Professional Documents

Culture Documents

Price Forecasting Techniques

Price Forecasting Techniques

Uploaded by

preetsinghalCopyright:

Available Formats

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Fixed Income Valuation CaseDocument10 pagesFixed Income Valuation CaseSAMRIDHI50% (2)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Suraj Trader Money ManagementDocument8 pagesSuraj Trader Money ManagementNasim MallickNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Finance Cheat SheetDocument4 pagesFinance Cheat SheetRudolf Jansen van RensburgNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- AssumptionsDocument1 pageAssumptionspreetsinghalNo ratings yet

- Unit3industrial ManagementDocument68 pagesUnit3industrial ManagementpreetsinghalNo ratings yet

- English TrainingDocument93 pagesEnglish TrainingpreetsinghalNo ratings yet

- Bioscience Feb 1990 40, 2 Research Library CoreDocument7 pagesBioscience Feb 1990 40, 2 Research Library CorepreetsinghalNo ratings yet

- Exotic Options: - Digital and Chooser OptionsDocument8 pagesExotic Options: - Digital and Chooser OptionsKausahl PandeyNo ratings yet

- Soal 1Document3 pagesSoal 1feronica utomoNo ratings yet

- Fedai RulesDocument36 pagesFedai RulesManipal SinghNo ratings yet

- Accounting For DerivativesDocument42 pagesAccounting For DerivativesSanath Fernando100% (1)

- Stock Up - Overstock - Com UpgradedDocument5 pagesStock Up - Overstock - Com UpgradedValuEngine.comNo ratings yet

- Kemrock QIP PPDDocument212 pagesKemrock QIP PPDKamlesh ThakurNo ratings yet

- Final Project Written Case - VisaDocument13 pagesFinal Project Written Case - VisaMaria Fernanda FloresNo ratings yet

- Let's Know: Learning Activity SheetDocument8 pagesLet's Know: Learning Activity SheetWahidah BaraocorNo ratings yet

- Berkshire Hathaway - Barclays CapitalDocument64 pagesBerkshire Hathaway - Barclays Capitalneo269No ratings yet

- A Commodities Reading ListDocument5 pagesA Commodities Reading Listlaozi222No ratings yet

- CK Infrastructure Holdings Limited: (Note 1)Document1 pageCK Infrastructure Holdings Limited: (Note 1)WF YeungNo ratings yet

- IBPA Pricing Public PDFDocument3 pagesIBPA Pricing Public PDFS. AgustinaNo ratings yet

- 10 Elements of A Winning Trading PlanDocument17 pages10 Elements of A Winning Trading PlanSrinivasan Rmasamy100% (1)

- Taza ChocolateDocument9 pagesTaza ChocolateChed Augustus AranNo ratings yet

- CDO and Synthetic CDODocument3 pagesCDO and Synthetic CDOJIGYASA KUMARINo ratings yet

- Book International Financial ManagementDocument201 pagesBook International Financial ManagementasadNo ratings yet

- Sakthi Fianance Project ReportDocument61 pagesSakthi Fianance Project ReportraveenkumarNo ratings yet

- FX Insifddggfght e PDFDocument16 pagesFX Insifddggfght e PDFPopeye AlexNo ratings yet

- Security Analysis and Portfolio ManagementDocument26 pagesSecurity Analysis and Portfolio ManagementXandarnova corpsNo ratings yet

- IC 11-22 AssignmentDocument9 pagesIC 11-22 Assignmentshinta anggraini putriNo ratings yet

- Garment ContenetDocument2 pagesGarment Conteneteyerusalem getahun100% (2)

- AnandKasturi Mumbai 15 YrsDocument4 pagesAnandKasturi Mumbai 15 YrsRamanujan VSNo ratings yet

- PSBA Integrated Review Financial Accounting and Reporting - Theory Christian Aris Valix Debt InvestmentsDocument2 pagesPSBA Integrated Review Financial Accounting and Reporting - Theory Christian Aris Valix Debt InvestmentsKendrew SujideNo ratings yet

