Professional Documents

Culture Documents

Thesun 2009-08-03 Page15 China Is Rich Abroad Because of Worker Bulge

Thesun 2009-08-03 Page15 China Is Rich Abroad Because of Worker Bulge

Uploaded by

Impulsive collectorOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Thesun 2009-08-03 Page15 China Is Rich Abroad Because of Worker Bulge

Thesun 2009-08-03 Page15 China Is Rich Abroad Because of Worker Bulge

Uploaded by

Impulsive collectorCopyright:

Available Formats

theSun | MONDAY AUGUST 3 2009 15

business

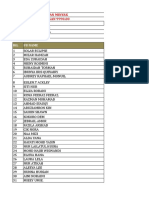

KL market summary

JULY 31, 2009

INDICES CHANGE Bourse poised to scale new high

FBMEMAS 7919.79 +83.13

FBMKLCI 1174.90 +14.24 SHARE prices on Bursa Malaysia are set to at- of Permodalan Nasional Bhd in managing its unit

INDUSTRIAL 2575.98 +38.98 tempt to scale new high this week with the launch trusts.

CONSUMER PROD 349.49 +4.61 of Amanah Saham 1Malaysia (AS 1Malaysia) “I expect AS 1Malaysia to be fully-subscribed

INDUSTRIAL PROD 89.41 +0.18 among the factors boosting confidence, dealers and the funds will be a boost to the stock

CONSTRUCTION 227.54 +4.08 said. market,” he said.

TRADING/SERVICES 155.23 +1.65 They said the FTSE Bursa Malaysia Kuala He said the overall trend this week would

FINANCE 9555.23 +77.63

PROPERTIES 752.21 +5.39

Lumpur Composite Index (FBM KLCI) is likely to also be influenced by the overseas trend, in

test the 1,183-point level with local and foreign particular the US. “Investors will be looking at

PLANTATION

MINING

5609.60

332.34

+10.77

+6.08 factors contributing to the upside. the US economy’s health for direction,” he said. EXCHANGE RATES July 31, 2009

FBMSHA 8107.56 +79.20 A dealer said market optimism is boosted Newly-listed integrated offshore crane

FMB2BRD 5291.32 +57.03 by expectation of more liquidity flowing into the services provider, Handal Resources Bhd, rose Foreign currency Bank sell Bank buy Bank buy

TECHNOLOGY 17.09 +0.31 local bourse in the coming months following the 18 sen to close at RM1.34 on Friday. TT/OD TT OD

TURNOVER VALUE

launch of the RM10 billion AS 1Malaysia. On a week-to-week basis, the FBM KLCI 1 US DOLLAR 3.5630 3.4980 3.4880

“It is expected to be well received by the gained 19.02 points to close at 1,174,90. 1 AUSTRALIAN DOLLAR 2.9770 2.8470 2.8310

1.257bil RM1.948bil

public who are encouraged by the track record – Bernama

1 BRUNEI DOLLAR 2.4780 2.4180 2.4100

1 CANADIAN DOLLAR 3.3000 3.2190 3.2070

1 EURO 5.0330 4.9110 4.8910

China is rich abroad 1 NEW ZEALAND DOLLAR

1 PAPUA N GUINEA KINA

1 SINGAPORE DOLLAR

1 STERLING POUND

1 SWISS FRANC

100 BANGLADESH TAKA

2.3570

1.4800

2.4775

5.8990

3.2870

5.3400

2.2520

1.2220

2.41890

5.7560

3.2070

5.2100

2.2360

1.2060

2.4100

5.7360

3.1920

5.0100

because of worker bulge

GENEVA: China can finance the US the United States and China. to spend vast sums on child-related

