Professional Documents

Culture Documents

The French Economy Exits Recession But Remains Fragile: Economic Research

The French Economy Exits Recession But Remains Fragile: Economic Research

Uploaded by

api-227433089Copyright:

Available Formats

You might also like

- PayslipDocument1 pagePayslipAshish Agarwal67% (3)

- #3 Financial Accounting and Reporting Test BankDocument32 pages#3 Financial Accounting and Reporting Test BankPatOcampo100% (5)

- 2014.10.31 Commerzbank - Week in FocusDocument18 pages2014.10.31 Commerzbank - Week in FocusAnonymous uiD5GJBgNo ratings yet

- France PestelDocument4 pagesFrance PestelJenab Pathan94% (16)

- Carlos Superdrug Corporation vs. DSWD, Et Al., Test of Police PowerDocument2 pagesCarlos Superdrug Corporation vs. DSWD, Et Al., Test of Police PowerRoward100% (1)

- BSBFIM601 Manage Finances: Learner WorkbookDocument71 pagesBSBFIM601 Manage Finances: Learner WorkbookGurjinder Hanjra0% (1)

- Business Management - AssignmentDocument8 pagesBusiness Management - AssignmentHeavenlyPlanetEarth100% (6)

- Europe Is Moving From Subzero To Subpar Growth: Economic ResearchDocument11 pagesEurope Is Moving From Subzero To Subpar Growth: Economic Researchapi-227433089No ratings yet

- The Economy of FranceDocument18 pagesThe Economy of Francejames killerNo ratings yet

- These Green Shoots Will Need A Lot of Watering: Economic ResearchDocument10 pagesThese Green Shoots Will Need A Lot of Watering: Economic Researchapi-231665846No ratings yet

- Portugal Economy ReportDocument17 pagesPortugal Economy Reportsouravsingh1987No ratings yet

- Has Austerity Failed in EuropeDocument3 pagesHas Austerity Failed in EuropeAndreea WeissNo ratings yet

- Indicators For GERMANY: France Ational Tatistical ATADocument25 pagesIndicators For GERMANY: France Ational Tatistical ATASatNam SiNgh TethiNo ratings yet

- Rising Domestic Demand and Net Exports Underpin German GrowthDocument15 pagesRising Domestic Demand and Net Exports Underpin German Growthapi-228714775No ratings yet

- French Macroeconomic, Insolvency Update - 011013Document3 pagesFrench Macroeconomic, Insolvency Update - 011013megachameleon1989No ratings yet

- EcoNote18 Solde Courant de La France enDocument8 pagesEcoNote18 Solde Courant de La France enPracheth ReddyNo ratings yet

- CEPS Greek MultipliersDocument5 pagesCEPS Greek MultipliersDimitris YannopoulosNo ratings yet

- MACRO ASSIGNMENT ABAS HASSAN ALI Mid Ka Saxda AhDocument14 pagesMACRO ASSIGNMENT ABAS HASSAN ALI Mid Ka Saxda AhCabaas XasanNo ratings yet

- Macroeconomic Analysis Of: France As An Investment OpportunityDocument51 pagesMacroeconomic Analysis Of: France As An Investment OpportunityJeso P. JamesNo ratings yet

- Italy Equities GarthwaiteDocument23 pagesItaly Equities GarthwaiteRichard WoolhouseNo ratings yet

- S&P Credit Research - Europe's Growth As Good As It Gets 2010 08 31Document6 pagesS&P Credit Research - Europe's Growth As Good As It Gets 2010 08 31thebigpicturecoilNo ratings yet

- Levi Institute Greece Analysis 2016Document13 pagesLevi Institute Greece Analysis 2016Chatzianagnostou GeorgeNo ratings yet

- How Attractive Is France From A Swedish Trade Perspective?: Comparison With Germany and The United KingdomDocument31 pagesHow Attractive Is France From A Swedish Trade Perspective?: Comparison With Germany and The United Kingdomapi-248259954No ratings yet

- President Hollande One Year On - What's Next? An Analysis From APCO Worldwide in ParisDocument12 pagesPresident Hollande One Year On - What's Next? An Analysis From APCO Worldwide in ParisAPCO WorldwideNo ratings yet

- News/uk-News/uk-Average-Salary-26500 - Figures-3002995Document7 pagesNews/uk-News/uk-Average-Salary-26500 - Figures-3002995AnaMariaNo ratings yet

- Globalization German1Document4 pagesGlobalization German1ismadinNo ratings yet

- France PestelDocument4 pagesFrance PestelSuraj OVNo ratings yet

- Highlights: Economy and Strategy GroupDocument33 pagesHighlights: Economy and Strategy GroupvladvNo ratings yet

- BNP Paribas The Financial Crisis and Household Savings Behaviour in France 11102010Document12 pagesBNP Paribas The Financial Crisis and Household Savings Behaviour in France 11102010YUGANDHAR016577No ratings yet

- AA Irish Times Income Tax Rates 270109 02Document4 pagesAA Irish Times Income Tax Rates 270109 02BruegelNo ratings yet

- France enDocument14 pagesFrance enCarciumaru AndreiNo ratings yet

- Liam Mescall Macro AnalysisDocument12 pagesLiam Mescall Macro AnalysisLiam MescallNo ratings yet

- Spain Becomes One of Europe's Highest Taxed Countries, Cato Economic Development Bulletin No. 15Document4 pagesSpain Becomes One of Europe's Highest Taxed Countries, Cato Economic Development Bulletin No. 15Cato InstituteNo ratings yet

- All Pain No GainDocument2 pagesAll Pain No Gainkeithxiaoxiao096No ratings yet

- European Economy: Macroeconomic Imbalances Hungary 2013Document34 pagesEuropean Economy: Macroeconomic Imbalances Hungary 2013Catalina GalerNo ratings yet

- Edexcel As Econ Unit 2 FullDocument198 pagesEdexcel As Econ Unit 2 Fullloca_sanamNo ratings yet

- Macroeconomics: Policies and Analysis Project Title - Vive La FranceDocument16 pagesMacroeconomics: Policies and Analysis Project Title - Vive La FranceArpita SenNo ratings yet

- Monthly: La Reforma Del Sector Servicios OUTLOOK 2012Document76 pagesMonthly: La Reforma Del Sector Servicios OUTLOOK 2012Anonymous OY8hR2NNo ratings yet

- GLEC Assignment-Country Report (Spain)Document15 pagesGLEC Assignment-Country Report (Spain)Sohil AggarwalNo ratings yet

- Pestel FranceDocument95 pagesPestel FranceChenxiWangNo ratings yet

- Trade Gloom Drives French and German Economic DivergenceDocument7 pagesTrade Gloom Drives French and German Economic DivergencemakedonisNo ratings yet

- Economy Survey FranceDocument12 pagesEconomy Survey FrancekpossouNo ratings yet

- Austerity - The New Normal - The Raving ReporterDocument10 pagesAusterity - The New Normal - The Raving ReporterFabrício BoneciniNo ratings yet

