Professional Documents

Culture Documents

Virtual Stock Tracking

Virtual Stock Tracking

Uploaded by

sumit1234aOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Virtual Stock Tracking

Virtual Stock Tracking

Uploaded by

sumit1234aCopyright:

Available Formats

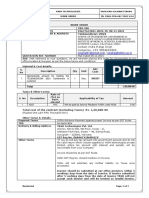

SAPM assignment

Virtual Stock-Tracking Initial Report

Submitted by:

SUMIT AGARWAL 12PGP099

Q2) Repeat the previous question using the weekly equity returns from your Stock-Track reports and the weekly Nifty Index. Discuss the difference that makes in your decisions if you consider the weekly return. Beta Daily Beta Weekly Beta Week 1 Week 2 Week 3 Week 4 0.89545 1.35660 0.80199 0.76284 0.96562

As can be seen in the table, the beta for the first week is quite dis-proportionate but for the other weeks is in line with the target beta of 0.83. First week can be attributed to start on Tuesday rather than on Monday, and on Monday generally the market rise due to weekend effects. The stocks in the first week rose more than the market. 3) Calculate the standard deviation of your weekly portfolio returns and compare them to the nifty index. Was the total risk of your portfolio more than or less than the nifty index? The standard deviation and the total risk are mentioned below in the table. Standard Deviation Standard Deviation Portfolio Standard Deviation Index 0.02905475 0.02136196 0.02036389 0.02035525 0.02583860 0.02346119 0.02116879 0.02157119 0.046296% 0.039155%

Week 1 Week 2 Week 3 Week 4 Total Risk

If we have a look at the standard deviation and the total risk for both the portfolio and the Index, we see that they are almost the same week by week basis and also in total risk with just a difference of 0.007%. This means that the portfolio performed very much in line with the market.

4).Using weekly portfolio returns for your portfolio and the nifty index, compare the two on a riskadjusted basis. You will calculate the total holding period returns, the Sharpe Index, and Treynor ratio for both portfolios. Which did better? Use 7% as the annual risk free rate or 0.1458% weekly. Portfolio Week 1 Holding Period Return Treynor Ratio Sharpe Index 2% 0.015891989 0.742015136

Week 2 Week 3 Week 4 Index Week 1 Week 2 Week 3 Week 4

1.8% 1.73% 2.38%

0.020898902 0.020775541 0.023089704

0.823059491 0.613364431 1.053239089

Holding Period Return Treynor Ratio Sharpe Index 1% 0.013526073 0.633185038 1% 0.003956851 0.19438968 3.49% 0.033469485 1.426589518 2.40% 0.022553342 1.045530662

If we compare the portfolio with the index we can see that the overall return is rather the same for both. However, there are weekly variations for e.x the portfolio performed better in the 1st and 2nd week, while the market did better with double the rise of portfolio in the 3rd week. With regards to the Treynor Ratio, again the performance is almost the same in the 1st and 4th week. The 2nd and 3rd week make up for each other in the difference. Hence, we cannot say anything about the portfolio outperforming the market or not in terms of systematic risk. For Sharpe index, we can clearly see, in 2 weeks the portfolio did better than the market while the market did better than the portfolio in 1 week. 5). Do you feel that the amount of risk that you took, and the strategies you took, were appropriate for your client given the target beta that you were given? (Note: this has nothing to do with whether or not your actual beta was near the target.) If this was your own real money, would you feel comfortable trading as you did this period? My target beta was 0.83 Market Return during the period was 8.148% while the portfolio return during the period was 8.485% which means that the portfolio was in line with the target beta considering the transaction cost and manpower cost in tracking. While the highest return did once go over 10.36% I followed more of the Price Momentum Strategy in which the stock that was doing well in the past month or week, I considered that particular stock. Also, in some cases I followed the Contrarian Strategy as in case of ONGC. But all these strategies were backed up by the news prevailing in the market. 6) What specific steps did you take during the period to attempt to adjust your portfolio beta to better achieve your target? How successful were these steps? I adjusted my portfolio beta according to the market scenario and the need of the hour. Some stocks of specific industry like the IT sector due to rupee depreciating wrt dollar added a boost to the IT stocks. So I purchased these stocks to boost my portfolio. I also concentrated more on Pharma sector which has been doing well and it gave me a huge profit.

