Professional Documents

Culture Documents

High Dividend Yield Stocks

High Dividend Yield Stocks

Uploaded by

kaizenlifeCopyright:

Available Formats

You might also like

- Solution Manual For Financial Accounting Tools For Business Decision Making 8th Edition by KimmelDocument53 pagesSolution Manual For Financial Accounting Tools For Business Decision Making 8th Edition by Kimmela527996566No ratings yet

- Financial Modeling of TCS LockDocument62 pagesFinancial Modeling of TCS LocksharadkulloliNo ratings yet

- Corporate Tax in SingaporeDocument23 pagesCorporate Tax in SingaporeMaria Bulgaru100% (1)

- Problems & Solutions - RNSDocument28 pagesProblems & Solutions - RNSAyushi0% (1)

- High Dividend Yield Stocks 2013Document2 pagesHigh Dividend Yield Stocks 2013Karthik ChockkalingamNo ratings yet

- Dividend Yield Stocks 300410Document1 pageDividend Yield Stocks 300410kunalprasherNo ratings yet

- NDTV Profit: NDTV Profit Khabar Movies Cricket Doctor Good Times Social Register Sign-InDocument30 pagesNDTV Profit: NDTV Profit Khabar Movies Cricket Doctor Good Times Social Register Sign-Inpriyamvada_tNo ratings yet

- Dividend Yield Stocks - HDFC Sec - 26 09 09Document1 pageDividend Yield Stocks - HDFC Sec - 26 09 09vishalknoxNo ratings yet

- Dividend Yield Stocks: Retail ResearchDocument2 pagesDividend Yield Stocks: Retail ResearchrajivNo ratings yet

- Weekly Market Outlook 11.03.13Document5 pagesWeekly Market Outlook 11.03.13Mansukh Investment & Trading SolutionsNo ratings yet

- Dividend Yield Stocks 6 JanDocument2 pagesDividend Yield Stocks 6 JanIndrayani NimbalkarNo ratings yet

- High Dividend Yield Stocks Feb 2016Document2 pagesHigh Dividend Yield Stocks Feb 2016parry0843No ratings yet

- Weekly Market Outlook 11.05.13Document5 pagesWeekly Market Outlook 11.05.13Mansukh Investment & Trading SolutionsNo ratings yet

- Plantations - Tea & Coffee.: Tata Coffee Equity Share Trend For The Past 5yearsDocument7 pagesPlantations - Tea & Coffee.: Tata Coffee Equity Share Trend For The Past 5yearsForum ThakkerNo ratings yet

- Results Tracker: Friday, 03 Aug 2012Document4 pagesResults Tracker: Friday, 03 Aug 2012Mansukh Investment & Trading SolutionsNo ratings yet

- Balance Sheet of ProvogueDocument2 pagesBalance Sheet of ProvogueAvinash GuptaNo ratings yet

- Full X-Ray Report - 20150313Document5 pagesFull X-Ray Report - 20150313Anand Mohan SinhaNo ratings yet

- Bank RatiosDocument5 pagesBank RatiosSubba RaoNo ratings yet

- Dividend Yielding StocksDocument2 pagesDividend Yielding StocksleninbapujiNo ratings yet

- Daily Equity Cash ReportDocument10 pagesDaily Equity Cash ReportDivyanshi SharmaNo ratings yet

- Results Tracker: Thursday, 03 Nov 2011Document6 pagesResults Tracker: Thursday, 03 Nov 2011Mansukh Investment & Trading SolutionsNo ratings yet

- Weekly Market Outlook 29.04.13Document5 pagesWeekly Market Outlook 29.04.13Mansukh Investment & Trading SolutionsNo ratings yet

- Dividend Yield StocksDocument2 pagesDividend Yield Stocksunu_uncNo ratings yet

- Competition: Regd. Office Address 9th Floor,, Nirmal Building, District State Pin Code 400021 Tel. No. 022-67789595Document5 pagesCompetition: Regd. Office Address 9th Floor,, Nirmal Building, District State Pin Code 400021 Tel. No. 022-67789595Tenzin Tennam SonamNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Document12 pagesStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Weekly Market Outlook 08.10.11Document5 pagesWeekly Market Outlook 08.10.11Mansukh Investment & Trading SolutionsNo ratings yet

- Daily Equity Cash Prediction Report by Tradeindia Research 10-03-2018Document10 pagesDaily Equity Cash Prediction Report by Tradeindia Research 10-03-2018Aashika JainNo ratings yet

- Nestle IndiaDocument38 pagesNestle Indiarranjan27No ratings yet

- 07 Findings and ConclusionDocument7 pages07 Findings and ConclusionAmish SoniNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Company Current Price (RS) % Change Equity Face Value Market Cap (Rs CR)Document5 pagesCompany Current Price (RS) % Change Equity Face Value Market Cap (Rs CR)Nikesh BeradiyaNo ratings yet

- Dividend Yield Stocks - HDFC Sec - 30 12 10Document2 pagesDividend Yield Stocks - HDFC Sec - 30 12 10Siddhi DesaiNo ratings yet

- Equity Premium Daily Journal-1st November 2017, WednesdayDocument13 pagesEquity Premium Daily Journal-1st November 2017, WednesdaySiddharth PatelNo ratings yet

- Daily Equity Newsletter: Indian MarketDocument4 pagesDaily Equity Newsletter: Indian Marketapi-196234891No ratings yet

- Morningstar® Portfolio X-Ray: H R T y UDocument5 pagesMorningstar® Portfolio X-Ray: H R T y UVishal BabutaNo ratings yet

- Results Tracker: Friday, 03 Feb 2012Document7 pagesResults Tracker: Friday, 03 Feb 2012Mansukh Investment & Trading SolutionsNo ratings yet

- Div Yield 10Document2 pagesDiv Yield 10Hardik SompuraNo ratings yet

- Daily Trade Journal - 27.03.2014Document6 pagesDaily Trade Journal - 27.03.2014Randora LkNo ratings yet

- Franklin India Prim A Plus FundDocument2 pagesFranklin India Prim A Plus FundBaargdon Rio GunaNo ratings yet