- German EconomyDocument5 pagesGerman EconomyprakharNo ratings yet

- Assessment 2A. International Monetary EconomicsDocument6 pagesAssessment 2A. International Monetary EconomicsBình MinhNo ratings yet

- Today's Calendar: Friday 15 November 2013Document9 pagesToday's Calendar: Friday 15 November 2013api-239816032No ratings yet

- News Coverage - France: Economy and Business News From The Past WeekDocument6 pagesNews Coverage - France: Economy and Business News From The Past Weekapi-248259954No ratings yet

- News Coverage - France: Economy and Business News From The Past WeekDocument5 pagesNews Coverage - France: Economy and Business News From The Past Weekapi-248259954No ratings yet

- News Coverage - France: Economy and Business News From The Past WeekDocument5 pagesNews Coverage - France: Economy and Business News From The Past Weekapi-248259954No ratings yet

- News Coverage - France: Economy and Business News From The Past WeekDocument5 pagesNews Coverage - France: Economy and Business News From The Past Weekapi-248259954No ratings yet

- German EconomyDocument5 pagesGerman EconomyprakharNo ratings yet

- I Securities Markets and Their Agents: Situation and OutlookDocument52 pagesI Securities Markets and Their Agents: Situation and OutlooksolajeroNo ratings yet

- Assignment - Economic GrowthDocument5 pagesAssignment - Economic Growthwilliam aarsethNo ratings yet

- I Securities Markets and Their Agents: Situation and OutlookDocument54 pagesI Securities Markets and Their Agents: Situation and OutlooksolajeroNo ratings yet

- I Securities Markets and Their Agents: Situation and OutlookDocument51 pagesI Securities Markets and Their Agents: Situation and OutlooksolajeroNo ratings yet

- Austerity in The Aftermath of The Great RecessionDocument3 pagesAusterity in The Aftermath of The Great RecessionAdrià LópezNo ratings yet

- News Coverage - France: Economy and Business News From The Past WeekDocument5 pagesNews Coverage - France: Economy and Business News From The Past Weekapi-248259954No ratings yet

- Pestal FranceDocument5 pagesPestal FranceNikhil Vijapur100% (1)

- Two Pillars OECDDocument10 pagesTwo Pillars OECDmalejandrabv87No ratings yet

- EC6201 International EconomicsDocument4 pagesEC6201 International EconomicsutahgurlNo ratings yet

- Deutsche Industriebank German Market Outlook 2014 Mid Cap Financial Markets in Times of Macro Uncertainty and Tightening Bank RegulationsDocument32 pagesDeutsche Industriebank German Market Outlook 2014 Mid Cap Financial Markets in Times of Macro Uncertainty and Tightening Bank RegulationsRichard HongNo ratings yet

- Paper - The Fiscal Crisis in Europe - 01Document9 pagesPaper - The Fiscal Crisis in Europe - 01290105No ratings yet

- PC 12 2017 - 2Document17 pagesPC 12 2017 - 2TBP_Think_TankNo ratings yet

- The French Economy, European Authorities, and The IMF: "Structural Reform" or Increasing Employment?Document25 pagesThe French Economy, European Authorities, and The IMF: "Structural Reform" or Increasing Employment?Center for Economic and Policy ResearchNo ratings yet

- EIB Investment Report 2021/2022 - Key findings: Recovery as a springboard for changeFrom EverandEIB Investment Report 2021/2022 - Key findings: Recovery as a springboard for changeNo ratings yet

- Japanese Corporates Hitch Growth Plans To Southeast Asian Infrastructure, But Face A Bumpy RideDocument14 pagesJapanese Corporates Hitch Growth Plans To Southeast Asian Infrastructure, But Face A Bumpy Rideapi-227433089No ratings yet

- Michigan Outlook Revised To Stable From Positive On Softening Revenues Series 2014A&B Bonds Rated 'AA-'Document3 pagesMichigan Outlook Revised To Stable From Positive On Softening Revenues Series 2014A&B Bonds Rated 'AA-'api-227433089No ratings yet

- Hooked On Hydrocarbons: How Susceptible Are Gulf Sovereigns To Concentration Risk?Document9 pagesHooked On Hydrocarbons: How Susceptible Are Gulf Sovereigns To Concentration Risk?api-227433089No ratings yet

- Metropolitan Transportation Authority, New York Joint Criteria TransitDocument7 pagesMetropolitan Transportation Authority, New York Joint Criteria Transitapi-227433089No ratings yet

- UntitledDocument10 pagesUntitledapi-227433089No ratings yet

- UntitledDocument16 pagesUntitledapi-227433089No ratings yet

- The Challenges of Medicaid Expansion Will Limit U.S. Health Insurers' Profitability in The Short TermDocument8 pagesThe Challenges of Medicaid Expansion Will Limit U.S. Health Insurers' Profitability in The Short Termapi-227433089No ratings yet

- How Is The Transition To An Exchange-Based Environment Affecting Health Insurers, Providers, and Consumers?Document5 pagesHow Is The Transition To An Exchange-Based Environment Affecting Health Insurers, Providers, and Consumers?api-227433089No ratings yet

- Global Economic Outlook: Unfinished BusinessDocument22 pagesGlobal Economic Outlook: Unfinished Businessapi-227433089No ratings yet

- 2014 Review of U.S. Municipal Water and Sewer Ratings: How They Correlate With Key Economic and Financial RatiosDocument12 pages2014 Review of U.S. Municipal Water and Sewer Ratings: How They Correlate With Key Economic and Financial Ratiosapi-227433089No ratings yet

- Recent Investor Discussions: U.S. Consumer Products Ratings Should Remain Stable in 2014 Amid Improved Consumer SpendingDocument6 pagesRecent Investor Discussions: U.S. Consumer Products Ratings Should Remain Stable in 2014 Amid Improved Consumer Spendingapi-227433089No ratings yet

- French Life Insurers' Credited Rates To Policyholders For 2013 Indicate A Renewed Focus On Volume GrowthDocument5 pagesFrench Life Insurers' Credited Rates To Policyholders For 2013 Indicate A Renewed Focus On Volume Growthapi-227433089No ratings yet

- U.S. State and Local Government Credit Conditions Forecast: Waiting - . - and Waiting To ExhaleDocument17 pagesU.S. State and Local Government Credit Conditions Forecast: Waiting - . - and Waiting To Exhaleapi-227433089No ratings yet

- Adding Skilled Labor To America's Melting Pot Would Heat Up U.S. Economic GrowthDocument17 pagesAdding Skilled Labor To America's Melting Pot Would Heat Up U.S. Economic Growthapi-227433089No ratings yet

- U.S. Corporate Flow of Funds in Fourth-Quarter 2013: Equity Valuations Surge As Capital Expenditures LagDocument12 pagesU.S. Corporate Flow of Funds in Fourth-Quarter 2013: Equity Valuations Surge As Capital Expenditures Lagapi-227433089No ratings yet

