Professional Documents

Culture Documents

Manila Standard Today - Business Daily Stocks Review (January 16, 2014)

Manila Standard Today - Business Daily Stocks Review (January 16, 2014)

Uploaded by

Manila Standard TodayOriginal Description:

Copyright

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Manila Standard Today - Business Daily Stocks Review (January 16, 2014)

Manila Standard Today - Business Daily Stocks Review (January 16, 2014)

Uploaded by

Manila Standard TodayCopyright:

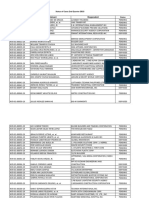

MST Business Daily Stocks Review

M

S

T

Thursday, January 16, 2014

52 Weeks

High Low

STOCKS

3.74

105.5

99

114

1.6

78.2

2.42

21

37.85

0.9

750

0.73

139.5

2.09

38.85

117

145

515

74.5

206.4

1450

160

2.92

2.12

56

62.3

79

0.69

50

1.32

16.6

22.75

0.68

451

0.2

76.5

1.64

21.85

65

83.5

353

40.75

105.7

943

106.8

2.12

AG Finance

Asia United Bank

Banco de Oro Unibank Inc.

Bank of PI

Bankard, Inc.

China Bank

BDO Leasing & Fin. Inc.

COL Financial

Eastwest Bank

First Abacus

Manulife Fin. Corp.

MEDCO Holdings

Metrobank

Natl Reinsurance Corp.

PB Bank

Phil. National Bank

Phil. Savings Bank

PSE Inc.

RCBC `A

Security Bank

Sun Life Financial

Union Bank

Vantage Equities

40.5

30

8.75

5

2.26

1.09

1.59

1.2

24.9

15.12

11

3.06

125

62.5

3.12

2.62

29.3

10.02

8.24

0.96

39.5

20

8.6

4.32

22

3.86

7.9

4.94

15.9

8.5

17

8.61

27.45

15.5

113.8

68

27.4

12.5

0.027

0.0120

15.98

12

5

1.81

0.87

0.45

179.5

99.8

12.24

9.1

3.52

1.8

28.4

11.34

41.4

25

24.2

12.02

22.5

2.52

397

248

13.5

6.8

6.88

4.5

16.3

10.22

19.48

10.16

11.18

4.8

6.15

3.89

3.74

1.98

125

65.5

750

200

3.34

0.9

0.220

0.102

3.3

1.59

3

1.08

135.4

70

2.18

1.11

2.92

2.120

2.92

2.12

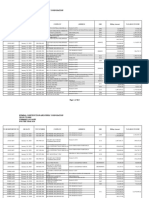

Aboitiz Power Corp.

Agrinurture Inc.

Alliance Tuna Intl Inc.

Alsons Cons.

Asiabest Group

Calapan Venture

Chemphil

Chemrez Technologies Inc.

Cirtek Holdings (Chips)

Concepcion

Da Vinci Capital

Del Monte

DNL Industries Inc.

Emperador

Energy Devt. Corp. (EDC)

EEI

Federal Res. Inv. Group

First Gen Corp.

First Holdings A

Ginebra San Miguel Inc.

Greenergy

Holcim Philippines Inc.

Integ. Micro-Electronics

Ionics Inc

Jollibee Foods Corp.

Lafarge Rep

LMG Chemicals

LT Group

Manila Water Co. Inc.

Megawide

Melco Crown

Mla. Elect. Co `A

Pancake House Inc.

Pepsi-Cola Products Phil.

Petron Corporation

Phinma Corporation

Phoenix Petroleum Phils.

RFM Corporation

Roxas Holdings

San Miguel Corp `A

San MiguelPure Foods `B

Seacem

Swift Foods, Inc.

TKC Steel Corp.

Trans-Asia Oil

Universal Robina

Victorias Milling

Vitarich Corp.

Vulcan Indl.

