Professional Documents

Culture Documents

Are Large Firms More Efficient Than Small Firms

Are Large Firms More Efficient Than Small Firms

Uploaded by

M TOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Are Large Firms More Efficient Than Small Firms

Are Large Firms More Efficient Than Small Firms

Uploaded by

M TCopyright:

Available Formats

Maylorn Thiva 12Au

Are Large Firms More Efficient Than Small Firms? (25 Marks)

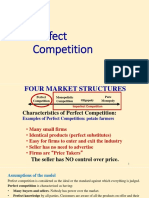

A perfectly competitive market has five criteria that it should match. They are as follows, there should be a large number of buyers and sellers, there should be perfect information, they should sell homogenous goods, there should not be barriers to entry or exit and they should be price takers. Economic efficiency is when a firm minimises costs incurred, with minimal undesired side effects. In this essay, I will analyse whether small firms, who exist in perfectly competitive markets are efficient or not. Small firms in a perfectly competitive market can be dynamically efficient. Dynamic efficiency occurs when a firm takes its profits and re-invests them into its production process, this is done to increase their productive efficiency and in order to develop their products. As firms in a perfectly competitive market are price takers, they can become productively efficient by taking existing products and re-investing them into their production process. When they do this, their average costs will go down, and the curve will shift downwards from AC to AC1. With the current market price, they will then earn abnormal profits. Thus the PC (perfect competition) market can be dynamically efficient.

Costs and Revenue Price

Output

Quantity

However, in PC markets, there is perfect knowledge and there are no barriers to entry or exit. So other firms will be able to copy the ideas of the firm, due to perfect knowledge, and they will be able to enter the market, due to freedom of entry. When other firms enter the market, the supply curve shifts rightwards from S to S1 and the market price is then lowered from P to P1, which means the firms new price is P=D=AR=MR1. This means that all firms in the market are back to earning normal profit. Although, as firms will not be able to enter the market straight away, this allows time for the original firm to maintain its abnormal profits. Any new firms that enter the market will not have been earning abnormal profits for that period of time, and thus the initial firms,

Maylorn Thiva 12Au

have an advantage in the sense that they have accumulated a certain amount of abnormal profit. This amount can then be re-invested into the production process again. Productive efficiency involves minimising the average costs of production. To achieve this, a firm must use the factors of production which are available, at the lowest cost per unit. The point on the diagram is where the MC curve intersects the AC curve, as this is the lowest point on the AC curve.

Cost

Output

However, the firm can always innovate and shift average cost to be lower, this will result in the AC curve to shift to AC1. If this happens, and the firm continues producing at its initial output point, then it is no longer productively efficient. This is because, the point at which the MC intersects with AC1 will occur at a different output point, where output will be less. On the other hand, if the firm then repeats the process of using available factors of production, then they can further reduce their average cost and increase output. Eventually, output will have increased to a point where it occurs where the MC curve intersects AC1. Thus the firm is productively efficient again. Allocative efficiency is when the value the consumer pays is equal to that of the cost that is used up in the production process, as in to say, the resources being used are being allocated efficiently. This occurs where the price curve (P) intersects the marginal cost curve (MC). This condition is forced to happen, as producing anything other than what is demanded by the consumer would mean a loss of business for the firm.

Cost and Revenue Price

Output

Quantity

In conclusion, I believe that the perfect competition market structure is economically

Maylorn Thiva 12Au

efficient. As firms in a PC market produce at the point where MC=MR as firms are profit maximisers. This point also matches conditions for different types of efficiency, such as allocative efficiency (P=MC), as P=AR=MR. It also matches the productive efficiency condition (AC=MC), as this point is also where the MC curve intersects the MC curve. The only type of efficiency that does not exactly apply is dynamic efficiency; however, as I have explained earlier, firms in a PC market can be dynamically efficient, although they may choose not to be.

