Professional Documents

Culture Documents

Presentation On Sec.32AC PDF

Presentation On Sec.32AC PDF

Uploaded by

rajdeeppawarCopyright:

Available Formats

You might also like

- Laptop Purchase AgreementDocument4 pagesLaptop Purchase AgreementPon Ganesh G67% (3)

- Report On Sinclair CompanyDocument5 pagesReport On Sinclair CompanyVictor LimNo ratings yet

- PGBPDocument61 pagesPGBPJyoti Kalotra0% (1)

- Chapter 17 - Test BankDocument44 pagesChapter 17 - Test Bankjdiaz_64624781% (16)

- Demonstration Problem - Chapter 4 - Internet Consulting ServicesDocument9 pagesDemonstration Problem - Chapter 4 - Internet Consulting ServicesTooba HashmiNo ratings yet

- Chemilite Case StudyDocument12 pagesChemilite Case StudyRavi Pratap Singh Tomar100% (3)

- English-Spanish Glossary of Tax Words and Phrases: Used in Publications Issued by The IRSDocument45 pagesEnglish-Spanish Glossary of Tax Words and Phrases: Used in Publications Issued by The IRSdaniela herreroNo ratings yet

- Notes On Income From Business or ProfessionDocument15 pagesNotes On Income From Business or Professionnitinsuba1980No ratings yet

- CAclubindia News - The SUPER Budget - AnalysisDocument15 pagesCAclubindia News - The SUPER Budget - AnalysisMahaveer DhelariyaNo ratings yet

- Scheme For Industrial Development of Jammu & KashmirDocument20 pagesScheme For Industrial Development of Jammu & KashmirShagir AliNo ratings yet

- Project PlanningDocument6 pagesProject PlanningIPS & Co.No ratings yet

- P 6 1. Business Laws PDFDocument70 pagesP 6 1. Business Laws PDFSruthi RekhaNo ratings yet

- Exemption 10AA Notes-1Document9 pagesExemption 10AA Notes-1SanaNo ratings yet

- PDF of PGBPDocument7 pagesPDF of PGBPCHENDUCHAITHUNo ratings yet

- Income Tax Amendments & Transition Notes For CA Inter May 24 byDocument63 pagesIncome Tax Amendments & Transition Notes For CA Inter May 24 byRutika ShindeNo ratings yet

- Presentation Taxation LawsDocument8 pagesPresentation Taxation LawsVineet GuptaNo ratings yet

- PGBP (Contd.)Document45 pagesPGBP (Contd.)Aarti SainiNo ratings yet

- Section 44ADDocument35 pagesSection 44ADManoj PruthiNo ratings yet

- P G B P: Rofits and Ains of Usiness or RofessionDocument4 pagesP G B P: Rofits and Ains of Usiness or RofessionankitshahjskNo ratings yet

- SJMS Associates Budget Highlights 2014Document50 pagesSJMS Associates Budget Highlights 2014Tharindu PereraNo ratings yet

- Deduction in Respect of Expenditure On Specified BusinessDocument5 pagesDeduction in Respect of Expenditure On Specified BusinessMukesh ManwaniNo ratings yet

- IND As Note Implications For Companies in India FinalDocument6 pagesIND As Note Implications For Companies in India FinalRavNeet KaUrNo ratings yet

- Section 44AD Advance LearningDocument36 pagesSection 44AD Advance LearningSuriyakumar ShanmugavelNo ratings yet

- Direct Tax AmendmentDocument1 pageDirect Tax AmendmentDevarajan VeeraraghavanNo ratings yet

- 17 Tax Credits For Companies SME TaxationDocument10 pages17 Tax Credits For Companies SME TaxationTayyaba YounasNo ratings yet

- Corporate and Other Law Chapter 8 1642827112Document22 pagesCorporate and Other Law Chapter 8 1642827112racheldavid400No ratings yet

- TAX Budget2012 Annexa4Document40 pagesTAX Budget2012 Annexa4Fiona Jinn NNo ratings yet

- T3 Ans.. (RA)Document8 pagesT3 Ans.. (RA)KY LawNo ratings yet

- Deduction Regarding Form of New Business and Location of New BusinessDocument61 pagesDeduction Regarding Form of New Business and Location of New BusinessKetan ThakkarNo ratings yet

- AllowancesDocument52 pagesAllowancesbiggoboziNo ratings yet

- New Business Tax PlanningDocument47 pagesNew Business Tax PlanningashishNo ratings yet

- Msme Note 24Document4 pagesMsme Note 24drishtijain22No ratings yet

- 3 Business IncomeDocument14 pages3 Business IncomeShreyas BhadaneNo ratings yet

- Special Economic ZoneDocument4 pagesSpecial Economic ZoneDhruvesh ModiNo ratings yet

- 43B (H)Document16 pages43B (H)anascrrNo ratings yet

- Ey Budget Connect 2023 Start UpsDocument6 pagesEy Budget Connect 2023 Start Upsgv.vidyadharNo ratings yet

- Operationalguidelines IippDocument69 pagesOperationalguidelines IippsurichimmaniNo ratings yet

- Professional Level - Options Module, Paper P6 (MYS) Advanced Taxation (Malaysia) September/December 2016 Sample Answers 1Document8 pagesProfessional Level - Options Module, Paper P6 (MYS) Advanced Taxation (Malaysia) September/December 2016 Sample Answers 1kok kuan wongNo ratings yet

