Professional Documents

Culture Documents

Power & Capital Goods

Power & Capital Goods

Uploaded by

Abhishek GuptaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Power & Capital Goods

Power & Capital Goods

Uploaded by

Abhishek GuptaCopyright:

Available Formats

UNNATI INVESTMENT MANAGEMENT AND RESEARCH GROUP

Sector Report Power and Capital Goods

Manish Gupta pg12manish_g@mdi.ac.in

Sankalp Raghuvanshi pg12sankalp_r@mdi.ac.in

Power And Capital Goods

Contents

EXECUTIVE SUMMARY ....................................................................................................................... 2

POWER OVERVIEW OF POWER SECTOR ........................................................................................................... 3 VALUE CHAIN ANALYSIS ..................................................................................................................... 8 MAJOR FACTORS AFECTING INDUSTRY ............................................................................................. 15 GOVERNMENT POLICIES ................................................................................................................... 23

CAPITAL GOODS OVERVIEW OF CAPITAL GOODS SECTOR ............................................................................................ 24 FACTORS AFFECTING CAPITAL GOODS INDUSTRY .............................................................................. 25

BUSINESS MODELS OF MAJOR PLAYERS ............................................................................................ 27 NTPC .........................................................................................................................................................27 POWER GRID CORPORATION OF INDIA LIMITED ......................................................................................31 PTC ............................................................................................................................................................34 LARSEN & TUOBRO ...................................................................................................................................37 BHEL ..........................................................................................................................................................40 IMPORTANT PARAMETERS ............................................................................................................... 43 RECENT DEVELOPMENTS .................................................................................................................. 44 COALGATE.................................................................................................................................................44 GRID FAILURES ..........................................................................................................................................45 IMPORT DUTY ON ELECTRICAL EQUIPMENT ............................................................................................45 FUEL SUPPLY AGREEMENTS (FSA) AND PRICE POOLING ..........................................................................46 SECTOR OUTLOOK ............................................................................................................................ 47 REFERENCES..................................................................................................................................... 48

1|Page

Power And Capital Goods

EXECUTIVE SUMMARY Power is a capital intensive and important industry for the nation. Per capita consumption of power represents the human development index of a nation. India has fifth largest generation capacity in the world, still per capita consumption is among the lowest in the world. Supply of power at a reasonable rate to rural India, and quality power at a competitive rate to Indian industries is important for the development of the nation. To sustain rapid economic growth, India needs rapid capacity addition in power generation. Power Ministry envisages 75,715MW capacity addition by 2017. In the 11 th plan, India added around 55,000MW, falling short from its initial target of around 78000MW. If Government is serious about meeting its 12th plan target, it needs to form a favourable and consistent policy on land acquisition, environmental clearance procedures, and find a lasting solution to fuel availability problem among other issues. In an otherwise service sector dominated country, Capital Goods sector has been contributing to Indias growth story from the last 6 -7 years. Like power, it is also a capital intensive sector. Governments thrust on infrastructure is driving the growth of this sector.. However, competition from Chinese firms, lack of skilled manpower, lack of latest technology and rising interest rates are the main problems impeding growth of this sector. Both, the power and capital goods are vital to sustain Indias rapid economic growth. As India records high GPD growth rate annually, both these sectors have tremendous scope and investment potential.

2|Page

Power And Capital Goods

OVERVIEW OF POWER SECTOR MAJOR SOURCES OF POWER

Thermal Power It is the largest source of power generation in India where the main raw material used is coal. Around 83% of thermal power is generated using coal as a raw material whereas 16% of thermal power is generated with the help of Gas and 1% of thermal power is generated with the help of Oil. Hydro Power Hydroelectric power or hydroelectricity is electrical power which is generated through the conversion of potential or kinetic energy of falling water into electricity. India has hydro power generation potential worth 1,50,000 MW, of which only 25 % has been harnessed till date.

3|Page

Power And Capital Goods

Nuclear Power A Nuclear Power Plant is a thermal power station in which the heat source is one or more nuclear reactors. A nuclear reactor is a device to initiate and control a sustained nuclear chain reaction. In the process, heat is generated which is then used to generate electricity. The fuel used is generally enriched uranium or thorium. Renewable Energy Sources The energy obtained from renewable sources like sun, wind, biomass can be converted into power. Renewable energy sources have great potential to contribute to improving energy security of India and reducing green-house gas emissions. India is among the five largest wind power generators in the world with Suzlon among the worlds top five wind turbine manufacturers. HISTORY OF POWER SECTOR IN INDIA The power sector in India has undergone a remarkable change post-Independence. In 1947, our country had a power generation capacity of 1362 MW. Most of the generation and distribution of electric power was done mainly by private utility companies as per the 1910 Electricity Act, which had primarily set up licensing rules for generation for public as well as private sector players. Post Independence Pre Liberalization Period (1947-1998) The Electricity Supply Act of 1948 brought into state purview all new power generation, transmission and distribution facilities. As a consequence, almost every state organized its own vertically integrated utility known as the State Electricity Board (SEB). Most of the SEBs were financially structured entirely through state government loans and operated under the influence of the States Energy Ministry. By 1991, the SEBs controlled a majority of power distribution and almost the entire distribution and transmission segment. Between 1948 and 1991, the overall generation capacity grew by over fifty times at a breakneck speed of 9.2 % per year which was almost double of the overall economic growth rate of the country during that period. However, due to inefficient policies, agricultural subsidies and the consequent development of captive power plants by industries, tariff formulations influenced by political motives, insufficient spending on the overhauling of power infrastructure and inefficient billing & metering, the SEBs soon became cash starved. AT&C losses reached as high as 50% causing the government to intervene and introduce the next stage of reforms.

4|Page

Power And Capital Goods

Post Liberalization Period: (1998 onwards) This period was characterized by the Electricity Regulatory Commissions Act, 1998 and later by the Electricity Act, 2003. Both are revolutionary pieces of legislation that envisage transforming the power sector in India. Salient features include: De-licensing of generation and captive generation freely permitted No license required for generation and distribution in rural India The state government required to unbundle State Electricity boards. However they are allowed to continue with them as distribution licensees and state transmission utilities Setting up state electricity regulatory commission (SERC) made mandatory An appellate tribunal to hear appeals against the decision of (CERC's) and SERC's Provisions related to thefts of electricity made more stringent

GOVERNMENT SCHEMES Restructured - Accelerated Power Reform and Development Programme (R-APRDP) The R-APRDP is a continuation of the APRDP started from the year 2000-01 as a last means for restoring the commercial viability of the Distribution Sector. The focus of the programme is on actual, demonstrable performance in terms of sustained loss reduction, establishment of reliable and automated systems for sustained collection of accurate base line data and the adoption of Information Technology in the areas of energy accounting. Its objectives are: Improving financial viability of State Power Utilities Reduction of AT & C losses Improving customer satisfaction Increasing reliability & quality of power supply

Rajiv Gandhi Grameen Vidyutikaran Yojana (RGGVY) RGGVY is a mammoth programme and also single largest programme taken up by the Govt. of India for electrification of all the villages across the nation. The sanctioned projects of RGGVY programme propose for the electrification of about 1.15 lakh Un-electrified villages intensive electrification of 3.46 lakh already electrified villages and release of free electricity connections to 2.34 crore BPL households spread across the nation. SEBs, Distribution Companies, Power Departments and CPSUs of Power Sector are involved in the program implementation.

