Professional Documents

Culture Documents

Howes Tax 2013 Charitable Contributions Guide

Howes Tax 2013 Charitable Contributions Guide

Uploaded by

Shawn M. CoxCopyright:

Available Formats

You might also like

- Nonprofit Law OutlineDocument38 pagesNonprofit Law OutlineAlex Sherman100% (8)

- Facility Event Space Rental AgreementDocument2 pagesFacility Event Space Rental Agreementmaelynsummer33% (3)

- Warehouse Donation Request 090214Document2 pagesWarehouse Donation Request 090214api-324831959No ratings yet

- Private Family FoundationsDocument5 pagesPrivate Family Foundationsapi-246909910100% (4)

- Nebraska FRSDocument87 pagesNebraska FRSMatt BrownNo ratings yet

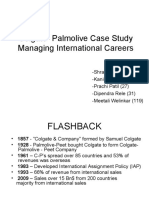

- Colgate-Palmolive Case Study Managing International CareersDocument9 pagesColgate-Palmolive Case Study Managing International CareersrushishastriNo ratings yet

- A Donor's Guide: Vehicle DonationDocument10 pagesA Donor's Guide: Vehicle Donationriki187No ratings yet

- A Donor's Guide To: Internal Revenue Service Tax Exempt and Government Entities Exempt OrganizationsDocument16 pagesA Donor's Guide To: Internal Revenue Service Tax Exempt and Government Entities Exempt OrganizationsFlorinNo ratings yet

- Donation Receipts: The Ultimate Guide For NonprofitsDocument9 pagesDonation Receipts: The Ultimate Guide For NonprofitsdonorkitefoundationNo ratings yet

- Lesson 8 Donors TaxDocument21 pagesLesson 8 Donors TaxCASTRO, HANNAH CAMILLE E.No ratings yet

- Charitable Contributions : Substantiation and Disclosure RequirementsDocument16 pagesCharitable Contributions : Substantiation and Disclosure RequirementsLance CrawfordNo ratings yet

- Lottery Information KitDocument30 pagesLottery Information KitDan StankovicNo ratings yet

- Sponsorship - Underwriting ContractDocument2 pagesSponsorship - Underwriting ContractEdalynn Franks WeissNo ratings yet

- July 2014: Can You Make Some Green by Investing Green?Document4 pagesJuly 2014: Can You Make Some Green by Investing Green?Income Solutions Wealth ManagementNo ratings yet

- Charitable Trusts: What Are The Advantages?Document3 pagesCharitable Trusts: What Are The Advantages?Derek FoldsNo ratings yet

- Top Compliance Issues For Canadian Registered Charities - Mark BlumbergDocument71 pagesTop Compliance Issues For Canadian Registered Charities - Mark BlumbergMark BlumbergNo ratings yet

- Grants and Subsidies: A Tax Guide For Organisations That Receive A Grant or SubsidyDocument18 pagesGrants and Subsidies: A Tax Guide For Organisations That Receive A Grant or SubsidyHimadhar SaduNo ratings yet

- Community Support OrganizationsDocument2 pagesCommunity Support OrganizationsadinaNo ratings yet

- Benevolent Funds Program 2011-09-21 ToolkitDocument22 pagesBenevolent Funds Program 2011-09-21 ToolkitNational Association of REALTORS®100% (1)

- Tax 2 Reviewer LectureDocument12 pagesTax 2 Reviewer LectureHazel Rocafort TitularNo ratings yet

- Charitable Giving Guidelines and Application: Form No. 3260 07/05 OLDocument4 pagesCharitable Giving Guidelines and Application: Form No. 3260 07/05 OLmargieejuddNo ratings yet

- Disciples Overivew of Ways To GiveDocument16 pagesDisciples Overivew of Ways To Giveadmin@fcctorrance.orgNo ratings yet

- Reporting Requirements For Charities and Not For Profit OrganizationsDocument15 pagesReporting Requirements For Charities and Not For Profit OrganizationsRay Brooks100% (1)

