Professional Documents

Culture Documents

The Saver's Tax Credit: Are You Saving in A 401 (K) or 403 (B) Plan?

The Saver's Tax Credit: Are You Saving in A 401 (K) or 403 (B) Plan?

Uploaded by

Gina McCaffreyCopyright:

Available Formats

You might also like

- Speed Secrets Professional Race Driving TechniquesDocument83 pagesSpeed Secrets Professional Race Driving Techniquescruxnexus89% (27)

- Bidder Invoice 1098458 01-06-2023 04-03-05Document2 pagesBidder Invoice 1098458 01-06-2023 04-03-05appp2711No ratings yet

- Applied Linear Regression Models by John Neter, William Wasserman, Michael H. KutnerDocument561 pagesApplied Linear Regression Models by John Neter, William Wasserman, Michael H. KutnerGina McCaffrey91% (11)

- General Payroll, Employment and DeductionsDocument6 pagesGeneral Payroll, Employment and DeductionsJosh LeBlancNo ratings yet

- Tax 2 Ust Exam Covid PDFDocument306 pagesTax 2 Ust Exam Covid PDFCorneliaAmarraBruhildaOlea-VolterraNo ratings yet

- Asian Transmission Vs CIR - Case DigestDocument1 pageAsian Transmission Vs CIR - Case DigestKaren Mae Servan100% (1)

- DeductionDocument1 pageDeductionQueenie AndayaNo ratings yet

- What Is An IRA? - RKB Accounting & Tax ServicesDocument6 pagesWhat Is An IRA? - RKB Accounting & Tax ServicesRKB AccountingNo ratings yet

- Personal Finance Another Perspective: Tax PlanningDocument50 pagesPersonal Finance Another Perspective: Tax PlanningcrazysidzNo ratings yet

- Centorbi - AE Taxes White Paper - DL - GGDocument8 pagesCentorbi - AE Taxes White Paper - DL - GGchad centorbiNo ratings yet

- 16 Don'T-Miss Tax DeductionsDocument4 pages16 Don'T-Miss Tax DeductionsGon FloNo ratings yet

- Retirement Strategies For Millennials: A Simple and Practical Plan for Retiring EarlyFrom EverandRetirement Strategies For Millennials: A Simple and Practical Plan for Retiring EarlyNo ratings yet

- US Individual RegulationDocument3 pagesUS Individual RegulationDarab AkhtarNo ratings yet

- 401 (K) Plan The Complete GuideDocument6 pages401 (K) Plan The Complete Guide9xw8phvcm4No ratings yet

- What Is Taxable Income?: Key TakeawaysDocument4 pagesWhat Is Taxable Income?: Key TakeawaysBella AyabNo ratings yet

- RRSP Quick Tips: Quick Tip #1 - Contribute Early To Maximize Your RRSPDocument2 pagesRRSP Quick Tips: Quick Tip #1 - Contribute Early To Maximize Your RRSPapi-117755361No ratings yet

- F 1040 EsDocument12 pagesF 1040 EsEndu EnduroNo ratings yet

- What Is A 401Document6 pagesWhat Is A 401KidMonkey2299No ratings yet

- Module 11 Retirement PlanningDocument33 pagesModule 11 Retirement PlanningmohebqasNo ratings yet

- CBW - Pitfalls White Paper FINALDocument12 pagesCBW - Pitfalls White Paper FINALChutsNo ratings yet

- Planning For RetirementDocument9 pagesPlanning For RetirementMaimai DuranoNo ratings yet

- Saver'S Tax Credit For Contributions by Individuals To Employer Retirement Plans and IrasDocument5 pagesSaver'S Tax Credit For Contributions by Individuals To Employer Retirement Plans and IrasIRSNo ratings yet

- Spring 2013 Tax, Retirement & Estate PlanningDocument4 pagesSpring 2013 Tax, Retirement & Estate PlanningBusiness Bank of Texas, N.A.No ratings yet

- Estate Tax After The Fiscal Cliff: Collaborative Financial Solutions, LLCDocument4 pagesEstate Tax After The Fiscal Cliff: Collaborative Financial Solutions, LLCJanet BarrNo ratings yet

- 10 Big Deductions Too Many People MissDocument4 pages10 Big Deductions Too Many People MissSly GrinkoNo ratings yet

- Taxes Summary Test NotesDocument10 pagesTaxes Summary Test NotesfemiadegbayoNo ratings yet

