Professional Documents

Culture Documents

Payroll Setup Checklist

Payroll Setup Checklist

Uploaded by

caliechOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Payroll Setup Checklist

Payroll Setup Checklist

Uploaded by

caliechCopyright:

Available Formats

PayrollSetupChecklist

Gatherthefollowingitemsbeforeyoustartsettinguppayroll.Youllneedthisinformationto quicklyandaccuratelysetupyouraccountandavoidproblemslaterwhenyoustartusing QuickBooksPayroll. 1. CompanyInformation Even though youve already set up your company file in QuickBooks, the payroll setup interviewrequiresthefollowinginformationaboutyourcompany: Companybankaccountinformation;onlyrequiredifyoullbepayingemployees bydirectdepositorepayingtaxes(useavoidedcheck,notadepositslip,ofthe bankaccountyoullusetopayemployees) Typesofcompensationyougivetoyouremployees,suchashourlywages, salariedwages,bonuses,commissions,andtips Typesofbenefitsyouofferyouremployees,suchashealthinsurance, dentalinsurance,401kretirementplan,vacation/sickleave,FlexibleSpending Account(FSA) Typesofotheradditionsanddeductionsyouprovideforyouremployees,such ascashadvances,mileagereimbursements,uniondues,andwagegarnishments 2. EmployeeInformation Foreachemployeewhoworkedforyouthiscalendaryear(includingactive,inactiveand terminatedemployees),youllneed: EmployeescompletedW4form(sampleattached) Payrate(hourly,salary,commission,etc.) Paycheckdeductions(401(k),insurance,garnishments,etc.) Sick/vacationhoursbalance(ifapplicable) Directdepositinformation(useavoidedcheck,notdepositslip,oftheemployees bankaccount) Hiredate Terminationdate(ifapplicable) 3. TaxInformation Thefollowingpayrolltaxinformationisavailablefromyourstateorlocaltaxagency.For contactinformationforeachstatetaxagencies,visit: http://www.quickbooks.com/support/fileandpay/agencycontact/ Stateunemploymentinsurance(SUI)contributionrate: Contactstateunemploymentinsuranceofficetoobtainyourrate StateagencyIDnumber(s) Forunemploymentand/orstatetaxwithholding;contacttheappropriatestate agencydirectlyifyoudonothaveanIDnumberforthem Stateassessment,surcharge,administrativeortrainingtaxrates(ifapplicable) Copiesofbothstateandfederaltaxformsforeachclosedquarterthisyear Taxdeposits/filingschedule(monthlyorquarterly)

4.

PayrollHistoryInformation Ifyouarestartingpayrollin: The1stquarterofthecalendaryear(January1throughMarch31): Payrollsummariesforeachpaycheckissuedduringthequarter The2nd,3rdor4thquarterofthecalendaryear(April1throughDecember31): Foreachclosedquarter:payrollsummariesbyquarter Forthecurrentquarter:payrollsummariesbypaycheck

NOTE: Employeepayrollsummariesshouldcontaingrosswages,taxeswithheld(Social Security,Medicare,statewithholding)andallotherdeductions(medicalinsurance,401(k)or otherretirementdeductions,uniondues,wagegarnishments,etc.) [CONTINUEDONNEXTPAGE]

HelpfulHintsforFindingInformation

Wevecompiledthefollowinglisttohelpyoufindtheinformationyoullneedifyouuseda differentpayrollserviceproviderpriortoQuickBooksPayroll,orifyoureswitchingfrom QuickBooksBasic,Standard,orEnhancedPayrolltoAssistedPayroll. IfyoureswitchingfromPaychex Payrollinformation UIRATEANDID EEINFO YTD QTD CURRENTPAYROLL RETURNS IfyoureswitchingfromADP Payrollinformation UIRATEANDID EEINFO YTD QTD Wheretofindit PayrollSummary EmployeeEarningsRecord EndofQuarterYTD EmployeeEarningsRecord PayrollJournalorPayrollRegister 941andStatereturnbyquarter

