Professional Documents

Culture Documents

Gold Price Data Analysis Using Rescaled Range (R/S) Analysis

Gold Price Data Analysis Using Rescaled Range (R/S) Analysis

Uploaded by

TJPRC PublicationsOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Gold Price Data Analysis Using Rescaled Range (R/S) Analysis

Gold Price Data Analysis Using Rescaled Range (R/S) Analysis

Uploaded by

TJPRC PublicationsCopyright:

Available Formats

GOLD PRICE DATA ANALYSIS USING RESCALED RANGE (R/S) ANALYSIS

SHAIKH YUSUF H

1

, KAPSAE S. K.

2

, KHAN A R

3

& G. RABBANI

4

1

Shivaji Arts, Commerce and Science College, Kannad, India

2

S.B. Science College, Aurangabad, Maharashtra, India

3,4

Maulana Azad College Dr. Rafiq Zakaria Campus, Dr. Rafiq Zakaria Marg,

Aurangabad, Maharashtra, India

ABSTRACT

Gold has been at centre of attraction from various angles, particularly for value and financial importance and

served as a reference. There has been a continuous rise in the international gold prices since for ages. Gold is a major part

of savings of investors, this has caused concern as to whether any correction in gold prices will have destabilizing

implications on the financial markets. With this backdrop, we make an attempt to analyze the gold prices over a period of

more than last 32 years to explore the variability in the gold price in India. The gold market has recently attracted a lot of

attention and the global price of gold is relatively higher than its historical changing pattern and trend. There has been a

drastic increase in international gold prices in the last few years, though there was one large correction in 2008. The gold

price data for about 32 years is divided into four sets for the purpose of implementation of Rescaled Range (R/S) Analysis.

R/S analysis is an effective technique for analyzing random data in the form of time series in order to bring out trends and

any memory effects present in the behavior of the changing data. Details of implementation of the R/S analysis technique

and estimation of the Hurst exponent H and the fractal dimensions are presented and findings and results discussed, it is

shown that the international gold prices exhibit a consistent trend of persistence and long term memory effect with fractal

dimension close to unity.

KEYWORDS: Gold Market, Gold Prices, Time Series, R/S Analysis, Fractal Dimension, Persistence, Memory Effect

INTRODUCTION

Like share prices the international gold prices exhibit a random variation and the parameters governing the gold

prices can not exactly be enlisted. Randomly varying prices pose difficulties in predicting trends and future patterns which

is of interest to investors and financial agencies. Such situations are at time handled using methods based on the concept of

fractals and fractal dimensions and the approach is found to be effective for non-stationary signals such as stock market

data [1 to 5]. These apparently irregularly changing signals are considered to be driven by external non stationary factors.

Standard methods such as Fourier analysis assume that the signals are stationary in temporal windows. Such an assumption

does not strictly apply for gold prices and stock market data as it changes constantly with an element of unpredictability

and the factors governing the prices keep on changing from time to time. Such irregular phenomena are at times handled

using the concept of fractals and fractal dimensions [6 to 8], fractals possess characteristics of self similarity and scale

invariance. Fractal based methods such as rescaled range analysis does not impose the above assumption and therefore are

better suited for the analyzing the data and has better predictability. In this paper, we use rescaled range analysis [9 to 15]

to analyze gold price (in IRS) data for more than last 32 years which gives statistical insight into the trends and tendencies

of fluctuations. The data spread over 32 years is divided into four part of approximately 8 years each (Set I to IV).

The four sets of data is independently subjected to R/S analysis and the findings are presented, it is shown that rescale

International Journal of Economics,

Commerce and Research (IJECR)

ISSN(P): 2250-0006; ISSN(E): 2319-4472

Vol. 4, Issue 1, Feb 2014, 7-14

TJPRC Pvt. Ltd.

8 Shaikh Yusuf H, Hydery Wasim Ahmed, Khan A R & G.Rabbani

range analysis can be used for assessing any trends of persistence or anti persistence that can be used for predicting future

trends.

GOLD PRICE DATA

Gold and Share market [16] form the fulcrum of economic trends in the market for ages and it has its own

importance in establishing strength or weakness of the prevailing economic trends. It is known that domestic gold prices

and international gold prices are closely interlinked. Variations in the international gold prices find almost similar echo in

the domestic gold prices. For a long time, macro fundamental such as international commodity prices, US exchange rate

and equity prices used to be the most dominating factors affecting the international gold prices and their impact used to be

identical both in the long-run and short-run[17]. However this linkage started showing weakness and the mutual

dependence was found to be more complex and the relative proportion of the two main deciding factors was found to

appreciably change.

Lot of standard software are available out there and for analyzing such data that in fact is a time series to evaluate

the volatility and assess the variation patterns, however these try to forecast future prices based on statistical theories and

historical weightages and at times are liked with news and technicals. Most of the times, statistically based parameters fail

drastically if the prices drastically change due to economic events (also known as news) or issues like change of rule or

Government, at times natural calamities and wars also shake the market drastically.

