Professional Documents

Culture Documents

15H 211

15H 211

Uploaded by

RajanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

15H 211

15H 211

Uploaded by

RajanCopyright:

Available Formats

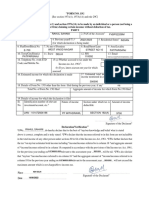

"FORM NO.

15H [See section 197A(1C) and rule 29C(1A)] Declaration under section 197A(1C) of the Incometax Act, 1961 to be made by an individual who is of the age of sixty years or more claiming certain receipts without deduction of tax.

PART I

1. Name of Assessee (Declarant) 2. PAN of the Assessee 3. Age 3. Assessment Year ( for which declaration is being made)

211

5. Flat/Door/Block No. 8. Road/Street/Lane 6. Name of Premises 9. Area/Locality

7. Assessed in which Ward/Circle 10. AO Code (under whom assessed last time Area Code AO Type Range Code AO No. 13. PIN 14. Last Assessment Year in which assessed

11. Town/City/District 15. Email

12. State

16. Telephone No. (with STD Code) and Mobile No.

17. Present Ward/Circle 19. Present AO Code (if not same as above) Area Code AO Type Range Code AO No.

18. Name of Business/Occupation 20. Jurisdictional Chief Commissioner of Incometax or Commissioner of Incometax (if not assessed to Incometax earlier) 21. Estimated total income from the sources mentioned below:

(Please tick the relevant box) Dividend from shares referred to in Schedule I Interest on securities referred to in Schedule II Interest on sums referred to in Schedule III Income form units referred to in Schedule IV The amount of withdrawal referred to in section 80CCA(2)(a) from National Savings Scheme referred to in ScheduleV 22. Estimated total income of the previous year in which income mentioned in Column 22 is to be included 23. Details of investments in respect of which the declaration is being made: SCHEDULEI (Details of shares, which stand in the name of the declarant and beneficially owned by him) No. of shares Class of shares & face value of each share Total value of shares Distinctive numbers of the shares Date(s) on which the shares were acquired by the declarant (dd/mm/yyyy)

SCHEDULEII (Details of the securities held in the name of declarant and beneficially owned by him) Description of securities Number of securities Amount of securities Date(s) of securities (dd/mm/yyyy) Date(s) on which the securities were acquired by the declarant (dd/mm/yyyy)

SCHEDULEIII (Details of the sums given by the declarant on interest) Name and address of the person to whom the Amount of sums given Date on which the sums were given Period for which sums sums are given on interest on interest on interest(dd/mm/yyyy) were given on interest Rate of interest

Finotax

1 of 3

SCHEDULEIV (Details of the mutual fund units held in the name of declarant and beneficially owned by him) Name and address of the mutual fund Number of units Class of units and face value of Distinctive number of units each unit Income in respect of units

SCHEDULEV (Details of the withdrawal made from National Savings Scheme) Particulars of the Post Office where the account under the National Savings Scheme is maintained and the account number Date on which the account was opened(dd/mm/yyyy) The amount of withdrawal from the account

**Signature of the Declarant

Declaration/Verification

*I/We do hereby declare that I am resident in India within the meaning of section 6 of the Incometax Act, 1961. I also, hereby declare that to the best of my knowledge and belief what is stated above is correct, complete and is truly stated and that the incomes referred to in this form are not includible in the total income of any other person u/s 60 to 64 of the Incometax Act, 1961. I further, declare that the tax on my estimated total income, including *income/incomes referred to in column 21 computed in accordance with the provisions of the Income tax Act, 1961, for the previous year ending on Place: Date: PART II [For use by the person to whom the declaration is furnished] Signature of the Declarant will be nil.

1. Name of the person responsible for paying the income referred to in Column 21 of Part I

2. PAN of the person indicated in Column 1 of Part II

3. Complete Address

4. TAN of the person indicated in Column 1 of Part II

5. Email

6. Telephone No. (with STD Code) and Mobile 7. Status No. 10. Amount of income paid 11. Date on which the income has been paid/credited (dd/mm/yyyy)

8. Date on which Declaration is Furnished (dd/mm/yyyy)

9. Period in respect of which the dividend has been declared or the income has been paid/credited

12. Date of declaration, distribution or payment of dividend/ withdrawal 13. Account Number of National Saving Scheme from which under the National Savingscheme(dd/mm/yyyy) withdrawal has been made

Forwarded to the Chief Commissioner or Commissioner of Incometax Place: Date: Signature of the person responsible for paying the income referred to in Column 22 of Part I

