Professional Documents

Culture Documents

AirAsia Introduction

AirAsia Introduction

Uploaded by

Daud SulaimanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

AirAsia Introduction

AirAsia Introduction

Uploaded by

Daud SulaimanCopyright:

Available Formats

TABLE OF CONTENTS

EXECUTIVE SUMMARY ........................................................................................................... 1.0 1.1 2.0 2.1 2.2 2.3 3.0 3.1 3.2 3.3 4.0 4.1 4.2 4.3 INTRODUCTION ............................................................................................................ .............................................................................. .................................................................................................. ....................................................................................... ......................................................... ..................................................................

1 2 3 4 5 " 10 11 11 12 14 14 15 1 1 1& 20 22 23 2" 2& 2' 31 31 32 33 34 3& 42

ASSUMPTIONS & LIMITATIONS MARKET OVERVIEW ENVIRONMENT ANALYSIS

REGULATORY ENVIRONMENT ANALYSIS MACRO!ECONOMIC ENVIRONMENT STRATEGY AND STRUCTURE VISION AND MISSION

................................................................................. .........

................................................................................................ ............................................................................ .......................................

ORGANISATIONAL STRUCTURE AND CORPORATE GOVERNENCE VALUE CREATING ACTIVITIES FINANCIAL PERFORMANCE

..................................................................................

AIRASIA #ORI$ONTAL AND VERTICAL ANALYSIS

COMPARISON BETWEEN AIRASIA AND MAS #ORI$ONTAL AND VERTICAL ANALYSIS ................................................................................................ RATIO ANALYSIS BETWEEN AIRASIA AND MAS AIRLINE .........................

4.3.1 LI%UIDITY RATIO ANALYSIS

............................................................................... ......................................................... ..................................................................... ....................................................................

4.3.2 ASSET MANAGEMENT RATIO ANALYSIS 4.3.3 PROFITABILITY RATIO ANALYSIS 4.3.4 SOLVENCY RATIO ANALYSIS 5.0 .0 ".0 &.0 CONCLUSION 4.3.5 S#ARE MARKET RATIO ANALYSIS RECOMMENDATION REFERENCE LIST APPENDIX

...............................................................................

............................................................................................................. ............................................................................................... .....................................................................................................

................................................................................................................... .................................................

A(()*+,- 1. L/0 C/12 C344,)4 M/+)5 E-(53*32,/* A(()*+,- 2. P/42)461 5 F/47) M/+)5 A(()*+,- 3. D)8,*,2,/* /8 R32,/1

.......................................................................... .......................................

................................................................................

A(()*+,- 4. V)42,735 & #/4,9/*235 3*35:1,1 C/;(34,1/*

A(()*+,- 5. M,*/4 R32,/ A*35:1,1 <)20))* A,4A1,3 3*+ MAS A,45,*)...................... A(()*+,- . S=34) (4,7) ;/>);)*21 8/4 A,4A1,3 3*+ MAS A,45,*)............................

EXECUTIVE SUMMARY

In its dynamic and competitive environment, AirAsia has managed to reap great benefits by practicing low cost advantage to its business model. The combination of technology advancement, marketing strategy and a strong recognition of various languages used by its customers, AirAsia has successfully developed its business into a prominent best performance company in Southeast Asias airline industry.

The purpose of this report is to analyse AirAsia via the Value non"financial and financial aspects.

eporting !ramework. The

creative framework assists readers to have a clearer picture of AirAsias performance in the

The non"!inancial aspects consist of internal and e#ternal analysis of AirAsia by using various tools including $%ST analysis, $orters & forces model, S'(T analysis and (rgani)ation analysis. AirAsia has shown its resilience by continuously improving their cost operation by implementing superior IT systems. Thus during the recent economic downturn, the situation had turn favourable to AirAsia towards gaining a larger market share. It is recommended that AirAsia continue to create more new routes to different countries and greater cost control effort.

The !inancial aspects consist of e#amining the economic performance, financial ratios, and stock market performance. AirAsia has portrayed strong performance in year *++,. 'e can see that AirAsia has implemented the right business model to win the competition within the industry. !or the past few months, AirAsias stock performance indicates that investors are gaining more confidence to invest in them due to growth rate in assets as well as the increasing new routes to different countries. (n the whole, this assignment will allow readers to grasp important financial and accounting concepts with emphasis given to -ualitative analysis of AirAsia as a company.

./$age

1.0 INTRODUCTION AirAsia is one of the fastest growing airline companies in the world with the reputation of having the largest low"fare airlines, no"frills airline and a pioneer in low cost travel in Asia 0'ikipedia, *+.+1. This report attempts to evaluate both the financial and non"financial aspects of AirAsia under the current economic climate. 2sing the Value year *++5 and *++,. There are 6 categories of information under the Value eporting !ramework 0which forms the basis of our analysis1. eporting !ramework adopted by $ricewaterhouse3oopers 0$'31, we will review the 4 years performance of AirAsia from the

F,?@4) 1. V35@) R)(/42,*? F43;)0/4A BS/@47). =22(.CC000.>35@)<31)+;3*3?);)*2.*)2C;)2=/+1D>35@)4)(/42,*?.=2;5E

*/$age

1.1

A11@;(2,/* 3*+ L,;,232,/*1 The study on AirAsia has some limitations in our research. .. The comparison between AirAsia and 7AS is solely based on the companys financial figures. *. The industry comparison is solely based on the principal activity of the airlines in providing air transportation services where both companies are operating on different strategic business respectively 07AS8 9ational Air 3arrier (perator, AirAsia 8 :udget air carrier operator1. 4. The AirAsia :hds financial figure in *++5 is not precisely a fair value due to the different accounting reporting approach been adopted by the company from . ;uly *++5 and onwards. 6. The financial figures that are e#tracted from both companies are compiled with the significant accounting and financial risks policies per stated in respective annual reports. &. The market price for 7AS < AirAsia is based on annual average share prices in the =>S%. This assignment is solely for academic purpose only. The group members shall not be held liable for any losses incurred based on the information provided. ?. Social study is arguable and sub@ective. 3onsumer habits and behavior changes based on situation and mood.

4/$age

2.0 MARKET OVERVIEW In the past few years, air travel has been growing at a rate of ?A a year and scheduled airlines carried more than . billion passengers in *++B. In 7alaysia, airline operations are separated into two, namely $assenger airlines and 3argo airlines. The passenger airliners in 7alaysia comprises of AirAsia, 7alaysia Airline System 07AS1, !irefly 0which is owned by 7AS1, >ayang">ayang Aerospace 0which is based in Sabah owned by :er@aya Croup1, Sabah Air and Dornbill Skyways 0which is a helicopter service that conducts operations in the rural area of Sarawak1. (ther than passenger airliners, there are also three cargo airliners operating in 7alaysia. They are Athena Air services, 7AS cargo and Transmile Air Services. Eespite the various kinds of air operators, the airline industry in 7alaysia is being monopoli)ed by two main operators namely 7AS and AirAsia. .

