 4.9510 4.9310

1 NEW ZEALAND DOLLAR 2.3600 2.2560 2.2400

1 PAPUA N GUINEA KINA 1.4900 1.2420 1.2260

So 1 SINGAPORE DOLLAR 2.4825 2.4220 2.4140

1 STERLING POUND 5.9140 5.7720 5.7520

gloriously

1 SWISS FRANC 3.3460 3.2650 3.2500

bad

7.9% in stunning rebound

100 ARAB EMIRATES DIRHAM 99.5700 94.3100 94.1100

pg 16 100 BANGLADESH TAKA 5.3400 5.2100 5.0100

100 CHINESE RENMINBI N/A N/A N/A

100 DANISH KRONE 70.1700 64.4800 64.2800

100 HONGKONG DOLLAR 47.1900 44.7000 44.5000

100 INDIAN RUPEE 7.6800 7.0600 6.8600

BEIJING: China’s economy Analysts said the rebound November last year. government’s target. 100 INDONESIAN RUPIAH 0.0371 0.0314 0.0264

grew 7.9% in the second quarter in China would offer a boost Li described the impact of The figure is generally seen 100 JAPANESE YEN 3.8200 3.7270 3.7170

of 2009, the government said yes- of confidence for the global the package as “remarkable”, as the minimum growth needed 100 NEW TAIWAN DOLLAR N/A N/A N/A

terday, in a stunning turnaround economy as it struggles out of but he also warned pitfalls lay to create enough jobs and pre- 100 NORWEGIAN KRONE 58.0300 53.2700 53.0700

for the Asian powerhouse that the worst economic crisis since ahead amid concerns of bub- vent major social unrest in the 100 PAKISTAN RUPEE 4.4900 4.1800 3.9800

offered some hope for the rest of the Great Depression of the bles in real estate and other key nation of 1.3 billion people. 100 PHILIPPINE PESO 7.6600 7.2000 7.0000

the world. 1930s. sectors. China’s exports dropped

With help from US$580 “China is the first big country “There are many difficulties 100 QATAR RIYAL 100.2400 95.3500 95.1500

21.4% year-on-year in June, the

billion (RM2.08 trillion) in to have made a strong comeback, and challenges existing in the government said last week, the 100 SAUDI RIYAL 97.3100 92.5700 92.3700

government pump priming, the so its rebound will definitely current national economic per- eighth straight monthly decline. 100 SOUTH AFRICAN RAND 45.6800 42.0300 41.8300

world’s third biggest economy offer a stabilising signal for the formance. The base for recovery However, industrial output, 100 SRI LANKA RUPEE 3.2600 2.9900 2.7900

picked up pace again after the world economy,” said He Jun, is still weak. The momentum for which illustrates activity in the 100 SWEDISH KRONA 47.9600 43.5400 43.3400

global economic crisis dragged a Beijing-based analyst with the picking up is unstable,” he said. nation’s millions of factories and 100 THAI BAHT 11.3200 9.6000 9.2000

growth down to 6.1% in the first Anbound Consulting research Economists also warned that workshops, expanded by 9.1% Source: Malayan Banking Berhad/Bernama

quarter. group. China’s rebound was unbal- in the second quarter of 2009

“The economy is rebounding However, He and other ana- anced, with the export sector from a year earlier, the bureau Singapore central bank reports

and the strength of the recovery lysts cautioned that immediate still struggling while massive said.

is increasing,” National Bureau and direct benefits would be bank lending had fuelled the In June, industrial output RM22.7bil net loss

Spokesman Li Xiaochao said at limited to countries that import potential for asset price bubbles increased by 10.7%, and by 7% SINGAPORE:The central bank said yesterday it suffered

a media briefing to release the heavily into China, chiefly and inflation. for the first half of 2009. a net loss of S$9.2 billion (RM22.7 billion) in the fiscal

data. resource-rich exporters and “Although private sector in- China’s urban fixed asset year ending March as its investments were hit by the

