Professional Documents

Culture Documents

Company Car Tax Rates

Company Car Tax Rates

Uploaded by

Keyconsulting UKCopyright:

Available Formats

You might also like

- Excel Mathematics Revision Exam Workbook Year 8Document201 pagesExcel Mathematics Revision Exam Workbook Year 8baysidetuition100% (1)

- Brilliant Passing Numerical Reasoning Tests Everything You Need To Know To Understand How To Practise For and Pass Numerical... (Rob Williams) (Z-Library)Document233 pagesBrilliant Passing Numerical Reasoning Tests Everything You Need To Know To Understand How To Practise For and Pass Numerical... (Rob Williams) (Z-Library)SNSD forever TaeyeonNo ratings yet

- GST Impact On Automobile IndustryDocument64 pagesGST Impact On Automobile IndustryJagadish Sahu100% (2)

- Beer Duty Return by Keyconsulting UKDocument2 pagesBeer Duty Return by Keyconsulting UKKeyconsulting UKNo ratings yet

- Application For VAT Registration UKDocument4 pagesApplication For VAT Registration UKKeyconsulting UKNo ratings yet

- Manual Thinkorswim Eng UsaDocument65 pagesManual Thinkorswim Eng UsaFernando Colomer100% (2)

- Company Car Fuel Benefit ChargeDocument2 pagesCompany Car Fuel Benefit ChargeKeyconsulting UKNo ratings yet

- What To Know Re Vat Reform Law (Ra 9337)Document5 pagesWhat To Know Re Vat Reform Law (Ra 9337)Jamie ArquiroNo ratings yet

- Fuel Duty Rates: Who Is Likely To Be Affected?Document5 pagesFuel Duty Rates: Who Is Likely To Be Affected?Nicklas Pluto TskaroziaNo ratings yet

- Key Features of BUDGET 2010-11: Presented To, Prof .BhaodasDocument27 pagesKey Features of BUDGET 2010-11: Presented To, Prof .Bhaodasbhavu_ashNo ratings yet

- Train Law: Legislative StatusDocument3 pagesTrain Law: Legislative Statustyrone corpuzNo ratings yet

- Auto 20120227 Mosl Su PG012Document12 pagesAuto 20120227 Mosl Su PG012Vince GaruNo ratings yet

- The Tax Reform For Acceleration and InclusionDocument3 pagesThe Tax Reform For Acceleration and InclusionbeckNo ratings yet

- Current AfiarsDocument7 pagesCurrent AfiarsDr.V.Bastin JeromeNo ratings yet

- Additional Information About TAXATIONDocument4 pagesAdditional Information About TAXATIONjudeNo ratings yet

- UNION BUDGET 2013-14: Tax Revenue and Insurance SectorDocument7 pagesUNION BUDGET 2013-14: Tax Revenue and Insurance SectorPulkit NehruNo ratings yet

- Train TaxDocument11 pagesTrain TaxLucela InocNo ratings yet

- Nirc and TrainDocument5 pagesNirc and TrainJasmine Marie Ng CheongNo ratings yet

- A Critical Review of The Tax Structure of BangladeshDocument4 pagesA Critical Review of The Tax Structure of BangladeshSumaiya IslamNo ratings yet

- Rs4,895Bn (9% Yoy Higher), With TotalDocument3 pagesRs4,895Bn (9% Yoy Higher), With TotalAsad MuhammadNo ratings yet

- Budget Summary 2015: Income Tax Tax Rates and Tax BandsDocument4 pagesBudget Summary 2015: Income Tax Tax Rates and Tax BandsArehman JamalNo ratings yet

- Tax Reform For Acceleration and Inclusion (TRAIN)Document15 pagesTax Reform For Acceleration and Inclusion (TRAIN)KeleeNo ratings yet

- Train LawDocument25 pagesTrain LawLouem GarceniegoNo ratings yet

- Corporate and Indirect Tax Survey 2009 (KPMG 2009)Document56 pagesCorporate and Indirect Tax Survey 2009 (KPMG 2009)So LokNo ratings yet

- Summary of 2012 13 Tax ProvisionsDocument17 pagesSummary of 2012 13 Tax ProvisionsdwightworleyNo ratings yet

- Union Budget 2010-2011: Symphony of Fiscal Consolidation and Continued GrowthDocument7 pagesUnion Budget 2010-2011: Symphony of Fiscal Consolidation and Continued GrowthChand AnsariNo ratings yet