One striking

feature of

100 DANISH KRONE

100 HONGKONG DOLLAR

100 INDIAN RUPEE

100 INDONESIAN RUPIAH

100 JAPANESE YEN

100 NORWEGIAN KRONE

69.6100

46.8000

7.6600

0.0373

3.7440

59.1700

63.9600

44.3200

7.0400

0.0314

3.6530

54.3400

63.7600

44.1200

6.8400

0.0264

3.6430

54.1400

economy because its workforce is large It also gives a new perspective to services and can go abroad in search 100 PAKISTAN RUPEE 4.4100 4.1100 3.9100

relative to children and old people, a the view long held by many econo- of securities and companies to buy, China’s 100 PHILIPPINE PESO 7.5700 7.1200 6.9200

new analysis suggests, trying to solve mists that so-called global imbalances, according to this analysis. demographic 100 QATAR RIYAL 99.5000 94.7900 94.5900

a mystery why Beijing is a major net principally the US trade deficit with The BIS, known as the central transition 100 SAUDI RIYAL 96.5000 91.7900 91.5900

creditor rather than a borrower as China matched by import earnings bankers’ central bank, circulated the during 100 SOUTH AFRICAN RAND 47.4600 43.4400 43.2400

emerging economies usually are. for China, would be a factor leading report last week, adding that the argu-

And this strong ratio of workers to a crisis of the kind the world is now ments developed by the authors do not

1985-2007 is 100 SRI LANKA RUPEE 3.2300 2.9600 2.7600

to dependants is set to last for at least experiencing. necessarily reflect those of the bank. that its youth 100 SWEDISH KRONA 49.9500 45.3700 45.1700

15 years although the net benefit for The conventional view is that the A net debtor in 1999, China has dependency 100 THAI BAHT 11.2200 9.5200 9.1200

China will decline as the burden of massive Chinese investment abroad since become a major net creditor ratio fell by Source: Malayan Banking Berhad/Bernama

old people creeps up while the cost of is a way of “sterilising” the country’s and is likely to remain so until 2025, half while

children remains steady. huge earnings from exports, or pre- according to the study.

The personal research by econo- venting them from causing inflation The country’s “net foreign asset po- its old-age

mists writing in a publication of the and driving up the yuan. The export sition (NFA),” the difference between dependency

Basel-based Bank for International surpluses are an undisputed fact: its overseas assets and liabilities, came increased

Settlements also implies that the work-

force is skewed, with young people

who have left a child-bulge bracket

however, the new research suggests

that they are not the only big source of

surplus funding available to China.

to 30% of its gross domestic product in

2007 and amounted to more than US$1

trillion (RM3.55 trillion).

only slightly,

leaving

the overall

Nissan

up to the age of 15 now boosting the

workforce.

And they are saving money sub-

stantially.

For the United States, struggling

to spark a recovery, the stakes are

high, a point apparently driven home

by senior US officials during talks in

In absolute terms, its NFA status

was second only to that of Japan.

The authors of the study describe

the turnaround in China’s external

dependence

unchanged.”

unveils ‘Leaf’

Economists Guonan Ma and Zhou

Haiwen argue that China’s savings

glut can in part be explained by its low

Washington last week with Chinese

Vice-Premier Wang Qishan.

US Treasury Secretary Timothy

financial situation as “puzzling,” given

its relatively low per capita income

level, US$2,500 (RM8,875), and its siz-

electric car

“youth dependency ratio,” that is, the Geithner urged China to shift its zling growth of recent years. YOKOHAMA: Nissan unveiled yesterday its first all

ratio of those below the age of 15 to the economy away from exports and to- “A faster growing economy tends to electric car, the Leaf, vowing to open a new chapter

working age population. wards domestic demand to strengthen attract more capital inflows,” the report for the troubled auto industry and take a lead over

A country’s “old-age dependency the ailing global economy. He was in noted, adding that “by conventional its bigger rivals in zero emission vehicles.

ratio,” by contrast, compares the per- essence asking the Chinese to save less wisdom China should ... be a signifi- The mid-sized hatchback, which will go on sale

centage of pensioners over 65 to the and import more. cant importer of foreign savings.” in late 2010 in Japan, the United States, and Europe,

work force. The personal research from the Ma But that is not what has happened, represents a bold bet by Nissan that hybrids are

“One striking feature of China’s and Haiwen offers insights into why the report contends, largely because merely a passing fad on the road to pure electric

demographic transition during 1985- China has funds to invest abroad and the Chinese are zealous savers rather vehicles.

