Professional Documents

Culture Documents

GBC 2

GBC 2

Uploaded by

vikcool812Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

GBC 2

GBC 2

Uploaded by

vikcool812Copyright:

Available Formats

cannonballs. Southwest bought Muse Air in the early 1980s, a big move outside its proven model; it failed.

Intel made an uncalibrated bet in the 1990s to push the personal computer industry to a new memory technology from RAMBUS; it failed. But in the rare instances in which the 10X cases fired uncalibrated cannonballs, they quickly learned from their mistakes and returned to a bullets-then-cannonballs approach.31 For most of its history, Progressive Insurance lived by an explicit guideline to prevent uncalibrated cannonballs: limit any new business to 5 percent of total corporate revenues until fine-tuned for sustained profitability. Progressive broke this rule in the mid-1980s when it moved into selling insurance to trucking companies and transitbus systems, jumping from zero to $61 million in net premiums written (almost 8 percent of total Progressive premiums) in less than two years. It multiplied the trucking-insurance staff nearly ten times in a single yeardespite an underwriting loss of 23 percentand then nearly tripled premiums again the next year. We thought the market was just bad drivers with bigger cars, said a Progressive executive. But the business turned out to be very different; trucking companies had much greater power to negotiate prices than individual drivers, and they had armies of sophisticated lawyers to battle claims disputes. A financial disaster, said Lewis of the $84 million loss that followed. Im ashamed for how we got into that position, he admitted. Then he pointed in the mirror to apportion blame: I truly am responsible for that.32 Even 10Xers make mistakes, even sometimes the big mistake of firing an uncalibrated cannonball. But they view mistakes as expensive tuition: better get something out of it, learn everything you can, apply the learning, and dont repeat. Whereas comparison cases often try to recover from the calamity of firing an uncalibrated cannonball by firing yet another uncalibrated cannonball, 10Xers recover by returning to the discipline of firing cannonballs only when they have empirical validation. Progressive vowed never to make the uncalibrated-cannonball mistake again and subsequently applied the lesson in its move into standard insurance. Progressive had built its success primarily upon non-standard insurance, selling to high-risk drivers shunned by traditional insurers. Should Progressive move into standard insurance, selling to the broad spectrum of drivers? Progressive executives didnt know, but they knew how to find out: fire bullets.33 In 1991, Progressive crafted experiments in a handful of states it knew well, such as Texas and Florida. Two years later, it continued firing bullets, testing standard insurance in more states. Bullet, bullet, bulleteach one showed results, each one validated the concept. Then in 1994, with empirical validationweve proven we can do this!Progressive concentrated a whole bunch of gunpowder, firing a cannonball, committing fully to standard insurance. By the end of 1996, Progressive offered standard insurance in all 43 states where it operated. Within five years, standard insurance accounted for nearly half of Progressives overall business, eventually catapulting it to the #4 spot overall in the American auto-insurance industry by 2002.34 In an interesting contrast to both the uncalibrated trucking cannonball and the calibrated standardauto-insurance cannonball, Progressive decided not to fire a cannonball on homeowners insurance. At first glance, the idea of selling homeowners insurance made sense. After all, why not enable customers to bundle together car and home insurance? We can envision reams of analysis demonstrating the synergies and strategic rationale for such a move, perhaps even making the case for a giant acquisition. But Progressive had learned: you can only know if something will actually work if you gain empirical validation, no matter how many slide decks support the idea. So, Progressive turned again to bullets, just like the move into standard auto insurance, testing in a handful of states. However, unlike the bullets fired into standard auto insurance, the homeowners-insurance bullets hit nothing, and Progressive pulled the plug.35 Progressives three strategic decisionstrucking insurance (uncalibrated cannonball), standard auto insurance (calibrated cannonball), and homeowners insurance (bullets followed by the decision not to fire a cannonball)all underscore one very big lesson. In the face of instability, uncertainty, and rapid change, relying upon pure analysis will likely not work, and just might get you killed. Analytic skills still matter, but empirical validation matters much more. And thats the underlying principle: empirical validation. Be creative, but validate your creative ideas with empirical experience. You dont even need to be the one to fire all the bullets; you can learn from the empirical experience of others. Southwest Airlines became one of the most successful startup companies of all time by betting on an empirically validated model that it copied from PSA. Roald Amundsen built his strategy on proven techniques, such as the use of dogs and sleds, thatd been honed for centuries by Eskimos. (Robert Falcon Scott, in contrast, bet big on his

newfangled motor sledges, which had never been fully tested in the most extreme polar conditions.) More important than being first or the most creative is figuring out what works in practice, doing it better than anyone else, and then making the very most of it with a 20 Mile March.36 Collins, Jim; Hansen, Morten T.. Great by Choice (Kindle Locations 1514-1565). HarperBusiness.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Aboitiz Power CorporationDocument10 pagesAboitiz Power CorporationrobertNo ratings yet

