Professional Documents

Culture Documents

State Bank of India (SBI) (: Sbin 500112 Sbid

State Bank of India (SBI) (: Sbin 500112 Sbid

Uploaded by

Sooraj GanapathyCopyright:

Available Formats

You might also like

- Regional Rural Banks of India: Evolution, Performance and ManagementFrom EverandRegional Rural Banks of India: Evolution, Performance and ManagementNo ratings yet

- Comparative Study of Education Loan Between Sbi and IciciDocument82 pagesComparative Study of Education Loan Between Sbi and IciciAvtaar Singh50% (2)

- Training and Development in SBIDocument34 pagesTraining and Development in SBIPooja More64% (14)

- HedgeWeekly2018 No23Document62 pagesHedgeWeekly2018 No23LondonAltsNo ratings yet

- Correspondent Banks ListDocument6 pagesCorrespondent Banks ListAbdul Wahab CheemaNo ratings yet

- Bank of Baroda MergerDocument3 pagesBank of Baroda MergerShubham DoshiNo ratings yet

- Saudi Bank Codes v5.1.2Document1 pageSaudi Bank Codes v5.1.2Saquib.MahmoodNo ratings yet

- State Bank of IndiaDocument5 pagesState Bank of IndiasahilkuNo ratings yet

- State Bank of IndiaDocument6 pagesState Bank of Indiaurvashi1508No ratings yet

- Commercial BanksDocument7 pagesCommercial Banksbbanik82No ratings yet

- Background of State Bank of IndiaDocument3 pagesBackground of State Bank of IndiaRahil KhnNo ratings yet

- State Bank of IndiaDocument6 pagesState Bank of Indiawolverineorigins02No ratings yet

- State Bank of India FinalDocument81 pagesState Bank of India FinalShaikh Shakeeb100% (1)

- State Bank of IndiaDocument11 pagesState Bank of IndiaShushma WankhedeNo ratings yet

- History: State Bank of India (SBI) Is A MultinationalDocument7 pagesHistory: State Bank of India (SBI) Is A MultinationalsrikanthuasNo ratings yet

- Sbi HistoryDocument6 pagesSbi HistoryVishh ChennNo ratings yet

- Project SbiDocument10 pagesProject SbiSNEHA MARIYAM VARGHESE SIM 16-18No ratings yet

- State Bank of IndiaDocument4 pagesState Bank of IndiaDeepali MestryNo ratings yet

- A ON State Bank of India: Submitted To: Submitted byDocument18 pagesA ON State Bank of India: Submitted To: Submitted bySapna AggarwalNo ratings yet

- State Bank of IndiaDocument7 pagesState Bank of Indiajay_kanjariaNo ratings yet

- Online Banking BMSDocument81 pagesOnline Banking BMSpriyanka yadavNo ratings yet

- Sbiproject 2015Document60 pagesSbiproject 2015kartikNo ratings yet

- Brave Bank in RelatedDocument189 pagesBrave Bank in RelatedGaurav GandhiNo ratings yet

- State Bank of India - WikipediaDocument26 pagesState Bank of India - Wikipediaryancar6100No ratings yet

- State Bank of India (SBI)Document24 pagesState Bank of India (SBI)Dayananda Singh AmomNo ratings yet

- Pure Banking Nothing ElseDocument15 pagesPure Banking Nothing Elsegenfuture21No ratings yet

- Sbi-Project 30Document31 pagesSbi-Project 30jagannathpressbdkNo ratings yet

- 1.1 Introduction of Sbi: Type Traded AsDocument45 pages1.1 Introduction of Sbi: Type Traded AsPraveen KumarNo ratings yet

- Banking ProjectDocument56 pagesBanking ProjectViki Sakpal100% (1)

- An Analysis On The State Bank of IndiaDocument11 pagesAn Analysis On The State Bank of IndiaShresth BhargavaNo ratings yet

- Gurvinder KaurDocument57 pagesGurvinder KaurDaman Deep Singh ArnejaNo ratings yet

- Project On State Bank of IndiaDocument24 pagesProject On State Bank of Indiamishra anuj61% (38)

