Professional Documents

Culture Documents

HW Sagnika

HW Sagnika

Uploaded by

jittu21120Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

HW Sagnika

HW Sagnika

Uploaded by

jittu21120Copyright:

Available Formats

1. What is RBI doing to make sure that banks are keeping certain customer satisfaction level? 2. What is servuction?

Servuction methodology is defined as the way of running on a day to day the production of the service (or better industrialized service production-i.e. with quality control parameters of industrialization); ensuring that the participants on each process, thread, activity and daily task, on the first and second line of the back office, do their work in such a way as to reduce to zero the generation of errors which could subsequently leave the Front Line and end customer facing eroding service quality. 3. What are financial advisor regulations laid by RBI recently? In January 2013, RBI proposed the financial advisors have to get registered with RBI by October 31. Advisors can register by filling up a form and paying the registration fees. But, only 11 advisors have registered themselves till September. 4. What is fiduciary responsibility? The term fiduciary refers to a relationship in which one person has a responsibility of care for the assets or rights of another person. A fiduciary is an individual who has this responsibility. The term "fiduciary" is derived from the Latin term for "faith" or "trust." A fiduciary relationship exists with individuals who handle money or property for others. For example, Trusted advisers like an accountant or an attorney or an insurance agent may also be fiduciaries. 5. Shivraj Puri scam Shivraj Puri, Relationship Manager at Citibank, Gurgaon and his father Raghu Raj Puri masterminded a Rs 400 crore scam. He was charged with luring high net worth individuals and corporate entities into making investment and diverting these investments into stock market and causing huge losses to the tune of R405.52 crore to the investors. Raghu Raj was the managing director of a Kolkata-based firm, Normans Martin Brokers Pvt Ltd, through which Shivraj allegedly used to divert money into stock markets by creating fictitious accounts. 6. Number of taxpayers in India - Total number of tax payers. is 32.4 million in 2011-2012. i.e., 2.66 % of the population pays income tax. Number of savings accounts in India 7. Household savings as percentage of what? Household savings distribution pie? In India household savings take up 70% of Gross Domestic Savings. Gross Domestic Savings = GDP final consumption Real estate and precious metals like gold account for around 65% of total household savings. 8. What are third party agencies in insurance? 9. Non Scheduled Banks? Non Scheduled Banks in India are those banks which are not part of the Second Schedule of Reserve Bank of India (RBI) Act, 1934 10. What norm banks signed voluntarily to disclose information and bring about transparency? 11. What is an Art fund?

Art funds are generally privately offered investment funds dedicated to the generation of returns through the acquisition and disposition of works of art. They are managed by a professional art investment management or advisory firm who receives a management fee and a portion of any returns delivered by the fund. The underlying characteristics of art investment funds are diverse and vary from fund to fund. While all art funds utilize some form and degree of a traditional buy and hold strategy, art funds differ in their aggregate size, duration, investment focus, investment strategies and portfolio restrictions. The unifying factor of all art investment vehicles is their focus on the art market, which is characterized by a lack of regulatory authority, deficient price discovery mechanisms, the nontransparency of the market and the subjective value and illiquid nature of fine art. Proponents of art investment funds argue that it is these very characteristics that generate the significant arbitrage opportunities within the market that seasoned art professionals can exploit for the benefit of the funds investors. Likewise, critics of art investment funds in turn point to such characteristics as denoting art as the riskiest asset class, thereby creating the potential for substantial investment losses among the funds investors. 12. Who is Michael Milken? As an executive at investment bank Drexel Burnham Lambert Inc. during the 1980s who used high-yield junk bonds for corporate financing and mergers and acquisitions. Michael Milken amassed an enormous personal fortune, but in 1989 he was indicted by a federal grand jury and eventually spent nearly two years in prison after pleading guilty to charges of securities fraud. While he is credited with founding the high-yield debt market, he was banned for life from the securities industry. Nicknamed "The Junk Bond King" in the 1980s, Milken earned between $200 million and $550 million a year at the height of his success. Following his release from prison, he worked as a strategic consultant. This was in violation of his probation, and he was subsequently fined $42 million for these actions. In 1993, Milken was diagnosed with prostate cancer; since then, he has devoted much of his time and resources to the pursuit of a cure for the disease. 13. What are Islamic banks? What is Islamic inheritance? How do they operate and take care of depositors? Islamic banks abide by the law of Sharia according to which paying interest is a sin. When Islamic banks lend money, they have a profit sharing agreement with the borrower instead of interest rates. 14. Can banks invest in stocks? If yes, what is the limit up to which they can invest? According to RBI, banks are allowed to invest in stocks to the limit of 40% of their net worth as on March 31 of the previous year. 15. What is the mortgage to GDP ratio of India? Compare with others Indias mortgage to GDP ratio is about 9%.