0.78

0.57

61

40

28.4

14.1

7.3

4.7

6.3

2.800

1.63

0.9

1.69

0.88

688

417.2

18.1

0.082

61.2

44

6.99

3.9

0.26

0.151

883.5

521

9.3

4.75

50

32.55

7.68

4.48

1.39

0.61

0.81

0.320

2.69

1.400

6.33

4

7.65

4.7

0.0620

0.030

2.7

1.02

0.420

0.280

1213

605

2.54

1.5

1.4

1.03

0.315

0.189

0.770

0.270

Abacus Cons. `A

Aboitiz Equity

Alliance Global Inc.

Anscor `A

Asia Amalgamated A

ATN Holdings A

ATN Holdings B

Ayala Corp `A

Cosco Capital

DMCI Holdings

Filinvest Dev. Corp.

Forum Pacific

GT Capital

House of Inv.

JG Summit Holdings

Lopez Holdings Corp.

Lodestar Invt. Holdg.Corp.

Mabuhay Holdings `A

Marcventures Hldgs., Inc.

Metro Pacific Inv. Corp.

Minerales Industrias Corp.

Pacifica `A

Prime Media Hldg

Sinophil Corp.

SM Investments Inc.

Solid Group Inc.

South China Res. Inc.

Top Frontier

Unioil Res. & Hldgs

Zeus Holdings

10.42

27

3.28

50.2

2.26

0.240

35.7

7.1

6.73

2.44

1.21

0.91

1.21

2.76

2.27

1.73

4.31

0.197

0.680

26.9

4.33

26.9

3.52

3.95

21.9

1.35

4.1

2.4

2.92

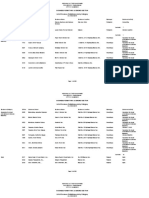

8990 HLDG

Anchor Land Holdings Inc.

A. Brown Co., Inc.

Alphaland Corp.

Araneta Prop `A

Arthaland Corp.

Ayala Land `B

Belle Corp. `A

Cebu Holdings

Century Property

Cityland Dev. `A

Cyber Bay Corp.

Empire East Land

Global-Estate

Filinvest Land,Inc.

Interport `A

Megaworld Corp.

MRC Allied Ind.

Phil. Estates Corp.

Phil. Realty `A

Primex Corp.

Robinsons Land `B

Rockwell

Shang Properties Inc.

SM Prime Holdings

Sta. Lucia Land Inc.

Starmalls

Suntrust Home Dev. Inc.

Vista Land & Lifescapes

2.21

15

1.16

13

0.53

0.174

21.85

4.25

3.7

1.08

0.97

0.49

0.84

1.3

1.35

1.05

2.38

0.077

0.400

17.9

2.4

18.2

1.68

2.7

14.24

0.58

3.31

0.51

2.12

3.15

1.62

47

29.8

1.61

1.01

0.95

0.6

31.95

17.5

0.2090

0.1090

7.78

2.97

84.8

49.7

6.56

3.72

1300

1000

1172

11.7

1670

1058

9.99

7.5

100.5

68.85

10

4.65

0.07

0.012

9.9

5.81

3.4

1.45

1.7

1.24

2.9

2

1.06

0.6

7.35

4.2

3.47

1.9

150

72

17.04

10.00

3290

2480

47.5

28.7

1.87

0.65

0.48

0.315

4.5

1.14

2GO Group

ABS-CBN

Acesite Hotel

APC Group, Inc.

Berjaya Phils. Inc.

Boulevard Holdings

Calata Corp.

Cebu Air Inc. (5J)

Discovery World

DFNN Inc.

FEUI

Globalports

Globe Telecom

GMA Network Inc.

Harbor Star

I.C.T.S.I.

IPeople Inc. `A

IP E-Game Ventures Inc.

Leisure & Resorts

Liberty Telecom

Lorenzo Shipping

Macroasia Corp.

Manila Bulletin

PAL Holdings Inc.

Paxys Inc.

Phil. Seven Corp.

Philweb.Com Inc.

PLDT Common

Puregold

Robinson RTL

STI Holdings

Travellers

Waterfront Phils.

Yehey

4.95

23.35

1.68

20.95

0.6

1.23

1.310

0.066

0.073

28.55

7.13

0.700

4.5

0.026

0.027

7.24

19.76

34.8

0.047

305.8

0.021

Apex `A

Atlas Cons. `A

Coal Asia

Dizon

Geograce Res. Phil. Inc.

