Professional Documents

Culture Documents

USA V Jerone Ian Mitchell Indictment

USA V Jerone Ian Mitchell Indictment

Uploaded by

CamdenCanaryCopyright:

Available Formats

You might also like

- The Bonds of Inequality: Debt and the Making of the American CityFrom EverandThe Bonds of Inequality: Debt and the Making of the American CityRating: 4 out of 5 stars4/5 (2)

- Austin Davidson AffidavitDocument8 pagesAustin Davidson AffidavitEmily BabayNo ratings yet

- Static Trip ManualDocument52 pagesStatic Trip ManualRavijoisNo ratings yet

- United States v. Louis A. Marchisio, John H. Seiter and W. Ward Whipple, 344 F.2d 653, 2d Cir. (1965)Document23 pagesUnited States v. Louis A. Marchisio, John H. Seiter and W. Ward Whipple, 344 F.2d 653, 2d Cir. (1965)Scribd Government DocsNo ratings yet

- United States v. McCann, 366 F.3d 46, 1st Cir. (2004)Document15 pagesUnited States v. McCann, 366 F.3d 46, 1st Cir. (2004)Scribd Government DocsNo ratings yet

- United States Court of Appeals, Fourth CircuitDocument10 pagesUnited States Court of Appeals, Fourth CircuitScribd Government DocsNo ratings yet

- United States Court of Appeals, Tenth Circuit.: Nos. 93-6026 To 93-6028Document20 pagesUnited States Court of Appeals, Tenth Circuit.: Nos. 93-6026 To 93-6028Scribd Government DocsNo ratings yet

- United States v. Benjamin, 252 F.3d 1, 1st Cir. (2001)Document15 pagesUnited States v. Benjamin, 252 F.3d 1, 1st Cir. (2001)Scribd Government DocsNo ratings yet

- McGuiness Updated ComplaintDocument113 pagesMcGuiness Updated ComplaintXerxes WilsonNo ratings yet

- US Bank Trust Natl v. Venice MD LLC, 4th Cir. (2004)Document14 pagesUS Bank Trust Natl v. Venice MD LLC, 4th Cir. (2004)Scribd Government DocsNo ratings yet

- United States v. Thomas A. Wilkinson, Iii, United States of America v. Edward M. Conk, 137 F.3d 214, 4th Cir. (1998)Document28 pagesUnited States v. Thomas A. Wilkinson, Iii, United States of America v. Edward M. Conk, 137 F.3d 214, 4th Cir. (1998)Scribd Government DocsNo ratings yet

- Fdic 10-5245-1315055-2011-06-24Document15 pagesFdic 10-5245-1315055-2011-06-24DinSFLANo ratings yet

- Choi v. Mian, 4th Cir. (1996)Document4 pagesChoi v. Mian, 4th Cir. (1996)Scribd Government DocsNo ratings yet

- Livingstone Securities Corporation v. Dean Martin, 327 F.2d 937, 1st Cir. (1964)Document5 pagesLivingstone Securities Corporation v. Dean Martin, 327 F.2d 937, 1st Cir. (1964)Scribd Government DocsNo ratings yet

- United States Court of Appeals, Seventh CircuitDocument11 pagesUnited States Court of Appeals, Seventh CircuitScribd Government DocsNo ratings yet

- United States Court of Appeals For The Third CircuitDocument23 pagesUnited States Court of Appeals For The Third CircuitScribd Government DocsNo ratings yet

- Westernbank v. Kachkar, RICO Amended ComplaintDocument54 pagesWesternbank v. Kachkar, RICO Amended ComplaintdavejphysNo ratings yet

- Mercantile Bank & Trust Co., Ltd., Counter-Defendant-Appellant v. Fidelity and Deposit Company, Etc., Counter-Claimant v. United States of America, Counter and International Energy Corporation, Counter-Defendants, 750 F.2d 838, 11th Cir. (1985)Document10 pagesMercantile Bank & Trust Co., Ltd., Counter-Defendant-Appellant v. Fidelity and Deposit Company, Etc., Counter-Claimant v. United States of America, Counter and International Energy Corporation, Counter-Defendants, 750 F.2d 838, 11th Cir. (1985)Scribd Government DocsNo ratings yet

- United States Court of Appeals Eighth CircuitDocument11 pagesUnited States Court of Appeals Eighth CircuitScribd Government DocsNo ratings yet

- Motion For Injunctive ReliefDocument34 pagesMotion For Injunctive ReliefURBNAnthony.com is NOW at No4sale.net Still Urbn Just No4SaleNo ratings yet

- United States Court of Appeals, Ninth CircuitDocument3 pagesUnited States Court of Appeals, Ninth CircuitScribd Government DocsNo ratings yet

- United States v. Farhad Bakhtiar and Anthony McDonald, 994 F.2d 970, 2d Cir. (1993)Document14 pagesUnited States v. Farhad Bakhtiar and Anthony McDonald, 994 F.2d 970, 2d Cir. (1993)Scribd Government DocsNo ratings yet

- United States v. Christo, 129 F.3d 578, 11th Cir. (1997)Document5 pagesUnited States v. Christo, 129 F.3d 578, 11th Cir. (1997)Scribd Government DocsNo ratings yet

- VanderKodde v. Mary Jane M. Elliott, PC, No. 19-1091 (6th Cir. Feb. 26, 2020)Document16 pagesVanderKodde v. Mary Jane M. Elliott, PC, No. 19-1091 (6th Cir. Feb. 26, 2020)RHTNo ratings yet

- Clay McCormack IndictmentDocument13 pagesClay McCormack IndictmentThe Jackson SunNo ratings yet

- Paul L. Banner, Trustee v. Saul D. Kassow, 104 F.3d 352, 2d Cir. (1996)Document5 pagesPaul L. Banner, Trustee v. Saul D. Kassow, 104 F.3d 352, 2d Cir. (1996)Scribd Government DocsNo ratings yet

- United States Court of Appeals, Ninth CircuitDocument6 pagesUnited States Court of Appeals, Ninth CircuitScribd Government DocsNo ratings yet

- United States v. Bennett, 37 F.3d 687, 1st Cir. (1994)Document22 pagesUnited States v. Bennett, 37 F.3d 687, 1st Cir. (1994)Scribd Government DocsNo ratings yet

- United States Court of Appeals, Sixth CircuitDocument10 pagesUnited States Court of Appeals, Sixth CircuitScribd Government DocsNo ratings yet

- United Pacific Insurance Co. v. The Idaho First National Bank, The Idaho First National Bank, Cross-Appellant v. United Pacific Insurance Co., Cross-Appellee, 378 F.2d 62, 1st Cir. (1967)Document9 pagesUnited Pacific Insurance Co. v. The Idaho First National Bank, The Idaho First National Bank, Cross-Appellant v. United Pacific Insurance Co., Cross-Appellee, 378 F.2d 62, 1st Cir. (1967)Scribd Government DocsNo ratings yet

- Collier V Gurstel Chargo ComplaintDocument8 pagesCollier V Gurstel Chargo ComplaintMark W. BennettNo ratings yet

- Glorvina Constant InformationDocument4 pagesGlorvina Constant Informationmtuccitto100% (1)

- United States v. Glenn W. McMurray R. Glade Whiting, and Robert H. Wilstead, Defendants, 656 F.2d 540, 10th Cir. (1980)Document19 pagesUnited States v. Glenn W. McMurray R. Glade Whiting, and Robert H. Wilstead, Defendants, 656 F.2d 540, 10th Cir. (1980)Scribd Government DocsNo ratings yet

- United States Court of Appeals, Eleventh CircuitDocument23 pagesUnited States Court of Appeals, Eleventh CircuitScribd Government DocsNo ratings yet