CURRENTPAYROLL RETURNS IfyoureswitchingfromQuickBooksBasic,Standard,orEnhancedPayrolltoAssisted Payroll Payrollinformation Wheretofindit UIRATEANDID PreviousQuarterReturnsorPayrollItemList EEINFO ContactList YTD PayrollSummary QTD PayrollSummary CURRENTPAYROLL PayrollSummary RETURNS 941andstatereturns Glossary: UIRATE UnemploymentInsuranceRate EEINFO EmployeeInformation YTD YeartoDate QTD QuartertoDate

Wheretofindit StatementofDepositsandFilingsfortheState MasterListorMasterControl MasterListorMasterControl Generallynotavailableuntilwellafterthequarter,sowill needtorefertoPayrollRegisters PayrollRegister StatementofDepositsandFilingsfortheState

Form W-4 (2008)

Purpose. Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. Consider completing a new Form W-4 each year and when your personal or financial situation changes. Exemption from withholding. If you are exempt, complete only lines 1, 2, 3, 4, and 7 and sign the form to validate it. Your exemption for 2008 expires February 16, 2009. See Pub. 505, Tax Withholding and Estimated Tax. Note. You cannot claim exemption from withholding if (a) your income exceeds $900 and includes more than $300 of unearned income (for example, interest and dividends) and (b) another person can claim you as a dependent on their tax return. Basic instructions. If you are not exempt, complete the Personal Allowances Worksheet below. The worksheets on page 2 adjust your withholding allowances based on itemized deductions, certain credits,

adjustments to income, or two-earner/multiple job situations. Complete all worksheets that apply. However, you may claim fewer (or zero) allowances. Head of household. Generally, you may claim head of household filing status on your tax return only if you are unmarried and pay more than 50% of the costs of keeping up a home for yourself and your dependent(s) or other qualifying individuals. See Pub. 501, Exemptions, Standard Deduction, and Filing Information, for information. Tax credits. You can take projected tax credits into account in figuring your allowable number of withholding allowances. Credits for child or dependent care expenses and the child tax credit may be claimed using the Personal Allowances Worksheet below. See Pub. 919, How Do I Adjust My Tax Withholding, for information on converting your other credits into withholding allowances. Nonwage income. If you have a large amount of nonwage income, such as interest or dividends, consider making estimated tax

payments using Form 1040-ES, Estimated Tax for Individuals. Otherwise, you may owe additional tax. If you have pension or annuity income, see Pub. 919 to find out if you should adjust your withholding on Form W-4 or W-4P. Two earners or multiple jobs. If you have a working spouse or more than one job, figure the total number of allowances you are entitled to claim on all jobs using worksheets from only one Form W-4. Your withholding usually will be most accurate when all allowances are claimed on the Form W-4 for the highest paying job and zero allowances are claimed on the others. See Pub. 919 for details. Nonresident alien. If you are a nonresident alien, see the Instructions for Form 8233 before completing this Form W-4. Check your withholding. After your Form W-4 takes effect, use Pub. 919 to see how the dollar amount you are having withheld compares to your projected total tax for 2008. See Pub. 919, especially if your earnings exceed $130,000 (Single) or $180,000 (Married).

Personal Allowances Worksheet (Keep for your records.)

A Enter 1 for yourself if no one else can claim you as a dependent You are single and have only one job; or B Enter 1 if: You are married, have only one job, and your spouse does not work; or Your wages from a second job or your spouses wages (or the total of both) are $1,500 or less.

E

3

Form

W-4

SA M

C Enter 1 for your spouse. But, you may choose to enter -0- if you are married and have either a working spouse or C more than one job. (Entering -0- may help you avoid having too little tax withheld.) D D Enter number of dependents (other than your spouse or yourself) you will claim on your tax return E E Enter 1 if you will file as head of household on your tax return (see conditions under Head of household above) F F Enter 1 if you have at least $1,500 of child or dependent care expenses for which you plan to claim a credit (Note. Do not include child support payments. See Pub. 503, Child and Dependent Care Expenses, for details.) G Child Tax Credit (including additional child tax credit). See Pub. 972, Child Tax Credit, for more information. If your total income will be less than $58,000 ($86,000 if married), enter 2 for each eligible child. If your total income will be between $58,000 and $84,000 ($86,000 and $119,000 if married), enter 1 for each eligible G child plus 1 additional if you have 4 or more eligible children. H Add lines A through G and enter total here. (Note. This may be different from the number of exemptions you claim on your tax return.) H If you plan to itemize or claim adjustments to income and want to reduce your withholding, see the Deductions For accuracy, and Adjustments Worksheet on page 2. complete all worksheets If you have more than one job or are married and you and your spouse both work and the combined earnings from all jobs exceed $40,000 ($25,000 if married), see the Two-Earners/Multiple Jobs Worksheet on page 2 to avoid having too little tax withheld. that apply. If neither of the above situations applies, stop here and enter the number from line H on line 5 of Form W-4 below.

