Professional Documents

Culture Documents

Light Newsletter IR - Year I - N

Light Newsletter IR - Year I - N

Uploaded by

LightRICopyright:

Available Formats

You might also like

- FedEx Strategic Analysis Including Value Chain SWOT Porter S 5 PDFDocument30 pagesFedEx Strategic Analysis Including Value Chain SWOT Porter S 5 PDFhs138066No ratings yet

- Ge Matrix CalculatorDocument4 pagesGe Matrix CalculatorRowen Elton Bedeau100% (1)

- Chapter 3 - Investments in Debt Securities and Other Non-Current Financial AssetsDocument56 pagesChapter 3 - Investments in Debt Securities and Other Non-Current Financial AssetsYel75% (4)

- Mozal CaseDocument41 pagesMozal Casearjrocks235100% (2)

- Light Newsletter IR - Year I - NDocument1 pageLight Newsletter IR - Year I - NLightRINo ratings yet

- Light Newsletter IR - Year I - NDocument1 pageLight Newsletter IR - Year I - NLightRINo ratings yet

- ALI Annual Report 2011aDocument166 pagesALI Annual Report 2011amojokinsNo ratings yet

- 1.goldman Funds Acquire Endesa's Spanish Gas Assets For $1.1 BN News 29 September 2010Document7 pages1.goldman Funds Acquire Endesa's Spanish Gas Assets For $1.1 BN News 29 September 2010Vaibhav AgrawalNo ratings yet

- Conference Call Transcript 4Q11 Results Mills (MILS3 BZ) February 14, 2012 Ramon VazquezDocument6 pagesConference Call Transcript 4Q11 Results Mills (MILS3 BZ) February 14, 2012 Ramon VazquezMillsRINo ratings yet

- q4 Ceo Remarks - FinalDocument11 pagesq4 Ceo Remarks - Finalakshay kumarNo ratings yet

- Mills 4Q12 ResultDocument15 pagesMills 4Q12 ResultMillsRINo ratings yet

- Case StudyDocument7 pagesCase StudyKrizzel ValerosNo ratings yet

- GNE RawDocument5 pagesGNE RawUday KiranNo ratings yet

- 03-12-20 AC FY2019 Earnings Release - For Disclosure - VFFDocument8 pages03-12-20 AC FY2019 Earnings Release - For Disclosure - VFFPaulNo ratings yet

- Mills: Net Earnings Grew 73.5%, A New Quarterly Record: Bm&Fbovespa: Mils3 Mills 2Q12 ResultsDocument14 pagesMills: Net Earnings Grew 73.5%, A New Quarterly Record: Bm&Fbovespa: Mils3 Mills 2Q12 ResultsMillsRINo ratings yet

- UntitledDocument7 pagesUntitledMillsRINo ratings yet

- Quarterly Report 1Q08: EBITDA of 1Q08 Reaches R$ 205 Million, With 28% MarginDocument17 pagesQuarterly Report 1Q08: EBITDA of 1Q08 Reaches R$ 205 Million, With 28% MarginKlabin_RINo ratings yet

- DemonstraDocument129 pagesDemonstraLightRINo ratings yet

- Mills 3Q12 ResultDocument14 pagesMills 3Q12 ResultMillsRINo ratings yet

- Anagement EportDocument14 pagesAnagement EportKlabin_RINo ratings yet

- Mills: Revenue Growth of 23.2% in 2011, With Record EBITDA: Bm&Fbovespa: Mils3 Mills 4Q11 ResultsDocument16 pagesMills: Revenue Growth of 23.2% in 2011, With Record EBITDA: Bm&Fbovespa: Mils3 Mills 4Q11 ResultsMillsRINo ratings yet

- Annual Review 2011Document52 pagesAnnual Review 2011Nooreza PeerooNo ratings yet

- 4Q12 Earnings ReleaseDocument55 pages4Q12 Earnings ReleaseMultiplan RINo ratings yet

- REA Group 2H12 PDFDocument3 pagesREA Group 2H12 PDFBernardo MirandaNo ratings yet

- Rio Tinto Delivers First Half Underlying Earnings of 2.9 BillionDocument58 pagesRio Tinto Delivers First Half Underlying Earnings of 2.9 BillionBisto MasiloNo ratings yet

- Market Notes May 13 FridayDocument3 pagesMarket Notes May 13 FridayJC CalaycayNo ratings yet