5|Page

Power And Capital Goods

Jawaharlal Nehru National Solar Mission (JNNSM) The National Solar Mission is a major initiative of the Government of India and State Governments to promote ecologically sustainable growth while addressing India's energy security challenge. It will also constitute a major contribution by India to the global effort to meet the challenges of climate change. Its motive is to implement a gradual shift from fossil fuels based energy generation to environment friendly and distributed source of energy. It was launched in 2010 with a target of deploying 20,000 MW of grid connected solar power by 2022 aiming at reduction in the cost of solar power generation in the country through long term policy framework, aggressive R&D and domestic production of critical raw materials and components. The Ministry of New and Renewable Energy (MNRE) is the nodal agency for its implementation. Ultra Mega Power Projects (UMPP) Ultra Mega Power projects (UMPP) are a series of ambitious power projects planned by the Government of India. With India being a country of chronic power deficits, the Government of India has planned to provide 'power for all' by the end of the eleventh plan (by 2012). This would entail the creation of an additional capacity of at least 100,000 MW by 2012. The Ultra Mega Power projects, each with a capacity of 4000 megawatts or above, are being developed with the aim of bridging this gap. The UMPPs are seen as an expansion of the MPP (Mega Power Projects) projects that the Government of India undertook in the 1990s, but met with limited success. The Ministry of Power, in association with the Central Electricity Authority and Power Finance Corporation Ltd., has launched an initiative for the development of coal-based UMPP's in India. These projects will be awarded to developers on the basis of competitive bidding.

S. No. 1 2 3

Particulars Total UMPPs Envisaged SPVs Incorporated Awarded

No. of UMPPs 16 12 4

Source : Power Finance Corporation As of Nov 2010, 16 UMPPs have been planned in Karnataka, Chattisgarh, Madhya Pradesh, Andhra Pradesh (2), Maharashtra (2), Orissa (3), Tamil Nadu (2), Gujarat (2) and Jharkhand.

6|Page

Power And Capital Goods

List of UMPPs awarded till date: UMPP Sasan Mundra Krishnapatnam Tilaiya Bedabahal UMPP Chhattisgarh Tamil Nadu 2nd Andhra Pradesh UMPP 1st and 2ndadditional UMPPs in Orissa 2nd Gujarat UMPP 2nd Tamil Nadu UMPP 2nd Jharkhand UMPP Karnataka Maharashtra Location Sasan in district Singrauli, Madhya Pradesh village Tundawand in district Kutch, Gujarat Krishnapatnam in district Nellore, Andhra Pradesh Near Tilaiya village in Hazaribaghand Koderma Districts, Near Bedabahal in Sundergarhdistrict, Orissa Jharkhand Near Salka&Khameria Villages in District Surguja, Chhattisgarh Village Cheyyur, DistrictKancheepuram, Tamil Nadu Village Nayunipalli, DistrictPrakasam, Andhra Pradesh Not yet finalised Not yet finalised Not yet finalised Not yet finalised Not yet finalised Not yet finalised Status Awarded Reliance Awarded TATA Power Awarded Reliance Awarded Reliance Bidding Bidding Pre-RfQ (request for qualification) Pre-RfQ -------

7|Page

Power And Capital Goods

VALUE CHAIN ANALYSIS

PLAYERS IN THE VALUE CHAIN 1. Government The Ministry of power is concerned with perspective planning, policy formulation, processing of projects for investment decision, monitoring of the implementation of power projects, training and manpower development and the administration and enactment of legislation in regard to thermal, hydro power generation, transmission and distribution. 2. Regulators/Govt. Agencies (a) Central Electricity Regulatory Commission (CERC) CERC is a key regulator of power sector in India, is a statutory body functioning with quasi-judicial status. CERC was initially constituted in 1998 for rationalization of electricity tariffs, transparent policies regarding subsidies,

8|Page

Power And Capital Goods

promotion of efficient and environmentally benign policies, and for matters connected Electricity Tariff regulation. (b) Central Electricity Authority of India (CEA) CEA is a statutory organisation which advises the government on matters relating to the National Electricity Policy and formulates short-term and perspective plans for the development of electricity systems. Under the Electricity Act 2003, CEA prescribes the standards on matters such as construction of electrical plants, electric lines and connectivity to the grid, installation and operation of meters and safety and grid standards. 3. Generation Companies like NTPC, Tata Power, Reliance Power, Lanco Infratech, Adani Power etc. These companies can either sell directly to end user as in the case of embedded generation or can sell to distribution companies via transmission grids and traders. These companies require following inputs: (a) Engineering Construction and Capital Goods (EPC Companies/Suppliers) These are goods used to set up a power plant. E.g. companies supplying electrical goods like ABB, Areva, L&T, Crompton Greaves, BHEL etc. Various other companies supplying mechanical and civil capital goods are also part of this. (b) Fuel Suppliers Companies like CIL(Coal),GAIL(Natural Gas),Petronet LNG (LNG) (c) Consultants Engineering Companies like TCE, DCPL etc. Merchant Power Plants They sell electricity in the competitive wholesale power market and are not tied up in the long term power purchase agreements (PPAs). Thus setting up these plants would mean financing by the developer, since financial institutions/lenders as a rule, may not be comfortable with projects that do not have long term PPAs. 4. Trading Companies like PTC India and exchanges like Indian Energy Exchange and Power exchange India help in inter-state as well as inter-country trading of power between various companies. 5. Transmission Companies like Power Grid, Reliance Infrastructure, Areva T&D etc. These companies require inputs in form of capital goods like towers, conductors, electrical equipment etc.

9|Page

Power And Capital Goods

6. Distribution Companies like various SEBs as well as private players like BSES (Reliance Infrastructure), NDPL (Tata Power) etc. 7. End Users The end users of power in India are broadly classified into industrial, domestic, agricultural and commercial categories. COSTS INVOLVED IN STAGES OF VALUE ADDITION Manufacturing stage The capital cost for any power plant is calculated as per Regulation 7 of the CERC (Terms and Conditions-of-Tariff) Regulations 2009-14. As per CERC regulations, capital costs for projects will include the expenditure incurred or projected to be incurred upto the COD (Commercial Operation Date), initial capitalized spares and additional capital expenditure incurred or projected to be incurred. Capital costs (including waste disposal and decommissioning costs for nuclear energy) tend to be low for fossil fuel power stations; high for wind turbines, solar PV and nuclear; very high for waste to energy, wave and tidal, solar thermal. The cost of setting up a coal based subcritical thermal plant comes out to be INR 4-4.5 crores/MW whereas a supercritical power plant costs around INR 5 crores/MW. Generation Stage The tariff of a thermal power plant consists of two parts capacity charge (for recovering annual fixed costs) and energy charge (for covering fuel supply costs). It is again calculated as per CERC-(Terms-and-Conditions-of-Tariff)-Regulations-2009-14. Fuel costs are high for fossil fuel and biomass sources, very low for renewable sources and waste to energy. Around 65 % of total power generation in India is through thermal power plants with coal being the major fuel. Domestic coal prices range between Rs 770 and Rs 1,700 a tonne. Transmission Stage The tariff for transmission of electricity on inter-State transmission system shall comprise transmission charge for recovery of annual fixed cost as described in CERC (Terms and Conditions of Tariff) Regulations 2009-14

10 | P a g e

Power And Capital Goods

GENERATION India has an Installed Generation Capacity of 180358 MW as on 31.07.2011. The annual growth in the energy generation during the year 2010-11 has been 5.55% against the CAGR of 5.17% during the period -2001-02 to 2010-11. The total power generation in the country during FY11 was 811.1 Billion Units (BUs) as against the target of 830.8 BUs. The Central Government remains the largest producer of electricity, followed by the State

Utilities and a fast catching private sector. The primary source of fuel is coal.