- PrabhakarDocument91 pagesPrabhakaransari naseem ahmadNo ratings yet

- Black Book ProjectDocument4 pagesBlack Book ProjectSwapnil HengadeNo ratings yet

- Banca or From A French Word Banque Both Mean A Bench: State Bank of India (SBI) Is An Indian MultinationalDocument9 pagesBanca or From A French Word Banque Both Mean A Bench: State Bank of India (SBI) Is An Indian MultinationalMansi ModhaveNo ratings yet

- State Bank of IndiaDocument12 pagesState Bank of IndiavarunNo ratings yet

- Acknowledgement: "State Bank of India"Document8 pagesAcknowledgement: "State Bank of India"Akchat JainNo ratings yet

- A Research Project On Credit Risk and Liquidity RiskDocument86 pagesA Research Project On Credit Risk and Liquidity RiskEkam JotNo ratings yet

- Banking Sector3Document21 pagesBanking Sector3santhoshniNo ratings yet

- CP of Sbi BankDocument4 pagesCP of Sbi Bankharman singh0% (1)

- History: State Bank of India (SBI) Is A Banking and Financial Services Company Based in India. It Is A StateDocument2 pagesHistory: State Bank of India (SBI) Is A Banking and Financial Services Company Based in India. It Is A StateBrijesh MiraniNo ratings yet

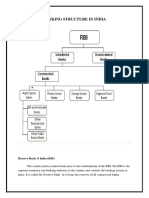

- Banking Structure in IndiaDocument49 pagesBanking Structure in IndiaAjay RapelliNo ratings yet

- State Bank of IndiaDocument1 pageState Bank of IndiaPaavni SharmaNo ratings yet

- Mission, Vision and ValuesDocument10 pagesMission, Vision and ValueskarthickkrishnanmbaNo ratings yet

- Training and Development in Sbi PDF FreeDocument34 pagesTraining and Development in Sbi PDF Freeshivangi guptaNo ratings yet

- IMC Project State Bank of IndiaDocument18 pagesIMC Project State Bank of IndiaRinni Shukla0% (1)

- Synopsis1Document10 pagesSynopsis1Pragya SisodiyaNo ratings yet

- State Bank of India - WikipediaDocument47 pagesState Bank of India - Wikipediasachisachi3638No ratings yet

- Untitled DocumentDocument2 pagesUntitled Document3290Rupali ShivaleNo ratings yet

- Project Report - SbiDocument3 pagesProject Report - SbiVISHWAS GOWDA H VNo ratings yet

- Kajal Final ProjectDocument60 pagesKajal Final ProjectSamuel Davis100% (1)

- State Bank of IndiaDocument20 pagesState Bank of IndiaLatika BhallaNo ratings yet

- Name: Arpita SengarDocument69 pagesName: Arpita Sengartripti48No ratings yet

- A Case Study On Mega Merger of SBI With Its Five SubsidariesDocument4 pagesA Case Study On Mega Merger of SBI With Its Five SubsidariesPooja MauryaNo ratings yet

- State Bank of IndiaDocument20 pagesState Bank of IndiaLatika BhallaNo ratings yet

- State Bank of IndiaDocument6 pagesState Bank of IndiaDavinder KumarNo ratings yet

- A cASE STUDY OF MEGA MERGER OF SBI WITH ITS FIVE SUBSIDIARIES PDFDocument4 pagesA cASE STUDY OF MEGA MERGER OF SBI WITH ITS FIVE SUBSIDIARIES PDFkartik naikNo ratings yet

- SBI IntroDocument16 pagesSBI IntroAakash JainNo ratings yet

- Objectives:-Following Are The Products and Services Od State Bank of IndiaDocument2 pagesObjectives:-Following Are The Products and Services Od State Bank of IndiaDorothy PriceNo ratings yet

- SBIDocument62 pagesSBISuru SurelaNo ratings yet

- Chapter 1Document12 pagesChapter 1tikeshNo ratings yet

- Banking India: Accepting Deposits for the Purpose of LendingFrom EverandBanking India: Accepting Deposits for the Purpose of LendingNo ratings yet

- Swot AnalysisDocument3 pagesSwot AnalysisAnitha M Johny Manjaly100% (1)