- 2012plan LimitsDocument4 pages2012plan LimitsAKTHOMNo ratings yet

- Individual Retirement Account: For New Accounts OnlyDocument24 pagesIndividual Retirement Account: For New Accounts OnlyHeidi LopezNo ratings yet

- Next Level Tax Course: The only book a newbie needs for a foundation of the tax industryFrom EverandNext Level Tax Course: The only book a newbie needs for a foundation of the tax industryNo ratings yet

- Year-Round Tax Saving Tips: Vow To Be More EfficientDocument4 pagesYear-Round Tax Saving Tips: Vow To Be More EfficientSrinivas ThoutaNo ratings yet

- Tax Tips 2022Document26 pagesTax Tips 2022Mary Juvy Ramao100% (1)

- Self-Help Guidebook for Retirement Planning For Couples and Seniors: Ultimate Retirement Planning Book for Life after Paid EmploymentFrom EverandSelf-Help Guidebook for Retirement Planning For Couples and Seniors: Ultimate Retirement Planning Book for Life after Paid EmploymentNo ratings yet

- CO Earned Income Tax Credit InformationDocument1 pageCO Earned Income Tax Credit InformationSaran KhalidNo ratings yet

- Lending Club Retirement GuideDocument8 pagesLending Club Retirement Guidecera66No ratings yet

- Windes 2021 Year End Year Round Tax Planning GuideDocument20 pagesWindes 2021 Year End Year Round Tax Planning GuideBrian SneeNo ratings yet

- A Guide To 2013 Tax Changes (And More)Document15 pagesA Guide To 2013 Tax Changes (And More)Doug PotashNo ratings yet

- Synergy Financial Group: Your Personal CFODocument4 pagesSynergy Financial Group: Your Personal CFOgvandykeNo ratings yet

- FP Group WorkDocument12 pagesFP Group WorkStellina JoeshibaNo ratings yet

- The Income Tax 2024: A Complete Guide to Permanently Reducing Your Taxes: Step-by-Step StrategiesFrom EverandThe Income Tax 2024: A Complete Guide to Permanently Reducing Your Taxes: Step-by-Step StrategiesNo ratings yet

- Strategies To Pay Less TaxDocument4 pagesStrategies To Pay Less TaxblkdwgNo ratings yet

- Tax Exemptions, Deductions, and CreditsDocument3 pagesTax Exemptions, Deductions, and CreditsSuNo ratings yet

- Tax DefinitionDocument2 pagesTax DefinitionvishanthNo ratings yet

- Build Tax-Free Wealth: How to Permanently Lower Your Taxes and Build More WealthFrom EverandBuild Tax-Free Wealth: How to Permanently Lower Your Taxes and Build More WealthNo ratings yet

- Year-End Tax Guide 2015/16Document10 pagesYear-End Tax Guide 2015/16api-311814387No ratings yet

- Ultimate Guide To Investment AccountsDocument14 pagesUltimate Guide To Investment Accountscarece7891No ratings yet

- 2011 Tax Reference GuideDocument11 pages2011 Tax Reference GuideSaver PlusNo ratings yet

- Tax-Efficiency in RetirementDocument2 pagesTax-Efficiency in RetirementJames FogalNo ratings yet

- Schwab Individual 401 (K) : BenefitsDocument4 pagesSchwab Individual 401 (K) : BenefitsJames StampNo ratings yet

- Tax-Free RetirementDocument8 pagesTax-Free RetirementNelson Yong100% (2)

- Ch4-Recordedlecture-Fall2023 17 5166787619170306Document38 pagesCh4-Recordedlecture-Fall2023 17 5166787619170306ronny nyagakaNo ratings yet

- It's Not What You Earn - It's What You Keep: Synergy Financial GroupDocument4 pagesIt's Not What You Earn - It's What You Keep: Synergy Financial GroupgvandykeNo ratings yet

- Some Terms in Income Tax ClarifiedDocument9 pagesSome Terms in Income Tax ClarifiedAnonymous ATg0gvcf9No ratings yet

- South Western Federal Taxation 2016 Essentials of Taxation Individuals and Business Entities 19th Edition Raabe Solutions ManualDocument44 pagesSouth Western Federal Taxation 2016 Essentials of Taxation Individuals and Business Entities 19th Edition Raabe Solutions Manualvernier.decyliclnn4100% (26)