- United States v. Vytautus Vebeliunas, Also Known As VV, 76 F.3d 1283, 2d Cir. (1996)Document17 pagesUnited States v. Vytautus Vebeliunas, Also Known As VV, 76 F.3d 1283, 2d Cir. (1996)Scribd Government DocsNo ratings yet

- United States v. David McKay Brian McKay, 274 F.3d 755, 2d Cir. (2001)Document6 pagesUnited States v. David McKay Brian McKay, 274 F.3d 755, 2d Cir. (2001)Scribd Government DocsNo ratings yet

- Sundquist Opin USBC-EDC 2017Document109 pagesSundquist Opin USBC-EDC 2017papergateNo ratings yet

- Domenick Falconi v. Federal Deposit Insurance Corporation, 257 F.2d 287, 3rd Cir. (1958)Document8 pagesDomenick Falconi v. Federal Deposit Insurance Corporation, 257 F.2d 287, 3rd Cir. (1958)Scribd Government DocsNo ratings yet

- Estate of John R. Taschler, Deceased, by Dorothy Taschler, and Dorothy Taschler v. United States, 440 F.2d 72, 3rd Cir. (1971)Document7 pagesEstate of John R. Taschler, Deceased, by Dorothy Taschler, and Dorothy Taschler v. United States, 440 F.2d 72, 3rd Cir. (1971)Scribd Government DocsNo ratings yet

- Simon v. FDIC, 48 F.3d 53, 1st Cir. (1995)Document7 pagesSimon v. FDIC, 48 F.3d 53, 1st Cir. (1995)Scribd Government DocsNo ratings yet

- James W. Bonar and Beverly J. Bonar v. Dean Witter Reynolds, Inc., John S. MC Nally, JR., Ed Leavenworth, 835 F.2d 1378, 11th Cir. (1988)Document17 pagesJames W. Bonar and Beverly J. Bonar v. Dean Witter Reynolds, Inc., John S. MC Nally, JR., Ed Leavenworth, 835 F.2d 1378, 11th Cir. (1988)Scribd Government DocsNo ratings yet

- Fidelity and Deposit Company of Maryland, A Corporation, and Mint Factors, Third-Party v. The United States, 393 F.2d 834, 3rd Cir. (1968)Document4 pagesFidelity and Deposit Company of Maryland, A Corporation, and Mint Factors, Third-Party v. The United States, 393 F.2d 834, 3rd Cir. (1968)Scribd Government DocsNo ratings yet

- Fed. Sec. L. Rep. P 98,860 Athalie Doris Joy v. Nelson L. North, Nelson L. North, 692 F.2d 880, 2d Cir. (1982)Document30 pagesFed. Sec. L. Rep. P 98,860 Athalie Doris Joy v. Nelson L. North, Nelson L. North, 692 F.2d 880, 2d Cir. (1982)Scribd Government DocsNo ratings yet

- Robert R. Wisdom Nancy J. Wisdom v. First Midwest Bank, of Poplar Bluff Jerry F. McLane Jerry Dorton Joey McLane, 167 F.3d 402, 1st Cir. (1999)Document9 pagesRobert R. Wisdom Nancy J. Wisdom v. First Midwest Bank, of Poplar Bluff Jerry F. McLane Jerry Dorton Joey McLane, 167 F.3d 402, 1st Cir. (1999)Scribd Government DocsNo ratings yet

- United States Court of Appeals, Second Circuit.: Argued: December 19, 2005. Decided: March 29, 2006Document9 pagesUnited States Court of Appeals, Second Circuit.: Argued: December 19, 2005. Decided: March 29, 2006Scribd Government DocsNo ratings yet

- Minchey v. Production Credit, 117 F.3d 1428, 10th Cir. (1997)Document7 pagesMinchey v. Production Credit, 117 F.3d 1428, 10th Cir. (1997)Scribd Government DocsNo ratings yet

- Kathy v. Kathy, Civil CourtDocument26 pagesKathy v. Kathy, Civil CourtXerxes WilsonNo ratings yet

- United States v. Wolf Jacobowitz, A/K/A "Jack Rice," True Name: "Kalman Schlesinger,", 877 F.2d 162, 2d Cir. (1989)Document12 pagesUnited States v. Wolf Jacobowitz, A/K/A "Jack Rice," True Name: "Kalman Schlesinger,", 877 F.2d 162, 2d Cir. (1989)Scribd Government DocsNo ratings yet

- United States District Court Eastern District of Michigan Southern DivisionDocument60 pagesUnited States District Court Eastern District of Michigan Southern DivisionAllie GrossNo ratings yet

- The First National Bank of Beaver, Oklahoma v. Mac J. Hough and Leona B. Hough, 643 F.2d 705, 1st Cir. (1981)Document3 pagesThe First National Bank of Beaver, Oklahoma v. Mac J. Hough and Leona B. Hough, 643 F.2d 705, 1st Cir. (1981)Scribd Government DocsNo ratings yet

- United States Court of Appeals, Eighth CircuitDocument5 pagesUnited States Court of Appeals, Eighth CircuitScribd Government DocsNo ratings yet

- Rhode Island Corp. v. Hayes, 64 F.3d 22, 1st Cir. (1995)Document9 pagesRhode Island Corp. v. Hayes, 64 F.3d 22, 1st Cir. (1995)Scribd Government DocsNo ratings yet

- First National Bank of Minneapolis, A National Banking Association v. Fidelity National Title Insurance Company, A Nebraska Corporation, 572 F.2d 155, 1st Cir. (1978)Document11 pagesFirst National Bank of Minneapolis, A National Banking Association v. Fidelity National Title Insurance Company, A Nebraska Corporation, 572 F.2d 155, 1st Cir. (1978)Scribd Government DocsNo ratings yet

- Complaint Against Picower Estate Over Madoff ClaimsDocument12 pagesComplaint Against Picower Estate Over Madoff ClaimsDealBookNo ratings yet

- United States Court of Appeals, Tenth CircuitDocument8 pagesUnited States Court of Appeals, Tenth CircuitScribd Government DocsNo ratings yet

- Hall v. Meisner, No. 21-1700 (6th Cir. Oct. 13, 2022)Document15 pagesHall v. Meisner, No. 21-1700 (6th Cir. Oct. 13, 2022)RHTNo ratings yet

- Willis M. Duryea, Jr. v. The Third Northwestern National Bank of Minneapolis, A National Banking Association Bruce Winslow, John Doe and Mary Roe, 606 F.2d 823, 3rd Cir. (1979)Document6 pagesWillis M. Duryea, Jr. v. The Third Northwestern National Bank of Minneapolis, A National Banking Association Bruce Winslow, John Doe and Mary Roe, 606 F.2d 823, 3rd Cir. (1979)Scribd Government DocsNo ratings yet

- Edward J. Minskoff Edward J. Minskoff Equities, Inc. v. American Express Travel Related Services Company, Inc., 98 F.3d 703, 2d Cir. (1996)Document10 pagesEdward J. Minskoff Edward J. Minskoff Equities, Inc. v. American Express Travel Related Services Company, Inc., 98 F.3d 703, 2d Cir. (1996)Scribd Government DocsNo ratings yet

- U.S. v. Sun Myung Moon 532 F.Supp. 1360 (1982)From EverandU.S. v. Sun Myung Moon 532 F.Supp. 1360 (1982)No ratings yet

- U.S. v. Sun Myung Moon 718 F.2d 1210 (1983)From EverandU.S. v. Sun Myung Moon 718 F.2d 1210 (1983)No ratings yet

- Advisors Mortgage V Real Source Title, John C. Povejsil, Jason E. Fischer, Frank T. Griebenow, New Millennium GroupDocument24 pagesAdvisors Mortgage V Real Source Title, John C. Povejsil, Jason E. Fischer, Frank T. Griebenow, New Millennium GroupCamdenCanaryNo ratings yet