- Company Secretary (ACS) Examination SyllabusDocument2 pagesCompany Secretary (ACS) Examination SyllabusSooraj GanapathyNo ratings yet

- Economics Open CourseDocument1 pageEconomics Open CourseSooraj GanapathyNo ratings yet

- Saint Gobain 22Document74 pagesSaint Gobain 22Sooraj Ganapathy100% (2)

- Saint Gobain 22Document74 pagesSaint Gobain 22Sooraj Ganapathy100% (2)

- 2013 CF - ValuationsDocument8 pages2013 CF - ValuationsSooraj GanapathyNo ratings yet

- Pdf&rendition 1 2Document92 pagesPdf&rendition 1 2DIVYANSHU CHATURVEDINo ratings yet

- Manual ParrillaDocument2 pagesManual Parrillalucas benegasNo ratings yet

- Cal PERSDocument17 pagesCal PERSFortuneNo ratings yet

- VC Detailed LinkedinDocument45 pagesVC Detailed LinkedinMichael BuryNo ratings yet

- Exam List of AUSTDocument2 pagesExam List of AUSTMaruf KhanNo ratings yet

- Compound Interest All QuestionsDocument9 pagesCompound Interest All QuestionsAbhraham Benjamin de VilliersNo ratings yet

- Project of Lipika FinalDocument48 pagesProject of Lipika FinalRashmi Ranjan PanigrahiNo ratings yet

- Agent - UploadDocument26 pagesAgent - UploadNagashree Narasimha MurthyNo ratings yet

- Syndicate Bank v. Channaveerappa Beleri & OrsDocument2 pagesSyndicate Bank v. Channaveerappa Beleri & OrsAnirudh Kaushal0% (1)

- Available Managed FundsDocument18 pagesAvailable Managed Fundsalman888No ratings yet

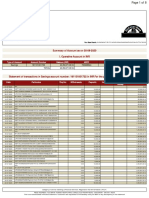

- Statement JAN2024 967279555 UnlockedDocument11 pagesStatement JAN2024 967279555 Unlockedkaifbhai2003No ratings yet

- Acct Statement - XX0575 - 21052022Document23 pagesAcct Statement - XX0575 - 21052022shivji007No ratings yet

- Cases in Credit Trans and Torts and Damages 2019Document4 pagesCases in Credit Trans and Torts and Damages 2019Reuel RealinNo ratings yet

- List of Live Authencaon User Agencies (Auas) As On 31.08.2016Document46 pagesList of Live Authencaon User Agencies (Auas) As On 31.08.2016Praneswar DasNo ratings yet

- Acct Statement - XX7971 - 09082023Document24 pagesAcct Statement - XX7971 - 09082023Ashish Singh bhandariNo ratings yet

- Scrisoare de Informare: %xqjăvlwDocument2 pagesScrisoare de Informare: %xqjăvlwFlorin BecheanuNo ratings yet

- Fundamental Equity Analysis - Euro Stoxx 50 Index PDFDocument103 pagesFundamental Equity Analysis - Euro Stoxx 50 Index PDFQ.M.S Advisors LLCNo ratings yet

- Bank AccountDocument4 pagesBank AccountKASSAHUN SHUMYENo ratings yet

- Kode BankDocument4 pagesKode BankMaha D NugrohoNo ratings yet

- Bocwwb Batch 4 Nominal RollDocument12 pagesBocwwb Batch 4 Nominal Rollshafignits_123No ratings yet

- A. Nómina Febrero 2022Document2,063 pagesA. Nómina Febrero 2022Irwin BenavidesNo ratings yet

- Ilovepdf MergedDocument152 pagesIlovepdf MergedStudent CoordinatorNo ratings yet

- Insurance V USA ExhibitsDocument1,326 pagesInsurance V USA ExhibitsDenise PridgenNo ratings yet

- Reporting Format - 457 CentresDocument44 pagesReporting Format - 457 CentresKuldeep SinghNo ratings yet

- Elian Braja Hatem Xhezairi Hatem Xhezairi Elian Braja Hatem XhezairiDocument22 pagesElian Braja Hatem Xhezairi Hatem Xhezairi Elian Braja Hatem XhezairiElian BrajaNo ratings yet

