Professional Documents

Culture Documents

Case 5 - Proton Full Assignment

Case 5 - Proton Full Assignment

Uploaded by

Shaa DidiCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Case 5 - Proton Full Assignment

Case 5 - Proton Full Assignment

Uploaded by

Shaa DidiCopyright:

Available Formats

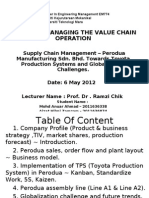

EPPA 4716 KAJIAN KES INTEGRASI

CASE 5: PROTON From SAGA to EXORA FOR : DR. ROSIATI BT RAM I

Gro!" M#m$#r% : &'%(m') &'%)(m N,'t(-') S#"') N!r!/ Am(r') Mo)0 Noor S(t( S'r(-' S'm't S'-0r'm't)( A2P R'm'A%)'03'-' $t A%m( F'(r!4 $t K'%m'GA***1+ GA***+. GA***16 GA***46 GA***4+ GA****4 GA****5

Kajian Kes Integrasi (EPPA 4716) Case 5 : Proton : From Saga to Exora

TAB E OF CONTENTS

Pages Executive Summary 1. From a financial analysis perspective, has the Proton management done a good o!" %. &hat characteristics should foreign partner have that 'ill ena!le maximum synergies" 3. &hat !road considerations should determine the parts of Proton that are 'orth )eeping and developing and the matter of operations to !e relocated or closed do'n" *. From a revie' of %((+ ,nternational -utomotive Policy, are there areas of possi!le colla!oration 'ith Proton, short of a full merger . ta)eover" /. &hat other information not included in the case could help consultant Saiful -la'i ma)es a more meaningful recommendation" &hy" %6 # 3* %3 # %/ %( # %% 1$ # %( 3-6 6 # 1$

0ecommendations

3* - 36

E6#7!t(8# S!mm'r3 Perusahaan 1tomo!il 2asional 3erhad or P01412 'as incorporated in 5alaysia on 6 5ay 1+$3 to manufacture, assem!le and sell motor vehicles and related products including accessories, spare parts and other components. Proton product7s line up comprised of Saga,

Page | 2

Kajian Kes Integrasi (EPPA 4716) Case 5 : Proton : From Saga to Exora

,s'ara, &ira, Satria, Satria 2eo, Persona, ,nspira and most recently, Exora. Proton7s plant located in Shah -lam and 4an ung 5alim. Severals challenges faced !y Proton. 1ne of the challenge is during the controversial sale of Proton sta)e in 58 -gusta of ,taly for a to)en of 91 to :E8, Sp- in 'hich :E8, sold it to 35& for 9+3 million. 3esides, proton also faced legal suits 'hen !eing sued !y ;hinese <oint 8enture =<8> partner, :oldstar ?eavy ,ndustry ;o. @td, for a hefty 0531 !ilion =05%/+ million> for failing the venture. ?o'ever, Proton claimed that :oldstar failed to o!tain a license for the <8. From the perspective of automotive outloo), Proton7s car sales comprised of %$A of the mar)et and hold a 3%A mar)et share.2ational -utomotive Policy =2-P>, revealed !y the 5inister of ,nternational 4rade and ,ndustry =5,4,> 'as !enefit Proton. Several )ey highlights of the announced 2-P are -pproved Permit =-P> system extended to %(1/, excise duty structure remained status Buo and import duty structure maintained (A for ;CD7s and /A for ;3E7s under the -sean Free 4rade -greement =-F4->. ,t 'as late %((+ and the 'orld 'as struggling in the process of li!eralisation and glo!alisation. &ith the advantages of protectionism, Proton, the 5alaysian national car ma)er had en oyed a fair degree of success in the home mar)et, and internationally, 'ith some of its export models over the last t'o decades. 4echnical tie-ups and colla!orations 'ith foreign partners had !een a mixed !ag of successess and failures. 4he li!eralisation measures announced !y the 5alaysian 5inister of 4rade and ,ndustry in the 2ational -utomotive Policy on %$ 1cto!er %((+ presented Proton 'ith a crossroad situation # either !uild on pass successes to'ards a !right future or suffer decline through !ad decisions against intense competition. multinational auto giant had sensed opportunity in Proton and 5alaysia and approached consultant, ;hartered -ccountant Saiful -la'i, to revie' Proton and to recommend 'hether an investment and.or colla!oration should !e considered.

PROTON Income Statement For the Year Ended 31st March (RM' Million)

2 ! 2 " 2 # 2 $ 2 %

Page |

Kajian Kes Integrasi (EPPA 4716) Case 5 : Proton : From Saga to Exora

Revenue (Loss)/Profit before taxation (Loss)/Profit after taxation Retaine! earnin"s attributab#e to s$are$o#!ers %ivi!en! Retaine! earnin"s &arrie! for'ar! Share In&ormation Per Share (asi& (#oss)/earnin"s (sen) %ivi!en! )ai! (sen) *et assets (R+) ,ssue! s$are &a)ita# ()

6,486.6 (319.2) (3 1.8) 4,174.5 (2 .6) 4,153.9

5,621.6 144.3 184.6 4,476.2 . 4,476.2

4,687.3 (618.1) (589.5) 4,319.2 (27.5) 4,291.7

7,796.9 18. 46.7 4,963.6 (54.9) 4,9 8.7

8,483.3 399.3 442.4 5, 54.2 (137.3) 4,916.9

(54.9) 5. 9.3 549,213

33.6 . 9.9 549,213

(1 7.3) 5. 9.5 549,213

8.5 1 . 1 .7 549,213

8 .6 25. 1 .7 549,213

PROTON 'alance Sheets (s (t 31st March (RM' Million)

2 ! 2 " 2 # 2 $ 2 %

Non)*+rrent (ssets

Pro)ert., )#ant an! e/ui)0ent Pre)ai! #an! #ease )a.0ents 1oo!'i## ,ntan"ib#e assets 2sso&iate! &o0)anies 3oint#. &ontro##e! entities ,nvest0ents %eferre! tax assets 2,827.1 . 29. 431.7 158.4 195.6 1 .4 5.7 3,$%#-! 3,15 .4 24.1 29. 275.2 165.4 192.7 1 .4 . 3,".#-2 3,169.5 9.9 29. 169.1 169.8 223.6 1 .4 . 3,#"1-3 3,3 2.9 1 . 29. 18. 16 .4 245.3 1 .4 1 5.8 3,""1-" 3,288.9 1 .1 29. 14.3 165.6 251.8 6.3 38.4 3," .-.

Total Non)*+rrent (ssets *+rrent (ssets

,nventories Re&eivab#es 4urrent invest0ents

1,395.1 1, 8 .3 15.3

1,1

.3

1,273.6 1,192. 73.4

1,389. 1,244. 212.

967.1 1,4 3.2 2 1.5

1, 99. 2 .8

Page | 4

Kajian Kes Integrasi (EPPA 4716) Case 5 : Proton : From Saga to Exora

%e)osits, ban5 an! &as$ ba#an&es

913.9 3,. .-$

1,226. 3,..$-1

626.5 3,1$%-%

1,586. .,.31-

2,454.7 %, 2$-%

Total *+rrent (ssets

*on6&urrent assets $e#! for sa#e

36.4

Total (ssets E/+it0

7$are 4a)ita# 8t$er Reserves Retaine! earnin"s

#, !"-!

#,2!3-3

$,!.$-"

",312-"

","3 -!

549.2 398.5 4,153.9

549.2 395.8 4,476.2

549.2 389.7 4,291.7

549.2 412.7 4,9 8.7

549.2 393.8 4,916.9

9/uit. attributab#e to e/uit. $o#!ers of t$e &o0)an.

5,1 1.6 . %,1 1-$

5,421.2 . %,.21-2

5,23 .6 . %,23 -$

5,87 .6 . %,"# -$

5,859.9 .3 %,"$ -2

+inorit. interest

Total E/+it0 Non)*+rrent 1ia2ilities

Lon"6ter0 #iabi#ities %effere! tax #iabi#ities

1 1.5 12.2 113-#

23 .5 2.4 232-!

181.6 .8 1"2-.

.3 .8

759.6 1.1 #$ -#

Total Non)*+rrent 1ia2ilities *+rrent 1ia2ilities

Pa.ab#es :axation 7$ort ter0 borro'in"s

1 1-1

1,571.3 6.3 3 6. 1,""3-$

1,524. 1.6 113.6 1,$3!-2

1,367.2 2.2 164.4 1,%33-"

1,519.4 16.9 8 4.8 2,3.1-1

1,979.5 2.6 227.9 2,21 -

Total *+rrent 1ia2ilities Total 1ia2ilities Total E/+it0 and 1ia2ilities

1,!!#-3

1,"#2-1

1,#1$-2

2,..2-2

2,!# -#

#, !"-!

#,2!3-3

$,!.$-"

",312-"

","3 -!