- UntitledDocument14 pagesUntitledapi-227433089No ratings yet

- New Jersey's GO Rating Lowered To A+' On Continuing Structural Imbalance Outlook StableDocument6 pagesNew Jersey's GO Rating Lowered To A+' On Continuing Structural Imbalance Outlook Stableapi-227433089No ratings yet

- Inside Credit: Private-Equity Owners Lead The European IPO Resurgence As Company Valuations ImproveDocument11 pagesInside Credit: Private-Equity Owners Lead The European IPO Resurgence As Company Valuations Improveapi-227433089No ratings yet

- The Media and Entertainment Outlook Brightens, But Regulatory Clouds GatherDocument17 pagesThe Media and Entertainment Outlook Brightens, But Regulatory Clouds Gatherapi-227433089No ratings yet

- Ca MGN 303 LpuDocument6 pagesCa MGN 303 LpuAvinash BeheraNo ratings yet

- Formalities For Setting Up A Small Business EnterpriseDocument8 pagesFormalities For Setting Up A Small Business EnterpriseMisba Khan0% (1)

- Finance Dept CircularsDocument490 pagesFinance Dept Circularssusanta_kumar50% (4)

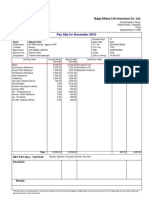

- Payslip Dec2023Document1 pagePayslip Dec2023dhanalakhNo ratings yet

- BIR Ruling No. 075-18Document10 pagesBIR Ruling No. 075-18liz kawiNo ratings yet

- Textile BusinessDocument23 pagesTextile BusinesszaeemisNo ratings yet

- Cost Management Periodic Average Costing Setup and Process Flow PDFDocument58 pagesCost Management Periodic Average Costing Setup and Process Flow PDFSmart Diamond0% (2)

- President Donald J. Trump's Accomplishment List Archive. - MAGAPILL PDFDocument33 pagesPresident Donald J. Trump's Accomplishment List Archive. - MAGAPILL PDFpeter100% (1)

- Meaning 'A Budget Is A Document Containing A Preliminary Approved Plan of Public Revenues and Expenditure'' - Rene StourmDocument3 pagesMeaning 'A Budget Is A Document Containing A Preliminary Approved Plan of Public Revenues and Expenditure'' - Rene StourmAvi KansalNo ratings yet

- Corpo - DigestDocument28 pagesCorpo - Digesterikha_aranetaNo ratings yet

- Inc StatDocument9 pagesInc StatAleem JafferyNo ratings yet

- Sea-Land Services, Inc. vs. Court of Appeals (April 30, 2001)Document5 pagesSea-Land Services, Inc. vs. Court of Appeals (April 30, 2001)Che Poblete CardenasNo ratings yet

- Positive and Normative EconomicsDocument2 pagesPositive and Normative EconomicsMawuena Susu100% (1)

- Assessment 2 Tax 1Document5 pagesAssessment 2 Tax 1Judy Ann GacetaNo ratings yet

- Ats New FormatDocument2 pagesAts New FormatJem MendenillaNo ratings yet

- Tl11a Fill 13eDocument1 pageTl11a Fill 13eMarcus MayellNo ratings yet

- Payroll Accounting 2018 28th Edition Bieg Test BankDocument15 pagesPayroll Accounting 2018 28th Edition Bieg Test Bankloanazura7k6bl100% (28)

- Engleza LuisDocument124 pagesEngleza LuisAndrei GheorghitaNo ratings yet

- B2C QuotationDocument5 pagesB2C QuotationSANSKAR AGRAWALNo ratings yet

- EC345 2022 - 23 Week 10 Welfare and PolicyDocument60 pagesEC345 2022 - 23 Week 10 Welfare and Policyfilipa barbosaNo ratings yet

- Moc 2Document13 pagesMoc 2pryaparagNo ratings yet

- Committees On Decentralisation (Government of India) : RecommendationsDocument92 pagesCommittees On Decentralisation (Government of India) : RecommendationsK Rajasekharan0% (1)

- National Income AssignmentDocument12 pagesNational Income AssignmentMaher SrivastavaNo ratings yet

- Detiland 2023 DocumentDocument3 pagesDetiland 2023 DocumentKWAMESANo ratings yet

- GO (P) No 87-2017-Fin Dated 05-07-2017Document3 pagesGO (P) No 87-2017-Fin Dated 05-07-2017Viswalal ViswanathanNo ratings yet

The French Economy Exits Recession But Remains Fragile: Economic Research

The French Economy Exits Recession But Remains Fragile: Economic Research

Uploaded by

api-227433089Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The French Economy Exits Recession But Remains Fragile: Economic Research

The French Economy Exits Recession But Remains Fragile: Economic Research

Uploaded by

api-227433089Copyright:

Available Formats

Economic Research:

The French Economy Exits Recession But Remains Fragile

Primary Credit Analyst: Jean-Michel Six, Paris (33) 1-4420-6705; jean-michel.six@standardandpoors.com Media Contact: Mark Tierney, London (44) 20-7176-3504; mark.tierney@standardandpoors.com

Table Of Contents

Taxes And Unemployment Are Weighing On Consumption Export Performance Is Likely To Improve Only Slowly The Outlook For Corporate Investment Is A Major Uncertainty The Task Ahead Is Finding Strong Sources Of Long-Term Growth Related Criteria And Research

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

OCTOBER 22, 2013 1

1210106 | 301674531

Economic Research:

The French Economy Exits Recession But Remains Fragile

After eight consecutive quarters of stagnation, France posted real GDP growth of 0.5%, marking an official end to recession. Temporary factors are part of the explanation for this turnaround, including the cold winter that boosted consumption of energy products. Meanwhile, higher inventories contributed 0.2 percentage point to the quarter's GDP growth. More importantly, public consumption rose by a strong 0.5%. On the other hand, the corporate and construction components of investment continued their decline. And more than 35,000 jobs were lost in the private sector. The second-quarter improvement in French economic conditions coincided with a broader one across the eurozone (0.3% real GDP growth). However, more recent data suggest that the momentum is diminishing in the second half of 2013. September's French Purchasing Managers Index, an indicator of economic strength for the manufacturing sector, continued to trail behind the eurozone overall average, stuck below the critical 50 line that separates recession from expansion (see chart 1 below). Industrial production contracted 1% a month in May, June, and July. And exports of goods dropped 4% in value terms year on year over that same three-month period. Those indicators support our expectations of relatively flat overall growth in the second half. (Watch the related CreditMatters TV segments titled "Has France Completely Left The Land Of Recession?" and "La France Est-Elle Dfinitivement Sortie De La Rcession?," dated Oct. 22, 2013.) Overview French economic conditions picked up in the second quarter, but in our view the sources of a strong, long-term recovery are not yet in place. Consumption and exports are stabilizing, and corporate margins should widen on the back of proposed tax measures. However, our projections show that the economy will still be approximately 3.5% below its growth potential at the end of 2014.