- Petters Company Alan M Miller A M Aero Inc DismissalDocument2 pagesPetters Company Alan M Miller A M Aero Inc DismissalCamdenCanaryNo ratings yet

- PAVEL SAKURETS Notary Application 842 Cannon 651-235-8972Document1 pagePAVEL SAKURETS Notary Application 842 Cannon 651-235-8972CamdenCanaryNo ratings yet

- IGOR KOMISARCHIK 1425 Colorado Ave 309 Main ST 651-260-7890 952-938-0730 Minnesota Notary ApplicationDocument2 pagesIGOR KOMISARCHIK 1425 Colorado Ave 309 Main ST 651-260-7890 952-938-0730 Minnesota Notary ApplicationCamdenCanaryNo ratings yet

- JAVAN INVESTMENTS LLC 2401 Lyndale Ave N Business Filing Andrei Gill Debora Gill Smith 763-443-7699Document3 pagesJAVAN INVESTMENTS LLC 2401 Lyndale Ave N Business Filing Andrei Gill Debora Gill Smith 763-443-7699CamdenCanaryNo ratings yet

- MICHELLE VRIEZE - Michelle Koenig Minnesota Notary Application 1001 4th Place NW 507-421-8483Document2 pagesMICHELLE VRIEZE - Michelle Koenig Minnesota Notary Application 1001 4th Place NW 507-421-8483CamdenCanaryNo ratings yet

- Order Barring Andrei Gill BankruptcyDocument1 pageOrder Barring Andrei Gill BankruptcyCamdenCanaryNo ratings yet

- Kenneth Jacqueline King Bankruptcy Adv Darlla GravdalDocument14 pagesKenneth Jacqueline King Bankruptcy Adv Darlla GravdalCamdenCanaryNo ratings yet

- My Dinh Lam Felony InformationDocument6 pagesMy Dinh Lam Felony InformationCamdenCanaryNo ratings yet

- Andrei Leon Gill SR Bankruptcy Petition 185 McCarrons BLVD PO Box 11683 06-05-2012Document71 pagesAndrei Leon Gill SR Bankruptcy Petition 185 McCarrons BLVD PO Box 11683 06-05-2012CamdenCanaryNo ratings yet

- Kenneth Jacqueline King Bankruptcy Adv Darlla GravdalDocument14 pagesKenneth Jacqueline King Bankruptcy Adv Darlla GravdalCamdenCanaryNo ratings yet

- Kenneth King StipulationDocument3 pagesKenneth King StipulationCamdenCanaryNo ratings yet

- Andrei Leon Gill Motion To Approve Settlement Rule 2004 Examination Producing Documents SubpoenaDocument22 pagesAndrei Leon Gill Motion To Approve Settlement Rule 2004 Examination Producing Documents SubpoenaCamdenCanaryNo ratings yet

- US V Troy Lamar KipperDocument1 pageUS V Troy Lamar KipperCamdenCanaryNo ratings yet

- Roberto Miguel Rodriguez Notary ApplicationDocument4 pagesRoberto Miguel Rodriguez Notary ApplicationCamdenCanaryNo ratings yet

- Ken King Bankruptcy Petition Kenneth Roy King 6713 ColfaxDocument60 pagesKen King Bankruptcy Petition Kenneth Roy King 6713 ColfaxCamdenCanaryNo ratings yet

- First Equity Group LLC Business FilingDocument3 pagesFirst Equity Group LLC Business FilingCamdenCanaryNo ratings yet

- Tennessee Business Quality Memphis Properties LLCDocument1 pageTennessee Business Quality Memphis Properties LLCCamdenCanaryNo ratings yet

- US V Steven Meldahl SJM Properties Consent DecreeDocument31 pagesUS V Steven Meldahl SJM Properties Consent DecreeCamdenCanaryNo ratings yet

- Clinical Practice Guideline - Ménière's Disease PDFDocument56 pagesClinical Practice Guideline - Ménière's Disease PDFCarol Natalia Fonseca SalgadoNo ratings yet

- 17 Artikel Analisis Komponen Produk Wisata Di Kabupaten KarawangDocument10 pages17 Artikel Analisis Komponen Produk Wisata Di Kabupaten KarawangPutri NurkarimahNo ratings yet

- Full Download pdf of (eBook PDF) The Global Casino: An Introduction to Environmental Issues 6th Edition all chapterDocument43 pagesFull Download pdf of (eBook PDF) The Global Casino: An Introduction to Environmental Issues 6th Edition all chapternahoonabid100% (5)

- Queues: Chapter 6 - Principles of Data Structures Using C by Vinu V DasDocument25 pagesQueues: Chapter 6 - Principles of Data Structures Using C by Vinu V DasAamir ChohanNo ratings yet

- Units Or: 1 Which IsDocument5 pagesUnits Or: 1 Which IsTanvi PriyaNo ratings yet

- Effect of Sic Particles On Mechanical Properties of Aluminium Adc12 Composite Through Stir Casting ProcessDocument6 pagesEffect of Sic Particles On Mechanical Properties of Aluminium Adc12 Composite Through Stir Casting ProcessJosiah PasaribuNo ratings yet

- Bunk Bed Plans SampleDocument4 pagesBunk Bed Plans SampleCedrickNo ratings yet

- Sew Infrastructure 1 Ebs Case Study 214465Document6 pagesSew Infrastructure 1 Ebs Case Study 214465Arun BatraNo ratings yet

- Demonstrating Value With BMC Server Automation (Bladelogic)Document56 pagesDemonstrating Value With BMC Server Automation (Bladelogic)abishekvsNo ratings yet

- 419 WK 9Document23 pages419 WK 9nhmae gcabNo ratings yet

- Transportation Engineering - I: Introduction To Bridge EngineeringDocument33 pagesTransportation Engineering - I: Introduction To Bridge Engineeringmit rami0% (1)

- Saes B 069Document9 pagesSaes B 069Eagle SpiritNo ratings yet

- YAMAUCHI Vs ROMEO F. SUÑIGADocument12 pagesYAMAUCHI Vs ROMEO F. SUÑIGAyan_saavedra_1No ratings yet

- المؤسسات الناشئة وامكانيات النمو-دراسة في انشاء حاضنات الأعمال لمرافقة المشروعات الناشئةDocument16 pagesالمؤسسات الناشئة وامكانيات النمو-دراسة في انشاء حاضنات الأعمال لمرافقة المشروعات الناشئةoussama bekhitNo ratings yet

- Investigative Skills 3Document75 pagesInvestigative Skills 3Keling HanNo ratings yet

- Welcome To Fourtower Bridge: A Paths Peculiar Module For Fantasy Roleplaying GamesDocument7 pagesWelcome To Fourtower Bridge: A Paths Peculiar Module For Fantasy Roleplaying GamesTapanco BarerraNo ratings yet

- Services Procurement Data SheetDocument5 pagesServices Procurement Data Sheetrollingstone3mNo ratings yet

- Revised - First Mid Examination-B.tech, BBA, BCA, MBA, MCA, BSC, BArch, Diploma ID (Except First Year) Odd Sem 2022-23Document12 pagesRevised - First Mid Examination-B.tech, BBA, BCA, MBA, MCA, BSC, BArch, Diploma ID (Except First Year) Odd Sem 2022-23Roʜʌŋ AŋʌŋɗNo ratings yet

- MSDS - Prominent-GlycineDocument6 pagesMSDS - Prominent-GlycineTanawat ChinchaivanichkitNo ratings yet

- 4 Statistics and Probability g11 Quarter 4 Module 4 Identifying The Appropriate Test Statistics Involving Population MeanDocument28 pages4 Statistics and Probability g11 Quarter 4 Module 4 Identifying The Appropriate Test Statistics Involving Population MeanISKA COMMISSIONNo ratings yet

