Professional Documents

Culture Documents

Form No.16: Part A

Form No.16: Part A

Uploaded by

Pradeep KumarOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Form No.16: Part A

Form No.16: Part A

Uploaded by

Pradeep KumarCopyright:

Available Formats

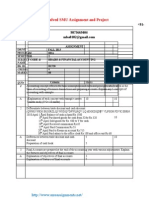

FORM NO.

16

[See rule 31(1) (a)]

PART A

Certificate under section 203 of the Income ta! Act" 1#61 for ta! deducted at source on sa$ar% Certificate No. &ast u'dated on Name and address of the (m'$o%er Name and address of the (m'$o%ee

PAN of the )eductor

TAN of the )eductor

PAN of the (m'$o%ee

(m'$o%ee Reference No. 'ro*ided +% the (m'$o%er ,If a*ai$a+$e-

Assessment /ear CIT ,T).Address . City.Pin code..,

Pe rio d

0ith the (m'$o%er

Fr om

To

.ummar% of amount 'aid1credited and ta! deducted at source thereon in res'ect of the em'$o%ee 2uarter,sRece Num+ers i't of 4uarter$% statements

under su+ section

ori3in a$ o T f ).

, 3 of

Amou nt 'aid1credited

Amount of ta! deducted , Rs. -

Amount of ta! de'osited1 remitted

,Rs. section 200

Tota$ ,Rs.-

I. )(TAI&. OF TA5 )()6CT() AN) )(PO.IT() IN T7( C(NTRA& 8O9(RNM(NT ACCO6NT T7RO687 :OO; A)<6.TM(NT ,The deductor to 'ro*ide 'a%ment 0ise detai$s of ta! deducted and de'osited 0ith res'ect to the deductee.$. No. Ta! )e'osited in res'ect of the deductee , Rs. :oo= Identification Num+er ,:INRecei't num+ers of ))O seria$ num+er in Form No. )ate of transfer .tatus of matchin3

2>8

*oucher

Form No. 2>8 ,dd1mm1%%%%-

0ith Form No.2>8

Tota$ , Rs. II. )(TAI&. OF TA5 )()6CT() AN) )(PO.IT() IN T7( C(NTRA& 8O9(RNM(NT ACCO6NT T7RO687 C7A&&AN ,The deductor to 'ro*ide 'a%ment 0ise detai$s of ta! deducted and de'osited 0ith res'ect to the deductee.$. No. Ta! )e'osited in res'ect Cha$$an Identification Num+er ,CINof the deductee

:.R Code of the :an= , Rs. :ranch

)ate on 0hich ta! de'osited ,dd1mm1%%%%-

Cha$$an .eria$ Num+er

.tatus of matchin3 0ith O&TA.

Tota$ , Rs. 9erificat ion I"?????.." son1dau3hter of ????.0or=in3 in the ca'acit% of ??. ,desi3nation- do here+% certif% that a sum of Rs. ????.. @Rs. ????.,in 0ords-A has +een deducted and de'osited to the credit of the Centra$ 8o*ernment. I further certif% that the information 3i*en a+o*e is true" com'$ete and correct and is +ased on the +oo=s of account" documents" T). statements" T). de'osited and other a*ai$a+$e records. P$ace )ate )esi3nationB NotesB Fu$$ NameB ,.i3nature of 'erson res'onsi+$e for deduction of ta!-

1. &. 3. -. 2. /.

Government deductors to fill information in item I if ta is !aid "it#out !roduction of an income$ta c#allan and in item II if ta is !aid accom!anied %y an income$ta c#allan. 'on$Government deductors to fill information in item II. (#e deductor s#all furnis# t#e address of t#e Commissioner of )ncome$ta ((*S) #avin+ ,urisdiction as re+ards (*S statements of t#e assessee. )f an assessee is em!loyed under one em!loyer only durin+ t#e year, certificate in .orm 'o. 1/ issued for t#e 0uarter endin+ on 31 st 1arc# of t#e financial year s#all contain t#e details of ta deducted and de!osited for all t#e 0uarters of t#e financial year. )f an assessee is em!loyed under more t#an one em!loyer durin+ t#e year, eac# of t#e em!loyers s#all issue Part A of t#e certificate in .orm 'o. 1/ !ertainin+ to t#e !eriod for "#ic# suc# assessee "as em!loyed "it# eac# of t#e em!loyers. Part 3 (Anne ure) of t#e certificate in .orm 'o.1/ may %e issued %y eac# of t#e em!loyers or t#e last em!loyer at t#e o!tion of t#e assessee. )n items I and II" in column for ta de!osited in res!ect of deductee, furnis# total amount of (*S and education cess.