(:!(0(t3 R't(o

PROTON RATIO ANA 9SIS +**5 +**. +**7

+**6

+**5

Page | 5

Kajian Kes Integrasi (EPPA 4716) Case 5 : Proton : From Saga to Exora

;urrent 0atio Fuic) 0atio A7t(8(t3 R't(o -verage 4ime ;ollection ,nventory 4urnover 4otal -sset 4urnover Fixed -sset 4urnover Pro;(t'$(/(t3 R't(o 2et Profit 5argin 0eturn on EBuity 0eturn on -sset F(-'-7('/ #8#r',# R't(o 4otal De!t EBuity 0atio @everage 0atio

1.$(6 1.(66 6(.6+ *.6/ (.+1 %.%+ -*.6/3A -/.+16A -*.%/1A (.%$1 (.3+%

%.1(% 1.*31 61.36 /.11 (.66 1.6$ 3.%$*A 3.*(/A %./31A (.%/6 (.3*/

%.(6* 1.%33 +%.$% 3.6$ (.66 1.*$ -1%./66A -11.%6(A -$.*$6A (.%*6 (.3%$

1.$+3 1.%++ /$.%* /.61 (.+* %.36 (./++A (.6+/A (./6%A (.%+* (.*16

%.%6* 1.$36 6(.36 $.66 (.+6 %./$ /.%1/A 6./*+A /.(1(A (.336 (./(6

<!#%t(o- 1 From a financial analysis perspective, has the Proton management done a good o!" ,n order to comment on the financial of P01412, analysis on financial ratio need to !e done. 4here are / types of ratios 'hich are liBuidity, activity, de!t, profita!ility and financial leverage ratio. 4he calculations of each ratio sho's accordingly 'ith !rief analysis.

1.

@iBuidity ratio 1.1 ;urrent ratio ;urrent ratio G ;urrent assets . ;urrent lia!ilities +**5 G 3*(*.6(.1$$3.6( = 1..1 +**.

Page | 6

Kajian Kes Integrasi (EPPA 4716) Case 5 : Proton : From Saga to Exora

G 3**6.1(.163+.%( = +.1* +**7 G 316/./(.1/33.$( = +.*6 +**6 G **31.((.%3*1.1( = 1..5 +**5 G /(%6./(.%%1(.(( = +.+7

From the ratio analysis in liBuidity for ;urrent ratio sho's that in year %((/ is %.%6* times and in year %((+ is 1.$(6 times 'hich mean the amount sho's are greater than 1.( 'here!y Proton are afford to repay short-term de!t. 4he higher the current ratio, the stronger the companyHs a!ility to repay short-term de!t !ut from year %((/ to %((+, the a!ility to pay de!t sho's rapidly do'n !y (.*6 times. 3ased on year %((+, Proton have assets 1.$(6 times from current lia!ilities and Proton provide 05 1.$(6 current assets for the purpose of repayment of short-term lia!ilities.

1.%

Fuic) 0atio Fuic) 0atio +**5 G =;urrent -ssets # ,nventory> . ;urrent @ia!ilities

Page | 7

Kajian Kes Integrasi (EPPA 4716) Case 5 : Proton : From Saga to Exora

G %((+./(.1$$3.6( = 1.*7 +**. G %3*/.$(.163+.%( = 1.41 +**7 G 1$+1.+(.1/33.$( = 1.+1 +**6 G 3(*%.((.%3*1.1( = 1.1* +**5 G *(/+.*(.%%1(.(( = 1..4 5easuring the a!ility of cash and cash assets to cover lia!ilities. From the ratio analysis in liBuidity for Fuic) ratio =-cid test ratio> sho's that in year %((/ is 1.$36 and in year %((+ is 1.(66 times, Proton has a ratio of 1.(66 times faster 'hich means total asset are met are the same for every 05 1 lia!ility asserted. 4his contrasts 'ith the year of %((/, Proton has 1.$36 times, 'here the different from year %((+ are (.66 times, meaning Proton 'hen year ahead the ratio is going do'n and it7s sho's that Proton not strong in finances and a!ility to pay de!t affected. 4hese ratios are moderately poor liBuidity. 4he only difference !et'een the current and Buic) ratios is that inventories =stoc)> is omitted from the Buic) ratio. ,nventories is sometimes very difficult to convert into cash, particularly at the value placed upon it in the !alance sheet. 3ecause it can !e difficult to generate liBuid funds

Page | !

Kajian Kes Integrasi (EPPA 4716) Case 5 : Proton : From Saga to Exora

through the sale of inventories, it is inappropriate to consider it 'hen loo)ing at the issue of 'hether Proton is a!le to pays its de!ts Buic)ly.

%.

-ctivity 0atio %.1 -verage 4ime ;ollection -verage 4ime ;ollection G 0eceiva!les . Sales x 36/ days +**5 G 1($(.3.6*$6.6 x 36/ days = 6*.75 +**. G 1(++.((./6%1.6( x 36/ days = 71.16 +**7 G 11+%.*6$6.3( x 36/ days = 5+..+ +**6 G 1%**.66+6.+( x 36/ days = 5..+4 +**5 G 1*(3.%(.$*$3.3 x 36/ days = 6*.17

Page | "

Kajian Kes Integrasi (EPPA 4716) Case 5 : Proton : From Saga to Exora

4he average collection period ratio indicates the average length of time =in days> a !usiness must 'ait !efore it receives payment from customers 'ho !uy merchandise on credit. ,n Proton, the higher average collection period ratio in the year %((6 'as +3 days and the lo'est 'as /$ days. 4he lo'er the average collection period, the faster a company receives its money from customers, and the stronger a company appears. 1n the other end of the continuum, the higher the average collection period ratio, the longer customers ta)e to pay their !ills, and the less sta!le a company appears. %.% ,nventory 4urnover ,nventory 4urnover +**5 G 6*$6.6(.13+/.1( = 4.65 +**. G /6%1.6(.11((.3( = 5.11 +**7 G *6$6.3(.1%63.6( = 1.6. +**6 G 66+6.+(.13$+.( = 5.61 +**5 G Sales . ,nventories

Page | 1#

Kajian Kes Integrasi (EPPA 4716) Case 5 : Proton : From Saga to Exora

G $*$3.3(.+66.1( = ..77 4he inventory turnover ratio provides an indication on 'hether a company has excessive or inadeBuate goods =products> in inventory. ,n Proton, year %((/ sho' that inventory turnover ratio is too high $.66, it means Proton is running out of inventory at various times throughout the !usiness year. -lso, in many cases, !usinesses 'ith a high inventory turnover ratio 'ill experience a loss of sales to competitors. 1n the other hand, the lo'er an inventory turnover ratio, the less cash reBuired !y a company to finance its inventory, and therefore the stronger a company generally appears.

%.3

4otal -sset 4urnover 4otal -sset 4urnover +**5 G 6*$6.6(.6(+$.+( = *.51 +**. G /6%1.6(.6%+3.3( = *.77 +**7 G *6$6.3(.6+*6.$( = *.67 +**6 G 66+6.+(.$31%.$( = *.54

Page | 11

Sales . 4otal -ssets

Kajian Kes Integrasi (EPPA 4716) Case 5 : Proton : From Saga to Exora

+**5 G $*$3.3(.$$3(.+( = *.56

-sset turnover =total asset turnover> is a financial ratio that measures the efficiency of a companyHs use of its assets to product sales. ,t is a measure of ho' efficiently management is using the assets at its disposal to promote sales. 4he ratio helps to measure the productivity of a companyHs assets. 4here is no set num!er that represents a good total asset turnover value !ecause every industry has varying !usiness models. ,t also depends on the proportion of la!our costs in relation to the capital reBuired, i.e. 'hether the process is la!our intensive or capital intensive. 4he higher the num!er, the !etter. ,f there is a lo' turnover, it may !e an indication that the !usiness should either utiliIe its assets in a more efficient manner or sell them. 3ut it also indicates pricing strategyJ companies 'ith lo' profit margins tend to have high asset turnover, 'hile those 'ith high profit margins have lo' asset turnover. %.* Fixed -sset 4urnover Fixed -sset 4urnover +**5 G 6*$6.6(.%$%6.1( = +.+5 +**. G /6%1.6(.31/(.*( = 1.7. G Sales . 4otal Fixed -ssets

Page | 12

Kajian Kes Integrasi (EPPA 4716) Case 5 : Proton : From Saga to Exora

+**7 G *6$6.3(.316+./( = 1.4. +**6 G 66+6.+(.33(%.+( = +.16 +**5 G $*$3.3(.3%$$.+( = +.5.