Also stocks like Sesa Goa which has been doing well recently, following the Price Momentum Strategy, it gave my portfolio a huge boost. 7) Did you learn anything about short-term trading? Trading on news? Yes, I learnt a lot about short term trading and trading on news. I did these for few stocks for example Ranbaxy and Sesa Goa. These stocks would rise and fall on alternative days. So I purchased them in the morning while sold them at the end of the day using intraday trading for them. Also news like rupee depreciating and Raghuram Rajans speech after his appointment as RBI Governor had huge impacts on IT Stocks and banking stocks respectively.

8) If you had it to do all over again, would you change your investment strategy in any way? If not, why? If yes, how? Yes, I will change my investment strategy that I adapted at the beginning of my purchase of stocks. At the beginning I purchased those stocks in my portfolio which did well in the last one year but at the later stage I changed my strategy by purchasing those stocks which did well in the last one month and last one weeks. These stocks with Price Momentum effect give better return than the stocks which had done better last year. 9) Did you feel that the use of Stock-Track substantially increased your understanding of portfolio management as compared to a class in which your only exposure would have been in a lecture? Would you recommend that Stock-Track be used in future sections of SAPM? Yes I feel that the use of Stock Track substantially increased my understanding of portfolio management as compared to a class in which my only exposure had been in a lecture. Yes I would recommend that Stock Track should be used in future sections of SAPM because during class lectures we learn how to judge a stock based on past records; however Stock Track gives us the actual feel how a stock behaves under the effect of systematic and un-systematic risks. The effect of recent happenings on the stock as well as on the market, impact the share price to the highest extent. This is outdone by the past study that we do. Past study gives us the range of stock fluctuations while the news gives us the direction (+ve or ve) of stock fluctuation.

You might also like

- Case - Numeric InvestorDocument5 pagesCase - Numeric InvestorRikesh Jain100% (1)

- @traderslibrary2 Gupta Trading Pairs Advance Statistical Tools ForDocument68 pages@traderslibrary2 Gupta Trading Pairs Advance Statistical Tools ForhiyyearNo ratings yet

- On Balance VolumeDocument8 pagesOn Balance VolumeShahzad Dalal100% (1)

- The Green Line: How to Swing Trade the Bottom of Any Stock Market Correction: Swing Trading BooksFrom EverandThe Green Line: How to Swing Trade the Bottom of Any Stock Market Correction: Swing Trading BooksRating: 1 out of 5 stars1/5 (1)

- Stock-Trak Project Final Preparation GuidlinesDocument1 pageStock-Trak Project Final Preparation GuidlinesKim Yoo SukNo ratings yet

- Expert Advisor and Forex Trading Strategies: Take Your Expert Advisor and Forex Trading To The Next LevelFrom EverandExpert Advisor and Forex Trading Strategies: Take Your Expert Advisor and Forex Trading To The Next LevelRating: 3 out of 5 stars3/5 (1)

- High Probability ETF Trading For AllDocument18 pagesHigh Probability ETF Trading For Alljbiddy7890% (1)

- Annual Report 2011-12 Misi (1) TulipDocument65 pagesAnnual Report 2011-12 Misi (1) Tulipajx1979No ratings yet

- Accelerating Dual Momentum Is Better Than Classic Dual MomentumDocument26 pagesAccelerating Dual Momentum Is Better Than Classic Dual MomentumAyhanNo ratings yet

- Unusual Volume SystemDocument14 pagesUnusual Volume SystemWilliam MercerNo ratings yet

