Professional Documents

Culture Documents

State Board of Equalization Proposed Fy-2015 Revenue Certification

State Board of Equalization Proposed Fy-2015 Revenue Certification

Uploaded by

FortySix NewsOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

State Board of Equalization Proposed Fy-2015 Revenue Certification

State Board of Equalization Proposed Fy-2015 Revenue Certification

Uploaded by

FortySix NewsCopyright:

Available Formats

STATE BOARD OF EQUALIZATION

PROPOSED FY-2015 REVENUE CERTIFICATION

19-Dec-2013

Shelly Paulk

Deputy Budget Director for Revenue

Office of Management and Enterprise Services

TABLE OF CONTENTS

Schedule 1

FY-2015 Funds to be Certified ...........................................................................................................3

Schedule 2

Itemized Estimates of Revenue ..........................................................................................................4

Schedule 3

Itemized Estimates of "Other" Revenues - General Revenue Fund ...................................................6

Schedule 4

FY-2014 Estimate (18-June-2013) vs. Proposed FY-2015 Estimate (20-Dec-2013) ..........................7

Schedule 5

FY-2014 Projection (20-Dec-2013) vs. Proposed FY-2015 Estimate (20-Dec-2013) .........................8

Schedule 6

FY-2014 Estimate (18-June-2013) vs. FY-2014 Projection (20-Dec-2013) ........................................9

Schedule 7

Education Reform Act HB 1017..................................................................................................... 10

Schedule 8

Legislated Revenue Adjustments: Informational ROADS Fund Apportionment Summary ............... 11

Appendix A-1

Comparison of Authorized Expenditures 2013 Session to Proposed Expenditure Authority 2014

Session ............................................................................................................................................ 12

Office of Management and Enterprise Services

19 December 2013

Schedule 1

FY-2014 Funds to be Certified

The summation of the itemized estimates of revenue, Schedule 2, and the amounts available for

appropriation are proposed as the amounts to be certified by the State Board of Equalization in

accordance with Section 23, Article X, Constitution of Oklahoma. The amounts proposed as

available for appropriation are calculated as 95 percent (95%) of the summation of the itemized

estimate of revenue for the respective funds.

Column 1

Column 2

TOTAL ESTIMATED

COLLECTIONS

Column 3

APPROPRIATIONS

AUTHORITY

Proposed Fy-20xx Estimates

GENERAL REVENUE

$5,867,409,575

$5,574,039,096

C.L.E.E.T.

$3,326,774

$3,160,435

COMMISSIONERS OF THE LAND OFFICE

$9,516,000

$9,040,200

MINERAL LEASING

$4,000,000

$3,800,000

SPECIAL OCCUPATIONAL HEALTH & SAFETY

$2,662,588

$2,529,459

PUBLIC BUILDING

$2,362,000

$2,243,900

$60,277,000

$57,263,150

$5,949,553,937

$5,652,076,240

OK EDUCATION LOTTERY TRUST FUND

TOTALS

Office of Management and Enterprise Services

19 December 2013

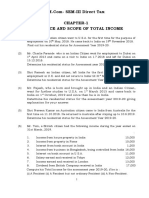

Schedule 2

Itemized Estimates of Revenue

The itemized estimate of revenues displayed in this schedule represents 100% of the estimate for the

General Revenue Fund and the Special Revenue Funds to be appropriated by the Legislature for the

fiscal year ending June 30, 2015 (FY-2015) and are the basis for the summation proposed for

certification in Schedule 1. For informational purposes the FY-2015 estimates of revenues are

compared to both the itemized estimates and the projections of revenues for the current fiscal year

(FY-2014).

Column 1

FUND NAME

Column 2

FY-2013

ACTUAL

Column 3

FY-2014

ESTIMATE

24-June-13

Column 4

Column 5

FY2014

PROJECTED

19-Dec-13

PROPOSED

FY-2014

ESTIMATE

19-Dec-13

GENERAL REVENUE

Alcohol Beverage Tax

Mixed Beverage Receipts Tax

Beverage Tax

Cigarette Tax

Tobacco Products Tax

Franchise Tax/Business Activity Tax

Gross Production Tax-Gas

Gross Production Tax-Oil

Income Tax-Individual

Income Tax-Corporate

Estate Tax

Insurance Premium tax

Motor Vehicle Taxes

Sales Tax

Use Tax

Interest & Investments

Other (Schedule 3)

$23,815,475

43,669,087

24,438,075

36,663,041

22,156,911

43,073,463

50,400,053

171,210,904

2,056,767,492

451,639,824

873,332

104,365,194

192,592,699

1,900,847,138

186,590,009

70,175,148

224,783,021

$25,593,000

49,929,000

25,625,000

39,894,446

24,783,927

44,218,000

150,996,000

120,549,000

* 2,103,434,551 *

481,870,200

0

78,875,660

214,920,480

2,030,782,388

204,490,830

86,000,000

206,378,234

General Revenue Totals

Transfers & Lapses

$5,556,249,734

8,282,053

$5,888,340,716

1,000,000

$5,753,885,353

1,000,000

$5,866,409,575

1,000,000

Revenue Comparison

One-Time Receipts

$5,604,069,438

0

$5,889,340,716

0

$5,754,885,353

0

$5,867,409,575

0

Total General Revenue

C.L.E.E.T.