- Weekly Market Outlook 25.03.13Document5 pagesWeekly Market Outlook 25.03.13Mansukh Investment & Trading SolutionsNo ratings yet

- Daily Note: Market UpdateDocument3 pagesDaily Note: Market UpdateAyush JainNo ratings yet

- Renewed Buying Interest On Bourse: Wednesday, April 03, 2013Document7 pagesRenewed Buying Interest On Bourse: Wednesday, April 03, 2013Randora LkNo ratings yet

- Dividend Yield Stocks 220811Document2 pagesDividend Yield Stocks 220811Atul KapoorNo ratings yet

- Daily Equity Cash Prediction Report by Tradeindia Research 28-03-2018Document10 pagesDaily Equity Cash Prediction Report by Tradeindia Research 28-03-2018Aashika JainNo ratings yet

- Ib Newsletter - As of Jun 302011Document5 pagesIb Newsletter - As of Jun 302011Anshul LodhaNo ratings yet

- MarketInsightUploads DividendYieldStocks8MarDocument2 pagesMarketInsightUploads DividendYieldStocks8MarsanakdasNo ratings yet

- Nov PMS PerformanceDocument3 pagesNov PMS PerformanceYASHNo ratings yet

- Ashok Leyland: S. No Ratio Year & Month Mar '12 Mar '11 Mar '10 Mar '09 Mar '08Document1 pageAshok Leyland: S. No Ratio Year & Month Mar '12 Mar '11 Mar '10 Mar '09 Mar '08Balaji GajendranNo ratings yet

- 2010goals IndiaDocument1 page2010goals IndiaVinita SarafNo ratings yet

- Study Of: Prof. Neeraj AmarnaniDocument20 pagesStudy Of: Prof. Neeraj Amarnanipankil_dalalNo ratings yet

- ET Top 500 Companies List India 2014Document45 pagesET Top 500 Companies List India 2014Saakshi KaulNo ratings yet

- Outstanding Stock List of Government of India Securities Outstanding As April 7, 2014Document7 pagesOutstanding Stock List of Government of India Securities Outstanding As April 7, 2014harsimransahniNo ratings yet

- Capital StructureDocument6 pagesCapital StructuredsgoudNo ratings yet

- Q2FY12 Results Tracker 13.10.11Document2 pagesQ2FY12 Results Tracker 13.10.11Mansukh Investment & Trading SolutionsNo ratings yet

- Financial Performance Evaluation of Indian Rare Earths LimitedDocument27 pagesFinancial Performance Evaluation of Indian Rare Earths LimitedNitheesh VsNo ratings yet

- Data Presentation and AnalysisDocument13 pagesData Presentation and AnalysisViru PatelNo ratings yet

- Results Tracker: Saturday, 28 July 2012Document13 pagesResults Tracker: Saturday, 28 July 2012Mansukh Investment & Trading SolutionsNo ratings yet

- Monthly Fund FactsheetDocument27 pagesMonthly Fund FactsheetAshik RameshNo ratings yet

- Daily Equity Cash Prediction Report by Tradeindia Research 21-03-2018Document10 pagesDaily Equity Cash Prediction Report by Tradeindia Research 21-03-2018Aashika JainNo ratings yet

- Guarantee Statement 2013 14Document3 pagesGuarantee Statement 2013 14Debasish SarmaNo ratings yet

- FMCG Dividend PolicyDocument11 pagesFMCG Dividend PolicyNilkesh ChikhaliyaNo ratings yet

- FCFE Analysis of TATA SteelDocument8 pagesFCFE Analysis of TATA SteelJobin Jose KadavilNo ratings yet

- Current Papers Solved by Fin 622 Subjective Papers by Adnan AwanDocument9 pagesCurrent Papers Solved by Fin 622 Subjective Papers by Adnan AwanShrgeel HussainNo ratings yet

- All About ReitsDocument2 pagesAll About Reitspolobook3782No ratings yet

- Shareholders Equity Bafacr4x Onlineglimpsenujpia 1Document12 pagesShareholders Equity Bafacr4x Onlineglimpsenujpia 1Aga Mathew MayugaNo ratings yet

- Center For Review and Special Studies - : Accounting For Shareholders' Equity (Study Notes)Document10 pagesCenter For Review and Special Studies - : Accounting For Shareholders' Equity (Study Notes)Yvonne DuyaoNo ratings yet

- Topic 4 BOND Merged CompressedDocument109 pagesTopic 4 BOND Merged Compressednurul shafifah bt ismailNo ratings yet

- Top 52 Financial Analyst Interview Questions and AnswersDocument24 pagesTop 52 Financial Analyst Interview Questions and AnswersJerry TurtleNo ratings yet

- Business Combination Part 3Document4 pagesBusiness Combination Part 3Aljenika Moncada GupiteoNo ratings yet

- Quizes For FINALSDocument21 pagesQuizes For FINALSSaeym SegoviaNo ratings yet

- Working Capital RequirementsDocument2 pagesWorking Capital RequirementsAshuwajitNo ratings yet

- Tax On Corporation - NotesDocument9 pagesTax On Corporation - NotesMervidelleNo ratings yet

- Course Code: Acfn2102: Financial Management-IDocument45 pagesCourse Code: Acfn2102: Financial Management-Itemesgen yohannesNo ratings yet

- Audit of The Capital Acquisition and Repayment CycleDocument30 pagesAudit of The Capital Acquisition and Repayment CycleLouis ValentinoNo ratings yet

- Total Excess of Cost Over Book Value Acquired $4,000,000Document5 pagesTotal Excess of Cost Over Book Value Acquired $4,000,000SAHRINDA YUNIAWATINo ratings yet

- CRDB Bank Q3 2020 Financial Statement PDFDocument1 pageCRDB Bank Q3 2020 Financial Statement PDFPatric CletusNo ratings yet

- Navneet Publications Strategy - FLAME School of BusinessDocument20 pagesNavneet Publications Strategy - FLAME School of Businesschandramohan.patelNo ratings yet

- Preparation of Company Accounts: Chapter-01Document18 pagesPreparation of Company Accounts: Chapter-01My ComputerNo ratings yet

- Practice Problems 6Document2 pagesPractice Problems 6zidan92No ratings yet

- DHHC Red Herring Prospectus - EnglishDocument212 pagesDHHC Red Herring Prospectus - EnglishAnis ThakurNo ratings yet