- Nirc and Train PDFDocument5 pagesNirc and Train PDFCedricNo ratings yet

- Budget 2011 Impact On Auto Sector: Cars and Bike Prices Won't Go UpDocument10 pagesBudget 2011 Impact On Auto Sector: Cars and Bike Prices Won't Go UpLigin MathewNo ratings yet

- 2011 09 Car Company Co2 Report FinalDocument28 pages2011 09 Car Company Co2 Report FinalProvocateur SamaraNo ratings yet

- Budget 2010 SummaryDocument2 pagesBudget 2010 SummaryGopal Singh BhardwajNo ratings yet

- Csos Position Paper On Tax Revenue Measures For FY 2015/16: Presented Before Parliament of UgandaDocument13 pagesCsos Position Paper On Tax Revenue Measures For FY 2015/16: Presented Before Parliament of Ugandaapi-284426542No ratings yet

- Vehicle Tax Design and Car Purchase Choices: A Case Study of IrelandDocument22 pagesVehicle Tax Design and Car Purchase Choices: A Case Study of IrelandcssdfdcNo ratings yet

- TAX RATES 2012/13: Telephone: 01437 765556 WWW - Ashmole.co - UkDocument7 pagesTAX RATES 2012/13: Telephone: 01437 765556 WWW - Ashmole.co - Ukapi-135774334No ratings yet

- Soc Sci IV:: Basic Economics With Agrarian Reform and TaxationDocument56 pagesSoc Sci IV:: Basic Economics With Agrarian Reform and Taxationphoebus ramirezNo ratings yet

- KBC Autolease Tax Brochure Company CarsDocument18 pagesKBC Autolease Tax Brochure Company CarszanjaneNo ratings yet

- Petroleum Pricing in India: Some Facts and FiguresDocument11 pagesPetroleum Pricing in India: Some Facts and FiguresVinayak OletiNo ratings yet

- (2018) New BIR Income Tax Rates andDocument31 pages(2018) New BIR Income Tax Rates andGlenn Cacho Garce100% (1)

- Road RA Case For Increasing Provincial Fuel Taxes (On A Temporary Basis) EportDocument20 pagesRoad RA Case For Increasing Provincial Fuel Taxes (On A Temporary Basis) EportCityNewsTorontoNo ratings yet

- Excise Tax P1 NewDocument2 pagesExcise Tax P1 Newdyulyanapransisko3095No ratings yet

- Tax NotesDocument6 pagesTax NotesRaymond PascoNo ratings yet

- Union Budget FY13Document8 pagesUnion Budget FY13Sriharsha KrishnaprakashNo ratings yet

- Republic Act No. 10963Document6 pagesRepublic Act No. 10963Rochelle GalidoNo ratings yet

- GST Impact On Automobile IndustryDocument65 pagesGST Impact On Automobile IndustryAnshNo ratings yet

- Memorandum Train LawDocument23 pagesMemorandum Train LawKweeng Tayrus FaelnarNo ratings yet

- Budget AnalysisDocument11 pagesBudget AnalysisvenkatpogaruNo ratings yet

- What It Means For: - You As An InvestorDocument1 pageWhat It Means For: - You As An InvestorIna PawarNo ratings yet

- KEY Tax Points From Today'S BudgetDocument6 pagesKEY Tax Points From Today'S Budgetapi-281744226No ratings yet

- Despite This Slowdown in FY 2012, in Cross Country Comparison, India Still Remains Amongst The Highest Grown EconomyDocument8 pagesDespite This Slowdown in FY 2012, in Cross Country Comparison, India Still Remains Amongst The Highest Grown EconomyGurunam Singh DeoNo ratings yet

- Industry Performance in 2014Document13 pagesIndustry Performance in 2014ctansariNo ratings yet

- Income Tax Personal Allowance For Those Born After 5 April 1948 and Basic Rate Limit For 2014-15Document4 pagesIncome Tax Personal Allowance For Those Born After 5 April 1948 and Basic Rate Limit For 2014-15Khurram AxENo ratings yet

- Impact of Goods and Services Tax (GST) To The Common ManDocument19 pagesImpact of Goods and Services Tax (GST) To The Common ManMerlyn CoelhoNo ratings yet

- Personal Income Tax: Reduced TaxesDocument8 pagesPersonal Income Tax: Reduced TaxesAcuxii PamNo ratings yet

- Microeconomics Budget Line GoodsDocument12 pagesMicroeconomics Budget Line GoodsRahul DubeyNo ratings yet