$5,604,069,438

$3,305,996

$5,889,340,716

$3,327,261

$5,754,885,353

$3,336,740

$5,867,409,575

$3,326,774

COMM of LAND OFFICE

$24,675,000

46,237,000

25,501,000

33,945,123

24,724,860

36,169,000

130,775,000

187,143,000

2,122,698,364 *

375,560,350

0

93,869,924

224,652,000

1,954,866,180

194,064,663

68,000,000

211,003,889

$25,275,000

49,991,000

25,422,000

34,807,417

25,816,464

35,165,000

145,355,000

147,466,000

2,126,273,813

420,838,950

0

93,869,924

208,187,000

2,033,853,383

209,499,905

73,000,000

211,588,721

$16,282,958

$15,855,000

$9,636,000

$9,516,000

MINERAL LEASING

$4,581,932

$3,500,000

$4,000,000

$4,000,000

SPECIAL OCCUPATIONAL HEALTH &

SAFETY

$3,311,156

$3,713,067

$3,311,160

$2,662,588

PUBLIC BUILDING

$3,576,702

$2,140,100

$2,274,800

$2,362,000

$70,113,527

$58,848,300

$64,547,000

$60,277,000

$5,705,241,709

$5,976,724,443

$5,841,991,052

$5,949,553,937

OK EDUCATION LOTTERY TRUST FUND

GRAND TOTAL

*In compliance with Section 34.87 of Title 62 of the Oklahoma Statutes, the State Regents for Higher

Education has adopted an estimate of $61m for funding of the Oklahoma's Promise scholarship fund

for FY-2015; $57m of which is requested from the General Revenue Fund (Personal Income Tax

collections). The amount of money allocated from income tax revenue for FY-2014 was $57m, and

$57m was funded for FY-2013. These amounts have been removed from the respective individual

income tax numbers. The Board voted to add back revenue from HB2032 which was declared

unconstitutional by the Supreme Court on Tuesday, 12/17/13. Appropriate amounts have been

added back to the FY-2014 projection and the FY-2015 estimate for individual income tax.

Office of Management and Enterprise Services

19 December 2013

Office of Management and Enterprise Services

19 December 2013

Schedule 3

Itemized Estimates of "Other" Revenues - General Revenue Fund

Column 1

Column 2

Column 3

FY-2013

ACTUAL

OTC:

Pari-Mutuel

Tribal Cigarette Compacts

FY-2014

ESTIMATE

24-Jun-13

1,183,821

13,610,106

Bingo Excise & Charity Games

Workers Comp Ins. Premium Tax

1,207,500

13,798,000

Column 4

Column 5

FY2014

PROJECTED

19-Dec-13

PROPOSED

FY-2015

ESTIMATE

19-Dec-13

1,007,500

13,798,000

1,007,500

13,798,000

164,017

158,000

157,000

158,000

9,932,736

9,907,000

10,557,000

11,028,000

11,119,000

Petroleum Excise Tax

10,270,426

9,898,000

11,261,000

Other OTC

24,591,361

27,110,000

25,171,000

27,160,000

$59,752,468

$62,078,500

$61,951,500

$64,270,500

ABLE

5,667,895

5,625,040

5,699,403

5,722,000

Attorney General

5,051,531

2,485,016

5,655,775

2,962,500

OMES - Central Services

405,394

145,200

291,678

315,973

CLEET

Consumer Credit

524,918

795,136

529,434

820,000

539,733

800,000

565,611

800,000

TOTAL OTC

COLLECTIONS BY OTHER AGENCIES

DPS

46,848,845

49,625,194

46,966,133

47,549,488

OMES - Employees Benefit Council

910,502

1,231,338

697,883

697,883

Horseracing

561,888

409,225

409,225

409,225

47,396,006

32,112,136

38,695,553

38,695,554

964,625

367,838

987,475

230,000

983,748

239,095

983,748

200,000

Insurance Comm

Labor

Medical Licensure

Nursing Board

313,180

320,641

320,641

320,716

2,639,318

2,394,000

2,732,000

2,732,000

Securities Comm

15,047,040

15,066,234

15,879,362

15,879,362

Treasurer (Unclaimed Property)

10,000,000

10,000,000

10,000,000

10,000,000

Tribal Gaming/HR Gaming

OMES - OPM

17,825,027

3,001,157

16,854,000

5,264,802

16,974,000

2,168,161

17,316,000

2,168,161

Sec of State

OMES - OSF

66,047

200,000

6,644,207

TOTAL MISC

165,030,553

144,299,734

149,052,389

147,318,221

GRAND OTHER

$224,783,021

$206,378,234

$211,003,889

$211,588,721

Other

Office of Management and Enterprise Services

19 December 2013

Schedule 4

COMPARISON OF REVENUE ESTIMATES

FY-2014 Final Estimate vs. Proposed FY-2015 Estimate

Column 1

GENERAL REVENUE

Alcohol Beverage Tax

Mixed Beverage Receipts Tax

Column 2

Column 3

Column 4

Column 5

FY-2014

ESTIMATE

24-Jun-13

PROPOSED

FY-2015

ESTIMATE

19-Dec-13

INCREASE

OR

(DECREASE)