Finotax

2 of 3

Notes: 1 2 3 The declaration should be furnished in duplicate. *Delete whichever is not applicable. Before signing the declaration/verification , the declarant should satisfy himself that the information furnished in this form is true, correct and complete in all respects. Any person making a false statement in the declaration shall be liable to prosecution under 277 of the Incometax Act, 1961 and on conviction be punishable i) ii) In a case where tax sought to be evaded exceeds twentyfive lakh rupees, with rigorous imprisonment which shall not be less than 6 months but which may extend to seven years and with fine; In any other case, with rigorous imprisonment which shall not be less than 3 months but which may extend to two years and with fine. 4 The person responsible for paying the income referred to in column 22 of Part I shall not accept the declaration where the amount of income of the nature referred to in subsection (1) or subsection (1A) of section 197A or the aggregate of the amounts of such income credited or paid or likely to be credited or paid during the previous year in which such income is to be included exceeds the maximum amount which is not chargeable to tax.";

Finotax

3 of 3

You might also like

- New Form 15H For Fixed Deposits Editable in PDFDocument2 pagesNew Form 15H For Fixed Deposits Editable in PDFMutual Funds Advisor ANANDARAMAN 944-529-6519No ratings yet

- Simple Guide for Drafting of Civil Suits in IndiaFrom EverandSimple Guide for Drafting of Civil Suits in IndiaRating: 4.5 out of 5 stars4.5/5 (4)

- SAP MDG Master Data Gove 6228635Document15 pagesSAP MDG Master Data Gove 6228635RajanNo ratings yet

- "Form No. 15H (See Section 197A (1C) and Rule 29C (1A) ) Declaration Under Section 197A (1C) of The Income of Sixty Years or More Claiming Certain Receipts Without Deduction of TaxDocument3 pages"Form No. 15H (See Section 197A (1C) and Rule 29C (1A) ) Declaration Under Section 197A (1C) of The Income of Sixty Years or More Claiming Certain Receipts Without Deduction of TaxRajanNo ratings yet

- Form No 15HDocument3 pagesForm No 15HsaymtrNo ratings yet

- Form 15g TaxguruDocument3 pagesForm 15g Taxguruulhas_nakasheNo ratings yet

- OBC Bank Form - 15H PDFDocument2 pagesOBC Bank Form - 15H PDFKrishnan Vaidyanathan100% (1)

- Form No. 15H: Part - IDocument2 pagesForm No. 15H: Part - Itoton33No ratings yet

- 15G FormDocument2 pages15G Formgrover.jatinNo ratings yet

- "Form No. 15G: AO No. AO Type Range Code Area CodeDocument2 pages"Form No. 15G: AO No. AO Type Range Code Area CodePruthvish ShuklaNo ratings yet

- Form 15g NewDocument4 pagesForm 15g NewnazirsayyedNo ratings yet

- TAX SAVING Form 15g Revised1 SBTDocument2 pagesTAX SAVING Form 15g Revised1 SBTrkssNo ratings yet

- "Form No. 15H: Area Code Range Code AO No. AO TypeDocument2 pages"Form No. 15H: Area Code Range Code AO No. AO Typepkw007No ratings yet

- PDF Editor: Form No. 15GDocument2 pagesPDF Editor: Form No. 15GImissYouNo ratings yet

- FORM-15G: (Please Tick The Relevant Box)Document4 pagesFORM-15G: (Please Tick The Relevant Box)Kayam BalajiNo ratings yet

- "Form No. 15H: Printed From WWW - Incometaxindia.gov - in Page 1 of 2Document2 pages"Form No. 15H: Printed From WWW - Incometaxindia.gov - in Page 1 of 2teniyaNo ratings yet

- Sr. No. Pan Place Name Father Name Address: Adddress Abc Company Company/Firm Name & Address Name of Owner Rahul DravidDocument7 pagesSr. No. Pan Place Name Father Name Address: Adddress Abc Company Company/Firm Name & Address Name of Owner Rahul DravidKartikey RanaNo ratings yet

- 15h Form (1) - CompressedDocument4 pages15h Form (1) - Compressedrekha safarirNo ratings yet

- PDFDocument4 pagesPDFushapadminivadivelswamyNo ratings yet

- 15G FormDocument2 pages15G Formsurendar147No ratings yet

- PDF 4Document3 pagesPDF 47ola007No ratings yet

- 15 G Form (Pre-Filled)Document2 pages15 G Form (Pre-Filled)Palaniappan Meyyappan83% (6)

- Tata Consumer ANNEXURE - 2 FORM 15HDocument5 pagesTata Consumer ANNEXURE - 2 FORM 15HAnbarasu MookiahpandianNo ratings yet

- New Form 15G Form 15H PDFDocument6 pagesNew Form 15G Form 15H PDFdevender143No ratings yet

- New Form 15G PDFDocument2 pagesNew Form 15G PDFSoma Sundar50% (2)