RESCALE RANGE ANALYSIS OF TIME SERIES

For the study natural phenomena possessing random character such as the flow of the Nile River in relation to

long term correlation Hurst introduced approach. This approach was based on the statistical assessment of many

observations of the natural phenomena. After studying 800 years of records, he showed that the flow of the Nile River was

not random, but had a pattern. He introduced a constant, K, which measures the bias of the fractional Brownian motion.

In 1968 Mandelbrot defined such pattern as fractal. There are many algorithms to calculate fractal characteristics such as

fractal dimensions, which is a number that quantitatively describes how an object fills its space. He renamed the constant K

to H in honor of Hurst. Rescaled range (R/S) analysis is a statistical method to analyse the records of natural phenomena in

the form of a time series. The theory of the rescaled range analysis was first given by Hurst. Mandelbrot and Wallis further

refined the method. Feder (1988) gives an excellent review of the analysis of data using time series [18, 19], history, theory

and applications, and adds some more statistical experiments to establish the effectiveness of this approach. The parameter

H, the Hurst exponent provides insight into the trends and patterns shown by the time series in respect of as to whether the

time series is random or not. It is also related to the fractal dimension, the Rescaled range analysis (R/S) approach of

estimating H is helpful in distinguishing a completely random time series from a correlated time series and. The value of H

reveals persistence of trends in a given time series.

METHODOLOGY

The approach for estimation of the Hurst exponent H follows simple statistical rules, for a time series like data,

start with the whole observed data set Z (t) that covers a total duration and calculate its mean over the whole of the

available data Z.

t

=

t

t

=

1 t

) t ( Z

1

Z

(1)

Gold Price Data Analysis Using Rescaled Range (R/S) Analysis 9

Then Sum the differences from the mean to get the cumulative total of the deviation from mean at each time point,

X (

t , t

), from the beginning of the period up to any time t using

( ) ( )

=

=

t

t

t

1

) , (

t

Z t Z t X

(2)

Then find the X max the maximum of X (t, t), X min the minimum of X(t, t) and calculate the self adjusted range

R(t) defined as the difference between maximum and minimum accumulated influx X

R (t ) = max X (t, t) - min X (t , t) (3)

The standard deviation S, of the values, Z (t) of the observation over the period,

( ) ( )

2

1

1

2 1

) ( |

.

|

\

|

=

=

t

t

t

t

t

Z t Z S

(4)

Hurst used a dimension less ratio R/S where

) (t S

is the standard deviation as a function of t

(R/S) = (t / 2) H (5)

Hurst exponent H can be found by plotting log (R/S) against log (t/2), the slope of the resulting straight line is the

Hurst exponent. The Hurst exponent gives a measure of the smoothness of a fractal object where H varies between 0 and 1.

Low H values indicate high levels of roughness or variability. High values of H indicate low value of roughness or high

levels of smoothness. The fractal dimension D is related to H as H = 2 D and higher the value of D, larger is the

variability or complexity associated with the time series. We use H and D to analyze the gold price data as it has a broad

applicability to signal processing due to its robustness. These parameters can be calculated by the rescaled range analysis

method. It is useful to distinguish between random and nonrandom data points/time series. If H equals 0.5, then the data is

determined to be random. If the H value is less than 0.5, it represents anti-persistence, meaning, if the signal is up/down in

the last period then more likely it will go down/up in the next period (i.e. if H is between 0 and 0.5 then an increasing trend

in the past implies a decreasing trend in the future and decreasing trend in past implies increasing trend in the future). If the

H value varies between 0.5 and 1, this represents persistence which indicates long memory effects, where, if the signal is

up/down in the last period, then most likely in the next period the signal will continue going up/down. This also means that

the increasing trend in the past implies increasing trend in the future also or decreasing trend in the past implies decreasing

trend in the future. It is important to note that persistent stochastic processes have little noise whereas anti-persistent

processes exhibit presence of high frequency noise.

The relationship between fractal dimensions D f and Hurst exponent H can be expressed as

D f = 2 H (6)

From the Hurst exponent H of a time series, the fractal dimension can be found from this equation. When

D f = 1.5, there is normal scaling. When D f is between 1.5 and 2, time series is anti-persistent and when D f is between 1

and 1.5 the time series is persistent. For D f =1, time series is a smooth curve and purely deterministic in nature and for

D f = 1.5 time series is purely random.

