Professional Documents

Culture Documents

ACC291 Effect of Unethical Behavior Article

ACC291 Effect of Unethical Behavior Article

Uploaded by

Super Lion Raven KingOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ACC291 Effect of Unethical Behavior Article

ACC291 Effect of Unethical Behavior Article

Uploaded by

Super Lion Raven KingCopyright:

Available Formats

Running head: EFFECT OF UNETHICAL BEHAVIOR ARTICLE

Effect of Unethical Behavior Article Name Here ACC/291 Instructor's Name Here Date Here

EFFECT OF UNETHICAL BEHAVIOR ARTICLE Effect of Unethical Behavior Article In recent news, government authorities are planning to arrest two former JPMorgan

Chase employees suspected of masking the size of a multi-billion trading loss, a dramatic turn in a case that tarnished the reputation of the nation's biggest bank and spotlighted the perils of Wall Street risk-taking (Protess & Silver-Greensberg, 2013, para. 1). The two former employers, Javier Martin-Artajo and Julien Grout are facing possible criminal fraud charges and may be extradited under an agreement with British authorities. Martin-Artajo was a manager who oversaw the trading strategy and Grout was a low-level trader in London (Protess & SilverGreensberg, 2013). The losses at the heart of the JPMorgan case stemmed from outsize wagers made by the traders at the bank's chief investment office in London. The traders used derivatives - complex financial contracts whose value is typically tied to an asset like corporate bonds - to be on the health of large corporations like American Airlines (Protess & Silver-Greensberg, 2013, para. 6). Those trades soured last year, racking up steep losses for the bank. JPMorgan, which initially disclosed the problem last May, has since announced that the losses reached more than $6 billion (Protess & Silver-Greensberg, 2013, para. 7). Investigations show that the manager directed the low-level trader to falsify internal records, understating the value of their trades causing JPMorgan to understate costs by $459 million (Protess & Silver-Greensberg, 2013). The Securities and Exchange Commission (SEC) is expected to cite JPMorgan for lax controls allowing traders to undervalue the bets. In an unusually agressive move, the SEC is seeking to extract an admission of wrongdoing from the nation's biggest bank. If JPMorgan concedes to that deman, such an admission would reverse a

EFFECT OF UNETHICAL BEHAVIOR ARTICLE longtime practice at the SEC, which has allowed defendents for decades to "neither admit nor deny wrongdoing" (Protess & Silver-Greensberg, 2013, para. 14). Under section 404 of the Sarbanes-Oxley Act of 2002, companies are required to establish internal controls and procedures for financial reporting. The chief executive and chief financial officer personally must declare that they have reviewed and approved the auditors' report and that the data is accurate. Section 404 forces top executives to be responsible and accountable for the information in the financial reports of their company. Reforms on the Act continue to improve financial reporting requirements, the configuration and quality of audit

procedures, and safeguards for investors. The Sarbanes-Oxley Act of 2002, provided extra legal protections to companies and forced executives to take personal responsibility for their actions. The Act is a legal addition to the cautionary measures companies should use to protect the company and its employees. Pursuing criminal charges against Martin-Artajo and Grout and possible civil charges against JPMorgan, the government is faced with the challenge of proving their case to a jury who must make every attempt to grasp reporting procedures, standards, and regulations in relation to Generally Accepted Accounting Principles (GAAP) and The Sarbanes-Oxley Act. The jury must also understand the roles of the SEC, the Public Company Accounting Oversight Board, and the Financial Accounting Standards Board to reach a sound decision. The usual methods used to test the scope of juror's comprehension abilities are not applicable as there is no way to test accurately if jurors will be able to understand all facets of the case. In cases such as Enron, WorldCom, and AGI, the issue at hand extends to the decisionmaking process in a court of law. Is it impossible for a jury of unqualified individuals to reach a rational and ethical verdict in a case that requires the knowledge and understanding of complex

EFFECT OF UNETHICAL BEHAVIOR ARTICLE controls and legal regulations. The most obvious solution would be to change the legal system but that conflicts with equitable rights that are the foundation of the Nation. Juries are trusted and given the responsibility of reaching a verdict based on evidence and personal understanding

of such evidence. The nature and knowledge of each juror is ultimately the deciding factor. The moral existence of individuals determines their sense of obligation to act ethically.