16. What is the maxi mum tenure of FD? Who offers it? 17. What is call money rate? When the call money rate was increased by 50%? It is the rate at which banks lend money to each other in order to meet their daily cash reserve ratio requirements. 18. What is a currency chest? How do banks use it? RBI authorizes certain bank branches to distribute currency notes and coins. They act as storehouses of currency. 19. SA and CA what are number of transactions? What is the charge structure if more transactions are done? 20. Why saving account interest was calculated on minimum of 10th and 30th day of the month? In the past, when banks did not have automated systems, the staff were required to look up the minimum balance of an account holder manually in the ledger. It was very cumbersome an people generally had substantial balance in the 1st week of a month. Hence, the minimum amount between the 10th and the 30th day was taken. 21. Up to what limit a bank employee can give as goodies when a new account is opened? 22. US Checking and US saving account? 23. What is the difference between NRE and NRO account and what is the tax liability for both? 1. Repatriation: NRE account is freely repatriable (Principal and interest earned) while the NRO account has restricted repatriability i.e permitted remittance allowed from NRO is up to USD 1 million net of applicable taxes in a financial year after giving undertaking along with a certificate from a chartered accountant. 2. Tax Treatment: NRE account is Tax free (no Income tax, wealth tax and gift tax) in India. On the other hand the interest earned in NRO account and credit balances are subject to respective income tax bracket and are also subject to applicable wealth and gift tax. 3. Deposit of Rupee funds generated in India: If an NRI/PIO/OCI is earning income originating in India (such as salary, rent, dividends etc.) he/she is only allowed to deposit it in NRO account. Deposit of such earnings is not permitted in NRE account. 4. Joint Holding: NRE account can be iointly held with another NRI but not with resident Indian. On the other hand NRO account can be held with NRI as well as resident Indian (close relative) as defined under Section 6 of the Companies Act 1956. Read more at: http://www.moneycontrol.com/news/fixed-income-bank-deposits/knowdifferencebetween-nrenro-account-_875207.html?utm_source=ref_article 24. What is Rupay network? RuPay is an Indian domestic card scheme conceived and launched by National Payments Corporation of India (NPCI) in 2012. Its mission is to fulfil the Reserve Bank of Indias vision of having a domestic, open loop and multilateral system of payments in India. RuPay works to enable electronic payment at all Indian banks and financial institutions. RuPay hopes to give banks new opportunities to operate in the card payments domain of India.

RuPay card scheme promises various benefits to their member banks and customers such as: A reduction in the overall transaction cost for the banks in India by introducing competition to international card schemes The development of products appropriate for India Providing a card payment service option to many banks that are currently not eligible for card issuance under the eligibility criteria of international card schemes Shifting Personal Consumption Expenditure (PCE) from cash to electronic payments RuPay is able to deliver these benefits to various stakeholders as it is a non-profit organization and possesses the backing of Reserve Bank of India. RuPay cards are acceptable at all ATMs across India under National Financial Switch (A product of NPCI) and its agreement with DFS has enabled its customers for international usage. According to the RBI data, there are around 124,079 ATMs and more than 5.4 lakh PoS terminals in India under RuPay platform. On June 21, 2013 NPCI enabled RuPay using PaySecure for e-commerce or online transactions using RuPay debit cards. RuPay platform's presence or support in 100% e-commerce or online transactions done in India is expected to be completed only by end of 2013. 25. Residents account for foreign currency?