China’s gross domestic prod- neighbouring nations in Asia. vestment has picked up, growth investments, a measure of global financial crisis. The figure compared with a profit

uct grew by 7.1% in the first half Before the global economic still relies heavily on the central government spending on infra- of US$7.44 billion (RM26.7 billion) in the previous financial

of 2009 compared with the same crisis struck, China experienced government’s expansionary structure, rose 33.6% in the first year and US$3.85 billion (RM13.8 billion) in the year before

period a year earlier, according double-digit annual growth from policies,” said Lu Zhengwei, a half of 2009 compared with the that, the Monetary Authority of Singapore (MAS) said. It

to the bureau. 2003 to 2007, and again for the Shanghai-based economist with same period a year earlier, the also represents about 3.5% of the central bank’s average

This put China back on track first two quarters of last year. the Industrial Bank. statistics bureau said. total assets, MAS said.

to achieve its goal of 8% growth To fight the downturn, the Nevertheless, Lu and other Investments in urban fixed MAS managing director Heng Swee Keat told reporters

for the year, despite the financial government began implement- analysts said China’s economy assets increased by 35.3% in the global meltdown “has weighed heavily on financial

crisis hitting its crucial export ing a four-trillion-yuan (RM2.08 would likely grow by around 8% June year-on-year, according to markets worldwide, leading to severe declines in the

sector particularly hard. trillion) stimulus package from growth in 2009, in line with the the bureau. – AFP valuation across many asset classes.” – AFP

You might also like

- Hay Group Guide Chart - Profile Method of Job Evaluation - Intro & OverviewDocument4 pagesHay Group Guide Chart - Profile Method of Job Evaluation - Intro & OverviewImpulsive collector100% (1)

- Binary Options EbookDocument19 pagesBinary Options EbookFlorin ApopeiNo ratings yet

- Hay Group Guide Chart - Profile Method of Job EvaluationDocument27 pagesHay Group Guide Chart - Profile Method of Job EvaluationImpulsive collector78% (9)

- Developing An Enterprise Leadership MindsetDocument36 pagesDeveloping An Enterprise Leadership MindsetImpulsive collectorNo ratings yet

- Compensation Fundamentals - Towers WatsonDocument31 pagesCompensation Fundamentals - Towers WatsonImpulsive collector80% (5)

- KL City Plan 2020Document10 pagesKL City Plan 2020Impulsive collector0% (2)

- Forexia Ecr StrategyDocument29 pagesForexia Ecr StrategyDennis Muzila100% (2)

- Use The Following Information For The Next Three Questions:: Activity 3.2Document11 pagesUse The Following Information For The Next Three Questions:: Activity 3.2Jade jade jadeNo ratings yet

- 6 Simple Strategies For Trading Forex PDFDocument89 pages6 Simple Strategies For Trading Forex PDFAgus Rian75% (4)

- Quiz - Effects of ForexDocument8 pagesQuiz - Effects of ForexVicky CastroNo ratings yet

- Thesun 2009-07-23 Page16 China Says It Has Evidence Rio Staff Stole State SecretsDocument1 pageThesun 2009-07-23 Page16 China Says It Has Evidence Rio Staff Stole State SecretsImpulsive collectorNo ratings yet

- Thesun 2009-10-13 Page17 Singapore q3 Boosts Asian Recovery HopesDocument1 pageThesun 2009-10-13 Page17 Singapore q3 Boosts Asian Recovery HopesImpulsive collectorNo ratings yet

- Thesun 2009-10-20 Page17 Malaysias Interest Rates at Appropriate Level ZetiDocument1 pageThesun 2009-10-20 Page17 Malaysias Interest Rates at Appropriate Level ZetiImpulsive collectorNo ratings yet

- Thesun 2009-10-09 Page16 B Braun Plans rm500m Reinvestment in PenangDocument1 pageThesun 2009-10-09 Page16 B Braun Plans rm500m Reinvestment in PenangImpulsive collectorNo ratings yet

- Thesun 2009-05-26 Page17 Steamlife Expects Better Profit This YearDocument1 pageThesun 2009-05-26 Page17 Steamlife Expects Better Profit This YearImpulsive collectorNo ratings yet