- AcvdvdDocument4 pagesAcvdvdvivek kasamNo ratings yet

- Small Scal Industry PolicyDocument6 pagesSmall Scal Industry PolicysweetuhemuNo ratings yet

- P6mys 2016 Septdec ADocument13 pagesP6mys 2016 Septdec AChoo LeeNo ratings yet

- Small Scale Exemption SchemeDocument8 pagesSmall Scale Exemption SchemebakulhariaNo ratings yet

- 80TTB - Provides Deduction Benefit On Interest Income For Senior CitizensDocument1 page80TTB - Provides Deduction Benefit On Interest Income For Senior CitizensArjun VermaNo ratings yet

- Chapter - 4 - Exemption and Allowances (Tax Holiday Exemption)Document35 pagesChapter - 4 - Exemption and Allowances (Tax Holiday Exemption)Sumon iqbalNo ratings yet

- Tax Planning With Reference To New Business - NatureDocument26 pagesTax Planning With Reference To New Business - NatureasifanisNo ratings yet

- Tax - Nature of BusinessDocument69 pagesTax - Nature of BusinessDhiraj MAkwanaNo ratings yet

- Section 35ADDocument2 pagesSection 35ADNilesh RoyNo ratings yet

- FAQ On Payment of Bonus ActDocument4 pagesFAQ On Payment of Bonus Actchirag bhojakNo ratings yet

- Presentation On Tax Planning With Referrence To Setting Up A New BusinessDocument30 pagesPresentation On Tax Planning With Referrence To Setting Up A New BusinessPooja MishraNo ratings yet

- Carry ForwardDocument16 pagesCarry Forwardpabloescobar11yNo ratings yet

- West Bengal Act - Labour - Bonus - ActDocument4 pagesWest Bengal Act - Labour - Bonus - ActRankit AlbelaNo ratings yet

- Acca P6Document11 pagesAcca P6novetanNo ratings yet

- Shared By: Sri J. Srinivas, APFC, Karimnagar, TelanganaDocument3 pagesShared By: Sri J. Srinivas, APFC, Karimnagar, TelanganaNandha KumarNo ratings yet

- Business and ProfessionDocument21 pagesBusiness and ProfessionKailash MotwaniNo ratings yet

- Tutorial 3 (1) Q1,2,4,5Document9 pagesTutorial 3 (1) Q1,2,4,5Shan JeefNo ratings yet

- Tax PlanningDocument12 pagesTax PlanningCharuJagwaniNo ratings yet

- Assignment On Exempted Income of CompaniesDocument19 pagesAssignment On Exempted Income of CompaniesDipti SahuNo ratings yet

- Budget Highlights 2012Document9 pagesBudget Highlights 2012Anshul GuptaNo ratings yet

- DGA Global - Union Budget Analysis - Income TaxDocument16 pagesDGA Global - Union Budget Analysis - Income TaxshwetaNo ratings yet

- Entrepreneurship ManagementDocument33 pagesEntrepreneurship ManagementhinalviraNo ratings yet

- Ule 42 For Ongoing Real Estate ProjectsDocument4 pagesUle 42 For Ongoing Real Estate ProjectsJigmeNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- Guidebook for Utilities-Led Business Models: Way Forward for Rooftop Solar in IndiaFrom EverandGuidebook for Utilities-Led Business Models: Way Forward for Rooftop Solar in IndiaNo ratings yet

- Mega Project Assurance: Volume One - The Terminological DictionaryFrom EverandMega Project Assurance: Volume One - The Terminological DictionaryNo ratings yet

- Diff Bet USGAAP IGAAP IFRSDocument7 pagesDiff Bet USGAAP IGAAP IFRSrajdeeppawarNo ratings yet

- SCS 2006 02Document40 pagesSCS 2006 02rajdeeppawarNo ratings yet

- SCS 2007 11Document46 pagesSCS 2007 11rajdeeppawarNo ratings yet

- Statutory Due Date For F y 15 16Document1 pageStatutory Due Date For F y 15 16rajdeeppawarNo ratings yet

- SCS 2007 02Document29 pagesSCS 2007 02rajdeeppawarNo ratings yet

- NOTE: Answer SIX Questions Including Question No.1 Which Is CompulsoryDocument4 pagesNOTE: Answer SIX Questions Including Question No.1 Which Is CompulsoryrajdeeppawarNo ratings yet

- Cost Accounting Standards at A GlanceDocument10 pagesCost Accounting Standards at A GlancerajdeeppawarNo ratings yet

- Roll No : Part - ADocument5 pagesRoll No : Part - ArajdeeppawarNo ratings yet

- Story On DT Case Law Nov.13: Amit JainDocument3 pagesStory On DT Case Law Nov.13: Amit JainrajdeeppawarNo ratings yet

- NOTE: Answer SIX Questions Including Question No.1 Which Is CompulsoryDocument3 pagesNOTE: Answer SIX Questions Including Question No.1 Which Is CompulsoryrajdeeppawarNo ratings yet

- Exam Centre Node CentreDocument17 pagesExam Centre Node CentrerajdeeppawarNo ratings yet