- DemonstraDocument117 pagesDemonstraLightRINo ratings yet

- Operator: Good Morning and Welcome To Mills 1Q12 Conference Call. Right Now AllDocument6 pagesOperator: Good Morning and Welcome To Mills 1Q12 Conference Call. Right Now AllMillsRINo ratings yet

- Mills: EBITDA Margin Reaches 43.3%, With Strong Growth: Bm&Fbovespa: Mils3 Mills 1Q12 ResultsDocument15 pagesMills: EBITDA Margin Reaches 43.3%, With Strong Growth: Bm&Fbovespa: Mils3 Mills 1Q12 ResultsMillsRINo ratings yet

- Management Report First Quarter 2020 Results: OPERATING HIGHLIGHTS (Continuing Operations)Document25 pagesManagement Report First Quarter 2020 Results: OPERATING HIGHLIGHTS (Continuing Operations)monjito1976No ratings yet

- Anagement Eport: Initial ConsiderationsDocument8 pagesAnagement Eport: Initial ConsiderationsKlabin_RINo ratings yet

- Light Newsletter IR - Year II - N? 7Document1 pageLight Newsletter IR - Year II - N? 7LightRINo ratings yet

- Light Newsletter Year II - N? 7Document1 pageLight Newsletter Year II - N? 7LightRINo ratings yet

- Multiplan Transcricao 1Q08 20080609 EngDocument6 pagesMultiplan Transcricao 1Q08 20080609 EngMultiplan RINo ratings yet

- NE 06-09 - em InglDocument101 pagesNE 06-09 - em InglLightRINo ratings yet

- BTG Pactual XII CEO Conference: February 2011Document38 pagesBTG Pactual XII CEO Conference: February 2011MillsRINo ratings yet

- Contributor Name Headline Document Document Type Analyst Primary Secondary Companies Primary Secondary IndustriesDocument10 pagesContributor Name Headline Document Document Type Analyst Primary Secondary Companies Primary Secondary Industriesn_ashok_2020No ratings yet

- Aba Message To SH & Priority Projects-July 2015Document4 pagesAba Message To SH & Priority Projects-July 2015joachimjackNo ratings yet

- EY Focus On The Trinidad and Tobago Budget 2018Document50 pagesEY Focus On The Trinidad and Tobago Budget 2018rose_kissme96No ratings yet

- Analyst Presentation - Aptech LTD Q3FY13Document31 pagesAnalyst Presentation - Aptech LTD Q3FY13ashishkrishNo ratings yet

- Mills Expands 2011 Capex Budget For Its Jahu Division: Press ReleaseDocument2 pagesMills Expands 2011 Capex Budget For Its Jahu Division: Press ReleaseMillsRINo ratings yet

- 1Q19 Cat Financial ResultsDocument4 pages1Q19 Cat Financial ResultsLiang ZhangNo ratings yet

- Multiplan Transc 1Q09 EngDocument4 pagesMultiplan Transc 1Q09 EngMultiplan RINo ratings yet

- Etd 2011 2 7 29Document1 pageEtd 2011 2 7 29143mahimaNo ratings yet

- EBITDA of R$ 1,077 Million in 2011 - The Best Result in The Company's HistoryDocument21 pagesEBITDA of R$ 1,077 Million in 2011 - The Best Result in The Company's HistoryKlabin_RINo ratings yet

- Ayala CorporationDocument9 pagesAyala CorporationJo AntisodaNo ratings yet

- SIE CY 2004 Volume 1 NewDocument54 pagesSIE CY 2004 Volume 1 NewShobi DionelaNo ratings yet

- Q1 Earnings Transcript (310312)Document13 pagesQ1 Earnings Transcript (310312)sgruen9903No ratings yet

- TABULODocument15 pagesTABULOHeidi DeanNo ratings yet

- Political EconomicalDocument15 pagesPolitical EconomicalRaymond PascualNo ratings yet

- BiffaDocument2 pagesBiffaeboroNo ratings yet

- Via Pse Edge: Philippine Stock Exchange, IncDocument3 pagesVia Pse Edge: Philippine Stock Exchange, IncRomeo CamarilloNo ratings yet

- MjsmithPWP Autumn Statement 2012 WebDocument10 pagesMjsmithPWP Autumn Statement 2012 Webmiles6026No ratings yet

- Gotham GSJ S 2020 - 3Document11 pagesGotham GSJ S 2020 - 3Gotham Insights100% (3)