Lepanto `A

Lepanto `B

Manila Mining `A

Manila Mining `B

Nickelasia

Nihao Mineral Resources

Omico

Oriental Peninsula Res.

Oriental Pet. `A

Oriental Pet. `B

Petroenergy Res. Corp.

Philex `A

PhilexPetroleum

Philodrill Corp. `A

Semirara Corp.

United Paragon

1.9

11.7

0.85

5

0.4

0.3950

0.4250

0.021

0.023

14.72

2.55

0.400

1.16

0.016

0.019

5.8

7.86

8.5

0.033

217

0.010

49.9

28.95

109

100.2

117

101

10.26

7.22

115

104.1

80.5

74.5

77.5

73

84

74.5

1080

1005

ABS-CBN Holdings Corp.

Ayala Corp. Pref B

First Gen G

GMA Holdings Inc.

Leisure and Resort

PCOR-Preferred

SMC Preferred A

SMC Preferred B

SMC Preferred C

SMPFC Preferred

LR Warrant

19.98

4.21

Ripple E-Business Intl

First Metro ETF

Previous

Close

High

Low

FINANCIAL

2.85

2.84

2.79

69.8

72

69.5

71.90

72.60

72.05

84.20

84.50

83.55

2.04

2.10

2.05

59.00

59.25

59.00

2.00

2.00

2.00

15.96

16.48

16.48

24.1

24.8

24.05

0.78

0.81

0.81

830.00

830.00

825.00

0.247

0.218

0.211

74.00

76.25

74.60

1.5

1.5

1.5

23.00

23.20

23.00

78.00

79.00

77.70

139.00

138.80

138.80

305

309

305

42.25

43.3

42.8

117

117.5

116.5

1345.00

1365.00

1355.00

125.00

125.00

124.70

2.5

2.5

2.5

INDUSTRIAL

35.8

35.95

35.5

5.05

5.32

5.15

0.99

0.98

0.96

1.32

1.33

1.32

11.9

12

11.62

7.2

7

6.5

210

107.5

107.5

3.05

3.18

3.05

14.4

14.4

14.4

24

23.8

23.35

0.9

0.9

0.88

22.45

24

22.5

6.61

6.860

6.6

11.28

11.52

11.28

5.36

5.48

5.35

10.16

10.60

10.16

8.23

12.34

12.30

15.12

15.32

15.2

62.95

64.35

63.3

20.35

20.30

19.60

0.0120

0.0120

0.0110

15.40

15.50

15.40

2.51

2.53

2.53

0.390

0.430

0.390

163.50

172.00

166.60

8.74

8.84

8.75

3.35

3.5

3.35

16.02

16.78

16.06

23.4

23.5

23.25

12.480

12.960

12.520

13.82

14.32

13.8

249.00

250.80

246.00

14.72

15.00

15.00

4.49

4.5

4.48

13.98

14.08

14.00

12.50

12.38

12.24

4.80

5.00

4.85

5.83

5.95

5.65

5.75

0.01

5.76

58.40

58.40

57.70

228.4

235.6

228

1.23

1.40

1.22

0.119

0.130

0.121

1.78

1.80

1.76

1.81

1.88

1.79

122.10

123.20

122.00

2.24

2.35

2.24

0.62

0.63

0.61

1.40

1.40

1.38

HOLDING FIRMS

0.500

0.490

0.485

54.20

54.20

53.25

25.55

25.65

25.55

6.54

6.50

6.50

1.86

1.86

1.86

1.2

1.26

1.2

1.18

1.25

1.18

530.5

541

531.5

8.74

8.8

8.71

58.50

58.80

58.05

4.42

4.42

4.37

0.197