Fixed asset turnover ratio compares the sales revenue a company to its fixed assets. 4his ratio tells us ho' effectively and efficiently a company is using its fixed assets to generate revenues. 4his ratio indicates the productivity of fixed assets in generating revenues. ,f a company has a high fixed asset turnover ratio, it sho's that the company is efficient at managing its fixed assets. Fixed assets are important !ecause they usually represent the largest component of total assets. -n increasing trend in fixed assets turnover ratio is desira!le !ecause it means that the company has less money tied up in fixed assets for each unit of sales. - declining trend in fixed asset turnover may mean that the company is over investing in the property, plant and eBuipment. 4he fixed assets usually include property, plant and eBuipment. 4he value of good'ill, long-term deferred tax and other fixed assets that do not !elong to property, plant and eBuipment is usually su!tracted from the total fixed assets to present a more meaningful fixed asset turnover ratio.

3.

Profita!ility 0atio

Page | 1

Kajian Kes Integrasi (EPPA 4716) Case 5 : Proton : From Saga to Exora

3.1

2et Profit 5argin 2et Profit 5argin +**5 G =3(1.$>.6*$6.6( = > 4.651? +**. G 1$*.6./6%1.6( = 1.+.4? +**7 G -/$+./.*6$6.3( = >1+.577? +**6 G *6.6.66+6.+( = *.555? +**5 G **%.*.$*$3.3( = 5.+15? G Profit =after tax> . 0evenue

Profita!ility ratios measure a company7s a!ility to generate earnings relative to sales, assets and eBuity. 4hese ratios assess the a!ility of a company to generate earnings, profits and cash flo's relative to relative to some metric, often the amount of money invested. 4hey highlight ho' effectively the profita!ility of a company is !eing managed. Different profita!ility ratios provide

Page | 14

Kajian Kes Integrasi (EPPA 4716) Case 5 : Proton : From Saga to Exora

different useful insights into the financial health and performance of a company. For example, gross profit and net profit ratios tell ho' 'ell the company is managing its expenses. 2et profit margin =or profit margin, net margin, return on revenue> is a ratio of profita!ility calculated as after-tax net income =net profits> divided !y sales =revenue>. 2et profit margin is displayed as a percentage. ,t sho's the amount of each sales 0inggit left over after all expenses have !een paid. 2et profit margin is a )ey ratio of profita!ility. ,t is very useful 'hen comparing companies in similar industries. - higher net profit margin means that a company is more efficient at converting sales into actual profit. 3.% 0eturn on EBuity =01E> 0eturn on EBuity +**5 G =3(1.$>./1(1.6( = > 5.516? +**. G 1$*.6./*%1.%( = 1.4*5? +**7 G -/$+././%3(.6( = >11.+7*? +**6 G *6.6./$6(.6( = *.755? G Profit =after tax> . 4otal EBuity

Page | 15

Kajian Kes Integrasi (EPPA 4716) Case 5 : Proton : From Saga to Exora

+**5 G **%.*./$6(.% = 7.545? 0eturn on eBuity =01E> is the amount of net income returned as a percentage of shareholders eBuity. ,t reveals ho' much profit a company earned in comparison to the total amount of shareholder eBuity found on the !alance sheet. 01E is one of the most important financial ratios and profita!ility metrics. ,t is often said to !e the ultimate ratio or the Kmother of all ratios7 that can !e o!tained from a company7s financial statement. ,t measures ho' profita!le a company is for the o'ner of the investment, and ho' profita!ly a company employs its eBuity. ?istorically, the average 01E has !een around 1(A to 1%A, at least in the ES and EC. For sta!le economics, 01Es more than 1%-1/A are considered desira!le. 3ut the ratio strongly depends on many factors such as industry, economic environment =inflation, macroeconomic ris)s, etc.>. 4he higher the 01E, the !etter. 3ut a higher 01E does not necessarily mean !etter financial performance of the company. -s sho'n a!ove, in the DuPont formula, the higher 01E can !e the result of high financial leverage, !ut too high financial leverage is dangerous for a companyHs solvency. 3.3 0eturn on -ssets =01-> 0eturn on -ssets +**5 G =3(1.$>.6(+$.+( = > 4.+51? +**. G 1$*.6.6%+3.3( = +.511?

Page | 16

G Profit =after tax> . 4otal -ssets

Kajian Kes Integrasi (EPPA 4716) Case 5 : Proton : From Saga to Exora

+**7 G -/$+./.6+*6.$( = >..4.6? +**6 G *6.6.$31%.$( = *.56+? +**5 G **%.*.$$3(.+( = 5.*1*? 0eturn on assets =01-> is a financial ratio that sho's the percentage of profit that a company earns in relation to its overall resources =total assets>. 0eturn on assets is a )ey profita!ility ratio 'hich measures the amount of profit made !y a company per 0inggit of its assets. ,t sho's the companyHs a!ility to generate profits !efore leverage, rather than !y using leverage. Enli)e other profita!ility ratios, such as return on eBuity =01E>, 01- measurements include all of a companyHs assets # including those 'hich arise from lia!ilities to creditors as 'ell as those 'hich arise from contri!utions !y investors. So, 01- gives an idea as to ho' efficiently management use company assets to generate profit, !ut is usually of less interest to shareholders than some other financial ratios such as 01E. 0eturn on assets gives an indication of the capital intensity of the company, 'hich 'ill depend on the industry. ;apital-intensive industries =such as railroads and thermal po'er plant> 'ill yield a lo' return on assets, since they must possess such valua!le assets to do !usiness. Shoestring operations =such as soft'are companies and personal services firms> 'ill have a high 01-J their reBuired assets are minimal. 4he num!er 'ill vary 'idely across different industries. 4his is 'hy, 'hen using 01- as a comparative measure, it is !est to compare it against a companyHs previous 01- figures or the 01- of a similar company. 4. Financial @everage 0atio

Page | 17

Kajian Kes Integrasi (EPPA 4716) Case 5 : Proton : From Saga to Exora

*.1

4otal De!t EBuity 0atio 4otal De!t EBuity +**5 G 1++6.3.6(+$.+ = *.+.1 +**. G 1$6%.1(.6%+3.3( = *.+57 +**7 G 1616.%.6+*6.$( = *.+47 +**6 G %**%.%.$31%.$( = *.+54 +**5 G %+6(.6.$$3(.+ = *.116 G 4otal @ia!ilities . 4otal EBuity L @ia!ilities

4he de!t-to-eBuity ratio =de!t.eBuity ratio, D.E> is a financial ratio indicating the relative proportion of entityHs eBuity and de!t used to finance an entityHs assets. 4his ratio is also )no'n as financial leverage. De!t-to-eBuity ratio is the )ey financial ratio and is used as a standard for udging a companyHs financial standing. ,t is also a measure of a companyHs a!ility to repay its o!ligations. &hen examining the health of a company, it is critical to pay attention to the

Page | 1!

Kajian Kes Integrasi (EPPA 4716) Case 5 : Proton : From Saga to Exora

de!t.eBuity ratio. ,f the ratio is increasing, the company is !eing financed !y creditors rather than from its o'n financial sources 'hich may !e a dangerous trend. @enders and investors usually prefer lo' de!t-to-eBuity ratios !ecause their interests are !etter protected in the event of a !usiness decline. 4hus, companies 'ith high de!t-to-eBuity ratios may not !e a!le to attract additional lending capital. - high de!t.eBuity ratio generally means that a company has !een aggressive in financing its gro'th 'ith de!t. 4his can result in volatile earnings as a result of the additional interest expense. ,f a lot of de!t is used to finance increased operations =high de!t to eBuity>, the company could potentially generate more earnings than it 'ould have 'ithout this outside financing. ,f this 'ere to increase earnings !y a greater amount than the de!t cost =interest>, then the shareholders !enefit as more earnings are !eing spread among the same amount of shareholders. ?o'ever, the cost of this de!t financing may out'eigh the return that the company generates on the de!t through investment and !usiness activities and !ecome too much for the company to handle. 4his can lead to !an)ruptcy, 'hich 'ould leave shareholders 'ith nothing. 4he de!t.eBuity ratio also depends on the industry in 'hich the company operates. For example, capital-intensive industries such as auto manufacturing tend to have a de!t.eBuity ratio a!ove %, 'hile personal computer companies have a de!t.eBuity of under (./.

*.%

@everage 0atio =:earing 0atio> @everage 0atio +**5 G 1++6.3./1(1.6 = *.15+ +**.

