Professional Documents

Culture Documents

Single Family Residence

Single Family Residence

Uploaded by

api-15743601Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Single Family Residence

Single Family Residence

Uploaded by

api-15743601Copyright:

Available Formats

August-09

SINGLE FAMILY RESIDENCE

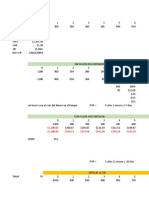

SUPPLY DEMAND EXPIRE DAYS ON MEDIAN MEDIAN MEDIAN

ON SOLD WITHDRAW IN PERCENT MONTHS MARKET MARKET LIST ASK AT CLOSE

CITY MARKET MONTH MONTH ESCROW SELLING SUPPLY SOLD SPEED PRICE OFFER PRICE

Reno 2,251 372 316 186 54% 6.1 129 33 $243 $198 $190

Sparks 861 164 141 103 54% 5.3 114 38 $189 $175 $170

WASHOE COUNTY TOTAL 3,112 536 457 289 54% 5.8 125 34 $227 $191 $184

Fernley 247 62 53 29 54% 4.0 107 50 $115 $110 $113

Dayton 175 34 31 8 53% 5.1 143 39 $196 $159 $157

Yerington 78 2 9 0 14% 52.0 164 4 $162 $125 $125

LYON COUNTY TOTAL 500 97 93 37 51% 11.9 121 39 $144 $128 $129

Gardnerville 306 34 27 9 56% 9.0 190 22 $354 $235 $223

Minden 140 17 14 9 56% 8.2 147 24 $389 $321 $299

DOUGLAS COUNTY TOTAL 446 51 41 18 56% 8.8 176 23 $366 $263 $248

Fallon (Churchill County ) 184 20 16 3 56% 9.4 163 21 $190 $149 $142

Carson City (Carson County) 392 59 49 16 55% 6.7 127 30 $259 $200 $195

TOTAL 4,634 762 654 363 54% 7.0 129 33 $234 $187 $181

Market Speed measures the rate of conversion of listings to closings. The higher this number, the faster the market is converting. The area with the highest

speed is the "quickest" area. All other things being equal, areas with the highest market speed are the most desirable to buyers.

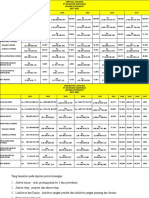

HISTORY OF SOLDS AND

PERCENT SELLING EXPIRE/WITHDRAW (ALL)

MARKET EFFICIENCY HISTORY OF MEDIAN SALE PRICE

$400 1,600

PEAK

Thousands

90%

81% $350 $340

1,400

80% 1,350

$300 1,168

$292

1,200

70% $250

64% $217 $199 $180 1,000

60% $200 d

$175

800 836

$150

50%

51% $116 PEAK

$100

$75 600

40%

$50 496

30% 400

25% 277

20% 200

Trend Of SFR Trend Of Condo

10% 0

04 04 05 05 06 06 07 07 08 08 09 09

0% n- ul- n- ul- n- ul- n- ul- n- ul- n- ul-

Closed Closed Change Percent Ja J Ja J Ja J Ja J Ja J Ja J

Ju 4

Ju 5

Ju 6

Ju 7

Ju 8

09

De 4

De 5

06

De 7

08

De 9

2008 2009 in Sales Change

0

0

0

SOLDS

c-

c-

c-

c-

c-

c-

n-

n-

n-

n-

n-

n-

De

De

Ju

3,987 5,454 1,467 37% EXPIRE/WITH

CONDO/TOWNHOME

SUPPLY DEMAND EXPIRE DAYS ON MEDIAN MEDIAN MEDIAN

ON SOLD WITHDRAW IN PERCENT MONTHS MARKET MARKET LIST ASK AT CLOSE

CITY MARKET MONTH MONTH ESCROW SELLING SUPPLY SOLD SPEED PRICE OFFER PRICE

Reno 446 59 51 39 53% 7.6 165 26 $110 $68 $65

Sparks 105 15 14 5 53% 7.0 130 29 $80 $82 $80

WASHOE TOTAL 551 74 65 44 53% 7.5 158 27 $104 $71 $68

Carson City 39 4 2 1 67% 9.8 171 21 $130 $94 $91

TOTAL 590 78 67 45 54% 7.7 158 26 $106 $72 $69

COURTESY OF FIRST CENTENNIAL TITLE

Information believed accurate but not guaranteed. Resale market only.