- KEY Tax Points From Today'S BudgetDocument6 pagesKEY Tax Points From Today'S Budgetapi-281744226No ratings yet

- Income Tax: 2013-14 Brief Commentary On Major Proposed Amendments Salary Income TaxationDocument10 pagesIncome Tax: 2013-14 Brief Commentary On Major Proposed Amendments Salary Income TaxationUmar SulemanNo ratings yet

- PWC Retail&Consumer Newsletter - March 19 To 23, 2012Document3 pagesPWC Retail&Consumer Newsletter - March 19 To 23, 2012jbabu123No ratings yet

- Budget 2013Document0 pagesBudget 2013Ern_DabsNo ratings yet

- Train Law - Docx2Document25 pagesTrain Law - Docx2Anonymous fDJvIHB2SY100% (2)

- Train Law: What Does It Change?: Tax Reform For Acceleration and Inclusion (Train) LawDocument8 pagesTrain Law: What Does It Change?: Tax Reform For Acceleration and Inclusion (Train) LawJoan PaynorNo ratings yet

- Assignment 1 - Gao, Gladys, Jennifer, KlarissaDocument3 pagesAssignment 1 - Gao, Gladys, Jennifer, KlarissaGladys TotiNo ratings yet

- Budget 2014Document12 pagesBudget 2014Nicholas AngNo ratings yet

- Year of Ill: A Pre-Budget (2012-2013) ReportDocument5 pagesYear of Ill: A Pre-Budget (2012-2013) ReportparimeshsNo ratings yet

- Chapter 4 enDocument13 pagesChapter 4 enS. M. Hasan ZidnyNo ratings yet

- The Economics of Road Transport - 2010Document4 pagesThe Economics of Road Transport - 2010dpsmafiaNo ratings yet

- Spread Betting ReturnDocument2 pagesSpread Betting ReturnKeyconsulting UKNo ratings yet

- Disclosable Tax Avoidance SchemesDocument1 pageDisclosable Tax Avoidance SchemesKeyconsulting UKNo ratings yet

- Company Car Fuel Benefit ChargeDocument2 pagesCompany Car Fuel Benefit ChargeKeyconsulting UKNo ratings yet

- Application For VAT Annaul AccountingDocument1 pageApplication For VAT Annaul AccountingKeyconsulting UKNo ratings yet

- Chapter 5 (What-If Analysis For Linear Programming) : Mcgraw-Hill/IrwinDocument26 pagesChapter 5 (What-If Analysis For Linear Programming) : Mcgraw-Hill/IrwinSandy LeeNo ratings yet

- Model Practice Set: General IntelligenceDocument5 pagesModel Practice Set: General IntelligenceDebarshi SenguptaNo ratings yet

- Class 7 - Maths - Comparing QuantitiesDocument19 pagesClass 7 - Maths - Comparing Quantitiessa.sharma.1981No ratings yet

- Fundamental Operation of Arithmetic: 1.1 Fraction 1.2 Ratio and Proportion 1.3 PercentageDocument16 pagesFundamental Operation of Arithmetic: 1.1 Fraction 1.2 Ratio and Proportion 1.3 Percentageashit_rasquinhaNo ratings yet

- Examples of Endangered Plants in The PhilippinesDocument4 pagesExamples of Endangered Plants in The PhilippinesRommel Urbano YabisNo ratings yet

- Speed Test - 11 Simple InterestDocument4 pagesSpeed Test - 11 Simple InterestFarhan R. PatelNo ratings yet

- Data InterpretationDocument5 pagesData InterpretationRohitVerma100% (1)

- Gwalior Glory High School: Syllabus To Be Covered in The Month of December (2021 - 22) Class - Vii EnglishDocument4 pagesGwalior Glory High School: Syllabus To Be Covered in The Month of December (2021 - 22) Class - Vii Englishtanya agarwalNo ratings yet

- Quiz Process CostingDocument3 pagesQuiz Process CostingBonnie Kim VillavendeNo ratings yet

- ForMass Board Game Action Research (Abstract) by Gerardo A. LaguadorDocument2 pagesForMass Board Game Action Research (Abstract) by Gerardo A. LaguadorJasmine V. LaguadorNo ratings yet

- ICSE 2014 Pupil Analysis MathematicsDocument26 pagesICSE 2014 Pupil Analysis MathematicsRohit AgarwalNo ratings yet

- ConnorsRSI Pullbacks Guidebook PDFDocument43 pagesConnorsRSI Pullbacks Guidebook PDFemirav2100% (1)