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

OCTOBER 22, 2013 2

1210106 | 301674531

Economic Research: The French Economy Exits Recession But Remains Fragile

Chart 1

Yet the French economy faces a big task: the recovery needs to be much more robust if only to close the output gap that's developed since 2007 (the beginning of the financial crisis) and which the Organization for Economic Cooperation and Development estimates at about 4%. More robust growth would also contribute to a meaningful inflection in the rising public debt trajectory (see chart 2). Meanwhile, the French unemployment rate at 11% in July stands well above those of the other so-called "core countries" in the monetary union--The Netherlands (7%), Belgium (8.9%), Germany (5.3%), and Austria (4.8%)--though it is below the eurozone average (12.1%. Between 1998 and 2007 real GDP growth averaged 2.3%. Is such a level of growth now out of reach?

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

OCTOBER 22, 2013 3

1210106 | 301674531

Economic Research: The French Economy Exits Recession But Remains Fragile

Chart 2

Taxes And Unemployment Are Weighing On Consumption

We expect only a slight 0.4% rise in consumption for full-year 2013, thanks to slower inflation and a slight acceleration in nominal wages. In 2012, real disposable income contracted 0.9%, a drop unseen since the 1980s. Yet the immediate effect on consumption was somewhat offset by a 0.5 point decline in the household savings rate. This effect is typical: households tend to smooth out the effects of a loss in purchasing power initially. However, over time, consumption readjusts to real disposable incomes. We believe this is the reason household spending was flat in the first half of this year. We expect consumption to remain flat in the third quarter but pick up in the final three months of the year--especially if consumers bring forward purchases ahead of the January 2014 increase in the valued-added tax (VAT) rate, to 20% from 19.6% for the standard rate. The outlook for consumer demand in 2014 and beyond is subject to other conflicting factors. France's budget for 2014--which the parliament still needs to approve--aims to shift the additional tax burden to households from corporations. The tax burden, according to this budget, which is still subject to revision, should increase by the equivalent of 0.15% of GDP to a record high of 46.1% of GDP. In absolute amounts, that's a 3 billion net increase in taxes. The breakdown is a 12.5 billion tax hike for households, mainly through the VAT rate hike (6 billion), an

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

OCTOBER 22, 2013 4

1210106 | 301674531

Economic Research: The French Economy Exits Recession But Remains Fragile

increase in property transfer taxes (1.3 billion), and a reduction in certain tax exemptions (1 billion). For business, the budget would represent a contraction in corporate taxes of about 10 billion. Higher direct taxes and social contributions between 2011 and 2014 are adding up to a cumulative reduction in purchasing power on the order of 2% of disposable incomes, a significant drag on consumer spending. A modest rise in consumer spending next year (0.2% according to our forecast) will therefore have to come from a drop in the savings rate. As for 2015, assuming fiscal pressure on households stabilizes, the beginning of an improvement in employment should allow for more robust growth in consumption (1.2% according to our forecast), although still below long-term trends. Household investment is likely to reflect the deterioration in spending power and, starting in 2014, a rise in long-term interest rates--partly resulting from tighter international financial conditions when the U.S. Federal Reserve begins to taper its securities-buying program. We expect household investment to contract 4% in 2013 (after a decline of 0.5% in 2012) and dip a further 2.5% in 2014, before stabilizing the following year.

Export Performance Is Likely To Improve Only Slowly

The share of French exports in total eurozone exports has been declining steadily from a peak of 17% in early 1999 to a low of 12.8% at the end of 2012, where it settled in the first half of 2013 (see chart 3).

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

OCTOBER 22, 2013 5

1210106 | 301674531

Economic Research: The French Economy Exits Recession But Remains Fragile

Chart 3

Unlike other countries in the eurozone, France's current deficit hasn't markedly shrunk since 2007. While the level remains low, the country has been steadily running deficits since 2005 after two decades of surpluses (see chart 4).

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

OCTOBER 22, 2013 6

1210106 | 301674531

Economic Research: The French Economy Exits Recession But Remains Fragile

Chart 4

France's deteriorating foreign competitiveness has two key components. The first is a decline in cost competitiveness, as reflected by trends in unit labor costs (ULCs), which measure the average cost of labor per unit of output. Productivity is a key factor influencing ULCs. On that score, the difference between Germany, the world champion in terms of trade surplus, and France is not striking at all. In fact, productivity dropped less in France than in Germany during the worst of the crisis in 2009. But in terms of labor costs differentials, France lost a lot of ground against Germany between 2000 and 2008. Since then, the gap has stabilized and could somewhat diminish in 2013 as German wage growth accelerates (see chart 5). On the other hand, the gap between French and Spanish labor costs has become much more favorable to Spanish exporters since 2009.

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

OCTOBER 22, 2013 7

1210106 | 301674531

Economic Research: The French Economy Exits Recession But Remains Fragile

Chart 5

The second key component of foreign competitiveness is more structural and relates to product differentiation. Competitive countries, simply put, sell products to the rest of the world that are more expensive than those they buy from the rest of the world. This is where the difference between Germany and France is striking. German exports are positioned in segments (particularly capital goods, but also luxury cars, for instance) where price elasticities are relatively low. Econometric models typically estimate the price elasticity of German exports at about 0.3 against more than 1.0 for France. German exports are therefore much less vulnerable to a rise in the euro exchange rate than their French competitors. In turn, strong product differentiation has allowed German manufacturers to increase their prices and therefore the overall value of their exports (see chart 6).

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

OCTOBER 22, 2013 8

1210106 | 301674531

Economic Research: The French Economy Exits Recession But Remains Fragile

Chart 6

As an aside, the French luxury goods industry (food and beverages, and fashion in particular) contributes significantly to the prestige of the country overseas. However, it accounts for just 1.4% of total exports, compared with 2.1% for Italy. What's more, France's market share in exports to the fast-growing BRICs (Brazil, Russia, India, and China) at 10%, is well below those of Switzerland, Italy, and Germany (33%, 16%, and 13%), according to 2011 data (Source: Direction Gnrale des Douanes, "Etudes et Eclairages 38," March 2013). Although many factors explain the differences between France and Germany regarding trends in product differentiation, we believe that one of the main reasons has to do with domestic demand. This has been more buoyant in France, essentially driven by household consumption, than in Germany since the late 1970s. A trade-off emerged between strong domestic demand and weak export performance as French producers relied on their domestic markets. Meanwhile, their German competitors were making forays into new markets abroad. Foreign demand, especially from the rest of Europe, should gradually improve in the coming 24 months, underpinning a rebound in French foreign sales. But stronger competitors, such as Spain, could harm the French performance. Outside the single currency union, the strong euro--now trading at about $1.36 and rising--will be a further handicap. And we believe that the single currency is likely to remain strong well into the first part of next year, since the Fed delayed its plan to wind down its securities purchases.