Source: CEA

11 | P a g e

Power And Capital Goods

TRANSMISSION Transmission of electricity is defined as bulk transfer of power over a long distance at a high voltage, generally of 132 KV and above. The entire country has been divided into five regions for transmission systems, namely Northern Region, North Eastern Region, Eastern Region, Southern Region and Western Region. The interconnected transmission system within each region is also called the regional grid. There is an uneven distribution of resources in our country which means that generated power has to be carried to great distances. Thus, it is essential to have a robust regional and inter regional transmission network. POWERGRID is working towards achieving its mission of " Establishment and Operation of Regional and National Power Grids to facilitate transfer of power within and across the regions with reliability, security and economy, on sound commercial principles ". As on June 30, 2011, National Grid with inter-regional power transfer capacity of about 23,800 MW has already been established and this capacity is planned to be enhanced to about 28,000 MW by 2012. The following table shows the progress that the transmission sector has made in the 11 th Five year plan thus far.

Source: Central Electricity Authority

12 | P a g e

Power And Capital Goods

DISTRIBUTION While severe fuel shortage is holding back the generation sector, the outlook for the distribution sector is not too bright either. The Power Finance Corporation recently reported that the accumulated deposits for distribution companies are increasing alarmingly and could have been as high as 750 billion as on March 1, 2009. The losses stood at 505 billion in 2007-08 and 394 billion in 2004-05. One of the key reasons for these staggering losses is that the tariff hike (5.2 % CAGR over FY 2004-09) have not kept pace with the rising power purchase costs (7.3 % CAGR). In addition, Aggregate Technical & Commercial losses (AT&C) at 28.4% and inadequate subsidies paid by the state governments have resulted in very high negative operating cash flows for many State Electricity Boards (SEBs). Many states such as Tamil Nadu have not raised tariffs since many years because of political pressures. The good news is that the issue is being taken up seriously and recently, eight states including Bihar, Punjab, Madhya Pradesh and Andhra Pradesh have decided to raise tariffs for 2011-2012. Among these, Bihar State Electricity Board has raised the tariff by as much as 19%. The implication of such high losses will be felt by the merchant power projects as the SEBs have now started to curtail power purchases to curb losses. The SEBs are expected to cut power take-off from merchant projects first as it is costly and has no contractual obligation. There are multiple recent instances of state utilities nudging IIPs not to use imported coal. For example, Reliance Powers Rosa plant in Uttar Pradesh and JSW's Ratnagiri plant in Maharashtra have been advised to run the plants only on cheaper domestic linkage coal. POWER TRADING In India, the generators of electricity like Central Generating Stations (CGSs), Independent Power Producers (IPPs) and State Electricity Boards (SEBs) have all their capacities tied up. Each SEB has an allocated share in central sector/ jointly owned projects and is expected to draw its share without much say about the price. In other words, the suppliers of electricity have little choice about whom to sell the power and the buyers have no choice about whom to purchase their power from. India being a predominantly agrarian economy, power demand is seasonal, weather sensitive and there exists substantial difference in demand of power during different hours of the day with variations during peak hours and off peak hours. Further, the geographical spread of India is very large and different parts of the country face different types of climate and different types of loads. Power demand during the rainy seasons is low in the States of Karnataka and Andhra Pradesh and high in Delhi and Punjab. Whereas many of the States face high demand during evening peak hours, cities like

13 | P a g e

Power And Capital Goods

Mumbai face high demand during office hours. Trading of power from surplus State Utilities to deficit ones, through marginal investment in removing grid constraints, could help in deferring or reducing investment for additional generation capacity, in increasing PLF and reducing average cost of energy.

Source: CEA Power Exchange Mechanism Currently CERC allows the purchase and sale of electricity on a day - ahead market basis through exchanges like PXI, IEX etc. The Indian markets are based on the auction trade mechanism where bids for the purchase and sale of contracts of one hour duration that cover all 24 hours for the next day are collected by between 10am and 12am. The Indian power market is divided into 10 separate bid areas which have different prices in case the unconstrained electricity flow between biding areas exceeds the available transfer capacity.

14 | P a g e

Power And Capital Goods

MAJOR FACTORS AFECTING INDUSTRY The government has sought to revive the health of power sector through assured fuel supply and power tariff increase. Such positive moves by the government will also help the industry to raise capital with relative ease as lenders would be more willing to lend. Nevertheless, poor financials of state distribution utilities (DISCOMS), lower domestic coal availability, falling merchant power rates and absence of cost linked tariff escalation is hitting the profitability of power producers.

Source: BSE FUEL SECURITY Constrained availability of fuel for power sector continues to be one of the key concerns affecting the power generation in India, which is predominantly based on fossil fuel i.e. coal and gas. The production of coal as well as gas has not kept pace with the demand. During year 2011-12, to meet the shortfall of indigenous coal, an estimated 27.58 MT of coal was imported against the requirement of 35 MT (excluding requirement of imported coal based plants). The generation loss reported due to coal supply shortages during 2011-12 has also increased to 8.82 BUs from 7.0 BUs for the same period last year.

15 | P a g e

Power And Capital Goods

The Indian government has come up with several solutions to address this problem with domestic coal supply: fuel supply agreements (FSAs) with Coal India to ensure coal supply; the use of price pooling of coal, where Coal India would import coal and supply it domestically; and captive mining, where Indian power producers mine coal blocks on their own or transport coal directly from Coal India's mines.

Source: BSE

Power Plants With Critical Levels Of Coal Stocks (less than 7 Days)

Source: Central Electricity Authority

16 | P a g e

Power And Capital Goods

Inspite of various measures being taken by Government of India, it is expected that Power Sector would continue to face fuel constraints. National energy requirement is expected to grow to almost 4 times of present level by 2030-31. To meet this demand, the domestic coal production has to grow in the range rate of 7%-9% range in order to match with the growth in demand. Issues such as domestic security, slow environmental clearances and a convoluted land acquisition process continue to delay the development of mines, while the lack of private sector involvement is negatively affecting the productivity of the mining sector. A mining bill (2011 MMDR bill) has been in the works since late-2011, but has yet to receive parliamentary approval. Non availability of coal and gas in desired quantity would have an adverse impact on the overall performance of the sector. The gap between demand and supply of coal is further expected to increase due to various ecological concerns. The indigenous coal supply has to be augmented to match the growth in power sector since most of the thermal plants cannot use coal blended with more than 15% of imported fuel due to the design of the boilers. ENVIRONMENTAL ISSUES Delay in submission of Environmental Impact Assessment (EIA) report and Environment Management Plan (EMP) has resulted in 48 power projects are held up in various stages of green clearance in the Ministry of Environment and Forests (MoEF). To expedite the clearances of power projects the Environment Ministry has constituted sector specific Expert Appraisal Committees (EACs) for appraisal of thermal, hydro and nuclear power projects which is expected to cater to capacity augmentation. The hydel power sector is the worst as a result of these hold ups. SHORTAGE OF POWER EQUIPMENT Indian electrical equipment industry, which has registered a negative growth of 2.4% % in the first quarter of the current FY 2012-13 for the first time in a decade. In recent years, a surge in imports of electrical equipment from abroad has been significantly impacting the Indian electrical equipment industry with under-utilisation of recently enhanced capacities across several products.

17 | P a g e

Power And Capital Goods

Delayed power projects

Responding to this trend, the Indian government approved a proposal to impose a 21% duty (5% customs duty, 12% countervailing duty and 4% special additional duty) on imported power equipment. Prior to this, India only levied a 5% customs duty on imported power equipment for less than 1,000-megawatts (MW) and almost no duty on capacity above 1,000MW. Although this could make it less likely for power equipment manufacturers to boost their cost competitiveness and result in increased costs for power producers, this has allowed a breathing space to the power equipment manufacturing industry. FDI IN POWER SECTOR The share of power sector in FDI as compared to other sectors is quite low, inspite of the fact that 100% foreign equity is permitted in generation, transmission, distribution and trading. During the period April, 2000 to March, 2012, Power sector has attracted FDI equity inflow of about 4% as compared to 19% by service sector and 7% each by telecommunications, construction activities, computer hardware & software and housing & real estate. The low FDI inflow in the power sector is indicative of lack of confidence of foreign investors which stems from lack of politico-administrative support on containment of commercial losses.

