Professional Documents

Culture Documents

U.S. Employment Tracker

U.S. Employment Tracker

Uploaded by

Cassidy TurleyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

U.S. Employment Tracker

U.S. Employment Tracker

Uploaded by

Cassidy TurleyCopyright:

Available Formats

U.S.

EMPLOYMENT TRACKER

December 2013

CASSIDY TURLEY RESEARCH

BLS Employment Report

November 2013

Job Growth Solid

A Jolly Good Week For The U.S. Economy

The economic data felt pretty good this week. On Monday, we learned that factory production as measured by the ISM manufacturing index continued to accelerate in November, a sixth consecutive monthly gain. On Tuesday and Wednesday, newly released gures showed demand for big-ticket items remains very healthy: vehicle sales surged to a seasonally adjusted annualized rate of 16.4 million units the highest rate in seven years and new home sales rose 25% in October from September. The good news continued. Thursday we discovered that most of us had underestimated economic growth. Real GDP expanded by 3.6% in the third quarter of 2013, revised upward from the earlier reading of 2.8%. However, the higher gure was due primarily to faster inventory accumulation, which doesnt bode well for Q4 GDP growth. That said, it is worth pointing out that businesses dont typically build up their inventories unless they see healthy demand for their products in the pipeline. Finally, all of this surprisingly (mostly) good news was capped off by a November jobs report that further conrms that businesses remain in solid growth mode. So lets drill down into the employment numbers and discern what the latest trends mean for commercial real estate fundamentals. The U.S. economy added 203,000 net new total nonfarm jobs in November, according to the Bureau of Labor Statistics (BLS). The gures for September and October were revised upward, adding 8,000 more jobs to the employment base in those two months than originally reported. The 3-month moving average which helps cut through the monthly data vagaries reveals that the U.S. economy is creating an average of 192,000 jobs per month, a solid acceleration from the 166,000 averaged over the summer. The unemployment rate, which comes from a different survey than the employment gures, fell from 7.3% to 7.0%. The ADP November employment report, released a day earlier than the ofcial government gures, conrmed a similarly strong trend. The ADP survey showed that private sector employment increased by 215,000 jobs from October to November. Small businesses (with 1-49 employees) led the way, adding 102,000 nonfarm payrolls in November. Large businesses (500+) added 65,000 and medium-sized businesses (50-499) added 48,000 jobs. The impact from implementation of the Affordable Care Act and the fear that businesses would slow hiring (or increase temp hiring) to avoid paying for health insurance has not shown up in the data, at least not yet. Overall, the latest employment trends indicate that the commercial real estate fundamentals will continue to tighten. Ofce-using employment rose by 31,000 in November; the manufacturing sector added 27,000 jobs, the retail sector added 22,000 jobs, and the construction sector added 17,000 jobs. Assuming the statistical relationship between employment and vacancy holds true, the latest job trends suggest that vacancy will decline by 10-20 bps across the major CRE segments from 2013Q3 to 2013Q4. Looking ahead. The improving economic data has rekindled the debate about whether the rst QE tapering that is, when the Fed will start to taper its assets purchase program -- will occur sooner rather than later. Certainly, that is how the equity markets see it at least as of this writing: the DJIA was down 1.6% for the rst week of December. Though the odds are increasing that the Fed may take action sooner, our baseline scenario assumes the central bank will wait until the March 18-19 FOMC meeting before reducing its monthly bond purchases. After all, Fed members will likely want to see a little more clarity with respect to scal policy from the Congress and the White House on future federal budgets and the debt ceiling status before they start tinkering with monetary policy. Policy issues aside, many things went right for the commercial real estate recovery in 2013: occupancy grew in all U.S. CRE sectors; there was robust demand for space in industrial and multifamily; property values climbed at a healthy clip in most metros. Yes, plenty of headwinds remain rising interest rates sit rmly at the top of our list of concerns. But the latest economic data gives us greater condence that the trend of tightening fundamentals will continue for the foreseeable future.