- Donor's TaxDocument29 pagesDonor's TaxPETERWILLE CHUANo ratings yet

- Tax 2 Reviewer LectureDocument13 pagesTax 2 Reviewer LectureShiela May Agustin MacarayanNo ratings yet

- Donation As An Estate Planning ToolDocument8 pagesDonation As An Estate Planning ToolMark Rainer Yongis LozaresNo ratings yet

- Legal Eats Workshop Presentation SlidesDocument140 pagesLegal Eats Workshop Presentation SlidesThe Sustainable Economies Law CenterNo ratings yet

- Tax Implications For Donations1Document9 pagesTax Implications For Donations1MasterHomerNo ratings yet

- Expenses 210701Document8 pagesExpenses 210701sarahNo ratings yet

- Charitable Gift Annuities - Gift It and Earn BenefitDocument1 pageCharitable Gift Annuities - Gift It and Earn BenefitPerttoh MusyimiNo ratings yet

- RA Guidance Notes Nov 22Document8 pagesRA Guidance Notes Nov 22y.lohvynenkoNo ratings yet

- USAA PresentationDocument43 pagesUSAA Presentationarkan1976No ratings yet

- 4 - Seed Fund GuidelinesDocument6 pages4 - Seed Fund GuidelinesM.Y.TechNo ratings yet

- DONORS TAX and ESTATE TAXDocument39 pagesDONORS TAX and ESTATE TAXmarjorie blancoNo ratings yet

- Nonprofit Organizations: Publication 18 - April 2013Document45 pagesNonprofit Organizations: Publication 18 - April 2013psawant77No ratings yet

- 80GDocument10 pages80GHari RittiNo ratings yet

- 2009 - 2010 Charitable Law Annual Report Final 7-12-11Document206 pages2009 - 2010 Charitable Law Annual Report Final 7-12-11Mike DeWineNo ratings yet

- Apple Donation Matching GuideDocument4 pagesApple Donation Matching Guidepalyc.ali2024No ratings yet

- Donations Form Jan 2020Document10 pagesDonations Form Jan 2020Becky AntoinetteNo ratings yet

- Discuss Other Business TaxDocument6 pagesDiscuss Other Business TaxLeoreyn Faye MedinaNo ratings yet

- Unit 2 Difference Between Profit and Non-Profit OrganizationDocument7 pagesUnit 2 Difference Between Profit and Non-Profit OrganizationRahul Banerjee100% (1)

- Donors TaxDocument6 pagesDonors TaxMaricrisNo ratings yet

- Charitable Remainder TrustDocument4 pagesCharitable Remainder Trustapi-246909910100% (1)

- NonProfits Sales TaxDocument3 pagesNonProfits Sales Taxrachael_brownel9802No ratings yet

- Gallivan Before You GiveDocument2 pagesGallivan Before You GiveNew York SenateNo ratings yet

- Fund RaisingDocument22 pagesFund RaisingPratyush GuptaNo ratings yet

- 17.funding DirectoryDocument8 pages17.funding DirectoryImprovingSupportNo ratings yet

- You Are The Best Social Entrepreneur: Tuesday, May 1, 2012, Edition-8Document6 pagesYou Are The Best Social Entrepreneur: Tuesday, May 1, 2012, Edition-8webnm_2011No ratings yet

- Noble Academic SocietyDocument8 pagesNoble Academic SocietyAnsâr El-MuhammadNo ratings yet

- Taxation Assignment #2Document2 pagesTaxation Assignment #2Keirulf Jay AlmarioNo ratings yet

- Bof BrochureDocument2 pagesBof Brochureapi-264544627No ratings yet

- Transfer Taxes: Donor'S TaxDocument8 pagesTransfer Taxes: Donor'S TaxracrabeNo ratings yet

- Modia 1412enDocument15 pagesModia 1412enJames GraveurNo ratings yet

- How Is A Nonprofit Different From A For-Profit Business? Answer: Here Are Some of The Differences Between A Business and ADocument7 pagesHow Is A Nonprofit Different From A For-Profit Business? Answer: Here Are Some of The Differences Between A Business and Argayathri16No ratings yet

- More Bang Than Your Buck Non Cash AssetsDocument1 pageMore Bang Than Your Buck Non Cash Assetscowivir671No ratings yet