0.198

0.197

745

762.5

750

6.20

6.20

6.20

38.50

39.80

38.95

4.33

4.4

4.3

0.62

0.66

0.61

0.600

0.620

0.600

3.48

3.49

3.36

4.17

4.18

4.06

5.1

5.15

5.14

0.0390

0.0410

0.0380

1.400

1.580

1.420

0.300

0.280

0.275

700.00

714.00

706.00

1.23

1.23

1.21

1.00

1.00

1.00

70.00

77.90

68.00

0.1610

0.1610

0.1610

0.330

0.340

0.340

PROPERTY

7.000

7.090

6.350

13.70

13.56

12.62

1.08

1.10

1.05

17.5

17.4

17

1.580

1.710

1.590

0.187

0.195

0.186

26.65

26.75

26.40

4.86

5.17

4.9

5.88

5.88

5.87

1.36

1.4

1.36

1.04

1.04

1.03

0.53

0.53

0.51

0.920

0.940

0.930

1.37

1.38

1.37

1.38

1.40

1.37

1.38

1.40

1.38

3.4

3.47

3.4

0.0730

0.0780

0.0720

0.3800

0.3900

0.3650

0.4600

0.4500

0.4250

3.10

3.29

3.00

19.72

20.00

19.78

1.57

1.72

1.54

3.24

3.19

3.14

14.50

14.60

14.46

0.62

0.63

0.62

3.53

3.43

3.42

0.940

0.930

0.900

5.270

5.250

5.190

SERVICES

1.87

1.9

1.87

30

30.95

30

1.03

1.04

1

0.640

0.640

0.630

27.5

27.5

27.5

0.1400

0.1460

0.1400

3.35

3.35

3.34

49.5

50

49.5

2.08

2.18

2

5.00

5.00

4.99

1115

1110

1110

8.15

8.15

8

1730

1774

1730

8.50

8.51

8.48

1.32

1.35

1.30

98.05

99

97.55

12.3

12.3

12.3

0.013

0.013

0.012

6.50

6.47

6.30

1.98

1.98

1.98

1.35

1.59

1.55

3.73

3.86

3.75

0.68

0.68

0.68

5.80

5.60

5.60

2.13

2.15

2.13

99.50

100.00

99.50

8.92

8.80

8.80

2682.00

2700.00

2684.00

38.85

39.15

39.00

58.20

58.00

57.50

0.66

0.67

0.66

9.88

10.2

9.8

0.340

0.365

0.340

1.080

1.080

1.080

MINING & OIL

1.88

1.97

1.90

14.78

14.76

14.48

0.85

0.85

0.82

6.00

6.15

5.70

0.420

0.420

0.415

0.395

0.400

0.380

0.395

0.395

0.385

0.0150

0.0160

0.0150

0.0180

0.0180

0.0180

17.22

17.3

17.1

2.34

2.39

2.28

0.3500

0.3550

0.3500

1.700

1.760

1.700

0.0170

0.0180

0.0170

0.0180

0.0180

0.0180

5.52

5.50

5.50

9.00

9.000

8.720

8.05

8.35

8.09

0.036

0.036

0.035

301.00

304.00

300.60

0.0110

0.0100

0.1000

PREFERRED

29.7

30

29.9

529

530

529

109

110

108.5

8.49

8.49

8.4

1.02

1.02

1.01

108.3

108.4

107.2

75.95

76.1

75.9

77.5

77.8

77.5

79.1

79.1

79

1060

1051

1051

WARRANTS & BONDS

0.265

0.44

0.280

SME

10.3

11.68

11.36

EXCHANGE TRADED FUNDS

95

95.8

95.5

Close Change Volume

Net Foreign

Trade/Buying

2.8

72

72.10

84.20

2.08

59.00

2.00

16.48

