Professional Documents

Culture Documents

FInancial Performance of HUL

FInancial Performance of HUL

Uploaded by

prasanthi13Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FInancial Performance of HUL

FInancial Performance of HUL

Uploaded by

prasanthi13Copyright:

Available Formats

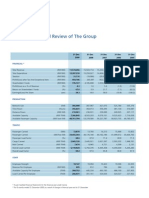

FINANCIAL

PERFORMANCE

10 YEAR RECORD

STANDALONE

Statement of Profit & Loss

Gross Sales*

Other Income

Interest

Profit Before Taxation @

Profit After Taxation @

Earnings Per Share of Re. 1

Dividend Per Share of Re. 1

Rs. crores

2003

2004

2005

11,096.02 10,888.38

459.83

318.83

(66.76) (129.98)

2,244.95 1,505.32

1,804.34 1,199.28

8.05

5.44

5.50

5.00

11,975.53

304.79

(19.19)

1,604.47

1,354.51

6.40

5.00

2006

2007

13,035.06 14,715.10

354.51

431.53

(10.73)

(25.50)

1,861.68 2,146.33

1,539.67 1,743.12

8.41

8.73

6.00

9.00#

2008-09

2009-10 2010-11 ^ 2011-12 ^ 2012-13 ^

(15months)

21,649.51 18,220.27 20,285.44 22,800.32 26,679.76

589.72

349.64

627.38

659.08 1,210.73

(25.32)

(6.98)

(0.24)

(1.24)

(25.15)

3,025.12 2,707.07 2,730.20

3,350.16 4,349.48

2,500.71 2,102.68 2,153.25

2,599.23 3,314.35

11.46

10.10

10.58

12.46

17.56

7.50

6.50

6.50

7.50

18.50#

* Sales before Excise Duty Charge @ Before Exceptional/Extraordinary items ^ 2010-11 2011-12 and 2012-13 based on Revised Schedule VI

2007

Includes Special Dividend

2003

2004

2005

Fixed Assets

Investments

Net Deferred Tax

Net Assets

(Current and Non-current)

1,369.47

2,574.93

267.44

(368.81)

1,517.56

2,229.56

226.00

(409.30)

1,483.53

2,014.20

220.14

(1,355.31)

Share Capital

Reserves & Surplus

Loan Funds

3,843.03

220.12

1,918.60

1,704.31

3,843.03

3,563.82

220.12

1,872.59

1,471.11

3,563.82

2,362.56

220.12

2,085.50

56.94

2,362.56

2,796.09

220.68

2,502.81

72.60

2,796.09

1,527.76

217.74

1,221.49

88.53

1,527.76

2,483.45

217.99

1,843.52

421.94

2,483.45

2,583.52

218.17

2,365.35

2,583.52

2,659.52

215.95

2,443.57

2,659.52

3,512.93

216.15

3,296.78

3,512.93

2,674.02

2008-09

(15months)

49

29

19

3

2009-10

2010-11

2011-12

2012-13

48

30

20

2

46

32

20

2

48

31

19

2

49

31

18

2

2008-09

(15months)

13.1

8.3*

11.6

107.5*

103.6*

2154

2009-10

2010-11

2011-12

2012-13

14.1

7.5

11.5

103.8

88.2

1791

12.1

8.3

10.6

87.5

74.0

1750

13.5

9.6

11.4

96.8

77.7

2250

14.1

10.6

12.4

109.1

94.7

2926

2009-10

2010-11

2011-12

2012-13

238.70

284.60

409.90

466.10

52,077

3,704

61,459

3,953

88,600

4,839

100,793

6,365

Balance Sheet

2006

1,511.01 1,708.14

2,413.93 1,440.80

224.55

212.39

(1,353.40) (1,833.57)

2008-09

2009-10 2010-11^

(15months)

2,078.84 2,436.07 2,457.86

332.62 1,264.08 1,260.67

254.83

248.82

209.66

(182.84) (1,365.45) (1,268.67)

2011-12^ 2012-13^

2,362.92 2,508.54

2,438.21 2,330.66

214.24

204.78

(1,502.44) (2,369.96)

