Professional Documents

Culture Documents

Accounting Standard (AS) 13 (Issued 1993)

Accounting Standard (AS) 13 (Issued 1993)

Uploaded by

Chanty SridharCopyright:

Available Formats

You might also like

- Solution For "Financial Statement Analysis" Penman 5th EditionDocument16 pagesSolution For "Financial Statement Analysis" Penman 5th EditionKhai Dinh Tran64% (28)

- Module 3 Answers To End of Module QuestionsDocument40 pagesModule 3 Answers To End of Module QuestionsYanLi100% (3)

- The Effects of Changes in Foreign Exchange Rates: Indian Accounting Standard (Ind AS) 21Document27 pagesThe Effects of Changes in Foreign Exchange Rates: Indian Accounting Standard (Ind AS) 21pg0utamNo ratings yet

- Chapter 14 Capital Structure and Financial Ratios: 1. ObjectivesDocument17 pagesChapter 14 Capital Structure and Financial Ratios: 1. Objectivessamuel_dwumfourNo ratings yet

- Chapter 2 Lecture Notes: Consolidation of Financial Information - Date of AcquisitionDocument7 pagesChapter 2 Lecture Notes: Consolidation of Financial Information - Date of AcquisitionAbraham Maharba BaezaNo ratings yet

- Statements of Accounting Standards (AS 10) : Accounting For Fixed AssetsDocument6 pagesStatements of Accounting Standards (AS 10) : Accounting For Fixed AssetsSantoshca1984No ratings yet

- 1.1 Overview-Ratios 1.2 Companies For Analysis 1.3 Objective & Scope of Research Study 1.4 Limitation of Study 1.5 Research MethodologyDocument55 pages1.1 Overview-Ratios 1.2 Companies For Analysis 1.3 Objective & Scope of Research Study 1.4 Limitation of Study 1.5 Research Methodologysauravv7No ratings yet

- Shapiro CHAPTER 2 SolutionsDocument14 pagesShapiro CHAPTER 2 Solutionsjimmy_chou1314100% (1)

- Module 2 SolutionsDocument61 pagesModule 2 Solutionsrasmussen123456No ratings yet

- Mba Faa I UnitDocument8 pagesMba Faa I UnitNaresh GuduruNo ratings yet

- Shapiro CHAPTER 2 SolutionsDocument14 pagesShapiro CHAPTER 2 SolutionsPradeep HemachandranNo ratings yet

- Earnings Per Share: Accounting Standard (AS) 20Document27 pagesEarnings Per Share: Accounting Standard (AS) 20Akshay JainNo ratings yet

- Chapter 4Document4 pagesChapter 4A Muneeb QNo ratings yet

- SM Chapter 06Document42 pagesSM Chapter 06mfawzi010No ratings yet

- Fixed AssetsDocument71 pagesFixed AssetsPochender VajrojNo ratings yet

- FM StudyguideDocument18 pagesFM StudyguideVipul SinghNo ratings yet

- Capital IQ, Broadridge, Factset, Shore Infotech Etc .: Technical Interview QuestionsDocument12 pagesCapital IQ, Broadridge, Factset, Shore Infotech Etc .: Technical Interview Questionsdhsagar_381400085No ratings yet

- Chapter 11 Dividend Policy: 1. ObjectivesDocument8 pagesChapter 11 Dividend Policy: 1. Objectivessamuel_dwumfourNo ratings yet

- Master of Business Administration: Project Report Optimization of Portfolio Risk and ReturnDocument55 pagesMaster of Business Administration: Project Report Optimization of Portfolio Risk and ReturnpiusadrienNo ratings yet

- Financial Statement AnalysisDocument6 pagesFinancial Statement AnalysisLiya JahanNo ratings yet

- Ross 9e FCF SMLDocument425 pagesRoss 9e FCF SMLAlmayaya100% (1)

- Cheat Sheet, Ratio Analysis: Short-Term (Operating) Activity RatiosDocument5 pagesCheat Sheet, Ratio Analysis: Short-Term (Operating) Activity RatiosQaiser KhanNo ratings yet

- Ind AS1Document33 pagesInd AS1SaibhumiNo ratings yet

- B. Woods Chapter 3Document29 pagesB. Woods Chapter 3Sincero MilanNo ratings yet

- Financial Management - MasenoDocument42 pagesFinancial Management - MasenoPerbz JayNo ratings yet

- Index: Stock Exchange Dow Jones Industrial Nikkei 225Document6 pagesIndex: Stock Exchange Dow Jones Industrial Nikkei 225Rana HaiderNo ratings yet

- Consolidated Financial Statements After Acquisition: Complete Equity Method On Books of InvestorDocument5 pagesConsolidated Financial Statements After Acquisition: Complete Equity Method On Books of Investorsalehin1969No ratings yet

- A Study On Credit Management With Reference To Canara BankDocument93 pagesA Study On Credit Management With Reference To Canara BankDeepika KrishnaNo ratings yet

- Leach TB Chap09 Ed3Document8 pagesLeach TB Chap09 Ed3bia070386No ratings yet

- Working Capital Management in HCL InfosystemDocument30 pagesWorking Capital Management in HCL InfosystemCyril ChettiarNo ratings yet

- Financial Management Part 2 RN 12.3.2013 JRM Capital Budgeting Decisions C CDocument7 pagesFinancial Management Part 2 RN 12.3.2013 JRM Capital Budgeting Decisions C CQueenielyn TagraNo ratings yet

- FIN621 Solved MCQs Finalterm Mega FileDocument23 pagesFIN621 Solved MCQs Finalterm Mega Filehaider_shah882267No ratings yet

- Mcs Merged Doc 2009.Document137 pagesMcs Merged Doc 2009.Nimish DeshmukhNo ratings yet

- The Cost of Capital Cost of Capital, Discounts Rates, and The Required Rate of ReturnDocument12 pagesThe Cost of Capital Cost of Capital, Discounts Rates, and The Required Rate of ReturnAveek ChatterjeeNo ratings yet