Report intended to be generally descriptive, not definitive.

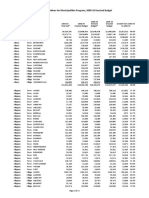

MARKET CONDITION REPORT

Reno-Sparks Area

August 2009

Welcome to the Reno-Sparks Market Condition Report (MCR) provided by First Centennial Title.

THE BIG PICTURE

¾ SUPPLY (ON MARKET): Continues to hold very steady in the current range with little meaningful deviation

(7th month). This implies that as the market resolves supply, it is being replaced with about the same level of

new activity.

¾ DEMAND (SOLD PER MONTH): Demand is up a solid 120 units from August for SFR and 17 units for

Condo. The increase for SFR is somewhat more than expected.

¾ FAILURES (EXPIRE-WITHDRAW): The rate of failure for SFR jumped significantly in concert with

demand. Condo rate down marginally.

¾ IN ESCROW (FUTURE CLOSINGS): SFR in escrow inventory moved up by 33 units even though closing

activity increased from the previous month. Based on this increase of properties in escrow, expect the SFR

closings to continue to increase while Condo will remain close to the current closing level.

¾ PERCENT SELLING: Due to the inordinate increase in failures for SFR, Percent Selling declined 5 points

while Condo rose 7 points.

¾ MONTHS SUPPLY: Market continues to tighten for both types and is still relatively elevated. Without

meaningful changes or shifts in Months Supply, current price trends will remain on current trajectories (slightly

negative per month).

¾ MARKET SPEED: Market Speed moved up for both types. The pace of the Reno market has resumed overall

positive movement. The best performing Reno submarket remains Fernley, returning a Market Speed of 50 (up

6 points from last month). The slowest is Yerington at a very sluggish 6. As a generalization, the Reno area

moves at a slower and less volatile pace than other market surveyed such as Las Vegas or Phoenix. This is due

to a lower percentage of transactions closing REO (about 40% in Reno versus 70% in Las Vegas-Phoenix).

¾ PRICES: Price indicators are erratic but signs of stabilization for SFR are apparent. Condo still demonstrating

a weaker price schedule. Expect this up and down trend to continue. Large changes in price should not be

expected, while relatively small diminishing negative shifts are more likely. This trend is generally in line with

other markets surveyed.

MCR TIP : Percent Selling measures the relationship between properties closing (success) and those failing

(expire, cancel or withdrawn). It can also be interpreted as “Closing Probability.” While the outcome of any one

listing cannot be known absolutely at the time of listing, its closing probability is an expression of what is

“expected” to occur based on the historical average outcomes.

You might also like

- AIFS Case Study SolutionsDocument4 pagesAIFS Case Study SolutionsOmarChehimi83% (6)

- Salesperson Ellis Barrow HammondDocument7 pagesSalesperson Ellis Barrow HammondRohan Chatterjee100% (1)

- Macroeconomics 1 (Econ 1192) Policy ReportDocument5 pagesMacroeconomics 1 (Econ 1192) Policy ReportAn NguyenthenamNo ratings yet

- Top 100 Aerospace Companies by Revenue 2018 PDFDocument8 pagesTop 100 Aerospace Companies by Revenue 2018 PDFNinerMike MysNo ratings yet

- Crafting Winning Strategies in A Mature MarketDocument7 pagesCrafting Winning Strategies in A Mature MarketRamashree SugumarNo ratings yet

- Single Family ResidenceDocument2 pagesSingle Family Residenceapi-15743601No ratings yet