Page | 1"

4otal @ia!ilities . 4otal EBuity

Kajian Kes Integrasi (EPPA 4716) Case 5 : Proton : From Saga to Exora

G 1$6%.1(./*%1.% = *.145 +**7 G 1616.%./%3(.6 = *.1+. +**6 G %**%.%./$6(.6 = *.416 +**5 G %+6(.6./$6(.% = *.5*7

-ny ratio used to calculate the financial leverage of a company to get an idea of that companyHs methods of financing or measure its a!ility to meet its financial o!ligations. 4here are several ratios, !ut the main factors evaluated !y a ratio include de!t, eBuity, assets, and interest expenses. - ratio used to measure a companyHs mix of operating costs that yields an approximation of ho' changes in output 'ill affect operating income. Fixed costs and varia!le costs are the t'o types of operating costsM depending on the company and the industry, the mix 'ill differ. :enerally, companies 'ith higher leverage as determined !y a leverage ratio are thought to !e more ris)y !ecause they have more lia!ilities and less eBuity. - leverage ratio is also called a gearing ratio or an eBuity multiplier. 4hese leverage ratios are very important for the company7s internal users as 'ell as external users. 4hese ratios helps identify the 'ea) areas of the company internally and help the shareholders ma)e a udgment a!out their investments. ;ompanies 'ith high

Page | 2#

Kajian Kes Integrasi (EPPA 4716) Case 5 : Proton : From Saga to Exora

fixed costs, after reaching the !rea)even point, see a greater increase in operating revenue 'hen output is increased compared 'ith companies 'ith high varia!le costs. 4he reason for this is that the costs already have !een incurred, and so every sale a!ove !rea)even transfers to the operating income. ,n contrast, a company 'ith high varia!le costs sees little increase in operating income 'ith additional output, !ecause costs continue to rise as outputs rise. 4he degree of operating leverage is the ratio used to calculate this mix and its effects on operating income.

<!#%t(o- + &hat characteristics should a foreign partner have that 'ill ena!le maximum synergies"

-s 'e )no', at the moment, P01412 do not has enough resources to stand !y itself. 4his means that it need other company to oin or cooperate in order to produce the products. ?o'ever, it is important for the foreign partner to have several good characteristics or Bualities in order to ensure that the partnership or colla!oration ta)en place 'ill !e successful and !enefit to P01412. Several characteristics that a foreign partner should have in order to ena!le P01412 maximiIe its synergies are J

1.

A08'-7# (- t#7)-o/o,3 2 t#7)-o/o,3 #6"#rt(%# 1ne of the ma or factor in order to ensure success in automotive industry are technology. 4echnology plays a very important part in producing a good Buality product !ecause consumer al'ays aim the !est technology. 4echnology in this 'orld are rapidly changing and of P01412 are una!le to follo' the technology flo', it might collapse !ecause the competition is very high.

Page | 21

Kajian Kes Integrasi (EPPA 4716) Case 5 : Proton : From Saga to Exora

1ther automotive company are very efficient in advancing their technology. 4hey al'ays moving for'ard and )no' the reBuirement of consumer and upgrade its products from time to time. ;ompany from country li)e <apan are 'ell esta!lished. ?o'ever, there are other company that a!le to move for'ard and !ecame the main competitor to the company that are already sta!le such as ?yundai.

4he foreign partner of P01412 should a company that is advance in technology so that they can give a good example, information and consultation and the technology can !e adapted !y P01412 for their !enefit.

%.

Goo0 m'r@#t(-, #6"#r(#-7# '-0 #;;ort 3esides technology, the foreign partner is also need to have a good mar)eting experience and !ac)ground. 5ar)eting is very important !ecause automotive industry are an industry that can !e distri!uted 'orld'ide and a good mar)eting effort is very important and needed.

5ar)eting is an effort that have to !e done all the time. ,f the company are already 'ell )no'n, mar)eting is still relevant in order to remind consumer a!out the existence of the !rand name !ecause competition is al'ays there to get consumer7s attention.

4he foreign partner that P01412 are loo) into to have partnership or colla!oration 'ith must have this characteristics to help P01412 maximiIe its sales.

Page | 22

Kajian Kes Integrasi (EPPA 4716) Case 5 : Proton : From Saga to Exora

3.

A$/# to '0'"t A(t) /o7'/ 7!/t!r# '-0 -orm% Different countries have different cultures and norms. ?o'ever, cultures and norms is something that should !e respected !y people from other country in 'hich foreign people should have respect on local culture and norms. Even though P01412 really need the partnership and colla!oration, this aspect cannot !e regarded as it 'ill affect the company as a 'hole.

*.

Pro0!7t(o- #;;(7(#-73 Production efficiency is very important to ensure Buality and reduce costs of production !ecause the cost in producing automo!ile product are very high. Foreign partner should !e efficient in their production so that the overall costs can !e reduced and the customer satisfaction can !e maximiIed.

/.

F(-'-7('/ (-8#%tm#-t @ast !ut not least, in order for P01412 to find partner, the partner must have a sta!le financial position. &ith a strong financial position, they can help P01412 in term of capital.

<!#%t(o- 1 &hat !road considerations should determine the parts of Proton that are 'orth )eeping and developing and the matter of operations to !e relocated or closed do'n"

SBOT ANA 9SIS :>

Page | 2

Kajian Kes Integrasi (EPPA 4716) Case 5 : Proton : From Saga to Exora

STRENGT&S ;ompetitively priced products @o' price in maintenance Easy access to service, maintenance, repairs and o!tain spare parts !ecause many service centre availa!le Easy availa!ility . stoc) !ecause produced in 5alaysia Extensive nation'ide distri!ution net'or) :ood Buality of certain parts such as air-conditioning &ide range of models 0LD # -s a company 'hich receive support from :overnment, Proton have enough fund to do 0LD and al'ays come 'ith ne' model :ood corporate governance ,nfluence of patriotism as Proton is national car-ma)er

BEAKNESSES 0eputation of poor product performance and functionality ?igh cost to expand their operation !y advance technology Short history in automotive industry 8ulnera!le to increasing material cost example steel ;ars are not fuel efficiency 3ehind in technology !ecause still using timing !elt 'hich is dangerous in term of safety Do not produce compact cars and *'heel drive such as Perodua 8iva and Ford 0anger Dependa!ility to foreign companies in order to get their technology 0educe profit in 'hich has to pay royalties 'hen colla!oration !eing made

OPPORTCNITIES ?igh demand on the products # 5alaysian al'ays 'aiting 'hen Proton are going to launch ne' model !ecause of price factor :overnment support 5alaysian products # -ttract many 5alaysian 'ho patrionism in order to support 5alaysian products 1pportunity to gro' their !usiness glo!ally 0LD Development -fter-sales services ;olla!orations 'ithin automotive industry

T&REATS ;ompetitors # local and international !rands. - lot of su!stitute products in mar)et and ne' model 'ith ne' technology are changing rapidly Fast changing and advanced engineering technology Economic do'nturn 'hich decrease of car sales ,ncrease in oil prices 'hich 'ill reduce demand 0eputation of poor product performance and functionality !ecause most ;hinese don7t !uy Proton

Page | 24

Kajian Kes Integrasi (EPPA 4716) Case 5 : Proton : From Saga to Exora

STRENGT&S

P014127s strength lies in its competitively priced product. ,t extensive nation'ide distri!ution net'or) helps the industry to move for'ard 'ith the support from 5alaysian government. 4he company also has good corporate governance, and highly regarded !y many 5alaysians out of patriotism they feel for this country as P01412 is the national car ma)er.

BEAKNESSES

,nexperience, apparently due to short history in car ma)ing certainly could not !e an excuse for P01412 to come out 'ith lo' Buality products. 4his could cost P01412 very high as over time, it might eopardiIe P014127s reputation. Poor product performance and functionality is something that cannot !e allo'ed to happen and Buality al'ays needs to !e monitored and assured to the customers. 1ther than that, operational cost and other expenses is al'ays a challenge to any industry and for the case of P01412, it is more vulnera!le to increasing ra' material cost such as steel particularly.

OPPORTCNITIES

4he demand for cars in any segment is al'ays there, except for more trying times li)e during economic crisis. 4here are al'ays opportunities for P01412 to !e a glo!al player. 2o!ody ever say that cars should only !e manufactured !y <apan, :ermany and other 'estern countries though of course these countries have the reputation of ma)ing good cars long !efore P01412 and 5alaysia comes into the picture. ;olla!orations 'ithin industry players could ena!le P01412 to do many things. 4hrough research and

Page | 25

Kajian Kes Integrasi (EPPA 4716) Case 5 : Proton : From Saga to Exora

development more innovative products could !e invented and ensure that P01412 as a !rand name remains in the industry.

T&REATS

1ne of the threats is of course from the rivals, the competitors in the automotive industry. Even Perusahaan 1tomotif Cedua =PE01DE-> # 5alaysian second national car ma)er, set up after P01412 started to challenge P01412Ks mar)et share in 5alaysia. Perodua actually did !etter in recent year and outperformed P01412 via their most 'ell selling model so far, 5y8i and gra! more than 3(A of overall mar)et share. Ender policy li)e -F4- =-SE-2 Free 4rade -rea> consumers can have more choices form ?12D-, 4oyota, ;hevrolet and others !rand to !e selected at a more afforda!le price, as 5alaysia no' has cut duties on imports from other Southeast -sian countries to less than five percent.

1n the !asis of a S&14 analysis a!ove, P01412 is no need to close or move part of P01412 as it is an icon for 5alaysia to !e proud of and 'ill !e a milestone in the future. -part from that also is allo'ing them to increase o! opportunities in the field and the most important automotive P01412 support from the government.