- ACC497 Ltweek 4 AssignmentDocument4 pagesACC497 Ltweek 4 AssignmentRobbie WolfNo ratings yet

- Gift Matching Program Application and Guidelines July 2009Document2 pagesGift Matching Program Application and Guidelines July 2009Ben HoNo ratings yet

- Health Care Finance I Slides 2017 Week 10Document50 pagesHealth Care Finance I Slides 2017 Week 10s430230No ratings yet

- Full Report - Choosing A Charitble Giving VehicleDocument28 pagesFull Report - Choosing A Charitble Giving VehicleFatihahZainalLimNo ratings yet

- Fundraising from Companies and Charitable Trusts/Foundations + From the Internet: Fundraising Material SeriesFrom EverandFundraising from Companies and Charitable Trusts/Foundations + From the Internet: Fundraising Material SeriesNo ratings yet

- Fundraising-from-Companies-&-Charitable-Trusts/Foundations +Through-The-InternetFrom EverandFundraising-from-Companies-&-Charitable-Trusts/Foundations +Through-The-InternetRating: 5 out of 5 stars5/5 (1)

- The Triple Tap Strategy GuideDocument11 pagesThe Triple Tap Strategy Guidebenjy woodNo ratings yet

- Inv 000070Document1 pageInv 000070prasanth mkNo ratings yet

- Exxon - Mobil - 2019 Financial and Operating DataDocument50 pagesExxon - Mobil - 2019 Financial and Operating DatajojoNo ratings yet

- Bank StatementsDocument4 pagesBank StatementshanhNo ratings yet

- ASSR AA STF NEW L8 PM 8.5.1D Prepayments Substantive Procedures Participant InstructionsDocument3 pagesASSR AA STF NEW L8 PM 8.5.1D Prepayments Substantive Procedures Participant InstructionsJimmieNo ratings yet

- COA CIRCULAR NO. 2021 014 December 22 2021Document14 pagesCOA CIRCULAR NO. 2021 014 December 22 2021juanNo ratings yet

- BRI Danareksa Sekuritas Outlook Report 2023 - Challenges RemainDocument48 pagesBRI Danareksa Sekuritas Outlook Report 2023 - Challenges RemainAbid M. SholihulNo ratings yet

- 2551MDocument2 pages2551MAlexiss Mace JuradoNo ratings yet

- MCQS 4Document23 pagesMCQS 4humna khanNo ratings yet

- Budget Cycle (Budget Accountability) TEAM 1Document43 pagesBudget Cycle (Budget Accountability) TEAM 1Patrick LanceNo ratings yet

- ED 2-Marks Qus & AnsDocument14 pagesED 2-Marks Qus & AnsVarun100% (3)

- Collateral Management AgendaDocument17 pagesCollateral Management AgendaSpikeNo ratings yet

- Fadi Ismail CV-4Document2 pagesFadi Ismail CV-4CatyNo ratings yet

- Opcf 21B Blanket Fleet Coverage For Ontario Licensed AutomobilesDocument2 pagesOpcf 21B Blanket Fleet Coverage For Ontario Licensed AutomobilesyazanNo ratings yet

- TSL Further Proof 159 Notice Rev1 ManishaDocument20 pagesTSL Further Proof 159 Notice Rev1 Manishamanishaghadage47817No ratings yet

- Month Sales (Credit) Purchase (Credit) Wages Manufacturing Expenses Administrative Expenses Selling ExpensesDocument3 pagesMonth Sales (Credit) Purchase (Credit) Wages Manufacturing Expenses Administrative Expenses Selling Expensesaishwarya raikar100% (2)

- Chapter 3 Intermediate AccountingDocument56 pagesChapter 3 Intermediate AccountingMae Ann RaquinNo ratings yet

- Financial Records and Reports of The Business 3Document11 pagesFinancial Records and Reports of The Business 3Vignette San AgustinNo ratings yet

- Accounting 2 - Partnership FormationDocument23 pagesAccounting 2 - Partnership FormationRhiena Joy BosqueNo ratings yet