- Market Action Report - Salem - April 2011Document11 pagesMarket Action Report - Salem - April 2011Rosi DeSantis GreenNo ratings yet

- March 2011 Sales SalemDocument10 pagesMarch 2011 Sales SalemRosi DeSantis GreenNo ratings yet

- Market Report - September 2010Document1 pageMarket Report - September 2010STAORNo ratings yet

- Local Governments Proposing Property Tax Increases in 2017Document2 pagesLocal Governments Proposing Property Tax Increases in 2017The Salt Lake TribuneNo ratings yet

- Market Analysis by Area YTD Dec. 09 Full YearDocument1 pageMarket Analysis by Area YTD Dec. 09 Full YearBreckenridge Grand Real EstateNo ratings yet

- A Glance at The Market: Salt Lake CountyDocument1 pageA Glance at The Market: Salt Lake Countyapi-20337212No ratings yet

- Market Analysis by Area YTD Nov. 09Document1 pageMarket Analysis by Area YTD Nov. 09Breckenridge Grand Real EstateNo ratings yet

- Deposit Deposit: Profit Recapitulation October 2021Document1 pageDeposit Deposit: Profit Recapitulation October 2021Sinthya MonicaNo ratings yet

- NWMLS September ReportDocument3 pagesNWMLS September ReportNeal McNamaraNo ratings yet

- Comparison of Incomes and Rents, Rent-Stabilized vs. Market-Rate RentalsDocument3 pagesComparison of Incomes and Rents, Rent-Stabilized vs. Market-Rate RentalsBrad LanderNo ratings yet

- Compare Jet Aircraft - JetBrokers Worldwide Corporate Aircraft SalesDocument9 pagesCompare Jet Aircraft - JetBrokers Worldwide Corporate Aircraft Salesborko manevNo ratings yet

- Ejercicios Cap 6 Berk y DemarzoDocument32 pagesEjercicios Cap 6 Berk y DemarzoMarina Oña CatotaNo ratings yet

- Precio Energia ElectricaDocument4 pagesPrecio Energia ElectricaJorge RodriguezNo ratings yet

- Currency USD USD USD USD USD USD USD: Growth Over Prior Year NA 436.1% 179.3% 55.6% 24.7% 96.3% 36.4%Document29 pagesCurrency USD USD USD USD USD USD USD: Growth Over Prior Year NA 436.1% 179.3% 55.6% 24.7% 96.3% 36.4%raman nandhNo ratings yet

- Sales Manager Dashboard Template: Daily TrackerDocument12 pagesSales Manager Dashboard Template: Daily TrackerAwais ZafarNo ratings yet

- Gaming Revenue IowaDocument8 pagesGaming Revenue IowaGazetteonlineNo ratings yet

- Market Analysis by Area YTD Oct. 09Document1 pageMarket Analysis by Area YTD Oct. 09Breckenridge Grand Real EstateNo ratings yet

- Lemon Grab PresentationDocument7 pagesLemon Grab PresentationMariline LeeNo ratings yet

- Commission Split Calculator: Price Group Current Splits Minimum Price Maximum Price Estimated FeesDocument4 pagesCommission Split Calculator: Price Group Current Splits Minimum Price Maximum Price Estimated FeesKanwal RizviNo ratings yet

- Coursera ExcelDocument88 pagesCoursera ExcelSuNo ratings yet

- Market Analysis by Area Nov. 09Document1 pageMarket Analysis by Area Nov. 09Breckenridge Grand Real EstateNo ratings yet

- Lista de Precios Lenceria Maguen PDFDocument1 pageLista de Precios Lenceria Maguen PDFMauricio RoccoNo ratings yet

- Island Land Sold - 2021Document3 pagesIsland Land Sold - 2021Louis CutajarNo ratings yet

- Real Life. Real Answers.: NaborDocument4 pagesReal Life. Real Answers.: Naborapi-26167871No ratings yet

- Behavioral Analysis by Category 2024-04-05T09 18 06.380443ZDocument2 pagesBehavioral Analysis by Category 2024-04-05T09 18 06.380443ZMine BeNo ratings yet