- TheSun 2009-06-26 Page16 Airlines Struggle As Flu Adds To Woes IataDocument1 pageTheSun 2009-06-26 Page16 Airlines Struggle As Flu Adds To Woes IataImpulsive collectorNo ratings yet

- Thesun 2009-10-14 Page15 Merrill Lynch Upbeat On Asia Pacific EconomiesDocument1 pageThesun 2009-10-14 Page15 Merrill Lynch Upbeat On Asia Pacific EconomiesImpulsive collectorNo ratings yet

- Thesun 2009-06-19 Page16 TM Expects 15pct Revenue From Wholesale BusinessDocument1 pageThesun 2009-06-19 Page16 TM Expects 15pct Revenue From Wholesale BusinessImpulsive collectorNo ratings yet

- Thesun 2009-07-15 Page15 China Stonewalling As Spy Probe Widens AustraliaDocument1 pageThesun 2009-07-15 Page15 China Stonewalling As Spy Probe Widens AustraliaImpulsive collectorNo ratings yet

- Thesun 2009-06-18 Page17 Obama To Unveil Financial Supervision ReformsDocument1 pageThesun 2009-06-18 Page17 Obama To Unveil Financial Supervision ReformsImpulsive collector100% (1)

- TheSun 2009-08-28 Page16 Ci Stays in Positive TerritoryDocument1 pageTheSun 2009-08-28 Page16 Ci Stays in Positive TerritoryImpulsive collectorNo ratings yet

- Thesun 2009-10-21 Page15 Msia Lags Rich Nations in Corporate Remuneration DisclosureDocument1 pageThesun 2009-10-21 Page15 Msia Lags Rich Nations in Corporate Remuneration DisclosureImpulsive collectorNo ratings yet

- TheSun 2009-09-10 Page15 Genting Spore Plans Billion-Dollar Rights IssueDocument1 pageTheSun 2009-09-10 Page15 Genting Spore Plans Billion-Dollar Rights IssueImpulsive collectorNo ratings yet

- TheSun 2009-09-15 Page19 Energy Giants To Develop Huge Aussie Gas FieldDocument1 pageTheSun 2009-09-15 Page19 Energy Giants To Develop Huge Aussie Gas FieldImpulsive collectorNo ratings yet

- TheSun 2009-09-04 Page12 Prices Firmer With Interest in HeavyweightsDocument1 pageTheSun 2009-09-04 Page12 Prices Firmer With Interest in HeavyweightsImpulsive collectorNo ratings yet

- Thesun 2009-06-04 Page13 Eas Leaders Firm Against Protectionist MeasuresDocument1 pageThesun 2009-06-04 Page13 Eas Leaders Firm Against Protectionist MeasuresImpulsive collectorNo ratings yet

- Thesun 2009-09-09 Page15 Stiglitz Warns of Economic Double DipDocument1 pageThesun 2009-09-09 Page15 Stiglitz Warns of Economic Double DipImpulsive collectorNo ratings yet

- Thesun 2009-08-27 Page15 Australia Approves Huge Gas Project To Supply China IndiaDocument1 pageThesun 2009-08-27 Page15 Australia Approves Huge Gas Project To Supply China IndiaImpulsive collectorNo ratings yet

- TheSun 2009-06-25 Page17 Obama Takes First Trade Action On ChinaDocument1 pageTheSun 2009-06-25 Page17 Obama Takes First Trade Action On ChinaImpulsive collectorNo ratings yet

- Thesun 2009-06-30 Page17 Wall Street Swindler Madoff Jailed For 150 YearsDocument1 pageThesun 2009-06-30 Page17 Wall Street Swindler Madoff Jailed For 150 YearsImpulsive collectorNo ratings yet

- Thesun 2009-06-09 Page17 Global Airlines To Lose Us$9b This Year Says IataDocument1 pageThesun 2009-06-09 Page17 Global Airlines To Lose Us$9b This Year Says IataImpulsive collectorNo ratings yet