- CFA Before The ExamDocument2 pagesCFA Before The Exampingu_513501No ratings yet

- Chapter 3 Test BankDocument60 pagesChapter 3 Test BankHaider EjazNo ratings yet

- EU Financial Market ReformDocument19 pagesEU Financial Market ReformKathia CentronNo ratings yet

- Malaysia Low ResDocument9 pagesMalaysia Low ResMujahidahFaqihahNo ratings yet

Price Forecasting Techniques

Price Forecasting Techniques

Uploaded by

preetsinghalCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Price Forecasting Techniques

Price Forecasting Techniques

Uploaded by

preetsinghalCopyright:

Available Formats

Price Forecasting Techniques

Price Forecasting Techniques

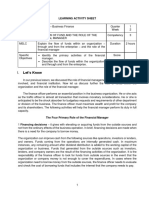

An important part of anticipating both future price levels and the risk that anticipated prices will not be achieved is developing strategies for forecasting prices. In general, there are two basic approaches to forecasting prices in grain markets: fundamental analysis and technical analysis. While they are often presented as substitutes or competitors in price forecasting, the two can be complimentary. Most market analysts pay attention to both fundamental and technical factors even though they may emphasize one over the other.

Fundamental Analysis

undamental price analysis is based on the notion that the underlying supply!demand conditions in a given market ultimately determine price. "ince the futures market is attempting to discover prices that will balance supply and demand in some future time period, there is uncertainty in initially establishing an e#uilibrium price. $he market may be %shocked& by new information, resulting in traders' changing their assessments of what the e#uilibrium price will be in the future. undamental analysis is attempts to both anticipate changes in supply!demand information, and to evaluate the direction and range of price movement resulting from new information. undamental analysis may be simple (intuitive), or complicated (using #uantitative statistical or mathematical models). In both cases, analysts are attempting to assess price implications of economic variables including: *) +) ,) -) .) seasonal use patterns seasonal supply patterns prices of substitute goods prices of compliment goods market structure

Intuitive analysis uses a basic understanding of economic principles to hypothesize about price changes. /uantitative analysis combines knowledge of economic theory with mathematics and statistics to establish e0plicit relationships between economic variables and price. "everal indicators are used to understand a given market. or e0ample, the following reports are used by analysts to understand the respective markets. Indicator 1"2A 3rop 4roduction 5eports 1"2A 3attle on eed 5eports 3orporate 7arnings 2eficit 4ro:ections Market "oybean, 3orn, and Wheat utures 6ive 3attle utures "84 .99 "tock Inde0 utures Interest 5ate utures

Grain Marketing

Page 1

Price Forecasting Techniques

$o use a leading indicator model a market analyst must find a time;lagged relationship between an asset's price and the economic indicator. Many of the price pro:ections you hear or read about relative to 1.". agricultural markets come from analysts who have looked at 1"2A supply!demand pro:ections, ad:usted those pro:ections for his or her own e0pectation of market conditions, and then inferred how the price should behave based on the supply!demand pro:ections. $he price forecast is generally based on how prices have behaved in similar circumstances in the past.

US Corn Balance Sheet (Sep/Aug) USDA 9"/9# 1,558 16 71.2 65.0 91.3% 11./" 7,374 %391% 4,696 1,598 2,228 %3"00 426 "/008./01 USDA 9#/9$

11/09/00

Market ng !ear Beg Stock& '(port& Acre& )lante* Acre& +ar,e&te* - +ar,e&te* ! el* )ro*uct on Total Suppl2 4ee* 5 re& *ual 4oo*/See*/'n*/ 67port& Total De(an* 6n* ng Stock& Stock& To U&e A,g/ 4ar( )r ce

USDA USDA 9$/9% 9%/99 Million Bushels 426 883 1,308 13 9 19 79.5 72.7 91.4% 10#/# 9,207 103099 5,505 1,782 1,504 %3$91 1,308 11/%%80/1. 80.2 72.6 90.5% 1.1/1 9,759 1130%" 5,496 1,822 1,981 9309% 1,787 19/0081/91