- Assignment Guide Title PageDocument19 pagesAssignment Guide Title PageAli NANo ratings yet

- Final - Asset Accounting ProcedureDocument38 pagesFinal - Asset Accounting ProcedureSonianNareshNo ratings yet

- Accounting Standard 16: Borrowing CostsDocument33 pagesAccounting Standard 16: Borrowing CostsP VenkatesanNo ratings yet

- Net Profit or Loss For The Period, Prior Period Items and Changes in Accounting PoliciesDocument6 pagesNet Profit or Loss For The Period, Prior Period Items and Changes in Accounting Policiessanyu1208No ratings yet

- Myanmar Accounting Standard 7: Statement of Cash FlowsDocument18 pagesMyanmar Accounting Standard 7: Statement of Cash FlowsKyaw Htin WinNo ratings yet

- Chapter 19 Consolidated Statement of Financial Position With Consolidated AdjustmentsDocument17 pagesChapter 19 Consolidated Statement of Financial Position With Consolidated Adjustmentssamuel_dwumfourNo ratings yet

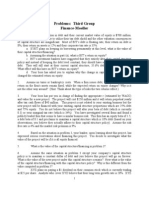

- Problems: Third Group Finance-MoellerDocument4 pagesProblems: Third Group Finance-MoellerEvan BenedictNo ratings yet

- Notes On Project FinanceDocument60 pagesNotes On Project FinanceJas SudanNo ratings yet

- Discuss Whether The Dividend Growth Model or The Capital Asset Pricing Model Offers The Better Estimate of Cost of Equity of A Company3Document24 pagesDiscuss Whether The Dividend Growth Model or The Capital Asset Pricing Model Offers The Better Estimate of Cost of Equity of A Company3Henry PanNo ratings yet

- D & G Case StudyDocument10 pagesD & G Case StudyVrusti RaoNo ratings yet

- Ch24 Full Disclosure in Financial ReportingDocument31 pagesCh24 Full Disclosure in Financial ReportingAries BautistaNo ratings yet

- Chapter 20 Consolidated Income Statement: 1. ObjectivesDocument13 pagesChapter 20 Consolidated Income Statement: 1. Objectivessamuel_dwumfourNo ratings yet

- MAS FS Analysis 40pagesDocument50 pagesMAS FS Analysis 40pageskevinlim186No ratings yet

- C 3 A F S: Hapter Nalysis of Inancial TatementsDocument27 pagesC 3 A F S: Hapter Nalysis of Inancial TatementskheymiNo ratings yet

- Solution Manual For Beams Chapter 8Document36 pagesSolution Manual For Beams Chapter 8Zulfi Rahman Hakim67% (6)

- Investments Profitability, Time Value & Risk Analysis: Guidelines for Individuals and CorporationsFrom EverandInvestments Profitability, Time Value & Risk Analysis: Guidelines for Individuals and CorporationsNo ratings yet

- Applied Corporate Finance. What is a Company worth?From EverandApplied Corporate Finance. What is a Company worth?Rating: 3 out of 5 stars3/5 (2)

- Analytical Corporate Valuation: Fundamental Analysis, Asset Pricing, and Company ValuationFrom EverandAnalytical Corporate Valuation: Fundamental Analysis, Asset Pricing, and Company ValuationNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Securities Brokerage Revenues World Summary: Market Values & Financials by CountryFrom EverandSecurities Brokerage Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Risk Premium & Management - an Asian Direct Real Estate (Dre) PerspectiveFrom EverandRisk Premium & Management - an Asian Direct Real Estate (Dre) PerspectiveNo ratings yet

- Sree Anjaneya Bhujanga Prayatha StotramDocument4 pagesSree Anjaneya Bhujanga Prayatha StotramChanty SridharNo ratings yet

- Schematic Representation of White Goods Solutions On Tally - ERP 9Document1 pageSchematic Representation of White Goods Solutions On Tally - ERP 9Chanty SridharNo ratings yet

- Mastering QuickBooks Payroll 2013Document105 pagesMastering QuickBooks Payroll 2013Chanty Sridhar100% (2)

- MIS Financials FormatDocument23 pagesMIS Financials FormatTango BoxNo ratings yet

- WWW Apspsc Gov inDocument19 pagesWWW Apspsc Gov inChanty SridharNo ratings yet

- Investors' Perception / Behaviour QuestionnaireDocument4 pagesInvestors' Perception / Behaviour QuestionnaireChanty SridharNo ratings yet

- Unique Features of Arjun30Document55 pagesUnique Features of Arjun30DARSHIL RAJPURANo ratings yet

- Software Requirements Specification: Version 1.0 ApprovedDocument5 pagesSoftware Requirements Specification: Version 1.0 Approvedsameen khanNo ratings yet

- 2 Span PSC Composite Girder Bridge PDFDocument51 pages2 Span PSC Composite Girder Bridge PDFAnkitKeshriNo ratings yet

- Executive Coaching AgreementDocument2 pagesExecutive Coaching AgreementAntonio PassarelliNo ratings yet

- Gaming Industry E Mail Id OnlyDocument4 pagesGaming Industry E Mail Id OnlySundararajan SrinivasanNo ratings yet

- Design Engineer CV TemplateDocument2 pagesDesign Engineer CV TemplateyogolainNo ratings yet

- Testing Laboratory DetailsDocument12 pagesTesting Laboratory DetailsSanjay KumarNo ratings yet

- Curs 11Document29 pagesCurs 11Aniculaesi MirceaNo ratings yet

- Brunswick Manual Preinstalacion GSXDocument33 pagesBrunswick Manual Preinstalacion GSXroberto dominguezNo ratings yet

- CNEP Presentation July-Aug 12Document23 pagesCNEP Presentation July-Aug 12RuchirNo ratings yet

- CE Board Nov 2020 - Hydraulics - Set 17Document2 pagesCE Board Nov 2020 - Hydraulics - Set 17Justine Ejay MoscosaNo ratings yet

