Professional Documents

Culture Documents

Investment Declaration Form 2012-13 PDF

Investment Declaration Form 2012-13 PDF

Uploaded by

novalhemantOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Investment Declaration Form 2012-13 PDF

Investment Declaration Form 2012-13 PDF

Uploaded by

novalhemantCopyright:

Available Formats

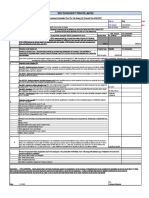

INVESTMENT Declaration Form for the period of APRIL 2012 TO MARCH 2013

EMP NAME

PAN No.

EMP NO

Location

DOJ

: Item Praticulars Deduction Under section 10 I am staying in a rented house and I agree to submit rent receipts House Rent when required.The Rent paid is (RS.xxxx for xx months) & the house is located city of .. I have taken exemption for LTA in the following years During the year 2006 - Yes / No During the year 2007 - Yes / No LTA - IF Applicable During the year 2008 - Yes / No as per your CTC During the year 2009 - Yes / No If I do not produce the bills to the satisfaction of the compnay can consider the amount paid towards LTA as taxable

E-mail id Max Limit Declared Amount

MAX BENEFIT PERMISSIBLE (Rs) AMOUNT (RS) 2 Sec 80D Premium in respect of Medical Insurance 15000 (for self, spouce,dependent childern), Addl 15000 is allowed if parents (not a Sr citizens) are covered. Another Addl 5000 is allowed if the parents are Sr citizens Maximum of Rs. 35000/- is allowed under this sec Sec 80DD (Medical treatment of handicapped dependents) Certificate from a doctor working in Government Hospital required Declaration by employee of amount incurred during the year Sec 80DDB (Medical treatment for specified ailments) Government Doctor(not less an MD) certificate in Form 101 Declaration by employee of amount incurred during the year. Please mention if treatment is on Senior Citizen Sec 80E Interest paid on loan availed for higher education Certificate from Financial Institution ( Only Interest part will be given as deduction and not Principal amount) Sec 80U (Physically handicapped or totally blind employee) Certificate from a doctor working in Government Hospital required 0

Maximum limit is 50,000 (In case of severe disablity more than 80% maximum limit is 75,000)

0 40000 or 60000 (Senior Citizen)

No Limit 0 0

5 6

Maximum limit is 50,000 (In case of severe disablity maximum limit is 75,000) Form 12 C is Mandatory to claim this exemption. (Loss should be mentioned in Bracket Eg:(150000))

Income or Loss from house property

0.00 DEDUCTION UNDER SEC 80C 8 Sec 80 CCC Contribution to Pension Fund 9 Life Insurance premium paid 10 Unit Linked Insurance Plan(ULIP) 11 National Savings Certificate(New Purchases) Maximum Limit u/s 80C is 12 Interest Accrued on NSC(Previous Investments) Rs.100000/- (Rs.100000/- including 13 Public Provident Fund(PPF) PF deduction from Salary).Additional 14 Equity Linked Savings Scheme of Rs.20,000/- exemption can be 15 Principle repayment of Housing Loan availed, if the investment is made 16 Mutual Fund Bonds towards infrastructure bonds 17 Tutions fees(Maximum 2 children) 18 Infrastructure Bonds 19 Subscription to the bonds issued by NABARD 20 Fixed Deposits more than 5 years made in Banks Note : The maximum amount of investments qualifying for deducation is Rs. 10,000/- under pension plan - 80CCC 10000 100000 100000 100000 100000 70000 100000 100000 100000 100000 120000 100000 100000

Income other than salary income Deduction under Section 24

If yes, then Form 12C detailing other income is attached

i.e. Interest paid less Net rental income will be Letout property / loss on house property exemption Interest on Housing Loan 150000( for self occupied) Interest if the loan is taken before 01/04/99 For letout (Nett rent-less interest paid will be interest on housing loan) Note : Form 12 C along with the calculation of loss on house property needs to be attached for considering the above Declaration: 1) I hereby declare that the information given above is correct and true in all respects. 2) I also undertake to indemnify the company for any loss/liability that may arise in the event of the above information being incorrect.

