Professional Documents

Culture Documents

td140220 2

td140220 2

Uploaded by

Joyce SampoernaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

td140220 2

td140220 2

Uploaded by

Joyce SampoernaCopyright:

Available Formats

PT Trimegah Securities Tbk - www.trimegah.

com

1 DAILY

TRIM Daily

Todays results are lackluster, with ITMG and JSMR both below expectations. Our

index target remain 5,120 and we continue to be upbeat on this years outlook.

We may see pro!t taking in near-term and suggest buying on weakness. We

think today focus will continue on CPO sector (AALI, LSIP, BWPT) and consumer

companies buoyed by decent LPPF result yesterday (in-line with consensus). We

also wrote interesting takeaway on KTA (loans without collateral) today. Our Buys

in Bank sector are BBRI, BBNI, BBTN with BBRI (TP 10,500) as top pick.

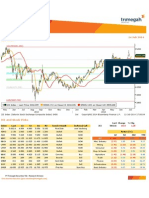

Jakarta Composite Index (JCI) has been keeping the positive trend since Monday

this week which closed at 4,592.7, rose by 36.5 points or 0.8% yesterday. Index

strengthen were backed by miscellaneous industries sector (+2.11%), infrastructure

utility & transportation sector (+1.33%) and consumer goods sector (+1.11%).

Total transaction value reached Rp7.1tr as foreign investor booked Rp1.1tr net

buy. Transaction value in regular market posted Rp6tr. As global market dropped

yesterday, we expect JCI to drop today between support-resistance levels of 4,535-

4,643

JCI 4,592.7

STOCK PRICE Rec Details

ANTM 1,060 Buy

We expect ANTM to move upward today as stochastic

indicator to form a golden cross. ANTMs support-

resistance level for today is 1,020-1,105

AALI 23,850 Buy

AALI is expected to continue its strengthening within

the support and resistance levels of 23,300-24,400

MEDC 2,525 Buy

MEDC remains strong with potential upside in the range

of 2,470-2,555 for today.

PTBA 9,350 Buy

With stochastic indicator to form a golden cross, we

expect a upware movement for PTBA today in the range

of 9,200-9,450

JPFA 1,600 Buy

JPFA will further increase today, in our view. Buy at

level 1,600 with target price 1,670

TINS 1,490 Spec Buy

Spec Buy TINS at level 1,460 with target price today

at level 1,530

AKRA 4,475 Spec Buy

Spec Buy AKRA at level 4,375 with target price today

at level 4,550

WIKA 1,995 Spec Buy

Spec Buy at level 1,970 with target price 2,060

(resistance)

KLBF 1,420 Spec Buy

MACD indicates positive signal of a potential technical

rebound for KLBF. Spec Buy at level 1,400 with target

price 1,450 (resistance)

ACES 880 Spec Buy

Spec Buy ACES at level 870 with target price today

at level 910

TRIM Highlights

Market View

Traders Pick

REKSA DANA TRIMEGAH

ASSET MANAGEMENT

Trim Kapital 7,743.3 1.54 117.5

Trim Kapital + 2,849.4 1.72 48.2

Trim Syariah SHM 1,425.0 0.69 9.7

Tram Consumption + 1,259.3 1.27 15.8

Trim Komb 2 1,718.6 1.32 22.4

Trim Syariah B 2,059.5 0.61 12.4

Trim Dana Stabil 2,067.6 0.02 0.3

Trim Dana Tetap 2 1,644.3 0.01 0.1

Tram PDPT USD 1.0 0.52 0.0

Tram Reguler INC 991.8 0.27 2.7

Tram Strategic Fund 1,022.0 1.11 11.2

Trim Kas 2 1,061.1 0.05 0.5

FEBRUARY 20, 2014

Change : 0.80%

Transaction Volume (m) : 5,203.3

Transaction Value (Rpbn) : 7,051.7

Mkt Cap (Rptr) : 4,552.2

Market P/E (x) : 14.3

Market Div. Yield (%) : 2.1

Dow Jones 16,040.6 -89.8 -0.6

Nasdaq 4,238.0 -34.8 -0.8

Nikkei 14,766.5 -76.7 -0.5

ST Times 3,088.8 18.0 0.6

FTSE 6,796.7 0.3 0.0

Hang Seng 22,664.5 76.8 0.3

GLOBAL INDICES

TLKM 38.8 11,409.9 0.12 0.3

DUAL LISTING (NYSE )

USD IDR 11,778 -70.0 -0.6

10 yr Indo Govr bond (%) 8.36 -0.1 -1.5

10 yr US govt bond (%) 2.7 -0.01 -0.4

Spread (%) 5.62 -0.11 -1.0

EIDO 25.2 -0.1 -0.5

Foreign YtD (USDmn) 624.9 150.4 31.7

OTHERS

Global Wrap

In U.S., the U.S. housing starts fell to a 880,000 annual unit rate in January,

lower than market consensus for 950,000. The U.S. building permits declined to a

937,000 unit rate in January, lower than market consensus for 975,000. The U.S.

PPI for total !nal demand rose 0.2% MoM or 1.2% YoY in January, in line with

market consensus

PT Trimegah Securities Tbk - www.trimegah.com

2 DAILY

JSMR: Booked FY13 earnings of Rp1.3tr dropped

21% YoY, below consensus estimates (94%)

2013 earnings reached Rp1.3tr down 21.0% YoY;

representing only 94.3% of FY13 consensus estimates;

below.

Lower earnings booked due to lower revenues and

higher operating expense. Operating expense grew

25.2% YoY to Rp7.6tr.