- 2012 Q4 Chart SetDocument37 pages2012 Q4 Chart SetcasefortrilsNo ratings yet

- Financial Analysis - JSW and JSL PDFDocument13 pagesFinancial Analysis - JSW and JSL PDFAnirban KarNo ratings yet

- CH 13Document18 pagesCH 13xxxxxxxxxNo ratings yet

- Supreme Court: Marubeni Corp. v. CIR G.R. No. 76573Document7 pagesSupreme Court: Marubeni Corp. v. CIR G.R. No. 76573Jopan SJNo ratings yet

- OrgMan Week 4 Quarter 1Document10 pagesOrgMan Week 4 Quarter 1Leonard ArenasNo ratings yet

- Stock Market Cycles A Practical ExplanationDocument184 pagesStock Market Cycles A Practical ExplanationNur Zhen67% (3)

- 3 3-Taxation in Mutual Fund - Basic - March 2016 PDFDocument18 pages3 3-Taxation in Mutual Fund - Basic - March 2016 PDFKshitiz RastogiNo ratings yet

- Company Profile: History of Wipro InfotechDocument36 pagesCompany Profile: History of Wipro InfotechservervcnewNo ratings yet

- 12 x10 Financial Statement AnalysisDocument19 pages12 x10 Financial Statement AnalysisHazel Jael HernandezNo ratings yet

High Dividend Yield Stocks

High Dividend Yield Stocks

Uploaded by

kaizenlifeOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

High Dividend Yield Stocks

High Dividend Yield Stocks

Uploaded by

kaizenlifeCopyright:

Available Formats

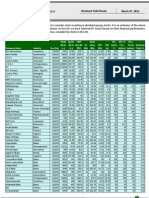

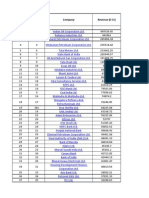

January 09, 2014

Dividend Yield Stocks

RETAIL RESEARCH

We present hereunder a table of companies that offer dividend yield of 3.00% and above.

Sr

No

Company

Dividend

(%)

Latest

Dividend

(%)

Latest1

Indiabulls Sec.*

150

46.2

3.8

22.9

7.8

466.8

20.2

BSE

Qrtly

Avg

Vol (

in'000)

363.9

9.4

0.4

14.9%

5.4

Shree Gan.Jew.

30

60

71.9

97.5

139.5

20.5

219.3

30.5

10

94.5

304.6

0.6

9.8%

0.3

Balmer Lawrie

308

280

28.5

51.4

410.0

296.6

899.9

315.8

10

4.8

302.8

0.3

9.8%

6.1

Andhra Bank

50

55

559.6

16.1

130.0

47.3

3469.4

62.0

10

320.9

146.8

0.0

8.1%

3.8

IL&FS Inv Manage*

50

75

62.7

2.5

16.3

9.4

264.9

12.7

73.6

9.0

0.2

7.9%

5.0

2.5

Syndicate Bank

Corporation Bank

Infinite Comp*

Equity

Rs Cr

EPS

Rs

52

Week

High

Rs

52

Week

Low

Rs

Mkt Cap

CMP

FV

BV

D/E

Ratio

Dividend

Yield %

PE

67

38

602.0

37.0

145.2

61.1

5540.9

92.1

10

304.5

180.9

0.0

7.3%

190

205

152.9

68.8

494.9

239.6

4005.5

262.0

10

25.0

600.0

0.0

7.3%

3.8

90

85

40.7

28.2

135.8

76.3

515.3

126.6

10

7.6

140.1

0.1

7.1%

4.5

RSWM Ltd

10

Allahabad Bank

100

23.2

42.4

176.0

88.5

337.9

146.0

10

10.5

127.2

5.0

6.9%

3.4

60

60

500.0

22.5

190.8

64.9

4635.3

92.7

10

365.6

213.4

0.0

6.5%

4.1

11

Union Bank (I)

12

Oil India

13

14

15

Morarjee Text.*

16

Repro India

17

Indian Bank

18

REI Agro*

19

Andhra Sugars

60

70

20

GHCL

20

20

21

India Glycols

60

30

31.0

46.2

175.0

84.4

329.4

22

Lumax Auto Tech.*

60

60

13.6

24.2

159.6

89.5

145.3

23

Kothari Products

200

150

6.6

44.0

435.0

273.9

236.6

356.9

24

Navin Fluo.Intl.

150

750

9.8

31.3

306.0

148.1

265.0

271.6

25

NIIT*

80

80

33.0

1.4

32.3

14.9

478.8

29.0

26

Kanoria Chem.

30

30

21.9

2.0

39.9

22.7

120.2

27.5

27

IDBI Bank

35

35

1332.8

11.0

118.2

52.3

8556.4

64.2

10

28

Deepak Fert.