Date : Place:

Signature of the Employee

You might also like

- Uniform Rules For Contract Bond (URCB)Document6 pagesUniform Rules For Contract Bond (URCB)badiehneshin100% (1)

- IT Declaration Form Revised SalaryDocument1 pageIT Declaration Form Revised SalaryMANUBHOPALNo ratings yet

- National Institute of Technology CalicutDocument7 pagesNational Institute of Technology CalicutraghuramaNo ratings yet

- IT Declaration Form FY 2018-19Document3 pagesIT Declaration Form FY 2018-19sgshekar3050% (2)

- IT Declaration FormatDocument2 pagesIT Declaration FormatKamal VermaNo ratings yet

- Investment Declaration Form F.Y. 2016-17Document2 pagesInvestment Declaration Form F.Y. 2016-17Sanjeev Kumar50% (2)

- Income Tax Declaration Form 2012-13Document2 pagesIncome Tax Declaration Form 2012-13asfsadfSNo ratings yet

- Income Tax NitDocument6 pagesIncome Tax NitrensisamNo ratings yet

- Investment Declaration Form - 1314 - IshitaDocument5 pagesInvestment Declaration Form - 1314 - IshitaIshita AwasthiNo ratings yet

- IT Declaration Form 2011-2012Document1 pageIT Declaration Form 2011-2012Shishir RoyNo ratings yet

- Income Tax DeclarationDocument1 pageIncome Tax Declarationrajshekarmech06No ratings yet

- Saving Form-Income Tax 12-13Document9 pagesSaving Form-Income Tax 12-13khaleel887No ratings yet

- Investment PlanDocument1 pageInvestment PlanNitin AgarwalNo ratings yet

- Investment Declaration Form11-12Document2 pagesInvestment Declaration Form11-12girijasankar11No ratings yet

- As Per New Budget Technosys - Investment - Declaration Form Fy 2014-15Document4 pagesAs Per New Budget Technosys - Investment - Declaration Form Fy 2014-15sandip_chauhan5862No ratings yet

- The ABC Foundation: Investment Declaration Form For Tax Saving For Financial Year 2018-2019 The Akshaya Patra FoundationDocument1 pageThe ABC Foundation: Investment Declaration Form For Tax Saving For Financial Year 2018-2019 The Akshaya Patra FoundationLantNo ratings yet

- Arrina Education Services Pvt. LTD.: Investment Declaration Form (FY 2012-2013)Document2 pagesArrina Education Services Pvt. LTD.: Investment Declaration Form (FY 2012-2013)JITEN2050No ratings yet

- Income Tax Ready Reckoner 2011-12Document28 pagesIncome Tax Ready Reckoner 2011-12kpksscribdNo ratings yet

- IT Declaration Form 2012-13Document1 pageIT Declaration Form 2012-13Suresh SharmaNo ratings yet

- Income Tax in IndiaDocument19 pagesIncome Tax in IndiaConcepts TreeNo ratings yet

- IT Declaration Form April 2023 To March 2024.Document3 pagesIT Declaration Form April 2023 To March 2024.partha.uneesolutionsNo ratings yet

- Theorem Tax Plan 2012-13Document1 pageTheorem Tax Plan 2012-13Ashwini PadhyNo ratings yet

- Investment Declaration Form For The Financial Year 2014 - 15Document7 pagesInvestment Declaration Form For The Financial Year 2014 - 15devanyaNo ratings yet

- IT Declaration Form 2020-21Document1 pageIT Declaration Form 2020-21Akshay AcchuNo ratings yet

- IT DeclarationDocument5 pagesIT Declarationkalpanagupta_purNo ratings yet

- Tax CalculatorDocument10 pagesTax Calculatorgsagar879No ratings yet

- Tax Decl Ration For 2011 - 2012Document1 pageTax Decl Ration For 2011 - 2012palavanish89No ratings yet

- Income Tax Exemptions For The Year 2010Document4 pagesIncome Tax Exemptions For The Year 2010Homework PingNo ratings yet

- Employees Proof Submission Form (EPSF) - 2010-11Document1 pageEmployees Proof Submission Form (EPSF) - 2010-11amararenaNo ratings yet

- Old Tax Regime of The FY 2019-20 New Tax Regime of FY The 2020-21Document4 pagesOld Tax Regime of The FY 2019-20 New Tax Regime of FY The 2020-21Suhas BNo ratings yet