- HSBC Holdings PLC, H1 2018 Earnings Call, Aug 06, 2018Document16 pagesHSBC Holdings PLC, H1 2018 Earnings Call, Aug 06, 2018MKNo ratings yet

- Citi Second Quarter 2014 Earnings Review: July 14, 2014Document28 pagesCiti Second Quarter 2014 Earnings Review: July 14, 2014Mark ReinhardtNo ratings yet

- Ge Webcast Pressrelease 10162009Document9 pagesGe Webcast Pressrelease 10162009qtipxNo ratings yet

- Pethealth Annual Report 2011 FINALDocument84 pagesPethealth Annual Report 2011 FINALNick PolingNo ratings yet

- Hindalco - Media - Press Releases - Novelis Reports Strong Fiscal Year 2012 ResultsDocument4 pagesHindalco - Media - Press Releases - Novelis Reports Strong Fiscal Year 2012 ResultsSandeep KumarNo ratings yet

- Multiplan Transc 4Q08.EnDocument4 pagesMultiplan Transc 4Q08.EnMultiplan RINo ratings yet

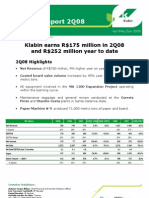

- Quarterly Report 2Q08: Klabin Earns R$175 Million in 2Q08 and R$252 Million Year To DateDocument15 pagesQuarterly Report 2Q08: Klabin Earns R$175 Million in 2Q08 and R$252 Million Year To DateKlabin_RINo ratings yet

- Jul20 ErDocument5 pagesJul20 Errwmortell3580No ratings yet

- CGD Securities - Morning Briefing - 02oct2013 PDFDocument7 pagesCGD Securities - Morning Briefing - 02oct2013 PDFIsaac MatheusNo ratings yet

- Corporate Presentation - Bank of America Merrill LynchDocument31 pagesCorporate Presentation - Bank of America Merrill LynchLightRINo ratings yet

- Presentation ? 4Q14 ResultsDocument21 pagesPresentation ? 4Q14 ResultsLightRINo ratings yet

- Minutes of Board of Directors Meeting 01 29 2015Document3 pagesMinutes of Board of Directors Meeting 01 29 2015LightRINo ratings yet

- Minutes of Board of Directors Meeting 02 05 2015Document3 pagesMinutes of Board of Directors Meeting 02 05 2015LightRINo ratings yet

- Relevant SaleDocument3 pagesRelevant SaleLightRINo ratings yet

- Minutes of Board of Directors Meeting 01 19 2015Document4 pagesMinutes of Board of Directors Meeting 01 19 2015LightRINo ratings yet

- Minutes of Board of Directors Meeting 12 12 2014Document4 pagesMinutes of Board of Directors Meeting 12 12 2014LightRINo ratings yet

- Light Newsletter IR - Year II - N? 8Document1 pageLight Newsletter IR - Year II - N? 8LightRINo ratings yet

- Minutes of Board of Directors Meeting 12 05 2014Document1 pageMinutes of Board of Directors Meeting 12 05 2014LightRINo ratings yet

- Change in The Expiry Date For The 1st Issue of Debentures of Light Energia, and 7th Issue of Debentures of Light SesaDocument1 pageChange in The Expiry Date For The 1st Issue of Debentures of Light Energia, and 7th Issue of Debentures of Light SesaLightRINo ratings yet

- AMMO Investor Presentation Final JGpower (1) 2018Document25 pagesAMMO Investor Presentation Final JGpower (1) 2018Ala Baster100% (1)

- FAR Chapter 1 Review NoteDocument9 pagesFAR Chapter 1 Review Noteniggy.fanNo ratings yet

- Novant Letter Regarding Withdrawal of Memorial Health DealDocument1 pageNovant Letter Regarding Withdrawal of Memorial Health Dealsavannahnow.comNo ratings yet

- Sample Qualified Written Request 2Document5 pagesSample Qualified Written Request 2james j jorissenNo ratings yet

- East Asian Miracle PDFDocument11 pagesEast Asian Miracle PDFDinesh KumarNo ratings yet

- Project Report On PVC PipesDocument54 pagesProject Report On PVC PipesUmer Shehzad79% (14)

- Circular 4 (2011) PDFDocument8 pagesCircular 4 (2011) PDFrajdeeppawarNo ratings yet

- How To Become An Entrepreneur Part 1Document18 pagesHow To Become An Entrepreneur Part 1aries mandy floresNo ratings yet