- The Dilemma of Dr. Faustus: The Medieval-Renaissance Conflict in Christopher Marlowe's "The Tragic History of Dr. Faustus" by April Rose FaleDocument5 pagesThe Dilemma of Dr. Faustus: The Medieval-Renaissance Conflict in Christopher Marlowe's "The Tragic History of Dr. Faustus" by April Rose FaleApril Rose100% (5)

- Beyond The Blackboard Reflection PaperDocument3 pagesBeyond The Blackboard Reflection PaperPacatang Evelyn100% (1)

- Oh The Tooth That One Ths Was A Story About Place ValueDocument9 pagesOh The Tooth That One Ths Was A Story About Place Valuecagena7907No ratings yet

- A Project Report ON A Study On Consumer Satisfaction of PlywoodDocument7 pagesA Project Report ON A Study On Consumer Satisfaction of Plywoodjassi nishadNo ratings yet

- Rural - India Oct 10 EDELWEISSDocument89 pagesRural - India Oct 10 EDELWEISSpkn04100% (1)

- Dissertation Topic MailDocument57 pagesDissertation Topic MailANUPNo ratings yet

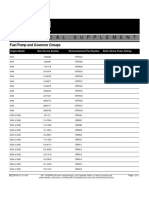

- FuelPump&GovernorGroups SELD0135 11Document11 pagesFuelPump&GovernorGroups SELD0135 11narit00007No ratings yet

- 1.1 Mechatronics Technology PRESENTATIONDocument46 pages1.1 Mechatronics Technology PRESENTATIONInnocent katengulaNo ratings yet

- CLPWPost War Literary WorksDocument4 pagesCLPWPost War Literary WorksRohann Ban0% (1)

USA V Jerone Ian Mitchell Indictment

USA V Jerone Ian Mitchell Indictment

Uploaded by

CamdenCanaryOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

USA V Jerone Ian Mitchell Indictment

USA V Jerone Ian Mitchell Indictment

Uploaded by

CamdenCanaryCopyright:

Available Formats

CASE 0:10-cr-00171-ADM-FLN Document 1 Filed 06/15/10 Page 1 of 9

UNITED STATES DISTRICT COURT

DISTRICT OF MINNESOTA

UNITED STATES OF AMERICA,

)

)

Plaintiff,

)

)

v.

)

)

1. ERICVAN ANTHONY MCDAVID,

)

a/k/a "BIG E,"

)

)

2. lbbY b\C !\!CL and

)

)

)

3 . JERONE IAN MITCHELL,

)

)

Defendants.

)

)

)

)

)

INDICTMENT

(18 u. s.c.

(18 u. s. c.

(18 u.s.c.

(18 u. s. c.

(28 u. s.c.

THE UNITED STATES GRAND JURY CHARGES THAT:

INTRODUCTORY ALLEGATIONS

'V

'-17 J

ADM

2)

3 71)

981 (a) (1) (C) )

1343)

2461(c) )

1. At all relevant times, defendants Ericvan Anthony

McDavid, a/k/a "Big E, " Larry Africanus Hutchinson and Jerone Ian

Mitchell were residents of the State of Minnesota.

2. Between 2005 and 2009, McDavid was either an owner or co-

owner of several businesses using the names of "EVM Properties"

(hereafter "EVM" ) , "Skyy Realty (hereafter "Skyy) and "Universal,

Inc. (hereafter "Universal" ) . McDavid was in the business of

buying and selling properties, property management, and recruiting

investors and property sellers to buy and sell residential

properties at inflated prices.

, c

|

|

illN 1 s 1orn !

11s. 01smrc-uR sr. PLI

JUh T

ZJ'J

Fl LEO

JUDGMENT ENTD _

DEPUTY CLERK _ _

CASE 0:10-cr-00171-ADM-FLN Document 1 Filed 06/15/10 Page 2 of 9

United States v. Ericvan Anthony McDavid. et al.

3. Between Z and Z Hutchinson was the owner of

several businesses using the names of "LAH Properties" (hereafter

"LAH" }, and "L & D Mortgage" (hereafter "L&D" }, and was an agent

for "Unity Realty" (hereafter "Unity" } Hutchinson was in the

business of property management.

4. Between Z and Z Mitchell was the owner of

"Infinite Developers" (hereafter "Infinite" } and was in the

business of construction.

COU 1

(18 U.S.C. 371: Conspiracy to Commit Wire Fraud}

5. From in or about April Z through in or about February

Z in the State and District of Minnesota and elsewhere, the

defendants,

ERICVA ANTHON MCDAVID,

a/k/a "BIG E, "

LRRY AFRICAS HUTCHINSON, and

JERONE IA MITCHELL,

did unlawfully and knowingly conspire, combine, confederate and

agree with other persons known and unknown to the grand jury to

commit an offense against the United States, that is, to devise a

scheme and artifice to defraud and to obtain money by means of

material false and fraudulent representations and promises and, for

the purpose of executing such scheme, to cause to be transmitted by

means of interstate wire certain writings, signs, signals,

Z

CASE 0:10-cr-00171-ADM-FLN Document 1 Filed 06/15/10 Page 3 of 9

United States v. Ericvan Anthony McDavid. et al.

pictures, and sounds, in violation of Title 18, United States Code,

Section 1343.

PUPOSE OF THE CONSPIRCY

6. The purpose of the conspiracy was to fraudulently obtain

loan proceeds by making materially false representations and

promises and withholding material information about the residential

property purchases orchestrated by McDavid, Hutchinson, Mitchell

and others acting on their behalf.

MANNER A MEANS

7. Beginning in 2005, McDavid and Hutchinson recruited straw

buyers, who generally maintained good credit. McDavid and

Hutchinson enticed potential Investors to purchase a home,

previously selected by McDavid and Hutchinson, by representing to

potential straw buyers that McDavid and Hutchinson would pay the

straw buyers between $15, 000 and $52, 000 per transaction.

8. Once a straw purchaser agreed to buy a property, McDavid

and Hutchinson, either by themselves, or through unindicted co

conspirators, fraudulently assisted the straw purchaser by

producing fraudulent 1003 loan applications, which were then

provided to various lenders, for the purpose of loan underwriting.

The fraudulent documentation falsely overstated the straw

purchaser

'

s assets, income, and nature of employment. The false

representations and omissions were material. Based on the

3

CASE 0:10-cr-00171-ADM-FLN Document 1 Filed 06/15/10 Page 4 of 9

United States v. Ericvan Anthony McDavid, et al.

fraudulent documentation, the proposed loans were approved. These

loans totaled in excess of $14, 600, 000.

9. Prior to closing on the properties, McDavid, Hutchinson

and Mitchell produced fraudulent documentation, including prepaid

management fees, construction invoices and non-existent second

mortgages. These documents were provided to the lenders and title

companies causing disbursements to be made to companies controlled

by McDavid, Hutchinson and Mitchell. Without the lenders

knowledge, the disbursements were then routed, in part, back to the

straw buyers.

10. McDavid and Hutchinson fraudulently also concealed that

they provided funds to the straw buyers to be passed off as the

straw buyers' own funds to close the transactions, thereby

misleading mortgage loan lenders to believe that the straw buyers

had a financial stake in the purchased residence and thus incentive

to pay the loan.

11. Following the closing of each of these real property

transactions, McDavid, Hutchinson and Mitchell, through their

companies - directly or indirectly - received a portion of each

straw purchaser

'

s mortgage loan proceeds, described in closing

documents as "pre-paid management fees," "construction invoice," or

"second mortgage payoff. "

transactions, McDavid,

In at least 40 separate real estate

Hutchinson and Mitchell secured

4

CASE 0:10-cr-00171-ADM-FLN Document 1 Filed 06/15/10 Page 5 of 9

United States v. Ericvan Anthony McDavid, et al.

approximately $1, 184, 555 in fraudulent payments from the loan

proceeds. The fraudulent payments were then distributed, in part,

to the straw buyers, McDavid, Hutchinson, Mitchell and other

participants in the fraudulent scheme.