- Old Faithful ReportDocument9 pagesOld Faithful Reportberjav1No ratings yet

- Stock Market ResearchDocument18 pagesStock Market ResearcheduNo ratings yet

- Quantitative TradingDocument34 pagesQuantitative TradingNikhitha PaiNo ratings yet

- Project 4 Trading StartegiesDocument5 pagesProject 4 Trading StartegiesJaren LinNo ratings yet

- Tor KLDocument49 pagesTor KLmuiesibaNo ratings yet

- My Favorite Trading Strategy Indicators: Trade IdeasDocument11 pagesMy Favorite Trading Strategy Indicators: Trade IdeasCheung Shuk HanNo ratings yet

- TraderEdge - Backtesting BlueprintDocument12 pagesTraderEdge - Backtesting Blueprintestudanteconcurseiro1980No ratings yet

- Trading As A Business - Chap 8Document10 pagesTrading As A Business - Chap 8DavidNo ratings yet

- Dispersion Trading HalleODocument29 pagesDispersion Trading HalleOHilal Halle OzkanNo ratings yet

- Notes On Chapter 1Document9 pagesNotes On Chapter 1Lucas KrennNo ratings yet

- A Global Market Rotation Strategy With An Annual Performance of 41.4 PercentDocument6 pagesA Global Market Rotation Strategy With An Annual Performance of 41.4 PercentLogical Invest100% (1)

- 2006 Loeys, J., Exploiting Cross-Market MomentumDocument16 pages2006 Loeys, J., Exploiting Cross-Market MomentumArthur FournierNo ratings yet

- 4 ETF Rotation Systems To Beat The MarketDocument18 pages4 ETF Rotation Systems To Beat The Marketeugene.kong2279100% (1)

- Nifty, With The Aim To Create A Win-Win Situation For Both Stock Brokers and Retail TradersDocument10 pagesNifty, With The Aim To Create A Win-Win Situation For Both Stock Brokers and Retail TraderskumardattNo ratings yet

- A Sleep Well Bond Rotation Strategy With 15 Percent Annualized Return Since 2008Document4 pagesA Sleep Well Bond Rotation Strategy With 15 Percent Annualized Return Since 2008Logical InvestNo ratings yet

- Stock-Trak Project 2013Document4 pagesStock-Trak Project 2013viettuan91No ratings yet

- December 9, 2011: Market OverviewDocument11 pagesDecember 9, 2011: Market OverviewValuEngine.comNo ratings yet

- FRP Mid TermDocument3 pagesFRP Mid TermShivam MongaNo ratings yet

- Final Exam Questions, Student ProposedDocument15 pagesFinal Exam Questions, Student ProposedVladimir GusevNo ratings yet

- Pairs Trading Cointegration ApproachDocument82 pagesPairs Trading Cointegration Approachalexa_sherpyNo ratings yet

- Stock Selection For IntradayDocument14 pagesStock Selection For IntradayRatulNo ratings yet

- Developing Profitable Trading Strategies - A Beginner’s Guide to Backtesting using Microsoft ExcelFrom EverandDeveloping Profitable Trading Strategies - A Beginner’s Guide to Backtesting using Microsoft ExcelNo ratings yet

- SSRNDocument18 pagesSSRNchandrakantgadhiaNo ratings yet

- Money Flow IndexDocument8 pagesMoney Flow IndexShahzad DalalNo ratings yet

- Pairs Advance Statistical Tools ForDocument68 pagesPairs Advance Statistical Tools ForbibsnNo ratings yet

- Stop Losses: Help or Hindrance?: Dr. Bruce VanstoneDocument16 pagesStop Losses: Help or Hindrance?: Dr. Bruce VanstoneAleksandrNo ratings yet