- Thesun 2009-07-28 Page17 World Stocks at 9-Mth PeakDocument1 pageThesun 2009-07-28 Page17 World Stocks at 9-Mth PeakImpulsive collector100% (2)

- TheSun 2009-09-11 Page15 Ipi For July Down 8.4pct Y-O-Y But Up 7.1pct From JuneDocument1 pageTheSun 2009-09-11 Page15 Ipi For July Down 8.4pct Y-O-Y But Up 7.1pct From JuneImpulsive collectorNo ratings yet

- TheSun 2009-07-02 Page16 No Plans For Third Stimulus Package Says NajibDocument1 pageTheSun 2009-07-02 Page16 No Plans For Third Stimulus Package Says NajibImpulsive collectorNo ratings yet

- Thesun 2009-06-02 Page15 GM Files For Bankruptcy Chrysler Sale ClearedDocument1 pageThesun 2009-06-02 Page15 GM Files For Bankruptcy Chrysler Sale ClearedImpulsive collectorNo ratings yet

- TheSun 2009-09-03 Page14 Allow Financial Institutions To Fail Says British EconomistDocument1 pageTheSun 2009-09-03 Page14 Allow Financial Institutions To Fail Says British EconomistImpulsive collectorNo ratings yet

- Thesun 2009-06-16 Page17 Bursa Malaysia Offers Multi-Currency TradingDocument1 pageThesun 2009-06-16 Page17 Bursa Malaysia Offers Multi-Currency TradingImpulsive collectorNo ratings yet

- Thesun 2009-07-01 Page15 Relaxation On Foreign Ownership of Funds Will Not Affect PNBDocument1 pageThesun 2009-07-01 Page15 Relaxation On Foreign Ownership of Funds Will Not Affect PNBImpulsive collectorNo ratings yet

- Thesun 2009-07-22 Page14 The Worst Is Over For Australia Says TreasurerDocument1 pageThesun 2009-07-22 Page14 The Worst Is Over For Australia Says TreasurerImpulsive collector100% (2)

- Thesun 2009-08-25 Page17 Market SummaryDocument1 pageThesun 2009-08-25 Page17 Market SummaryImpulsive collectorNo ratings yet

- TheSun 2009-07-24 Page14 Porsche Boss Resigns VW Tie-Up Gains GroundDocument1 pageTheSun 2009-07-24 Page14 Porsche Boss Resigns VW Tie-Up Gains GroundImpulsive collector100% (2)

- Thesun 2009-05-22 Page15 S and P Cuts Outlook On British Economy To NegativeDocument1 pageThesun 2009-05-22 Page15 S and P Cuts Outlook On British Economy To NegativeImpulsive collectorNo ratings yet

- TheSun 2009-07-27 Page15 Bursa Likely To Break 1165 Resistance LevelDocument1 pageTheSun 2009-07-27 Page15 Bursa Likely To Break 1165 Resistance LevelImpulsive collector100% (2)

- Thesun 2009-07-16 Page16 Rudd Warns China Over Detained Rio SpyDocument1 pageThesun 2009-07-16 Page16 Rudd Warns China Over Detained Rio SpyImpulsive collector100% (2)

- Thesun 2009-08-20 Page17 Australia Inks Massive Engery Deal With ChinaDocument1 pageThesun 2009-08-20 Page17 Australia Inks Massive Engery Deal With ChinaImpulsive collectorNo ratings yet

- Thesun 2009-08-04 Page13 Emerging Markets Power Ahead Japan Gloom DarkensDocument1 pageThesun 2009-08-04 Page13 Emerging Markets Power Ahead Japan Gloom DarkensImpulsive collectorNo ratings yet

- Thesun 2009-08-06 Page13 Lloyds Posts Huge Loss As Bad Debts SurgeDocument1 pageThesun 2009-08-06 Page13 Lloyds Posts Huge Loss As Bad Debts SurgeImpulsive collector100% (2)

- TheSun 2009-08-07 Page15 Mas Posts Record RM876m Net Profit For Q2Document1 pageTheSun 2009-08-07 Page15 Mas Posts Record RM876m Net Profit For Q2Impulsive collector100% (2)