USDA 99/00 1,787 15 77.4 70.5 91.1% 1../% 9,437 1130.9 5,676 1,913 1,935 93"01 1,715 1%/0181/%0

USDA OCT 00/01 1,715 10 79.6 73.0 91.7% 1.9/# 10,192 11391$ 5,850 1,975 2,275 103100 1,817 1$/9981/%"

USDA NOV 00/01 1,715 10 79.6 73.0 91.7% 1.$/$ 10,054 113$$9 5,850 1,975 2,275 103100 1,679 1#/#081/90

79.2 72.6 91.7% 10$/0 9,233 93#$0 5,302 1,692 1,795 %3$%9 883 10/0180/$1

$able *: 1" 3orn <alance "heet or e0ample, consider the supply!demand balance sheet above. 1"2A has given us their pro:ections for production and consumption of corn for the coming marketing year ("eptember *, +999 through August ,*, +99*), as well as their average farm price estimate. $heir average farm price estimate is derived using fundamental analysis. $hey know what the average farm price was in previous years, and what the supply!demand balance was in those years. <y looking at the previous year's relationship, they can infer what the price will average this year if their supply!demand estimates are realized. Many private price forecasters start with the 1"2A data, and then make changes for either supply and!or demand pro:ections that they believe are not realistic. or e0ample, if I thought e0ports would be less than 1"2A, I would lower the e0port estimate and then lower my

Grain Marketing

Page 2

Price Forecasting Techniques

pro:ected price. $his is precisely the method used by a large percentage of market analysts and advisors giving you price pro:ections for agricultural markets. undamental analysis is sometimes used to generate short term forecasts as well. or e0ample, one number that comes out of the supply!demand balance sheets from 1"2A is ending stocks. =rain ending stocks represent the amount of a grain that will be left over as we go into the ne0t harvest (i.e., how much will we still have on August ,*). $his is important because it represents our safety net against a crop problem in the ne0t harvest. 6ook at the supply!demand balance sheet above. >otice that, in general, the smaller the ending stocks, the higher the average farm price. In turns out that harvest prices are also significantly impacted by the ending stocks pro:ection for the following August. $he picture below shows the relationship between the average 2ecember futures price in >ovember (vertical a0is) versus the carryout pro:ection going into harvest (horizontal a0is).

No,e(9er )r ce : Dec 4uture& ,&/ 6n* ng Stock&

3.5

3.3 1995 3.1

2.9 1996 8/9u&hel 2.7 1997 2.5 1993 1991 1990 1998 1992 1999 1.9

2.3

2.1

1994

1.7 0 500 1000 1500 2000 2500

igure *: 3orn >ovember price of 2ecember futures versus ending stock pro:ections in ?ctober

Grain Marketing

Page 3

Price Forecasting Techniques

If you look at the line going through the various points, you can forecast where the futures price should be each >ovember given the carryout pro:ection 1"2A estimates in ?ctober. or e0ample, this past ?ctober 1"2A pro:ected the corn carryout for the +999!9* marketing year to be *.@ billion bushels (on the graph above that would be *@99). 1sing the graph above one would e0pect the >ovember price for 2ecember futures to average about A+.*9 per bushel. When the ending stocks forecast was released in mid;?ctober, 2ecember futures prices was less than A+.99 per bushel. If you believed the forecast of an average price of A+.*9 in >ovember, you would have collected your deficiency payment as soon as possible e0pecting prices to rise in >ovember, and not sold your cash corn until >ovember. If you were a speculator in the futures market, you would have bought 2ecember corn futures following the ?ctober report and looked to sell the contract in >ovember *9 or *+ cents per bushel higher than you bought. $he picture below shows what actually happened. In >ovember the 2ecember futures contract traded between A+.9. per bushel and A+.*. per bushel. It also appears to have averaged about A+.*9 per bushel, thus the fundamental price forecast proved accurate. igure +: 3orn 2ecember futures price

In this case we were only looking at one variable, and using that one factor to forecast price. In practice, some analysts try to look at a whole host of factors simultaneously in forecasting price. $his generally re#uires the use of statistical and!or e0plicit mathematical models, and is often #uite rigorous. Bowever, the basic principle is the same. We observe a relationship between price and supply!demand factors based on previous e0perience, and use the historical relationship to make forecasts of future price levels.