F,?@4) 2. N)2 I*7/;) 8/4 M3F/4 G5/<35 A,45,*)1 BS/@47). =22(.CC000./*)0/45+.7/;C/0C*)01!3*+!,*8/4;32,/*C8372!1=))21E

6/$age

2.1 E*>,4/*;)*2 A*35:1,1 unning businesses in the airline industry has become tougher in todays competitive era. :usinesses are not @ust facing higher pressure from increasing number of competitors, but they also have to compete in a more dynamic and comple# environment. According to :oeing 3ompany, the Airline business models as shown in the following diagram 0:oeing, *++&1.

F,?@4) 3. I*+@124: E*>,4/*;)*2 C=355)*?)1 BS/@47). B/),*?G 2005E

According to (3onnell and 'illiams 0*++&1, direct competition between full service airlines and no"frills carriers is intensifying across the world. The old business model focused on providing full airline service. The new business model aimed to make the business more efficient leading to cost advantage. The following Table . shows the product features of low cost and full service carriers.

F,?@4) 4. P4/+@72 F)32@4)1 O8 L/0 C/12 3*+ F@55 S)4>,7) C344,)41 S/@47). O6C/**)55 3*+ W,55,3;1 B2005G (. 25'H2"2E &/$age

This Flow"cost revolutionG forces the traditional full"services carriers to respond to this phenomenon progressively. The emergence and growth of no frills, low"cost carriers have radically altered the nature of competition within the industry. 7ost ma@or >ow cost carriers 0>331 have e#ploited different operation methods to provide low"fares, which is the >33 business models competitive edge. Dowever, not all >33s carriers are profitable. (nly the market"leading operators are able to produce a consistent level returns above their cost of capital 0Eoganis, *++.1. The Flow"cost carrierG business design could be defined by the following three key elements.

F,?@4) 5. LCC1 B@1,*)11 D)1,?* S/@47). MERCER M3*3?);)*2 C/*1@52,*? B2002E

2.2 R)?@532/4: E*>,4/*;)*2 A*35:1,1 Covernment policies are important drivers for the success of airline industry. In the late .,,+s, there was an increase in privatisation and deregulation of the airline industry in Asia. It was noticeable that some Asian countries established open"skies agreements while others allowed the entry of private airliners. In *++?, the governments intervention and regulation remained substantial. !or instance, although Thai AirAsia managed to launch its services between Singapore and Thailand in *++6 successfully, the company still could not e#pand beyond the Singapore"Thailand routes because it could not ac-uire landing rights elsewhere.

?/$age

In 7alaysia, the airline industry is heavily regulated. The authority responsible for overseeing the industry in 7alaysia is the Eepartment (f 3ivil Aviation 0E3A1. The E3As main ob@ective is to ensure that the air transportation system that operates via direct service providers is always safe for passengers. Its priority is to ensure aviation service providers conduct their activities in compliance with appropriate regulations.

2.3 M374/!)7/*/;,7 E*>,4/*;)*2 $%ST analysis and $orter & !orce 7odel provide an overall environment analysis of AirAsia. Also, the analysis of >33 industry reveals the strength and weaknesses as well as the threat and opportunity for AirAsia.

F,?@4) . PEST A*35:1,1 8/4 A,4A1,3

5/$age

P/42)461 F,>) F/47)1 M/+)5 8/4 A,4A1,3

F,?@4) ". A*35:1,1 U1,*? P/42)461 5 F/47)1 8/4 A,4A1,3

B/$age

SWOT A*35:1,1 The S'(T analysis is used to determine the strengths, weaknesses, opportunities and threats facing AirAsia and allows AirAsia to attain its goals.

F,?@4) &. SWOT A*35:1,1 8/4 A,4A1,3

,/$age

3.0

STRATEGY AND STRUCTURE BCOST LEADERS#IP STRATEGYE 3E L/0 C/12 :y pursuing cost leadership strategy, AirAsia has successfully drive cost of its operations lower relative to its nearest regional competitors namely !irefly. Initially AirAsia has chosen to lease planes instead of purchasing them 0Ansett 'orldwide, *++.1. Fuel hedging was a tactical move that contributed to marginal profit by pegging the price of @et fuel instead of relying on market crude oil price volatility. <E E88,7,)*7: A*+ S,;(5,7,2: The mostly IT savvy generation of today prefer to make online transactions that gives customers and seasoned travelers much desired convenience. Dence AirAsia developed a user friendly and stable website platform to promote its online booking. 7E S)4>,7) A*+ C31= F5/0 'ith the advent of the (pen Skies Treaty, Air Asia has endeavor to capture more airspace available regionally, to stimulate new markets via offering more destinations to potential travelers.

F,?@4) '. S2432)?,7 S24@72@4) /8 A,4A1,3

.+ / $ a g e

3.1

V,1,/* 3*+ M,11,/* 8/4 A,4A1,3 V,1,/* S232);)*2 To be the largest low cost airline in Asia and serving the 4 billion people who are currently underserved with poor connectivity and high fares. M,11,/* S232);)*2 AirAsia strives toH I :e the best company to work for whereby employees are treated as part of a big family I 3reate a globally recogni)ed AS%A9 brand I Attain the lowest cost so that everyone can fly with AirAsia I 7aintain the highest -uality product, embracing technology to reduce cost and enhance service level

3.2

O4?3*,132,/*35 S24@72@4) 3*+ C/4(/432) G/>)4*3*7) O4?3*,132,/*35 S24@72@4) The organi)ationalJcorporate structure of AirAsia, based on its business entities are categori)ed as belowH

F,?@4) 10. O()432,/*35 C/4(/432) S24@72@4) /8 A,4A1,3 .. / $ a g e

C/4(/432) G/>)4*3*7) Air Asia has won the award for best corporate governance for best rising Asian companies *++B. The foundation of its corporate governance strictly relies on its :oard of Eirectors as a vital source for internal accountability. 3urrently the board consists of 4 insiders 0the firms 3%( and top level managers1 and related outsiders 0not directly involved in day to day operations of the firm1.

3.3

V35@) C4)32,*? A72,>,2,)1 C@12/;)4 AirAsia was the first airliner to utilise e"ticketing in order to save cost of issuing physical tickets. This eliminates the need for large and e#pensive booking reservation systems. The airlines created convenience for its customers to purchase tickets from post offices or designated AT7 machines 0Khu, *+.+1. P)/(5) AirAsias organisational structure is simple and flat, enabling them to achieve more consistency and cost reduction. !urthermore, the salaries offered by the company were below its rivals. Dowever, the airline was able to keep its workforce motivated by providing a competitive remuneration policy. %mployees are offered a wide range of incentives that includes productivity and performance"based bonuses, stock options. These efforts enhanced productivity and further strengthened employer"employee relationships. Also, AirAsia has a corporate safety and training commitment to ensure that their staffs perform their tasks in a safe and efficient manner 0Annual eport AirAsia, *++,1. I**/>32,/* AirAsias aircrafts were designed to minimise wear and tear, cleaning time and cost. This allows for -uicker turnarounds between flights and helps increase revenues 0Khu, *+.+1.

.* / $ a g e

7oreover, the airline leverages on innovative ideas to derive substantial ancillary revenues from additional services. It has its own branded credit card and offers corporate travels services. AirAsias planes are also converted into Fflying billboardsG for advertisement. Such uni-ue innovations led to lower costs and increases in revenues 0:kkok, *++&1. B43*+1 3*+ I*2)55)72@35 A11)21 AirAsia has a strong brand reputation and the company has won several prestigious awards. It is associated with globally recognised organisations such as AT<T, 'illiams !., :ritish 7otoC$, and $rofessional Came 7atch (fficials. It has also become a recogni)ed AS%A9 brand through its operational bases, diversity of its staff and its commitment to the region. AirAsia has promoted its company without incurring high sales and marketing e#penses 0Annual eport AirAsia, *++,1.