2007 is that its youth dependency ratio points to a high ratio of personal sav- than consumers of foreign goods. The Leaf, described by Nissan as “the world’s

fell by half while its old-age depend- ings and a reduction of government And those savings are increas- first affordable, zero-emission car,” can travel more

ency increased only slightly, leaving borrowing as important factors. ingly being invested abroad, notably than 160km on a single charge, at a top speed of

the overall dependence unchanged,” These, they say, are driven by de- in the US, where Chinese holdings in 140kph, the company said.

the report said. mographics and enable the emerging US Treasury bonds now amount to It will “lead the way to a zero emission future,

The suggestion that demographics Chinese powerhouse to export capital more than US$800 billion (RM2.840 opening a new era in the automotive industry,”

are a hidden key to why China is able instead of importing it, and thereby trillion). chief executive Carlos Ghosn said, unveiling the

to buy assets around the world, holding defying classical economic theory. “Given China’s growing role in the car at the group’s new headquarters in Yokohama,

huge amounts of US government debt, With a relatively low percentage of global financial system, the stakes are southwest of Tokyo.

casts surprising light on an issue at the the population under 15, the Chinese high, not only for China but for the rest of “The Leaf is totally neutral to the environment:

heart of long-standing tension between government is freed from having the world,” the authors contend. – AFP there is no exhaust pipe, no gasoline-burning

engine. There is only the quiet, efficient power

provided by our own lithium-ion battery packs.”

paint thinner, have occupied the factory to ensure their survival. The price was not announced but Ghosn said it

in Pyeongtaek, 70km south of Seoul since India’s private carriers, which carry would be “very competitive.”

May 21 in protest at job cuts. about 80% of the country’s airline traffic,

briefs

Nissan plans to sell the car at a similar price to

The debt-stricken firm in February are caught in a quagmire of soaring a comparable model with a petrol-powered engine.

secured court protection from creditors losses, high debt and falling passenger Ghosn with the The battery, which will be stored under the seat

after China’s Shanghai Automotive Indus- numbers. Leaf electric and floor, will be leased separately.

try gave up management control. “We need help to stay in business,” car he unveiled “The monthly cost of the battery, plus the elec-

Court-appointed managers have since said Naresh Goyal, chairman of Jet

Talks collapse at troubled struggled to turn it around through job Airways, India’s second-largest carrier by

in Yokohama tric charge, will be less than the cost of gasoline,”

Ghosn said. - AFP

yesterday.

South Korean auto firm cuts and cost savings. market share, as the stoppage for Aug 18

EPAPIX

SEOUL: Talks aimed at ending a prolonged The programme calls for the sacking was announced late last week.

industrial dispute at South Korea’s trou- of 2,646 workers or 36% of the workforce, India’s airline sector was once vaunted

bled auto firm Ssangyong Motor collapsed in what would be the country’s first mass as a symbol of the country’s economic

yesterday as management pulled out of layoff since the onset of the global eco- vibrancy.

negotiations. nomic crisis in September. – AFP But its fortunes have nose-dived due

Managers said in a statement that to over-expansion, intense competition

three days of talks had failed due to the Loss-hit Indian airlines and expensive fuel and other costs.

union’s insistence on “unacceptable” The move to suspend flights is to

demands for no layoffs and no lawsuits plan stoppage “highlight the urgency for the govern-

over their two-month occupation of the NEW DELHI: India’s private airlines, ment to intervene immediately,” said Anil

firm’s factory. awash in red ink, say they will ground Baijal, secretary general of the Federation

Hundreds of workers, armed with their planes in an unprecedented one-day of Indian Airlines (FIA) which represents

metal pipes, slingshots and inflammable stoppage to demand the government act seven private carriers. – AFP

You might also like

- Corts Mammoth Amalan Pen Gurus AnDocument17 pagesCorts Mammoth Amalan Pen Gurus AnYiNg YaNgNo ratings yet

- Hay Group Guide Chart - Profile Method of Job EvaluationDocument27 pagesHay Group Guide Chart - Profile Method of Job EvaluationImpulsive collector78% (9)

- Hay Group Guide Chart - Profile Method of Job Evaluation - Intro & OverviewDocument4 pagesHay Group Guide Chart - Profile Method of Job Evaluation - Intro & OverviewImpulsive collector100% (1)

- Developing An Enterprise Leadership MindsetDocument36 pagesDeveloping An Enterprise Leadership MindsetImpulsive collectorNo ratings yet

- Compensation Fundamentals - Towers WatsonDocument31 pagesCompensation Fundamentals - Towers WatsonImpulsive collector80% (5)

