Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

18 viewsA C Choksi: Marico Limited

A C Choksi: Marico Limited

Uploaded by

vvkguptavoonnaIndian Hotels Company Limited (IHCL), which operates hotels under the Taj brand, has several growth opportunities in India. As the Indian economy and tourism industry continue to grow, demand for hotels is increasing. IHCL is well positioned to benefit from rising domestic tourism, business travel, and government initiatives to promote tourism. IHCL has a wide network of luxury and premium hotels across India and internationally, operating in multiple market segments. With India's strong economic growth and rising incomes, IHCL is poised for continued expansion in the growing Indian hotel industry.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Black Book On CSR TCSDocument86 pagesBlack Book On CSR TCSShaikh Sohaib100% (1)

- Marico AssignmentDocument46 pagesMarico AssignmentRafiqul Awal0% (2)

- Ironhack - Financing Options FR, en & ESDocument32 pagesIronhack - Financing Options FR, en & ESBelinda PHAMNo ratings yet

- Week 3 Illustrative Lecture QuestionsDocument4 pagesWeek 3 Illustrative Lecture QuestionsKristel AndreaNo ratings yet

- Equity Research Report HDFC BankDocument4 pagesEquity Research Report HDFC BankNikhil KumarNo ratings yet

- ContinentalDocument20 pagesContinentalAna Maria BorcanNo ratings yet

- A C Choksi: Marico LimitedDocument40 pagesA C Choksi: Marico LimitedArvind SainathNo ratings yet

- Marico BangladeshDocument18 pagesMarico BangladeshQuazi Omar FerdousNo ratings yet

- Mid-Cap Marvels: RCM ResearchDocument20 pagesMid-Cap Marvels: RCM ResearchmannimanojNo ratings yet

- SAPM Project Report On Colgate Palmolive (India) LimitedDocument13 pagesSAPM Project Report On Colgate Palmolive (India) Limitedkalyani swathikaNo ratings yet

- Media Release Q1FY12Document3 pagesMedia Release Q1FY12guptaswati7No ratings yet

- Indoco RemediesDocument19 pagesIndoco RemediesMNo ratings yet

- High Five StocksDocument7 pagesHigh Five Stockseswar414No ratings yet

- SBICap Diwali 2016Document16 pagesSBICap Diwali 2016penumudi233No ratings yet

- Marico LTD Q2'13 Earning EstimateDocument2 pagesMarico LTD Q2'13 Earning EstimateSuranjoy SinghNo ratings yet

- A Project Report On: Marketing Strategy of Dabur Vatika Hair Oil & Dabur ChyawanprashDocument88 pagesA Project Report On: Marketing Strategy of Dabur Vatika Hair Oil & Dabur Chyawanprashvkumar_34528750% (2)

- Project On Dabur India LTD.: By: K. Sai PrasadDocument3 pagesProject On Dabur India LTD.: By: K. Sai Prasadapi-3805289No ratings yet

- Term Paper Topic:: Course Name: Course CodeDocument25 pagesTerm Paper Topic:: Course Name: Course CodeMehedi Hasan ShakilNo ratings yet

- Marico Investor Presentation - Feb14Document27 pagesMarico Investor Presentation - Feb14Tushar PatilNo ratings yet

- FM Cia3Document30 pagesFM Cia3dhrivsitlani29No ratings yet

- A Study On Inventory Management On HeroDocument17 pagesA Study On Inventory Management On HeroTarun Nani100% (1)

- Cox and Kings IPO AnalysisDocument15 pagesCox and Kings IPO AnalysisShishir SourabhNo ratings yet

- Arvind Limited IC 070314Document30 pagesArvind Limited IC 070314Saurabh LohariwalaNo ratings yet

- Executive SummaryDocument17 pagesExecutive SummaryMehedi Hasan ShakilNo ratings yet

- Marico 4Q FY 2013Document11 pagesMarico 4Q FY 2013Angel BrokingNo ratings yet

- DIL India InvConf May 2010Document33 pagesDIL India InvConf May 2010Puneet KumarNo ratings yet

- Ankit TNG Retail India Pvt. LTD.: Credit Analysis & Research LimitedDocument3 pagesAnkit TNG Retail India Pvt. LTD.: Credit Analysis & Research LimitedjshashaNo ratings yet

- Gic, Baring India Pe Investing $100 MN in MaricoDocument33 pagesGic, Baring India Pe Investing $100 MN in Maricogauravbansall567No ratings yet

- Dabur India LTD: Key Financial IndicatorsDocument4 pagesDabur India LTD: Key Financial IndicatorsHardik JaniNo ratings yet

- FM ProjectDocument13 pagesFM Projectabhi choudhuryNo ratings yet

- Cera Sanitaryware - CRISIL - Aug 2014Document32 pagesCera Sanitaryware - CRISIL - Aug 2014vishmittNo ratings yet

- India Consumer - Enjoying A Slice of Luxury.248.175.146Document60 pagesIndia Consumer - Enjoying A Slice of Luxury.248.175.146Harinig05No ratings yet

- SBI Securities Morning Update - 13-01-2023Document7 pagesSBI Securities Morning Update - 13-01-2023deepaksinghbishtNo ratings yet

- SSRN Id4195028Document28 pagesSSRN Id4195028Vaibhav ChaturvediNo ratings yet

- BCG Analysis-Report: Prepared By: Sanya Nauharia Sankara Narayanan Nikhil Jha Jay Saxena Jayant Choudhary Manju DhindwalDocument9 pagesBCG Analysis-Report: Prepared By: Sanya Nauharia Sankara Narayanan Nikhil Jha Jay Saxena Jayant Choudhary Manju DhindwalJay SaxenaNo ratings yet

- TRENT Ltd.Document15 pagesTRENT Ltd.Sanjeedeep Mishra , 315No ratings yet

- Analyst PresentationDocument20 pagesAnalyst PresentationroselilygirlNo ratings yet

- 15 Stocks Oct15th2018Document4 pages15 Stocks Oct15th2018ShanmugamNo ratings yet

- Market Macroscope - May'24 - 240503 - 201834Document32 pagesMarket Macroscope - May'24 - 240503 - 201834Balamurugan SundaramoorthyNo ratings yet

- Summary of Dabur'S Chairman'S Message, Management Discussion and Analysis and Director'S ReportDocument4 pagesSummary of Dabur'S Chairman'S Message, Management Discussion and Analysis and Director'S ReportAnchitLPNo ratings yet

- SBI Securities Morning Update - 18-01-2023Document7 pagesSBI Securities Morning Update - 18-01-2023deepaksinghbishtNo ratings yet

- Indianivesh Securities Private Limited: Balanced Aggressive ConservativeDocument9 pagesIndianivesh Securities Private Limited: Balanced Aggressive ConservativeShashi KapoorNo ratings yet

- Muhurat Picks 2015: Company CMP Target Upside (%)Document12 pagesMuhurat Picks 2015: Company CMP Target Upside (%)abhijit99541623974426No ratings yet

- Business PlanDocument9 pagesBusiness PlanAjit Singh RathoreNo ratings yet

- Financial Modeling Dabur Template-DCFDocument87 pagesFinancial Modeling Dabur Template-DCFSidharthNo ratings yet

- BritanniaDocument3 pagesBritanniaDarshan MaldeNo ratings yet

- Results Press Release For December 31, 2015 (Result)Document3 pagesResults Press Release For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Canara Revecco ManufacturingDocument7 pagesCanara Revecco ManufacturingRanjan Sharma100% (1)

- Study of FMCGDocument28 pagesStudy of FMCGNikhil GuptaNo ratings yet

- Batch-III: (CH Institute of Management and CommunicationDocument6 pagesBatch-III: (CH Institute of Management and CommunicationSwati DwivediNo ratings yet

- BPSM MaricoDocument41 pagesBPSM MaricoChirag7083100% (2)

- Redington IndiaDocument73 pagesRedington Indialokesh38No ratings yet

- Mandhana IndustMandhana Industries Limited - Q1FY14-1.pdfries Limited - Q1FY14-1Document23 pagesMandhana IndustMandhana Industries Limited - Q1FY14-1.pdfries Limited - Q1FY14-1mdd25No ratings yet

- Marico: Performance HighlightsDocument12 pagesMarico: Performance HighlightsAngel BrokingNo ratings yet

- A Study of Financial Statement of Dabur India LTD.: Submitted byDocument17 pagesA Study of Financial Statement of Dabur India LTD.: Submitted byAkash ShettyNo ratings yet