cassidyturley.com | 1

203,000

Change in total nonfarm employment

31,000 27,000 22,000

Ofce-using Manufacturing Retail

Job Impact on Q4 Vacancy

Actual Forecast *Corr Ofce Industrial Multi-family Retail

.80 .78 .74 .84

Q3

15.2% 8.4% 4.2% 10.5%

Q4

15.1% 8.2% 4.1% 10.4%

*Correlation between jobs & vacancy

Source: Cassidy Turley Research

Ofce-using Employment

Nearly back to pre-recession levels

29500 29000 28500 28000 27500 27000 Oct 2003 Jan 2009 Oct 2010 May 2012 Oct 2013 Apr 2007 Jul 2005

Office-using, ths, SA

Source: BLS

U.S. EMPLOYMENT TRACKER

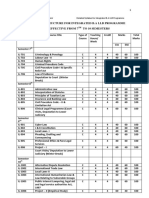

Employment Situation by Metro:

Total Nonfarm* (000s)

Atlanta, GA Austin, TX Baltimore, MD Boston, MA Charlotte, NC Chicago, IL Cincinnati, OH Columbus, OH Dallas, TX Dayton, OH Denver, CO Detroit, MI Edison, NJ Fort Lauderdale, FL Houston, TX Indianapolis, IN Kansas City, MO Las Vegas, NV Los Angeles, CA Louisville, KY Miami, FL Milwaukee, WI Minneapolis, MN Nashville, TN New York, NY Newark, NJ Oakland, CA Philadelphia, PA Phoenix, AZ Pittsburgh, PA Portland, OR Raleigh, NC Sacramento, CA San Diego, CA San Francisco, CA San Jose, CA Seattle, WA St. Louis, MO Tampa, FL Washington DC Metro West Palm Beach, FL 66.7 23.3 21.6 55.4 23.6 56.6 8.0 13.5 72.2 -1.4 35.8 -5.3 12.3 20.8 84.3 13.2 7.8 18.8 55.7 14.7 5.3 4.0 39.5 26.7 81.7 13.0 6.6 18.0 35.4 18.7 19.2 8.3 5.2 20.1 22.6 25.1 39.6 10.9 42.2 30.0 11.0

CASSIDY TURLEY RESEARCH

Ofce-Using* (000s)

24.9 9.0 9.5 16.8 7.9 31.8 4.2 4.1 39.1 0.6 13.3 2.3 1.5 3.2 16.5 1.5 5.0 2.3 22.6 2.6 3.6 -0.5 5.5 10.2 6.7 1.4 -2.1 5.8 11.2 9.5 5.7 3.9 -0.7 2.7 10.2 13.2 7.1 1.4 12.3 4.0 2.8

Industrial Sector* (000s)

5.1 1.6 0.0 -0.5 4.1 6.9 2.7 3.8 0.8 -0.9 2.1 2.1 1.6 2.1 16.8 -0.7 1.0 -0.3 -4.7 2.3 1.3 -1.3 -0.4 6.5 2.3 3.7 -1.0 -2.3 4.9 0.9 4.8 2.8 1.9 -1.9 1.2 2.4 3.3 3.3 1.3 0.1 -0.9

Unemployment Oct 2013

7.7% 5.3% 6.9% 6.5% 8.0% 9.1% 7.2% 7.2% 6.0% 7.7% 6.5% 10.3% 7.8% 5.4% 6.0% 6.9% 6.3% 9.4% 9.7% 8.0% 8.0% 7.1% 4.5% 6.7% 8.4% 8.3% 7.1% 7.9% 7.0% 6.8% 6.9% 6.3% 8.4% 7.1% 5.3% 6.7% 5.7% 7.1% 6.6% 5.8% 6.7%

% Chg

2.8% 2.8% 1.6% 2.2% 2.8% 1.5% 0.8% 1.4% 3.4% -0.4% 2.9% -0.7% 1.2% 2.8% 3.1% 1.4% 0.8% 2.3% 1.4% 2.4% 0.5% 0.5% 2.2% 3.4% 1.5% 1.3% 0.7% 0.9% 2.0% 1.6% 1.9% 1.6% 0.6% 1.6% 2.2% 2.7% 2.7% 0.8% 3.6% 2.1% 2.1%