PERCENT

CHANGE

$25,593,000

49,929,000

$25,275,000

49,991,000

Beverage Tax

25,625,000

25,422,000

(203,000)

-0.8%

Cigarette Tax

39,894,446

34,807,417

(5,087,029)

-12.8%

Tobacco Products Tax

24,783,927

25,816,464

1,032,536

4.2%

44,218,000

150,996,000

35,165,000

145,355,000

(9,053,000)

(5,641,000)

-20.5%

-3.7%

22.3%

Franchise Tax

Gross Production Tax-Gas

Gross Production Tax-Oil

($318,000)

62,000

-1.2%

0.1%

120,549,000

147,466,000

26,917,000

Income Tax-Individual

2,103,434,551

2,126,273,813

22,839,262

1.1%

Income Tax-Corporate

481,870,200

420,838,950

(61,031,250)

-12.7%

Estate Tax

0.0%

78,875,660

214,920,480

93,869,924

208,187,000

14,994,264

(6,733,480)

19.0%

-3.1%

2,030,782,388

2,033,853,383

3,070,995

0.2%

204,490,830

209,499,905

5,009,075

2.4%

86,000,000

73,000,000

(13,000,000)

-15.1%

206,378,234

211,588,721

5,210,486

2.5%

General Revenue Totals

Transfers & Lapses

$5,888,340,716

1,000,000

$5,866,409,575

1,000,000

($21,931,141)

0

-0.4%

0.0%

Revenue Comparison

$5,889,340,716

$5,867,409,575

($21,931,141)

-0.4%

One-Time Receipts

Total General Revenue

0

$5,889,340,716

0

$5,867,409,575

0

($21,931,141)

0.0%

-0.4%

$3,327,261

$3,326,774

($487)

0.0%

Insurance Premium tax

Motor Vehicle Taxes

Sales Tax

Use Tax

Interest & Investments

Other (Schedule 3)

C.L.E.E.T.

COMM of LAND OFFICE

$15,855,000

$9,516,000

($6,339,000)

-40.0%

MINERAL LEASING

$3,500,000

$4,000,000

$500,000

14.3%

SPECIAL OCCUPATIONAL HEALTH &

SAFETY

$3,713,067

$2,662,588

($1,050,478)

-28.3%

PUBLIC BUILDING

$2,140,100

$2,362,000

$221,900

10.4%

$58,848,300

$60,277,000

$1,428,700

2.4%

$5,976,724,443

$5,949,553,937

($27,170,507)

-0.5%

OK EDUCATION LOTTERY TRUST FUND

GRAND TOTAL

Office of Management and Enterprise Services

19 December 2013

Schedule 5

COMPARISON OF REVENUE ESTIMATES

FY-2014 Projection vs. Proposed FY-2015 Estimate

Column 1

Column 2

Column 3

Column 4

Column 5

FY-2014

PROJECTED

19-DEC-13

PROPOSED

FY-2015

ESTIMATE

19-Dec-13

INCREASE

OR

(DECREASE)

PERCENT

CHANGE

GENERAL REVENUE

Alcohol Beverage Tax

Mixed Beverage Receipts Tax

$24,675,000

46,237,000

$25,275,000

49,991,000

$600,000

3,754,000

2.4%

8.1%

Beverage Tax

25,501,000

25,422,000

(79,000)

-0.3%

Cigarette Tax

33,945,123

34,807,417

862,294

2.5%

Tobacco Products Tax

24,724,860

25,816,464

1,091,604

4.4%

36,169,000

130,775,000

35,165,000

145,355,000

(1,004,000)

14,580,000

-2.8%

11.1%

-21.2%

Franchise Tax/Business Activity Tax

Gross Production Tax-Gas

Gross Production Tax-Oil

187,143,000

147,466,000

(39,677,000)

Income Tax-Individual

2,122,698,364

2,126,273,813

3,575,449

0.2%

Income Tax-Corporate

375,560,350

420,838,950

45,278,600

12.1%

Estate Tax

0.0%

93,869,924

224,652,000

93,869,924

208,187,000

0

(16,465,000)

0.0%

-7.3%

1,954,866,180

2,033,853,383

78,987,203

4.0%

194,064,663

209,499,905

15,435,242

8.0%

68,000,000

73,000,000

5,000,000

7.4%

211,003,889

211,588,721

584,831

0.3%

General Revenue Totals

Transfers & Lapses

$5,753,885,353

1,000,000

$5,866,409,575

1,000,000

$112,524,222

0

2.0%

0.0%

Revenue Comparison

$5,754,885,353

$5,867,409,575

$112,524,222

2.0%

0.0%

$5,754,885,353

$5,867,409,575

$112,524,222

2.0%

C.L.E.E.T.