Grain Marketing

Page 4

Price Forecasting Techniques

Technical Analysis

While fundamental price analysis often asks the #uestion: CWhere should the price beDC given economic conditions, technical analysis asks the #uestion: CBow will we get thereDC As such, technical analysis often deals with the timing of pricing decisions within a given price range. While sophisticated mathematical models are often employed with technical analysis, the only data used is past price history, volume traded, and in futures markets the open interest (i.e., how many futures contracts are outstanding). As such, technical analysis is simply the analysis of price trends ;; by looking at past prices, volume, and open interest technical analysts attempt to identify buy and sell signals based on underlying market emotion. $he idea is to reduce the opportunity cost of buying too early or selling too late. $here are literally an infinite number of ways to look at past prices, but some of the more common technical indicators include: *. <ar 3harts +. 6ines of support and resistance ,. 3onsolidation planes (also called price channels) -. Eey reversals .. 4rice =aps and F. Moving Averages

Bar Chart

?n bar charts, price is plotted on the vertical a0is and time (days or weeks) on the horizontal a0is. 7ach time period shows a vertical bar indicating high, low and closing price (settlement). $he open, or first price of the time period, is also often included.

Grain Marketing

Page 5

Price Forecasting Techniques

igure +: 3M7 6ive 3attle utures: <ar 3hart $he most common time periods used in constructing bar charts are days, weeks, and months. Bowever, some short term futures traders construct bar charts using ., *G9, or *. minute intervals. $hrough time, up and down trends develop, displaying the process of price discovery, and bar charts provide a way to identify these trends.

Trend line (lines of support or resistance)

As trends develop over time, bar charts can be enhanced to determine the e0act nature of the trend. $his is done by constructing lines of support and!or resistance. In up trends, support lines are drawn connecting the lowest of lows over a given time period. $hese lines are called lines of support. As long as price action in succeeding trading days does not penetrate the up;trending line, it is assumed that the market will continue to trend upward, and holding long positions (i.e., being a market buyer or a keeper of a physical commodity) is :ustified. ?nce a day is encountered where price action penetrates the line of support, it is assumed that the market trend is over, and prices are likely to move sideways or down, suggesting that long positions in the market now face an increased likelihood of losing money. In down trends, resistance lines are drawn connecting the highest of highs over some time period. When the resistance lines are penetrated by some day's price action, it is assumed that the downtrend is over and prices are likely to get higher. At this point, short positions (i.e., initial sellers in the market) face increased price risk.

Grain Marketing

Page 6

Price Forecasting Techniques

In both cases the lines are e0tended to and beyond the current date. ?ne (or more) closes below a support line is a CsellC signal. ?ne (or more) closes above a resistance line is a CbuyC signal. $he close is the markets closing price if the bar chart is plotted using days as the time interval, or the last price traded in the time interval if it is other than days. As with all technical analysis techni#ues, the selection of he time interval over which the lines of support and!or resistance are constructed are e0tremely sub:ective, and affect the levels of support and!or resistance identified. $his is a significant limitation. $he length of time over which the trend line is drawn greatly affects its slope and sensitivity. In general, the more bars included in the construction of a trend, the more confidence one has that the prices have changed direction when the trend is violated.

igure ,: 3M7 6ive 3attle utures: $rend 6ines

Consolidation Planes

When price congestion occurs in a sideways pattern, parallel horizontal lines are drawn from the highest highs and lowest lows in the congestion area. $he market signal is to sell at the upper end of the channel and buy at the lower end of the channel as long as the pattern is maintained. A breakout up or down is indicated when a close occurs outside of the congestion area. $his is often interpreted as some important change in the underlying fundamental relationships for the