Meanwhile, revenues reached Rp10.3tr down 12.4%

YoY; representing 124.7% of consensus estimates;

higher.

(Rpbn) 4Q12 3Q13 4Q13

QoQ chg

(%)

YoY chg

(%)

FY13

YoY chg

(%)

FY13/

Cons (%)

Revenue 3,683 2,315 3,227 39.4 (12.4) 10,295 13.5 124.7

Operating pro!t 768 593 629 6.1 (18.1) 2,663 (10.5) 104.6

Net pro!t 396 262 313 19.6 (21.0) 1,336 (16.6) 94.3

Operating margin (%) 20.9 25.6 19.5 25.9

Net margin (%) 10.8 11.3 9.7 13.0

Result 4Q13

JSMR

PT Trimegah Securities Tbk - www.trimegah.com

3 DAILY

News of the Day

SMGR: Tonasa V has started operation

SMGR has of!cially operated its new cement plant, Tonasa

V yesterday. Tonasa V plant is expected to increase Semen

Tonasas production capacity up to 7mn tons p.a (22.0% of

current SMGRs production capacity of 31.8mn tons p.a.).

Last year, Semen Tonasa managed to book 5.5mn tons sales

(+ 20.7% YoY). Source: Bisnis Indonesia

INDF: To create joint-venture with Roxas Holdings Inc.

for sugar product expansion in South East Asia

INDF will distribute sugar produced by Roxas Holdings, its

sister company (also owned by First Paci!c) in Indonesia.

Roxas Holdings is located in the Philippines. Source: Investor

Daily

Comment: Indonesia is a net sugar importer so this makes

sense.

CTRA: To issue Rp500bn bonds

CTRA through its subsidiary plans to issue Rp500bn worth of

bonds in 1Q14. The bonds which will be issued would have

a 5-year tenor. The funds raised will be used to !nance the

Companys expansion within Jakarta area. Source: Kontan

Comment: Positiv

WSKT: Allocates 2014 capex totaling to Rp860bn

WSKT plans to draw a bank loan amounting to Rp360bn for

funding 2014 capex. WSKT allocates 2014 capex totaling

to Rp860bn whereas WSKT still having the IPO proceed

amounting to Rp250bn. WSKT has Rp5.0tr bank loan facility

from several banks which has been used as much as Rp800bn.

Source: Investor Daily

Comment: WSKT capex is higher than our estimate of

Rp464bn. We are checking with company on their capex

purposes.

ITMG: Posted lower than expected FY13 earnings

ITMG booked FY13 net pro!t of USD230mn, dropped 46% YoY.

This result came 7% lower than our estimate while reaching

11% below the consensus. Top-line came 11% below our

expectation on slightly lower sales volumes of 29.1mn tons

(TRIM Research: 29.5mn tons) and ASP of USD74.9/ton

(TRIM Research: USD75.1/ton). Source: Company

KTA or Loans without collateral

KTA has been around since at least 5 years ago and promoted

through third party, who normally promote the credit

through cold calls and cold texting (unsolicited calls and text

messages). We usually got 5-7 messages offering these loans

daily. This piques our interest so we called several of them

to !nd out the procedures to get the loans, credit limit, etc.

Here are our !ndings:

Interest rate is surprisingly low at 1.49% - 1.89%

per month or 17.9 22.7% simple annual rate. This is similar

to micro/small business loans at other banks which range

between 18-24%.

The requirements (ID, credit card data, tax data,

and bank account data) are similar to borrowing at a banks

small business loan division.

NOT shadow-banking. Credits are offered by banks

(mostly foreign banks instituted in Indonesia). The third party

only act as broker of loans.

Max 5x credit limit of existing credit card. Good to

know rule of thumb next time you plan to lend money to your

friend.

Among banks, we reiterate our Buy calls on BBRI, BBTN, and

BBNI with BBRI as top pick (please see Robby Ha!ls Bank

sector report dated 4 Feb 2014).

Value Requirement Bank Interest Rate Maturity

Process

Period

Limit

Up to IDR1bn ID (KTP), Credit Card, NPWP,

Saving Account book

Standard

Chartered

Bank

Below IDR90mn

-1.79% per month

5 years

3-5 work-

ing days

5x Credit Card

Above

IDR90mn-1.49%

per month

Up to IDR1bn ID (KTP), Credit Card, NPWP,

Saving Account book

ANZ

Below IDR90mn-

1.89% per month

5 years

3-5 work-

ing days

5x Credit Card

Above

IDR90mn-1.69%

per month

Up to IDR1bn

ID (KTP), Credit Card, NPWP,

Saving Account book

DBS

Below

IDR90mn-1.89%

per month

3 years 7 Days 5x Credit Card

Above

IDR90mn-1.5% per

month

Up to IDR1bn

ID (KTP), Credit Card, NPWP,

Saving Account book

Danamon

Bank

Below

IDR90mn-1.89%

per month

3 Years 7 Days 5x Credit Card

Above

IDR90mn-1.89%

per month

KTA (KREDIT TANPA AGUNAN) OR LOANS WITHOUT COLLATERAL

PT Trimegah Securities Tbk - www.trimegah.com

4 DAILY

Indices Region +/- (%) YTD (%)

-5.50 -0.33 -0.36

-12.01 -0.65 -1.06

-89.84 -0.56 -3.23

1.47

0.34 0.10 2.03

0.28 0.00 0.71

0.27 0.00 1.13

10.39 0.24 1.05

2.53

-8.46

-18.64 -1.24 -1.18

-1.97

Market Div. Yield (%)