- NOTE: Answer SIX Questions Including Question No.1 Which Is CompulsoryDocument3 pagesNOTE: Answer SIX Questions Including Question No.1 Which Is CompulsoryrajdeeppawarNo ratings yet

- TCODE - MIRO Enter Vendor InvoiceDocument8 pagesTCODE - MIRO Enter Vendor InvoicerajdeeppawarNo ratings yet

- TCODE - S - ALR - 87013127 List of OrdersDocument5 pagesTCODE - S - ALR - 87013127 List of OrdersrajdeeppawarNo ratings yet

- TCODE - S - ALR - 87005722 Maintain Plan VersionDocument4 pagesTCODE - S - ALR - 87005722 Maintain Plan VersionrajdeeppawarNo ratings yet

- TCODE - KSVB - Execute - Plan - Cost - DistributionDocument5 pagesTCODE - KSVB - Execute - Plan - Cost - DistributionrajdeeppawarNo ratings yet

- TCODE - S - ALR - 87013180 Listing of Materials by Period StatusDocument4 pagesTCODE - S - ALR - 87013180 Listing of Materials by Period StatusrajdeeppawarNo ratings yet

- TCODE - S - ALR - 87013099 Order Plan - Actual ComparisonDocument4 pagesTCODE - S - ALR - 87013099 Order Plan - Actual ComparisonrajdeeppawarNo ratings yet

- TCODE - S - ALR - 87011994 Asset Balances ReportDocument5 pagesTCODE - S - ALR - 87011994 Asset Balances ReportrajdeeppawarNo ratings yet

- TCODE - OKP1 - Period - Lock - UnlockDocument3 pagesTCODE - OKP1 - Period - Lock - UnlockrajdeeppawarNo ratings yet

- TCODE - S - ALR - 87012052 Asset RetirementsDocument3 pagesTCODE - S - ALR - 87012052 Asset RetirementsrajdeeppawarNo ratings yet

- TCODE - S - ALR - 87012050 Asset Aquisitions ListDocument3 pagesTCODE - S - ALR - 87012050 Asset Aquisitions ListrajdeeppawarNo ratings yet

- Sales Representatives TrainingDocument27 pagesSales Representatives Trainingsteve@air-innovations.co.zaNo ratings yet

- Papa V ValenciaDocument1 pagePapa V ValenciaCistron ExonNo ratings yet

- 2019 Cpa ExamDocument14 pages2019 Cpa ExamBonDocEldRicNo ratings yet

- Partnership Liquidation Exam AnswersDocument7 pagesPartnership Liquidation Exam AnswersAlexandriteNo ratings yet

- CheatsheetDocument2 pagesCheatsheetravapu345100% (1)

- 8043 PDFDocument274 pages8043 PDFChandana RajasriNo ratings yet

- NPS Contribution Form PDFDocument1 pageNPS Contribution Form PDFratan203No ratings yet

- Premiere Development Bank, Petitioner, Entral Surety & Insurance Company, IncDocument18 pagesPremiere Development Bank, Petitioner, Entral Surety & Insurance Company, IncMarkNo ratings yet

- CMA DATA Format BlankDocument16 pagesCMA DATA Format BlankRaghavendra Kulkarni40% (5)

- Operating Income: Gross Profit Total Sales CogsDocument2 pagesOperating Income: Gross Profit Total Sales CogsBeth GuiangNo ratings yet

- WBIMFDocument13 pagesWBIMFSuraj JayNo ratings yet

- 2020 S1 Accg3020 L01Document32 pages2020 S1 Accg3020 L01elviraanggrainiNo ratings yet

- Bennett Jones - Ontario and Toronto Land Transfer TaxDocument30 pagesBennett Jones - Ontario and Toronto Land Transfer TaxRogaes EnpédiNo ratings yet

- Holiday Entertainment Co. - Group 5 ReportDocument12 pagesHoliday Entertainment Co. - Group 5 Reportbamd888100% (1)

- Statement of Financial PositionDocument18 pagesStatement of Financial PositionriaNo ratings yet

- Student'S Weekly Activity SheetDocument13 pagesStudent'S Weekly Activity SheetJulie Ranjo100% (1)

- Mihaljevic On Value Investors' Dilemma: When To Sell A Winner?Document3 pagesMihaljevic On Value Investors' Dilemma: When To Sell A Winner?The Manual of IdeasNo ratings yet

- Sappari K. Sawadjaan V The Honorable Court of Appeals, The Civil Service Commission and Al-Amanah Investment Bank of The PhilippinesDocument1 pageSappari K. Sawadjaan V The Honorable Court of Appeals, The Civil Service Commission and Al-Amanah Investment Bank of The PhilippinesPatrick ToNo ratings yet

- Job OrderDocument2 pagesJob OrderaliNo ratings yet

- Esi Act - Theory of Notional Extension IncludedDocument15 pagesEsi Act - Theory of Notional Extension Includedrashmi_shantikumarNo ratings yet

- Exam-Prep Answers For EconomicsDocument21 pagesExam-Prep Answers For EconomicsAejaz MohamedNo ratings yet

- PPP Debt, Deposit and Remittance Heads of Accounts Session 7Document41 pagesPPP Debt, Deposit and Remittance Heads of Accounts Session 7Balu Mahendra SusarlaNo ratings yet