PART : ,Anne!ure)etai$s of .a$ar% 'aid and an% other income and ta! deducted 1 Gross Salary (a Salary as !er !rovisions contained in ) sec.15(1) (% ) (c ) (d ) & 4s . 4s.

6alue of !er0uisites u7s 15(&) (as !er .orm 'o.1&3A, "#erever a!!lica%le) Profits in lieu of salary under section 15(3)(as !er .orm 'o.1&3A, "#erever a!!lica%le) (otal 8ess9 Allo"ance to t#e e tent e em!t u7s 1: Allo"ance 4s.

4s.

4s.

4s.

4s.

4s.

3 -

3alance(1$&) *eductions 9 (a ) ;ntertainment allo"ance (% ) (a on em!loyment A++re+ate of -(a) and (%) )ncome c#ar+ea%le under t#e #ead <salaries< (3$2) Add9 Any ot#er income re!orted %y t#e em!loyee )ncome 4s.

4s.

4s. 4s. 4s. 4 s .

2 / 5

4s. = Gross total income (/>5) *eductions under C#a!ter 6)$A 4 s .

(1)

(a) section =:C (i) (ii) (iii) (iv)

sections =:C, =:CCC and =:CC* Gross Amount . . . . 4s. 4s. 4s. 4s. *educti%le amount

(2) (/)

(vii)

. . 4 s .

4s.

(%) section =:CCC

4s. section =:CC*

4 s .

(3)

'ote9 1. A++re+ate amount deducti%le under sections =:C, =:CCC and =:CC*(1) s#all not e ceed one la@# ru!ees.

At#er sections (e.+. =:;, =:G, =:((A, etc.) under C#a!ter 6)$A. Gross amount (i) (ii) (iii) (iv) (v) 1 : 1 1 1 & 1 3 1 1 2 1 / section.. section.. section.. section.. section.. 4s. 4s. 4s. 4s. 4s. Bualifyin+ amount 4s. 4s. 4s. 4s. 4s. *educti%le amount 4s. 4s. 4s. 4s. 4s. 4s 4s 4s 4s. 4s. 4s 4s. 9erification I" ???????????.." son1dau3hter of ???????????????.0or=in3 in the ca'acit% of .?????????......... ,desi3nationdo here+% certif% that the information 3i*en a+o*e is true" com'$ete and correct and is +ased on the +oo=s of account" documents" T). statements" and other a*ai$a+$e records. P$ace )ate ,.i3nature of 'erson res'onsi+$e for deduction of ta!Fu$$ NameB CCCCCCCCCCCCCCCCCCCCCCCDE

A++re+ate of deducti%le amount under C#a!ter 6)$A (otal )ncome (=$ 1:) (a on total income ;ducation cess C 3D (on ta com!uted at S. 'o. 1&) (a Paya%le (1&>13) 8ess9 4elief under section =? (attac# details) (a !aya%le (1-$ 12)

)esi3nationB

You might also like

- CXC Principles of Accounts Past Papers May 2012Document9 pagesCXC Principles of Accounts Past Papers May 2012ArcherAcs86% (7)

- Formula, Rates and Due Dates READocument21 pagesFormula, Rates and Due Dates REAKaren Balisacan Segundo Ruiz100% (2)

- Insolvensi Borang Penyataan Hal EhwalDocument20 pagesInsolvensi Borang Penyataan Hal EhwalMahadi Marop Dee100% (1)

- All About SAP - How To Use F110 in Sap - Step by StepDocument3 pagesAll About SAP - How To Use F110 in Sap - Step by StepAnanthakumar ANo ratings yet

- BIACS 2 - Seville Biennial: The Unhomely (Review)Document3 pagesBIACS 2 - Seville Biennial: The Unhomely (Review)foggy_notionNo ratings yet

- Form No 15HDocument2 pagesForm No 15HPrajesh SrivastavaNo ratings yet

- Management Accounting PMA1A - Need Solution - Ur Call Away - 9582940966Document4 pagesManagement Accounting PMA1A - Need Solution - Ur Call Away - 9582940966Ambrish (gYpr.in)No ratings yet

- Utual UND: Ssignmen T ONDocument9 pagesUtual UND: Ssignmen T ONMahbubul Bari ShiblyNo ratings yet

- Order in The Matter of Amrit Projects (N. E.) LimitedDocument13 pagesOrder in The Matter of Amrit Projects (N. E.) LimitedShyam SunderNo ratings yet