- Tax Planning Strategies and Wealth Management Unit 2Document47 pagesTax Planning Strategies and Wealth Management Unit 2ANAM AFTAB 22GSOB2010404No ratings yet

- Case 2 - For Pop FinalDocument7 pagesCase 2 - For Pop Finalapi-283228440No ratings yet

- SETC Tax Credit Guide 130316Document2 pagesSETC Tax Credit Guide 130316r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- Q No4:10 Sources of Nontaxable Income / Other Sources: Income That Isn't Taxed 1. Disability Insurance PaymentsDocument3 pagesQ No4:10 Sources of Nontaxable Income / Other Sources: Income That Isn't Taxed 1. Disability Insurance PaymentswaqasNo ratings yet

- Collaborative Financial Solutions, LLC Breaking Down The Taxpaying Population: Where Do You Fit In?Document4 pagesCollaborative Financial Solutions, LLC Breaking Down The Taxpaying Population: Where Do You Fit In?Janet BarrNo ratings yet

- SETC Tax Credit Guide 214276Document2 pagesSETC Tax Credit Guide 214276r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- Ceesay Exp19 Word Ch04 CapAssessment RetirementDocument10 pagesCeesay Exp19 Word Ch04 CapAssessment RetirementcsaysalifuNo ratings yet

- Preparing For EOFY June 2011Document2 pagesPreparing For EOFY June 2011nsfpNo ratings yet

- Solved ProblemsDocument55 pagesSolved ProblemsJamaal JallowNo ratings yet

- Math 104A Practice Final ProblemsDocument3 pagesMath 104A Practice Final ProblemsGina McCaffreyNo ratings yet

- Direct Deposit FormDocument1 pageDirect Deposit FormLatonya DodsonNo ratings yet

- Hsbcuk Account Closure FormDocument6 pagesHsbcuk Account Closure FormZaid SolkarNo ratings yet

- Cyprus International CompaniesDocument11 pagesCyprus International CompaniesGigi LunetteNo ratings yet

- Unit Test-3 (Types of Plan)Document3 pagesUnit Test-3 (Types of Plan)Gemini PatelNo ratings yet

- Tokyo HotelDocument1 pageTokyo HotelRachelle BillonesNo ratings yet

- BillDocument1 pageBillMushtaq Ali KhokharNo ratings yet

- WWW Abasynisb Edu PK PDFDocument1 pageWWW Abasynisb Edu PK PDFowaisyaqoob29No ratings yet

- Dhanalaxmi Traders Annexure-18-19Document2 pagesDhanalaxmi Traders Annexure-18-19info.ashokchoudhary.icaNo ratings yet

- The City of Iloilo Vs Smart Communications, Inc. Taxation 2 DigestDocument3 pagesThe City of Iloilo Vs Smart Communications, Inc. Taxation 2 DigestEllen Glae DaquipilNo ratings yet

- Gradfee2013 To 2016Document37 pagesGradfee2013 To 2016nemson999No ratings yet

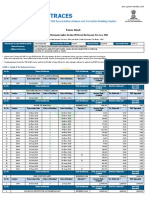

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document7 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961AshishNo ratings yet

- VAT To Remedies of A Taxpayer (95%)Document61 pagesVAT To Remedies of A Taxpayer (95%)Yrjell ObsiomaNo ratings yet

- TAX102: Transfer and Business Taxation: Optional RegistrationDocument3 pagesTAX102: Transfer and Business Taxation: Optional Registrationaccounts 3 lifeNo ratings yet

- Basic Principles LectureDocument7 pagesBasic Principles LectureevaNo ratings yet

- Tripsavr Presentation PlanDocument59 pagesTripsavr Presentation PlanAdelia Triana PamungkasNo ratings yet

- Worldwide VAT, GST and Sales Tax GuideDocument2,080 pagesWorldwide VAT, GST and Sales Tax Guideİsmayil AlizadaNo ratings yet

- UBS Lesson 1Document4 pagesUBS Lesson 1Yau Xiang YingNo ratings yet

- Rekening Koran (Account Statement) : Date & Time Value Date Description Debit Balance Credit Reference NoDocument2 pagesRekening Koran (Account Statement) : Date & Time Value Date Description Debit Balance Credit Reference NofirmanNo ratings yet

- Table Sap b1Document25 pagesTable Sap b1shmilyou100% (2)