- UntitledDocument4 pagesUntitledRizki YusufNo ratings yet

- Assignment 4.1Document15 pagesAssignment 4.1nachiket lokhande100% (1)

- May 2017 Rental TableDocument1 pageMay 2017 Rental TablewalsarajNo ratings yet

- DIA Lunes Lunes Lunes Lunes Lunes Lunes Lunes Lunes Lunes Lunes Lunes Lunes Lunes LunesDocument8 pagesDIA Lunes Lunes Lunes Lunes Lunes Lunes Lunes Lunes Lunes Lunes Lunes Lunes Lunes LunesJuan Martin OropezaNo ratings yet

- Comments On The Failure of The 2020 DHA Annual PHA Plan To Deconcentrate PovertyDocument4 pagesComments On The Failure of The 2020 DHA Annual PHA Plan To Deconcentrate PovertyAllen BotnickNo ratings yet

- Sample Model - 2Document9 pagesSample Model - 2bookinghub19No ratings yet

- AIM 09 - 10 Remaining PaymentsDocument72 pagesAIM 09 - 10 Remaining PaymentsrkarlinNo ratings yet

- Cost Breakdown YTD OctDocument1 pageCost Breakdown YTD OctBreckenridge Grand Real EstateNo ratings yet

- Cost Breakdown Oct. 09 PDFDocument1 pageCost Breakdown Oct. 09 PDFBreckenridge Grand Real EstateNo ratings yet

- Arra Percent Budget by Dist 2009 10Document14 pagesArra Percent Budget by Dist 2009 10jspectorNo ratings yet

- Market Analysis by Area Oct. 09Document1 pageMarket Analysis by Area Oct. 09Breckenridge Grand Real EstateNo ratings yet

- CLW Analysis 6-1-21Document5 pagesCLW Analysis 6-1-21HunterNo ratings yet

- Island Properties Sold - Comparison 2020 IIDocument1 pageIsland Properties Sold - Comparison 2020 IILouis CutajarNo ratings yet

- Trabajo InventariosDocument5 pagesTrabajo InventariosMax VazquezNo ratings yet

- Financial Projections Slide TemplatesDocument4 pagesFinancial Projections Slide Templatestutus RiyonoNo ratings yet

- Market Snapshot Full Years 08-09Document1 pageMarket Snapshot Full Years 08-09Breckenridge Grand Real EstateNo ratings yet

- Case Study Part4Document4 pagesCase Study Part4LUKE O'DONNELLNo ratings yet

- Oct 21 StatsDocument1 pageOct 21 StatsMatt PollockNo ratings yet

- K 12 EducationDocument15 pagesK 12 EducationWTOL DIGITAL100% (1)

- Island Homes Sold - 2020Document3 pagesIsland Homes Sold - 2020cutty54No ratings yet

- Year-End Value of A Deposit $100 Annua Rate 10% Compund InterestDocument5 pagesYear-End Value of A Deposit $100 Annua Rate 10% Compund InterestMuhammad EhtishamNo ratings yet

- Exercise 7Document4 pagesExercise 7MarxlenBedolidoNo ratings yet

- Cootamundra House PricesDocument4 pagesCootamundra House PricesDaisy HuntlyNo ratings yet

- ST Louis Total Market Overview Real Estate Statistics Data Reports - Week - of - 04-12-11Document2 pagesST Louis Total Market Overview Real Estate Statistics Data Reports - Week - of - 04-12-11kevincottrellNo ratings yet

- Real Life. Real Answers.: NaborDocument4 pagesReal Life. Real Answers.: Naborapi-26167871No ratings yet

- January Sales Trend Re 2009-1Document4 pagesJanuary Sales Trend Re 2009-1Dewita SoeharjonoNo ratings yet

- General Information About PortfolioDocument18 pagesGeneral Information About PortfolioVipendra Singh RajputNo ratings yet

