Professional Documents

Culture Documents

Daily-Sgx-Report by Epic Research Singapore 10 Dec 2013

Daily-Sgx-Report by Epic Research Singapore 10 Dec 2013

Uploaded by

Christopher HenryOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Daily-Sgx-Report by Epic Research Singapore 10 Dec 2013

Daily-Sgx-Report by Epic Research Singapore 10 Dec 2013

Uploaded by

Christopher HenryCopyright:

Available Formats

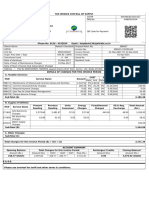

DAILY REPORT 10th DECEMBER

Snapshot for Straits Times Index STI (FSSTI)

Open Previous Close Day Range Year-to- Date 1-Year 52-Week Range 3,122.14 3,114.17 3,108.18 3,126.01 +1.22% +3.37% 2,990.68 - 3,464.79

Straits Times Index (STI)

TOP GAINERS

2.50% 2.00% 1.50% 1.00% 0.50% 0.00%

TOP GAINERS & LOSERS TOP GAINER Hongkong Land Holdin... Golden Agri-Resource... Noble Group Ltd SIA Engineering Co L... Keppel Corp Ltd Jardine Matheson Hol... United Overseas Bank... % Change +2.02% +1.83% +1.46% +1.46% +1.19% +0.43% +0.34% +0.28% +0.23% 0.00% % Change -3.06% -1.53% -1.29% -0.99% -0.94% -0.77% -0.77% -0.69% -0.67% -0.57%

Page 1

HKL

GGR NOBL

SIE

KEP

JM

UOB

SGX

JCNC

CT

% Change 2.02% 1.83% 1.46% 1.46% 1.19% 0.43% 0.34% 0.28% 0.23% 0.00%

Singapore Exchange L... Jardine Cycle & Carr... CapitaMall Trust TOP LOSER Thai Beverage PCL ComfortDelGro Corp L... CapitaMalls Asia Ltd CapitaLand Ltd Sembcorp Industries ... Hutchison Port Holdi... Singapore Technologi... Sembcorp Marine Ltd

TOP LOOSERS

0.00% -0.50% -1.00% -1.50% -2.00% -2.50% -3.00% -3.50%

THBE V

CD

CMA CAPL

SCI

HPHT

STE

SMM GENS

WIL

Genting Singapore PL... Wilmar International...

%Change -3.06 -1.53 -1.29 -0.99 -0.94 -0.77 -0.77 -0.69 -0.67 -0.57

YOUR MINTVISORY

DAILY REPORT 10th DECEMBER

MARKET UPDATES & STOCK RECOMMENDATION China's export easily beats forecast in November by a rise of 12.7% y-o-y against a median forecast of 7.1% adding to a recent proof of stabilization in the world's second largest economy. Taiwan's external trade data for November will be released today. Export growth will remain negative, and the rate of decline will be close to Octobers -1.5% YoY.

HONGKONG LAND

Although mortgages are likely to soften in 2H14 (mortgages comprised 30% of total loans as of Sep 13), domestic business loans and trade finance loans (largely US$) may continue to thrive given strong GDP growth prospects and improved external environment. Stronger than expected business loans could provide a boost to overall loan growth in 2014. Every 1ppt increase in loan growth would lift earnings by 0.8%. NIM uplift would give greater ammunition to earnings.