- Bill 15Document1 pageBill 15jay_p_shahNo ratings yet

- Chime Spending StatementDocument3 pagesChime Spending Statementbussinesl lasNo ratings yet

- 0 - Receipt - 1303668Document1 page0 - Receipt - 1303668Vaibhav ShindeNo ratings yet

- Fully Automated GST InvoiceDocument6 pagesFully Automated GST InvoiceShaswata MallickNo ratings yet

- Meralco Vs CIRDocument22 pagesMeralco Vs CIRmifajNo ratings yet

- Transactions-In-The-Real-Estate-Sector 2020 - PWC ReportDocument56 pagesTransactions-In-The-Real-Estate-Sector 2020 - PWC ReportNimisha GandechaNo ratings yet

- Rental Income and Expenses 2021Document2 pagesRental Income and Expenses 2021Finn KevinNo ratings yet

- Terms and Conditions - UCPB Debit CardDocument2 pagesTerms and Conditions - UCPB Debit Cardsky9213100% (2)

The Saver's Tax Credit: Are You Saving in A 401 (K) or 403 (B) Plan?

The Saver's Tax Credit: Are You Saving in A 401 (K) or 403 (B) Plan?

Uploaded by

Gina McCaffreyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Saver's Tax Credit: Are You Saving in A 401 (K) or 403 (B) Plan?

The Saver's Tax Credit: Are You Saving in A 401 (K) or 403 (B) Plan?

Uploaded by

Gina McCaffreyCopyright:

Available Formats

The Savers Tax Credit

Are you saving in a 401(k) or 403(b) Plan?

Did you know you might be eligible for a tax credit by making a 401(k) or 403(b) contribution to the plan?

Saving for one's retirement plan is not always a priority. However, there is an added incentive to save for retirement in the form of a nonrefundable tax credit known as "the saver's tax credit". A tax credit reduces the amount of tax you owe, unlike a tax deduction that merely reduces the amount of your taxable income. A tax credit is a dollar-for-dollar reduction of taxes owed. You may be eligible to claim a tax credit of up to $1,000 when you make salary reduction contributions to your 401(k) plan, Simple 401(k), 403(b) plan, traditional IRA, or Roth IRA. The tax credit was created for low-income and moderate-income savers and has been in effect since 2002. This credit applies only as a reduction to your income tax liability, not as cash in hand via a refund. If you owe no federal income tax, you are not eligible for a tax credit. In order to qualify for the savers credit you must be: 18 years of age or older, not a full-time student, and not claimed as a dependent on someone elses return. If you think you cant afford to save for retirement, think again. Not only could contributing to your retirement plan account at work reduce the federal income tax that comes out of your paycheck, you could also get back up to $1,000 when you file your federal tax return.

Savers Credit Available to Some Taxpayers

Some taxpayers can save for retirement and earn a special tax credit. This credit, referred to as the savers credit can offset the first $2,000 contributed to the taxpayers IRA, 401(k) and other retirement plans. The Savers Credit is like a rebate: Depending on your income and tax filing status, its worth as much as 50% of every dollar you save for retirement (up to $2,000 for married taxpayers who each save at least $2,000 and file jointly; up to $1,000 for singles).

M So, what are you waiting for? Start saving for your futureand earning your credittoday!

There is a catch. The credit is only available to taxpayers which meet certain income criteria. The credit has been available as a permanent fixture since 2006 but the income amounts are indexed each year. Currently, they are:

Married Filing Jointly AGI up to $35,500 $35,501 - $38,500 $38,501 - $59,000

Head of Household AGI up to $26,625 $26,626 - $28,875 $28,876 - $44,250

Singles and Others AGI up to $17,750 $17,751 19,250 $19,251 - $29,500

Savers Credit 50% of your contribution 20% of your contribution 10% of your contribution

To claim the credit, use form 8880 together with your Form 1040. Be sure and read the instructions or consult with your tax advisor.

If you havent already enrolled in the plan, do it now! Start TODAY.

Talk to your tax advisor to see if you qualify.