- Marico Ltd.Document16 pagesMarico Ltd.Mitali ParekhNo ratings yet

- India Equity Analytics Today: Buy Stock of KPIT TechDocument24 pagesIndia Equity Analytics Today: Buy Stock of KPIT TechNarnolia Securities LimitedNo ratings yet

- Fortnightly: Ipca LabDocument5 pagesFortnightly: Ipca Labbinoy666No ratings yet

- Gillette India LTD 2010 83514Document10 pagesGillette India LTD 2010 83514Rakesh ChawlaNo ratings yet

- Hero ScribdDocument16 pagesHero ScribdApoorv KalraNo ratings yet

- Policies to Support the Development of Indonesia’s Manufacturing Sector during 2020–2024: A Joint ADB–BAPPENAS ReportFrom EverandPolicies to Support the Development of Indonesia’s Manufacturing Sector during 2020–2024: A Joint ADB–BAPPENAS ReportNo ratings yet

- Entrepreneurship: Model Assignment answer with theory and practicalityFrom EverandEntrepreneurship: Model Assignment answer with theory and practicalityNo ratings yet

- Model Answer: E-Commerce store launch by Unilever in Sri LankaFrom EverandModel Answer: E-Commerce store launch by Unilever in Sri LankaNo ratings yet

- Golden OrioleDocument2 pagesGolden OriolevvkguptavoonnaNo ratings yet

- Quotation For 2050 PDFDocument1 pageQuotation For 2050 PDFvvkguptavoonnaNo ratings yet

- Sea Food Consumption & Prices - Page 54-60 - NielsenDocument140 pagesSea Food Consumption & Prices - Page 54-60 - NielsenvvkguptavoonnaNo ratings yet

- No Nly .: Statement of Encumbrance On PropertyDocument1 pageNo Nly .: Statement of Encumbrance On PropertyvvkguptavoonnaNo ratings yet

- Quotaion For 2275 PDFDocument1 pageQuotaion For 2275 PDFvvkguptavoonnaNo ratings yet

- FY15 Virtusa Corporation Annual ReportDocument140 pagesFY15 Virtusa Corporation Annual ReportvvkguptavoonnaNo ratings yet

- Shri Saibaba Sansthan Trust, Shirdi: Online Services AcknowledgementDocument2 pagesShri Saibaba Sansthan Trust, Shirdi: Online Services AcknowledgementvvkguptavoonnaNo ratings yet

- KGS Research - Assistant ManagerDocument4 pagesKGS Research - Assistant ManagervvkguptavoonnaNo ratings yet

- Being Part of An Open Source Community: Ramindu DeshapriyaDocument7 pagesBeing Part of An Open Source Community: Ramindu DeshapriyavvkguptavoonnaNo ratings yet

- Ecommerce Business in India - 2014 To 2015 ReportDocument4 pagesEcommerce Business in India - 2014 To 2015 ReportSivakumar VeerappanNo ratings yet

- How Java Professionals Can Tap Into The Largest E-Commerce OpportunityDocument26 pagesHow Java Professionals Can Tap Into The Largest E-Commerce OpportunityvvkguptavoonnaNo ratings yet

- Global Headquarters: North America - SalesDocument10 pagesGlobal Headquarters: North America - SalesvvkguptavoonnaNo ratings yet

- ICT Inntegration in M&ADocument14 pagesICT Inntegration in M&AvvkguptavoonnaNo ratings yet

- Jim Beam in AustraliaDocument3 pagesJim Beam in AustraliavvkguptavoonnaNo ratings yet

- IT Industry Performance Annual Review: 2007-08: Press ConferenceDocument33 pagesIT Industry Performance Annual Review: 2007-08: Press ConferencevvkguptavoonnaNo ratings yet

- UK IRI Sales Various Categories 2005Document3 pagesUK IRI Sales Various Categories 2005vvkguptavoonnaNo ratings yet

- Millwardbrown Perspectives 2008-2009Document221 pagesMillwardbrown Perspectives 2008-2009vvkguptavoonnaNo ratings yet

- Brand Name Pack Size Price Price Per KG Source: LifesaversDocument1 pageBrand Name Pack Size Price Price Per KG Source: LifesaversvvkguptavoonnaNo ratings yet

- Second Half Goal With Hedging ExplainedDocument5 pagesSecond Half Goal With Hedging ExplainedsoatenatorNo ratings yet

- Chapter 3 Problems AnswersDocument11 pagesChapter 3 Problems AnswersOyunboldEnkhzayaNo ratings yet

- ChecklistDocument2 pagesChecklistKyra AlesonNo ratings yet

- 09 Chapter 2Document21 pages09 Chapter 2Alexyius AnsiNo ratings yet

- Full Text of SB 1201 LA River Expanded Public Access BillDocument12 pagesFull Text of SB 1201 LA River Expanded Public Access BillSouthern California Public RadioNo ratings yet

- Test Bank For Principles of Corporate Finance 9th Edition Richard A BrealeyDocument18 pagesTest Bank For Principles of Corporate Finance 9th Edition Richard A BrealeyPedro Chun100% (39)

- Mcncies 7 S Consortium-Securities-LtdDocument42 pagesMcncies 7 S Consortium-Securities-LtdAkhil Raj VNo ratings yet

- Accounting RemedialDocument40 pagesAccounting Remedialwhyme_bNo ratings yet

- Croatia Progress ReportDocument53 pagesCroatia Progress ReportSerbanat AndaNo ratings yet

- Mas QuizzerDocument11 pagesMas QuizzerNica Jane MacapinigNo ratings yet

- Strategic Analysis On SonyDocument37 pagesStrategic Analysis On Sonylavkush_khannaNo ratings yet

- Wells Fargo Case StudyDocument15 pagesWells Fargo Case StudySodeinde JedidiahNo ratings yet

- Current Affairs 2017 PDF Capsule by AffairscloudDocument392 pagesCurrent Affairs 2017 PDF Capsule by Affairscloudkewal259No ratings yet

- Brookfield 1995Document4 pagesBrookfield 1995RahmanNo ratings yet

- APGLI Refund Form (Death Claim)Document4 pagesAPGLI Refund Form (Death Claim)teja ptoNo ratings yet

- ASB3210 Exam 2020 With SolutionsDocument19 pagesASB3210 Exam 2020 With SolutionsSubmission PortalNo ratings yet

- Annual Report Including With Notice of 30Th Annual General Meeting (AGM/EGM)Document240 pagesAnnual Report Including With Notice of 30Th Annual General Meeting (AGM/EGM)Shyam SunderNo ratings yet

- Stoploss Brochure enDocument1 pageStoploss Brochure envolvoproNo ratings yet

- Internshiip Report For OnnorokomDocument69 pagesInternshiip Report For OnnorokomTanvir KhanNo ratings yet

- Erona Ress: Teaching The TeachersDocument16 pagesErona Ress: Teaching The TeachersAnonymous 9eadjPSJNgNo ratings yet

- With Answer Keys Unit 10 & 11Document18 pagesWith Answer Keys Unit 10 & 11Oyun-erdene ErdenebilegNo ratings yet

- Kher Kishor SinghDocument6 pagesKher Kishor SinghSwati SharmaNo ratings yet

- HEPBURN - Solution DevDocument7 pagesHEPBURN - Solution DevAbishek GuptaNo ratings yet

- 2020-07-03 - Verde Resources Antabamba ProjectDocument15 pages2020-07-03 - Verde Resources Antabamba Projectyaku1618No ratings yet

- Hjil 20 2 Sommers PhillipsDocument33 pagesHjil 20 2 Sommers PhillipsHelpin HandNo ratings yet

A C Choksi: Marico Limited

A C Choksi: Marico Limited

Uploaded by

vvkguptavoonna0 ratings0% found this document useful (0 votes)

18 views0 pagesIndian Hotels Company Limited (IHCL), which operates hotels under the Taj brand, has several growth opportunities in India. As the Indian economy and tourism industry continue to grow, demand for hotels is increasing. IHCL is well positioned to benefit from rising domestic tourism, business travel, and government initiatives to promote tourism. IHCL has a wide network of luxury and premium hotels across India and internationally, operating in multiple market segments. With India's strong economic growth and rising incomes, IHCL is poised for continued expansion in the growing Indian hotel industry.