26. What are two factor authentications? Two-step authentication is a process involving two stages to verify the identity of an entity trying to access services in a computer or in a network. While withdrawing money from an automated teller machine (ATM), the system uses a form of two-step verification. To prove who the individual was when accessing our money, the system requires two items: the ATM card (application of the possession factor) and the personal identification number (PIN) (application of the knowledge factor). If an individual loses their ATM card, money is still safe; anyone who finds the card cannot withdraw money as they do not know the PIN. The same is true if the attacker has only knowledge of the PIN and does not have the card. This is what makes two-step verification more secure: there are two layers of security. 27. OTP one time password? A one-time password (OTP) is a password that is valid for only one login session or transaction. OTPs avoid a number of shortcomings that are associated with traditional (static) passwords. The most important shortcoming that is addressed by OTPs is that, in contrast to static passwords, they are not vulnerable to replay attacks. This means that a potential intruder who manages to record an OTP that was already used to log into a service or to conduct a transaction will not be able to abuse it, since it will be no longer valid. On the downside, OTPs are difficult for human beings to memorize. Therefore they require additional technology to work. 28. Which are non-bank credit card issuers in the world? GE Capital Central Card, Tesco Lotus Card, Power Buy, First Choice

29. SARFAESI act? The Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002, allows banks and financial institutions to auction properties (residential and commercial) when borrowers fail to repay their loans. It enables banks to reduce their nonperforming assets (NPAs) by adopting measures for recovery or reconstruction.If a borrower defaults on repayment of his/her home loan for six months at stretch, banks give him/her a 60day period to regularise the repayment, that is, start repaying. On failure to do so, banks declare the loan an NPA and auction it to recover the debt. 30. What is an Octopus card? The Octopus card is a reusable contactless stored value smart card for making electronic payments in online or offline systems in Hong Kong. Launched in September 1997 to collect fares for the territory's mass transit system, the Octopus card system is the second contactless smart card system in the world, after the Korean Upass, and has since grown into a widely used payment system for all public transport in Hong Kong. The Octopus has also grown to be used for payment in many retail shops in Hong Kong, from convenience stores, supermarkets, fastfood restaurants, on-street parking meters, car parks, to other point-of-sale applications such as service stations and vending machines. According to Octopus Cards Limited, operator of the Octopus card system, there are more than 20 million cards in circulation, nearly three times the population of Hong Kong. The cards are used by 95% of the population of Hong Kong aged 16 to 65, generating over 12 million daily transactions worth a total over HK$130 million. 31. What is the charge card? What are contactless cards? A charge card is a card that provides a payment method enabling the cardholder to make purchases which are paid for by the card issuer, to whom the cardholder becomes indebted. The cardholder is obligated to repay the debt to the card issuer in full by the due date, usually on a monthly basis, or be subject to late fees and restrictions on further card use. 32. Charge card vs. Credit Cards? Though the terms charge card and credit card are sometimes used interchangeably, they are distinct protocols of financial transactions. Credit cards are revolving credit instruments that do not need to be paid in full every month. There is no late fee payable so long as the minimum payment is made at specified intervals (usually every thirty days). The balance of the account accrues interest, which may be backdated to the date of initial purchase. Charge cards are typically issued without spending limits, whereas credit cards usually have a specified credit limit that the cardholder may not exceed. 33. Which system enables NEFT and RTGS in the backend? Coverage of RTGS and NEFT? 34. Citibank Suraksha Scheme Citibank Suraksha - an insurance scheme offered by the bank along with Tata Aig life insurance company to its card holders, was launched in June 2001, but remained free of charge for the first three months. During these three months, the bank tapped its card holders for insurance. Once the initial three months were over (ended on august 31, 2001), the card holder would be

