Professional Documents

Culture Documents

Manage-Free Economic-Burieva Nigora Hasanovna

Manage-Free Economic-Burieva Nigora Hasanovna

Uploaded by

Impact JournalsOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Manage-Free Economic-Burieva Nigora Hasanovna

Manage-Free Economic-Burieva Nigora Hasanovna

Uploaded by

Impact JournalsCopyright:

Available Formats

IMPACT: International Journal of Research in Business Management (IMPACT: IJRBM) ISSN(E): 2321-886X; ISSN(P): 2347-4572 Vol.

1, Issue 7, Dec 2013, 9-12 Impact Journals

FREE ECONOMIC ZONES IN UZBEKISTAN: THE CONDITIONS AND EXPECTED EFFICIENCY

BURIEVA NIGORA KHASANOVNA & OSTONOKULOV AZAMAT ABDUKARIMOVICH Department of Budget Accounting, Tashkent Financial Institute, Tashkent, Uzbekistan

ABSTRACT

Free economic zones (FIEZ) became one of the most effective and promising forms of attracting investment for development of economic and scientific potential. There are currently about 3000 FIEZs in 120 countries worldwide. The most important aspect of the functioning of the FIEZ is a system of preferences and privileges granted to foreign and domestic investors.

KEYWORDS: Free Economic Zones, Tax and Custom INTRODUCTION

Today, with the liberalization and modernization of the economy, in order to ensure the products conforming to international standards, it is necessary to create favorable conditions to attract foreign investment, primarily direct investment. Certainly, free economic zones are designed to address these pressing problems: Accelerating the development of innovation, the introduction of advanced technology, the development of export infrastructure, transport and telecommunications; Improving competitiveness through the implementation of the requirements of international quality certification and packaging of local products and services in the domestic and foreign markets; Makes it possible to address such critical issues as the creation of new jobs, the training of skilled workers, engineers, and business managers. Main purpose of the organization of free economic zones is the promotion of economic development of a given region or industrial sector, in addition, the use of free economic zones as a method of upgrading the regional economy in the period of transition to a market economy. International experience shows that, today, free economic zones are used not only to raise capital, but also as a means of regional economic policy. In Uzbekistan, in order to achieve these objectives, as well as for the implementation of activities in free economic zones benefits of international experience were created: Free Industrial Economic Zone "Navoi"; A special industrial zone "Angren"; A special industrial zone "Djizak". Free Industrial Economic Zone (FIEZ) "Navoi" was organized by the decree of the President of the Republic of Uzbekistan 4059 of 02.12.2008 year. It is located in the district of Navoi region Karmana. Area of 500 hectares, on which a special legal regime, including tax, currency and customs regimes, simplified procedure for entry, stay and departure, as well as obtaining permits for employment non-resident citizens of the Republic of Uzbekistan. The legal basis