.4 / $ a g e

4.0 FINANCIAL PERFORMANCE BR)8)4 A(()*+,- 4E 4.1 A,4A1,3 #/4,9/*235 3*+ V)42,735 F,*3*7,35 A*35:1,1 ! F/4 A55 F,*3*7,35 S232);)*21 V)42,735 A*35:1,1 In year *++B, AirAsia made a net loss of 0" 76,?,&?41. This is mainly due to the sudden increase in fuel e#penses which comprise of 6,A of total sales cost and an increase in derivatives e#penses 0shares, warrants, commission, etc1 which comprise of *6A of the total sales. In *++,, AirAsia managed to reduce significantly on its fuel e#penses to 4+A of sales and derivatives e#penses to .A. As a result, AirAsia went back to the black in *++, with a 7&.&,*?5 net profit 0.?A of total sales1 compared to 0" 76,&,&?41 total loss in *++B 0".5A of total sales1.

#/4,9/*235 A*35:1,1 In *++,, AirAsia made a .+A increase in sales over *++B. In addition, AirAsia also managed to decrease its operating e#penses with its main contribution from its fuel e#penses with a 44A decrease in *++, and made a gain in the unwinding of derivatives. Although other e#penses has also increased in *++, across the board, the gain from AirAsia over the increase in sales and fuel e#penses far outweighs the other increase in e#penses incurred resulting to a net profit of 7&.&,*?5 in *++, compared to a net loss of 0 76,?,&?41 in *++B. AirAsia has also made a significant increase in its total assets with ma@or contribution from investment in property, plant and e-uipment 0*+A increased in non"current asset1 and an increase in bank balances 04B&A increase in current assets1 in *++,. Its shareholders fund has also increased in *++, by ?4A to 7*,?*.,+*+. The total 3ash flow for AirAsia in *++, has increased significantly by *,&A from 7.*+,B+4 in *++B to 75.B,6?& in *++,. This is mainly contributed by a positive operating cash flow in *++, and a significant reduction in investing activities.

.6 / $ a g e

4.2

C/;(34,1/* <)20))* A,4A1,3 & MAS /* #/4,9/*235 3*+ V)42,735 F,*3*7,35 A*35:1,1 V)42,735 A*35:1,1 Although the Sales revenue for 7AS for *++, is 4.? times over AirAsia, its operating profit in *++, went into the negatives due to e#tremely high operating e#penses. AirAsias ability to hedge its fuel prices during the oil crisis in *++B has resulted to an improved management of its fuel e#penses in *++B. This has resulted to an operating profit of *,A 0 7,*.,5&61 form sales revenue for AirAsia in *++, compared to "?A 0" 7?*B,*?+1 for 7AS in *++,. 7ASs 6A net profit from sales in *++, was due to its high derivative gains. This has put AirAsia in a better financial position compared to 7AS with a .?A net profit from sales revenue. 7ASs current asset is *.. times more than AirAsia. Dowever when it comes to current liabilities, 7ASs current liabilities in *++, is way more than its current assets. This has resulted to 7AS having a 0" 755.,..+1 net current assets compared to AirAsias 7&..,*B6 net current asset. In terms of shareholders funds, AirAsias value is 4.& times more than 7AS which stands at 7*,?*.,+*+. This has put AirAsia at a stronger financial position compared to 7AS.

#/4,9/*235 A*35:1,1 7ASs poor performance in *++, is also due to its drop of sales revenue by *&A. Dowever its operating e#penditure still remain high. Although 7ASs net profit for the year *++, has increased by .+.A over *++B, it is still more lucrative to invest in AirAsia in *++, which has gained a higher profit in absolute value and has a lower operating cost in *++, compared to 7AS. Although 7ASs 3ash and 3ash %-uivalents is 4.6 times more than AirAsia, this does not mean 7AS is in a better financial position than AirAsia. 3omparatively, 7AS has a negative operating cash flow in *++, unlike AirAsia. 7a@ority of 7ASs cash flow from investing activities comes from 'ithdrawalJ$lacement of negotiable instruments of deposits and deposits pledged with banks. Dowever AirAsias negative cash flow from investing activities goes to investment in $roperty, plant and e-uipment to increase its non"current assets. AirAsia also has a higher cash flow from financing activities which is ..B times more than 7AS. .& / $ a g e

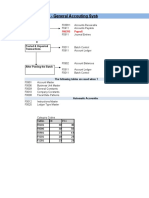

4.3 R32,/ A*35:1,1 <)20))* A,4A1,3 3*+ MAS A,45,*) (ur findings on ma@or ratio analysis AirAsia and 7AS Airline by li-uidity, asset management, profitability, solvency and share market measurement is shown below. The detailed e#planations of ratios are elaborated in the appendi#.

4.3.1

L,I@,+,2: R32,/ A*35:1,1

T3<5) 1. L,12 /8 L,I@,+,2: R32,/ A*35:1,1 <)20))* A,4A1,3 3*+ MAS A,45,*)1

Liquidity Analysis Airasia Berhad 2008 (Restated) Malaysian Airline System Berhad 2008 (Restated) 2007 (Restated)

2009

*2007

2009

Quick ratio (QR)

*Rem arks: !r 2007" the #!m $arati%e &i'ures are n!t in &air %alue( )he &i'ure are the added %alue &r!m the &inan#ial year ended *0 +une 2007 and ended *, -e#em .er 2007( 1.2! 1." 1.#2

".7!

1.27

1.2

Current Assets - Inventory_____ Current Liabilities

T3<5) 2. %@,7A R32,/ A*35:1,1 <)20))* A,4A1,3 3*+ MAS A,45,*)1

.? / $ a g e

3E %@,7A R32,/ I*243! E*2,2: R32,/ A*35:1,1 BA,4A1,3 B)4=3+E The highest figure was recorded in *++5 but the trend is moving towards stronger position in its payment ability from least li-uidity assets to their short term liabilities from *++B to *++,. This might indicate that the company has a healthy inventory and receivables assets management and its turnover period.

I*+@124: A>)43?) R32,/ A*35:1,1 BA,4A1,3 B)4=3+ & M353:1,3* A,45,*) S:12); B)4=3+E 3ompared with AirAsia, 7AS Airline has a weaker inventory and receivables assets management. This seems to indicate that 7AS Airline is utili)ing debt financing strategy in its operations. This strategy might need to be reviewed if the strategy is ineffective as 7AS Airline is running national air carrier business and involves with the intervention of government in business policies.

.5 / $ a g e

4.3.2

A11)2 M3*3?);)*2 R32,/ A*35:1,1

T3<5) 3. L,12 /8 A11)2 M3*3?);)*2 R32,/ A*35:1,1 <)20))* A,4A1,3 3*+ MAS A,45,*)1

As s et Mana'em e nt Analys is Air as ia Be rhad 2008 (Res tated) Malays ian Airline Sys te m Be rhad 2008 (Res tated) 2007 (Re s tate d)

2009

*2007

2009

Inventory $urnover Ratio (I$R) = ___'et sales_____ Avera(e $otal Inventory )ays in Inventory =

*Re m ark s: !r 2007" the #!m $arati%e &i'ur es are n!t in &air %alue ( )he &i'ure are the adde d %alue &r!m the &inan#ial ye ar e nde d *0 +une 2007 and e nded *, -e #e m .e r 2007( 1%! 1&# 12"

2!