- Income Tax-V - BookDocument60 pagesIncome Tax-V - BookSiddarood KumbarNo ratings yet

- Essay About Reading Online VS Reading PhysicalDocument7 pagesEssay About Reading Online VS Reading PhysicalKener SevillaNo ratings yet

- CEN-TC227-WG1 N1449 CEN TC227 WG1 - CEN Enquiry Draft EN-131Document48 pagesCEN-TC227-WG1 N1449 CEN TC227 WG1 - CEN Enquiry Draft EN-131kamagaraNo ratings yet

- Pharmaceutical Market Europe - June 2020Document50 pagesPharmaceutical Market Europe - June 2020Areg GhazaryanNo ratings yet

- Chapter 7Document22 pagesChapter 7Te'Lou JocoyNo ratings yet

- Diagnostic User Dossier: V42 ECU / 2A SoftwareDocument120 pagesDiagnostic User Dossier: V42 ECU / 2A SoftwarecdoniguianNo ratings yet

- Commodore Magazine Vol-08-N09 1987 SepDocument132 pagesCommodore Magazine Vol-08-N09 1987 SepSteven DNo ratings yet

- FG Riskadjustmentmethodology Module1Document12 pagesFG Riskadjustmentmethodology Module1J CHANGNo ratings yet

- Confidence Siswa Sma Dalam Materi Peluang: Analisis Kemampuan Kemampuan Penalaran Dan SelfDocument8 pagesConfidence Siswa Sma Dalam Materi Peluang: Analisis Kemampuan Kemampuan Penalaran Dan SelfAfifah R. AminiNo ratings yet

- E JB TutorialDocument141 pagesE JB TutorialManikandan ChellaNo ratings yet

- Practice Paper XDocument14 pagesPractice Paper XRohit KumarNo ratings yet

- Astm C143Document4 pagesAstm C143Audrey Schwartz100% (2)

- Asco 7000 Series Operators Manual Group 5 ControllerDocument32 pagesAsco 7000 Series Operators Manual Group 5 ControllerAhmed Tarek100% (1)

- Itc 6700 IP PA SystemDocument56 pagesItc 6700 IP PA Systemjudy kimNo ratings yet

- Ge1000 Guitar Complex Effect ManualDocument3 pagesGe1000 Guitar Complex Effect Manualpaolo.sinistroNo ratings yet

- Ch3 Crack SealingDocument26 pagesCh3 Crack SealingWinengkuNo ratings yet

- English 1-2-1Document7 pagesEnglish 1-2-1Arlene Suan Paña SevensixfourzeroNo ratings yet

- Tle - Ia (Smaw NC I) Activity Sheet Quarter 1 - Competency 4.1-4.4Document10 pagesTle - Ia (Smaw NC I) Activity Sheet Quarter 1 - Competency 4.1-4.4Joy BuycoNo ratings yet

- Right To Information Vs Right To Privacy: BY-Kanhaiya SinghalDocument5 pagesRight To Information Vs Right To Privacy: BY-Kanhaiya SinghalKanhaiya SinghalNo ratings yet

Accounting Standard (AS) 13 (Issued 1993)

Accounting Standard (AS) 13 (Issued 1993)

Uploaded by

Chanty SridharOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounting Standard (AS) 13 (Issued 1993)

Accounting Standard (AS) 13 (Issued 1993)

Uploaded by

Chanty SridharCopyright:

Available Formats

Accounting Standard (AS) 13 (issued 1993) Accounting for Investments Paragraphs INTRODUCTION Definitions !

"#ANATION Forms of Investments Classification of Investments Cost of Investments Carr$ing Amount of Investments C!rrent Investments "ong-term Investments Investment Properties Disposal of Investments $eclassification of Investments Disclos!re ACCOUNTIN% STANDARD Classification of Investments Cost of Investments Investment Properties Carr%ing &mo!nt of Investments Changes in Carr%ing &mo!nts of Investments Disposal of Investments Disclos!re && CTI' DAT 1-3 3 4-25 4-6 7-8 -13 14-1 14-16 17-1 2# 21-22 23-24 25 26-35 26-27 28-2 3# 31-32 33 34 35 3(

(This Accounting Standard includes paragraphs 26-35 set in bold italic type and paragraphs 1-25 set in plain type, which have equal authority !aragraphs in "old italic type indicate the #ain principles This Accounting Standard should "e read in the conte$t o% the !re%ace to the State#ents o% Accounting Standards1 & 'he follo(ing is the te)t of &cco!nting *tan+ar+ ,&*- 13. /&cco!nting for Investments0. iss!e+ 1% the Co!ncil of the Instit!te of Chartere+ &cco!ntants of In+ia2 2

Introduction 12 'his *tatement +eals (ith acco!nting for investments in the financial statements of enterprises an+ relate+ +isclos!re re3!irements2 3 22 'his *tatement +oes not +eal (ith4 a2 the 1ases for recognition of interest. +ivi+en+s an+ rentals earne+ on investments (hich are covere+ 1% &cco!nting *tan+ar+ on $even!e $ecognition5 operating or finance leases5 investments of retirement 1enefit plans an+ life ins!rance enterprises5 an+ m!t!al f!n+s an+ vent!re capital f!n+s 4 an+6or the relate+ asset management companies. 1an7s an+ p!1lic financial instit!tions forme+ !n+er a Central or *tate 8overnment &ct or so +eclare+ !n+er the Companies &ct. 1 562