- FInal Exam KeyDocument27 pagesFInal Exam KeyQasim AtharNo ratings yet

- Project Financing StructureDocument8 pagesProject Financing StructureJulian ChackoNo ratings yet

- pdf14 Ultimate Guide To AssetsDocument24 pagespdf14 Ultimate Guide To AssetsBlack WidowNo ratings yet

- Factors Behind The Selection of Construction EquipmentsDocument6 pagesFactors Behind The Selection of Construction EquipmentsfabilNo ratings yet

- Advanced Financial ManagementDocument5 pagesAdvanced Financial ManagementAkshay KapoorNo ratings yet

- Financial Performance Analysis of First Security Islami Bank LimitedDocument21 pagesFinancial Performance Analysis of First Security Islami Bank LimitedSabrinaIra50% (2)

- Bloomberg Cheat Sheets PDFDocument45 pagesBloomberg Cheat Sheets PDFRakesh SuriNo ratings yet

- Project Report On Payables ManagementDocument61 pagesProject Report On Payables Managementsexy2248No ratings yet

- Final Report g4Document43 pagesFinal Report g4SuduNo ratings yet

- Types of InsuranceDocument2 pagesTypes of InsurancePrem KumarNo ratings yet

- Krugman TB Ch07 With AnswersDocument340 pagesKrugman TB Ch07 With AnswersJean ChanNo ratings yet

- Olympus 1Document22 pagesOlympus 1Preemnath KatareNo ratings yet

- Eeca Questions and Answer PDFDocument6 pagesEeca Questions and Answer PDFNAM CINEMANo ratings yet

- CFA 1 Micro EconomicsDocument61 pagesCFA 1 Micro EconomicsSandeep ShivhareNo ratings yet

- OTC Derivatives - Product History and Regulation (9-09)Document87 pagesOTC Derivatives - Product History and Regulation (9-09)Manish AnandNo ratings yet

- Weekly Xxvix - July 18 To 22, 2011Document2 pagesWeekly Xxvix - July 18 To 22, 2011JC CalaycayNo ratings yet

- Ratio Analysis and Equity ValuationDocument68 pagesRatio Analysis and Equity ValuationDui Diner MusafirNo ratings yet

- Godrej PropertiesDocument18 pagesGodrej PropertiesAnjali ShergilNo ratings yet

Light Newsletter IR - Year I - N

Light Newsletter IR - Year I - N

Uploaded by

LightRIOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Light Newsletter IR - Year I - N

Light Newsletter IR - Year I - N

Uploaded by

LightRICopyright:

Available Formats

INVESTOR RELATIONS

Bi-monthly Newsletter Year I No. 0

This is the launch issue of Lights IR newsletter. Exclusively created for our investors, the newsletter will be released every two months and includes the companys actions, projects and results. Wait for our news and enjoy your reading.

Investor Relations Department. Superintendence of Finance and Investor Relations.

6th LIGHT ANNUAL AND INVESTORS MEETING

n June 25, the 6 Light Annual and Investors Meeting was held at Centro Cultural Light. Paulo Roberto Pinto, Lights CEO, opened the event presenting the Companys results and investments, with special mention to the project rea de Perda Zero (APZ Zero Loss Area) Light Legal , which associates technology, relationship and the continuous work of teams trained to act in areas with high losses and default levels. Rio de Janeiro is a place where losses are linked to the financial situation of residents in a very peculiar way, a matter that is associated with city regions with high informality. The increase in peoples income increase tends to push the percentage of losses up and not the other way around. With APZ, we are on our way to minimize this problem. We want to reach 30 units and 400,000 clients by December, "said Paulo Roberto Pinto.

th

With APZ, we are on the right path to minimize losses. We want to reach 30 units and 400,000 clients by December. Paulo Roberto Pinto.

a watershed for Light, and it may have an impact on the companys results and the markets confidence on the companys policies to fight its losses. With respect to the tariff review, Joo Batista Zolini highlighted the importance of the technical work that has been done with the Brazilian Electricity Regulatory Agency (Aneel) to establish a level of regulatory losses that allows the company to continue with its investments. "We are trying to establish a regulatory loss curve that complies with Aneels rules, but also considers Rios distinct situation," said Mr. Zolini. Lights Energy Officer, Evandro Vasconcelos, discussed marketing strategy and generation expansion. "The repricing of Light Energias energy, previously contracted in the 2004 auctions that expire now in 2013, represents a substantial increase in Lights EBITDA. We also made large investments in infrastructure over the last four years. The expansion plan of Light s generation park envisages an installed capacity increase of 59.8% by 2017, considering the interest in the Lajes, Renova, Belo Monte, Itaocara and Guanhes power plants, "said Vasconcelos.