55

55

88.2

16.9

130.4

81.2

912.0

103.4

10

16.8

29

Surya Roshni

40

43.8

16.8

84.4

59.4

331.8

75.7

10

50.2

125.8

2.1

5.3%

4.5

30

Rane Holdings*

80

100

14.3

46.3

207.5

136.1

222.8

156.0

10

1.0

315.8

0.7

5.1%

3.4

80

80

596.8

31.2

281.0

97.1

7397.2

124.0

10

793.6

265.1

0.0

6.5%

4.0

300

400

601.1

53.5

629.7

415.0

27965.0

465.2

10

43.6

320.2

0.0

6.4%

8.7

Bank of Maha

23

22

661.5

11.6

66.2

33.7

2361.5

35.7

10

110.3

65.8

0.0

6.4%

3.1

Ashoka Buildcon*

40

79.0

7.7

83.3

41.3

498.4

63.1

10

21.7

65.6

1.7

6.3%

8.2

25

25.4

9.6

31.9

9.9

104.8

28.9

10.8

22.7

2.1

6.1%

3.0

100

100

10.9

35.7

226.0

118.0

180.9

166.0

10

11.8

171.8

1.1

6.0%

4.6

66

75

429.8

29.0

218.9

60.5

4785.5

111.4

10

184.9

245.7

0.0

5.9%

3.8

50

50

95.8

9.1

15.2

5.6

814.3

8.5

558.9

34.4

1.8

5.9%

0.9

27.1

27.2

152.0

97.0

278.8

102.9

10

2.3

234.5

0.5

5.8%

3.8

100.0

15.4

38.5

29.0

354.1

35.4

10

19.0

56.7

3.2

5.6%

2.3

106.4

10

32.9

173.1

4.1

5.6%

2.3

106.6

10

2.5

155.0

0.1

5.6%

4.4

10

0.3

1118.5

0.5

5.6%

8.1

10

5.7

516.6

0.2

5.5%

8.7

318.3

40.4

0.2

5.5%

20.7

13.5

98.4

0.3

5.5%

13.7

286.1

145.9

0.0

5.5%

5.8

144.3

0.8

5.3%

6.1

31

Coal India*

140

100

6316.4

26.2

372.1

238.4

174078.9

275.6

10

259.9

76.7

0.0

5.1%

10.5

32

Central Bank

25

20

1044.6

10.9

95.6

48.9

5170.7

49.5

10

211.0

102.6

0.0

5.1%

4.5

33

Geojit BNP*

100

75

22.8

2.9

27.5

15.7

456.8

20.0

32.5

20.6

0.1

5.0%

6.8

34

Indbul.Wholesale*

50

10.1

11.0

25.9

9.2

101.0

20.0

44.3

162.9

0.0

5.0%

1.8

35

Welspun India*

40

100.2

4.2

86.9

46.5

813.1

81.2

10

12.9

98.8

2.3

4.9%

19.4

36

Hinduja Ventures

150

150

20.6

31.5

595.0

242.1

629.5

306.2

10

30.2

398.2

0.5

4.9%

9.7

37

S Mobility*

50

50

70.3

1.1

49.1

22.2

719.1

30.7

51.9

31.8

0.0

4.9%

29.1

38

Canara Bank

130

110

443.0

64.4

550.0

189.9

11885.7

268.3

10

282.1

512.6

0.0

4.8%

4.2

39

India Infoline*

150

75

59.1

9.6

90.9

40.0

1845.1

62.5

58.6

66.2

4.1

4.8%

6.5

14.3

40

Aptech*

40

30

48.8

5.8

88.0

40.2

409.1

83.9

10

160.6

69.9

0.0

4.8%

41

Gayatri Projects

30

30

30.2

23.8

124.8

47.5

190.3

63.0

10

18.1

220.9

6.9

4.8%

2.6

42

Chambal Fert.

19

19

416.2

7.8

72.0

30.6

1662.8

40.0

10

208.0

44.5

2.4

4.8%

5.1

12.9

43

Gateway Distr.*

70

60

108.6

11.5

154.0

98.1

1612.7

148.6

10

37.2

72.6

0.2

4.7%

44

Puravankar.Proj.*

70

20

118.6

10.9

122.8

58.1

1781.1

75.1

18.1

88.2

0.9

4.7%

6.9

45

Noida Tollbridg.

10

10

186.2

2.6

24.2

18.7

403.1

21.7

10

60.1

26.2

0.2

4.6%

8.4

46

SRF

100

140

57.4

44.0

238.5

125.6

1245.2

216.9

10

30.0

337.6

0.7

4.6%

4.9

47

Smartlink Netwr.

100

1600

6.0

2.8

62.0

39.0

130.7

43.6

4.7

136.7

0.0

4.6%

15.5

48

Power Fin.Corpn.

70

60

1320.0

37.0

227.0

97.4

20236.2

153.3

10

247.8

183.0

5.6

4.6%

4.1

RETAIL RESEARCH

49

Pennar Inds.*

20

20

60.5

2.6

29.9

18.3

265.6

22.0

22.0

25.5

0.5

4.6%

8.3

50

Punjab Natl.Bank

270

220

353.5

119.3

922.1

402.2

21250.6

601.2

10

238.9

934.6

0.0

4.5%

5.0

51

NTPC

57.5

40

8245.5

13.0

167.3

122.7

107026.1

129.8

10

411.7

98.8

0.8

4.4%

10.0

52

OnMobile Global*

15

10

114.2

4.1

49.7

19.1

387.2

33.9

10

229.2

79.6

0.1

4.4%

8.2

53

RCF

15

14

551.7

4.3

57.2

26.0

1870.2

33.9

10

146.0

42.5

0.7

4.4%

7.9

54

Graphite India

175

175

39.1

8.2

88.2

57.6

1550.5

79.4

9.5

87.6

0.4

4.4%

9.7

55

Balrampur Chini

200

24.4

0.0

54.0

34.6

1117.7

45.8

141.2

53.8

1.5

4.4%

1643.6

56

EID Parry*

600

400

17.6

3.9

207.8

103.0

2426.9

138.1

21.8

138.1

1.5

4.3%

35.0

57

IRB Infra.Devl.*

40

18

332.4

16.1

137.2

51.9

3062.7

92.2

10

617.2

98.0

2.5

4.3%

5.7

58

India Nipp.Elec.

90

90

11.3

21.7

218.9

145.0

234.6

207.4

10

3.8

177.1

0.0

4.3%

9.6

59

Cosmo Films*

25

50

19.4

10.4

89.0

44.2

112.3

57.8

10

8.9

178.3

1.4

4.3%

5.6

60

Bank of India

100

70

596.6

52.7

392.2

127.0

13788.4

231.1

10

695.0

378.2

0.0

4.3%

4.4

61

Swelect Energy*

80

30

10.1

27.3

193.0

126.1

190.2

188.2

10

2.2

654.5

0.1

4.3%

6.9

62

KCP Sugar &Inds.

70

70

11.3

2.5

24.0

15.0

187.7

16.6

16.4

20.2

0.4

4.2%

6.5

63

Rolta India*

30

30

161.3

19.9

77.3

50.0

1153.5

71.5

10

287.7

54.7

2.2

4.2%

3.6

64

Ansal Housing

10

59.4

6.9

23.0

11.3

115.5

19.5

10

21.6

62.3

1.2

4.1%

2.8

65

K P R Mill Ltd*

60

50

37.7

29.6

173.0

100.1

553.9

147.0

10

19.8

183.5

1.3

4.1%

5.0

66

Jay Shree Tea

80

60

14.4

7.7

128.0

73.3

283.7

98.3

38.2

152.6

1.1

4.1%

12.7

67

PTL Enterprises

50

50

13.2

2.5

32.8

16.2

162.9

24.6

5.2

6.5

4.9

4.1%

9.9

68

Rural Elec.Corp.

