Professional Documents

Culture Documents

Daily 02.12.2013

Daily 02.12.2013

Uploaded by

FEPFinanceClubOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Daily 02.12.2013

Daily 02.12.2013

Uploaded by

FEPFinanceClubCopyright:

Available Formats

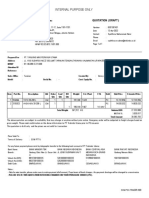

DAILY

02nd December 2013

PSI20: +0.02% DAX30: -0.04% FTSE100: -0.83% S&P500: -0.27% NIKKEI225: -0.04%

The Portuguese main index closed positive today, contradicting the world trend, mostly due to the high increase in Mota-Engil and BCP prices (keeping last weeks trend) in more than 5% . More >> The State today announced that it will hold a swap of Treasury Bonds tomorrow, with the implicit yield in the 10-year bonds increasing again above 6%. More >> The Automobile Association of Portugal (ACAP) announced that last November, the market of new vehicles sold reached 10.965, being 23,9% more than in the same period last year. More >> European equities closed lower on Monday, as Spanish shares sunk on disappointing manufacturing data, while retailers struggled on the first day of December trade. More >> Manufacturing in the euro zone accelerated at its fastest pace in two and a half years in November, helped by a ramp-up in production, reaching 51,6, compared with 51,3 in the previous month. More >> Manufacturing activity in the U.K. expanded in November at the fastest rate since February 2011, fuelling optimism over the countrys economic outlook. More >> U.S. stocks fell, with the Standard & Poors 500 extending declines in the final hour of trading, amid data showed manufacturing unexpectedly climbed last month and reports on holiday retail sales. More >> Hilton Worldwide Holdings Inc. (HLT) plans to raise as much as $2.4 billion in its U.S. initial public offering, the most ever for a hotel company. More >> Even with the strength of labor market, labor-intensive industries wont return to the U.S. as long as the huge labor compensation gaps persist with Asian and other developing countries. More >>

Japanese stocks ended flat in choppy trade on Monday as investors turned cautious after the market's recent rapid gains and awaited major U.S. economic data. More >> Chinas move to end a 14-month ban on IPOs and allow the sale of preferred shares led to a rally in stocks as investors bet the measures will boost fees for brokerages and ease banks funding. More >> China's manufacturing activity maintained its steady growth in November. The HSBC November PMI stood at 50.8, down a touch from 50.9 in October but better than a flash estimate of 50.4. More >>

OIL(WTI 93.86$/bl; +1.15%; Brent 111.45$/bl; +1.36%) and GOLD (1217.60$/oz t; -2.40%): Oil prices shot up and gold dropped on Monday after data revealed that industrial activity in the U.S. and China, the world's largest consumers of crude, beat expectations and painted a picture of a global economy poised to demand more fuel and energy going forward. More on Oil >> More on Gold >> NATURAL GAS (3.967$/MMBtu; +1.69%): Natural gas futures rose as updated weather forecasting models continued to point to colder than average temperatures in the U.S. More >>

DISCLAIMER: Daily Briefs contains a summary of financial news covered on conventional news services around the world. Daily Briefs coverage of subjects is based on t whims of its volunteer contributors. FEP Finance Club is not responsible for any imprecision or error in the content of any news.

You might also like

- Equity Valuation Report - LVMHDocument3 pagesEquity Valuation Report - LVMHFEPFinanceClubNo ratings yet

- CTX510 Eco BA EN SI-v1.1 000Document207 pagesCTX510 Eco BA EN SI-v1.1 000Miliano Filho80% (5)

- Equity Valuation Report - SpotifyDocument3 pagesEquity Valuation Report - SpotifyFEPFinanceClub100% (1)

- Anti-Money Laundering Act As AMENDED BY RA 9194,10167,10365Document12 pagesAnti-Money Laundering Act As AMENDED BY RA 9194,10167,10365mtabcao100% (2)

- Internal Vs External RecruitmentDocument16 pagesInternal Vs External RecruitmentSarmad Ali100% (1)