- LatinFocus Consensus Forecast - February 2020Document142 pagesLatinFocus Consensus Forecast - February 2020Felipe OrnellesNo ratings yet

- 4B Merc 2 Insurance Credit Trans PPSADocument203 pages4B Merc 2 Insurance Credit Trans PPSAMica Joy FajardoNo ratings yet

- Chapter 8 Partnership AccountingDocument16 pagesChapter 8 Partnership Accountingk.muhammed aaqibNo ratings yet

- A.J. Gen. MerchandisingDocument5 pagesA.J. Gen. MerchandisingErish Jay ManalangNo ratings yet

- Key Issues Key IssuesDocument11 pagesKey Issues Key IssuesPaulo MedeirosNo ratings yet

- LIC Housing FinDocument18 pagesLIC Housing FinvishalNo ratings yet

- CCRIS - Data Review Form - 230516Document1 pageCCRIS - Data Review Form - 230516Vinod JeyapalanNo ratings yet

- 1) Assess The Current Financial Health and Recent Financial Performance of The Firm. Identify Any Strengths or WeaknessesDocument2 pages1) Assess The Current Financial Health and Recent Financial Performance of The Firm. Identify Any Strengths or WeaknessesJane SmithNo ratings yet

Howes Tax 2013 Charitable Contributions Guide

Howes Tax 2013 Charitable Contributions Guide

Uploaded by

Shawn M. CoxCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Howes Tax 2013 Charitable Contributions Guide

Howes Tax 2013 Charitable Contributions Guide

Uploaded by

Shawn M. CoxCopyright:

Available Formats

3)

The goods or services are membership benets.

Contributions of Less Than $500

A written acknowledgement is still required if the contribution is $250 or more. If the organization sells the vehicle without any signicant intervening use or material improvement, and the sale yields gross proceeds of $500 or less, the deduction is equal to the lesser of fair market value or $500. Example: Jack donates his car, worth $800, to a charity that turns around and sells it for $400 without any signicant intervening use or without making any material improvements. Jack can deduct $500 as a charitable contribution for the donation of his car. Because his deduction is $250 or more, he still needs a written acknowledgement from the charity, but the acknowledgement is not required to be attached to his return.

2014

Donating a Vehicle

Written Acknowledgement

Obtain written acknowledgement from the organization, which includes details on the use or disposition of the vehicle by the donee organization. A copy of the written acknowledgement must be attached to the tax return.

Charitable Contributions Guide

Deduction Limits

A deduction for used items donated to a charity are generally equal to the fair market value of the item at the time of the donation. In the case of vehicles, the deduction may be less than fair market value under the gross proceeds deduction limit. 1) If the organization sells the donated vehicle without a signicant intervening use or material improvement by the donee organization, then the deduction is limited to the gross proceeds received from the sale. 2) If the organization sells the donated vehicle after signicant intervening use or material improvement to the vehicle, the deduction is limited to the fair market value of the vehicle. 3) If the organization sells the vehicle at signicantly below fair market value, the gross proceeds limitation will not apply if it was a gratuitous transfer to a needy individual in line with the purpose of the charity to provide transportation to the poor.

There are many events that occur during the year that can affect your tax situation. Preparation of your tax return involves summarizing transactions and events that occurred during the prior year. In most situations, treatment is rmly established at the time the transaction occurs. However, negative tax effects can be avoided by proper planning. Please contact us in advance if you have questions about the tax effects of a transaction or event, including the following: Retirement. Pension or IRA distributions. Notice from IRS or other Signicant change in income or revenue department. deductions. Divorce or separation. Job change. Self-employment. Marriage. Charitable contributions Attainment of age 59 or 70. of property in excess of Sale or purchase of a business. $5,000. Sale or purchase of a residence or other real estate.

This brochure contains general information for taxpayers and should not be relied upon as the only source of authority. Taxpayers shouldseek professional tax advice for moreinformation. Copyright 2013 Tax Materials, Inc. All Rights Reserved

Contact Us

Contributions That Benet theTaxpayer

If a taxpayer receives a benet in exchange for a charitable contribution, the deduction is reduced by the value of the benet received.