10

Burieva Nigora Khasanovna & Ostonokulov Azamat Abdukarimovich

for the functioning of FIEZ "Navoi" governed by the "Regulations on the free industrial economic zone "Navoi"" (approved by the Cabinet of Ministers of Uzbekistan on 27.01.2009, 21). The main activity of business entities in FIEZ is to develop a wide range of high-tech industries, competitive on world markets through the introduction of modern high-efficiency equipment and machinery, production lines and modules, and innovative technologies. If your company has this feature, you may contact the Directorate FIEZ with the application for the listing of participants in economic activity and to register in the free industrial and economic zone. In the case of a positive decision, you become the owner of the following: Tax Benefits Residents in FIEZ "Navoi", the volume of direct investments made are exempt from land tax, property tax, income tax, tax on improvement and development of social infrastructure, unified tax payment (for small businesses), as well as mandatory contributions to the Republican road Fund and Republican school Fund : 3 million Euros to 10 million Euros - for 7 years; From 10 million Euros to 30 million Euros - for 10 years. However, the 5-year rate of single tax payment shall be fixed at 50 % below current rates; More than 30 million Euros - for 15 years, and for 10 years the rates of the EPP shall be fixed at 50 % below current rates. Customs Privileges Enterprises registered in FIEZ "Navoi" are exempt from the payment of customs duties (except for customs clearance) for imported equipment and raw materials and components for the production of exports for the whole period of operation of the free industrial and economic zone. In order to manufacture products intended for sale in the domestic market of Uzbekistan, customs duties for goods imported into the country raw materials and component products, if legal documents are not provided other benefits, are charged at the rate of 50 % of the rates ( except for customs clearance), with this time of payment may be extended to 180 days. Special industrial zone (SIZ) "Angren" and "Djizak" organized by the decree of the President of the Republic of Uzbekistan 4436 of 13.04.2012 in the city of Tashkent region and the presidential decree number 4516 of 18.03.2013, the Djizak in the field, along with the branch of the district Syrdarya region, respectively. The main tasks and activities of these zones is considered to be: Creating an enabling environment to attract investments, especially direct, for establishment and effective operation of modern high-tech productions for competitive on the domestic and global markets products with high added value; Providing integrated and effective use of production and resource potential of the region included in the special industrial zone, the creation of new enterprises to more advanced processing of mineral resources; Deepening the processes of localization of production of high-tech products based on local raw materials and on the basis of establishing close cooperative ties and development of industrial cooperation between enterprises of special industrial zones and the whole country;

Free Economic Zones in Uzbekistan: The Conditions and Expected Efficiency

11

Provision of advanced development and efficient use of the transport, engineering, communications and social infrastructure, further development and widespread use of the potential of the logistics center "Angren" created a system of roads and container cargo. Place participant in these special industrial zones defined by the Governing Body of SIZ "Angren" and "Djizak." During the period of implementation of actions on the territory of special industrial zones are special tax regime

and customs privileges. Tax incentives and preferences of residents SIZ "Angren" and "Djizak": Income tax , property tax of legal entities , the tax for the improvement and development of social infrastructure , the single tax for small businesses, as well as mandatory contributions to the Republican Road Fund; Customs duties (except customs duty) on the equipment, components and materials that are not produced in the country , imported into the territory of SIZ "Angren" and " Djizak " in the implementation of projects on the lists approved by the Cabinet of Ministers. The above benefits are available depending on the amount of investments made, including the equivalent of: 300 thousand U.S. dollars to $ 3 million - for a period of 3 years; More than $ 3 million to $ 10 million - for a period of 5 years; More than $ 10 million - for a period of 7 years. In Uzbekistan, the organization of free economic zones and attitudes regarding their activities are regulated by the Law of the Republic of Uzbekistan "On free economic zones", adopted on 25 April 1996. In addition, taking into account established in the territory of the free economic zone of a special legal regime, as well as reflected in the specific list provided at the time of the economic activities of privileges and preferences to the current law introduced the possibility of reflecting the decree on the organization of free economic zones of additional guarantees and benefits.

CONCLUSIONS

In turn, the economic agents in free economic zones established on taxation and customs duties being able to save on average as a result of defined benefits in relation to other territories for those costs 15-20 % equity acquisition of local raw materials from most of the costs associated with production and, thereby, reduce production costs by an average of 10-15 %, as well as through direct sales of their products to consumers to increase profits by 15-20 %. In general, through the implementation of activities in free economic zones, economic agents can save an average of 20-30 % of its own funds and increase revenues by 15-20 %. Thus, in free zones entities have the possibility of introducing new production techniques and technology and the expansion of its activities to maximize income.

REFERENCES

1. Law of the Republic of Uzbekistan "On free economic zones" 25.04.1996. 2. Decree of the President of the Republic of Uzbekistan 4059 of 02.12.2008 "On the organization of free industrial and economic zone in Navoi region". 3. Decree of the President of the Republic of Uzbekistan 4436 of 13.04.2012, "On the creation of a special industrial zone" Angren".

