Professional Documents

Culture Documents

ABC IPO Underwriters

ABC IPO Underwriters

Uploaded by

Prithvi BarodiaCopyright:

Available Formats

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (350)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Mergers & AcquisitionsDocument5 pagesMergers & Acquisitionsnamratha minupuriNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- CHRO's ListDocument18 pagesCHRO's ListKumar AnudeepNo ratings yet

- Delaware Corporation Manual 2004Document49 pagesDelaware Corporation Manual 2004documentseeker100% (1)

- INTERCO CaseDocument35 pagesINTERCO Casezyamanda0% (1)

- Business AcumenDocument1 pageBusiness AcumenPrithvi BarodiaNo ratings yet

- Presentation Notes RMDocument3 pagesPresentation Notes RMPrithvi BarodiaNo ratings yet

- Dominos in US Aus MalaysiaDocument9 pagesDominos in US Aus MalaysiaPrithvi BarodiaNo ratings yet

- Early Career: Dhirajlal Hirachand Ambani (28 December 1932 - 6 July 2002) Better KnownDocument1 pageEarly Career: Dhirajlal Hirachand Ambani (28 December 1932 - 6 July 2002) Better KnownPrithvi BarodiaNo ratings yet

- Chapter-I: 1.1. Indian Two-Wheeler SectorDocument32 pagesChapter-I: 1.1. Indian Two-Wheeler SectorPrithvi BarodiaNo ratings yet

- C S 3 E - D A - R T - N M: ASE Tudy ON Ntrepreneurs Hirubhai Mbani Atan ATA Arayana UrthyDocument11 pagesC S 3 E - D A - R T - N M: ASE Tudy ON Ntrepreneurs Hirubhai Mbani Atan ATA Arayana UrthyPrithvi BarodiaNo ratings yet

- DCF BasicsDocument2 pagesDCF BasicsPrithvi BarodiaNo ratings yet

- The M&A SettingDocument1 pageThe M&A SettingPrithvi BarodiaNo ratings yet

- Dominos Swot & 4 PsDocument10 pagesDominos Swot & 4 PsPrithvi BarodiaNo ratings yet

- Domios IndiaDocument9 pagesDomios IndiaPrithvi BarodiaNo ratings yet

- Case Study - Dhirubhai AmbaniDocument1 pageCase Study - Dhirubhai AmbaniPrithvi Barodia0% (1)

- Abc Ipo Top Investors:: Commission and ExpensesDocument4 pagesAbc Ipo Top Investors:: Commission and ExpensesPrithvi BarodiaNo ratings yet

- Rural Market For FMCG: Around 6,00,000 Villages. Rural India Offers Tremendous GrowthDocument3 pagesRural Market For FMCG: Around 6,00,000 Villages. Rural India Offers Tremendous GrowthPrithvi BarodiaNo ratings yet

- Stock MarketDocument16 pagesStock MarketHades RiegoNo ratings yet

- Esop MLPDocument26 pagesEsop MLPYohanes Widi SonoNo ratings yet

- Company Name Job - TitleDocument4 pagesCompany Name Job - TitlePragati SahuNo ratings yet

- Cagayan, Butuan, IliganDocument24 pagesCagayan, Butuan, Iliganmark gonzalesNo ratings yet

- IL Corporations Bar OutlineDocument8 pagesIL Corporations Bar OutlineJulia NiebrzydowskiNo ratings yet

- SSI Group, InC Preliminary Information Statement 2015Document121 pagesSSI Group, InC Preliminary Information Statement 2015ADxnUdn4eNNo ratings yet

- Analysis (In Millions) 2007 2006 InformationDocument18 pagesAnalysis (In Millions) 2007 2006 InformationGustin PrayogoNo ratings yet

- Enron Scandal - The Fall of A Wall Street DarlingDocument11 pagesEnron Scandal - The Fall of A Wall Street DarlingElleNo ratings yet

- Financial Strategies For Value Creation (IIP)Document8 pagesFinancial Strategies For Value Creation (IIP)Sayed Fareed HasanNo ratings yet

- Manna Order Form 2011Document2 pagesManna Order Form 2011Hill Middle School PTSANo ratings yet

- BBI (Letter)Document4 pagesBBI (Letter)familylifers coopNo ratings yet

- 16 1Document34 pages16 1Tarek El KadyNo ratings yet

- CIO Evolution Delegates PDFDocument1 pageCIO Evolution Delegates PDFLinky DooNo ratings yet

- Acctg1205 - Chapter 6Document28 pagesAcctg1205 - Chapter 6Elj Grace BaronNo ratings yet

- PANTONE® PLASTICS Color System TMDocument3 pagesPANTONE® PLASTICS Color System TMmimjunNo ratings yet

- Meaning of Memorandum of Association (Moa) and Various Clauses of MoaDocument13 pagesMeaning of Memorandum of Association (Moa) and Various Clauses of MoabhargaviNo ratings yet