- South Suburban - EastDocument1 pageSouth Suburban - EastpsobaniaNo ratings yet

- SEG Funding by DistrictDocument4 pagesSEG Funding by DistrictSylvia Ulloa100% (1)

- Market-Based Valuation Approach - Blk1Document33 pagesMarket-Based Valuation Approach - Blk1Kim GeminoNo ratings yet

- Measures For Correcting The Adverse Balance of PaymentsDocument9 pagesMeasures For Correcting The Adverse Balance of Paymentstheseawolf100% (8)

- IS-LM Model - Part 2Document45 pagesIS-LM Model - Part 2Logan ThakurNo ratings yet

- Session 19 - Dividend Policy at Linear TechDocument2 pagesSession 19 - Dividend Policy at Linear TechRichBrook7No ratings yet

- British Columbia ModelDocument49 pagesBritish Columbia ModelpatricioNo ratings yet

- Control de Lectura #1 Macro2Document6 pagesControl de Lectura #1 Macro2ManuelNo ratings yet

- Investment Project EvaluationDocument2 pagesInvestment Project EvaluationDare SmithNo ratings yet

- This Chapter Discussed The Major Aspects Needed To Consider, Researched and Analyzed by The Consultant in Preparing The Project Feasibility StudyDocument6 pagesThis Chapter Discussed The Major Aspects Needed To Consider, Researched and Analyzed by The Consultant in Preparing The Project Feasibility StudyNika Ella SabinoNo ratings yet

- The Circular Flow Model of Income: and ItsDocument36 pagesThe Circular Flow Model of Income: and ItsM Shubaan Nachiappan(Student)No ratings yet

- HI5003 Tutorial Assessment T2.2020Document5 pagesHI5003 Tutorial Assessment T2.2020shikha khanejaNo ratings yet

- Ch3 LifeCycleDocument14 pagesCh3 LifeCycleadamNo ratings yet

- Law of Return To Scale FinalDocument12 pagesLaw of Return To Scale FinalShahenaNo ratings yet

- Nigerian Financial SystemDocument13 pagesNigerian Financial Systemolowo100% (2)

- HarrodDocument7 pagesHarrodvikram inamdarNo ratings yet

- Lesson 3: Institutional PerspectiveDocument3 pagesLesson 3: Institutional PerspectiveCaselyn Magat BuzonNo ratings yet

- Ee Unit 1Document128 pagesEe Unit 1aryanchopra989No ratings yet

- SemioticsDocument66 pagesSemioticsilookieNo ratings yet

- Rebuilding A National Icon-The MAS Recovery PlanDocument48 pagesRebuilding A National Icon-The MAS Recovery PlanAikFanYapNo ratings yet

- Geography 2010 P2Document11 pagesGeography 2010 P2Alisha Hosein100% (2)

- Full Report December 2011: U.S. Manufacturing Competitiveness InitiativeDocument0 pagesFull Report December 2011: U.S. Manufacturing Competitiveness Initiativeapi-238443539No ratings yet

- Economic Analysis of New Business PDFDocument8 pagesEconomic Analysis of New Business PDFshule1No ratings yet

- Trends in Global and Regional Disparities: The Economy and Its Increasing DisparitiesDocument13 pagesTrends in Global and Regional Disparities: The Economy and Its Increasing Disparitiesmartin sirifaveNo ratings yet

- UGB363Document14 pagesUGB363Sherali BekmurodovNo ratings yet

- 6th Sem FM-DIVIDEND POLICY by Amit Mitra-AMDocument34 pages6th Sem FM-DIVIDEND POLICY by Amit Mitra-AMGaurav SharmaNo ratings yet

- Economics-Class XI, SAMPLE PAPER 2023-24Document7 pagesEconomics-Class XI, SAMPLE PAPER 2023-24bansaladitya1708100% (1)

- Definition of Capital BudgetingDocument6 pagesDefinition of Capital Budgetingkaram deenNo ratings yet

- Economic Environment 1Document40 pagesEconomic Environment 1Hitendra Shrivastava100% (1)