1.1

1.2

1.7

1.8

2.2

2.7

4.2

4.9

6.6

25.0

TLKM

UNVR

PGAS

KLBF

ASII

GGRM

BBRI

MNCN

BMTR

INVS

JCI

-1.97

-2.36

23.49 1.11 1.26

1.58 0.14 9.41

-76.7 -0.52 -9.36

-5.48 -0.45 -6.43

-2.75

-3.98 -0.20 -3.40

-0.40

-2.48

1.72

100.65 1.62 6.87

-2.01

3.56 0.62 14.56

Market Div. Yield (%)

-1.1

-1.4

-2.0

-2.1

-2.1

-2.3

-2.4

-3.6

-4.3

-4.9

LPKR

BBCA

BTPN

BDMN

SMAR

AKRA

HERO

WIKA

SMRA

BEST

1,018,014

384,204

296,109

279,916

277,217

212,302

198,017

163,483

160,719

148,648

BBRI

BMRI

TRAM

TLKM

ASII

PGAS

BBNI

GGRM

BBCA

MPPA

JCI ####

763,761

347,272

327,805

252,957

240,313

224,508

216,331

214,994

207,787

196,676

189,226

ENRG

TRAM

BUMI

CNKO

TLKM

SSMS

IATA

LCGP

ELSA

KLBF

DOID

Market Div. Yield (%)

6,392

5,490

5,316

5,300

5,294

4,751

4,078

4,070

3,956

TIFA

BBRI

WIKA

KLBF

SIDO

MNCN

LPPF

TLKM

ASII

BBNI

YTD (Rp) 7.45% 5,203.3 MXWO MSCI Word 1,655.0 -5.50 -0.33 -0.36

YTD (USD) 3.48% 7,051.7 SPX S&P 500 1,828.8 -12.01 -0.65 -1.06

Moving Avg 20day 4,452.3 4,552.2 US

Moving Avg 50day 4,336.2 14.3 16,040.6 -89.84 -0.56 -3.23

Moving Avg 200day 4,529.8 2.1 Nasdaq US 4,238.0 -34.83 -0.82 1.47

Europe

Indonesia & Sectors +/- (%) YTD (%) EURO 50 Europe 334.9 0.34 0.10 2.03

MSCI Indonesia 5,352.2 54.0 1.02 9.04 FTSE London 6,796.7 0.28 0.00 0.71

JII 621.7 6.6 1.08 6.26 DAX Jerman 9,660.1 0.27 0.00 1.13

LQ45 773.5 7.1 0.92 8.78 CAC France 4,341.1 10.39 0.24 1.05

JAKFIN Index 609.5 2.7 0.45 12.80 SMI Swiss 8,410.6 -9.29 -0.11 2.53

JAKINFR Index 997.0 13.1 1.33 7.16 BRIC

-3.49 BOVESPA Brazil 47,150.8 551.1 1.18 -8.46

JAKCONS Index 1,930.9 21.2 1.11 8.35 MICEX Russia 1,485.6 -18.64 -1.24 -1.18

JAKTRAD Index 806.4 7.2 0.89 3.82 SENSEX India 20,723.0 88.76 0.43 -1.97

JAKMIND Index 1,237.4 25.5 2.11 2.69 NIFTY India 6,152.8 25.65 0.42 -2.36

JAKBIND Index 521.0 2.6 0.51 8.37 SHCOMP China 2,142.6 23.49 1.11 1.26

15.93 SZCOMP China 1,157.2 1.58 0.14 9.41

-2.10

Nikkei Japan 14,766.5 -76.7 -0.52 -9.36

Commodities +/- (%) YTD (%) TPX Japan 1,218.5 -5.48 -0.45 -6.43

Hong kong 22,664.5 76.80 0.34 -2.75

CRB Index 301.7 3.2 1.08 7.68 KOSPI S.Korea 1,942.9 -3.98 -0.20 -3.40

TAIEX Taiwan 8,577.0 20.78 0.24 -0.40

Crude Oil (USD/bbl) 103.3 0.9 0.86 4.97 FSSTI Singapore 3,088.8 18.01 0.59 -2.48

Natural Gas 6.1 0.6 10.77 45.37 ASEAN

-10.95 SET Thailand 1,321.0 -5.21 -0.39 1.72

-10.35 PCOMP Philipines 6,294.6 100.65 1.62 6.87

KLCI Malaysia 1,829.5 4.21 0.23 -2.01

-1.29 VNINDEX Vietnam 578.1 3.56 0.62 14.56

Nickel (USD/tonne) 14,515 55.0 0.38 4.42

Tin (USD/tonne) 23,195 45 0.19 3.78

Market Div. Yield (%)

Dow Jones Industrial

Developed ASIA

TLKM

UNVR

PGAS

KLBF

GGRM

BBRI

MNCN

BMTR

JCI

HSI

Indices

YTD (Rp) 7.45% 5,203.3 MXWO MSCI Word 1,655.0

YTD (USD) 3.48% 7,051.7 SPX S&P 500 1,828.8

Moving Avg 20day 4,452.3 4,552.2 US

Moving Avg 50day 4,336.2 14.3

Moving Avg 200day 4,529.8 2.1 Nasdaq US 4,238.0

Europe

Nilai (Rpbn)

Mkt Cap (Rptr)

4,592.65 36.46 0.80%

Market P/E (x)

Volume (m)

Dow Jones Industrial

JCI

Market Div. Yield (%) 1

Indonesia & Sectors +/- (%) YTD (%)