- Applications of The Geometric MeanDocument5 pagesApplications of The Geometric MeanCalvin E. AmosNo ratings yet

- Curriculum Map For MathematicsDocument6 pagesCurriculum Map For MathematicsKofi MawusiNo ratings yet

- QMM 2 6 2017Document87 pagesQMM 2 6 2017Sandeep VijayakumarNo ratings yet

- ST#1 With Tos Q3 GR5 MathDocument3 pagesST#1 With Tos Q3 GR5 MathHarold Jay CisterNo ratings yet

- Bothwell Lesson PlanDocument3 pagesBothwell Lesson Planapi-665708315No ratings yet

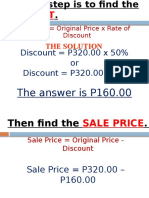

- Discount and Sale Price SolutionDocument14 pagesDiscount and Sale Price SolutionRonnel SingsonNo ratings yet

- Lesson Plan 24Document17 pagesLesson Plan 24Jay BolanoNo ratings yet

- CH 2.1Document32 pagesCH 2.1Smpnsatubontang KaltimNo ratings yet

- RunwiseFX CSA User GuideDocument92 pagesRunwiseFX CSA User Guidepayman zNo ratings yet

- Comparing QuantitiesDocument23 pagesComparing QuantitiesAnanya TiwaryNo ratings yet

- S1T2-Engg. Maths 3 Yr TML Sem 1 Book VersionDocument139 pagesS1T2-Engg. Maths 3 Yr TML Sem 1 Book VersionGopinath ChakrabortyNo ratings yet

- Fractions Decimals Percentages PDFDocument9 pagesFractions Decimals Percentages PDFMOBILE HUBNo ratings yet

- Week Learning Area Learning Objectives Learning Outcomes Remarks 1. Whole NumbersDocument9 pagesWeek Learning Area Learning Objectives Learning Outcomes Remarks 1. Whole NumbersadelymohdNo ratings yet

- X ICSE Maths 01Document130 pagesX ICSE Maths 01rst100% (4)

- Basic Stuff On How Percentages WorkDocument21 pagesBasic Stuff On How Percentages WorkBaberBegNo ratings yet

Company Car Tax Rates

Company Car Tax Rates

Uploaded by

Keyconsulting UKOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Company Car Tax Rates

Company Car Tax Rates

Uploaded by

Keyconsulting UKCopyright:

Available Formats

Company Car Tax Rates

Who is likely to be affected?

Businesses and employers that provide company cars and employees provided with company cars that are made available for private use.

General description of the measure

For 2014-15, the measure increases the appropriate percentage of the list price subject to tax by one percentage point for cars emitting more than 75g of carbon dioxide per kilometre, to a maximum of 35 per cent.

Policy objective

The measure ensures that company car tax continues to reflect changes in fuel efficiency and supports the sustainability of the public finances. In addition, new European standards which come into force in September 2015 will require diesel cars to have the same air quality emissions as petrol cars. The diesel supplement will therefore be removed in April 2016.

Background to the measure

Company Car Tax rates have traditionally been announced around two years in advance, to give certainty to industry. Finance Bill 2012 will legislate 2014-15 company car tax rates.

Detailed proposal

Operative date

This measure will take effect from 6 April 2014.

Current law

Sections 121 to 148 of the Income Tax (Earnings & Pensions) Act 2003 (ITEPA) provide for calculating the cash equivalent of the benefit of a company car which is made available for private use. In broad terms, this depends on the list price of the car multiplied by the level of carbon dioxide emissions the car produces, which is expressed as the appropriate percentage.

Proposed revisions

Legislation will be introduced in Finance Bill 2012 to increase by one percentage point, the level of the appropriate percentage for company cars, to a maximum of 35 percent. This excludes zero emission vehicles and vehicles emitting 75 grams or less carbon dioxide per kilometre, which are subject to special rates in 2014-15. Legislation will be introduced in a later Finance Bill to make the following changes: In both 2015-16 and 2016-17, the appropriate percentages of the list price subject to tax will increase by two percentage points, to a maximum of 37 per cent. From April 2016, the Government will remove the 3 percentage point diesel supplement so that diesel cars will be subject to the same level of tax as petrol cars.

From April 2015, the five year exemption for zero carbon and the lower rate for ultra low carbon emission cars will come to an end as legislated in Finance Bill 2010. The appropriate percentage for zero emission and all low carbon cars emitting less than 95g of carbon dioxide per kilometre will be 13 per cent in 2015-16, and will increase by two percentage points in 2016-17. A full table of rates can be found in the 'Overview of Tax Legislation and Rates' document that is published alongside the Budget.