State Bank of India (SBI) (: Sbin 500112 Sbid

State Bank of India (SBI) (: Sbin 500112 Sbid

Uploaded by

Sooraj GanapathyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

State Bank of India (SBI) (: Sbin 500112 Sbid

State Bank of India (SBI) (: Sbin 500112 Sbid

Uploaded by

Sooraj GanapathyCopyright:

Available Formats

Revenue

147,843.92 crore (US$32.97 billion)

(2011)

[1]

State Bank of India (SBI) (NSE: SBIN, BSE: 500112, LSE: SBID) is the largest Indian banking and financial services company (by turnover and total assets) with its headquarters in Mumbai, India. It is state-owned. The bank traces its ancestry to British India, through the Imperial Bank of India, to the founding in 1806 of the Bank of Calcutta, making it the 11,179.94 crore (US$2.49 billion)(2011) Profit oldest commercial bank in the Indian Subcontinent. Bank of Madras merged into the other two presidency banks, Bank of Calcutta and Bank of Bombay to form Imperial Bank of India, which in turn became State Bank of India. Thegovernment of India nationalised the Imperial Bank of $322.077 billion (2010) Total assets India in 1955, with the Reserve Bank of India taking a 60% stake, and renamed it the State Bank of India. In 2008, the government took over the stake held by the Reserve Bank of India. SBI provides a range of banking products through its vast network of $19.048 billion (2010) Total equity branches in India and overseas, including products aimed at nonresident Indians(NRIs). The State Bank Group, with over 16,000 branches, has the largest banking branch network in India. SBI has 14 Local Head Offices and 57 Zonal Offices that are located at important Government of India Owner(s) cities throughout the country. It also has around 130 branches overseas. With an asset base of $352 billion and $285 billion in deposits, SBI is a regional banking behemoth and is one of the largest financial institution in the world. It has a market share among Indian commercial banks of 200,299 (2010) Employees about 20% in deposits and loans.[2] T The State Bank of India is the 29th most reputed company in the world according to Forbes.[3] Also SBI is the only bank featured in the coveted "top 10 brands of India" list in an annual survey conducted by Brand Finance and The Economic Times in Statebankofindia.com Website 2010.[4] The State Bank of India is the largest of the Big Four banks of India, along with ICICI Bank, Punjab National Bank and HDFC Bankits main competitors.[5]

Operating income 33,710.31 crore (US$7.52 billion)

(2011)

[1]

[1]

[1]

[1]

[1]

History The roots of the State Bank of India rest in the first decade of 19th century, when the Bank of Calcutta, later renamed the Bank of Bengal, was established on 2 June 1806. The Bank of Bengal was one of three Presidency banks, the other two being the Bank of Bombay (incorporated on 15 April 1840) and the Bank of Madras (incorporated on 1 July 1843). All three Presidency banks were incorporated as joint stock companies and were the result of the royal charters. These three banks received the exclusive right to issue paper currency in 1861 with the Paper Currency Act, a right they retained until the formation of theReserve Bank of India. The Presidency banks amalgamated on 27 January 1921, and the reorganised banking entity took as its name: Imperial Bank of India. The Imperial Bank of India remained a joint stock company

Pursuant to the provisions of the State Bank of India Act (1955), the Reserve Bank of India, which is India's central bank, acquired a controlling interest in the Imperial Bank of India. On 30 April 1955, the Imperial Bank of India became the State Bank of India. The government of India recently acquired the Reserve Bank of India's stake in SBI so as to remove any conflict of interest because the RBI is the country's banking regulatory authority.In 1959, the government passed the State Bank of India (Subsidiary Banks) Act, enabling the State Bank of India to take over eight former state-associated banks as its subsidiaries. On 13 September 2008, the State Bank of Saurashtra, one of its associate banks, merged with the State Bank of India.SBI has acquired local banks in rescues. For instance, in 1985, it acquired the Bank of Cochin in Kerala, which had 120 branches. SBI was the acquirer as its affiliate, the State Bank of Travancore, already had an extensive network in Kerala.

