Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

23 viewsFin O Pedia Issue51 Jan13 Jan19

Fin O Pedia Issue51 Jan13 Jan19

Uploaded by

CMDfromNagpurFinance Magazine

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Direct Selling Report-Naswiz PDFDocument3 pagesDirect Selling Report-Naswiz PDFBhupesh KumarNo ratings yet

- Financial Accounting Syllabus 2018/2019Document6 pagesFinancial Accounting Syllabus 2018/2019what's up bro?No ratings yet

- 1-Care and ConcernDocument1 page1-Care and Concernsukumaran3210% (1)

- CreativeBrief SilkbySaatchiDocument8 pagesCreativeBrief SilkbySaatchiCeren KolsariciNo ratings yet

- Corporate FinanceDocument4 pagesCorporate FinanceSaurabh Singh RawatNo ratings yet

- Marketing - Rural Marketing - Promotion of Brand in Rural Market of India1Document103 pagesMarketing - Rural Marketing - Promotion of Brand in Rural Market of India1Sumit Kumar100% (1)

- 7 Jo Costing StudentDocument7 pages7 Jo Costing StudentMaria Cristina A. BarrionNo ratings yet

- ECON 103 - Exam 2 Study GuideDocument3 pagesECON 103 - Exam 2 Study GuideAndros MafraNo ratings yet

- Module 27 - Impairment of AssetsDocument76 pagesModule 27 - Impairment of AssetsGrace GabrielNo ratings yet

- Inter Company InvoicingDocument41 pagesInter Company InvoicingShanti BollinaNo ratings yet

- Anti Fencing LawDocument6 pagesAnti Fencing LawKenneth Ray AgustinNo ratings yet

- DefinitionDocument2 pagesDefinitionsadathnooriNo ratings yet

- Marketing Communications Integrating Off PDFDocument37 pagesMarketing Communications Integrating Off PDFRatih Frayunita Sari100% (1)

- India Interstate Regulatory RequirementsDocument18 pagesIndia Interstate Regulatory RequirementsRohit CharpeNo ratings yet

- HDCM Syllabus PDFDocument26 pagesHDCM Syllabus PDFManjunath BendigeriNo ratings yet

- Specialty Clothing Retail Business PlanDocument26 pagesSpecialty Clothing Retail Business Planloso1990No ratings yet

- Ho Workingcapmgt SbuDocument4 pagesHo Workingcapmgt SbuAngel Alejo AcobaNo ratings yet

- Markstrat - BasicsDocument15 pagesMarkstrat - Basicsgaurav guptaNo ratings yet

- Introduction To Merchandising TransactionsDocument9 pagesIntroduction To Merchandising TransactionsCarrie DizonNo ratings yet

- Notes - Class 4Document3 pagesNotes - Class 4Majed Abou AlkhirNo ratings yet

- Intr Say Tra NG StraesDocument6 pagesIntr Say Tra NG Straesspajk6No ratings yet

- CAF Streetcar Delivery ResponseDocument3 pagesCAF Streetcar Delivery ResponseCherylVariNo ratings yet

- Wallstreetjournal 20171106 TheWallStreetJournalDocument48 pagesWallstreetjournal 20171106 TheWallStreetJournalsadaq84No ratings yet

- HTTP://WWW Bized Co UkDocument18 pagesHTTP://WWW Bized Co UknandupgmNo ratings yet

- State Investment House Inc Vs CADocument2 pagesState Investment House Inc Vs CAGulf StreamNo ratings yet

- 1995 April RUNGTA BILLDocument1 page1995 April RUNGTA BILLRishabh SharmaNo ratings yet

- Chapter 05 FORECASTING MARKET DEMAND AND SALES BUDGETSDocument27 pagesChapter 05 FORECASTING MARKET DEMAND AND SALES BUDGETSNorozNo ratings yet

- ProductivityDocument5 pagesProductivityRana HaiderNo ratings yet

- Peter England Denim Brands ProfileDocument3 pagesPeter England Denim Brands ProfileaeibelNo ratings yet