EFFECT OF UNETHICAL BEHAVIOR ARTICLE References Protess, B., & Silver-Greensberg, J. (2013). U.S. said to plan to arrest pair in big bank loss. Retrieved from http://dealbook.nytimes.com/2013/08/09/authorities-set-to-arrest-2former-jpmorgan-employees-in-london-whalecase/?nl=todaysheadlines&emc=edit_th_20130810&_r=1&

You might also like

- Solution Manual For Managers and The Legal Environment Strategies For Business 9th Edition Constance e Bagley Isbn 10 1337555088 Isbn 13 9781337555081Document11 pagesSolution Manual For Managers and The Legal Environment Strategies For Business 9th Edition Constance e Bagley Isbn 10 1337555088 Isbn 13 9781337555081Paul Fuselier100% (34)

- GF&Co: JPM - Out of ControlDocument45 pagesGF&Co: JPM - Out of Controldavid_dayen3823100% (1)

- Amanda Brown CasestudyDocument4 pagesAmanda Brown Casestudyapi-380155657No ratings yet

- Yellow Book: Presented by-H.V.Sithuruwan Fernando (Engineering Cadet)Document24 pagesYellow Book: Presented by-H.V.Sithuruwan Fernando (Engineering Cadet)piliyandalaleosNo ratings yet

- Cato Handbook Congress: Washington, D.CDocument9 pagesCato Handbook Congress: Washington, D.CDiscoverupNo ratings yet

- Ais Rivera PDFDocument12 pagesAis Rivera PDFHannah LegaspiNo ratings yet

- Chapter 6 EBPA (ING)Document66 pagesChapter 6 EBPA (ING)Yovie SantriaNo ratings yet

- Bankster Hearings - SchapiroDocument29 pagesBankster Hearings - SchapiroForeclosure FraudNo ratings yet

- Ans:-The Determinants of Structure of Financial Markets AreDocument3 pagesAns:-The Determinants of Structure of Financial Markets Aresajeev georgeNo ratings yet

- Accounting ScandalDocument12 pagesAccounting ScandalHannah Pamela LegaspiNo ratings yet

- Maximizing The Value of Distressed Assets - Bankruptcy Law and The Efficient Reorganization of FirmsDocument48 pagesMaximizing The Value of Distressed Assets - Bankruptcy Law and The Efficient Reorganization of Firmsvidovdan9852No ratings yet

- SJLS Dec09 332Document33 pagesSJLS Dec09 332kieumy98No ratings yet

- Hedge Funds and Private Equity FundsDocument13 pagesHedge Funds and Private Equity FundsMarketsWikiNo ratings yet

- International Journal of Law and ManagementDocument17 pagesInternational Journal of Law and ManagementRoman ZantaraiaNo ratings yet

- Law & Corporate FinanceDocument238 pagesLaw & Corporate FinanceRajesh Shantaram Shinde100% (1)

- EnronDocument30 pagesEnronrakshitgupta17No ratings yet

- CH 4Document6 pagesCH 4Mona Adila PardedeNo ratings yet

- CMGT502 w07 CorporateGovernanceDocument37 pagesCMGT502 w07 CorporateGovernanceGourav JenaNo ratings yet

- Auditor Liability: Fair and Reasonable' Punishment?Document6 pagesAuditor Liability: Fair and Reasonable' Punishment?kawsursharifNo ratings yet

- White & CaseDocument24 pagesWhite & CaseGarethvanZylNo ratings yet

- Ghillyer EthicsNow IM Ch06Document28 pagesGhillyer EthicsNow IM Ch06JeenahNo ratings yet

- Issues in Commodity FinanceDocument23 pagesIssues in Commodity FinancevinaymathewNo ratings yet

- Dodd-Frank Act Honor ResearchDocument7 pagesDodd-Frank Act Honor ResearchLinh KinNo ratings yet

- OCC Guidance On Unfair or Deceptive Acts or Practices Advisory-Letter-2002-3Document8 pagesOCC Guidance On Unfair or Deceptive Acts or Practices Advisory-Letter-2002-3Charlton ButlerNo ratings yet

- Securities and Exchange Commission: Sarbanes-Oxley ActDocument10 pagesSecurities and Exchange Commission: Sarbanes-Oxley ActLedayl MaralitNo ratings yet

- Legal Briefing Note V0.91 (Sept 11)Document8 pagesLegal Briefing Note V0.91 (Sept 11)Anthony MeadowsNo ratings yet

- Auditor Independence Revisited The Effects PDFDocument15 pagesAuditor Independence Revisited The Effects PDFWibowo SanuNo ratings yet

- Assignment 1 Final Paper (Edited)Document8 pagesAssignment 1 Final Paper (Edited)paterneNo ratings yet

- Corporate America and SarbanesDocument2 pagesCorporate America and SarbanesMohammad Nowaiser MaruhomNo ratings yet

- Research Paper On JP Morgan ChaseDocument7 pagesResearch Paper On JP Morgan Chaseafmcvhffm100% (1)

- Financial Fraud Sept 08Document29 pagesFinancial Fraud Sept 08rebuka sultanaNo ratings yet