- Vipin Form 16Document5 pagesVipin Form 16Jagdish Sharma CANo ratings yet

- D Package Scheme of Incentives-2007Document7 pagesD Package Scheme of Incentives-2007banavaram1No ratings yet

- Concept of IncomeDocument12 pagesConcept of IncomeCara HenaresNo ratings yet

- Ch24 Full Disclosure in Financial ReportingDocument31 pagesCh24 Full Disclosure in Financial ReportingAries BautistaNo ratings yet

- CIR Vs Raul Gonzales DigestDocument4 pagesCIR Vs Raul Gonzales DigestFroilan Villafuerte Faurillo100% (2)

- Cir Vs Sony Philippines Inc (GR 178697 November 17 2010)Document11 pagesCir Vs Sony Philippines Inc (GR 178697 November 17 2010)Brian BaldwinNo ratings yet

- Outreach Plan Template: 1. Cover Page/Contact Information/SignaturesDocument7 pagesOutreach Plan Template: 1. Cover Page/Contact Information/SignaturesYen055No ratings yet

- By CA Rajeev Kumar Ranjan Mob. No. 8100052661: Management's Responsibility For The Financial StatementsDocument3 pagesBy CA Rajeev Kumar Ranjan Mob. No. 8100052661: Management's Responsibility For The Financial Statementspathan1990No ratings yet

- You're Nearly There! To Ensure That Your Payment Is Received by Your Institution Without Any Delays, Please Follow The Instructions BelowDocument6 pagesYou're Nearly There! To Ensure That Your Payment Is Received by Your Institution Without Any Delays, Please Follow The Instructions BelowJosin JoseNo ratings yet

- Interim Order in The Matter of Progress Cultivation Limited.Document12 pagesInterim Order in The Matter of Progress Cultivation Limited.Shyam SunderNo ratings yet

- All CA KRI 14.10Document2 pagesAll CA KRI 14.10manishluv13No ratings yet

- Order in The Matter of Greentouch Projects Ltd.Document15 pagesOrder in The Matter of Greentouch Projects Ltd.Shyam Sunder0% (1)

- Financial Statements, Cash Flows, and Taxes: Homework ForDocument9 pagesFinancial Statements, Cash Flows, and Taxes: Homework Foradarshdk1No ratings yet

- Karpagam Institute of Technology Mca Continuous Assessment Internal Test-IDocument5 pagesKarpagam Institute of Technology Mca Continuous Assessment Internal Test-IanglrNo ratings yet

- Section-IV Qualification CriteriaDocument6 pagesSection-IV Qualification CriteriaYohannes GebreNo ratings yet

- Form No. 15G: Area Code AO Type Range Code Ao NoDocument2 pagesForm No. 15G: Area Code AO Type Range Code Ao NoRanjan ManoNo ratings yet

- Luc RareDocument29 pagesLuc RareGabriela Anca BarbuNo ratings yet

- HDFC Bank Home LoanDocument30 pagesHDFC Bank Home LoanMark MurphyNo ratings yet

- Index: CNDI 06 Increase Topicality LAB: Arnett/Burshteyn/LinDocument15 pagesIndex: CNDI 06 Increase Topicality LAB: Arnett/Burshteyn/LinIMNo ratings yet

- Accounting Group Study 1Document13 pagesAccounting Group Study 1ahmustNo ratings yet

- Domondon NotesDocument15 pagesDomondon NotesShiela ValdezNo ratings yet

- Financial Accounting Assignment KUDocument5 pagesFinancial Accounting Assignment KUdmugalloyNo ratings yet

- FAQsDocument10 pagesFAQsrajdeeppawarNo ratings yet

- Financial Condition Report (FCR) For General Insurance CompaniesDocument28 pagesFinancial Condition Report (FCR) For General Insurance Companiesraheja_ashishNo ratings yet

- User Guidance: Guide NotesDocument13 pagesUser Guidance: Guide NotesdaveleyconsNo ratings yet

- Application For BankDocument11 pagesApplication For Bankvenkat12350No ratings yet

- Ind AS1Document33 pagesInd AS1SaibhumiNo ratings yet

- Read The Instructions On The Reverse Side Before Completing This FormDocument2 pagesRead The Instructions On The Reverse Side Before Completing This FormTabitha HowardNo ratings yet

- Form 12 A Statement of Contribution For Unexmpted Establishments PFDocument2 pagesForm 12 A Statement of Contribution For Unexmpted Establishments PFRamana KanthNo ratings yet