BUY HONGKONG LAND ABOVE 6.070 TG 6.120, 6.180, 6.250 SL 6.000 Disclaimer

The information and views in this report, our website & all the service we provide are believed to be reliable, but we do not accept any responsibility (or liability) for errors of fact or opinion. Users have the right to choose the product/s that suits them the most. Sincere efforts have been made to present the right investment perspective. The information contained herein is based on analysis and up on sources that we consider reliable. This material is for personal information and based upon it & takes no responsibility The information given herein should be treated as only factor, while making investment decision. The report does not provide individually tailor-made investment advice. Epic research recommends that investors independently evaluate particular investments and strategies, and encourages investors to seek the advice of a financial adviser. Epic research shall not be responsible for any transaction conducted based on the information given in this report, which is in violation of rules and regulations of NSE and BSE. The share price projections shown are not necessarily indicative of future price performance. The information herein, together with all estimates and forecasts, can change without notice. Analyst or any person related to epic research might be holding positions in the stocks recommended. It is understood that anyone who is browsing through the site has done so at his free will and does not read any views expressed as a recommendation for which either the site or its owners or anyone can be held responsible for . Any surfing and reading of the information is the acceptance of this disclaimer. All Rights Reserved. Investment in equity & bullion market has its own risks. We, however, do not vouch for the accuracy or the completeness thereof. We are not responsible for any loss incurred whatsoever for any financial profits or loss which may arise from the recommendations above epic research does not purport to be an invitation or an offer to buy or sell any financial instrument. Our Clients (Paid or Unpaid), any third party or anyone else have no rights to forward or share our calls or SMS or Report or Any Information Provided by us to/with anyone which is received directly or indirectly by them. If found so then Serious Legal Actions can be taken.

Give us a missed call at +6531581402

YOUR MINTVISORY

Visit us @ www.epicresearch.sg

Page 2

You might also like

- White Label ATMDocument8 pagesWhite Label ATMch_nasir834481No ratings yet

- Snapshot For Straits Times Index STI (FSSTI) Straits Times Index (STI)Document2 pagesSnapshot For Straits Times Index STI (FSSTI) Straits Times Index (STI)api-237906069No ratings yet

- Snapshot For Straits Times Index STI (FSSTI) Straits Times Index (STI)Document2 pagesSnapshot For Straits Times Index STI (FSSTI) Straits Times Index (STI)api-237906069No ratings yet

- Snapshot For Straits Times Index STI (FSSTI) Straits Times Index (STI)Document2 pagesSnapshot For Straits Times Index STI (FSSTI) Straits Times Index (STI)api-237906069No ratings yet

- Daily-Sgx-Report by Epic Research Singapore 19 Feb 2014Document2 pagesDaily-Sgx-Report by Epic Research Singapore 19 Feb 2014Nidhi JainNo ratings yet

- Daily-Sgx-Report by Epic Research Singapore 20 Feb 2014Document2 pagesDaily-Sgx-Report by Epic Research Singapore 20 Feb 2014Nidhi JainNo ratings yet

- Snapshot For Straits Times Index STI (FSSTI) Straits Times Index (STI)Document2 pagesSnapshot For Straits Times Index STI (FSSTI) Straits Times Index (STI)api-237906069No ratings yet

- Snapshot For Straits Times Index STI (FSSTI) Straits Times Index (STI)Document2 pagesSnapshot For Straits Times Index STI (FSSTI) Straits Times Index (STI)api-237906069No ratings yet

- Snapshot For Straits Times Index STI (FSSTI) Straits Times Index (STI)Document2 pagesSnapshot For Straits Times Index STI (FSSTI) Straits Times Index (STI)api-237906069No ratings yet

- Snapshot For Straits Times Index STI (FSSTI) Straits Times Index (STI)Document2 pagesSnapshot For Straits Times Index STI (FSSTI) Straits Times Index (STI)api-237906069No ratings yet

- Open: 3,227.65 Day Range: 3,22.99 - 3,244.40 Year To Date: +4.34% Previous Close: 3,229.91 52-Week Range: 2,931.60 - 3,464.79 1-Year: +9.19%Document2 pagesOpen: 3,227.65 Day Range: 3,22.99 - 3,244.40 Year To Date: +4.34% Previous Close: 3,229.91 52-Week Range: 2,931.60 - 3,464.79 1-Year: +9.19%api-211507971No ratings yet

- Snapshot For Straits Times Index STI (FSSTI) Straits Times Index (STI)Document2 pagesSnapshot For Straits Times Index STI (FSSTI) Straits Times Index (STI)api-237906069No ratings yet

- Snapshot For Straits Times Index STI (FSSTI) Straits Times Index (STI)Document2 pagesSnapshot For Straits Times Index STI (FSSTI) Straits Times Index (STI)api-237906069No ratings yet

- Snapshot For Straits Times Index STI (FSSTI)Document2 pagesSnapshot For Straits Times Index STI (FSSTI)api-237906069No ratings yet

- Snapshot For Straits Times Index STI (FSSTI) Straits Times Index (STI)Document2 pagesSnapshot For Straits Times Index STI (FSSTI) Straits Times Index (STI)api-237906069No ratings yet