- TheSun 2009-05-20 Page15 China Lets HSB Bea Issue Yuan Bonds in HKDocument1 pageTheSun 2009-05-20 Page15 China Lets HSB Bea Issue Yuan Bonds in HKImpulsive collectorNo ratings yet

- Thesun 2009-05-28 Page17 Chrysler Faces D-Day As GM Nears BankruptcyDocument1 pageThesun 2009-05-28 Page17 Chrysler Faces D-Day As GM Nears BankruptcyImpulsive collectorNo ratings yet

- TheSun 2009-07-30 Page15 Carlsberg Msia To Acquire Spore Ops For Rm370Document1 pageTheSun 2009-07-30 Page15 Carlsberg Msia To Acquire Spore Ops For Rm370Impulsive collector100% (2)

- Thesun 2009-05-08 Page13 TM Mulls Bidding For Digital SpectrumDocument1 pageThesun 2009-05-08 Page13 TM Mulls Bidding For Digital SpectrumImpulsive collectorNo ratings yet

- Thesun 2009-10-12 Page15 High Hurdles For Imf On Road To New World OrderDocument1 pageThesun 2009-10-12 Page15 High Hurdles For Imf On Road To New World OrderImpulsive collectorNo ratings yet

- Thesun 2009-09-02 Page12 Regional Surveys Show Us Economy Picking UpDocument1 pageThesun 2009-09-02 Page12 Regional Surveys Show Us Economy Picking UpImpulsive collectorNo ratings yet

- Thesun 2009-07-09 Page17 China Holds Rio Tinto Exec As Spy Iron Ore Deal Said DoneDocument1 pageThesun 2009-07-09 Page17 China Holds Rio Tinto Exec As Spy Iron Ore Deal Said DoneImpulsive collectorNo ratings yet

- TheSun 2009-11-03 Page15 Us Lender Cit Files For BankruptcyDocument1 pageTheSun 2009-11-03 Page15 Us Lender Cit Files For BankruptcyImpulsive collectorNo ratings yet

- Market Update 3rd November 2017Document1 pageMarket Update 3rd November 2017Anonymous iFZbkNwNo ratings yet

- Thesun 2009-05-05 Page13 Ci Breaches 1000 Point Psychological BarrierDocument1 pageThesun 2009-05-05 Page13 Ci Breaches 1000 Point Psychological BarrierImpulsive collectorNo ratings yet

- Thesun 2009-07-08 Page15 World Bank Rolls Out Rm32bil in FinancingDocument1 pageThesun 2009-07-08 Page15 World Bank Rolls Out Rm32bil in FinancingImpulsive collectorNo ratings yet

- Market Technical Reading - Selling On The Recent Highflyers May Dampen Sentiment - 22/07/2010Document6 pagesMarket Technical Reading - Selling On The Recent Highflyers May Dampen Sentiment - 22/07/2010Rhb InvestNo ratings yet

- Market Technical Reading - A Penetration of The 10-Day SMA Is Crucial To Trading Sentiment... - 30/09/2010Document6 pagesMarket Technical Reading - A Penetration of The 10-Day SMA Is Crucial To Trading Sentiment... - 30/09/2010Rhb InvestNo ratings yet

- Thesun 2009-10-22 Page17 Brewery Sector To Improve Next Year Says OskDocument1 pageThesun 2009-10-22 Page17 Brewery Sector To Improve Next Year Says OskImpulsive collectorNo ratings yet

- TheSun 2009-10-16 Page15 Ocbc Buys Ings Asian Private BankDocument1 pageTheSun 2009-10-16 Page15 Ocbc Buys Ings Asian Private BankImpulsive collectorNo ratings yet

- Thesun 2009-06-17 Page15 Sports Car Maker To Take Over SaabDocument1 pageThesun 2009-06-17 Page15 Sports Car Maker To Take Over SaabImpulsive collectorNo ratings yet