12

Burieva Nigora Khasanovna & Ostonokulov Azamat Abdukarimovich

4. Decree of the President of the Republic of Uzbekistan 4516 of 18.03.2013, "On the creation of a special industrial zone" Djizak". 5. Internet sites: www.lex.uz and www.gov.uz.

You might also like

- Performance and Policies Vishal Sarin LHSBDocument20 pagesPerformance and Policies Vishal Sarin LHSBAnoop KularNo ratings yet

- Belgrade Chamber of Commerce GUIDE For Investors 2015Document16 pagesBelgrade Chamber of Commerce GUIDE For Investors 2015Marko BabicNo ratings yet

- Social Economic ZoneDocument3 pagesSocial Economic ZoneRakesh Raj SinghaniayaNo ratings yet

- Attracting Investments To Small Industry ZonesDocument6 pagesAttracting Investments To Small Industry ZonesAcademic JournalNo ratings yet

- Integrative Approach To The System of Higher Education of Foreign Countries, Economically Developed in The Republic of UzbekistanDocument5 pagesIntegrative Approach To The System of Higher Education of Foreign Countries, Economically Developed in The Republic of UzbekistanOpen Access JournalNo ratings yet

- Special Economic ZxfxdonesDocument3 pagesSpecial Economic ZxfxdonesShIva Leela ChoUdaryNo ratings yet

- Ans: Industrial Enterprise Act 1992:: Name: Sandisha Shrestha Section: B Roll No: 157110 Section: BDocument5 pagesAns: Industrial Enterprise Act 1992:: Name: Sandisha Shrestha Section: B Roll No: 157110 Section: BMilisha ShresthaNo ratings yet

- The Main Objectives of The SEZ Act AreDocument4 pagesThe Main Objectives of The SEZ Act AreParag YadavNo ratings yet

- EcoZone TaxationDocument10 pagesEcoZone TaxationjanewightNo ratings yet

- Free Zones Bill 2012 Part I JL EditsDocument2 pagesFree Zones Bill 2012 Part I JL EditsKollin RukundoNo ratings yet

- SEZ Notes - February 18th, 2009: DegreeDocument5 pagesSEZ Notes - February 18th, 2009: DegreeZofail HassanNo ratings yet

- SEZ Notes - ManagementParadise - Com - Your MBA Online Degree Program and Management Students Forum For MBA, BMS, MMS, BMM, BBA, Students & AspirantsDocument5 pagesSEZ Notes - ManagementParadise - Com - Your MBA Online Degree Program and Management Students Forum For MBA, BMS, MMS, BMM, BBA, Students & AspirantsVinod WaghelaNo ratings yet

- Project Report - BepDocument11 pagesProject Report - Bepstudyy bossNo ratings yet

- Special Economic ZoneDocument16 pagesSpecial Economic ZoneEsheeta KainthlaNo ratings yet

- The Current Status of SEZ, India: S. Chandrachud, Dr. N. GajalakshmiDocument10 pagesThe Current Status of SEZ, India: S. Chandrachud, Dr. N. GajalakshmiInternational Organization of Scientific Research (IOSR)No ratings yet

- Special Economic Zones (SEZ) : The Next Frontier For IndiaDocument21 pagesSpecial Economic Zones (SEZ) : The Next Frontier For IndiaGurpreet Singh BhatiaNo ratings yet

- Special Economic Zone - DefinitionDocument4 pagesSpecial Economic Zone - Definitionaastha vermaNo ratings yet

- Industrial Market Serbia PDFDocument34 pagesIndustrial Market Serbia PDFIvica JovanovicNo ratings yet

- Key Priorities of SMEs' Development in UzbekistanDocument15 pagesKey Priorities of SMEs' Development in UzbekistanADBI EventsNo ratings yet

- Special Economic ZoneDocument9 pagesSpecial Economic ZoneGïŘï Yadav RasthaNo ratings yet