- KL City Plan 2020Document10 pagesKL City Plan 2020Impulsive collector0% (2)

- MSSSB Customer List - RizanDocument35 pagesMSSSB Customer List - RizanmirasugardaddyNo ratings yet

- GreenPalm Off-Market Deal Instructions Including Certified Mill DetailsDocument19 pagesGreenPalm Off-Market Deal Instructions Including Certified Mill DetailsvbsreddyNo ratings yet

- Thesun 2009-07-16 Page16 Rudd Warns China Over Detained Rio SpyDocument1 pageThesun 2009-07-16 Page16 Rudd Warns China Over Detained Rio SpyImpulsive collector100% (2)

- Thesun 2009-07-28 Page17 World Stocks at 9-Mth PeakDocument1 pageThesun 2009-07-28 Page17 World Stocks at 9-Mth PeakImpulsive collector100% (2)

- Thesun 2009-10-12 Page15 High Hurdles For Imf On Road To New World OrderDocument1 pageThesun 2009-10-12 Page15 High Hurdles For Imf On Road To New World OrderImpulsive collectorNo ratings yet

- TheSun 2009-08-07 Page15 Mas Posts Record RM876m Net Profit For Q2Document1 pageTheSun 2009-08-07 Page15 Mas Posts Record RM876m Net Profit For Q2Impulsive collector100% (2)

- TheSun 2009-09-14 Page13 Lehmans Collapse An Insiders ViewDocument1 pageTheSun 2009-09-14 Page13 Lehmans Collapse An Insiders ViewImpulsive collectorNo ratings yet

- Thesun 2009-10-26 Page13 Addressing The Social Impact of The CrisisDocument1 pageThesun 2009-10-26 Page13 Addressing The Social Impact of The CrisisImpulsive collectorNo ratings yet

- Thesun 2009-07-22 Page14 The Worst Is Over For Australia Says TreasurerDocument1 pageThesun 2009-07-22 Page14 The Worst Is Over For Australia Says TreasurerImpulsive collector100% (2)

- TheSun 2009-08-10 Page15 World Pins Recovery Hopes On Rising House PricesDocument1 pageTheSun 2009-08-10 Page15 World Pins Recovery Hopes On Rising House PricesImpulsive collectorNo ratings yet

- Thesun 2009-10-09 Page16 B Braun Plans rm500m Reinvestment in PenangDocument1 pageThesun 2009-10-09 Page16 B Braun Plans rm500m Reinvestment in PenangImpulsive collectorNo ratings yet

- Thesun 2009-08-17 Page15 Britian May Tighten Laws On Bankers Pay DarlingDocument1 pageThesun 2009-08-17 Page15 Britian May Tighten Laws On Bankers Pay DarlingImpulsive collectorNo ratings yet

- Thesun 2009-08-27 Page15 Australia Approves Huge Gas Project To Supply China IndiaDocument1 pageThesun 2009-08-27 Page15 Australia Approves Huge Gas Project To Supply China IndiaImpulsive collectorNo ratings yet

- TheSun 2009-08-28 Page16 Ci Stays in Positive TerritoryDocument1 pageTheSun 2009-08-28 Page16 Ci Stays in Positive TerritoryImpulsive collectorNo ratings yet

- TheSun 2009-09-15 Page19 Energy Giants To Develop Huge Aussie Gas FieldDocument1 pageTheSun 2009-09-15 Page19 Energy Giants To Develop Huge Aussie Gas FieldImpulsive collectorNo ratings yet

- Thesun 2009-07-23 Page16 China Says It Has Evidence Rio Staff Stole State SecretsDocument1 pageThesun 2009-07-23 Page16 China Says It Has Evidence Rio Staff Stole State SecretsImpulsive collectorNo ratings yet

- Thesun 2009-05-26 Page17 Steamlife Expects Better Profit This YearDocument1 pageThesun 2009-05-26 Page17 Steamlife Expects Better Profit This YearImpulsive collectorNo ratings yet

- TheSun 2009-09-10 Page15 Genting Spore Plans Billion-Dollar Rights IssueDocument1 pageTheSun 2009-09-10 Page15 Genting Spore Plans Billion-Dollar Rights IssueImpulsive collectorNo ratings yet