2,674.02

216.25

2,457.77

^ 2010-11, 2011-12 and 2012-13 based on Revised Schedule VI

2003

2004

2005

2006

2007

44

24

26

6

45

26

24

5

45

28

22

5

47

29

20

4

47

29

21

3

Key Ratios and EVA

2003

2004

2005

2006

2007

EBIT as % of Sales

Fixed asset Turnover (No. of times)

PAT / Sales (%)

Return on Capital Employed (%)

Return on Networth (%)

Economic Value Added (EVA)

(Rs. crores)

18.4

8.1

16.3

60.2

82.8

1429

13.4

7.2

11.0

45.9

57.2

886

12.3

8.1

11.3

68.7

61.1

1014

13.1

8.6

11.8

67.0

68.1

1126

13.1

8.6

11.8

78.0

80.1

1314

2003

2004

2005

2006

2007

204.70

143.50

197.25

216.55

2008-09

(15months)

213.90

237.50

45,059

2,999

31,587

2,674

43,419

2,638

47,788

2,813

46,575

3,133

Segment-Wise Sales (%)

Soaps and Detergents

Personal Products

Beverages and Packaged Foods

Others

* Shown on annualised basis

Others

HUL Share Price on BSE

(Rs. Per Share of Re. 1)*

Market Capitalisation (Rs. crores)

Contribution to Exchequer

(Rs. crores)

51,770

4,429

* Based on year-end closing prices quoted in the Bombay Stock Exchange.

Financial Performance

Hindustan Unilever Limited

OVERVIEW

REPORTS

FINANCIAL STATEMENTS

SHAREHOLDER INFORMATION

PERFORMANCE

TRENDS

GROSS SALES (Rs. crores)

PROFIT AFTER TAX (Rs. crores)

27500

3500

25000

20000

8.0

1000

CONTRIBUTION TO EXCHEQUER

(Rs. crores)

12.0

6000

10.0

4000

50

30

2012-13

2011-12

2010-11

2009-10

*2008-09

2007

2006

2005

2.0

2004

1000

2003

2012-13

2011-12

2010-11

2009-10

*2008-09

2007

2006

2005

2004

2003

10

2012-13

2011-12

2010-11

2009-10

4.0

2000

20

*2008-09

6.0

3000

40

2007

8.0

2012-13

60

2011-12

70

5000

2010-11

80

7000

2009-10

90

2008-09

100

FIXED ASSETS TURNOVER

(No. of times)

2007

SEGMENT WISE SALES (%)

2006

2012-13

2011-12

2010-11

2009-10

*2008-09

2007

2006

2005

2004

2003

2012-13

2011-12

2010-11

2009-10

*2008-09

2007

2006

2005

2004

2003

2005

4.0

500

2500

2006

5000

2004

7500

2005

1500

10000

2003

12500

12.0

2004

2000

2003

15000

16.0

2500

17500

20.0

3000

22500

EBIT (% of Sales)

Soaps and Detergents Personal Products

Beverages and Packaged Foods Others

EARNINGS AND DIVIDEND PER SHARE

(Rs. )

14.00

12.00

4.00

Annual Report 2012-13

2012-13

#

2011-12

2010-11

2009-10

*2008-09

2007

#

2006

2005

2004

2003

2012-13

2011-12

2010-11

2009-10

*2008-09

2007

2006

2005

2004

2003

Earnings per share Dividend per share

* Figures are for 15 months period # Includes Special Dividend

100

20,000

2.00

0

150

50

2012-13

400

200

40,000

6.00

800

250

300

2011-12

8.00

60,000

2010-11

1200

350

2009-10

10.00

400

80,000

2008-09

1600

450

2007

2000

500

100,000

16.00

2400

120,000

2006

2800

18.00

2005

20.00

2004

3200

MARKET CAPITALISATION

& HUL SHARE PRICE

2003

ECONOMIC VALUE ADDED (EVA)

(Rs. crores)

Market capitalisation (Rs. in crores) HUL share price (Rs.)

Based on year-end closing prices quoted in the Bombay

Stock Exchange.