% Chg

3.8% 4.6% 3.2% 2.5% 3.3% 3.2% 1.8% 1.7% 6.2% 0.8% 3.7% 1.4% 0.6% 1.6% 2.8% 0.7% 1.9% 1.4% 2.3% 2.1% 1.6% -0.2% 1.2% 5.5% 0.4% 0.5% -0.9% 1.2% 2.4% 3.6% 2.5% 2.8% -0.4% 0.9% 2.9% 4.9% 1.9% 0.5% 3.9% 0.1% 2.0%

% Chg

1.2% 1.5% 0.0% -0.2% 2.7% 1.0% 1.3% 2.6% 0.2% -1.3% 1.2% 1.4% 1.0% 2.3% 3.2% -0.4% 0.6% -0.4% -0.6% 1.6% 0.7% -0.7% -0.1% 3.8% 0.6% 1.3% -0.6% -0.9% 1.9% 0.4% 2.2% 3.4% 2.7% -1.2% 1.3% 1.0% 1.3% 1.5% 0.8% 0.1% -0.9%

*Employment change, Aug - Oct 2012 over Aug - Oct 2013

Source: BLS

U.S. Research

Kevin Thorpe, Chief Economist Jennifer Edwards, Project Manager Tel: 202.463.2100

2 | Cassidy Turley

U.S. EMPLOYMENT TRACKER

Employment Indicators

By Company Size

U.S. Nonfarm Private Sector Job Growth, 000s

CASSIDY TURLEY RESEARCH

U.S. Jobs Lost/Gained

Recession vs. Recovery, 000s

Professional and business services Leisure and hospitality Retail trade Manufacturing Transportation and utilities Construction

120 100 80 60 40 20 0

Small (1-490

Medium (50-499)

Large (500+)

Financial activities Information

Sept-13

Oct-13

Nov-13

-2500

-1250 Jobs Lost

1250 Jobs Regained

2500

Source: ADP National Employment Report

Source: BLS

Unemployment vs. Ofce Vacancy

Job Openings

Total Nonfarm, (SA Millions)

11.0% 10.0% 9.0% 8.0% 7.0%

Q3 09 Q3 10 Q3 11 Q3 12 Q3 13

18% 17% 16% 15%

4 3.5 3 2.5 2 1.5

Dec 2000 Sep 2002 Dec 2007 Mar 2006 Sep 2009 Aug 2011 Sep 2013

Sep 2013

Jun 2004

Unemployment Rate

Source: Cassidy Turley Research; BLS

Office Vacancy Rate

Source: BLS

Job Openings

Jobless Claims

U.S. Nonfarm Private Sector Job Growth, 000s

Quit Rate

Condence Growing to Seek New Employment

Dec 2000

Sep 2002

Dec 2007

Mar 2006

Sep 2009

2.7

May 13 Aug 13 Nov 12 Nov 13 Feb 13

Initial Claims (ths.)

Continuing Claims (mil)

Source: BLS

Quit Rate, Total Nonfarm (SA, %)

Source: Employment and Training Administration

cassidyturley.com | 3

U.S. Research Kevin Thorpe, Chief Economist Jennifer Edwards, Manager Tel: 202.463.2100

Aug 2011

Jun 2004

390 380 370 360 350 340 330 320 310 300 290

3.3 3.2 3.1 3 2.9 2.8

2.6 2.4 2.2 2 1.8 1.6 1.4 1.2

You might also like

- Strategic ManagementDocument22 pagesStrategic ManagementAhmad Azhar Aman ShahNo ratings yet

- Entrep. Business PlanDocument8 pagesEntrep. Business PlanJames Temena50% (2)

- Siño, Ferl Diane S. BSA31: Guide QuestionsDocument5 pagesSiño, Ferl Diane S. BSA31: Guide QuestionsFerl Diane SiñoNo ratings yet

- CDMDocument13 pagesCDMHoward100% (1)

- Employment Tracker April 2012Document2 pagesEmployment Tracker April 2012Anonymous Feglbx5No ratings yet

- WF Weekly Econ 04-10-131Document9 pagesWF Weekly Econ 04-10-131BlackHat InvestmentsNo ratings yet

- MFM Jul 8 2011Document14 pagesMFM Jul 8 2011timurrsNo ratings yet

- Employment Tracker February 2012Document2 pagesEmployment Tracker February 2012Anonymous Feglbx5No ratings yet

- America's Lost DecadeDocument10 pagesAmerica's Lost DecadeFrode HaukenesNo ratings yet