automatically enrolled into the insurance scheme, unless he or she withdrew from the scheme by ringing up the Citibank customer centre or by writing to the bank. What this means is that, from September 1, 2001, all interested subscribers and those subscribers who may not have even read the bank's newsletter, or could not contact the bank for withdrawing the insurance cover, would have to pay around rs 204 per annum for the services. They also alleged that the clause which says that a card holder has to withdraw from the scheme on his own is displayed in one small corner of a mailer "which is bound to be missed, if a person does not know what he is looking for. Angry card-holders have launched internet activism, which itself is an emerging phenomena, to counter Citibank and spread the message around through e-mail. Card holders are not objecting to the Citibank statement that the bank had sent out mails in May 2001 to inform them about this scheme. Their issue is: should non-reply be taken as consent. The bank also charged an administration charge. 30,000-odd subscribers who had decided to opt out of the scheme. 35. Citibank Unex 1999? 36. Nostro vs. Vostro? The terms nostro and vostro remove the potential ambiguity when referring to these two separate accounts of the same balance and set of transactions. Speaking from the bank's point-of-view: A nostro is our account of our money, held by you A vostro is your account of your money, held by us All "bank accounts" as the term is normally understood, including personal or corporate checking, loan, and savings accounts, are treated as vostros by the bank. They also regard as vostro purely internal funds such as treasury, trading and suspense accounts; although there is no "you" in the sense of an external customer, the money is still "held by us". A client bank elects to open an account - nostro with another facilitator bank, in the absence of having access to primary clearing arrangements (generally with the Central Bank in the country where the currency is considered a local currency), for settling Treasury or Trade transactions. 37. What is the link between prepaid card and mobile payments? 38. What is a home saver loan? In this case, the borrower does not have to pay interest against a home loan as a current account is kept against the home loan. It is deducted from the minimum balance of the current account. 39. Whole life policy in India? A 'whole of life' (WoL) insurance plan provides insurance cover for the entire lifespan of a policyholder. This feature distinguishes it from other life insurance products that have fixed term of coverage. Since, in WoL plans, the policyholder pays the premium for a longer tenure, insurance companies add 'endowment' or 'savings' element to the risk cover to ensure there is a cash value attached to the premiums paid. The 'endowment' or the 'savings' element can be incorporated either on a traditional or a unitlinked platform. In India, WoL plans on a traditional 'with-profits' platform are more common. This means premiums are payable throughout the lifetime of the policyholder and the policy benefits are given to the nominee on the death of the policyholder. 40. What are family offices?

A family office or single family office (SFO) is a private company that manages investments and trusts for a single family. The company's financial capital is the family's own wealth, often accumulated over many family generations. Traditional family offices provide personal services such as managing household staff and making travel arrangements. Other services typically handled by the traditional family office include property management, day-to-day accounting and payroll activities, and management of legal affairs. Family offices often provide family management services, which includes family governance, financial and investment education, philanthropy coordination, and succession planning. A family office can cost over $1 million to operate, so the family's net worth usually exceeds $100 million. 41. What is scheme US 64? Launched in 1964, the US-64, an open-ended balanced fund, is its flagship fund. The scheme had a size of Rs. 12,778 crores as on June 30, 2001, about 13 per cent of the entire mutual fund industry. For the first time in 37 years, UTI decided to suspend the purchase and sale of its US64 scheme for six months and a furore followed. The UTI justified this extreme step on the grounds that the restructuring of the scheme's huge and varied portfolio would require time. Since its inception, the US-64 distributed dividends on a regular basis, and thus acquired its enviable reputation. In the early part of the 1990s, the UTI decided to distribute the reserves built-up over the years to unitholders in the form of higher dividends, preferential offers, rights and bonus shares.Savvy individual investors and corporates caught on to the bonanza pretty quickly, and the funds collected by the scheme spurted. While the dividend rate rose from 18 per cent in 1990 to 26 per cent in 1995, unit capital more than doubled from a little over Rs. 7,000 crores to over Rs. 15,000 crores. When the stock market fell in the later part of the 1990s, the NAV of US-64 fell substantially, and the fund was in serious trouble. In February 1999, the Government appointed Deepak Parekh Committee came out with its recommendations for saving the fund. Following the report, the Government announced a bailout package of Rs. 3,300 crores which basically consisted of transferring select public sector holdings from the fund to a separate scheme and in lieu thereof government bonds were issued to the US-64 scheme. 42. What are the IRDA rules for multiple insurance companies tying up with banks banc assurance? 43. Egg bank Egg is a former British internet bank headquartered in Derby, that is now a trading name of Yorkshire Building Society. Egg was born out of the UK banking arm of Prudential plc, Prudential Banking plc, which was established in 1996, and the Egg brand was launched in 1998.It was only possible to operate an Egg account over the internet, or via their call centre. Egg specialised in savings and general insurance but no longer offers loans, credit cards or mortgage products. The credit card business was sold to Barclaycard, followed by the remaining savings and mortgage business to Yorkshire Building Society, which subsequently transferred all remaining customer accounts over from Egg. Following the sale of its assets, Egg Banking plc, which remained under the ownership of Citigroup, was renamed Canada Square Operations Limited and continues to handle matters

relating to certain Egg products from before the sale of assets and any assets that were not transferred to the new owners 44. Guru Swaroop Srivastava Guru Swaroop Srivastava was the Chairman of the Swaroop Group. He purchased 125 paintings of M. F. Hussain for Rs 100 Crores. He was charged with forging the signatures of two accountants in order to get a Rs 60 Crore loan from HDFC Bank as was arrested by Delhi Police.