- SAP AR Dilip SadhDocument90 pagesSAP AR Dilip SadhDilip SadhNo ratings yet

Fin O Pedia Issue51 Jan13 Jan19

Fin O Pedia Issue51 Jan13 Jan19

Uploaded by

CMDfromNagpur0 ratings0% found this document useful (0 votes)

23 views4 pagesFinance Magazine

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentFinance Magazine

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

23 views4 pagesFin O Pedia Issue51 Jan13 Jan19

Fin O Pedia Issue51 Jan13 Jan19

Uploaded by

CMDfromNagpurFinance Magazine

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 4

2013

Top Stories: International

Know Your Basics: Order Driven Market Quote Driven Market

Know Your Basics:

FIN-O-PEDIA

Lets Talk FINANCE!!

A SIMSREE Finance Forum Initiative | Issue 51

SYDENHAM INSTITUTE OF MANAGEMENT STUDIES, RESEARCH & ENTREPRENEURSHIP EDUCATION

Know Your Basics:

In this issue of Fin-O-Pedia, we are going to discuss what are Order Driven Market and Quote Driven Market. Further we will see the difference between the two to get more understanding of these terms.

Order Driven Market:

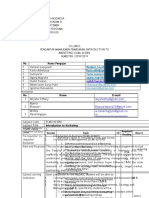

Definition: The financial market where all sellers and buyers display the amounts of security they wish to buy or sell as well as the prices at which they wish to buy or sell a particular security. What exactly is an Order Driven Market? In this type of market, all of the orders of buyers and sellers are displayed. It displays the price of the securities the buyer or seller is willing to buy or sell at respectively. It also displays the amount of securities the buyer or seller is willing to buy or sell at the quoted price. For example, if you buy 200 shares of XYZ Company, this order will be displayed and will be visible to all the people who have access to this information. The biggest advantage of this market is its transparency, since the entire order book is displayed for investors who wish to access this information. Most exchanges charge fees for such information. But the drawback of this market is that there is no guarantee of order execution. NSE trading mechanism operates on the principles of order driven system. A sample display in an order driven market is as shown in the next picture.

In the adjacent table, all of the buy and sell orders are displayed showing the price and share amount of the order. This is the peculiarity of the order driven market. Now, according to what we see in the table, someone could come into the market and buy 59,100 shares for Rs.42.65.

Quote Driven Market:

Definition: An electronic stock exchange system in which prices are determined from bid and ask quotations made by market makers, dealers or specialist is a Quote Driven Market. What exactly is a Quote Driven Market? As opposed to Order Driven Market, this market only displays bids and asks of designated market makers and specialists for a specific security. A market maker can be defined as a broker-dealer firm which accepts the risk of holding a certain number of shares of a security in order to facilitate trading in that security. This market only displays the bid and the ask offers of designated market makers, dealers or specialists. In other words, this market displays the offered price of the securities by a market maker. It will not display the order placed by you. The bid will change as the demand and supply of the security changes. Continuing above example, if you buy 200 shares of XYZ Company, it will not be displayed in the Quote Driven Market. Suppose there is one market maker for this stock, it would post its bid - say, Rs.50.50 - and its ask - say, Rs.51.50. This would be all the information which will be displayed. Now, you can buy the shares of XYZ Company at Rs.51.50 and sell it at Rs.50.50. The major advantage of this type of market is the liquidity it presents as the market makers are required to meet their quoted prices either buying or selling. The major drawback of the quote driven market is that, unlike the order driven market, it does not show transparency in the market. NYSE and NASDAQ are both considered as hybrid markets. A hybrid market combines the features of both of these markets.

3|Page

Difference between Order Driven Market and Quote Driven Market:

In this section, we will discuss major differences between Order Driven Market and Quote Driven Market in detail, so that we will have more understanding of these two markets. What is displayed The basic difference between the two markets is what is displayed in the market as far as orders and bid and ask prices are concerned. The order driven market displays all of the bids and asks, whereas the quote driven market focuses on the bids and asks of market makers. Guarantee of execution In an order driven market, there is no guarantee of order execution. In oppose to that, in a quote driven market, there is guarantee of order of execution. Transparency An order driven market is transparent in the sense that it clearly shows all of the market orders and what price people are willing to buy at or sell a particular security. But this is not the case with quote driven market. In quote driven market only displays the bid and the ask offers of designated market makers, dealers or specialists. Liquidity There is presence of market makers in a quote driven market. This leads to more liquidity of this market as compared to the order driven market.