Charitable Organizations

Qualied charitable organizations include nonprot groups that are religious, charitable, educational, scientic, or literary in purpose, or that work to prevent cruelty to children or animals.

Examples of Qualied and Nonqualied Organizations Qualied Churches, mosques, temples, synagogues. Boy and Girl Scouts, Boys and Girls Clubs of America, Red Cross, Goodwill, Salvation Army, United Way. Fraternal orders, if gifts used for qualied charitable purposes. Veterans and certain cultural groups. Nonprot schools, colleges, museums, hospitals, and organizations trying to nd medical cures. Federal, state, and local governments, if gifts are solely for public purposes, including nonprot volunteer re departments, and public parks facilities. Nonqualied Country clubs, lodges, fraternal orders, and similar groups, unless they are a qualied charity. Civic leagues, social and sports clubs, labor unions and chambers of commerce. Political organizations and candidates. Communist organizations. [IRC170(k)] Foreign organizations. Exceptions: Contributions to certain Canadian, Israeli, and Mexican charities are deductible. See IRS Pub. 526. Homeowners associations.

unless the clothing or household item is in good used condition or better. The IRS is authorized by regulation to deny a deduction for any contribution of clothing or a household item that has minimal monetary value, such as used socks and undergarments.

Example: Paul made a $70 donation to Public TV and received a $40 CD of his all-time favorite band, the Hermans Hermits, in appreciation for his donation. His deduction equals $30.

Recordkeeping Rules for Charitable Contributions

To help substantiate a deduction for the fair market value of used items donated to charity, make a list of each item donated on a separate sheet of paper, along with the following information. Name and address of charity. Date items were donated to the charity. Description of each item donated. Fair market value of each item at the time they were donated. Date each donated item was originally purchased or acquired. Cost or other basis of each item donated.

Auto Expenses

Deductible out-of-pocket expenses include the cost of using the taxpayers auto in providing services for a charitable organization. Deduct the actual cost of gas and oil or the standard mileage rate. Add parking and tolls to amount claimed for either standard mileage rate or actual expenses. A mileage log is required.

Standard Mileage Rate

The general standard mileage rate for charity is 14 per mile in 2013.

Contributions of Property

If used items were given to charity, such as clothing or furniture, the fair market value of the items is used to determine the deductible amount. Fair market value is what a willing buyer would pay a willing seller when neither has to buy or sell and both are aware of the conditions of the sale.

Part Contribution, Part Goods or Services

A written statement from a charity is required if a donation is more than $75 and is partly a contribution and partly for goods or services. The statement must contain an estimate of the value of goods or services received. Exception: A written statement for goods or services is not required if one of the following is true. 1) The charity is a federal, state, or local government or a religious organization where the benet is an intangible religious benet, such as admission to a religious ceremony. 2) The goods or services are of token value.

Expenses Incurred While Volunteering

Out-of-pocket expenses incurred in performing volunteer work for a charitable organization (including the charitable mileage deduction) are considered cash contributions. The value of a donors time is not deductible.

Planning Tip: Most cell phones today can take

pictures. Take a picture of all items donated. Keep the electronic pictures for proof the items were in good used condition or better at the time they were donated.

Note: No deduction is allowed for a charitable contribution of clothing or household items

You might also like

- Nonprofit Law OutlineDocument38 pagesNonprofit Law OutlineAlex Sherman100% (8)

- Facility Event Space Rental AgreementDocument2 pagesFacility Event Space Rental Agreementmaelynsummer33% (3)

- Warehouse Donation Request 090214Document2 pagesWarehouse Donation Request 090214api-324831959No ratings yet

- Private Family FoundationsDocument5 pagesPrivate Family Foundationsapi-246909910100% (4)

- Nebraska FRSDocument87 pagesNebraska FRSMatt BrownNo ratings yet

- Colgate-Palmolive Case Study Managing International CareersDocument9 pagesColgate-Palmolive Case Study Managing International CareersrushishastriNo ratings yet

- A Donor's Guide: Vehicle DonationDocument10 pagesA Donor's Guide: Vehicle Donationriki187No ratings yet