$3,336,740

$3,326,774

($9,966)

-0.3%

COMM of LAND OFFICE

$9,636,000

$9,516,000

($120,000)

-1.2%

MINERAL LEASING

$4,000,000

$4,000,000

$0

0.0%

SPECIAL OCCUPATIONAL HEALTH &

SAFETY

$3,311,160

$2,662,588

($648,572)

-19.6%

PUBLIC BUILDING

$2,274,800

$2,362,000

$87,200

3.8%

$64,547,000

$60,277,000

($4,270,000)

-6.6%

$5,841,991,052

$5,949,553,937

$107,562,884

1.8%

Insurance Premium tax

Motor Vehicle Taxes

Sales Tax

Use Tax

Interest & Investments

Other (Schedule 3)

One-Time Receipts

Total General Revenue

OK EDUCATION LOTTERY TRUST FUND

GRAND TOTAL

Office of Management and Enterprise Services

19 December 2013

Schedule 6

COMPARISON OF REVENUE ESTIMATES

FY-2014 Official Estimate vs. FY-2014 Projection

Column 1

GENERAL REVENUE

Alcohol Beverage Tax

Mixed Beverage Receipts Tax

Column 2

Column 3

Column 4

Column 5

FY-2014

PROJECTED

24-JUN-13

PROPOSED

FY-2014

ESTIMATE

19-Dec-13

INCREASE

OR

(DECREASE)

PERCENT

CHANGE

$25,593,000

49,929,000

$24,675,000

46,237,000

Beverage Tax

25,625,000

25,501,000

(124,000)

-0.5%

Cigarette Tax

39,894,446

33,945,123

(5,949,323)

-14.9%

Tobacco Products Tax

24,783,927

24,724,860

(59,067)

-0.2%

44,218,000

150,996,000

36,169,000

130,775,000

(8,049,000)

(20,221,000)

-18.2%

-13.4%

55.2%

Franchise Tax/Business Activity Tax

Gross Production Tax-Gas

Gross Production Tax-Oil

($918,000)

(3,692,000)

-3.6%

-7.4%

120,549,000

187,143,000

66,594,000

Income Tax-Individual

2,103,434,551

2,122,698,364

19,263,813

0.9%

Income Tax-Corporate

481,870,200

375,560,350

(106,309,850)

-22.1%

Estate Tax

0.0%

78,875,660

214,920,480

93,869,924

224,652,000

14,994,264

9,731,520

19.0%

4.5%

2,030,782,388

1,954,866,180

(75,916,208)

-3.7%

204,490,830

194,064,663

(10,426,167)

-5.1%

86,000,000

68,000,000

(18,000,000)

-20.9%

206,378,234

211,003,889

4,625,655

2.2%

General Revenue Totals

Transfers & Lapses

$5,888,340,716

1,000,000

$5,753,885,353

1,000,000

($134,455,363)

0

-2.3%

0.0%

Revenue Comparison

$5,889,340,716

$5,754,885,353

($134,455,363)

-2.3%

0.0%

$5,889,340,716

$5,754,885,353

($134,455,363)

-2.3%

$3,327,261

$3,336,740

$9,479

0.3%

$15,855,000

$9,636,000

($6,219,000)

-39.2%

MINERAL LEASING

$3,500,000

$4,000,000

$500,000

14.3%

SPECIAL OCCUPATIONAL HEALTH &

SAFETY

$3,713,067

$3,311,160

($401,907)

-10.8%

PUBLIC BUILDING

$2,140,100

$2,274,800

$134,700

6.3%

$58,848,300

$64,547,000

$5,698,700

9.7%

$5,976,724,443

$5,841,991,052

($134,733,391)

-2.3%

Insurance Premium tax

Motor Vehicle Taxes

Sales Tax

Use Tax

Interest & Investments

Other (Schedule 3)

One-Time Receipts

Total General Revenue

C.L.E.E.T.

COMM of LAND OFFICE

OK EDUCATION LOTTERY TRUST FUND

GRAND TOTAL

Office of Management and Enterprise Services

19 December 2013

Schedule 7

Education Reform Act HB 1017

SB 826 of the Second Regular Session of the Forty-fifth Legislature amended Section 41.29a of Title

62 to require that The Office of Accountability account for and report monthly revenues which

accrue to the Education Reform Revolving Fund. The Education Reform Revolving Fund on June 1,

1996 began receiving revenue attributable to the revenue provisions of HB 1017 rather than these

revenues first being apportioned to the General Revenue Fund.