- Comm. Rathgeber 11-5-13 PDFDocument3 pagesComm. Rathgeber 11-5-13 PDFdmnpoliticsNo ratings yet

- Department of Accountancy: Page - 1Document47 pagesDepartment of Accountancy: Page - 1NoroNo ratings yet

- Income Tax Rates/Slabs For A.Y. (2011-12) : Slab (RS.) Tax (RS.)Document4 pagesIncome Tax Rates/Slabs For A.Y. (2011-12) : Slab (RS.) Tax (RS.)Achal MittalNo ratings yet

Presentation On Sec.32AC PDF

Presentation On Sec.32AC PDF

Uploaded by

rajdeeppawarOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Presentation On Sec.32AC PDF

Presentation On Sec.32AC PDF

Uploaded by

rajdeeppawarCopyright:

Available Formats

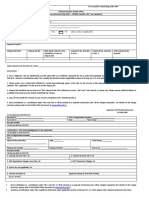

Availing Investment Allowance Incentive "Detailed Analysis "

Rajdeep Pawar March 13, 2013

Section 32AC Investment in New Plant & Machinery

In order to encourage substantial Investment in Plant & Machinery, It is proposed in Budget 2013-14 to insert a new section 32AC in the Income Tax Act. As per this section 15% of the amount invested in new Plant & Machinery will be allowed as deduction while computing taxable Income of the Assessee. This deduction will be in addition to Depreciation Allowance available in respect of new Plant & Machinery.

Contents

Applicability Conditions Consequences of Transfer with in 5 Years Challenges & Way Forward Approach

Applicability

Section 32AC : Investment in New Plant & Machinery Applicability

Applicable for COMPANY ASSESSEE only Individual, HUF, Partnership Firms, AOP / BOI, Cooperative Societies, Artificial Juridical Person etc. are not eligible to claim deduction under this section Company must be in the BUSINESS OF MANUFACTURE OR PRODUCTION of any ARTICLE OR THING Company must be in the business of Manufacturing or Production. Service Industry is not eligible for this deduction (ie from IGL Group point of view, KIFTPL, KHL & IGL Finance are not eligible to claim this deduction). Power Generation and Mining can be considered as Manufacturing or Production

Conditions

Section 32AC : Investment in New Plant & Machinery

Conditions

Eligible Company should : ACQUIRE & INSTALL NEW ASSETS COSTING TO RS.100 CRORE OR MORE BETWEEN 01.04.2013 to 31.03.2015 Then there shall be allowed a deduction of a sum equal to 15% of the actual cost of New Assets Unlike section 32 relating to Depreciation, The amount of deduction under this section will not be reduced from the cost of new assets. (Please note that there is no condition attached relating to payment in respect of New Assets)

Section 32AC : Investment in New Plant & Machinery

Conditions

Illustrations: Calculate the amount of deduction u/s 32AC in the following cases : (1) M/s ABC Ltd. Acquired & Installed New Assets costing to Rs.95 Cr. in FY13-14 and New Assets costing to Rs.10 Cr. in FY14-15. Sol.: In FY13-14, M/s ABC Ltd will not be eligible for any deduction u/s 32AC. However in FY14-15, M/s ABC Ltd will get a deduction @ 15% of Rs.105 Cr. in this section. (2) M/s ABC Ltd. Acquired & Installed New Assets costing to Rs.101 Cr. In FY13-14 and New Assets costing to Rs.25 Cr in FY14-15. Sol.: In FY13-14, M/s ABC Ltd will be eligible for deduction u/s 32AC @15% on Rs.101 Cr. and in FY14-15, M/s ABC Ltd can claim deduction u/s 32AC @15% on Rs.25 Cr. (3) M/s ABC Ltd. Acquired & Installed New Assets costing to Rs.85 Cr. In FY13-14 and New Assets costing to Rs.14 Cr. in FY14-15. Sol.: M/s ABC Ltd. Is not eligible for deduction under this section as requirement of minimum investment of Rs.100 Cr. before 01.04.2015 not met.

8

Section 32AC : Investment in New Plant & Machinery

Conditions

NEW ASSET means new Plant & Machinery but doesnt include:

(a) Any P&M which before its installation by Assessee used by any other person (b) Any P&M installed in any office premises or any residential accommodation (c) Office Appliances including Computers or Computer Softwares (d) Vehicles, Ships or Aircrafts; and (e) Any P&M, the whole of the actual cost of which is allowed as deduction in computing Income chargeable under the head PGBP of any previous year. Question : Whether deduction under this section will be available on the assets for which 100% advance was made prior to 01.04.2013 but Plant & Machinery received and capitalised by the Assessee after 01.04.2013? Ans: In my opinion and going by the Intention of the Law, if Advance is paid but new asset is received & installed after 31.03.2013, then we can treat the same as Investment for the purpose of this section.