- Thesun 2009-10-20 Page17 Malaysias Interest Rates at Appropriate Level ZetiDocument1 pageThesun 2009-10-20 Page17 Malaysias Interest Rates at Appropriate Level ZetiImpulsive collectorNo ratings yet

- Thesun 2009-06-04 Page13 Eas Leaders Firm Against Protectionist MeasuresDocument1 pageThesun 2009-06-04 Page13 Eas Leaders Firm Against Protectionist MeasuresImpulsive collectorNo ratings yet

- TheSun 2009-05-29 Page15 GM Talks With Europe Break Down in AngerDocument1 pageTheSun 2009-05-29 Page15 GM Talks With Europe Break Down in AngerImpulsive collectorNo ratings yet

- Thesun 2009-08-26 Page15 Market SummaryDocument1 pageThesun 2009-08-26 Page15 Market SummaryImpulsive collectorNo ratings yet

- TheSun 2009-06-25 Page17 Obama Takes First Trade Action On ChinaDocument1 pageTheSun 2009-06-25 Page17 Obama Takes First Trade Action On ChinaImpulsive collectorNo ratings yet

- Thesun 2009-06-18 Page17 Obama To Unveil Financial Supervision ReformsDocument1 pageThesun 2009-06-18 Page17 Obama To Unveil Financial Supervision ReformsImpulsive collector100% (1)

- Thesun 2009-07-17 Page13 Chinas Economy Grows 7Document1 pageThesun 2009-07-17 Page13 Chinas Economy Grows 7Impulsive collectorNo ratings yet

- TheSun 2009-06-26 Page16 Airlines Struggle As Flu Adds To Woes IataDocument1 pageTheSun 2009-06-26 Page16 Airlines Struggle As Flu Adds To Woes IataImpulsive collectorNo ratings yet

- Thesun 2009-06-09 Page17 Global Airlines To Lose Us$9b This Year Says IataDocument1 pageThesun 2009-06-09 Page17 Global Airlines To Lose Us$9b This Year Says IataImpulsive collectorNo ratings yet

- Thesun 2009-10-13 Page17 Singapore q3 Boosts Asian Recovery HopesDocument1 pageThesun 2009-10-13 Page17 Singapore q3 Boosts Asian Recovery HopesImpulsive collectorNo ratings yet

- Thesun 2009-06-02 Page15 GM Files For Bankruptcy Chrysler Sale ClearedDocument1 pageThesun 2009-06-02 Page15 GM Files For Bankruptcy Chrysler Sale ClearedImpulsive collectorNo ratings yet

- TheSun 2009-09-03 Page14 Allow Financial Institutions To Fail Says British EconomistDocument1 pageTheSun 2009-09-03 Page14 Allow Financial Institutions To Fail Says British EconomistImpulsive collectorNo ratings yet

- TheSun 2009-09-04 Page12 Prices Firmer With Interest in HeavyweightsDocument1 pageTheSun 2009-09-04 Page12 Prices Firmer With Interest in HeavyweightsImpulsive collectorNo ratings yet

- Thesun 2009-10-21 Page15 Msia Lags Rich Nations in Corporate Remuneration DisclosureDocument1 pageThesun 2009-10-21 Page15 Msia Lags Rich Nations in Corporate Remuneration DisclosureImpulsive collectorNo ratings yet

- Thesun 2009-06-17 Page15 Sports Car Maker To Take Over SaabDocument1 pageThesun 2009-06-17 Page15 Sports Car Maker To Take Over SaabImpulsive collectorNo ratings yet

- Thesun 2009-08-25 Page17 Market SummaryDocument1 pageThesun 2009-08-25 Page17 Market SummaryImpulsive collectorNo ratings yet

- Thesun 2009-09-09 Page15 Stiglitz Warns of Economic Double DipDocument1 pageThesun 2009-09-09 Page15 Stiglitz Warns of Economic Double DipImpulsive collectorNo ratings yet

- Thesun 2009-06-19 Page16 TM Expects 15pct Revenue From Wholesale BusinessDocument1 pageThesun 2009-06-19 Page16 TM Expects 15pct Revenue From Wholesale BusinessImpulsive collectorNo ratings yet

- Thesun 2009-06-03 Page15 Asean and South Korea Sign Free Trade AgreementDocument1 pageThesun 2009-06-03 Page15 Asean and South Korea Sign Free Trade AgreementImpulsive collectorNo ratings yet