- New Form No 15GDocument4 pagesNew Form No 15GDevang PatelNo ratings yet

- "Form No. 15GDocument2 pages"Form No. 15GJayvin ShiluNo ratings yet

- Form 15H Format 1Document4 pagesForm 15H Format 1ASHISH KININo ratings yet

- Form 15 HDocument2 pagesForm 15 Hsingh ramanpreetNo ratings yet

- Srnoin Form 15G Srnoin Form 15H Particulars (Required Details)Document6 pagesSrnoin Form 15G Srnoin Form 15H Particulars (Required Details)priyaradhiNo ratings yet

- New FORM 15H Applicable PY 2016-17Document2 pagesNew FORM 15H Applicable PY 2016-17addsingh100% (1)

- Form-15GDocument2 pagesForm-15GvikramNo ratings yet

- Icici Form 15GDocument2 pagesIcici Form 15Grajanikant_singhNo ratings yet

- Bonds Form 15gDocument3 pagesBonds Form 15gRishi TNo ratings yet

- Tax Form 15H PDFDocument4 pagesTax Form 15H PDFraviNo ratings yet

- Income-Tax Rules, 1962: (See Section 197A (1), 197A (1A) and Rule 29C)Document4 pagesIncome-Tax Rules, 1962: (See Section 197A (1), 197A (1A) and Rule 29C)utuavn evNo ratings yet

- 103120000000007845Document3 pages103120000000007845arjunv_14100% (1)

- Form15h GH01389401 PDFDocument3 pagesForm15h GH01389401 PDFNamme KyarakhahaiNo ratings yet

- Form 15H(49)filledDocument4 pagesForm 15H(49)filleddivya.behindthelenseNo ratings yet

- FORM-NO.-15GDocument2 pagesFORM-NO.-15GShreejit SahaNo ratings yet

- BLANK IOCL Form 15GDocument3 pagesBLANK IOCL Form 15Gsaiboyshostel37No ratings yet

- Form 15 GDocument2 pagesForm 15 GRahul SahaniNo ratings yet

- Flat/Door/Block No. 7 7. Name of Premises 8.Rond/Street/Lane os9.Area/Locality Vaidn Hna QovDocument3 pagesFlat/Door/Block No. 7 7. Name of Premises 8.Rond/Street/Lane os9.Area/Locality Vaidn Hna QovVishwini ViswanathanNo ratings yet

- 15 G Form (Pre-Filled)Document8 pages15 G Form (Pre-Filled)pankaj_electricalNo ratings yet

- 15 G Form (Pre-Filled)Document2 pages15 G Form (Pre-Filled)Pawan Yadav0% (2)

- PAN No.Document5 pagesPAN No.haldharkNo ratings yet

- TourDocument4 pagesTourAnup SahNo ratings yet

- Form 15G WordDocument2 pagesForm 15G WordMahesh RathodNo ratings yet

- Form 15GDocument3 pagesForm 15Gsriramdutta9No ratings yet

- Form No 15GDocument2 pagesForm No 15Gnarendra1968No ratings yet

- Income-Tax Rules, 1962Document2 pagesIncome-Tax Rules, 1962Abdul SattarNo ratings yet

- Form 15gDocument4 pagesForm 15gcontactus kannanNo ratings yet

- Bar Review Companion: Taxation: Anvil Law Books Series, #4From EverandBar Review Companion: Taxation: Anvil Law Books Series, #4No ratings yet

- 1040 Exam Prep: Module II - Basic Tax ConceptsFrom Everand1040 Exam Prep: Module II - Basic Tax ConceptsRating: 1.5 out of 5 stars1.5/5 (2)

- Report of Al Capone for the Bureau of Internal RevenueFrom EverandReport of Al Capone for the Bureau of Internal RevenueNo ratings yet

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- NCD Product NoteDocument5 pagesNCD Product NoteRajanNo ratings yet

- QB 640005Document19 pagesQB 640005RajanNo ratings yet

- Power R Finance C Corporatio On Limited D: Gene Eral RisksDocument92 pagesPower R Finance C Corporatio On Limited D: Gene Eral RisksRajanNo ratings yet

- "Form No. 15H (See Section 197A (1C) and Rule 29C (1A) ) Declaration Under Section 197A (1C) of The Income of Sixty Years or More Claiming Certain Receipts Without Deduction of TaxDocument3 pages"Form No. 15H (See Section 197A (1C) and Rule 29C (1A) ) Declaration Under Section 197A (1C) of The Income of Sixty Years or More Claiming Certain Receipts Without Deduction of TaxRajanNo ratings yet

- Epm Install Start Here 11111Document118 pagesEpm Install Start Here 11111RajanNo ratings yet

- Data Obfuscation and EncryptionDocument10 pagesData Obfuscation and EncryptionRajanNo ratings yet