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

OCTOBER 22, 2013 9

1210106 | 301674531

Economic Research: The French Economy Exits Recession But Remains Fragile

The Outlook For Corporate Investment Is A Major Uncertainty

Corporate investment in France reached a bottom in the second quarter after 18 months of consecutive declines. Meanwhile since February, the business climate has been improving (see chart 7). Yet indications pointing to a recovery in capital expenditures remain fragile. Loans to nonfinancial companies have steadily declined since September 2012, and the latest data from the European Central Bank shows a 1.7% contraction in the 12 months to August 2013. In real terms, corporate investment was still 6.3% below its 2007 average at the end of the second quarter.

Chart 7

Unlike in previous recoveries, investment has not been leading but rather has been lagging behind the pickup. True, this observation does not apply only to France. Germany's capital spending is down 7.8% over the same period, while Italy's has dropped 27.2%. Outside the eurozone, and despite stronger economic growth than in these other countries since the beginning of the year, U.K. investment has remained 15.5% below its 2007 average. What's more unique to France is the steady deterioration in corporate margins since 2007. They touched 28.2% of value added in the second quarter, the lowest since 1985, and 2.5 points below the 1988-2007 average (see chart 8).

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

OCTOBER 22, 2013 10

1210106 | 301674531

Economic Research: The French Economy Exits Recession But Remains Fragile

Chart 8

We think corporate margins may stabilize, however, as the economy picks up and productivity modestly accelerates. Energy prices should also bring a more positive contribution as the euro strengthens while oil prices edge lower. Beyond these cyclical factors, the French economic authorities are placing a lot of hope in a new tax cut for nonfinancial corporates, equivalent to a reduction in employers' social security contributions. This tax reduction, the "credit d'impot pour la comptitivit et l'emploi" (CICE), which started to phase in at the beginning of this year, is to amount to 10 billion in 2014 and 20 billion the following year. It should lead to a significant increase in corporate aftertax profits of about 7%. The authorities expect that this measure will improve corporate price competitiveness through a reduction in unit labor costs as well as non-price competitiveness as it fosters a recovery in capital spending. Plus, the government estimates that this measure could directly result in some 90,000 additional jobs in 2014. In the first instance, we expect an increase in corporate margins and an upturn in capital spending. But the effect on hiring is likely to take time, we believe, because at the end of a recession productivity is typically low. In October, France's Commissariat gnral la stratgie et la prospective (a high-level strategic policy group), published an initial assessment of CICE's impact on the corporate sector. It shows that the manufacturing and retail

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

OCTOBER 22, 2013 11

1210106 | 301674531

Economic Research: The French Economy Exits Recession But Remains Fragile

sectors are benefitting, but that the nonexporting part of the manufacturing sector has benefitted the most so far. Overall, we anticipate that corporate investment should rise by about 1.8% in 2014 (versus a decline of 2% in 2013) and gain further momentum in 2015 (4%). In that case, by the end of 2015, capital spending in real terms would still be 2.9% below its 2007, pre-crisis level.

The Task Ahead Is Finding Strong Sources Of Long-Term Growth

Our forecast has French GDP growth averaging 0.7% in 2014 and 1.4% in 2015 (see table 1 below). Official estimates suggest that the post-2007 economic and financial crisis caused a loss in France's production capacity equivalent to about 5% of GDP. The loss corresponds to the effects of long-term unemployment, the lack of productive investment, and bankruptcies in the nonfinancial corporate sector particularly during the 2009 and 2012 recessions. Based on our projections, the economy at the end of 2014 will still be approximately 3.5% below its growth potential. The French economy will likely be playing catch-up for several years beyond 2014. In particular, whether exports can regain competitiveness and increase their market shares abroad remains a major source of uncertainty. What's more, the recovery in capital spending remains subject to a return of confidence that fiscal uncertainty could further delay. The same can be said about consumer demand: Households in the recent past have offset a drop in their real incomes through variations in their savings rates. But if they perceive that the fiscal bite is likely to extend beyond 2014, households could modify the way they arbitrage between consumption and savings. But the path toward sustainable long-term growth, similar to what France experienced a decade earlier, is mired in risks and uncertainties. Table 1

Main European Economic Indicators Central forecast Real GDP (% change) 2012 2013(f) 2014(f) 2015(f) CPI inflation (%) 2012 2013(f) 2014(f) 2015(f) Unemployment rate (%) 2012 2013(f) 2014(f) 2015(f) 5.5 5.4 5.2 5.1 10.3 11.0 11.0 10.3 10.7 12.2 12.5 12.0 25.1 26.7 27.0 26.0 5.3 6.7 7.2 7.0 7.6 8.5 8.6 8.1 11.4 12.4 12.5 12.0 8.0 7.9 7.8 7.5 2.9 3.2 3.1 3.0 2.1 1.6 1.8 1.7 2.2 1.0 1.5 1.4 3.3 1.5 1.6 1.2 2.4 1.8 1.4 1.3 2.8 2.6 1.4 1.2 2.6 1.3 1.6 1.9 2.5 1.6 1.6 1.5 2.8 2.7 2.3 2.0 -0.7 -0.2 0.5 1.0 0.7 0.5 1.8 1.7 0.0 0.0 0.7 1.4 -2.5 -1.8 0.5 0.9 -1.6 -1.5 0.5 1.1 -1.2 -1.2 0.5 1.3 -0.1 -0.1 0.8 1.5 -0.6 -0.7 0.9 1.3 0.1 1.5 2.1 2.0 1.0 1.7 1.8 1.7 Germany France Italy Spain Netherlands Belgium Eurozone U.K. Switzerland

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

OCTOBER 22, 2013 12

1210106 | 301674531

Economic Research: The French Economy Exits Recession But Remains Fragile

Table 1 (cont.)

Central banks policy rates (yearly average) 2012 2013(f) 2014(f) 2015(f) 10-year bond yield (yearly average) 2012 2013(f) 2014(f) 2015(f) Alternative Scenario: Extended recession Real GDP (% change) 2013(f) 2014(f) 2015(f) Germany 0.1 0.5 0.6 France -0.5 -0.4 0.2 Italy -2.6 -0.7 -0.5 Spain -2.0 -1.0 -0.4 Netherlands -1.4 -0.4 0.1 Belgium -0.3 -0.5 0.4 Eurozone -1.2 -0.4 0.1 U.K. 1.4 0.5 0.6 Switzerland 1.5 0.4 0.8 European Central Bank 0.8 0.6 0.5 0.5 Bank of England 0.5 0.5 0.5 0.6

Germany 1.6 1.8 2.3 2.8

U.K. 1.9 2.5 3.1 3.5

Related Criteria And Research

Special Report: Global Economic Outlook: Taking Stock Five Years On From The Great Financial Crisis, Oct. 8, 2013

