Professional Documents

Culture Documents

Barry 2003 ITR

Barry 2003 ITR

Uploaded by

Greg O'MearaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Barry 2003 ITR

Barry 2003 ITR

Uploaded by

Greg O'MearaCopyright:

Available Formats

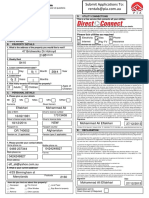

MR BARRY JAMES O'MEARA

TFN: 621 259 015

Part A

Privacy

Electronic Lodgment Declaration (Form I)

This declaration is to be completed where a taxpayer elects to use the Electronic Lodgement Service. It is the responsibility of the taxpayer to retain this declaration for a period of five years after the declaration is made, penalties may apply for failure to do so. The ATO is authorised by the Income Tax Assessment Act 1936, the Income Tax Assessment Act 1997 and the Taxation Administration Act 1953 to ask for information in this form. We need this information to help us to administer the taxation laws. We may give this information to other government agencies authorised by law to receive it-for example, benefit payment agencies such as Centrelink, the Department of Education, Science and Training and the Department of Family and Community Services; law enforcement agencies such as the National Crime Authority; and other agencies such as the Child Support Agency and the Australian Bureau of Statistics. Your tax file number You do not have to quote your TFN. However, you cannot lodge your income tax form electronically if you do not quote your TFN. Electronic funds transfer - direct debit Where you have requested an EFT direct debit some of your details will be provided to your financial institution and the ATO's sponsor bank to facilitate the payment of your taxation liability from your nominated account. Family tax benefit Where you have claimed the Family Tax Benefit (FTB), your claim will not be accepted if you do not provide the TFN of each person included in your claim unless you are exempt from providing it-exemptions are explained on page 17 FTB tax claim instructions 2003. The Family Assistance Office-which is a partnership between Centrelink, the ATO, the Health Insurance Commission (HIC) and the Department of Family and Community Services (FaCS)-is authorised by the A New Tax System (Family Assistance) (Administration) Act 1999 to ask for the information in the FTB tax claims. The information will be used for the purposes of administering family assistance payments. Limited personal information may be used for customer surveys run by the ATO and its client departments, or by research organisations on their behalf. Limited information about you may also be disclosed to others when your circumstances affect their entitlements to payments and services. The FAO may also give this information to someone else if you give permission, or to government agencies authorised by law to receive it-for example, partner agencies including Centrelink, the ATO, the HIC and FaCS; assistance agencies such as the Aboriginal and Torres Strait Islander Commission; the Department of Employment, Workplace Relations and Small Business and the Department of Education and Training; and other agencies such as the Child Support Agency and the Department of Immigration and Multicultural Affairs. Tax file number (TFN) Name

621 259 015 MR BARRY JAMES O'MEARA

Year

2003

Declaration

I declare that the information provided to the agent for the preparation of the document is true and correct; and the agent is authorised to give the document to the Commissioner of Taxation.

Important:

The tax law imposes heavy penalties for giving false or misleading information.

Signature

Date

Part B

ELECTRONIC FUNDS TRANSFER CONSENT

This declaration is to be completed when an Electronic Funds Transfer (EFT) of a refund is requested and the return is being lodged through the Electronic Lodgment Service. This authorisation will remain valid until the next income tax return/amendment is lodged or until the ATO receives new EFT instructions. The declaration must be signed by the taxpayer prior to the EFT details being transmitted to the ATO. If you have already provided these details and account details are the same as last year, do not write them again. Important: Care should be taken when completing EFT details as the payment of any refund, including Family Tax Benefit, will be made to the account specified. Agent's Reference Number Account Name I authorise the refund to be deposited directly to the specified account, as above or as previously advised.

Signature

Date

Part C

I declare that:

Tax Agent's Certificate

CAPRICORN ACCOUNTING SERVICE PTY LTD

I have prepared this income tax return and/or Famiy Tax Benefit tax claim in accordance with the information supplied by the entity; I have received a declaration made by the entity that the information provided to me for the preparation of this document is true and correct; and I am authorised by the entity to give the information in this document to the Commissioner. Agent's Signature Contact Name

Date

Client's Reference

OMEA10

Pain 08 61037567

Agent's Reference Number

Agent's Phone Number

62192005

IN-CONFIDENCEwhen completed

Page 1 of 4

EI ndividual tax return 2003tax agents

1 July 2002 to 30 June 2003

Your tax file number (TFN) 621 259 015

See the Privacy note in the Taxpayer's declaration on page 12 of this tax return.