82.5

75

987.5

43.1

266.1

146.2

20055.3

203.1

10

159.8

177.5

6.2

4.1%

4.7

69

Multi Comm. Exc.

240

240

51.0

47.0

1458.3

238.3

3021.0

592.4

10

457.5

227.1

0.0

4.1%

12.6

70

DCM

30

25

17.4

17.1

91.4

59.0

129.2

74.4

10

7.5

118.4

1.0

4.0%

4.4

71

NRB Bearings

85

100

19.4

4.4

45.4

26.5

409.9

42.3

6.5

20.4

1.2

4.0%

9.7

72

HEG

80

50

40.0

17.5

236.4

140.2

800.2

200.3

10

3.9

236.5

1.5

4.0%

11.5

73

IFCI

10

10

1661.1

2.5

40.2

17.9

4169.2

25.1

10

1222.1

35.1

3.8

4.0%

9.9

74

Hexaware Tech.*

270

200

59.9

11.4

140.1

72.3

4085.0

136.4

127.9

40.2

0.0

4.0%

11.9

75

Dhunseri Petro.

45

45

35.0

24.6

125.0

72.8

402.5

114.9

10

4.6

221.6

1.8

3.9%

4.7

76

Peninsula Land

75

55

55.9

3.8

80.4

25.8

1071.9

38.4

246.3

58.7

0.8

3.9%

10.2

77

Sonata Software*

175

75

10.5

4.1

48.4

22.0

470.8

44.8

94.0

32.5

0.1

3.9%

10.9

78

MphasiS*

170

170

210.1

35.4

513.0

335.0

9152.2

435.6

10

11.6

234.8

0.1

3.9%

12.3

79

JSW Energy*

20

1640.1

8.1

75.0

33.8

8438.1

51.5

10

259.0

37.8

1.7

3.9%

6.4

80

NOCIL

160.8

0.7

19.1

12.0

249.4

15.5

10

95.7

22.7

0.3

3.9%

22.5

81

HPCL

85

85

338.6

197.4

381.4

158.5

7531.1

222.4

10

135.2

394.5

3.2

3.8%

1.1

82

Tata Chemicals*

100

100

254.8

30.3

381.5

234.5

6720.9

263.8

10

47.9

251.8

1.1

3.8%

8.7

83

Dhampur Sugar*

12.5

12.5

57.2

5.6

54.3

27.7

195.7

34.2

10

48.7

80.6

2.5

3.7%

6.1

84

Aarti Inds.

70

70

44.3

14.1

108.4

62.0

855.9

96.6

10.5

85.4

1.1

3.6%

6.8

85

Sasken Comm.Tec.*

70

70

21.2

23.0

201.5

100.6

410.8

194.0

10

31.1

195.5

0.0

3.6%

8.4

86

Cairn India*

115

1910.6

64.0

349.9

267.9

60994.6

319.3

10

138.8

249.6

0.0

3.6%

5.0

87

Apar Inds.

52.5

40

38.5

28.3

159.0

83.0

561.9

146.1

10

29.0

162.9

1.7

3.6%

5.2

88

Polaris Finan.*

100

100

49.8

17.6

155.0

96.1

1397.3

140.4

112.6

134.9

0.1

3.6%

8.0

89

KCP

100

150

12.9

0.6

46.2

23.0

362.2

28.1

6.7

37.9

0.7

3.6%

44.6

90

Mah. Seamless

120

120

34.8

13.3

277.7

151.1

1175.9

168.9

2.1

315.2

0.1

3.6%

12.7

91

Binani Inds

30

30

29.6

9.6

142.0

52.5

254.9

86.1

10

22.4

62.3

13.4

3.5%

9.0

92

Bank of Baroda

215

170

422.5

105.4

898.9

429.3

26058.9

616.8

10

243.5

785.0

0.0

3.5%

5.9

93

Sundaram Clayton

280

115

10.1

17.5

413.5

250.1

813.6

402.0

2.7

460.5

1.4

3.5%

23.0

3.9

94

Sarla Performanc*

60

50

7.0

44.5

198.0

145.0

120.3

173.1

10

0.4

205.0

0.7

3.5%

95

Hinduja Global*

200

200

20.6

68.3

583.8

218.0

1190.4

578.2

10

27.9

600.0

0.5

3.5%

8.5

96

GMM Pfaudler

140

140

2.9

6.6

109.9

62.0

118.2

81.0

2.4

81.4

0.0

3.5%

12.2

12.4

97

ONGC

190

195

4277.8

22.2

354.1

234.4

236260.7

276.2

229.4

178.3

0.1

3.4%

98

BPCL

110

110

723.1

104.1

449.0

256.0

23413.3

323.8

10

109.1

232.0

1.9

3.4%

3.1

99

India Cements

20

20

307.2

1.5

92.6

43.0

1817.0

59.2

10

268.3

115.9

0.9

3.4%

38.9

5.1

100

APL Apollo*

50

20

23.4

29.3

231.5

128.0

347.0

148.1

10

15.8

162.1

1.1

3.4%

101

Electrost.Cast.