Performance Trends

You might also like

- Ad Copy That SellsDocument58 pagesAd Copy That SellsMonica Istrate100% (21)

- Slate Finance Overview 3.0.2Document20 pagesSlate Finance Overview 3.0.2Jesse Barrett-MillsNo ratings yet

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- Intermediate Financial Accounting Study NotesDocument23 pagesIntermediate Financial Accounting Study NotesSayTing ToonNo ratings yet

- Equity ValuationDocument46 pagesEquity ValuationShayne Simora100% (3)

- Financial Performance: 10 Year RecordDocument1 pageFinancial Performance: 10 Year RecordnitishNo ratings yet

- Financial Performance: 10 Year Track RecordDocument2 pagesFinancial Performance: 10 Year Track RecordSheikh HasanNo ratings yet

- Growing Sustainably: Hindustan Unilever LimitedDocument164 pagesGrowing Sustainably: Hindustan Unilever LimitedFarid PatcaNo ratings yet

- JK Tyres & Industries LTD: Lower Sales Hinder Performance, Maintain BUYDocument4 pagesJK Tyres & Industries LTD: Lower Sales Hinder Performance, Maintain BUYDeepa GuptaNo ratings yet

- 4Q 2006Document2 pages4Q 2006doansiscusNo ratings yet

- First Global: Canara BankDocument14 pagesFirst Global: Canara BankAnkita GaubaNo ratings yet

- Financial Highlights 2010Document2 pagesFinancial Highlights 2010adityahrcNo ratings yet

- Maruti Suzuki, 1Q FY 2014Document16 pagesMaruti Suzuki, 1Q FY 2014Angel BrokingNo ratings yet

- KSL - Ushdev International Limited (IC) - 25 Jan 2013Document12 pagesKSL - Ushdev International Limited (IC) - 25 Jan 2013Rajesh KatareNo ratings yet

- Cairn India - 2QFY15 - HDFC SecDocument7 pagesCairn India - 2QFY15 - HDFC Secsatish_xpNo ratings yet

- Six Yrs Per OGDCLDocument2 pagesSix Yrs Per OGDCLMAk KhanNo ratings yet

- Progress Report June 2011Document21 pagesProgress Report June 2011Lasantha DadallageNo ratings yet

- Faysal Bank Spread Accounts 2012Document133 pagesFaysal Bank Spread Accounts 2012waqas_haider_1No ratings yet

- Earth: Current Previous Close 2013 TP Exp Return Support Resistance CGR 2012 N/RDocument4 pagesEarth: Current Previous Close 2013 TP Exp Return Support Resistance CGR 2012 N/RCamarada RojoNo ratings yet

- Maruti Suzuki: Performance HighlightsDocument13 pagesMaruti Suzuki: Performance HighlightsAngel BrokingNo ratings yet

- FFC Financials2008Document10 pagesFFC Financials2008Sonia AgarwalNo ratings yet

- Growth Rates (%) % To Net Sales % To Net SalesDocument21 pagesGrowth Rates (%) % To Net Sales % To Net Salesavinashtiwari201745No ratings yet

- Home Depot in The New MillenniumDocument11 pagesHome Depot in The New MillenniumagnarNo ratings yet

- GAIL 2QF12 Result ReviewDocument6 pagesGAIL 2QF12 Result ReviewdikshitmittalNo ratings yet

- Oil & Gas: Crude, Cairn and Psus - Heady CocktailDocument9 pagesOil & Gas: Crude, Cairn and Psus - Heady Cocktaildiptendrasarkar9062No ratings yet

- Indian Oil Corporation LTD: Key Financial IndicatorsDocument4 pagesIndian Oil Corporation LTD: Key Financial IndicatorsBrinda PriyadarshiniNo ratings yet

- Assignments Semester IDocument13 pagesAssignments Semester Idriger43No ratings yet

- Attock Oil RefineryDocument2 pagesAttock Oil RefineryOvais HussainNo ratings yet

- KPMG Budget BriefDocument52 pagesKPMG Budget BriefAsad HasnainNo ratings yet

- Sui Southern Gas Company Limited: Analysis of Financial Statements Financial Year 2004 - 2001 Q Financial Year 2010Document17 pagesSui Southern Gas Company Limited: Analysis of Financial Statements Financial Year 2004 - 2001 Q Financial Year 2010mumairmalikNo ratings yet

- Punj Lloyd Q4FY11 Result UpdateDocument5 pagesPunj Lloyd Q4FY11 Result UpdateAakash AroraNo ratings yet

- MSSL Results Quarter Ended 31st December 2011Document4 pagesMSSL Results Quarter Ended 31st December 2011kpatil.kp3750No ratings yet