Original Description:

asfdf

Original Title

MARINDUS_20110523

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentIndian Hotels Company Limited (IHCL), which operates hotels under the Taj brand, has several growth opportunities in India. As the Indian economy and tourism industry continue to grow, demand for hotels is increasing. IHCL is well positioned to benefit from rising domestic tourism, business travel, and government initiatives to promote tourism. IHCL has a wide network of luxury and premium hotels across India and internationally, operating in multiple market segments. With India's strong economic growth and rising incomes, IHCL is poised for continued expansion in the growing Indian hotel industry.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

18 views0 pagesA C Choksi: Marico Limited

A C Choksi: Marico Limited

Uploaded by

vvkguptavoonnaIndian Hotels Company Limited (IHCL), which operates hotels under the Taj brand, has several growth opportunities in India. As the Indian economy and tourism industry continue to grow, demand for hotels is increasing. IHCL is well positioned to benefit from rising domestic tourism, business travel, and government initiatives to promote tourism. IHCL has a wide network of luxury and premium hotels across India and internationally, operating in multiple market segments. With India's strong economic growth and rising incomes, IHCL is poised for continued expansion in the growing Indian hotel industry.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 0

A C Choksi

Share Brokers Private Limited

A C Choksi Institutional Research research@acchoksi.com

1

Company Overview :

Key Positives

Good business potential and opportunities

Indian Hotels Company Limited (IHCL) and its subsidiaries are collectively known as Taj Hotels Resorts and Palaces and is recognised as one of Asia's largest

and finest hotel company. Taj Hotels Resorts and Palaces have hotels in the locations across India with an additional international hotels also in the Maldives,

Malaysia, Australia, UK, USA, Bhutan, Sri Lanka, Africa and the Middle East. Spanning the length and breadth of the country, gracing important industrial

towns and cities, beaches, hill stations, historical and pilgrim centres and wildlife destinations, each Taj hotel offers the luxury of service, the best of Indian

hospitality, vantage locations, modern amenities and business facilities.IHCL operates in the luxury, premium, mid-market and value segments of the market.

India is one of the fastest growing travel and tourism market.In India, from 2004 -09 the travel and tourism demand has increased at a compound growth rate

(CAGR) of 16.4% and is estimated to reach U.S.$ 91.7 billion in 2009.It is further expected to reach US$266.1 billion by 2019.(Source:World Travel and Tourism

Council)

The hotel industry, on the whole, is seeing increased occupancy levels and revenue per available room in all major cities. With the growth in a economy and

increase in the disposable incomes, people are opting for leisure travel which is driving domestic tourism and in turn demand for hotels In addition, competition

in airfares and better infrastructure leading to improving connectivity between various destinations are also leading to increase in travel and in turn demand for

the hotels.

On account of higher earnings and improved business confidence; Corporate meetings, incentive, conventions and entertainment (MICE) segment also offer a

huge opportunity to the Indian hospitality industry. Further, with increase in business opportunities in smaller cities there is simultaneous increase in the

business travel and for budget hotels in these cities.

Government as well as states are taking initiatives for promoting tourism.These initiatives are contributing substantially in increasing the travel and tourism

demand and in turn beneficial for the hotel industry.

Because of various factors like ancient history and diverse culture, over the years India has emerged as a popular tourist destination. Also as we have national

parks and wildlife sanctuaries spread across the country, adventure and wildlife tourism`s popularity is increasing. In 2010, there has been a rise in the number

of foreigners visiting the country. According to Tourism ministry, foreign tourist arrival grew 9.9% between January and October this year from the same period

a year ago. Foreign tourist arrivals could pick up further in 2011 also because of events like the cricket world cup in February, possible IPL cricket tournament

and Formula One event in October.

Thus as seen, IHCL being one of the leading hotel in the country has various favorable growth opportunities.

Source: A C Choksi Research

Source: CEA, A C Choksi Research

Source: A C Choksi Research

Nurturing Wealth

Initiation Report

Sector: FMCG

Marico Limited

Well oiled to stride high !!!

Swati Gupta

Senior Analyst

Email :

Tel: 91-22-3021 9046

Mehul Jhaveri - Technical Analyst

swati@acchoksi.com

Recommendation: BUY

Target Price: Rs. 158

Investment Summary :

?

?

?

Lifestyle changes in India to scale up demand for Saffola and

Premium Hair Oils

Parachute-well oiled for a high growth stride

International Business Group (IBG) to witness rapid growth

India's economic growth has accelerated significantly over the past

two decades; well synchronized with robust pace of urbanization.

With rising urbanization and improving household disposable

income, consumers are gradually becoming health conscious. This

persistent shift for India over past two decades augurs well for

Marico's business model, which is increasingly gaining traction in

Health care and Hair care space via Saffola and Premium Hair oil

brands. The company is likely to witness a robust demand for both

the segments. In our view, Saffola will be a major growth driver for

Marico and its volume and value growth will register a CAGR of

17.5% and 24.5% respectively during FY2011-2014E. The value

added hair oils category is expected to register a steady growth of

28.3% CAGR during the period FY2011-2014E.

Marico is the market leader in the coconut oil (CNO) market in India

through its flagship brand Parachute. Marico is well-positioned to

become the key beneficiary of changing preferences of Indian

consumers as there exists a large headroom for growth with 40%

market share with unorganized players. Marico has well defined

growth strategy in place to expand in hair care segment 1) by

improving profitability in coconut oil segment, where it enjoys high

pricing power 2) to expand its hair care basket by launching new

product variants under its flagship brand Parachute. We believe

rising pricing power, better product portfolio and favorable

competition dynamics will drive growth momentum in the hair care

space.

IBG currently contributes approximately 23% of Marico's total

revenue and has been growing at a CAGR of approximately 36%

over the past 4 years. Going forward, we expect the IBG to grow at a

CAGR of 21.5% between 2011 and 2014 and by FY14 it is expected

to contribute 25 - 26% of the total revenue.

A C Choksi

Share Brokers Private Limited

A C Choksi Research Institutional research@acchoksi.com

2

Nurturing Wealth

Research Report|FMCG

May 23, 2011

Recommendation: BUY

Target Price (Rs.) 158.0

Recommendation Price (Rs.) 135.0

Potential Return (%) 17%

BSE Sensex 17993

Stock Data

BSE Code 531642

NSE Code MARICO

Bloomberg MRCO IN

Reuters Code MRCO. BO

52-Week Range (Rs. ) 153/99. 8

Key Financials

Shares Outstanding (mn) 614. 4

Fa ce Value (Rs.) 1

Market Capita l (Rs. bn) 84. 2

Pa st 3 Yrs Sales Growth (%) 14. 5

Pa st 3 Yrs PAT Growth (%) 14. 6

Dividend Payout (%) 11%

Valuation:

We are initiating coverage on Marico for 12-18 month horizon, with a target price of Rs. 158

per share based on DCF Valuation method. Our DCF valuation is based on a WACC of

9.65% and perpetual growth rate of 5.0%.

The stock is currently, trading in the 18-22x two-year forward PE band. We believe that the

stock should sustain in this trading range on account of increasing awareness towards health

care, economic recovery and consumers preference to uptrade with increase in income levels

and urbanization. Further, Kayas turnaround and strong growth in International business

group will also give thrust to overall profitability and revenue growth. Our DCF-based target

price implies an earnings multiple of 21.6x FY13 earnings which is within the trading range.

A C Choksi

Share Brokers Private Limited

A C Choksi Research Institutional research@acchoksi.com

3

Nurturing Wealth

Research Report|FMCG

May 23, 2011

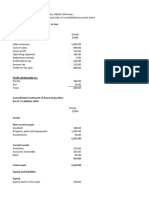

FINANCIAL SUMMARY

Particulars (Rs. Mn) FY10 FY11 FY12E FY13E FY14E

Total Revenue 26, 790 31, 562 37, 383 44,317 52,450

EBITDA 3, 934 4, 377 5, 232 6,397 7,996

Post-Tax Income/(Loss) 2, 317 2, 864 3, 446 4,479 5,788

Earnings (Rs. ) 3.80 4. 66 5. 61 7. 29 9. 42

EPS Growth 22.7% 22. 6% 20. 3% 30. 0% 29. 2%

EBITDA Margin 14.7% 13. 9% 14. 0% 14. 4% 15. 2%

PE (x) 35. 5 29. 0 24. 1 18.5 14. 3

P/BV (x) 12. 7 9. 1 6. 8 5.1 3. 9

EV/EBITDA (x) 21. 9 20. 2 16. 5 13.0 9. 8

EV/Sales (x) 3. 2 2. 8 2. 3 1.9 1. 5

ROE 35% 31% 28% 28% 27%

ROCE 30% 22% 26% 30% 32%

Source: Company, A C Choksi Insti t ut ional Research

Two year forward PE-Band

Company Overview:

Business Description:

?

?

?