- Thesun 2009-08-20 Page17 Australia Inks Massive Engery Deal With ChinaDocument1 pageThesun 2009-08-20 Page17 Australia Inks Massive Engery Deal With ChinaImpulsive collectorNo ratings yet

- TheSun 2009-11-04 Page15 Huge Shake-Up For Rbs and LloydsDocument1 pageTheSun 2009-11-04 Page15 Huge Shake-Up For Rbs and LloydsImpulsive collectorNo ratings yet

- Thesun 2009-07-15 Page15 China Stonewalling As Spy Probe Widens AustraliaDocument1 pageThesun 2009-07-15 Page15 China Stonewalling As Spy Probe Widens AustraliaImpulsive collectorNo ratings yet

- TheSun 2009-07-27 Page15 Bursa Likely To Break 1165 Resistance LevelDocument1 pageTheSun 2009-07-27 Page15 Bursa Likely To Break 1165 Resistance LevelImpulsive collector100% (2)

- Thesun 2009-06-30 Page17 Wall Street Swindler Madoff Jailed For 150 YearsDocument1 pageThesun 2009-06-30 Page17 Wall Street Swindler Madoff Jailed For 150 YearsImpulsive collectorNo ratings yet

- Thesun 2009-06-10 Page12 Regional Airlines To See Recovery As Early As 2010Document1 pageThesun 2009-06-10 Page12 Regional Airlines To See Recovery As Early As 2010Impulsive collectorNo ratings yet

- Thesun 2009-10-14 Page15 Merrill Lynch Upbeat On Asia Pacific EconomiesDocument1 pageThesun 2009-10-14 Page15 Merrill Lynch Upbeat On Asia Pacific EconomiesImpulsive collectorNo ratings yet

- TheSun 2009-07-02 Page16 No Plans For Third Stimulus Package Says NajibDocument1 pageTheSun 2009-07-02 Page16 No Plans For Third Stimulus Package Says NajibImpulsive collectorNo ratings yet

- TheSun 2009-09-11 Page15 Ipi For July Down 8.4pct Y-O-Y But Up 7.1pct From JuneDocument1 pageTheSun 2009-09-11 Page15 Ipi For July Down 8.4pct Y-O-Y But Up 7.1pct From JuneImpulsive collectorNo ratings yet

- Thesun 2009-05-22 Page15 S and P Cuts Outlook On British Economy To NegativeDocument1 pageThesun 2009-05-22 Page15 S and P Cuts Outlook On British Economy To NegativeImpulsive collectorNo ratings yet

- Thesun 2009-08-06 Page13 Lloyds Posts Huge Loss As Bad Debts SurgeDocument1 pageThesun 2009-08-06 Page13 Lloyds Posts Huge Loss As Bad Debts SurgeImpulsive collector100% (2)

- TheSun 2009-07-24 Page14 Porsche Boss Resigns VW Tie-Up Gains GroundDocument1 pageTheSun 2009-07-24 Page14 Porsche Boss Resigns VW Tie-Up Gains GroundImpulsive collector100% (2)

- Thesun 2009-06-11 Page14 Shares and Oil Surge On Recovery Hopes Dollar SlipsDocument1 pageThesun 2009-06-11 Page14 Shares and Oil Surge On Recovery Hopes Dollar SlipsImpulsive collectorNo ratings yet

- Thesun 2009-06-24 Page15 Asian Shares Dive On Global Recovery Fears Profit TakingDocument1 pageThesun 2009-06-24 Page15 Asian Shares Dive On Global Recovery Fears Profit TakingImpulsive collectorNo ratings yet

- Thesun 2009-10-15 Page14 HK Ready To Avert Property BubbleDocument1 pageThesun 2009-10-15 Page14 HK Ready To Avert Property BubbleImpulsive collectorNo ratings yet

- Amwatch: Stock Focus of The DayDocument4 pagesAmwatch: Stock Focus of The DayBrian StanleyNo ratings yet

- Thesun 2009-05-28 Page17 Chrysler Faces D-Day As GM Nears BankruptcyDocument1 pageThesun 2009-05-28 Page17 Chrysler Faces D-Day As GM Nears BankruptcyImpulsive collectorNo ratings yet