10 Shaikh Yusuf H, Hydery Wasim Ahmed, Khan A R & G.Rabbani

R/S ANALYSIS OF GOLD PRICE TIME SERIES

The international gold price data (in IRS) spread over about 32 years is split into four parts with 2048 data points

in each set (Set I to IV) For the purpose of implementation of R/S analysis. Set I is for the years 2005 to 2013, Set II

for 1997 to 2005, Set III is for 1989 to 1997 and set IV is for 1981 to 1989. This covers a period from 19/11/1981 to

12/04/2013; daily record of international gold price [20] in Indian Rupees is used. Figure 1 is the complete plot showing

the changing gold prices over 32 years, the period under study. The initial part of the plot looks like more or less flat

compared to the later part giving a feel that there was no appreciable rising trend in the initial part. To explore the reality,

instead of price versus time a plot of log of price versus time is shown in Figure 2, it is seen from this plot that rising trend

persist over the entire period and is superimposed with fluctuations. For a different comparison, the four sets of data are

plotted on a graph shown in Figure 3, for ease of comparison all the prices in each set are normalized to unity at the end of

each series. This figure clearly indicates that there has been a continuously rising trend in all the four sets however with

varying trends and the Set I representing the latest gold prices show relatively faster rising trend compared to the rest of

the three sets. The R/S analysis was implemented individually on each set taking one set at a time.

Figure 1: Shows Gold Prices per 10g from 02/01/1979 to 12/04/2013

Figure 2: Shows Log of Gold Prices per 10g from 02/01/1979 to 12/04/2013

Gold Price Data Analysis Using Rescaled Range (R/S) Analysis 11

Figure 3: Represent Time Series of 4 Sets of 2048 Data Points

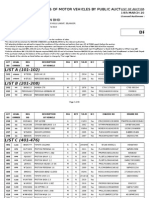

The results of R/S analysis implemented individually on each sets (Set I to IV) taking one set at a time is

presented in Table 1 First column is the log(/2) value and the remaining four columns show the corresponding values of

log(R/S) for each set. The log log plot of R/S against /2 is shown in Figure 4, it is interesting to note that all the four plots

for the four sets lie close to each other showing identical trend and almost superimpose. The slope of the straight line best

fitting the data point lie between 0.5 and 1.0, in fact more than 0.9, indicating persistent trend implying that the rising

prices continue to rise and the falling prices continue to fall that is in agreement with what is seen from the plots, of course

there is always a variability and there are turning points where the prices show the trend reversal and that is one point or

two and rest of the points follow certain trend.

Table 1: Mean R/S and t/2 for Gold Price Data (from 19/11/1981 to 12/04/2013)

S

No

Log(T/2)

Log(R/S)

Set I Set II Set III Set IV

1 0.30103 0.0015 0.0769 0.0640 0.0178

2 0.6021 0.2805 0.2804 0.2716 0.2491

3 0.9031 0.5635 0.5326 0.5234 0.5005

4 1.2041 0.8533 0.8118 0.8129 0.7804

5 1.5051 1.1482 1.0871 1.1020 1.0711

6 1.8062 1.4460 1.3759 1.3845 1.3801

7 2.1072 1.7454 1.6787 1.6953 1.6824

8 2.4082 2.0456 1.9801 1.9367 1.9731

9 2.7093 2.3462 2.2705 2.3094 2.3216

10 3.0103 2.6470 2.5822 2.6444 2.5785

Figure 4: Gives Rescale Range Analysis of 4 Sets of Gold Price Analysis of 2048 Data Points

12 Shaikh Yusuf H, Hydery Wasim Ahmed, Khan A R & G.Rabbani

The value of the Hurst exponent estimated from the slope of the graph and the fractal dimension calculated from

the Hurst exponent are tabulated in Table 2 the values of R2 are shown in the last column which indicated the least square

fit line best describes the data as the points lie well along this straight line and the value of R2 is close to unity.

The value of Hurst exponent H ranges approximately from 0.94 to 0.98 confirming the persistence in trends, meaning that

a rising trend is precursor of further rise. The fractal dimension D f for Set I and IV are on the lower side indicating

relatively less fluctuations and complexity of trend as compared to the remaining two sets.

Table 2

S.

No.

Set

Hurst

Exponent H

Fractal

Dimension D

f

R

2

1 I 0.9796 1.0204 0.9998

2 II 0.9383 1.0617 0.9980

3 III 0.9560 1.0440 0.9970

4 IV 0.9650 1.0350 0.9983

RESULTS AND DISCUSSIONS

Random data like gold prices and share market data that possesses a high degree of variability and

unpredictability can be analysed using R/S analysis and Hurst exponent H. Hurst exponent is an indicative of the presence

of noise or fluctuations in the data which in turn gives information on the volatility of the prices and turbulence in the

price. The results of R/S analysis as applied to international gold prices (in IRS) show that there is persistence in the trends

exhibited by the gold prices over the entire period studied as the value of H likes between 0.5 and 1.0. This also confirms

long term memory effect that the trends tend to continue. As the value of H range from about 0.94 to 0.98, it indicates that

H being on the higher side tending to unity, imply that the time series lean towards deterministic nature and show limited

roughness or variability. A closer examination of the four sets of data and their respective H and D values shows that

Set I has the highest value of H and Set 2 has the lowest showing that the variability for Set - I is less as compared to

that for Set II which is clearly visible from Figure 2 as there are more ups and down in Set II as compared to Set I.

The remaining two sets exhibit intermediate characteristics as compared to the two. However all the four sets clearly

confirm persistence of the trend and existence of long term memory effect with limited degree of local fluctuations.