- 7.4.14 Red Notes TaxDocument41 pages7.4.14 Red Notes TaxRey Jan N. VillavicencioNo ratings yet

- Milo TaxDocument5 pagesMilo TaxMilo LANo ratings yet

- Ais510 PBL Question Sept2012-Jan2013 Uitm SarawakDocument9 pagesAis510 PBL Question Sept2012-Jan2013 Uitm SarawakNu'ul Qiqi ZaidNo ratings yet

- Dokumen - Tips - Latihan Soal Sap Finance Lengkap Ada JawabanDocument6 pagesDokumen - Tips - Latihan Soal Sap Finance Lengkap Ada Jawabanurbae chaNo ratings yet

- Form 3CD NewDocument16 pagesForm 3CD NewRikta KariaNo ratings yet

- Case Digests: Taxation LawDocument10 pagesCase Digests: Taxation LawRoosevelt GuerreroNo ratings yet

- ACORD v. ZamoraDocument14 pagesACORD v. ZamoraJon SantosNo ratings yet

- A Rediff Article On NGOs in IndiaDocument10 pagesA Rediff Article On NGOs in IndiasivaramanlbNo ratings yet

- Ajara Urban Co-Op Bank LTD., Ajara Dist - Kolhapur: N.M. Joshi MargDocument32 pagesAjara Urban Co-Op Bank LTD., Ajara Dist - Kolhapur: N.M. Joshi Margpramesh1010No ratings yet

- GHMC 208 GO FormDocument6 pagesGHMC 208 GO Formmohdaslam89No ratings yet

- CitibankDocument24 pagesCitibankMonefah MulokNo ratings yet

- 126 Resource MAFA May 1996 May 2001Document267 pages126 Resource MAFA May 1996 May 2001Erwin Labayog MedinaNo ratings yet

- Events After The Reporting Period: Myanmar Accounting Standard 10Document5 pagesEvents After The Reporting Period: Myanmar Accounting Standard 10Kyaw Htin WinNo ratings yet

- United Republic of Tanzania Open Performance Review and Appraisal FormDocument7 pagesUnited Republic of Tanzania Open Performance Review and Appraisal FormStan George ChibelenjeNo ratings yet

- 15 - Proposal Template May 2011Document16 pages15 - Proposal Template May 2011uromancyNo ratings yet

- For Solved SMU Assignment and Project: Contact EmailDocument4 pagesFor Solved SMU Assignment and Project: Contact EmailArvind KNo ratings yet

- Kaiser Tax Sheltered Annuity 5500 For 2010Document38 pagesKaiser Tax Sheltered Annuity 5500 For 2010James LindonNo ratings yet

- Economic & Budget Forecast Workbook: Economic workbook with worksheetFrom EverandEconomic & Budget Forecast Workbook: Economic workbook with worksheetNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Divided States: Strategic Divisions in EU-Russia RelationsFrom EverandDivided States: Strategic Divisions in EU-Russia RelationsNo ratings yet

- Kolkata Trams PDFDocument1 pageKolkata Trams PDFPradeep KumarNo ratings yet

- Indian Chemical Society: Application For MembershipDocument5 pagesIndian Chemical Society: Application For MembershipPradeep KumarNo ratings yet

- B.MAT 2015: Brilliant'S Mock All-India Test Series Y.G. File Problem PackageDocument3 pagesB.MAT 2015: Brilliant'S Mock All-India Test Series Y.G. File Problem PackagePradeep KumarNo ratings yet

- Shri Kshetra TrimbakeshwarDocument21 pagesShri Kshetra TrimbakeshwarPradeep KumarNo ratings yet

- Teaching Staff Name 1 2 3 Laliteshwar Pratap Singh 4 5 6 7 8 9 10 11 12 13 14Document2 pagesTeaching Staff Name 1 2 3 Laliteshwar Pratap Singh 4 5 6 7 8 9 10 11 12 13 14Pradeep KumarNo ratings yet

- D.K.Pandaey: Job ResponsibilityDocument2 pagesD.K.Pandaey: Job ResponsibilityPradeep KumarNo ratings yet

- Galgotias University Engineering Entrance Examination (GEEE) - 2014Document1 pageGalgotias University Engineering Entrance Examination (GEEE) - 2014Pradeep KumarNo ratings yet

- Standard SolutionDocument9 pagesStandard SolutionPradeep KumarNo ratings yet

- Helpdesk: Home A/C Details Recharge View/Modify Packages Everywhere TV Order Showcase Record Shows ActveDocument1 pageHelpdesk: Home A/C Details Recharge View/Modify Packages Everywhere TV Order Showcase Record Shows ActvePradeep KumarNo ratings yet