12. From in or about April 2005 though in or about February

2009, McDavid, Hutchinson, and Mitchell, with the assistance of

others acting at their direction, convinced Investors to purchase

approximately 25 residential properties in Minnesota in this manner

resulting in fraudulent loans in excess of $14, 600,000 and losses

of approximately $5.8 million.

OVRT ACTS

13, In furtherance of the conspiracy and to achieve its

object, all of the above listed defendants committed, directly and

through accomplices, among other acts, the following overt acts

(which encompass only some of the real estate transactions involved

in the conspiracy) :

Sale of 6500 Harbor Place, Prior Lake, Minnesota

a. On or about August 24, 2006, a straw purchaser purchased

the above mentioned property. An unindicted co-conspirator

falsified the loan application by supplying materially false

information regarding the straw purchaser's monthly income, and

employment position. In addition, fraudulent second mortgage

documents were submitted by Mitchell

'

s company, Infinite, in the

5

CASE 0:10-cr-00171-ADM-FLN Document 1 Filed 06/15/10 Page 6 of 9

United States v. Ericvan Anthony McDavid, et al.

amount of $125,000. These documents caused Fieldstone Mortgage

Company to issue loans in the amount of $620,000. Although there

was no legitimate second mortgage on this property, the title

company transferred, by wire, funds the amount of $71, 922.36 to

Infinite. On August 2 5, 2 0 0 6 , Infinite received the funds .

Subsequently, on August 29, 2006, Infinite transferred by wire,

funds in the amount of $60, 000 to an account in the control of the

straw purchaser.

Sale of 13250 Pennsylvania Avenue, Savage, Minnesota

b. On or about November 22, 2006, McDavid, being the

purchaser of the property,

supplying materially false

falsified the loan application by

information regarding his monthly

income. In addition, a construction invoice was submitted by

Mitchell's company, Infinite, in the amount of $102, 354.89, for

work to be completed. This caused Southstar Funding, LLC. to issue

a loan in the amount of $852, 000. Although no work was done by

Infinite, the title company issued a check in the amount of

$102,354.89 to Infinite. On November 24, 2006, this check was

deposited into an Infinite account. On November 27, 2006, Infinite

made an electronic money transfer in the amount of $102,354.89 to

an account in the control of McDavid.

6

CASE 0:10-cr-00171-ADM-FLN Document 1 Filed 06/15/10 Page 7 of 9

United States v. Ericvan Anthony McDavid. et al.

Sale of 4310 Windwood Way. Minnetonka. Minnesota

c. On or about April 27, 2007, McDavid, being the purchaser

of the property, falsified the loan application by supplying

materially false information regarding his monthly income. In

addition, a construction invoice was submitted by Hutchinson's

company, L, in the amount of $195,000, for work that had

allegedly been completed. This caused Minnesota Lending Company to

issue a loan in the amount of $650,000. This also caused American

Investor's Bank and Mortgage to issue a loan in the amount of

$100,000. Although no work was done by L, the title company

transferred, by wire, funds in the amount of $183,109.18 to LAH.

On May 1, 2007, LAH received the funds. Subsequently, on May 1,

2007, L issued a check in amount of $93,000 to an account in the

control of McDavid. On May 2, 2007, LAH issued a second check in

the amount of $90,000 to an account in the control of McDavid. All

in violation of Title 18, United States Code, Section 371.

COUS 2-8

(18 U.S.C. 1343: Mortgage Fraud through Use of the Interstate

Wire)

14. The grand jury re-alleges and incorporates by reference

the allegations contained in paragraphs 1 through 13 as though

fully stated herein for the purpose of alleging the substantive

wire fraud offenses alleged in Counts 2 through 8 below.

7

CASE 0:10-cr-00171-ADM-FLN Document 1 Filed 06/15/10 Page 8 of 9

United States v. Ericvan Anthony McDavid. et al.

15. On or about the dates set forth below, in the State and

District of Minnesota, the defendants,

ERICVA ATHONY MCDAVID,

a/k/ a "BIG E, "

LARRY AFRICANUS HUTCHINSON, and

JERONE IAN MITCHELL,

along with others known and unknown to the Grand Jury, each

aiding and abetting the others, for the purpose of executing the

above-described scheme and artifice, did knowingly cause to be

transmitted, in interstate commerce, by means of wire

communication, certain signals and sounds, as further described

below:

Count On or About Date Wire Comunication

2 August 24, 2006 Wire transfer of $529,999. 44

from Citibank NA in New York

to M&I Bank in Wisconsin and

then to M&I Bank in Minnesota

3 August 24, 2006 Wire transfer of $92,479. 10

from Citibank NA in New York

to M&I Bank in Wisconsin and

then to M&I Bank in Minnesota

4 August 25, 2006 Wire transfer of $71,922. 36

from M&I Bank in Wisconsin to

Wells Fargo Bank in

California with further

credit to Wells Fargo Bank in

Minnesota

5 November 22, 2006 Wire transfer of $679,254.57

from US Bank in Wisconsin to

US Bank in Minnesota

8

CASE 0:10-cr-00171-ADM-FLN Document 1 Filed 06/15/10 Page 9 of 9

United States v. Ericvan Anthony McDavid, et al.

6 November 22, 2006 Wire transfer of $169,962.64

from us Bank in Wisconsin to

us Bank in Minnesota

7 April 27

'

2007 Wire transfer of $99,726.10

from United Bankers Bank in

Minnesota to M&I Bank in

Wisconsin

8 May 1, 2007 Wire transfer of $183,109.18

from M&I Bank in Wisconsin to

CCFCU in Minnesota

all in violation of Title 18, United States Code, Sections 1343

and 2.

FORFEITURE ALLEGATIONS

The Grand Jury realleges and incorporates paragraphs 1 through

15 of the Indictment, and makes it a part of these forfeiture

allegations.

As the result of the offenses alleged in Counts 1 through 8 of

this Indictment, the defendants,

ERICVA ATHON MCDAVID,

a/k/a "BIG E,"

LARRY AFRICAS HUTCHINSON, and

JERONE IA MITCHELL,

shall forfeit to the United States pursuant to Title 18, United

States Code, Section 981(a) (1) (C), and Title 28, United States

Code, Section 2461(c), all their rights, title and interest in any

property constituting, or derived from, proceeds traceable to the

violations of Title 18, United States Code, Sections 371, 1343,

and 2.

A TRUE BILL

UNITED STATES ATTORNEY FOREPERSON

9

You might also like

- The Bonds of Inequality: Debt and the Making of the American CityFrom EverandThe Bonds of Inequality: Debt and the Making of the American CityRating: 4 out of 5 stars4/5 (2)

- Austin Davidson AffidavitDocument8 pagesAustin Davidson AffidavitEmily BabayNo ratings yet

- Static Trip ManualDocument52 pagesStatic Trip ManualRavijoisNo ratings yet

- United States v. Louis A. Marchisio, John H. Seiter and W. Ward Whipple, 344 F.2d 653, 2d Cir. (1965)Document23 pagesUnited States v. Louis A. Marchisio, John H. Seiter and W. Ward Whipple, 344 F.2d 653, 2d Cir. (1965)Scribd Government DocsNo ratings yet

- United States v. McCann, 366 F.3d 46, 1st Cir. (2004)Document15 pagesUnited States v. McCann, 366 F.3d 46, 1st Cir. (2004)Scribd Government DocsNo ratings yet

- United States Court of Appeals, Fourth CircuitDocument10 pagesUnited States Court of Appeals, Fourth CircuitScribd Government DocsNo ratings yet

- United States Court of Appeals, Tenth Circuit.: Nos. 93-6026 To 93-6028Document20 pagesUnited States Court of Appeals, Tenth Circuit.: Nos. 93-6026 To 93-6028Scribd Government DocsNo ratings yet