Cut here and give Form W-4 to your employer. Keep the top part for your records.

A B

PL

Date

Employees Withholding Allowance Certificate

Last name 2

OMB No. 1545-0074

Department of the Treasury Internal Revenue Service

Whether you are entitled to claim a certain number of allowances or exemption from withholding is subject to review by the IRS. Your employer may be required to send a copy of this form to the IRS.

2008

Type or print your first name and middle initial. Home address (number and street or rural route)

Your social security number

Single Married Married, but withhold at higher Single rate. Note. If married, but legally separated, or spouse is a nonresident alien, check the Single box.

City or town, state, and ZIP code

4 If your last name differs from that shown on your social security card, check here. You must call 1-800-772-1213 for a replacement card.

5 6 7

5 Total number of allowances you are claiming (from line H above or from the applicable worksheet on page 2) 6 Additional amount, if any, you want withheld from each paycheck I claim exemption from withholding for 2008, and I certify that I meet both of the following conditions for exemption. Last year I had a right to a refund of all federal income tax withheld because I had no tax liability and This year I expect a refund of all federal income tax withheld because I expect to have no tax liability. If you meet both conditions, write Exempt here 7

Under penalties of perjury, I declare that I have examined this certificate and to the best of my knowledge and belief, it is true, correct, and complete.

Employees signature

(Form is not valid unless you sign it.)

8

Employers name and address (Employer: Complete lines 8 and 10 only if sending to the IRS.)

9 Office code (optional) 10

Employer identification number (EIN)

For Privacy Act and Paperwork Reduction Act Notice, see page 2.

Cat. No. 10220Q

Form

W-4

(2008)

You might also like

- Updated Memorandum - IRS Audits of The President, S Corporations, and Reasonable Compensation To S Corporation Shareholder-EmployeesDocument6 pagesUpdated Memorandum - IRS Audits of The President, S Corporations, and Reasonable Compensation To S Corporation Shareholder-Employeesstevennelson1075% (4)

- WPS Salary Debit Authority Letter TemplateDocument1 pageWPS Salary Debit Authority Letter Templatetaraivan100% (2)

- Global Taxation Accounting Service Incrmdeh PDFDocument7 pagesGlobal Taxation Accounting Service Incrmdeh PDFbutterfoot87No ratings yet

- Appendic 3D-1 - Reporting ChecklistDocument2 pagesAppendic 3D-1 - Reporting ChecklistLuis Enrique Altamar RamosNo ratings yet

- AR Payment Terms SetupDocument8 pagesAR Payment Terms SetupJoydeep KarNo ratings yet

- (Answers) 20200915172413prl3 - v1 - 0 - Exercise - Year - End - Federal - 2017 - 0120Document13 pages(Answers) 20200915172413prl3 - v1 - 0 - Exercise - Year - End - Federal - 2017 - 0120Arslan Hafeez100% (1)

- Types of SelfDocument8 pagesTypes of SelfcoolmdNo ratings yet

- Payroll Manager or Payroll DirectorDocument4 pagesPayroll Manager or Payroll Directorapi-78120304No ratings yet

- Accounting Interview QuestionsDocument43 pagesAccounting Interview QuestionsArif ullahNo ratings yet

- LCCI 48182 L1 Bookkeeping Collation September 2015 PDFDocument46 pagesLCCI 48182 L1 Bookkeeping Collation September 2015 PDF苏进凯No ratings yet

- Introduction To AccountsDocument35 pagesIntroduction To Accountswiq001No ratings yet