Summary of impacts

Exchequer impact (m) 2012-13 2013-14 2014-15 2015-16 2016-17 +120 +375 +350 These figures are set out in Table 2.1 of Budget 2012 and have been certified by the Office for Budget Responsibility. More details can be found in the policy costings document published alongside Budget 2012. Increasing Company Car Tax will increase average income tax rates for those who receive this benefit-in-kind. Since those affected are predominantly higher income households the impact on consumption and labour supply is expected to be relatively small. On average this measure will give year on year increases in the tax paid by an employee driving a petrol company car of 70 in 2014-15, 165 in 2015-16 and 165 in 2016-17. An employee driving a diesel company car will see average increases of 85 in 2014-15 and 190 in 2015-16, followed by a reduction of 85 in 2016-17. A basic rate taxpayer driving a typical diesel fuelled car, such as a Ford Focus, with a list price of 18,000 and CO2 emissions of 146g/km will pay around 35 more in 2014-15, 70 more in 2015-16 and 35 less in 2016-17. A higher rate tax payer driving the same company car will pay 70 more in 2014-15, 145 more in 2015-16 and 70 less in 2016-17. A basic rate taxpayer driving a typical petrol fuelled Ford Focus with a list price of 16,300 and CO2 emissions of 159g/km will pay around 30 more in 2014-15, 65 more in 2015-16 and 65 more in 2016-17. A higher rate tax payer driving the same company car will pay 65 more in 2014-15, 130 more in 2015-16 and 165 more in 2016-17. Equalities impacts The changes apply equally to all company car drivers. There are no particular impacts on people with protected characteristics. Over 90 per cent of individuals receiving company cars have incomes above the UK median income for taxpayers, and around 60 per cent are higher or additional rate taxpayers. Impact on business including civil society organisations Operational impact (m) (HMRC) The measure is expected to have no impact on businesses (of all sizes including small firms) or civil society organisations as employer reporting and administration requirements will not change.

Economic impact

Impact on individuals and households

Routine IT and guidance changes required for HM Revenue & Customs.

Other impacts

No other impacts have been identified.

Monitoring and evaluation

The measure will be kept under review through regular communication with affected taxpayer groups.

Further advice

If you have any questions about this change, please contact Su McLean-Tooke on 020 7147 2665 (email: susan.mclean-tooke@hmrc.gsi.gov.uk).

You might also like

- Excel Mathematics Revision Exam Workbook Year 8Document201 pagesExcel Mathematics Revision Exam Workbook Year 8baysidetuition100% (1)

- Brilliant Passing Numerical Reasoning Tests Everything You Need To Know To Understand How To Practise For and Pass Numerical... (Rob Williams) (Z-Library)Document233 pagesBrilliant Passing Numerical Reasoning Tests Everything You Need To Know To Understand How To Practise For and Pass Numerical... (Rob Williams) (Z-Library)SNSD forever TaeyeonNo ratings yet

- GST Impact On Automobile IndustryDocument64 pagesGST Impact On Automobile IndustryJagadish Sahu100% (2)

- Beer Duty Return by Keyconsulting UKDocument2 pagesBeer Duty Return by Keyconsulting UKKeyconsulting UKNo ratings yet

- Application For VAT Registration UKDocument4 pagesApplication For VAT Registration UKKeyconsulting UKNo ratings yet

- Manual Thinkorswim Eng UsaDocument65 pagesManual Thinkorswim Eng UsaFernando Colomer100% (2)

- Company Car Fuel Benefit ChargeDocument2 pagesCompany Car Fuel Benefit ChargeKeyconsulting UKNo ratings yet

- What To Know Re Vat Reform Law (Ra 9337)Document5 pagesWhat To Know Re Vat Reform Law (Ra 9337)Jamie ArquiroNo ratings yet

- Fuel Duty Rates: Who Is Likely To Be Affected?Document5 pagesFuel Duty Rates: Who Is Likely To Be Affected?Nicklas Pluto TskaroziaNo ratings yet

- Key Features of BUDGET 2010-11: Presented To, Prof .BhaodasDocument27 pagesKey Features of BUDGET 2010-11: Presented To, Prof .Bhaodasbhavu_ashNo ratings yet

- Train Law: Legislative StatusDocument3 pagesTrain Law: Legislative Statustyrone corpuzNo ratings yet