- Employment Tracker Nov 2012Document2 pagesEmployment Tracker Nov 2012Anonymous Feglbx5No ratings yet

- Employment Tracker December 2011Document2 pagesEmployment Tracker December 2011William HarrisNo ratings yet

- Senate Hearing, 108TH Congress - The Employment Situation: February 2004Document53 pagesSenate Hearing, 108TH Congress - The Employment Situation: February 2004Scribd Government DocsNo ratings yet

- Cassidy Turley - U.S. EMPLOYMENT TRACKER February 2014Document3 pagesCassidy Turley - U.S. EMPLOYMENT TRACKER February 2014Cassidy TurleyNo ratings yet

- U.S. Weekly Financial Notes: October Surprise: Economic ResearchDocument14 pagesU.S. Weekly Financial Notes: October Surprise: Economic Researchapi-227433089No ratings yet

- Gittleman GreatResignationperspective 2022Document10 pagesGittleman GreatResignationperspective 2022Domenico LeoneNo ratings yet

- Running Head: Assignment 1: Descriptive Statistics 1Document5 pagesRunning Head: Assignment 1: Descriptive Statistics 1Premium GeeksNo ratings yet

- AGC's Simonson: Sector Could See 300K New Jobs Next YearDocument3 pagesAGC's Simonson: Sector Could See 300K New Jobs Next YearMike KarlinsNo ratings yet

- Labour Market Overview, UK November 2023Document33 pagesLabour Market Overview, UK November 2023AmrNo ratings yet

- The Capital Area Council of Governments: Employment Update - JanuaryDocument3 pagesThe Capital Area Council of Governments: Employment Update - JanuaryJohn ReesNo ratings yet

- Commercial Real Estate Outlook 2012 11Document8 pagesCommercial Real Estate Outlook 2012 11National Association of REALTORS®No ratings yet

- Weekly Economic Commentary 9/10/2012Document4 pagesWeekly Economic Commentary 9/10/2012monarchadvisorygroupNo ratings yet

- Er 20130620 Bull Acci Q 22013Document5 pagesEr 20130620 Bull Acci Q 22013David SmithNo ratings yet

- Weekly Economic Update - 6!6!14Document2 pagesWeekly Economic Update - 6!6!14Anonymous Feglbx5No ratings yet

- Commercial Real Estate Outlook: 2016 Q3Document17 pagesCommercial Real Estate Outlook: 2016 Q3National Association of REALTORS®100% (4)

- U.S. Added 273,000 Jobs in February Before Coronavirus Spread Widely - The New York TimesDocument3 pagesU.S. Added 273,000 Jobs in February Before Coronavirus Spread Widely - The New York TimesJustBNo ratings yet

- Utah Trendlines: Sep-Oct 2011Document28 pagesUtah Trendlines: Sep-Oct 2011State of UtahNo ratings yet

- ConstructionDocument9 pagesConstructionjoycechicagoNo ratings yet

- News Release: Markit Flash U.S. Manufacturing PMIDocument4 pagesNews Release: Markit Flash U.S. Manufacturing PMIDavid TaggartNo ratings yet

- ANZ Job Ads Mar-13Document16 pagesANZ Job Ads Mar-13Belinda WinkelmanNo ratings yet

- Productivity in The Services SectorDocument26 pagesProductivity in The Services Sectorsumedh11septNo ratings yet

- Weekly Economic Commentary 11/112013Document5 pagesWeekly Economic Commentary 11/112013monarchadvisorygroupNo ratings yet

- DC Economic and Revenue Trends Report - September 2014Document20 pagesDC Economic and Revenue Trends Report - September 2014Susie CambriaNo ratings yet

- ANZ Job Ads Dec12Document16 pagesANZ Job Ads Dec12ftforfree2436No ratings yet

- September 27, 2013: Survey Last Actual Comerica Economics Commentary Fed Funds Rate (Effective)Document3 pagesSeptember 27, 2013: Survey Last Actual Comerica Economics Commentary Fed Funds Rate (Effective)belger5No ratings yet