- Payables User ManualDocument85 pagesPayables User Manualseenu126No ratings yet

- California Mutual Dispute Resolution AgreementDocument9 pagesCalifornia Mutual Dispute Resolution AgreementSonia ValdiviaNo ratings yet

- Recording Transactions: Powerpoint Presentation by Phil Johnson ©2015 John Wiley & Sons Australia LTDDocument34 pagesRecording Transactions: Powerpoint Presentation by Phil Johnson ©2015 John Wiley & Sons Australia LTDShiTheng Love UNo ratings yet

- Using Revenue ManagementDocument148 pagesUsing Revenue Managementpammi veeranji ReddyNo ratings yet

- 67079bos54071 Inter gp2Document91 pages67079bos54071 Inter gp2Hari AdabalaNo ratings yet

- Cashbook Processing On Sage Pastel PartnerDocument3 pagesCashbook Processing On Sage Pastel PartnerNyasha MakoreNo ratings yet

- Payroll Brochure For Prospective ClientsDocument2 pagesPayroll Brochure For Prospective Clientsanon-414607100% (3)

- Change of Sponsor Consent Form: Salam Shanti DeviDocument3 pagesChange of Sponsor Consent Form: Salam Shanti DeviMoya MeiteiNo ratings yet

- Accounting Tax Assistant Bookkeeping in Roanoke VA Resume Theresa ClementDocument3 pagesAccounting Tax Assistant Bookkeeping in Roanoke VA Resume Theresa ClementTheresa ClementNo ratings yet

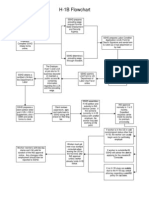

- H-1B FlowchartDocument1 pageH-1B FlowchartWilliam BaileyNo ratings yet

- HR and Payroll White PaperDocument12 pagesHR and Payroll White PaperRajat KaushikNo ratings yet

- Accounting Financial: General LedgerDocument8 pagesAccounting Financial: General LedgerSumeet KaurNo ratings yet

- 20 Easy Steps To Starting Your Bookkeeping Business: by Sylvia JaumannDocument13 pages20 Easy Steps To Starting Your Bookkeeping Business: by Sylvia JaumannDave A ValcarcelNo ratings yet

- Avalara Growing Your Accounting Practice How Tax Compliance Adds To Your Bottom LineDocument22 pagesAvalara Growing Your Accounting Practice How Tax Compliance Adds To Your Bottom LineJonathan StepanNo ratings yet

- Retail Banking Teller ResumeDocument1 pageRetail Banking Teller Resumemohit sharmaNo ratings yet

- Manual Payroll Processing Free Doc TemplateDocument55 pagesManual Payroll Processing Free Doc TemplateSwaminathan NatarajanNo ratings yet

- Financial and Program Management and Control/Accounting Department Procedure Manual: Sample Policy and ProcedureDocument25 pagesFinancial and Program Management and Control/Accounting Department Procedure Manual: Sample Policy and ProcedureMahmoud Salah100% (1)

- Bookkeeper ResumeDocument6 pagesBookkeeper Resumeasbbrfsmd100% (1)

- User Manual - Import Payroll DataDocument8 pagesUser Manual - Import Payroll Dataharry.anjh3613No ratings yet

- ADP PayrollDocument12 pagesADP PayrollIn StockNo ratings yet

- GuidetoFinance HR PayrollFormsDocument33 pagesGuidetoFinance HR PayrollFormsAsna AyazNo ratings yet

- Payroll: 1. What Is Oracle Payroll?Document8 pagesPayroll: 1. What Is Oracle Payroll?balasukNo ratings yet

- Layoff Consequences H 1bsDocument2 pagesLayoff Consequences H 1bsnithincb20001No ratings yet

- Payroll Global Userguider4-1873385 PDFDocument137 pagesPayroll Global Userguider4-1873385 PDFnamitakumari844140No ratings yet

- DALDA AR QuestionaireDocument8 pagesDALDA AR QuestionaireAnum ImranNo ratings yet

- New Client Checklist 2023Document26 pagesNew Client Checklist 2023MUSTAFA AMIRINo ratings yet