Are you an Australian resident? Have you included any attachments

other than PAYG payment summaries?

Y N

Print Y for yes or N for no. Print Y for yes or N for no.

Your name

Titlefor example, Mr, Mrs, Ms, Miss Surname or family name Given names

MR O'MEARA BARRY

Your sexprint X

in the relevant box

Male

Female

JAMES

Has any part of your name changed since completing your last tax return?

Print Y for yes If yes, print or N for no.

previous surname.

Your postal address

C/- Success Tax Professionals PO Box 420 Cloverdale

Print Y for yes or N for no.

Has your postal address changed since completing your last tax return?

WA

6985

Your home address

If the same as your current postal address, print AS ABOVE.

14 O'NEILE PARADE REDCLIFFE WA 6104

Your date of birth

If you were under 18 years of age on 30 June 2003 you must complete item A1 on page 4 of this tax return.

Final tax return

12/04/1938

If you know this is your final tax return, print FINAL

Your daytime telephone number

Area code

Telephone number

Your spouses name

Surname or family name Given names

O'MEARA HELEN TERESA

Electronic funds transfer (EFT)

Do you want to use EFT this year for your tax refund N Print Y for yes or N for no. or family tax benefit payment where applicable? BSB number Must be six digits Account name If you answered yes, complete the account details do not provide details if they are the same as last year. Account number

IN-CONFIDENCEwhen completed

Detailed

Individual tax return 2003

MR BARRY JAMES O'MEARA

TFN: 621 259 015

Page 2 of 4

Income

1

Salary or wages

Your main salary and wage occupation

Handyman

Payer Allowances Lump A Lump B

Occupation code Tax Withheld

X 9993

Gross

RESORT AND HOTEL MANAGEMENT PTY LTD SIN AUS BEL PTY LTD

ABN: 99 081 092 971 3,381.00 17,055 15,488

ABN: 68 056 736 148 3,347.00

Total tax withheld

Add up the

boxes.

6,728.00

Only used by taxpayers completing the supplementary section

Transfer the amount from TOTAL SUPPLEMENT INCOME OR LOSS

LOSS

5,115 / L

LOSS

TOTAL INCOME OR LOSS

Add up the income amounts and deduct any loss amount in the boxes.

27,428 /

CLAIM

Deductions

D3 Work related uniform, occupation specific or protective clothing, laundry and dry cleaning expenses PROTECTIVE CLOTHING & LAUNDRY SUN PROTECTION D5 Other work related expenses BANK FEES D8 Gifts or donations DOORKNOCKS D10 Cost of managing tax affairs CASH & PARTNERS ACCOUNTANTS 411 20 32 165 P 85 P

250 / P

E J M

32

20 411

Only used by taxpayers completing the supplementary section

Transfer the amount from TOTAL SUPPLEMENT DEDUCTIONS

0 713

LOSS

TOTAL DEDUCTIONS SUBTOTAL TAXABLE INCOME OR LOSS

Items D1 to D

add up the

boxes

TOTAL INCOME OR LOSS less TOTAL DEDUCTIONS Subtract item L1 amounts from amount at SUBTOTAL

26,715 /

LOSS

26,715 /

Tax offsets

T2 Senior Australians If you had a spouse during 200203 you must

TAX OFFSET

complete Spouse detailsmarried or de facto.

N D

CODE

Only used by taxpayers completing the supplementary section

Transfer the amount from TOTAL SUPPLEMENT TAX OFFSETS.

TOTAL TAX OFFSETS

Items T1 to

add up the

boxes

IN-CONFIDENCEwhen completed

Detailed

Individual tax return 2003

MR BARRY JAMES O'MEARA

TFN: 621 259 015

Page 3 of 4

M2

Medicare levy surcharge (MLS) THIS ITEM IS COMPULSORY

If you do not complete this question you may be charged the full Medicare levy surcharge. For the whole period 1 July 2002 to 30 June 2003, were you and all your dependants (including your spouse) - if you had any - covered by private patient HOSPITAL cover? Number of days NOT liable for surcharge Number of dependent children

E N A D

Print Y for yes or N for no.