<!#%t(o- 4 From a revie' of %((+ 2ational -utomotive Policy, are there areas of possi!le colla!oration 'ith Proton, short of a full merger.ta)eover"

Page | 26

Kajian Kes Integrasi (EPPA 4716) Case 5 : Proton : From Saga to Exora

1>

T)# A""ro8#0 Prm(t DAPE %3%t#m #6t#-0#0 to +*15 4he -P system 'ould !e phased out in stages end in %(1/. 4he -P holders 'ould also !e audited t'ice yearly and those found uncompetitive 'ould !e removed from the list. ,nitially slated to !e a!olished !y end-%(1( !y the previous 2-P in %((6, the system, instead, 'as extended to %(1/ !y the :overnment.

%>

T)# #67(%# 0!t3 %tr!7t!r# r#m'(-#0 %t't!% :!o 4he excise duty structure should !e maintained so that the dumping of imported cars 'ill !e status Buo. 4his 'ill result in improved gro'th of the national car in the mar)et.

3>

T)# (m"ort 0!t3 %tr!7t!r# m'(-t'(-#0 *? ;or CKD% '-0 5? ;or CBC% !-0#r t)# A%#'- Fr## Tr'0# A,r##m#-t DAFTAE 5alaysian continues to non-compliance 'ith the ;ommon Effective Preferential 4ax =;EP4> -greement 'here the import duties for the ;E3s of 5alaysia, 3runei, ,ndonesia, the Philippines, Singapore and 4hailand 'ould !e eliminated no later than 1 <anuary %(1(, 'hich 'ould ma)e all cars exported from 5alaysia less attractively priced. 4he policy again 'as negative to all automotive manufacturers !y impeding higher export volumes and possi!ly deterring automotive manufacturers from setting up in 5alaysia as an -SE-2 export hu!, given that there 'as no timeline given to remove the structure.

*>

F!// /($#r'/(%'t(o- o; /o7'/ '%%#m$/#0 /!6!r3 "'%%#-,#r 8#)(7/#% '$o8# 1F.**77 A(t) o->t)#>ro'0 "r(7#% o; '$o8# RM15*KF #;;#7t(8# 1 J'-!'r3 +*1* Foreign firms could freely o!tain a manufacturing licence and hold a 1((A sta)e in a company to assem!le passenger vehicles provided they fulfilled certain conditions. 4he

Page | 27

Kajian Kes Integrasi (EPPA 4716) Case 5 : Proton : From Saga to Exora

current policy of contract assem!ly 'as maintained to encourage utilisation of existing excess capacity. 4he policy !enefited Proton, 'hich focused primarily on the lo'er-end mar)et =the smaller vehicle segment> as the non-li!eralisation of small vehicle segment assem!lers and.or manufacturers continued to protect the local incum!ents. 5oreover, the policy 'as attractive for Proton as it provided means for it to employ its underutilised capacity =estimated volumes for the 4an ung 5alim plant at 1/(,((( units per year and the Shah -lam plant at %((,((( units per year 'ere under-utilised at /(A> and !oost its revenue stream. Proton must focus to produce vehicles a!ove 1,$((cc to fulfil demand of 5alaysian consumer.

/>

A// (m"ort#0 !%#0 8#)(7/#% "r(7#% to $# ,'4#tt#0 to "r#8#-t !-0#r>0#7/'r't(o4his 'as aimed to prevent manipulation of car prices. 1nly the pricelist of ne' imported ;3Es 'ould !e gaIetted for the purpose of duty computation. - separate gaIetted pricelist for used ;3Es 'ould !e issued to supplement the existing list of ne' ;3Es to prevent the under-declaration of grey imports !y registering the vehicles as NusedO instead of Nne'O.

6>

T)# (m"ort o; !%#0 "'rt% '-02or 7om"o-#-t% to $# "ro)($(t#0 '-0 t)# ,r'0!'/ ")'%(-,>o!t o; (m"ort#0 !%#0 7omm#r7('/ 8#)(7/#% to $# #;;#7t(8# ;rom 1 J!-# +*11 '-0 1 J'-!'r3 +*16 r#%"#7t(8#/3 to "romot# %';#t3 '-0 #-8(ro-m#-t'/ 7o-7#r-% 4he policy 'ould !e very costly for customers paying more for ne' auto parts 'hen the NhalfcutsO 'ould !e !anned.

6>

I-7#-t(8#% ;or m'-!;'7t!r#r% o; 7r(t(7'/ '-0 )(,) 8'/!#>'00#0 "'rt% 7om"o-#-t%

Page | 2!

Kajian Kes Integrasi (EPPA 4716) Case 5 : Proton : From Saga to Exora

4he high value-automotive-part manufacturers such as transmissions, !ra)e systems, air!ags and steering systems 'ould en oy incentives such as 1(-year 1((A fiscal deduction Pioneer Status =PS> or a /-year 1((A tax exempted ,nvestment 4ax -llo'ance =,4->. Similarly, the investments made for the assem!ly or manufacture of hy!rid and electric vehicles 'ould !e granted the a!ovementioned incentives in addition to other incentives such as customised trainings and research and development =0LD> grants. Spilled-over from ,ncentive no. 6, this 'as a measure to promote the local long-term development goal of !ecoming a regional 0LD and manufacturing hu!.

$>

A ;r##4# o- m'-!;'7t!r(-, /(7#-7# ;or r#7o-0(t(o-(-, '-0 r#$!(/t '7t(8(t(#% A(// 7o-t(-!# 4his policy 'as aimed to filter out possi!le malpractices 'ith respect to the re!uilt segment in the automotive industry.

+>

Ro'0Aort)(-#%% I-tro0!7t(o- o; E-0>o;> (;# G#)(7/# DE GE Po/(73 Ender this policy, effective 1 <anuary %(1(, vehicles of 1/ years and a!ove =additional provisions 'ere to !e made availa!le for vintage cars> 'ould have to undergo mandatory inspection to Bualify for road tax rene'al, and those that fail road'orthiness 'ould !e disposed. 4here 'ere a!out %.6 million passenger vehicles older than 1( years on the road.

1(>

Proto- to #%t'$/(%) ' %tr't#,(7 "'rt-#r%)(" A(t) ,/o$'/ OEM% to #-)'-7# (t% ,/o$'/ 7om"#t(t(8#-#%% ;or /o-,>t#rm 8('$(/(t3 Discussions surrounding Proton forming potential strategic partnerships 'ith 8&, 0enault S- and :5 had long !een ongoing in the mar)et. Proton had !een eyeing for a strategic partnership to increase its technological pro'ess in exchange for a gate'ay to

Page | 2"

Kajian Kes Integrasi (EPPA 4716) Case 5 : Proton : From Saga to Exora

the -sean region, an advanced 0LD platform and ample production capacity. ?o'ever, the slo' pace li!eralisation of the automotive industry =e.g. a reluctance to a!olish the -P system and the non-compliance to ;EP4 -greement> 'as ma)ing 5alaysia less attractive to the foreign automotive players as compared to the other regions li)e 4hailand and ,ndonesia for example, 8& had already invested in an assem!ly plant in ,ndonesia, 'hich 'as expected to !e operational !y %(1%.

3ased from a revie' of %((+ 2ational -utomotive Policy, Proton should merge 'ith other local automotive to overcome and solve their pro!lem. 4hey can discuss and ma)e a clear term and conditions in an agreement a!out the !est solution for !oth of them. <!#%t(o- 5 &hat other information not included in the case could help consultant Saiful -la'i ma)es a more meaningful recommendation" &hy" -s a consultant, ;hartered -ccountant, Saiful -la'i have to prepared a Pro ected 3udgeting to revie' Proton and to recommend 'hether an investment and.or colla!oration should !e considered. 4here are a fe' information in this case are not included. 4hese areJ

1.