Marico is one of the leading Indian FMCG players in the beauty and wellness space

offering products and services in hair care, health care and skin care segments to

consumers in domestic and international markets. The company was incorporated on

13th October 1988, under the name Marico Foods Ltd, and it began commercial

operations in April 1990 when it took over the consumer products division of Bombay Oil

Industries. Marico acquired Parachute and Saffola brands from Bombay Oil Industries in

FY 2000. On April 25 2005 the company was renamed as Marico Limited and subsequently

got listed on the Bombay Stock Exchange in 1996. Based in Mumbai, the company has a

distribution network of over 3.3 mn outlets in India and overseas. Marico's operations are

primarily based in India with flourishing international presence primarily in Middle East,

SAARC countries, Egypt and South Africa. The manufacturing facilities of the company

are located at Goa, Kanjikode, Jalgaon, Pondicherry, Dehradun, Baddi, Ponta Sahib and

Daman supported by subcontracting units.

The company's product portfolio comprises of well known brands such as Parachute,

Saffola, Hair & Care, Nihar, Shanti Amla, Mediker and Revive. Apart from the robust

growth led by introduction of new products under flagship brands, Marico pursued the

inorganic route aggressively to accelerate growth and capture market share. The company

has strengthened its product portfolio through acquisitions in domestic and international

markets.

Marico's business structure is segregated into three Strategic Business Units (SBU's):

Consumer Products Business (Domestic) Includes coconut oil, hair oil, edible oil, hair

care products, fabric care products and processed foods.

Consumer Products Business (International) Includes coconut oil, hair creams & gels,

hair care products and health care products.

Kaya Marico offers hair care and skin care services through a chain of clinics under

the brand name Kaya and Derma Rx.

Share Brokers Private Limited

A C Choksi Research Institutional research@acchoksi.com

4

Research Report|FMCG

Nurturing Wealth

May 23, 2011

A C Choksi

Share Brokers Private Limited

A C Choksi Research Institutional research@acchoksi.com

5

Nurturing Wealth

Research Report|FMCG

May 23, 2011

Business Structure

Source: Company, A C Choksi Institutional Research

?Consumer Products Business (Domestic):

Coconut Oil: Marico's coconut oil basket primarily comprises of Parachute, Oil of

Malabar and Nihar with an indicative market share by volume of approximately 52.6% as

on March 2011. Marico markets coconut oil mainly through its flagship brand, Parachute

which is a market leader in the industry with an approximate volume market share of

45.8% as on March 2011. Marico acquired Nihar from Hindustan UniLever Limited

(HUL) in February 2006 which has a strong equity in the eastern region with market share

of 6.0%.

Hair Oil: Marico's hair oil portfolio comprises of Parachute Jasmine, Nihar Naturals,

Hair & Care, Parachute Advansed and Shanti Amla with an indicative market share of 23%

in FY11. Parachute Jasmine and Hair & Care are light, fragrant and non sticky hair oils

which target a specific consumer group in the 18-24 year age bracket. Parachute Advansed

is a combination of coconut oil and other essential oils, targeted at young females and is

A C Choksi

Share Brokers Private Limited

A C Choksi Research Institutional research@acchoksi.com

6

Nurturing Wealth

Research Report|FMCG

priced higher than company's flagship Parachute coconut oil brand. Shanti Amla is the

second-largest brand in India in the amla category competing with the likes of Dabur Amla

Oil.

Edible Oil: Marico offers refined edible oil in the premium segment through its Saffola

brand. Saffola is Marico's flagship product which is positioned on the good for heart

platform and enjoys a strong brand loyalty. Leveraging on the success of the Saffola brand,

the company launched three blends Saffola Tasty Blend (corn oil and safflower oil),

Saffola Gold (80% rice bran oil & 20% safflower oil) and Saffola Active (rice bran and soya

oil). As Saffola is promoted on the heart health platform it enjoys premium pricing over

the other edible oil brands.

Functional foods under Saffola brand: With evolving tastes and preferences of

customers, Marico exploited available opportunities by prototyping products on its

existing flagship brands. The company launched a number of health friendly products

under the Saffola brand. The company has expanded the Saffola franchise by launching

Saffola Oats (prototyped in Maharashtra). During Q4FY10, Saffola Arise was launched

across key Saffola markets. It is a low Glycomic-Index (GI) rice that helps in weight

management.

Other brands: Marico is present in hair cream and hair gel market through Parachute

Advansed hair creams and hair gels with a market share of approximately 27% at the end of

March 2011. The company dominates the anti-lice treatment product market in India

through its brand Mediker which has a market share of approximately 96%. Revive is a

liquid fabric whitener for washing clothes and the company has a market share of

approximately 80% in this category.

May 23, 2011

A C Choksi

Domestic Business Brands

Parachute, Oil Of Malabar, Nihar Coconut Oil 53

Hair Oil (Hair & Care, Parachute

Jasmine, Parachute Advansed,

Hair Oils 23

Shanti Amla, Nihar)

Saffola Super Premium Refined

Safflower oil

53

Mediker Anti-lice Treatment 96

Revive Instant fabric starch 80

Source: Company

Market share

range %

Category

A C Choksi

Share Brokers Private Limited

A C Choksi Research Institutional research@acchoksi.com

7

Nurturing Wealth

Research Report|FMCG

?Consumer Products Business (International):

Marico has flourishing international presence in Middle East, Bangladesh, Egypt, South

Africa, Malaysia and Vietnam. Over the past four years, the international business revenue

has increased at a CAGR of 36% while the contribution to sales has increased from 13% in

FY 2007 to 23% in FY 2011. Parachute is the largest selling coconut oil brand in

Bangladesh and Marico has successfully doubled its market share in eight years from 36%

in FY 2003 to approximately 80% in FY 2011. The company has a strong distribution

network in Bangladesh with approximately 300,000 outlets. Leveraging upon the extensive

distribution network created by Parachute, the company introduced an Egyptian brand

Hair Code hair dye in Bangladesh. Hair Code has achieved about 29% value market share

thus establishing itself as a strong number 2 player. In addition to this, Marico had also

launched Saffola oil in Bangladesh during FY 2011 which is gaining traction in the market.

Marico operates in the Middle East through its subsidiaries, Marico Middle East FZE and

Kaya Skin Care FZE and its product portfolio comprises of Parachute coconut oil and

Parachute hair creams and gels. Marico entered the South African market in FY 2008

through the acquisition of Enaleni's consumer brands. The company commands a market

share of approximately 60% in the hair care category in Egypt through its Fiance and Hair

Code brands.

Investment Summary :

?Cigarette business: Stable and Sure

?Revival in FTA & capacity expansion will boost Hotels business

?Other FMCG: Consistent efforts will become profitable in FY13

?Paper and Paperboards: On a high stride ride

?Agri Business: Improving Margins

?Strong defensive player

?Valuation

Tobacco industry has received adverse tax shocks a number of times during this decade, yet ITC's earnings growth have remained quite stable as ITC

has managed to pass on tax hikes. This year, union budget increased excise duty exorbitantly. As a result, we expect volumes to decline by 2% in FY11.

However, net realizations of the company will grow and will result into margin expansion. After such a severe excise hike, we expect that further

increases will be moderate over the next couple of years. Hence, we expect volumes to grow by 4% and 6% in FY12 and FY13 respectively after

factoring in 5% hike in excise duty each year.

Foreign tourist arrival (FTA) has started showing signs of revival as FTA posted 15% y-o-y growth in Nov'10. As economic recovery is on the anvil,

aggressive capacity expansion plans of ITC will help the company to tap the growing opportunity in hotels industry without stressing its balance sheet

with financial leverage, which is common in this capital intensive industry.

Other FMCG business has been a loss making segment as ITC expanded its portfolio and invested aggressively on brand positioning over the years.

However, we believe losses have peaked in FY09 and started shrinking from there on and will turn into profits by Fy13.

We expect ITC's paper and paper board business to register strong growth in revenues and margins, going forward. Revenue growth will be driven by

capacity expansion, strong demand from external as well as internal consumption and rising prices of paper. On the other hand, backward integration

into pulp manufacturing will insulate ITC from the high international prices of pulp and would result into margins improvement on buoyant paper

prices.

The company is focusing towards improvement in product mix and is likely to trade into high margin commodities which will result into margin

expansion in the segment.

ITC is a strong defensive player focused on domestic theme. In a scenario of uncertain global economies, rising interest rates and high commodity

prices, ITC is wellhedged due to its diversified business model. Currently, FMCG companies are facing margin pressure due to high input prices.

However, ITC has an edge over its competitors in FMCG space because of its supply chain efficiency. Along with that, an increase in commodity prices

improves profitability of its Agri business division which partly negate the impact of hardening commodity prices for the company as a whole.