- 06 Financial HighlightsDocument1 page06 Financial HighlightsKhaira UmmatienNo ratings yet

- CP All Public Company Limited: 1Q08: Presentation ResultsDocument28 pagesCP All Public Company Limited: 1Q08: Presentation ResultsJakkapong TachawongsuwonNo ratings yet

- Sbi Analyst PPT Fy16Document49 pagesSbi Analyst PPT Fy16tamirisaarNo ratings yet

- Accounts AssignmentDocument7 pagesAccounts AssignmentHari PrasaadhNo ratings yet

- Six Years at A Glance: Chairman's Review Financial Analysis Financial Statements Annual General Meeting GovernanceDocument5 pagesSix Years at A Glance: Chairman's Review Financial Analysis Financial Statements Annual General Meeting GovernanceraviaxgNo ratings yet

- 0 DividendDocument1 page0 DividendmbrechlinNo ratings yet

- 6 - Zee Entertainment Enterprises 2QF15Document7 pages6 - Zee Entertainment Enterprises 2QF15girishrajsNo ratings yet

- Financial Statements For Indian Overseas Bank (8789430) Annual Income Statement of IobDocument20 pagesFinancial Statements For Indian Overseas Bank (8789430) Annual Income Statement of Iob10pec002No ratings yet

- Session 1 2021 SharedDocument44 pagesSession 1 2021 SharedPuneet MeenaNo ratings yet

- BGR Energy Systems LTD: Revenue Below Estimates Multiple Hurdles For Growth, Downgrade To REDUCEDocument5 pagesBGR Energy Systems LTD: Revenue Below Estimates Multiple Hurdles For Growth, Downgrade To REDUCEmittleNo ratings yet

- Hindustan Oil Exploration Company Limited CMP Rs. 127: 1QFY12 Results ReviewDocument4 pagesHindustan Oil Exploration Company Limited CMP Rs. 127: 1QFY12 Results ReviewsharadNo ratings yet

- Bakrie Sumatra Plantations 2012 Annual ReportDocument330 pagesBakrie Sumatra Plantations 2012 Annual ReportAntEsillorNo ratings yet

- Maruti Suzuki Result UpdatedDocument11 pagesMaruti Suzuki Result UpdatedAngel BrokingNo ratings yet

- Bank of Baroda: Q4FY11 - Core Numbers On Track CMPDocument5 pagesBank of Baroda: Q4FY11 - Core Numbers On Track CMPAnkita GaubaNo ratings yet

- Summit Bank Annual Report 2012Document200 pagesSummit Bank Annual Report 2012AAqsam0% (1)

- Ho Bee - Kim EngDocument8 pagesHo Bee - Kim EngTheng RogerNo ratings yet

- PagesDocument17 pagesPagesmarlynrich3652No ratings yet

- ITC Ten Years at GlanceDocument1 pageITC Ten Years at Glancevicky_maddy248_86738No ratings yet

- 2006 To 2008 Blance SheetDocument4 pages2006 To 2008 Blance SheetSidra IrshadNo ratings yet

- FMT Tafi Federal LATESTDocument62 pagesFMT Tafi Federal LATESTsyamputra razaliNo ratings yet

- Bharti Airtel: Concerns Due To Currency VolatilityDocument7 pagesBharti Airtel: Concerns Due To Currency VolatilityAngel BrokingNo ratings yet

- 5 YearsDocument1 page5 YearsTangie LeeNo ratings yet

- Key Economic Indicators of Pakistan'S EconomyDocument3 pagesKey Economic Indicators of Pakistan'S Economyvipdik13No ratings yet

- Tcl Multimedia Technology Holdings Limited TCL 多 媒 體 科 技 控 股 有 限 公 司Document18 pagesTcl Multimedia Technology Holdings Limited TCL 多 媒 體 科 技 控 股 有 限 公 司Cipar ClauNo ratings yet

- Meraih Kinerja Pengelolaan Hutan Lestari Kelas Dunia: Achieving World Class Performance in Sustainable Forest ManagementDocument32 pagesMeraih Kinerja Pengelolaan Hutan Lestari Kelas Dunia: Achieving World Class Performance in Sustainable Forest ManagementDody Heriawan PriatmokoNo ratings yet

- Alok Result 30 Sept 2011Document24 pagesAlok Result 30 Sept 2011Mohnish KatreNo ratings yet