12 c2 +2

9 & limite+ revision to this *tan+ar+ has 1een ma+e in 2##3. p!rs!ant to (hich paragraph 2 ,+- of this *tan+ar+ has 1een revise+ ,*ee footnote 4 to this *tan+ar+-2 1 &ttention is specificall% +ra(n to paragraph 423 of the Preface. accor+ing to (hich &cco!nting *tan+ar+s are inten+e+ to appl% onl% to items (hich are material2 2 It ma% 1e note+ that this &cco!nting *tan+ar+ is no( man+ator%2 $eference ma% 1e ma+e to the section title+ /&nno!ncements of the Co!ncil regar+ing stat!s of vario!s +oc!ments iss!e+ 1% the Instit!te of Chartere+ &cco!ntants of In+ia0 appearing at the 1eginning of this Compen+i!m for a +etaile+ +isc!ssion on the implications of the man+ator% stat!s of an acco!nting stan+ar+2 3 *hares. +e1ent!res an+ other sec!rities hel+ as stoc7-in-tra+e ,i2e2. for sale in the or+inar% co!rse of 1!siness- are not /investments0 as +efine+ in this *tatement2 :o(ever. the manner in (hich the% are acco!nte+ for an+ +isclose+ in the financial statements is 3!ite similar to that applica1le in respect of c!rrent investments2 &ccor+ingl%. the provisions of this *tatement. to the e)tent that the% relate to c!rrent investments. are also applica1le to shares. +e1ent!res an+ other sec!rities hel+ as stoc7-in-tra+e. (ith s!ita1le mo+ifications as specifie+ in this *tatement2 4 'he Co!ncil of the Instit!te +eci+e+ to ma7e the limite+ revision to &* 13 in 2##3 p!rs!ant to (hich the (or+s /an+ vent!re capital f!n+s0 have 1een a++e+ in paragraph 2 ,+- of &* 132 'his revision comes into effect in respect of acco!nting perio+s commencing on or after 1-4-2##22 ,*ee /'he Chartere+ &cco!ntant0. ;arch 2##3. pp2 41-2

Definitions 32 'he follo(ing terms are !se+ in this *tatement (ith the meanings assigne+4

'nvest#ents are assets hel+ 1% an enterprise for earning income 1% (a% of +ivi+en+s. interest. an+ rentals. for capital appreciation. or for other 1enefits to the investing

enterprise2

&ssets

hel+

as

stoc7-in-tra+e

are

not

/investments02

A current invest#ent is an investment that is 1% its nat!re rea+il% realisa1le an+ is inten+e+ to 1e hel+ for not more than one %ear from the +ate on (hich s!ch investment is ma+e2 & long ter# invest#ent is an investment other than a c!rrent investment2

&n investment propert% is an investment in lan+ or 1!il+ings that are not inten+e+ to 1e occ!pie+ s!1stantiall% for !se 1%. or in the operations of. the investing enterprise2 (air value is the amo!nt for (hich an asset co!l+ 1e e)change+ 1et(een a 7no(le+gea1le. (illing 1!%er an+ a 7no(le+gea1le. (illing seller in an arm0s length transaction2 <n+er appropriate circ!mstances. mar7et val!e or net realisa1le val!e provi+es an evi+ence of fair val!e2 )ar*et value is the amo!nt o1taina1le from the sale of an investment in an open mar7et. net of e)penses necessaril% to 1e inc!rre+ on or 1efore +isposal2 )*+anation &orms of Investments 42 =nterprises hol+ investments for +iverse reasons2 For some enterprises. investment activit% is a significant element of operations. an+ assessment of the performance of the enterprise ma% largel%. or solel%. +epen+ on the reporte+ res!lts of this activit%2 52 *ome investments have no ph%sical e)istence an+ are represente+ merel% 1% certificates or similar +oc!ments ,e2g2. shares- (hile others e)ist in a ph%sical form ,e2g2. 1!il+ings-2 'he nat!re of an investment ma% 1e that of a +e1t. other than a short or long term loan or a tra+e +e1t. representing a monetar% amo!nt o(ing to the hol+er an+ !s!all% 1earing interest5 alternativel%. it ma% 1e a sta7e in the res!lts an+ net assets of an enterprise s!ch as an e3!it% share2 ;ost investments represent financial rights. 1!t some are tangi1le. s!ch as certain investments in lan+ or 1!il+ings2 62 For some investments. an active mar7et e)ists from (hich a mar7et val!e can 1e esta1lishe+2 For s!ch investments. mar7et val!e generall% provi+es the 1est evi+ence of fair val!e2 For other investments. an active mar7et +oes not e)ist an+ other means are !se+ to +etermine fair val!e2 C+assification of Investments 72 =nterprises present financial statements that classif% fi)e+ assets. investments an+ c!rrent assets into separate categories2 Investments are classifie+ as long term investments an+ c!rrent investments2 C!rrent investments are in the nat!re of c!rrent assets. altho!gh the common practice ma% 1e to incl!+e them in investments2 5 82 Investments other than c!rrent investments are classifie+ as long term investments. even tho!gh the% ma% 1e rea+il% mar7eta1le2

5 *hares. +e1ent!res an+ other sec!rities hel+ for sale in the or+inar% co!rse of 1!siness are +isclose+ as /stoc7-in-tra+e0 !n+er the hea+ /c!rrent assets02