%"

%"

________&#*___________ Inventory $urnover ratio

&

&

12

T3<5) 4. I*>)*2/4: T@4*/>)4 R32,/ <)20))* A,4A1,3 3*+ MAS A,45,*)1

.B / $ a g e

3E I*>)*2/4: T@4*/>)4 R32,/ I*243! E*2,2: R32,/ A*35:1,1 BA,4A1,3 B)4=3+E !or AirAsia, it showed low rate of inventory turnover due to the business provides low fare and no frills air transportation services and therefore is not a highly inventory sensitive entity. AirAsia inventories consist of flight e-uipment e#pendable parts, materials, and supplies and are carried at average cost, which appro#imates market value. These items are charged to e#penses when issued for use.

I*+@124: A>)43?) R32,/ A*35:1,1 BA,4A1,3 B)4=3+ & M353:1,3* A,45,*) S:12); B)4=3+E 3ompared to AirAsia, 7AS Airline is showing a inventory management compared to AirAsia. As a national air carrier, 7AS Airline may applying material hedging strategy in where the materials and parts purchase in bulk basis in order to obtain at a lower price.

Ass et Mana'em ent Analysis Airasia Berhad 2008 (Restated) Malaysian Airline System Berhad 2008 (Restated) 2007 (Restated)

2009

*2007

2009

Return on Assets ratio (R+A) = _____-ro.it______ Avera(e total assets

*Rem arks: !r 2007" the #!m $arati%e &i'ure s are n!t in &air %alue ( )he &i'ure are the added %alue &r!m the &inan#ial year ended *0 +une 2007 and ended *, -e #em .er 2007( %.%%, -*.27, .2%,

*.7 ,

2.%%,

."#,

T3<5) 5. R)2@4* /* A11)2 R32,/ A*35:1,1 <)20))* A,4A1,3 3*+ MAS A,45,*)1

<E R)2@4* /* A11)2 R32,/ I*243! E*2,2: R32,/ A*35:1,1 BA,4A1,3 B)4=3+E The figure has shown that AirAsia is having a low figure in this ratio. This is due to the air transportation industry are normally a debt intensive and re-uires high costs of fi#ed assets such as aircrafts, plants and e-uipments. A significant improvement in *++, is showing that AirAsia is moving a positive ability to convert its assets in returns. ., / $ a g e

I*+@124: A>)43?) R32,/ A*35:1,1 BA,4A1,3 B)4=3+ & M353:1,3* A,45,*) S:12); B)4=3+E !rom figures, both AirAsia and 7AS Airline are moving a positive ability 045A"7AS Airline and B6A" AirAsia1 to convert its assets in revenues from *++B to *++,.

4.3.3

P4/8,23<,5,2: R32,/ A*35:1,1

T3<5) . L,12 /8 P4/8,2 R32,/ A*35:1,1 <)20))* A,4A1,3 3*+ MAS A,45,*)1

/r!&ita.ility Analysis Airasia Berhad 2008 (Restated) Malaysian Airline System Berhad 2008 (Restated) 2007 (Restated)

2009

*2007

2009

'et -ro.it /ar(in ratio (-/) _____'et -ro.it______ 'et 0ales

*Rem arks: !r 2007" the #!m $arati%e &i'ures are n!t in &air %alue( )he &i'ure are the added %alue &r!m the &inan#ial year ended *0 +une 2007 and ended *, -e#em .er 2007( 1#.1*, -17.&7, %2. 2,

%.&#,

1.#%,

*.*%,

T3<5) ". N)2 P4/8,2 M34?,* R32,/ A*35:1,1 <)20))* A,4A1,3 3*+ MAS A,45,*)1

3E N)2 P4/8,2 M34?,* R32,/ *+ / $ a g e

I*243! E*2,2: R32,/ A*35:1,1 BA,4A1,3 B)4=3+E !rom the figures, it showed that the air transportation industry is heavy competitive in the market due to low numbers in this ratio. 7eantime, randomi)ed pricing strategy adopted by AirAsia is supported the organisation moving toward to improve this ratio by increasing the market demand and profit ma#imisation.

I*+@124: A>)43?) R32,/ A*35:1,1 BA,4A1,3 B)4=3+ & M353:1,3* A,45,*) S:12); B)4=3+E !rom figures, both AirAsia and 7AS Airline 07AS and AirAsia" 5A1 are moving a positive trend to generate profits from each dollar of sales from *++B to *++,.

/r!&ita.ility Analysis Airasia Berhad 2008 (Restated) Malaysian Airline System Berhad 2008 (Restated) 2007 (Restated)

2009

*2007

2009

Return on 12uity ratio (R+1) = _______-ro.it______ Avera(e total e2uity

*Remarks: !r 2007" the #!m $arati%e &i'ures are n!t in &air %alue( )he &i'ure are the added %alue &r!m the &inan#ial year ended *0 +une 2007 and ended *, -e#em .er 2007( 1!.&1, -&". , %%."2,

#*.!1,

*. #,

2".**,

T3<5) &. L,12 /8 R)2@4* O* EI@,2: R32,/ A*35:1,1 <)20))* A,4A1,3 3*+ MAS A,45,*)1

<E R)2@4* O* EI@,2: R32,/ I*243! E*2,2: R32,/ A*35:1,1 BA,4A1,3 B)4=3+E AirAsia (% increased ?4A from *++B to *++, since from a significant drop from *++5 to

*++B. This has shown that the company assets is moving a positive trend and utili)e efficiently in order to generate more sales and the value of (%. I*+@124: A>)43?) R32,/ A*35:1,1 BA,4A1,3 B)4=3+ & M353:1,3* A,45,*) S:12); B)4=3+E

*. / $ a g e

!rom figures, both AirAsia and 7AS Airline are moving a positive trend to generate investment returns to shareholders 0.++A"7AS Airline and ?*A" AirAsia1 from *++B to *++,.

4.3.4

S/5>)*7: R32,/ A*35:1,1

T3<5) '. L,12 /8 S/5>)*7: R32,/ A*35:1,1 <)20))* A,4A1,3 3*+ MAS A,45,*)1

S!l%en#y Rati! Analysis Airasia Berhad 2008 (Restated) Malaysian Airline System Berhad 2008 (Restated) 2007 (Restated)

2009

*2007

2009

)ebt to 12uity ratio =

$otal Liabilities $otal 12uity

*Rem arks: !r 2007" the #!m $arati%e &i'ures are n!t in &air %alue( )he &i'ure are the added %alue &r!m the &inan#ial year ended *0 +une 2007 and ended *, -e#em .er 2007( &.&* %. # 2."#

1".%"

1.%"

2.**

T3<5) 10. L,12 /8 D)<2 2/ EI@,2: R32,/ A*35:1,1 <)20))* A,4A1,3 3*+ MAS A,45,*)1

3E D)<2 T/ EI@,2: R32,/ I*243! E*2,2: R32,/ A*35:1,1 BA,4A1,3 B)4=3+E !rom figures, AirAsia is non aggressive in financing business growth by the debts costs. The company shows high li-uidity and healthy financial status in recovering its debts.