- Daily 22.01.2014Document1 pageDaily 22.01.2014FEPFinanceClubNo ratings yet

- Daily 4.12.2013Document1 pageDaily 4.12.2013FEPFinanceClubNo ratings yet

- Daily 03.12.2013Document1 pageDaily 03.12.2013FEPFinanceClubNo ratings yet

- Daily 27.05.2014Document1 pageDaily 27.05.2014FEPFinanceClubNo ratings yet

- Daily 30.12.2013Document1 pageDaily 30.12.2013FEPFinanceClubNo ratings yet

- Daily 21.11.2013Document1 pageDaily 21.11.2013FEPFinanceClubNo ratings yet

- Daily 02.04.2014Document1 pageDaily 02.04.2014FEPFinanceClubNo ratings yet

- Daily 20.03.2014Document1 pageDaily 20.03.2014FEPFinanceClubNo ratings yet

- Daily 18.12.2013Document1 pageDaily 18.12.2013FEPFinanceClubNo ratings yet

- Daily 17.06.2014Document1 pageDaily 17.06.2014FEPFinanceClubNo ratings yet

- Daily 02.01.2014Document1 pageDaily 02.01.2014FEPFinanceClubNo ratings yet

- Daily: PSI20: DAX30: FTSE100: S&P500: NIKKEI225Document1 pageDaily: PSI20: DAX30: FTSE100: S&P500: NIKKEI225FEPFinanceClubNo ratings yet

- Daily 22.10.2013Document1 pageDaily 22.10.2013FEPFinanceClubNo ratings yet

- Daily 11.12.2013Document1 pageDaily 11.12.2013FEPFinanceClubNo ratings yet

- Daily 27.11.2013Document1 pageDaily 27.11.2013FEPFinanceClubNo ratings yet

- Daily 10.12.2013Document1 pageDaily 10.12.2013FEPFinanceClubNo ratings yet

- Daily 26.03.2014Document1 pageDaily 26.03.2014FEPFinanceClubNo ratings yet

- Daily: PSI20: DAX30: FTSE100: S&P500: NIKKEI225Document1 pageDaily: PSI20: DAX30: FTSE100: S&P500: NIKKEI225FEPFinanceClubNo ratings yet

- Daily 09.12.2013Document1 pageDaily 09.12.2013FEPFinanceClubNo ratings yet

- Daily: PSI20: DAX30: FTSE100: S&P500: NIKKEI225Document1 pageDaily: PSI20: DAX30: FTSE100: S&P500: NIKKEI225FEPFinanceClubNo ratings yet

- Daily 06.02.2014Document1 pageDaily 06.02.2014FEPFinanceClubNo ratings yet

- Daily 19.02.2014 PDFDocument1 pageDaily 19.02.2014 PDFFEPFinanceClubNo ratings yet

- Daily 15.10.2013Document1 pageDaily 15.10.2013FEPFinanceClubNo ratings yet

- Daily 18.06.2013Document1 pageDaily 18.06.2013FEPFinanceClubNo ratings yet

- Daily 29.01.2014Document1 pageDaily 29.01.2014FEPFinanceClubNo ratings yet

- Daily: 4 June 2014Document1 pageDaily: 4 June 2014FEPFinanceClubNo ratings yet

- Daily 23.10.2013Document1 pageDaily 23.10.2013FEPFinanceClubNo ratings yet

- Daily 23.12.2013Document1 pageDaily 23.12.2013FEPFinanceClubNo ratings yet

- Daily 10.02.2014Document1 pageDaily 10.02.2014FEPFinanceClubNo ratings yet

- Daily: PSI20: DAX30: FTSE100: S&P500: NIKKEI225Document1 pageDaily: PSI20: DAX30: FTSE100: S&P500: NIKKEI225FEPFinanceClubNo ratings yet

- Daily 04.06.2014Document1 pageDaily 04.06.2014FEPFinanceClubNo ratings yet

- Daily 10.06.2013Document1 pageDaily 10.06.2013FEPFinanceClubNo ratings yet

- Daily 17.02.2014Document1 pageDaily 17.02.2014FEPFinanceClubNo ratings yet

- Daily 18.11.2013Document1 pageDaily 18.11.2013FEPFinanceClubNo ratings yet

- Daily 09.01.2014Document1 pageDaily 09.01.2014FEPFinanceClubNo ratings yet

- Daily 15.01.2014Document1 pageDaily 15.01.2014FEPFinanceClubNo ratings yet

- Daily 20.02.2014Document1 pageDaily 20.02.2014FEPFinanceClubNo ratings yet

- Daily 03.09.2013Document1 pageDaily 03.09.2013FEPFinanceClubNo ratings yet

- Daily 29.10.2013Document1 pageDaily 29.10.2013FEPFinanceClubNo ratings yet

- Daily 28.04.2014Document1 pageDaily 28.04.2014FEPFinanceClubNo ratings yet

- Daily 11.11.2013Document1 pageDaily 11.11.2013FEPFinanceClubNo ratings yet

- Daily 11.06.2014Document1 pageDaily 11.06.2014FEPFinanceClubNo ratings yet

- Daily 17.12.2013Document1 pageDaily 17.12.2013FEPFinanceClubNo ratings yet

- Daily 11.03.2014 PDFDocument1 pageDaily 11.03.2014 PDFFEPFinanceClubNo ratings yet