You might also like

- Chapter 15bDocument8 pagesChapter 15bmas_999No ratings yet

- NESTLE (Coffee, Supply Chain)Document4 pagesNESTLE (Coffee, Supply Chain)Atc Tuition Centre0% (1)

- Analysis of Perfectly Competitive Market by Meinrad C. BautistaDocument22 pagesAnalysis of Perfectly Competitive Market by Meinrad C. BautistaRad BautistaNo ratings yet

- Business Economics V1Document9 pagesBusiness Economics V1Anees MerchantNo ratings yet

- Managerial Economics: Unit 9Document18 pagesManagerial Economics: Unit 9Mary Grace V. PeñalbaNo ratings yet

- 3.4. Market StructuresDocument24 pages3.4. Market StructuresDecision SitoboliNo ratings yet

- Perfect Competition: Market PowerDocument13 pagesPerfect Competition: Market Powerdenny_sitorusNo ratings yet

- Micro Economic Assighment Send MainDocument9 pagesMicro Economic Assighment Send MainMohd Arhaan KhanNo ratings yet

- Pure CompetitionDocument9 pagesPure Competitioncindycanlas_07No ratings yet

- Economics For Managers - Session 11Document16 pagesEconomics For Managers - Session 11Abimanyu NNNo ratings yet

- MarketDocument42 pagesMarketSnn News TubeNo ratings yet

- CH 20 Perfect CompetitionDocument12 pagesCH 20 Perfect CompetitionAsad Uz JamanNo ratings yet

- Chapter 8 Profit Maximization &cmptitive SupplyDocument92 pagesChapter 8 Profit Maximization &cmptitive Supplysridhar7892No ratings yet

- Market Structures HandoutDocument10 pagesMarket Structures HandoutSuzanne HolmesNo ratings yet

- Basic Definitions: Profit MaximizationDocument5 pagesBasic Definitions: Profit MaximizationAdrianna LenaNo ratings yet

- Lecture 16 Market Structures-Perfect CompetitionDocument41 pagesLecture 16 Market Structures-Perfect CompetitionDevyansh GuptaNo ratings yet

- Perfect Competition: Necessary ConditionsDocument5 pagesPerfect Competition: Necessary ConditionsΜιχάλης ΘεοχαρόπουλοςNo ratings yet

- 4.2. Perfect CompetitionDocument31 pages4.2. Perfect CompetitionAshwini SakpalNo ratings yet

- George Oxley, Economics Questions: (I Will Have The Diagrams When I See You On Monday)Document3 pagesGeorge Oxley, Economics Questions: (I Will Have The Diagrams When I See You On Monday)GOXStrapNo ratings yet

- Managerial EconomicsDocument24 pagesManagerial EconomicsVatsal LadNo ratings yet

- Price and Output Determination Under Perfect Competition MarketDocument5 pagesPrice and Output Determination Under Perfect Competition MarketNEXUS OFFICIALNo ratings yet

- Lec 15,16,17perfect CompetitionDocument19 pagesLec 15,16,17perfect CompetitionSabira RahmanNo ratings yet

- Chapter FiveDocument39 pagesChapter FiveBikila DessalegnNo ratings yet

- Equilibrium Under Perfect Competition - Perfectly Competitive MarketDocument8 pagesEquilibrium Under Perfect Competition - Perfectly Competitive MarketShital ShastriNo ratings yet

- Perfect Competition: 1.large Numbers of Sellers and BuyersDocument10 pagesPerfect Competition: 1.large Numbers of Sellers and Buyersatik jawadNo ratings yet

- Perfect CompetitionDocument12 pagesPerfect CompetitionNomanNo ratings yet

- Economic Analysis Ch.7.2023Document24 pagesEconomic Analysis Ch.7.2023Amgad ElshamyNo ratings yet

- MB0042 - Managerial Economics: A1) Meaning of Firm and IndustryDocument23 pagesMB0042 - Managerial Economics: A1) Meaning of Firm and IndustryArpita BanerjeeNo ratings yet

- Requirmen For Perfect CompititionDocument4 pagesRequirmen For Perfect CompititionVijayNo ratings yet