- Auto 20120227 Mosl Su PG012Document12 pagesAuto 20120227 Mosl Su PG012Vince GaruNo ratings yet

- The Tax Reform For Acceleration and InclusionDocument3 pagesThe Tax Reform For Acceleration and InclusionbeckNo ratings yet

- Current AfiarsDocument7 pagesCurrent AfiarsDr.V.Bastin JeromeNo ratings yet

- Additional Information About TAXATIONDocument4 pagesAdditional Information About TAXATIONjudeNo ratings yet

- UNION BUDGET 2013-14: Tax Revenue and Insurance SectorDocument7 pagesUNION BUDGET 2013-14: Tax Revenue and Insurance SectorPulkit NehruNo ratings yet

- Train TaxDocument11 pagesTrain TaxLucela InocNo ratings yet

- Nirc and TrainDocument5 pagesNirc and TrainJasmine Marie Ng CheongNo ratings yet

- A Critical Review of The Tax Structure of BangladeshDocument4 pagesA Critical Review of The Tax Structure of BangladeshSumaiya IslamNo ratings yet

- Rs4,895Bn (9% Yoy Higher), With TotalDocument3 pagesRs4,895Bn (9% Yoy Higher), With TotalAsad MuhammadNo ratings yet

- Budget Summary 2015: Income Tax Tax Rates and Tax BandsDocument4 pagesBudget Summary 2015: Income Tax Tax Rates and Tax BandsArehman JamalNo ratings yet

- Tax Reform For Acceleration and Inclusion (TRAIN)Document15 pagesTax Reform For Acceleration and Inclusion (TRAIN)KeleeNo ratings yet

- Train LawDocument25 pagesTrain LawLouem GarceniegoNo ratings yet

- Corporate and Indirect Tax Survey 2009 (KPMG 2009)Document56 pagesCorporate and Indirect Tax Survey 2009 (KPMG 2009)So LokNo ratings yet

- Summary of 2012 13 Tax ProvisionsDocument17 pagesSummary of 2012 13 Tax ProvisionsdwightworleyNo ratings yet

- Union Budget 2010-2011: Symphony of Fiscal Consolidation and Continued GrowthDocument7 pagesUnion Budget 2010-2011: Symphony of Fiscal Consolidation and Continued GrowthChand AnsariNo ratings yet

- Nirc and Train PDFDocument5 pagesNirc and Train PDFCedricNo ratings yet

- Budget 2011 Impact On Auto Sector: Cars and Bike Prices Won't Go UpDocument10 pagesBudget 2011 Impact On Auto Sector: Cars and Bike Prices Won't Go UpLigin MathewNo ratings yet

- 2011 09 Car Company Co2 Report FinalDocument28 pages2011 09 Car Company Co2 Report FinalProvocateur SamaraNo ratings yet

- Budget 2010 SummaryDocument2 pagesBudget 2010 SummaryGopal Singh BhardwajNo ratings yet

- Csos Position Paper On Tax Revenue Measures For FY 2015/16: Presented Before Parliament of UgandaDocument13 pagesCsos Position Paper On Tax Revenue Measures For FY 2015/16: Presented Before Parliament of Ugandaapi-284426542No ratings yet

- Vehicle Tax Design and Car Purchase Choices: A Case Study of IrelandDocument22 pagesVehicle Tax Design and Car Purchase Choices: A Case Study of IrelandcssdfdcNo ratings yet

- TAX RATES 2012/13: Telephone: 01437 765556 WWW - Ashmole.co - UkDocument7 pagesTAX RATES 2012/13: Telephone: 01437 765556 WWW - Ashmole.co - Ukapi-135774334No ratings yet

- Soc Sci IV:: Basic Economics With Agrarian Reform and TaxationDocument56 pagesSoc Sci IV:: Basic Economics With Agrarian Reform and Taxationphoebus ramirezNo ratings yet

- KBC Autolease Tax Brochure Company CarsDocument18 pagesKBC Autolease Tax Brochure Company CarszanjaneNo ratings yet

- Petroleum Pricing in India: Some Facts and FiguresDocument11 pagesPetroleum Pricing in India: Some Facts and FiguresVinayak OletiNo ratings yet

- (2018) New BIR Income Tax Rates andDocument31 pages(2018) New BIR Income Tax Rates andGlenn Cacho Garce100% (1)