REFERENCES

1. Lo A. W., Long Term memory in stock market prices Econometrica 59, 1279 1313.

2. Cheung, Yin-Wong, A search for long memory in international Stock Market returns Journal of International

Money and Finance 14, 597 615(1993).

3. Lo Andrew W. A Craig Mac Kinlay, Long Term memory in stock market Prices Chapter 6 in A Non-Random

Walk Down Wall Street (Princeton Unversity Press. Princeton NJ).

4. Sidra Malik, Shahid Hussain and Shakil Ahmed, Impact of Political Event on Trading volume and Stock

Returns: The Case of KSE International Review of Business Research Papers Vol. 5 No. 4 Pp. 354-364

(June 2009)

5. Mazharul H. Kazi, Stock Market Price Movements and Macroeconomic Variables International Review of

Business research Papers Vol. 4 No.3 June Pp.114-126(2008).

6. B. B. Mandelbrot, The Fractal geometry of Nature Freeman, (San Francisco). (1982).

Gold Price Data Analysis Using Rescaled Range (R/S) Analysis 13

7. B.B. Mandelbrot, Fractals and Scaling in Finance, Springer Verlag, New York (1997).

8. B. B. Mandelbrot, Scaling in Financial Prices: IV Multifractal Concenration uantitative Finance 1(6), 641- 649.

9. Razdan Scaling in the Bombay stock exchange index Pramana 58, 3,537(2002).

10. H.E Hurst., Long-term storage capacity of reservoirs Trans. Am. Soc. Civil Eng116, 770 (1951).

11. Indian Stock Market Research: 5 years Fact sheets and Analysis http://www.equitymaster.com/research-it/

12. X. Zhou, N. Persaud, H. Wang. Scale invariance of daily runoff time series in agricultural watersheds Hydrology

and Earth System Sciences 10, 79(2006).

13. A.R Rao., D. Bhattacharya, Comparison of Hurst Exponent Estimates in Hydrometeorological Time Series J. of

Hydrologic Eng, 4, 3, 225,(1999).

14. Granger, C. W. J, Some properties of Time Series Data and Their Use in Econometric Specification. Journal of

Econometrics; 16: 121-130(1981).

15. Dr. S. Kaliyamoorthy, Relationship of Gold Market and Stock Market: An Analysis International Journal of

Business and Management Tomorrow Vol. 2 No. 6 (2012).

16. Capie, F., Terence, C.M., Wood, G., Gold as a hedge against the dollar International Financial Markets,

Institution and Money 15, 343-352(2005).

17. T. Di Matteo, T. Aste., Michel M. Dacorogna., Long term memories of developed and emerging markets: Using

the scaling analysis to characterize their stage of development Journal of Banking and Finance 29,

827- 851(2005).

18. J. W. Kantelhardt, B. E Koscielny., H. H Rego A, S Havlin, Bunde A, Physica A 295, 441(2001).

19. T.C. Mills, Statistical analysis of daily gold price data Physica A 338 (34), 559566(2004).

You might also like

- Church Recommendation Letter PDFDocument2 pagesChurch Recommendation Letter PDFSB Msomi0% (1)

- Training Design For BasketballDocument3 pagesTraining Design For BasketballRiza Mae Buendicho Castor100% (3)

- Parities and Spread Trading in Gold and Silver MarketssDocument14 pagesParities and Spread Trading in Gold and Silver MarketssSanchit GuptaNo ratings yet

- Long-Term Memory Effect in Stock Prices Analysis: Svetlana DanilenkoDocument5 pagesLong-Term Memory Effect in Stock Prices Analysis: Svetlana DanilenkoBar FooNo ratings yet

- Time SeriesDocument19 pagesTime SeriesbehnazNo ratings yet

- Is Hurst Exponent Value Useful in Forecasting Financial Time Series?Document10 pagesIs Hurst Exponent Value Useful in Forecasting Financial Time Series?MaxNo ratings yet

- Time Series DataDocument19 pagesTime Series Datak61.2212155214No ratings yet

- Monthly XAF-USD Exchange Rates Modeling by SARIMA TechniquesDocument13 pagesMonthly XAF-USD Exchange Rates Modeling by SARIMA Techniquesmbakop andreNo ratings yet

- A Theory of Volatility SpreadsDocument29 pagesA Theory of Volatility SpreadsobrefoNo ratings yet

- Collapsing Exchange Rate Regimes: Some Linear ExamplesDocument13 pagesCollapsing Exchange Rate Regimes: Some Linear Examplesdominic.soon8900100% (2)

- A Study of Forecasting of Exchange Rates Using Non Robust and Robust EstimatorsDocument10 pagesA Study of Forecasting of Exchange Rates Using Non Robust and Robust EstimatorsPuneet RawalNo ratings yet

- Hurst ExponentDocument8 pagesHurst Exponentharrison9No ratings yet

- Discovering Pattern Associations in Hang Seng Index Constituent StocksDocument10 pagesDiscovering Pattern Associations in Hang Seng Index Constituent StocksAndyIsmailNo ratings yet