You might also like

- Tim Hortons - Market EntryDocument18 pagesTim Hortons - Market EntryParas KatariaNo ratings yet

- Shriram Finace Sip ReportDocument64 pagesShriram Finace Sip Reportshiv khillari75% (4)

- Hope and Other Dangerous Pursuits - Discussion GuideDocument4 pagesHope and Other Dangerous Pursuits - Discussion GuideHoughton Mifflin Harcourt0% (2)

- Interview Questions For Bank in BangladeDocument7 pagesInterview Questions For Bank in BangladeKhaleda Akhter100% (1)

- PO Interview Questions 1Document5 pagesPO Interview Questions 1Sridhar VasuNo ratings yet

- Top Bank Interview QuestionsDocument5 pagesTop Bank Interview QuestionsRahul Kumar KNo ratings yet

- Banking TermsDocument10 pagesBanking TermsTusharNo ratings yet

- What Do You Understand by The GDP of The Country?Document5 pagesWhat Do You Understand by The GDP of The Country?S.s.SubramanianNo ratings yet

- PO Interview Questions 2Document10 pagesPO Interview Questions 2Samir RustogiNo ratings yet

- Bank Interview Question For Business GraduateDocument7 pagesBank Interview Question For Business GraduateHumayun KabirNo ratings yet

- Top 60 Bank Interview QuestionsDocument12 pagesTop 60 Bank Interview QuestionsRamojeevaNo ratings yet

- Interview PreparationDocument17 pagesInterview PreparationAnmolDhillonNo ratings yet

- Bank Interviw QutionDocument17 pagesBank Interviw QutionAlex KumieNo ratings yet

- Banking Interview QuestionsDocument19 pagesBanking Interview QuestionsMithilesh Kumar YadavNo ratings yet

- Jaiib Demo NotesDocument16 pagesJaiib Demo Notesaditya_bb_sharmaNo ratings yet

- Financial Institutions and Markets A ST MoumdzDocument10 pagesFinancial Institutions and Markets A ST MoumdzNageshwar SinghNo ratings yet

- For More Click HereDocument13 pagesFor More Click HereBrijesh NimeshNo ratings yet

- FM - 19bsp3027Document20 pagesFM - 19bsp3027unnati khandelwalNo ratings yet

- Shiv RamDocument71 pagesShiv RamaanandmathurNo ratings yet

- Standard Chartered BankDocument28 pagesStandard Chartered BankRajni YadavNo ratings yet

- Short Questions-Central BankDocument6 pagesShort Questions-Central BanksadNo ratings yet

- Top 50 Banking Interview QuestionsDocument7 pagesTop 50 Banking Interview QuestionschoprahridyeshNo ratings yet

- PBB Short NotesDocument47 pagesPBB Short Notesstudy studyNo ratings yet

- BFM AssignmentDocument12 pagesBFM AssignmentSiddharth ParasharNo ratings yet

- NBFC Full NotesDocument69 pagesNBFC Full NotesJumana haseena SNo ratings yet

- Kalinga UniversityDocument47 pagesKalinga Universityayushrath86No ratings yet

- Banking (Mohit Sharma)Document84 pagesBanking (Mohit Sharma)riya das100% (1)

- Remaining PagesDocument40 pagesRemaining PagesNitish Pandey0% (1)

- Components of The Indian Debt MarketDocument3 pagesComponents of The Indian Debt MarketkalaswamiNo ratings yet

- Banking Revision NotesDocument14 pagesBanking Revision Notesbeena antuNo ratings yet

- Union Bank of IndiaDocument58 pagesUnion Bank of Indiadivyesh_variaNo ratings yet