- A Donor's Guide To: Internal Revenue Service Tax Exempt and Government Entities Exempt OrganizationsDocument16 pagesA Donor's Guide To: Internal Revenue Service Tax Exempt and Government Entities Exempt OrganizationsFlorinNo ratings yet

- Donation Receipts: The Ultimate Guide For NonprofitsDocument9 pagesDonation Receipts: The Ultimate Guide For NonprofitsdonorkitefoundationNo ratings yet

- Lesson 8 Donors TaxDocument21 pagesLesson 8 Donors TaxCASTRO, HANNAH CAMILLE E.No ratings yet

- Charitable Contributions : Substantiation and Disclosure RequirementsDocument16 pagesCharitable Contributions : Substantiation and Disclosure RequirementsLance CrawfordNo ratings yet

- Lottery Information KitDocument30 pagesLottery Information KitDan StankovicNo ratings yet

- Sponsorship - Underwriting ContractDocument2 pagesSponsorship - Underwriting ContractEdalynn Franks WeissNo ratings yet

- July 2014: Can You Make Some Green by Investing Green?Document4 pagesJuly 2014: Can You Make Some Green by Investing Green?Income Solutions Wealth ManagementNo ratings yet

- Charitable Trusts: What Are The Advantages?Document3 pagesCharitable Trusts: What Are The Advantages?Derek FoldsNo ratings yet

- Top Compliance Issues For Canadian Registered Charities - Mark BlumbergDocument71 pagesTop Compliance Issues For Canadian Registered Charities - Mark BlumbergMark BlumbergNo ratings yet

- Grants and Subsidies: A Tax Guide For Organisations That Receive A Grant or SubsidyDocument18 pagesGrants and Subsidies: A Tax Guide For Organisations That Receive A Grant or SubsidyHimadhar SaduNo ratings yet

- Community Support OrganizationsDocument2 pagesCommunity Support OrganizationsadinaNo ratings yet

- Benevolent Funds Program 2011-09-21 ToolkitDocument22 pagesBenevolent Funds Program 2011-09-21 ToolkitNational Association of REALTORS®100% (1)

- Tax 2 Reviewer LectureDocument12 pagesTax 2 Reviewer LectureHazel Rocafort TitularNo ratings yet

- Charitable Giving Guidelines and Application: Form No. 3260 07/05 OLDocument4 pagesCharitable Giving Guidelines and Application: Form No. 3260 07/05 OLmargieejuddNo ratings yet

- Disciples Overivew of Ways To GiveDocument16 pagesDisciples Overivew of Ways To Giveadmin@fcctorrance.orgNo ratings yet

- Reporting Requirements For Charities and Not For Profit OrganizationsDocument15 pagesReporting Requirements For Charities and Not For Profit OrganizationsRay Brooks100% (1)

- Donor's TaxDocument29 pagesDonor's TaxPETERWILLE CHUANo ratings yet

- Tax 2 Reviewer LectureDocument13 pagesTax 2 Reviewer LectureShiela May Agustin MacarayanNo ratings yet

- Donation As An Estate Planning ToolDocument8 pagesDonation As An Estate Planning ToolMark Rainer Yongis LozaresNo ratings yet

- Legal Eats Workshop Presentation SlidesDocument140 pagesLegal Eats Workshop Presentation SlidesThe Sustainable Economies Law CenterNo ratings yet

- Tax Implications For Donations1Document9 pagesTax Implications For Donations1MasterHomerNo ratings yet

- Expenses 210701Document8 pagesExpenses 210701sarahNo ratings yet

- Charitable Gift Annuities - Gift It and Earn BenefitDocument1 pageCharitable Gift Annuities - Gift It and Earn BenefitPerttoh MusyimiNo ratings yet

- RA Guidance Notes Nov 22Document8 pagesRA Guidance Notes Nov 22y.lohvynenkoNo ratings yet

- USAA PresentationDocument43 pagesUSAA Presentationarkan1976No ratings yet

- 4 - Seed Fund GuidelinesDocument6 pages4 - Seed Fund GuidelinesM.Y.TechNo ratings yet