- Reliance PetroleumDocument5 pagesReliance PetroleumRomeo RobinNo ratings yet

- Faq - PacraDocument8 pagesFaq - PacraJohn BandaNo ratings yet

- Straight ProblemsDocument12 pagesStraight Problemsnana100% (2)

- Chapter 5 Investments in Equity SecuritiesDocument13 pagesChapter 5 Investments in Equity SecuritiesKrissa Mae Longos100% (2)

- Mergers and AcquisitionDocument25 pagesMergers and AcquisitionA.KNo ratings yet

- CIO or CEODocument4 pagesCIO or CEOapi-122239907No ratings yet

- Screeners Test Calendar 2022Document7 pagesScreeners Test Calendar 2022Manoj Khatana GujjarNo ratings yet

- Berle 1947 - Theory of Enterprise Entity PDFDocument17 pagesBerle 1947 - Theory of Enterprise Entity PDFJosiah BalgosNo ratings yet

- RSU DocumentDocument2 pagesRSU DocumentShivam JaiswalNo ratings yet

- 12.1 Partnership Form of OrganizationDocument8 pages12.1 Partnership Form of OrganizationcanteroalexNo ratings yet

ABC IPO Underwriters

ABC IPO Underwriters

Uploaded by

Prithvi BarodiaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ABC IPO Underwriters

ABC IPO Underwriters

Uploaded by

Prithvi BarodiaCopyright:

Available Formats

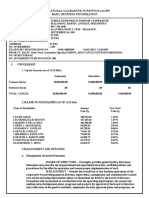

Underwriters of Agricultural Bank of China Ltd.

s Hong Kong initial public offering are tapping a smaller pool of fees than the prospectus would otherwise indicate, and the unusually large group seven in all means that each is getting a smaller piece of the pie. But it still stands to be a big payday, with some investment banks standing to gain more than others, and with Goldman Sachs Group Inc. leading the way. According to a person familiar with the situation, Goldman Sachs and China International Capital Corp. will each collect 17% of the fee pool set aside by AgBank for the underwriters. Based on the prospectus, that pool should stand at 1.98% of the total proceeds from the Hong Kong IPO, which raised $10.44 billion, but given AgBank isnt paying out fees on funds raised by cornerstone investors it brought in by itself, the actual payout is more like 1.35% of the total, the person said. That translates into a pool of about $140.9 million, or $23.96 million each for Goldman Sachs and CICC. Goldman is also the stabilizing manager for the deal, giving it further opportunities to benefit from brokerage fees if it finds itself needing to prop up AgBanks share price during the first 30 days of the stock trading. Morgan Stanley, which was joint global coordinator of the IPO together with Goldman and CICC, will get 15%, and J.P. Morgan Chase & Co., Deutsche Bank AG and Macquarie Group Ltd. each stand to take home 13% of the pool, the person said. AgBanks own investment banking unit, ABC International Holdings Ltd. which was also nominally one of the global coordinators will get 12%. The fees, while handsome, are not breaking any records. When China Construction Bank Corp. listed in Hong Kong in 2005, the underwriters shared $230.7 million in fees, according to Thomson Reuters, despite raising $9.2 billion, significantly less than AgBank. But as the first of Chinas major banks to list, the underwriters and other advisers spent about a year and a half putting the CCB deal together, establishing a template for the next ones. Still, it hasnt been a cakewalk for the underwriters on the AgBank deal, who have been forced to turn around one of the biggest IPOs in history in a bit over three months. Underwriters for Industrial & Commercial Bank of China Ltd. had more than six months to prepare before raising $21.9 billion for that bank in what is still the worlds biggest IPO.

AgBank so far has raised $19.23 billion in its dual listing in Hong Kong and Shanghai, but may raise as much as $22.1 billion if demand for shares justifies an overallotment being exercised. The bank also kept the underwriters on their toes by not formally saying which banks would be anointed global coordinators until well into the IPO process. Another person familiar with the situation said AgBank initially told the investment banks to decide among themselves how the fees would be distributed before later deciding on an appropriate allocation itself.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (350)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Mergers & AcquisitionsDocument5 pagesMergers & Acquisitionsnamratha minupuriNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- CHRO's ListDocument18 pagesCHRO's ListKumar AnudeepNo ratings yet

- Delaware Corporation Manual 2004Document49 pagesDelaware Corporation Manual 2004documentseeker100% (1)

- INTERCO CaseDocument35 pagesINTERCO Casezyamanda0% (1)

- Business AcumenDocument1 pageBusiness AcumenPrithvi BarodiaNo ratings yet

- Presentation Notes RMDocument3 pagesPresentation Notes RMPrithvi BarodiaNo ratings yet

- Dominos in US Aus MalaysiaDocument9 pagesDominos in US Aus MalaysiaPrithvi BarodiaNo ratings yet

- Early Career: Dhirajlal Hirachand Ambani (28 December 1932 - 6 July 2002) Better KnownDocument1 pageEarly Career: Dhirajlal Hirachand Ambani (28 December 1932 - 6 July 2002) Better KnownPrithvi BarodiaNo ratings yet