- Daily SGX Report 18 FebDocument2 pagesDaily SGX Report 18 FebNidhi JainNo ratings yet

- Snapshot For Straits Times Index STI (FSSTI) Straits Times Index (STI)Document2 pagesSnapshot For Straits Times Index STI (FSSTI) Straits Times Index (STI)api-237906069No ratings yet

- Snapshot For Straits Times Index STI (FSSTI) Straits Times Index (STI)Document2 pagesSnapshot For Straits Times Index STI (FSSTI) Straits Times Index (STI)api-237906069No ratings yet

- Snapshot For Straits Times Index STI (FSSTI) Straits Times Index (STI)Document2 pagesSnapshot For Straits Times Index STI (FSSTI) Straits Times Index (STI)api-237906069No ratings yet

- Snapshot For Straits Times Index STI (FSSTI) Straits Times Index (STI)Document2 pagesSnapshot For Straits Times Index STI (FSSTI) Straits Times Index (STI)api-237906069No ratings yet

- Snapshot For Straits Times Index STI (FSSTI) Straits Times Index (STI)Document2 pagesSnapshot For Straits Times Index STI (FSSTI) Straits Times Index (STI)api-237906069No ratings yet

- Daily SGX Market Report by EPIC RESEARCH 6th February 2014Document2 pagesDaily SGX Market Report by EPIC RESEARCH 6th February 2014Nidhi JainNo ratings yet

- Snapshot For Straits Times Index STI (FSSTI) Straits Times Index (STI)Document2 pagesSnapshot For Straits Times Index STI (FSSTI) Straits Times Index (STI)api-237906069No ratings yet

- Snapshot For Straits Times Index STI (FSSTI) Straits Times Index (STI)Document2 pagesSnapshot For Straits Times Index STI (FSSTI) Straits Times Index (STI)Nidhi JainNo ratings yet

- Daily SGX Report 25 FebDocument2 pagesDaily SGX Report 25 FebNidhi JainNo ratings yet

- Snapshot For Straits Times Index STI (FSSTI) Straits Times Index (STI)Document2 pagesSnapshot For Straits Times Index STI (FSSTI) Straits Times Index (STI)api-237906069No ratings yet

- Snapshot For Straits Times Index STI (FSSTI) Straits Times Index (STI)Document2 pagesSnapshot For Straits Times Index STI (FSSTI) Straits Times Index (STI)api-237906069No ratings yet

- Snapshot For Straits Times Index STI (FSSTI) Straits Times Index (STI)Document2 pagesSnapshot For Straits Times Index STI (FSSTI) Straits Times Index (STI)api-237906069No ratings yet

- Daily Equty Report by Epic Research - 13 June 2012Document4 pagesDaily Equty Report by Epic Research - 13 June 2012Evita GoldenNo ratings yet

- Snapshot For Straits Times Index STI (FSSTI) Straits Times Index (STI)Document2 pagesSnapshot For Straits Times Index STI (FSSTI) Straits Times Index (STI)api-237906069No ratings yet

- Daily Equty Report by Epic Research - 14 June 2012Document4 pagesDaily Equty Report by Epic Research - 14 June 2012Jenny JamesNo ratings yet

- Daily-Sgx-Report by Epic Research Singapore 21 Feb 2014Document2 pagesDaily-Sgx-Report by Epic Research Singapore 21 Feb 2014Nidhi JainNo ratings yet

- Snapshot For Straits Times Index STI (FSSTI) Straits Times Index (STI)Document2 pagesSnapshot For Straits Times Index STI (FSSTI) Straits Times Index (STI)api-237906069No ratings yet

- Snapshot For Straits Times Index STI (FSSTI) Straits Times Index (STI)Document2 pagesSnapshot For Straits Times Index STI (FSSTI) Straits Times Index (STI)api-237906069No ratings yet

- Daily-Sgx-Report by Epic Research Singapore 26 Feb 2014Document2 pagesDaily-Sgx-Report by Epic Research Singapore 26 Feb 2014Nidhi JainNo ratings yet

- Daily SGX Report 21 FebDocument2 pagesDaily SGX Report 21 FebNidhi JainNo ratings yet