- Batten 2005Document12 pagesBatten 2005Graphix GurujiNo ratings yet

- Hurst Exponent ModifiedDocument20 pagesHurst Exponent ModifiedNirbhaySinghNo ratings yet

- Non-Linear Forecasting in High Frequency Time SeriesDocument17 pagesNon-Linear Forecasting in High Frequency Time SeriesDylan AdrianNo ratings yet

- Jsaer2016 03 02 11 15Document5 pagesJsaer2016 03 02 11 15jsaereditorNo ratings yet

- A Study of The USDX Based On ARIMA ModelDocument5 pagesA Study of The USDX Based On ARIMA Modelkamran raiysatNo ratings yet

- Application of Non-Linear Time Series Analysis Techniques To High Frequency Currency Exchange DataDocument46 pagesApplication of Non-Linear Time Series Analysis Techniques To High Frequency Currency Exchange Dataaaditya01No ratings yet

- The UK Demand For Broad Money Over The Long Run: Neil R. Ericsson, David F. Hendry, and Kevin M. Prestwich May 1, 1997Document30 pagesThe UK Demand For Broad Money Over The Long Run: Neil R. Ericsson, David F. Hendry, and Kevin M. Prestwich May 1, 1997postscriptNo ratings yet

- Non-Periodic Australian Stock Market Cycles: Evidence From Rescaled Range AnalysisDocument23 pagesNon-Periodic Australian Stock Market Cycles: Evidence From Rescaled Range Analysisdw258No ratings yet

- Understanding VolatilityDocument9 pagesUnderstanding VolatilityrajadeyNo ratings yet

- Emerging Markets Review: Paresh Kumar Narayan, Susan Sunila Sharma, Dinh Hoang Bach Phan, Guangqiang Liu TDocument16 pagesEmerging Markets Review: Paresh Kumar Narayan, Susan Sunila Sharma, Dinh Hoang Bach Phan, Guangqiang Liu TDessy ParamitaNo ratings yet

- Rescaled Range AnalysisDocument7 pagesRescaled Range Analysissobek77No ratings yet

- Acp 2022 316Document17 pagesAcp 2022 316Oussama EchateNo ratings yet

- Multifractality and Heteroscedastic DynaDocument5 pagesMultifractality and Heteroscedastic DynaHeather Dea JenningsNo ratings yet

- Royal Statistical Society, Wiley Journal of The Royal Statistical Society. Series B (Statistical Methodology)Document29 pagesRoyal Statistical Society, Wiley Journal of The Royal Statistical Society. Series B (Statistical Methodology)KirilNo ratings yet

- The Temporal Relationship Between Large-And Small-Capitalization Stock Returns: Evidence From The UKDocument10 pagesThe Temporal Relationship Between Large-And Small-Capitalization Stock Returns: Evidence From The UKCápMinhQuyềnNo ratings yet

- A Momentum Trading Approach To Technical Analysis of Dow Jones IndustrialsDocument12 pagesA Momentum Trading Approach To Technical Analysis of Dow Jones Industrialsapi-230887302No ratings yet

- Jurnal VarxxDocument9 pagesJurnal Varxxzenna aprianiNo ratings yet

- Exchange Rate Forecasting JournalDocument13 pagesExchange Rate Forecasting JournalPrashant TejwaniNo ratings yet

- Cybernetics and Systems Analysis Volume 34 Issue 3 1998 (Doi 10.1007/bf02666991) S. B. Kurilenko - Seasonal Adjustment of Some Economic IndicatorsDocument5 pagesCybernetics and Systems Analysis Volume 34 Issue 3 1998 (Doi 10.1007/bf02666991) S. B. Kurilenko - Seasonal Adjustment of Some Economic IndicatorsEugenio MartinezNo ratings yet

- Trend Detection of Rainfall in Alluvial Gangetic Plain of UttarakhandDocument7 pagesTrend Detection of Rainfall in Alluvial Gangetic Plain of UttarakhandharshitNo ratings yet

- Cross-Correlations Between Volume Change and Price ChangeDocument6 pagesCross-Correlations Between Volume Change and Price Changeav_meshramNo ratings yet

- The GazeDocument115 pagesThe Gazeniran_iranNo ratings yet

- Exchange RateDocument10 pagesExchange Rateilaman6608No ratings yet

- The Dynamics of Financial Markets: Fibonacci Numbers, Elliott Waves, and SolitonsDocument27 pagesThe Dynamics of Financial Markets: Fibonacci Numbers, Elliott Waves, and SolitonsHakimi BobNo ratings yet

- The Margrabe FormulaDocument8 pagesThe Margrabe FormulabobmezzNo ratings yet

- Stock CyclesDocument15 pagesStock CyclesmubeenNo ratings yet

- Phillips & Perron - Biometrika - 1988 - Unit Root TestDocument13 pagesPhillips & Perron - Biometrika - 1988 - Unit Root TestLAURA VALENTINA RIQUETH PACHECONo ratings yet