I*+@124: A>)43?) R32,/ A*35:1,1 BA,4A1,3 B)4=3+ & M353:1,3* A,45,*) S:12); B)4=3+E ** / $ a g e

As compared to 7AS Airline, 7AS Airline adopting different financing strategy compared to AirAsia. 7AS Airline is focused on debt financing to increase operations 0due to high debt to e-uity ratio1. As a national carrier, 7AS Airline believed this could potentially generate more earnings than it would have without this outside financing sub@ect if this were to increase earnings by a greater amount than the debt cost 0interest1. This strategy is also able to satisfy shareholders due to more earnings gained. Dowever, 7AS Airline must be careful in managing this strategy due to this approach may outweigh the return of 7AS Airline generates that may lead to bankruptcy.

4.3.5

S=34) M34A)2 R32,/ A*35:1,1

T3<5) 11. L,12 /8 M34A)2 R32,/ A*35:1,1 <)20))* A,4A1,3 3*+ MAS A,45,*)1

Share Mar ket Rati! Analysis Airasia Be rhad 2008 (Res tated) Malaysian Airline Sys te m Be rhad 2008 (Re state d) 2007 (Re state d)

2009

*2007

2009

*Rem arks : !r 2007" the #!m $arati%e &i'ures ar e n!t in &air %alue( )he &i'ure are the adde d %alue &r!m the &inan#ial year e nded *0 +une 2007 and ende d *, -e#em .e r 2007( 1arnin( 3er 04are -5asic (0en) -)ilute6 (0en) )ivi6en6 6eclare6 3er s4are (0en) -rice to 1arnin(s ratio (-71) = ____/arket 3rice o. co88on stock_____ 1arnin(s 3er 04are 2".#" 2".#" n7a "."# -21.1" -21.1" n7a -"."# 1 .1" 17.!" n7a ".1" 2!.&" 2 .#" n7a ".1" 1%.#" 1%.#" n7a ".2% * ."" *%.2" 2.*" ".1"

T3<5) 12. L,12 /8 PCE R32,/ A*35:1,1 <)20))* A,4A1,3 3*+ MAS A,45,*)1

3E PCE R32,/

*4 / $ a g e

I*243!E*2,2: R32,/ A*35:1,1 BA,4A1,3 B)4=3+E !rom the figures, the decrease in the $J% ratio in *++B is mainly due to the decrease in share price during the recession but not really related to the confident of the investor on AirAsia. Dowever, the trend is improving in *++, as the share price is increase and gaining investor confident again. I*+@124: A>)43?) R32,/ A*35:1,1 BA,4A1,3 B)4=3+ & M353:1,3* A,45,*) S:12); B)4=3+E The $J% ratio growth trends of AirAsia are higher than 7AS Airlines from *++B to *++,. This is indicating that investors confident to invest in AirAsia higher than 7AS Airlines due to aggressive growth rate in assets, e#panding its flight routes services in 7alaysia, Indonesia and Thailand to cater to the rising demand for budget flights.

*6 / $ a g e

T3<5) 13. S=34) P4,7) T4)*+ R32,/ <)20))* A,4A1,3 3*+ MAS A,45,*)1 B=+

*& / $ a g e

T3<5) 14. S=34) P4,7) T4)*+ R32,/ <)20))* A,4A1,3 3*+ MAS A,45,*)1 B=+ 7/;(34)+ 2/ KLSE

*? / $ a g e

5.0

CONCLUSION N/*!8,*3*7,35 ()48/4;3*7) AirAsia has addressed all foreseeable risk in its comprehensive risk framework. They have strong internal asset and operating management within the group. Air Asia is the first airline implementing fully ticketless air travel system and keep improving the service value to its customers. Apart from that, the company had still a lot of room for growth in their flight routes and e#panding its e#isting related diversified business units. F,*3*7,35 ()48/4;3*7) AirAsia stands a strong position in every segment measurement from *++B to *++,. The companys significant improvement in *++, based on its strength and opportunities has placed itself well to provide e#posure to growing markets. 7eantime, the strong li-uidity, solvency measurement has proven that Air Asia has outshined them especially in this high capital investment in this industry. The company has the ability to fund new aircraft purchases and repay loans no longer a ma@or concern as operating cash flows has strengthen. Dowever, the selected a set of financial ratios we have analysed which is satisfy the independence criterion. It has no absolute ade-uacy in terms of measuring the overall financial profile of an organisation and always sub@ect to -uestions of @udgement 0>aurent, .,5,1.

*5 / $ a g e

.0

RECOMMENDATION :ased on detailed analysis above, some recommendations are given below to maintain Air Asia current healthy financial positionH %nhance its strategic business planning includes the continuation of cost"controlling efforts, increasing its list of destination cities flight routes and e#panding its related diversified business units. Improve timeliness in its service level in flight schedule and aircraft maintenance services. etire some of its older, more maintenance"intensive aircraft to contribute to Air Asias costs and consideration leasing the fi#ed assets to reduce li-uidity burden.

*B / $ a g e

".0

REFERENCE LIST

AirAsia Annual eport and !inancial Statements *++5, accessed on ** 9ovember *+.+ LhttpHJJwww.airasia.comJmyJenJcorporateJirannualreport.htmlM AirAsia Annual eport and !inancial Statements *++B, accessed on ** 9ovember *+.+ LhttpHJJwww.airasia.comJmyJenJcorporateJirannualreport.htmlM AirAsia Annual eport and !inancial Statements *++,, accessed on ** 9ovember *+.+ LhttpHJJwww.airasia.comJmyJenJcorporateJirannualreport.htmlM AirAsia :erhad !ourth Nuarter 0(ctober"Eecember1 eport *++,, accessed .st Eec .+ LhttpHJJwww.airasia.comJiwov" resourcesJmyJcommonJpdfJAirAsiaJI JAAO6N+,O$ressO elease.pdfM :a)ley 7., Dancock $., :erry A. and ;arvis . *++?, 3ontemporary Accounting, Thomson, ? %dition, Australia. :kkok *++&, PAirAsia aircraft to become flying billboards viewed online 4+th 9ovember *+.+, LhttpHJJwww.bkkok.comJnewsJnewsOarchivedJairasia"aircraft"to"become"flying" billboards.htmlM Eoganis, ., *++.. The Airline :usiness in the *.st 3entury. outledge, >ondon. Eudney, E., ;irasakuldech, :., 0*++B1, P eturn $redictability and the $J% atioH eading the %ntrails, The ;ournal of Investing, !all *++B, Vol. .5, 9o. 4, pp.5&" B*. Darvard :usiness eview 0.,*51, PSummaries of :usiness esearchH 7arket 3apitali)ation ates of Industrial %arnings, pp.5&"B+ =immel et al 0*++?1, QAccounting" :uilding business skillsQ, *nd %dition, ;ohn 'iley < Sons, Australia. >aurent, 0.,5,1, PImproving The %fficiency and %ffectiveness of !inancial atio Analysis, ;oumal of :usiness !inance < Accounting, Vol. ?,9o.4, pp. 6+.R6.4. >ive Trading 9ews (nline 0*+.+1 P:ursa 7alaysia at 4+ 7onth Digh, AirAsia 3onsiders Eividend, S(nlineT, *6th August, accessed .st Eec .+ LhttpHJJwww.livetradingnews.comJbursa"malaysia"at"4+"month"high"airasia"considers"dividend" .,B6B.htmM 7AS Airline Systems :erhad Annual eport and !inancial Statements *++5, accessed .st Eec .+ LhttpHJJmalaysiaairlines.listedcompany.comJar.htmlM 7AS Airline Systems :erhad Annual eport and !inancial Statements *++B, accessed .st Eec .+ LhttpHJJmalaysiaairlines.listedcompany.comJar.htmlM 7AS Airline Systems :erhad Annual eport and !inancial Statements *++,, accessed .st Eec .+ LhttpHJJmalaysiaairlines.listedcompany.comJar.htmlM