- Daily Equity ReportDocument4 pagesDaily Equity ReportJames KingNo ratings yet

- Snapshot For Straits Times Index STI (FSSTI) Straits Times Index (STI)Document2 pagesSnapshot For Straits Times Index STI (FSSTI) Straits Times Index (STI)api-237906069No ratings yet

- Snapshot For Straits Times Index STI (FSSTI) Straits Times Index (STI)Document2 pagesSnapshot For Straits Times Index STI (FSSTI) Straits Times Index (STI)api-237906069No ratings yet

- Daily Market Update 21.10.2013Document2 pagesDaily Market Update 21.10.2013Randora LkNo ratings yet

- Daily Equty Report by Epic Research - 20 June 2012Document4 pagesDaily Equty Report by Epic Research - 20 June 2012Christopher FrazierNo ratings yet

- Equity Tips and Market Outlook For 19 OCtDocument7 pagesEquity Tips and Market Outlook For 19 OCtRani RaiNo ratings yet

- Weekly-Forex-report by EPIC RESEARCH 11.02.13Document6 pagesWeekly-Forex-report by EPIC RESEARCH 11.02.13EpicresearchNo ratings yet

- Weekly Forex Report 1 APRIL 2013: WWW - Epicresearch.CoDocument6 pagesWeekly Forex Report 1 APRIL 2013: WWW - Epicresearch.Coapi-210648926No ratings yet

- Daily-Sgx-Report by Epic Research Singapore 07 Feb 2014Document2 pagesDaily-Sgx-Report by Epic Research Singapore 07 Feb 2014Nidhi JainNo ratings yet

- Equity Tips and Market Analysis For 12 JulyDocument7 pagesEquity Tips and Market Analysis For 12 JulySurbhi JoshiNo ratings yet

- EPIC Research ReportDocument10 pagesEPIC Research Reportapi-221305449No ratings yet

- EPIC Research ReportDocument10 pagesEPIC Research Reportapi-221305449No ratings yet

- Snapshot For Straits Times Index STI (FSSTI)Document2 pagesSnapshot For Straits Times Index STI (FSSTI)api-237906069No ratings yet

- EPIC Research ReportDocument10 pagesEPIC Research Reportapi-221305449No ratings yet

- EPIC Research ReportDocument10 pagesEPIC Research Reportapi-221305449No ratings yet

- Snapshot For Straits Times Index STI (FSSTI) Straits Times Index (STI)Document2 pagesSnapshot For Straits Times Index STI (FSSTI) Straits Times Index (STI)api-237906069No ratings yet

- EPIC Research ReportDocument10 pagesEPIC Research Reportapi-221305449No ratings yet

- Equity Market Analysis or Levels On 21th AugustDocument7 pagesEquity Market Analysis or Levels On 21th AugustTheequicom AdvisoryNo ratings yet

- Daily News Letter 01oct2012Document7 pagesDaily News Letter 01oct2012Theequicom AdvisoryNo ratings yet

- EPIC Research ReportDocument9 pagesEPIC Research Reportapi-221305449No ratings yet

- Market Analysis Report On 12 OCTOBETRDocument7 pagesMarket Analysis Report On 12 OCTOBETRTheequicom AdvisoryNo ratings yet

- Daily-Equity-Report Epicresearch 26 July 2013Document10 pagesDaily-Equity-Report Epicresearch 26 July 2013Gauri OjhaNo ratings yet

- Equity Market Analysis or Levels On 14th SeptemberDocument7 pagesEquity Market Analysis or Levels On 14th SeptemberTheequicom AdvisoryNo ratings yet

- Weekly Equity Report by Epicresearch 5 August 2013Document9 pagesWeekly Equity Report by Epicresearch 5 August 2013Gauri OjhaNo ratings yet

- Charting Your Course Toward a Comfortable RetirementFrom EverandCharting Your Course Toward a Comfortable RetirementNo ratings yet

- WONG vs. CA (Effects: Drawer)Document1 pageWONG vs. CA (Effects: Drawer)Jurico AlonzoNo ratings yet

- XI - (Commerce) AccountingDocument2 pagesXI - (Commerce) AccountingSameer HussainNo ratings yet