- Road RA Case For Increasing Provincial Fuel Taxes (On A Temporary Basis) EportDocument20 pagesRoad RA Case For Increasing Provincial Fuel Taxes (On A Temporary Basis) EportCityNewsTorontoNo ratings yet

- Excise Tax P1 NewDocument2 pagesExcise Tax P1 Newdyulyanapransisko3095No ratings yet

- Tax NotesDocument6 pagesTax NotesRaymond PascoNo ratings yet

- Union Budget FY13Document8 pagesUnion Budget FY13Sriharsha KrishnaprakashNo ratings yet

- Republic Act No. 10963Document6 pagesRepublic Act No. 10963Rochelle GalidoNo ratings yet

- GST Impact On Automobile IndustryDocument65 pagesGST Impact On Automobile IndustryAnshNo ratings yet

- Memorandum Train LawDocument23 pagesMemorandum Train LawKweeng Tayrus FaelnarNo ratings yet

- Budget AnalysisDocument11 pagesBudget AnalysisvenkatpogaruNo ratings yet

- What It Means For: - You As An InvestorDocument1 pageWhat It Means For: - You As An InvestorIna PawarNo ratings yet

- KEY Tax Points From Today'S BudgetDocument6 pagesKEY Tax Points From Today'S Budgetapi-281744226No ratings yet

- Despite This Slowdown in FY 2012, in Cross Country Comparison, India Still Remains Amongst The Highest Grown EconomyDocument8 pagesDespite This Slowdown in FY 2012, in Cross Country Comparison, India Still Remains Amongst The Highest Grown EconomyGurunam Singh DeoNo ratings yet

- Industry Performance in 2014Document13 pagesIndustry Performance in 2014ctansariNo ratings yet

- Income Tax Personal Allowance For Those Born After 5 April 1948 and Basic Rate Limit For 2014-15Document4 pagesIncome Tax Personal Allowance For Those Born After 5 April 1948 and Basic Rate Limit For 2014-15Khurram AxENo ratings yet

- Impact of Goods and Services Tax (GST) To The Common ManDocument19 pagesImpact of Goods and Services Tax (GST) To The Common ManMerlyn CoelhoNo ratings yet

- Personal Income Tax: Reduced TaxesDocument8 pagesPersonal Income Tax: Reduced TaxesAcuxii PamNo ratings yet

- Microeconomics Budget Line GoodsDocument12 pagesMicroeconomics Budget Line GoodsRahul DubeyNo ratings yet

- KEY Tax Points From Today'S BudgetDocument6 pagesKEY Tax Points From Today'S Budgetapi-281744226No ratings yet

- Income Tax: 2013-14 Brief Commentary On Major Proposed Amendments Salary Income TaxationDocument10 pagesIncome Tax: 2013-14 Brief Commentary On Major Proposed Amendments Salary Income TaxationUmar SulemanNo ratings yet

- PWC Retail&Consumer Newsletter - March 19 To 23, 2012Document3 pagesPWC Retail&Consumer Newsletter - March 19 To 23, 2012jbabu123No ratings yet

- Budget 2013Document0 pagesBudget 2013Ern_DabsNo ratings yet

- Train Law - Docx2Document25 pagesTrain Law - Docx2Anonymous fDJvIHB2SY100% (2)

- Train Law: What Does It Change?: Tax Reform For Acceleration and Inclusion (Train) LawDocument8 pagesTrain Law: What Does It Change?: Tax Reform For Acceleration and Inclusion (Train) LawJoan PaynorNo ratings yet

- Assignment 1 - Gao, Gladys, Jennifer, KlarissaDocument3 pagesAssignment 1 - Gao, Gladys, Jennifer, KlarissaGladys TotiNo ratings yet

- Budget 2014Document12 pagesBudget 2014Nicholas AngNo ratings yet

- Year of Ill: A Pre-Budget (2012-2013) ReportDocument5 pagesYear of Ill: A Pre-Budget (2012-2013) ReportparimeshsNo ratings yet

- Chapter 4 enDocument13 pagesChapter 4 enS. M. Hasan ZidnyNo ratings yet

- The Economics of Road Transport - 2010Document4 pagesThe Economics of Road Transport - 2010dpsmafiaNo ratings yet

- Spread Betting ReturnDocument2 pagesSpread Betting ReturnKeyconsulting UKNo ratings yet

- Disclosable Tax Avoidance SchemesDocument1 pageDisclosable Tax Avoidance SchemesKeyconsulting UKNo ratings yet