18 | P a g e

Power And Capital Goods

Source: Department of Industrial Policy & Promotion (DIPP) The fragile financial health of state utilities, uncertainty of fuel availability, capped regulatory returns on equity coupled with delays in land, forest and environmental clearances which lead to cost escalation. LAND ACQUISITION ISSUES The Land Acquisition Rehabilitation and Resettlement Bill, 2011, introduced in Parliament recently, has proposed a substantial hike in compensation for project affected people, linking land prices to four times the market value. The new legislation would shoot up the land acquisition cost from the present about 10% to over 20% of the project cost. The general rule for land requirement of power projects is 1 acre of land for 1 mw of power. Power companies are focusing on developing new units in the projects where additional land is available as a part of their land optimization strategy. GROWING FOCUS ON RENEWABLES As on 30/06/2012, India has a totalled installed capacity of 25000 MW of Renewable Energy, making its contribution 12.1% of totalled installed capacity. 2/3 rd of this is generated from wind energy. India has become the fourth largest country in the world in terms of installed capacity of wind turbines (more than 14100 MW).Mini-hydro has an installed grid connected capacity of more than 3000MW and biomass more than 2600MW. India plans to add 30,000 MW of renewable energy in the 12th five year plan by 2017, of which 15,000 MW would come from wind energy. Growth in renewable energy is driven by the following factors: An increasingly wide gap between supply and demand

19 | P a g e

Power And Capital Goods

The need to reduce the pressure on the balance of payments for imports of fossil fuels (80% of domestic crude consumption is imported and 30% of total imports goes for oil imports) The need for viable solutions for rural electrification The pressure to abate green house gas emissions Source wise estimate of renewable power in India (Total reserves: 89970MW)

State wise estimate of renewable power in India. Total reserves: 89970MW

Source: Ministry of Statistics and Programme Implementation, Energy Statists Report 2012

20 | P a g e

Power And Capital Goods

India has huge potential for renewable energy. India has resources for generating around 89760MW of renewable energy (excluding solar). The following graphs show the source wise and state wise potential of renewable power in India (excluding solar power). Key challenges for development of renewable energy are: Optimal pricing of power generated from the renewable energy sources per unit cost of production needs to come down There are quality and consistency issues with renewable power at present The costs of technology development and production is very high and need to be reduced significantly Availability of finances for funding such capital intensive projects.

TARIFF HIKES In 2010-2011, average tariff rose by 6.5% whereas cost of supply increased by 16.5%. States like Tamil Nadu, Rajasthan and Haryana have not increased tariffs mainly due to political reasons. Tamil Nadu has not revised tariff since 2003. Average loss per unit sold to consumer has been between 80 paisa and rupees one between 2005-2010. Indian consumers on average pay much less for a unit of

Source : TERI, November 2011 electricity than countries which are richer than India. In India, the average tariff charged is eight US cents per unit compared to 12-15 cents in Canada, South Africa and the US and 1920 cents in much of Europe and the developing world.

21 | P a g e

Power And Capital Goods

To improve the quality of power supply, and reduce the financial burden mounting on SEBs, it is imperative that the electricity tariffs are revised. POOR SEB HEALTH Discoms are plagued with obsolete technology, overstaffing and low manpower productivity. They have huge shortage of funds and heavily rely on government subsidies, which, many a times, is delayed or not paid in full.

Source : TERI, November 2011 Thus SEBs resort to load shedding and curb power purchase, particularly from merchant projects, since their power is costly and carry no contractual obligation. HIGH AT&C LOSSES Aggregate technical and commercial losses for India are around 27.15%. Accelerated Power Development Reforms Program (APDRP) aims to bring it down to 15%. For this, Rs. 50,000 Cr. were earmarked for the 11th five year plan. However, the target could not be achieved, and it is believed that by end of 12th five year plan, we will be able to achieve it. Old worn out and poor distribution network, power theft, billing and metering inefficiencies are some of the reasons for low AT&C losses.

22 | P a g e

Power And Capital Goods

GOVERNMENT POLICIES Electricity Act 2003 An Act to consolidate the laws relating to generation, transmission, distribution, trading and use of electricity and generally for taking measures conducive to development of electricity industry, promoting competition therein, protecting interest of consumers and supply of electricity to all areas. The Electricity Act is a revolutionary piece of legislation that envisages transforming the power sector in India. Below are its key features: Generation has been de-licensed and captive generation freely permitted No license required for generation and distribution in rural India The state government required to unbundle State Electricity boards. However they are allowed to continue with them as distribution licensees and state transmission utilities Setting up state electricity regulatory commission (SERC) made mandatory An appellate tribunal to hear appeals against the decision of (CERC's) and SERC's Provisions related to thefts of electricity made more stringent Trading as, a distinct activity recognised with the safeguard of Regulatory commissions being authorised to fix ceiling on trading margins Open access in transmission with provision for surcharge for taking care of current level of cross subsidy, with the surcharge being gradually phased out.

National Electricity policy Section 3 of the Electricity Act 2003 requires the Central Government to formulate the National Electricity Policy in consultation with central electricity authority and state governments. It aims at laying guidelines for accelerated development of the power sector, providing supply of electricity to all areas and protecting interests of consumers and other stakeholders keeping in view availability of energy resources, technology available to exploit these resources, economics of generation using different resources, and energy security issues. The National Electricity Policy has the following Aims & Objectives: Access to Electricity - Available for all households in next five years Availability of Power - Demand to be fully met by 2012 Supply of Reliable and Quality Power of specified standards in an efficient manner and at reasonable rates Per capita availability of electricity to be increased to over 1000 units by 2012

23 | P a g e

Power And Capital Goods

OVERVIEW OF CAPITAL GOODS SECTOR The Indian economic policy post-independence was strongly influenced by the colonial experience which was seen as unfair by the policy makers at that point of time. Hence, India leaned towards the Soviet Union Model of policy making. Domestic policy consisted of protectionism, economic interventionism and central planning.

Source: BSE Website The policy, however envisaged rapid development of the technology and capital intensive heavy industry by direct or indirect intervention. This was, in part, inspired by the Sov iet Union which had progressed rapidly by state led industrialization due to its vibrant Engineering & Capital Goods Sector. Hence, a robust Engineering and Capital Goods Sector has been at the core of the industrial policy of India since 1951. Owing to these factors and a strong import substitution policy, India has a well-built Engineering and capital Goods Base. The range of machinery produced includes Heavy Electrical Machinery, Textile Machinery, Earth Moving equipment, Construction Equipment, Food Processing instruments, Mining Machinery, Cement Machinery, Sugar Machinery, Industrial Furnaces, Metallurgical equipment etc. However, one fundamental concern that has been always present is that in some cases, the quality raw material present in India is not up to the international standards and sometimes this causes the quality of the final product to deteriorate. As always, economic growth is a key determinant of energy demand and the energy consumption generally mirrors the economic cycle.

24 | P a g e

Power And Capital Goods

FACTORS AFFECTING CAPITAL GOODS INDUSTRY MONETARY CONDITIONS The Reserve Bank of India has brought the repo rate down by 50 basis points to 8.00% in April 2012 which is its first rate cut in three years, it is still significantly higher than the rates seen in 2010 and the cost of capital in India remains relatively high.