- Micro Lecture 4Document16 pagesMicro Lecture 4Cate MasilunganNo ratings yet

- Firms in Perfectly Competitive Markets: Chapter Summary and Learning ObjectivesDocument33 pagesFirms in Perfectly Competitive Markets: Chapter Summary and Learning ObjectivesseriosulyawksomNo ratings yet

- Profit Maximization and Competitive SupplyDocument4 pagesProfit Maximization and Competitive SupplyRodney Meg Fitz Balagtas100% (1)

- Business EconomicsDocument13 pagesBusiness EconomicsQuerida FernandesNo ratings yet

- Econ Full ScriptDocument8 pagesEcon Full ScriptKent brian JalalonNo ratings yet

- Module 5 - Chapter 7 Q&ADocument6 pagesModule 5 - Chapter 7 Q&ABusn DNo ratings yet

- ME - Price Output Determination (Monopolistic Comp.)Document5 pagesME - Price Output Determination (Monopolistic Comp.)soubhagya_babuNo ratings yet

- A) Perfect CompetitionDocument5 pagesA) Perfect CompetitionHemalsha TashiyaNo ratings yet

- Economic Module 7Document8 pagesEconomic Module 7PatrickNo ratings yet

- 4.2.2 Monopolistic CompetitionDocument6 pages4.2.2 Monopolistic CompetitionArpita PriyadarshiniNo ratings yet

- Perfect CompetitionDocument12 pagesPerfect CompetitionMikail Lee BelloNo ratings yet

- Firms in Competitive P MarketsDocument51 pagesFirms in Competitive P Marketsamitnd55No ratings yet

- Perfect Competititon Chpter 14unit 4Document7 pagesPerfect Competititon Chpter 14unit 4GA ahuja Pujabi aaNo ratings yet

- Parkin 13ge Econ IMDocument12 pagesParkin 13ge Econ IMDina SamirNo ratings yet

- Managerial Decisions For Firms With Market Power: Essential ConceptsDocument8 pagesManagerial Decisions For Firms With Market Power: Essential ConceptsRohit SinhaNo ratings yet

- Econ2011-Chapter 8: Competitive Markets (Perfect Competition)Document10 pagesEcon2011-Chapter 8: Competitive Markets (Perfect Competition)RosemaryTanNo ratings yet

- ECO101 Perfect Competitive MarketDocument14 pagesECO101 Perfect Competitive Marketxawad13No ratings yet

- Unit 3Document20 pagesUnit 3SivaramkrishnanNo ratings yet

- Lecture - 01. PURE COMPETITION: Handout - 1Document11 pagesLecture - 01. PURE COMPETITION: Handout - 1sofia100% (1)

- Comments and SuggestionsDocument4 pagesComments and SuggestionsIsa MlqNo ratings yet

- Perfect CompetitionDocument71 pagesPerfect CompetitionSumedha SunayaNo ratings yet

- Market Structure in EconomicsDocument11 pagesMarket Structure in EconomicsOh ok SodryNo ratings yet

- Perfect Competition ADocument67 pagesPerfect Competition APeter MastersNo ratings yet

- 212 f09 NotesB Ch9Document20 pages212 f09 NotesB Ch9RIchard RobertsNo ratings yet

- Profit MaximisationDocument6 pagesProfit MaximisationAlexcorbinNo ratings yet

- 10e 12 Chap Student WorkbookDocument23 pages10e 12 Chap Student WorkbookkartikartikaaNo ratings yet

- Managerial Economics For Non-Major - CHAPTER 6 (2) - 1Document18 pagesManagerial Economics For Non-Major - CHAPTER 6 (2) - 1endiolalain aNo ratings yet

- Assignment UnitVI ManagerialEconomicsDocument13 pagesAssignment UnitVI ManagerialEconomicsDuncanNo ratings yet

- Unit IVDocument53 pagesUnit IVS1626No ratings yet

- NCERT Solutions For Class 12 Micro Chapter 4 - The Theory of The Firm Under Perfect Competition - .Document27 pagesNCERT Solutions For Class 12 Micro Chapter 4 - The Theory of The Firm Under Perfect Competition - .NatashaNo ratings yet