*, / $ a g e

9ew Straits Time 9ewspaper (nline 0*+.+1 PAirAsia shares top 7AS for first time, S(nlineT, .&th (ctober, accessed .st Eec .+ LhttpHJJfindarticles.comJpJnews"articlesJnew"straits" timesJmiOB+.?JisO*+.+.+.&Jairasia"shares"masJaiOn&&&&B6.&JM (3onnel, ;., < 'illiams, C.. 0*++&1. $assengers $erceptions (f >ow 3ost Airlines And !ull Service 3arriersH A case study involving yanair, Aer >ingus, AirAsia and 7alaysia Airlines, ;ournal of Air Transport 7anagement Vol. .. pp. *&,"*5* Strategic Advantage *++&, 7ichael $orterQs !ive !orces Analysis, Strategic Advantage, Inc. $hoeni#, accessed online *&th 9ovember *+.+ LhttpHJJwww.strategy6u.comJassessmentOtoolsJinfo.phpU s8*M The Star (nline 0*+.+1 PAirAsia overtakes 7AS in market cap, S(nlineT, **th (ctober, accessed .st Eec .+ LhttpHJJbi).thestar.com.myJnewsJstory.aspU file8J*+.+J.+J**JbusinessJ5*5?**5<sec8businessM Value :ased 7anagement, accessed on *& 9ovember *+.+ LhttpHJJwww.valuebasedmanagement.netJmethodsOvaluereporting.htmlM Vahoo Singapore !inance 0*+.+1 PAirAsia :erhad Distorical Share $rice and Share 3hart accessed .st Eec .+ LhttpHJJsg.finance.yahoo.comJ-JhpU s8&+,,.=><a8++<b8.<c8*++5<d8..<e84.<f8*++,<g8mWM Vahoo Singapore !inance 0*+.+1 P7as Airline Systems :erhad Distorical Share $rice and Share 3hart, accessed .st Eec .+ LhttpHJJsg.finance.yahoo.comJ-JhpU s845B?.=><a8++<b8.<c8*++5<d8..<e84.<f8*++,<g8mM Khu, A., 0*+.+1, PStrengths and 'eaknesses of AirAsia, !actoid), viewed online *,th 9ovember *+.+, L httpHJJfactoid).comJstrengths"and"weaknesses"of"airasiaJM

4+ / $ a g e

&.0

APPENDIX

A(()*+,- 1. L/0 C/12 C344,)4 M/+)5 E-(53*32,/* 0.1 Simple $roduct " " " " 0*1 3atering on demand for e#tra payment $lanes with narrow seating 0but huge capacity1 9o seat assignment 9o fre-uent flyer programmes.

$ositioning " " " " " 9on"business passengers Short"haul point"to"point traffic with high fre-uencies Aggressive marketing Secondary airports 3ompetition with all transport carriers

041

>ow (perating 3osts " " " " " " >ow wages >ow airport fees >ow costs for maintenance Digh resource productivity Short ground waits due to simple boarding processes 9o air freight, no hub services, short cleaning timesX and high percentage of online sales.

There are two >33s modelsH .. Independent Airlines 0e.g. AirAsia, Southwest, ;etblue, yanair, and %asy@et1 *. $arent airlines 0e.g. !irefly, ;etstar, ;etstar Asia, Valuair, and Tiger1

4. / $ a g e

A(()*+,- 2. P/42)461 5 F/47)1

TD %AT (! 9%' %9T A9TSH LOW Threat of 9ew %ntrants is DICD whenH %conomies of scale are low 3apital J Investment re-uirements are low Switching costs are low Access to industry distribution channels is low $roduct differentiation is low The likelihood of retaliation from e#isting industry players is low Covernment policies creating barriers are low $('% (! :2V% SH #IG# $ower of :uyers is DICD whenH 3oncentration of buyers relative to suppliers is high $roduct differentiation of suppliers is low $rofitability of buyers is low Important of suppliers input to -uality product is low Threat of backward integration by buyers is high Switching costs are low TD %AT (! S2:STIT2T% $ (E23TH MODERATE Threat of Substitute $roduct is DICD whenH The differentiation of the substitute product is high :uyers willingness to substitute The relative price and performance of substitutes TD %AT (! S2$$>I% SH #IG# Threat of suppliers is DICD whenH 3oncentration of buyers relative to suppliers is high Availability of substitute product is low Importance of customer to suppliers is low Eifferentiation of the suppliers products and services is high Switching costs of the buyers is high Threat of forward integration by the supplier is high I9T%9SITV (! IVA> VH #IG# Intensity of ivalry is DICD whenH 9umber of competitors is high Industry growth rate is low !i#ed costs are high Storage costs are high $roduct differentiation is low Switching costs are low %#it barriers are high Strategic stakes are high #,?= L/0 #,?= L/0 #,?= L/0 #,?= L/0 #,?= L/0

4* / $ a g e

A(()*+,- 3. D)8,*,2,/* /8 R32,/1 atio Nuick atio 0Acid Test atio1 Eefinition 7easures an organisation immediate least li-uidity of its current assets to pay back its short"term liabilities. The least li-uidity of the current assets is e#clude inventory and prepaid assets. The higher the numbers indicate better paying capabilities. 7eantime, the lesser value of this ratio 0e.g. less than .1 shows the Inventory Turnover atio higher changes the company unable to pay off the liabilities when payment due Shows the efficiency of an organisation to manage their stock level. Digh level of inventory is considered unhealthy due to they are representing an investment with a rate of return e-ual to )ero and also causing trouble when the eturn (n Assets atio inventories getting cheaper. Indicator of how profitable an organisation is relative to its total assets. This ratio gives an idea as to how efficient management is at using its assets to generate earnings. The higher the numbers indicate the better in an organisationQs ability converting asset to profits. 9et $rofit 7argin atio 7easures profit on an organisation that can be generated by each dollar of sales. The higher the number indicates better position of an organisation to generate profit by each dollar of sales. In addition, profit margin ratio also may imply howQs an organisation using compromise its pricing strategy in order to eturn (n %-uity atio Eebt To %-uity atio achieve its strategic business strategy. 7easurement of the ability of an organisation to generate investment returns to the shareholders. 7easurement of an organisation e-uity and debt to finance its assets. A high numbers indicates that an orgnisation has been aggressive in financing its growth with debt. This can result in volatile earnings as a result of the $J% atio additional interest e#pense. 7easures the relationship between market price per share and earning per share by anlaysing the share valuation versus the actually income generate by an organisation. The high the $J% ratio indicates the investor willing to pay more for each unit of income.