9

Section 32AC : Investment in New Plant & Machinery

Conditions - Questions

Questions : Whether deduction under this section will be available on the assets for which 100% payment is made after 31.03.2013 but Plant & Machinery were received & installed Prior to 01.04.2013? Ans.: For this section we are not concerned about timing of payment rather we are concerned about acquisition and installation of New Plant & Machinery during specified period. In this case we can not claim deduction under this section. If any Plant & Machinery had already been purchased before 01.04.2013 but lying in Capital Work-in-progress pending installation, whether the same will be eligible for deduction under this section? Ans.: As per the conditions specified to claim this deduction, new Plant & Machinery should be Acquired & Installed during specified period (ie between 01.04.2013 to 31.03.2015). Hence Plant & Machinery acquired before 01.04.2013 and lying in CWIP will not be eligible for deduction under this section.

10

Section 32AC : Investment in New Plant & Machinery

Conditions - Questions

Questions : Will the Computer (including Computer Softwares) used in manufacturing process be qualified as new asset under this section? Ans.: As per the rule of Interpretation, words coming next will derive its meaning from the words coming first to it. Hence only those Computers which will be used as office appliances will not be considered as New Assets but Computers that will be used in Manufacturing process should be considered as New Asset If Company purchased trucks or lorries for transferring raw material from stores to Plants, will these be treated as New Assets under this section? Ans.: No In case the Asset acquired has previously been used for any purpose by any other person, will that asset be qualified as new asset under this section? Ans.: No

11

Section 32AC : Investment in New Plant & Machinery

Conditions - Questions

Questions : Whether deduction u/s 32AC will be available in case there are Business Losses? Ans.: Yes deduction under this section will be available (subject to fulfilment of specified conditions) in case of Business Loss. However deduction under this section will then be submerged in the business losses and will be carried forward for next eight years. What will be the treatment of deduction u/s 32AC in case of MAT Calculation? Ans.: No adjustment is specified in respect of this deduction in the calculation of Book profit for MAT purpose. What will be the effect if New Asset is acquired & installed during the specified period but put to use after 31.03.2015? Ans.: No effect as to claim deduction under this section, there is requirement of acquisition & installation of new assets and it is immaterial whether the asset is put to use in specified period or not.

12

Consequences of Transfer of Asset with in 5 Years

13

Section 32AC : Investment in New Plant & Machinery

Consequences of Transfer with in 5Yrs

If any new asset acquired and installed by the Assessee is sold or otherwise transferred, except in connection with the amalgamation or demerger, within 5 years from the date of its installation then deduction allowed in respect of such new assets under this section shall be deemed to be the Income of the Assessee chargeable under the head PGBP of the previous year in which such asset is sold or transferred, in addition to taxability of gains arising on account of transfer of such new asset. Questions : M/s ABC Ltd claimed deduction of Rs.30 Cr. In FY13-14 u/s 32AC but in FY16-17 P&M in respect of which deduction was claimed, is sold. What will be the treatment in this case? Ans: For Previous year 16-17, Rs.30 Cr. will be chargeable to tax under the head PGBP in addition to taxability of any gain or loss arising on account of such sale.

14

Section 32AC : Investment in New Plant & Machinery

Consequences of Transfer with in 5Yrs

Questions : M/s ABC Ltd claimed deduction of Rs.30 Cr. In FY13-14 u/s 32AC but in FY16-17 P&M in respect of which deduction was claimed, is transferred to (A) Amalgamated Company in the scheme of Amalgamation or (B) Resulting Company in the scheme of demerger. What will be the treatment in these cases? Ans: Provisions of this section will apply to the amalgamated company or resulting company as they would have applied to the amalgamating company or demerged company. M/s ABC Ltd. Which has invested a sum of Rs. 80 Cr. in New Assets after 01.04.2013, get demerged and New Assets worth Rs. 60 Cr. are transferred to one Resultant Company X Ltd. & New Assets worth Rs.20 Cr transferred to other Resultant company Y Ltd.. Before 01.04.2015, Both X Ltd & Y Ltd invested Rs.50 Cr. in New Assets, Will both XLtd & Y Ltd be eligible for deduction under this section? Ans.: Only X Ltd will be eligible for deduction under this section as it has complied with the requirement of Investment of Rs.100 Cr. or more in new assets.

15

Challenges & Way Forward Approach

Challenges.

Way forward approach

Aggregating investments of Rs.100 Crs during Medium sized corporate can also aggregate their FY 14, FY 15 is a key challenge for a medium size investments at least over two years of periods to corporates. While this allowance is granted for claim this benefit. all the corporates, only the large corporates are likely to benefit from this incentive.

Installation of an asset is an important Robust planning for the timely acquisition and condition for availing this Investment Allowance. installation should be in place to avail this Investment Allowance. Installation of P&M amounting worth exceeding Rs.100Crs typically takes longer time for final installation. Two year timeframe may be inadequate to achieve this.

Sale of P&M within 5 years from the date of installation will require the assessee to surrender the tax benefit availed on the investment allowance.

As these P&M will not form regular block of assets from investment allowance point of view, one needs to keep detailed documentation for these assets to give correct treatment at the time of acquisition, installation and sale thereof.

17

Thank You!