- Eco 111 Principles of Economics - 014352Document6 pagesEco 111 Principles of Economics - 014352ebubeeke846No ratings yet

- IB HL Economics - Market Structure Question and Answer.Document4 pagesIB HL Economics - Market Structure Question and Answer.Harrison Munday100% (1)

- The Market Makers (Review and Analysis of Spluber's Book)From EverandThe Market Makers (Review and Analysis of Spluber's Book)No ratings yet

- Nestlé India Transcript of Financial Analyst MeetDocument34 pagesNestlé India Transcript of Financial Analyst MeetArzoo SinghalNo ratings yet

- San Lorenzo Development Corporation vs. Court of AppealsDocument15 pagesSan Lorenzo Development Corporation vs. Court of Appealslance zoletaNo ratings yet

- CNG Filling StationDocument32 pagesCNG Filling Stationpradip_kumar0% (1)

- ITC E ChoupalDocument23 pagesITC E Choupalgag90No ratings yet

- Model Question Paper Mk0018 - International Marketing Section A - 1 Mark QuestionsDocument29 pagesModel Question Paper Mk0018 - International Marketing Section A - 1 Mark QuestionsRohandude SharmaNo ratings yet

- Project Report On Deterjent by Arvind YadavDocument50 pagesProject Report On Deterjent by Arvind Yadavarvind yadav90% (10)

- Chapters 6 and 7 Supply Network Relationships, Supply Network BehaviorDocument4 pagesChapters 6 and 7 Supply Network Relationships, Supply Network BehaviorSabam JuventusNo ratings yet

- Business Math: Chapter 3 (Lesson 1,2,3 and 4)Document52 pagesBusiness Math: Chapter 3 (Lesson 1,2,3 and 4)wilhelmina romanNo ratings yet

- Major Components of A Typical Startup-Airline Business Plan: Executive SummaryDocument8 pagesMajor Components of A Typical Startup-Airline Business Plan: Executive Summarysubrat kumarNo ratings yet

- RESA CondominiumDocument18 pagesRESA CondominiumPinoy Doto Best Doto100% (1)

- Sap CoDocument19 pagesSap Cokprakashmm100% (3)

- National FoodsDocument3 pagesNational FoodsUsman AliNo ratings yet

- Ias 2Document2 pagesIas 2Chaudary Usama Anas100% (3)

- Accounting For Merchand ch3Document14 pagesAccounting For Merchand ch3Ealshady HoneyBee Work Force100% (2)

- Relationship MarketingDocument9 pagesRelationship MarketingMing ChieNo ratings yet

- Here Is Why He FiledDocument83 pagesHere Is Why He FileddiannedawnNo ratings yet

- Reviewer - Forms of ContractsDocument3 pagesReviewer - Forms of ContractsBonna De RuedaNo ratings yet

- OntarioDocument14 pagesOntarioSudhanshu S ThakoreNo ratings yet

- Module 1 EconomicsDocument27 pagesModule 1 EconomicsRenuka.nNo ratings yet

- DecathlonDocument1 pageDecathlonNeenaNo ratings yet

- Capstone Till DateDocument225 pagesCapstone Till DateSaima Nazir Khan100% (1)

- Agreement - Marketing PartnerDocument3 pagesAgreement - Marketing PartnerDheerazNo ratings yet

- Futures 1Document66 pagesFutures 1shivaNo ratings yet

- Profit Prior To IncorporationDocument3 pagesProfit Prior To Incorporationsonika7No ratings yet

- New Microsoft Office Word DocumentDocument5 pagesNew Microsoft Office Word DocumentSupriya SahayNo ratings yet

- The Corn Book: Double Luck Double LuckDocument24 pagesThe Corn Book: Double Luck Double LuckVictoriaNo ratings yet

- Historical Background of DelhiDocument39 pagesHistorical Background of DelhiRashmiNo ratings yet

- Pipe Fitters HandbookDocument316 pagesPipe Fitters HandbookKevin BlackwellNo ratings yet