International presence As of 31 December 2009, the bank had 151 overseas offices spread over 32 countries. It has branches of the parent in Colombo, Dhaka, Frankfurt, Hong Kong, Tehran, Johannesburg, London, Los Angeles, Male in the Maldives, Muscat, New York, Osaka, Sydney, and Tokyo. It has offshore banking units in the Bahamas, Bahrain, and Singapore, and representative offices in Bhutan and Cape Town. It also has an ADB in Boston, USA.SBI operates several foreign subsidiaries or affiliates. In 1990, it established an offshore bank: State Bank of India (Mauritius).In 1982, the bank established a subsidiary, State Bank of India (California), which now has nine branches eight branches in the state of California and one in Washington, D.C. The 9th branch was opened in Tustin, California on 7 March 2011. The other seven branches in California are located in Los Angeles, Artesia, San Jose, Canoga Park, Fresno, San Diego and Bakersfield.The Canadian subsidiary, State Bank of India (Canada) also dates to 1982. It has seven branches, four in the Toronto area and three in British Columbia.In Nigeria, SBI operates as INMB Bank. This bank began in 1981 as the Indo-Nigerian Merchant Bank and received permission in 2002 to commence retail banking. It now has five branches in Nigeria.In Nepal, SBI owns 55% of Nepal SBI Bank, which has branches throughout the country. In Moscow, SBI owns 60% of Commercial Bank of India, with Canara Bank owning the rest. In Indonesia, it owns 76% of PT Bank Indo Monex.The State Bank of India already has a branch in Shanghai and plans to open one in Tianjin.[6]In Kenya, State Bank of India owns 76% of Giro Commercial Bank, which it acquired for US$8 million in October 2005.[7]

[edit]Associate

banks

SBI has SEVEN associate banks; all use the same logo of a blue circle and all the associates use the "State Bank of" name, followed by the regional headquarters' name;

State Bank of Bikaner & Jaipur

State Bank of Hyderabad State Bank of Mysore State Bank of Patiala State Bank of Travancore State Bank of Saurashtra State Bank of Indore

Earlier SBI had only seven associate banks that constituted the State Bank Group. Originally, the then seven banks that became the associate banks belonged to princely states until the government nationalised them between October 1959 and May 1960. In tune with the first Five Year Plan, emphasising the development of rural India, the government integrated these banks into the State Bank of India system to expand its rural outreach. [8] There has been a proposal to merge all the associate banks into SBI to create a "mega bank" and streamline operations. The first step towards unification occurred on 13 August 2008 when State Bank of Saurashtra merged with SBI, reducing the number of state banks from seven to six. Then on 19 June 2009 the SBI board approved the merger of its subsidiary, State Bank of Indore, with itself. SBI holds 98.3% in State Bank of Indore. (Individuals who held the shares prior to its takeover by the government hold the balance of 1.77%.) [9] The acquisition of State Bank of Indore added 470 branches to SBI's existing network of 12,448 and over 21,000 ATMs. Also, following the acquisition, SBI's total assets will inch very close to the Rs 10-lakh crore mark. Total assets of SBI and the State Bank of Indore stood at Rs 998,119 crore as on March 2009. The process of merging of State Bank of Indore was completed by April 2010, and the SBI Indore Branches started functioning as SBI [10] branches on 26 August 2010.

Branches of SBI

State Bank of India has 131 foreign offices in 132 countries across the globe. SBI has about 25,000 ATMs (25,000th ATM was inaugurated by the then Chairman of State Bank Shri O.P.Bhatt on 31 March 2011, the day of his retirement); and SBI group(including associate banks) has about 45,000 ATMs. SBI has 26,500 branches, including branches that belong to its associate banks. SBI includes 99345 offices in India.