- Arch Modelling in Finance PDFDocument55 pagesArch Modelling in Finance PDFernestoarmijoNo ratings yet

- Time-Dependent Hurst Exponent in Financial Time SeriesDocument5 pagesTime-Dependent Hurst Exponent in Financial Time Seriesaldeni_filhoNo ratings yet

- An Investment Strategy Based On Stochastic Unit Root ModelsDocument8 pagesAn Investment Strategy Based On Stochastic Unit Root ModelsHusain SulemaniNo ratings yet

- Foreign ExchnageDocument34 pagesForeign ExchnageNiranjan HnNo ratings yet

- Dynamic Factor Models M WatsonDocument43 pagesDynamic Factor Models M WatsondondidaNo ratings yet

- Constantinos Var LowDocument18 pagesConstantinos Var LowmubeenNo ratings yet

- Rolling Regression TheoryDocument30 pagesRolling Regression TheoryLuis EduardoNo ratings yet

- Reconciling Alternative Estimates of Elasticity of Substitution (Berndt1976)Document11 pagesReconciling Alternative Estimates of Elasticity of Substitution (Berndt1976)Franco BailonNo ratings yet

- Maximum Likelihood Estimation and Inference On Cointegration Applications To The Demand For MoneyDocument42 pagesMaximum Likelihood Estimation and Inference On Cointegration Applications To The Demand For MoneyzedNo ratings yet

- Chaos, Solitons and Fractals: Gürsan Çoban, Ali H. BüyüklüDocument6 pagesChaos, Solitons and Fractals: Gürsan Çoban, Ali H. BüyüklümerlNo ratings yet

- Dynamic Relation Between Exchange Rate and Stock Prices - A Case For India Golaka C. Nath and G. P. SamantaDocument8 pagesDynamic Relation Between Exchange Rate and Stock Prices - A Case For India Golaka C. Nath and G. P. SamantaTen WangNo ratings yet

- MULTIVARIATE COINTEGRATION ANALYSIS AND THE LONG-RUN VALIDITY OF PPP - Peter Kugler and Carlos LenzDocument6 pagesMULTIVARIATE COINTEGRATION ANALYSIS AND THE LONG-RUN VALIDITY OF PPP - Peter Kugler and Carlos LenzovidorlimagabrielNo ratings yet

- A Practical Guide To Measuring The Hurst Parameter: Richard G. Clegg June 28, 2005Document13 pagesA Practical Guide To Measuring The Hurst Parameter: Richard G. Clegg June 28, 2005Marysol AyalaNo ratings yet

- International Review of Economics and Finance: Petre CaraianiDocument22 pagesInternational Review of Economics and Finance: Petre CaraianiLidia Valdivia RosasNo ratings yet

- 3Document7 pages3HofidisNo ratings yet

- A PDE Approach To Asian Options AnalyticDocument28 pagesA PDE Approach To Asian Options Analyticg5v7rm5spmNo ratings yet

- Tech Ah 2010 SepDocument14 pagesTech Ah 2010 SepndokuchNo ratings yet

- IFM Part2 UpdatedDocument61 pagesIFM Part2 UpdatedMandar Priya PhatakNo ratings yet

- Testing For Seasonality : Philip Hans FransesDocument4 pagesTesting For Seasonality : Philip Hans Fransestunghuong151283No ratings yet

- JeanninIoriSamuels PinningDocument12 pagesJeanninIoriSamuels PinningginovainmonaNo ratings yet

- An Empirical Study of Price-Volume Relation: Contemporaneous Correlation and Dynamics Between Price Volatility and Trading Volume in the Hong Kong Stock Market.From EverandAn Empirical Study of Price-Volume Relation: Contemporaneous Correlation and Dynamics Between Price Volatility and Trading Volume in the Hong Kong Stock Market.No ratings yet

- Flame Retardant Textiles For Electric Arc Flash Hazards: A ReviewDocument18 pagesFlame Retardant Textiles For Electric Arc Flash Hazards: A ReviewTJPRC PublicationsNo ratings yet

- Baluchari As The Cultural Icon of West Bengal: Reminding The Glorious Heritage of IndiaDocument14 pagesBaluchari As The Cultural Icon of West Bengal: Reminding The Glorious Heritage of IndiaTJPRC PublicationsNo ratings yet

- Comparative Study of Original Paithani & Duplicate Paithani: Shubha MahajanDocument8 pagesComparative Study of Original Paithani & Duplicate Paithani: Shubha MahajanTJPRC PublicationsNo ratings yet

- 2 29 1645708157 2ijtftjun20222Document8 pages2 29 1645708157 2ijtftjun20222TJPRC PublicationsNo ratings yet

- 2 52 1649841354 2ijpslirjun20222Document12 pages2 52 1649841354 2ijpslirjun20222TJPRC PublicationsNo ratings yet