- Declaration Form 12BB 2022 23Document4 pagesDeclaration Form 12BB 2022 23S S PradheepanNo ratings yet

- TDS Declaration FormDocument2 pagesTDS Declaration FormA M P KumarNo ratings yet

- Swami Samarth Tax Consultants: If You Miss This Vital Step, Your Return Will Be Treated As Not FiledDocument2 pagesSwami Samarth Tax Consultants: If You Miss This Vital Step, Your Return Will Be Treated As Not FiledmakamkkumarNo ratings yet

- Income Tax Calculator FY 2013 14Document4 pagesIncome Tax Calculator FY 2013 14faiza17No ratings yet

- TDS (Tax Deducted at Source) : ST STDocument6 pagesTDS (Tax Deducted at Source) : ST STRuchiRangariNo ratings yet

- De Smet Engineers & Contractors India Private Limited Investment Declaration Form For Financial Year 2019 - 2020Document5 pagesDe Smet Engineers & Contractors India Private Limited Investment Declaration Form For Financial Year 2019 - 2020Lakshmanan SNo ratings yet

- Declaration For Proposed Tax Saving Investment and Expenditures For F.Y. 2011 12Document11 pagesDeclaration For Proposed Tax Saving Investment and Expenditures For F.Y. 2011 12nikhiljain17No ratings yet

- For Shalini Investment Declaration-2012-13Document1 pageFor Shalini Investment Declaration-2012-13Poorni GanesanNo ratings yet

- Deductions: Basic Rule The Aggregate Amount of Deductions Under Sections 80C To 80U Cannot Exceed The Gross Total IncomeDocument28 pagesDeductions: Basic Rule The Aggregate Amount of Deductions Under Sections 80C To 80U Cannot Exceed The Gross Total IncomeAmar ItagiNo ratings yet

- Investment Declaration Form For FY - 2017-18Document2 pagesInvestment Declaration Form For FY - 2017-18arunNo ratings yet

- Investment Declaration Form - (FY 24-25)Document3 pagesInvestment Declaration Form - (FY 24-25)niketanNo ratings yet

- Income From House Property Income From Business or Profession Capital Gains Income From Other SourcesDocument4 pagesIncome From House Property Income From Business or Profession Capital Gains Income From Other SourcesPooja TanejaNo ratings yet

- Investment DeclarationDocument2 pagesInvestment DeclarationshivshenoyNo ratings yet

- Budget 2015Document16 pagesBudget 2015Sachin SharmaNo ratings yet

- Income Tax Declaration Form - F.Y. 2020-21Document8 pagesIncome Tax Declaration Form - F.Y. 2020-21LTelford RudraprayagNo ratings yet

- Chapter 12 TaxdeductionsDocument16 pagesChapter 12 TaxdeductionsRiya SharmaNo ratings yet

- Tax Declaration Form 2021 22Document4 pagesTax Declaration Form 2021 22Kasiviswanathan ChinnathambiNo ratings yet

- It Declaration Year 2011 12Document1 pageIt Declaration Year 2011 12Vijay BokadeNo ratings yet

- Taxation Quiz Problem 50 ItemsDocument6 pagesTaxation Quiz Problem 50 ItemsTray AhlNo ratings yet

- Income Tax Calculator FY 2012 13Document4 pagesIncome Tax Calculator FY 2012 13raattaiNo ratings yet

- Investment Declaration Form (Hemarus)Document4 pagesInvestment Declaration Form (Hemarus)Shashi NaganurNo ratings yet

- Income Tax Rates 2011-12 Exemption Deduction Tax Calculation Income Tax Ready Reckoner FreeDocument6 pagesIncome Tax Rates 2011-12 Exemption Deduction Tax Calculation Income Tax Ready Reckoner FreevickycdNo ratings yet

- Guidelines For Income Tax DeclarationDocument9 pagesGuidelines For Income Tax Declarationapoorva1801No ratings yet

- HRA, Chapter VI A - 80CCD, 80C, 80D, Other IncomeDocument9 pagesHRA, Chapter VI A - 80CCD, 80C, 80D, Other Incomefaiyaz432No ratings yet

- Investment Declaration FY 2024-25Document6 pagesInvestment Declaration FY 2024-25Kumar BhaskarNo ratings yet