Cost of Investments

2 'he cost of an investment incl!+es ac3!isition charges s!ch as 1ro7erage. fees an+ +!ties2 1#2 If an investment is ac3!ire+. or partl% ac3!ire+. 1% the iss!e of shares or other sec!rities. the ac3!isition cost is the fair val!e of the sec!rities iss!e+ ,(hich. in appropriate cases. ma% 1e in+icate+ 1% the iss!e price as +etermine+ 1% stat!tor% a!thorities-2 'he fair val!e ma% not necessaril% 1e e3!al to the nominal or par val!e of the sec!rities iss!e+2 112 If an investment is ac3!ire+ in e)change. or part e)change. for another asset. the ac3!isition cost of the investment is +etermine+ 1% reference to the fair val!e of the asset given !p2 It ma% 1e appropriate to consi+er the fair val!e of the investment ac3!ire+ if it is more clearl% evi+ent2 122 Interest. +ivi+en+s an+ rentals receiva1les in connection (ith an investment are generall% regar+e+ as income. 1eing the ret!rn on the investment2 :o(ever. in some circ!mstances. s!ch inflo(s represent a recover% of cost an+ +o not form part of income2 For e)ample. (hen !npai+ interest has accr!e+ 1efore the ac3!isition of an interest1earing investment an+ is therefore incl!+e+ in the price pai+ for the investment. the s!1se3!ent receipt of interest is allocate+ 1et(een pre-ac3!isition an+ post-ac3!isition perio+s5 the pre-ac3!isition portion is +e+!cte+ from cost2 >hen +ivi+en+s on e3!it% are +eclare+ from pre-ac3!isition profits. a similar treatment ma% appl%2 If it is +iffic!lt to ma7e s!ch an allocation e)cept on an ar1itrar% 1asis. the cost of investment is normall% re+!ce+ 1% +ivi+en+s receiva1le onl% if the% clearl% represent a recover% of a part of the cost2 132 >hen right shares offere+ are s!1scri1e+ for. the cost of the right shares is a++e+ to the carr%ing amo!nt of the original hol+ing2 If rights are not s!1scri1e+ for 1!t are sol+ in the mar7et. the sale procee+s are ta7en to the profit an+ loss statement2 :o(ever. (here the investments are ac3!ire+ on c!m-right 1asis an+ the mar7et val!e of investments imme+iatel% after their 1ecoming e)-right is lo(er than the cost for (hich the% (ere ac3!ire+. it ma% 1e appropriate to appl% the sale procee+s of rights to re+!ce the carr%ing amo!nt of s!ch investments to the mar7et val!e2 Carr$ing Amount of Investments +urrent 'nvest#ents 142 'he carr%ing amo!nt for c!rrent investments is the lo(er of cost an+ fair val!e2 In respect of investments for (hich an active mar7et e)ists. mar7et val!e generall% provi+es the 1est evi+ence of fair val!e2 'he val!ation of c!rrent investments at lo(er of cost an+ fair val!e provi+es a pr!+ent metho+ of +etermining the carr%ing amo!nt to 1e state+ in the 1alance sheet2 152 ?al!ation of c!rrent investments on overall ,or glo1al- 1asis is not consi+ere+ appropriate2 *ometimes. the concern of an enterprise ma% 1e (ith the val!e of a categor% of relate+ c!rrent investments an+ not (ith each in+ivi+!al investment. an+ accor+ingl% the investments ma% 1e carrie+ at the lo(er of cost an+ fair val!e comp!te+ categor%(ise ,i2e2 e3!it% shares. preference shares. converti1le +e1ent!res. etc2-2 :o(ever. the more pr!+ent an+ appropriate metho+ is to carr% investments in+ivi+!all% at the lo(er of cost an+ fair val!e2 162 For c!rrent investments. an% re+!ction to fair val!e an+ an% reversals of s!ch re+!ctions are incl!+e+ in the profit an+ loss statement2

,ong-ter# 'nvest#ents 172 "ong-term investments are !s!all% carrie+ at cost2 :o(ever. (hen there is a +ecline. other than temporar%. in the val!e of a long term investment. the carr%ing amo!nt is re+!ce+ to recognise the +ecline2 In+icators of the val!e of an investment are o1taine+ 1% reference to its mar7et val!e. the investee0s assets an+ res!lts an+ the e)pecte+ cash flo(s from the investment2 'he t%pe an+ e)tent of the investor0s sta7e in the investee are also ta7en into acco!nt2 $estrictions on +istri1!tions 1% the investee or on +isposal 1% the investor ma% affect the val!e attri1!te+ to the investment2 182 "ong-term investments are !s!all% of in+ivi+!al importance to the investing enterprise2 'he carr%ing amo!nt of long-term investments is therefore +etermine+ on an in+ivi+!al investment 1asis2 1 2 >here there is a +ecline. other than temporar%. in the carr%ing amo!nts of long term investments. the res!ltant re+!ction in the carr%ing amo!nt is charge+ to the profit an+ loss statement2 'he re+!ction in carr%ing amo!nt is reverse+ (hen there is a rise in the val!e of the investment. or if the reasons for the re+!ction no longer e)ist2 Investment "ro*erties 2#2 'he cost of an% shares in a co-operative societ% or a compan%. the hol+ing of (hich is +irectl% relate+ to the right to hol+ the investment propert%. is a++e+ to the carr%ing amo!nt of the investment propert%2 Dis*osa+ of Investments 212 @n +isposal of an investment. the +ifference 1et(een the carr%ing amo!nt an+ the +isposal procee+s. net of e)penses. is recognise+ in the profit an+ loss statement2 222 >hen +isposing of a part of the hol+ing of an in+ivi+!al investment. the carr%ing amo!nt to 1e allocate+ to that part is to 1e +etermine+ on the 1asis of the average carr%ing amo!nt of the total hol+ing of the investment2 6 6 In respect of shares. +e1ent!res an+ other sec!rities hel+ as stoc7-in-tra+e. the cost of stoc7s +ispose+ of is +etermine+ 1% appl%ing an appropriate cost form!la ,e2g2 first-in. firsto!t5 average cost. etc2-2 'hese cost form!lae are the same as those specifie+ in &cco!nting *tan+ar+ ,&*- 2. in respect of ?al!ation of Inventories2 Rec+assification of Investments 232 >here long-term investments are reclassifie+ as c!rrent investments. transfers are ma+e at the lo(er of cost an+ carr%ing amo!nt at the +ate of transfer2 242 >here investments are reclassifie+ from c!rrent to long-term. transfers are ma+e at the lo(er of cost an+ fair val!e at the +ate of transfer2 Disc+osure 252 'he follo(ing +isclos!res in financial statements in relation to investments are appropriate4a2 12 the acco!nting policies for the +etermination of carr%ing amo!nt of investments5 the amo!nts incl!+e+ in profit an+ loss statement for4

i2

interest. +ivi+en+s ,sho(ing separatel% +ivi+en+s from s!1si+iar% companies-. an+ rentals on investments sho(ing separatel% s!ch income from long term an+ c!rrent investments2 8ross income sho!l+ 1e state+. the amo!nt of income ta) +e+!cte+ at so!rce 1eing incl!+e+ !n+er &+vance 'a)es Pai+5 profits an+ losses on +isposal of c!rrent investments an+ changes in carr%ing amo!nt of s!ch investments5 profits an+ losses on +isposal of long term investments an+ changes in the carr%ing amo!nt of s!ch investments5

ii2

iii2

c2

significant restrictions on the right of o(nership. realisa1ilit% of investments or the remittance of income an+ procee+s of +isposal5 the aggregate amo!nt of 3!ote+ an+ !n3!ote+ investments. giving the aggregate mar7et val!e of 3!ote+ investments5 other +isclos!res as specificall% re3!ire+ 1% the relevant stat!te governing the enterprise2