- There Are 13 Functional Sezs and About 61 Sezs, Which Have Been Approved and Are Under The Process of Establishment in IndiaDocument6 pagesThere Are 13 Functional Sezs and About 61 Sezs, Which Have Been Approved and Are Under The Process of Establishment in IndiaShifa Kunal GuptaNo ratings yet

- Special Economic ZonesDocument10 pagesSpecial Economic ZonesPranay Manikanta JainiNo ratings yet

- Characteristics of Urgut Free Economic Zone Activity in Investment Processes in The CountryDocument5 pagesCharacteristics of Urgut Free Economic Zone Activity in Investment Processes in The CountryResearch ParkNo ratings yet

- Meaning and Definition of Special Economic ZoneDocument12 pagesMeaning and Definition of Special Economic ZoneMubina shaikhNo ratings yet

- Special Economic Zones: A Brief Study OFDocument23 pagesSpecial Economic Zones: A Brief Study OFShailesh BansalNo ratings yet

- Topic 4 - PEZA LawDocument74 pagesTopic 4 - PEZA LawSonjayson CalNo ratings yet

- SEZ PresentationDocument18 pagesSEZ Presentationvinunair79No ratings yet

- Indian Sez ModelsDocument24 pagesIndian Sez ModelsAnuja BakareNo ratings yet

- Special Economic ZoneDocument1 pageSpecial Economic ZoneJananee RajagopalanNo ratings yet

- Cottage Industries and VATDocument8 pagesCottage Industries and VATAdib TasnimNo ratings yet

- Seminars On General Topics: Sez and Its Effect On The EconomyDocument21 pagesSeminars On General Topics: Sez and Its Effect On The EconomyLubna ShaikhNo ratings yet

- Tiu Montelibano Et Al Vs CA Hon Guingona Subic 301 SCRA 278Document6 pagesTiu Montelibano Et Al Vs CA Hon Guingona Subic 301 SCRA 278Jarvin David ResusNo ratings yet

- PDF Study On Special Economic Zones in India CompressDocument38 pagesPDF Study On Special Economic Zones in India CompressVicky VermaNo ratings yet

- Understanding SEZ and Its Implications: The Inception of The Special Economic Zones (SEZ) in India Was Done byDocument8 pagesUnderstanding SEZ and Its Implications: The Inception of The Special Economic Zones (SEZ) in India Was Done byDeepika PrakashNo ratings yet

- Special Economic ZonesDocument3 pagesSpecial Economic ZonesSarath Kumar ReddyNo ratings yet

- Introduction and HistoryDocument9 pagesIntroduction and Historyvidit1789No ratings yet

- Indian Business Environment Foreign Trade Policy of IndiaDocument28 pagesIndian Business Environment Foreign Trade Policy of IndiaReshma RavichandranNo ratings yet

- Project Land Laws Muktesh Swamy Sem VIII Section C Roll No 94Document19 pagesProject Land Laws Muktesh Swamy Sem VIII Section C Roll No 94mukteshNo ratings yet

- Introduction - Facilities and Incentives - Export Performances - Operational Sezs in India - Approved Sezs in IndiaDocument10 pagesIntroduction - Facilities and Incentives - Export Performances - Operational Sezs in India - Approved Sezs in IndiaArti SharmaNo ratings yet

- The Current Status of SEZ, India: S. Chandrachud, Dr. N. GajalakshmiDocument3 pagesThe Current Status of SEZ, India: S. Chandrachud, Dr. N. GajalakshmiManisha TiwariNo ratings yet

- Special Economic Zones (Sez)Document3 pagesSpecial Economic Zones (Sez)kunalagrey.milsNo ratings yet

- Presentation On SEZ Concept in IndiaDocument12 pagesPresentation On SEZ Concept in IndiaVishal TrivediNo ratings yet

- SEZ - India and China: An OverviewDocument14 pagesSEZ - India and China: An OverviewNandakumar GanesamoorthyNo ratings yet

- Development With Special Emphasis On SEZ: Need, Performance and Government Strategy For InfrastructuralDocument5 pagesDevelopment With Special Emphasis On SEZ: Need, Performance and Government Strategy For InfrastructuralSimran SimieNo ratings yet