- 2 33 1641272961 1ijsmmrdjun20221Document16 pages2 33 1641272961 1ijsmmrdjun20221TJPRC PublicationsNo ratings yet

- Covid-19: The Indian Healthcare Perspective: Meghna Mishra, Dr. Mamta Bansal & Mandeep NarangDocument8 pagesCovid-19: The Indian Healthcare Perspective: Meghna Mishra, Dr. Mamta Bansal & Mandeep NarangTJPRC PublicationsNo ratings yet

- Using Nanoclay To Manufacture Engineered Wood Products-A ReviewDocument14 pagesUsing Nanoclay To Manufacture Engineered Wood Products-A ReviewTJPRC PublicationsNo ratings yet

- 2 4 1644229496 Ijrrdjun20221Document10 pages2 4 1644229496 Ijrrdjun20221TJPRC PublicationsNo ratings yet

- Development and Assessment of Appropriate Safety Playground Apparel For School Age Children in Rivers StateDocument10 pagesDevelopment and Assessment of Appropriate Safety Playground Apparel For School Age Children in Rivers StateTJPRC PublicationsNo ratings yet

- An Observational Study On-Management of Anemia in CKD Using Erythropoietin AlphaDocument10 pagesAn Observational Study On-Management of Anemia in CKD Using Erythropoietin AlphaTJPRC PublicationsNo ratings yet

- 2 51 1656420123 1ijmpsdec20221Document4 pages2 51 1656420123 1ijmpsdec20221TJPRC PublicationsNo ratings yet

- 2 51 1651909513 9ijmpsjun202209Document8 pages2 51 1651909513 9ijmpsjun202209TJPRC PublicationsNo ratings yet

- 2 44 1653632649 1ijprjun20221Document20 pages2 44 1653632649 1ijprjun20221TJPRC PublicationsNo ratings yet

- Vitamin D & Osteocalcin Levels in Children With Type 1 DM in Thi - Qar Province South of Iraq 2019Document16 pagesVitamin D & Osteocalcin Levels in Children With Type 1 DM in Thi - Qar Province South of Iraq 2019TJPRC PublicationsNo ratings yet

- Dr. Gollavilli Sirisha, Dr. M. Rajani Cartor & Dr. V. Venkata RamaiahDocument12 pagesDr. Gollavilli Sirisha, Dr. M. Rajani Cartor & Dr. V. Venkata RamaiahTJPRC PublicationsNo ratings yet

- A Review of "Swarna Tantram"-A Textbook On Alchemy (Lohavedha)Document8 pagesA Review of "Swarna Tantram"-A Textbook On Alchemy (Lohavedha)TJPRC PublicationsNo ratings yet

- Self-Medication Prevalence and Related Factors Among Baccalaureate Nursing StudentsDocument8 pagesSelf-Medication Prevalence and Related Factors Among Baccalaureate Nursing StudentsTJPRC PublicationsNo ratings yet

- Effectiveness of Reflexology On Post-Operative Outcomes Among Patients Undergoing Cardiac Surgery: A Systematic ReviewDocument14 pagesEffectiveness of Reflexology On Post-Operative Outcomes Among Patients Undergoing Cardiac Surgery: A Systematic ReviewTJPRC PublicationsNo ratings yet

- 2 51 1647598330 5ijmpsjun202205Document10 pages2 51 1647598330 5ijmpsjun202205TJPRC PublicationsNo ratings yet

- Analysis of Bolted-Flange Joint Using Finite Element MethodDocument12 pagesAnalysis of Bolted-Flange Joint Using Finite Element MethodTJPRC PublicationsNo ratings yet

- 2 67 1653022679 1ijmperdjun202201Document12 pages2 67 1653022679 1ijmperdjun202201TJPRC PublicationsNo ratings yet

- Numerical Analysis of Intricate Aluminium Tube Al6061T4 Thickness Variation at Different Friction Coefficient and Internal Pressures During BendingDocument18 pagesNumerical Analysis of Intricate Aluminium Tube Al6061T4 Thickness Variation at Different Friction Coefficient and Internal Pressures During BendingTJPRC PublicationsNo ratings yet

- Effect of Degassing Pressure Casting On Hardness, Density and Tear Strength of Silicone Rubber RTV 497 and RTV 00A With 30% Talc ReinforcementDocument8 pagesEffect of Degassing Pressure Casting On Hardness, Density and Tear Strength of Silicone Rubber RTV 497 and RTV 00A With 30% Talc ReinforcementTJPRC PublicationsNo ratings yet

- 2 67 1645871199 9ijmperdfeb202209Document8 pages2 67 1645871199 9ijmperdfeb202209TJPRC PublicationsNo ratings yet

- 2 67 1644220454 Ijmperdfeb202206Document9 pages2 67 1644220454 Ijmperdfeb202206TJPRC PublicationsNo ratings yet

- 2 67 1641277669 4ijmperdfeb202204Document10 pages2 67 1641277669 4ijmperdfeb202204TJPRC PublicationsNo ratings yet