- Thesun 2009-06-03 Page15 Asean and South Korea Sign Free Trade AgreementDocument1 pageThesun 2009-06-03 Page15 Asean and South Korea Sign Free Trade AgreementImpulsive collectorNo ratings yet

- Thesun 2009-08-11 Page17 Confidence Up But Trading Conditions Still ToughDocument1 pageThesun 2009-08-11 Page17 Confidence Up But Trading Conditions Still ToughImpulsive collectorNo ratings yet

- Market Technical Reading: Uptrend Remains Intact - 03/09/2010Document6 pagesMarket Technical Reading: Uptrend Remains Intact - 03/09/2010Rhb InvestNo ratings yet

- Market Technical Reading: Trading Sentiment To Remain Upbeat... - 30/03/2010Document6 pagesMarket Technical Reading: Trading Sentiment To Remain Upbeat... - 30/03/2010Rhb InvestNo ratings yet

- Thesun 2009-08-03 Page15 China Is Rich Abroad Because of Worker BulgeDocument1 pageThesun 2009-08-03 Page15 China Is Rich Abroad Because of Worker BulgeImpulsive collectorNo ratings yet

- Hay Group Guide Chart & Profile Method of Job Evaluation - An Introduction & OverviewDocument15 pagesHay Group Guide Chart & Profile Method of Job Evaluation - An Introduction & OverviewAyman ShetaNo ratings yet

- Futuretrends in Leadership DevelopmentDocument36 pagesFuturetrends in Leadership DevelopmentImpulsive collector100% (1)

- CLC Building The High Performance Workforce A Quantitative Analysis of The Effectiveness of Performance Management StrategiesDocument117 pagesCLC Building The High Performance Workforce A Quantitative Analysis of The Effectiveness of Performance Management StrategiesImpulsive collector100% (1)

- Coaching in OrganisationsDocument18 pagesCoaching in OrganisationsImpulsive collectorNo ratings yet

- Strategy+Business - Winter 2014Document108 pagesStrategy+Business - Winter 2014GustavoLopezGNo ratings yet

- Strategy+Business Magazine 2016 AutumnDocument132 pagesStrategy+Business Magazine 2016 AutumnImpulsive collector100% (3)

- Megatrends Report 2015Document56 pagesMegatrends Report 2015Cleverson TabajaraNo ratings yet

- Managing Conflict at Work - A Guide For Line ManagersDocument22 pagesManaging Conflict at Work - A Guide For Line ManagersRoxana VornicescuNo ratings yet

- 2015 Summer Strategy+business PDFDocument104 pages2015 Summer Strategy+business PDFImpulsive collectorNo ratings yet

- TheSun 2009-11-04 Page15 Huge Shake-Up For Rbs and LloydsDocument1 pageTheSun 2009-11-04 Page15 Huge Shake-Up For Rbs and LloydsImpulsive collectorNo ratings yet

- Talent Analytics and Big DataDocument28 pagesTalent Analytics and Big DataImpulsive collectorNo ratings yet

- TheSun 2009-11-04 Page14 Significant Success in Islamic Finance Says PMDocument1 pageTheSun 2009-11-04 Page14 Significant Success in Islamic Finance Says PMImpulsive collectorNo ratings yet

- TheSun 2009-11-04 Page11 We Await Answers To Dipang TragedyDocument1 pageTheSun 2009-11-04 Page11 We Await Answers To Dipang TragedyImpulsive collectorNo ratings yet

- Deloitte Analytics Analytics Advantage Report 061913Document21 pagesDeloitte Analytics Analytics Advantage Report 061913Impulsive collectorNo ratings yet

- 2016 Summer Strategy+business PDFDocument116 pages2016 Summer Strategy+business PDFImpulsive collectorNo ratings yet

- Global Talent 2021Document21 pagesGlobal Talent 2021rsrobinsuarezNo ratings yet

- Bucking The Buck Us Financial Sanctions and The International Backlash Against The Dollar Daniel Mcdowell Full ChapterDocument68 pagesBucking The Buck Us Financial Sanctions and The International Backlash Against The Dollar Daniel Mcdowell Full Chapterrobert.hanson139100% (8)