You might also like

- Speed Secrets Professional Race Driving TechniquesDocument83 pagesSpeed Secrets Professional Race Driving Techniquescruxnexus89% (27)

- Bidder Invoice 1098458 01-06-2023 04-03-05Document2 pagesBidder Invoice 1098458 01-06-2023 04-03-05appp2711No ratings yet

- Applied Linear Regression Models by John Neter, William Wasserman, Michael H. KutnerDocument561 pagesApplied Linear Regression Models by John Neter, William Wasserman, Michael H. KutnerGina McCaffrey91% (11)

- General Payroll, Employment and DeductionsDocument6 pagesGeneral Payroll, Employment and DeductionsJosh LeBlancNo ratings yet

- Tax 2 Ust Exam Covid PDFDocument306 pagesTax 2 Ust Exam Covid PDFCorneliaAmarraBruhildaOlea-VolterraNo ratings yet

- Asian Transmission Vs CIR - Case DigestDocument1 pageAsian Transmission Vs CIR - Case DigestKaren Mae Servan100% (1)

- DeductionDocument1 pageDeductionQueenie AndayaNo ratings yet

- What Is An IRA? - RKB Accounting & Tax ServicesDocument6 pagesWhat Is An IRA? - RKB Accounting & Tax ServicesRKB AccountingNo ratings yet

- Personal Finance Another Perspective: Tax PlanningDocument50 pagesPersonal Finance Another Perspective: Tax PlanningcrazysidzNo ratings yet

- Centorbi - AE Taxes White Paper - DL - GGDocument8 pagesCentorbi - AE Taxes White Paper - DL - GGchad centorbiNo ratings yet

- 16 Don'T-Miss Tax DeductionsDocument4 pages16 Don'T-Miss Tax DeductionsGon FloNo ratings yet

- Retirement Strategies For Millennials: A Simple and Practical Plan for Retiring EarlyFrom EverandRetirement Strategies For Millennials: A Simple and Practical Plan for Retiring EarlyNo ratings yet

- US Individual RegulationDocument3 pagesUS Individual RegulationDarab AkhtarNo ratings yet

- 401 (K) Plan The Complete GuideDocument6 pages401 (K) Plan The Complete Guide9xw8phvcm4No ratings yet

- What Is Taxable Income?: Key TakeawaysDocument4 pagesWhat Is Taxable Income?: Key TakeawaysBella AyabNo ratings yet

- RRSP Quick Tips: Quick Tip #1 - Contribute Early To Maximize Your RRSPDocument2 pagesRRSP Quick Tips: Quick Tip #1 - Contribute Early To Maximize Your RRSPapi-117755361No ratings yet

- F 1040 EsDocument12 pagesF 1040 EsEndu EnduroNo ratings yet

- What Is A 401Document6 pagesWhat Is A 401KidMonkey2299No ratings yet

- Module 11 Retirement PlanningDocument33 pagesModule 11 Retirement PlanningmohebqasNo ratings yet

- CBW - Pitfalls White Paper FINALDocument12 pagesCBW - Pitfalls White Paper FINALChutsNo ratings yet

- Planning For RetirementDocument9 pagesPlanning For RetirementMaimai DuranoNo ratings yet

- Saver'S Tax Credit For Contributions by Individuals To Employer Retirement Plans and IrasDocument5 pagesSaver'S Tax Credit For Contributions by Individuals To Employer Retirement Plans and IrasIRSNo ratings yet

- Spring 2013 Tax, Retirement & Estate PlanningDocument4 pagesSpring 2013 Tax, Retirement & Estate PlanningBusiness Bank of Texas, N.A.No ratings yet

- Estate Tax After The Fiscal Cliff: Collaborative Financial Solutions, LLCDocument4 pagesEstate Tax After The Fiscal Cliff: Collaborative Financial Solutions, LLCJanet BarrNo ratings yet

- 10 Big Deductions Too Many People MissDocument4 pages10 Big Deductions Too Many People MissSly GrinkoNo ratings yet

- Taxes Summary Test NotesDocument10 pagesTaxes Summary Test NotesfemiadegbayoNo ratings yet

- 2012plan LimitsDocument4 pages2012plan LimitsAKTHOMNo ratings yet

- Individual Retirement Account: For New Accounts OnlyDocument24 pagesIndividual Retirement Account: For New Accounts OnlyHeidi LopezNo ratings yet

- Next Level Tax Course: The only book a newbie needs for a foundation of the tax industryFrom EverandNext Level Tax Course: The only book a newbie needs for a foundation of the tax industryNo ratings yet

- Year-Round Tax Saving Tips: Vow To Be More EfficientDocument4 pagesYear-Round Tax Saving Tips: Vow To Be More EfficientSrinivas ThoutaNo ratings yet

- Tax Tips 2022Document26 pagesTax Tips 2022Mary Juvy Ramao100% (1)