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

OCTOBER 22, 2013 13

1210106 | 301674531

Copyright 2013 by Standard & Poor's Financial Services LLC. All rights reserved. No content (including ratings, credit-related analyses and data, valuations, model, software or other application or output therefrom) or any part thereof (Content) may be modified, reverse engineered, reproduced or distributed in any form by any means, or stored in a database or retrieval system, without the prior written permission of Standard & Poor's Financial Services LLC or its affiliates (collectively, S&P). The Content shall not be used for any unlawful or unauthorized purposes. S&P and any third-party providers, as well as their directors, officers, shareholders, employees or agents (collectively S&P Parties) do not guarantee the accuracy, completeness, timeliness or availability of the Content. S&P Parties are not responsible for any errors or omissions (negligent or otherwise), regardless of the cause, for the results obtained from the use of the Content, or for the security or maintenance of any data input by the user. The Content is provided on an "as is" basis. S&P PARTIES DISCLAIM ANY AND ALL EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE, FREEDOM FROM BUGS, SOFTWARE ERRORS OR DEFECTS, THAT THE CONTENT'S FUNCTIONING WILL BE UNINTERRUPTED, OR THAT THE CONTENT WILL OPERATE WITH ANY SOFTWARE OR HARDWARE CONFIGURATION. In no event shall S&P Parties be liable to any party for any direct, indirect, incidental, exemplary, compensatory, punitive, special or consequential damages, costs, expenses, legal fees, or losses (including, without limitation, lost income or lost profits and opportunity costs or losses caused by negligence) in connection with any use of the Content even if advised of the possibility of such damages. Credit-related and other analyses, including ratings, and statements in the Content are statements of opinion as of the date they are expressed and not statements of fact. S&P's opinions, analyses, and rating acknowledgment decisions (described below) are not recommendations to purchase, hold, or sell any securities or to make any investment decisions, and do not address the suitability of any security. S&P assumes no obligation to update the Content following publication in any form or format. The Content should not be relied on and is not a substitute for the skill, judgment and experience of the user, its management, employees, advisors and/or clients when making investment and other business decisions. S&P does not act as a fiduciary or an investment advisor except where registered as such. While S&P has obtained information from sources it believes to be reliable, S&P does not perform an audit and undertakes no duty of due diligence or independent verification of any information it receives. To the extent that regulatory authorities allow a rating agency to acknowledge in one jurisdiction a rating issued in another jurisdiction for certain regulatory purposes, S&P reserves the right to assign, withdraw, or suspend such acknowledgement at any time and in its sole discretion. S&P Parties disclaim any duty whatsoever arising out of the assignment, withdrawal, or suspension of an acknowledgment as well as any liability for any damage alleged to have been suffered on account thereof. S&P keeps certain activities of its business units separate from each other in order to preserve the independence and objectivity of their respective activities. As a result, certain business units of S&P may have information that is not available to other S&P business units. S&P has established policies and procedures to maintain the confidentiality of certain nonpublic information received in connection with each analytical process. S&P may receive compensation for its ratings and certain analyses, normally from issuers or underwriters of securities or from obligors. S&P reserves the right to disseminate its opinions and analyses. S&P's public ratings and analyses are made available on its Web sites, www.standardandpoors.com (free of charge), and www.ratingsdirect.com and www.globalcreditportal.com (subscription) and www.spcapitaliq.com (subscription) and may be distributed through other means, including via S&P publications and third-party redistributors. Additional information about our ratings fees is available at www.standardandpoors.com/usratingsfees.

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

OCTOBER 22, 2013 14

1210106 | 301674531

You might also like

- PayslipDocument1 pagePayslipAshish Agarwal67% (3)

- #3 Financial Accounting and Reporting Test BankDocument32 pages#3 Financial Accounting and Reporting Test BankPatOcampo100% (5)

- 2014.10.31 Commerzbank - Week in FocusDocument18 pages2014.10.31 Commerzbank - Week in FocusAnonymous uiD5GJBgNo ratings yet

- France PestelDocument4 pagesFrance PestelJenab Pathan94% (16)

- Carlos Superdrug Corporation vs. DSWD, Et Al., Test of Police PowerDocument2 pagesCarlos Superdrug Corporation vs. DSWD, Et Al., Test of Police PowerRoward100% (1)

- BSBFIM601 Manage Finances: Learner WorkbookDocument71 pagesBSBFIM601 Manage Finances: Learner WorkbookGurjinder Hanjra0% (1)

- Business Management - AssignmentDocument8 pagesBusiness Management - AssignmentHeavenlyPlanetEarth100% (6)

- Europe Is Moving From Subzero To Subpar Growth: Economic ResearchDocument11 pagesEurope Is Moving From Subzero To Subpar Growth: Economic Researchapi-227433089No ratings yet

- The Economy of FranceDocument18 pagesThe Economy of Francejames killerNo ratings yet

- These Green Shoots Will Need A Lot of Watering: Economic ResearchDocument10 pagesThese Green Shoots Will Need A Lot of Watering: Economic Researchapi-231665846No ratings yet

- Portugal Economy ReportDocument17 pagesPortugal Economy Reportsouravsingh1987No ratings yet

- Has Austerity Failed in EuropeDocument3 pagesHas Austerity Failed in EuropeAndreea WeissNo ratings yet

- Indicators For GERMANY: France Ational Tatistical ATADocument25 pagesIndicators For GERMANY: France Ational Tatistical ATASatNam SiNgh TethiNo ratings yet

- Rising Domestic Demand and Net Exports Underpin German GrowthDocument15 pagesRising Domestic Demand and Net Exports Underpin German Growthapi-228714775No ratings yet

- French Macroeconomic, Insolvency Update - 011013Document3 pagesFrench Macroeconomic, Insolvency Update - 011013megachameleon1989No ratings yet

- EcoNote18 Solde Courant de La France enDocument8 pagesEcoNote18 Solde Courant de La France enPracheth ReddyNo ratings yet

- CEPS Greek MultipliersDocument5 pagesCEPS Greek MultipliersDimitris YannopoulosNo ratings yet

- MACRO ASSIGNMENT ABAS HASSAN ALI Mid Ka Saxda AhDocument14 pagesMACRO ASSIGNMENT ABAS HASSAN ALI Mid Ka Saxda AhCabaas XasanNo ratings yet

- Macroeconomic Analysis Of: France As An Investment OpportunityDocument51 pagesMacroeconomic Analysis Of: France As An Investment OpportunityJeso P. JamesNo ratings yet

- Italy Equities GarthwaiteDocument23 pagesItaly Equities GarthwaiteRichard WoolhouseNo ratings yet

- S&P Credit Research - Europe's Growth As Good As It Gets 2010 08 31Document6 pagesS&P Credit Research - Europe's Growth As Good As It Gets 2010 08 31thebigpicturecoilNo ratings yet

- Levi Institute Greece Analysis 2016Document13 pagesLevi Institute Greece Analysis 2016Chatzianagnostou GeorgeNo ratings yet

- How Attractive Is France From A Swedish Trade Perspective?: Comparison With Germany and The United KingdomDocument31 pagesHow Attractive Is France From A Swedish Trade Perspective?: Comparison With Germany and The United Kingdomapi-248259954No ratings yet

- President Hollande One Year On - What's Next? An Analysis From APCO Worldwide in ParisDocument12 pagesPresident Hollande One Year On - What's Next? An Analysis From APCO Worldwide in ParisAPCO WorldwideNo ratings yet