24.8

0.81

830.00

0.218

75.80

1.5

23.00

77.85

138.80

307

43.05

117.2

1365.00

125.00

2.5

-1.75

3.15

0.28

0.00

1.96

0.00

0.00

3.26

2.90

3.85

0.00

-11.74

2.43

0.00

0.00

-0.19

-0.14

0.66

1.89

0.17

1.49

0.00

0.00

34,000

77,680

2,926,490

1,470,620

32,000

43,720

12,000

300

43,500

170,000

660

230,000

4,371,590

80,000

119,600

222,110

610

16,760

432,100.00

878,390

155

49,730

10,000

35.8

5.15

0.96

1.33

11.9

7

107.5

3.16

14.4

23.8

0.9

22.5

6.79

11.36

5.35

10.38

12.34

15.28

64.1

19.60

0.0120

15.50

2.53

0.395

166.60

8.82

3.4

16.78

23.5

12.800

14.32

250.80

15.00

4.48

14.00

12.24

5.00

5.82

5.99

57.95

230

1.33

0.121

1.78

1.85

122.10

2.25

0.61

1.38

0.00

1.98

-3.03

0.76

0.00

-2.78

-48.81

3.61

0.00

-0.83

0.00

0.22

2.72

0.71

-0.19

2.17

49.94

1.06

1.83

-3.69

0.00

0.65

0.80

1.28

1.90

0.92

1.49

4.74

0.43

2.56

3.62

0.72

1.90

-0.22

0.14

-2.08

4.17

-0.17

4.17

-0.77

0.70

8.13

1.68

0.00

2.21

0.00

0.45

-1.61

-1.43

4,216,300

600

111,000

50,000

10,800

21,100

1,075

720,000

3,000

61,000

139,000

86,400

11,605,100

13,374,900

5,647,400

2,307,300

3,700

705,700

297,270

10,600

4,000,000

2,600

55,000

650,000

378,240

80,000

223,000

14,710,300

308,200

22,600

6,228,700

288,980

200

4,267,000

1,199,400

121,800

1,040,000

2,105,500

194,600

194,830

2,850

5,617,000

480,000

171,000

18,023,000

1,510,100

9,172,000

868,000

34,000

24,745,835.00

0.485

53.30

25.55

6.50

1.86

1.26

1.25

538

8.74

58.30

4.37

0.198

759.5

6.20

39.00

4.3

0.62

0.620

3.44

4.10

5.15

0.0400

1.580

0.280

709.50

1.23

1.00

73.00

0.1610

0.340

-3.00

-1.66

0.00

-0.61

0.00

5.00

5.93

1.41

0.00

-0.34

-1.13

0.51

1.95

0.00

1.30

-0.69

0.00

3.33

-1.15

-1.68

0.98

2.56

12.86

-6.67

1.36

0.00

0.00

4.29

0.00

3.03

1,317,000.00

470,900.00

10,011,400

1,900

10,000

135,000

51,000

630,740

955,300

1,354,130

18,000

30,000

188,730

20,000

2,454,400

709,000

115,000

7,000

2,399,000

15,437,000

3,800

5,600,000

16,000

590,000

253,020

56,000

40,000

878,470

40,000

250,000

53,900.00

112,497.00

-56,678,510.00

6.950

12.94

1.05

17.4

1.670

0.195

26.45

4.98

5.87

1.4

1.03

0.53

0.940

1.37

1.37

1.39

3.46

0.0780

0.3850

0.4500

3.11

19.86

1.62

3.14

14.46

0.62

3.42

0.930

5.220

-0.71

-5.55

(2.78)