We value ITC on SOTP basis due to diversity of its businesses. SOTP price target implies a 20x P/E multiple for the cigarette business. Our price target

implies an earnings multiple of 23.1x FY12E earnings.

Source: CEA, A C Choksi Research

Source: A C Choksi Research

Nurturing Wealth

Source : A C Choksi Research

Source : A C Choksi Research

Source : A C Choksi Research

Segment-wise Revenue Contribution in FY10 Segment-wise EBIT Contribution in FY10

December 24, 2010

May 23, 2011

?Kaya:

Marico offers hair care and skin care services through a chain of clinics under the brand

name Kaya. At present, there are a total of 103 clinics with 81 situated in India, 16 in the

Middle East, 2 in Bangladesh in addition to the 4 clinics and medi-spas in Singapore and

Malaysia through Derma Rx.

A C Choksi

International Category Products

Bangladesh Coconut Oil,Edible oil &

Hair care

Parachute oil, Saffola, Hair

Code

South Africa Hair care and Health care Caivil, Black Chic, Hercules,

Ingwe

Egypt Hair care Fiancee and Hair Code

Middle East Skin Care Parachute cream & Gels

Malaysia Hair care Code 10

Vietnam Personal care, Home Care

& Foods

X-Men, L'Ovita, Thuan Phat

Food

Source: Company

A C Choksi

Share Brokers Private Limited

A C Choksi Research Institutional research@acchoksi.com

8

Nurturing Wealth

Research Report|FMCG

?Health and wellness market offers huge growth potential in India

1) India: moving towards a double-digit growth trajectory

India's economic growth has accelerated significantly over the past two decades. Spending

power of its citizens also increased as real average household disposable income has

broadly doubled since 1985. With rising incomes, household disposable consumption has

soared and new Indian middle class has emerged. Demand for FMCG has a positive

correlation with the rising income levels. As growing middle class continues to see its

income level rise, it is likely to up-trade from popular category products to premium

category products. Further, stimulus packages by Government of India and robust

agricultural production led to an increase in rural income, which in turn resulted into

strategic shift in consumer preference from unbranded to branded products.

Prior to global economic slowdown, India reported growth of over 9% for 3

consecutive years while during economic slowdown it moderated to 6.7% - still high

compared to other world economies. Indian economy is on the recovery path and

reported a growth rate of 8.6% in FY 2011, which is expected to touch 9% levels in

FY 2012 and 10% in FY 2015.

Investment Summary :

?Cigarette business: Stable and Sure

?Revival in FTA & capacity expansion will boost Hotels business

?Other FMCG: Consistent efforts will become profitable in FY13

?Paper and Paperboards: On a high stride ride

?Agri Business: Improving Margins

?Strong defensive player

?Valuation

Tobacco industry has received adverse tax shocks a number of times during this decade, yet ITC's earnings growth have remained quite stable as ITC

has managed to pass on tax hikes. This year, union budget increased excise duty exorbitantly. As a result, we expect volumes to decline by 2% in FY11.

However, net realizations of the company will grow and will result into margin expansion. After such a severe excise hike, we expect that further

increases will be moderate over the next couple of years. Hence, we expect volumes to grow by 4% and 6% in FY12 and FY13 respectively after

factoring in 5% hike in excise duty each year.

Foreign tourist arrival (FTA) has started showing signs of revival as FTA posted 15% y-o-y growth in Nov'10. As economic recovery is on the anvil,

aggressive capacity expansion plans of ITC will help the company to tap the growing opportunity in hotels industry without stressing its balance sheet

with financial leverage, which is common in this capital intensive industry.

Other FMCG business has been a loss making segment as ITC expanded its portfolio and invested aggressively on brand positioning over the years.

However, we believe losses have peaked in FY09 and started shrinking from there on and will turn into profits by Fy13.

We expect ITC's paper and paper board business to register strong growth in revenues and margins, going forward. Revenue growth will be driven by

capacity expansion, strong demand from external as well as internal consumption and rising prices of paper. On the other hand, backward integration

into pulp manufacturing will insulate ITC from the high international prices of pulp and would result into margins improvement on buoyant paper

prices.

The company is focusing towards improvement in product mix and is likely to trade into high margin commodities which will result into margin

expansion in the segment.

ITC is a strong defensive player focused on domestic theme. In a scenario of uncertain global economies, rising interest rates and high commodity

prices, ITC is wellhedged due to its diversified business model. Currently, FMCG companies are facing margin pressure due to high input prices.

However, ITC has an edge over its competitors in FMCG space because of its supply chain efficiency. Along with that, an increase in commodity prices

improves profitability of its Agri business division which partly negate the impact of hardening commodity prices for the company as a whole.

We value ITC on SOTP basis due to diversity of its businesses. SOTP price target implies a 20x P/E multiple for the cigarette business. Our price target

implies an earnings multiple of 23.1x FY12E earnings.

Source: CEA, A C Choksi Research

Source: A C Choksi Research

Nurturing Wealth

Source : A C Choksi Research

Source : A C Choksi Research

Source : A C Choksi Research

Segment-wise Revenue Contribution in FY10 Segment-wise EBIT Contribution in FY10

December 24, 2010

Source: RBI & Economic Research

May 23, 2011

Investment Thesis

GDP Growth

A C Choksi

Share Brokers Private Limited

A C Choksi Research Institutional research@acchoksi.com

9

Nurturing Wealth

Research Report|FMCG

2)Urbanization to contribute in future growth of the economy

Urbanization is a key indicator of economic development of a country. With

economic expansion, its towns and cities expand in size and volume and the

contribution of the urban sector to the national economy increases. Urban India is

undergoing a deep transition phase in terms of physical form, demographic profile

and socio-economic diversity. The rate of urban growth in the country is very high as

compared to developed countries, and the large cities are becoming larger mostly due

to continuous migration of population to these cities.

Urban population of India is expected to reach 433mn by 2021, while the total

population may reach 1340mn (Source: Registrar General, Government of India).

Thus, the level of urbanization in the country in the year 2021 is expected to be about

32%.

Investment Summary :

?Cigarette business: Stable and Sure

?Revival in FTA & capacity expansion will boost Hotels business

?Other FMCG: Consistent efforts will become profitable in FY13

?Paper and Paperboards: On a high stride ride

?Agri Business: Improving Margins

?Strong defensive player

?Valuation

Tobacco industry has received adverse tax shocks a number of times during this decade, yet ITC's earnings growth have remained quite stable as ITC

has managed to pass on tax hikes. This year, union budget increased excise duty exorbitantly. As a result, we expect volumes to decline by 2% in FY11.

However, net realizations of the company will grow and will result into margin expansion. After such a severe excise hike, we expect that further

increases will be moderate over the next couple of years. Hence, we expect volumes to grow by 4% and 6% in FY12 and FY13 respectively after

factoring in 5% hike in excise duty each year.

Foreign tourist arrival (FTA) has started showing signs of revival as FTA posted 15% y-o-y growth in Nov'10. As economic recovery is on the anvil,

aggressive capacity expansion plans of ITC will help the company to tap the growing opportunity in hotels industry without stressing its balance sheet

with financial leverage, which is common in this capital intensive industry.

Other FMCG business has been a loss making segment as ITC expanded its portfolio and invested aggressively on brand positioning over the years.

However, we believe losses have peaked in FY09 and started shrinking from there on and will turn into profits by Fy13.

We expect ITC's paper and paper board business to register strong growth in revenues and margins, going forward. Revenue growth will be driven by

capacity expansion, strong demand from external as well as internal consumption and rising prices of paper. On the other hand, backward integration

into pulp manufacturing will insulate ITC from the high international prices of pulp and would result into margins improvement on buoyant paper

prices.

The company is focusing towards improvement in product mix and is likely to trade into high margin commodities which will result into margin

expansion in the segment.

ITC is a strong defensive player focused on domestic theme. In a scenario of uncertain global economies, rising interest rates and high commodity

prices, ITC is wellhedged due to its diversified business model. Currently, FMCG companies are facing margin pressure due to high input prices.

However, ITC has an edge over its competitors in FMCG space because of its supply chain efficiency. Along with that, an increase in commodity prices

improves profitability of its Agri business division which partly negate the impact of hardening commodity prices for the company as a whole.

We value ITC on SOTP basis due to diversity of its businesses. SOTP price target implies a 20x P/E multiple for the cigarette business. Our price target

implies an earnings multiple of 23.1x FY12E earnings.