18

You might also like

- Laptop Purchase AgreementDocument4 pagesLaptop Purchase AgreementPon Ganesh G67% (3)

- Report On Sinclair CompanyDocument5 pagesReport On Sinclair CompanyVictor LimNo ratings yet

- PGBPDocument61 pagesPGBPJyoti Kalotra0% (1)

- Chapter 17 - Test BankDocument44 pagesChapter 17 - Test Bankjdiaz_64624781% (16)

- Demonstration Problem - Chapter 4 - Internet Consulting ServicesDocument9 pagesDemonstration Problem - Chapter 4 - Internet Consulting ServicesTooba HashmiNo ratings yet

- Chemilite Case StudyDocument12 pagesChemilite Case StudyRavi Pratap Singh Tomar100% (3)

- English-Spanish Glossary of Tax Words and Phrases: Used in Publications Issued by The IRSDocument45 pagesEnglish-Spanish Glossary of Tax Words and Phrases: Used in Publications Issued by The IRSdaniela herreroNo ratings yet

- Notes On Income From Business or ProfessionDocument15 pagesNotes On Income From Business or Professionnitinsuba1980No ratings yet

- CAclubindia News - The SUPER Budget - AnalysisDocument15 pagesCAclubindia News - The SUPER Budget - AnalysisMahaveer DhelariyaNo ratings yet

- Scheme For Industrial Development of Jammu & KashmirDocument20 pagesScheme For Industrial Development of Jammu & KashmirShagir AliNo ratings yet

- Project PlanningDocument6 pagesProject PlanningIPS & Co.No ratings yet

- P 6 1. Business Laws PDFDocument70 pagesP 6 1. Business Laws PDFSruthi RekhaNo ratings yet

- Exemption 10AA Notes-1Document9 pagesExemption 10AA Notes-1SanaNo ratings yet

- PDF of PGBPDocument7 pagesPDF of PGBPCHENDUCHAITHUNo ratings yet

- Income Tax Amendments & Transition Notes For CA Inter May 24 byDocument63 pagesIncome Tax Amendments & Transition Notes For CA Inter May 24 byRutika ShindeNo ratings yet

- Presentation Taxation LawsDocument8 pagesPresentation Taxation LawsVineet GuptaNo ratings yet

- PGBP (Contd.)Document45 pagesPGBP (Contd.)Aarti SainiNo ratings yet

- Section 44ADDocument35 pagesSection 44ADManoj PruthiNo ratings yet

- P G B P: Rofits and Ains of Usiness or RofessionDocument4 pagesP G B P: Rofits and Ains of Usiness or RofessionankitshahjskNo ratings yet

- SJMS Associates Budget Highlights 2014Document50 pagesSJMS Associates Budget Highlights 2014Tharindu PereraNo ratings yet

- Deduction in Respect of Expenditure On Specified BusinessDocument5 pagesDeduction in Respect of Expenditure On Specified BusinessMukesh ManwaniNo ratings yet

- IND As Note Implications For Companies in India FinalDocument6 pagesIND As Note Implications For Companies in India FinalRavNeet KaUrNo ratings yet

- Section 44AD Advance LearningDocument36 pagesSection 44AD Advance LearningSuriyakumar ShanmugavelNo ratings yet

- Direct Tax AmendmentDocument1 pageDirect Tax AmendmentDevarajan VeeraraghavanNo ratings yet

- 17 Tax Credits For Companies SME TaxationDocument10 pages17 Tax Credits For Companies SME TaxationTayyaba YounasNo ratings yet

- Corporate and Other Law Chapter 8 1642827112Document22 pagesCorporate and Other Law Chapter 8 1642827112racheldavid400No ratings yet

- TAX Budget2012 Annexa4Document40 pagesTAX Budget2012 Annexa4Fiona Jinn NNo ratings yet

- T3 Ans.. (RA)Document8 pagesT3 Ans.. (RA)KY LawNo ratings yet

- Deduction Regarding Form of New Business and Location of New BusinessDocument61 pagesDeduction Regarding Form of New Business and Location of New BusinessKetan ThakkarNo ratings yet

- AllowancesDocument52 pagesAllowancesbiggoboziNo ratings yet

- New Business Tax PlanningDocument47 pagesNew Business Tax PlanningashishNo ratings yet

- Msme Note 24Document4 pagesMsme Note 24drishtijain22No ratings yet

- 3 Business IncomeDocument14 pages3 Business IncomeShreyas BhadaneNo ratings yet

- Special Economic ZoneDocument4 pagesSpecial Economic ZoneDhruvesh ModiNo ratings yet

- 43B (H)Document16 pages43B (H)anascrrNo ratings yet

- Ey Budget Connect 2023 Start UpsDocument6 pagesEy Budget Connect 2023 Start Upsgv.vidyadharNo ratings yet

- Operationalguidelines IippDocument69 pagesOperationalguidelines IippsurichimmaniNo ratings yet

- Professional Level - Options Module, Paper P6 (MYS) Advanced Taxation (Malaysia) September/December 2016 Sample Answers 1Document8 pagesProfessional Level - Options Module, Paper P6 (MYS) Advanced Taxation (Malaysia) September/December 2016 Sample Answers 1kok kuan wongNo ratings yet

- AcvdvdDocument4 pagesAcvdvdvivek kasamNo ratings yet

- Small Scal Industry PolicyDocument6 pagesSmall Scal Industry PolicysweetuhemuNo ratings yet

- P6mys 2016 Septdec ADocument13 pagesP6mys 2016 Septdec AChoo LeeNo ratings yet

- Small Scale Exemption SchemeDocument8 pagesSmall Scale Exemption SchemebakulhariaNo ratings yet