- OZL Macquarie Australia ConferenceDocument13 pagesOZL Macquarie Australia ConferenceStephen C.No ratings yet

- Thesun 2009-08-21 Page15 Australia-China Ties Full of ChallengesDocument1 pageThesun 2009-08-21 Page15 Australia-China Ties Full of ChallengesImpulsive collectorNo ratings yet

- Thesun 2009-06-16 Page17 Bursa Malaysia Offers Multi-Currency TradingDocument1 pageThesun 2009-06-16 Page17 Bursa Malaysia Offers Multi-Currency TradingImpulsive collectorNo ratings yet

- Thesun 2009-07-09 Page17 China Holds Rio Tinto Exec As Spy Iron Ore Deal Said DoneDocument1 pageThesun 2009-07-09 Page17 China Holds Rio Tinto Exec As Spy Iron Ore Deal Said DoneImpulsive collectorNo ratings yet

- Market Update 28th February 2018Document1 pageMarket Update 28th February 2018Anonymous iFZbkNwNo ratings yet

- TheSun 2009-07-30 Page15 Carlsberg Msia To Acquire Spore Ops For Rm370Document1 pageTheSun 2009-07-30 Page15 Carlsberg Msia To Acquire Spore Ops For Rm370Impulsive collector100% (2)

- Get ReportDocument8 pagesGet ReportNguyễn Trúc LâmNo ratings yet

- Modern Portfolio Management: Moving Beyond Modern Portfolio TheoryFrom EverandModern Portfolio Management: Moving Beyond Modern Portfolio TheoryNo ratings yet

- Coaching in OrganisationsDocument18 pagesCoaching in OrganisationsImpulsive collectorNo ratings yet

- Futuretrends in Leadership DevelopmentDocument36 pagesFuturetrends in Leadership DevelopmentImpulsive collector100% (1)

- Megatrends Report 2015Document56 pagesMegatrends Report 2015Cleverson TabajaraNo ratings yet

- Strategy+Business - Winter 2014Document108 pagesStrategy+Business - Winter 2014GustavoLopezGNo ratings yet

- Hay Group Guide Chart & Profile Method of Job Evaluation - An Introduction & OverviewDocument15 pagesHay Group Guide Chart & Profile Method of Job Evaluation - An Introduction & OverviewAyman ShetaNo ratings yet

- CLC Building The High Performance Workforce A Quantitative Analysis of The Effectiveness of Performance Management StrategiesDocument117 pagesCLC Building The High Performance Workforce A Quantitative Analysis of The Effectiveness of Performance Management StrategiesImpulsive collector100% (1)

- 2016 Summer Strategy+business PDFDocument116 pages2016 Summer Strategy+business PDFImpulsive collectorNo ratings yet

- Managing Conflict at Work - A Guide For Line ManagersDocument22 pagesManaging Conflict at Work - A Guide For Line ManagersRoxana VornicescuNo ratings yet

- 2015 Summer Strategy+business PDFDocument104 pages2015 Summer Strategy+business PDFImpulsive collectorNo ratings yet

- Strategy+Business Magazine 2016 AutumnDocument132 pagesStrategy+Business Magazine 2016 AutumnImpulsive collector100% (3)

- Talent Analytics and Big DataDocument28 pagesTalent Analytics and Big DataImpulsive collectorNo ratings yet

- Global Talent 2021Document21 pagesGlobal Talent 2021rsrobinsuarezNo ratings yet

- Deloitte Analytics Analytics Advantage Report 061913Document21 pagesDeloitte Analytics Analytics Advantage Report 061913Impulsive collectorNo ratings yet

- TheSun 2009-11-04 Page14 Significant Success in Islamic Finance Says PMDocument1 pageTheSun 2009-11-04 Page14 Significant Success in Islamic Finance Says PMImpulsive collectorNo ratings yet

- TheSun 2009-11-04 Page15 Huge Shake-Up For Rbs and LloydsDocument1 pageTheSun 2009-11-04 Page15 Huge Shake-Up For Rbs and LloydsImpulsive collectorNo ratings yet

- TheSun 2009-11-04 Page11 We Await Answers To Dipang TragedyDocument1 pageTheSun 2009-11-04 Page11 We Await Answers To Dipang TragedyImpulsive collectorNo ratings yet