- DONORS TAX and ESTATE TAXDocument39 pagesDONORS TAX and ESTATE TAXmarjorie blancoNo ratings yet

- Nonprofit Organizations: Publication 18 - April 2013Document45 pagesNonprofit Organizations: Publication 18 - April 2013psawant77No ratings yet

- 80GDocument10 pages80GHari RittiNo ratings yet

- 2009 - 2010 Charitable Law Annual Report Final 7-12-11Document206 pages2009 - 2010 Charitable Law Annual Report Final 7-12-11Mike DeWineNo ratings yet

- Apple Donation Matching GuideDocument4 pagesApple Donation Matching Guidepalyc.ali2024No ratings yet

- Donations Form Jan 2020Document10 pagesDonations Form Jan 2020Becky AntoinetteNo ratings yet

- Discuss Other Business TaxDocument6 pagesDiscuss Other Business TaxLeoreyn Faye MedinaNo ratings yet

- Unit 2 Difference Between Profit and Non-Profit OrganizationDocument7 pagesUnit 2 Difference Between Profit and Non-Profit OrganizationRahul Banerjee100% (1)

- Donors TaxDocument6 pagesDonors TaxMaricrisNo ratings yet

- Charitable Remainder TrustDocument4 pagesCharitable Remainder Trustapi-246909910100% (1)

- NonProfits Sales TaxDocument3 pagesNonProfits Sales Taxrachael_brownel9802No ratings yet

- Gallivan Before You GiveDocument2 pagesGallivan Before You GiveNew York SenateNo ratings yet

- Fund RaisingDocument22 pagesFund RaisingPratyush GuptaNo ratings yet

- 17.funding DirectoryDocument8 pages17.funding DirectoryImprovingSupportNo ratings yet

- You Are The Best Social Entrepreneur: Tuesday, May 1, 2012, Edition-8Document6 pagesYou Are The Best Social Entrepreneur: Tuesday, May 1, 2012, Edition-8webnm_2011No ratings yet

- Noble Academic SocietyDocument8 pagesNoble Academic SocietyAnsâr El-MuhammadNo ratings yet

- Taxation Assignment #2Document2 pagesTaxation Assignment #2Keirulf Jay AlmarioNo ratings yet

- Bof BrochureDocument2 pagesBof Brochureapi-264544627No ratings yet

- Transfer Taxes: Donor'S TaxDocument8 pagesTransfer Taxes: Donor'S TaxracrabeNo ratings yet

- Modia 1412enDocument15 pagesModia 1412enJames GraveurNo ratings yet

- How Is A Nonprofit Different From A For-Profit Business? Answer: Here Are Some of The Differences Between A Business and ADocument7 pagesHow Is A Nonprofit Different From A For-Profit Business? Answer: Here Are Some of The Differences Between A Business and Argayathri16No ratings yet

- More Bang Than Your Buck Non Cash AssetsDocument1 pageMore Bang Than Your Buck Non Cash Assetscowivir671No ratings yet

- ACC497 Ltweek 4 AssignmentDocument4 pagesACC497 Ltweek 4 AssignmentRobbie WolfNo ratings yet

- Gift Matching Program Application and Guidelines July 2009Document2 pagesGift Matching Program Application and Guidelines July 2009Ben HoNo ratings yet

- Health Care Finance I Slides 2017 Week 10Document50 pagesHealth Care Finance I Slides 2017 Week 10s430230No ratings yet

- Full Report - Choosing A Charitble Giving VehicleDocument28 pagesFull Report - Choosing A Charitble Giving VehicleFatihahZainalLimNo ratings yet

- Fundraising from Companies and Charitable Trusts/Foundations + From the Internet: Fundraising Material SeriesFrom EverandFundraising from Companies and Charitable Trusts/Foundations + From the Internet: Fundraising Material SeriesNo ratings yet

- Fundraising-from-Companies-&-Charitable-Trusts/Foundations +Through-The-InternetFrom EverandFundraising-from-Companies-&-Charitable-Trusts/Foundations +Through-The-InternetRating: 5 out of 5 stars5/5 (1)