Symbol and slogan

The symbol of the State Bank of India is a circle and not key hole and a small man at the centre of the circle. A circle depicts perfection and the common man being the centre of the bank's business. Slogans

With you all the way Pure banking nothing else The Banker to every Indian The Nation banks on us

Recent Awards and Recognitions

Best Online Banking Award, Best Customer Initiative Award & Best Risk Management Award (Runner Up) by IBA Banking Technology Awards 2010 The Bank of the year 2009, India (won the second year in a row) by The Banker Magazine Best Bank Large and Most Socially Responsible Bank by the Business Bank Awards 2009 Best Bank 2009 by Business India The Most Trusted Brand 2009 by The Economic Times Most Preferred Bank & Most preferred Home loan provider by CNBC Visionaries of Financial Inclusion By FINO Technology Bank of the Year by IBA Banking Technology Awards SKOCH Award 2010 for Virtual corporation Category for its e-payment solution

You might also like

- Regional Rural Banks of India: Evolution, Performance and ManagementFrom EverandRegional Rural Banks of India: Evolution, Performance and ManagementNo ratings yet

- Comparative Study of Education Loan Between Sbi and IciciDocument82 pagesComparative Study of Education Loan Between Sbi and IciciAvtaar Singh50% (2)

- Training and Development in SBIDocument34 pagesTraining and Development in SBIPooja More64% (14)

- HedgeWeekly2018 No23Document62 pagesHedgeWeekly2018 No23LondonAltsNo ratings yet

- Correspondent Banks ListDocument6 pagesCorrespondent Banks ListAbdul Wahab CheemaNo ratings yet

- Bank of Baroda MergerDocument3 pagesBank of Baroda MergerShubham DoshiNo ratings yet

- Saudi Bank Codes v5.1.2Document1 pageSaudi Bank Codes v5.1.2Saquib.MahmoodNo ratings yet

- State Bank of IndiaDocument5 pagesState Bank of IndiasahilkuNo ratings yet

- State Bank of IndiaDocument6 pagesState Bank of Indiaurvashi1508No ratings yet

- Commercial BanksDocument7 pagesCommercial Banksbbanik82No ratings yet

- Background of State Bank of IndiaDocument3 pagesBackground of State Bank of IndiaRahil KhnNo ratings yet

- State Bank of IndiaDocument6 pagesState Bank of Indiawolverineorigins02No ratings yet

- State Bank of India FinalDocument81 pagesState Bank of India FinalShaikh Shakeeb100% (1)

- State Bank of IndiaDocument11 pagesState Bank of IndiaShushma WankhedeNo ratings yet

- History: State Bank of India (SBI) Is A MultinationalDocument7 pagesHistory: State Bank of India (SBI) Is A MultinationalsrikanthuasNo ratings yet

- Sbi HistoryDocument6 pagesSbi HistoryVishh ChennNo ratings yet

- Project SbiDocument10 pagesProject SbiSNEHA MARIYAM VARGHESE SIM 16-18No ratings yet

- State Bank of IndiaDocument4 pagesState Bank of IndiaDeepali MestryNo ratings yet

- A ON State Bank of India: Submitted To: Submitted byDocument18 pagesA ON State Bank of India: Submitted To: Submitted bySapna AggarwalNo ratings yet

- State Bank of IndiaDocument7 pagesState Bank of Indiajay_kanjariaNo ratings yet

- Online Banking BMSDocument81 pagesOnline Banking BMSpriyanka yadavNo ratings yet

- Sbiproject 2015Document60 pagesSbiproject 2015kartikNo ratings yet

- Brave Bank in RelatedDocument189 pagesBrave Bank in RelatedGaurav GandhiNo ratings yet

- State Bank of India - WikipediaDocument26 pagesState Bank of India - Wikipediaryancar6100No ratings yet

- State Bank of India (SBI)Document24 pagesState Bank of India (SBI)Dayananda Singh AmomNo ratings yet

- Pure Banking Nothing ElseDocument15 pagesPure Banking Nothing Elsegenfuture21No ratings yet

- Sbi-Project 30Document31 pagesSbi-Project 30jagannathpressbdkNo ratings yet

- 1.1 Introduction of Sbi: Type Traded AsDocument45 pages1.1 Introduction of Sbi: Type Traded AsPraveen KumarNo ratings yet

- Banking ProjectDocument56 pagesBanking ProjectViki Sakpal100% (1)

- An Analysis On The State Bank of IndiaDocument11 pagesAn Analysis On The State Bank of IndiaShresth BhargavaNo ratings yet

- Gurvinder KaurDocument57 pagesGurvinder KaurDaman Deep Singh ArnejaNo ratings yet