365

Spouse detailsmarried or de facto

Only provide these details if you had a spousemarried or de factoduring 200203 and you completed any of the following items: 6, T1, T2, M1, M2 (and at label E you printed N), T6 (supplementary section)

Spouses date of birth Did you have a spouse for the full year 1 July 2002 to 30 June 2003?

K 10/05/1941 L Y M

To

Print Y for yes or N for no.

From

If you did not have a spouse for the full year, write the dates you had a spouse between 1 July 2002 and 30 June 2003. Spouses 200203 taxable income

N O

3,070

Refer to TaxPack 2003 before you complete item 12. If you are required to complete item 12 include deferred non-commercial business losses from a prior year at either labels X or Y as appropriate. Refer to TaxPack 2003 for the relevant code.

Supplementary section Income

12 Partnerships and trusts

Non-primary production Distribution from partnerships, less foreign income Distribution from trusts, less net capital gains and foreign income Landcare operations expenses Other deductions relating to distribution in labels O and U

O U J

5,115 / L

Distributions of net capital gains (including net foreign capital gains) must be included at item 17 Distributions of foreign income must be included at item 18 or 19

TYPE

LOSS

Net non-primary production distribution

5,115 / L 5,115 / L

35 018 311

Credits: Abn

Y P

B J & H T O'MEARA

PP Inc

0/ 0.00

Tfn

NPP Inc

0.00

Imp

0.00

Trustee

17

Capital gains

Did you have a capital gains tax event during the year?

G N

Print Y for yes or N for no.

Net capital gain

18

Foreign entities

Did you have either a direct or indirect interest in a controlled foreign company (CFC)? Have you e v e r, either directly or indirectly, caused the transfer of propertyincluding moneyor services to a non-resident trust estate? Did you have an interest in a foreign investment fund (FIF) or a foreign life assurance policy (FLP)?

Print Y for yes or N for no. Print Y for yes or N for no. Print Y for yes or N for no.

CFC income Transferor trust income FIF and FLP income

K B C

W N J N

19

Foreign source income and foreign assets or property

During the year did you own, or have an interest in, assets located outside Australia which had a total value of AUD $50,000 or more?

P N

Print Y for yes or N for no.

F

Detailed

IN-CONFIDENCEwhen completed

Individual tax return 2003

MR BARRY JAMES O'MEARA

TFN: 621 259 015

Page 4 of 4

LOSS

TOTAL SUPPLEMENT INCOME OR LOSS

P9 Business loss activity details

Items 12 to 22 add up income amounts and deduct any loss amounts in the boxes. Transfer this amount to

5,115 / L

Note: If you incurred a net loss from more than three business activities this year show the three activities with the highest losses. If you print loss code 8 at labels G, M or S you must complete item 15.

Activity 1

Description of activity Industry code

D LAWNMOWING ROUND

Type of loss Deferred non-commercial loss from a prior year Net loss

Partnership (P) or sole trader (S)

E 95250

Activity 2

F P

5,115 F

Description of activity Industry code

J

Type of loss Deferred non-commercial loss from a prior year Net loss

F M N O F

Partnership (P) or sole trader (S)

Activity 3

Description of activity Industry code

P

Type of loss Deferred non-commercial loss from a prior year Net loss

F S T U F

Partnership (P) or sole trader (S)

Q Taxpayers declaration

Read and sign the declaration after completing your tax return, including the supplementary section, business and professional items section and other schedules if applicable. I declare that: the information provided to my registered tax agent for the preparation of this tax return is true and correct and I understand the ATO has the right to review my tax return and, for a period of up to 6 years, to issue me with a revised assessment if a review shows any inaccuracies in income or entitlements that change my assessment I authorise my registered tax agent to lodge this tax return. Taxpayer's Signature

Day Month Year

Date

Important:

The tax law imposes heavy penalties for giving false or misleading information.