- Comparative Fe Analysis of Automotive Leaf Spring Using Composite MaterialsDocument22 pagesComparative Fe Analysis of Automotive Leaf Spring Using Composite MaterialsTJPRC PublicationsNo ratings yet

- 2 67 1640070534 2ijmperdfeb202202Document14 pages2 67 1640070534 2ijmperdfeb202202TJPRC PublicationsNo ratings yet

- Next Generation'S Energy and Time Efficient Novel Pressure CookerDocument16 pagesNext Generation'S Energy and Time Efficient Novel Pressure CookerTJPRC PublicationsNo ratings yet

- Mktmgt1207 g3 Attitudes and IntentionsDocument19 pagesMktmgt1207 g3 Attitudes and IntentionsHazel Roxas DraguinNo ratings yet

- MODULE 08 Artificial IntelligenceDocument84 pagesMODULE 08 Artificial IntelligenceSkylarNo ratings yet

- Sustainable Development in South AfricaDocument8 pagesSustainable Development in South AfricaMABUELANo ratings yet

- Construction MethodologyDocument62 pagesConstruction MethodologyVenkat TalupulaNo ratings yet

- Customer Relationship Management in Banking Sector: Problems and Challenges Dr. D.R. Bajwa Associate Professor Dept. of Commerce & Management Government P.G. College, Ambala Cantt, Haryana (India)Document14 pagesCustomer Relationship Management in Banking Sector: Problems and Challenges Dr. D.R. Bajwa Associate Professor Dept. of Commerce & Management Government P.G. College, Ambala Cantt, Haryana (India)MIKIYASNo ratings yet

- The - Law - of - the - Garbage - Truck - Bài dịch số 3 PDFDocument1 pageThe - Law - of - the - Garbage - Truck - Bài dịch số 3 PDFĐoàn-Nguyễn Quốc TriệuNo ratings yet

- Simarouba Brochure, UAS Bangalore, IndiaDocument9 pagesSimarouba Brochure, UAS Bangalore, IndiaGanesan SNo ratings yet

- Zebra Rfid LabelDocument4 pagesZebra Rfid LabeldishaNo ratings yet

- NMR Solvent Data ChartDocument2 pagesNMR Solvent Data ChartNGUYỄN HOÀNG LINHNo ratings yet

- Mathematical Model Prototype To Optimise EngineeriDocument10 pagesMathematical Model Prototype To Optimise EngineeriJawad AhmadNo ratings yet

- Surneco Vs ErsDocument10 pagesSurneco Vs ErsMark Jason Crece AnteNo ratings yet

- A Demonstration Plan in EPP 6 I. Learning OutcomesDocument4 pagesA Demonstration Plan in EPP 6 I. Learning Outcomeshezil CuangueyNo ratings yet

- Porps Prospectus 2022 23Document16 pagesPorps Prospectus 2022 23Siva SubrahmanyamNo ratings yet

- Spawn Production of Common CarpDocument5 pagesSpawn Production of Common CarpGrowel Agrovet Private Limited.No ratings yet

- Fernandez vs. VillegasDocument2 pagesFernandez vs. VillegasedreaNo ratings yet

- Draft List: Proclamation of Sales of Motor Vehicles by Public AuctDocument20 pagesDraft List: Proclamation of Sales of Motor Vehicles by Public AuctHd YusNo ratings yet

- Statement of Interest 2Document2 pagesStatement of Interest 2JOHN MENSAH100% (1)

- Novice PDFDocument23 pagesNovice PDFabeatty34No ratings yet

- PepsiDocument35 pagesPepsiZain Ali100% (1)

- Code of Civil ProcedureDocument10 pagesCode of Civil ProcedureBalasahebPandhareNo ratings yet

- Face Liveness Detection For Biometric Antispoofing Applications Using Color Texture and Distortion Analysis FeaturesDocument10 pagesFace Liveness Detection For Biometric Antispoofing Applications Using Color Texture and Distortion Analysis FeaturesEditor IJRITCCNo ratings yet

- Teachers Who Write Conference: Jay PariniDocument3 pagesTeachers Who Write Conference: Jay PariniJenny AlbrightNo ratings yet

- 2023-06-28Document1,532 pages2023-06-28X YzNo ratings yet

- Manual de Intretinere Si Reparatii Auto in Limba Romana GratisDocument3 pagesManual de Intretinere Si Reparatii Auto in Limba Romana Gratisviper33_4u25% (4)

- Informator 1 2007 UkDocument4 pagesInformator 1 2007 UksiviigiNo ratings yet

- HERTZ GLOBAL HOLDINGS INC 8-K (Events or Changes Between Quarterly Reports) 2009-02-24Document30 pagesHERTZ GLOBAL HOLDINGS INC 8-K (Events or Changes Between Quarterly Reports) 2009-02-24http://secwatch.comNo ratings yet

- Reflection On Being A Practcie TeacherDocument1 pageReflection On Being A Practcie TeacherDave Cali-atNo ratings yet