- Project On State Bank of IndiaDocument24 pagesProject On State Bank of Indiamishra anuj61% (38)

- PrabhakarDocument91 pagesPrabhakaransari naseem ahmadNo ratings yet

- Black Book ProjectDocument4 pagesBlack Book ProjectSwapnil HengadeNo ratings yet

- Banca or From A French Word Banque Both Mean A Bench: State Bank of India (SBI) Is An Indian MultinationalDocument9 pagesBanca or From A French Word Banque Both Mean A Bench: State Bank of India (SBI) Is An Indian MultinationalMansi ModhaveNo ratings yet

- State Bank of IndiaDocument12 pagesState Bank of IndiavarunNo ratings yet

- Acknowledgement: "State Bank of India"Document8 pagesAcknowledgement: "State Bank of India"Akchat JainNo ratings yet

- A Research Project On Credit Risk and Liquidity RiskDocument86 pagesA Research Project On Credit Risk and Liquidity RiskEkam JotNo ratings yet

- Banking Sector3Document21 pagesBanking Sector3santhoshniNo ratings yet

- CP of Sbi BankDocument4 pagesCP of Sbi Bankharman singh0% (1)

- History: State Bank of India (SBI) Is A Banking and Financial Services Company Based in India. It Is A StateDocument2 pagesHistory: State Bank of India (SBI) Is A Banking and Financial Services Company Based in India. It Is A StateBrijesh MiraniNo ratings yet

- Banking Structure in IndiaDocument49 pagesBanking Structure in IndiaAjay RapelliNo ratings yet

- State Bank of IndiaDocument1 pageState Bank of IndiaPaavni SharmaNo ratings yet

- Mission, Vision and ValuesDocument10 pagesMission, Vision and ValueskarthickkrishnanmbaNo ratings yet

- Training and Development in Sbi PDF FreeDocument34 pagesTraining and Development in Sbi PDF Freeshivangi guptaNo ratings yet

- IMC Project State Bank of IndiaDocument18 pagesIMC Project State Bank of IndiaRinni Shukla0% (1)

- Synopsis1Document10 pagesSynopsis1Pragya SisodiyaNo ratings yet

- State Bank of India - WikipediaDocument47 pagesState Bank of India - Wikipediasachisachi3638No ratings yet

- Untitled DocumentDocument2 pagesUntitled Document3290Rupali ShivaleNo ratings yet

- Project Report - SbiDocument3 pagesProject Report - SbiVISHWAS GOWDA H VNo ratings yet

- Kajal Final ProjectDocument60 pagesKajal Final ProjectSamuel Davis100% (1)

- State Bank of IndiaDocument20 pagesState Bank of IndiaLatika BhallaNo ratings yet

- Name: Arpita SengarDocument69 pagesName: Arpita Sengartripti48No ratings yet

- A Case Study On Mega Merger of SBI With Its Five SubsidariesDocument4 pagesA Case Study On Mega Merger of SBI With Its Five SubsidariesPooja MauryaNo ratings yet

- State Bank of IndiaDocument20 pagesState Bank of IndiaLatika BhallaNo ratings yet

- State Bank of IndiaDocument6 pagesState Bank of IndiaDavinder KumarNo ratings yet

- A cASE STUDY OF MEGA MERGER OF SBI WITH ITS FIVE SUBSIDIARIES PDFDocument4 pagesA cASE STUDY OF MEGA MERGER OF SBI WITH ITS FIVE SUBSIDIARIES PDFkartik naikNo ratings yet

- SBI IntroDocument16 pagesSBI IntroAakash JainNo ratings yet

- Objectives:-Following Are The Products and Services Od State Bank of IndiaDocument2 pagesObjectives:-Following Are The Products and Services Od State Bank of IndiaDorothy PriceNo ratings yet

- SBIDocument62 pagesSBISuru SurelaNo ratings yet

- Chapter 1Document12 pagesChapter 1tikeshNo ratings yet

- Banking India: Accepting Deposits for the Purpose of LendingFrom EverandBanking India: Accepting Deposits for the Purpose of LendingNo ratings yet