+2

e2

Accounting Standard Classification of Investments ,(An enterprise should disclose current investments and long term investments distinctly in its financial statements. ,.- Further classification of current and long-term investments should be as specified in the statute governing the enterprise. In the absence of a statutory requirement, such further classification should disclose, where applicable, investments in: a. b. c. d. overnment or !rust securities "hares, debentures or bonds Investment properties #thers-specifying nature.

Cost of Investments ,/!he cost of an investment should include acquisition charges such as bro$erage, fees and duties. ,9If an investment is acquired, or partly acquired, by the issue of shares or other securities, the acquisition cost should be the fair value of the securities issued %which in appropriate cases may be indicated by the issue price as determined by statutory authorities&. !he fair value may not necessarily be equal to the nominal or par value of the securities issued. If an investment is acquired in e'change for another asset, the acquisition cost of the investment should be determined by reference to the fair value of the asset given up. Alternatively, the acquisition cost of the investment may be determined with reference to the fair value of the investment acquired if it is more clearly evident.

Investment (roperties 30An enterprise holding investment properties should account for them as long term investments. Carrying Amount of Investments 31Investments classified as current investments should be carried in the financial statements at the lower of cost and fair value determined either on an individual investment basis or by category of investment, but not on an overall %or global& basis. 3,Investments classified as long term investments should be carried in the financial statements at cost. )owever, provision for diminution shall be made to recognise a decline, other than temporary, in the value of the investments, such reduction being determined and made for each investment individually. Changes in Carrying Amounts of Investments 33Any reduction in the carrying amount and any reversals of such reductions should be charged or credited to the profit and loss statement. *isposal of Investments 31#n disposal of an investment, the difference between the carrying amount and net disposal proceeds should be charged or credited to the profit and loss statement. *isclosure 32- !he following information should be disclosed in the financial statements: a. the accounting investments+ policies for determination of carrying amount of

b.

classification of investments as specified in paragraphs ,- and ,. above+ the amounts included in profit and loss statement for: i. interest, dividends %showing separately dividends from subsidiary companies&, and rentals on investments showing separately such income from long term and current investments. ross income should be stated, the amount of income ta' deducted at source being included under Advance !a'es (aid+ profits and losses on disposal of current investments and changes in the carrying amount of such investments+ and profits and losses on disposal of long term investments and changes in the carrying amount of such investments+

c.

ii.

iii.

d.

significant restrictions on the right of ownership, realisability of investments or the remittance of income and proceeds of disposal+ the aggregate amount of quoted and unquoted investments, giving the

e.

aggregate mar$et value of quoted investments+ f. other disclosures as specifically required by the relevant statute governing the enterprise.

ffective Date 3(!his Accounting "tandard comes into effect for financial statements covering periods commencing on or after April /, /001.

You might also like

- Solution For "Financial Statement Analysis" Penman 5th EditionDocument16 pagesSolution For "Financial Statement Analysis" Penman 5th EditionKhai Dinh Tran64% (28)

- Module 3 Answers To End of Module QuestionsDocument40 pagesModule 3 Answers To End of Module QuestionsYanLi100% (3)

- The Effects of Changes in Foreign Exchange Rates: Indian Accounting Standard (Ind AS) 21Document27 pagesThe Effects of Changes in Foreign Exchange Rates: Indian Accounting Standard (Ind AS) 21pg0utamNo ratings yet

- Chapter 14 Capital Structure and Financial Ratios: 1. ObjectivesDocument17 pagesChapter 14 Capital Structure and Financial Ratios: 1. Objectivessamuel_dwumfourNo ratings yet

- Chapter 2 Lecture Notes: Consolidation of Financial Information - Date of AcquisitionDocument7 pagesChapter 2 Lecture Notes: Consolidation of Financial Information - Date of AcquisitionAbraham Maharba BaezaNo ratings yet

- Statements of Accounting Standards (AS 10) : Accounting For Fixed AssetsDocument6 pagesStatements of Accounting Standards (AS 10) : Accounting For Fixed AssetsSantoshca1984No ratings yet

- 1.1 Overview-Ratios 1.2 Companies For Analysis 1.3 Objective & Scope of Research Study 1.4 Limitation of Study 1.5 Research MethodologyDocument55 pages1.1 Overview-Ratios 1.2 Companies For Analysis 1.3 Objective & Scope of Research Study 1.4 Limitation of Study 1.5 Research Methodologysauravv7No ratings yet

- Shapiro CHAPTER 2 SolutionsDocument14 pagesShapiro CHAPTER 2 Solutionsjimmy_chou1314100% (1)

- Module 2 SolutionsDocument61 pagesModule 2 Solutionsrasmussen123456No ratings yet

- Mba Faa I UnitDocument8 pagesMba Faa I UnitNaresh GuduruNo ratings yet

- Shapiro CHAPTER 2 SolutionsDocument14 pagesShapiro CHAPTER 2 SolutionsPradeep HemachandranNo ratings yet

- Earnings Per Share: Accounting Standard (AS) 20Document27 pagesEarnings Per Share: Accounting Standard (AS) 20Akshay JainNo ratings yet