- IFS Apps 2004 - 7.5 SP5 Enhancement SummaryDocument91 pagesIFS Apps 2004 - 7.5 SP5 Enhancement SummaryamalkumarNo ratings yet

- Peoplesoft 9 and 9.1 Payroll Tax Update 10-E Year End Processing 2010: U.S., Puerto Rico, and U. S. TerritoriesDocument147 pagesPeoplesoft 9 and 9.1 Payroll Tax Update 10-E Year End Processing 2010: U.S., Puerto Rico, and U. S. Territoriessrasrk11No ratings yet

- Examples of Customized Charts of AccountsDocument33 pagesExamples of Customized Charts of AccountsDennis lugodNo ratings yet

- Employers Guide To Taxable Benefits and Allowances - CRA - Canada Revenue AgencyDocument42 pagesEmployers Guide To Taxable Benefits and Allowances - CRA - Canada Revenue AgencyGord McCallumNo ratings yet

- Income Tax Under Canadian RegulationsDocument10 pagesIncome Tax Under Canadian Regulationshemayal0% (1)

- Financial Accounting For ICWADocument944 pagesFinancial Accounting For ICWAAmit Kumar100% (2)

- Practical HRDocument3 pagesPractical HRSameera BandaraNo ratings yet

- Us W-2 2015 PDFDocument7 pagesUs W-2 2015 PDFkevsNo ratings yet

- Chapter 1Document22 pagesChapter 1Severus HadesNo ratings yet

- 25 Chart of AccountsDocument104 pages25 Chart of AccountsFiania WatungNo ratings yet

- Accounting Services Proposal Template (New)Document4 pagesAccounting Services Proposal Template (New)marvbeats1555No ratings yet

- Transaction EntriesDocument17 pagesTransaction EntriesKotesh KumarNo ratings yet

- Complete Details Payroll Salary ComDocument9 pagesComplete Details Payroll Salary ComTahmina KhanomNo ratings yet

- PL SQL ExercisesDocument4 pagesPL SQL ExercisesSirajuddin Mohamed SaleemNo ratings yet

- Accounts Payable Balance Sheet Entries: How Do They Show Up?Document9 pagesAccounts Payable Balance Sheet Entries: How Do They Show Up?atia fawzyNo ratings yet

- Accrual Accounting Basic RulesDocument8 pagesAccrual Accounting Basic RulesRaviSankarNo ratings yet

- Nextgen Requirements Analysis 9-22-11Document12 pagesNextgen Requirements Analysis 9-22-11AshxroseNo ratings yet

- Vaibhav Ram Chavan Offer Letter - PDF 3Document2 pagesVaibhav Ram Chavan Offer Letter - PDF 3vrc1498No ratings yet

- Descriptive Chart of Accounts Model TemplateDocument17 pagesDescriptive Chart of Accounts Model Templateयशोधन कुलकर्णीNo ratings yet

- PF1 Chapter 8 SlidesDocument47 pagesPF1 Chapter 8 SlidesNamie Namie100% (1)

- Employee Provident FundDocument7 pagesEmployee Provident FundAkm Ashraf Uddin0% (1)

- HR Software For UAE - Best Payroll SystemDocument6 pagesHR Software For UAE - Best Payroll SystemBalbir SinghNo ratings yet

- Vision Class SyllabusDocument7 pagesVision Class SyllabuscaliechNo ratings yet

- History 41 Poem My Pain Runs DeepDocument1 pageHistory 41 Poem My Pain Runs DeepcaliechNo ratings yet

- Tips For Successful LeadershipDocument19 pagesTips For Successful LeadershipcaliechNo ratings yet

- Ritual WorksheetDocument2 pagesRitual Worksheetcaliech100% (1)

- John Doe Smith 2 CHH ST BILE, GA 35555Document1 pageJohn Doe Smith 2 CHH ST BILE, GA 35555caliechNo ratings yet

- Page 2Document2 pagesPage 2caliechNo ratings yet

- Amount Chargeable (In Words)Document1 pageAmount Chargeable (In Words)Saurav Kumar SinghNo ratings yet

- Nidhi Form 16 UpdateDocument3 pagesNidhi Form 16 UpdateAbhinav NigamNo ratings yet