Source: Reserve Bank of India Rupee remains close to an all-time low range of INR 55 /US $. This is slated to dampen construction activity as overseas equipment and raw materials are more costly for Indian construction companies. LOW RESEARCH AND DEVELOPMENT EXPENDITURE Indian companies lack strong R&D project management skills and their R&D spending is low. Historically, the aggregate domestic R&D spending has never exceeded 1 percent of GDP. It is 0.9% of GDP at present, as compared to 1.4% for China, 2% for Singapore, 2.82 % for US and 3% for South Korea. Government plans to increase the expenditure to 2% of GDP by the end of 12th five year plan.

25 | P a g e

Power And Capital Goods

LACK OF SKILLED MANPOWER India lacks skilled manpower at both, technician level and graduate level. The technical, vocational training infrastructure in India, in the form of Industrial Training Institutes and other similar institutes, is grossly inadequate to meet the industries burgeoning demand. Also, the quality of training provided is far below the essential needs in terms of modern range of equipment and knowledge of advances in manufacturing processes. At higher skills level also, there is a gap between the number of well trained graduates or diploma holders required and those willing to enter and stay in the industry. This is due to more lucrative avenues available to the graduate engineers in forms of IT or professional management careers, or due to mobility of best trained resources to higher wage countries like US and the Middle East.

26 | P a g e

Power And Capital Goods

BUSINESS MODELS OF MAJOR PLAYERS NTPC NTPC was set up in 1975 to accelerate power development in India by an Act of Parliament. It is emerging as a diversified power major with presence in the entire value chain of the power generation business. Apart from its main business power generation, it has ventured into consultancy, power trading, ash utilisation and coal mining. The total installed capacity of the company is 39,174 MW with 16 coal based and 7 gas based stations located across the country making it the largest power company in India. NTPC has been operating its plants at high efficiency levels. Although the company has 17.75% of the total national capacity, it contributes 27.40% of total power generation due to its focus on high efficiency.

Source: Website of NTPC The company has set a target to have an installed power generating capacity of 1,28,000 MW by the year 2032. The capacity will have a diversified fuel mix comprising 56% coal, 16% Gas, 11% Nuclear, 9% renewable energy and 8% hydro power based capacity. By 2032, non fossil fuel based generation capacity shall make up nearly 28% of NTPCs portfolio. NTPC has adopted a multi-pronged strategy such as Greenfield Projects, Brownfield Projects, Joint Venture and Acquisition route.

27 | P a g e

Power And Capital Goods

NTPC has also adopted the Diversification Strategy in related business areas, such as, Services, Coal Mining, Power Trading, Power Exchange, Manufacturing to ensure robustness and growth of the company. NTPC has also formulated its business plan of capacity addition of about 1,000 MW thru renewable resources by 2017. In addition, capacity addition of 301 MW through Solar PV and Thermal by 2014 has envisaged in line with National Solar Mission. BUSINESS DIVISIONS Hydro Power In order to give impetus to hydro power growth in the country and to have a balanced portfolio of power generation, NTPC entered hydro power business with the 800 MW Koldam hydro project in Himachal Pradesh. Two more projects have also been taken up in Uttarakhand. A wholly owned subsidiary, NTPC Hydro Ltd., is setting up hydro projects of capacities up to 250 MW. Coal Mining In a major backward integration move to create fuel security, NTPC has ventured into coal mining business with an aim to meet about 20% of its coal requirement from its captive mines by 2017. The Government of India has so far allotted 7 coal blocks to NTPC, including 2 blocks to be developed through joint venture route. Power Trading NTPC Vidyut Vyapar Nigam Ltd. (NVVN), a wholly owned subsidiary was created for trading power leading to optimal utilization of NTPCs assets. It is the second largest power trading company in the country. In order to facilitate power trading in the country, National Power Exchange Ltd., a JV between NTPC, NHPC, PFC and TCS has been formed for operating a Power Exchange. Ash Business NTPC has focused on the utilization of ash generated by its power stations to convert the challenge of ash disposal into an opportunity. Ash is being used as a raw material input for cement companies and brick manufacturers. NVVN is engaged in the business of Fly Ash export and sale to domestic customers. Joint ventures with cement companies are being planned to set up cement grinding units in the vicinity of NTPC stations.

28 | P a g e

Power And Capital Goods

Power Distribution NTPC Electric Supply Company Ltd. (NESCL), a wholly owned subsidiary of NTPC, was set up for distribution of power. NESCL is actively engaged in Rajiv Gandhi Gramin Vidyutikaran Yojana programme for rural electrification and also working as 'Advisor cum Consultant' for Ministry of Power for implementation of Accelerated Power Development and Reforms Programme(APDRP) launched by Government of India. Equipment Manufacturing Enormous growth in power sector necessitates augmentation of power equipment manufacturing capacity. NTPC has formed JVs with BHEL and Bharat Forge Ltd. for power plant equipment manufacturing. NTPC has also acquired stake in Transformers and Electricals Kerela Ltd. (TELK) for manufacturing and repair of transformers. STRENGTHS Operational Performance NTPC has consistently operated at much higher operating efficiency as compared to all India operating performance. Project Management Integrated system for the planning, scheduling, monitoring and control of approved projects under implementation covering all aspects of the project, from concept to commissioning is used. Bulk ordering of Super-critical units of 660 MW and 800 MW to reduce engineering time and thereby reduce project execution time. Robust Financials Low gearing and healthy coverage ratios aid preferred borrowing. The ability to service debt liability remains strong due to certainty of revenues. Long Term Fuel Supply Agreements Coal supply agreements with various subsidiary coal companies of CIL for all the coal based stations which were under commercial operation and long term Gas Supply Agreements (GSAs) with GAIL for supply of Administered Price Mechanism (APM) gas. Low Cost Producer

29 | P a g e

Power And Capital Goods

Most of the stations are pit-head stations which provides a cost advantage as compared to our peers. The low average tariff of your Company also ensures lower risk concerning power off-take in the sector. CHALLENGES Sustaining leadership position in the country Reduce its dependence on fossil fuels Acquisition of land related delays Environmental, pollution and other related regulatory norms

30 | P a g e

Power And Capital Goods

POWER GRID CORPORATION OF INDIA LIMITED PGCIL is Indian state owned Navaratna company. It was incorporated in 1989 for the purpose of power transmission across the country. As on 31st March, 2012, company owns and operates a transmission network of about 92,981ckt kms of inter-State transmission lines, 150 nos. of EHV & HVDC substations with transformation capacity of about 1,25,000 MVA and transmits about 50% of total power generated in the country. The company earns its revenue primarily from the following three sources: Transmission charges It earned 9544 Crore (88.49% of its total earnings) in 2011-2012 from its core business of transmission. It is the single largest player in this segment, and with huge capital investments planned in the 12th plan, it shall further strengthen its position in the transmission segment. Consultancy It earned 290 Crore in 2011-2012 from its consultancy business. It started its consultancy business in 1995 and has since provided consultancy in more than 225 power transmission projects. It has provided its services not only to domestic clients but also to overseas ones in the Gulf countries, Africa, Sri Lanka and Bhutan Telecom (via its subsidiary Power System Operation Corporation Limited POSOCO) It earned 201 Crore in from its telecom network in 2011-2012. The telecom vertical, has been operational since 2007. PGCIL has installed 1,50,000 towers over a network of 21,000 kilometres across the country. It has leased bandwidth to over 60 customers including major telecom operators like BSNL, VSNL, Bharti Airtel and reliance Communications.