Source: A C Choksi Research

Source: A C Choksi Research

Nurturing Wealth

Source : A C Choksi Research

Source : A C Choksi Research

Source : A C Choksi Research

Segment-wise Revenue Contribution in FY10 Segment-wise EBIT Contribution in FY10

December 24, 2010

May 23, 2011

Urbanization

Source : Registrar General, Government of India

By 2021, the contribution of urban sector to GDP will grow to 75% from current

62% levels. During last decade, aggregate urban consumption has grown by 6.2%

outpacing GDP growth. Going forward, urban consumption is expected to grow at a

CAGR of 9.4% over the next 20 years (Source: Mckinsey). Thus, average annual

spending per urban Indian household will more than triple in 2025.

A C Choksi

Share Brokers Private Limited

A C Choksi Research Institutional research@acchoksi.com

10

Nurturing Wealth

Research Report|FMCG

Source: Government of India

Source: A C Choksi Research

Nurturing Wealth

Source : A C Choksi Research

Source : A C Choksi Research

Source : A C Choksi Research

Segment-wise Revenue Contribution in FY10 Segment-wise EBIT Contribution in FY10

December 24, 2010

May 23, 2011

Aggregate Urban Consumption Contribution of Urban sector to GDP

Source: Planning Commission

Source: Mckinsey

3)Rising income levels and increasing discretionary spends reflects improving

lifestyle

Since 1996, India's consumption pattern saw a major shift from food consumption

to non-food consumption, which includes health, hospitality and educational

spending. This scenario was the same with both rural and urban India's population.

Non food consumption for the cities, in particular is contributing much more than

food consumption to the total expenditure. Rising income levels will bring more and

more urban population aware towards health and wellness.

Declining trend in food related consumption indicating lifestyle changes

A C Choksi

Share Brokers Private Limited

A C Choksi Research Institutional research@acchoksi.com

11

Nurturing Wealth

Research Report|FMCG

Health Care

?Saffola to remain on a high growth path

?Increasing Cardiovascular Cases in India will make people shift towards

healthy oils

Saffola is a forty year-old brand and one of the major revenue drivers for Marico. The

brand is positioned in a niche category of 'good for Heart' platform to tap the health

conscious Indian consumers and therefore offers higher realizations than other edible

oils. As Marico targets health conscious consumers in the country, increasing

awareness over cardiac problems, coupled with rising incomes, will lead to strong

growth in Saffola, going forward. The consistent launch of innovative edible oil

variants and functional foods under the brand is expected to further support growth

under the Saffola franchise.

Starting from a level of about 380 lakh cases in the year 2005, there may be as many as

641 lakh cases of cardiovascular disease (CVD) in 2015. The rates of prevalence of

CVD in rural populations will be lower than in urban populations, but will continue to

increase, reaching roughly 13.5% of the rural population in the age group of 60-69

years by 2015. The prevalence rates among younger adults and women (in the age group

of 40 years and above) are also likely to increase. With rising aspirations and increasing

stress levels, India will see a major number of CVD cases in the bracket of working age

population. It is estimated that 82% of total CVD cases will be witnessed in the age

bracket of 20-59. We believe the steady rise in the awareness towards healthy lifestyle

will attract more and more consumers toward Saffola brand.

Nurturing Wealth

Source : A C Choksi Research

Source : A C Choksi Research

Source : A C Choksi Research

December 24, 2010

Business Overview

May 23, 2011

A C Choksi

Burden of cardiovascular diseases in India

Source : NHFCA

Marico emerges

as a key

beneficiary of

urbanization and

rising income

levels in rural

and middle class

households due

to its niche

positioning in

Health care and

Hair Care space

Share Brokers Private Limited

A C Choksi Research Institutional research@acchoksi.com

12

Nurturing Wealth

Research Report|FMCG

?Presence across price points expands market reach:

Leveraging on the success of the Saffola brand, Marico launched 3 blends; Saffola

Tasty Blend (corn oil & safflower oil), Saffola Gold (80% rice bran oil and 20%

safflower) and Saffola Active (rice bran & soya oil). Saffola has grown at a healthy rate

over the past several years, driven by changing consumer preference for branded oils.

These variants fill the gap between premium category Saffola oil and regular edible oils.

Hence, it taps the customers who wish to choose healthy refined oil but were not able to

do so because of high premium of Saffola oil over regular edible oils. This expands

market reach of the Saffola brand to middle class and aspiring customers. This strategy

to expand product basket across various price points entail dual benefit for the

company, as rising income levels make customers to uptrade to high-margin premium

product. On the other hand, during rising inflation when consumers tend to

downtrade, offerings across various price points helps Marico to retain market share.

Nurturing Wealth

Source : A C Choksi Research

Source : A C Choksi Research

Source : A C Choksi Research

December 24, 2010

Business Overview

Nurturing Wealth

Source : A C Choksi Research

Source : A C Choksi Research

Source : A C Choksi Research

December 24, 2010

Business Overview

May 23, 2011

A C Choksi

Prices of Saffola's various brands

Source: Company, A C Choksi Institutional Research

Share Brokers Private Limited

A C Choksi Research Institutional research@acchoksi.com

13

Nurturing Wealth

Research Report|FMCG

?Brand Extension: Entry in high growth, nascent categories with a niche of

health positioning

?Saffola's success reflects brand power of Marico:

?Saffolas Outlook:

With evolving tastes and consumer preferences, Marico has exploited available

opportunities by prototyping products using its existing flagship brands. The company

launched a number of health conscious products under the Saffola brand. The

company has expanded the Saffola franchise by launching Saffola Oats (prototyped in

Maharashtra). The Oats market in India is approximately Rs 1200-1400mn and is

growing fast at a rate of approximately 40%. While the category has seen the recent

entry of a few players, the nascent market and healthy trend provides room for all

players to participate in this category growth. Saffola will also play a role in expanding

the market. During Q4FY10, Saffola Arise was launched across key Saffola markets.

The performance so far has been encouraging in the West & South India markets where

short grain rice is common. During Q4FY11 two more variants in Basmati and long

grain rice were introduced to strengthen the position in the North where the longer

grain is preferred. The packaged rice market in India is approximately Rs 4000mn and is

growing at over 20%. With its innovative health positioning Saffola is likely to create a

sizable franchise for itself over the next two to three years.

Saffola consistently maintained double digit volume growth since FY 2004 on account

of huge branding and creating a different category of consumer which is urban and

focused towards the heart related issues such as cholesterol. Though caters to a very

niche but high income group of population, Saffola maintained its market share over

15%. The brand witnessed major competition from Agro Tech Food's Sundrop brand

which was also categorized in the same niche. During FY 2005-10, Saffola's volume

registered a CAGR of 15% while its revenues reported a CAGR of 18%. Going

forward, we expect that strong demographics of India and Marico's increasing focus on

Saffola will help to improve its contribution to business. In our view, Saffola will be a

major growth driver for Marico and its volume and value growth will register a CAGR

of 17.5% and 24.5% respectively during FY 2011-14.

During FY 2011, Rice bran prices registered a significant increase of approximately

21% whereas safflower prices remained flat. To factor in the impact of the same the

company had taken a blended price increase of approximately 12% during the year.

Going forward, we expect an increase in safflower prices as during the current crop

Investment Summary :

?Cigarette business: Stable and Sure

?Revival in FTA & capacity expansion will boost Hotels business

?Other FMCG: Consistent efforts will become profitable in FY13

?Paper and Paperboards: On a high stride ride

?Agri Business: Improving Margins

?Strong defensive player

?Valuation

Tobacco industry has received adverse tax shocks a number of times during this decade, yet ITC's earnings growth have remained quite stable as ITC

has managed to pass on tax hikes. This year, union budget increased excise duty exorbitantly. As a result, we expect volumes to decline by 2% in FY11.

However, net realizations of the company will grow and will result into margin expansion. After such a severe excise hike, we expect that further

increases will be moderate over the next couple of years. Hence, we expect volumes to grow by 4% and 6% in FY12 and FY13 respectively after

factoring in 5% hike in excise duty each year.

Foreign tourist arrival (FTA) has started showing signs of revival as FTA posted 15% y-o-y growth in Nov'10. As economic recovery is on the anvil,

aggressive capacity expansion plans of ITC will help the company to tap the growing opportunity in hotels industry without stressing its balance sheet

with financial leverage, which is common in this capital intensive industry.

Other FMCG business has been a loss making segment as ITC expanded its portfolio and invested aggressively on brand positioning over the years.

However, we believe losses have peaked in FY09 and started shrinking from there on and will turn into profits by Fy13.

We expect ITC's paper and paper board business to register strong growth in revenues and margins, going forward. Revenue growth will be driven by

capacity expansion, strong demand from external as well as internal consumption and rising prices of paper. On the other hand, backward integration

into pulp manufacturing will insulate ITC from the high international prices of pulp and would result into margins improvement on buoyant paper

prices.