EDUCATION REFORM ACT

Column 1

Column 2

Column 3

FY-2013

ACTUAL

FY-2014

ESTIMATE

24-Jun-13

Income Tax - Individual

Income Tax - Corporate

235,242,084

96,155,575

$245,111,349

102,591,720

$242,001,196

79,958,010

$247,328,288

89,597,970

Sales Tax

237,807,948

254,060,325

244,562,854

254,444,521

23,343,278

25,582,754

24,278,392

26,209,413

3,016,330

3,165,092

2,924,123

2,949,771

455,824

504,231

514,188

542,733

130,593,701

220

123,596,000

0

124,476,000

0

126,984,000

0

694,095

580,242

473,746

457,145

$727,309,055

$755,191,714

$719,188,510

$748,513,840

SOURCE

Use Tax

Cigarette Tax

Tobacco Products Tax

Tribal Gaming/Horse Track

Special License Plates

Business Activity Tax

TOTAL 100% OF ESTIMATE

Increase in FY-20xx proposed estimate over FY-20xx estimate

Office of Management and Enterprise Services

10

Column 4

Column 5

FY-2014

PROJECTED

19-Dec-13

PROPOSED

FY-2015

ESTIMATE

19-Dec-13

($6,677,873)

19 December 2013

Schedule 8

Legislated Revenue Adjustments: Informational ROADS Fund

Apportionment Summary

Column 1

Column 2

Column 3

Column 4

Column 5

Legislated Adjustments for FY-2010 and FY-2011:

House Bill 2272, passed in the 2008 Legislative Session, amends Title 69, Section 1521 of the Oklahoma Highway

Code. Effective July 1, 2009 for FY-2010, the Transportation Department will receive the total amount apportioned to

the ROADS fund for the preceding fiscal year plus an additional $30 million each year until a cap of $370 million is

reached.

Legislated Apportionment Comparison:

FY-2009

ESTIMATE

19-Feb-08

FY-2010

ESTIMATE

22-Dec-08

FY-2011

ESTIMATE

22-Dec-09

$137,500,000

$155,000,000

$185,000,000

17,500,000

30,000,000

30,000,000

OK Tourism & Passenger Rail Rev. Fund

2,000,000

2,000,000

2,000,000

Public transit Rev. Fund

3,000,000

3,000,000

3,000,000

$160,000,000

$190,000,000

$220,000,000

Apportionment to ROADS Fund

Additional ROADS Fund

Total Apportionment from Individual. Income Tax

Legislated Adjustments for FY-2012, FY-2013, FY-2014 and FY-2015:

Senate Bill 1466, passed in the 2010 Legislative Session, amends Title 69, Section 1521 of the

Oklahoma Highway Code. Effective July 1, 2011 for FY-2012 and for each fiscal year thereafter, the

Transportation Department will receive the total amount apportioned to the ROADS fund for the

preceding fiscal year plus an additional $35.7 million each year until a cap of $400 million is reached.

Senate Bill 976, passed in the 2011 Legislative Session, amends Title 69, Section 1521 of the

Oklahoma Highway Code. Effective August 26, 2011 for FY-2013, the Transportation Department will

receive the total amount apportioned to the ROADS FUND for the preceding fiscal year plus an

additional $41.7 million each year until a cap of $435 million is reached. House Bill 2248, effective

July 1, 2012, amends the same title and section. For FY-2014 and all fiscal years until the cap is

reached, the Transportation Department will receive the total amount apportioned to the ROADS

Fund for the preceding fiscal year plus an additional $59.7 million. The cap was raised to $575

million.

Apportionment to ROADS Fund

Additional ROADS Fund

OK Tourism & Passenger Rail Rev. Fund

Public Transit Rev. Fund

Total Apportionment from Individual

Income Tax

Office of Management and Enterprise Services

11

FY-2012

ESTIMATE

21-Dec-10

$215,000,000

35,700,000

2,000,000

3,000,000

Proposed

FY-2013

ESTIMATE

20-Dec-11

$250,700,000

41,700,000

2,000,000

3,000,000

Proposed

FY-2014

ESTIMATE

20-Dec-12

$292,400,000

59,700,000

2,000,000

3,000,000

$255,700,000

$297,400,000

$357,100,000

19 December 2013

Appendix A-1

Comparison of Authorized Expenditures 2013 Session to

Proposed Expenditure Authority 2014 Session

Column 1

Column 2

Column 3

Column 4

Authorized

Expenditures*

2013 Session

24-Jun-13

FY-2014

Proposed

Expenditure

Authority**

2014 Session

19-Dec-13

FY-2015

Column 5

Increase or

(Decrease)

Percent

Change

Non-Restricted Funds

General Revenue Fund

Certified

5,592,023,679

$5,574,039,096

($17,984,583)

-0.3%

16,067,152

2,850,000

(13,217,152)

-82.3%

108,670,391

132,541,781

23,871,390

22.0%

5,716,761,222

$5,709,430,877

($7,330,345)

-0.1%

3,160,898

$3,160,435

($463)

0.0%

144,570

3,545

(141,025)

-97.5%

3,305,468

$3,163,980

($141,488)

-4.3%

3,325,000

1,756,422

$3,800,000

1,032,258

$475,000

(724,164)

14.3%

-41.2%

5,081,422

$4,832,258

($249,164)