Out of a total fund requirement of 1,80,000 Crore, required for transmission system during the 12th five year plan, PGCILs contribution would be around 100,000 Crore rupees. Due to its excellent credit rating with financial institutions,( Domestic credit rating agencies namely, CRISIL, CARE and ICRA have assigned credit ratings of AAA/Stable (triple AAA with stable outlook), AAA and LAAA respectively for its bonds issue) it should not have any problem in mobilizing the resources for meeting the planned investment during XII plan period.

31 | P a g e

Power And Capital Goods

INCOME BREAKUP (2011-2012)

Source: PGCIL Annual Report

PGCIL is currently working on higher transmission voltages of 800kV HVDC & 1200kV Ultra High Voltage AC (UHVAC). Implementation of 800kV, 6000 MW multi-terminal HVDC system of around 2000 km from North Eastern Region (Biswanath Chariali in Assam and Alipurduar of West Bengal) to Northern Region (Agra in Uttar Pradesh) is under construction. It shall be amongst worlds largest 800kV multi-terminal HVDC system. Company is also working on 12000kV UHVAC transmission system. The 1200kV UHVAC technology, the highest voltage level in the world, is being developed by the company in collaboration with 35 Indian manufacturers. This is one of the unique R&D projects in public-private partnership model. The pilot 1200kV S/c line was successfully test charged and 1200 kV D/c line erected at 1200kV UHVAC National Test Station at Bina, Madhya Pradesh in February, 2012 . The 1200 kV UHVAC technology is currently under field testing. This endeavour shall benefit Indian power sector to enter into new era of 1200kV level with 1200kV class equipment from the manufacturers within the country.

32 | P a g e

Power And Capital Goods

STRENGTHS High margin business By virtue of its business model, PGCILs expenses are mainly incurred on employee remuneration and maintenance. Its earnings are not adversely affected by factors like fuel cost hikes that affect the power generation companies. Consequently, PGCIL is able to enjoy high operating margins in excess of 80%. Rapid expansion It has planned a capital expenditure of 100,000 Crore in the 12 th plan. Its capital work-in-progress stands at around INR 15,000 crore which would lead to additional asset formation in the next two-three years. Also, Central Electricity Regulatory Commission (CERC) has given its nod for the installation of nine high-speed transmission corridors (HSTCs) at a total investment of Rs 60,000 crore. Asset formation and HSTCs will definitely increase its revenue in the next 2 -3 years. Non-existent competition PGCIL is one of the few government-regulated monopolies still in existence in India. It has a monopoly over long-distance high voltage power transmission in the country. PGCIL owns and operates most of Indias inter-state and inter-regional power transmission network.

CHALLENGES High Capital investment requirement Transmission projects require substantial capital outlays before commencing operations. For the 12th Plan, PGCIL plans to raise $1 billion (Rs 4,573 crore) from the World Bank and $750 million (Rs 3,430 crore) from the Asian Development Bank. Companies debt equity ratio stands at 2.22 at end of financial year 2011-2012, higher than that of 1.85 at end of financial year 2010-2011. This can go further up as company plans to borrow money for its capital expenditure. Delay in projects Delays in commissioning of new projects would have a negative impact on the company. Transmission projects linked to generation projects are more vulnerable to delays as compared to other projects, especially considering the fuel shortage currently faced by many power generation projects.

33 | P a g e

Power And Capital Goods

PTC PTC Limited India was set up in 1999 as Power Trading Corporation of India Ltd at the initiative of Government of India with the chief objectives of promoting power trading to optimally utilize the existing resources and development of power market for enhancing market based investment in the Indian Power Sector. It has been the market leader in power trading since it began sustained trading in 2001-02

Source: PTC Corporate Presentation (31-3-2012) Its promoters include some of the biggest names of power industry in India backed by Central Government, viz. Power Grid Corporation of India Ltd. (PGCIL), Power Finance Corporation Ltd. (PFC), National Thermal Power Corporation Ltd. (NTPC), National Hydroelectric Power Corporation Ltd. (NHPC) and Damodar Valley Corporation (DVC). PTC aims to become an integrated energy player by providing a complete range of services in the power trading market including intermediation for long-term supply of power from identified domestic IPPs and cross-border power projects, financial services like providing equity and debt support to projects in the energy value chain and fuel intermediation for cross-border power plants. It has floated a subsidiary for each of these ancillary businesses. BUSINESS MODEL Long term power sale solutions It involves contracts for 10-35 years with power being sold from a generating plant to one or more state utility companies. PTC enters into long term Power Purchase Agreements (PPAs) with Independent Power Producers (IPPs) and long term back-to-back Power Sale

34 | P a g e

Power And Capital Goods

Agreements (PSAs) for sale of electricity from such projects to various Distribution companies (DISCOMS) thereby mitigating the risk for both. Short term power sale solutions It spans anywhere between a few hours to one year where surplus power is sourced from generating plants for sale to various state utilities across the country. Short Term market comprises of bilateral transactions through trading licensees, between utilities, power exchange transactions and balancing market in the form of unscheduled interchange (UI) Power sourcing and supply solutions PTC aims to develop a commercially vibrant power market by enabling small power producers with minimum contract demand of 5 MW to enter into agreements with PTC for purchasing power through short term and medium term bilateral arrangements. It also facilitates procurement of renewable power or Renewable Energy Certificates (REC) for fulfilment of Renewable Purchase Obligation (RPO) by power producers. Advisory services PTC provides tariff and financial modelling for upcoming IPPs by sharing its expertise, filing Tariff Petition before the Regulatory Commission and Drafting of Power Purchase Agreement and Power Sale Agreement, both short term and long term. It also helps its customers to setup businesses processes for trading. STRENGTHS Leading Market Position with approx. 43% market-share in power trading as well as Co-promoter of Indias First National Power Exchange (IEX) It has presence in entire energy value chain by diversifying its businesses into Power Trading, Direct Investments in Power projects, Fuel Intermediation, Power Tolling Arrangements and Advisory Services Robust financial performance with CAGR of 15% for last 5 years and revenues for FY12 at INR 76,503 Cr (albeit a bit lower than in FY11) Strong network of relationships with key industry participants, Government, Utilities, IPPs and marquee investors like Goldman Sachs and Macquarie provides an edge over competitors

35 | P a g e

Power And Capital Goods

Source: PTC Corporate Presentation (31-3-2012) CHALLENGES Defaults on Power Purchase Agreement (PPA) by LANCO, Torrent Power and JP Power Ventures on various legal counts. The cases are sub judice. Although CERC has increased cap on short term margins to 7 paise/kWh from 4 paise/kWh with no cap on longterm margins, its reversal in future could risk earnings. PTC covers credit risk for its customers. Considering the weak financial health of various SEBs, payment defaults by the companies it sells power to can put severe financial strain on PTC.

36 | P a g e

Power And Capital Goods

LARSEN & TUOBRO Larsen & Toubro Limited (L&T) is a technology, engineering, construction and manufacturing company. It is one of the largest and most respected companies in India's private sector. Considered as the bellwether of Capital Goods sector in India, it has more than seven decades of a strong, customer-focused approach and the continuous quest for world-class quality have enabled it to attain and sustain leadership in all its major lines of business. The company was founded in Mumbai in 1938 and went public in 1950. It posted a revenue of INR 520.89 billion for FY 11. L&T has an international presence, with a global spread of offices. A thrust on international business has seen overseas earnings grow significantly. It continues to grow its global footprint, with offices and manufacturing facilities in multiple countries. The company's businesses are supported by a wide marketing and distribution network, and have established a reputation for strong customer support.