MSCI Indonesia 5,352.2 54.0 1.02 9.04 FTSE London 6,796.7

JII 621.7 6.6 1.08 6.26 DAX Jerman 9,660.1

LQ45 773.5 7.1 0.92 8.78 CAC France 4,341.1

JAKFIN Index 609.5 2.7 0.45 12.80 SMI Swiss 8,410.6

JAKINFR Index 997.0 13.1 1.33 7.16

JAKMINE Index 1,379.4 0.3 0.02 -3.49

JAKCONS Index 1,930.9 21.2 1.11 8.35 MICEX Russia 1,485.6

JAKTRAD Index 806.4 7.2 0.89 3.82 SENSEX India 20,723.0

JAKMIND Index 1,237.4 25.5 2.11 2.69 NIFTY India 6,152.8

JAKBIND Index 521.0 2.6 0.51 8.37 SHCOMP China 2,142.6

JAKPROP Index 390.7 -2.0 -0.50 15.93 SZCOMP China 1,157.2

JAKAGRI Index 2,095.1 18.4 0.89 -2.10

Commodities +/- (%) YTD (%)

Developed ASIA

CRB Index 301.7 3.2 1.08 7.68 KOSPI S.Korea 1,942.9

Oil & Gas TAIEX Taiwan 8,577.0

Crude Oil (USD/bbl) 103.3 0.9 0.86 4.97 FSSTI Singapore 3,088.8

Natural Gas 6.1 0.6 10.77 45.37 ASEAN

COAL (AUS Daily) 77.7 0.3 0.32 -10.95 SET Thailand 1,321.0

COAL (Australia,wk) 75.8 0.0 0.00 -10.35 PCOMP Philipines 6,294.6

Industrial Metals KLCI Malaysia 1,829.5

Alumunium (USD/tonne) 1,739.0 3.3 0.19 -1.29 VNINDEX Vietnam 578.1

Nickel (USD/tonne) 14,515 55.0 0.38 4.42

Tin (USD/tonne) 23,195 45 0.19 3.78

Precious Metal Kurs Region +/- (%) YTD (%)

Gold (USD/t oz.) 1,320.4 -4.0 -0.30 9.82 USDEUR Euro 0.728

Silver (USD/t oz.) 21.9 -0.0 -0.22 12.98 USDGBP 0.600

Soft Commodities USDCHF Switzerland 0.889

CPO (Malaysia - Rm/tonne) 2,708.0 -2.0 -0.07 3.04 USDCAD Canada 1.108

Rubber (JPY/kg) 2,236.3 7.0 0.31 -15.88 USDAUD Australia 1.111

Corn (USD/bu.) 453.8 4.3 0.95 7.52 USDNZD New Zealand 1.209

Wheat (USD/bu.) 620.3 8.3 1.35 2.48 USDJPY Japan 102.31

Soybeans (USD/bu.) 1,354.3 -6.8 -0.50 3.18 USDCNY China 6.08

Rice (Indonesia) (Rp/kg) 8,600.0 0.0 0.00 0.00 USDHKD Hongkong 7.755

USDSGD Singapore 1.263

Rupiah Indonesia 11,778

9.82 USDEUR Euro 0.728 0.001 0.18 0.18

12.98 USDGBP 0.600 0.000 0.02 -0.68

USDCHF Switzerland 0.889 0.001 0.08 -0.34

3.04 USDCAD Canada 1.108 0.013 1.21 4.10

-15.88 USDAUD Australia 1.111 0.003 0.30 -1.27

Corn (USD/bu.) 453.8 4.3 0.95 7.52 USDNZD New Zealand 1.209 0.005 0.37 -0.93

Wheat (USD/bu.) 620.3 8.3 1.35 2.48 USDJPY Japan 102.31 -0.050 -0.05 -2.79

3.18 USDCNY China 6.08 0.01 0.15 0.35

Rice (Indonesia) (Rp/kg) 8,600.0 0.0 0.00 0.00 USDHKD Hongkong 7.755 0.001 0.01 0.01

USDSGD Singapore 1.263 0.002 0.17 0.03

Rupiah Indonesia 11,778 -70.00 -0.59 -3.23

Market Div. Yield (%)

United Kingdom

Statistics

INDONESIA & SECTORS +/- (%) YTD(%)

COMMODITIES +/- (%) YTD(%)

INDICES REGION +/- (%) YTD(%)

KURS REGION +/- (%) YTD(%)

JCI WINNERS (%) JCI LOSERS (%) JCI VALUE (Rpmn) JCI VOLUME (Lot) JCI FREQ (X)