C!rr#-t M'r@#t S(t!'t(oE7o-om3 4here 'ere a!out $(6 million cars and light truc)s on the road in %((6, consuming over %6( !illion ES gallons =+$(,(((,((( m3> of gasoline and diesel fuel yearly. 4he automo!ile is a primary mode of transportation for many developed economies. 4he Detroit !ranch of 3oston ;onsulting :roup predicts that, !y %(1*, one-third of 'orld demand 'ill !e in the four 30,; mar)ets =3raIil, 0ussia, ,ndia and ;hina>. 1ther potentially po'erful automotive mar)ets are ,ran and ,ndonesia. Emerging auto mar)ets

Page | #

Kajian Kes Integrasi (EPPA 4716) Case 5 : Proton : From Saga to Exora

already !uy more cars than esta!lished mar)ets. -ccording to a <.D. Po'er study, emerging mar)ets accounted for /1 percent of the glo!al light-vehicle sales in %(1(. 4he study expects this trend to accelerate. Bor/0 motor 8#)(7/# "ro0!7t(oG/o$'/ "ro0!7t(o- o; motor 8#)(7/# =cars and commercial vehicles> 9#'r 1++6 1++$ 1+++ %((( %((1 %((% %((3 %((* %((/ %((6 %((6 %(($ %((+ Pro0!7t(o/*,*3*,((( /%,+$6,((( /6,%/$,$+% /$,36*,16% /6,3(*,+%/ /$,++*,31$ 6(,663,%%/ 6*,*+6,%%( 66,*$%,*3+ 6+,%%%,+6/ 63,%66,(61 6(,/%(,*+3 61,6+1,$6$ -%.6A 6.%A 3.$A -3./A *.$A %.$A 6.3A 3.1A *.1A /.$A -3.6A -1%.*A C)'-,#

To" 8#)(7/# m'-!;'7t!r(-, ,ro!"% $3 8o/!m#

Page | 1

Kajian Kes Integrasi (EPPA 4716) Case 5 : Proton : From Saga to Exora

4he ta!le !elo' sho's the 'orldHs largest motor vehicle manufacturing groups, along 'ith the marBuis produced !y each one. 4he ta!le is ran)ed !y %(1( end of year production figures from the ,nternational 1rganiIation of 5otor 8ehicle 5anufacturers =1,;-> for the parent group, and then alpha!etically !y marBuee. <oint ventures are not reflected in this ta!le. Production figures of oint ventures are typically included in 1,;ran)ings, 'hich can !ecome a source of controversy.

Page | 2

Kajian Kes Integrasi (EPPA 4716) Case 5 : Proton : From Saga to Exora

Page |

Kajian Kes Integrasi (EPPA 4716) Case 5 : Proton : From Saga to Exora

+.

It#m (- I-7om# St't#m#-t D(-t#r-'/ (-;orm't(o-E

,ncome statement is a statement sho'ing all the income and expenses in order to produce a company7s net profit and income attri!uta!le to shareholders. ?o'ever, the income statement of P01412 from year %((/ until %((+ does not sho' a lot of cost and expenses incurred.

-ll the items !elo' are items that should !e included in the income statement !ut they are not revealed in the income statement of Proton.

1. ;ost of Sales %. 1ther operating income 3. Distri!ution costs *. -dministrative expenses /. 1ther operating expenses 6. Finance cost 6. Share of results associated companies $. Share of results of ointly controlled entities +. 0esearch and Development ;ost 1(. ,nterest charges

Page | 4

Kajian Kes Integrasi (EPPA 4716) Case 5 : Proton : From Saga to Exora

4he values of a!ove items are very important to determine, influence and help Saiful -la'i to ma)e a reasona!le, rationale and correct udgment.

For example cost of sales. ;ost of sales is !eing used to determine ratio of inventory turnover. ,nventory turnover ratio is a ratio that measures a company7s a!ility to sell its products or convert its inventory into cash in a year. 3y )no'ing this ratio, Saiful -la'i 'ill )no' ho' efficient Proton in planning its production and sales to ensure that there is a !alance !et'een them to avoid inventory that is )ept too long.

1.

R#%#'r7) A-0 D#8#/o"m#-t DRHDE

2ext is 0esearch and Development ;ost. P01412 has !een given a huge amount of allocation from :overnment to do research and development and they are al'ays doing it in order to improve the Buality of their product. 3y right, amount of research and development should !e reported in the income statement. 4he value 'ill help Saiful ala'i to decide 'hether or not P01412 has done a good research !y comparing to the cost of research and the result or outcome from the research. 0esearch and development is the 'ay to change and a path to development. ,t increases the efficiency in the organiIation !y finding different efficient and effective means of 'or)ing. 0LD is the source of information and it updated the organiIation data and insists the organiIation to fell change in environment. it tell the organiIation a!out changing in the preferences and taste of customers. 0LD demonstrates the need of consumers and customers for particular product. -dministrative expenses are also important to !e revealed. 4his is !ecause the amount 'ill determine ho' efficient P01412 in spending its administrative expenses. -n

Page | 5

Kajian Kes Integrasi (EPPA 4716) Case 5 : Proton : From Saga to Exora

administrative expense is not an operating expense and does not determine !y the production.

,nterest charges are amount of interest paid !y company for loan !eing made 'hether long term or short term. 4his amount is also need to !e revealed to let Saiful -la'i )no' 'hether P01412 has made a 'ise in ma)ing an outsource financing.

4.

SBOT A-'/3%(% o; Proto- '-0 (t% 7om"#t(tor

S&14 -nalysis is an analysis that consists of a company7s strength, 'ea)ness, opportunity and threat. 4he analysis 'ill help company to discover their o'n strength and 'ea)ness and opportunity and threat that they are facing from outside. ,t 'ill also help company to increase value of a company in all aspects from the capital financing to production of products. 4his includes the Buality of product, the effectiveness and efficiency of each department, the s)ills and )no'ledge of their la!our and so forth. 3y )no'ing their o'n 'ea)nesses, they are a!le to find solution to overcome the 'ea)nesses in order to minimiIe it so that a company can focus on expanding its strength. 1pportunity and threat is something that a company have to )no' in order to

Page | 6

Kajian Kes Integrasi (EPPA 4716) Case 5 : Proton : From Saga to Exora

expand and gro' its !usiness. 4o ensure the successful of a company in a long term, they need to gro' and expand. Same goes to P01412. - 3( years is a long ourney made !y P01412 'here!y they has to )no' exactly the opportunity that is availa!le for them to ta)e and the threat that they need to !e a'are.

4his analysis should !e revealed !ecause from the analysis, Saiful -la'i 'ill have a !road mind of P01412 and also manage to decide the crossroads of P01412 in a long run as 'ell.

3esides S&14 -nalysis of Proton, other information that should !e included is lists of its competitors and their S&14 -nalysis. 4his information is very useful to Saiful -la'i so that he manages to ma)e a comparison and a!le to )no' 'here P01412 stand compare to its competitors and discover 'ea)nesses of P01412 !etter.

5.

PROTONI% 7or"or't# (-;orm't(o-

,n order for Saiful -la'i to evaluate P01412, he needs the company7s corporate information. 4he corporate information includesJ 1. ;ompany7s vision and mission

Page | 7

Kajian Kes Integrasi (EPPA 4716) Case 5 : Proton : From Saga to Exora

%. ,nternal and external environment of the company 3. Short term and long term o! ectives *. Strategies-strategies that have !een implemented !y the company to achieve goals

6.

R#8(#A o; t)# ',r##m#-t '-0 7o//'$or't(o- )'% $##- 0o-# $3 PROTON D0o(-, "'"#rAor@E

Since P01412 !een esta!lished in 1+$3, there are many colla!oration made !y P01412 'ith international company to produce ne' model. 7. C!%tom#r F##0$'7@ ;ustomer feed!ac) is vital to ma)ing a !usiness 'or). 4he customers are the heart of P014127s operationM 'ithout them, it 'ould !e impossi!le to have any of the success that the company does. ;ustomer feed!ac) can !e an excellent 'ay to )eep the !usiness going in a positive direction. Get Honest Opinions ;ustomer feed!ac) is a vital 'ay to get honest opinions on P014127s services or products from people 'ho are familiar 'ith them. 4hese opinions can ma)e it easier to get into the minds of the most important critics. Improve Relations &hen customers feel that a !usiness truly cares a!out them and 'hat they thin), they may !e more li)ely to !e loyal customers. &hen a !usiness ma)es changes according to feed!ac), it sho's that they truly listen and respect those opinions. Inexpensive Business Advice

Page | !

Kajian Kes Integrasi (EPPA 4716) Case 5 : Proton : From Saga to Exora

Some !usinesses pay thousands of dollars for someone to come in and tell them 'hat improvements need to !e made to the !usiness to get more customers. ;ustomer feed!ac) is essentially inexpensive !usiness advice directly from the source. More Customers &hen a !usiness is 'illing to receive feed!ac) and listen to it, 'ord spreads and more customers may !e 'illing to give the company a shot !ased on your commitment to excellent customer service. Positive Changes - !usiness does not li)e to !rag a!out the negative aspects of their operationM they 'ant to have mostly positive things to say. ;ustomer feed!ac) can mean positive changes according to their comments, 'hich could mean a !etter reputation and more money for the !usiness. So, in this case, the information a!out the customer feed!ac) is important !ecause it could help Saiful -la'i to identify the customer satisfaction a!out P014127s product. .. M'r@#t(-, 4he heart of the !usiness success lies in its mar)eting. 5ost aspects of your !usiness depend on successful mar)eting. 4he overall mar)eting um!rella covers advertising, pu!lic relations, promotions and sales. 5ar)eting is a process !y 'hich a product or service is introduced and promoted to potential customers. &ithout mar)eting, the !usiness may offer the !est products or services in your industry, !ut none of the potential customers 'ould )no' a!out it. &ithout mar)eting, sales may crash and companies may have to close.