-4.9%

Certified

1,767,873

$2,529,459

$761,586

43.1%

Cash

1,543,287

492,809

(1,050,478)

-68.1%

3,311,160

$3,022,268

($288,892)

-8.7%

Certified

2,033,095

$2,243,900

$210,805

10.4%

Cash

5,720,066

1,940,154

(3,779,912)

-66.1%

7,753,161

$4,184,054

($3,569,107)

-46.0%

126,343,946

$521

($126,343,425)

-100.0%

126,343,946

$521

($126,343,425)

-100.0%

Bond Series- A

$0

$0

0.0%

Bond Series - B

0.0%

$0

$0

0.0%

$5,862,556,379

$5,724,633,958

($137,922,421)

-2.4%

Prior Year Certified

Cash

TOTAL

C.L.E.E.T. Fund

Certified

Cash

TOTAL

Mineral Leasing Fund

Certified

Cash

TOTAL

OHSA Fund

TOTAL

Public Building Fund

TOTAL

Special Cash Fund

Cash

TOTAL

Subtotal Non-Restricted Funds

Office of Management and Enterprise Services

12

19 December 2013

Appendix A-1 (continued)

Comparison of Authorized Expenditures 2013

Session to Proposed Expenditure Authority 2014 Session

Column 1

Column 2

Column 3

Authorized

Expenditures*

2013 Session

24-Jun-13

FY-2014

Proposed

Expenditure

Authority**

2014 Session

19-Dec-13

FY-2015

Column 4

Column 5

Increase or

(Decrease)

Percent

Change

Restricted Funds

Commission of the Land Office Fund

Certified

15,062,250

$9,040,200

($6,022,050)

-40.0%

Prior Year Certified

0.0%

Cash

0.0%

15,062,250

$9,040,200

($6,022,050)

-40.0%

Certified

55,905,885

$57,263,150

$1,357,265

2.4%

Cash

12,432,930

12,617,292

184,362

1.5%

68,338,815

$69,880,442

$1,541,627

2.3%

83,401,065

$78,920,642

($4,480,423)

-5.4%

$5,945,957,444

$5,803,554,600

($142,402,844)

-2.4%

$47,372,299

$47,372,299

($0)

0.0%

$47,372,299

$47,372,299

($0)

0.0%

$47,372,299

$47,372,299

($0)

0.0%

$767,691,714

$748,513,840

($19,177,874)

-2.5%

$21,375,000

$14,250,000

($7,125,000)

-33.3%

$43,000,000

$43,000,000

$0

0.0%

$208,707,119

$206,610,439

($2,096,680)

-1.0%

$7,128,848,174

$6,958,045,775

($170,802,399)

-2.4%

TOTAL

OK Education Lottery Trust Fund

TOTAL

Subtotal Restricted Funds

Total-Restricted & Non-Restricted

Common Ed. Tech Fund

Revolving Fund Estimate

OK Student Aid Fund

Revolving Fund Estimate

Higher Ed. Capital Fund

Revolving Fund Estimate

1017 Fund

Revolving Fund Estimate

Tobacco Settlement Fund

Revolving Fund Estimate

State Judicial Revolving Fund

Revolving Fund Estimate

State Transportation Fund

Revolving Fund Estimate

Total

*Authorized Expenditures represent the total amount actually spent by the Legislature.

**Expenditure Authority represents the total amount that is available for the Legislature to spend.

Office of Management and Enterprise Services

13

19 December 2013

You might also like

- Review For Exam I - SOLUTIONDocument11 pagesReview For Exam I - SOLUTIONcmrweber13100% (4)

- IGCSE Economics Self Assessment Chapter 28 AnswersDocument3 pagesIGCSE Economics Self Assessment Chapter 28 AnswersDesre100% (1)

- 12 568bk PDFDocument60 pages12 568bk PDFAReliableSourceNo ratings yet

- 2013 Manitoba Budget SummaryDocument44 pages2013 Manitoba Budget SummarytessavanderhartNo ratings yet

- LAPD-Gen-G01 - Taxation in South Africa - External GuideDocument91 pagesLAPD-Gen-G01 - Taxation in South Africa - External GuideUrvashi KhedooNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- PTC India Limited: Registered Office:2nd Floor, NBCC Tower, 15 Bhikaji Cama Place New Delhi - 110 066 (CINDocument3 pagesPTC India Limited: Registered Office:2nd Floor, NBCC Tower, 15 Bhikaji Cama Place New Delhi - 110 066 (CINDeepak GuptaNo ratings yet

- Treasury Inspector General For Tax AdministrationDocument21 pagesTreasury Inspector General For Tax AdministrationBecket AdamsNo ratings yet

- Flora Executive Summary 2013Document3 pagesFlora Executive Summary 2013Drei GoNo ratings yet

- 2017 PBB AsDocument29 pages2017 PBB AsDonkuro PuovarrNo ratings yet

- Macrohon Executive Summary 2013Document7 pagesMacrohon Executive Summary 2013rominadulfo4bNo ratings yet