40,272

25,0

PT Trimegah Securities Tbk - www.trimegah.com

5 DAILY

World Economic Calendar

Date Time Country Event Period Survey Actual Prior

14-Feb-14 ID BoP Current Account Balance (USD bn) 4Q -- -4.0 -8.5

ID Motorcycle Sales Jan -- 579,361 551,283

ID Local Auto Sales Jan -- 103,494 97,691

US Import Price Index YoY Jan -1.0 -1.5 -1.1

US Industrial Production MoM Jan 0.2 -0.3 0.3

US Univ. of Michigan Con!dence Feb P 80.2 81.2 81.2

CN PPI YoY Jan -1.6 -1.6 -1.4

CN CPI YoY Jan 2.4 2.5 2.5

EC GDP SA QoQ (%) 4Q A 0.2 0.3 0.1

EC GDP SA YoY (%) 4Q A 0.4 0.5 -0.3

GE GDP SA QoQ (%) 4Q P 0.3 0.4 0.3

GE GDP NSA YoY (%) 4Q P 1.3 1.3 1.1

17-Feb-14 JN GDP SA QoQ (%) 4Q P 0.7 0.3 0.3

JN GDP Annualized SA QoQ (%) 4Q P 2.8 1.0 1.1

JN Industrial Production YoY (%) Dec F -- 7.1 7.3

18-Feb-14 US NAHB Housing Market Index Feb 56 46 56

US Empire Manufacturing Feb 8.50 4.48 12.51

EC ZEW Survey Expectations Feb -- 68.5 73.3

EC Current Account NSA (EUR bn) Dec -- 33.2 27.2

GE ZEW Survey Current Situation Feb 44 50 41.2

GE ZEW Survey Expectations Feb 61.5 55.7 61.7

19-Feb-14 US Housing Starts (000's) Jan 900 -- 999

US Housing Starts MoM (%) Jan -9.9 -- -9.8

US PPI MoM Jan -- -- 0.4

US PPI YoY Jan -- -- 1.2

US Building Permits (000's) Jan 960 -- 986

US Building Permits MoM Jan -3.1 -- -3.0

20-Feb-14 US CPI MoM (%) Jan 0.2 -- 0.3

US CPI Ex Food and Energy MoM (%) Jan 0.1 -- 0.1

US CPI YoY (%) Jan -- -- 1.5

US CPI Ex Food and Energy YoY (%) Jan -- -- 1.7

US Initial Jobless Claims 15-Feb 334 -- 339

US Markit US PMI Preliminary Feb 53.7 -- --

CN HSBC/Markit Flash Mfg PMI Feb -- -- 49.5

EC PMI Manufacturing Feb A -- -- 54

EC PMI Services Feb A -- -- 51.6

EC Consumer Con!dence Feb A -- -- -11.7

GE PMI Manufacturing Feb A -- -- 56.5

GE PMI Services Feb A -- -- 53.1

21-Feb-14 US Existing Home Sales (mn) Jan 4.69 -- 4.87

US Existing Home Sales MoM Jan -3.7 -- 1.0

24-Feb-14 US Chicago Fed Nat Activity Index Jan -- -- 0.16

US Dallas Fed Manf. Activity Feb -- -- 3.8

GE IFO Business Climate Feb -- -- 110.6

GE IFO Expectations Feb -- -- 108.9

EC CPI MoM (%) Jan -- -- 0.3

EC CPI YoY (%) Jan F -- -- --

25-Feb-14 US House Price Index MoM (%) Dec -- -- 0.1

US Consumer Con!dence Index Feb 80.0 -- 80.7

GE GDP SA QoQ (%) 4Q F -- -- 0.4

GE GDP NSA YoY (%) 4Q F -- -- 1.3

PT Trimegah Securities Tbk - www.trimegah.com

6 DAILY

RESEARCH TEAM

Sebastian Tobing, CFA

Head of Research & Institutional Sales

(sebastian.tobing@trimegah.com)

Frederick Daniel Tanggela

Equity Analyst

(frederick.daniel@trimegah.com)

Robby Ha!l

Equity Analyst

(robby.ha!l@trimegah.com)

Melvina Wildasari

Equity Analyst

(melvina.wildasari@trimegah.com)

EQUITY CAPITAL MARKET TEAM

JAKARTA

Nathanael Benny Prasetyo

Head of Retail ECM

(benny.prasetyo@trimegah.com)

Ariawan Anwar

Artha Graha, Jakarta

(ariawan.anwar@trimegah.com)

Windra Djulnaily

Pluit, Jakarta

(windra.djulnaily@trimegah.com)

Musji Hartono

Mangga Dua, Jakarta

(musji.hartono@trimegah.com)

Ferry Zabur

Kelapa Gading, Jakarta

(ferry.zabur@trimegah.com)

Very Wijaya

BSD, Jakarta

(very.wijaya@trimegah.com)

SUMATRA

Juliana Effendy

Medan, Sumatera Utara

(juliana.effendi@trimegah.com)

Tantie Rivi Watie

Pekanbaru, Riau

(tantierw@trimegah.com)

Hari Mulyono Soewandi

Palembang, Sumatra Selatan

(hari.mulyono@trimegah.com)

Maria Renata

Equity Analyst

(maria.renata@trimegah.com)

Gina Novrina Nasution, CSA

Equity Analyst

(gina.nasution@trimegah.com)

Hapiz Sakti Azi

Research Associate

(hapiz.azi@trimegah.com)

Mardhika Rinaldi

Research Associate

(mardhika.rinaldi@trimegah.com)

EAST INDONESIA

Wiranto Sunyoto

Branch Area Manager

(wiranto.sunyoto@trimegah.com)

Sonny Muljadi

Surabaya, Jawa Timur

(sonny.muljadi@trimegah.com

Ni Made Dwi Hapsari Wijayanti

Denpasar, Bali

(dwihapsari.wijayanti@trimegah.com)

Ivan Jaka Perdana

Malang, Jawa Timur

(ivan.perdana@trimegah.com)

Agus Jatmiko

Balikpapan, Kalimantan Timur

(agus.jatmiko@trimegah.com)

Ari!n Pribadi

Ujung Pandang, Sulawesi Selatan

(ari!n.pribadi@trimegah.com)

CENTRAL JAVA

Agus Bambang Suseno

Solo, Jawa Tengah

(agus.suseno@trimegah.com)

Andrew Jatmiko

Yogyakarta, Jawa Tengah

(andrew.jatmiko@trimegah.com)

Muhammad Ishaq

Semarang, Jawa Tengah

muhammad.ishaq@trimegah.com)

Rovandi

Research Associate

(rovandi@trimegah.com)

WEST JAVA

Asep Saepudin

Bandung, Jawa Barat

(asep.saepudin@trimegah.com)