- Chapter-I: 1.1. Indian Two-Wheeler SectorDocument32 pagesChapter-I: 1.1. Indian Two-Wheeler SectorPrithvi BarodiaNo ratings yet

- C S 3 E - D A - R T - N M: ASE Tudy ON Ntrepreneurs Hirubhai Mbani Atan ATA Arayana UrthyDocument11 pagesC S 3 E - D A - R T - N M: ASE Tudy ON Ntrepreneurs Hirubhai Mbani Atan ATA Arayana UrthyPrithvi BarodiaNo ratings yet

- DCF BasicsDocument2 pagesDCF BasicsPrithvi BarodiaNo ratings yet

- The M&A SettingDocument1 pageThe M&A SettingPrithvi BarodiaNo ratings yet

- Dominos Swot & 4 PsDocument10 pagesDominos Swot & 4 PsPrithvi BarodiaNo ratings yet

- Domios IndiaDocument9 pagesDomios IndiaPrithvi BarodiaNo ratings yet

- Case Study - Dhirubhai AmbaniDocument1 pageCase Study - Dhirubhai AmbaniPrithvi Barodia0% (1)

- Abc Ipo Top Investors:: Commission and ExpensesDocument4 pagesAbc Ipo Top Investors:: Commission and ExpensesPrithvi BarodiaNo ratings yet

- Rural Market For FMCG: Around 6,00,000 Villages. Rural India Offers Tremendous GrowthDocument3 pagesRural Market For FMCG: Around 6,00,000 Villages. Rural India Offers Tremendous GrowthPrithvi BarodiaNo ratings yet

- Stock MarketDocument16 pagesStock MarketHades RiegoNo ratings yet

- Esop MLPDocument26 pagesEsop MLPYohanes Widi SonoNo ratings yet

- Company Name Job - TitleDocument4 pagesCompany Name Job - TitlePragati SahuNo ratings yet

- Cagayan, Butuan, IliganDocument24 pagesCagayan, Butuan, Iliganmark gonzalesNo ratings yet

- IL Corporations Bar OutlineDocument8 pagesIL Corporations Bar OutlineJulia NiebrzydowskiNo ratings yet

- SSI Group, InC Preliminary Information Statement 2015Document121 pagesSSI Group, InC Preliminary Information Statement 2015ADxnUdn4eNNo ratings yet

- Analysis (In Millions) 2007 2006 InformationDocument18 pagesAnalysis (In Millions) 2007 2006 InformationGustin PrayogoNo ratings yet

- Enron Scandal - The Fall of A Wall Street DarlingDocument11 pagesEnron Scandal - The Fall of A Wall Street DarlingElleNo ratings yet

- Financial Strategies For Value Creation (IIP)Document8 pagesFinancial Strategies For Value Creation (IIP)Sayed Fareed HasanNo ratings yet

- Manna Order Form 2011Document2 pagesManna Order Form 2011Hill Middle School PTSANo ratings yet

- BBI (Letter)Document4 pagesBBI (Letter)familylifers coopNo ratings yet

- 16 1Document34 pages16 1Tarek El KadyNo ratings yet

- CIO Evolution Delegates PDFDocument1 pageCIO Evolution Delegates PDFLinky DooNo ratings yet

- Acctg1205 - Chapter 6Document28 pagesAcctg1205 - Chapter 6Elj Grace BaronNo ratings yet

- PANTONE® PLASTICS Color System TMDocument3 pagesPANTONE® PLASTICS Color System TMmimjunNo ratings yet

- Meaning of Memorandum of Association (Moa) and Various Clauses of MoaDocument13 pagesMeaning of Memorandum of Association (Moa) and Various Clauses of MoabhargaviNo ratings yet

- Reliance PetroleumDocument5 pagesReliance PetroleumRomeo RobinNo ratings yet

- Faq - PacraDocument8 pagesFaq - PacraJohn BandaNo ratings yet

- Straight ProblemsDocument12 pagesStraight Problemsnana100% (2)

- Chapter 5 Investments in Equity SecuritiesDocument13 pagesChapter 5 Investments in Equity SecuritiesKrissa Mae Longos100% (2)

- Mergers and AcquisitionDocument25 pagesMergers and AcquisitionA.KNo ratings yet

- CIO or CEODocument4 pagesCIO or CEOapi-122239907No ratings yet

- Screeners Test Calendar 2022Document7 pagesScreeners Test Calendar 2022Manoj Khatana GujjarNo ratings yet

- Berle 1947 - Theory of Enterprise Entity PDFDocument17 pagesBerle 1947 - Theory of Enterprise Entity PDFJosiah BalgosNo ratings yet

- RSU DocumentDocument2 pagesRSU DocumentShivam JaiswalNo ratings yet

- 12.1 Partnership Form of OrganizationDocument8 pages12.1 Partnership Form of OrganizationcanteroalexNo ratings yet