- State Bank of India (SBI)Document24 pagesState Bank of India (SBI)Dayananda Singh AmomNo ratings yet

- Chapter 1 Introduction To BanksDocument30 pagesChapter 1 Introduction To BanksMohamed AR WarsameNo ratings yet

- Dubai Insurance Companies1Document39 pagesDubai Insurance Companies1abdulpanasiaNo ratings yet

- 2012 Gold Investment GuideDocument16 pages2012 Gold Investment Guidesingh1910511753No ratings yet

- Chapter 4: Interest Rate Derivatives: 4.3 SwaptionsDocument12 pagesChapter 4: Interest Rate Derivatives: 4.3 Swaptionsz_k_j_vNo ratings yet

- CompaniesDocument2 pagesCompaniesPrachi AgrawalNo ratings yet

- kw3 778Document31 pageskw3 778Tejas GNo ratings yet

- Middle East Turnaround:: Strategy at Abu Dhabi Commercial Bank After The Financial CrisisDocument9 pagesMiddle East Turnaround:: Strategy at Abu Dhabi Commercial Bank After The Financial CrisisVimal JephNo ratings yet

- Short Term FinancingDocument39 pagesShort Term Financingfaysal.bhatti3814No ratings yet

- Bill of Exchange (MCQ) : Gravity 4 CaDocument12 pagesBill of Exchange (MCQ) : Gravity 4 CaAmit ChaudhryNo ratings yet

- Sujith Deepak Kumar-Shivani - 36107: Non-Fund Based Facilities in Indian Banking SectorDocument24 pagesSujith Deepak Kumar-Shivani - 36107: Non-Fund Based Facilities in Indian Banking SectorSujith DeepakNo ratings yet

- Pt. Crompton Prima Switchgear Indonesia: Agreement of Borrowing CB Pole 150 KVDocument1 pagePt. Crompton Prima Switchgear Indonesia: Agreement of Borrowing CB Pole 150 KVRiyan RifandiNo ratings yet

- Chapter 1Document11 pagesChapter 1xyzNo ratings yet

- Rguynn Regulation of Foreign Banks Chapter10 Apr12Document110 pagesRguynn Regulation of Foreign Banks Chapter10 Apr12pmcmenamy01No ratings yet

- Comparitive Analysis of Public Sector and Private Sectors Banks PDFDocument67 pagesComparitive Analysis of Public Sector and Private Sectors Banks PDFAnonymous y3E7ia100% (1)

- View ReportDocument6 pagesView ReportLisbeth GalvisNo ratings yet

- Table 9. Balance Sheet-Life InsurersDocument18 pagesTable 9. Balance Sheet-Life InsurersDrRitesh PatelNo ratings yet

- RKC KosmosDocument2 pagesRKC Kosmosamritam yadavNo ratings yet

- Module 8 Monpol&cenbanDocument6 pagesModule 8 Monpol&cenbanfranz mallariNo ratings yet

- Angel Guard Questions and AnswersDocument1 pageAngel Guard Questions and AnswersJuan Carlos RiveraNo ratings yet

- Ilyas Kahn, List of DirectorshipsDocument56 pagesIlyas Kahn, List of DirectorshipslifeinthemixNo ratings yet

- Sanction Letter 643735Document6 pagesSanction Letter 643735Purushothaman PurushothNo ratings yet

- Land Bank of The Philippines Special Assets Department: KYC QuestionnaireDocument1 pageLand Bank of The Philippines Special Assets Department: KYC Questionnairehernie w. vergel de dios jrNo ratings yet

- New UBP Corporate Card Application - Employee - New Fillable (SCO)Document5 pagesNew UBP Corporate Card Application - Employee - New Fillable (SCO)HazelNo ratings yet

- Masters in Business Administration-MBA Semester-4 MF0007 - Treasury Management - 2 Credits Assignment Set-1Document9 pagesMasters in Business Administration-MBA Semester-4 MF0007 - Treasury Management - 2 Credits Assignment Set-1kipokhriyalNo ratings yet

- Chapter 27 - Cash Management REFERENCEDocument29 pagesChapter 27 - Cash Management REFERENCEPatricia Jean DigoNo ratings yet

- Venture Debt OverviewDocument23 pagesVenture Debt OverviewKent WhiteNo ratings yet