50

50

32.7

3.0

28.5

9.8

484.3

14.8

79.6

50.6

1.3

3.4%

5.0

102

Praj Inds.*

81

81

35.5

2.8

52.4

30.0

852.6

48.1

213.6

32.2

0.0

3.4%

16.9

103

J K Cements

65

50

69.9

17.2

350.0

148.2

1348.9

192.9

10

3.1

209.3

0.9

3.4%

11.2

104

Titagarh Wagons

40

80

20.1

9.7

384.0

69.9

239.6

119.5

10

30.8

307.5

0.2

3.3%

12.4

RETAIL RESEARCH

105

Asian Hotels (E)

45

45

11.4

26.4

223.0

116.0

154.4

135.0

10

0.0

698.5

0.2

3.3%

5.1

106

Hind. Unilever

1850

750

216.3

16.1

725.0

432.3

120954.2

559.3

114.1

13.2

0.0

3.3%

34.7

270.5

320

489.5

21.8

245.4

100.4

40446.6

165.3

730.9

124.8

0.1

3.3%

7.6

12300.7

1.7

29.4

14.8

23002.4

18.7

10

685.4

24.69

0.6

3.2%

10.7

108.7

107

BHEL

108

NHPC Ltd

109

Oriental Hotels

55

45

17.9

0.2

23.9

14.4

309.9

17.4

4.3

22.28

0.8

3.2%

110

Banco Products*

90

125

14.3

9.8

67.3

33.0

406.1

56.8

32.7

66

0.4

3.2%

5.8

111

Kirl.Pneumatic

120

120

12.8

34.1

550.0

320.0

489.2

381.0

10

7.1

211.3

0.0

3.1%

11.2

11.4

112

Compucom Soft.

20

15

15.8

1.1

20.9

7.8

101.0

12.8

29.6

13.57

0.2

3.1%

113

Nava Bharat Vent

250

200

17.9

23.1

206.6

155.0

1432.4

160.4

1.6

275.6

0.4

3.1%

7.0

114

Navneet Educat.

90

70

47.6

4.6

70.0

50.0

1375.6

57.8

30.6

17.58

0.4

3.1%

12.6

115

Elecon Engg.Co

50

90

21.8

2.8

49.5

18.6

350.3

32.2

50.7

49.36

1.3

3.1%

11.6

116

JK Lakshmi Cem.

50

40

58.4

9.6

161.8

49.1

938.3

80.4

50.3

107

0.8

3.1%

8.4

117

IOCL

62

50

2428.0

64.4

375.0

186.2

48534.7

199.9

10

63.6

259.6

1.3

3.1%

3.1

118

Sona Koyo Steer.*

65

65

19.9

1.7

21.2

9.0

417.3

21.0

145.0

13.2

1.3

3.1%

12.1

119

JM Financial*

90

60

75.5

2.9

31.8

15.5

2196.2

29.1

571.3

27.16

1.7

3.1%

10.0

120

Sudarshan Chem.

125

125

6.9

41.7

468.0

256.0

280.3

405.0

10

1.5

295.4

1.8

3.1%

9.7

121

Rain Industries*

55

55

67.3

10.2

51.4

29.3

1210.9

36.0

10.9

75.83

2.3

3.1%

3.5

122

Ashiana Housing*

22.5

22.5

18.6

18.5

74.4

38.0

137.8

74.1

10

9.9

28.81

0.1

3.0%

4.0

123

Bajaj Corp

650

400

14.8

12.1

287.2

198.0

3177.2

215.4

17.4

32.72

0.0

3.0%

17.8

124

Jayant Agro Org.*

45

40

7.5

16.5

139.7

68.6

112.1

74.8

4.7

115.8

1.8

3.0%

4.5

125

Indbull.RealEst.*

100

84.8

6.1

87.3

50.2

2823.8

66.6

1147.0

159.9

0.3

3.0%

10.9

126

Neyveli Lignite

18

28

1677.7

7.5

87.8

49.0

10091.4

60.2

10

52.3

77.19

0.5

3.0%

8.0

127

ADF Foods*

15

15

22.4

5.0

98.0

35.0

112.2

50.2

10

10.3

67.61

0.3

3.0%

10.0

128

Sukhjit Starch

50

45

7.4

25.8

275.0

146.2

124.1

168.1

10

0.9

221.2

0.8

3.0%

6.5

129

Godawari Power*

25

25

32.8

35.6

125.9

61.5

275.4

84.1

10

13.7

237.3

1.7

3.0%

2.4

*= Consolidated numbers

DataSource: Capitaline

Note:

1. Unforeseen deterioration in performance could affect dividend payouts and consequently the dividend yields.

2. Companies which have declared Special/extraordinary dividends in recent past have been excluded

3. Investors may check the book closure/record dates for dividend before taking investment decision.

4. Stocks having market cap of less than Rs.100 cr have been excluded from the above.

HDFC securities Limited, I Think Techno Campus, Building B, Alpha, Office Floor 8, Near Kanjurmarg Station, Opposite

Crompton Greaves, Kanjurmarg (East), Mumbai 400042, Fax: (022) 30753435

Disclaimer: This document has been prepared by HDFC securities Limited and is meant for sole use by the recipient and not for circulation. This document is not

to be reported or copied or made available to others. It should not be considered to be taken as an offer to sell or a solicitation to buy any security. The

information contained herein is from sources believed reliable. We do not represent that it is accurate or complete and it should not be relied upon as such. We

may have from time to time positions or options on, and buy and sell securities referred to herein. We may from time to time solicit from, or perform investment

banking, or other services for, any company mentioned in this document. This report is intended for non- Institutional Clients only

RETAIL RESEARCH

You might also like

- Solution Manual For Financial Accounting Tools For Business Decision Making 8th Edition by KimmelDocument53 pagesSolution Manual For Financial Accounting Tools For Business Decision Making 8th Edition by Kimmela527996566No ratings yet

- Financial Modeling of TCS LockDocument62 pagesFinancial Modeling of TCS LocksharadkulloliNo ratings yet

- Corporate Tax in SingaporeDocument23 pagesCorporate Tax in SingaporeMaria Bulgaru100% (1)

- Problems & Solutions - RNSDocument28 pagesProblems & Solutions - RNSAyushi0% (1)

- High Dividend Yield Stocks 2013Document2 pagesHigh Dividend Yield Stocks 2013Karthik ChockkalingamNo ratings yet

- Dividend Yield Stocks 300410Document1 pageDividend Yield Stocks 300410kunalprasherNo ratings yet

- NDTV Profit: NDTV Profit Khabar Movies Cricket Doctor Good Times Social Register Sign-InDocument30 pagesNDTV Profit: NDTV Profit Khabar Movies Cricket Doctor Good Times Social Register Sign-Inpriyamvada_tNo ratings yet

- Dividend Yield Stocks - HDFC Sec - 26 09 09Document1 pageDividend Yield Stocks - HDFC Sec - 26 09 09vishalknoxNo ratings yet