- Balance Sheet: As at June 30,2011Document108 pagesBalance Sheet: As at June 30,2011Asfandyar NazirNo ratings yet

- OSIMDocument6 pagesOSIMKhin QianNo ratings yet

- Prime Focus - Q4FY12 - Result Update - Centrum 09062012Document4 pagesPrime Focus - Q4FY12 - Result Update - Centrum 09062012Varsha BangNo ratings yet

- PepsiCo's Quaker BidDocument54 pagesPepsiCo's Quaker Bidarjrocks23550% (2)

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosFrom EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosNo ratings yet

- Fats & Oils Refining & Blending World Summary: Market Values & Financials by CountryFrom EverandFats & Oils Refining & Blending World Summary: Market Values & Financials by CountryNo ratings yet

- CRISIL Research Ier Report Fortis HealthcareDocument28 pagesCRISIL Research Ier Report Fortis HealthcareSai SantoshNo ratings yet

- Relationships Among Inflation, Interest Rates, and Exchange RatesDocument2 pagesRelationships Among Inflation, Interest Rates, and Exchange RatesPradip KadelNo ratings yet

- StudentDocument33 pagesStudentKevin Che100% (2)

- S I O S T: Ukkur Nstitute F Cience EchnologyDocument11 pagesS I O S T: Ukkur Nstitute F Cience EchnologyMuhammad ShahidNo ratings yet

- Thesis Budgeting and Performance PDFDocument189 pagesThesis Budgeting and Performance PDFHA CskNo ratings yet

- ProvisionDocument6 pagesProvisionsayedrushdiNo ratings yet

- Adil ProfileDocument2 pagesAdil ProfileAnonymous oVIAFmiNo ratings yet

- Bisnis InternasionalDocument10 pagesBisnis InternasionalFAS ANo ratings yet

- Financial Forecasting, Planning, and BudgetingDocument38 pagesFinancial Forecasting, Planning, and BudgetingjawadzaheerNo ratings yet

- Practical AccountingDocument13 pagesPractical AccountingDecereen Pineda RodriguezaNo ratings yet

- Augat v. AegisDocument9 pagesAugat v. AegisgesmerNo ratings yet

- Statement of Changes in EquityDocument3 pagesStatement of Changes in EquitybarrylucasNo ratings yet

- Microsoft Word - Choice of Superannuation Fund Form - HESTADocument2 pagesMicrosoft Word - Choice of Superannuation Fund Form - HESTAYhr YhNo ratings yet

- Capital BudgetingmbaeserveDocument30 pagesCapital BudgetingmbaeserveDavneet ChopraNo ratings yet

- EY M&A MaturityDocument16 pagesEY M&A MaturityppiravomNo ratings yet

- Crystal Meadows of TahoeDocument8 pagesCrystal Meadows of TahoePrashuk Sethi100% (1)

- PartnershipDocument9 pagesPartnershipGrace A. ManaloNo ratings yet

- Mba Mco101 Unit 5Document15 pagesMba Mco101 Unit 5Sam GosaNo ratings yet

- The Strategy of International BusinessDocument9 pagesThe Strategy of International BusinessEfra SndovalNo ratings yet

- EEE Final ReportDocument32 pagesEEE Final ReportZen AlkaffNo ratings yet

- CAIIB QuestionsDocument11 pagesCAIIB QuestionsSupratik PandeyNo ratings yet

- RBI FAQ of FDI in IndiaDocument53 pagesRBI FAQ of FDI in Indiaaironderon1No ratings yet

- Accounting Standard (As-1) : Disclosure of Accounting PolicyDocument4 pagesAccounting Standard (As-1) : Disclosure of Accounting PolicyrockyrrNo ratings yet

- Aea Training Centre: 1 Floor, Devi House 2, Dr. A Perdreau Street, Port Louis, 2080272Document3 pagesAea Training Centre: 1 Floor, Devi House 2, Dr. A Perdreau Street, Port Louis, 2080272Hasan Ali BokhariNo ratings yet

- All Subjects PicpaDocument16 pagesAll Subjects PicpaMJ YaconNo ratings yet

- 060.JUDGE B From Ready Search (ASIC Broker)Document71 pages060.JUDGE B From Ready Search (ASIC Broker)Flinders TrusteesNo ratings yet