- Bounce PDFDocument3 pagesBounce PDFAnonymous Feglbx5No ratings yet

- Point of View: Labour Force: Top 200: Movers and ShakersDocument4 pagesPoint of View: Labour Force: Top 200: Movers and ShakersLong LuongNo ratings yet

- Pantheon Macroeconomics U.S. Economic Monitor, 2 April 2014.Document4 pagesPantheon Macroeconomics U.S. Economic Monitor, 2 April 2014.Pantheon MacroeconomicsNo ratings yet

- Economics Assignment Part A: Date AuthorDocument12 pagesEconomics Assignment Part A: Date AuthorjenadenebNo ratings yet

- Young Voters Want JobsDocument3 pagesYoung Voters Want Jobsapi-288608374No ratings yet

- Challenger ReleaseDocument12 pagesChallenger ReleaseLoren SteffyNo ratings yet

- Weekly Economic Update - 6!16!14Document2 pagesWeekly Economic Update - 6!16!14Anonymous Feglbx5No ratings yet

- Economics PracticeDocument2 pagesEconomics Practicebenjamin.bond123No ratings yet

- The Macro Bulletin: Stuck in Part-Time EmploymentDocument3 pagesThe Macro Bulletin: Stuck in Part-Time EmploymentTBP_Think_TankNo ratings yet

- Sacramento's Labor Market & Regional Economy: Mid-Year UpdateDocument4 pagesSacramento's Labor Market & Regional Economy: Mid-Year UpdateKevin SmithNo ratings yet

- 2016 q2 Commercial Real Estate Outlook 05-18-2016Document17 pages2016 q2 Commercial Real Estate Outlook 05-18-2016National Association of REALTORS®No ratings yet

- Revenue Status Report FY 2011-2012 - General Fund 20111231Document19 pagesRevenue Status Report FY 2011-2012 - General Fund 20111231Infosys GriffinNo ratings yet

- 1 10 UpdateDocument3 pages1 10 Updatenatdogg1No ratings yet

- Morning Review - 081210Document10 pagesMorning Review - 081210pdoorNo ratings yet

- Industrial Forecast2015 17 PDFDocument20 pagesIndustrial Forecast2015 17 PDFKepo DehNo ratings yet

- Economic Insight Report-25 Sept 15Document2 pagesEconomic Insight Report-25 Sept 15Anonymous hPUlIF6No ratings yet

- Debt Be Not ProudDocument11 pagesDebt Be Not Proudsilver999No ratings yet

- Weekly Economic Commentary 4-13-12Document8 pagesWeekly Economic Commentary 4-13-12monarchadvisorygroupNo ratings yet

- Weekly Economic Commentary 11-3-11Document7 pagesWeekly Economic Commentary 11-3-11monarchadvisorygroupNo ratings yet

- Eekly Conomic Pdate: Doug Potash PresentsDocument3 pagesEekly Conomic Pdate: Doug Potash PresentsDoug PotashNo ratings yet

- Good News Is Bad News Once Again As Stronger Employment Growth Spooks MarketsDocument12 pagesGood News Is Bad News Once Again As Stronger Employment Growth Spooks Marketsjjy1234No ratings yet

- Employment Statistics-AustraliaDocument10 pagesEmployment Statistics-Australia202220012No ratings yet

- U.S. Regional Economic Overview: A More Balanced RecoveryDocument6 pagesU.S. Regional Economic Overview: A More Balanced RecoveryAnonymous Feglbx5No ratings yet

- Saturday 3Document2 pagesSaturday 3Samen MeasNo ratings yet

- Dashboard - US Manufacturing Spring 2013Document7 pagesDashboard - US Manufacturing Spring 2013gpierre7833No ratings yet

- Wage PDFDocument3 pagesWage PDFAnonymous Feglbx5No ratings yet

- Data Points Newsletter 2012 July FinalDocument2 pagesData Points Newsletter 2012 July FinalJOHNALEXANDERREESNo ratings yet

- Employment ReportDocument5 pagesEmployment ReportPutryna Abah Eddy SoegitoNo ratings yet

- Paul Craig Roberts: Economy US ViewpointsDocument3 pagesPaul Craig Roberts: Economy US Viewpointskwintencirkel3715No ratings yet

- Cassidy Turley - U.S. EMPLOYMENT TRACKER February 2014Document3 pagesCassidy Turley - U.S. EMPLOYMENT TRACKER February 2014Cassidy TurleyNo ratings yet