- The Triple Tap Strategy GuideDocument11 pagesThe Triple Tap Strategy Guidebenjy woodNo ratings yet

- Inv 000070Document1 pageInv 000070prasanth mkNo ratings yet

- Exxon - Mobil - 2019 Financial and Operating DataDocument50 pagesExxon - Mobil - 2019 Financial and Operating DatajojoNo ratings yet

- Bank StatementsDocument4 pagesBank StatementshanhNo ratings yet

- ASSR AA STF NEW L8 PM 8.5.1D Prepayments Substantive Procedures Participant InstructionsDocument3 pagesASSR AA STF NEW L8 PM 8.5.1D Prepayments Substantive Procedures Participant InstructionsJimmieNo ratings yet

- COA CIRCULAR NO. 2021 014 December 22 2021Document14 pagesCOA CIRCULAR NO. 2021 014 December 22 2021juanNo ratings yet

- BRI Danareksa Sekuritas Outlook Report 2023 - Challenges RemainDocument48 pagesBRI Danareksa Sekuritas Outlook Report 2023 - Challenges RemainAbid M. SholihulNo ratings yet

- 2551MDocument2 pages2551MAlexiss Mace JuradoNo ratings yet

- MCQS 4Document23 pagesMCQS 4humna khanNo ratings yet

- Budget Cycle (Budget Accountability) TEAM 1Document43 pagesBudget Cycle (Budget Accountability) TEAM 1Patrick LanceNo ratings yet

- ED 2-Marks Qus & AnsDocument14 pagesED 2-Marks Qus & AnsVarun100% (3)

- Collateral Management AgendaDocument17 pagesCollateral Management AgendaSpikeNo ratings yet

- Fadi Ismail CV-4Document2 pagesFadi Ismail CV-4CatyNo ratings yet

- Opcf 21B Blanket Fleet Coverage For Ontario Licensed AutomobilesDocument2 pagesOpcf 21B Blanket Fleet Coverage For Ontario Licensed AutomobilesyazanNo ratings yet

- TSL Further Proof 159 Notice Rev1 ManishaDocument20 pagesTSL Further Proof 159 Notice Rev1 Manishamanishaghadage47817No ratings yet

- Month Sales (Credit) Purchase (Credit) Wages Manufacturing Expenses Administrative Expenses Selling ExpensesDocument3 pagesMonth Sales (Credit) Purchase (Credit) Wages Manufacturing Expenses Administrative Expenses Selling Expensesaishwarya raikar100% (2)

- Chapter 3 Intermediate AccountingDocument56 pagesChapter 3 Intermediate AccountingMae Ann RaquinNo ratings yet

- Financial Records and Reports of The Business 3Document11 pagesFinancial Records and Reports of The Business 3Vignette San AgustinNo ratings yet

- Accounting 2 - Partnership FormationDocument23 pagesAccounting 2 - Partnership FormationRhiena Joy BosqueNo ratings yet

- LatinFocus Consensus Forecast - February 2020Document142 pagesLatinFocus Consensus Forecast - February 2020Felipe OrnellesNo ratings yet

- 4B Merc 2 Insurance Credit Trans PPSADocument203 pages4B Merc 2 Insurance Credit Trans PPSAMica Joy FajardoNo ratings yet

- Chapter 8 Partnership AccountingDocument16 pagesChapter 8 Partnership Accountingk.muhammed aaqibNo ratings yet

- A.J. Gen. MerchandisingDocument5 pagesA.J. Gen. MerchandisingErish Jay ManalangNo ratings yet

- Key Issues Key IssuesDocument11 pagesKey Issues Key IssuesPaulo MedeirosNo ratings yet

- LIC Housing FinDocument18 pagesLIC Housing FinvishalNo ratings yet

- CCRIS - Data Review Form - 230516Document1 pageCCRIS - Data Review Form - 230516Vinod JeyapalanNo ratings yet

- 1) Assess The Current Financial Health and Recent Financial Performance of The Firm. Identify Any Strengths or WeaknessesDocument2 pages1) Assess The Current Financial Health and Recent Financial Performance of The Firm. Identify Any Strengths or WeaknessesJane SmithNo ratings yet