- BA Finance Domain - Interview QuestionsDocument6 pagesBA Finance Domain - Interview QuestionsBharti Penumarthy50% (2)

- The Silver Bullet and The Silver ShieldDocument24 pagesThe Silver Bullet and The Silver ShieldSid100% (1)

- ICDR Regulations For SMEsDocument4 pagesICDR Regulations For SMEsShubham MundraNo ratings yet

- Business Combinations Chapter 3 Reverse AcquisitionDocument24 pagesBusiness Combinations Chapter 3 Reverse AcquisitionGia Sarah Barillo BandolaNo ratings yet

- Fundamentals of Accounting, Business and Management 2Document86 pagesFundamentals of Accounting, Business and Management 2Derek Jason DomanilloNo ratings yet

- Republic Act No. 3765: Declaration of PolicyDocument3 pagesRepublic Act No. 3765: Declaration of Policyjeffprox69No ratings yet

- Charles Ngo Reading ListDocument2 pagesCharles Ngo Reading ListCarlos Chizzini MeloNo ratings yet

- SL AllDocument10 pagesSL AllyogeshsannapuriNo ratings yet

- Reserve Bank of IndiaDocument21 pagesReserve Bank of IndiaAcchu BajajNo ratings yet

- INTEREST - Exception To Medel Case Jocelyn M. Toledo vs. Marilou M. HydenDocument2 pagesINTEREST - Exception To Medel Case Jocelyn M. Toledo vs. Marilou M. HydenBenjie PangosfianNo ratings yet

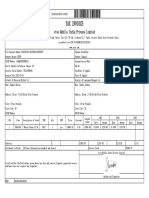

- Tax Invoice: Vivo Mobile India Private LimitedDocument1 pageTax Invoice: Vivo Mobile India Private LimitedRaghav SharmaNo ratings yet

- Profile of SQUARE PHARMACEUTICALS LTD by Biplob - BSP UIUDocument10 pagesProfile of SQUARE PHARMACEUTICALS LTD by Biplob - BSP UIUBiplob Sarkar100% (2)

- Katowice Banks 2020 Credit Portfolio AlignmentDocument52 pagesKatowice Banks 2020 Credit Portfolio AlignmentComunicarSe-Archivo100% (1)

- GAAP vs. IFRS What's The DifferenceDocument1 pageGAAP vs. IFRS What's The DifferenceHafisMohammedSahibNo ratings yet

- US Internal Revenue Service: 2006p1212 Sect I-IiiDocument173 pagesUS Internal Revenue Service: 2006p1212 Sect I-IiiIRSNo ratings yet

- Audit of Other Items of Statement of Financial PositionDocument13 pagesAudit of Other Items of Statement of Financial PositionArlyn Pearl PradoNo ratings yet

- Tax Invoice: (See Rule 5 Under Tax Invoice, Credit and Debit Note Rules)Document5 pagesTax Invoice: (See Rule 5 Under Tax Invoice, Credit and Debit Note Rules)Bharat DafalNo ratings yet

- Tokyo, Japan (April 11, 2014) - As Announced in A Release Dated April 7, 2014, Pursuant To ADocument9 pagesTokyo, Japan (April 11, 2014) - As Announced in A Release Dated April 7, 2014, Pursuant To AnarayanasamNo ratings yet

- 6905 12135 1 PBDocument29 pages6905 12135 1 PBpakgikNo ratings yet

- Chapter 1: The Meaning and Objectives of Managerial AccountingDocument12 pagesChapter 1: The Meaning and Objectives of Managerial AccountingNgan Tran Nguyen ThuyNo ratings yet

- Kaizen MF VCF Updates 09 09Document62 pagesKaizen MF VCF Updates 09 09Sanjay KumarNo ratings yet

- The Adaptive Markets Hypothesis: Market Efficiency From An Evolutionary PerspectiveDocument33 pagesThe Adaptive Markets Hypothesis: Market Efficiency From An Evolutionary PerspectiveMark JonhstonNo ratings yet

- EnergDocument45 pagesEnergmelvingodricarceNo ratings yet

- Tamil Nadu Open University Guindy, Chennai - 600 025: P.G. / PG DiplomaDocument12 pagesTamil Nadu Open University Guindy, Chennai - 600 025: P.G. / PG DiplomaMukesh BishtNo ratings yet

- Feizi 2016 The Impact of The Financial Distress On Tax Avoidance in Listed FirmsDocument10 pagesFeizi 2016 The Impact of The Financial Distress On Tax Avoidance in Listed Firmsgiorgos1978No ratings yet

- Chapter 1 - An Overview of Financial ManagementDocument18 pagesChapter 1 - An Overview of Financial ManagementYzah CariagaNo ratings yet

- Unilever Business Valuation - UCSDDocument11 pagesUnilever Business Valuation - UCSDsloesp100% (1)

- Aditya Project Work 2Document42 pagesAditya Project Work 2aditya mayukh100% (1)