- High Probability ETF Trading 7 Professional Strategies To Improve Your ETF Trading by Larry Connors, Cesar Alvarez, Connors Research LLCDocument136 pagesHigh Probability ETF Trading 7 Professional Strategies To Improve Your ETF Trading by Larry Connors, Cesar Alvarez, Connors Research LLCpetruzzellikelley100% (1)

- Navigator SystemDocument19 pagesNavigator SystemMj Ar100% (1)

- The Internal Bar Strength IndicatorDocument30 pagesThe Internal Bar Strength IndicatorCharles BaronyNo ratings yet

- Prime Market Terminal Strategy BookDocument30 pagesPrime Market Terminal Strategy Bookketan dontamsettiNo ratings yet

- Advance Trading Algorithms ExplanationDocument9 pagesAdvance Trading Algorithms ExplanationMadhav GoyalNo ratings yet

- Capital Letter August 2011Document5 pagesCapital Letter August 2011marketingNo ratings yet

- Kaufmann News, Fading The - V39 - C10 - 313KAUFDocument10 pagesKaufmann News, Fading The - V39 - C10 - 313KAUFJoseph WestNo ratings yet

- An Intraday Trend-Following Trading Strategy On Equity Derivatives in IndiaDocument12 pagesAn Intraday Trend-Following Trading Strategy On Equity Derivatives in IndiasuneetaNo ratings yet

- Tutorials in Applied Technical Analysis: Do We Need To Re-Invent The Wheel?Document24 pagesTutorials in Applied Technical Analysis: Do We Need To Re-Invent The Wheel?Pinky BhagwatNo ratings yet

- Momentum Strategy Master ThesisDocument6 pagesMomentum Strategy Master Thesisnancyjarjissterlingheights100% (2)

- Chang 2012 Financial ReviewDocument22 pagesChang 2012 Financial ReviewabhinavatripathiNo ratings yet

- Strategize Your Investment In 30 Minutes A Day (Steps)From EverandStrategize Your Investment In 30 Minutes A Day (Steps)No ratings yet

- Best Stocks for Day Trading: How to Find the Best Stocks for Your Day Trading StrategyFrom EverandBest Stocks for Day Trading: How to Find the Best Stocks for Your Day Trading StrategyRating: 3.5 out of 5 stars3.5/5 (3)

- Day Trading Strategies: Momentum Indicators: Day Trading Made Easy, #5From EverandDay Trading Strategies: Momentum Indicators: Day Trading Made Easy, #5No ratings yet

- Trading DayDocument15 pagesTrading DaydmidNo ratings yet

- Sentiment Analysis of Twitter Feeds For The Prediction of Stock Market MovementDocument5 pagesSentiment Analysis of Twitter Feeds For The Prediction of Stock Market MovementkavitaNo ratings yet

- 7.b.fundamental Analysis - 230720 - 204624Document7 pages7.b.fundamental Analysis - 230720 - 204624alanorules001No ratings yet

- Predicting ETF Returns - Final ReportDocument10 pagesPredicting ETF Returns - Final ReportNNo ratings yet

- Learn Intraday TradingDocument12 pagesLearn Intraday TradingSANUNo ratings yet

- Launch of Conviction ListDocument11 pagesLaunch of Conviction ListWilson WongNo ratings yet

- VCE Summer Internship Program 2021: Tushar Gupta 2 Equity ResearchDocument10 pagesVCE Summer Internship Program 2021: Tushar Gupta 2 Equity ResearchTushar GuptaNo ratings yet

- Data Preparation For Strategy ReturnsDocument6 pagesData Preparation For Strategy ReturnsNumXL ProNo ratings yet

- Nitin BhatiaDocument132 pagesNitin BhatiaKailash Chandra PradhanNo ratings yet

- 06 AnsDocument4 pages06 AnsAnonymous 8ooQmMoNs1No ratings yet

- John Schuler's ResumeDocument1 pageJohn Schuler's ResumeJohn SchulerNo ratings yet

- Del Campo V CaDocument2 pagesDel Campo V CaRosana Villordon SoliteNo ratings yet