- Daily 19.06.2013Document1 pageDaily 19.06.2013FEPFinanceClubNo ratings yet

- Daily 13.05.2014Document1 pageDaily 13.05.2014FEPFinanceClubNo ratings yet

- Daily Briefs: Dropped Nearly 1.5% Penalized by Jerónimo Martins and Banking Sector FallsDocument1 pageDaily Briefs: Dropped Nearly 1.5% Penalized by Jerónimo Martins and Banking Sector FallsFEPFinanceClubNo ratings yet

- Daily 18.03.2014Document1 pageDaily 18.03.2014FEPFinanceClubNo ratings yet

- Daily 03.06.2013Document1 pageDaily 03.06.2013FEPFinanceClubNo ratings yet

- Daily: Closed Closed ClosedDocument1 pageDaily: Closed Closed ClosedFEPFinanceClubNo ratings yet

- Daily 13.11.2013Document1 pageDaily 13.11.2013FEPFinanceClubNo ratings yet

- Daily 22.04.2014Document1 pageDaily 22.04.2014FEPFinanceClubNo ratings yet

- Daily 09.06.2014Document1 pageDaily 09.06.2014FEPFinanceClubNo ratings yet

- Daily 07.01.2014Document1 pageDaily 07.01.2014FEPFinanceClubNo ratings yet

- Daily 21.05.2013Document1 pageDaily 21.05.2013FEPFinanceClubNo ratings yet

- Daily 19.09.2013Document1 pageDaily 19.09.2013FEPFinanceClubNo ratings yet

- Daily 08.04.2014Document1 pageDaily 08.04.2014FEPFinanceClubNo ratings yet

- Daily 05.12.2013Document1 pageDaily 05.12.2013FEPFinanceClubNo ratings yet

- Daily: 4 June 2013Document1 pageDaily: 4 June 2013FEPFinanceClubNo ratings yet

- Equity Valuation Report - TOTAL, GALPDocument10 pagesEquity Valuation Report - TOTAL, GALPFEPFinanceClubNo ratings yet

- Monthly FX Report - October 2017Document3 pagesMonthly FX Report - October 2017FEPFinanceClubNo ratings yet

- Equity Valuation Report - AppleDocument3 pagesEquity Valuation Report - AppleFEPFinanceClubNo ratings yet

- Equity Valuation Report - Corticeira AmorimDocument3 pagesEquity Valuation Report - Corticeira AmorimFEPFinanceClubNo ratings yet

- Monthly FX Report FebruaryDocument3 pagesMonthly FX Report FebruaryFEPFinanceClubNo ratings yet

- Job Interviews: The Key To Your Success or Not: May S ArticleDocument3 pagesJob Interviews: The Key To Your Success or Not: May S ArticleFEPFinanceClubNo ratings yet

- Media Market PDFDocument10 pagesMedia Market PDFFEPFinanceClubNo ratings yet

- Equity Valuation Report - TwitterDocument3 pagesEquity Valuation Report - TwitterFEPFinanceClubNo ratings yet

- Monthly FX Report - January 15Document3 pagesMonthly FX Report - January 15FEPFinanceClubNo ratings yet

- Monthly FX Report AprilDocument3 pagesMonthly FX Report AprilFEPFinanceClubNo ratings yet

- Equity Valuation Report - Jerónimo MArtinsDocument2 pagesEquity Valuation Report - Jerónimo MArtinsFEPFinanceClub100% (1)

- Monthly FX Report - November 15Document3 pagesMonthly FX Report - November 15FEPFinanceClubNo ratings yet

- Equity Valuation Report - Altri SGPSDocument2 pagesEquity Valuation Report - Altri SGPSFEPFinanceClubNo ratings yet

- Article 1Document2 pagesArticle 1FEPFinanceClubNo ratings yet

- Equity Valuation Report - EDPDocument2 pagesEquity Valuation Report - EDPFEPFinanceClubNo ratings yet

- Article 9Document2 pagesArticle 9FEPFinanceClubNo ratings yet

- Equity Valuation Report - TelefonicaDocument2 pagesEquity Valuation Report - TelefonicaFEPFinanceClubNo ratings yet

- Equity Valuation Report - TESCODocument2 pagesEquity Valuation Report - TESCOFEPFinanceClub100% (1)

- Equity Valuation Report - IberdrolaDocument2 pagesEquity Valuation Report - IberdrolaFEPFinanceClubNo ratings yet