- Chapter 4Document4 pagesChapter 4A Muneeb QNo ratings yet

- SM Chapter 06Document42 pagesSM Chapter 06mfawzi010No ratings yet

- Fixed AssetsDocument71 pagesFixed AssetsPochender VajrojNo ratings yet

- FM StudyguideDocument18 pagesFM StudyguideVipul SinghNo ratings yet

- Capital IQ, Broadridge, Factset, Shore Infotech Etc .: Technical Interview QuestionsDocument12 pagesCapital IQ, Broadridge, Factset, Shore Infotech Etc .: Technical Interview Questionsdhsagar_381400085No ratings yet

- Chapter 11 Dividend Policy: 1. ObjectivesDocument8 pagesChapter 11 Dividend Policy: 1. Objectivessamuel_dwumfourNo ratings yet

- Master of Business Administration: Project Report Optimization of Portfolio Risk and ReturnDocument55 pagesMaster of Business Administration: Project Report Optimization of Portfolio Risk and ReturnpiusadrienNo ratings yet

- Financial Statement AnalysisDocument6 pagesFinancial Statement AnalysisLiya JahanNo ratings yet

- Ross 9e FCF SMLDocument425 pagesRoss 9e FCF SMLAlmayaya100% (1)

- Cheat Sheet, Ratio Analysis: Short-Term (Operating) Activity RatiosDocument5 pagesCheat Sheet, Ratio Analysis: Short-Term (Operating) Activity RatiosQaiser KhanNo ratings yet

- Ind AS1Document33 pagesInd AS1SaibhumiNo ratings yet

- B. Woods Chapter 3Document29 pagesB. Woods Chapter 3Sincero MilanNo ratings yet

- Financial Management - MasenoDocument42 pagesFinancial Management - MasenoPerbz JayNo ratings yet

- Index: Stock Exchange Dow Jones Industrial Nikkei 225Document6 pagesIndex: Stock Exchange Dow Jones Industrial Nikkei 225Rana HaiderNo ratings yet

- Consolidated Financial Statements After Acquisition: Complete Equity Method On Books of InvestorDocument5 pagesConsolidated Financial Statements After Acquisition: Complete Equity Method On Books of Investorsalehin1969No ratings yet

- A Study On Credit Management With Reference To Canara BankDocument93 pagesA Study On Credit Management With Reference To Canara BankDeepika KrishnaNo ratings yet

- Leach TB Chap09 Ed3Document8 pagesLeach TB Chap09 Ed3bia070386No ratings yet

- Working Capital Management in HCL InfosystemDocument30 pagesWorking Capital Management in HCL InfosystemCyril ChettiarNo ratings yet

- Financial Management Part 2 RN 12.3.2013 JRM Capital Budgeting Decisions C CDocument7 pagesFinancial Management Part 2 RN 12.3.2013 JRM Capital Budgeting Decisions C CQueenielyn TagraNo ratings yet

- FIN621 Solved MCQs Finalterm Mega FileDocument23 pagesFIN621 Solved MCQs Finalterm Mega Filehaider_shah882267No ratings yet

- Mcs Merged Doc 2009.Document137 pagesMcs Merged Doc 2009.Nimish DeshmukhNo ratings yet

- The Cost of Capital Cost of Capital, Discounts Rates, and The Required Rate of ReturnDocument12 pagesThe Cost of Capital Cost of Capital, Discounts Rates, and The Required Rate of ReturnAveek ChatterjeeNo ratings yet

- Assignment Guide Title PageDocument19 pagesAssignment Guide Title PageAli NANo ratings yet

- Final - Asset Accounting ProcedureDocument38 pagesFinal - Asset Accounting ProcedureSonianNareshNo ratings yet

- Accounting Standard 16: Borrowing CostsDocument33 pagesAccounting Standard 16: Borrowing CostsP VenkatesanNo ratings yet

- Net Profit or Loss For The Period, Prior Period Items and Changes in Accounting PoliciesDocument6 pagesNet Profit or Loss For The Period, Prior Period Items and Changes in Accounting Policiessanyu1208No ratings yet

- Myanmar Accounting Standard 7: Statement of Cash FlowsDocument18 pagesMyanmar Accounting Standard 7: Statement of Cash FlowsKyaw Htin WinNo ratings yet

- Chapter 19 Consolidated Statement of Financial Position With Consolidated AdjustmentsDocument17 pagesChapter 19 Consolidated Statement of Financial Position With Consolidated Adjustmentssamuel_dwumfourNo ratings yet

- Problems: Third Group Finance-MoellerDocument4 pagesProblems: Third Group Finance-MoellerEvan BenedictNo ratings yet

- Notes On Project FinanceDocument60 pagesNotes On Project FinanceJas SudanNo ratings yet

- Discuss Whether The Dividend Growth Model or The Capital Asset Pricing Model Offers The Better Estimate of Cost of Equity of A Company3Document24 pagesDiscuss Whether The Dividend Growth Model or The Capital Asset Pricing Model Offers The Better Estimate of Cost of Equity of A Company3Henry PanNo ratings yet

- D & G Case StudyDocument10 pagesD & G Case StudyVrusti RaoNo ratings yet

- Ch24 Full Disclosure in Financial ReportingDocument31 pagesCh24 Full Disclosure in Financial ReportingAries BautistaNo ratings yet

- Chapter 20 Consolidated Income Statement: 1. ObjectivesDocument13 pagesChapter 20 Consolidated Income Statement: 1. Objectivessamuel_dwumfourNo ratings yet

- MAS FS Analysis 40pagesDocument50 pagesMAS FS Analysis 40pageskevinlim186No ratings yet

- C 3 A F S: Hapter Nalysis of Inancial TatementsDocument27 pagesC 3 A F S: Hapter Nalysis of Inancial TatementskheymiNo ratings yet

- Solution Manual For Beams Chapter 8Document36 pagesSolution Manual For Beams Chapter 8Zulfi Rahman Hakim67% (6)

- Investments Profitability, Time Value & Risk Analysis: Guidelines for Individuals and CorporationsFrom EverandInvestments Profitability, Time Value & Risk Analysis: Guidelines for Individuals and CorporationsNo ratings yet

- Applied Corporate Finance. What is a Company worth?From EverandApplied Corporate Finance. What is a Company worth?Rating: 3 out of 5 stars3/5 (2)