The company is focusing towards improvement in product mix and is likely to trade into high margin commodities which will result into margin

expansion in the segment.

ITC is a strong defensive player focused on domestic theme. In a scenario of uncertain global economies, rising interest rates and high commodity

prices, ITC is wellhedged due to its diversified business model. Currently, FMCG companies are facing margin pressure due to high input prices.

However, ITC has an edge over its competitors in FMCG space because of its supply chain efficiency. Along with that, an increase in commodity prices

improves profitability of its Agri business division which partly negate the impact of hardening commodity prices for the company as a whole.

We value ITC on SOTP basis due to diversity of its businesses. SOTP price target implies a 20x P/E multiple for the cigarette business. Our price target

implies an earnings multiple of 23.1x FY12E earnings.

Source: CEA, A C Choksi Research

Source: A C Choksi Research

Nurturing Wealth

Source : A C Choksi Research

Source : A C Choksi Research

Source : A C Choksi Research

Segment-wise Revenue Contribution in FY10 Segment-wise EBIT Contribution in FY10

December 24, 2010

Nurturing Wealth

Source : A C Choksi Research

Source : A C Choksi Research

December 24, 2010

Business Overview

May 23, 2011

A C Choksi

Share Brokers Private Limited

A C Choksi Research Institutional research@acchoksi.com

14

Nurturing Wealth

Research Report|FMCG

season for safflower, production is expected to decline by approximately 9.8% y-o-y

(Source: COOIT). We have factored in a price increase of 17% in safflower prices during

FY 2012. On the other hand, rice bran oil production is expected to increase by

approximately 6.25% y-o-y during the current crop season. Thus, we have factored in a

moderate increase of 8% in rice bran oil prices during FY 2012. Hence, we believe that

blended realizations of the company will increase by approximately 11% during FY

2012. We expect that Saffola will register a volume growth of 17% during the year.

Investment Summary :

?Cigarette business: Stable and Sure

?Revival in FTA & capacity expansion will boost Hotels business

?Other FMCG: Consistent efforts will become profitable in FY13

?Paper and Paperboards: On a high stride ride

?Agri Business: Improving Margins

?Strong defensive player

?Valuation

Tobacco industry has received adverse tax shocks a number of times during this decade, yet ITC's earnings growth have remained quite stable as ITC

has managed to pass on tax hikes. This year, union budget increased excise duty exorbitantly. As a result, we expect volumes to decline by 2% in FY11.

However, net realizations of the company will grow and will result into margin expansion. After such a severe excise hike, we expect that further

increases will be moderate over the next couple of years. Hence, we expect volumes to grow by 4% and 6% in FY12 and FY13 respectively after

factoring in 5% hike in excise duty each year.

Foreign tourist arrival (FTA) has started showing signs of revival as FTA posted 15% y-o-y growth in Nov'10. As economic recovery is on the anvil,

aggressive capacity expansion plans of ITC will help the company to tap the growing opportunity in hotels industry without stressing its balance sheet

with financial leverage, which is common in this capital intensive industry.

Other FMCG business has been a loss making segment as ITC expanded its portfolio and invested aggressively on brand positioning over the years.

However, we believe losses have peaked in FY09 and started shrinking from there on and will turn into profits by Fy13.

We expect ITC's paper and paper board business to register strong growth in revenues and margins, going forward. Revenue growth will be driven by

capacity expansion, strong demand from external as well as internal consumption and rising prices of paper. On the other hand, backward integration

into pulp manufacturing will insulate ITC from the high international prices of pulp and would result into margins improvement on buoyant paper

prices.

The company is focusing towards improvement in product mix and is likely to trade into high margin commodities which will result into margin

expansion in the segment.

ITC is a strong defensive player focused on domestic theme. In a scenario of uncertain global economies, rising interest rates and high commodity

prices, ITC is wellhedged due to its diversified business model. Currently, FMCG companies are facing margin pressure due to high input prices.

However, ITC has an edge over its competitors in FMCG space because of its supply chain efficiency. Along with that, an increase in commodity prices

improves profitability of its Agri business division which partly negate the impact of hardening commodity prices for the company as a whole.

We value ITC on SOTP basis due to diversity of its businesses. SOTP price target implies a 20x P/E multiple for the cigarette business. Our price target

implies an earnings multiple of 23.1x FY12E earnings.

Source: A C Choksi Institutional Research

Source: A C Choksi Research

Nurturing Wealth

Source : A C Choksi Research

Source : A C Choksi Research

Source : A C Choksi Research

Segment-wise Revenue Contribution in FY10 Segment-wise EBIT Contribution in FY10

December 24, 2010

Nurturing Wealth

Source : A C Choksi Research

Source : A C Choksi Research

December 24, 2010

Business Overview

May 23, 2011

A C Choksi

Saffola's Volume growth

Saffola's Value growth

Safflower Seed

Particulars (in Lakh Tonnes)

2010-11 Season 2009-10 Season

State

-Ma hara shtra 0. 85 0. 9

-Karnataka 0.4 0. 4

-Andhra Pradesh 0.1 0. 1

-Others 0. 05 0. 1

Total 1.4 1.5

Retained for sowing & Direct

Consumption 0.1 0. 1

Marketable surplus for crushing 1.3 1.4

Source: COOIT

Trade Estimate

Share Brokers Private Limited

A C Choksi Research Institutional research@acchoksi.com

15

Nurturing Wealth

Research Report|FMCG

Investment Summary :

?Cigarette business: Stable and Sure

?Revival in FTA & capacity expansion will boost Hotels business

?Other FMCG: Consistent efforts will become profitable in FY13

?Paper and Paperboards: On a high stride ride

?Agri Business: Improving Margins

?Strong defensive player

?Valuation

Tobacco industry has received adverse tax shocks a number of times during this decade, yet ITC's earnings growth have remained quite stable as ITC

has managed to pass on tax hikes. This year, union budget increased excise duty exorbitantly. As a result, we expect volumes to decline by 2% in FY11.

However, net realizations of the company will grow and will result into margin expansion. After such a severe excise hike, we expect that further

increases will be moderate over the next couple of years. Hence, we expect volumes to grow by 4% and 6% in FY12 and FY13 respectively after

factoring in 5% hike in excise duty each year.

Foreign tourist arrival (FTA) has started showing signs of revival as FTA posted 15% y-o-y growth in Nov'10. As economic recovery is on the anvil,

aggressive capacity expansion plans of ITC will help the company to tap the growing opportunity in hotels industry without stressing its balance sheet

with financial leverage, which is common in this capital intensive industry.

Other FMCG business has been a loss making segment as ITC expanded its portfolio and invested aggressively on brand positioning over the years.

However, we believe losses have peaked in FY09 and started shrinking from there on and will turn into profits by Fy13.

We expect ITC's paper and paper board business to register strong growth in revenues and margins, going forward. Revenue growth will be driven by

capacity expansion, strong demand from external as well as internal consumption and rising prices of paper. On the other hand, backward integration

into pulp manufacturing will insulate ITC from the high international prices of pulp and would result into margins improvement on buoyant paper

prices.

The company is focusing towards improvement in product mix and is likely to trade into high margin commodities which will result into margin

expansion in the segment.

ITC is a strong defensive player focused on domestic theme. In a scenario of uncertain global economies, rising interest rates and high commodity

prices, ITC is wellhedged due to its diversified business model. Currently, FMCG companies are facing margin pressure due to high input prices.

However, ITC has an edge over its competitors in FMCG space because of its supply chain efficiency. Along with that, an increase in commodity prices

improves profitability of its Agri business division which partly negate the impact of hardening commodity prices for the company as a whole.

We value ITC on SOTP basis due to diversity of its businesses. SOTP price target implies a 20x P/E multiple for the cigarette business. Our price target

implies an earnings multiple of 23.1x FY12E earnings.

Source: CEA, A C Choksi Research

Source: A C Choksi Institutional Research

Nurturing Wealth

Source : A C Choksi Research

Source : A C Choksi Research

Source : A C Choksi Research

Segment-wise Revenue Contribution in FY10 Segment-wise EBIT Contribution in FY10

December 24, 2010

Nurturing Wealth

Source : A C Choksi Research

Source : A C Choksi Research

December 24, 2010

Business Overview

Saffola's Gross blended realization Growth

May 23, 2011

Raw Material Prices

Kardi Oil Rice Bran Oil

Source : A C Choksi Institutional Research

A C Choksi

Share Brokers Private Limited

A C Choksi Research Institutional research@acchoksi.com

16

Nurturing Wealth

Research Report|FMCG

?Supply Side Hedge:

?Skewed urbanization in India became favorable for Marico:

Safflower cultivation in India is continuously declining over the last 10 years, and has

declined by 64% since 1991. Production has also declined by 41% during the same

period. Major reasons for decline in area and production of safflower are higher

remuneration from competing crops such as sorghum and gram and low price

realization for the farmers as compared to other oilseed crops.