Page | "

Kajian Kes Integrasi (EPPA 4716) Case 5 : Proton : From Saga to Exora

For example, PE01DE- has oined a program N&hat7s Ep :raduateO 'ith a lo' minimum monthly installment, /(A discount, free maintenance cost, insurance incentive and free driving license. 5. Pro0!7t(o4he processes and methods used to transform tangi!le inputs =ra' materials, semifinished goods, su!assem!lies> and intangi!le inputs =ideas, information, )no'ledge> into goods or services. 0esources are used in this process to create an output that is suita!le for use or has exchange value. 4his information could help Saiful -la'i to )no' the extent to 'hich the productions of Proton meet the needs and preferences of customers.

Co-7/!%(o3ase on this case, our recommendations areJ 1. 3ased on the financial analysis has !een made, 'e can see that Proton are no longer a!le to pursue the !usiness !y their o'n !ecause of the lo' liBuidation ratio and high leverage ratios. 4herefore, Proton may consider to ma)e a colla!oration 'ith the local partners or foreign partners. %. ;hoosing the foreign partners is not easier as 'e can tal). 5any thing and aspect that 'e must consider !efore 'e ma)e colla!oration 'ith the foreign partners li)e cultural issue and adherence to the rules and regulation in this country.

$ S&14 analysis is very important to a company to understand their strengths and

'ea)nesses as 'ell as to find out 'hat are the opportunities that can !e seiIed and the threats to !e avoided. 4herefore, refer to this case, Proton can use that S&14 analysis 'hether to ma)e an investment or colla!oration.

Page | 4#

Kajian Kes Integrasi (EPPA 4716) Case 5 : Proton : From Saga to Exora

4$ 5isuse of po'er and fraud !y high level of management should !e addressed and

investigate either !y ma or shareholders, :overnment !odies and create Proton ;ommission to solve Proton pro!lems in the future development /. 4he production of a!ove models usually comes from colla!oration of Proton 'ith foreign partners. From example, colla!oration 'ith 5itsu!ishi produced ,nspira 'hile colla!oration 'ith 0enault S- produced Savvy. Proton also used foreign technology in the production of cars such as @otus. 0ecently, Proton also going to have colla!oration 'ith ?onda. ,n terms of mar)eting, steps have !een ta)en to increase proton visi!ility in foreign countries such as Egypt, Syria, 4hailand, ;hina and ,ndonesia. 6. ;olla!oration, <oint 8enture or Short term partners ip 'ith local automotive such as Perodua to !e thin) deeply or provide an opportunity for the company to overcome the pro!lem of Proton. 3elo' the S&14 -nalysis of Perodua to !e analysed or to !e considered as follo's JSBOT A-'/3%(% P#ro0!' Str#-,t)% 1. ?ighly demand-although only a fe' model !ut it suits many people %. 8alue for money-fuel efficiency and price reasona!le 3. @o' maintenance-every 1(,((( )m *. ?ave a good reputation /. Excellent reali!ility and !uild Buality plus the impressive standard eBuipment specification and latest generation technology apparent in models 6. -ccording to the $(.%( rule, the prices of Perodua cars are relatively afforda!le to the $(A of the people.

Page | 41

B#'@-#%%#% 1. @o' 0LD and not innovative-only fe' models availa!le and the same car only upgraded-do not produce ne' model of car %. Design not impressive 3. &ea) management team *. Dependa!ility to 4oyota company !ecause using their technology

Kajian Kes Integrasi (EPPA 4716) Case 5 : Proton : From Saga to Exora

6. Easy to drift for !eginner $. Suita!le for single and couple O""ort!-(t(#% 1. 1pportunity to gro' !ecause meet the demand people no'adays-fuel saving and compact car %. 1pportunity to mar)et glo!ally 3. 1pportunity to produce more products due to goos reputation-people have trust in ne' product T)r#'t% 1. Economic slo'do'n %. ;ompetition especially Proton from competitors

6. ;hanging existing engine technology to green technology from fuel to hy!rid =electricity> $. ;reativity in technology innovation can !e considered and asses !y doing mar)eting survey to the nation'ide customers such as favourite colour, design, car capacity, car Buality, etc +. 5ar)eting strategy to !e revised, improve and implement immediately to increase sales, customer satisfaction, customer reBuirements etc 1(. ;omprehensive and accepta!le in generate 3udget ;ash Flo' and Financial 3udgeting to solve Proton financial situation and to create opportunity for future development 11. Full utilisation of factory space 'ith mass production not produce only one type of car !ut mixture type of cars in !oth factory either in 4an ung 5alim or Shah -lam

Page | 42

You might also like

- Ads653 Case StudyDocument14 pagesAds653 Case StudyAnis NajwaNo ratings yet

- Comparative Management Assignment.Document17 pagesComparative Management Assignment.Sajid AfridiNo ratings yet

- Case Study of HY DiariesDocument4 pagesCase Study of HY DiariesDba Dba100% (1)

- Alia Syazwani Practical Training ReportDocument22 pagesAlia Syazwani Practical Training ReportAli Hisham GholamNo ratings yet

- Fin 658 Group Assignment Fsa ToolsDocument42 pagesFin 658 Group Assignment Fsa ToolsMALISSA ZARINA ROSDEENNo ratings yet

- Internship ReportDocument34 pagesInternship ReportAsnawi Nor Azizan50% (2)

- ITT400 - Introduction To Data Communication and Networking: Universiti Teknologi MARADocument3 pagesITT400 - Introduction To Data Communication and Networking: Universiti Teknologi MARALuqman HasifNo ratings yet

- Concrete Mix Design M-30 (Paver Block) Grade: Name of Work Client Authority Engineer ContractorDocument23 pagesConcrete Mix Design M-30 (Paver Block) Grade: Name of Work Client Authority Engineer ContractorAshok amlapure75% (4)

- DISA Parts and Services Catalogue 2019Document141 pagesDISA Parts and Services Catalogue 2019Yanto Daryanto100% (2)

- Ab5.49 - Report Group A - HLB2013Document12 pagesAb5.49 - Report Group A - HLB2013alya farhana100% (1)

- Internship Report Nur Adibah Binti IbrahimDocument40 pagesInternship Report Nur Adibah Binti IbrahimAtiqah Nabilah RazaliNo ratings yet

- Proton ExoraDocument40 pagesProton ExoraAzlina Mohamat Nor75% (4)

- Individual Assignment 1 MGT 420 Principles and Prectice of ManagementDocument6 pagesIndividual Assignment 1 MGT 420 Principles and Prectice of ManagementFahmi Rosli100% (1)

- Simple Internship ReportDocument14 pagesSimple Internship ReportMinXhaoChanNo ratings yet

- Answer Project FAR610Document15 pagesAnswer Project FAR610Syahrul Amirul100% (1)

- Main Challenges Proton (Contain 2)Document6 pagesMain Challenges Proton (Contain 2)Yapi Yapo Jr.No ratings yet

- 81-Automated Cloth LineDocument1 page81-Automated Cloth Linezul67% (3)

- WiFi Function Manual of Charge Point-181030 PDFDocument16 pagesWiFi Function Manual of Charge Point-181030 PDFfreesonNo ratings yet

- Asm654 Blended Learning (2 Dimensional Matrix and 3d Cube Exercise) (New)Document2 pagesAsm654 Blended Learning (2 Dimensional Matrix and 3d Cube Exercise) (New)imzamilasNo ratings yet

- Form 5 Essay ProjectDocument26 pagesForm 5 Essay ProjectSuriati Ku IshakNo ratings yet

- RET 550 Assignment 2 (GROUP 1)Document8 pagesRET 550 Assignment 2 (GROUP 1)NOR AIMAN AZIM NOR AZLISHAMNo ratings yet

- Fin 548 Answer SchemeDocument23 pagesFin 548 Answer SchemeDayah Angelofluv100% (1)

- GP Ocean Food BerhadDocument4 pagesGP Ocean Food BerhadlilymintNo ratings yet

- MGT657 Latest Words 31.12Document61 pagesMGT657 Latest Words 31.12Nurul SyakilahNo ratings yet

- Assignment 1 Fin 555 FinDocument9 pagesAssignment 1 Fin 555 FinLuqmanulhakim JohariNo ratings yet

- Car One Moment, MPV The Next.: Product InformationDocument31 pagesCar One Moment, MPV The Next.: Product InformationPaulNo ratings yet

- Answer Scheme Fin542 Apr2011Document6 pagesAnswer Scheme Fin542 Apr2011JaneahmadzackNo ratings yet

- Elc650 Email TemplateDocument1 pageElc650 Email TemplateChoco WaffleNo ratings yet

- I) Ii) Iii) 5 September 2014: ACC 106/115/117/114/418 (GENERIC CODES) AssignmentDocument4 pagesI) Ii) Iii) 5 September 2014: ACC 106/115/117/114/418 (GENERIC CODES) AssignmentBryan Villarreal20% (5)