-0.57

5.70

4.28

-0.75

2.47

-0.17

2.94

-0.96

0.00

2.17

0.00

-0.72

0.72

1.76

6.85

1.32

-2.17

0.32

0.71

3.18

-3.09

-0.28

0.00

-3.12

-1.06

-0.95

1,200

8,600

33,000

54,600

1,482,000

40,000

9,286,000

6,183,000

1,400

6,461,000

33,000

2,000

133,000

12,141,000

12,141,000

269,000

14,432,000

420,000

1,340,000

800,000

123,000

170,900

4,115,000

28,000

15,634,200

72,000

66,000

313,000

2,748,700

1.9

30.05

1.04

0.640

27.5

0.1420

3.35

49.5

2.18

5.00

1110

8

1760

8.50

1.30

97.75

12.3

0.013

6.30

1.98

1.55

3.84

0.68

5.60

2.15

100.00

8.80

2686.00

39.00

58.00

0.67

10

0.340

1.080

1.60

0.17

0.97

0.00

0.00

1.43

0.00

0.00

4.81

0.00

-0.45

-1.84

1.73

0.00

-1.52

-0.31

0.00

0.00

-3.08

0.00

14.81

2.95

0.00

-3.45

0.94

0.50

-1.35

0.15

0.39

-0.34

1.52

1.21

0.00

0.00

4,000

118,200

142,000

130,000

300

61,740,000

22,000

390,000

204,000

59,100

45

9,000

53,215

481,600

569,000

2,223,820

100

5,300,000

1,600

1,000

3,000

63,591,000

79,000

6,700

102,000

3,610

20,000

119,170

2,891,600

48,830

1,372,000

10,808,900

520,000

7,000

-5,610.00

1.91

14.48

0.82

5.90

0.420

0.385

0.385

0.0160

0.0180

17.12

2.35

0.3500

1.700

0.0170

0.0180

5.50

8.78

8.09

0.036

301.80

0.0100

1.60

-2.03

-3.53

-1.67

0.00

-2.53

-2.53

6.67

0.00

-0.58

0.43

0.00

0.00

0.00

0.00

-0.36

-2.44

0.50

0.00

0.27

-9.09

361,000

1,212,600

1,094,000

62,400

1,190,000

5,800,000

4,090,000

81,000,000

30,000,000

941,400

491,000

110,000

2,633,000

16,900,000

2,500,000

5,000

1,157,600

2,600

3,700,000

189,870

48,400,000

77,900.00

-7,149,292.00

30

530

110

8.49

1.01

107.2

75.9

77.8

79

1051

1.01

0.19

0.92

0.00

-0.98

-1.02

-0.07

0.39

-0.13

-0.85

128,300

180

66,900

137,000

4,934,000

9,970

257,450

11,600

84,300

1,100

1,310,870.00

0.380

43.40

2,770,000

11.68

13.40

5,000

95.5

0.53

10,550

1,918,894.50

42,211,625.50

25,793,470.00

571,860.00

-137,700.00

-439,900.00

80,148,514.50

-105,000.00

701,500.00

-2,310,364.50

4,032,488.00

-1,186,445.00

14,637,790.00

2,031,388.00

-1,935,060.00

22,948,837.00

-20,337,284.00

-16,698,530.00

9,684,844.00

2,407,246.00

-514,944.50

4,000.00

-113,850.00

27,300.00

35,299,529.00

90,732,378.00

-1,529,860.00

-11,943,714.00

-11,943,714.00

2,696,450.00

-3,902,788.00

-1,504,170.00

485,000.00

-1,179,115.00

497,939.00

-6,983,616.50

-335,920.00

196,920.00

4,840.00

532,040.00

4,179,647.00

7,015,500.00

45,197,965.00

767,552.00

4,524,819.50

-9,436,720.00

-40,840,550.00

-222,280.00

74,430.00

-649,910.00

-31,119,350.00

-24,750.00

26,194,350.00

-20,000.00

-13,512,865.50

-3,220.00

6,780.00

593,300.00

-10,700.00

15,257,050.00

-16,357,600.00

-1.00

-4,570,100.00

-5,744,700.00

-5,744,700.00

-13,800.00

-7,836,790.00

-45,000.00

-19,320.00

-1,998.00

-92,300.00

-74,501,100.00

-13,020.00

-11,633,673.00

-2,000,575.00

-16,300.00

10,445,165.00

49,220.00

-41,341,697.00

-1,276,150.00

5,600.00

21,500.00

42,765.00

-88,000.00

17,809,610.00

80,751,835.00

-292,900.00

268,000.00

-41,986,660.00

-161,300.00

116,400.00

79,000.00

180,000.00

1,944,796.00

281,100.00

134,720.00

27,000.00

106,900.00

31,500.00

-6,718,464.00

-403,440.00

-1,052,890.00

-775,000.00

You might also like

- 2019 Q2 Status of CasesDocument469 pages2019 Q2 Status of CasesJenny Vi Estonelo67% (3)

- Creative Directions: Mastering the Transition from Talent to LeaderFrom EverandCreative Directions: Mastering the Transition from Talent to LeaderNo ratings yet

- Project Sourcing & Monitoring (170719)Document10 pagesProject Sourcing & Monitoring (170719)apollo castroNo ratings yet