Grain Marketing

Page 7

Price Forecasting Techniques

particular market being watched, but the actual fundamental data is not important to the measurement of the price pattern.

igure -: 3M7 6ive 3attle utures: 3onsolidation 4lanes

Key Reversal

A key reversal occurs on what is called an outside day, and indicates a reversal in the previous price trend. ?utside days are when the day's high is higher than the previous day's high, and the low is lower than the previous day's low. Many technicians also re#uire that the closing price must be lower than previous day's lowest price for a bearish key reversal. A bearish key reversal means price are e0pected to go down. In other words, if the market had been trending up, a bearish key reversal would be a sell signal based on the assumption that the market will now trend down. If the market had been trending down, and the close is above the previous days high, a bullish key reversal is recorded, and a buy signal is generated. A key reversal indicates a day of huge battling over fundamental information. $he closing price indicates who won the battle among buyers and sellers.

Grain Marketing

Page 8

Price Forecasting Techniques

igure .: 3<?$ "oybean utures: Eey 5eversal

aps

=aps reflect a strong change in supply!demand assessment due to new market information, or a change in the general interpretation of e0isting information. A gap is when a given day's high (low) is lower (higher) than the previous day's low (high). $his can be interpreted two ways. ?ne is that an important signal of short;term direction has developed and prices will move away from the gap. In other words, if today's highest price is below yesterday's lowest price, prices are e0pected to continue deteriorating in the short run. Bowever, many Htrader's believe that gaps will almost always eventually be filled, and thus e0pect that at some point prices will turn and trade back through the gap.

Grain Marketing

Page 9

Price Forecasting Techniques

igure F: 3<?$ "oybean utures: 4rice =aps A close e0amination of historical charts will reveal both interpretations.

!oving Averages

Moving averages are used to smooth out daily price fluctuations so that an analyst might get a better idea of the underlying market trend. $hey tend to be used two ways. irst, a rather long term moving average is followed. When the price crosses the moving average, a buy or sell signal is generated. or e0ample, a trader might follow a .9;day moving average of corn prices (usually based on the closing prices). If prices are trending up, the moving average will be below the price level. ?nce the price in a given day closes below the .9 day moving average a sell signal is generated, and the trader would sell corn futures. $he second way moving averages are employed is to track a short and a longer moving average, and initiate positions when they cross. or e0ample, a trader may track a .;day and a *9;day moving average for corn. When the market is moving up, the .;day moving average will lie above the *9 day. If prices correct and start to move down, the . day moving average will respond #uicker than the *9 day, and after a few days of lower prices will cross the *9 day average and then lie below it. When the shorter average crosses the longer average, a trade signal is generated. If the .;day crosses the *9;day from above, a sell signal is generated. If the .;day crosses the *9;day from below, a buy signal is generated.

Grain Marketing

Page 1

Price Forecasting Techniques

"horter averages will be more sensitive to trend changes but will also give many false signals in a sideways market. Moving averages work best in well;defined trend markets.

igure I: 3M7 6ean Bog utures: Moving Averages

"ummary

$echnical analysis can be a powerful tool in terms of helping one pick market entry and e0it points. Bowever, it is very important to realize that the selection of the proper time period over which to contract a technical indicator is completely arbitrary. In general, the longer the time period used, the more reliable the indicator. Bowever, the longer the time period used, the more likely the indicator will not be realized. It is also important to recognize that technical indicators are sometimes self;fulfilling prophesies (if enough people believe a gap should be filled prices will trade back towards the gap). 2o not confuse this with some market imperative that %forces& the market to achieve a technical ob:ective. $he most successful technical trades use a portfolio of indicators, and look for some consensus among them (i.e., I out of J reveal the same ob:ective). ocusing on one technical indicator is e0tremely dangerous, and will not likely lead to satisfactory results.