- ICS Transmile Group Berhad PDFDocument36 pagesICS Transmile Group Berhad PDFUmar othman0% (1)

- Perodua Part 1Document35 pagesPerodua Part 1doctoraspire50% (10)

- Micro Accounting SystemDocument1 pageMicro Accounting SystemkhanNo ratings yet

- Report Case Study Fin534 Group AssignmentDocument15 pagesReport Case Study Fin534 Group Assignment‘Alya Qistina Mohd ZaimNo ratings yet

- MKT 537/536 Oct 2007Document8 pagesMKT 537/536 Oct 2007myraNo ratings yet

- Fin430 - Dec2019Document6 pagesFin430 - Dec2019nurinsabyhahNo ratings yet

- Lotus KFM Berhad FADocument19 pagesLotus KFM Berhad FAGeorge BichangaNo ratings yet

- Eco745 - Economics For Business Decisions: Group ProjectDocument11 pagesEco745 - Economics For Business Decisions: Group ProjectJulia Sa'ayonNo ratings yet

- Maf603-Test 2-Jan 2021-QDocument2 pagesMaf603-Test 2-Jan 2021-QPutri Naajihah 4GNo ratings yet

- Accounting Assessment Report - Hup Seng Berhad & Hwa Tai IndustriesDocument16 pagesAccounting Assessment Report - Hup Seng Berhad & Hwa Tai IndustriesYoga ManiNo ratings yet

- Q2 Zakat Project (FAR658)Document11 pagesQ2 Zakat Project (FAR658)Syahrul Amirul50% (2)

- Opm 530 Individual Assignment: Video Summary: Name: Muhammad Lutfil Hadi Bin EsaDocument10 pagesOpm 530 Individual Assignment: Video Summary: Name: Muhammad Lutfil Hadi Bin EsaMuhd Lutfil Hadi EsaNo ratings yet

- Guidelines To Article Analysis Elc501Document10 pagesGuidelines To Article Analysis Elc501Akmal RahimNo ratings yet

- Fin 533 Chapter 6 Past Year QuestionDocument2 pagesFin 533 Chapter 6 Past Year QuestionWAN NORSYAMILANo ratings yet

- Maybank ServicesDocument3 pagesMaybank Serviceseggie dan0% (1)

- Jawabab MK WayanDocument1 pageJawabab MK WayanErica LesmanaNo ratings yet

- Logbook Aisyah Athirah Abdul RazabDocument28 pagesLogbook Aisyah Athirah Abdul Razabauni fildzahNo ratings yet

- Chapter 3 OPM GROUP ASSIGNMENTDocument5 pagesChapter 3 OPM GROUP ASSIGNMENTSaleh Hashim100% (1)

- Eiwu / Sharp Picket, Press Statement 28 Feb 2013Document2 pagesEiwu / Sharp Picket, Press Statement 28 Feb 2013Salam Salam Solidarity (fauzi ibrahim)100% (1)

- SAS Slide SDFDSFDSFSD Dfsdsdfwyr6uDocument37 pagesSAS Slide SDFDSFDSFSD Dfsdsdfwyr6uIkhram JohariNo ratings yet

- HTH 558 - Test December 2020Document1 pageHTH 558 - Test December 2020Ariana ArissaNo ratings yet

- Assingment 1 - Case StudyDocument23 pagesAssingment 1 - Case StudyMUHAMMAD NASRUN NAJMI LEHASROMNo ratings yet

- Short Report UitmDocument6 pagesShort Report UitmAkiff ZaQuan ArifNo ratings yet

- Faculty of Business Management Bachelor of Business Administration (Hons) Operation Management (Ba244)Document6 pagesFaculty of Business Management Bachelor of Business Administration (Hons) Operation Management (Ba244)Fitrah LemanNo ratings yet

- Ibm554 Ba2463d Group 2 Assignment 1Document47 pagesIbm554 Ba2463d Group 2 Assignment 1Aqilah PeiruzNo ratings yet

- Adm650 - Group 4 - Am2256cDocument34 pagesAdm650 - Group 4 - Am2256c2022398019No ratings yet

- FIN420 Individual Assignment 20214Document3 pagesFIN420 Individual Assignment 20214Admin & Accounts AssistantNo ratings yet

- Action On Trigger Responsibility Response PlanDocument4 pagesAction On Trigger Responsibility Response PlanFatin AmiraNo ratings yet

- TRIM DailyDocument7 pagesTRIM DailyJoyce SampoernaNo ratings yet

- Financial Analysis 105-115Document10 pagesFinancial Analysis 105-115deshpandep33No ratings yet

- Project Proposal Form: High School Student Council OfficersDocument4 pagesProject Proposal Form: High School Student Council OfficersasdfghjklostNo ratings yet

- A Study On Performance of Ipos in Indian Stock MarketDocument58 pagesA Study On Performance of Ipos in Indian Stock MarketAmit SharmaNo ratings yet

- Project ReportDocument89 pagesProject ReportPriyankaThakur100% (1)

- Nestle OLDDocument19 pagesNestle OLDtony_njNo ratings yet

- Ana&Physio 16 - Human DevelopmentDocument37 pagesAna&Physio 16 - Human DevelopmentShery Han Bint HindawiNo ratings yet

- Agile DeckDocument42 pagesAgile Deckketantank09100% (1)

- GPNA-BoneSubstituteBrochure Single FINAL PDFDocument16 pagesGPNA-BoneSubstituteBrochure Single FINAL PDFPratyusha VallamNo ratings yet

- JD DM PurchasingDocument1 pageJD DM PurchasingSachin RatheeNo ratings yet

- I Wonder 4 Yearly Plan (Jordan)Document5 pagesI Wonder 4 Yearly Plan (Jordan)Sana' JarrarNo ratings yet

- Ghasem Hosseini Salekdeh (Eds.) - Agricultural Proteomics Volume 1 - Crops, Horticulture, Farm Animals, Food, Insect and Microorganisms (2016, Springer International Publishing) PDFDocument246 pagesGhasem Hosseini Salekdeh (Eds.) - Agricultural Proteomics Volume 1 - Crops, Horticulture, Farm Animals, Food, Insect and Microorganisms (2016, Springer International Publishing) PDFLa Ciencia de AlejoNo ratings yet

- BBG ShortcutsDocument2 pagesBBG ShortcutsnikhilagaNo ratings yet

- Basic Business Statistics: 12 EditionDocument51 pagesBasic Business Statistics: 12 EditionMustakim Mehmud TohaNo ratings yet

- K DLP Week 22 Day 3 CarinaDocument6 pagesK DLP Week 22 Day 3 Carinacarina pelaezNo ratings yet

- VMP 530vhmDocument2 pagesVMP 530vhmelienai10% (1)

- White Resonant MirrorDocument7 pagesWhite Resonant Mirrorlucia.marneanuNo ratings yet

- Gordon 2009 CatalogDocument68 pagesGordon 2009 Catalogpolanck100% (3)

- Chapter 12Document61 pagesChapter 12AmalNo ratings yet

- DelegationDocument25 pagesDelegationKarthik Sathyan100% (3)

- Automation PrinciplesDocument45 pagesAutomation PrinciplesLuis DerasNo ratings yet

- English 9thDocument1 pageEnglish 9thAlrayyan RashidNo ratings yet

- Adverbs PlaceDocument2 pagesAdverbs PlaceLuizNo ratings yet

- NOKIA Connected Mode Mobility Algo - SimplifiedDocument27 pagesNOKIA Connected Mode Mobility Algo - SimplifiedMohamed Abd-ElsalamNo ratings yet

- Nonverbal CommunicationDocument23 pagesNonverbal CommunicationNaman Agarwal100% (1)

- Prove That 7 Is Irrational ?: 10th ClassDocument11 pagesProve That 7 Is Irrational ?: 10th ClassMahesh YadavNo ratings yet

- Respiratory DiseaseDocument27 pagesRespiratory Diseaseعبدالسلام الأسمرNo ratings yet

- French Ab Initio Writing Format Booklet: June 2018Document41 pagesFrench Ab Initio Writing Format Booklet: June 2018Marian Molina RuanoNo ratings yet

- Test Bank For Stuttering Foundations and Clinical Applications 0131573101Document24 pagesTest Bank For Stuttering Foundations and Clinical Applications 0131573101JimmyHaynessfmg100% (46)

- 0606 Additional Mathematics: MARK SCHEME For The October/November 2014 SeriesDocument6 pages0606 Additional Mathematics: MARK SCHEME For The October/November 2014 SeriesKennedy Absalom ModiseNo ratings yet

- Research Paper On Skill MatrixDocument5 pagesResearch Paper On Skill Matrixlixdpuvkg100% (1)

- ED215 Observed Lesson Plan 1Document2 pagesED215 Observed Lesson Plan 1adrvazquezNo ratings yet

- Hdiv ReferenceDocument96 pagesHdiv ReferencejorgesharklasersNo ratings yet