- Building Directory Metro ManilaDocument12 pagesBuilding Directory Metro ManilaRose CuraNo ratings yet

- Cases For Civil Law Review (Torts and Damages)Document3 pagesCases For Civil Law Review (Torts and Damages)ervingabralagbonNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (May 13, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (May 13, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (May 6, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (May 6, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (May 12, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (May 12, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (May 8, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (May 8, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (January 20, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (January 20, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (June 9, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (June 9, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (February 13, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (February 13, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (January 23, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (January 23, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (June 3, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (June 3, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (December 2, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (December 2, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (December 10, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (December 10, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (February 14, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (February 14, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (May 28, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (May 28, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (December 13, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (December 13, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (March 31, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (March 31, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (December 1, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (December 1, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (March 7, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (March 7, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (March 26, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (March 26, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (February 20, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (February 20, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (December 4, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (December 4, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (November 11, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (November 11, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (October 21, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (October 21, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (May 22, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (May 22, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (April 22, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (April 22, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (December 6, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (December 6, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (April 29, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (April 29, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (April 2, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (April 2, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (May 20, 2013Document1 pageManila Standard Today - Business Daily Stocks Review (May 20, 2013Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (October 1, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (October 1, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (March 12, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (March 12, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (September 2, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (September 2, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (August 5, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (August 5, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (April 1, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (April 1, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (September 24, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (September 24, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (December 5, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (December 5, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (February 10, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (February 10, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (February 10, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (February 10, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (October 13, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (October 13, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (December 18, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (December 18, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (December 18, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (December 18, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (November 19, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (November 19, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (August 27, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (August 27, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (November 13, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (November 13, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (February 18, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (February 18, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (April 8, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (April 8, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (January 27, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (January 27, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (January 6, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (January 6, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (October 29, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (October 29, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (October 7, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (October 7, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (November 11, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (November 11, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (December 17, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (December 17, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (September 10, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (September 10, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (December 11, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (December 11, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (November 18, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (November 18, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (January 17, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (January 17, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (October 2, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (October 2, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (July 10, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (July 10, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (August 5, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (August 5, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (July 25, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (July 25, 2013)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (June 4, 2015)Document1 pageThe Standard - Business Daily Stocks Review (June 4, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (June 5, 2015)Document1 pageThe Standard - Business Daily Stocks Review (June 5, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (June 8, 2015)Document1 pageThe Standard - Business Daily Stocks Review (June 8, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 7, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 7, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (June 3, 2015)Document1 pageThe Standard - Business Daily Stocks Review (June 3, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (June 2, 2015)Document1 pageThe Standard - Business Daily Stocks Review (June 2, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 22, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 22, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 25, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 25, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Weekly Stock Review (May 25 - 29, 2015)Document1 pageManila Standard Today - Business Weekly Stock Review (May 25 - 29, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 26, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 26, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 13, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 13, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (April 30, 2015)Document1 pageThe Standard - Business Daily Stocks Review (April 30, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 7, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 7, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 20, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 20, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 5, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 5, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 18, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 18, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 7, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 7, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (April 22, 2015)Document1 pageThe Standard - Business Daily Stocks Review (April 22, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 6, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 6, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 11, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 11, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (April 29, 2015)Document1 pageThe Standard - Business Daily Stocks Review (April 29, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Busines Weekly Stock Review (May 4-8, 2015)Document1 pageManila Standard Today - Busines Weekly Stock Review (May 4-8, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Weekly Stock Review (April 20 - 24, 2015)Document1 pageManila Standard Today - Business Weekly Stock Review (April 20 - 24, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 4, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 4, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (April 28, 2015)Document1 pageThe Standard - Business Daily Stocks Review (April 28, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (April 24, 2015)Document1 pageThe Standard - Business Daily Stocks Review (April 24, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (April 23, 2015)Document1 pageThe Standard - Business Daily Stocks Review (April 23, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (April 17, 2015)Document1 pageThe Standard - Business Daily Stocks Review (April 17, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Weekly Stocks Review (April 19, 2015)Document1 pageThe Standard - Business Weekly Stocks Review (April 19, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (April 16, 2015)Document1 pageThe Standard - Business Daily Stocks Review (April 16, 2015)Manila Standard TodayNo ratings yet