- Sgem Paper 2018 Naydenov Ivanov PDFDocument8 pagesSgem Paper 2018 Naydenov Ivanov PDFAnna RodinaNo ratings yet

- SEZ PolicyDocument30 pagesSEZ PolicyKushal UpadhyayaNo ratings yet

- Special Economic Zones (SEZ) : The Next Frontier For IndiaDocument21 pagesSpecial Economic Zones (SEZ) : The Next Frontier For IndiaVani RanjanNo ratings yet

- There Are 13 Functional Sezs and About 61 Sezs, Which Have Been Approved and Are Under The Process of Establishment in IndiaDocument13 pagesThere Are 13 Functional Sezs and About 61 Sezs, Which Have Been Approved and Are Under The Process of Establishment in Indiaabhinavanand6No ratings yet

- Re-Structure The StructuredDocument13 pagesRe-Structure The StructuredAkash PamnaniNo ratings yet

- Investment Promotion Regime in AzerbaijanDocument14 pagesInvestment Promotion Regime in AzerbaijankamalaslanNo ratings yet

- About Pakista1Document4 pagesAbout Pakista1kakar1No ratings yet

- 130 2016 TT-BTC 323146Document15 pages130 2016 TT-BTC 323146LET LEARN ABCNo ratings yet

- Role of Special Economic Zone in Strategic Plannnig For Business Unit EstablishmentDocument25 pagesRole of Special Economic Zone in Strategic Plannnig For Business Unit EstablishmentShiv RajNo ratings yet

- A Special Economic ZoneDocument12 pagesA Special Economic ZoneVlad SemenovNo ratings yet

- LAPD IT G28a Brochure On The Special Economic Zone Tax IncentiveDocument3 pagesLAPD IT G28a Brochure On The Special Economic Zone Tax Incentivelebomaedi5No ratings yet

- Special Economic Zone - Wikipedia, The Free EncyclopediaDocument14 pagesSpecial Economic Zone - Wikipedia, The Free EncyclopediaSudhansu SethiNo ratings yet

- Special Economic Zone (SEZ)Document27 pagesSpecial Economic Zone (SEZ)ChunnuriNo ratings yet

- Special Economic Zones PPT NewDocument42 pagesSpecial Economic Zones PPT NewtimciNo ratings yet

- Special Economic Zone - Presentation TranscriptDocument3 pagesSpecial Economic Zone - Presentation Transcriptkmr_arn100% (1)

- 23-01-2023-1674461160-6-Impact - Ijrhal-Ijrhal-Teachers' Perception On Emergency Remote Teaching - Ert - A Correlation StudyDocument14 pages23-01-2023-1674461160-6-Impact - Ijrhal-Ijrhal-Teachers' Perception On Emergency Remote Teaching - Ert - A Correlation StudyImpact JournalsNo ratings yet

- 19-11-2022-1668837986-6-Impact - Ijrhal-2. Ijrhal-Topic Vocational Interests of Secondary School StudentsDocument4 pages19-11-2022-1668837986-6-Impact - Ijrhal-2. Ijrhal-Topic Vocational Interests of Secondary School StudentsImpact JournalsNo ratings yet

- 21-09-2022-1663757902-6-Impact - Ijranss-4. Ijranss - Surgery, Its Definition and TypesDocument10 pages21-09-2022-1663757902-6-Impact - Ijranss-4. Ijranss - Surgery, Its Definition and TypesImpact JournalsNo ratings yet

- 19-11-2022-1668838190-6-Impact - Ijrhal-3. Ijrhal-A Study of Emotional Maturity of Primary School StudentsDocument6 pages19-11-2022-1668838190-6-Impact - Ijrhal-3. Ijrhal-A Study of Emotional Maturity of Primary School StudentsImpact JournalsNo ratings yet