Source: BSE BUSINESS DIVISONS Hydrocarbon L&T's Hydrocarbon Business delivers 'design to build' world-class engineering and construction solutions on turnkey basis in oil & gas, petroleum refining, chemicals &

37 | P a g e

Power And Capital Goods

petrochemicals and fertiliser sectors. It includes Design & Engineering Services, Fabrication and installation capabilities. Heavy Engineering It has integrated strengths in process technology, basic and detailed engineering, equipment fabrication, procurement, project management, erection, construction and commissioning. L&T Construction L&T Construction undertakes Engineering Procurement and Construction (EPC) projects with single source responsibility. Power L&T Power partners with its customers in providing solutions. In-house strengths are supplemented by collaborations with global leaders in the fields of engineering and manufacturing. Electrical & Automation Electrical & Automation business comprises low and medium voltage switchgear products; low and medium voltage electrical systems; marine switchgear, switchboards & control systems; energy meters & relays and automation solutions. Its products and solutions cater to utilities, industries, commercial establishments and individual user segments. Information Technology L&T Infotech is a global IT services and solutions provider providing boasting a clientele including industry leaders like Chevron, Freescale, Hitachi, Sanyo and Lafarge. Shipbuilding The Shipbuilding facility is involved in construction of high tech vessels. The shipyard is geared up to take up construction of niche vessels such as specialized Heavy lift Cargo Vessels, CNG carriers, Chemical tankers, defense & para military vessels and other role specific vessels. Railway Projects The business includes Integrated railway projects, Metro rail systems, Mono rail systems, Stations & buildings, Railway bridges, System engineering (electrification & signaling and Telecommunication systems), Rolling stock

38 | P a g e

Power And Capital Goods

STRENGTHS Forays into the international markets, particularly in the middle East, provides thrust to International Business Concentration on superior execution and enhanced delivery capability for achieving targeted sales and profitability in 2012-2013 strengthening Execution and Operational efficiency High Capital expenditure to acquire various plant and equipment for the businesses in Engineering and Construction segment New Business Structure and Strategic Plan instutionalising Independent Companies (ICs) structure in L&T Group for empowering businesses for scaling up performance

CHALLENGES Rising Raw Material prices could impact L&T's Margins Timely execution of projects is important as it impacts the profitability (legal costs, penalties etc.) of the company Risks due to Currency fluctuation affects the profits of L&T as it operates in many countries, owing to which it is exposed to currency fluctuation risks

39 | P a g e

Power And Capital Goods

BHEL BHEL is the largest engineering and manufacturing enterprise of its kind in India and it was incorporated in the year of 1964. BHEL is amongst the few companies in the world who have the capability to manufacture entire range of power plant equipment. The company has realized the capacity to deliver 20,000 MW p.a. power equipment capacity. In 1991-92, it has divested a part of its equity shares to public and financial institutions. At present the government of India holds 67.72% in the total equity capital of the company. BUSINESS SEGMENTS

Power Generation / Transmission In power generation, BHEL is the largest producer in India supplying wide range of products & systems for thermal, gas, nuclear and hydro based utilities and captive power plants. BHEL supplies boilers, generators, steam turbines and matching equipment of up to 800 MW ratings in this segment, including sets of 660/700/800 MW based on supercritical technology. BHEL has a substantial presence in the transmission segment also. Products manufactured include transformers, shunt reactors, switchgears, insulators etc. It is the first company in India to indigenously develop and manufacture 333 MVA, 1200kV transformers. Industries BHEL is a leading manufacturer of a variety of industrial systems & products to meet the demand of a range of industries like metallurgy, cement, paper, refineries, petro-chemicals, sugar etc. Products include compressors, turbines, boilers, valves, heat exchangers etc. This segment of the company is fully geared to execute EPC contracts for captive power plants from concept to commissioning. BHEL also possesses expertise to design, manufacture and service various types of onshore rigs for the Oil & Gas Sector. Additionally, the company has also made headways in the field of renewable energy with products like solar powered street lighting, rural water pumping solutions etc.

40 | P a g e

Power And Capital Goods

International Business BHEL has established its references in 75 countries. These references encompass almost the entire range of BHEL products and services, covering Thermal, Hydro and Gas-based turnkey power projects, Substation projects, Rehabilitation projects, besides a wide variety of products like Transformers, Compressors, Valves, Oil field equipment, Electrostatic Precipitators, Photovoltaic equipment, Insulators, Heat Exchangers, Switchgears, Castings and Forgings etc. BHEL has also proved its capability to undertake projects on fast-track basis. Continued focus on After-Sales-Services has led to orders for Spares & Services from Indonesia, Bhutan, Oman, Malaysia, Bangladesh, Vietnam, Srilanka, Saudi Arabia and UAE during 2011-12. Besides undertaking turnkey projects on its own, BHEL also possesses the requisite flexibility to interface and complement other international companies for large projects. SECTOR WISE ORDER BOOK OUTSTANDING AS ON 31st MAR 2012 (TOTAL INR 1,36,000 Cr)

Source: BHEL Annual Report STRENGTHS Strong Research and Development team BHEL is one of the few Indian companies that has strong focus on research and development. It filed 351 IPRs in 2011-2012, taking its total IPR tally to 1786. It was ranked the ninth most innovative company in the world by Forbes Strong Brand Image The past track record of the power plant equipment manufacturer in the country and in international markets plays an important role in winning project bids Complete range of products for power transmission and distribution

41 | P a g e

Power And Capital Goods

CHALLENGES Financial instability in Europe and political turmoil in Middle East & North Africa (MENA) region is causing delays in financial closure & project financing, resulting in postponement of finalization of new projects. 28% of Bharat Heavy Electricals Ltd's order book is at risk of cancellation or deferment due to either non-availability of coal linkage or cancellation of existing linkage, following the coal allocation scam, Coalgate. Increasing competition from foreign firms, some of which are technology leaders is putting pressure on the margins. These firms are forming JVs with local manufacturers and bidding aggressively to capture market share. Delays in land acquisition, getting environmental clearances, fuel availability etc are affecting implementation of power projects.

42 | P a g e

Power And Capital Goods

IMPORTANT PARAMETERS Plant Load Factor (PLF) It is a measure of average capacity utilisation calculated as the ratio of the actual output of a power plant over a period of time and its output if it had operated at full capacity during that time period. Important financials for evaluation (a) Turnover (b) Enterprise value/Installed capacity (c) Enterprise value/Power generated (d) EBITDA margin (e) EBIT margin (f) Profit margin (g) Debt equity ratio Order book It is a record of the outstanding orders that an organization has received. It consists of the specifications and delivery times of orders recorded in it, or the term may be used generally to describe the health of a company. Plant availability factor It is the amount of time for which a power plant can generate electricity relative to the total time frame being considered. Book to bill ratio It is the ratio of orders received to units shipped and billed for a specified period. It is an indication of the performance and outlook for individual companies and the capital goods sector. Order backlog The order backlog is the value of the orders that a manufacturer has signed but not completed and been paid for yet. The level of backlogs is an important indicator of whether the industry is growing or not. Falling backlogs may be a sign that new orders are dropping and the old ones are being fulfilled, and that producers are less willing to hold large stocks or inventories.

43 | P a g e

Power And Capital Goods

RECENT DEVELOPMENTS COALGATE

Source: CAG Report no. - 7 of 2012-13 on Performance Audit of Allocation of Coal Blocks The possibility of cancellation of coal block allocation due to the political furore resulted as a publication of CAG report on coal scam has created a negative sentiment in the power industry as it may result in exacerbation of coal shortage.