44 / $ a g e

A(()*+,- 4. V)42,735 & #/4,9/*235 A*35:1,1

46 / $ a g e

4& / $ a g e

4? / $ a g e

45 / $ a g e

A(()*+,- 5. M,*/4 R32,/ A*35:1,1 <)20))* A,4A1,3 3*+ MAS A,45,*)

4B / $ a g e

4, / $ a g e

6+ / $ a g e

6. / $ a g e

A(()*+,- . S=34) (4,7) ;/>);)*21 8/4 A,4A1,3 3*+ MAS A,45,*)

6* / $ a g e

64 / $ a g e

You might also like

- Report Writing of Bbs 4th Year OnDocument53 pagesReport Writing of Bbs 4th Year OnKARINA SHAKYANo ratings yet

- Peachtree Plumbing Valuation ReportDocument40 pagesPeachtree Plumbing Valuation ReportBobYu100% (1)

- Case 9 AirasiaDocument10 pagesCase 9 AirasiaaryaNo ratings yet

- Management Air AsiaDocument19 pagesManagement Air AsiaPrisy ChooNo ratings yet

- Cinepax Cinema ProjectDocument14 pagesCinepax Cinema Projectkainat khalidNo ratings yet

- AirAsia SlidesDocument9 pagesAirAsia SlidesjaysonchammbaNo ratings yet

- Awf-Amo-004 - Corporate Commitment by Accountable Manager Rev.0 PDFDocument3 pagesAwf-Amo-004 - Corporate Commitment by Accountable Manager Rev.0 PDFDharmendra Sumitra UpadhyayNo ratings yet

- Airline Simulation SWOTDocument1 pageAirline Simulation SWOTJohn PickleNo ratings yet

- Air AsiaDocument25 pagesAir AsiaCeline SuHuiNo ratings yet

- Group CorporateStrategyDocument25 pagesGroup CorporateStrategyKhai EmanNo ratings yet

- Air Asia Media KitDocument4 pagesAir Asia Media KitGoro Saruwatari100% (1)

- CSR Air AsiaDocument4 pagesCSR Air AsiaSharone LeeNo ratings yet

- Air Asia Airlines Company Company BackgroundDocument5 pagesAir Asia Airlines Company Company BackgroundAmirahNo ratings yet

- Air Asia ReportDocument6 pagesAir Asia ReportLydia Ng100% (1)

- Discover AirasiaDocument55 pagesDiscover Airasiasuhrid02No ratings yet

- Market Planning Air AsiaDocument19 pagesMarket Planning Air Asiachei an goiNo ratings yet

- Garuda Indonesia I.1 Garuda Indonesia at GlanceDocument14 pagesGaruda Indonesia I.1 Garuda Indonesia at GlanceveccoNo ratings yet

- Air AsiaDocument8 pagesAir AsiaViCky PhangNo ratings yet

- Air Asia Airlines Company Company BackgroundDocument5 pagesAir Asia Airlines Company Company BackgroundChe TaNo ratings yet

- ReferencesDocument9 pagesReferencesFarah WahidaNo ratings yet

- Air Asia Mix MarketingDocument29 pagesAir Asia Mix MarketingHadzme Hajan100% (1)

- Air Asia SM AssignmentDocument5 pagesAir Asia SM AssignmentFaizan JavedNo ratings yet

- Airline IndustryDocument37 pagesAirline IndustrySudhakar TummalaNo ratings yet

- History of Mas AirlinesDocument18 pagesHistory of Mas AirlinesSyed Ktwenty100% (1)

- Singapor AirlineDocument12 pagesSingapor AirlineHArix IFtikharNo ratings yet

- Malaysia AirlinesDocument5 pagesMalaysia AirlineslolopNo ratings yet

- SM 2Document9 pagesSM 2Jamuna Rani100% (1)

- PEST and SWOT Analysis of AirAsias International Business OperationsDocument21 pagesPEST and SWOT Analysis of AirAsias International Business OperationsDoremon G Fly100% (1)

- Air Asia Strategic ManagementDocument2 pagesAir Asia Strategic ManagementAffizul AzuwarNo ratings yet

- Strategic Management of AppleDocument4 pagesStrategic Management of AppleLahari ChowdaryNo ratings yet

- AIRASIA-Cover To Page 109Document125 pagesAIRASIA-Cover To Page 109Pavitra RajasegaranNo ratings yet

- HRM in British Airways and Jet AirwaysDocument49 pagesHRM in British Airways and Jet AirwaysRita JainNo ratings yet

- Project Report On Jet Airways CitrixDocument9 pagesProject Report On Jet Airways CitrixvithanibharatNo ratings yet

- AirAsia India Economic ProspectsDocument28 pagesAirAsia India Economic ProspectsKr SimantNo ratings yet

- Spice JetDocument4 pagesSpice JetPratik JagtapNo ratings yet

- Aircraft MaintenanceDocument16 pagesAircraft MaintenancebogosilekNo ratings yet

- Airasia: Airasia Berhad (Myx: 5099 (HTTP://WWW - BursamalaysiDocument13 pagesAirasia: Airasia Berhad (Myx: 5099 (HTTP://WWW - BursamalaysimuhdfirdausNo ratings yet

- Branding Strategy and Market Share: A Case Study of Jet AirwaysDocument8 pagesBranding Strategy and Market Share: A Case Study of Jet Airwaysakshat mathurNo ratings yet

- UNIT 10 Work - Based ExperienceDocument5 pagesUNIT 10 Work - Based Experiencechandni0810No ratings yet

- Sri LankanDocument21 pagesSri Lankansbandara50% (2)

- It Implementations and Strategic Alignment of Air AsiaDocument5 pagesIt Implementations and Strategic Alignment of Air AsiaManish SharmaNo ratings yet

- MGT DexandraDocument12 pagesMGT DexandraAINUL MARDIYAH MOHD AZMI0% (1)

- Assigment BEGDocument5 pagesAssigment BEGDanielNathNo ratings yet

- GSM AssignmentDocument15 pagesGSM AssignmentSushma chhetri0% (1)

- Strategic Management - Vision, Mission (Final Draft)Document3 pagesStrategic Management - Vision, Mission (Final Draft)Aiman FakhrullahNo ratings yet

- Customer Satisfaction in Airline IndustryDocument5 pagesCustomer Satisfaction in Airline IndustryAzuati MahmudNo ratings yet

- Air AsiaDocument7 pagesAir AsiaShafika Hanis100% (1)

- Business Ethics Presentation On Emirates Airline: Presented byDocument9 pagesBusiness Ethics Presentation On Emirates Airline: Presented byYaseen AmjadNo ratings yet

- Strategic Management Airasia Strategic MDocument26 pagesStrategic Management Airasia Strategic MShariful islamNo ratings yet

- Assignment of Product and Brand ManagementDocument10 pagesAssignment of Product and Brand ManagementdinnubhattNo ratings yet

- Fakulti Sains Sukan Dan Rekreasi: Group AssignmentDocument11 pagesFakulti Sains Sukan Dan Rekreasi: Group Assignmentsaidatul aliahNo ratings yet

- Product Life CycleDocument5 pagesProduct Life CycleEkkala Naruttey0% (1)