- 12-11-2022-1668238142-6-Impact - Ijrbm-01.Ijrbm Smartphone Features That Affect Buying Preferences of StudentsDocument7 pages12-11-2022-1668238142-6-Impact - Ijrbm-01.Ijrbm Smartphone Features That Affect Buying Preferences of StudentsImpact JournalsNo ratings yet

- 09-12-2022-1670567569-6-Impact - Ijrhal-05Document16 pages09-12-2022-1670567569-6-Impact - Ijrhal-05Impact JournalsNo ratings yet

- 14-11-2022-1668421406-6-Impact - Ijrhal-01. Ijrhal. A Study On Socio-Economic Status of Paliyar Tribes of Valagiri Village AtkodaikanalDocument13 pages14-11-2022-1668421406-6-Impact - Ijrhal-01. Ijrhal. A Study On Socio-Economic Status of Paliyar Tribes of Valagiri Village AtkodaikanalImpact JournalsNo ratings yet

- 28-10-2022-1666956219-6-Impact - Ijrbm-3. Ijrbm - Examining Attitude ...... - 1Document10 pages28-10-2022-1666956219-6-Impact - Ijrbm-3. Ijrbm - Examining Attitude ...... - 1Impact JournalsNo ratings yet

- 12-10-2022-1665566934-6-IMPACT - IJRHAL-2. Ideal Building Design y Creating Micro ClimateDocument10 pages12-10-2022-1665566934-6-IMPACT - IJRHAL-2. Ideal Building Design y Creating Micro ClimateImpact JournalsNo ratings yet

- 09-12-2022-1670567289-6-Impact - Ijrhal-06Document17 pages09-12-2022-1670567289-6-Impact - Ijrhal-06Impact JournalsNo ratings yet

- 05-09-2022-1662375638-6-Impact - Ijranss-1. Ijranss - Analysis of Impact of Covid-19 On Religious Tourism Destinations of Odisha, IndiaDocument12 pages05-09-2022-1662375638-6-Impact - Ijranss-1. Ijranss - Analysis of Impact of Covid-19 On Religious Tourism Destinations of Odisha, IndiaImpact JournalsNo ratings yet

- 22-09-2022-1663824012-6-Impact - Ijranss-5. Ijranss - Periodontics Diseases Types, Symptoms, and Its CausesDocument10 pages22-09-2022-1663824012-6-Impact - Ijranss-5. Ijranss - Periodontics Diseases Types, Symptoms, and Its CausesImpact JournalsNo ratings yet

- 19-09-2022-1663587287-6-Impact - Ijrhal-3. Ijrhal - Instability of Mother-Son Relationship in Charles Dickens' Novel David CopperfieldDocument12 pages19-09-2022-1663587287-6-Impact - Ijrhal-3. Ijrhal - Instability of Mother-Son Relationship in Charles Dickens' Novel David CopperfieldImpact JournalsNo ratings yet

- 25-08-2022-1661426015-6-Impact - Ijrhal-8. Ijrhal - Study of Physico-Chemical Properties of Terna Dam Water Reservoir Dist. Osmanabad M.S. - IndiaDocument6 pages25-08-2022-1661426015-6-Impact - Ijrhal-8. Ijrhal - Study of Physico-Chemical Properties of Terna Dam Water Reservoir Dist. Osmanabad M.S. - IndiaImpact JournalsNo ratings yet

- 29-08-2022-1661768824-6-Impact - Ijrhal-9. Ijrhal - Here The Sky Is Blue Echoes of European Art Movements in Vernacular Poet Jibanananda DasDocument8 pages29-08-2022-1661768824-6-Impact - Ijrhal-9. Ijrhal - Here The Sky Is Blue Echoes of European Art Movements in Vernacular Poet Jibanananda DasImpact JournalsNo ratings yet

- 25-08-2022-1661424544-6-Impact - Ijranss-6. Ijranss - Parametric Metric Space and Fixed Point TheoremsDocument8 pages25-08-2022-1661424544-6-Impact - Ijranss-6. Ijranss - Parametric Metric Space and Fixed Point TheoremsImpact JournalsNo ratings yet