- 80TTB - Provides Deduction Benefit On Interest Income For Senior CitizensDocument1 page80TTB - Provides Deduction Benefit On Interest Income For Senior CitizensArjun VermaNo ratings yet

- Chapter - 4 - Exemption and Allowances (Tax Holiday Exemption)Document35 pagesChapter - 4 - Exemption and Allowances (Tax Holiday Exemption)Sumon iqbalNo ratings yet

- Tax Planning With Reference To New Business - NatureDocument26 pagesTax Planning With Reference To New Business - NatureasifanisNo ratings yet

- Tax - Nature of BusinessDocument69 pagesTax - Nature of BusinessDhiraj MAkwanaNo ratings yet

- Section 35ADDocument2 pagesSection 35ADNilesh RoyNo ratings yet

- FAQ On Payment of Bonus ActDocument4 pagesFAQ On Payment of Bonus Actchirag bhojakNo ratings yet

- Presentation On Tax Planning With Referrence To Setting Up A New BusinessDocument30 pagesPresentation On Tax Planning With Referrence To Setting Up A New BusinessPooja MishraNo ratings yet

- Carry ForwardDocument16 pagesCarry Forwardpabloescobar11yNo ratings yet

- West Bengal Act - Labour - Bonus - ActDocument4 pagesWest Bengal Act - Labour - Bonus - ActRankit AlbelaNo ratings yet

- Acca P6Document11 pagesAcca P6novetanNo ratings yet

- Shared By: Sri J. Srinivas, APFC, Karimnagar, TelanganaDocument3 pagesShared By: Sri J. Srinivas, APFC, Karimnagar, TelanganaNandha KumarNo ratings yet

- Business and ProfessionDocument21 pagesBusiness and ProfessionKailash MotwaniNo ratings yet

- Tutorial 3 (1) Q1,2,4,5Document9 pagesTutorial 3 (1) Q1,2,4,5Shan JeefNo ratings yet

- Tax PlanningDocument12 pagesTax PlanningCharuJagwaniNo ratings yet

- Assignment On Exempted Income of CompaniesDocument19 pagesAssignment On Exempted Income of CompaniesDipti SahuNo ratings yet

- Budget Highlights 2012Document9 pagesBudget Highlights 2012Anshul GuptaNo ratings yet

- DGA Global - Union Budget Analysis - Income TaxDocument16 pagesDGA Global - Union Budget Analysis - Income TaxshwetaNo ratings yet

- Entrepreneurship ManagementDocument33 pagesEntrepreneurship ManagementhinalviraNo ratings yet

- Ule 42 For Ongoing Real Estate ProjectsDocument4 pagesUle 42 For Ongoing Real Estate ProjectsJigmeNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- Guidebook for Utilities-Led Business Models: Way Forward for Rooftop Solar in IndiaFrom EverandGuidebook for Utilities-Led Business Models: Way Forward for Rooftop Solar in IndiaNo ratings yet

- Mega Project Assurance: Volume One - The Terminological DictionaryFrom EverandMega Project Assurance: Volume One - The Terminological DictionaryNo ratings yet

- Diff Bet USGAAP IGAAP IFRSDocument7 pagesDiff Bet USGAAP IGAAP IFRSrajdeeppawarNo ratings yet

- SCS 2006 02Document40 pagesSCS 2006 02rajdeeppawarNo ratings yet

- SCS 2007 11Document46 pagesSCS 2007 11rajdeeppawarNo ratings yet

- Statutory Due Date For F y 15 16Document1 pageStatutory Due Date For F y 15 16rajdeeppawarNo ratings yet

- SCS 2007 02Document29 pagesSCS 2007 02rajdeeppawarNo ratings yet

- NOTE: Answer SIX Questions Including Question No.1 Which Is CompulsoryDocument4 pagesNOTE: Answer SIX Questions Including Question No.1 Which Is CompulsoryrajdeeppawarNo ratings yet

- Cost Accounting Standards at A GlanceDocument10 pagesCost Accounting Standards at A GlancerajdeeppawarNo ratings yet

- Roll No : Part - ADocument5 pagesRoll No : Part - ArajdeeppawarNo ratings yet

- Story On DT Case Law Nov.13: Amit JainDocument3 pagesStory On DT Case Law Nov.13: Amit JainrajdeeppawarNo ratings yet

- NOTE: Answer SIX Questions Including Question No.1 Which Is CompulsoryDocument3 pagesNOTE: Answer SIX Questions Including Question No.1 Which Is CompulsoryrajdeeppawarNo ratings yet

- Exam Centre Node CentreDocument17 pagesExam Centre Node CentrerajdeeppawarNo ratings yet

- NOTE: Answer SIX Questions Including Question No.1 Which Is CompulsoryDocument3 pagesNOTE: Answer SIX Questions Including Question No.1 Which Is CompulsoryrajdeeppawarNo ratings yet

- TCODE - MIRO Enter Vendor InvoiceDocument8 pagesTCODE - MIRO Enter Vendor InvoicerajdeeppawarNo ratings yet

- TCODE - S - ALR - 87013127 List of OrdersDocument5 pagesTCODE - S - ALR - 87013127 List of OrdersrajdeeppawarNo ratings yet