- Important Banking Interview - Question & Answers: January 27, 2014 at 12:11pmDocument10 pagesImportant Banking Interview - Question & Answers: January 27, 2014 at 12:11pmMadhankumar LakshmipathyNo ratings yet

- 33-Top 60 Bank Interview QuestionsDocument10 pages33-Top 60 Bank Interview Questionsshubh9190No ratings yet

- Hinduja Leyland Finance LTDDocument28 pagesHinduja Leyland Finance LTDShekhar Landage100% (1)

- MFS HomeworkDocument13 pagesMFS HomeworkManish JhawarNo ratings yet

- AnswersDocument9 pagesAnswersamirNo ratings yet

- Final Project EXIM FINANCEDocument78 pagesFinal Project EXIM FINANCErohit utekar100% (1)

- Topic 2Document16 pagesTopic 2Anonymous lVpFnX3No ratings yet

- Investment Banking in IndiaDocument6 pagesInvestment Banking in IndiaYadvendra YadavNo ratings yet

- 5Document4 pages5shruthiNo ratings yet

- FMI Module 1Document17 pagesFMI Module 1sahadcptNo ratings yet

- Indian Financial SystemDocument16 pagesIndian Financial SystemHardik RankaNo ratings yet

- 45 NBFCDocument109 pages45 NBFCViji RangaNo ratings yet

- Q1. Find A Few of The Pension Plans Offered by The Insurance CompanyDocument5 pagesQ1. Find A Few of The Pension Plans Offered by The Insurance CompanyHarit RustagiNo ratings yet

- Banking ProjectDocument8 pagesBanking Projectbobby palleNo ratings yet

- Comparative Study of Capital Market and Money Market)Document45 pagesComparative Study of Capital Market and Money Market)Gaurav KumarNo ratings yet

- Kiran Gundaye (2029)Document55 pagesKiran Gundaye (2029)Kiran GundayeNo ratings yet

- Call MoneyDocument23 pagesCall MoneyGaurav BhattacharyaNo ratings yet

- Banking WELCOME50Document24 pagesBanking WELCOME50Mahi MaheshNo ratings yet

- Chapter-Ii Industry Profile & Company ProfileDocument84 pagesChapter-Ii Industry Profile & Company ProfileMubeenNo ratings yet

- Vision: ValuesDocument8 pagesVision: ValuesBharatSeerviNo ratings yet

- BM - Ref Note 1Document4 pagesBM - Ref Note 1Karan TrivediNo ratings yet

- Finance BasicsDocument5 pagesFinance BasicsSneha Satyamoorthy100% (1)

- Banking Project - Indian Financial SystemDocument16 pagesBanking Project - Indian Financial SystemAayush VarmaNo ratings yet

- Merchant Banking: Submitted By: Anshul Sharma Sonam MishraDocument34 pagesMerchant Banking: Submitted By: Anshul Sharma Sonam MishraAnshul SharmaNo ratings yet

- BM ReportDocument20 pagesBM ReportChandrasekhar SatpathyNo ratings yet

- Money Market Means Market Where Money or Its: Equivalent Can Be TradedDocument62 pagesMoney Market Means Market Where Money or Its: Equivalent Can Be Tradedtrupti_viradiyaNo ratings yet

- What Is A BankDocument13 pagesWhat Is A BankShivkumar ReddyNo ratings yet

- Depository System in IndiaDocument4 pagesDepository System in Indiaaruvankadu100% (1)

- Call Money and Repo RateDocument20 pagesCall Money and Repo RateShashank JoganiNo ratings yet

- RM AssignmentDocument2 pagesRM Assignmentjittu21120No ratings yet

- SendKeys MethodDocument5 pagesSendKeys Methodjittu21120No ratings yet

- NM DatabasesDocument5 pagesNM Databasesjittu21120No ratings yet

- Six SigmaDocument7 pagesSix Sigmajittu21120No ratings yet

- IAPMDocument6 pagesIAPMjittu21120No ratings yet

- Transferance of SpiritsDocument13 pagesTransferance of SpiritsMiracle Internet Church50% (2)

- ECO402 Solved Mid Term Corrected by Suleyman KhanDocument15 pagesECO402 Solved Mid Term Corrected by Suleyman KhanSuleyman KhanNo ratings yet