- Dividend Yield Stocks: Retail ResearchDocument2 pagesDividend Yield Stocks: Retail ResearchrajivNo ratings yet

- Weekly Market Outlook 11.03.13Document5 pagesWeekly Market Outlook 11.03.13Mansukh Investment & Trading SolutionsNo ratings yet

- Dividend Yield Stocks 6 JanDocument2 pagesDividend Yield Stocks 6 JanIndrayani NimbalkarNo ratings yet

- High Dividend Yield Stocks Feb 2016Document2 pagesHigh Dividend Yield Stocks Feb 2016parry0843No ratings yet

- Weekly Market Outlook 11.05.13Document5 pagesWeekly Market Outlook 11.05.13Mansukh Investment & Trading SolutionsNo ratings yet

- Plantations - Tea & Coffee.: Tata Coffee Equity Share Trend For The Past 5yearsDocument7 pagesPlantations - Tea & Coffee.: Tata Coffee Equity Share Trend For The Past 5yearsForum ThakkerNo ratings yet

- Results Tracker: Friday, 03 Aug 2012Document4 pagesResults Tracker: Friday, 03 Aug 2012Mansukh Investment & Trading SolutionsNo ratings yet

- Balance Sheet of ProvogueDocument2 pagesBalance Sheet of ProvogueAvinash GuptaNo ratings yet

- Full X-Ray Report - 20150313Document5 pagesFull X-Ray Report - 20150313Anand Mohan SinhaNo ratings yet

- Bank RatiosDocument5 pagesBank RatiosSubba RaoNo ratings yet

- Dividend Yielding StocksDocument2 pagesDividend Yielding StocksleninbapujiNo ratings yet

- Daily Equity Cash ReportDocument10 pagesDaily Equity Cash ReportDivyanshi SharmaNo ratings yet

- Results Tracker: Thursday, 03 Nov 2011Document6 pagesResults Tracker: Thursday, 03 Nov 2011Mansukh Investment & Trading SolutionsNo ratings yet

- Weekly Market Outlook 29.04.13Document5 pagesWeekly Market Outlook 29.04.13Mansukh Investment & Trading SolutionsNo ratings yet

- Dividend Yield StocksDocument2 pagesDividend Yield Stocksunu_uncNo ratings yet

- Competition: Regd. Office Address 9th Floor,, Nirmal Building, District State Pin Code 400021 Tel. No. 022-67789595Document5 pagesCompetition: Regd. Office Address 9th Floor,, Nirmal Building, District State Pin Code 400021 Tel. No. 022-67789595Tenzin Tennam SonamNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Document12 pagesStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Weekly Market Outlook 08.10.11Document5 pagesWeekly Market Outlook 08.10.11Mansukh Investment & Trading SolutionsNo ratings yet

- Daily Equity Cash Prediction Report by Tradeindia Research 10-03-2018Document10 pagesDaily Equity Cash Prediction Report by Tradeindia Research 10-03-2018Aashika JainNo ratings yet

- Nestle IndiaDocument38 pagesNestle Indiarranjan27No ratings yet

- 07 Findings and ConclusionDocument7 pages07 Findings and ConclusionAmish SoniNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Company Current Price (RS) % Change Equity Face Value Market Cap (Rs CR)Document5 pagesCompany Current Price (RS) % Change Equity Face Value Market Cap (Rs CR)Nikesh BeradiyaNo ratings yet

- Dividend Yield Stocks - HDFC Sec - 30 12 10Document2 pagesDividend Yield Stocks - HDFC Sec - 30 12 10Siddhi DesaiNo ratings yet

- Equity Premium Daily Journal-1st November 2017, WednesdayDocument13 pagesEquity Premium Daily Journal-1st November 2017, WednesdaySiddharth PatelNo ratings yet

- Daily Equity Newsletter: Indian MarketDocument4 pagesDaily Equity Newsletter: Indian Marketapi-196234891No ratings yet

- Morningstar® Portfolio X-Ray: H R T y UDocument5 pagesMorningstar® Portfolio X-Ray: H R T y UVishal BabutaNo ratings yet

- Results Tracker: Friday, 03 Feb 2012Document7 pagesResults Tracker: Friday, 03 Feb 2012Mansukh Investment & Trading SolutionsNo ratings yet

- Div Yield 10Document2 pagesDiv Yield 10Hardik SompuraNo ratings yet

- Daily Trade Journal - 27.03.2014Document6 pagesDaily Trade Journal - 27.03.2014Randora LkNo ratings yet

- Franklin India Prim A Plus FundDocument2 pagesFranklin India Prim A Plus FundBaargdon Rio GunaNo ratings yet

- Weekly Market Outlook 25.03.13Document5 pagesWeekly Market Outlook 25.03.13Mansukh Investment & Trading SolutionsNo ratings yet

- Daily Note: Market UpdateDocument3 pagesDaily Note: Market UpdateAyush JainNo ratings yet

- Renewed Buying Interest On Bourse: Wednesday, April 03, 2013Document7 pagesRenewed Buying Interest On Bourse: Wednesday, April 03, 2013Randora LkNo ratings yet

- Dividend Yield Stocks 220811Document2 pagesDividend Yield Stocks 220811Atul KapoorNo ratings yet

- Daily Equity Cash Prediction Report by Tradeindia Research 28-03-2018Document10 pagesDaily Equity Cash Prediction Report by Tradeindia Research 28-03-2018Aashika JainNo ratings yet

- Ib Newsletter - As of Jun 302011Document5 pagesIb Newsletter - As of Jun 302011Anshul LodhaNo ratings yet

- MarketInsightUploads DividendYieldStocks8MarDocument2 pagesMarketInsightUploads DividendYieldStocks8MarsanakdasNo ratings yet

- Nov PMS PerformanceDocument3 pagesNov PMS PerformanceYASHNo ratings yet

- Ashok Leyland: S. No Ratio Year & Month Mar '12 Mar '11 Mar '10 Mar '09 Mar '08Document1 pageAshok Leyland: S. No Ratio Year & Month Mar '12 Mar '11 Mar '10 Mar '09 Mar '08Balaji GajendranNo ratings yet