- Self-Help Guidebook for Retirement Planning For Couples and Seniors: Ultimate Retirement Planning Book for Life after Paid EmploymentFrom EverandSelf-Help Guidebook for Retirement Planning For Couples and Seniors: Ultimate Retirement Planning Book for Life after Paid EmploymentNo ratings yet

- CO Earned Income Tax Credit InformationDocument1 pageCO Earned Income Tax Credit InformationSaran KhalidNo ratings yet

- Lending Club Retirement GuideDocument8 pagesLending Club Retirement Guidecera66No ratings yet

- Windes 2021 Year End Year Round Tax Planning GuideDocument20 pagesWindes 2021 Year End Year Round Tax Planning GuideBrian SneeNo ratings yet

- A Guide To 2013 Tax Changes (And More)Document15 pagesA Guide To 2013 Tax Changes (And More)Doug PotashNo ratings yet

- Synergy Financial Group: Your Personal CFODocument4 pagesSynergy Financial Group: Your Personal CFOgvandykeNo ratings yet

- FP Group WorkDocument12 pagesFP Group WorkStellina JoeshibaNo ratings yet

- The Income Tax 2024: A Complete Guide to Permanently Reducing Your Taxes: Step-by-Step StrategiesFrom EverandThe Income Tax 2024: A Complete Guide to Permanently Reducing Your Taxes: Step-by-Step StrategiesNo ratings yet

- Strategies To Pay Less TaxDocument4 pagesStrategies To Pay Less TaxblkdwgNo ratings yet

- Tax Exemptions, Deductions, and CreditsDocument3 pagesTax Exemptions, Deductions, and CreditsSuNo ratings yet

- Tax DefinitionDocument2 pagesTax DefinitionvishanthNo ratings yet

- Build Tax-Free Wealth: How to Permanently Lower Your Taxes and Build More WealthFrom EverandBuild Tax-Free Wealth: How to Permanently Lower Your Taxes and Build More WealthNo ratings yet

- Year-End Tax Guide 2015/16Document10 pagesYear-End Tax Guide 2015/16api-311814387No ratings yet

- Ultimate Guide To Investment AccountsDocument14 pagesUltimate Guide To Investment Accountscarece7891No ratings yet

- 2011 Tax Reference GuideDocument11 pages2011 Tax Reference GuideSaver PlusNo ratings yet

- Tax-Efficiency in RetirementDocument2 pagesTax-Efficiency in RetirementJames FogalNo ratings yet

- Schwab Individual 401 (K) : BenefitsDocument4 pagesSchwab Individual 401 (K) : BenefitsJames StampNo ratings yet

- Tax-Free RetirementDocument8 pagesTax-Free RetirementNelson Yong100% (2)

- Ch4-Recordedlecture-Fall2023 17 5166787619170306Document38 pagesCh4-Recordedlecture-Fall2023 17 5166787619170306ronny nyagakaNo ratings yet

- It's Not What You Earn - It's What You Keep: Synergy Financial GroupDocument4 pagesIt's Not What You Earn - It's What You Keep: Synergy Financial GroupgvandykeNo ratings yet

- Some Terms in Income Tax ClarifiedDocument9 pagesSome Terms in Income Tax ClarifiedAnonymous ATg0gvcf9No ratings yet

- South Western Federal Taxation 2016 Essentials of Taxation Individuals and Business Entities 19th Edition Raabe Solutions ManualDocument44 pagesSouth Western Federal Taxation 2016 Essentials of Taxation Individuals and Business Entities 19th Edition Raabe Solutions Manualvernier.decyliclnn4100% (26)

- Tax Planning Strategies and Wealth Management Unit 2Document47 pagesTax Planning Strategies and Wealth Management Unit 2ANAM AFTAB 22GSOB2010404No ratings yet

- Case 2 - For Pop FinalDocument7 pagesCase 2 - For Pop Finalapi-283228440No ratings yet

- SETC Tax Credit Guide 130316Document2 pagesSETC Tax Credit Guide 130316r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- Q No4:10 Sources of Nontaxable Income / Other Sources: Income That Isn't Taxed 1. Disability Insurance PaymentsDocument3 pagesQ No4:10 Sources of Nontaxable Income / Other Sources: Income That Isn't Taxed 1. Disability Insurance PaymentswaqasNo ratings yet