- Analytical Corporate Valuation: Fundamental Analysis, Asset Pricing, and Company ValuationFrom EverandAnalytical Corporate Valuation: Fundamental Analysis, Asset Pricing, and Company ValuationNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Securities Brokerage Revenues World Summary: Market Values & Financials by CountryFrom EverandSecurities Brokerage Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Risk Premium & Management - an Asian Direct Real Estate (Dre) PerspectiveFrom EverandRisk Premium & Management - an Asian Direct Real Estate (Dre) PerspectiveNo ratings yet

- Sree Anjaneya Bhujanga Prayatha StotramDocument4 pagesSree Anjaneya Bhujanga Prayatha StotramChanty SridharNo ratings yet

- Schematic Representation of White Goods Solutions On Tally - ERP 9Document1 pageSchematic Representation of White Goods Solutions On Tally - ERP 9Chanty SridharNo ratings yet

- Mastering QuickBooks Payroll 2013Document105 pagesMastering QuickBooks Payroll 2013Chanty Sridhar100% (2)

- MIS Financials FormatDocument23 pagesMIS Financials FormatTango BoxNo ratings yet

- WWW Apspsc Gov inDocument19 pagesWWW Apspsc Gov inChanty SridharNo ratings yet

- Investors' Perception / Behaviour QuestionnaireDocument4 pagesInvestors' Perception / Behaviour QuestionnaireChanty SridharNo ratings yet

- Unique Features of Arjun30Document55 pagesUnique Features of Arjun30DARSHIL RAJPURANo ratings yet

- Software Requirements Specification: Version 1.0 ApprovedDocument5 pagesSoftware Requirements Specification: Version 1.0 Approvedsameen khanNo ratings yet

- 2 Span PSC Composite Girder Bridge PDFDocument51 pages2 Span PSC Composite Girder Bridge PDFAnkitKeshriNo ratings yet

- Executive Coaching AgreementDocument2 pagesExecutive Coaching AgreementAntonio PassarelliNo ratings yet

- Gaming Industry E Mail Id OnlyDocument4 pagesGaming Industry E Mail Id OnlySundararajan SrinivasanNo ratings yet

- Design Engineer CV TemplateDocument2 pagesDesign Engineer CV TemplateyogolainNo ratings yet

- Testing Laboratory DetailsDocument12 pagesTesting Laboratory DetailsSanjay KumarNo ratings yet

- Curs 11Document29 pagesCurs 11Aniculaesi MirceaNo ratings yet

- Brunswick Manual Preinstalacion GSXDocument33 pagesBrunswick Manual Preinstalacion GSXroberto dominguezNo ratings yet

- CNEP Presentation July-Aug 12Document23 pagesCNEP Presentation July-Aug 12RuchirNo ratings yet

- CE Board Nov 2020 - Hydraulics - Set 17Document2 pagesCE Board Nov 2020 - Hydraulics - Set 17Justine Ejay MoscosaNo ratings yet

- Income Tax-V - BookDocument60 pagesIncome Tax-V - BookSiddarood KumbarNo ratings yet

- Essay About Reading Online VS Reading PhysicalDocument7 pagesEssay About Reading Online VS Reading PhysicalKener SevillaNo ratings yet

- CEN-TC227-WG1 N1449 CEN TC227 WG1 - CEN Enquiry Draft EN-131Document48 pagesCEN-TC227-WG1 N1449 CEN TC227 WG1 - CEN Enquiry Draft EN-131kamagaraNo ratings yet

- Pharmaceutical Market Europe - June 2020Document50 pagesPharmaceutical Market Europe - June 2020Areg GhazaryanNo ratings yet

- Chapter 7Document22 pagesChapter 7Te'Lou JocoyNo ratings yet

- Diagnostic User Dossier: V42 ECU / 2A SoftwareDocument120 pagesDiagnostic User Dossier: V42 ECU / 2A SoftwarecdoniguianNo ratings yet

- Commodore Magazine Vol-08-N09 1987 SepDocument132 pagesCommodore Magazine Vol-08-N09 1987 SepSteven DNo ratings yet

- FG Riskadjustmentmethodology Module1Document12 pagesFG Riskadjustmentmethodology Module1J CHANGNo ratings yet

- Confidence Siswa Sma Dalam Materi Peluang: Analisis Kemampuan Kemampuan Penalaran Dan SelfDocument8 pagesConfidence Siswa Sma Dalam Materi Peluang: Analisis Kemampuan Kemampuan Penalaran Dan SelfAfifah R. AminiNo ratings yet

- E JB TutorialDocument141 pagesE JB TutorialManikandan ChellaNo ratings yet

- Practice Paper XDocument14 pagesPractice Paper XRohit KumarNo ratings yet

- Astm C143Document4 pagesAstm C143Audrey Schwartz100% (2)

- Asco 7000 Series Operators Manual Group 5 ControllerDocument32 pagesAsco 7000 Series Operators Manual Group 5 ControllerAhmed Tarek100% (1)

- Itc 6700 IP PA SystemDocument56 pagesItc 6700 IP PA Systemjudy kimNo ratings yet

- Ge1000 Guitar Complex Effect ManualDocument3 pagesGe1000 Guitar Complex Effect Manualpaolo.sinistroNo ratings yet

- Ch3 Crack SealingDocument26 pagesCh3 Crack SealingWinengkuNo ratings yet

- English 1-2-1Document7 pagesEnglish 1-2-1Arlene Suan Paña SevensixfourzeroNo ratings yet

- Tle - Ia (Smaw NC I) Activity Sheet Quarter 1 - Competency 4.1-4.4Document10 pagesTle - Ia (Smaw NC I) Activity Sheet Quarter 1 - Competency 4.1-4.4Joy BuycoNo ratings yet

- Right To Information Vs Right To Privacy: BY-Kanhaiya SinghalDocument5 pagesRight To Information Vs Right To Privacy: BY-Kanhaiya SinghalKanhaiya SinghalNo ratings yet