Privacy: It is not an offence not to quote your tax file number (TFN). However, your assessment will be delayed if you do

not quote your TFN. The ATO is authorised by the Income Tax Assessment Act 1936 (ITAA 1936) and the Income Tax Assessment Act 1997 and the A New Tax System (Family Assistance)(Administration) Act 1999 to ask for information in this tax return. We need this information to help administer the taxation laws. We may give this information to other government agencies authorised by law to receive it-for example, benefit payment agencies such as Centrelink, the Department of Education, Science and Training and the Department of Family and Community Services; law enforcement agencies such as the National Crime Authority; and other agencies such as the Child Support Agency, the Australian Bureau of Statistics and the Reserve Bank of Australia.

Tax agents certificate I, CAPRICORN ACCOUNTING SERVICE PTY LTD

declare that this tax return has been prepared in accordance with information supplied by the taxpayer, that the taxpayer has given me a declaration stating that the information provided to me is true and correct and that the taxpayer has authorised me to lodge the tax return. Agents signature Date

Day Month Year

Clients reference

OMEA10

Contact name Agents telephone number

Area code Telephone number

Agents reference number

Pain

08

61037567

62192005

IN-CONFIDENCEwhen completed

Detailed

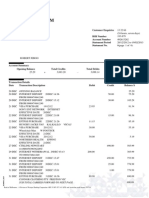

2003 Income Tax Return Tax Estimate

MR BARRY JAMES O'MEARA

Tax Payable for Individual

Taxable Income Tax Free Part

TFN: 621 259 015

26,715 6,000 4,394.50

Sub-Total $

Tax Payable on Taxable Income

4,394.50

Less Offsets:

Offsets (T1 to T11 except T2 and T5) Seniors / Pension / Beneficiary Offset Low Income Offset Lump Sum Life Assurance Bonus Other Offsets

0.00 3,081.00 0.00 0.00 0.00 0.00

Sub-Total $

3,081.00 1,313.50

Plus:

Medicare Levy

0.00

Sub-Total $

0.00 1,313.50

Less Credits:

Tax withheld - salary & wage type income Arrears tax withheld Foreign Tax Credits TFN Amounts (credits) Franking Tax Offset (refundable) Other Refundable Credits Other Amounts withheld - ABN/Voluntary/Labour Baby Bonus Offset (refundable) PAYG Income Tax Instalments

6,728.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

Sub-Total $

6,728.00 5,414.50

Estimated Tax Refund

DISCLAIMER =========== This estimate is provided without warranty of any kind. It is subject to legislative changes and includes estimates of currently unknown rates. WARNING : Any amount shown as FTB is subject to assessment from the FAO, and may be adjusted by amounts not included in this return.

IN-CONFIDENCEwhen completed

You might also like

- Notice of Assessment - Year Ended 30 June 2020: !Msî15U (P4 Î#BabäDocument4 pagesNotice of Assessment - Year Ended 30 June 2020: !Msî15U (P4 Î#BabäClaudia AttardNo ratings yet

- Australian Payslip Generator TemplateDocument1 pageAustralian Payslip Generator TemplateFarzinNo ratings yet

- Your Centrelink Statement For Disability Support Pension: Reference: 204 552 505CDocument3 pagesYour Centrelink Statement For Disability Support Pension: Reference: 204 552 505CChellii McgrailNo ratings yet

- GCMS Reference Manual 28 May 2015Document445 pagesGCMS Reference Manual 28 May 2015Bom100% (2)

- Noa 2022Document2 pagesNoa 2022ragprasathNo ratings yet

- Notice of Assessment - Year Ended 30 June 2020: Ms Elaine S Ross 64 Corrofin ST Ferny Grove QLD 4055Document2 pagesNotice of Assessment - Year Ended 30 June 2020: Ms Elaine S Ross 64 Corrofin ST Ferny Grove QLD 4055Vaccine ScamNo ratings yet

- CompleteFreedom-2517-03Apr2021 2021-04-08 at 8.15.26 AMDocument67 pagesCompleteFreedom-2517-03Apr2021 2021-04-08 at 8.15.26 AMSimerjeet SinghNo ratings yet