Also present were Joo Batista Zolini, Chief Financial and Investor Relations Officer; Evandro Vasconcelos, Energy Officer; Ziza Valadares, Communication Officer; and Ricardo Rocha, Distribution Officer. The businessman Luiz Pinheiro, responsible for APZ Cosmos (Campo Grande), was invited to talk about the successful performance of his, which was the pioneer unit. "In nine months of operation, APZ Cosmos, which has 35,000 clients, reduced commercial losses from 48% (before the implementation of the centralized measurement system) to 16.2%. Default increased from 91.5% to 99.2%. This is quite a significant result, "said Pinheiro. Some analysts who visited APZ Cosmos, in Campo Grande, on the day of the Investors Meeting (06/25) said they believe the project is

Paulo Roberto Pinto received from APIMEC a seal that celebrates the 9th consecutive year of this partnership.

RESULTS

Total energy consumption rose by 3.7% in 1Q13 over 1Q12, to 6,407 GWh, fueled by the increased consumption in the residential and commercial segments, up by 3.2% and 7.8% respectively. Consolidated net revenue, excluding revenue from construction, totaled R$1,883.1 million in the quarter, 6.9% up on 1Q12. First-quarter consolidated EBITDA came to R$355.1 million, 18.1% down on 1Q12, mainly due to higher expenses with power purchase by the distributor, despite partial coverage by the CDE transfer (Decree 7945/13) totaling R$428 million. Adjusted for the regulatory asset (CVA), 1Q13 adjusted EBITDA stood at R$456.3 million, 5.8% more than in 1Q12. First-quarter net income amounted to R$78.6 million versus R$140.1 million in 1Q12, down by 43.8%, influenced by nonmanageable costs with power purchase by the distributor. Adjusted by the regulatory asset (CVA), adjusted net income totaled R$145.4 million, 4.8% more than in 1Q12.

Joo Batista Zolini presents the results for the first quarter of 2013.

This electronic newsletter is intended for Lights investors. The bimonthly publication is a joint effort of the Superintendence of Finance and Investor Relations and the Investor Relations Department, with the coordination of Lights Superintendence of Corporate Communication. Suggestions and questions can be forwarded to ri@light.com.br. If you no longer wish to receive this newsletter, please contact ri@light.com.br.

You might also like

- FedEx Strategic Analysis Including Value Chain SWOT Porter S 5 PDFDocument30 pagesFedEx Strategic Analysis Including Value Chain SWOT Porter S 5 PDFhs138066No ratings yet

- Ge Matrix CalculatorDocument4 pagesGe Matrix CalculatorRowen Elton Bedeau100% (1)

- Chapter 3 - Investments in Debt Securities and Other Non-Current Financial AssetsDocument56 pagesChapter 3 - Investments in Debt Securities and Other Non-Current Financial AssetsYel75% (4)

- Mozal CaseDocument41 pagesMozal Casearjrocks235100% (2)

- Light Newsletter IR - Year I - NDocument1 pageLight Newsletter IR - Year I - NLightRINo ratings yet

- Light Newsletter IR - Year I - NDocument1 pageLight Newsletter IR - Year I - NLightRINo ratings yet

- ALI Annual Report 2011aDocument166 pagesALI Annual Report 2011amojokinsNo ratings yet

- 1.goldman Funds Acquire Endesa's Spanish Gas Assets For $1.1 BN News 29 September 2010Document7 pages1.goldman Funds Acquire Endesa's Spanish Gas Assets For $1.1 BN News 29 September 2010Vaibhav AgrawalNo ratings yet

- Conference Call Transcript 4Q11 Results Mills (MILS3 BZ) February 14, 2012 Ramon VazquezDocument6 pagesConference Call Transcript 4Q11 Results Mills (MILS3 BZ) February 14, 2012 Ramon VazquezMillsRINo ratings yet

- q4 Ceo Remarks - FinalDocument11 pagesq4 Ceo Remarks - Finalakshay kumarNo ratings yet

- Mills 4Q12 ResultDocument15 pagesMills 4Q12 ResultMillsRINo ratings yet

- Case StudyDocument7 pagesCase StudyKrizzel ValerosNo ratings yet

- GNE RawDocument5 pagesGNE RawUday KiranNo ratings yet

- 03-12-20 AC FY2019 Earnings Release - For Disclosure - VFFDocument8 pages03-12-20 AC FY2019 Earnings Release - For Disclosure - VFFPaulNo ratings yet