- Guidelines SDocument5 pagesGuidelines SveraristuNo ratings yet

- Deductions On Section 80CDocument12 pagesDeductions On Section 80CViraja GuruNo ratings yet

- Notes To Investment Proof SubmissionDocument10 pagesNotes To Investment Proof SubmissionnikunjrnanavatiNo ratings yet

- MockDocument18 pagesMockSmarty ShivamNo ratings yet

- Income Tax Calculator For MaleDocument19 pagesIncome Tax Calculator For MaleAlok SaxenaNo ratings yet

- St. Paul Fire & Marine Insurance Co. vs. Macondray & Co., IncDocument2 pagesSt. Paul Fire & Marine Insurance Co. vs. Macondray & Co., Inctiffatendido100% (3)

- Quiz 4Document4 pagesQuiz 4cece ceceNo ratings yet

- FARAP-4406C: Investment Property & Other InvestmentsDocument10 pagesFARAP-4406C: Investment Property & Other InvestmentsLei PangilinanNo ratings yet

- N 137Document53 pagesN 137Aep SaepudinNo ratings yet

- Financial AccountingDocument20 pagesFinancial Accountingzeyyahji100% (1)

- Commercial Law AssignmentDocument9 pagesCommercial Law AssignmentsueannNo ratings yet

- APGLI FormDocument18 pagesAPGLI Formapi-3710215100% (3)

- Business RegistrationDocument7 pagesBusiness RegistrationEric SanchezNo ratings yet

- Claremont COURIER 7-1-16Document30 pagesClaremont COURIER 7-1-16Peter WeinbergerNo ratings yet

- Control of Well Limits: How Much Is Enough?Document23 pagesControl of Well Limits: How Much Is Enough?Salem HalbaouiNo ratings yet

- Draft Contract of LeaseDocument5 pagesDraft Contract of LeaseMarx de ChavezNo ratings yet

- Human Resource Management in Bangladesh - Exim BankDocument57 pagesHuman Resource Management in Bangladesh - Exim BankShohidullah Kaiser100% (2)

- Ground Lease FormDocument91 pagesGround Lease Formpmariano_5No ratings yet

- Capital AssessmentDocument57 pagesCapital AssessmentAnonymous DLEF3GvNo ratings yet

- Introduction To CooperativesDocument2 pagesIntroduction To CooperativesLian Blakely CousinNo ratings yet

- Icare Brochure PDFDocument6 pagesIcare Brochure PDFyatinthoratscrbNo ratings yet

- Tarun's Summer Internship ProjectDocument39 pagesTarun's Summer Internship Projectgrvmundra33% (3)

- OCR 104A: Application For Mediation or Hearing - Form ADocument4 pagesOCR 104A: Application For Mediation or Hearing - Form AjohnNo ratings yet

- Các Bài Thư Mẫu HayDocument13 pagesCác Bài Thư Mẫu HayHà Huy TấnNo ratings yet

- Gurughasidas Central University, Bilaspur: "Power and Duties of Income-Tax Authorities"Document20 pagesGurughasidas Central University, Bilaspur: "Power and Duties of Income-Tax Authorities"Kishori PatelNo ratings yet

- DT NewDocument23 pagesDT NewSanket MhetreNo ratings yet

- The Commercial BankDocument6 pagesThe Commercial BankLuis UntalanNo ratings yet

- Safety of Ships Shipping-Review-2015Document36 pagesSafety of Ships Shipping-Review-2015Rishabh SinghNo ratings yet

- 2010 ADSO As DGPA Tax ReturnDocument17 pages2010 ADSO As DGPA Tax ReturnDentist The MenaceNo ratings yet

- Bancassurance Report FinalDocument152 pagesBancassurance Report FinalMohammed BenaliNo ratings yet

- CommuniCare Health Services - Redacted HWMDocument31 pagesCommuniCare Health Services - Redacted HWMAnonymous kprzCiZNo ratings yet

- Commercial Law Reviewer - AbellaDocument79 pagesCommercial Law Reviewer - Abellapolbisente100% (2)

- Iiflar2011 12Document106 pagesIiflar2011 12Aisha GuptaNo ratings yet

- CONTINGENT CONTRACTS VincyDocument5 pagesCONTINGENT CONTRACTS Vincyvincy gladisNo ratings yet