- View AttachmentDocument6 pagesView AttachmentAlvin NgNo ratings yet

- Early Release Superannuation Approval 7115569398585Document1 pageEarly Release Superannuation Approval 7115569398585DanielWildSheepZaninNo ratings yet

- Centrelink PaygDocument1 pageCentrelink PaygChandra BhattNo ratings yet

- Child Care Subsidy (0028112904)Document9 pagesChild Care Subsidy (0028112904)ammar naeemNo ratings yet

- Income Statement: Llillliltll) Ilililtil)Document1 pageIncome Statement: Llillliltll) Ilililtil)Indy EfuNo ratings yet

- 29 Calneggia DRDocument6 pages29 Calneggia DRJohn ReidNo ratings yet

- Ohio BMV - Online ServicesDocument2 pagesOhio BMV - Online Servicestaylor mogerNo ratings yet

- Your Centrelink Statement For Parenting Payment: Reference: 207 828 705JDocument3 pagesYour Centrelink Statement For Parenting Payment: Reference: 207 828 705JhanhNo ratings yet

- Pandemic Leave Disaster Payment: Claim ForDocument8 pagesPandemic Leave Disaster Payment: Claim ForSarah VirziNo ratings yet

- Employee Tax and Super Details: InstructionsDocument2 pagesEmployee Tax and Super Details: InstructionsRobin GarnierNo ratings yet

- 26082021-PAYG Payment Summary-G Khajarian (CLAIM-00464429)Document1 page26082021-PAYG Payment Summary-G Khajarian (CLAIM-00464429)Garo KhatcherianNo ratings yet

- Chorinho Pacoqui o Du SilvaDocument9 pagesChorinho Pacoqui o Du SilvaAlejo GarciaNo ratings yet

- Business Activity Statement: Summary of AmountsDocument2 pagesBusiness Activity Statement: Summary of AmountsSimona StratulatNo ratings yet

- PAYG Payment Summary Individual Non-Business: Ai Thi Hoai Nguyen 1/3 Mary ST North Melbourne Vic 3051Document1 pagePAYG Payment Summary Individual Non-Business: Ai Thi Hoai Nguyen 1/3 Mary ST North Melbourne Vic 3051hungdahoangNo ratings yet

- Wage Easy ATO Payment Summaries (2018 Jun 28)Document1 pageWage Easy ATO Payment Summaries (2018 Jun 28)Haillander Lopes viannaNo ratings yet

- Medicare Enrolment Form (MS004) PDFDocument13 pagesMedicare Enrolment Form (MS004) PDFDanielWildSheepZaninNo ratings yet

- Your Centrelink Statement For Youth Allowance: Reference: 280 993 398VDocument3 pagesYour Centrelink Statement For Youth Allowance: Reference: 280 993 398Vbob0% (1)

- Natalie Ruth Grace Payslip 1Document2 pagesNatalie Ruth Grace Payslip 1bonnie zhuNo ratings yet

- Pre-Filling Report 2017: Taxpayer DetailsDocument2 pagesPre-Filling Report 2017: Taxpayer DetailsUsama AshfaqNo ratings yet

- CV Daniel PDFDocument3 pagesCV Daniel PDFDanielWildSheepZaninNo ratings yet

- Express Freedom: Statement of AccountDocument6 pagesExpress Freedom: Statement of Accountfaulrn111No ratings yet

- PAYG Payment Summary - Individual Non-Business: Matthew Burn 1933b/702 Harris Street Ultimo NSW 2007Document1 pagePAYG Payment Summary - Individual Non-Business: Matthew Burn 1933b/702 Harris Street Ultimo NSW 2007Anonymous JytY5quhSgNo ratings yet

- Income Tax Account Statement of Account: MR Daniel Zanin 25 Bulgoon CR Ocean Shores NSW 2483Document2 pagesIncome Tax Account Statement of Account: MR Daniel Zanin 25 Bulgoon CR Ocean Shores NSW 2483DanielWildSheepZaninNo ratings yet

- Prefill 2019Document2 pagesPrefill 2019Usama AshfaqNo ratings yet

- Manpreet Kaur USQ Application FormDocument5 pagesManpreet Kaur USQ Application FormGagandeep KaurNo ratings yet