- Mfmu December 14Document17 pagesMfmu December 140302038No ratings yet

- November 2014 OMB ReportDocument4 pagesNovember 2014 OMB ReportRob PortNo ratings yet

- Tax Stats 2019 FullDocument316 pagesTax Stats 2019 FullBusinessTechNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Stly - 10q12013.htm - Generated by SEC Publisher For SEC FilingDocument22 pagesStly - 10q12013.htm - Generated by SEC Publisher For SEC Filingjcf129erNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- 1H15 PPT - VFDocument29 pages1H15 PPT - VFClaudio Andrés De LucaNo ratings yet

- Cymax Stores Inc Audit Year Ending 31 December 2015Document20 pagesCymax Stores Inc Audit Year Ending 31 December 2015Sean CraigNo ratings yet

- Katzie First Nation - Financial Statements 2013Document32 pagesKatzie First Nation - Financial Statements 2013Monisha Caroline MartinsNo ratings yet

- Revised Financial Results & Limited Review For Sept 30, 2015 (Standalone) (Result)Document7 pagesRevised Financial Results & Limited Review For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- FY2014 Analysis of Revenue and ExpenditureDocument28 pagesFY2014 Analysis of Revenue and ExpenditureAzman JantanNo ratings yet

- 1392-Annual Fiscal ReportDocument39 pages1392-Annual Fiscal ReportMacro Fiscal PerformanceNo ratings yet

- Public Accounts 2013-14 ManitobaDocument240 pagesPublic Accounts 2013-14 ManitobaAnishinabe100% (1)

- Annual Report FY2020Document424 pagesAnnual Report FY2020SAGAR KASERANo ratings yet

- Second Quarter Fiscal Update and Economic Statement: November 2012Document16 pagesSecond Quarter Fiscal Update and Economic Statement: November 2012pkGlobalNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Update JulDocument4 pagesUpdate Jultom_scheckNo ratings yet

- 2014 Reference Form - Version 2Document123 pages2014 Reference Form - Version 2BVMF_RINo ratings yet

- Quickstart 2013-14Document29 pagesQuickstart 2013-14Rick KarlinNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document6 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- MNG Comm. Report 2020-21 (Ann-C)Document18 pagesMNG Comm. Report 2020-21 (Ann-C)shabishahNo ratings yet

- Financial Results, Limited Review Report, Results Press Release For December 31, 2015 (Result)Document8 pagesFinancial Results, Limited Review Report, Results Press Release For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Analysis Model of Financial Investment and Budget ExecutionDocument9 pagesAnalysis Model of Financial Investment and Budget Executionrodica_limbutuNo ratings yet

- Easycred 2013 IFRS FS - Final For IssueDocument56 pagesEasycred 2013 IFRS FS - Final For IssuerefreshgNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- 2Q15 PresentationDocument16 pages2Q15 PresentationMultiplan RINo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- 2015 Spring Reports of The Auditor General of CanadaDocument27 pages2015 Spring Reports of The Auditor General of CanadaJoe RaymentNo ratings yet

- Abia State 2023 Q2 Budget Performance ReportDocument47 pagesAbia State 2023 Q2 Budget Performance ReportAYOBAMI OJUAWONo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Aip 2014 FinalDocument85 pagesAip 2014 Finalbash bashNo ratings yet

- State of Citys Finances2014Document57 pagesState of Citys Finances2014alykatzNo ratings yet

- Puerto Rico Tax Expenditure Report 2017 Version Final Septiembre 2019Document208 pagesPuerto Rico Tax Expenditure Report 2017 Version Final Septiembre 2019Rubén E. Morales RiveraNo ratings yet

- 2022 Tax Expenditure Report FinalDocument43 pages2022 Tax Expenditure Report FinalKirimi StanleyNo ratings yet

- Key Energy Services, Inc.: United States Securities and Exchange Commission Form 10-QDocument61 pagesKey Energy Services, Inc.: United States Securities and Exchange Commission Form 10-QAlok PatelNo ratings yet

- Kisoro District Local Government Report of The Auditor General2017Document21 pagesKisoro District Local Government Report of The Auditor General2017Alex NkurunzizaNo ratings yet

- Ipsas 22-Disclosure of Financial Information About The General Government SectorDocument26 pagesIpsas 22-Disclosure of Financial Information About The General Government Sectorriska putri utamiNo ratings yet

- Philequity 2014Document41 pagesPhilequity 2014Lilian AndersonNo ratings yet

- Illinois Comprehensive Annual Financial Report FY 2013Document351 pagesIllinois Comprehensive Annual Financial Report FY 2013Reboot IllinoisNo ratings yet

- Balancing Fiscal Consolidation With Growth: Uncertainty Over GAARDocument42 pagesBalancing Fiscal Consolidation With Growth: Uncertainty Over GAARChinmay ShirsatNo ratings yet

- FY 2016 17 National Budget Framework Paper NBFPDocument435 pagesFY 2016 17 National Budget Framework Paper NBFPThe Independent MagazineNo ratings yet