- United States v. Benjamin, 252 F.3d 1, 1st Cir. (2001)Document15 pagesUnited States v. Benjamin, 252 F.3d 1, 1st Cir. (2001)Scribd Government DocsNo ratings yet

- McGuiness Updated ComplaintDocument113 pagesMcGuiness Updated ComplaintXerxes WilsonNo ratings yet

- US Bank Trust Natl v. Venice MD LLC, 4th Cir. (2004)Document14 pagesUS Bank Trust Natl v. Venice MD LLC, 4th Cir. (2004)Scribd Government DocsNo ratings yet

- United States v. Thomas A. Wilkinson, Iii, United States of America v. Edward M. Conk, 137 F.3d 214, 4th Cir. (1998)Document28 pagesUnited States v. Thomas A. Wilkinson, Iii, United States of America v. Edward M. Conk, 137 F.3d 214, 4th Cir. (1998)Scribd Government DocsNo ratings yet

- Fdic 10-5245-1315055-2011-06-24Document15 pagesFdic 10-5245-1315055-2011-06-24DinSFLANo ratings yet

- Choi v. Mian, 4th Cir. (1996)Document4 pagesChoi v. Mian, 4th Cir. (1996)Scribd Government DocsNo ratings yet

- Livingstone Securities Corporation v. Dean Martin, 327 F.2d 937, 1st Cir. (1964)Document5 pagesLivingstone Securities Corporation v. Dean Martin, 327 F.2d 937, 1st Cir. (1964)Scribd Government DocsNo ratings yet

- United States Court of Appeals, Seventh CircuitDocument11 pagesUnited States Court of Appeals, Seventh CircuitScribd Government DocsNo ratings yet

- United States Court of Appeals For The Third CircuitDocument23 pagesUnited States Court of Appeals For The Third CircuitScribd Government DocsNo ratings yet

- Westernbank v. Kachkar, RICO Amended ComplaintDocument54 pagesWesternbank v. Kachkar, RICO Amended ComplaintdavejphysNo ratings yet

- Mercantile Bank & Trust Co., Ltd., Counter-Defendant-Appellant v. Fidelity and Deposit Company, Etc., Counter-Claimant v. United States of America, Counter and International Energy Corporation, Counter-Defendants, 750 F.2d 838, 11th Cir. (1985)Document10 pagesMercantile Bank & Trust Co., Ltd., Counter-Defendant-Appellant v. Fidelity and Deposit Company, Etc., Counter-Claimant v. United States of America, Counter and International Energy Corporation, Counter-Defendants, 750 F.2d 838, 11th Cir. (1985)Scribd Government DocsNo ratings yet

- United States Court of Appeals Eighth CircuitDocument11 pagesUnited States Court of Appeals Eighth CircuitScribd Government DocsNo ratings yet

- Motion For Injunctive ReliefDocument34 pagesMotion For Injunctive ReliefURBNAnthony.com is NOW at No4sale.net Still Urbn Just No4SaleNo ratings yet

- United States Court of Appeals, Ninth CircuitDocument3 pagesUnited States Court of Appeals, Ninth CircuitScribd Government DocsNo ratings yet

- United States v. Farhad Bakhtiar and Anthony McDonald, 994 F.2d 970, 2d Cir. (1993)Document14 pagesUnited States v. Farhad Bakhtiar and Anthony McDonald, 994 F.2d 970, 2d Cir. (1993)Scribd Government DocsNo ratings yet

- United States v. Christo, 129 F.3d 578, 11th Cir. (1997)Document5 pagesUnited States v. Christo, 129 F.3d 578, 11th Cir. (1997)Scribd Government DocsNo ratings yet

- VanderKodde v. Mary Jane M. Elliott, PC, No. 19-1091 (6th Cir. Feb. 26, 2020)Document16 pagesVanderKodde v. Mary Jane M. Elliott, PC, No. 19-1091 (6th Cir. Feb. 26, 2020)RHTNo ratings yet

- Clay McCormack IndictmentDocument13 pagesClay McCormack IndictmentThe Jackson SunNo ratings yet

- Paul L. Banner, Trustee v. Saul D. Kassow, 104 F.3d 352, 2d Cir. (1996)Document5 pagesPaul L. Banner, Trustee v. Saul D. Kassow, 104 F.3d 352, 2d Cir. (1996)Scribd Government DocsNo ratings yet

- United States Court of Appeals, Ninth CircuitDocument6 pagesUnited States Court of Appeals, Ninth CircuitScribd Government DocsNo ratings yet

- United States v. Bennett, 37 F.3d 687, 1st Cir. (1994)Document22 pagesUnited States v. Bennett, 37 F.3d 687, 1st Cir. (1994)Scribd Government DocsNo ratings yet

- United States Court of Appeals, Sixth CircuitDocument10 pagesUnited States Court of Appeals, Sixth CircuitScribd Government DocsNo ratings yet

- United Pacific Insurance Co. v. The Idaho First National Bank, The Idaho First National Bank, Cross-Appellant v. United Pacific Insurance Co., Cross-Appellee, 378 F.2d 62, 1st Cir. (1967)Document9 pagesUnited Pacific Insurance Co. v. The Idaho First National Bank, The Idaho First National Bank, Cross-Appellant v. United Pacific Insurance Co., Cross-Appellee, 378 F.2d 62, 1st Cir. (1967)Scribd Government DocsNo ratings yet

- Collier V Gurstel Chargo ComplaintDocument8 pagesCollier V Gurstel Chargo ComplaintMark W. BennettNo ratings yet

- Glorvina Constant InformationDocument4 pagesGlorvina Constant Informationmtuccitto100% (1)

- United States v. Glenn W. McMurray R. Glade Whiting, and Robert H. Wilstead, Defendants, 656 F.2d 540, 10th Cir. (1980)Document19 pagesUnited States v. Glenn W. McMurray R. Glade Whiting, and Robert H. Wilstead, Defendants, 656 F.2d 540, 10th Cir. (1980)Scribd Government DocsNo ratings yet

- United States Court of Appeals, Eleventh CircuitDocument23 pagesUnited States Court of Appeals, Eleventh CircuitScribd Government DocsNo ratings yet

- United States v. Vytautus Vebeliunas, Also Known As VV, 76 F.3d 1283, 2d Cir. (1996)Document17 pagesUnited States v. Vytautus Vebeliunas, Also Known As VV, 76 F.3d 1283, 2d Cir. (1996)Scribd Government DocsNo ratings yet

- United States v. David McKay Brian McKay, 274 F.3d 755, 2d Cir. (2001)Document6 pagesUnited States v. David McKay Brian McKay, 274 F.3d 755, 2d Cir. (2001)Scribd Government DocsNo ratings yet

- Sundquist Opin USBC-EDC 2017Document109 pagesSundquist Opin USBC-EDC 2017papergateNo ratings yet

- Domenick Falconi v. Federal Deposit Insurance Corporation, 257 F.2d 287, 3rd Cir. (1958)Document8 pagesDomenick Falconi v. Federal Deposit Insurance Corporation, 257 F.2d 287, 3rd Cir. (1958)Scribd Government DocsNo ratings yet

- Estate of John R. Taschler, Deceased, by Dorothy Taschler, and Dorothy Taschler v. United States, 440 F.2d 72, 3rd Cir. (1971)Document7 pagesEstate of John R. Taschler, Deceased, by Dorothy Taschler, and Dorothy Taschler v. United States, 440 F.2d 72, 3rd Cir. (1971)Scribd Government DocsNo ratings yet

- Simon v. FDIC, 48 F.3d 53, 1st Cir. (1995)Document7 pagesSimon v. FDIC, 48 F.3d 53, 1st Cir. (1995)Scribd Government DocsNo ratings yet