- News/uk-News/uk-Average-Salary-26500 - Figures-3002995Document7 pagesNews/uk-News/uk-Average-Salary-26500 - Figures-3002995AnaMariaNo ratings yet

- Globalization German1Document4 pagesGlobalization German1ismadinNo ratings yet

- France PestelDocument4 pagesFrance PestelSuraj OVNo ratings yet

- Highlights: Economy and Strategy GroupDocument33 pagesHighlights: Economy and Strategy GroupvladvNo ratings yet

- BNP Paribas The Financial Crisis and Household Savings Behaviour in France 11102010Document12 pagesBNP Paribas The Financial Crisis and Household Savings Behaviour in France 11102010YUGANDHAR016577No ratings yet

- AA Irish Times Income Tax Rates 270109 02Document4 pagesAA Irish Times Income Tax Rates 270109 02BruegelNo ratings yet

- France enDocument14 pagesFrance enCarciumaru AndreiNo ratings yet

- Liam Mescall Macro AnalysisDocument12 pagesLiam Mescall Macro AnalysisLiam MescallNo ratings yet

- Spain Becomes One of Europe's Highest Taxed Countries, Cato Economic Development Bulletin No. 15Document4 pagesSpain Becomes One of Europe's Highest Taxed Countries, Cato Economic Development Bulletin No. 15Cato InstituteNo ratings yet

- All Pain No GainDocument2 pagesAll Pain No Gainkeithxiaoxiao096No ratings yet

- European Economy: Macroeconomic Imbalances Hungary 2013Document34 pagesEuropean Economy: Macroeconomic Imbalances Hungary 2013Catalina GalerNo ratings yet

- Edexcel As Econ Unit 2 FullDocument198 pagesEdexcel As Econ Unit 2 Fullloca_sanamNo ratings yet

- Macroeconomics: Policies and Analysis Project Title - Vive La FranceDocument16 pagesMacroeconomics: Policies and Analysis Project Title - Vive La FranceArpita SenNo ratings yet

- Monthly: La Reforma Del Sector Servicios OUTLOOK 2012Document76 pagesMonthly: La Reforma Del Sector Servicios OUTLOOK 2012Anonymous OY8hR2NNo ratings yet

- GLEC Assignment-Country Report (Spain)Document15 pagesGLEC Assignment-Country Report (Spain)Sohil AggarwalNo ratings yet

- Pestel FranceDocument95 pagesPestel FranceChenxiWangNo ratings yet

- Trade Gloom Drives French and German Economic DivergenceDocument7 pagesTrade Gloom Drives French and German Economic DivergencemakedonisNo ratings yet

- Economy Survey FranceDocument12 pagesEconomy Survey FrancekpossouNo ratings yet

- Austerity - The New Normal - The Raving ReporterDocument10 pagesAusterity - The New Normal - The Raving ReporterFabrício BoneciniNo ratings yet

- German EconomyDocument5 pagesGerman EconomyprakharNo ratings yet

- Assessment 2A. International Monetary EconomicsDocument6 pagesAssessment 2A. International Monetary EconomicsBình MinhNo ratings yet

- Today's Calendar: Friday 15 November 2013Document9 pagesToday's Calendar: Friday 15 November 2013api-239816032No ratings yet

- News Coverage - France: Economy and Business News From The Past WeekDocument6 pagesNews Coverage - France: Economy and Business News From The Past Weekapi-248259954No ratings yet

- News Coverage - France: Economy and Business News From The Past WeekDocument5 pagesNews Coverage - France: Economy and Business News From The Past Weekapi-248259954No ratings yet

- News Coverage - France: Economy and Business News From The Past WeekDocument5 pagesNews Coverage - France: Economy and Business News From The Past Weekapi-248259954No ratings yet

- News Coverage - France: Economy and Business News From The Past WeekDocument5 pagesNews Coverage - France: Economy and Business News From The Past Weekapi-248259954No ratings yet

- German EconomyDocument5 pagesGerman EconomyprakharNo ratings yet

- I Securities Markets and Their Agents: Situation and OutlookDocument52 pagesI Securities Markets and Their Agents: Situation and OutlooksolajeroNo ratings yet

- Assignment - Economic GrowthDocument5 pagesAssignment - Economic Growthwilliam aarsethNo ratings yet

- I Securities Markets and Their Agents: Situation and OutlookDocument54 pagesI Securities Markets and Their Agents: Situation and OutlooksolajeroNo ratings yet

- I Securities Markets and Their Agents: Situation and OutlookDocument51 pagesI Securities Markets and Their Agents: Situation and OutlooksolajeroNo ratings yet

- Austerity in The Aftermath of The Great RecessionDocument3 pagesAusterity in The Aftermath of The Great RecessionAdrià LópezNo ratings yet

- News Coverage - France: Economy and Business News From The Past WeekDocument5 pagesNews Coverage - France: Economy and Business News From The Past Weekapi-248259954No ratings yet

- Pestal FranceDocument5 pagesPestal FranceNikhil Vijapur100% (1)

- Two Pillars OECDDocument10 pagesTwo Pillars OECDmalejandrabv87No ratings yet

- EC6201 International EconomicsDocument4 pagesEC6201 International EconomicsutahgurlNo ratings yet

- Deutsche Industriebank German Market Outlook 2014 Mid Cap Financial Markets in Times of Macro Uncertainty and Tightening Bank RegulationsDocument32 pagesDeutsche Industriebank German Market Outlook 2014 Mid Cap Financial Markets in Times of Macro Uncertainty and Tightening Bank RegulationsRichard HongNo ratings yet

- Paper - The Fiscal Crisis in Europe - 01Document9 pagesPaper - The Fiscal Crisis in Europe - 01290105No ratings yet

- PC 12 2017 - 2Document17 pagesPC 12 2017 - 2TBP_Think_TankNo ratings yet

- The French Economy, European Authorities, and The IMF: "Structural Reform" or Increasing Employment?Document25 pagesThe French Economy, European Authorities, and The IMF: "Structural Reform" or Increasing Employment?Center for Economic and Policy ResearchNo ratings yet

- EIB Investment Report 2021/2022 - Key findings: Recovery as a springboard for changeFrom EverandEIB Investment Report 2021/2022 - Key findings: Recovery as a springboard for changeNo ratings yet

- Japanese Corporates Hitch Growth Plans To Southeast Asian Infrastructure, But Face A Bumpy RideDocument14 pagesJapanese Corporates Hitch Growth Plans To Southeast Asian Infrastructure, But Face A Bumpy Rideapi-227433089No ratings yet

- Michigan Outlook Revised To Stable From Positive On Softening Revenues Series 2014A&B Bonds Rated 'AA-'Document3 pagesMichigan Outlook Revised To Stable From Positive On Softening Revenues Series 2014A&B Bonds Rated 'AA-'api-227433089No ratings yet

- Hooked On Hydrocarbons: How Susceptible Are Gulf Sovereigns To Concentration Risk?Document9 pagesHooked On Hydrocarbons: How Susceptible Are Gulf Sovereigns To Concentration Risk?api-227433089No ratings yet