- PAYG Payment Summary - Individual Non-Business: Muhammad Danish 22/324 Woodstock Avenue Mount Druitt NSW 2770Document1 pagePAYG Payment Summary - Individual Non-Business: Muhammad Danish 22/324 Woodstock Avenue Mount Druitt NSW 2770Danish MuhammadNo ratings yet

- The Property Investors Alliance: Electricity Gas Phone Internet Pay TV InsuranceDocument4 pagesThe Property Investors Alliance: Electricity Gas Phone Internet Pay TV InsuranceRaza RNo ratings yet

- Child Care Subsidy (0028112904) PDFDocument9 pagesChild Care Subsidy (0028112904) PDFammar naeemNo ratings yet

- PAYG Payment Summary - Individual Non-BusinessDocument1 pagePAYG Payment Summary - Individual Non-BusinessShubham SurekaNo ratings yet

- PAYG Payment Summary - Individual Non-Business: Fook Ngo 139 Railway Avenue Laverton VIC 3028Document1 pagePAYG Payment Summary - Individual Non-Business: Fook Ngo 139 Railway Avenue Laverton VIC 3028Fook NgoNo ratings yet

- Tax Statement 2014 CbhsDocument1 pageTax Statement 2014 CbhsChandra BhattNo ratings yet

- Nat14869 01.2006Document1 pageNat14869 01.2006stive007No ratings yet

- SR Notice of Assessment 2015Document1 pageSR Notice of Assessment 2015Ded MarozNo ratings yet

- About Sanda Islam Your Family Assistance: Reference: 605 730 292XDocument3 pagesAbout Sanda Islam Your Family Assistance: Reference: 605 730 292XAriful RussellNo ratings yet

- Https Download - Ib.nab - Com.au Ibdownload Download 947636060-22aug2014Document2 pagesHttps Download - Ib.nab - Com.au Ibdownload Download 947636060-22aug2014gizzeleneNo ratings yet

- Print - Australian Taxation OfficeDocument2 pagesPrint - Australian Taxation OfficeThi MaiNo ratings yet

- HR Manager Digital Technology & Innovation 1 Charles ST, Level 3A ParramattaDocument3 pagesHR Manager Digital Technology & Innovation 1 Charles ST, Level 3A ParramattaKiran PNo ratings yet

- Income Tax Account Statement of Account: MR Brock W Johnson 177 Barrabool RD Highton Vic 3216Document2 pagesIncome Tax Account Statement of Account: MR Brock W Johnson 177 Barrabool RD Highton Vic 3216Annie LamNo ratings yet

- Tat ATO 2022Document3 pagesTat ATO 2022Tate chanNo ratings yet

- NRAS Tenancy Managers - Australian Government Department Families, Housing, Community Services and Indigenous AffairsDocument12 pagesNRAS Tenancy Managers - Australian Government Department Families, Housing, Community Services and Indigenous Affairsbackch9011No ratings yet

- Customer Services OnlineDocument1 pageCustomer Services OnlineBrendan Han YungNo ratings yet

- Your Statement: Smart AccessDocument16 pagesYour Statement: Smart AccessDanielWildSheepZaninNo ratings yet

- Grant For Crisis Payment S303833612Document2 pagesGrant For Crisis Payment S303833612anthony rudduck100% (1)

- Application 14 - NISHADIDocument3 pagesApplication 14 - NISHADIamal_post100% (1)

- Sagar Sapkota Full Application PDFDocument14 pagesSagar Sapkota Full Application PDFAnnie LamNo ratings yet

- Sam StatementDocument11 pagesSam StatementAmrinder Setia100% (1)

- Emergency Recovery Payment Grant A199480158Document2 pagesEmergency Recovery Payment Grant A199480158HenhamNo ratings yet

- Statement 31072012Document11 pagesStatement 31072012Amrinder Setia100% (1)

- LicenseDocument6 pagesLicenseRazvannusNo ratings yet

- Congratulations On A Great Choice!: Paying Your PremiumDocument5 pagesCongratulations On A Great Choice!: Paying Your Premiummark georgeNo ratings yet