- Company Car Fuel Benefit ChargeDocument2 pagesCompany Car Fuel Benefit ChargeKeyconsulting UKNo ratings yet

- Application For VAT Annaul AccountingDocument1 pageApplication For VAT Annaul AccountingKeyconsulting UKNo ratings yet

- Chapter 5 (What-If Analysis For Linear Programming) : Mcgraw-Hill/IrwinDocument26 pagesChapter 5 (What-If Analysis For Linear Programming) : Mcgraw-Hill/IrwinSandy LeeNo ratings yet

- Model Practice Set: General IntelligenceDocument5 pagesModel Practice Set: General IntelligenceDebarshi SenguptaNo ratings yet

- Class 7 - Maths - Comparing QuantitiesDocument19 pagesClass 7 - Maths - Comparing Quantitiessa.sharma.1981No ratings yet

- Fundamental Operation of Arithmetic: 1.1 Fraction 1.2 Ratio and Proportion 1.3 PercentageDocument16 pagesFundamental Operation of Arithmetic: 1.1 Fraction 1.2 Ratio and Proportion 1.3 Percentageashit_rasquinhaNo ratings yet

- Examples of Endangered Plants in The PhilippinesDocument4 pagesExamples of Endangered Plants in The PhilippinesRommel Urbano YabisNo ratings yet

- Speed Test - 11 Simple InterestDocument4 pagesSpeed Test - 11 Simple InterestFarhan R. PatelNo ratings yet

- Data InterpretationDocument5 pagesData InterpretationRohitVerma100% (1)

- Gwalior Glory High School: Syllabus To Be Covered in The Month of December (2021 - 22) Class - Vii EnglishDocument4 pagesGwalior Glory High School: Syllabus To Be Covered in The Month of December (2021 - 22) Class - Vii Englishtanya agarwalNo ratings yet

- Quiz Process CostingDocument3 pagesQuiz Process CostingBonnie Kim VillavendeNo ratings yet

- ForMass Board Game Action Research (Abstract) by Gerardo A. LaguadorDocument2 pagesForMass Board Game Action Research (Abstract) by Gerardo A. LaguadorJasmine V. LaguadorNo ratings yet

- ICSE 2014 Pupil Analysis MathematicsDocument26 pagesICSE 2014 Pupil Analysis MathematicsRohit AgarwalNo ratings yet

- ConnorsRSI Pullbacks Guidebook PDFDocument43 pagesConnorsRSI Pullbacks Guidebook PDFemirav2100% (1)

- Applications of The Geometric MeanDocument5 pagesApplications of The Geometric MeanCalvin E. AmosNo ratings yet

- Curriculum Map For MathematicsDocument6 pagesCurriculum Map For MathematicsKofi MawusiNo ratings yet

- QMM 2 6 2017Document87 pagesQMM 2 6 2017Sandeep VijayakumarNo ratings yet

- ST#1 With Tos Q3 GR5 MathDocument3 pagesST#1 With Tos Q3 GR5 MathHarold Jay CisterNo ratings yet

- Bothwell Lesson PlanDocument3 pagesBothwell Lesson Planapi-665708315No ratings yet

- Discount and Sale Price SolutionDocument14 pagesDiscount and Sale Price SolutionRonnel SingsonNo ratings yet

- Lesson Plan 24Document17 pagesLesson Plan 24Jay BolanoNo ratings yet

- CH 2.1Document32 pagesCH 2.1Smpnsatubontang KaltimNo ratings yet

- RunwiseFX CSA User GuideDocument92 pagesRunwiseFX CSA User Guidepayman zNo ratings yet

- Comparing QuantitiesDocument23 pagesComparing QuantitiesAnanya TiwaryNo ratings yet

- S1T2-Engg. Maths 3 Yr TML Sem 1 Book VersionDocument139 pagesS1T2-Engg. Maths 3 Yr TML Sem 1 Book VersionGopinath ChakrabortyNo ratings yet

- Fractions Decimals Percentages PDFDocument9 pagesFractions Decimals Percentages PDFMOBILE HUBNo ratings yet

- Week Learning Area Learning Objectives Learning Outcomes Remarks 1. Whole NumbersDocument9 pagesWeek Learning Area Learning Objectives Learning Outcomes Remarks 1. Whole NumbersadelymohdNo ratings yet

- X ICSE Maths 01Document130 pagesX ICSE Maths 01rst100% (4)

- Basic Stuff On How Percentages WorkDocument21 pagesBasic Stuff On How Percentages WorkBaberBegNo ratings yet