- Computation Draft Shubham RefundDocument5 pagesComputation Draft Shubham RefundShubham JainNo ratings yet

- Tax CalculatorDocument1 pageTax CalculatorLovish VatwaniNo ratings yet

- Flipkart Labels 26 Feb 2024 08 29Document2 pagesFlipkart Labels 26 Feb 2024 08 29royalskhatriNo ratings yet

- Fresh: Commission/Incentive Approval ReportDocument2 pagesFresh: Commission/Incentive Approval ReportRohit ChhabraNo ratings yet

- Invoice: Page 1 of 2Document2 pagesInvoice: Page 1 of 2Mohammed RiyanNo ratings yet

- TRAIN Act of 2018 & Taxation Law UpdatesDocument21 pagesTRAIN Act of 2018 & Taxation Law UpdatesPafra BariuanNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengalurunilnikNo ratings yet

- #A#c#0#47m - 639034022092104544 - Itns280 - 22092021 - Aveva Information Technology India Private LimitedDocument1 page#A#c#0#47m - 639034022092104544 - Itns280 - 22092021 - Aveva Information Technology India Private LimitedVinayak DhotreNo ratings yet

- Rani TattDocument1 pageRani TattHardeep SinghNo ratings yet

- GSTR-2A Data Entry Instructions Worksheet Name GSTR-2A Table Reference Field NameDocument39 pagesGSTR-2A Data Entry Instructions Worksheet Name GSTR-2A Table Reference Field NameSanjay kumarNo ratings yet

- 672 Dattetreya ChecklistDocument5 pages672 Dattetreya ChecklistR NitsNo ratings yet

- CIR Vs Norton and Harrison CompanyDocument1 pageCIR Vs Norton and Harrison CompanymarvinNo ratings yet

- PayslipDocument1 pagePayslipSanthosh ChNo ratings yet

- Alexander Howden Co. Ltd. v. CIR 13 SCRA 601 G.R. No. L 19392 April 14 1965Document1 pageAlexander Howden Co. Ltd. v. CIR 13 SCRA 601 G.R. No. L 19392 April 14 1965Oro Chamber100% (2)

- Orient Cables (India) Pvt. LTD: Party DetailsDocument1 pageOrient Cables (India) Pvt. LTD: Party DetailsShashank SaxenaNo ratings yet

- Indirect Tax Effective RateDocument4 pagesIndirect Tax Effective RateomkargokhaleNo ratings yet

- Notice: Meetings: Taxpayer Advocacy Panel Ad Hoc IRS Forms and Publications/Language Services Issue CommitteeDocument2 pagesNotice: Meetings: Taxpayer Advocacy Panel Ad Hoc IRS Forms and Publications/Language Services Issue CommitteeJustia.comNo ratings yet

- PremiumPaidStatement 2023-2024Document1 pagePremiumPaidStatement 2023-2024Vinay PandeyNo ratings yet

- Income Tax Payment Challan: PSID #: 139758233Document1 pageIncome Tax Payment Challan: PSID #: 139758233umaar99No ratings yet

- Scientific Publishing Services (P) LTD.: Pay Slip For The Month of October 2020Document1 pageScientific Publishing Services (P) LTD.: Pay Slip For The Month of October 2020Jagan EashwarNo ratings yet

- How To Calculate TDS From SalaryDocument3 pagesHow To Calculate TDS From SalaryNaveen Kumar NaiduNo ratings yet

- GST Year End Activities For FY 21-22Document2 pagesGST Year End Activities For FY 21-22saileepatankar3No ratings yet

- Qap FormatDocument8 pagesQap FormatPau Line EscosioNo ratings yet

- Apollo Medicine InvoiceJul 28 2023 15 53Document1 pageApollo Medicine InvoiceJul 28 2023 15 53NeerajNo ratings yet

- 2023 PCL Chapter 4 Income TaxDocument67 pages2023 PCL Chapter 4 Income TaxSkyNo ratings yet

- TaxReturn PDFDocument7 pagesTaxReturn PDFChristine WillisNo ratings yet

- AssignmentDocument1 pageAssignmentfzm6vfrpv7No ratings yet