Grain Marketing

Page 11

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Fixed Income Valuation CaseDocument10 pagesFixed Income Valuation CaseSAMRIDHI50% (2)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Suraj Trader Money ManagementDocument8 pagesSuraj Trader Money ManagementNasim MallickNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Finance Cheat SheetDocument4 pagesFinance Cheat SheetRudolf Jansen van RensburgNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- AssumptionsDocument1 pageAssumptionspreetsinghalNo ratings yet

- Unit3industrial ManagementDocument68 pagesUnit3industrial ManagementpreetsinghalNo ratings yet

- English TrainingDocument93 pagesEnglish TrainingpreetsinghalNo ratings yet

- Bioscience Feb 1990 40, 2 Research Library CoreDocument7 pagesBioscience Feb 1990 40, 2 Research Library CorepreetsinghalNo ratings yet

- Exotic Options: - Digital and Chooser OptionsDocument8 pagesExotic Options: - Digital and Chooser OptionsKausahl PandeyNo ratings yet

- Soal 1Document3 pagesSoal 1feronica utomoNo ratings yet

- Fedai RulesDocument36 pagesFedai RulesManipal SinghNo ratings yet

- Accounting For DerivativesDocument42 pagesAccounting For DerivativesSanath Fernando100% (1)

- Stock Up - Overstock - Com UpgradedDocument5 pagesStock Up - Overstock - Com UpgradedValuEngine.comNo ratings yet

- Kemrock QIP PPDDocument212 pagesKemrock QIP PPDKamlesh ThakurNo ratings yet

- Final Project Written Case - VisaDocument13 pagesFinal Project Written Case - VisaMaria Fernanda FloresNo ratings yet

- Let's Know: Learning Activity SheetDocument8 pagesLet's Know: Learning Activity SheetWahidah BaraocorNo ratings yet

- Berkshire Hathaway - Barclays CapitalDocument64 pagesBerkshire Hathaway - Barclays Capitalneo269No ratings yet

- A Commodities Reading ListDocument5 pagesA Commodities Reading Listlaozi222No ratings yet

- CK Infrastructure Holdings Limited: (Note 1)Document1 pageCK Infrastructure Holdings Limited: (Note 1)WF YeungNo ratings yet

- IBPA Pricing Public PDFDocument3 pagesIBPA Pricing Public PDFS. AgustinaNo ratings yet

- 10 Elements of A Winning Trading PlanDocument17 pages10 Elements of A Winning Trading PlanSrinivasan Rmasamy100% (1)

- Taza ChocolateDocument9 pagesTaza ChocolateChed Augustus AranNo ratings yet

- CDO and Synthetic CDODocument3 pagesCDO and Synthetic CDOJIGYASA KUMARINo ratings yet

- Book International Financial ManagementDocument201 pagesBook International Financial ManagementasadNo ratings yet

- Sakthi Fianance Project ReportDocument61 pagesSakthi Fianance Project ReportraveenkumarNo ratings yet

- FX Insifddggfght e PDFDocument16 pagesFX Insifddggfght e PDFPopeye AlexNo ratings yet

- Security Analysis and Portfolio ManagementDocument26 pagesSecurity Analysis and Portfolio ManagementXandarnova corpsNo ratings yet

- IC 11-22 AssignmentDocument9 pagesIC 11-22 Assignmentshinta anggraini putriNo ratings yet

- Garment ContenetDocument2 pagesGarment Conteneteyerusalem getahun100% (2)

- AnandKasturi Mumbai 15 YrsDocument4 pagesAnandKasturi Mumbai 15 YrsRamanujan VSNo ratings yet

- PSBA Integrated Review Financial Accounting and Reporting - Theory Christian Aris Valix Debt InvestmentsDocument2 pagesPSBA Integrated Review Financial Accounting and Reporting - Theory Christian Aris Valix Debt InvestmentsKendrew SujideNo ratings yet

- CFA Before The ExamDocument2 pagesCFA Before The Exampingu_513501No ratings yet

- Chapter 3 Test BankDocument60 pagesChapter 3 Test BankHaider EjazNo ratings yet

- EU Financial Market ReformDocument19 pagesEU Financial Market ReformKathia CentronNo ratings yet

- Malaysia Low ResDocument9 pagesMalaysia Low ResMujahidahFaqihahNo ratings yet