- Furosemide DSDocument2 pagesFurosemide DSjhanrey0810_18768No ratings yet

- OX App Suite User Guide English v7.6.0Document180 pagesOX App Suite User Guide English v7.6.0Ranveer SinghNo ratings yet

- M HealthDocument81 pagesM HealthAbebe ChekolNo ratings yet

- A Kinsha 2013Document698 pagesA Kinsha 2013alexander2beshkovNo ratings yet

- ANALE - Stiinte Economice - Vol 2 - 2014 - FinalDocument250 pagesANALE - Stiinte Economice - Vol 2 - 2014 - FinalmhldcnNo ratings yet

- SB KarbonDocument3 pagesSB KarbonAbdul KarimNo ratings yet

- Consultancy - Software DeveloperDocument2 pagesConsultancy - Software DeveloperImadeddinNo ratings yet

- Phd:304 Lab Report Advanced Mathematical Physics: Sachin Singh Rawat 16PH-06 (Department of Physics)Document12 pagesPhd:304 Lab Report Advanced Mathematical Physics: Sachin Singh Rawat 16PH-06 (Department of Physics)sachin rawatNo ratings yet

- Roger Dale Stafford, Sr. v. Ron Ward, Warden, Oklahoma State Penitentiary at McAlester Oklahoma Drew Edmondson, Attorney General of Oklahoma, 59 F.3d 1025, 10th Cir. (1995)Document6 pagesRoger Dale Stafford, Sr. v. Ron Ward, Warden, Oklahoma State Penitentiary at McAlester Oklahoma Drew Edmondson, Attorney General of Oklahoma, 59 F.3d 1025, 10th Cir. (1995)Scribd Government DocsNo ratings yet

- DS Masteri An PhuDocument174 pagesDS Masteri An PhuPhong PhuNo ratings yet

- International Law: Savarkar CaseDocument15 pagesInternational Law: Savarkar CaseArunesh Chandra100% (1)

- New Hardcore 3 Month Workout PlanDocument3 pagesNew Hardcore 3 Month Workout PlanCarmen Gonzalez LopezNo ratings yet

- TVGOS Training ManualDocument44 pagesTVGOS Training ManualFranciscoStarNo ratings yet

- Not in His Image (15th Anniversary Edition) - Preface and IntroDocument17 pagesNot in His Image (15th Anniversary Edition) - Preface and IntroChelsea Green PublishingNo ratings yet

- Weekly Home Learning Plan: Grade Section Quarter Week Inclusive DateDocument3 pagesWeekly Home Learning Plan: Grade Section Quarter Week Inclusive DateMarvin Yebes ArceNo ratings yet

- Desmand Whitson Resume 1PDFDocument2 pagesDesmand Whitson Resume 1PDFRed RaptureNo ratings yet

- Drill #1 With RationaleDocument12 pagesDrill #1 With RationaleRellie CastroNo ratings yet

- Metaverse Report - Thought Leadership 1Document17 pagesMetaverse Report - Thought Leadership 1Tejas KNo ratings yet

- View AnswerDocument112 pagesView Answershiv anantaNo ratings yet

- The Secret Book of JamesDocument17 pagesThe Secret Book of JameslaniNo ratings yet

- ECON7002: Unemployment and InflationDocument65 pagesECON7002: Unemployment and InflationNima MoaddeliNo ratings yet

- Veterinary MicrobiologyDocument206 pagesVeterinary MicrobiologyHomosapienNo ratings yet

- State of The Handloom Industry of BangladeshDocument8 pagesState of The Handloom Industry of BangladeshNoshin NawarNo ratings yet

- Explaining Kidney Test Results 508 PDFDocument3 pagesExplaining Kidney Test Results 508 PDFBishnu GhimireNo ratings yet

- Emu LinesDocument22 pagesEmu LinesRahul MehraNo ratings yet

- Linkages and NetworkDocument28 pagesLinkages and NetworkJoltzen GuarticoNo ratings yet

- A Bravo Delta Lancaster Model Worth 329: 38 Paralle L Paralle LDocument116 pagesA Bravo Delta Lancaster Model Worth 329: 38 Paralle L Paralle LAnonymous 7Je2SSU100% (2)

- William Angelo - Week-7.AssessmentDocument2 pagesWilliam Angelo - Week-7.Assessmentsup shawtyNo ratings yet