- Collaborative Financial Solutions, LLC Breaking Down The Taxpaying Population: Where Do You Fit In?Document4 pagesCollaborative Financial Solutions, LLC Breaking Down The Taxpaying Population: Where Do You Fit In?Janet BarrNo ratings yet

- SETC Tax Credit Guide 214276Document2 pagesSETC Tax Credit Guide 214276r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- Ceesay Exp19 Word Ch04 CapAssessment RetirementDocument10 pagesCeesay Exp19 Word Ch04 CapAssessment RetirementcsaysalifuNo ratings yet

- Preparing For EOFY June 2011Document2 pagesPreparing For EOFY June 2011nsfpNo ratings yet

- Solved ProblemsDocument55 pagesSolved ProblemsJamaal JallowNo ratings yet

- Math 104A Practice Final ProblemsDocument3 pagesMath 104A Practice Final ProblemsGina McCaffreyNo ratings yet

- Direct Deposit FormDocument1 pageDirect Deposit FormLatonya DodsonNo ratings yet

- Hsbcuk Account Closure FormDocument6 pagesHsbcuk Account Closure FormZaid SolkarNo ratings yet

- Cyprus International CompaniesDocument11 pagesCyprus International CompaniesGigi LunetteNo ratings yet

- Unit Test-3 (Types of Plan)Document3 pagesUnit Test-3 (Types of Plan)Gemini PatelNo ratings yet

- Tokyo HotelDocument1 pageTokyo HotelRachelle BillonesNo ratings yet

- BillDocument1 pageBillMushtaq Ali KhokharNo ratings yet

- WWW Abasynisb Edu PK PDFDocument1 pageWWW Abasynisb Edu PK PDFowaisyaqoob29No ratings yet

- Dhanalaxmi Traders Annexure-18-19Document2 pagesDhanalaxmi Traders Annexure-18-19info.ashokchoudhary.icaNo ratings yet

- The City of Iloilo Vs Smart Communications, Inc. Taxation 2 DigestDocument3 pagesThe City of Iloilo Vs Smart Communications, Inc. Taxation 2 DigestEllen Glae DaquipilNo ratings yet

- Gradfee2013 To 2016Document37 pagesGradfee2013 To 2016nemson999No ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document7 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961AshishNo ratings yet

- VAT To Remedies of A Taxpayer (95%)Document61 pagesVAT To Remedies of A Taxpayer (95%)Yrjell ObsiomaNo ratings yet

- TAX102: Transfer and Business Taxation: Optional RegistrationDocument3 pagesTAX102: Transfer and Business Taxation: Optional Registrationaccounts 3 lifeNo ratings yet

- Basic Principles LectureDocument7 pagesBasic Principles LectureevaNo ratings yet

- Tripsavr Presentation PlanDocument59 pagesTripsavr Presentation PlanAdelia Triana PamungkasNo ratings yet

- Worldwide VAT, GST and Sales Tax GuideDocument2,080 pagesWorldwide VAT, GST and Sales Tax Guideİsmayil AlizadaNo ratings yet

- UBS Lesson 1Document4 pagesUBS Lesson 1Yau Xiang YingNo ratings yet

- Rekening Koran (Account Statement) : Date & Time Value Date Description Debit Balance Credit Reference NoDocument2 pagesRekening Koran (Account Statement) : Date & Time Value Date Description Debit Balance Credit Reference NofirmanNo ratings yet

- Table Sap b1Document25 pagesTable Sap b1shmilyou100% (2)

- Bill 15Document1 pageBill 15jay_p_shahNo ratings yet

- Chime Spending StatementDocument3 pagesChime Spending Statementbussinesl lasNo ratings yet

- 0 - Receipt - 1303668Document1 page0 - Receipt - 1303668Vaibhav ShindeNo ratings yet

- Fully Automated GST InvoiceDocument6 pagesFully Automated GST InvoiceShaswata MallickNo ratings yet

- Meralco Vs CIRDocument22 pagesMeralco Vs CIRmifajNo ratings yet

- Transactions-In-The-Real-Estate-Sector 2020 - PWC ReportDocument56 pagesTransactions-In-The-Real-Estate-Sector 2020 - PWC ReportNimisha GandechaNo ratings yet

- Rental Income and Expenses 2021Document2 pagesRental Income and Expenses 2021Finn KevinNo ratings yet

- Terms and Conditions - UCPB Debit CardDocument2 pagesTerms and Conditions - UCPB Debit Cardsky9213100% (2)