Marico is the major procurer of safflower in India. However, Marico's continuous

thrust on product improvisation had reduced the supply side constraint as the company

had chosen to offer blended oils rather than pure safflower oils. Incorporation of rice

bran oil in its edible oil portfolio provides multiple benefits to the company, as 1) with

Cholesterol lowering property rice bran oil has the ideal SFA/MUFA/PUFA ratio

which is the closest to WHO recommendation as compared to other edible oils; hence it

gels well with the Marico's Healthy Edible Oil strategy; 2) rice

bran oil production in India is increasing consistently, thus it hedges Marico against

supply side hiccups; 3) price of rice bran oil is low as compared to safflower oil prices;

this facilitates Marico to offer healthy oils at lower price points while maintaining its

margins.

Several states in India are at a low level of urbanization, in that they have not attained

even the 1951 national level of urbanization. These are Assam, Bihar, Himachal

Pradesh, and Orissa. Uttar Pradesh and Chhattisgarh are still to cross the 1971 national

level of urbanization (Source: Registrar General, Government of India). Marico

generates approximately 60% of its revenue from South and West regions, which are

developing fast and with strong distribution network in place it provides an

opportunity to expand its Health care brand in these regions rapidly.

Investment Summary :

?Cigarette business: Stable and Sure

?Revival in FTA & capacity expansion will boost Hotels business

?Other FMCG: Consistent efforts will become profitable in FY13

?Paper and Paperboards: On a high stride ride

?Agri Business: Improving Margins

?Strong defensive player

?Valuation

Tobacco industry has received adverse tax shocks a number of times during this decade, yet ITC's earnings growth have remained quite stable as ITC

has managed to pass on tax hikes. This year, union budget increased excise duty exorbitantly. As a result, we expect volumes to decline by 2% in FY11.

However, net realizations of the company will grow and will result into margin expansion. After such a severe excise hike, we expect that further

increases will be moderate over the next couple of years. Hence, we expect volumes to grow by 4% and 6% in FY12 and FY13 respectively after

factoring in 5% hike in excise duty each year.

Foreign tourist arrival (FTA) has started showing signs of revival as FTA posted 15% y-o-y growth in Nov'10. As economic recovery is on the anvil,

aggressive capacity expansion plans of ITC will help the company to tap the growing opportunity in hotels industry without stressing its balance sheet

with financial leverage, which is common in this capital intensive industry.

Other FMCG business has been a loss making segment as ITC expanded its portfolio and invested aggressively on brand positioning over the years.

However, we believe losses have peaked in FY09 and started shrinking from there on and will turn into profits by Fy13.

We expect ITC's paper and paper board business to register strong growth in revenues and margins, going forward. Revenue growth will be driven by

capacity expansion, strong demand from external as well as internal consumption and rising prices of paper. On the other hand, backward integration

into pulp manufacturing will insulate ITC from the high international prices of pulp and would result into margins improvement on buoyant paper

prices.

The company is focusing towards improvement in product mix and is likely to trade into high margin commodities which will result into margin

expansion in the segment.

ITC is a strong defensive player focused on domestic theme. In a scenario of uncertain global economies, rising interest rates and high commodity

prices, ITC is wellhedged due to its diversified business model. Currently, FMCG companies are facing margin pressure due to high input prices.

However, ITC has an edge over its competitors in FMCG space because of its supply chain efficiency. Along with that, an increase in commodity prices

improves profitability of its Agri business division which partly negate the impact of hardening commodity prices for the company as a whole.

We value ITC on SOTP basis due to diversity of its businesses. SOTP price target implies a 20x P/E multiple for the cigarette business. Our price target

implies an earnings multiple of 23.1x FY12E earnings.

Source: CEA, A C Choksi Research

Source: A C Choksi Research

Nurturing Wealth

Source : A C Choksi Research

Source : A C Choksi Research

Source : A C Choksi Research

Segment-wise Revenue Contribution in FY10 Segment-wise EBIT Contribution in FY10

December 24, 2010

Nurturing Wealth

Source : A C Choksi Research

Source : A C Choksi Research

December 24, 2010

Business Overview

May 23, 2011

A C Choksi

Share Brokers Private Limited

A C Choksi Research Institutional research@acchoksi.com

17

Nurturing Wealth

Research Report|FMCG

Hair Care

?Hair Oil Industry; growing at par with FMCG Industry Average:

?Parachute-well oiled for a high growth stride:

Hair care products contribute approximately 8% of the total FMCG market (Rs

1611bn) in India (Source: A C Nielsen). Hair care industry is growing at par with overall

industry average of approximately 13-14%. Shampoo and hair oils, including coconut

oils, continue to be the key components of this segment. Hair oils category constitute

more than 55% of the overall hair care industry in India. Hair oil category witnessed a

volume growth of 17% CAGR from FY 2007 to FY 2010 whereas it witnessed value

growth of 21% CAGR over the same period. This growth is primarily attributed to the

improvement in distribution network and supply chain efficiency.

Marico is the market leader in the coconut oil (CNO) market in India through its

flagship brand Parachute. Market size of branded coconut oil in India is

approximately Rs 19bn. In light of growing urbanization and increasing affordability,

customers are becoming more brand conscious. Marico is well-positioned to become

the key beneficiary of changing preferences of Indian consumers as there exists a large

headroom for growth with 40% market share of total CNO market with unorganized

players. To exploit this untapped market, Marico has launched packs at low price points

in order to facilitate the conversion of loose oil users of coconut oil to Parachute.

During, rising input cost scenario the company had restrained from increasing prices at

lower price points. The company has clear-cut growth strategy in place to expand in hair

care segment 1) expanding profitability in coconut oil segment, where it enjoys high

pricing power; 2) to expand its hair care basket by launching new product variants under

its flagship brand Parachute (only in the product categories where it can achieve

dominant market share). Thus, the company has strategically decided not to focus on

niche markets like shampoo and hair-colorant due to high competitive intensity in the

categories. We believe pricing power, better product portfolio and favorable

competition dynamics will drive growth momentum in the hair care space.

Investment Summary :

?Cigarette business: Stable and Sure

?Revival in FTA & capacity expansion will boost Hotels business

?Other FMCG: Consistent efforts will become profitable in FY13

?Paper and Paperboards: On a high stride ride

?Agri Business: Improving Margins

?Strong defensive player

?Valuation

Tobacco industry has received adverse tax shocks a number of times during this decade, yet ITC's earnings growth have remained quite stable as ITC

has managed to pass on tax hikes. This year, union budget increased excise duty exorbitantly. As a result, we expect volumes to decline by 2% in FY11.

However, net realizations of the company will grow and will result into margin expansion. After such a severe excise hike, we expect that further

increases will be moderate over the next couple of years. Hence, we expect volumes to grow by 4% and 6% in FY12 and FY13 respectively after

factoring in 5% hike in excise duty each year.

Foreign tourist arrival (FTA) has started showing signs of revival as FTA posted 15% y-o-y growth in Nov'10. As economic recovery is on the anvil,

aggressive capacity expansion plans of ITC will help the company to tap the growing opportunity in hotels industry without stressing its balance sheet

with financial leverage, which is common in this capital intensive industry.

Other FMCG business has been a loss making segment as ITC expanded its portfolio and invested aggressively on brand positioning over the years.

However, we believe losses have peaked in FY09 and started shrinking from there on and will turn into profits by Fy13.

We expect ITC's paper and paper board business to register strong growth in revenues and margins, going forward. Revenue growth will be driven by

capacity expansion, strong demand from external as well as internal consumption and rising prices of paper. On the other hand, backward integration

into pulp manufacturing will insulate ITC from the high international prices of pulp and would result into margins improvement on buoyant paper

prices.

The company is focusing towards improvement in product mix and is likely to trade into high margin commodities which will result into margin

expansion in the segment.

ITC is a strong defensive player focused on domestic theme. In a scenario of uncertain global economies, rising interest rates and high commodity

prices, ITC is wellhedged due to its diversified business model. Currently, FMCG companies are facing margin pressure due to high input prices.

However, ITC has an edge over its competitors in FMCG space because of its supply chain efficiency. Along with that, an increase in commodity prices