- James W. Bonar and Beverly J. Bonar v. Dean Witter Reynolds, Inc., John S. MC Nally, JR., Ed Leavenworth, 835 F.2d 1378, 11th Cir. (1988)Document17 pagesJames W. Bonar and Beverly J. Bonar v. Dean Witter Reynolds, Inc., John S. MC Nally, JR., Ed Leavenworth, 835 F.2d 1378, 11th Cir. (1988)Scribd Government DocsNo ratings yet

- Fidelity and Deposit Company of Maryland, A Corporation, and Mint Factors, Third-Party v. The United States, 393 F.2d 834, 3rd Cir. (1968)Document4 pagesFidelity and Deposit Company of Maryland, A Corporation, and Mint Factors, Third-Party v. The United States, 393 F.2d 834, 3rd Cir. (1968)Scribd Government DocsNo ratings yet

- Fed. Sec. L. Rep. P 98,860 Athalie Doris Joy v. Nelson L. North, Nelson L. North, 692 F.2d 880, 2d Cir. (1982)Document30 pagesFed. Sec. L. Rep. P 98,860 Athalie Doris Joy v. Nelson L. North, Nelson L. North, 692 F.2d 880, 2d Cir. (1982)Scribd Government DocsNo ratings yet

- Robert R. Wisdom Nancy J. Wisdom v. First Midwest Bank, of Poplar Bluff Jerry F. McLane Jerry Dorton Joey McLane, 167 F.3d 402, 1st Cir. (1999)Document9 pagesRobert R. Wisdom Nancy J. Wisdom v. First Midwest Bank, of Poplar Bluff Jerry F. McLane Jerry Dorton Joey McLane, 167 F.3d 402, 1st Cir. (1999)Scribd Government DocsNo ratings yet

- United States Court of Appeals, Second Circuit.: Argued: December 19, 2005. Decided: March 29, 2006Document9 pagesUnited States Court of Appeals, Second Circuit.: Argued: December 19, 2005. Decided: March 29, 2006Scribd Government DocsNo ratings yet

- Minchey v. Production Credit, 117 F.3d 1428, 10th Cir. (1997)Document7 pagesMinchey v. Production Credit, 117 F.3d 1428, 10th Cir. (1997)Scribd Government DocsNo ratings yet

- Kathy v. Kathy, Civil CourtDocument26 pagesKathy v. Kathy, Civil CourtXerxes WilsonNo ratings yet

- United States v. Wolf Jacobowitz, A/K/A "Jack Rice," True Name: "Kalman Schlesinger,", 877 F.2d 162, 2d Cir. (1989)Document12 pagesUnited States v. Wolf Jacobowitz, A/K/A "Jack Rice," True Name: "Kalman Schlesinger,", 877 F.2d 162, 2d Cir. (1989)Scribd Government DocsNo ratings yet

- United States District Court Eastern District of Michigan Southern DivisionDocument60 pagesUnited States District Court Eastern District of Michigan Southern DivisionAllie GrossNo ratings yet

- The First National Bank of Beaver, Oklahoma v. Mac J. Hough and Leona B. Hough, 643 F.2d 705, 1st Cir. (1981)Document3 pagesThe First National Bank of Beaver, Oklahoma v. Mac J. Hough and Leona B. Hough, 643 F.2d 705, 1st Cir. (1981)Scribd Government DocsNo ratings yet

- United States Court of Appeals, Eighth CircuitDocument5 pagesUnited States Court of Appeals, Eighth CircuitScribd Government DocsNo ratings yet

- Rhode Island Corp. v. Hayes, 64 F.3d 22, 1st Cir. (1995)Document9 pagesRhode Island Corp. v. Hayes, 64 F.3d 22, 1st Cir. (1995)Scribd Government DocsNo ratings yet

- First National Bank of Minneapolis, A National Banking Association v. Fidelity National Title Insurance Company, A Nebraska Corporation, 572 F.2d 155, 1st Cir. (1978)Document11 pagesFirst National Bank of Minneapolis, A National Banking Association v. Fidelity National Title Insurance Company, A Nebraska Corporation, 572 F.2d 155, 1st Cir. (1978)Scribd Government DocsNo ratings yet

- Complaint Against Picower Estate Over Madoff ClaimsDocument12 pagesComplaint Against Picower Estate Over Madoff ClaimsDealBookNo ratings yet

- United States Court of Appeals, Tenth CircuitDocument8 pagesUnited States Court of Appeals, Tenth CircuitScribd Government DocsNo ratings yet

- Hall v. Meisner, No. 21-1700 (6th Cir. Oct. 13, 2022)Document15 pagesHall v. Meisner, No. 21-1700 (6th Cir. Oct. 13, 2022)RHTNo ratings yet

- Willis M. Duryea, Jr. v. The Third Northwestern National Bank of Minneapolis, A National Banking Association Bruce Winslow, John Doe and Mary Roe, 606 F.2d 823, 3rd Cir. (1979)Document6 pagesWillis M. Duryea, Jr. v. The Third Northwestern National Bank of Minneapolis, A National Banking Association Bruce Winslow, John Doe and Mary Roe, 606 F.2d 823, 3rd Cir. (1979)Scribd Government DocsNo ratings yet

- Edward J. Minskoff Edward J. Minskoff Equities, Inc. v. American Express Travel Related Services Company, Inc., 98 F.3d 703, 2d Cir. (1996)Document10 pagesEdward J. Minskoff Edward J. Minskoff Equities, Inc. v. American Express Travel Related Services Company, Inc., 98 F.3d 703, 2d Cir. (1996)Scribd Government DocsNo ratings yet

- U.S. v. Sun Myung Moon 532 F.Supp. 1360 (1982)From EverandU.S. v. Sun Myung Moon 532 F.Supp. 1360 (1982)No ratings yet

- U.S. v. Sun Myung Moon 718 F.2d 1210 (1983)From EverandU.S. v. Sun Myung Moon 718 F.2d 1210 (1983)No ratings yet

- Advisors Mortgage V Real Source Title, John C. Povejsil, Jason E. Fischer, Frank T. Griebenow, New Millennium GroupDocument24 pagesAdvisors Mortgage V Real Source Title, John C. Povejsil, Jason E. Fischer, Frank T. Griebenow, New Millennium GroupCamdenCanaryNo ratings yet

- Petters Company Alan M Miller A M Aero Inc DismissalDocument2 pagesPetters Company Alan M Miller A M Aero Inc DismissalCamdenCanaryNo ratings yet

- PAVEL SAKURETS Notary Application 842 Cannon 651-235-8972Document1 pagePAVEL SAKURETS Notary Application 842 Cannon 651-235-8972CamdenCanaryNo ratings yet

- IGOR KOMISARCHIK 1425 Colorado Ave 309 Main ST 651-260-7890 952-938-0730 Minnesota Notary ApplicationDocument2 pagesIGOR KOMISARCHIK 1425 Colorado Ave 309 Main ST 651-260-7890 952-938-0730 Minnesota Notary ApplicationCamdenCanaryNo ratings yet

- JAVAN INVESTMENTS LLC 2401 Lyndale Ave N Business Filing Andrei Gill Debora Gill Smith 763-443-7699Document3 pagesJAVAN INVESTMENTS LLC 2401 Lyndale Ave N Business Filing Andrei Gill Debora Gill Smith 763-443-7699CamdenCanaryNo ratings yet

- MICHELLE VRIEZE - Michelle Koenig Minnesota Notary Application 1001 4th Place NW 507-421-8483Document2 pagesMICHELLE VRIEZE - Michelle Koenig Minnesota Notary Application 1001 4th Place NW 507-421-8483CamdenCanaryNo ratings yet

- Order Barring Andrei Gill BankruptcyDocument1 pageOrder Barring Andrei Gill BankruptcyCamdenCanaryNo ratings yet