- Mills: Net Earnings Grew 73.5%, A New Quarterly Record: Bm&Fbovespa: Mils3 Mills 2Q12 ResultsDocument14 pagesMills: Net Earnings Grew 73.5%, A New Quarterly Record: Bm&Fbovespa: Mils3 Mills 2Q12 ResultsMillsRINo ratings yet

- UntitledDocument7 pagesUntitledMillsRINo ratings yet

- Quarterly Report 1Q08: EBITDA of 1Q08 Reaches R$ 205 Million, With 28% MarginDocument17 pagesQuarterly Report 1Q08: EBITDA of 1Q08 Reaches R$ 205 Million, With 28% MarginKlabin_RINo ratings yet

- DemonstraDocument129 pagesDemonstraLightRINo ratings yet

- Mills 3Q12 ResultDocument14 pagesMills 3Q12 ResultMillsRINo ratings yet

- Anagement EportDocument14 pagesAnagement EportKlabin_RINo ratings yet

- Mills: Revenue Growth of 23.2% in 2011, With Record EBITDA: Bm&Fbovespa: Mils3 Mills 4Q11 ResultsDocument16 pagesMills: Revenue Growth of 23.2% in 2011, With Record EBITDA: Bm&Fbovespa: Mils3 Mills 4Q11 ResultsMillsRINo ratings yet

- Annual Review 2011Document52 pagesAnnual Review 2011Nooreza PeerooNo ratings yet

- 4Q12 Earnings ReleaseDocument55 pages4Q12 Earnings ReleaseMultiplan RINo ratings yet

- REA Group 2H12 PDFDocument3 pagesREA Group 2H12 PDFBernardo MirandaNo ratings yet

- Rio Tinto Delivers First Half Underlying Earnings of 2.9 BillionDocument58 pagesRio Tinto Delivers First Half Underlying Earnings of 2.9 BillionBisto MasiloNo ratings yet

- Market Notes May 13 FridayDocument3 pagesMarket Notes May 13 FridayJC CalaycayNo ratings yet

- DemonstraDocument117 pagesDemonstraLightRINo ratings yet

- Operator: Good Morning and Welcome To Mills 1Q12 Conference Call. Right Now AllDocument6 pagesOperator: Good Morning and Welcome To Mills 1Q12 Conference Call. Right Now AllMillsRINo ratings yet

- Mills: EBITDA Margin Reaches 43.3%, With Strong Growth: Bm&Fbovespa: Mils3 Mills 1Q12 ResultsDocument15 pagesMills: EBITDA Margin Reaches 43.3%, With Strong Growth: Bm&Fbovespa: Mils3 Mills 1Q12 ResultsMillsRINo ratings yet

- Management Report First Quarter 2020 Results: OPERATING HIGHLIGHTS (Continuing Operations)Document25 pagesManagement Report First Quarter 2020 Results: OPERATING HIGHLIGHTS (Continuing Operations)monjito1976No ratings yet

- Anagement Eport: Initial ConsiderationsDocument8 pagesAnagement Eport: Initial ConsiderationsKlabin_RINo ratings yet

- Light Newsletter IR - Year II - N? 7Document1 pageLight Newsletter IR - Year II - N? 7LightRINo ratings yet

- Light Newsletter Year II - N? 7Document1 pageLight Newsletter Year II - N? 7LightRINo ratings yet

- Multiplan Transcricao 1Q08 20080609 EngDocument6 pagesMultiplan Transcricao 1Q08 20080609 EngMultiplan RINo ratings yet

- NE 06-09 - em InglDocument101 pagesNE 06-09 - em InglLightRINo ratings yet

- BTG Pactual XII CEO Conference: February 2011Document38 pagesBTG Pactual XII CEO Conference: February 2011MillsRINo ratings yet

- Contributor Name Headline Document Document Type Analyst Primary Secondary Companies Primary Secondary IndustriesDocument10 pagesContributor Name Headline Document Document Type Analyst Primary Secondary Companies Primary Secondary Industriesn_ashok_2020No ratings yet

- Aba Message To SH & Priority Projects-July 2015Document4 pagesAba Message To SH & Priority Projects-July 2015joachimjackNo ratings yet