- Financial Results For December 31, 2015 (Result)Document3 pagesFinancial Results For December 31, 2015 (Result)Shyam SunderNo ratings yet

- QCOM Alignment PlanDocument17 pagesQCOM Alignment Planmtan88No ratings yet

- Resa 31.12.2019 FT PDFDocument82 pagesResa 31.12.2019 FT PDFArnnava SharmaNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- Securities Brokerage Revenues World Summary: Market Values & Financials by CountryFrom EverandSecurities Brokerage Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Sales Financing Revenues World Summary: Market Values & Financials by CountryFrom EverandSales Financing Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- CIR vs. BPI PDFDocument7 pagesCIR vs. BPI PDFColeen ReyesNo ratings yet

- 156 PMK.010 2015per TranslateDocument7 pages156 PMK.010 2015per TranslateHenryNo ratings yet

- 11 Handout 1Document4 pages11 Handout 1Jeffer Jay GubalaneNo ratings yet

- New TDS & TCS Provisions - SummaryDocument12 pagesNew TDS & TCS Provisions - Summaryyashgoyal87502No ratings yet

- Negotiable Commercial Paper: Not Guaranteed ProgrammeDocument21 pagesNegotiable Commercial Paper: Not Guaranteed ProgrammeDavid CartellaNo ratings yet

- Train LawDocument5 pagesTrain LawKyrell MaeNo ratings yet

- Decision of Any High Court Binding On All Subordinate Authorities and Tribunals Through Out India Untill Contrary View Is Taken by Other HCDocument4 pagesDecision of Any High Court Binding On All Subordinate Authorities and Tribunals Through Out India Untill Contrary View Is Taken by Other HCAnurag TamrakarNo ratings yet

- Form No. 15G: Part - IDocument2 pagesForm No. 15G: Part - Ibalaji stationersNo ratings yet

- Basic PrinciplesDocument7 pagesBasic PrinciplesRodison de GuiaNo ratings yet

- RMC No. 50-2018 WTWDocument21 pagesRMC No. 50-2018 WTWAris Basco DuroyNo ratings yet

- Morales Taxation Topic 8 Withholding TaxDocument9 pagesMorales Taxation Topic 8 Withholding TaxMary Joice Delos santosNo ratings yet

- Income Taxation of Individual Taxpayers in The Philippines: 25k/child 25k/child 25k/childDocument7 pagesIncome Taxation of Individual Taxpayers in The Philippines: 25k/child 25k/child 25k/childLet it beNo ratings yet

- FIRST INTEGRATION EXAM - 3rd Term 20-21Document14 pagesFIRST INTEGRATION EXAM - 3rd Term 20-21Dominic Dela VegaNo ratings yet

- Reason To Invest in SerbiaDocument20 pagesReason To Invest in SerbiacristianfolicaNo ratings yet

- Module 3 Individual Taxpayers 1Document8 pagesModule 3 Individual Taxpayers 1Chryshelle Anne Marie LontokNo ratings yet

- Citizenship and Residency Inside RP Outside RPDocument2 pagesCitizenship and Residency Inside RP Outside RPRhea Royce CabuhatNo ratings yet

- Direct Tax Code: Term ProjectDocument22 pagesDirect Tax Code: Term Projectvikaschugh01No ratings yet

- Form W-4 (2019) : Specific InstructionsDocument5 pagesForm W-4 (2019) : Specific Instructionsjok mongNo ratings yet

- Financial Stament Review PDFDocument8 pagesFinancial Stament Review PDFglenn dandyne montanoNo ratings yet

- Case 18Document151 pagesCase 18Muskan AroraNo ratings yet

- Acc 201 Taxation PDFDocument166 pagesAcc 201 Taxation PDFadekunle tosinNo ratings yet

- PBL (Mathematics) - Income Tax Assessment-Poah Zhi XianDocument14 pagesPBL (Mathematics) - Income Tax Assessment-Poah Zhi XianZhi Xian PoahNo ratings yet

- 45 CD South African Airways Vs CirDocument1 page45 CD South African Airways Vs CirMaribeth G. TumaliuanNo ratings yet

- Taxation Matrix of LumberaDocument14 pagesTaxation Matrix of LumberaYannie EsparteroNo ratings yet

- Commissioner of Internal Revenue v. Suter and Court of Tax Appeals, 27 SCRA 152 (1969)Document7 pagesCommissioner of Internal Revenue v. Suter and Court of Tax Appeals, 27 SCRA 152 (1969)Hazel FernandezNo ratings yet

- Green Star Express, Inc. v. Nissin-Universal RobinaDocument5 pagesGreen Star Express, Inc. v. Nissin-Universal RobinaRoger AquinoNo ratings yet

- Indian Tax ManagmentDocument242 pagesIndian Tax ManagmentSandeep SandyNo ratings yet

- Tax Nov 22 RTPDocument28 pagesTax Nov 22 RTPShailjaNo ratings yet

- Direct Taxes Sem-Iii-20Document22 pagesDirect Taxes Sem-Iii-20Pranita MandlekarNo ratings yet