- 23-08-2022-1661248618-6-Impact - Ijrhal-6. Ijrhal - Negotiation Between Private and Public in Women's Periodical Press in Early-20th Century PunjabDocument10 pages23-08-2022-1661248618-6-Impact - Ijrhal-6. Ijrhal - Negotiation Between Private and Public in Women's Periodical Press in Early-20th Century PunjabImpact JournalsNo ratings yet

- 23-08-2022-1661248432-6-Impact - Ijrhal-4. Ijrhal - Site Selection Analysis of Waste Disposal Sites in Maoming City, GuangdongDocument12 pages23-08-2022-1661248432-6-Impact - Ijrhal-4. Ijrhal - Site Selection Analysis of Waste Disposal Sites in Maoming City, GuangdongImpact JournalsNo ratings yet

- Monitoring The Carbon Storage of Urban Green Space by Coupling Rs and Gis Under The Background of Carbon Peak and Carbon Neutralization of ChinaDocument24 pagesMonitoring The Carbon Storage of Urban Green Space by Coupling Rs and Gis Under The Background of Carbon Peak and Carbon Neutralization of ChinaImpact JournalsNo ratings yet

- 25-08-2022-1661424708-6-Impact - Ijranss-7. Ijranss - Fixed Point Results For Parametric B-Metric SpaceDocument8 pages25-08-2022-1661424708-6-Impact - Ijranss-7. Ijranss - Fixed Point Results For Parametric B-Metric SpaceImpact JournalsNo ratings yet

- The Analysis On Environmental Effects of Land Use and Land Cover Change in Liuxi River Basin of GuangzhouDocument16 pagesThe Analysis On Environmental Effects of Land Use and Land Cover Change in Liuxi River Basin of GuangzhouImpact JournalsNo ratings yet

- 06-08-2022-1659783347-6-Impact - Ijrhal-1. Ijrhal - Concept Mapping Tools For Easy Teaching - LearningDocument8 pages06-08-2022-1659783347-6-Impact - Ijrhal-1. Ijrhal - Concept Mapping Tools For Easy Teaching - LearningImpact JournalsNo ratings yet

- 24-08-2022-1661313054-6-Impact - Ijranss-5. Ijranss - Biopesticides An Alternative Tool For Sustainable AgricultureDocument8 pages24-08-2022-1661313054-6-Impact - Ijranss-5. Ijranss - Biopesticides An Alternative Tool For Sustainable AgricultureImpact JournalsNo ratings yet

- 08-08-2022-1659935395-6-Impact - Ijrbm-2. Ijrbm - Consumer Attitude Towards Shopping Post Lockdown A StudyDocument10 pages08-08-2022-1659935395-6-Impact - Ijrbm-2. Ijrbm - Consumer Attitude Towards Shopping Post Lockdown A StudyImpact JournalsNo ratings yet

- The Analysis On Tourist Source Market of Chikan Ancient Town by Coupling Gis, Big Data and Network Text Content AnalysisDocument16 pagesThe Analysis On Tourist Source Market of Chikan Ancient Town by Coupling Gis, Big Data and Network Text Content AnalysisImpact JournalsNo ratings yet

- Income Tax Act 2015 (Act 896)Document182 pagesIncome Tax Act 2015 (Act 896)Kobby Katalist Amuzu-Quaidoo100% (1)

- Amalgamation IIDocument26 pagesAmalgamation IIMumtazAhmadNo ratings yet

- Consignment SD MMDocument65 pagesConsignment SD MMAl-Mahad International SchoolNo ratings yet

- Curriculum For Amfi-Mutual Fund (Basic) Module: Chapter One Concept and Role of Mutual Funds Section OneDocument10 pagesCurriculum For Amfi-Mutual Fund (Basic) Module: Chapter One Concept and Role of Mutual Funds Section OneJignesh MehtaNo ratings yet