- Your National Insurance Number: About This FormDocument4 pagesYour National Insurance Number: About This FormTatyana TerziyskaNo ratings yet

- 2015 Noa Elena - 1Document1 page2015 Noa Elena - 1Ded MarozNo ratings yet

- 2012 ISA PackDocument12 pages2012 ISA Packinfo328750% (2)

- Scan 0001Document11 pagesScan 0001Kimmie3050% (2)

- Annual Report Draft 2014-15 v1.0Document18 pagesAnnual Report Draft 2014-15 v1.0Greg O'MearaNo ratings yet

- Welcome To Season 2015 - 2016: Upcoming EventsDocument6 pagesWelcome To Season 2015 - 2016: Upcoming EventsGreg O'MearaNo ratings yet

- This Saturday Is BLAC's Fundraising Day! Please Bring Your Gold Coins!Document1 pageThis Saturday Is BLAC's Fundraising Day! Please Bring Your Gold Coins!Greg O'MearaNo ratings yet

- Welcome To Season 2015 - 2016: Upcoming EventsDocument6 pagesWelcome To Season 2015 - 2016: Upcoming EventsGreg O'MearaNo ratings yet

- Allsopp Relay ProgrammeDocument1 pageAllsopp Relay ProgrammeGreg O'MearaNo ratings yet

- Klac - Agm Minutes 2013-2014Document2 pagesKlac - Agm Minutes 2013-2014Greg O'MearaNo ratings yet

- Klac Agm Agenda 2014-15Document2 pagesKlac Agm Agenda 2014-15Greg O'MearaNo ratings yet

- Welcome To Season 2014 - 2015: Coach's CornerDocument6 pagesWelcome To Season 2014 - 2015: Coach's CornerGreg O'MearaNo ratings yet

- Final Roster 2015Document4 pagesFinal Roster 2015Greg O'MearaNo ratings yet

- Welcome To Season 2014 - 2015: Coach's CornerDocument6 pagesWelcome To Season 2014 - 2015: Coach's CornerGreg O'MearaNo ratings yet

- Roster 2013-2014 (Champs Day 1 - 15 Feb)Document1 pageRoster 2013-2014 (Champs Day 1 - 15 Feb)Greg O'MearaNo ratings yet

- Roster 2013-2014 (Week 16 - 08 Feb)Document1 pageRoster 2013-2014 (Week 16 - 08 Feb)Greg O'MearaNo ratings yet

- Roster 2013-2014 (Week 5 - 09 Nov) PDFDocument1 pageRoster 2013-2014 (Week 5 - 09 Nov) PDFGreg O'MearaNo ratings yet

- Rosemary Bennett CertificateDocument1 pageRosemary Bennett CertificateGreg O'MearaNo ratings yet

- Roster 2013-2014 (Week 6 - 16 Nov)Document1 pageRoster 2013-2014 (Week 6 - 16 Nov)Greg O'MearaNo ratings yet

- The Mad ButcherDocument1 pageThe Mad ButcherGreg O'MearaNo ratings yet

- Roster 2013-2014 (Week 4 - 02 Nov) - 1 PDFDocument1 pageRoster 2013-2014 (Week 4 - 02 Nov) - 1 PDFGreg O'MearaNo ratings yet

- The New Season Is Here!: Spring EditionDocument4 pagesThe New Season Is Here!: Spring EditionGreg O'MearaNo ratings yet

- Roster 2013-2014 (Week 3 - 26 Oct)Document1 pageRoster 2013-2014 (Week 3 - 26 Oct)Greg O'MearaNo ratings yet

- Roster 2013-2014 (Week 1 - 12 Oct)Document1 pageRoster 2013-2014 (Week 1 - 12 Oct)Greg O'MearaNo ratings yet

- Kewdale: Little Athletics ClubDocument3 pagesKewdale: Little Athletics ClubGreg O'MearaNo ratings yet

- NewsletterDocument6 pagesNewsletterGreg O'MearaNo ratings yet

- Torbela v. Sps. Rosario Banco Filipino G.R. No. 140528Document17 pagesTorbela v. Sps. Rosario Banco Filipino G.R. No. 140528Ace MereriaNo ratings yet