- Windows10 Commercial ComparisonDocument1 pageWindows10 Commercial ComparisoncetelecNo ratings yet

- Approaches To Development Communication-DoneDocument16 pagesApproaches To Development Communication-DoneChiragNo ratings yet

- Test PortDocument24 pagesTest PortquasibuddhaNo ratings yet

- User Licence 1 - Purpose of The LicenceDocument3 pagesUser Licence 1 - Purpose of The LicenceAnugrah Putra RaNo ratings yet

- Case 7 - Property RightsDocument2 pagesCase 7 - Property RightsVic RabayaNo ratings yet

- Development And Application Of Mobile Banking Concept: ТEME, г. XLI, бр. 2, априлDocument3 pagesDevelopment And Application Of Mobile Banking Concept: ТEME, г. XLI, бр. 2, априлKimberly ManradgeNo ratings yet

- Social Banking in India: An Outline: XLRI: School of Business & Human Resources Jamshedpur IndiaDocument5 pagesSocial Banking in India: An Outline: XLRI: School of Business & Human Resources Jamshedpur IndiaAbhijit PandaNo ratings yet

- Submitted byDocument9 pagesSubmitted byTyagi Munda AnkushNo ratings yet

- GFR 12 Recurring 2018-19)Document2 pagesGFR 12 Recurring 2018-19)RAVI RanjanNo ratings yet

- Director Client Service Marketing in Chicago IL Resume Susan FriestadDocument2 pagesDirector Client Service Marketing in Chicago IL Resume Susan FriestadSusanFriestadNo ratings yet

- Strategic ManagementDocument3 pagesStrategic ManagementMichael OdiemboNo ratings yet

- Strategic Management: Aftab KHANDocument13 pagesStrategic Management: Aftab KHANRuben KempterNo ratings yet

- EBP 03-Activity-1Document2 pagesEBP 03-Activity-1Levi AckermanNo ratings yet

- Orderdateregion Rep Item Units Unit Cost TotalDocument5 pagesOrderdateregion Rep Item Units Unit Cost TotalIndonesia FursNo ratings yet

- Unit 3 Lean Manufacturing NotesDocument4 pagesUnit 3 Lean Manufacturing NotesPraval SaiNo ratings yet

- Instructions: Students May Work in Groups On The Problem Set. Each Student Must Turn in His/her OWNDocument16 pagesInstructions: Students May Work in Groups On The Problem Set. Each Student Must Turn in His/her OWNHamna AzeezNo ratings yet

- Eight Paths of Innovations in A Lean Startup Manner: A Case StudyDocument17 pagesEight Paths of Innovations in A Lean Startup Manner: A Case StudyruwanegoNo ratings yet

- Marketing Management Question Bank For MidDocument5 pagesMarketing Management Question Bank For Middynamo vjNo ratings yet

- BS 1449 PT 1 Sec 1 - 5 1991 Cold Rolled S - S by BS EN 10268Document10 pagesBS 1449 PT 1 Sec 1 - 5 1991 Cold Rolled S - S by BS EN 10268Fu Ki chunNo ratings yet

- 2) Philippine Blooming Mills v. CADocument5 pages2) Philippine Blooming Mills v. CAAlexandraSoledadNo ratings yet

- Marginal CostingDocument10 pagesMarginal CostingJoydip DasguptaNo ratings yet

- Anzauz Anzauz Production Station - Hazop Action Clo: Engineeri Engineering MilestonesDocument3 pagesAnzauz Anzauz Production Station - Hazop Action Clo: Engineeri Engineering MilestonesadilsiddiqueNo ratings yet

- Honda Motorcycle 1987 OEM Parts Diagram For Right Crankcase Cover - Partzilla - Com - CopieDocument7 pagesHonda Motorcycle 1987 OEM Parts Diagram For Right Crankcase Cover - Partzilla - Com - Copiesteve.boisvertNo ratings yet

- TMP 8301381451 DavidsonDocument1 pageTMP 8301381451 Davidsondenny palimbungaNo ratings yet

- Dhaka Stock Exchange LimitedDocument11 pagesDhaka Stock Exchange LimitedCarl JohnsonNo ratings yet

- Fundamentals of Corporate Finance: Prepared by (M.Zahid Khan)Document34 pagesFundamentals of Corporate Finance: Prepared by (M.Zahid Khan)Syed Maaz HasanNo ratings yet

- Wear Sleeves, SKF Speedi-Sleeve: DimensionsDocument2 pagesWear Sleeves, SKF Speedi-Sleeve: DimensionsP S VenkateshNo ratings yet