- Killing The KDocument19 pagesKilling The KJeron JacksonNo ratings yet

- Mori, Yoshitaka 2016 Mobility and PlaceDocument8 pagesMori, Yoshitaka 2016 Mobility and Place신현준No ratings yet

- Statement For Aug 18, 2023Document1 pageStatement For Aug 18, 2023Hawa KabiaNo ratings yet

- Confirmations - MITS 2017 MumbaiDocument24 pagesConfirmations - MITS 2017 Mumbaikartik baugNo ratings yet

- 14Nov21-Brochure - Telemedicon-202Document2 pages14Nov21-Brochure - Telemedicon-202TULSI CHARAN DASNo ratings yet

- WHITE TOWN GROUP-4 FinalDocument112 pagesWHITE TOWN GROUP-4 Finalaswath manoj100% (1)

- Nuclear & Thermal Power Plants (Top MCQ)Document27 pagesNuclear & Thermal Power Plants (Top MCQ)mat kumarNo ratings yet

- PanLapat Carbon Calculation ZERODocument2 pagesPanLapat Carbon Calculation ZEROLapatifyNo ratings yet

- Smedsep GP 5-Upscaling 1oct07Document2 pagesSmedsep GP 5-Upscaling 1oct07neerajgupta1987No ratings yet

- Continous Compounded Interest Pert CCIHWDocument4 pagesContinous Compounded Interest Pert CCIHWH2wo FansNo ratings yet

- Alphaex Capital Candlestick Pattern Cheat Sheet InfographDocument1 pageAlphaex Capital Candlestick Pattern Cheat Sheet InfographAlfian Amin100% (1)

- Tabora Declaration (Abridged English Version)Document5 pagesTabora Declaration (Abridged English Version)Zitto Kabwe100% (1)

- Etisalat Annual Report 2011 PDFDocument2 pagesEtisalat Annual Report 2011 PDFNon0% (1)

- Principles of Marketing Eighth Edition Philip Kotler and Gary ArmstrongDocument14 pagesPrinciples of Marketing Eighth Edition Philip Kotler and Gary ArmstrongFatimah KhanNo ratings yet

- Chapter 1Document17 pagesChapter 1mymajdahotmailNo ratings yet

- Winwin NegociationDocument200 pagesWinwin NegociationManuel Palm LeitonNo ratings yet

- Advertisement & Media Sector - Advertisement & Media CompaniesDocument9 pagesAdvertisement & Media Sector - Advertisement & Media Companiesmrunali.talentcornerNo ratings yet

- Macarena Gomezbarris The Extractive Zone Social Ecologies and Decolonial PerspectivesDocument209 pagesMacarena Gomezbarris The Extractive Zone Social Ecologies and Decolonial PerspectivesNina Hoechtl100% (2)

- SS en 934-6-2008 (2015)Document16 pagesSS en 934-6-2008 (2015)Heyson JayNo ratings yet

- Reading Comprehension Grade 10semester 2 20231206 193833Document27 pagesReading Comprehension Grade 10semester 2 20231206 193833aolefirNo ratings yet

- Feldman-Mahalanobis ModelDocument3 pagesFeldman-Mahalanobis ModelPankaj PatilNo ratings yet

- Notes of BanksDocument5 pagesNotes of Banksromeo n bartolomeNo ratings yet

- Hybrid Electric VehiclesDocument16 pagesHybrid Electric Vehiclestapas_kbNo ratings yet

- BNMDocument39 pagesBNMKhairy Al-Habshee67% (3)

- New Requirements Flyer-FinalDocument1 pageNew Requirements Flyer-FinalplattehealthdeptNo ratings yet

- Shunglu ReportDocument235 pagesShunglu ReportNDTVNo ratings yet

- Performance of UCBsDocument22 pagesPerformance of UCBsvenugopal_posinaNo ratings yet