Arif!anto

Cirebon, Jawa Barat

(arif!anto@trimegah.com)

6

PT Trimegah Securities Tbk - www.trimegah.com

7 DAILY

DISCLAIMER:

This report has been prepared by PT Trimegah Securities Tbk on behalf of itself and its af!liated companies

and is provided for information purposes only. Under no circumstances is it to be used or considered as

an offer to sell, or a solicitation of any offer to buy. This report has been produced independently and the

forecasts, opinions and expectations contained herein are entirely those of Trimegah Securities. While all

reasonable care has been taken to ensure that information contained herein is not untrue or misleading at

the time of publication, Trimegah Securities makes no representation as to its accuracy or completeness and

it should not be relied upon as such. This report is provided solely for the information of clients of Trimegah

Securities who are expected to make their own investment decisions without reliance on this report. Neither

Trimegah Securities nor any of!cer or employee of Trimegah Securities accept any liability whatsoever for

any direct or consequential loss arising from any use of this report or its contents. Trimegah Securities and/or

persons connected with it may have acted upon or used the information herein contained, or the research or

analysis on which it is based, before publication. Trimegah Securities may in future participate in an offering

of the companys equity securities.

PT Trimegah Securities Tbk

Gedung Artha Graha 18

th

Floor

Jl. Jend. Sudirman Kav. 52-53

Jakarta 12190, Indonesia

t. +62-21 2924 9088

f. +62-21 2924 9150

www.trimegah.com

You might also like

- Clean Room Requirements 20130927Document5 pagesClean Room Requirements 20130927HNmaichoi100% (1)

- UOP 304-08 Bromine Number and Bromine Index of Hydrocarbons by Potentiometric TitrationDocument13 pagesUOP 304-08 Bromine Number and Bromine Index of Hydrocarbons by Potentiometric TitrationMorteza SepehranNo ratings yet

- td140218 2Document6 pagestd140218 2Joyce SampoernaNo ratings yet

- td140219 2Document7 pagestd140219 2Joyce SampoernaNo ratings yet

- 2010 May - Morning Pack (DBS Group) For Asian StocksDocument62 pages2010 May - Morning Pack (DBS Group) For Asian StocksShipforNo ratings yet

- TRIM DailyDocument14 pagesTRIM DailyJoyce SampoernaNo ratings yet

- Market Outlook 1st March 2012Document4 pagesMarket Outlook 1st March 2012Angel BrokingNo ratings yet

- Daily Trade Journal - 17.01.2014Document6 pagesDaily Trade Journal - 17.01.2014Randora LkNo ratings yet

- OCBC Research Report 2013 July 9 by MacquarieDocument6 pagesOCBC Research Report 2013 July 9 by MacquarietansillyNo ratings yet

- MOSt Market Outlook 15 TH February 2024Document10 pagesMOSt Market Outlook 15 TH February 2024Sandeep JaiswalNo ratings yet

- SBI Securities Morning Update - 13-01-2023Document7 pagesSBI Securities Morning Update - 13-01-2023deepaksinghbishtNo ratings yet

- Commodity Price of #Gold, #Sliver, #Copper, #Doller/rs and Many More. Narnolia Securities Limited Market Diary 03.03.2014Document4 pagesCommodity Price of #Gold, #Sliver, #Copper, #Doller/rs and Many More. Narnolia Securities Limited Market Diary 03.03.2014Narnolia Securities LimitedNo ratings yet

- Weekly Wrap: Investment IdeaDocument8 pagesWeekly Wrap: Investment Ideavignesh_sundaresan_1No ratings yet

- Market Outlook 12th March 2012Document4 pagesMarket Outlook 12th March 2012Angel BrokingNo ratings yet

- MOSt Market Outlook 7 TH February 2024Document10 pagesMOSt Market Outlook 7 TH February 2024Sandeep JaiswalNo ratings yet

- Market Outlook 26th December 2011Document4 pagesMarket Outlook 26th December 2011Angel BrokingNo ratings yet

- Sip 06 May 201010Document5 pagesSip 06 May 201010Sneha SharmaNo ratings yet

- XL Axiata TBK: (EXCL)Document4 pagesXL Axiata TBK: (EXCL)Hamba AllahNo ratings yet

- TRIM DailyDocument16 pagesTRIM DailyJoyce SampoernaNo ratings yet

- BIMBSec - Digi Company Update - 20120502Document3 pagesBIMBSec - Digi Company Update - 20120502Bimb SecNo ratings yet

- Smart Gains 42 PDFDocument4 pagesSmart Gains 42 PDF476No ratings yet

- Rambling Souls - Axis Bank - Equity ReportDocument11 pagesRambling Souls - Axis Bank - Equity ReportSrikanth Kumar KonduriNo ratings yet

- Centrum ProfileDocument31 pagesCentrum Profileprathna7No ratings yet

- Daily Trade Journal - 13.06.2013Document7 pagesDaily Trade Journal - 13.06.2013Randora LkNo ratings yet

- MOSt Market Outlook 4 TH April 2024Document10 pagesMOSt Market Outlook 4 TH April 2024Sandeep JaiswalNo ratings yet

- Market Outlook 11th October 2011Document5 pagesMarket Outlook 11th October 2011Angel BrokingNo ratings yet

- MOSt Market Outlook 2 ND April 2024Document10 pagesMOSt Market Outlook 2 ND April 2024Sandeep JaiswalNo ratings yet

- FBM Klci - Daily: Near Term ConsolidationDocument3 pagesFBM Klci - Daily: Near Term ConsolidationFaizal FazilNo ratings yet