- Metropolitan Transportation Authority, New York Joint Criteria TransitDocument7 pagesMetropolitan Transportation Authority, New York Joint Criteria Transitapi-227433089No ratings yet

- UntitledDocument10 pagesUntitledapi-227433089No ratings yet

- UntitledDocument16 pagesUntitledapi-227433089No ratings yet

- The Challenges of Medicaid Expansion Will Limit U.S. Health Insurers' Profitability in The Short TermDocument8 pagesThe Challenges of Medicaid Expansion Will Limit U.S. Health Insurers' Profitability in The Short Termapi-227433089No ratings yet

- How Is The Transition To An Exchange-Based Environment Affecting Health Insurers, Providers, and Consumers?Document5 pagesHow Is The Transition To An Exchange-Based Environment Affecting Health Insurers, Providers, and Consumers?api-227433089No ratings yet

- Global Economic Outlook: Unfinished BusinessDocument22 pagesGlobal Economic Outlook: Unfinished Businessapi-227433089No ratings yet

- 2014 Review of U.S. Municipal Water and Sewer Ratings: How They Correlate With Key Economic and Financial RatiosDocument12 pages2014 Review of U.S. Municipal Water and Sewer Ratings: How They Correlate With Key Economic and Financial Ratiosapi-227433089No ratings yet

- Recent Investor Discussions: U.S. Consumer Products Ratings Should Remain Stable in 2014 Amid Improved Consumer SpendingDocument6 pagesRecent Investor Discussions: U.S. Consumer Products Ratings Should Remain Stable in 2014 Amid Improved Consumer Spendingapi-227433089No ratings yet

- French Life Insurers' Credited Rates To Policyholders For 2013 Indicate A Renewed Focus On Volume GrowthDocument5 pagesFrench Life Insurers' Credited Rates To Policyholders For 2013 Indicate A Renewed Focus On Volume Growthapi-227433089No ratings yet

- U.S. State and Local Government Credit Conditions Forecast: Waiting - . - and Waiting To ExhaleDocument17 pagesU.S. State and Local Government Credit Conditions Forecast: Waiting - . - and Waiting To Exhaleapi-227433089No ratings yet

- Adding Skilled Labor To America's Melting Pot Would Heat Up U.S. Economic GrowthDocument17 pagesAdding Skilled Labor To America's Melting Pot Would Heat Up U.S. Economic Growthapi-227433089No ratings yet

- U.S. Corporate Flow of Funds in Fourth-Quarter 2013: Equity Valuations Surge As Capital Expenditures LagDocument12 pagesU.S. Corporate Flow of Funds in Fourth-Quarter 2013: Equity Valuations Surge As Capital Expenditures Lagapi-227433089No ratings yet

- UntitledDocument14 pagesUntitledapi-227433089No ratings yet

- New Jersey's GO Rating Lowered To A+' On Continuing Structural Imbalance Outlook StableDocument6 pagesNew Jersey's GO Rating Lowered To A+' On Continuing Structural Imbalance Outlook Stableapi-227433089No ratings yet

- Inside Credit: Private-Equity Owners Lead The European IPO Resurgence As Company Valuations ImproveDocument11 pagesInside Credit: Private-Equity Owners Lead The European IPO Resurgence As Company Valuations Improveapi-227433089No ratings yet

- The Media and Entertainment Outlook Brightens, But Regulatory Clouds GatherDocument17 pagesThe Media and Entertainment Outlook Brightens, But Regulatory Clouds Gatherapi-227433089No ratings yet

- Ca MGN 303 LpuDocument6 pagesCa MGN 303 LpuAvinash BeheraNo ratings yet

- Formalities For Setting Up A Small Business EnterpriseDocument8 pagesFormalities For Setting Up A Small Business EnterpriseMisba Khan0% (1)

- Finance Dept CircularsDocument490 pagesFinance Dept Circularssusanta_kumar50% (4)

- Payslip Dec2023Document1 pagePayslip Dec2023dhanalakhNo ratings yet

- BIR Ruling No. 075-18Document10 pagesBIR Ruling No. 075-18liz kawiNo ratings yet

- Textile BusinessDocument23 pagesTextile BusinesszaeemisNo ratings yet

- Cost Management Periodic Average Costing Setup and Process Flow PDFDocument58 pagesCost Management Periodic Average Costing Setup and Process Flow PDFSmart Diamond0% (2)

- President Donald J. Trump's Accomplishment List Archive. - MAGAPILL PDFDocument33 pagesPresident Donald J. Trump's Accomplishment List Archive. - MAGAPILL PDFpeter100% (1)

- Meaning 'A Budget Is A Document Containing A Preliminary Approved Plan of Public Revenues and Expenditure'' - Rene StourmDocument3 pagesMeaning 'A Budget Is A Document Containing A Preliminary Approved Plan of Public Revenues and Expenditure'' - Rene StourmAvi KansalNo ratings yet

- Corpo - DigestDocument28 pagesCorpo - Digesterikha_aranetaNo ratings yet

- Inc StatDocument9 pagesInc StatAleem JafferyNo ratings yet

- Sea-Land Services, Inc. vs. Court of Appeals (April 30, 2001)Document5 pagesSea-Land Services, Inc. vs. Court of Appeals (April 30, 2001)Che Poblete CardenasNo ratings yet

- Positive and Normative EconomicsDocument2 pagesPositive and Normative EconomicsMawuena Susu100% (1)

- Assessment 2 Tax 1Document5 pagesAssessment 2 Tax 1Judy Ann GacetaNo ratings yet

- Ats New FormatDocument2 pagesAts New FormatJem MendenillaNo ratings yet

- Tl11a Fill 13eDocument1 pageTl11a Fill 13eMarcus MayellNo ratings yet

- Payroll Accounting 2018 28th Edition Bieg Test BankDocument15 pagesPayroll Accounting 2018 28th Edition Bieg Test Bankloanazura7k6bl100% (28)

- Engleza LuisDocument124 pagesEngleza LuisAndrei GheorghitaNo ratings yet

- B2C QuotationDocument5 pagesB2C QuotationSANSKAR AGRAWALNo ratings yet

- EC345 2022 - 23 Week 10 Welfare and PolicyDocument60 pagesEC345 2022 - 23 Week 10 Welfare and Policyfilipa barbosaNo ratings yet

- Moc 2Document13 pagesMoc 2pryaparagNo ratings yet

- Committees On Decentralisation (Government of India) : RecommendationsDocument92 pagesCommittees On Decentralisation (Government of India) : RecommendationsK Rajasekharan0% (1)

- National Income AssignmentDocument12 pagesNational Income AssignmentMaher SrivastavaNo ratings yet

- Detiland 2023 DocumentDocument3 pagesDetiland 2023 DocumentKWAMESANo ratings yet

- GO (P) No 87-2017-Fin Dated 05-07-2017Document3 pagesGO (P) No 87-2017-Fin Dated 05-07-2017Viswalal ViswanathanNo ratings yet