- Shifting Intersections: Fluidity of Gender and Race in Chimamanda Ngozi Adichie's AmericanahDocument3 pagesShifting Intersections: Fluidity of Gender and Race in Chimamanda Ngozi Adichie's AmericanahSirley LewisNo ratings yet

- Chapter 3 Ins200Document11 pagesChapter 3 Ins2002024985375No ratings yet

- My First Two Thousand Years - The Autobio - George Sylvester ViereckDocument392 pagesMy First Two Thousand Years - The Autobio - George Sylvester Viereckglencbr100% (1)

- Public Safety and Security Ecosystems (Mpsa-Barmm) : Workshop DefinitionsDocument16 pagesPublic Safety and Security Ecosystems (Mpsa-Barmm) : Workshop DefinitionsFayyaz DeeNo ratings yet

- Iesba Fact SheetDocument2 pagesIesba Fact Sheetlee0% (1)

- Assessment Task 2 of 2 Portfolio and Written Questions: Submission InformationDocument28 pagesAssessment Task 2 of 2 Portfolio and Written Questions: Submission InformationDiego Grecco100% (1)

- List of Network HospitalsDocument270 pagesList of Network HospitalsAbhishekNo ratings yet

- Natural DisastersDocument22 pagesNatural DisastersAnonymous r3wOAfp7j50% (2)

- 2 Young KydallaDocument364 pages2 Young Kydalladalya0019No ratings yet

- Android Update For SAMSUNG Galaxy Tab 7.0 Plus (GT-P6200) - Android Updates DownloadsDocument5 pagesAndroid Update For SAMSUNG Galaxy Tab 7.0 Plus (GT-P6200) - Android Updates DownloadsJoeJojoNo ratings yet

- CD NCLEX NOTES-Infection ControlDocument1 pageCD NCLEX NOTES-Infection ControlrenchiecaingletNo ratings yet

- Obligations and Contracts: San Beda College of LawDocument36 pagesObligations and Contracts: San Beda College of LawGlory Nicol OrapaNo ratings yet

- Human-Bird Conflicts and Management Issues in IndiaDocument12 pagesHuman-Bird Conflicts and Management Issues in IndiaShihab KhaledinNo ratings yet

- Dilip Kumar Behera-1Document3 pagesDilip Kumar Behera-1dilipbeheraNo ratings yet

- Annual Question Paper For 5th Class (G.K)Document7 pagesAnnual Question Paper For 5th Class (G.K)Dhananjay DashNo ratings yet

- Intermediate 4 Final ExamDocument4 pagesIntermediate 4 Final ExamWilliam Fernando Mendoza Romero100% (1)

- Writing Persuasive MessagesDocument24 pagesWriting Persuasive MessagesAreeba Imtiaz HUssainNo ratings yet

- Arvind Menon (AIR 201 - CSE 2011) Shares His Success-StoryDocument10 pagesArvind Menon (AIR 201 - CSE 2011) Shares His Success-StoryAravind MenonNo ratings yet

- Greeting Lesson PlanDocument4 pagesGreeting Lesson Planhawanur266No ratings yet

- Tinci - Attestation COSMOS Raw Materials - 2022 - Valid To 31.12.22Document4 pagesTinci - Attestation COSMOS Raw Materials - 2022 - Valid To 31.12.22Jade LaceyNo ratings yet

- Impact of COVID On Spice SectorDocument10 pagesImpact of COVID On Spice SectorRatulNo ratings yet

- Principios Matematicos de La HidraulicaDocument35 pagesPrincipios Matematicos de La HidraulicaNieves Olmos Ballesta100% (1)

- 07 MalnutritionDocument132 pages07 MalnutritionMary Marjorie RodaviaNo ratings yet

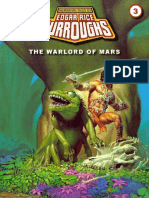

- Edgar Rice Burroughs - (John Carter Barsoom #3) The Warlord of MarsDocument152 pagesEdgar Rice Burroughs - (John Carter Barsoom #3) The Warlord of MarsConstantin Clement VNo ratings yet

- Transcript 1Document7 pagesTranscript 1HANA ZANE AGUSTINNo ratings yet