- Name of The Company: Honda Malaysia SDN BHD Hong Bee Hardware Company SDN BHD Hong Leong Bank BHDDocument20 pagesName of The Company: Honda Malaysia SDN BHD Hong Bee Hardware Company SDN BHD Hong Leong Bank BHDNJeric Ligeralde AresNo ratings yet

- 2insolvency - 2 - Bursa MalaysiaDocument9 pages2insolvency - 2 - Bursa Malaysiabilly93No ratings yet

- List of Sub-Sectors and Counters Sub-Sector Counter AgrochemicalDocument21 pagesList of Sub-Sectors and Counters Sub-Sector Counter Agrochemicalnasstain nal arzihiNo ratings yet

- Public Mutual PDFDocument256 pagesPublic Mutual PDFDavid BockNo ratings yet

- Gaji September 2023Document30 pagesGaji September 2023SITI KHADIJAH BINTI MOHNINo ratings yet

- The Edge Magazine - 20160519Document33 pagesThe Edge Magazine - 20160519kflimNo ratings yet

- TNB Ppu Gold Coast Siteplan - 01 (Endorsed)Document1 pageTNB Ppu Gold Coast Siteplan - 01 (Endorsed)Aizuddin RosliNo ratings yet

- Listed Company Annual Report 2010Document66 pagesListed Company Annual Report 2010Ana MuslimahNo ratings yet

- Petronas Training FilialeDocument1 pagePetronas Training FilialeMeetzy OfficielNo ratings yet

- Rules On Bursa Malaysia Securities BerhadDocument193 pagesRules On Bursa Malaysia Securities BerhadSeo Soon YiNo ratings yet

- FDsetia 20150923pj8xfnDocument41 pagesFDsetia 20150923pj8xfnJames WarrenNo ratings yet

- Broadband FebDocument33 pagesBroadband FebSANTAASREE A/P KUMARAVEEL MoeNo ratings yet

- List of CompanyDocument8 pagesList of CompanyFaiznaim Jaafar100% (1)

- Bank Swift CodeDocument6 pagesBank Swift CodeYew HongNo ratings yet

- Revised Chapter 2Document44 pagesRevised Chapter 2kellydaNo ratings yet

- Internal Audit in The States and Local Government of MalaysiaDocument33 pagesInternal Audit in The States and Local Government of MalaysiaUmmu ZubairNo ratings yet

- Rekod Nama Pegawai (Ladang) (150911)Document92 pagesRekod Nama Pegawai (Ladang) (150911)Operation LNVNo ratings yet

- Malaysia Truly AsiaDocument4 pagesMalaysia Truly AsiaDiv KabraNo ratings yet

- Traceability Summary - Supplies July 2019 - June 2020: PGEO Edible Oils SDN BHD, Pasir GudangDocument5 pagesTraceability Summary - Supplies July 2019 - June 2020: PGEO Edible Oils SDN BHD, Pasir GudangAdri Ayah BaimNo ratings yet

- (S) (S) (S) (S) (S) (S) (S) : Consumer ProductsDocument21 pages(S) (S) (S) (S) (S) (S) (S) : Consumer ProductsPeach PeaceNo ratings yet

- Attachment 6166 1250736042Document64 pagesAttachment 6166 1250736042SarengatSSNo ratings yet

- LISTING Projek Petroleum and OilDocument33 pagesLISTING Projek Petroleum and Oilsyaz inaNo ratings yet

- List of Local BanksDocument1 pageList of Local BanksNabilah RozzaniNo ratings yet

- Manpower GPS Klang Terminal - HQCDocument21 pagesManpower GPS Klang Terminal - HQCPark Jie AnmNo ratings yet

- Company Background: Stable of Funds IncludeDocument27 pagesCompany Background: Stable of Funds IncludeHakim IshakNo ratings yet

- Reporte Corporativo de Louis Dreyfus Company (LDC)Document21 pagesReporte Corporativo de Louis Dreyfus Company (LDC)OjoPúblico Periodismo de InvestigaciónNo ratings yet

- Lampiran A - Emk Fasa 1 2015 (Agihan Kedua)Document759 pagesLampiran A - Emk Fasa 1 2015 (Agihan Kedua)you chinhuaNo ratings yet