- Anthony - DerivativeDocument7 pagesAnthony - DerivativeTony BestNo ratings yet

- Sarbanes-Oxley (SOX) Act of 2002: Presented by GroupDocument11 pagesSarbanes-Oxley (SOX) Act of 2002: Presented by GroupMathew Joshy 18099No ratings yet

- Business and Economic Crime in An International ContexDocument21 pagesBusiness and Economic Crime in An International Contexحسن خالد وسوNo ratings yet

- Conducting Anticorruption Due Diligence in M&A DealsDocument4 pagesConducting Anticorruption Due Diligence in M&A DealsMoaaz AhmedNo ratings yet

- Interfin Bank AssignmentDocument6 pagesInterfin Bank AssignmentAaron KuudzeremaNo ratings yet

- Value Creation Through Corporate GovernanceDocument11 pagesValue Creation Through Corporate GovernanceAbdel AyourNo ratings yet

- Business Law Today Article - August 2, 2010Document4 pagesBusiness Law Today Article - August 2, 2010Stuart DemingNo ratings yet

- 2002 - 04 - ISDA - Enron - Corporate Failure, Market SuccessDocument24 pages2002 - 04 - ISDA - Enron - Corporate Failure, Market Successthcm2011No ratings yet

- How Much Will The Amnesty Cost?Document8 pagesHow Much Will The Amnesty Cost?gustafgeysbertNo ratings yet

- Chapter 4Document4 pagesChapter 4viechocNo ratings yet

- Ethical and Professional Standards - Application Assignment Dec 2023 1Document7 pagesEthical and Professional Standards - Application Assignment Dec 2023 1sachin.saroa.1No ratings yet

- HealthSouth Case For Moodle EditableDocument9 pagesHealthSouth Case For Moodle EditableGisselle CollinsNo ratings yet

- Enron Case StudyDocument9 pagesEnron Case StudyDr CommissionerNo ratings yet

- Ethics For A Post-Enron America: John R. BoatrightDocument2 pagesEthics For A Post-Enron America: John R. Boatrightayoub dangerNo ratings yet

- Tutorial 3 Home WorkDocument6 pagesTutorial 3 Home WorkchubstNo ratings yet

- FinalprojectbusDocument8 pagesFinalprojectbusapi-302579024No ratings yet

- Business Ethics - Part 2 - Chapter 6Document43 pagesBusiness Ethics - Part 2 - Chapter 6Sarah JarrarNo ratings yet

- Research Paper On Sarbanes Oxley ActDocument7 pagesResearch Paper On Sarbanes Oxley Actegw0a18w100% (1)

- Sarbanes-Oxley Act of 2002 Jadeen Service Hampton University 2014 MBA 315 3/5/2014Document12 pagesSarbanes-Oxley Act of 2002 Jadeen Service Hampton University 2014 MBA 315 3/5/2014jadeen serviceNo ratings yet

- Debt Enforcement Around The World 2007-8Document45 pagesDebt Enforcement Around The World 2007-8djordje.makicNo ratings yet

- Honesty and Business Ethics in The Accounting Profession: August 1979Document12 pagesHonesty and Business Ethics in The Accounting Profession: August 1979sizzunsNo ratings yet

- AGENCY PROBLEMS IN CORPORATE GOVERNANCE: Accountability of Managers and StockholdersDocument65 pagesAGENCY PROBLEMS IN CORPORATE GOVERNANCE: Accountability of Managers and Stockholdersrachellesg75% (12)

- PDF Solution Manual For Ethical Obligations and Decision Making in Accounting Text and Cases 2Nd Edition by Mintz Online Ebook Full ChapterDocument44 pagesPDF Solution Manual For Ethical Obligations and Decision Making in Accounting Text and Cases 2Nd Edition by Mintz Online Ebook Full Chapterzenaida.mcpherson439100% (6)

- Unclearedmargin Factsheet09171 PDFDocument2 pagesUnclearedmargin Factsheet09171 PDFMarketsWikiNo ratings yet

- Mergers Acquisitions - Philippines PDFDocument10 pagesMergers Acquisitions - Philippines PDFAl GNo ratings yet

- 3 A Brief History of CGDocument27 pages3 A Brief History of CGM YounasNo ratings yet

- Iaqf Competition PaperDocument10 pagesIaqf Competition Paperapi-262753233No ratings yet

- The Insider's Guide to Securities Law: Navigating the Intricacies of Public and Private OfferingsFrom EverandThe Insider's Guide to Securities Law: Navigating the Intricacies of Public and Private OfferingsRating: 5 out of 5 stars5/5 (1)