- EY Focus On The Trinidad and Tobago Budget 2018Document50 pagesEY Focus On The Trinidad and Tobago Budget 2018rose_kissme96No ratings yet

- Analyst Presentation - Aptech LTD Q3FY13Document31 pagesAnalyst Presentation - Aptech LTD Q3FY13ashishkrishNo ratings yet

- Mills Expands 2011 Capex Budget For Its Jahu Division: Press ReleaseDocument2 pagesMills Expands 2011 Capex Budget For Its Jahu Division: Press ReleaseMillsRINo ratings yet

- 1Q19 Cat Financial ResultsDocument4 pages1Q19 Cat Financial ResultsLiang ZhangNo ratings yet

- Multiplan Transc 1Q09 EngDocument4 pagesMultiplan Transc 1Q09 EngMultiplan RINo ratings yet

- Etd 2011 2 7 29Document1 pageEtd 2011 2 7 29143mahimaNo ratings yet

- EBITDA of R$ 1,077 Million in 2011 - The Best Result in The Company's HistoryDocument21 pagesEBITDA of R$ 1,077 Million in 2011 - The Best Result in The Company's HistoryKlabin_RINo ratings yet

- Ayala CorporationDocument9 pagesAyala CorporationJo AntisodaNo ratings yet

- SIE CY 2004 Volume 1 NewDocument54 pagesSIE CY 2004 Volume 1 NewShobi DionelaNo ratings yet

- Q1 Earnings Transcript (310312)Document13 pagesQ1 Earnings Transcript (310312)sgruen9903No ratings yet

- TABULODocument15 pagesTABULOHeidi DeanNo ratings yet

- Political EconomicalDocument15 pagesPolitical EconomicalRaymond PascualNo ratings yet

- BiffaDocument2 pagesBiffaeboroNo ratings yet

- Via Pse Edge: Philippine Stock Exchange, IncDocument3 pagesVia Pse Edge: Philippine Stock Exchange, IncRomeo CamarilloNo ratings yet

- MjsmithPWP Autumn Statement 2012 WebDocument10 pagesMjsmithPWP Autumn Statement 2012 Webmiles6026No ratings yet

- Gotham GSJ S 2020 - 3Document11 pagesGotham GSJ S 2020 - 3Gotham Insights100% (3)

- HSBC Holdings PLC, H1 2018 Earnings Call, Aug 06, 2018Document16 pagesHSBC Holdings PLC, H1 2018 Earnings Call, Aug 06, 2018MKNo ratings yet

- Citi Second Quarter 2014 Earnings Review: July 14, 2014Document28 pagesCiti Second Quarter 2014 Earnings Review: July 14, 2014Mark ReinhardtNo ratings yet

- Ge Webcast Pressrelease 10162009Document9 pagesGe Webcast Pressrelease 10162009qtipxNo ratings yet

- Pethealth Annual Report 2011 FINALDocument84 pagesPethealth Annual Report 2011 FINALNick PolingNo ratings yet

- Hindalco - Media - Press Releases - Novelis Reports Strong Fiscal Year 2012 ResultsDocument4 pagesHindalco - Media - Press Releases - Novelis Reports Strong Fiscal Year 2012 ResultsSandeep KumarNo ratings yet

- Multiplan Transc 4Q08.EnDocument4 pagesMultiplan Transc 4Q08.EnMultiplan RINo ratings yet

- Quarterly Report 2Q08: Klabin Earns R$175 Million in 2Q08 and R$252 Million Year To DateDocument15 pagesQuarterly Report 2Q08: Klabin Earns R$175 Million in 2Q08 and R$252 Million Year To DateKlabin_RINo ratings yet

- Jul20 ErDocument5 pagesJul20 Errwmortell3580No ratings yet

- CGD Securities - Morning Briefing - 02oct2013 PDFDocument7 pagesCGD Securities - Morning Briefing - 02oct2013 PDFIsaac MatheusNo ratings yet

- Corporate Presentation - Bank of America Merrill LynchDocument31 pagesCorporate Presentation - Bank of America Merrill LynchLightRINo ratings yet

- Presentation ? 4Q14 ResultsDocument21 pagesPresentation ? 4Q14 ResultsLightRINo ratings yet

- Minutes of Board of Directors Meeting 01 29 2015Document3 pagesMinutes of Board of Directors Meeting 01 29 2015LightRINo ratings yet

- Minutes of Board of Directors Meeting 02 05 2015Document3 pagesMinutes of Board of Directors Meeting 02 05 2015LightRINo ratings yet