- IBM AssignmentDocument9 pagesIBM AssignmentkheramitNo ratings yet

- The Seleucid Mint of Antioch / by Edward T. NewellDocument179 pagesThe Seleucid Mint of Antioch / by Edward T. NewellDigital Library Numis (DLN)0% (1)

- The Ethiopian Financial Institutions and Capital MarketDocument41 pagesThe Ethiopian Financial Institutions and Capital Markethabtamu100% (5)

- Kathleen Brooks On ForexDocument36 pagesKathleen Brooks On ForexLawalNo ratings yet

- Treasury Management AssignmentDocument11 pagesTreasury Management AssignmentBulshaale Binu Bulshaale100% (1)

- Foreign Exchange Operations of Jamuna BankDocument43 pagesForeign Exchange Operations of Jamuna BankHole StudioNo ratings yet

- Vocabulary in Context. MoneyDocument12 pagesVocabulary in Context. MoneyShaxnoza JienbaevaNo ratings yet

- BUS 430 Syllabus Fall 2018Document7 pagesBUS 430 Syllabus Fall 2018rickNo ratings yet

- Section 1 - Reading Comprehension Read The Text Carefully and Answer The Questions That Follow. Choose The Most Appropriate AnswerDocument3 pagesSection 1 - Reading Comprehension Read The Text Carefully and Answer The Questions That Follow. Choose The Most Appropriate AnswerlenakaNo ratings yet

- Trade BackTestDocument8 pagesTrade BackTestDriez 1No ratings yet

- Chapter - 6: International Monetary SystemDocument24 pagesChapter - 6: International Monetary Systemtemesgen yohannesNo ratings yet

- Calculation Variables - Historical - Actuals: Geography Category Title 2014 2015 2016 2017 2018 2019Document1 pageCalculation Variables - Historical - Actuals: Geography Category Title 2014 2015 2016 2017 2018 2019KaranveerGrewalNo ratings yet

- Responsive Document - CREW: Federal Reserve Board of Governors: Regarding Efforts To Influence Financial Regulatory Reform: 6/13/2012 - PDF 5Document188 pagesResponsive Document - CREW: Federal Reserve Board of Governors: Regarding Efforts To Influence Financial Regulatory Reform: 6/13/2012 - PDF 5CREWNo ratings yet

- FRM Learning Objectives 2023Document58 pagesFRM Learning Objectives 2023Tejas JoshiNo ratings yet

- Classification of Money2Document2 pagesClassification of Money2Tilahun TolesaNo ratings yet

- International FinanceDocument44 pagesInternational FinanceSAMSONI lucasNo ratings yet

- Illyria Cow Calves Meta RBN 2012Document20 pagesIllyria Cow Calves Meta RBN 2012helvetica1No ratings yet

- 2011 Traders ManualDocument107 pages2011 Traders ManualPtg Futures100% (3)

- Treasury FunctionsDocument2 pagesTreasury Functionssunshine9016No ratings yet

- Press Release BARX Launch 10092015Document2 pagesPress Release BARX Launch 10092015Anonymous FnM14a0No ratings yet

- Remittances Covering Intermediary Trade) : TO, Lulu Forex PVT LTD Application For Remittance AbroadDocument2 pagesRemittances Covering Intermediary Trade) : TO, Lulu Forex PVT LTD Application For Remittance AbroadRiya sahaNo ratings yet

- A.R.T.S - Acepack Venture SDN BHD Jimmy111Document36 pagesA.R.T.S - Acepack Venture SDN BHD Jimmy111uzaimyNo ratings yet

- Ch02 Foreign Exchange MarketsDocument8 pagesCh02 Foreign Exchange MarketsPaw VerdilloNo ratings yet

- Ghana's Legislative System Provides A Framework For Investment - Ghana 2018 - Oxford Business GroupDocument13 pagesGhana's Legislative System Provides A Framework For Investment - Ghana 2018 - Oxford Business GroupEsinam AdukpoNo ratings yet