- Micro Environment Air AsiaDocument9 pagesMicro Environment Air AsiaKeith PerkinsNo ratings yet

- Oasis AirlineDocument5 pagesOasis AirlineRd Indra AdikaNo ratings yet

- Air AsiaDocument32 pagesAir AsiaLittle FaithNo ratings yet

- Airasia Project PresentationDocument52 pagesAirasia Project Presentationlens00700100% (3)

- Air AsiaDocument33 pagesAir AsiaJain05No ratings yet

- Qantas Case StudyDocument24 pagesQantas Case StudyThuy HongNo ratings yet

- Analysis of AirAsia, Malaysian Airlines and Singapore AirlinesDocument39 pagesAnalysis of AirAsia, Malaysian Airlines and Singapore AirlinesZia100% (12)

- HOS801 - Assignment 2 - Exemplar 2Document25 pagesHOS801 - Assignment 2 - Exemplar 2simran chawlaNo ratings yet

- Singapore AirlinesDocument23 pagesSingapore Airlinesbhashika prakashNo ratings yet

- The Low Budget Airline Jetstar Asia Airways Tourism EssayDocument10 pagesThe Low Budget Airline Jetstar Asia Airways Tourism EssayudanasrNo ratings yet

- Oligopoly and GameTheory SDKJFSKFDJDocument9 pagesOligopoly and GameTheory SDKJFSKFDJDaud SulaimanNo ratings yet

- Innovation Michalko 2006 Chapter 9 ThinkertoysDocument37 pagesInnovation Michalko 2006 Chapter 9 ThinkertoysDaud SulaimanNo ratings yet

- Microecon CostDocument26 pagesMicroecon CostDaud SulaimanNo ratings yet

- Financial Statements: BAO6504 Accounting For ManagementDocument20 pagesFinancial Statements: BAO6504 Accounting For ManagementDaud SulaimanNo ratings yet

- Theory of The FirmDocument15 pagesTheory of The FirmDaud SulaimanNo ratings yet

- Afraid To FlyDocument3 pagesAfraid To FlyDaud SulaimanNo ratings yet

- Supply Chain Management Review SCMR - SepOct - 2012 - t504Document69 pagesSupply Chain Management Review SCMR - SepOct - 2012 - t504Daud SulaimanNo ratings yet

- Microeconomics MidtermDocument17 pagesMicroeconomics Midtermdashe100% (1)

- THE DOMINANT ECONOMICS PARADIGM AND CORPORATE SOCIAL RESPONSIBILITY (Korhonen 2002)Document14 pagesTHE DOMINANT ECONOMICS PARADIGM AND CORPORATE SOCIAL RESPONSIBILITY (Korhonen 2002)Daud SulaimanNo ratings yet

- Supply Chain Management of Pepsi Cola, PakistanDocument16 pagesSupply Chain Management of Pepsi Cola, Pakistanmazuu97% (37)

- Ford in ChinaDocument4 pagesFord in ChinaDaud SulaimanNo ratings yet

- Ford in ChinaDocument4 pagesFord in ChinaDaud SulaimanNo ratings yet

- 32 July 1 August 2007 Aba Bank MarkenngDocument8 pages32 July 1 August 2007 Aba Bank MarkenngDaud SulaimanNo ratings yet

- Marketing Multiple Choice Questions and AnswersDocument9 pagesMarketing Multiple Choice Questions and AnswersNicola DudanuNo ratings yet

- Reliance Eqity FundDocument27 pagesReliance Eqity FundMohamed SharifNo ratings yet

- Perpetual Inventory - JOURNALDocument3 pagesPerpetual Inventory - JOURNALG09 CARGANILLA, Angelika M.No ratings yet

- PTPP Uob 15 Mar 2022Document5 pagesPTPP Uob 15 Mar 2022Githa Adhi Pramana I GDNo ratings yet

- Finance Process Flow in JDEDocument35 pagesFinance Process Flow in JDERamesh KumarNo ratings yet

- WA EbookDocument8 pagesWA Ebook10xpassiveincomeestateNo ratings yet

- Agency of Record Registration: 1.1 Advertising Agency 1.2 Media BuyingDocument8 pagesAgency of Record Registration: 1.1 Advertising Agency 1.2 Media Buyingashish9dubey-16No ratings yet

- Purchase Requisition (PR) : PT Ansaf Inti ResourcesDocument1 pagePurchase Requisition (PR) : PT Ansaf Inti Resourcesghan sugandiNo ratings yet

- Functionality in ERP EHPDocument57 pagesFunctionality in ERP EHPSunil PeddiNo ratings yet

- Bajaj Fans PresentationDocument27 pagesBajaj Fans Presentationneha160No ratings yet

- Managing People 2-2Document17 pagesManaging People 2-2leminhanh2402No ratings yet

- Strategic Audit Report Amway Holdings SDN BHDDocument75 pagesStrategic Audit Report Amway Holdings SDN BHDYung Yee100% (1)

- Project Report On Mutual FundDocument60 pagesProject Report On Mutual FundBaldeep KaurNo ratings yet

- Role That CA's Can Play in Growth of Indian EconomyDocument3 pagesRole That CA's Can Play in Growth of Indian EconomySwarna LathaNo ratings yet

- Internal SwotDocument3 pagesInternal SwotMicah CarpioNo ratings yet

- Deloitte-Entrance-Test 21.22Document20 pagesDeloitte-Entrance-Test 21.22Vũ Tăng ThếNo ratings yet

- I. Accounting Methods For By-Products: Exercise 3Document2 pagesI. Accounting Methods For By-Products: Exercise 3Crescent OsamuNo ratings yet

- Entrep Report Outline (04!04!22)Document8 pagesEntrep Report Outline (04!04!22)Jirah MartinNo ratings yet

- Closing Entries, Worksheet, Post Closing Trial BalanceDocument12 pagesClosing Entries, Worksheet, Post Closing Trial BalanceHendra SetiyawanNo ratings yet

- Research Paper On Marketing StrategiesDocument6 pagesResearch Paper On Marketing Strategiesafedpmqgr100% (1)

- The Use of The Kano Model To Enhance Customer Satisfaction: Laura Južnik Rotar, Mitja KOZARDocument13 pagesThe Use of The Kano Model To Enhance Customer Satisfaction: Laura Južnik Rotar, Mitja KOZARCristinaNo ratings yet

- Chapter 1 CLCDocument17 pagesChapter 1 CLCLinh BùiNo ratings yet

- Private, Public and Global EnterprisesDocument16 pagesPrivate, Public and Global EnterprisesNishtha GuptaNo ratings yet

- Chapter 3 Performance Management and Strategic PlanningDocument3 pagesChapter 3 Performance Management and Strategic PlanningDeviane CalabriaNo ratings yet

- OM MBA Chap 1Document34 pagesOM MBA Chap 1Asmish EthiopiaNo ratings yet

- FM Booster May 24 NotesDocument129 pagesFM Booster May 24 Notes311812922nishanthininkNo ratings yet

- Depository System in India Needs and ProgressDocument17 pagesDepository System in India Needs and ProgressGaurav PandeyNo ratings yet

- FDRM Unit IVDocument104 pagesFDRM Unit IVAnonymous kwi5IqtWJNo ratings yet