- Absolute Containers Brochure 2019 2 27 PDFDocument19 pagesAbsolute Containers Brochure 2019 2 27 PDFEduardo SolanoNo ratings yet

- Mikrotik Products PresentationDocument85 pagesMikrotik Products PresentationinnovativekaluNo ratings yet

- Open Source Business Intelligence ToolsDocument33 pagesOpen Source Business Intelligence ToolsansanaNo ratings yet

- Data - Sheet Hora CV Act DetailsDocument2 pagesData - Sheet Hora CV Act DetailsAnand K. MouryaNo ratings yet

- Foundations of ControlDocument48 pagesFoundations of ControlAndy WilliamNo ratings yet

- Presentation 4th Global Tea Forum Dubai (World Tea News)Document10 pagesPresentation 4th Global Tea Forum Dubai (World Tea News)Dan BoltonNo ratings yet

- Overview MSSLDocument23 pagesOverview MSSLVijya GargNo ratings yet

- The Sociology of C. Wright Mills: Max WeberDocument16 pagesThe Sociology of C. Wright Mills: Max WeberMuhammad YaseenNo ratings yet

- College Athletes Protection and Compensation ActDocument50 pagesCollege Athletes Protection and Compensation ActCody Brunner100% (1)

- Construction Chemicals Knowlege Paper 2013 FinalDocument28 pagesConstruction Chemicals Knowlege Paper 2013 FinalVimal GopalakrishnanNo ratings yet

- Manual de Usuario Ph-MetroDocument16 pagesManual de Usuario Ph-Metrojuan alejandro moyaNo ratings yet

- 2.1.2.3 Packet Tracer - Blinking An LED Using BlocklyDocument11 pages2.1.2.3 Packet Tracer - Blinking An LED Using BlocklyDenisa ZahariaNo ratings yet

- The Smaller Condition Monitoring Systems That Give You More LexibilityDocument8 pagesThe Smaller Condition Monitoring Systems That Give You More LexibilityEdwin BermejoNo ratings yet

- Statement of PurposeDocument1 pageStatement of PurposeEngr Mubashir MukhtarNo ratings yet

- Made Easy-ECDocument33 pagesMade Easy-ECb prashanthNo ratings yet

- Ship-Theory Propulsion 1Document29 pagesShip-Theory Propulsion 1Goutam Kumar Saha100% (1)

- Quality Assurance Handbook: Education CommitteeDocument49 pagesQuality Assurance Handbook: Education CommitteeEzana EzanaNo ratings yet

- MDR Proposal Extension-Q-N-A 0Document10 pagesMDR Proposal Extension-Q-N-A 0EuMDR CompNo ratings yet

- General Specifications: GX10/GX20 Paperless Recorder Release R4Document28 pagesGeneral Specifications: GX10/GX20 Paperless Recorder Release R4PUNiiZIHIEIRNo ratings yet

- Seed Enterprise Investment SchemeDocument60 pagesSeed Enterprise Investment SchemeOllie MarshallNo ratings yet

- Sp14 Cs188 Lecture 4 - Csps IDocument43 pagesSp14 Cs188 Lecture 4 - Csps IYash OzaNo ratings yet

- Security Information and Event Management: Radboud University NijmegenDocument75 pagesSecurity Information and Event Management: Radboud University NijmegenproftechitspecialistNo ratings yet

- Rigveda International School Tohana It Project CLASS: 10 Rsip. Subject: It. Submitted By: Prabhat and Nikhil GargDocument18 pagesRigveda International School Tohana It Project CLASS: 10 Rsip. Subject: It. Submitted By: Prabhat and Nikhil GargPrabhat GoswamiNo ratings yet

- Maharshi GurukulDocument4 pagesMaharshi GurukulManas PanigrahiNo ratings yet

- Ai in EduDocument14 pagesAi in EduKang YihyunNo ratings yet

- Railway BridgeDocument41 pagesRailway Bridgebfrantic100% (2)

- Use To Show An Exact Time: - Two O'clock - Midnight / Noon - The Moment, EtcDocument3 pagesUse To Show An Exact Time: - Two O'clock - Midnight / Noon - The Moment, EtcKasira PammpersNo ratings yet