- 2010goals IndiaDocument1 page2010goals IndiaVinita SarafNo ratings yet

- Study Of: Prof. Neeraj AmarnaniDocument20 pagesStudy Of: Prof. Neeraj Amarnanipankil_dalalNo ratings yet

- ET Top 500 Companies List India 2014Document45 pagesET Top 500 Companies List India 2014Saakshi KaulNo ratings yet

- Outstanding Stock List of Government of India Securities Outstanding As April 7, 2014Document7 pagesOutstanding Stock List of Government of India Securities Outstanding As April 7, 2014harsimransahniNo ratings yet

- Capital StructureDocument6 pagesCapital StructuredsgoudNo ratings yet

- Q2FY12 Results Tracker 13.10.11Document2 pagesQ2FY12 Results Tracker 13.10.11Mansukh Investment & Trading SolutionsNo ratings yet

- Financial Performance Evaluation of Indian Rare Earths LimitedDocument27 pagesFinancial Performance Evaluation of Indian Rare Earths LimitedNitheesh VsNo ratings yet

- Data Presentation and AnalysisDocument13 pagesData Presentation and AnalysisViru PatelNo ratings yet

- Results Tracker: Saturday, 28 July 2012Document13 pagesResults Tracker: Saturday, 28 July 2012Mansukh Investment & Trading SolutionsNo ratings yet

- Monthly Fund FactsheetDocument27 pagesMonthly Fund FactsheetAshik RameshNo ratings yet

- Daily Equity Cash Prediction Report by Tradeindia Research 21-03-2018Document10 pagesDaily Equity Cash Prediction Report by Tradeindia Research 21-03-2018Aashika JainNo ratings yet

- Guarantee Statement 2013 14Document3 pagesGuarantee Statement 2013 14Debasish SarmaNo ratings yet

- FMCG Dividend PolicyDocument11 pagesFMCG Dividend PolicyNilkesh ChikhaliyaNo ratings yet

- FCFE Analysis of TATA SteelDocument8 pagesFCFE Analysis of TATA SteelJobin Jose KadavilNo ratings yet

- Current Papers Solved by Fin 622 Subjective Papers by Adnan AwanDocument9 pagesCurrent Papers Solved by Fin 622 Subjective Papers by Adnan AwanShrgeel HussainNo ratings yet

- All About ReitsDocument2 pagesAll About Reitspolobook3782No ratings yet

- Shareholders Equity Bafacr4x Onlineglimpsenujpia 1Document12 pagesShareholders Equity Bafacr4x Onlineglimpsenujpia 1Aga Mathew MayugaNo ratings yet

- Center For Review and Special Studies - : Accounting For Shareholders' Equity (Study Notes)Document10 pagesCenter For Review and Special Studies - : Accounting For Shareholders' Equity (Study Notes)Yvonne DuyaoNo ratings yet

- Topic 4 BOND Merged CompressedDocument109 pagesTopic 4 BOND Merged Compressednurul shafifah bt ismailNo ratings yet

- Top 52 Financial Analyst Interview Questions and AnswersDocument24 pagesTop 52 Financial Analyst Interview Questions and AnswersJerry TurtleNo ratings yet

- Business Combination Part 3Document4 pagesBusiness Combination Part 3Aljenika Moncada GupiteoNo ratings yet

- Quizes For FINALSDocument21 pagesQuizes For FINALSSaeym SegoviaNo ratings yet

- Working Capital RequirementsDocument2 pagesWorking Capital RequirementsAshuwajitNo ratings yet

- Tax On Corporation - NotesDocument9 pagesTax On Corporation - NotesMervidelleNo ratings yet

- Course Code: Acfn2102: Financial Management-IDocument45 pagesCourse Code: Acfn2102: Financial Management-Itemesgen yohannesNo ratings yet

- Audit of The Capital Acquisition and Repayment CycleDocument30 pagesAudit of The Capital Acquisition and Repayment CycleLouis ValentinoNo ratings yet

- Total Excess of Cost Over Book Value Acquired $4,000,000Document5 pagesTotal Excess of Cost Over Book Value Acquired $4,000,000SAHRINDA YUNIAWATINo ratings yet

- CRDB Bank Q3 2020 Financial Statement PDFDocument1 pageCRDB Bank Q3 2020 Financial Statement PDFPatric CletusNo ratings yet

- Navneet Publications Strategy - FLAME School of BusinessDocument20 pagesNavneet Publications Strategy - FLAME School of Businesschandramohan.patelNo ratings yet

- Preparation of Company Accounts: Chapter-01Document18 pagesPreparation of Company Accounts: Chapter-01My ComputerNo ratings yet

- Practice Problems 6Document2 pagesPractice Problems 6zidan92No ratings yet

- DHHC Red Herring Prospectus - EnglishDocument212 pagesDHHC Red Herring Prospectus - EnglishAnis ThakurNo ratings yet

- 2012 Q4 Chart SetDocument37 pages2012 Q4 Chart SetcasefortrilsNo ratings yet

- Financial Analysis - JSW and JSL PDFDocument13 pagesFinancial Analysis - JSW and JSL PDFAnirban KarNo ratings yet

- CH 13Document18 pagesCH 13xxxxxxxxxNo ratings yet

- Supreme Court: Marubeni Corp. v. CIR G.R. No. 76573Document7 pagesSupreme Court: Marubeni Corp. v. CIR G.R. No. 76573Jopan SJNo ratings yet

- OrgMan Week 4 Quarter 1Document10 pagesOrgMan Week 4 Quarter 1Leonard ArenasNo ratings yet

- Stock Market Cycles A Practical ExplanationDocument184 pagesStock Market Cycles A Practical ExplanationNur Zhen67% (3)

- 3 3-Taxation in Mutual Fund - Basic - March 2016 PDFDocument18 pages3 3-Taxation in Mutual Fund - Basic - March 2016 PDFKshitiz RastogiNo ratings yet

- Company Profile: History of Wipro InfotechDocument36 pagesCompany Profile: History of Wipro InfotechservervcnewNo ratings yet

- 12 x10 Financial Statement AnalysisDocument19 pages12 x10 Financial Statement AnalysisHazel Jael HernandezNo ratings yet