- MOSt Market Outlook 3 RD April 2024Document10 pagesMOSt Market Outlook 3 RD April 2024Sandeep JaiswalNo ratings yet

- RHB Equity 360° (Axiata, Furniture, Kossan Technical: IJM) - 22/04/2010Document3 pagesRHB Equity 360° (Axiata, Furniture, Kossan Technical: IJM) - 22/04/2010Rhb InvestNo ratings yet

- Market Outlook 23rd December 2011Document4 pagesMarket Outlook 23rd December 2011Angel BrokingNo ratings yet

- Market Outlook 28th March 2012Document4 pagesMarket Outlook 28th March 2012Angel BrokingNo ratings yet

- Annual Report 2012-2013 Federal BankDocument192 pagesAnnual Report 2012-2013 Federal BankMoaaz AhmedNo ratings yet

- Markets For You - 27.03.12Document2 pagesMarkets For You - 27.03.12Bharat JadhavNo ratings yet

- MOSt Market Outlook 21 ST March 2024Document10 pagesMOSt Market Outlook 21 ST March 2024Sandeep JaiswalNo ratings yet

- CIMB Research On AffinDocument8 pagesCIMB Research On AffinBrian StanleyNo ratings yet

- Regional: Refer To Important Disclosures at The End of Each ReportDocument13 pagesRegional: Refer To Important Disclosures at The End of Each ReportnaufalmuhammadNo ratings yet

- Daily Trade Journal - 06.08.2013Document6 pagesDaily Trade Journal - 06.08.2013Randora LkNo ratings yet

- IPO Grading: Muthoot Finance LimitedDocument16 pagesIPO Grading: Muthoot Finance LimitedDolly DodhiaNo ratings yet

- Initiating Coverage Report - YES BankDocument35 pagesInitiating Coverage Report - YES Bankarnabmoitra11No ratings yet

- Daily Trade Journal - 19.11.2013Document6 pagesDaily Trade Journal - 19.11.2013Randora LkNo ratings yet

- Mansek Investor Digest 29 Apr 2024 Fiscal Watch, 1Q24 Cement AKRADocument8 pagesMansek Investor Digest 29 Apr 2024 Fiscal Watch, 1Q24 Cement AKRAbotoy26No ratings yet

- Mansek Investor Digest 29 May 2024 - AVIA, 4M24 BNGA BNLIDocument6 pagesMansek Investor Digest 29 May 2024 - AVIA, 4M24 BNGA BNLIAndreas PaskalisNo ratings yet

- Sharekhan's Top SIP Fund PicksDocument4 pagesSharekhan's Top SIP Fund PicksKabeer ChawlaNo ratings yet

- 2013-5-13 Big OcbcDocument5 pages2013-5-13 Big OcbcphuawlNo ratings yet

- TRIM DailyDocument15 pagesTRIM DailyJoyce SampoernaNo ratings yet

- Market Outlook: Dealer's DiaryDocument5 pagesMarket Outlook: Dealer's DiaryVaibhav BhadangeNo ratings yet

- PC Jeweller LTD IER InitiationReport 2Document28 pagesPC Jeweller LTD IER InitiationReport 2Himanshu JainNo ratings yet

- Manappuram General Finance & Leasing Ltd. (Gold Loan)Document14 pagesManappuram General Finance & Leasing Ltd. (Gold Loan)Rushabh ShahNo ratings yet

- 4QFY16 Top Picks Equity ResearchDocument3 pages4QFY16 Top Picks Equity ResearchJason Soans100% (1)

- Development Credit Bank 290611Document2 pagesDevelopment Credit Bank 290611bharat108No ratings yet

- NTB - Quick View - 23.08.2013Document2 pagesNTB - Quick View - 23.08.2013Randora LkNo ratings yet

- Ideas Troika 15 Jul 2015Document14 pagesIdeas Troika 15 Jul 2015bodaiNo ratings yet

- MOSt Market Outlook 1 ST April 2024Document10 pagesMOSt Market Outlook 1 ST April 2024Sandeep JaiswalNo ratings yet

- SBI Securities Morning Update - 02-11-2022Document5 pagesSBI Securities Morning Update - 02-11-2022deepaksinghbishtNo ratings yet

- Shriram Transport Finance CoDocument17 pagesShriram Transport Finance Conikp_patilNo ratings yet

- Daily Trade Journal - 10.02.2014Document6 pagesDaily Trade Journal - 10.02.2014Randora LkNo ratings yet

- MOSt Market Outlook 16 TH February 2024Document10 pagesMOSt Market Outlook 16 TH February 2024Sandeep JaiswalNo ratings yet

- Sector ReportDocument19 pagesSector ReportDeep GhoshNo ratings yet

- Abhishek JainDocument10 pagesAbhishek JainAniruddh Singh ThakurNo ratings yet

- SKS MicrofinanceDocument13 pagesSKS MicrofinanceprojectbpfpNo ratings yet

- Activities Related to Credit Intermediation Miscellaneous Revenues World Summary: Market Values & Financials by CountryFrom EverandActivities Related to Credit Intermediation Miscellaneous Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- TRIM DailyDocument16 pagesTRIM DailyJoyce SampoernaNo ratings yet

- TRIM DailyDocument14 pagesTRIM DailyJoyce SampoernaNo ratings yet

- TRIM DailyDocument17 pagesTRIM DailyJoyce SampoernaNo ratings yet

- TRIM DailyDocument14 pagesTRIM DailyJoyce SampoernaNo ratings yet

- TRIM DailyDocument15 pagesTRIM DailyJoyce SampoernaNo ratings yet

- Created by Trial Version: Market ShareDocument1 pageCreated by Trial Version: Market ShareJoyce SampoernaNo ratings yet