4|Page

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Direct Selling Report-Naswiz PDFDocument3 pagesDirect Selling Report-Naswiz PDFBhupesh KumarNo ratings yet

- Financial Accounting Syllabus 2018/2019Document6 pagesFinancial Accounting Syllabus 2018/2019what's up bro?No ratings yet

- 1-Care and ConcernDocument1 page1-Care and Concernsukumaran3210% (1)

- CreativeBrief SilkbySaatchiDocument8 pagesCreativeBrief SilkbySaatchiCeren KolsariciNo ratings yet

- Corporate FinanceDocument4 pagesCorporate FinanceSaurabh Singh RawatNo ratings yet

- Marketing - Rural Marketing - Promotion of Brand in Rural Market of India1Document103 pagesMarketing - Rural Marketing - Promotion of Brand in Rural Market of India1Sumit Kumar100% (1)

- 7 Jo Costing StudentDocument7 pages7 Jo Costing StudentMaria Cristina A. BarrionNo ratings yet

- ECON 103 - Exam 2 Study GuideDocument3 pagesECON 103 - Exam 2 Study GuideAndros MafraNo ratings yet

- Module 27 - Impairment of AssetsDocument76 pagesModule 27 - Impairment of AssetsGrace GabrielNo ratings yet

- Inter Company InvoicingDocument41 pagesInter Company InvoicingShanti BollinaNo ratings yet

- Anti Fencing LawDocument6 pagesAnti Fencing LawKenneth Ray AgustinNo ratings yet

- DefinitionDocument2 pagesDefinitionsadathnooriNo ratings yet

- Marketing Communications Integrating Off PDFDocument37 pagesMarketing Communications Integrating Off PDFRatih Frayunita Sari100% (1)

- India Interstate Regulatory RequirementsDocument18 pagesIndia Interstate Regulatory RequirementsRohit CharpeNo ratings yet

- HDCM Syllabus PDFDocument26 pagesHDCM Syllabus PDFManjunath BendigeriNo ratings yet

- Specialty Clothing Retail Business PlanDocument26 pagesSpecialty Clothing Retail Business Planloso1990No ratings yet

- Ho Workingcapmgt SbuDocument4 pagesHo Workingcapmgt SbuAngel Alejo AcobaNo ratings yet

- Markstrat - BasicsDocument15 pagesMarkstrat - Basicsgaurav guptaNo ratings yet

- Introduction To Merchandising TransactionsDocument9 pagesIntroduction To Merchandising TransactionsCarrie DizonNo ratings yet

- Notes - Class 4Document3 pagesNotes - Class 4Majed Abou AlkhirNo ratings yet

- Intr Say Tra NG StraesDocument6 pagesIntr Say Tra NG Straesspajk6No ratings yet

- CAF Streetcar Delivery ResponseDocument3 pagesCAF Streetcar Delivery ResponseCherylVariNo ratings yet

- Wallstreetjournal 20171106 TheWallStreetJournalDocument48 pagesWallstreetjournal 20171106 TheWallStreetJournalsadaq84No ratings yet

- HTTP://WWW Bized Co UkDocument18 pagesHTTP://WWW Bized Co UknandupgmNo ratings yet

- State Investment House Inc Vs CADocument2 pagesState Investment House Inc Vs CAGulf StreamNo ratings yet

- 1995 April RUNGTA BILLDocument1 page1995 April RUNGTA BILLRishabh SharmaNo ratings yet

- Chapter 05 FORECASTING MARKET DEMAND AND SALES BUDGETSDocument27 pagesChapter 05 FORECASTING MARKET DEMAND AND SALES BUDGETSNorozNo ratings yet

- ProductivityDocument5 pagesProductivityRana HaiderNo ratings yet

- Peter England Denim Brands ProfileDocument3 pagesPeter England Denim Brands ProfileaeibelNo ratings yet

- SAP AR Dilip SadhDocument90 pagesSAP AR Dilip SadhDilip SadhNo ratings yet