- Single Tenant Net Lease Investment OverviewDocument30 pagesSingle Tenant Net Lease Investment OverviewCassidy TurleyNo ratings yet

- Fiscal Cliff ReportDocument39 pagesFiscal Cliff ReportCassidy TurleyNo ratings yet

- 2013 2Q Industrial SnapshotDocument2 pages2013 2Q Industrial SnapshotCassidy TurleyNo ratings yet

- Whats Hot in Commercial Real Estate in 2013Document37 pagesWhats Hot in Commercial Real Estate in 2013Cassidy TurleyNo ratings yet

- Grievance & DisciplineDocument11 pagesGrievance & DisciplinekashishNo ratings yet

- From Seventh To Ten SemesterDocument55 pagesFrom Seventh To Ten SemesterTaashifNo ratings yet

- Literature Review On Agricultural Development in NigeriaDocument9 pagesLiterature Review On Agricultural Development in Nigeriac5rk24grNo ratings yet

- Corporate & Business Law: Mock Exam 3:: A. One Week B. Two Weeks C. One MonthDocument15 pagesCorporate & Business Law: Mock Exam 3:: A. One Week B. Two Weeks C. One MonthFyutfi100% (1)

- Andonnino Report Peoples Europe 1985Document32 pagesAndonnino Report Peoples Europe 1985chris68197No ratings yet

- Ethical Issues in Information Technology (IT)Document24 pagesEthical Issues in Information Technology (IT)mohammed BiratuNo ratings yet

- Tax 2011Document42 pagesTax 2011murabitomNo ratings yet

- 03 Corporate Culture With ScriptDocument36 pages03 Corporate Culture With ScriptJakhongir ShirinovNo ratings yet

- PagesDocument108 pagesPagesBilhan ReddyNo ratings yet

- ISO37001Document8 pagesISO37001Abu HanifNo ratings yet

- The Complete Guide To Winning Business Finance Interviews V1 PDFDocument58 pagesThe Complete Guide To Winning Business Finance Interviews V1 PDFTanmaya DashNo ratings yet

- Case Study Hrm2Document17 pagesCase Study Hrm2Xiao Yun YapNo ratings yet

- Firesoft 2023 It Salary GuideDocument18 pagesFiresoft 2023 It Salary GuideTimNo ratings yet

- RECRUITMENT & SELECTION PRACTICES AT Indian Oil (IOCL)Document61 pagesRECRUITMENT & SELECTION PRACTICES AT Indian Oil (IOCL)nandratul100% (3)

- Medical Benefits PolicyDocument6 pagesMedical Benefits PolicyBushra IftikharNo ratings yet

- Circular 10 2012Document67 pagesCircular 10 2012oatsej4014No ratings yet

- Business, Trade and CommerceDocument25 pagesBusiness, Trade and CommerceAnand KumarNo ratings yet

- A Tale of Two Auto PlantsDocument471 pagesA Tale of Two Auto PlantssonirocksNo ratings yet

- City of Columbia Salaries and Overtime Pay 2010Document73 pagesCity of Columbia Salaries and Overtime Pay 2010SZepelinNo ratings yet

- CASE: Distributor Sales Force Performance ManagementDocument3 pagesCASE: Distributor Sales Force Performance ManagementArjun NandaNo ratings yet

- Indg 163Document8 pagesIndg 163api-60715666No ratings yet

- Human Resource Accounting: Meaning, Definition, Objectives and Limitations! MeaningDocument5 pagesHuman Resource Accounting: Meaning, Definition, Objectives and Limitations! MeaningJahanvi BansalNo ratings yet

- Job Descriptions ManualDocument36 pagesJob Descriptions ManualProf. Lakshman Madurasinghe100% (87)

- Ilp PresentationDocument13 pagesIlp PresentationSreekumar ThottapillilNo ratings yet

- The Role of The Marine Industry in China's National Economy - An Input-Output AnalysisDocument8 pagesThe Role of The Marine Industry in China's National Economy - An Input-Output AnalysisAyuni ChoirunnisaNo ratings yet

- EthicsDocument15 pagesEthicsFunwayo ShabaNo ratings yet