- Tallest Buildings in The PhilippinesDocument8 pagesTallest Buildings in The PhilippinesJohn Remmel RogaNo ratings yet

- The Philippine Stock Exchange, Inc. Daily Quotation Report: December 24, 2021Document11 pagesThe Philippine Stock Exchange, Inc. Daily Quotation Report: December 24, 2021craftersxNo ratings yet

- Fria List of CasesDocument2 pagesFria List of CasesJhomel Delos ReyesNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (May 22, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (May 22, 2013)Manila Standard TodayNo ratings yet

- CASE LIST Negotiable Instruments Law Under Dean Jose R. SundiangDocument2 pagesCASE LIST Negotiable Instruments Law Under Dean Jose R. SundiangErica Dela CruzNo ratings yet

- List of Accredited Collection Agency As of April 2023Document3 pagesList of Accredited Collection Agency As of April 2023Samantha janeNo ratings yet

- Tin LibraryDocument2 pagesTin LibraryKeizer DelacruzNo ratings yet

- HernandoCaseList Poli Labor CivDocument3 pagesHernandoCaseList Poli Labor CivAmiell100% (1)

- TORTS Cases 3B For Digest and RecitationDocument3 pagesTORTS Cases 3B For Digest and RecitationKiana AbellaNo ratings yet

- Schedule For Pullout On July 22, 2016Document48 pagesSchedule For Pullout On July 22, 2016Monix JoseNo ratings yet

- SMART and GLOBE NUMBERS PHILIPPINESDocument2 pagesSMART and GLOBE NUMBERS PHILIPPINESMaiko IchijoNo ratings yet

- Mobile Number Prefixes in The Philippines 2018Document5 pagesMobile Number Prefixes in The Philippines 2018Dmb Toolmaster TradingNo ratings yet

- Aia Philam Life Health InvestDocument6 pagesAia Philam Life Health InvestJG MespNo ratings yet

- Clinic Status During Enhanced Community QuarantineDocument27 pagesClinic Status During Enhanced Community QuarantineNovelyn DalumpinesNo ratings yet

- 2 Alorica Shuttle Service March 29-April 4 AM SHIFTDocument2 pages2 Alorica Shuttle Service March 29-April 4 AM SHIFTRafael John Guiraldo OaniNo ratings yet

- UntitledDocument2 pagesUntitledRechelle Argones AquinoNo ratings yet

- Kempal Construction and Supply Corporation 200-105-729-0000 Summary of Sales For The Year 2020Document162 pagesKempal Construction and Supply Corporation 200-105-729-0000 Summary of Sales For The Year 2020Pajarillo Kathy AnnNo ratings yet

- Inteluck Trucker Rates - RustansDocument5 pagesInteluck Trucker Rates - RustansNico Rivera CallangNo ratings yet

- Bills Test Data LatestDocument6 pagesBills Test Data Latestraj federerNo ratings yet

- A Cebuana Lhuillier Branch in Angeles CityDocument2 pagesA Cebuana Lhuillier Branch in Angeles CityitsmenatoyNo ratings yet

- Sticker MonitorDocument21 pagesSticker MonitorRestia SchleiferNo ratings yet

- 0009 Voters - List. Bay, Laguna - Brgy Bitin - Precint.0131aDocument4 pages0009 Voters - List. Bay, Laguna - Brgy Bitin - Precint.0131aIwai MotoNo ratings yet

- Google MapsDocument1 pageGoogle MapsAmir IcoNo ratings yet

- BusinessDocument230 pagesBusinessRobert SonguitanNo ratings yet

- List of BSP Supervised Electronic Money Issuers (Emis) As of 20 April 2022Document4 pagesList of BSP Supervised Electronic Money Issuers (Emis) As of 20 April 2022Daryll AlveroNo ratings yet

- Manila Standard Today - Business Daily Stock Review (October 25, 2013) IssueDocument1 pageManila Standard Today - Business Daily Stock Review (October 25, 2013) IssueManila Standard TodayNo ratings yet