- Risk in the Global Real Estate Market: International Risk Regulation, Mechanism Design, Foreclosures, Title Systems, and REITsFrom EverandRisk in the Global Real Estate Market: International Risk Regulation, Mechanism Design, Foreclosures, Title Systems, and REITsNo ratings yet

- MTTM 11Document17 pagesMTTM 11Rakesh dahiyaNo ratings yet

- DunavskastrategijaEUu21 VekuDocument347 pagesDunavskastrategijaEUu21 VekuRadovi1231123No ratings yet

- Units: Angeles University Foundation School of Law Schedule of Classes Second Semester, AY 2020-2021Document3 pagesUnits: Angeles University Foundation School of Law Schedule of Classes Second Semester, AY 2020-2021Cinja ShidoujiNo ratings yet

- 12 - Epstein Barr Virus (EBV)Document20 pages12 - Epstein Barr Virus (EBV)Lusiana T. Sipil UnsulbarNo ratings yet

- Planning AnswersDocument51 pagesPlanning AnswersBilly Dentiala IrvanNo ratings yet

- Advances in Accounting, Incorporating Advances in International AccountingDocument14 pagesAdvances in Accounting, Incorporating Advances in International AccountingWihl Mathew ZalatarNo ratings yet

- Business MeetingDocument30 pagesBusiness Meetingchxth staroNo ratings yet

- Report Appendix PDFDocument5 pagesReport Appendix PDFRyan O'CallaghanNo ratings yet

- Edgar Rice Burroughs - (John Carter Barsoom #3) The Warlord of MarsDocument152 pagesEdgar Rice Burroughs - (John Carter Barsoom #3) The Warlord of MarsConstantin Clement VNo ratings yet

- Social, Economic and Political Thought: Summer 2012Document12 pagesSocial, Economic and Political Thought: Summer 2012Jan Robert Ramos GoNo ratings yet

- 3 The Origins of MarketingDocument8 pages3 The Origins of MarketingCPAREVIEWNo ratings yet

- UOP Olefin Production Solutions BrochureDocument2 pagesUOP Olefin Production Solutions BrochureAbhik Banerjee100% (1)

- Indian Genre Fiction - Pasts and Future Histories - Bodhisattva Chattopadhyay, Aakriti Mandhwani and Anwesha - Studies in Global Genre Fiction, 2019 - 9780429456169 - Anna's ArchiveDocument224 pagesIndian Genre Fiction - Pasts and Future Histories - Bodhisattva Chattopadhyay, Aakriti Mandhwani and Anwesha - Studies in Global Genre Fiction, 2019 - 9780429456169 - Anna's ArchiveManshi YadavNo ratings yet

- Murang A New Court Links and ContactsDocument1 pageMurang A New Court Links and ContactsFaith NyokabiNo ratings yet

- RSLogix 5000 Fatal Error 0x80042008Document2 pagesRSLogix 5000 Fatal Error 0x80042008Thandayudhapani VeeraputhiranNo ratings yet

- SPJIMR - SP Jain Institute of Management & Research, MumbaiDocument2 pagesSPJIMR - SP Jain Institute of Management & Research, MumbaiArindom BhattacharjeeNo ratings yet

- Shagun Dissertation Report 2023Document76 pagesShagun Dissertation Report 2023tarun ranaNo ratings yet

- Page - NBB ResearchDocument41 pagesPage - NBB ResearchToche DoceNo ratings yet

- Science and SocietyDocument1 pageScience and SocietyAhmad KeatsNo ratings yet

- Holy GrailDocument3 pagesHoly GrailPeter SoukarasNo ratings yet

- Mythologyof NakshatrasDocument65 pagesMythologyof NakshatrasMusical Songs100% (1)

- Blades in The Dark Cheat Sheet RevisedDocument2 pagesBlades in The Dark Cheat Sheet RevisedJustin KietzmanNo ratings yet

- Tithonus' by TennysonDocument10 pagesTithonus' by TennysonMs-CalverNo ratings yet

- Project Communication Assessment 1Document10 pagesProject Communication Assessment 1Tanmay JhulkaNo ratings yet

- CSCS Quick GuideDocument6 pagesCSCS Quick GuideLica EmilNo ratings yet

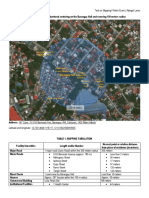

- Test On Mapping or Prelim ExamDocument6 pagesTest On Mapping or Prelim ExamAbegail LaronNo ratings yet

- The Following Text Is For Questions 91 To 95Document4 pagesThe Following Text Is For Questions 91 To 95NapNo ratings yet

- Olano V Lim Eng CoDocument22 pagesOlano V Lim Eng CoRimvan Le SufeorNo ratings yet