- Investment DecisionDocument26 pagesInvestment DecisionToyin Gabriel AyelemiNo ratings yet

- WelcomeKit - T02331230922015210 - 4 Nov 2022Document3 pagesWelcomeKit - T02331230922015210 - 4 Nov 2022Sambath KumarNo ratings yet

- Dr.Y.S. Rajasekhara Reddy Hyderabad 30th July 2008: Key ProcessDocument3 pagesDr.Y.S. Rajasekhara Reddy Hyderabad 30th July 2008: Key Processash6731No ratings yet

- Module 5 - Current Liabilities - Part 1Document51 pagesModule 5 - Current Liabilities - Part 1Joshua CabinasNo ratings yet

- SHAKEY'SDocument76 pagesSHAKEY'SSheila Mae AramanNo ratings yet

- ACCA - IAS 29 Presentation - CPD TinasheDocument21 pagesACCA - IAS 29 Presentation - CPD TinasheTawanda NgoweNo ratings yet

- Chapter 8 - Solution To Problems and CasesDocument8 pagesChapter 8 - Solution To Problems and Caseschandel08100% (1)

- Mis For HDFCDocument16 pagesMis For HDFCAlankrita Mayura MinzNo ratings yet

- Macroeconomic Policy ObjectivesDocument15 pagesMacroeconomic Policy Objectivesapi-53255207No ratings yet

- SIDC Publication Form 2020 V1 PDFDocument4 pagesSIDC Publication Form 2020 V1 PDFJohn SmithNo ratings yet

- A.M. 00-2-01 SC Legal FeesDocument10 pagesA.M. 00-2-01 SC Legal FeesattyrichiereyNo ratings yet

- FFM ArticlesDocument16 pagesFFM ArticlesHasniza HashimNo ratings yet

- Essel Propack LTDDocument8 pagesEssel Propack LTDmaheshNo ratings yet

- CM2436190009975 PDFDocument1 pageCM2436190009975 PDFparthapaul2000No ratings yet

- "Any Fool Can Lend Money, But It Takes Lot of Skills To Get It Back" Presented By-Anisha.NDocument20 pages"Any Fool Can Lend Money, But It Takes Lot of Skills To Get It Back" Presented By-Anisha.NShalini NagavarapuNo ratings yet

- Loan Account Statement For LPCAL00041651130Document3 pagesLoan Account Statement For LPCAL00041651130Arijit DasNo ratings yet

- Pricing ScheduleDocument9 pagesPricing SchedulemalesNo ratings yet

- Salient Features of GSTDocument9 pagesSalient Features of GSTKunal MalhotraNo ratings yet

- Obligasi Indonesia - Harga Dan Quota Indikasi Dapat Berubah Sewaktu-WaktuDocument3 pagesObligasi Indonesia - Harga Dan Quota Indikasi Dapat Berubah Sewaktu-WaktuQA DataonNo ratings yet

- Cold Storage V/s Knitwear Case WACDocument6 pagesCold Storage V/s Knitwear Case WACHamza AmanullahNo ratings yet

- Operational Budgeting-Test BankDocument25 pagesOperational Budgeting-Test Bankremon4hr75% (8)

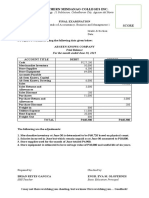

- Acctg1 FinalDocument1 pageAcctg1 FinalBrian Reyes GangcaNo ratings yet

- Jindal Invst PresentationDocument25 pagesJindal Invst PresentationCma Abdul HadiNo ratings yet

- Freshservice-Inr Invoice 16A6aDTmKYKwj1HZGDocument1 pageFreshservice-Inr Invoice 16A6aDTmKYKwj1HZGpratik jadhavNo ratings yet

- F & A Notes - Units 2Document35 pagesF & A Notes - Units 2Anna GillNo ratings yet

- What Is Mortgage Markets?Document8 pagesWhat Is Mortgage Markets?Hades RiegoNo ratings yet