- Kenneth Jacqueline King Bankruptcy Adv Darlla GravdalDocument14 pagesKenneth Jacqueline King Bankruptcy Adv Darlla GravdalCamdenCanaryNo ratings yet

- My Dinh Lam Felony InformationDocument6 pagesMy Dinh Lam Felony InformationCamdenCanaryNo ratings yet

- Andrei Leon Gill SR Bankruptcy Petition 185 McCarrons BLVD PO Box 11683 06-05-2012Document71 pagesAndrei Leon Gill SR Bankruptcy Petition 185 McCarrons BLVD PO Box 11683 06-05-2012CamdenCanaryNo ratings yet

- Kenneth Jacqueline King Bankruptcy Adv Darlla GravdalDocument14 pagesKenneth Jacqueline King Bankruptcy Adv Darlla GravdalCamdenCanaryNo ratings yet

- Kenneth King StipulationDocument3 pagesKenneth King StipulationCamdenCanaryNo ratings yet

- Andrei Leon Gill Motion To Approve Settlement Rule 2004 Examination Producing Documents SubpoenaDocument22 pagesAndrei Leon Gill Motion To Approve Settlement Rule 2004 Examination Producing Documents SubpoenaCamdenCanaryNo ratings yet

- US V Troy Lamar KipperDocument1 pageUS V Troy Lamar KipperCamdenCanaryNo ratings yet

- Roberto Miguel Rodriguez Notary ApplicationDocument4 pagesRoberto Miguel Rodriguez Notary ApplicationCamdenCanaryNo ratings yet

- Ken King Bankruptcy Petition Kenneth Roy King 6713 ColfaxDocument60 pagesKen King Bankruptcy Petition Kenneth Roy King 6713 ColfaxCamdenCanaryNo ratings yet

- First Equity Group LLC Business FilingDocument3 pagesFirst Equity Group LLC Business FilingCamdenCanaryNo ratings yet

- Tennessee Business Quality Memphis Properties LLCDocument1 pageTennessee Business Quality Memphis Properties LLCCamdenCanaryNo ratings yet

- US V Steven Meldahl SJM Properties Consent DecreeDocument31 pagesUS V Steven Meldahl SJM Properties Consent DecreeCamdenCanaryNo ratings yet

- Clinical Practice Guideline - Ménière's Disease PDFDocument56 pagesClinical Practice Guideline - Ménière's Disease PDFCarol Natalia Fonseca SalgadoNo ratings yet

- 17 Artikel Analisis Komponen Produk Wisata Di Kabupaten KarawangDocument10 pages17 Artikel Analisis Komponen Produk Wisata Di Kabupaten KarawangPutri NurkarimahNo ratings yet

- Full Download pdf of (eBook PDF) The Global Casino: An Introduction to Environmental Issues 6th Edition all chapterDocument43 pagesFull Download pdf of (eBook PDF) The Global Casino: An Introduction to Environmental Issues 6th Edition all chapternahoonabid100% (5)

- Queues: Chapter 6 - Principles of Data Structures Using C by Vinu V DasDocument25 pagesQueues: Chapter 6 - Principles of Data Structures Using C by Vinu V DasAamir ChohanNo ratings yet

- Units Or: 1 Which IsDocument5 pagesUnits Or: 1 Which IsTanvi PriyaNo ratings yet

- Effect of Sic Particles On Mechanical Properties of Aluminium Adc12 Composite Through Stir Casting ProcessDocument6 pagesEffect of Sic Particles On Mechanical Properties of Aluminium Adc12 Composite Through Stir Casting ProcessJosiah PasaribuNo ratings yet

- Bunk Bed Plans SampleDocument4 pagesBunk Bed Plans SampleCedrickNo ratings yet

- Sew Infrastructure 1 Ebs Case Study 214465Document6 pagesSew Infrastructure 1 Ebs Case Study 214465Arun BatraNo ratings yet

- Demonstrating Value With BMC Server Automation (Bladelogic)Document56 pagesDemonstrating Value With BMC Server Automation (Bladelogic)abishekvsNo ratings yet

- 419 WK 9Document23 pages419 WK 9nhmae gcabNo ratings yet

- Transportation Engineering - I: Introduction To Bridge EngineeringDocument33 pagesTransportation Engineering - I: Introduction To Bridge Engineeringmit rami0% (1)

- Saes B 069Document9 pagesSaes B 069Eagle SpiritNo ratings yet

- YAMAUCHI Vs ROMEO F. SUÑIGADocument12 pagesYAMAUCHI Vs ROMEO F. SUÑIGAyan_saavedra_1No ratings yet

- المؤسسات الناشئة وامكانيات النمو-دراسة في انشاء حاضنات الأعمال لمرافقة المشروعات الناشئةDocument16 pagesالمؤسسات الناشئة وامكانيات النمو-دراسة في انشاء حاضنات الأعمال لمرافقة المشروعات الناشئةoussama bekhitNo ratings yet

- Investigative Skills 3Document75 pagesInvestigative Skills 3Keling HanNo ratings yet

- Welcome To Fourtower Bridge: A Paths Peculiar Module For Fantasy Roleplaying GamesDocument7 pagesWelcome To Fourtower Bridge: A Paths Peculiar Module For Fantasy Roleplaying GamesTapanco BarerraNo ratings yet

- Services Procurement Data SheetDocument5 pagesServices Procurement Data Sheetrollingstone3mNo ratings yet

- Revised - First Mid Examination-B.tech, BBA, BCA, MBA, MCA, BSC, BArch, Diploma ID (Except First Year) Odd Sem 2022-23Document12 pagesRevised - First Mid Examination-B.tech, BBA, BCA, MBA, MCA, BSC, BArch, Diploma ID (Except First Year) Odd Sem 2022-23Roʜʌŋ AŋʌŋɗNo ratings yet

- MSDS - Prominent-GlycineDocument6 pagesMSDS - Prominent-GlycineTanawat ChinchaivanichkitNo ratings yet

- 4 Statistics and Probability g11 Quarter 4 Module 4 Identifying The Appropriate Test Statistics Involving Population MeanDocument28 pages4 Statistics and Probability g11 Quarter 4 Module 4 Identifying The Appropriate Test Statistics Involving Population MeanISKA COMMISSIONNo ratings yet

- The Dilemma of Dr. Faustus: The Medieval-Renaissance Conflict in Christopher Marlowe's "The Tragic History of Dr. Faustus" by April Rose FaleDocument5 pagesThe Dilemma of Dr. Faustus: The Medieval-Renaissance Conflict in Christopher Marlowe's "The Tragic History of Dr. Faustus" by April Rose FaleApril Rose100% (5)

- Beyond The Blackboard Reflection PaperDocument3 pagesBeyond The Blackboard Reflection PaperPacatang Evelyn100% (1)

- Oh The Tooth That One Ths Was A Story About Place ValueDocument9 pagesOh The Tooth That One Ths Was A Story About Place Valuecagena7907No ratings yet

- A Project Report ON A Study On Consumer Satisfaction of PlywoodDocument7 pagesA Project Report ON A Study On Consumer Satisfaction of Plywoodjassi nishadNo ratings yet

- Rural - India Oct 10 EDELWEISSDocument89 pagesRural - India Oct 10 EDELWEISSpkn04100% (1)

- Dissertation Topic MailDocument57 pagesDissertation Topic MailANUPNo ratings yet

- FuelPump&GovernorGroups SELD0135 11Document11 pagesFuelPump&GovernorGroups SELD0135 11narit00007No ratings yet

- 1.1 Mechatronics Technology PRESENTATIONDocument46 pages1.1 Mechatronics Technology PRESENTATIONInnocent katengulaNo ratings yet

- CLPWPost War Literary WorksDocument4 pagesCLPWPost War Literary WorksRohann Ban0% (1)