- TCODE - S - ALR - 87005722 Maintain Plan VersionDocument4 pagesTCODE - S - ALR - 87005722 Maintain Plan VersionrajdeeppawarNo ratings yet

- TCODE - KSVB - Execute - Plan - Cost - DistributionDocument5 pagesTCODE - KSVB - Execute - Plan - Cost - DistributionrajdeeppawarNo ratings yet

- TCODE - S - ALR - 87013180 Listing of Materials by Period StatusDocument4 pagesTCODE - S - ALR - 87013180 Listing of Materials by Period StatusrajdeeppawarNo ratings yet

- TCODE - S - ALR - 87013099 Order Plan - Actual ComparisonDocument4 pagesTCODE - S - ALR - 87013099 Order Plan - Actual ComparisonrajdeeppawarNo ratings yet

- TCODE - S - ALR - 87011994 Asset Balances ReportDocument5 pagesTCODE - S - ALR - 87011994 Asset Balances ReportrajdeeppawarNo ratings yet

- TCODE - OKP1 - Period - Lock - UnlockDocument3 pagesTCODE - OKP1 - Period - Lock - UnlockrajdeeppawarNo ratings yet

- TCODE - S - ALR - 87012052 Asset RetirementsDocument3 pagesTCODE - S - ALR - 87012052 Asset RetirementsrajdeeppawarNo ratings yet

- TCODE - S - ALR - 87012050 Asset Aquisitions ListDocument3 pagesTCODE - S - ALR - 87012050 Asset Aquisitions ListrajdeeppawarNo ratings yet

- Sales Representatives TrainingDocument27 pagesSales Representatives Trainingsteve@air-innovations.co.zaNo ratings yet

- Papa V ValenciaDocument1 pagePapa V ValenciaCistron ExonNo ratings yet

- 2019 Cpa ExamDocument14 pages2019 Cpa ExamBonDocEldRicNo ratings yet

- Partnership Liquidation Exam AnswersDocument7 pagesPartnership Liquidation Exam AnswersAlexandriteNo ratings yet

- CheatsheetDocument2 pagesCheatsheetravapu345100% (1)

- 8043 PDFDocument274 pages8043 PDFChandana RajasriNo ratings yet

- NPS Contribution Form PDFDocument1 pageNPS Contribution Form PDFratan203No ratings yet

- Premiere Development Bank, Petitioner, Entral Surety & Insurance Company, IncDocument18 pagesPremiere Development Bank, Petitioner, Entral Surety & Insurance Company, IncMarkNo ratings yet

- CMA DATA Format BlankDocument16 pagesCMA DATA Format BlankRaghavendra Kulkarni40% (5)

- Operating Income: Gross Profit Total Sales CogsDocument2 pagesOperating Income: Gross Profit Total Sales CogsBeth GuiangNo ratings yet

- WBIMFDocument13 pagesWBIMFSuraj JayNo ratings yet

- 2020 S1 Accg3020 L01Document32 pages2020 S1 Accg3020 L01elviraanggrainiNo ratings yet

- Bennett Jones - Ontario and Toronto Land Transfer TaxDocument30 pagesBennett Jones - Ontario and Toronto Land Transfer TaxRogaes EnpédiNo ratings yet

- Holiday Entertainment Co. - Group 5 ReportDocument12 pagesHoliday Entertainment Co. - Group 5 Reportbamd888100% (1)

- Statement of Financial PositionDocument18 pagesStatement of Financial PositionriaNo ratings yet

- Student'S Weekly Activity SheetDocument13 pagesStudent'S Weekly Activity SheetJulie Ranjo100% (1)

- Mihaljevic On Value Investors' Dilemma: When To Sell A Winner?Document3 pagesMihaljevic On Value Investors' Dilemma: When To Sell A Winner?The Manual of IdeasNo ratings yet

- Sappari K. Sawadjaan V The Honorable Court of Appeals, The Civil Service Commission and Al-Amanah Investment Bank of The PhilippinesDocument1 pageSappari K. Sawadjaan V The Honorable Court of Appeals, The Civil Service Commission and Al-Amanah Investment Bank of The PhilippinesPatrick ToNo ratings yet

- Job OrderDocument2 pagesJob OrderaliNo ratings yet

- Esi Act - Theory of Notional Extension IncludedDocument15 pagesEsi Act - Theory of Notional Extension Includedrashmi_shantikumarNo ratings yet

- Exam-Prep Answers For EconomicsDocument21 pagesExam-Prep Answers For EconomicsAejaz MohamedNo ratings yet

- PPP Debt, Deposit and Remittance Heads of Accounts Session 7Document41 pagesPPP Debt, Deposit and Remittance Heads of Accounts Session 7Balu Mahendra SusarlaNo ratings yet

- Comm. Rathgeber 11-5-13 PDFDocument3 pagesComm. Rathgeber 11-5-13 PDFdmnpoliticsNo ratings yet

- Department of Accountancy: Page - 1Document47 pagesDepartment of Accountancy: Page - 1NoroNo ratings yet

- Income Tax Rates/Slabs For A.Y. (2011-12) : Slab (RS.) Tax (RS.)Document4 pagesIncome Tax Rates/Slabs For A.Y. (2011-12) : Slab (RS.) Tax (RS.)Achal MittalNo ratings yet