44 | P a g e

Power And Capital Goods

GRID FAILURES India has five regional grids - northern, eastern, north-eastern, southern and western grids. All of them, except the southern grid, are interconnected synchronously. A massive blackout resulted due to grid failure on two consecutive days viz. July 30-31, 2012 has focused the attention of the power industry on the need for investments in transmission sector. The following factors contributed to the country's grid failures: Insufficient capacity Lack of a smart grid system to monitor the entire network (inter and intra state) allowed state utilities to overdraw power The absence or improper use of protection systems such as under-frequency relays meant that regional grids or facilities connected to the network were unable to isolate themselves in time to prevent tripping PGCIL had taken steps to develop a smarter transmission grid. There are plans to implement a pilot project to test a new generation of monitoring units in the northern region grid. These new units allow the grid to be monitored at a much faster rate and in real-time, compared with the existing system, which only allowed a steady state view of the grid. The Union Power Ministry has decided to take up the work of connecting the southern grid with the national grid on a war footing with a deadline of 2014.

IMPORT DUTY ON ELECTRICAL EQUIPMENT The Union Cabinet has approved 21% import duty on sourcing power equipments from oversees. The Cabinet has approved 5% basic customs duty, 12% CVD or Counter Vailing Duty (a sort of equalization levy to make up for the excise on local products) and 4% Special Additional Duty (SAD), totalling 21%. This duty structure will apply only to the so-called mega projects, or those generating at least 1,000 megawatts (MW). The decision will benefit companies like Bharat Heavy Electricals Ltd (BHEL) and Larsen and Toubro Ltd (L&T), which have been demanding increase in import duties for the past two years amid increasing competition from cheaper Chinese equipment. In recent years, Chinese manufacturers such as Dong Fang, Shanghai Electric and Harbin, have bagged orders for around 80,000 MW of equipment, from Indian groups like Adani Power and Reliance Power. These companies have said that electricity tariffs might rise due to imposition of such duty. Apart from BHEL and L&T, power generation equipment makers having a manufacturing base in India Doosan Heavy Industries and Construction Co. Ltd; the joint ventures between L&T and Mitsubishi Heavy Industries Ltd; Toshiba Corp. of Japan and the JSW Group; Ansaldo Caldaie

45 | P a g e

Power And Capital Goods

SpA of Italy and Gammon India Ltd; Alstom SA of France and Bharat Forge Ltd; BGR Energy Systems Ltd and Hitachi Power Europe GmbH, and Thermax Ltd and Babcock and Wilcox Co. will benefit from such a move. FUEL SUPPLY AGREEMENTS (FSA) AND PRICE POOLING Presently Coal India has a monopoly in coal mining in India and is owned by GOI. Due to long standing power shortages, the Government of India has forced CIL to sign fuel supply agreements with power producers with a guaranteed supply at least 80% of contracted quantity to avoid penalties through a presidential directive. CIL believes it does not have the ability to meet the minimum requirements above 65% of contracted quantity. CIL is looking forward towards international market to meet the demand thrust upon it. This model under which CIL will import coal and supply it domestically is called price pooling. Under it, power plants in coastal areas will receive 30% of their total requirement in imported coal, while those within 300 km of the coastline will be supplied with 15%. The remaining power plants will use 100% domestic coal. The resultant increase in the price of coal will be distributed equally among all consumers irrespective of the coal supplied. The price pooling model is currently awaiting approval from the prime minister. Till date, the CIL board is deliberating on the FSA clauses. Some independent directors have also tried to draw a relation between the presidential directive and coalgate by articulating that CIL is being forced to supply coal to even those power producers which have been allocated captive coal blocks leading to even greater windfall profits.

46 | P a g e

Power And Capital Goods

SECTOR OUTLOOK Power and Capital Goods sector are vital input for production and rapid growth of GDP will need to be supported by an increase in energy consumption. This is especially so in India where large sections of the population are still without access to energy resulting in considerable demand supply gap. Capital Goods sector directly affects many industries like textile, infrastructure, power, cement, mining and more. Due to governments thrust on power and infrastructure, this sector has been performing well since last 6-7 years. Good performance of this sector is vital to sustain rapid economic growth of the country. Focus in generation is on twin measures of energy efficiency and larger share of clean energy. Use of super critical and ultra-super critical technologies in power generation is expected to reduce the coal requirement of electricity production. GOI aims to increase the share of new and renewable energy in total commercial energy from 10% presently to 15% by 2020. Given the inability of Coal India Limited (CIL) to cater to the coal requirements from power producers, the expected demand can only be met with increase in imports. The technical limitation for this is that Indian power plants are not designed to take more than 10% to 15% of imported coal. Besides, power producers are not willing to accept higher cost fuel. Electricity to the consumer is under-priced. Electricity prices are set by State regulators but most regulators hold back tariff adjustments under political pressure. This jeopardises the financial position of the discoms. Though in the last year, due to coordinated efforts, several states have increased power tariffs and others are expected to follow suit. The share of the private sector in generation and transmission is expected to rise on the back of expansion in production and consumption of electricity. Capacity expansion has gone up substantially and this share is expected to increase further to about 50% in next five years creating huge investment opportunities for private players. The distribution segment in the power sector is clearly the weakest link in the power system with current losses of distribution utilities at approx. INR 70,000 crore. There is a need for bringing in modern systems of management, use of IT and/or privatisation creating opportunities in the long run. In our view, though there are multiple challenges, adequate policy action and coordinated efforts by stakeholders shall result in sustained growth for the sector.

47 | P a g e

Power And Capital Goods

REFERENCES Approach paper 12th Five year plan (http://planningcommission.gov.in/plans/planrel/12appdrft/appraoch_12plan.pdf) Website of NTPC www.ntpc.co.in Website of PGCIL www.powergridindia.com Website of PTC www.ptcindia.com Website of L&T www.larsentoubro.com Website of BHEL www.bhel.com Website of Central Electricity Regulatory Commission www.cercind.gov.in Website of Central Electricity Authority http://www.cea.nic.in CAG Report No. - 7 of 2012-13 for the period ended March 2012 - Performance Audit of Allocation of Coal Blocks and Augmentation of Coal Production (www.saiindia.gov.in/english/home/Our_Products/Audit_Report/Government_Wise /union_audit/recent_reports/union_performance/2012_2013/Commercial/Report_ No_7/Report_No_7.htm) ISI emerging Markets database Website of Reserve Bank of India http://www.rbi.org.in/ www.moneycontrol.com

48 | P a g e

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Economist - September 22ndDocument107 pagesThe Economist - September 22ndAbhishek Gupta50% (2)

- MGI India Consumer Executive SummaryDocument18 pagesMGI India Consumer Executive SummaryAbhishek GuptaNo ratings yet

- Tokyo Motor Show 2007Document41 pagesTokyo Motor Show 2007Abhishek GuptaNo ratings yet

- Transporter: XYZ & Co. Business Process Change Case AnalysisDocument1 pageTransporter: XYZ & Co. Business Process Change Case AnalysisAbhishek GuptaNo ratings yet

- Power & Capital GoodsDocument49 pagesPower & Capital GoodsAbhishek GuptaNo ratings yet

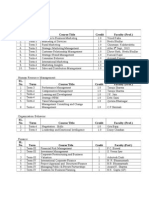

- SL. No. Term Course Title Credit Faculty (Prof.) : MarketingDocument3 pagesSL. No. Term Course Title Credit Faculty (Prof.) : MarketingAbhishek GuptaNo ratings yet

- Action Plan - Clean India Day 2013Document2 pagesAction Plan - Clean India Day 2013Abhishek GuptaNo ratings yet

- MDI Executive Batch Profile 2013-14Document7 pagesMDI Executive Batch Profile 2013-14Abhishek GuptaNo ratings yet

- Action Plan - Clean India Day 2013Document2 pagesAction Plan - Clean India Day 2013Abhishek GuptaNo ratings yet

- Nature's Greatest Puzzles: Chris QuiggDocument46 pagesNature's Greatest Puzzles: Chris QuiggAbhishek GuptaNo ratings yet