- Swot AnalysisDocument3 pagesSwot AnalysisAnitha M Johny Manjaly100% (1)

- Company Secretary (ACS) Examination SyllabusDocument2 pagesCompany Secretary (ACS) Examination SyllabusSooraj GanapathyNo ratings yet

- Economics Open CourseDocument1 pageEconomics Open CourseSooraj GanapathyNo ratings yet

- Saint Gobain 22Document74 pagesSaint Gobain 22Sooraj Ganapathy100% (2)

- Saint Gobain 22Document74 pagesSaint Gobain 22Sooraj Ganapathy100% (2)

- 2013 CF - ValuationsDocument8 pages2013 CF - ValuationsSooraj GanapathyNo ratings yet

- Pdf&rendition 1 2Document92 pagesPdf&rendition 1 2DIVYANSHU CHATURVEDINo ratings yet

- Manual ParrillaDocument2 pagesManual Parrillalucas benegasNo ratings yet

- Cal PERSDocument17 pagesCal PERSFortuneNo ratings yet

- VC Detailed LinkedinDocument45 pagesVC Detailed LinkedinMichael BuryNo ratings yet

- Exam List of AUSTDocument2 pagesExam List of AUSTMaruf KhanNo ratings yet

- Compound Interest All QuestionsDocument9 pagesCompound Interest All QuestionsAbhraham Benjamin de VilliersNo ratings yet

- Project of Lipika FinalDocument48 pagesProject of Lipika FinalRashmi Ranjan PanigrahiNo ratings yet

- Agent - UploadDocument26 pagesAgent - UploadNagashree Narasimha MurthyNo ratings yet

- Syndicate Bank v. Channaveerappa Beleri & OrsDocument2 pagesSyndicate Bank v. Channaveerappa Beleri & OrsAnirudh Kaushal0% (1)

- Available Managed FundsDocument18 pagesAvailable Managed Fundsalman888No ratings yet

- Statement JAN2024 967279555 UnlockedDocument11 pagesStatement JAN2024 967279555 Unlockedkaifbhai2003No ratings yet

- Acct Statement - XX0575 - 21052022Document23 pagesAcct Statement - XX0575 - 21052022shivji007No ratings yet

- Cases in Credit Trans and Torts and Damages 2019Document4 pagesCases in Credit Trans and Torts and Damages 2019Reuel RealinNo ratings yet

- List of Live Authencaon User Agencies (Auas) As On 31.08.2016Document46 pagesList of Live Authencaon User Agencies (Auas) As On 31.08.2016Praneswar DasNo ratings yet

- Acct Statement - XX7971 - 09082023Document24 pagesAcct Statement - XX7971 - 09082023Ashish Singh bhandariNo ratings yet

- Scrisoare de Informare: %xqjăvlwDocument2 pagesScrisoare de Informare: %xqjăvlwFlorin BecheanuNo ratings yet

- Fundamental Equity Analysis - Euro Stoxx 50 Index PDFDocument103 pagesFundamental Equity Analysis - Euro Stoxx 50 Index PDFQ.M.S Advisors LLCNo ratings yet

- Bank AccountDocument4 pagesBank AccountKASSAHUN SHUMYENo ratings yet

- Kode BankDocument4 pagesKode BankMaha D NugrohoNo ratings yet

- Bocwwb Batch 4 Nominal RollDocument12 pagesBocwwb Batch 4 Nominal Rollshafignits_123No ratings yet

- A. Nómina Febrero 2022Document2,063 pagesA. Nómina Febrero 2022Irwin BenavidesNo ratings yet

- Ilovepdf MergedDocument152 pagesIlovepdf MergedStudent CoordinatorNo ratings yet

- Insurance V USA ExhibitsDocument1,326 pagesInsurance V USA ExhibitsDenise PridgenNo ratings yet

- Reporting Format - 457 CentresDocument44 pagesReporting Format - 457 CentresKuldeep SinghNo ratings yet

- Elian Braja Hatem Xhezairi Hatem Xhezairi Elian Braja Hatem XhezairiDocument22 pagesElian Braja Hatem Xhezairi Hatem Xhezairi Elian Braja Hatem XhezairiElian BrajaNo ratings yet