- TRIM DailyDocument9 pagesTRIM DailyJoyce SampoernaNo ratings yet

- TRIM DailyDocument9 pagesTRIM DailyJoyce SampoernaNo ratings yet

- TRIM Technical Call: JCI ChartDocument5 pagesTRIM Technical Call: JCI ChartJoyce SampoernaNo ratings yet

- TRIM Technical Call: JCI ChartDocument5 pagesTRIM Technical Call: JCI ChartJoyce SampoernaNo ratings yet

- TRIM DailyDocument7 pagesTRIM DailyJoyce SampoernaNo ratings yet

- td140219 2Document7 pagestd140219 2Joyce SampoernaNo ratings yet

- td140502 2Document12 pagestd140502 2Joyce SampoernaNo ratings yet

- td140414 2Document6 pagestd140414 2Joyce SampoernaNo ratings yet

- td140218 2Document6 pagestd140218 2Joyce SampoernaNo ratings yet

- Tea & TebDocument2 pagesTea & TebHadjer ZitouneNo ratings yet

- Manual Board 945GCT-M (2.0A)Document48 pagesManual Board 945GCT-M (2.0A)BalrogJoelNo ratings yet

- Littelfuse Magnetic Sensors and Reed Switches Inductive Load Arc Suppression Application Note PDFDocument2 pagesLittelfuse Magnetic Sensors and Reed Switches Inductive Load Arc Suppression Application Note PDFMarcelo SantibañezNo ratings yet

- Housekeeping: Hotel Management Hospitality ServicesDocument41 pagesHousekeeping: Hotel Management Hospitality ServicesDASARATHI_PRAVEENNo ratings yet

- DBSTDocument118 pagesDBSTBihanChathuranga100% (6)

- Desain Kompensator Phase Lag Dan Phase Lead Kawasan FrekuensiDocument15 pagesDesain Kompensator Phase Lag Dan Phase Lead Kawasan FrekuensiBenof Arya SahadewoNo ratings yet

- 04 - Rotational Motion - JEE PDFDocument124 pages04 - Rotational Motion - JEE PDFCefas Almeida50% (2)

- Haloalkanes and Haloarenes Question Bank 1690183665Document26 pagesHaloalkanes and Haloarenes Question Bank 1690183665Pratibaa LNo ratings yet

- Offset Flail Mowers: OFM3678, OFM3690 & OFM3698Document38 pagesOffset Flail Mowers: OFM3678, OFM3690 & OFM3698gomezcabellojosemanuelNo ratings yet

- Applied Mathematics OneDocument251 pagesApplied Mathematics OneSetegn YeshawNo ratings yet

- DR HaifaDocument28 pagesDR HaifaAlex SamNo ratings yet

- Wastage of Food in Indian WeddingsDocument9 pagesWastage of Food in Indian WeddingsThe United IndianNo ratings yet

- ZF5HP19FL VW+Audi+Porsche Gas North AmericaDocument63 pagesZF5HP19FL VW+Audi+Porsche Gas North Americadeliveryvalve100% (1)

- Class 9 Science 3Document7 pagesClass 9 Science 3chandralok_kumarNo ratings yet

- Truss-Design 18mDocument6 pagesTruss-Design 18mARSENo ratings yet

- Silage Pile Sizing Documentation 5 12 2016 3Document9 pagesSilage Pile Sizing Documentation 5 12 2016 3Zaqueu Ferreira RodriguesNo ratings yet

- Skema Jawapan Instrumen Bi PTTS 2023Document9 pagesSkema Jawapan Instrumen Bi PTTS 2023Darina Chin AbdullahNo ratings yet

- EoE Programme AgendaDocument9 pagesEoE Programme AgendathegpcgroupNo ratings yet

- Artificial Higher Order Neural Networks For Economics and BusinessDocument542 pagesArtificial Higher Order Neural Networks For Economics and Businessjasonmiller.uga5271100% (1)

- SSS08 0063 Datasheet Saab 2000 AIRTRACERDocument2 pagesSSS08 0063 Datasheet Saab 2000 AIRTRACERJosé Luis DelgadoNo ratings yet

- High Voltage Switching Operations: The Next StepDocument2 pagesHigh Voltage Switching Operations: The Next Steplenon chidzivaNo ratings yet

- Integrity Management of Safety Critical Equipment and SystemsDocument10 pagesIntegrity Management of Safety Critical Equipment and SystemsLi QiNo ratings yet

- SK CatalougeDocument16 pagesSK CatalougeDevvratNo ratings yet

- Format-Input-Soal-Doc-2 BAHASA INGGRISDocument21 pagesFormat-Input-Soal-Doc-2 BAHASA INGGRISma itholNo ratings yet

- SanDiegoZoo GuideMap 1.2016 REFERNCEDocument1 pageSanDiegoZoo GuideMap 1.2016 REFERNCETerry Tmac McElwainNo ratings yet

- Essential Conditions For Efficient Engine OperationDocument4 pagesEssential Conditions For Efficient Engine OperationMelanie Saldivar CapalunganNo ratings yet

- Apour Pressure For Liquid Vapour Equilibrium: Antoine'S Equation Fitting (T in Kelvin and P in Kpa)Document2 pagesApour Pressure For Liquid Vapour Equilibrium: Antoine'S Equation Fitting (T in Kelvin and P in Kpa)makari66No ratings yet

- Chapter 7 Types of Food and Beverage ServiceDocument23 pagesChapter 7 Types of Food and Beverage ServiceJessicaNo ratings yet