- Relevant SaleDocument3 pagesRelevant SaleLightRINo ratings yet

- Minutes of Board of Directors Meeting 01 19 2015Document4 pagesMinutes of Board of Directors Meeting 01 19 2015LightRINo ratings yet

- Minutes of Board of Directors Meeting 12 12 2014Document4 pagesMinutes of Board of Directors Meeting 12 12 2014LightRINo ratings yet

- Light Newsletter IR - Year II - N? 8Document1 pageLight Newsletter IR - Year II - N? 8LightRINo ratings yet

- Minutes of Board of Directors Meeting 12 05 2014Document1 pageMinutes of Board of Directors Meeting 12 05 2014LightRINo ratings yet

- Change in The Expiry Date For The 1st Issue of Debentures of Light Energia, and 7th Issue of Debentures of Light SesaDocument1 pageChange in The Expiry Date For The 1st Issue of Debentures of Light Energia, and 7th Issue of Debentures of Light SesaLightRINo ratings yet

- AMMO Investor Presentation Final JGpower (1) 2018Document25 pagesAMMO Investor Presentation Final JGpower (1) 2018Ala Baster100% (1)

- FAR Chapter 1 Review NoteDocument9 pagesFAR Chapter 1 Review Noteniggy.fanNo ratings yet

- Novant Letter Regarding Withdrawal of Memorial Health DealDocument1 pageNovant Letter Regarding Withdrawal of Memorial Health Dealsavannahnow.comNo ratings yet

- Sample Qualified Written Request 2Document5 pagesSample Qualified Written Request 2james j jorissenNo ratings yet

- East Asian Miracle PDFDocument11 pagesEast Asian Miracle PDFDinesh KumarNo ratings yet

- Project Report On PVC PipesDocument54 pagesProject Report On PVC PipesUmer Shehzad79% (14)

- Circular 4 (2011) PDFDocument8 pagesCircular 4 (2011) PDFrajdeeppawarNo ratings yet

- How To Become An Entrepreneur Part 1Document18 pagesHow To Become An Entrepreneur Part 1aries mandy floresNo ratings yet

- FInal Exam KeyDocument27 pagesFInal Exam KeyQasim AtharNo ratings yet

- Project Financing StructureDocument8 pagesProject Financing StructureJulian ChackoNo ratings yet

- pdf14 Ultimate Guide To AssetsDocument24 pagespdf14 Ultimate Guide To AssetsBlack WidowNo ratings yet

- Factors Behind The Selection of Construction EquipmentsDocument6 pagesFactors Behind The Selection of Construction EquipmentsfabilNo ratings yet

- Advanced Financial ManagementDocument5 pagesAdvanced Financial ManagementAkshay KapoorNo ratings yet

- Financial Performance Analysis of First Security Islami Bank LimitedDocument21 pagesFinancial Performance Analysis of First Security Islami Bank LimitedSabrinaIra50% (2)

- Bloomberg Cheat Sheets PDFDocument45 pagesBloomberg Cheat Sheets PDFRakesh SuriNo ratings yet

- Project Report On Payables ManagementDocument61 pagesProject Report On Payables Managementsexy2248No ratings yet

- Final Report g4Document43 pagesFinal Report g4SuduNo ratings yet

- Types of InsuranceDocument2 pagesTypes of InsurancePrem KumarNo ratings yet

- Krugman TB Ch07 With AnswersDocument340 pagesKrugman TB Ch07 With AnswersJean ChanNo ratings yet

- Olympus 1Document22 pagesOlympus 1Preemnath KatareNo ratings yet

- Eeca Questions and Answer PDFDocument6 pagesEeca Questions and Answer PDFNAM CINEMANo ratings yet

- CFA 1 Micro EconomicsDocument61 pagesCFA 1 Micro EconomicsSandeep ShivhareNo ratings yet

- OTC Derivatives - Product History and Regulation (9-09)Document87 pagesOTC Derivatives - Product History and Regulation (9-09)Manish AnandNo ratings yet

- Weekly Xxvix - July 18 To 22, 2011Document2 pagesWeekly Xxvix - July 18 To 22, 2011JC CalaycayNo ratings yet

- Ratio Analysis and Equity ValuationDocument68 pagesRatio Analysis and Equity ValuationDui Diner MusafirNo ratings yet

- Godrej PropertiesDocument18 pagesGodrej PropertiesAnjali ShergilNo ratings yet